The ways we connect, create, collaborate in our workplaces has seen major shifts in the last year. And the tech industry has continually supported that shift as they create new capabilities and upgrade existing ones. Technology providers will continue to revamp their product offerings to support the increase in adoption of the hybrid work model work – a fusion of remote and in-office. In the Top 5 Future of Work Trends for 2021, Ecosystm had predicted, “Every major digital workspace provider (such as Microsoft, Google, Zoom, Cisco, AWS and so on) will broaden their digital workplace capabilities and integrate them more effectively, making them easier to procure and use. Instead of a “tool-centric” approach to getting work done (chat vs video vs document sharing vs online meetings vs whiteboards and so on), it will become a platform play.”

Ecosystm Principal Advisor, Ravi Bhogaraju says, “It is becoming clear that companies and individuals are grappling with three issues – the changing size and composition of the workforce; the productivity of those who are driving the businesses; and attracting, reskilling and engaging the broader workforce.” These are the challenges that tech providers will have to help organisations with.

Google Upgrades its Collaboration Platform

The Google Workspace was launched in October last year, and last week saw the tech giant announce a series of upgrades and innovations to better support the flexibility needs of frontline and remote workers.

Workspace is Google’s office productivity suite comprising video conferencing, cloud storage, collaboration tools, security and management controls built into a cohesive environment. The new features announced by Google Workspaces include Focus Time to avoid distractions by limiting notifications, recurring out-of-office and location indicators to make colleagues aware if the person is working from home or office, support for Google voice assistant in workplaces, second-screen experiences to support multiple devices, and features for frontline workers designed to help mobile employees collaborate and communicate better with the rest of the organisation. Google is also working on a trimmed down version of Google Workspace – Google Workspace Essentials – which will provide support for Chat, Jamboard, and Calendar. Workspace is estimated to have 2.6 billion monthly active users.

Bhogaraju says, “One of the issues that is fast emerging as significant is not just the employee experience or customer experience but the complexity of the digital workplace as platforms introduce newer and advanced features. In the end, there has to be simplicity, clarity, and a clear focus on the goals – not just an overload of features that makes life more complex for the employee. It would be critical to enable these features thoughtfully and reskill staff adequately so that the adoption and impact to business process is felt in their day-to-day activities.”

Workspace Transformation across Industries

With many of Google’s employees and developers working remotely, the company has first-hand experience of the challenges of remote working and is leveraging the experience. Google Workspace is also working on custom solutions for various industries. In Retail for example, Woolworths, rolled out Google Workspace and Chrome for geographically dispersed teams to collaborate in real-time and adopt custom-made applications linked to global servers to allow managers to log and address tickets from the shop floor itself. Similarly in Aviation, All Nippon Airways uses Google Workspace to allow pilots, cabin attendants, HR and finance staff to communicate and collaborate in real-time across the globe, using Google Meet, Google Docs, Google Sheets and Google Slides from their PCs, smartphones or tablets. Google retains its focus on the Education industry – Google Workspace Education Fundamentals is free for all qualifying institutions. Solutions such as Google’s Classroom, Teach from Anywhere hub, roster sync, mobile grading and EdTech tools aim to enable better learning and teaching experience for students and educators.

Tech Companies Revamping their Collaboration Offerings

With more companies rethinking their work policies, leaders in the collaboration space are also stepping up their game to evolve their offerings for the hybrid norm. Microsoft’s Viva unifies the experience across Teams and Microsoft 365 for employee communications, wellbeing, learning and knowledge discovery. Similarly, Zoom too has upgraded and integrated various utility, sharing, and management features to support a hybrid workforce. Tech companies are being forced to invest in creating next-generation tools to stay relevant, as Future of Work models continue to shift and evolve.

As tech companies evolve their capabilities, Bhogaraju warns organisations on how they should leverage them. “While technology companies continue to deliver feature rich suites – in reality the uptake and embedding of these programs into the day-to-day business processes is still in its early stages. Business, HR and IT teams continue to struggle. They tend to operate within independent thought silos and there is limited consensus on which feature is really needed and how it can add to the productivity and efficiency. Without this crucial context and an effective change management program – they remain rich features and not impactful ones.”

The hybrid workplace model is gaining popularity in 2021. Check out Ecosytsm’s top 5 Future of Work Trends For 2021. Signup for Free to download the report.

