The first impact of the pandemic and the disruption it caused, was organisations scrambling to empower their remote employees. Over the last 2 years, significant investments have been made on collaboration platforms and tools. Now organisations are having to work towards making these workplaces truly hybrid where organisations have to ensure that all employees get the same experience, irrespective of where they choose to work from.

In 2022, organisations will continue to invest in building the Digital Workplace and address the associated technology, people, and process challenges.

Read on to find out what Ecosystm Analysts, Audrey William, Tim Sheedy and Venu Reddy think will be the key trends for the Digital Workplace in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for the Digital Workplace in 2022 as PDF

An Update (1 October 2021): This acquisition did not go through even after the boards of directors of both companies had approved it. It was voted down by Five9 shareholders, citing growth and valuation concerns. This is an unusual example of an acquisition not going through because of unwillingness of one of the companies. In recent times, regulators have stopped some acquisitions. Incidentally, there were some concerns raised by the by Federal Communications Commission (FCC) as Zoom is based in US. but has product development operations in China.

The partnership arrangement between the two companies will continue including support for integrations between their respective Unified Communications as a Service (UCaaS) and Contact Centre as a Service (CCaaS) solutions and joint go-to-market initiatives.

Zoom has announced their intention to acquire cloud contact centre service provider Five9 in an all-stock deal for about USD 14.7 Billion. This is Zoom’s largest-ever acquisition as the communications platform continues to expand their services and launch new products. The deal is expected to be completed in the first half of 2022 and Five9 will be an operating unit of Zoom.

The last year has seen Zoom scaling up their product offerings, including cloud calling solution – Zoom Phone, conference hosting solution – Zoom Rooms, and applications and productivity tools – Zoom Apps and Zoom Marketplace. Zoom also acquired real-time translation startup Kites GmbH to offer multi-language translation capabilities, and Keybase – a secure messaging and file-sharing service to build end-to-end encryption for its video conferencing platform.

Ecosystm Analysts share their thoughts on Zoom’s strategy and roadmap, how Five9 will augment Zoom’s capabilities, and the impact the acquisition will have on Zoom’s competitors and the market.

Why Contact Centre?

Ecosystm Principal Advisor Tim Sheedy says, “Zoom is moving beyond its period of ‘organic hypergrowth’ brought on by the pandemic. While the paying customer base for their core video collaboration service will continue to grow, growth rates are likely to begin to track the market. To grow beyond market rates, Zoom needs to move into new markets – through product development or acquisition.”

Talking about the importance of voice services, Sheedy adds, “Voice services are an obvious adjacent market to help drive growth, and Zoom already has seen some success with their Zoom phone service and associated devices – in fact, they already have 1.5 million users. The Five9 acquisition gives the company a stronger and deeper capability in the voice sector; buying them a significant chunk of the voice services in business – the contact centre. In many businesses, the contact centre already accounts for over 50% of their voice minute usage, so winning this space will go a long way towards winning the overall voice and collaboration supplier in enterprises.”

Ecosystm Principal Advisor Audrey William predicts exciting times ahead for Zoom. “With Zoom already having a platform for video, then bringing voice into that equation and now a contact centre solution, makes them take on their competitors in an all-native cloud stack. There is a still a large installed base of on-prem UC customers and with Zoom seeing success with Zoom phones in the short time frame since its launch, this is where this will get exciting for Zoom. The telephony piece is still important in the race to simplify how we work, communicate, and collaborate today. It is that same voice/telephony discussion that can lead to a routing discussion, which then leads to a contact centre discussion.”

Ecosystm research shows that 54% of organisations are challenged in their customer experience delivery because of integration issues between multiple platforms. William sees this as an opportunity for Zoom. “The use cases to integrate workflows into the video environment is going to be important for Zoom. Video is now being used to solve customer service issues like letting the agents take over the screen to see how to help solve the customer problem immediately by using video and contact centre applications. The ability to bring this natively together will be very powerful. Zoom is investing heavily into apps and working to partner with ISVs who can develop workflows suitable for easy customer communication in specific industries such as Healthcare and Financial Services.”

Why Five9?

