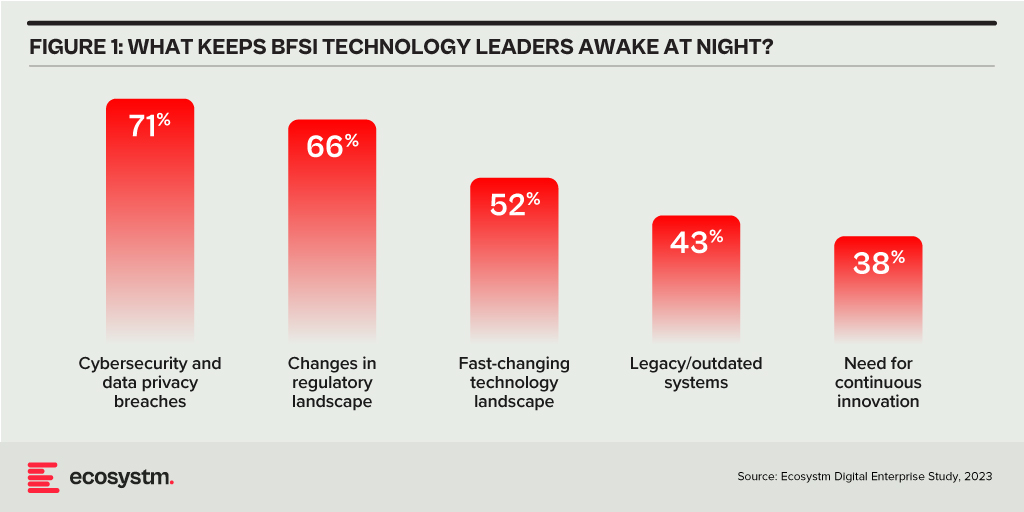

Ecosystm research reveals a stark reality: 75% of technology leaders in Financial Services anticipate data breaches.

Given the sector’s regulatory environment, data breaches carry substantial financial implications, emphasising the critical importance of giving precedence to cybersecurity. This is compelling a fresh cyber strategy focused on early threat detection and reduction of attack impact.

Read on to find out how tech leaders are building a culture of cyber-resilience, re-evaluating their cyber policies, and adopting technologies that keep them one step ahead of their adversaries.

Download ‘Cyber-Resilience in Finance: People, Policy & Technology’ as a PDF

Fintechs have carved out a niche both in their customer-centric approach and in crafting solutions for underserved communities without access to traditional financial services. Irrespective of their objectives, there is an immense reliance on innovation for lower-cost, personalised, and more convenient services.

However, a staggering 75% of venture-backed fintech startups fail to scale and grow – and this applies to fintechs as well.

Here are the 5 areas that fintechs need to focus on to succeed in a competitive market.

Download ‘Building a Successful Fintech Business’ as a PDF

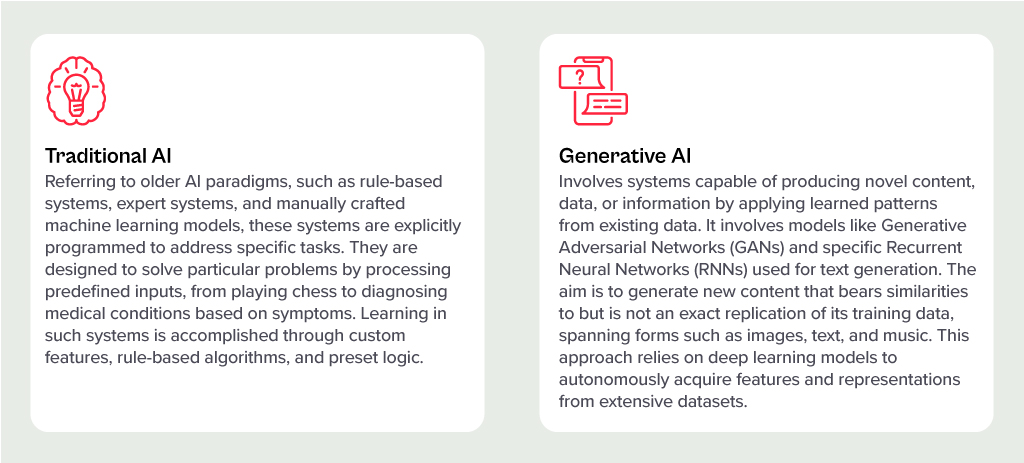

Generative AI has stolen the limelight in 2023 from nearly every other technology – and for good reason. The advances made by Generative AI providers have been incredible, with many human “thinking” processes now in line to be automated.

