The global economy remains fragile due to multiple factors; and banking organisations will need to weather the storm. While large and well-capitalised banks are expected to fare better, there is a need for the industry to pursue new sources of value beyond traditional boundaries.

Banking industry leaders should be bold, proactive, and envision possibilities beyond current uncertainties. Technology has a key role to play in turning their innovation and resiliency goals into reality.

Read on to find out how the National Australia Bank, the Scottish National Investment Bank, the ANZ Bank, the Swiss National Bank, Mastercard, and the French banking group Crédit Agricole are leading the charge in driving innovation within the banking industry by investing in new technologies and exploring business models to better serve their customers.

Download ‘The Future of Banking’ as a PDF

Leading Banking and Financial Services organisations play a crucial role in financing sustainability transition. They have the infrastructure and resources to kickstart their own sustainability journey. But beyond that, they also have a greater role in building a sustainable value chain.

This extends to helping the traditional economy to transition; green investments to promote organisations with the right intentions; and empowering their customers to make environmentally-friendly choices.

As a technology leader in BFSI, you are an integral part of your organisation’s sustainability journey. Here are 5 ways in which BFSI tech leaders can support their organisations to turn sustainability intentions into reality.

Align tech with business goals and strategy. Think like a business leader and understand larger goals beyond technology deployments to empower your team.

View reporting as more than a checklist. You are in an ideal position to demonstrate the value of data insights beyond reporting mandates to the leadership team – link them to larger business outcomes.

Build intelligence into your facilities and assets. Consider investing in an intelligent enterprise asset management solution to automate asset and infrastructure management, remotely monitor and manage asset operations, and achieve sustainable business outcomes.

Automate your infrastructure allocation. You are increasingly using FinOps tools and other predictive analytics dashboards for cost and resource optimisation – extend the use for greater energy efficiency.

Understand your organisation’s unique sustainability journey. Seek independent opinion from third parties to empower your organisation to take the first step in the sustainability strategy, derive insights from data assets, and create market differentiation.

Read on to find more.

Download 5 Sustainability Actions for BFSI Tech Leaders as a PDF

Ecosystm and Bitstamp, conducted an invitation-only Executive ThinkTank at the Point Zero Forum in Zurich. A select group of regulators and senior leaders from financial institutions from across the globe came together to share their insights and experiences on Decentralised Finance (DeFi), innovations in the industry, and the outlook for the future.

Here are the 5 key takeaways from the ThinkTank.

- Regulators: Perception vs. Reality. Regulators are generally perceived as having a bias against innovations in the Financial Services industry. In reality, they want to encourage innovation, and the industry players welcome these regulations as guardrails against unscrupulous practices.

- Institutional Players’ Interest in DeFi. Many institutional players are interested in DeFi to enable the smooth running of processes and products and to reduce costs. It is being evaluated in areas such as lending, borrowing, and insurance.

- Evolving Traditional Regulations. In a DeFi world, participants and actors are connected by technology. Hence, setting the framework and imposing good practices when building projects will be critical. Regulations need to find the right balance between flexibility and rigidity.

- The Importance of a Digital Asset Listing Framework. There has been a long debate on who should be the gatekeeper of digital asset listings. From a regulator’s perspective, the liability of projects needs to shift from the consumer to the project and the gatekeeper.

- A Simplified Disclosure Document. Major players are willing to work with regulators to develop a simple disclosure document that describes the project for end-users or investors.

Read below to find out more.

Download Pathways for Aligning Innovation and Regulation in a DeFi World as a PDF

Ecosystm supported by their partner EY, conducted an invitation-only Executive ThinkTank at the Point Zero Forum in Zurich. A select group of regulators, investors, technology providers, and senior leaders from financial institutions from across the globe came together to share their insights and experiences on the practicability, regulatory support, and implications of sustainable finance portfolios.

Here are some of the key takeaways from the ThinkTank.

- The Barriers to a Sustainable Future. The first step towards a sustainable future is recognising the challenges organisations face when pursuing Net Zero targets. Often, Net Zero targets are looked upon as additional costs.

- Overcoming the Challenges. It is important to connect Net Zero back to business goals, given that there might be sudden shifts in regulations and because of the emergence of environment-conscious consumers.

- A Sustainable Future Requires a Collaborative Approach. Global governments, regulators, Financial Services institutions, other enterprises, and technology providers need to collaborate on building a sustainable future.

- A Time for Simplification. Clear mandates on reporting climate aspects similar to how financial aspects are reported, will result in greater adoption of sustainability and ESG measures.

- The Role of Digital Architecture. The path to a Net Zero, decarbonised world will be technology-led.

Read below to find out more.