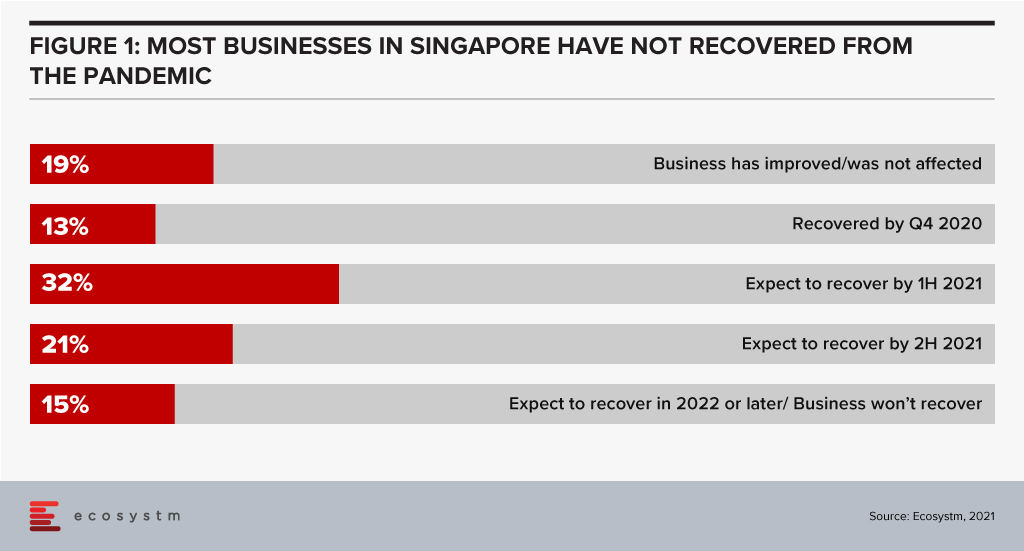

The past twelve months have been tough. Most businesses in Singapore (68%) still haven’t seen revenue recover to pre-pandemic levels. Many budgets are down and you are likely to have a long list of spending options that might help you grow revenue and pull your business out of the pandemic-induced slump. Even if your business is doing well, the pressure on budgets is real.

Increasing your CX Spend

Despite the pressure on budgets Ecosystm data makes a strong case to not cut your customer experience (CX) spend! Businesses in Singapore that are cutting their CX spend are less likely to return to growth, more likely to be competing on price (hence cutting margins), not focused on their digital and omnichannel customers, and have lower levels of innovation. Funnily enough, these are also the businesses with complex, legacy systems which need more focus to provide an improved CX! To be quite frank, businesses in Singapore who are cutting CX spend are setting themselves up for failure. With other businesses increasing CX spend, the gap between the customer experiences will grow to a point where customers will leave and it will be hard to catch up.

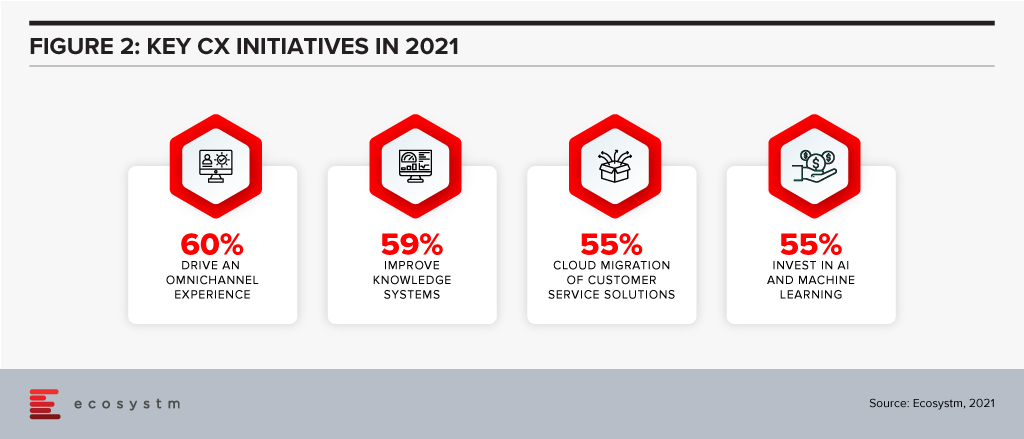

Prioritising your CX Spend

So now that you have secured your CX spend, where will you get the biggest bang for your buck? Let’s look at where businesses in Singapore are focusing their CX initiatives in 2021.

Offering an omnichannel experience. Your customers expect more than just a great digital experience – they want the right experience at the right touchpoint. The CX leaders in Singapore (who, unsurprisingly are often the market leaders) are already offering great omnichannel experiences, so this is quickly becoming about catching up – and not about getting ahead. Providing a consistent, personalised, and optimised experience across your digital touchpoints needs to be a top priority for your business today. If you are not offering conversational commerce solutions, start that strategy as soon as possible – you need to be where your customers are today. Extending this to physical channels and broader ecosystem partners should also be on your agenda.