But before we had Generative AI, there was the run-of-the-mill “traditional AI”. However, despite the traditional tag, these capabilities have a long way to run within your organisation. In fact, they are often easier to implement, have less risk (and more predictability) and are easier to generate business cases for. Traditional AI systems are often already embedded in many applications, systems, and processes, and can easily be purchased as-a-service from many providers.

Unlocking the Potential of AI Across Industries

Many organisations around the world are exploring AI solutions today, and the opportunities for improvement are significant:

- Manufacturers are designing, developing and testing in digital environments, relying on AI to predict product responses to stress and environments. In the future, Generative AI will be called upon to suggest improvements.

- Retailers are using AI to monitor customer behaviours and predict next steps. Algorithms are being used to drive the best outcome for the customer and the retailer, based on previous behaviours and trained outcomes.

- Transport and logistics businesses are using AI to minimise fuel usage and driver expenses while maximising delivery loads. Smart route planning and scheduling is ensuring timely deliveries while reducing costs and saving on vehicle maintenance.

- Warehouses are enhancing the safety of their environments and efficiently moving goods with AI. Through a combination of video analytics, connected IoT devices, and logistical software, they are maximising the potential of their limited space.

- Public infrastructure providers (such as shopping centres, public transport providers etc) are using AI to monitor public safety. Video analytics and sensors is helping safety and security teams take public safety beyond traditional human monitoring.

AI Impacts Multiple Roles

Even within the organisation, different lines of business expect different outcomes for AI implementations.

- IT teams are monitoring infrastructure, applications, and transactions – to better understand root-cause analysis and predict upcoming failures – using AI. In fact, AIOps, one of the fastest-growing areas of AI, yields substantial productivity gains for tech teams and boosts reliability for both customers and employees.

- Finance teams are leveraging AI to understand customer payment patterns and automate the issuance of invoices and reminders, a capability increasingly being integrated into modern finance systems.

- Sales teams are using AI to discover the best prospects to target and what offers they are most likely to respond to.

- Contact centres are monitoring calls, automating suggestions, summarising records, and scheduling follow-up actions through conversational AI. This is allowing to get agents up to speed in a shorter period, ensuring greater customer satisfaction and increased brand loyalty.

Transitioning from Low-Risk to AI-Infused Growth

These are just a tiny selection of the opportunities for AI. And few of these need testing or business cases – many of these capabilities are available out-of-the-box or out of the cloud. They don’t need deep analysis by risk, legal, or cybersecurity teams. They just need a champion to make the call and switch them on.

One potential downside of Generative AI is that it is drawing unwarranted attention to well-established, low-risk AI applications. Many of these do not require much time from data scientists – and if they do, the challenge is often finding the data and creating the algorithm. Humans can typically understand the logic and rules that the models create – unlike Generative AI, where the outcome cannot be reverse-engineered.

The opportunity today is to take advantage of the attention that LLMs and other Generative AI engines are getting to incorporate AI into every conceivable aspect of a business. When organisations understand the opportunities for productivity improvements, speed enhancement, better customer outcomes and improved business performance, the spend on AI capabilities will skyrocket. Ecosystm estimates that for most organisations, AI spend will be less than 5% of their total tech spend in 2024 – but it is likely to grow to over 20% within the next 4-5 years.

Trust in the Banking, Financial Services, and Insurance (BFSI) industry is critical – and this amplifies the value of stolen data and fuels the motivation of malicious actors. Ransomware attacks continue to escalate, underscoring the need for fortified backup, encryption, and intrusion prevention systems. Similarly, phishing schemes have become increasingly sophisticated, placing a burden on BFSI cyber teams to educate employees, inform customers, deploy multifactor authentication, and implement fraud detection systems. While BFSI organisations work to fortify their defences, intruders continually find new avenues for profit – cyber protection is a high-stakes game of technological cat and mouse!

Some of these challenges inherent to the industry include the rise of cryptojacking – the unauthorised use of a BFSI company’s extensive computational resources for cryptocurrency mining.

Building Trust Amidst Expanding Threat Landscape

BFSI organisations face increasing complexity in their IT landscapes. Amidst initiatives like robo-advisory, point-of-sale lending, and personalised engagements – often facilitated by cloud-based fintech providers – they encounter new intricacies. As guest access extends to bank branches and IoT devices proliferate in public settings, vulnerabilities can emerge unexpectedly. Threats may arise from diverse origins, including misconfigured ATMs, unattended security cameras, or even asset trackers. Ensuring security and maintaining customer trust requires BFSI organisations to deploy automated and intelligent security systems to respond to emerging new threats.