Download Risks and Opportunities of Net Zero Commitments and Decarbonisation Pathways as a PDF

It’s been a while since I lived in Zurich. It was about this time of year when I first visited the city that I instantly fell in love with. Beautiful blue skies and if you’re lucky enough, you can see the snow-capped mountains from Lake Zurich. It’s hard not to be instantly drawn to this small city of approximately 1.4 million people, which punches well above its weight class. One out of every eleven jobs in Switzerland is in Zurich. The financial sector generates around a quarter of the city’s economic output and provides approximately 59,000 full time equivalent jobs – accounting for 16% of all employment in the city.

Between 21-23 June, Zurich will also be home to the Point Zero Forum – an exclusive invite-only, in-person gathering of select global leaders, founders and investors with the purpose of developing new ideas on emerging concepts such as decentralised finance (DeFi), Web 3.0, embedded finance and sustainable finance; driving investment activity; and bringing together public and private sector leaders to brainstorm on regulatory requirements.

The Future of DeFi

Zug is a little canton outside of Zurich and is famously known as “Crypto Valley”. When I lived in Zurich, Zug was the home of many of the country’s leading hedge funds as Zug’s low tax, business friendly environment and fantastic quality of life attracted many of the world’s leading fund managers and companies. Today the same can be said about crypto companies setting up shop in Zug. And crypto ecosystems are expanding exponentially.

However, with the increase in the global adoption of cryptocurrency, what role will the regulators play in aligning regulation without stifling innovation? How can Crypto Valley and Singapore play a role in defining the role regulation will play in a DeFi world?

DeFi is moving fast and we are seeing an explosion of new ideas and positive outcomes. So, what can we expect from all of this? Well, that is what I will discuss with a group of regulators and industry players in a round table discussion on How an Adaptive and Centralised Regulatory Approach can Shape a Protected Future of Finance at the Point Zero Forum. We will explore the role of regulators in a fast-moving industry that has recently seen some horror stories and how industry participants are willing to work with regulators to meet in the middle to build an exciting and sometimes unpredictable future. How do we regulate something in the future? I am personally looking forward to the knowledge sharing.

For the industry to strive and innovate, we need both regulators and industry players to work together and agree to a working framework that helps deliver innovation and growth by creating new technology and jobs. But we also need to keep an eye out on the increasing number of scams in the industry. It is true to say that we have seen our fair share of them in recent months. The total collapse of TerraUSD and Luna and the collapse of the wider crypto market that saw an estimated loss of USD 500 billion has really spooked global markets.

So is cryptocurrency here for good and will it be widely adopted globally? How will regulators see the recent collapse of Luna and view regulations moving forward? We have reached an interesting point with cryptocurrencies and digital assets in general. Is it time to reflect on the current market or should we push forward and try to find a workable middle ground?

Let’s find out. Watch this space for my follow-up post after the Point Zero Forum event!

When non-organic (man-made) fabric was introduced into fashion, there were a number of harsh warnings about using polyester and man-made synthetic fibres, including their flammability.

In creating non-organic data sets, should we also be creating warnings on their use and flammability? Let’s look at why synthetic data is used in industries such as Financial Services, Automotive as well as for new product development in Manufacturing.

Synthetic Data Defined

Synthetic data can be defined as data that is artificially developed rather than being generated by actual interactions. It is often created with the help of algorithms and is used for a wide range of activities, including as test data for new products and tools, for model validation, and in AI model training. Synthetic data is a type of data augmentation which involves creating new and representative data.

Why is it used?

The main reasons why synthetic data is used instead of real data are cost, privacy, and testing. Let’s look at more specifics on this:

- Data privacy. When privacy requirements limit data availability or how it can be used. For example, in Financial Services where restrictions around data usage and customer privacy are particularly limiting, companies are starting to use synthetic data to help them identify and eliminate bias in how they treat customers – without contravening data privacy regulations.

- Data availability. When the data needed for testing a product does not exist or is not available to the testers. This is often the case for new releases.

- Data for testing. When training data is needed for machine learning algorithms. However, in many instances, such as in the case of autonomous vehicles, the data is expensive to generate in real life.

- Training across third parties using cloud. When moving private data to cloud infrastructures involves security and compliance risks. Moving synthetic versions of sensitive data to the cloud can enable organisations to share data sets with third parties for training across cloud infrastructures.

- Data cost. Producing synthetic data through a generative model is significantly more cost-effective and efficient than collecting real-world data. With synthetic data, it becomes cheaper and faster to produce new data once the generative model is set up.

Why should it cause concern?

If real dataset contains biases, data augmented from it will contain biases, too. So, identification of optimal data augmentation strategy is important.

If the synthetic set doesn’t truly represent the original customer data set, it might contain the wrong buying signals regarding what customers are interested in or are inclined to buy.