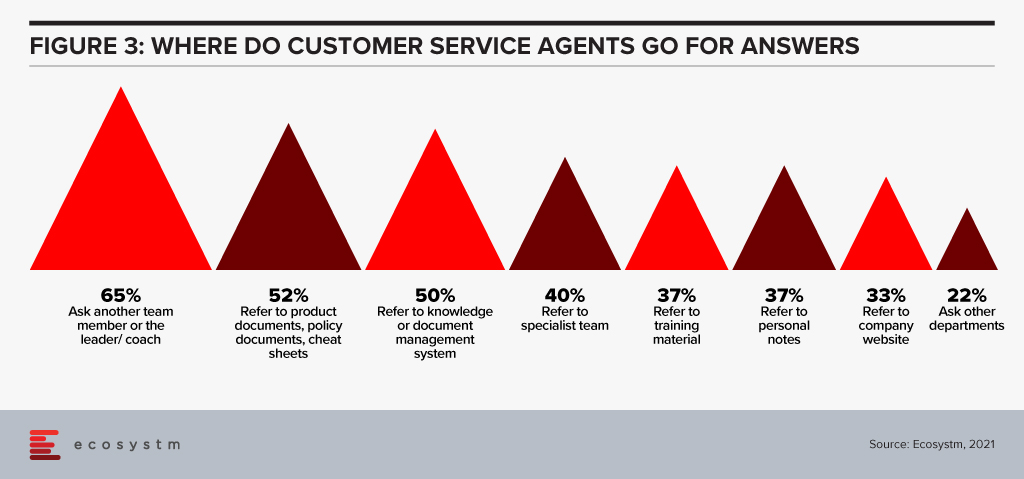

Improving knowledge systems. Your knowledge systems don’t do what they say on the box. They don’t provide answers to questions – for employees or customers. In fact, if your customer service agents get asked a question they don’t know the answer to, their number one source for answers is actually their colleagues or team leaders – NOT the knowledge management system! Start investing in systems – or ideally a single system – that help your employees get better, faster answers to questions. Make sure that the system is providing the same answers to both your employees and your customers across all touchpoints – physical and digital.

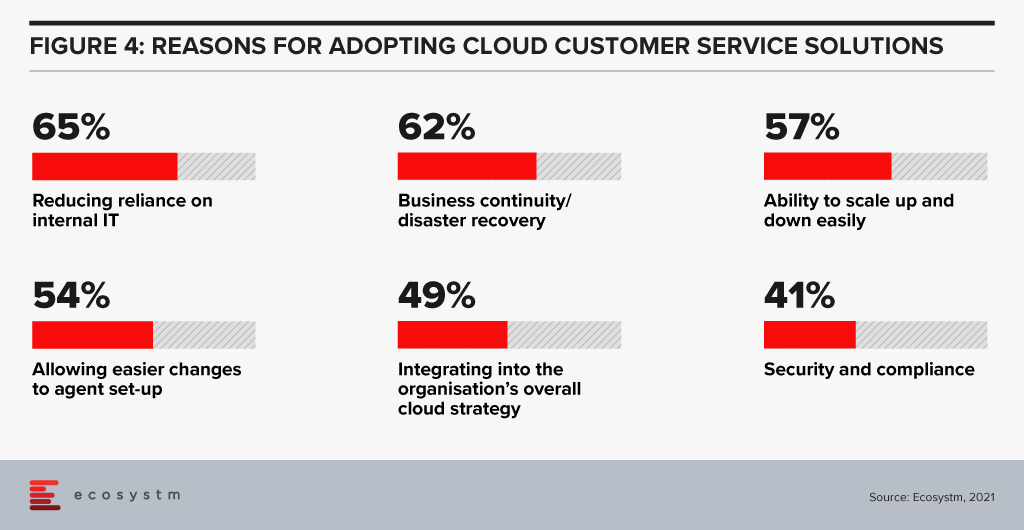

Migrating customer service platforms to the cloud. Over half the businesses in Singapore that we assessed have this as a top CX priority. Cloud solutions offer faster time to value, lower management costs, give access to more regular improvements and often provide the ability to easily integrate with partners who offer product extensions and customisations. This trend will continue in 2021 and 2022 as more businesses realise that their legacy customer service or contact centre platform is inhibiting their ability to innovate their customer experience. These systems also help businesses to stay compliant and reduce the reliance on internal IT – which has traditionally struggled to keep up with the fast-changing nature of the contact centre and customer service teams.