Ecosystm research finds that nearly 70% of BFSI organisations have the intention of adopting AI and automation for security operations, over the next two years. But the reality is that adoption is still fairly nascent. Their top cyber focus areas remain data security, risk and compliance management, and application security.

Addressing Alert Fatigue and Control Challenges

According to Ecosystm research, 50% of BFSI organisations use more than 50 security tools to secure their infrastructure – and these are only the known tools. Cyber leaders are not only challenged with finding, assessing, and deploying the right tools, they are also challenged with managing them. Management challenges include a lack of centralised control across assets and applications and handling a high volume of security events and false positives.

Software updates and patches within the IT environment are crucial for security operations to identify and address potential vulnerabilities. Management of the IT environment should be paired with greater automation – event correlation, patching, and access management can all be improved through reduced manual processes.

Security operations teams must contend with the thousands of alerts that they receive each day. As a result, security analysts suffer from alert fatigue and struggle to recognise critical issues and novel threats. There is an urgency to deploy solutions that can help to reduce noise. For many organisations, an AI-augmented security team could de-prioritise 90% of alerts and focus on genuine risks.

Taken a step further, tools like AIOps can not only prioritise alerts but also respond to them. Directing issues to the appropriate people, recommending actions that can be taken by operators directly in a collaboration tool, and rules-based workflows performed automatically are already possible. Additionally, by evaluating past failures and successes, AIOps can learn over time which events are likely to become critical and how to respond to them. This brings us closer to the dream of NoOps, where security operations are completely automated.

Threat Intelligence and Visibility for a Proactive Cyber Approach

New forms of ransomware, phishing schemes, and unidentified vulnerabilities in cloud are emerging to exploit the growing attack surface of financial services organisations. Security operations teams in the BFSI sector spend most of their resources dealing with incoming alerts, leaving them with little time to proactively investigate new threats. It is evident that organisations require a partner that has the scale to maintain a data lake of threats identified by a broad range of customers even within the same industry. For greater predictive capabilities, threat intelligence should be based on research carried out on the dark web to improve situational awareness. These insights can help security operations teams to prepare for future attacks. Regular reporting to keep CIOs and CISOs informed of the changing threat landscape can also ease the mind of executives.

To ensure services can be delivered securely, BFSI organisations require additional visibility of traffic on their networks. The ability to not only inspect traffic as it passes through the firewall but to see activity within the network is critical in these increasingly complex environments. Network traffic anomaly detection uses machine learning to recognise typical traffic patterns and generates alerts for abnormal activity, such as privilege escalation or container escape. The growing acceptance of BYOD has also made device visibility more complex. By employing AI and adopting a zero-trust approach, devices can be profiled and granted appropriate access automatically. Network operators gain visibility of unknown devices and can easily enforce policies on a segmented network.

Intelligent Cyber Strategies

Here is what BFSI CISOs should prioritise to build a cyber resilient organisation.

Automation. The volume of incoming threats has grown beyond the capability of human operators to investigate manually. Increase the level of automation in your SOC to minimise the routine burden on the security operations team and allow them to focus on high-risk threats.

Cyberattack simulation exercises. Many security teams are too busy dealing with day-to-day operations to perform simulation exercises. However, they are a vital component of response planning. Organisation-wide exercises – that include security, IT operations, and communications teams – should be conducted regularly.

An AIOps topology map. Identify where you have reliable data sources that could be analysed by AIOps. Then select a domain by assessing the present level of observability and automation, IT skills gap, frequency of threats, and business criticality. As you add additional domains and the system learns, the value you realise from AIOps will grow.

A trusted intelligence partner. Extend your security operations team by working with a partner that can provide threat intelligence unattainable to most individual organisations. Threat intelligence providers can pool insights gathered from a diversity of client engagements and dedicated researchers. By leveraging the experience of a partner, BFSI organisations can better plan for how they will respond to inevitable breaches.

Conclusion

An effective cybersecurity strategy demands a comprehensive approach that incorporates technology, education, and policies while nurturing a culture of security awareness throughout the organisation. CISOs face the daunting task of safeguarding their organisations against relentless cyber intrusion attempts by cybercriminals, who often leverage cutting-edge automated intrusion technologies.

