The last year has really pushed the Education sector into transforming both its teaching and learning practices. The urgency of the situation accelerated the use of networking to extend the reach and range of educational opportunities for remote learning.

Education technology has rushed to embrace opportunities to facilitate a new normal for Education. This new normal must enable and support education access, experiences, and outcomes as well as aid in developing strong relationships within Education ecosystems.

Education technology, commonly known as EdTech, focuses on leveraging emerging technologies like cloud and AI to deliver interactive and multimedia coursework over online platforms. This also requires a state-of-the-art network to support. 5G provides instantaneous access to cloud services. Use of 5G – as well as network function virtualisation (NFV), network slicing, and multi-access edge computing (MEC) – has the capability of delivering significant performance benefits across these emerging educational applications and use cases.

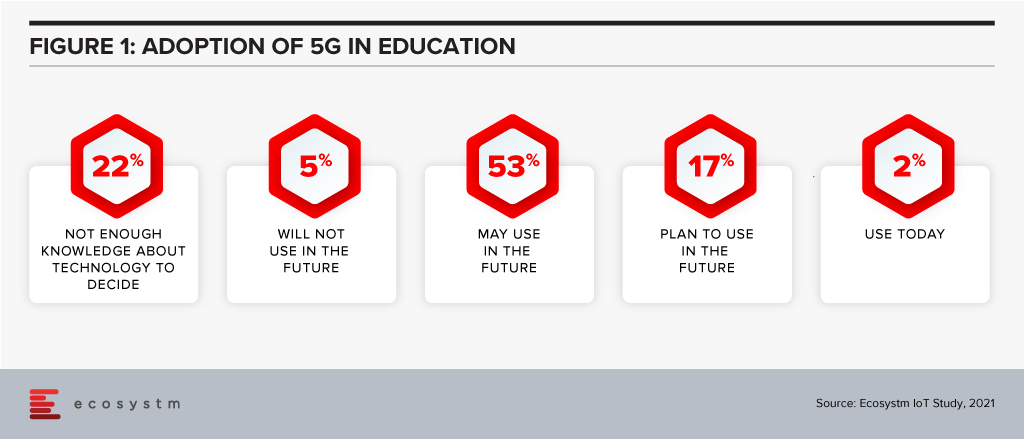

At present, many educational institutions are aware of the possibilities, but are not active users of 5G network infrastructure (Figure 1).

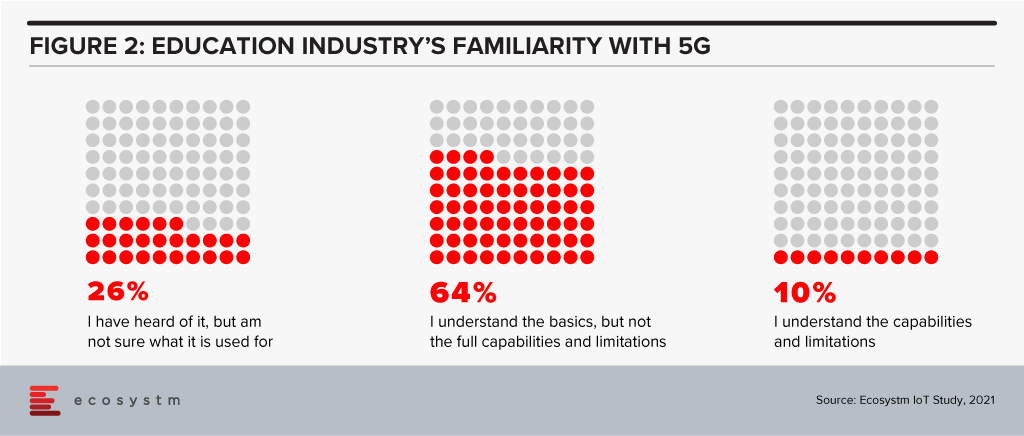

Educational institutions plan to do some near-term investments but are not clear in what areas to apply the enhanced capabilities (Figure 2).

Role of the Network in Adaptive Learning

In their recent whitepaper, network provider Ciena talks about “the concept of an adaptive learning strategy – a technology-based teaching method that replaces the traditional one-size-fits-all teaching style with one that is more personalised to individual students. This approach leverages next-generation learning technologies to analyse a student’s performance and reactions to digital content in real-time, and modifies the lesson based on that data.”

To create an adaptive learning strategy that can be individualised, these learners need to be enabled by technology to be immersed in a learning experience, complete with multimedia and access to a knowledge base for information. And this is where a solid 5G network implementation can create access and bandwidth to the resources required.

Example of 5G and Immersive Learning

An example of adaptive learning where the technology not only supports but challenges the learner can be found in a BT-led new immersive classroom developed within the Muirfield Centre in Cumbernauld, North Lanarkshire, using innovative technology to transform a classroom into an engaging and digital learning environment.

Pupils at Carbrain Primary School, Cumbernauld, were the first to dive into the new experience with an underwater lesson about the ocean. The 360-degree room creates a digital projection that uses all four classroom walls and the ceiling to bring the real-world into an immersive experience for students. The concept aims to push beyond traditional methods of teaching to create an inclusive digital experience that helps explain abstract and challenging concepts through a 3D model. It will also have the potential to support students with learning difficulties in developing imagination, creative and critical thinking, and problem-solving skills. BT has deployed its 5G Rapid Site solution to support 5G innovation and digital transformation of UK’s Education sector. The solution is made possible through the EE 5G network which brings ultrafast speeds and enhanced reliability to classrooms.

Conclusion

5G is expected to provide network improvement in the areas of latency, energy efficiency, the accuracy of terminal location, reliability, and availability – therefore creating the ability to better leverage cloud capacity.

With the greater bandwidth that 5G provides, learners and instructors, can connect virtually from any location with minimal disruption with more devices than on previous networks. This allows students to enjoy a rich learning experience and not be disadvantaged by their location for remote learning, or by the uncertainty of educational access. This also provides more possibilities of exploration and discovery beyond the physical confines of the classroom and puts those resources in the hands of eager learners.

As educational institutions reopen, institutions are looking at ways to redesign the education experience. Connected devices are helping schools and universities expand the boundaries of education. Explore what the IoT-enabled future of education would look like

Last week AT&T announced a partnership with Fortinet to expand their managed security services portfolio. This partnership provides global managed Secure Access Service Edge (SASE) solutions at scale. The solution uses Fortinet’s SASE stack which unifies software-defined wide-area network (SD-WAN) and network security capabilities into AT&T managed cybersecurity framework. Additionally, AT&T SASE and Fortinet will integrate with AT&T Alien Labs Threat Intelligence platform, a threat intelligence unit to enhance detection and response. AT&T has plans to update its managed SASE service during the year and will continue to bring more options.