Investing in AI and machine learning. Many businesses are using AI to provide the personalised and optimised customer experiences they aspire to. AI and machine learning are allowing businesses to create personalised offers, offer a next-best action and automate services. Advanced banks in Singapore can create interest rate offers for each individual customer based on their credit profile and history. 46% of businesses in Singapore are already using AI to offer recommendations for customer service agents, 44% to optimise or test messaging and campaigns and 43% to provide faster, more accurate access to information and knowledge. 18 months ago, AI was a business differentiator – allowing your business to create a stand-out CX. Today AI is quickly becoming a standard practice – the battle now is around using AI to create personalised and optimised experiences.

A great customer experience will be the most important factor in lifting your business to pre-pandemic growth levels and helping your business remain competitive in today’s tough business conditions. When it comes to CX, there is no such thing as “saving your way to growth”.

Your opportunity to drive greater business success lies in your ability to better win, serve and retain your customers. Refresh your customer strategy and capability today to make 2021 an exceptional year for your business.

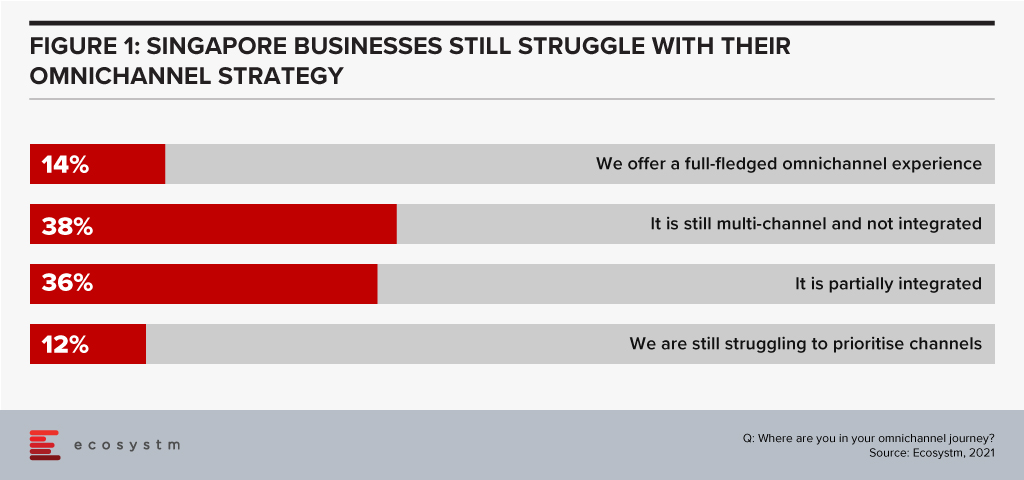

Customer needs are changing. Quickly. In 2020 having a great digital strategy went from being a nice-to-have to an absolute necessity. And in 2021, businesses that have great omnichannel experiences will go from a small minority to a majority as customers demand that they are served on their terms in their chosen platform. Only 14% of businesses in Singapore offer a complete omnichannel experience today – serving customers on their terms regardless of the location or platform (Figure 1). These businesses are setting the benchmark that the rest of the market needs to meet soon.

The Growing Importance of Social Media in Delivering Customer Experience

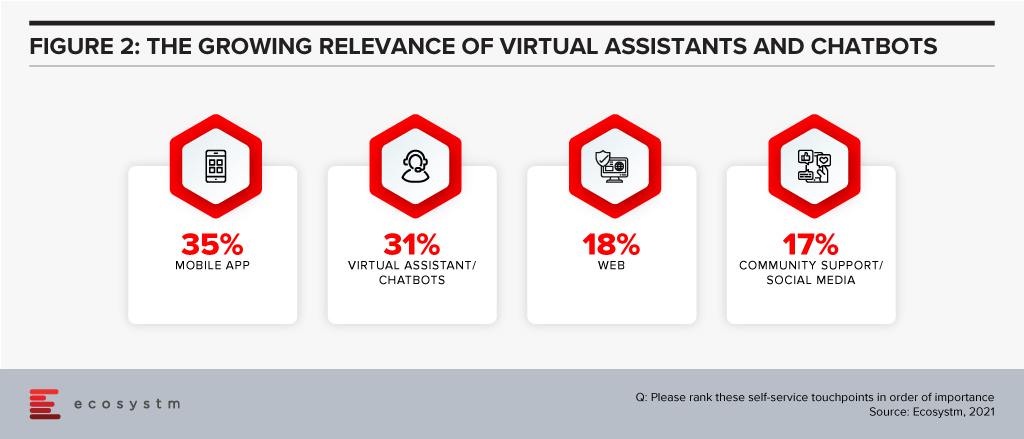

Chat and messaging are quickly becoming the normal way to interact with businesses – the view of a few years ago that “no one wants to chat with a bot” has quickly turned around. Now virtual assistants and chatbots are the second most important self-service channel for businesses in Singapore (Figure 2).