Five9 is considered a pioneer in cloud contact centre solutions and owns a comprehensive suite of applications for contact centre delivery and customer management operations across different channels. Five9 has made several acquisitions and enhancements to their CCaaS solution in recent years to make their stack more complete with richer AI offerings. They include Inference Solutions to offer their customers a Conversational AI solution and Whendu’s iPaaS platform which provides a no-code, visual application workflow tool.

William says, “More contact centres want to do away with monolithic IVR systems that confuse customers with too many long menus. The Agent Assist solutions are also gaining importance especially in the hybrid work model where agents face challenges working in isolation and not being on a floor with their colleagues and managers.”

Five9 has acquired a cloud workforce optimisation provider Virtual Observer. “So, we are not looking at just a basic level contact centre solution but an offering with important capabilities demanded by customers,” says William. “During the investor call this week, Zoom’s Eric Yuan and Rowan Trollope made it clear that they have been listening to customer feedback on how effective it would be to have a single platform that can accommodate UC and contact centres in the cloud. Zoom also sees Five9 as a good fit culturally; and their goal now will be to disrupt all legacy systems with cloud-native communications.”

What lies ahead?

William thinks that Zoom’s competitors will be watching this integration closely, especially those that lack an all-in-one native cloud UCaaS and CCaaS stack. “However, some of Zoom’s competitors have an established base of large enterprise customers and have done well to grow revenues and defend their base over the years. Working with in-country partners and ISVs will be critical for Zoom’s growth across regions.”

Sheedy thinks that the most important takeaway from this acquisition is not that Zoom is moving into the contact centre space. “It is that Zoom realises they have a “once in a generation” opportunity to grow beyond their core and cement their position as a supplier of collaboration and communication services – and that they are willing to flex their balance sheet and share price to create their future. The competition – from Microsoft in particular – will be strong. Google, AWS, Salesforce, and Facebook are also making a play for this market. Zoom has found themselves in their current position of strength due to good luck and good timing – and they appear to be telling the market that they aren’t going to give up their leadership without a significant battle.”

“Enterprises will be the true winners in this battle – with better, more integrated, lower cost and easier to implement communications and collaboration solutions for their employees and customers,” adds Sheedy.

Last week Zoom announced a USD 100 million Zoom Apps Fund to promote the development of Zoom’s ecosystem of Zoom applications, integrations, video, developer tools, and hardware.

As part of Zoom Apps Fund, the company will invest in a portfolio of companies that are promoting and innovating on Zoom’s video conferencing platform. The portfolio companies will receive initial investments between USD 250,000 and USD 2.5 million to build solutions. To support the practice, Zoom is providing its tools and expertise to various start-ups, entrepreneurs, and industry players to build applications and integrate Zoom’s functionality and native interface in their products.

In March, Zoom introduced an SDK designed to help programmers embed Zoom functionality inside their applications. Zoom SDK is a component of Zoom Developer platform which includes SDKs, APIs, webhooks, chatbots, and distribution for applications and integration. Last year Zoom launched Zoom Apps and Zoom Marketplace at its Zoomtopia virtual conference to bring applications and productivity into the Zoom experience.

Zoom is not alone in evolving their Unified communications as a service (UCaaS) capabilities and market. Tencent rolled out their video conferencing solution for the global market, Facebook expanded their offerings in videoconferencing applications through the integration of new features, Google announced a series of upgrades and innovations to better support the flexibility needs of frontline and remote workers in Google Workspaces, and Microsoft introduced Viva that aims to bring together communications, knowledge, learning, resources, and insights together.

“Ecosystm research shows that 50% of organisations will continue to increase use of collaboration platforms and tools in 2021. However, if videoconferencing remains just a tool to log in to for meetings without purpose-built workflows and functionality that suit worker profiles, then it will start losing its attractiveness. Vendors need to work on user interface, UX, the lighting, security, audio quality and many other aspects that draws users to the platform.

The big question is what next for videoconferencing vendors? How can engineering teams innovate to build the capabilities organisations want when they use drawing tools, share images, have chats and discussions within collaboration platforms? How do you make the experience real so employees can “live and breathe” in the environment?

Zoom investing in understanding what apps and workflows are suited for a particular vertical or business is fundamental to the future of video and collaboration and will be a big game changer.”

