The emergence of COVID-19 last year caused a rapid shift towards work and study from home, and a pickup in eCommerce and social media usage. Tech companies running large data centre-based “webscale” networks have eagerly exploited these changes. Already flush with cash, the webscalers invested aggressively in expanding their networks, in an effort to blanket the globe with rapid, responsive connectivity. Capital investments have soared. For the webscale sector, spending on data centres and related network technology accounts for over 40% of the total CapEx.

Here are the 3 key emerging trends in the data centre market:

#1 Top cloud providers drive webscale investment but are not alone

The webscale sector’s big cloud providers have accounted for much of the recent CapEx surge. AWS, Google, and Microsoft have been building larger facilities, expanding existing campuses and clusters, and broadening their cloud region footprint into smaller markets. These three account for just under 60% of global webscale tech CapEx over the last four quarters. Alibaba and Tencent have been reinforcing their footprints in China and expanding overseas, usually with partners. Numerous smaller cloud providers – notably Oracle and IBM – are also expanding their cloud services offerings and coverage.

Facebook and Apple, while they don’t provide cloud services, also continue to invest aggressively in networks to support large volumes of customer traffic. If we look at Facebook, the reason becomes clear: as of early 2021, they needed to support 65 billion WhatsApp messages per day, over 2 billion minutes of voice and video calls per day, and on a monthly basis their Messenger platform carries 81 billion messages.

The facilities these webscale players are building can be immense. For instance, Microsoft was scheduled to start construction this month on two new data centres in Des Moines Iowa, each of which costs over USD 1 billion and measures over 167 thousand square metres. And Microsoft is not alone in building these large facilities.

#2 Building it all alone is not an option for even the biggest players

The largest webscalers – Google, AWS, Facebook and Microsoft – clearly prefer to design and operate their own facilities. Each of them spends heavily on both external procurement and internal design for the technology that goes into their data centres. Custom silicon and the highest speed, most advanced optical interconnect solutions are key. As utility costs are a huge element of running a data centre, webscalers also seek out the lowest cost (and, increasingly, greenest) power solutions, often investing in new power sources directly. Webscalers aim to deploy facilities that are on the bleeding edge of technology. Nonetheless, in order to reach the far corners of the earth, they have to also rely on other providers’ network infrastructure. Most importantly, this means renting out space in data centres owned by carrier-neutral network operators (CNNOs) in which to install their gear.

The Big 4 webscalers do this as little as possible. For many smaller webscalers though, piggybacking on other networks is the norm. Of course, they want some of their own data centres – usually the largest ones closest to their main concentrations of customers and traffic generators. But leasing space – and functionalities like cloud on-ramps – in third-party facilities helps enormously with time to market.

Oracle is a case in point. They have expanded their cloud services business dramatically in the last few years and attracted some marquee names to their client list, including Zoom, FedEx and Cisco. To ramp up, Oracle reported a rise in CapEx, growing to USD 2.1 billion in the 12 months ended June 2021, which represents a 31% increase from the previous year. However, when compared to Microsoft’s spending this appears modest. Microsoft reported having spent USD 20.6 billion in the 12 months ended June 2021 – a 33% increase over the previous year – to help drive the growth of their Azure cloud service.

One reason behind Oracle’s more modest spending is how heavily the company has relied on colocation partners for their cloud buildouts. Oracle partners with Equinix, Digital Realty, and other providers of neutral data centre space to speed their cloud time to market. Oracle rents space in 29 Digital Realty locations, for instance, and while Equinix doesn’t quantify its partnership with Oracle, Oracle’s cloud regions across the globe access the Oracle Cloud Infrastructure (OCI) via the Equinix Cloud Exchange Fabric. Oracle also works with telecom providers; their Dubai cloud region, launched in October 2020, is hosted out of an Etisalat owned data centre.

#3 Carrier-neutral data centre investment is surging in concert with webscale/cloud growth

As the webscale sector has raced to expand over the last 2 years, companies that specialise in carrier-neutral data centres have benefited. Industry sources estimate that as much as 50% or more of the cloud sector’s total data centre footprint is actually in these third-party data centres. That is unlikely to change, especially as some CNNOs are explicitly aiming to build out their networks in areas where webscalers have less incentive to devote resources. It’s not just about the webscalers’ need for space; the need for highly responsive, low latency networks is also key, and interconnection closer to the end-user is a driver.