In fact, Zendesk’s global study shows that most customers (45%) use embedded messaging over social messaging apps (31%) and text/SMS (20%). That might be great for self-service, but for commerce, boundless opportunities exist to move to where the customer lives, communicates, and socialises today.

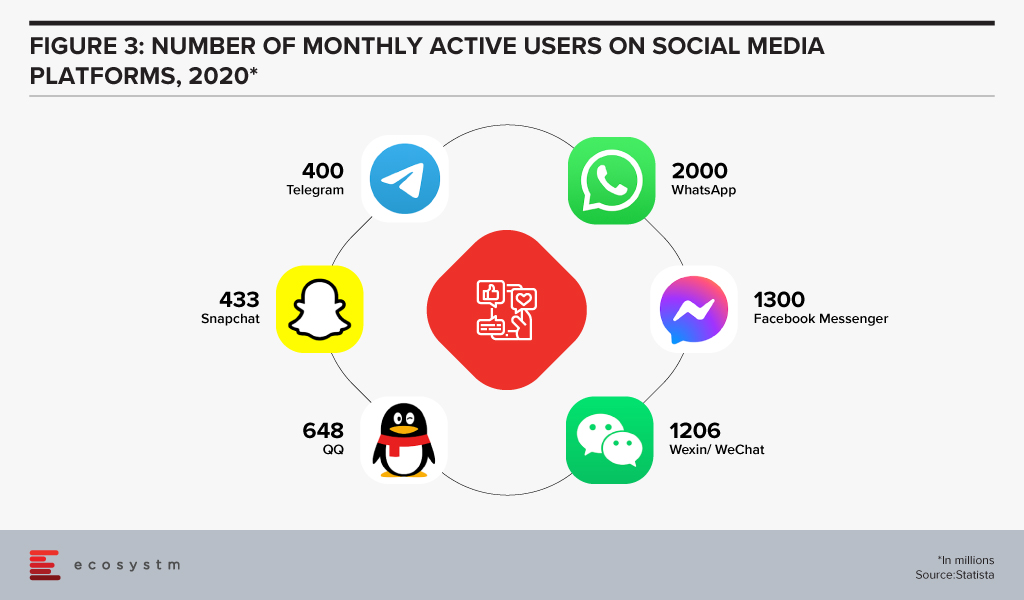

Smart businesses understand that customers spend their lives in other chat and social media platforms – such as Facebook Messenger, TikTok, Instagram, WeChat, Discord and WhatsApp. More customers expect to be served in these channels; they expect to be able to transact with their brands of choice. Why should they go to a mobile banking app to find their balance? Why can’t they get it in WhatsApp? They are often learning about the next Jordan or Yeezy shoe drop from their social network in Messenger – so why not transact with them there? Consider all your own personal WhatsApp, Messenger and other messaging platform groups discussing social activities, sporting teams, school activities or the latest fashion – these are ALL opportunities for commerce (Figure 3).

And there are use cases now. Airlines – such as KLM and Etihad Airways – are engaging customers on WeChat, Kakao Talk, and WhatsApp, helping them reschedule flights and answering customer service queries. Telecommunications providers are allowing customers to raise issues on messaging platforms – and are also using them to upsell and cross-sell new services. Transportation providers are making it easier to find a car or the the next scheduled bus right there in the messaging platforms. Retailers – such as 1-800 Flowers and Culture Kings – are not only serving customers but finding new customers on these messaging platforms.

Going beyond the messaging platforms, businesses are also looking to serve customers on their smart devices – such as Amazon Alexa/Echo and Google Nest/Home devices. Alerting customers to order updates, shipping details and product promotions is becoming standard practice for leading businesses. Digitally-savvy banks are allowing customers to not only track their balance but also make transfers and payments using these smart platforms.

Customers are more comfortable with these conversational commerce options – and they actually expect you to offer such services on your site, in your app, on their smart devices, and on their messaging platforms of choice. Your ability to provide outstanding customer experiences will not only be your ticket back to revenue growth but the recipe for long term business success. Meeting customer needs on their terms is a good place to start.

