Much has been written (and discussed on webinars) about the demands of managing the work-from-anywhere experience. We were all thrown into this last year, and are still working our way through the challenges. For most employees it has been a positive experience – but there is still a lot more we can and should do to improve experiences for employees and their managers.

Workplace Analytics Gains Significance

At the start of 2020, my colleague Audrey William and I discussed the need for workplace analytics when predicting workplace trends for the year, but the pandemic delayed many of these investments. As working from home (or from anywhere) becomes a long-term trend, we are learning that managers need tools to better empower their employees to deliver what the business needs. There are many reports of employees working overtime; working longer days; not taking breaks; being in back-to-back meetings for days on end; skipping meals; and wearing themselves out.

There are many benefits of remote work – employees have the freedom to manage the day as they choose, they have no commute and (conceptually) more harmony between work and home duties. But there are also many processes that are harder. It is not as easy to find the right person to connect to or learn from, get the best information or answer to a question, and get coaching and new skills. Managers need to understand their employee work experience because they don’t sit with or supervise them all day. Self-service for employees used to mean walking around the office and having a conversation or meeting. Today, we need to make these outcomes easier for every worker regardless of location.

Microsoft Lauches Viva

Microsoft has announced the release of Viva – a new product suite to help businesses overcome these challenges. They have published a “Future of Employee Experience” video here as part of the launch – but don’t watch it – or if you do, be prepared to be disappointed when you see the actual products… The good news is that we have moved from oval-shaped phones in Future of Work videos in 2000 (because all web content is designed for round screens right?) to transparent phones in 2010 (who needs to be able to see what’s on the screen?) to virtual screens in Future of Work videos in 2021… Guess they’ll never become a reality either!

Based off the early reviews and commentary about Viva, I believe Microsoft is really onto a winner here:

- Managers need better analytics about how their team spends their days and employees need insights as to how to increase their productivity or find a better balance in their life.

- Employees need to find the people and information in their business to connect with and learn from – how often do employees reach out to others to ask for help or information when the answers they were looking for weren’t too far away. This information needs to be easier to find – even surfaced to employees before they go looking for it.

- Everyone in your business needs to keep learning within their flow of work – the formal training programs offered by most businesses today are useless if employees are too busy to take the course.

- Business leaders need to drive cultural change more effectively or support their broader business initiatives by linking employees with the information and insights that can help reinforce or change organisational culture.

Viva should support these outcomes. Microsoft is partnering with many other businesses to make this work (systems integrators, training providers, workplace and HR platforms etc). If the products deliver as promised, they might provide the missing link that many businesses need today to keep their employees safe, productive, happy and connected.

Learn about the factors that have been accelerating the shift towards the new ways of working. The top 5 Future of Work Trends For 2021 are available for download from the Ecosystm platform. Signup for Free to download the report.

As organisations stride towards digitalisation, re-evaluating their business continuity plans and defining how the Future of Work will look for them, cloud adoption is expected to surge. Almost all technologies being evaluated by organisations today have cloud as their pillar. Cloud will the key enabler for ease of doing business, real-time data access for productivity increase, and process automation.

Ecosystm Advisors Claus Mortensen, Darian Bird and Tim Sheedy present the top 5 Ecosystm predictions for Cloud Trends in 2021. This is a summary of our cloud predictions – the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Cloud Trends for 2021

- 2021 Will be All About SaaS

2020 was a breakout year for SaaS providers – and a tough one for a lot of on-premises software vendors. SaaS (or mainly SaaS) providers like Salesforce, Zoom, Microsoft had record growth and some of the best quarters in their history, while other mainly on-premises software providers have had poor quarters. SAP is even accelerating the transition to a 100% cloud-based business as their revenue suffers. The race to deploy SaaS tools and platforms is well and truly happening. Many of the usual ROI models and business cases have been abandoned as the need for agility – to drive business change at pace trumps most other business needs. Ecosystm data validates this

This trend will continue in 2021 – in fact, we expect it to accelerate. Most SaaS solutions (such as CRM, ERP, SCM, HRM etc.) are implemented by less than 30% of businesses today – which means the upside for the SaaS providers is huge.

- Hybrid Cloud Will Finally Become Mainstream

The sudden move to remote working in 2020 forced most organisations to increase their use and reliance on cloud-based applications. Employees have relied on collaborative tools such as Zoom, Microsoft Teams and WebEx to conduct virtual meetings, call centre workers had to respond to calls from home – most if not all relying on cloud-based apps and platforms. This trend is set to continue going forward. Ecosystm research finds that 44% of organisations will spend more on cloud-based collaboration tools in the next 6-12 months.

But the forced adoption of these tools has also prompted many – especially larger organisations – to worry about losing control of their IT resources, including worries related to security and compliance, cost, and reliability. As for the latter, both Microsoft Azure and Zoom experienced outages after the pandemic hit and this has made many organisations wary of relying too much on a single public cloud platform. Ecosystm therefore expects a sharp increase in focus on hybrid cloud platforms in 2021 as IT Teams seek to regain control of the apps and services their employees rely the most upon.