“Zoom is continuing to expand the markets in which they operate and investing in start-ups increases their opportunities to grow as a platform. Their App Marketplace already offers a rich source of innovations, with Zoom themselves appearing to develop integration with market leaders such as Salesforce and HubSpot in the CRM category. This has led to Zoom integrations in close to 80 CRM products – including integrations developed in-house by Salesforce and HubSpot to supplement Zoom capabilities.

They are promoting an open web and audio-conferencing platform that does not limit users to the walled-garden approach of competitors such as Microsoft Teams.

Zoom’s strategy creates the opportunity for CIOs to access a widely used, rich functionality, digital collaboration channel – one they can integrate seamlessly into their existing digital channels knowing that their customers are likely to be highly familiar with the user experience.”

Get more insights on the impact of the COVID-19 pandemic and technology areas that will see innovations, as organisations get into the recovery phase.

BetterUp, a mobile-based professional learning and wellness platform that connects employees with career experts recently raised USD 125 million Series D funding backed by Salesforce Ventures, in partnership with ICONIQ Capital, Lightspeed Venture Partners, Threshold Ventures, and Sapphire Ventures among others, bringing the company’s valuation to USD 1.73 billion. Previously in 2012, the company had raised USD 43 million in venture capital funding with an additional Series B funding of USD 30 million in March 2018. The BetterUp platform combines behavioural science, AI, and human interaction to enhance employees’ personal and professional well-being. Recently, the company also revealed two new products – Identify AI, to help organisations determine the right people to invest in and the appropriate coaching needed through the use of AI; and Coaching Cloud for customised training for frontline, professional, and executive employees.

This announcement comes on the back of several wins for BetterUp. To boost employee performance and organisational growth NASA and the Federal Aviation Administration (FAA) partnered with BetterUp to support new ways of coaching and preparing a workforce for change. The world’s largest brewer, AB InBev has partnered with BetterUp to strengthen diversity and inclusion through BetterUp’s coaching platform.

The Need to Improve Employee Experience

The pandemic changed the working arrangement of millions of employees and industries across the globe who are now working remotely or in a hybrid environment.

Ecosystm Principal Advisor, Audrey William says, “Driving better employee experience (EX) should take centre stage this year with enterprises putting employees at the centre of all initiatives. We will see EX platforms get integrated further and deeper into workplace collaboration and HR applications. In the last 12 months, we have seen apps monitoring wellness and sleep, training and coaching, meditation, employee motivation, and so on sit within larger collaboration platforms such as Slack, Zoom, Microsoft, Cisco and others.”

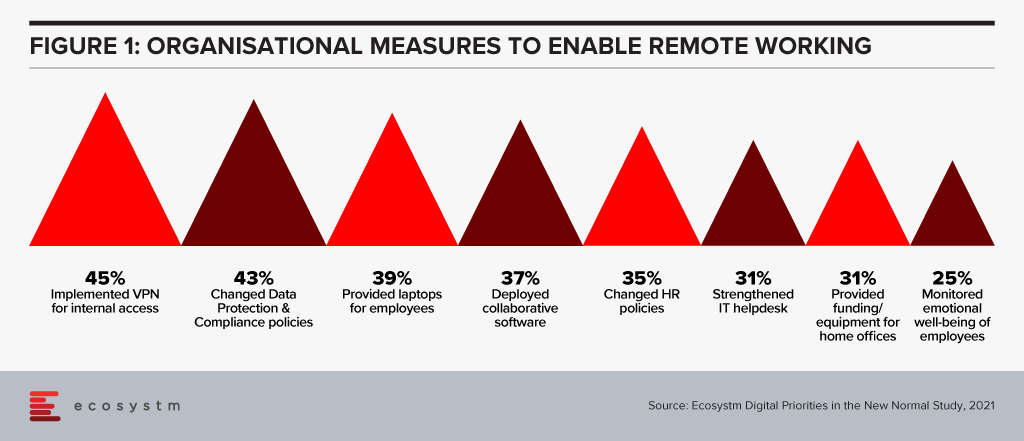

While the primary focus has been on optimising the work environment, it is time for organisations to start focusing on employee well-being. Ecosystm research shows that organisations implemented several measures to empower a remote workforce last year when the pandemic hit. But there was not enough focus on employee well-being (Figure 1).