Synthetic data also requires some form of output/quality control and internal regulation, specifically in highly regulated industries such as the Financial Services.

Creating incorrect synthetic data also can get a company in hot water with external regulators. For example, if a company created a product that harmed someone or didn’t work as advertised, it could lead to substantial financial penalties and, possibly, closer scrutiny in the future.

Conclusion

Synthetic data allows us to continue developing new and innovative products and solutions when the data necessary to do so wouldn’t otherwise be present or available due to volume, data sensitivity or user privacy challenges. Generating synthetic data comes with the flexibility to adjust its nature and environment as and when required in order to improve the performance of the model to create opportunities to check for outliers and extreme conditions.

We are seeing a rise in social and environmental consciousness – especially in the younger generation. Their awareness of human rights, the environment and inclusion is growing exponentially – they want to create impact. Organisations are being driven to develop and demonstrate an Environmental, Social and Governance (ESG) consciousness in their actions and investments.

In this Ecosystm Snapshot, we cover some of the recent examples of how governments and individual advocates are creating a difference; and how financial organisations and tech providers are embracing ESG.

Read how organisations such as Sun Cable, Equinix, Microsoft, NVIDIA, Prologis, Zensung, Ergo, Munich Re, Natwest, JPMorgan, Credit Suisse and others are working to make the world a better place.

In this Insight, guest author Anupam Verma talks about the technology-led evolution of the Banking industry in India and offers Cloud Service Providers guidance on how to partner with banks and financial institutions. “It is well understood that the banks that were early adopters of cloud have clearly gained market share during COVID-19. Banks are keen to adopt cloud but need a partnership approach balancing innovation with risk management so that it is ‘not one step forward and two steps back’ for them.”

India has been witnessing a digital revolution. Rapidly rising mobile and internet penetration has created an estimated 1 billion mobile users and more than 600 million internet users. It has been reported that 99% of India’s adult population now has a digital identity in the form of Aadhar and a large proportion of the adult Indians have a bank account.

Indians are adapting to consume multiple services on the smartphone and are demanding the same from their financial services providers. COVID-19 has accelerated this digital trend beyond imagination and is transforming India from a data-poor to a data-rich nation. This data from various alternate sources coupled with traditional sources is the inflection point to the road to financial inclusion. Strong digital infrastructure and digital footprints will create a world of opportunities for incumbent banks, non-banks as well as new-age fintechs.

The Cloud Imperative for Banks

Banks today have an urgent need to stay relevant in the era of digitally savvy customers and rising fintechs. This journey for banks to survive and thrive will put Data Analytics and Cloud at the front and centre of their digital transformation.

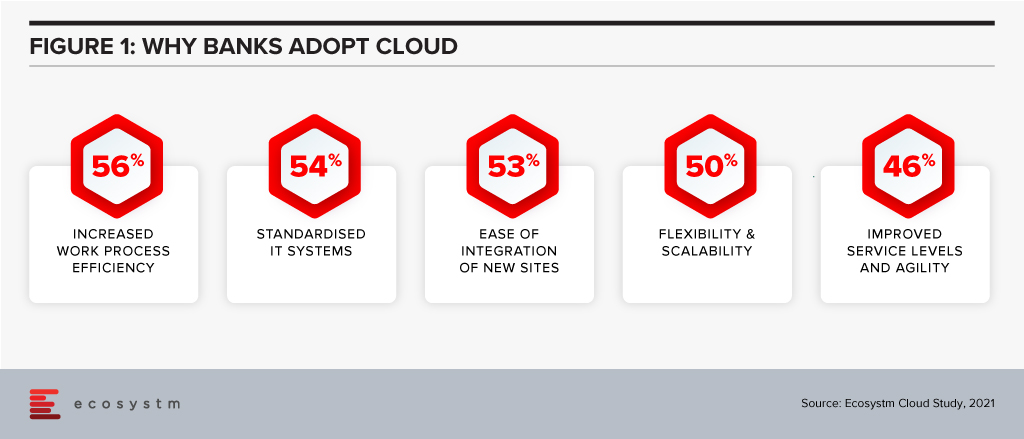

A couple of years ago, banks viewed cloud as an outsourcing infrastructure to improve the cost curve. Today, banks are convinced that cloud provides many more advantages (Figure 1).

Banks are also increasingly partnering with fintechs for applications such as KYC, UI/UX and customer service. Fintechs are cloud-native and understand that cloud provides exponential innovation, speed to market, scalability, resilience, a better cost curve and security. They understand their business will not exist or reach scale if not for cloud. These bank-fintech partnerships are also making banks understand the cloud imperative.