- Carrier Investment in 5G Will Give Edge Computing a Boost

The gap between the hype around edge computing and the actual capabilities it offers will narrow in 2021 as 5G networks are built out. One of the most promising methods of deploying edge computing involves carriers embedding cloud capacity in their own data centres connected to their 5G networks. This ensures data does not unnecessarily leave the network, reducing latency and preserving bandwidth. This combination of 5G and the Edge will be of particular benefit to applications that until now have faced a trade-off between mobility and connectivity. Over the last twelve months, the major hyperscalers announced their 5G edge computing offerings, and some of the major global telecom providers have served as test cases by partnering with at least one hyperscaler and will likely add more over the next year. Expect this ecosystem to expand greatly in 2021.

Cloud environments can benefit from pushing computing-heavy workloads to the Edge in much the same way as IoT and provides a great platform for managing the edge computing endpoints. The flipside of pushing containers to the Edge will be the increased complexity and the fact that the number of attack surfaces will increase. Containerisation must therefore be deployed with security at its core.

- Stateful Applications Will Move to the Cloud with Containers and Orchestration

As organisations seek to migrate workloads and applications between platforms in an increasingly hybrid cloud environment, the need for “lifting and shifting”, refactoring and partitioning applications will increase. These approaches all have their shortcomings, however. Lifting and shifting an application may limit its functionality now or in the future; refactoring may take too long or be too costly; and partitioning is often not feasible or possible. A better approach to this task is to modernise the applications to make use of application containers like Docker, Windows Server Containers, Linux VServer and so on, to enable a faster and more seamless way to migrate applications between platforms. We also see container orchestration environments like Kubernetes and containerised development and deployment platforms like IBM’s Cloud Paks.

How these technologies are used to deploy stateful applications in multicloud environments will evolve. A raft of container management platforms, based on Kubernetes, are being released to simplify what was once a complex DIY process. New entrants will look to challenge the cloud hyperscalers, virtualisation giants, and Kubernetes specialists. The emerging features that previously required cobbling together third-party tools, like service mesh, data fabric, and machine learning, will speed up containerisation of stateful core applications. The deployment of containers on bare metal rather than in virtualised environments will also gather pace. The most challenging task will be delivering containerised applications at the Edge, forcing developers and platform providers to create inventive solutions.

- Serverless will take us a step closer to NoOps

As the application lifecycle speeds up and the distinction between development and operations shrinks, the motivation to adopt serverless computing will grow in 2021. While NoOps, the concept that operations could become so automated that it fades into the background, is still a distant goal, serverless computing will make a stride in that direction by abstracting the application from the infrastructure. Having seen the agility benefits of a microservices architecture, many DevOps teams will experiment with breaking services down further into functions. Moreover, the pay-as-you-go model of serverless will appeal to OpEx driven organisations. Expect stories of bill shock, however, as were seen in the early days of cloud adoption. While AWS Lambda is currently considered the serverless industry standard, it is likely that in 2021, Microsoft, Google, and IBM will ramp up efforts in this space. Each of these providers will build out their offering in terms of languages supported, event triggers, consumption plans, machine learning/AI options, observability, and user experience.

Ecosystm had predicted that in 2020, AI and analytics would be a top priority for organisations as they embarked or continued on their Digital Transformation journeys. What we saw instead was organisations collecting the right data – but handling more pressing matters this year. They focused more on cybersecurity frameworks, enabling remote employees and the shifts in product and service delivery. In 2021, as organisations work their way to recovery, they will re-evaluate their AI and automation roadmaps, more actively. Ecosystm Advisors Alea Fairchild, Andrew Milroy and Tim Sheedy present the top 5 Ecosystm predictions for AI & Automation in 2021.

This is a summary of the AI & Automation predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 AI & Automation Trends for 2021

- AI Will Move from a Competitive Advantage to a Must-Have

The best practices and leading-edge technology-centric implementations, over the years gives a very good indication of market trends. In 2018 and 2019 AI-centric engagements were few and far between – they were still in the “innovation stage” as trials and small projects. In 2020, AI was mentioned in most applications, showcased as best practices. AI is currently a competitive advantage for businesses. CIOs and their businesses are using AI to get ahead of their competitors and highlighting these practices for external recognition.

That also means that it is a matter of time before AI becomes a standard practice – processes are smart “out-of-the-box”; intelligent applications are an expectation, not the exception; systems learn because that is how they were designed, not as an overlay. If your competitors are using AI today to get ahead of you, then you need to also use AI to catch up and keep up. In 2021, having a smart business will not get you ahead of the pack – it will move you into it.