Talking about the AT&T-Fortinet partnership, Ecosystm Principal Advisor, Ashok Kumar says, “This move continues the trend of the convergence of networking and security solutions. AT&T is positioning themselves well with their integrated offer of network and security services to address the needs of global enterprises.”

Convergence of Network & Security

AT&T’s improved global managed security service includes features such as secure web gateway, firewall-as-a service, cloud access security broker (CASB) and zero-trust access, which provides security teams and analysts with unified capabilities across the cloud, networks and endpoints. The solution aims to enable enterprises to create a more resilient network bringing the core capabilities of the two companies that will reduce operational costs and deliver a unified offering.

Last year AT&T also partnered with Cisco to expand its SD-WAN solution and to support AT&T Managed Services using Cisco’s vManage controller through a single management interface. Over the past years multiple vendors including Fortinet have developed comprehensive SASE solution capabilities through partnerships or acquisitions to provide a unified offering. Last year Fortinet acquired Opaq, a SASE cloud provider to bolster their security capabilities through OPAQ’s patented Zero Trust Network Access (ZTNA) cloud solution and to strengthen SD-WAN, security and edge package.

The Push Towards Flexible Networking

Kumar says, “The pandemic has created a higher demand and value for secure networking services. Enterprises experienced greater number of phishing and malware attacks last year with the sudden increase in work-from-home users. The big question enterprises need to ask themselves is whether legacy networks can support their evolving business priorities.”

“As global economies look to recover, securing remote users working from anywhere, with full mobility, will be a high priority for all enterprises. Enterprises need to evaluate mobile SASE services that provide frictionless identity management with seamless user experiences, and be compatible with the growing adoption of 5G services in 2021 and beyond.”

The Top 5 Telecommunications & Mobility Trends that will dominate the telecom industry to watch out for in 2021. Signup for Free to download the report.

Public sector organisations are looking at 2021 as the year where they either hobble back to normalcy or implement their successful pilots (that were honed under tremendous pressure). Ecosystm research finds that 60% of government agencies are looking at 2021 as the year they make a recovery to normal – or the normal that finally emerges. The path to recovery will be technology-driven, and this time they will look at scalability and data-driven intelligence.

Ecosystm Advisors Alan Hesketh, Mike Zamora and Sash Mukherjee present the top 5 Ecosystm predictions for Cities of the Future in 2021. This is a summary of our Cities of the Future predictions – the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Cities of the Future Trends for 2021

#1 Cities Will Re-start Their Transformation Journey by Taking Stock

In 2021 the first thing that cities will do is introspect and reassess. There have been a lot of abrupt policy shifts, people changes, and technology deployments. Most have been ad-hoc, without the benefit of strategy planning, but many of the services that cities provide have been transformed completely. Government agencies in cities have seen rapid tech adoption, changes in their business processes and in the mindset of how their employees – many who were at the frontline of the crisis – provide citizen services.

Technology investments, in most cases, took on an unexpected trajectory and agencies will find that they have digressed from their technology and transformation roadmap. This also provides an opportunity, as many solutions would have gone through an initial ‘proof-of-concept’ without the formal rigours and protocols. Many of these will be adopted for longer term applications. In 2021, they will retain the same technology priorities as 2020, but consolidate and strengthen on their spend.

#2 Cities Will be Instrumented Using Intelligent Edge Devices

The capabilities of edge devices continue to increase dramatically, while costs decline. This reduces the barriers to entry for cities to collect and analyse significantly more data about the city and its people. Edge devices move computational power and data storage as close to the point of usage as possible to provide good performance. Devices range from battery powered IoT devices for data collection through to devices such as smart CCTV cameras with embedded pattern recognition software.

Cities will develop many use cases for intelligent edge devices. These uses will range from enhancing old assets using newer approaches to data collection – through to accelerating the speed and quality of the build of a new asset. The move to data-driven maintenance and decision-making will improve outcomes.

#3 COVID-19 Will Impact City Design

The world has received a powerful reminder of the vulnerability of densely populated cities, and the importance of planning and regulating public health. COVID-19 will continue to have an impact on city design in 2021.

A critical activity in controlling the pandemic in this environment is the test-and-trace capabilities of the local public health authorities. Technology to provide automated, accurate, contact tracing to replace manual efforts is now available. Scanning of QR codes at locations visited is proving to be the most widely adopted approach. The willingness of citizens to track their travels will be a crucial aid in managing the spread of COVID-19.

Early detection of new disease outbreaks, or other high-risk environmental events, is essential to minimise harm. Intelligent edge devices that detect the presence of viruses will become crucial tools in a city’s defence.

Intelligent edge devices will also play a role in managing building ventilation. Well-ventilated spaces are an important factor in controlling virus transmission. But a limited number of buildings have ventilation systems that are capable of meeting those requirements. Property owners will begin to refit their facilities to provide better air movement.

#4 Technology Vendors Will Emerge as the Conductors of Cities of the Future

The built environment comprises not only of the physical building, but also the space around the buildings and building operations. The real estate developer/investor owns the building – the urban fabric, the relationship of buildings to each other, the common space and the common services provided to the city, is owned by the City. The question is who will coordinate the players, e.g. business, citizens, government and the built environment. Ideally the government should be the conductor. However, they may not have sufficient experience or knowledge to properly implement this role. This means a capable and knowledgeable neutral consultant will at least initially fill this role. There is an opportunity for a technology vendor to fill that consulting role and impact the city fabric. This enhanced city environment will be requested by the Citizen, driven by the City, and guided by Technology Vendors. 2021 will see leading technology vendors working very closely with cities.

#5 Compliance Will be at the Core of Citizen Engagement Initiatives

Many Smart Cities have long focused on online services – over the last couple of years mobile apps have further improved citizen services. In 2020, the pandemic challenged government agencies to continue to provide services to citizens who were housebound and had become more digital savvy almost overnight. And many cities were able to scale up to fulfill citizen expectations.

However, in 2021 there will be a need to re-evaluate measures that were implemented this year – and one area that will be top priority for public sector agencies is compliance, security and privacy.

The key drivers for this renewed focus on security and privacy are:

- The need to temper the focus of ‘service delivery at any cost’ and further remind agencies and employees that security and privacy must comply with standard to allow the use of government data.