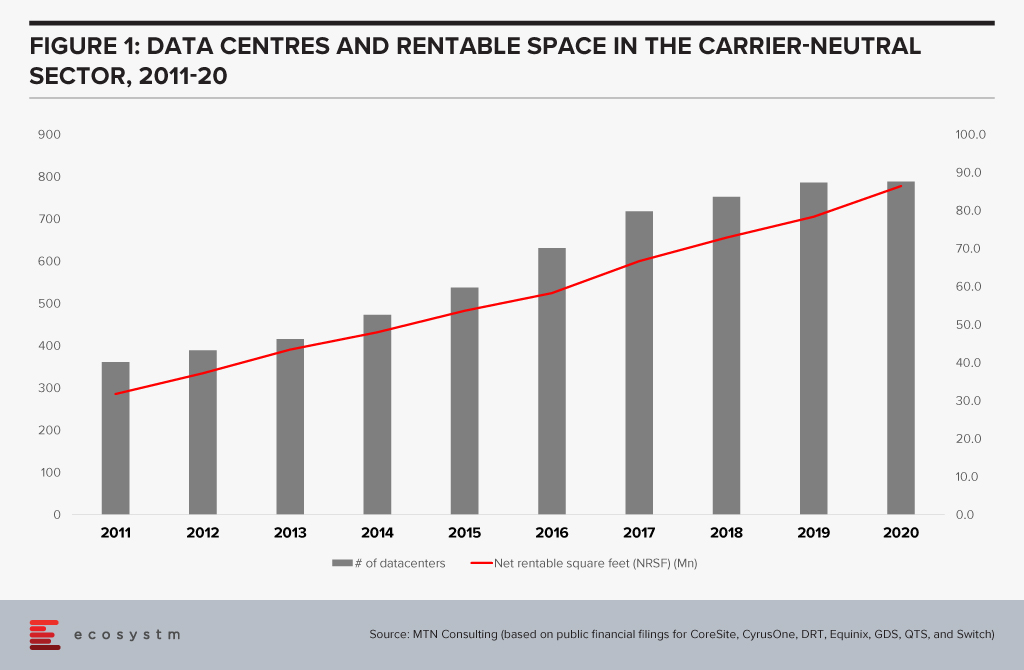

Looking at the biggest publicly traded carrier-neutral providers in the data centre sector shows that their capacity has expanded significantly in the last few years (Figure 1)

By my estimation, for the first 6 months of 2021, CapEx reported publicly for these CNNOs increased 18% against 1H20, to an estimated USD 4.1 Billion. Beyond the big public names, private equity investment is blossoming in the data centre market, in part aimed at capturing some of the demand growth generated by webscalers. Examples include Blackstone’s acquisition of QTS Realty Trust, Goldman Sachs setting up a data centre-focused venture called Global Compute Infrastructure; and Macquarie Capital’s strategic partnership with Prime Data Centers.

Some of this new investment target core facilities in the usual high-traffic clusters, but some also target smaller country markets (e.g. STT’s new Bangkok-based data centre), and the network edge (e.g. EdgeConneX, a portfolio company of private equity fund EQT Infrastructure).

EdgeConneX is a good example of the flexibility required by the market. They build smaller size facilities and deploy infrastructure closer to the edge of the network, including a PoP in Boston’s Prudential Tower. The company offers data centre solutions “ranging from 40kW to 40MW or more.” They have built over 40 data centres in recent years, including both edge data centres and a number of regional and hyperscale facilities across North America, Europe, and South America. Notably, EdgeConneX recently created a joint venture with India’s property group Adani – AdaniConneX – which looks to leverage India’s status of being the current hotspot for carrier-neutral data centre investment.

As enterprises across many vertical markets continue to adopt cloud services, and their requirements grow more stringent, the investment climate for new data centre capacity is likely to remain strong. Webscale providers will provide much of this capacity, but carrier-neutral specialists have an important role to play.

Why do we use AI? The goal of a business in adding intelligence is to enhance business decision-making, and growing revenue and profit within the framework of its business model.

The problem many organisations face is that they understand their own core competence in their own industry, but they do not understand how to tweak and enhance business processes to make the business run better. For example, AI can help transform the way companies run their production lines, enabling greater efficiency by enhancing human capabilities, providing real-time insights, and facilitating design and product innovation. But first, one has to be able to understand and digest the data within the organisation that would allow that to happen.