- AI Will Thrive in Areas where the Cost of Failure is Low

While organisations will be forced to adopt AI to remain competitive, initial exploration of AI solutions will be in areas that they consider low risk. The Financial Services, Retail, and other transaction-oriented industries will use AI to drive improved personalisation, increase customer retention, and improve their ability to lower risk and combat fraud. These are process-driven areas, where manual processes are being enhanced and enriched by AI. Although machine learning and other AI technologies will help improve the speed and quality of services, they will not be a replacement for many of the more complex business practices that companies and their employees frequently overlook to automate. The ‘low hanging fruit’ to add AI to will come first, with various degrees of success.

There will be industries and processes where organisations will be more skeptical about adopting AI. If Google finds a wrong translation or gives a wrong link, it is not a big concern, unlike a wrong diagnosis or wrong medication. In areas that are crucial to our well-being – such as healthcare – AI does not yet have the trust for acceptance of society. There are still questions around ethics and algorithm concerns.

- Technology Providers Will Stop Talking about AI

Technology vendors highlight what they consider their key differentiators, that show that they are ahead of the game. When every piece of software and hardware is intelligent, vendors will stop talking about the fact that they are intelligent. This may not fully happen in 2021 – but ENOUGH technology will be intelligent for those who have not yet made their software smart to understand that they cannot talk about its intelligent capabilities as that just shows they are behind the market.

The good news is that the less we hear about AI, the more intelligent applications will become. AI is quickly becoming a core capability and a base expectation. Systems that learn and adapt will be standard very soon – but be wary, as significant market changes can break these systems! Many companies learned that the pandemic broke their algorithms as times were no longer “normal”.

- Enterprises Will Seek Hyperautomation Solutions

RPA will increasingly become part of large enterprise application implementations. Technology vendors are adding RPA functionality either organically or through acquisitions to their enterprise application suites. RPA often works in conjunction with major software products provided by companies such as Salesforce, SAP, Microsoft, and IBM. Rather than having an operative enter data into multiple systems, a bot can be created to do this. Large software vendors are taking advantage of this opportunity by trying to own entire workflows. They are increasingly integrating RPA into their offerings as well as competing directly in the RPA market with pureplay RPA vendors.

As the RPA offerings continue to mature, enterprises seek to scale implementations and to automate non-repetitive processes, which require more intelligence. They will seek to automate more processes at scale. They will demand solutions that process unstructured data, handle exceptions, and continuously learn, further increasing productivity. Intelligent automation typically incorporates AI, particularly voice and vision capabilities and uses machine learning to optimise processes. Hyperautomation turbo charges intelligent automation by automating multiple processes at scale – and will become core to digital transformation initiatives in 2021.

- Businesses Will Put “Automation Targets” in Place

2020 was the year that many businesses started seeing some broad and tangible benefits from their automation initiatives. Automation was one of the big winners of the year, as many businesses took extra steps to take humans out of processes – particularly those humans that had to be in a specific location, such as a warehouse, the finance team, the front desk and so on (because of the pandemic, they were often working at home instead). Senior management is seeing the benefits of automation, and they will start to ask their teams why more processes are not automated Therefore we will start to see managers put targets around a certain percentage of tasks automated in an area – e.g. 70% of contact centre processes will be automated, 90% of the digital customer experience for a certain outcome will be automated and so on. Achieving these numbers may not be easy, but the targets will change the mindset of people designing, implementing, and improving processes.

2020 has been a watershed year for Future of Work policies and technologies. Organisations are still evaluating their workplace strategies and 2021 is likely to see experiments in work models – every organisation will choose the model that works for their nature of work and their organisational culture. Against this backdrop of disruption and change, Ecosystm’s 360o Future of Work team – Audrey William, Mike Zamora, Ravi Bhogaraju and Tim Sheedy – present the top 5 Ecosystm predictions for the Future of Work in 2021.

This is a summary of the predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Future of Work Trends For 2021

- Human-centricity Will be Front and Centre of Organisational Priorities

2020 saw immense humanitarian disruption. Enabling remote work was a key component of business continuity. Both organisations and their employees have a better understanding now of the implications of remote working and how it can be made to work. They are also aware of the challenges of remote working. Monitoring productivity, maintaining the right work-life balance and ensuring employee emotional well-being have been challenging. Despite the challenges, hybrid/blended working is definitely here to stay. Employees will expect more options on the location of their work, often choosing to work where they are most productive.

All decisions related to the organisation, filtered through the lens of human-centricity, will drive better employee engagement – and engaged employees provide better customer experience. Organisations that will operationalise this at scale and across cultures will emerge as success stories.