- The rise of cyberattacks that target not only essential infrastructure, but also individual citizens and small and medium enterprises (SMEs).

- The rise of app adoption by city agencies – many that have been developed by third parties. It will become essential to evaluate their compliance to security and privacy requirements.

As organisations stride towards digitalisation, re-evaluating their business continuity plans and defining how the Future of Work will look for them, cloud adoption is expected to surge. Almost all technologies being evaluated by organisations today have cloud as their pillar. Cloud will the key enabler for ease of doing business, real-time data access for productivity increase, and process automation.

Ecosystm Advisors Claus Mortensen, Darian Bird and Tim Sheedy present the top 5 Ecosystm predictions for Cloud Trends in 2021. This is a summary of our cloud predictions – the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Cloud Trends for 2021

- 2021 Will be All About SaaS

2020 was a breakout year for SaaS providers – and a tough one for a lot of on-premises software vendors. SaaS (or mainly SaaS) providers like Salesforce, Zoom, Microsoft had record growth and some of the best quarters in their history, while other mainly on-premises software providers have had poor quarters. SAP is even accelerating the transition to a 100% cloud-based business as their revenue suffers. The race to deploy SaaS tools and platforms is well and truly happening. Many of the usual ROI models and business cases have been abandoned as the need for agility – to drive business change at pace trumps most other business needs. Ecosystm data validates this

This trend will continue in 2021 – in fact, we expect it to accelerate. Most SaaS solutions (such as CRM, ERP, SCM, HRM etc.) are implemented by less than 30% of businesses today – which means the upside for the SaaS providers is huge.

- Hybrid Cloud Will Finally Become Mainstream

The sudden move to remote working in 2020 forced most organisations to increase their use and reliance on cloud-based applications. Employees have relied on collaborative tools such as Zoom, Microsoft Teams and WebEx to conduct virtual meetings, call centre workers had to respond to calls from home – most if not all relying on cloud-based apps and platforms. This trend is set to continue going forward. Ecosystm research finds that 44% of organisations will spend more on cloud-based collaboration tools in the next 6-12 months.

But the forced adoption of these tools has also prompted many – especially larger organisations – to worry about losing control of their IT resources, including worries related to security and compliance, cost, and reliability. As for the latter, both Microsoft Azure and Zoom experienced outages after the pandemic hit and this has made many organisations wary of relying too much on a single public cloud platform. Ecosystm therefore expects a sharp increase in focus on hybrid cloud platforms in 2021 as IT Teams seek to regain control of the apps and services their employees rely the most upon.

- Carrier Investment in 5G Will Give Edge Computing a Boost

The gap between the hype around edge computing and the actual capabilities it offers will narrow in 2021 as 5G networks are built out. One of the most promising methods of deploying edge computing involves carriers embedding cloud capacity in their own data centres connected to their 5G networks. This ensures data does not unnecessarily leave the network, reducing latency and preserving bandwidth. This combination of 5G and the Edge will be of particular benefit to applications that until now have faced a trade-off between mobility and connectivity. Over the last twelve months, the major hyperscalers announced their 5G edge computing offerings, and some of the major global telecom providers have served as test cases by partnering with at least one hyperscaler and will likely add more over the next year. Expect this ecosystem to expand greatly in 2021.

Cloud environments can benefit from pushing computing-heavy workloads to the Edge in much the same way as IoT and provides a great platform for managing the edge computing endpoints. The flipside of pushing containers to the Edge will be the increased complexity and the fact that the number of attack surfaces will increase. Containerisation must therefore be deployed with security at its core.

- Stateful Applications Will Move to the Cloud with Containers and Orchestration

As organisations seek to migrate workloads and applications between platforms in an increasingly hybrid cloud environment, the need for “lifting and shifting”, refactoring and partitioning applications will increase. These approaches all have their shortcomings, however. Lifting and shifting an application may limit its functionality now or in the future; refactoring may take too long or be too costly; and partitioning is often not feasible or possible. A better approach to this task is to modernise the applications to make use of application containers like Docker, Windows Server Containers, Linux VServer and so on, to enable a faster and more seamless way to migrate applications between platforms. We also see container orchestration environments like Kubernetes and containerised development and deployment platforms like IBM’s Cloud Paks.

How these technologies are used to deploy stateful applications in multicloud environments will evolve. A raft of container management platforms, based on Kubernetes, are being released to simplify what was once a complex DIY process. New entrants will look to challenge the cloud hyperscalers, virtualisation giants, and Kubernetes specialists. The emerging features that previously required cobbling together third-party tools, like service mesh, data fabric, and machine learning, will speed up containerisation of stateful core applications. The deployment of containers on bare metal rather than in virtualised environments will also gather pace. The most challenging task will be delivering containerised applications at the Edge, forcing developers and platform providers to create inventive solutions.

- Serverless will take us a step closer to NoOps

As the application lifecycle speeds up and the distinction between development and operations shrinks, the motivation to adopt serverless computing will grow in 2021. While NoOps, the concept that operations could become so automated that it fades into the background, is still a distant goal, serverless computing will make a stride in that direction by abstracting the application from the infrastructure. Having seen the agility benefits of a microservices architecture, many DevOps teams will experiment with breaking services down further into functions. Moreover, the pay-as-you-go model of serverless will appeal to OpEx driven organisations. Expect stories of bill shock, however, as were seen in the early days of cloud adoption. While AWS Lambda is currently considered the serverless industry standard, it is likely that in 2021, Microsoft, Google, and IBM will ramp up efforts in this space. Each of these providers will build out their offering in terms of languages supported, event triggers, consumption plans, machine learning/AI options, observability, and user experience.

AWS has been busy this year moving beyond its stronghold of public cloud to bring infrastructure closer to the enterprise and ultimately to where the end user needs computing most. The global availability of AWS Outposts, essentially AWS on prem, the launch of AWS Wavelength, edge computing embedded in 5G networks, and the extension of the AWS Snow Family of edge devices, have all combined to create a compelling hybrid cloud story. This evolution in AWS’ strategy has required a maturing of its partner ecosystem, building alliances with telcos, co-location providers, and integrators that are all still trying to cement their roles in the hybrid cloud space.

Outposts: The AWS Vision of Hybrid Could

Outposts launched late last year with availability extended to many mature countries in January 2020, in addition to India, Malaysia, New Zealand, Taiwan, Thailand, Israel, Brazil, and Mexico in June. The plug and play system delivers AWS compute and storage from the organisation’s own data centre with a rack that requires only power and network access. The system is managed with the same tools and APIs used in public AWS regions, providing a single hybrid cloud management console. Outposts is targeted primarily at the enterprise space, with the cheapest development and testing units coming in at $7-8k monthly or around $250-280k upfront, depending on the country. Other higher-end configurations include general purpose, compute optimised, graphics optimised, memory optimised, and storage optimised. Monthly installments attract a 10-15% premium over upfront payments.