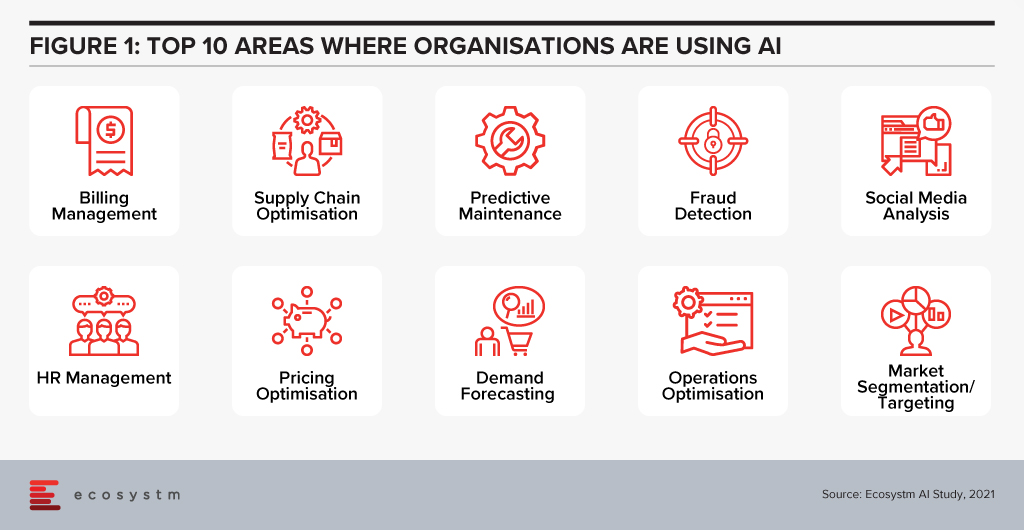

Ecosystm research shows that AI adoption crosses the gambit of business processes (Figure 1), but not all firms are process optimised to achieve those goals internally.

The initial landscape for AI services primarily focused on tech companies building AI products into their own solutions to power their own services. So, the likes of Amazon, Google and Apple were investing in people and processes for their own enhancements.

As the benefits of AI are more relevant in a post-pandemic world with staff and resource shortages, non-tech firms are becoming interested in applying those advantages to their own business processes.

AI for Decisions

Recent start-up ventures in AI are focusing on non-tech companies and offering services to get them to use AI within their own business models. Peak AI says that their technology can help enterprises that work with physical products to make better, AI-based evaluations and decisions, and has recently closed a funding round of USD 21 million.

The relevance of this is around the terminology that Peak AI has introduced. They call what they offer “Decision Intelligence” and are crafting a market space around it. Peak’s basic premise was to build AI not as a business goal for itself but as a business service aided by a solution and limited to particular types of added value. The goal of Peak AI is to identify where Decision Intelligence can add value, and help the company build a business case that is both achievable and commercially viable.

For example, UK hard landscaping manufacturer Marshalls worked with Peak AI to streamline their bid process with contractors. This allows customers to get the answers they need in terms of bid decisions and quotes quickly and efficiently, significantly speeding up the sales cycle.

AI-as-a-Service is not a new concept. Canadian start-up Element AI tried to create an AI services business for non-tech companies to use as they might these days use consulting services. It never quite got there, though, and was acquired by ServiceNow last year. Peak AI is looking at specific elements such as sales, planning and supply chain for physical products in how decisions are made and where adding some level of automation in the decision is beneficial. The Peak AI solution, CODI (Connected Decision Intelligence) sits as a layer of intelligence that between the other systems, ingesting the data and aiding in its utilisation.

The added tool to create a data-ingestion layer for business decision-making is quite a trend right now. For example, IBM’s Causal Inference 360 Toolkit offers access to multiple tools that can move the decision-making processes from “best guess” to concrete answers based on data, aiding data scientists to apply and understand causal inference in their models.

Implications on Business Processes

The bigger problem is not the volume of data, but the interpretation of it.

Data warehouses and other ways of gathering data to a central or cloud-based location to digest is also not new. The real challenge lies with the interpretation of what the data means and what decisions can be fine-tuned with this data. This implies that data modelling and process engineers need to be involved. Not every company has thought through the possible options for their processes, nor are they necessarily ready to implement these new processes both in terms of resources and priorities. This also requires data harmonisation rules, consistent data quality and managed data operations.

Given the increasing flow of data in most organisations, external service providers for AI solution layers embedded in the infrastructure as data filters could be helpful in making sense of what exists. And they can perhaps suggest how the processes themselves can be readjusted to match the growth possibilities of the business itself. This is likely a great footprint for the likes of Accenture, KPMG and others as process wranglers.

Over the past year we have seen global systems integrators (SIs) – Accenture, IBM, Deloitte, Fujitsu, Capgemini and others – make many acquisitions, particularly in the public cloud, AI, cybersecurity and data space. Much of the growth in spending over the past few years have been driven by these categories: in 2020 if a software company was purely or mainly SaaS, they are likely to have witnessed strong growth. If they were on-premises software, they were lucky not to see declining revenues. While it is normal for the larger SIs and consultants to play catch up through acquisition, it is becoming harder for them to gain traction in these new areas.

Technology Shifts Drive Market Fragmentation

With every technology-driven business change new SIs, consultants, and managed services providers emerge. It happened with the move to big ERP systems, the move towards Business Intelligence, the emergence of SaaS etc. But I think we are now seeing something different. More than just the smaller players going after opportunities earlier, I believe we are seeing a changing buying behaviour from tech and business buyers – a greater willingness for larger enterprises to give their most important, business-critical strategies and implementations to smaller, less established players.