- Technology Will Bond with Facilities and Operations – Connecting with HR Will be a Challenge

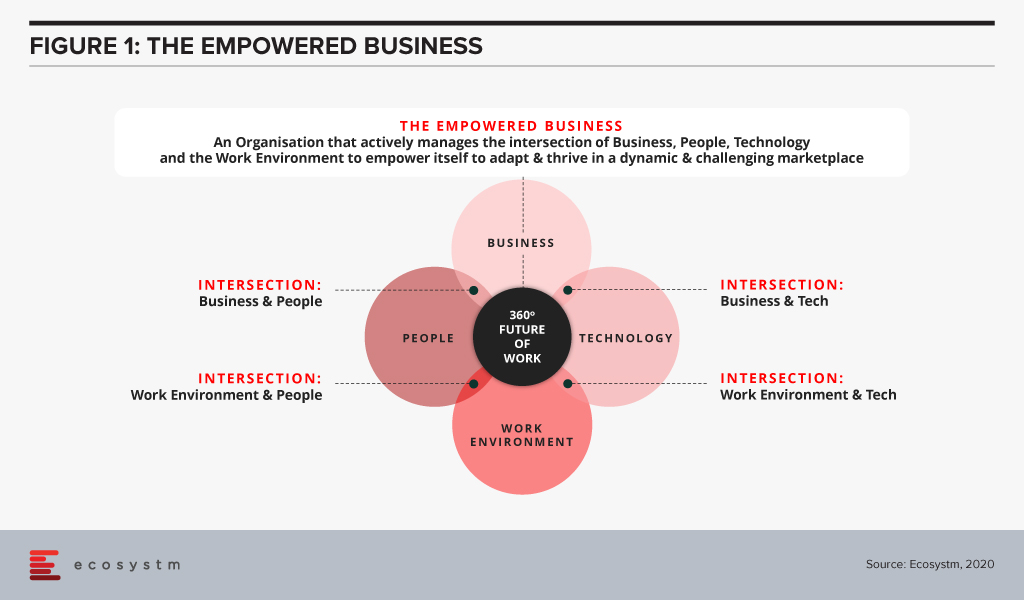

There has to be an alignment between the Business, People, Work Environment and Technology to make an organisation truly empowered to handle sudden pivots that will be required in 2021 as well (Figure 1).

This will require cross-departmental coordination and synergy. Tech teams have traditionally driven the Digital Workplace strategy; now they will have to work closely with Operations and Facilities Management teams on “Smart and Safe Office” strategies. That may not be the real challenge given that there are overlaps between these three teams – they have a shared language and similar KPIs. The real challenge will be the need for Tech teams and HR to work more closely to improve the overall employee experience, including a focus on employee productivity and wellness. Human-centricity makes the role of HR even more important – IT will find it challenging to find common grounds as there have traditionally been few shared KPIs between these two departments.

- Office Spaces Will Become Truly Digital

The hybrid/blended workplace model means that the physical workplace is not disappearing soon. Even as the model evolves for each organisation, what becomes clear is that employee expectations have changed drastically in the last year, and the traditional employee experience expectations of Salary, Recognition, and Job Satisfaction may not be enough. Employees will now expect flexibility, social cohesion, and effective communication. If they are to return to the physical office, they will expect the same benefits as working from home.

This will drive the adoption of digital tech to ensure the office space is safer, more effective and a productive environment for the employees and the business. Two key areas of focus will be on seamless access to information and employee control over work environment.

- Providers Will Deepen Digital Workplace Offerings, but the Market Will Not Consolidate

Key tech providers in the digital workspace space (such as Microsoft, Google, Zoom, Cisco, AWS and so on) will broaden their capabilities and make it easier to procure and use solutions. It will no longer be a “tool-centric” approach (chat, video, document sharing, online meetings, whiteboards and so on) – it will become a platform play. Information workers will be able to choose the approach that best fits the problem they are trying to resolve, without being limited by the capabilities of the tool. E.g. documents will be sharable and editable within chats; whiteboards will be integrated into all other communication services and so on.

Tech providers will deepen and strengthen their capabilities organically and acquisitions will mostly be about buying market share, customers and not the technology.

- Industry-centric Digital Workplace Services Will Emerge and Witness Rapid Growth

The Services industry has been leading in the adoption of digital workplaces – but blue-collar roles and front-line employees will also start benefiting from these technologies. In 2021, new digital workplace capabilities will extend beyond the employee base to systems that drive better connectivity and communication with customers. This will open the market up for smaller, niche players (and this may well run counter to the previous trend). Tech teams will focus on employees and a platform-based approach to collaboration, while Customer teams and others will implement tools and platforms to better communicate outside of the business. The next few years will bring the traditional “employee-centric” collaboration players into direct competition with the “customer-centric” ones. Those that play across both today (such as Google) will be better positioned to win the enterprise-wide “Future of Work” style deals.

Telstra and Microsoft have extended their partnership to jointly build solutions harnessing the capabilities of AI, IoT, and Digital Twin technologies in Australia. The partnership will also enable both companies to work on sustainability, emission reduction, and digital transformation initiatives.

The adoption of cloud and 5G technology is already on the rise and creating opportunities across the globe. The Microsoft-Telstra partnership is set to bring together the capabilities of both providers for businesses in Australia and globally. Their focus on AI, IoT, cloud and 5G will enable Australia’s developers and independent software vendors (ISVs) to leverage AI with low latency 5G access to drive efficiency, and enhance decision making. This will also see practical applications and new solutions in areas like asset tracking, supply chain management, and smart spaces to enhance customer experience.