Delivering a Personalised Conversational Customer Experience

Customer experience (CX) decision-makers will have to rethink how they approach building richer CX capabilities to deliver personalised conversational interactions with customers.

Messaging should become part of a wider AI, Data, and Mobile strategy. Contact centre teams might feel that this is too ambitious a project and would prefer to continue to serve customers through the more traditional channels only. So, it is important to identify the key stakeholder/s who will drive the initiative. And the contact centre team should work with the Digital, Innovation and Marketing teams.

Designing the mobile experience and in app messaging for CX should have some of the following features:

- Ability to click a button to request for a service or escalate an issue that will, in turn, result in the company contacting the customer either by messaging or calling.

- Giving customers the option to contact through popular messaging platforms such as Facebook Messenger, WhatsApp, LINE, WeChat, and others. Unifying these systems in a single interface that integrates with your customer service application is best practice.

- Having one single interface to manage and make payments – within the app itself or on the social messaging platform. Conversational commerce is about creating an ongoing relationship with customers throughout the entire customer journey. Don’t just focus on the sale or the post-sales experience – customers expect to be able to interact with your business from their platform of choice regardless of their need or stage in the customer journey.

- Embed deep analytics into the communication services to help the organisation better deliver a personalised CX.

- Ensure you have a solid, unified knowledge management interface at the backend so that all questions lead to the same answers regardless of channel, platform or touchpoint.

Your opportunity to drive greater business success lies in your ability to better win, serve and retain your customers. Refresh your customer strategy and capability today to make 2021 an exceptional year for your business.

Authored by Alea Fairchild and Audrey William

There is a lot of hope on AI and automation to create intellectual wealth, efficiency, and support for some level of process stability. After all, can’t we just ask Siri or Alexa and get answers so we can make a decision and carry on?

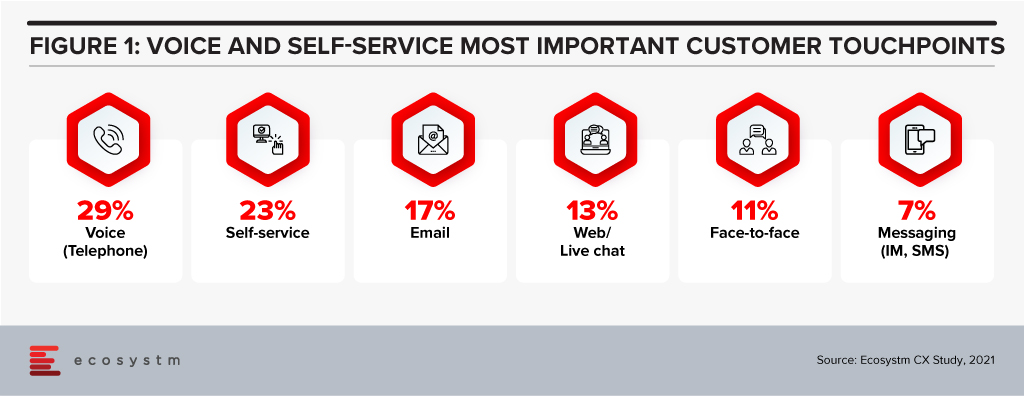

Automation has been touted as the wonder formula for workplace process optimisation. In reality it’s not the quick fix that many business leaders desire. But we keep raising the bar on expectations from automation. Investments in voice technologies, intelligent assistants, augmented reality and touchscreens are changing customer experience (Figure 1). Chatbots are ubiquitous, and everything has the potential to be personalised. But will they solve our problems?

100 percent automation is not effective

Let’s first consider using automation to replace face-to-face interactions. There was a time when people were raving about the check-in experience at some of the hotels in Japan where robots and automated systems would take care of the check-in, in-stay and check-out processes. Sounds simple and good? Till 2019, if you checked into the Henn-na Hotel in Japan, you would be served and taken care of by 243 robots. It was viewed by many as a template for what a fully automated hotel could look like in the future.

The hotel had an in-room voice assistant called Churi. It could cope with basic commands, such as turning the lights on and off, but it was found to be deficient when guests started asking questions about places to visit or other more sophisticated queries. It was not surprising that the hotel decided to retire their robots. In the end it created more work for the hotel staff on-site.

People love the personal touch when they are in a hotel; and talking to someone at the front desk, requesting assistance from hotel staff, or even just a short chat over breakfast are some of the small nuances of why the emotional connection matters. Many quarantine hotels today use robots for food delivery, but the hotel staff is still widely available for questions. That automation is good, but you need the human intervention. So, getting the balance right is key.