William says, “A hybrid work environment may have negative impact on your employees. You may face issues such as longer working hours, employee burnout, lesser social engagements and connection, loneliness – and mental and emotional issues and depression”.

“Organisations that place an emphasis on the employees will see their revenues grow and also see less attrition. The more you invest in your people, the more you will get back in return. It is as simple as that! You can see that now in some organisations where employees are being given more flexibility, employers are not dictating how they should work, diversity and inclusion efforts have become mainstream, and efforts are being made to make employees feel like they belong.”

William adds, “However, Ecosystm research finds that organisations have gone back to putting customers and business growth first – losing focus on their employees. Only 27% of organisations globally say that they have improving employee experience as a key business priority in 2021. It is time for this culture and mindset to change. And solutions such as BetterUp can make a difference.”

Transform and be better prepared for future disruption, and the ever-changing competitive environment and customer, employee or partner demands in 2021. Download Ecosystm Predicts: The top 5 Future of Work Trends For 2021.

The ways we connect, create, collaborate in our workplaces has seen major shifts in the last year. And the tech industry has continually supported that shift as they create new capabilities and upgrade existing ones. Technology providers will continue to revamp their product offerings to support the increase in adoption of the hybrid work model work – a fusion of remote and in-office. In the Top 5 Future of Work Trends for 2021, Ecosystm had predicted, “Every major digital workspace provider (such as Microsoft, Google, Zoom, Cisco, AWS and so on) will broaden their digital workplace capabilities and integrate them more effectively, making them easier to procure and use. Instead of a “tool-centric” approach to getting work done (chat vs video vs document sharing vs online meetings vs whiteboards and so on), it will become a platform play.”

Ecosystm Principal Advisor, Ravi Bhogaraju says, “It is becoming clear that companies and individuals are grappling with three issues – the changing size and composition of the workforce; the productivity of those who are driving the businesses; and attracting, reskilling and engaging the broader workforce.” These are the challenges that tech providers will have to help organisations with.

Google Upgrades its Collaboration Platform

The Google Workspace was launched in October last year, and last week saw the tech giant announce a series of upgrades and innovations to better support the flexibility needs of frontline and remote workers.

Workspace is Google’s office productivity suite comprising video conferencing, cloud storage, collaboration tools, security and management controls built into a cohesive environment. The new features announced by Google Workspaces include Focus Time to avoid distractions by limiting notifications, recurring out-of-office and location indicators to make colleagues aware if the person is working from home or office, support for Google voice assistant in workplaces, second-screen experiences to support multiple devices, and features for frontline workers designed to help mobile employees collaborate and communicate better with the rest of the organisation. Google is also working on a trimmed down version of Google Workspace – Google Workspace Essentials – which will provide support for Chat, Jamboard, and Calendar. Workspace is estimated to have 2.6 billion monthly active users.

Bhogaraju says, “One of the issues that is fast emerging as significant is not just the employee experience or customer experience but the complexity of the digital workplace as platforms introduce newer and advanced features. In the end, there has to be simplicity, clarity, and a clear focus on the goals – not just an overload of features that makes life more complex for the employee. It would be critical to enable these features thoughtfully and reskill staff adequately so that the adoption and impact to business process is felt in their day-to-day activities.”

Workspace Transformation across Industries

With many of Google’s employees and developers working remotely, the company has first-hand experience of the challenges of remote working and is leveraging the experience. Google Workspace is also working on custom solutions for various industries. In Retail for example, Woolworths, rolled out Google Workspace and Chrome for geographically dispersed teams to collaborate in real-time and adopt custom-made applications linked to global servers to allow managers to log and address tickets from the shop floor itself. Similarly in Aviation, All Nippon Airways uses Google Workspace to allow pilots, cabin attendants, HR and finance staff to communicate and collaborate in real-time across the globe, using Google Meet, Google Docs, Google Sheets and Google Slides from their PCs, smartphones or tablets. Google retains its focus on the Education industry – Google Workspace Education Fundamentals is free for all qualifying institutions. Solutions such as Google’s Classroom, Teach from Anywhere hub, roster sync, mobile grading and EdTech tools aim to enable better learning and teaching experience for students and educators.