Technology Enhancing the Built Environment

Microsoft Azure and Telstra’s 5G capabilities will come together to develop new industry solutions – the combination of cloud computing power and telecom infrastructure will enable businesses and industries to leverage a unified IoT platform where they can get information through sensors, and perform real-time compute and data operations. Telstra and Microsoft will also build digital twins for Telstra’s customers and Telstra’s own commercial buildings which will be initially deployed at five buildings. Upon completion, the digital twin will enable Telstra to form a digital nerve centre and map physical environments in a virtual space based on real-world models and plot what-if scenarios.

Telstra CEO, Andy Penn says, “If you think about the physical world – manufacturing, cities, buildings, mining, logistics – the physical world hasn’t really been digitised yet. So, how do you digitise the physical world? Well, what you do is put sensors into physical assets. Those sensors can draw information around that physical asset, which you can then capture and then understand.”

Ecosystm Principal Advisor, Mike Zamora finds the comment interesting and says, “It isn’t so much that the physical world is digitized – it is more about how digital tools enhance and enable the physical world to be more effective to help the occupier of the space. This has been the history of the physical space. There have been many ‘tools’ over time to help the physical world – the elevator in the late 1880s enabled office buildings to be taller; the use of steel improved structural support, allowing structural walls to be thinner and buildings taller. These two ‘tools’ enabled the modern skyscraper to be born. The HVAC system developed in the early 1900s, enabled occupants to be more comfortable inside a building year-round in any climate.”

“Digital tools (sensors, etc) are just the latest to be used to enhance the physical space for the occupant. Digital twins enable an idea to be replicated in 3D – prior to having to spend millions of dollars and hundreds of man hours to see if a new idea is viable. Its advent and use enable more experimentation at a lower cost and faster set up. This equates into a lower risk. It is a welcomed tool which will propel the experimentation in the physical world.”

Talking about emerging technologies, Zamora says, “Digital twins along with other digital tools, such as 3D printing, AI, drones with 4K cameras and others will enable the built environment to develop at a very quick pace. It is the pace that will be welcomed, as the built environment is typically a slow-moving asset (pardon the pun).”

“Expect the Built Environment developers, designers, investors, and occupiers to welcome the concept. It will allow them to dream of the possible.”

Telstra and Microsoft – Joint Goals

Telstra and Microsoft have partnered over the years over multiple projects. Last year, the companies partnered to bring Telstra’s eSIM functionality to Windows devices for data and wireless connectivity; they have also worked on Telstra Data Hub for secured data sharing between data producers, businesses and government agencies; and most recently collaborated on Telstra’s exclusive access to Xbox All Access subscription service to Australian gamers with the announcement of Microsoft’s Xbox Series X and Xbox Series S gaming consoles expected to release in November.

This announcement also sees them work jointly towards their sustainability goals. Both companies are committed to sustainability and addressing climate change. Earlier this year, Microsoft announced its plans to be carbon negative by 2030, while Telstra has also set a target to generate 100% renewable energy by 2025 and reducing its absolute carbon emissions by 50% by the same time. To enable sustainability, Telstra and Microsoft are exploring technology to reduce carbon emissions. This includes further adoption of cloud for operations and services, remote working, and piloting on real-time data reporting solutions.

Telstra also aims to leverage Microsoft technology for its ongoing internal digital transformation, adopting Microsoft Azure as its cloud platform to streamline operations, and infrastructure modernisation, including transition from legacy and on-premise infrastructure to cloud based applications.

Contact centres were already on a path to modernisation – which got accelerated by the COVID-19 crisis. The need for omnichannel delivery and better insights from customer data has forced contact centres to adopt cloud solutions. Ecosystm Principal Advisor Audrey William says, “There is still a disconnect between integrating and synchronising customer data between Sales, Marketing and Customer Teams. However, the market is starting to see contact centre vendors work closer with vendors in customer experience management segment.”

Genesys and Adobe are collaborating on integrating Genesys cloud and the Adobe Experience Platform. The deeper integration of both platforms is aimed to give organisations a better omnichannel presence. The platform is live for users and Genesys and Adobe will introduce other features and capabilities throughout 2020. Genesys is already a partner of Adobe’s Exchange Program designed for technology partners to supplement Exchange Marketplace with extensions and applications for Adobe Creative Cloud users.