Empathy plays a big role in delivering great Customer Experience

Similarly, there was a time when many industry observers and technology providers said that a contact centre will be fully automated, reducing the number of agents. While technologies such as Conversational AI have come along where you can now automate common or repetitive questions and with higher accuracy levels, the human agent still plays a critical role in answering the more complex queries. When the customer has a complicated question or request, then they will WANT to speak to an agent.

When it reaches a point where the conversation with the chatbot starts getting complicated and the customers need more help there should be the option – within the app, website or any other channel – to escalate the call seamlessly to a human agent. Sometimes, a chat is where the good experience happens – the emotional side of the conversation, the laughter, the detailed explanation. This human touch cannot be replaced by machines. Disgruntled customers are happier when an agent shows empathy. Front line staff and human agents act as the face of a company’s brand. Complete automation will not allow the individual to understand the culture of the company. These can be attained through conversations.

Humans as supervisors for AI – The New Workplace

Empathy, intuitiveness, and creativity are all human elements in the intelligence equation. Workers in the future will need to make their niche in a fluid and unpredictable environment; and translating data into action in a non-replicable way is one of the values of human input. The essence of engineering is the capacity to design around human limitations. This requires an understanding of how humans behave and what they want. We call that empathy. It is the difference between the engineer who designs a product, and the engineer who delivers a solution. We don’t teach our computer scientists and engineering students a formula for empathy. But we do try to teach them respect for both the people and the process.

For efficiency, we turn to automation of processes, such as RPA. This is designed to try to eradicate human error and assist us in doing our job better, faster and at a lower cost by automating routine processes. If we design it right, humans take the role of monitoring or supervisory controlling, rather than active participation.

At present, AI is not seen as a replacement for our ingenuity and knowledge, but as a support tool. The value in AI is in understanding and translating human preferences. Humans-in-the-loop AI system building puts humans in the decision loop. They also shift pressure away from building “perfect” algorithms. Having humans involved in the ethical norms of the decision allows the backstop of overly orchestrated algorithms.

That being said, the astute use of AI can deepen insights into what truly makes us human and can humanise experiences by setting a better tone and a more trusted engagement. Using things like sentiment analysis can de-escalate customer service encounters to regain customer loyalty.

The next transformational activity for renovating work is to advance interactions with customers by interpreting what they are asking for and humanising the experience of acquiring it which may include actually dealing with a human contact centre agent – decisions that are supported at the edge by automation, but at the core by a human being.

Implications

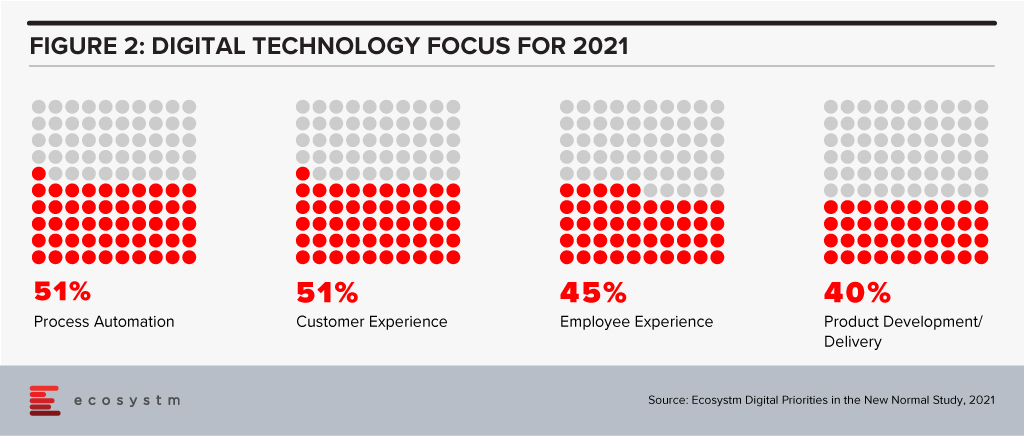

Ecosystm research shows that process automation will be a key priority for technology investments in 2021 (Figure 2).

With AI and automation, a priority in 2021, it will be important to keep these considerations in mind:

- Making empathy and the human connection the core of customer experiences will bring success.

- Rigorous, outcome-based testing will be required when process automation solutions are being evaluated. In areas where there are unsatisfactory results, human interactions cannot – and should not – be replaced.

- It may be easy to achieve 90% automation for dealing with common, repetitive questions and processes. But there should always be room for human intervention in the event of an issue – and it should be immediate and not 24 hours later!

- Employees can drive greater value by working alongside the chatbot, robot or machine.