Traditionally, banks in India have had concerns around data privacy and data sovereignty. There are also risks around migrating legacy systems, which are made of monolithic applications and do not have a service-oriented architecture. As a result, banks are now working on complete re-architecture of the core legacy systems. Banks are creating web services on top of legacy systems, which can talk to the new technologies. New applications being built are cloud ready. In fact, many applications may not connect to the core legacy systems. They are exploring moving customer interfaces, CRM applications and internal workflows to the cloud. Still early days, but banks are using cloud analytics for marketing campaigns, risk modelling and regulatory reporting.

The remote working world is irreversible, and banks also understand that cloud will form the backbone for internal communication, virtual desktops, and virtual collaboration.

Strategy for Cloud Service Providers (CSPs)

It is estimated that India’s public cloud services market is likely to become the largest market in the Asia Pacific behind only China, Australia, and Japan. Ecosystm research shows that 70% of banking organisations in India are looking to increase their cloud spending. Whichever way one looks at it, cloud is likely to remain a large and growing market. The Financial Services industry will be one of the prominent segments and should remain a focus for cloud service providers (CSPs).

I believe CSPs targeting India’s Banking industry should bucket their strategy under four key themes:

- Partnering to Innovate and co-create solutions. CSPs must work with each business within the bank and re-imagine customer journeys and process workflow. This would mean banking domain experts and engineering teams of CSPs working with relevant teams within the bank. For some customer journeys, the teams have to go back to first principles and start from scratch i.e the financial need of the customer and how it is being re-imagined and fulfilled in a digital world.

CSPs should also continue to engage with all ecosystem partners of banks to co-create cloud-native solutions. These partners could range from fintechs to vendors for HR, Finance, business reporting, regulatory reporting, data providers (which feeds into analytics engine).

CSPs should partner with banks for experimentation by providing test environments. Some of the themes that are critical for banks right now are CRM, workspace virtualisation and collaboration tools. CSPs could leverage these themes to open the doors. API banking is another area for co-creating solutions. Core systems cannot be ‘lifted & shifted’ to the cloud. That would be the last mile in the digital transformation journey. - Partnering to mitigate ‘fear of the unknown’. As in the case of any key strategic shift, the tone of the executive management is important. A lot of engagement is required with the entire senior management team to build the ‘trust quotient’ of cloud. Understanding the benefits, risks, controls and the concept of ‘shared responsibility’ is important. I am an AWS Certified Cloud Practitioner and I realise how granular the security in the cloud can be (which is the responsibility of the bank and not of the CSP). This knowledge gap can be massive for smaller banks due to the non-availability of talent. If security in the cloud is not managed well, there is an immense risk to the banks.

- Partnering for Risk Mitigation. Regulators will expect banks to treat CSPs like any other outsourcing service providers. CSPs should work with banks to create robust cloud governance frameworks for mitigating cloud-related risks such as resiliency, cybersecurity etc. Adequate communication is required to showcase the controls around data privacy (data at rest and transit), data sovereignty, geographic diversity of Availability Zones (to mitigate risks around natural calamities like floods) and Disaster Recovery (DR) site.

- Partnering with Regulators. Building regulatory comfort is an equally important factor for the pace and extent of technology adoption in Financial Services. The regulators expect the banks to have a governance framework, detailed policies and operating guidelines covering assessment, contractual consideration, audit, inspection, change management, cybersecurity, exit plan etc. While partnering with regulators on creating the framework is important, it is equally important to demonstrate that banks have the skill sets to run the cloud and manage the risks. Engagement should also be linked to specific use cases which allow banks to effectively compete with fintech’s in the digital world (and expand financial access) and use cases for risk mitigation and fraud management. This would meet the regulator’s dual objective of market development as well as market stability.

Financial Services is a large and growing market for CSPs. Fintechs are cloud-native and certain sectors in the industry (like non-banks and insurance companies) have made progress in cloud adoption. It is well understood that the banks that were early adopters of cloud have clearly gained market share during COVID-19. Banks are keen to adopt cloud but need a partnership approach balancing innovation with risk management so that it is ‘not one step forward and two steps back’ for them.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

Industries continue to innovate and disrupt to create and maintain a competitive edge – and their technology partners evolve their solution offerings to empower them.

We bring to you latest industry news from the Healthcare, Financial Services, Retail, Travel & Hospitality and Entertainment & Media industries to show you how organisations are leveraging technology. Find out more about organisations such as Services Australia, Paypal, Walmart, Zara and Amex – and how tech providers such as IBM, Oracle, Google and Uplift are supporting organisations across industries.

View the latest Ecosystm Bytes on Industries of the Future below, and reach out to our experts if you have questions.

For more ‘byte sized’ insights click on the link below