The launch of hybrid cloud solutions by the major cloud providers and containerised services that allow workloads to be deployed in public and private environments will ensure enterprises are willing to continue their cloud journeys. Security concerns and data residency regulations have prevented many organisations from shifting sensitive workloads to the cloud. Moreover, as industries launch new customer-facing digital services or transform their manufacturing systems, latency will become a concern for some workloads. Hybrid cloud addresses each of these issues by employing either public or private resources depending on the data, location, or capacity needs.

AWS Outposts has two variants, namely Native AWS and VMware Cloud on AWS. Organisations already heavily invested in the AWS ecosystem will likely choose Native AWS and use Outposts as a means of migrating further workloads that require an on-prem environment over to a hybrid cloud environment. More traditional organisations, such as banks, may select the VMware Cloud on AWS variant as a means of retaining the same operational experience that they are accustomed to in their existing VMware environments today.

AWS will rely heavily on its network of enterprise partners for sales, management, and maintenance services for Outposts. AWS partners like Accenture, HCL, TCS, Deloitte, DXC, NTT Data, and Rackspace have all shifted in recent years to deliver the full stack from infrastructure to application services and now have a ready-made hybrid cloud platform to migrate on to. AWS is also in the process of recruiting co-location partners to serve Outposts from third-party data centres, providing another option that enterprises are familiar with. This will likely come as welcomed news for co-location providers that have been fighting uphill against AWS.

Wavelength: Embedding Cloud in 5G Networks

Another major announcement in AWS’s drive towards hybrid cloud and edge computing was the general availability of Wavelength in August. This service embeds AWS into the data centres of 5G network operators to reduce latency and bandwidth transmission. Data for applications residing in Wavelength Zones is not required to leave the 5G network. AWS is looking to attract mobile operators, who previously might have viewed it as a competitor while the public cloud space was more fragmented and open to telcos. These partnerships are another example of AWS expanding its ecosystem. Current Wavelength partners are Verizon, Vodafone Business, KDDI, and SK Telecom. With their own take on edge services, Microsoft has signed up the likes of Telstra and NTT Communications, while Google has enlisted AT&T and Telefónica. Edge computing in 5G networks will be the next battleground for cloud supremacy.

On a smaller scale, AWS has released new additions to its Snow Family of edge computing devices. AWS Snowcone is a compact, rugged computing device designed to process data on the network edge where cloud services may be insufficient. The processed data can then be uploaded to the cloud either through a network connection or by physically shipping the device to AWS. The convergence of IT and OT will drive the need for these edge devices in remote locations, such as mines and farms and in mobile environments for the healthcare and transportation industries.

Competitive Strategies

Openness will become a critical difference between how cloud platform providers approach hybrid cloud and edge computing. While AWS is certainly extending its ecosystem to include partners that it previously would have viewed as rivals, as the dominant player, it will be less compelled to open up to its largest competitors. If it can control the full system from ultraportable device, to $1M server rack, to cloud management console, it can potentially deliver a better experience for clients. Conversely, the likes of Microsoft, Google, and IBM, all need to be willing to provide whichever service the client desires, whether that is an end-to-end solution, management of a competitor’s cloud service, or an OEM’s hardware.

Last week, HPE announced that they will acquire Silver Peak – the wide area networks (WAN) specialist, including WAN optimisation and Software-Defined (SD-WAN) – in a deal worth USD 925 million. The move is in line with HPE’s Intelligent Edge strategy and their intention to provide a comprehensive edge-to-cloud networking solution.

HPE Building Intelligent Edge Capabilities

In 2018, HPE announced their intention to invest USD 4 billion over the next 4 years, to build an Intelligent Edge offering. This acquisition will give them the ability to combine the Aruba Edge Services platform with Silver Peak’s SD-WAN platform, to provide next-generation networking solutions.

In 2015, HPE acquired Aruba for USD 3 billion to strengthen capabilities on integrated and secure wireless technology and to support the access to cloud application, at a faster speed. Bringing together the innovation and technology capabilities of both units will accelerate HPE’s edge-to-cloud strategy to enhance distributed cloud models for application and data services for users.

Ecosystm Principal Advisor, Ashok Kumar says, “HPE leaped into the wireless local area networks (WLAN) space with the acquisition of a major enterprise Wi-Fi network vendor Aruba Networks, five years ago. With the acquisition of SD-WAN vendor Silver Peak last week, HPE extends enterprises’ reach with its Intelligent Edge portfolio. The synergy of Aruba and Silver Peak provides a fuller enterprise networking portfolio of solutions for HPE.”

The acquisition has been announced as markets are gearing towards recovery and organisations are opting for a more distributed working environments with remote employees. Kumar says, “The convergence area of networking and security at the enterprise edge is a high growth area that has accelerated due to the COVID-19 pandemic to address the remote worker’s needs.”

The current situation, compounded by the 5G rollouts in several global markets, is also forcing telecom operators to transform their business models. Telecom providers will now have to increasingly target B2B opportunities. Last month also saw HPE announce their Edge Orchestrator, a SaaS offering bringing lower latency, optimised bandwidth and improved security and privacy for telecom providers and their own enterprise customers to take advantage of 5G. Aruba Networks also rolled out a cloud native platform, Aruba ESP that has AIOps, Zero Trust network security and a unified infrastructure for data centres capabilities, to support remote operations.

“HPE’s success in this area will be dependent upon the tight integration of the two product line portfolios, and the channels of distribution, to effectively address the needs of enterprises at the edge with smarter solutions,” says Kumar.

The Growing Importance of SD-WAN

In the report, The Top 5 Telecommunications & Mobility Trends for 2020, Ecosystm had noted the growing significance of SD-WAN for enterprises, as they undertake Digital Transformation (DX) journeys and require more responsive and self-sustaining networks. The entire network infrastructure will have to be software-centric allowing for agility, scalability, and normalising costs with business growth. This has proved to be especially true in the wake of the current crisis.

“The network is a foundation on which a significant amount of Digital Transformation (DX) becomes possible, so as companies move through their DX journeys, often changing course, the network will need to adapt with them. AI, virtualisation and SD-WAN will bring increasing levels of flexibility as they lessen the need for specialised hardware, centralise control, and speed up configuration changes.