Augmenting the CX journey through Data Synchronization

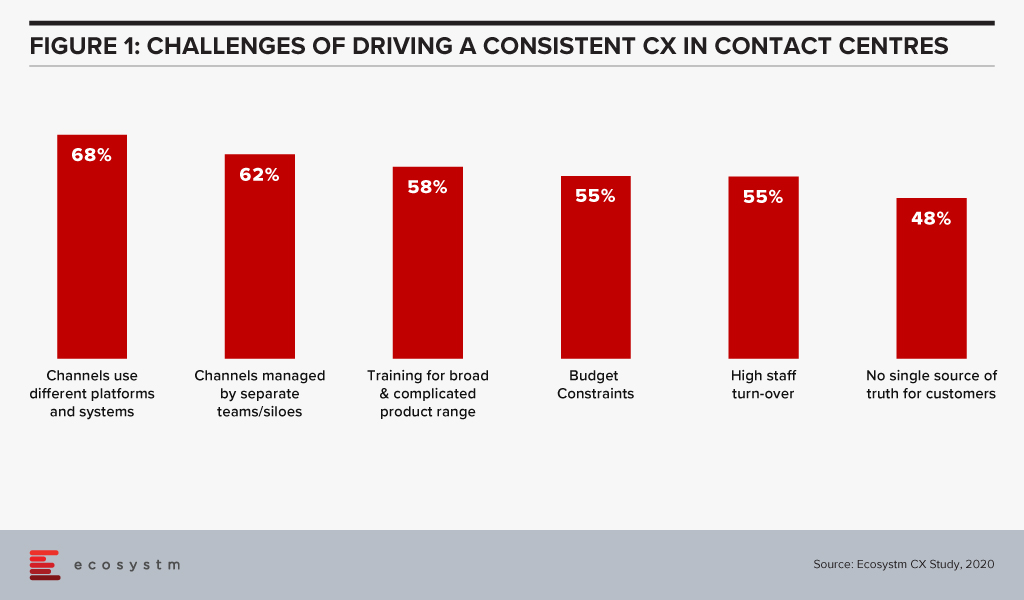

Ecosystm data finds that 62% of contact centres have driving omnichannel experience as a key customer experience (CX) priority and 57% want to analyse data across multiple data repositories. However, when asked about the challenges of driving consistent CX, data access and integration appears to be a barrier in achieving their priorities. These challenges are the reason why getting a “true view” of the customer data has been an arduous task and achieving consistent CX continues to be a struggle.

William says. “The customer data collected by a particular service or department does not always move along in real-time with the customer interactions across different touchpoints. This complicates maintaining a real-time customer profile and impacts the CX.”

“Sales and Marketing have different KPIs and tend to view customer data from different angles. The data from in-store, Marketing and Sales interactions sits within departmental silos. They may deal with the same customers and not follow them through their entire journey. This leads to missed opportunities in reaching out to them at the right time with the right products to upsell, resell or provide better CX. Data synchronisation across channels, would solve that problem.”

Integrating Genesys and Adobe Experience Platform will give organisations the capability to provide contact centre agents with real-time customer data and profiles from a single point to provide an personalised experience. The platform is powered by Genesys Predictive Engagement that uses AI to provide more intelligence based on past interactions to drive effective, data-driven conversations. In addition to this, the partnership also enables businesses and marketing departments to customise campaigns and extend their digital and voice capabilities for optimal conversions. William says, “The ability to use AI to understand customer intent, behaviour and patterns is critical as it will allow brands to re-look at how to design the customer journey. When you keep using the same and outdated profile, it will be hard to have discussions around intent, customer interest and assess how customer priorities have changed. Accurate and automate data profiling will lead to more targeted and accurate marketing campaigns.”

Genesys Deepening Industry Partnerships

Genesys is re-shaping its strategy on Contact Centre as a Service (CCaaS) offerings through partnerships and working on its vision of providing Experience as a Service to its global clients. The need for CCaaS has been accelerated by the pandemic. Last month Genesys signed a five year deal with Infosys to develop and deploy cloud CX and contact centre solutions.

Earlier this year, Genesys partnered with MAXIMUS, a US Government services provider to set up the MAXIMUS Genesys Engagement Platform, an integrated, cloud-based omnichannel contact centre solution driven by the government requirement for public sector organisations to provide seamless customer experiences similar to those offered in the private sector.

The company has also partnered with various other industry leaders like Microsoft, Google Cloud, and Zoom to roll out cloud-based innovations to benefit customers.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

There has been a heightened interest in the cloud in EMEA in recent times, triggered by several regional and country level announcements.

The European Union (EU) founded the GAIA-X Foundation to build a unified system of cloud and data services to be protected by EU Laws – including GDPR, the free flow of non-personal data regulation and the Cybersecurity Act. France and Germany kicked off the GAIA-X cloud project last year and the system is open for participation to national and European initiatives for exchange of data across industries and services such as AI, IoT and data analytics. GAIA-X took another step towards becoming a real option for European organisations with the establishment as a legal entity in June. Founding members of GAIA-X include Atos, Bosch, BMW, Deutsche Telekom, EDF, German Edge Cloud, Orange, OVHcloud, SAP, and Siemens. Non-European providers, such as AWS, Microsoft, Google, and IBM will also have the opportunity to join GAIA-X. The UK Crown Commercial Service (CCS) has also been entering into agreements with public cloud platform providers to encourage increased cloud adoption in cash-strapped public sector organisations. It is a good time to evaluate organisations’ perception on cloud and their adoption patterns.