To maintain an advantage over these threats, cybersecurity teams must have access to continuous threat intelligence; automation will be essential in addressing the shortage of security expertise and managing the overwhelming volume and frequency of security events. Collaborating with a specialised partner possessing both scale and experience is often the answer for organisations that want to augment their cybersecurity teams with intelligent, automated agents capable of swiftly

As they continue to promote innovation in the Financial Services industry, the Monetary Authority of Singapore (MAS) introduced the Financial Sector Technology and Innovation Scheme 3.0 (FSTI 3.0) earlier this week, pledging up to SGD 150 million over three years. FSTI 3.0 aims to boost innovation by supporting projects that use cutting-edge technologies or have a regional scope, while strengthening the technology ecosystem in the industry. This initiative includes three tracks:

- Enhanced Centre of Excellence track to expand grant funding to corporate venture capital entities

- Innovation Acceleration track to support emerging tech based FinTech solutions, and

- Environmental, Social, and Governance (ESG) FinTech track to accelerate ESG adoption in fintech

Additionally, FSTI 3.0 will continue to support areas like AI, data analytics, and RegTech while emphasising talent development. We can expect to see transformative financial innovation through greater industry collaboration.

MAS’ Continued Focus on Innovation

Over the years, the MAS has consistently been a driving force behind innovation in the Financial Services industry. They have actively promoted and supported technological advancements to enhance the industry’s competitiveness and resilience.

The FinTech Regulatory Sandbox framework offers a controlled space for financial institutions and FinTech innovators to test new financial products and services in a real-world setting, with tailored regulatory support. By temporarily relaxing specific regulatory requirements, the sandbox encourages experimentation, while ensuring safeguards to manage risks and uphold the financial system’s stability. Upon successful experimentation, entities must seamlessly transition to full compliance with relevant regulations.

Innovation Labs serve as incubators for new ideas, fostering a culture of experimentation and collaboration. They collaborate with disruptors, startups, and entrepreneurs to develop groundbreaking solutions. Labs like Accenture Innovation Hub, Allianz Asia Lab, Aviva Digital Garage, ANZ Innovation Lab, and AXA Digital Hive drive create prototypes, and roll out market solutions.

Building an Ecosystem

Partnerships between financial institutions, technology companies, startups, and academia contribute to Singapore’s economic growth and global competitiveness while ensuring adaptive regulation in an evolving landscape. By creating a vibrant ecosystem, MAS has facilitated knowledge exchange, collaborative projects, and the development of innovative solutions. For instance, in 2022, MAS partnered with United Nations Capital Development Fund (UNCDF) to build digital financial ecosystems for MSMEs in emerging economies.

This includes supporting projects that address environmental, social, and governance (ESG) concerns within the financial sector. For instance, MAS worked with the People’s Bank of China to establish the China-Singapore Green Finance Taskforce (GFTF) to enhance collaboration in green and transition finance. The aim is to focus on taxonomies, products, and technology to support the transition to a low-carbon future in the region, co-chaired by representatives from both countries.

MAS has also promoted Open Banking and API Frameworks to encourage financial institutions to adopt open banking practices enabling easier integration of financial services and encouraging innovation by third-party developers. This also empowers customers to have greater control over their financial data while fostering the development of new financial products and services by FinTech companies.

Regulators in Asia Pacific Taking a Proactive Approach

While Singapore is at the forefront of financial innovations, other regulatory and government bodies in Asia Pacific are also taking on an increasingly proactive role in nurturing innovation. This stance is being driven by a twofold objective – to accelerate economic growth through technological advancements and to ensure that innovative solutions align with regulatory requirements and safeguard consumer interests.

Recognising the potential of fintech to enhance financial services and drive economic growth, the Hong Kong Monetary Authority (HKMA) established the Fintech Facilitation Office (FFO) to facilitate communication between the fintech industry and traditional financial institutions. The central bank’s Smart Banking Initiatives, including the Faster Payment System, Open API Framework, and the Banking Made Easy initiative that reduces regulatory frictions help to enhance the efficiency and interoperability of digital payments.

The Financial Services Agency of Japan (FSA) has been actively working on creating a regulatory framework to facilitate fintech innovation, including revisions to existing laws to accommodate new technologies like blockchain. In 2020, FSA launched the Blockchain Governance Initiative Network (BGIN) to facilitate collaboration between the government, financial institutions, and the private sector to explore the potential of blockchain technology in enhancing financial services.