The availability of high-bandwidth, low latency networks coupled with SD-WAN will allow enterprises to shift away from thinking of their network as a physical space and start seeing it as a set of capabilities, taking work beyond a physical address. Equipment will be increasingly centralised in data centres (possibly on the Edge) to provide the ability to truly work anywhere.”

Download Report: The Top 5 Cloud Trends For 2020

The full findings and implications of the report ‘Ecosystm Predicts: The Top 5 Cloud Trends For 2020’ are available for download from the Ecosystm website. Signup for Free to download the report and gain insight into ‘the top 5 Cloud trends for 2020’, implications for tech buyers, implications for tech vendors, insights, and more resources.

Australia’s data centre market has grown exponentially, to a large part due to the Government’s strong policies around cloud adoption. This is in line with the vision of creating a Digital Economy by 2025. Australia’s Tech Future talks about technological changes in 4 key areas including building infrastructure and providing secure access to high-quality data. Availability of local data centres is key to building better infrastructure to support the Digital Economy.

Cloud adoption, especially in the small and medium enterprise (SME) sector is expected to continue to rise. The Ecosystm Business Pulse Study shows that only 16% of Australian organisations had not increased their cloud investments after the COVID-19 crisis and its impact on the economy.

Ecosystm Principal Advisor, Tim Sheedy says, “The current pandemic has highlighted the digital ‘haves and have nots’ in Australia. The NBN has helped to narrow the gap, but too many in rural and regional Australia continue to suffer the tyranny of distance. Businesses and government departments have been reluctant to relocate outside of the major cities due to the lack of internet and data centre infrastructure. Investing in data centres in rural and regional locations will not only help to close the digital divide but also remove a significant barrier that stops businesses from investing in and relocating to locations out of cities.”

Growing Australia’s Data Centre Footprint

This week, Australia’s Leading Edge Data Centres and Schneider Electric announced a AU$30 million project where Schneider Electric will provide Tier-3-designed prefabricated data centre modules for Leading Edge’s six locations in Australia. Each site will host 75 racks with 5kW power density to support computing operations and minimise data exchange delays. Ecosystm Principal Advisor, Darian Bird says, “The inaccessible nature of some sites makes them suitable for prefabricated data centres, which are plug-and-play containers that can be set up and maintained by a relatively small IT team. Standardisation in edge data centres and automation are key to remote management for anyone deploying distributed infrastructure.”

This announcement follows the news that Leading Edge has secured an investment of AU$20 million from Washington H. Soul Pattinson to construct 20 Tier-3 data centres across Australia. They have also received funding from the SparkLabs Cultiv8 2020 accelerator group. The funding will be used to build more than 20 Tier 3 data centres across regional Australia to provide faster internet speeds and direct cloud connectivity.

This will impact businesses that host mission-critical applications, and stricter uptime requirements, and is expected to benefit IoT, AgriTech and telecom industry applications.

Impact on Industry

Edge connectivity will create a seamless experience for the users to take advantage of faster computing with a local host, lower latency by taking connectivity to where operations reside, and data sovereignty by keeping data within the region, aiding in the development of Australia’s Digital Economy.

Sheedy sees this as an opportunity for primary industries. “One of the real challenges for farms and other agribusinesses investing in IoT and other tech-based solutions has been the lack of local or nearby computing infrastructure that will support applications that require low latency. Leading Edge’s investments in providing data centres in rural and regional Australia will mean these businesses can accelerate their digital transformations.”

With the simultaneous rollout of 5G, Smart City initiatives will also benefit from edge data centres. “Investment in edge infrastructure is likely to take off and follow the 5G coverage map across Australia. We will see operators take advantage of their vast network footprint and combine micro data centres with some 5G antenna locations,” says Bird. “Smart City initiatives will be made possible by 5G connected IoT devices but computing at the edge will be needed to keep, for example, public safety systems, operating in real-time. Many monitoring systems will require local data analysis to be effective.”

Bird also sees potential impacts on the Entertainment industry. “The COVID-19 restrictions and the launch of new services such as Disney+ and Binge in Australia will ensure streaming video continues its impressive growth trajectory. Even facilities such as sports stadiums are beginning to deliver in-person digital experiences to grab back attention from their online competitors. Positive user experience is crucial here and low latency is a must. We’ll see a shift towards edge computing delivered on-site as part of a distributed network. Regional data centres and local caching have always been vital for content delivery to ensure the quality of service and reduce bandwidth costs but the scale is unprecedented.”

Bird talks about potential retail opportunities in the future. “We may see anchor tenants at malls offering their excess capacity to smaller, nearby stores that need the benefits of edge but can’t justify the investment, similar to the way Amazon launched AWS.”

April saw the disruption of normal business operations due to the COVID-19 crisis. However, telecommunications companies continued initiatives to identify the best ways to serve customers and enterprises. The month saw a lot of activity in the 5G space across the globe, including partnerships, innovation in productisation and identifying 5G use cases.

Telecom providers building their 5G capabilities

Ecosystm Principal Advisor, Shamir Amanullah noted in his blog that in the new normal telecom providers have fast evolved as the backbone of business and social interactions. Telecom operators are fervently working towards 5G network and services deployment in order to be an early mover in the market. In China, China Mobile has been one of the leaders in rolling out country-wide 5G. The tender to build around 250,000 fifth-generation wireless network base stations across 28 provincial regions was put out in March and in early April, Huawei emerged as the key winner with the contract to build nearly 60% of the base stations. ZTE also won nearly a third of the contract. Global network equipment providers will find entering the China market as challenge for a number of reasons, including the strength of their local players.

Huawei continues to be under scrutiny in the global market, however British telecom provider chose Ericsson to build the core of its 5G network. BT hopes to create and define a future roadmap of new services such as mobile edge computing, network slicing, enhanced mobile broadband and various enterprise services. The US market is another arena where the battle for 5G will be fought out. The T-Mobile – Sprint merger was finalised in early April. The New T-Mobile is committed to building the world’s best nationwide 5G network, which will bring lightning-fast speeds to urban areas and underserved rural communities alike. Other vendors are also vying for a larger share of the US market. Nex-Tech Wireless, a smaller rural telecom provider based in Kansas, is planning to transition from 4G to 5G by using Ericsson’s Dynamic Spectrum Sharing (DSS) to deploy 5G on existing bands. This will help Next-Tech wireless to leverage existing assets instead of building 5G capabilities from the ground-up – enabling them to seamlessly transfer from 4G to 5G.