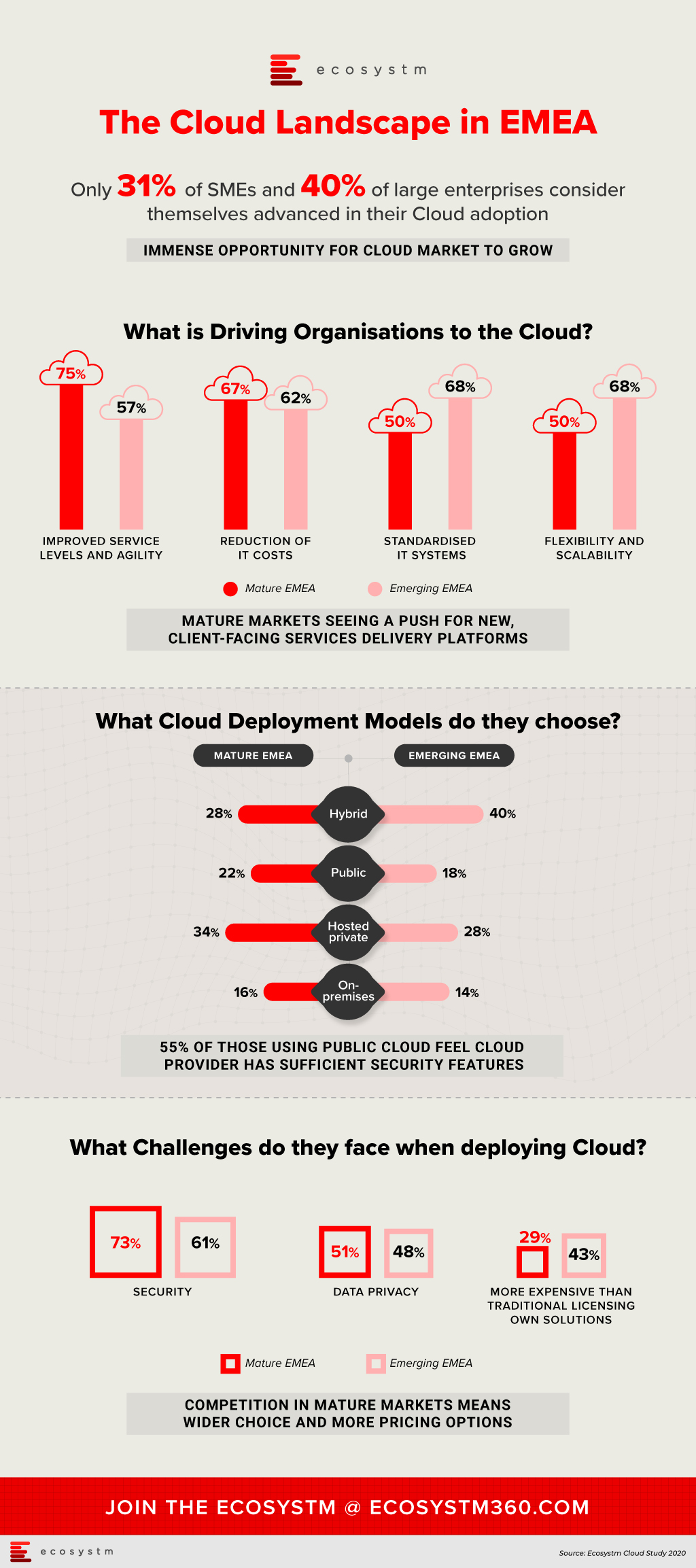

Ecosystm research finds that while most organisations have migrated at least some simple workloads to the cloud, the sophistication of these systems ranges from SaaS deployed as shadow IT, all the way up to cloud-native applications that are core to a digital business strategy. When asked about the maturity of their cloud deployments, 36% of organisations in EMEA consider themselves advanced, leaving the remaining 64% with more basic environments. These figures vary by business size with only 31% of SMEs considering their deployments advanced, rising to 40% for large enterprises.

Cloud technology providers should segment the market according to the maturity of their client’s systems. Those in the early stages of modernising their infrastructure will be seeking different benefits and will have different concerns than those already using cloud to underpin their digital transformation.

In the mature economies in the region, 75% of those with advanced deployments, considered improved service levels and agility as a key benefit of cloud. These organisations have moved beyond simply replacing legacy systems with cloud infrastructure and now look to the IT department to provide a platform on which new, client-facing services can be delivered. In the emerging economies, the most-reported benefits of cloud are flexibility and scalability, and standardised systems, both at 68% of respondents. These could be viewed as benefits expected from organisations not as far along in the cloud journey. The benefit of reduced IT costs was important in both mature EMEA (67%) and emerging EMEA (62%).