And I am not suggesting that the larger SIs are not performing well. Many are growing at 10-25% YoY – but at the same time, many are also growing at a slower rate than the markets they play in. The Ecosystm RNx for global IT services and consulting providers shows that the global providers continue to power ahead. But they need to adapt to changing market conditions.

New Cloud/AI Partners Winning Consulting and Implementation Deals

We have seen a new community of partners emerge with tech changes, such as the hyperscale cloud platforms and AI/machine learning tools. Traditionally, these companies would be good at one thing – and would learn slowly. For example, in the SAP ERP growth period, the projects were large and long. A single, mid-sized SI might only be working with 2-3 clients at a time. Therefore, the IP that they collected was limited – and they would find themselves with focused or niche skills. The large SIs had done many large, long projects across the globe and had much best-practice IP to call upon, giving them a broader and deeper knowledge of the technology and industries. Smaller providers had limited IP and industry experience.

But in this cloud and AI era, specialist providers work on hundreds of smaller projects with dozens or hundreds of clients. With the technology constantly evolving, the skills are constantly improving. While the global SIs are working on many cloud and AI engagements, they are often part of longer engagements – giving the consultants and tech teams less exposure to the new and evolving cloud platforms.

In a world where technology is changing at pace, the traditional global SI practice of “learning from peers across the globe” doesn’t happen at the pace the market requires. By the time your peers in the business have completed a project, documented it, and shared learnings, the market has moved on and technology has changed. Today it is easier and faster to learn directly from the tech vendors and cloud platform providers and their training partners. The network effect of knowledge in a team on the opposite side of the globe for a global SI is less valuable to clients. Often the smaller and mid-sized SIs have a deeper, broader knowledge of the technology platforms and toolsets than the larger providers – giving them a competitive advantage. For example, if you want the actual experience of moving SAP to Azure, or Oracle to AWS – you’ll often find the smaller providers have more experience. And this continues to play out. In many markets in the world, the top 5-10 SIs for cloud, AI and cybersecurity has a high proportion of local specialist providers.

Tech Buyers No Longer Look for Culturally Aligned Partners

Tech buyers themselves are changing too. In years gone by, the smaller tech partners would tell us that they felt they were included in bids to drive down the price from the global SIs. But today the story is different. Smaller partners are admired for their agility and innovation. Large enterprise customers will choose small providers because the small SI is NOT like them. In the past, they chose the global SI because they were just like them!

Because of this, the large SIs are mopping up their smaller competitors across the globe. Accenture has acquired 40 companies in the past 10-11 months, IBM has acquired over 10, Atos and Cognizant have also acquired many companies in the past 12 months. They are doing this for the skills as much as for the clients, along with getting a foothold in a new market or strengthening their position in geography. The challenge will be to hang on to the clients, culture, and the IP of the acquired business. Often these smaller competitors are growing at a significant pace – and the biggest risk is that the acquiring company takes their eyes off the prize.

Global SIs Still Own the Industry Play

Despite these challenges, one of the areas that the global SIs will continue to dominate is the industry play. I have discussed how as technologies mature, industry plays become more relevant.

Smaller and mid-sized SIs and consultants find it hard to create deep pools of expertise across multiple industries. While some may have a deep focus on a single or two industries, only the large players have broad and deep geography and industry experience. This puts many of the acquisitions into context – the global SIs will take these acquisitions and use that deep and broad technical and business knowledge and add it to their industry knowledge to create a more compelling offering.

Their challenge will still be one of cultural alignment. As discussed, many companies seek out tech partners who represent what they want to be, not what they are. The ability for the Global SIs to retain the culture, agility and innovation of the acquired business will determine their ability to continue to see similar or improved levels of growth from the acquired business. Using their IP in the context of industries will be the key to their ongoing success.

The Media & Entertainment industry has enjoyed a boom over the last year – and the Sports industry has a key role to play in that. As sporting events resume this year, the conversations are increasingly about what technology can achieve. How can technology keep players and fans safe? How to leverage technology to give the virtual audience a real-life experience of their favourite sporting event? Which are the technologies that should be leveraged to maintain audience engagement?

Here are some examples of how immersive technologies are delighting fans globally; how technology providers are focusing on creating solutions to capture a larger share of this growing market; and the growth of innovative, tech-driven ecosystems in the industry.

The Ecosystm RNx – Top 10 Global IT Services & Consulting Company Rankings is based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an End User, it is likely that you are looking to partner with the right services provider who can guide your transformation journey. This vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience, integration capabilities and strategy.

If you are an IT Services & Consulting Company, you operate in a competitive world with several global and regional players – this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.