The 5G developments are by no means limited mostly to the US and China. Korea’s telecom provider, KT and Far EasTone Taiwan (FET) signed an MOU to collaborate and jointly develop 5G services and digital content. With this deal, KT plans to boost its 5G powered content and services presence through FET.

Tech Vendors evolving their 5G offerings

Network and communications equipment providers have much to gain and more to lose as organisations look to leverage 5G for their IoT use cases. If 5G uptake does not take off, the bigger losers will be the network and communications equipment providers – the real investors in the technology. Also, as telecom providers look to monetise 5G they will find themselves dealing with a completely different customer base – they will take help from tech vendors that have more experience in the enterprise space, as well as industry expertise. Both network equipment vendors and other tech vendors are actively evolving their product offerings. There were numerous examples of this in April.

Microsoft’s decision to acquire Affirmed Networks is an example of how the major cloud providers are trying to be better embedded with 5G capabilities. This month also saw Microsoft announce Azure Edge Zones aimed at reducing latency for both public and private networks. AT&T is a good example of how public carriers will use the Azure Edge Zones. As part of the ongoing partnership with Microsoft, AT&T has already launched a Dallas Edge Zone, with another one planned for Los Angeles, later in the year. Microsoft also intends to offer the Azure Edge Zones, independent of carriers in denser areas. They also launched Azure Private Edge Zones for private enterprise networks suitable for delivering ultra-low latency performance for IoT devices.

The examples go beyond the cloud platform providers. Samsung and Xilinx, have joined forces to enable 5G deployments, with Samsung aiming to use the Xilinx Versal adaptive compute acceleration platform (ACAP) for worldwide 5G commercial deployments. Versal ACAP offers the compute density at low power consumption to perform the real-time, low-latency signal processing needed by 5G. Following the successful pilot of 450 MHz proof of concept 5G network, Nokia has partnered with PGE Systemy, a large energy sector company in Poland to deploy industrial grade 5G solutions and to support energy distribution for its next gen power grid. It is the band of choice for machine-to-machine communications in the energy sector, including smart meters. Nokia also released an AI-as-a-service offering – Nokia AVA 5G cognitive operations – to help telecom providers transform their services with AI-based solutions to support, network, business and operations.

Use cases for 5G adoption firming up

5G promises to revolutionise various industry solutions based on required data rates, low latency, reliability, and machine-type communications. Telecom providers and tech vendors alike are working on developing industry use cases to drive up adoption.

Vodafone Qatar and Dreama Orphan Care Centre and Protection Social Rehabilitation Centre (AMAN) have collaborated to support remote learning and education using 5G technology. This is aimed to enhance virtual education through e-learning, online schools, and connecting teachers and students through high-speed learning environment. In the post-COVID 19 era remote learning is expected to become a key sector and there is immense potential for uptake.

The Manufacturing industry remains a top focus area for 5G providers, with their early adoption of sensors and sensor data analytics. The Smart Internet Lab at the University of Bristol, UK has been awarded a 2 years project by UK’s Department for Digital, Culture, Media and Sport (DCMS) to enable 5G connectivity for the manufacturing sector. The project will primarily work on improving productivity and manufacturing, easy asset tracking and management with involvement of AR/VR technologies and industrial system management.

Gaming is another sector with huge potential for 5G adoption. With cloud gaming, gamers can access a library of popular high-quality games minus the need for expensive hardware which has been the case in the past. China Mobile Hong Kong and Ubitus teamed up to launch a 5G cloud gaming service – UGAME. The application is available for download from the Google Play store. While still at a beta phase, the telecom provider promises a revolutionary gaming experience, where the need for computers or consoles will be lessened by augmented smartphone capabilities.

In the midst of the uncertainties, telecom, network equipment providers and cloud platform providers appear to be gearing up for 5G in enabling a contactless and remote economy.

In our blog, Artificial Intelligence – Hype vs Reality, published last month we explored why the buzz around AI and machine learning have got senior management excited about future possibilities of what technology can do for their business. AI – starting with automation – is being evaluated by organisations across industries. Several functions within an organisation can leverage AI and the technology is set to become part of enterprise solutions in the next few years. AI is fast becoming the tool which empowers business leaders to transform their organisations. However, it also requires a rethink on data integration and analysis, and the use of the intelligence generated. For a successful AI implementation, an organisation will have to leverage other enabling technologies.

Technologies Enabling AI

IoT

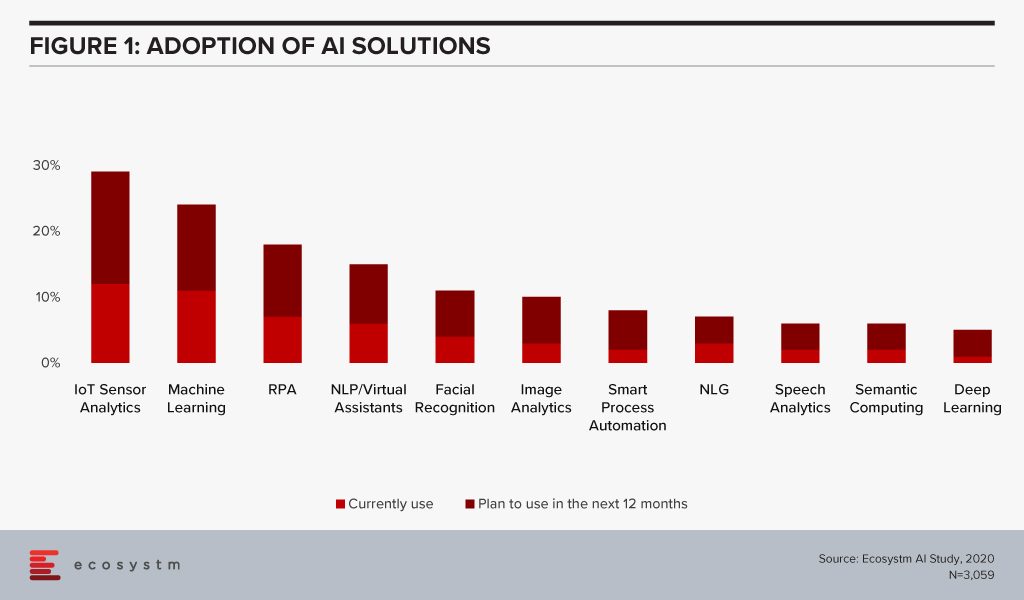

Organisations have been evaluating IoT – especially for Industry 4.0 – for the better part of the last decade. Many organisations, however, have found IoT implementations daunting for various reasons – concerns around security, technology integration challenges, customisation to meet organisational and system requirements and so on. As the hype around what AI can do for the organisation increases, they are being forced to re-look at their IoT investments. AI algorithms derive intelligence from real-time data collected from sensors, remote inputs, connected things, and other sources. No surprise then that IoT Sensor Analytics is the AI solution that is seeing most uptake (Figure 1).