Looking at those who consider their cloud deployments as still basic, security is the leading challenge to greater adoption and by a large margin. Of those respondents in mature EMEA, 73% cited security as a key challenge, more than 20 percentage points higher than the next greatest difficulty. In emerging EMEA, a similar trend was evident, with 61% of respondents considering security as a key challenge. Moreover, data privacy is the second-most significant concern for those who do not consider their cloud deployments advanced. This was visible in both mature EMEA (51%) and emerging EMEA (48%). As organisations look to shift more critical workloads to the cloud, they will be increasing their attack surfaces and at the same time will face greater consequences if a breach does occur.

Services providers targeting organisations with less developed cloud environments should include security early in the conversation to push them along to the next stage of maturity.

The challenge that varied most according to market maturity and business size was the concern that cloud-based services were more expensive that traditional licencing or in-house solutions. Only 29% of respondents with basic cloud deployments in the mature economies, held this view, while in emerging economies the figure rose to 43%. Competition in those mature markets has in some cases put pressure on prices or at least resulted in wider choice. While 29% of SME respondents considered cost a key challenge, 41% of large enterprises did. Migrating larger, more complex environments to cloud will be viewed as more costly than the status quo due to organisational inertia.

The perception that cloud can be more costly, provides an opportunity for cloud management including expense optimisation services.

Organisations looking to move from a basic cloud environment to one that adopts a cloud-first model should begin with a maturity assessment. Understand what your systems will look like at the next stage, what the benefits will be, and what are the risks. More importantly, decide on the long-term business goal that you are trying to achieve, particularly how IT can be a critical player in the organisation’s digital strategy.

Note: Mature economies – France, Germany and the UK/ Emerging economies – Middle Eastern countries, Russia and South AfricaIdentify emerging cloud computing trends that can help you drive digital business decision making, vendor and technology platform selection and investment strategies.Gain access to more insights from the Ecosystm Cloud Study.

Last year Microsoft announced it was developing a new version of Flight Simulator which caught many of us by surprise. Flight Simulator? Really? The last launch of a new version of the game was in 2006 – 14 years ago, now!! How does something come back after all these years?

Now that it has launched about a week ago, the initial feedback has been extremely positive and it appears that Microsoft has a winner here. An analysis even claims that it will spur $2.6 billion in hardware sales of PCs, game accessories and the like!

I wanted to unpeel the onion a bit to take a closer look at what is going on and discovered a world of interesting developments around this product.

My first thoughts on hearing the announcement was that Microsoft, who has been steadily losing the battle of consoles to Sony’s PlayStation platform, was reviving this old favourite to resuscitate its drooping share.

Not a bad move. Flight Simulator has a core of die-hard fans – it even boasts of professional pilots who play the game as relaxation. It has a long history and a captive fan community. But it is old. That loyal community is not part of the demographic that a gaming company would normally look at today.

The other interesting aspect to consider is the COVID-19 situation this year. Obviously, Microsoft did not know this at the time they embarked on this project but the pandemic has turned everything on its head – hardware sales are through the roof – including accessories, at a time when people have been homebound and looking for entertainment within the four walls of one’s abode. The Ecosystm Digital Priorities in the New Normal study finds that 76% of organisations increased their hardware investments when the crisis hit – and 67% of organisations expect their hardware spending to go up in 2020-21. And that is only on the enterprise side of things. On the consumer side, at this point joysticks are in short supply – a trend that seems to have been accelerated by the Microsoft launch last week, interestingly – and so are PCs. The PC vendors are all enjoying a bumper year of growth. This is an ideal time to launch a really cool new version of the game.

Microsoft’s Bigger Game

The reality however is that while Flight Simulator will add to the revenue and also give Xbox One a fillip, Microsoft is probably after a much bigger “game” (excuse the pun!). The company has called its ‘Xbox Game Pass’ the Netflix of the gaming market. With multiple cloud-based gaming platforms having been launched – many with subscription services – the battle is on to decide the winners in a relatively new space. To this end, Microsoft has announced an intention to make Game Pass available across different devices – XBox console, PCs, tablets, phones. Having a title like Flight Simulator available through Game Pass, will act as a key hook to get customers to sign up for the subscription.

The new Flight Simulator version has been developed using AI and real-world imagery brought in with data from Bing Maps. With the newly added realistic scenery, it also seems like a great fit for use with the HoloLens Virtual Reality headsets. In one shot Microsoft is showcasing their lead in areas of technology which are likely to prove attractive to developers in a big way. I believe that this is a way for them to entice more developers on to Azure and to Microsoft cloud to develop their games – “AI SDKs anyone? Virtual Reality tools anyone?”

What seems at first glance like the launch of a new “future is here” version of a great game will turn out to be a possible big swing at multiple targets by Microsoft – at leadership in gaming with Game Pass; at reviving Xbox fortunes; at leadership in game development platforms, with Azure packing AI services, Bing Maps, AR/VR tools, among other technologies to move more development on to the Microsoft cloud. In the process Microsoft launched a highly enjoyable game and got closer to their ultimate aim to indeed become the Netflix of gaming.

Great move Microsoft! Tip: This could also give them a foothold in the virtual travel and virtual vacations market! That would be a hot seller in these times.