The Central Bank of the Philippines (Bangko Sentral ng Pilipinas – BSP) has launched an e-payments project to overcome challenges hindering electronic retail purchases, such as limited interbank transfer facilities, high bank fees, and low levels of trust among merchants and consumers. The initiative included the establishment of the National Retail Payment System, a framework for retail payment, and the introduction of automated clearing houses like PESONet and InstaPay. These efforts have increased the percentage of retail purchases made electronically from 1% to over 10% within five years, demonstrating the positive impact of effective cooperation and innovative policies in driving a shift towards a cash-lite economy.

The promotion of fintech innovation highlights a collective belief in its potential to transform finance and boost economies. As regulations adapt for technologies like blockchain and open banking, the Asia Pacific region is promoting collaboration between traditional financial institutions and emerging fintech players. This approach underscores a commitment to balance innovation with responsible oversight, ensuring that advanced financial solutions comply with regulatory standards.

Generative AI is seeing enterprise interest and early adoption enhancing efficiency, fostering innovation, and pushing the boundaries of possibility. It has the potential of reshaping industries – and fast!

However, alongside its immense potential, Generative AI also raises concerns. Ethical considerations surrounding data privacy and security come to the forefront, as powerful AI systems handle vast amounts of sensitive information.

Addressing these concerns through responsible AI development and thoughtful regulation will be crucial to harnessing the full transformative power of Generative AI.

Read on to find out the key challenges faced in implementing Generative AI and explore emerging use cases in industries such as Financial Services, Retail, Manufacturing, and Healthcare.

Download ‘Generative AI: Industry Adoption’ as a PDF

Zurich will be the centre of attention for the Financial and Regulatory industries from June 26th to 28th as it hosts the second edition of the Point Zero Forum. Organised by Elevandi and the Swiss State Secretariat for International Finance, this event serves as a platform to encourage dialogue on policy and technology in Financial Services, with a particular emphasis on adopting transformative technologies and establishing the necessary governance and risk frameworks.

As a knowledge partner, Ecosystm is deeply involved in the Point Zero Forum. Throughout the event, we will actively engage in discussions and closely monitor three key areas: ESG, digital assets, and Responsible AI.

Read on to find out what our leaders — Amit Gupta (CEO, Ecosystm Group), Ullrich Loeffler (CEO and Co-Founder, Ecosystm), and Anubhav Nayyar (Chief Growth Advisor, Ecosystm) — say about why this will be core to building a sustainable and innovative future.

Download ‘Building Synergy Between Policy & Technology’ as a PDF

After the resounding success of the inaugural event last year, Ecosystm is once again partnering with Elevandi and the State Secretariat for International Finance SIF as a knowledge partner for the Point Zero Forum 2023. In this Ecosystm Insights, our guest author Jaskaran Bhalla, Content Lead, Elevandi talks about the Point Zero Forum 2023 and how it is all set to explore digital assets, sustainability, and AI in an ever-evolving Financial Services landscape.

The Point Zero Forum is returning for its second edition between 26 to 28 June 2023 in Zurich, Switzerland. The inaugural Forum held in June 2022 attracted over 1,000 leaders and featured more than 200 esteemed speakers from Europe, Asia Pacific, the USA, and MENA. The Forum represents a collaboration between the Swiss State Secretariat for International Finance (SIF) and Elevandi and is organised in cooperation with the BIS Innovation Hub, the Monetary Authority of Singapore (MAS), and the Swiss National Bank.

As we gear up for this year’s Point Zero Forum, let’s take a moment to reflect on some of the pivotal developments that have shaped the Financial Services industry since the previous Forum and also moulded the three key themes that will take centre stage this year: Sustainability, Artificial Intelligence (AI), and Digital Assets.

COP27, the rise of blended finance and the groundbreaking Net-Zero Public Data Utility

In November 2022, the Government of the Arab Republic of Egypt hosted the 27th session of the Conference of the Parties of the UNFCCC (COP27), with a view to accelerate the transition to a low-carbon future. In the build-up to COP27, Ravi Menon, the Managing Director of the MAS spoke at the inaugural Transition Finance towards Net-Zero conference and shared with the audience that the world is currently not on a trajectory to achieve net-zero emissions by 2050. And according to the UN Emissions Gap report 2021, based on the current policies in place, the world is 55% short of the emissions reduction target for 2030. He also elaborated on the significant role that blended finance can play in tackling climate change, a theme that widely resonated with the global leaders at COP27. To enable easy and transparent reporting on climate commitments, the Climate Data Steering Committee (CDSC) outlined the next steps on its recommended plans for the Net-Zero Data Public Utility (NZDPU) at COP 27. NZDPU aims to aid efforts to transition to a net-zero economy by addressing data gaps, inconsistencies, and barriers to information that slow climate action.