Tech Companies Revamping their Collaboration Offerings

With more companies rethinking their work policies, leaders in the collaboration space are also stepping up their game to evolve their offerings for the hybrid norm. Microsoft’s Viva unifies the experience across Teams and Microsoft 365 for employee communications, wellbeing, learning and knowledge discovery. Similarly, Zoom too has upgraded and integrated various utility, sharing, and management features to support a hybrid workforce. Tech companies are being forced to invest in creating next-generation tools to stay relevant, as Future of Work models continue to shift and evolve.

As tech companies evolve their capabilities, Bhogaraju warns organisations on how they should leverage them. “While technology companies continue to deliver feature rich suites – in reality the uptake and embedding of these programs into the day-to-day business processes is still in its early stages. Business, HR and IT teams continue to struggle. They tend to operate within independent thought silos and there is limited consensus on which feature is really needed and how it can add to the productivity and efficiency. Without this crucial context and an effective change management program – they remain rich features and not impactful ones.”

The hybrid workplace model is gaining popularity in 2021. Check out Ecosytsm’s top 5 Future of Work Trends For 2021. Signup for Free to download the report.

As organisations stride towards digitalisation, re-evaluating their business continuity plans and defining how the Future of Work will look for them, cloud adoption is expected to surge. Almost all technologies being evaluated by organisations today have cloud as their pillar. Cloud will the key enabler for ease of doing business, real-time data access for productivity increase, and process automation.

Ecosystm Advisors Claus Mortensen, Darian Bird and Tim Sheedy present the top 5 Ecosystm predictions for Cloud Trends in 2021. This is a summary of our cloud predictions – the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Cloud Trends for 2021

- 2021 Will be All About SaaS

2020 was a breakout year for SaaS providers – and a tough one for a lot of on-premises software vendors. SaaS (or mainly SaaS) providers like Salesforce, Zoom, Microsoft had record growth and some of the best quarters in their history, while other mainly on-premises software providers have had poor quarters. SAP is even accelerating the transition to a 100% cloud-based business as their revenue suffers. The race to deploy SaaS tools and platforms is well and truly happening. Many of the usual ROI models and business cases have been abandoned as the need for agility – to drive business change at pace trumps most other business needs. Ecosystm data validates this

This trend will continue in 2021 – in fact, we expect it to accelerate. Most SaaS solutions (such as CRM, ERP, SCM, HRM etc.) are implemented by less than 30% of businesses today – which means the upside for the SaaS providers is huge.

- Hybrid Cloud Will Finally Become Mainstream

The sudden move to remote working in 2020 forced most organisations to increase their use and reliance on cloud-based applications. Employees have relied on collaborative tools such as Zoom, Microsoft Teams and WebEx to conduct virtual meetings, call centre workers had to respond to calls from home – most if not all relying on cloud-based apps and platforms. This trend is set to continue going forward. Ecosystm research finds that 44% of organisations will spend more on cloud-based collaboration tools in the next 6-12 months.

But the forced adoption of these tools has also prompted many – especially larger organisations – to worry about losing control of their IT resources, including worries related to security and compliance, cost, and reliability. As for the latter, both Microsoft Azure and Zoom experienced outages after the pandemic hit and this has made many organisations wary of relying too much on a single public cloud platform. Ecosystm therefore expects a sharp increase in focus on hybrid cloud platforms in 2021 as IT Teams seek to regain control of the apps and services their employees rely the most upon.

- Carrier Investment in 5G Will Give Edge Computing a Boost

The gap between the hype around edge computing and the actual capabilities it offers will narrow in 2021 as 5G networks are built out. One of the most promising methods of deploying edge computing involves carriers embedding cloud capacity in their own data centres connected to their 5G networks. This ensures data does not unnecessarily leave the network, reducing latency and preserving bandwidth. This combination of 5G and the Edge will be of particular benefit to applications that until now have faced a trade-off between mobility and connectivity. Over the last twelve months, the major hyperscalers announced their 5G edge computing offerings, and some of the major global telecom providers have served as test cases by partnering with at least one hyperscaler and will likely add more over the next year. Expect this ecosystem to expand greatly in 2021.