This is especially true for asset and logistics-driven industries such as Resource & Primary, Energy & Utilities, Manufacturing and Retail. Of the AI solutions, the biggest growth in 2020 will also come from IoT Analytics – with Healthcare and Transportation ramping up their IoT spend. And industries will also look at different ways they can leverage the IoT data for operational efficiency and improved customer experience (CX). For instance, in Transportation, AI can use IoT sensor data from a fleet to help improve time, cost and fuel efficiency – suggesting less congested routes with minimal stops through GPS systems, maintaining speeds with automated speed limiters – and also in predictive fleet maintenance.

IoT sensors are already creating – and will continue to create large amounts of data. As organisations look to AI-enabled IoT devices, there will be a shift from one-way transactions (i.e. collecting and analysing data) to bi-directional transactions (i.e. sensing and responding). Eventually, IoT as a separate technology will cease to exist and will become subsumed by AI.

Cloud

AI is changing the way organisations need to store, process and analyse the data to derive useful insights and decision-making practices. This is pushing the adoption of cloud, even in the most conservative organisations. Cloud is no longer only required for infrastructure and back-up – but actually improving business processes, by enabling real-time data and systems access.

Over the next decades, IoT devices will grow exponentially. Today, data is already going into the cloud and data centres on a real-time basis from sensors and automated devices. However, as these devices become bi-directional, decisions will need to be made in real-time as well. This has required cloud environments to evolve as the current cloud environments are unable to support this. Edge Computing will be essential in this intelligent and automated world. Tech vendors are building on their edge solutions and tech buyers are increasingly getting interested in the Edge allowing better decision-making through machine learning and AI. Not only will AI drive cloud adoption, but it will also drive cloud providers to evolve their offerings.

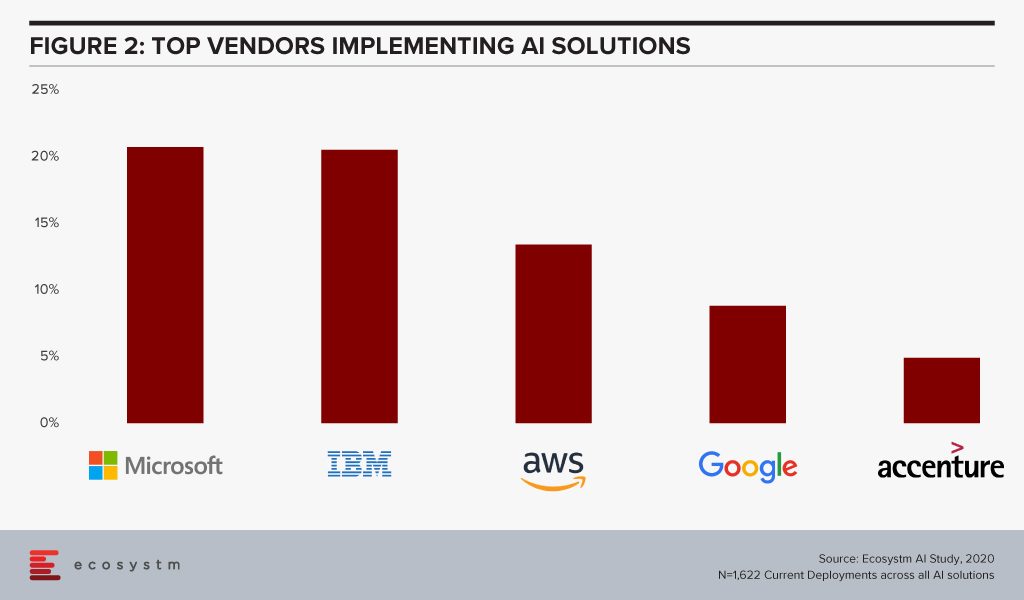

The global Ecosystm AI study finds that four of the top five vendors that organisations are using for their AI solutions (across data mining, computer vision, speech recognition and synthesis, and automation solutions) today, are also leading cloud platform providers (Figure 2).

The fact that intelligent solutions are often composed of multiple AI algorithms gives the major cloud platforms an edge – if they reside on the same cloud environment, they are more likely to work seamlessly and without much integration or security issues. Cloud platform providers are also working hard on their AI capabilities.

Cybersecurity & AI

The technology area that is getting impacted by AI most is arguably Cybersecurity. Security Teams are both struggling with cybersecurity initiatives as a result of AI projects – and at the same time are being empowered by AI to provide more secure solutions for their organisations.

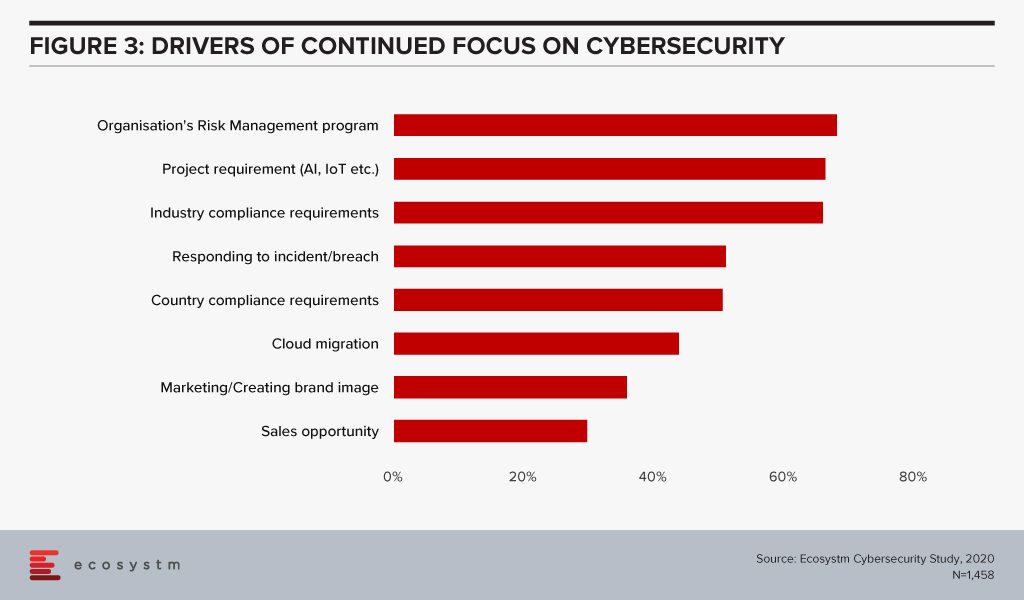

The global Ecosystm Cybersecurity study finds that one of the key drivers that is forcing Security Teams to keep an eye on their cybersecurity measures is the organisations’ needs to handle security requirements for their Digital Transformation (DX) projects involving AI and IoT deployments (Figure 3).