The Point Zero Forum 2023 will deep-dive into the data, technologies, and capital and risk management solutions that can accelerate the fair transition towards a low-carbon future.

Panel Discussion Highlight: The opening panel discussion, “Data for Net-Zero: Views from the Climate Data Steering Committee,” scheduled for 26 June, will feature members of the CDSC, which include the Financial Conduct Authority, the MAS, Glasgow Financial Alliance for Net Zero (GFANZ), and the Swiss State Secretariat for International Finance. The panel will discuss the role of new technologies and collaborative platforms in promoting greater accessibility of transition data and innovative business models.

The launch of ChatGPT by OpenAI and its record for the fastest 100M monthly active users

The launch of ChatGPT by OpenAI on 30 November, 2022 led to widespread adoption by users globally – eventually setting the record for the fastest-growing, active users, hitting 100M monthly active users by Feb 2023. While on one hand users rushed to share enormous efficiency gains achieved by the use of ChatGPT, on the other hand ChatGPT soon became a disruptive tool to spread fake news.

The Point Zero Forum 2023 will deep-dive into Generative AI’s potential for enhancing efficiency, improving risk management, and providing better customer experience in the Financial Services industry, while highlighting the need for ensuring fair, ethical, accountable, and transparent use of these technologies.

Panel Discussion Highlight: The session “Breaking New Ground with Generative AI: Project MindForge”, scheduled for 27 June, will feature global leaders from NVIDIA, the MAS, Citigroup and Bloomberg. The panel will discuss the opportunities of Generative AI for the Financial Services sector.

MiCA regulation gets adopted by the EU lawmakers and sets a precedent for digital asset regulations

More than 2.5 years after it was first proposed, the EU Markets in Crypto-Assets (MiCA) regulation was approved in April 2023 by EU Parliament. While there is still work to be done to implement MiCA and measure its success, and to answer open questions around regulation for out-of-scope assets (like DeFI and NFTs), the digital assets industry is keenly observing whether MiCA could serve as a template for global crypto regulation. In May 2023, the International Organization Of Securities Commissions (IOSCO), the global standard setter for securities markets, also joined the global discussion on digital asset regulation by issuing for consultation detailed recommendations to jurisdictions across the globe as to how to regulate crypto assets.

The Point Zero Forum 2023 will do a stocktake on key global regulatory frameworks, market infrastructure, and use cases for the widespread adoption of digital assets, asset tokenisation, and distributed ledger technology.

Panel Discussion Highlight: The sessions “State of Global Digital Asset Regulation: Navigating Opportunities in an Evolving Landscape” and “Interoperability and Regulatory Compliance: Building the Future of Digital Asset Infrastructure”, scheduled on 26 and 27 June respectively, will feature global leaders from both public sector (such as the MAS, Bank of Italy, Bank of Thailand, U.S. Commodity Futures Trading Commission, EU Parliament) and private sector organisations (such as JP Morgan, Sygnum, SBI Digital Assets, Chainalysis, GBBC, SIX Digital Exchange). The discussions will centre around digital asset regulations and key considerations in the rapidly evolving world of digital assets.

Register here at https://www.pointzeroforum.com/registration. Receive 10% off the Industry Pass by entering the code ‘JB10’ at check out. (Policymakers, regulators, think tanks, and academics receive complimentary access/ Founders of tech companies (incorporated for less than 3 years) can apply for a discounted Founder’s Pass)

The Financial Services industry can benefit greatly from leveraging Data and AI technologies to enhance client value and innovation. BFSI organisations want to deliver AI-driven outcomes.

However, many AI projects fail to deliver long-term business value. Leaders in the industry must overcome challenges such as

- Converting proofs of concept to scalable implementations

- Deploying end-to-end AI and Data strategies

- Evolving business requirements

- Responding to emerging trends such as Generative AI.

As a technology leader in BFSI, here are 5 ways you can help deliver on your organisation’s AI ambitions.

- Think in terms of outcomes – not use cases

- Identify and eliminate digital debt

- Build the right data platform architecture

- Adopt a dual AI strategy

- Be part of an innovation ecosystem

Read on to find out more.

Click here to download ‘5 Actions to Achieve Your AI Ambitions’ as a PDF