Cloud environments can benefit from pushing computing-heavy workloads to the Edge in much the same way as IoT and provides a great platform for managing the edge computing endpoints. The flipside of pushing containers to the Edge will be the increased complexity and the fact that the number of attack surfaces will increase. Containerisation must therefore be deployed with security at its core.

- Stateful Applications Will Move to the Cloud with Containers and Orchestration

As organisations seek to migrate workloads and applications between platforms in an increasingly hybrid cloud environment, the need for “lifting and shifting”, refactoring and partitioning applications will increase. These approaches all have their shortcomings, however. Lifting and shifting an application may limit its functionality now or in the future; refactoring may take too long or be too costly; and partitioning is often not feasible or possible. A better approach to this task is to modernise the applications to make use of application containers like Docker, Windows Server Containers, Linux VServer and so on, to enable a faster and more seamless way to migrate applications between platforms. We also see container orchestration environments like Kubernetes and containerised development and deployment platforms like IBM’s Cloud Paks.

How these technologies are used to deploy stateful applications in multicloud environments will evolve. A raft of container management platforms, based on Kubernetes, are being released to simplify what was once a complex DIY process. New entrants will look to challenge the cloud hyperscalers, virtualisation giants, and Kubernetes specialists. The emerging features that previously required cobbling together third-party tools, like service mesh, data fabric, and machine learning, will speed up containerisation of stateful core applications. The deployment of containers on bare metal rather than in virtualised environments will also gather pace. The most challenging task will be delivering containerised applications at the Edge, forcing developers and platform providers to create inventive solutions.

- Serverless will take us a step closer to NoOps

As the application lifecycle speeds up and the distinction between development and operations shrinks, the motivation to adopt serverless computing will grow in 2021. While NoOps, the concept that operations could become so automated that it fades into the background, is still a distant goal, serverless computing will make a stride in that direction by abstracting the application from the infrastructure. Having seen the agility benefits of a microservices architecture, many DevOps teams will experiment with breaking services down further into functions. Moreover, the pay-as-you-go model of serverless will appeal to OpEx driven organisations. Expect stories of bill shock, however, as were seen in the early days of cloud adoption. While AWS Lambda is currently considered the serverless industry standard, it is likely that in 2021, Microsoft, Google, and IBM will ramp up efforts in this space. Each of these providers will build out their offering in terms of languages supported, event triggers, consumption plans, machine learning/AI options, observability, and user experience.

2020 has been a watershed year for Future of Work policies and technologies. Organisations are still evaluating their workplace strategies and 2021 is likely to see experiments in work models – every organisation will choose the model that works for their nature of work and their organisational culture. Against this backdrop of disruption and change, Ecosystm’s 360o Future of Work team – Audrey William, Mike Zamora, Ravi Bhogaraju and Tim Sheedy – present the top 5 Ecosystm predictions for the Future of Work in 2021.

This is a summary of the predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Future of Work Trends For 2021

- Human-centricity Will be Front and Centre of Organisational Priorities

2020 saw immense humanitarian disruption. Enabling remote work was a key component of business continuity. Both organisations and their employees have a better understanding now of the implications of remote working and how it can be made to work. They are also aware of the challenges of remote working. Monitoring productivity, maintaining the right work-life balance and ensuring employee emotional well-being have been challenging. Despite the challenges, hybrid/blended working is definitely here to stay. Employees will expect more options on the location of their work, often choosing to work where they are most productive.

All decisions related to the organisation, filtered through the lens of human-centricity, will drive better employee engagement – and engaged employees provide better customer experience. Organisations that will operationalise this at scale and across cultures will emerge as success stories.

- Technology Will Bond with Facilities and Operations – Connecting with HR Will be a Challenge