While AI deployments keep challenging Security Teams, AI is also helping cybersecurity professionals. Many businesses and industries are increasingly leveraging AI in their Security Operations (SecOps) solutions. AI analyses the inflow and outflow of data in a system and analyses threats based on the learnings. The trained AI systems and algorithms help businesses to curate and fight thousands of daily breaches, unsafe codes and enable proactive security and quick incident response. As organisations focus their attention on Data Security, SecOps & Incident Response and Threat Analysis & Intelligence, they will evaluate solutions with embedded AI.

AI and the Experience Economy

AI has an immense role to play in improving CX and employee experience (EX) by giving access to real-time data and bringing better decision-making capabilities.

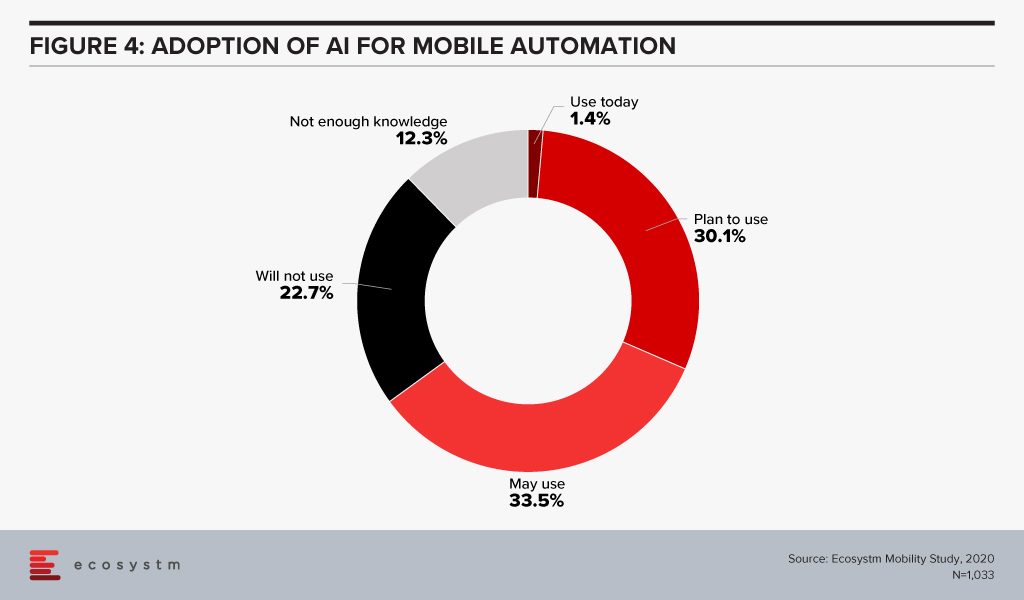

Enterprise mobility was a key area of focus when smartphones were introduced to the modern workplace. Since then enterprise mobility has evolved as business-as-usual for IT Teams. However, with the introduction of AI, organisations are being forced to re-evaluate and revamp their enterprise mobility solutions. As an example, it has made mobile app testing easier for tech teams. Mobile automation will help automate testing of a mobile app – across operating systems (Figure 4). While more organisations tend to outsource their app development functions today, mobile automation reduces the testing time cycle, allowing faster app deployments – both for internal apps (increasing employee productivity and agility) and for consumer apps (improving CX).

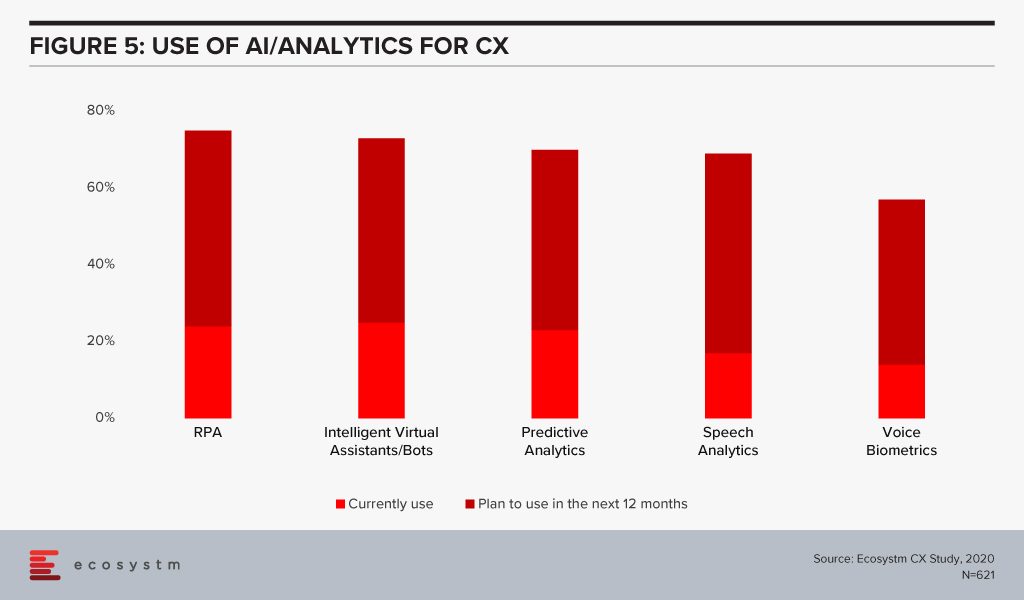

CX Teams within organisations are especially evaluating AI technologies. Visual and voice engagement technologies such as NLP, virtual assistants and chatbots enable efficient services, real-time delivery and better customer engagement. AI also allows organisations to offer personalised services to customers providing spot offers, self-service solutions and custom recommendations. Customer centres are re-evaluating their solutions to incorporate more AI-based solutions (Figure 5).

The buzz around AI is forcing tech teams to evaluate how AI can be leveraged in their enterprise solutions and at enabling technologies that will make AI adoption seamless. Has your organisation started re-evaluating other tech areas because of your AI requirements? Let us know in the comments below.