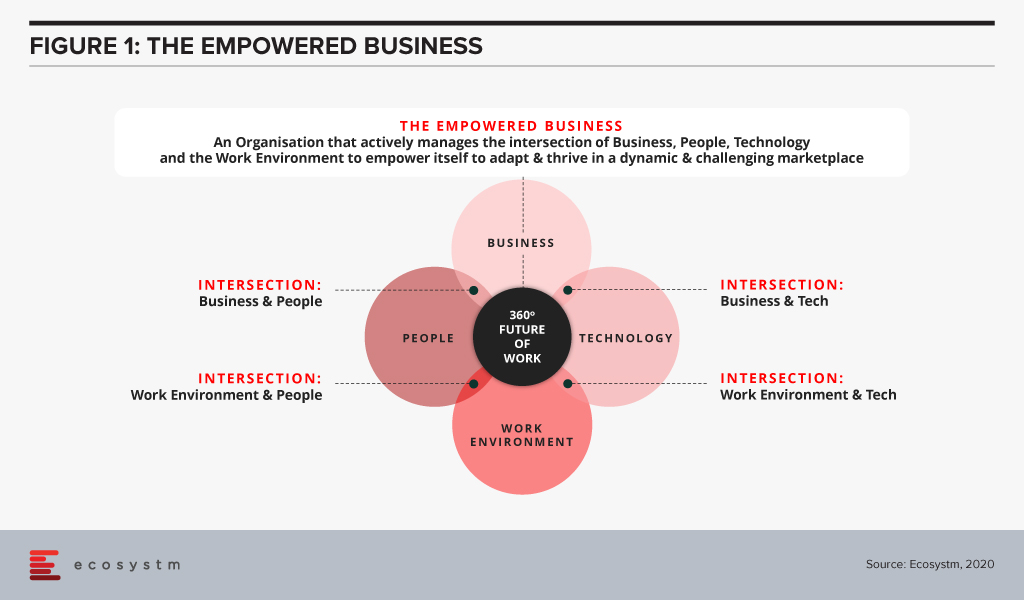

There has to be an alignment between the Business, People, Work Environment and Technology to make an organisation truly empowered to handle sudden pivots that will be required in 2021 as well (Figure 1).

This will require cross-departmental coordination and synergy. Tech teams have traditionally driven the Digital Workplace strategy; now they will have to work closely with Operations and Facilities Management teams on “Smart and Safe Office” strategies. That may not be the real challenge given that there are overlaps between these three teams – they have a shared language and similar KPIs. The real challenge will be the need for Tech teams and HR to work more closely to improve the overall employee experience, including a focus on employee productivity and wellness. Human-centricity makes the role of HR even more important – IT will find it challenging to find common grounds as there have traditionally been few shared KPIs between these two departments.

- Office Spaces Will Become Truly Digital

The hybrid/blended workplace model means that the physical workplace is not disappearing soon. Even as the model evolves for each organisation, what becomes clear is that employee expectations have changed drastically in the last year, and the traditional employee experience expectations of Salary, Recognition, and Job Satisfaction may not be enough. Employees will now expect flexibility, social cohesion, and effective communication. If they are to return to the physical office, they will expect the same benefits as working from home.

This will drive the adoption of digital tech to ensure the office space is safer, more effective and a productive environment for the employees and the business. Two key areas of focus will be on seamless access to information and employee control over work environment.

- Providers Will Deepen Digital Workplace Offerings, but the Market Will Not Consolidate

Key tech providers in the digital workspace space (such as Microsoft, Google, Zoom, Cisco, AWS and so on) will broaden their capabilities and make it easier to procure and use solutions. It will no longer be a “tool-centric” approach (chat, video, document sharing, online meetings, whiteboards and so on) – it will become a platform play. Information workers will be able to choose the approach that best fits the problem they are trying to resolve, without being limited by the capabilities of the tool. E.g. documents will be sharable and editable within chats; whiteboards will be integrated into all other communication services and so on.

Tech providers will deepen and strengthen their capabilities organically and acquisitions will mostly be about buying market share, customers and not the technology.

- Industry-centric Digital Workplace Services Will Emerge and Witness Rapid Growth

The Services industry has been leading in the adoption of digital workplaces – but blue-collar roles and front-line employees will also start benefiting from these technologies. In 2021, new digital workplace capabilities will extend beyond the employee base to systems that drive better connectivity and communication with customers. This will open the market up for smaller, niche players (and this may well run counter to the previous trend). Tech teams will focus on employees and a platform-based approach to collaboration, while Customer teams and others will implement tools and platforms to better communicate outside of the business. The next few years will bring the traditional “employee-centric” collaboration players into direct competition with the “customer-centric” ones. Those that play across both today (such as Google) will be better positioned to win the enterprise-wide “Future of Work” style deals.