Ecosystm Predicts: The Top 5 Customer Experience Trends for 2021

Download Ecosystm’s complimentary report detailing the top 5 customer experience trends for 2021 that your company should pay attention to along with tips on how to stay ahead of the curve.

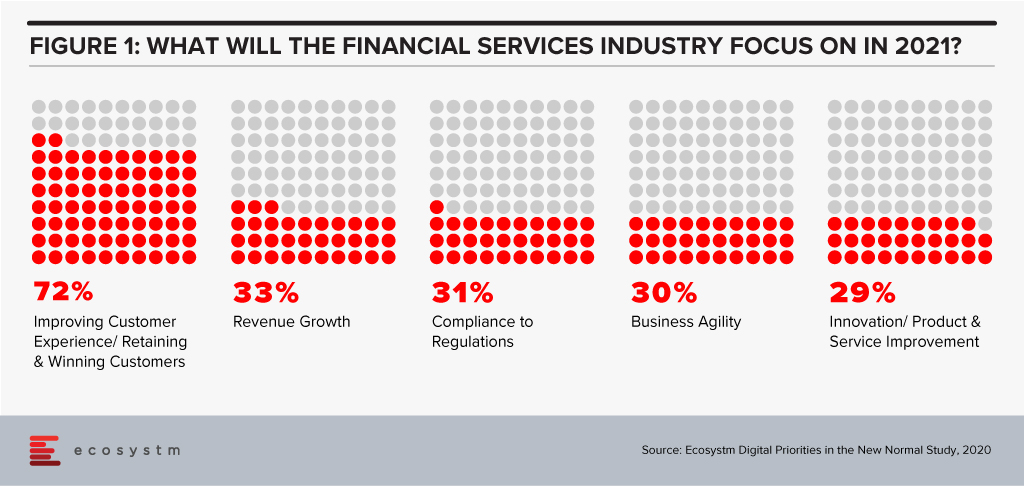

The disruption that we faced in 2020 has created a new appetite for adoption of technology and digital in a shorter period. Crises often present opportunities – and the FinTech and Financial Services industries benefitted from the high adoption of digital financial services and eCommerce. In 2021, there will be several drivers to the transformation of the Financial Services industry – the rise of the gig economy will give access to a larger talent pool; the challenges of government aid disbursement will be mitigated through tech adoption; compliance will come sharply back into focus after a year of ad-hoc technology deployments; and social and environmental awareness will create a greater appetite for green financing. However, the overarching driver will be the heightened focus on the individual consumer (Figure 1).

2021 will finally see consumers at the core of the digital financial ecosystem.

Ecosystm Advisors Dr. Alea Fairchild, Amit Gupta and Dheeraj Chowdhry present the top 5 Ecosystm predictions for FinTech in 2021 – written in collaboration with the Singapore FinTech Festival. This is a summary of the predictions; the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 FinTech Trends for 2021

#1 The New Decade of the ‘Empowered’ Consumer Will Propel Green Finance and Sustainability Considerations Beyond Regulators and Corporates

We have seen multiple countries set regulations and implement Emissions Trading Systems (ETS) and 2021 will see Environmental, Social and Governance (ESG) considerations growing in importance in the investment decisions for asset managers and hedge funds. Efforts for ESG standards for risk measurement will benefit and support that effort.

The primary driver will not only be regulatory frameworks – rather it will be further propelled by consumer preferences. The increased interest in climate change, sustainable business investments and ESG metrics will be an integral part of the reaction of the society to assist in the global transition to a greener and more humane economy in the post-COVID era. Individuals and consumers will demand FinTech solutions that empower them to be more environmentally and socially responsible. The performance of companies on their ESG ratings will become a key consideration for consumers making investment decisions. We will see corporate focus on ESG become a mainstay as a result – driven by regulatory frameworks and the consumer’s desire to place significant important on ESG as an investment criterion.

#2 Consumers Will Truly Be ‘Front and Centre’ in Reshaping the Financial Services Digital Ecosystems

Consumers will also shape the market because of the way they exercise their choices when it comes to transactional finance. They will opt for more discrete solutions – like microfinance, micro-insurances, multiple digital wallets and so on. Even long-standing customers will no longer be completely loyal to their main financial institutions. This will in effect take away traditional business from established financial institutions. Digital transformation will need to go beyond just a digital Customer Experience and will go hand-in-hand with digital offerings driven by consumer choice.

As a result, we will see the emergence of stronger digital ecosystems and partnerships between traditional financial institutions and like-minded FinTechs. As an example, platforms such as the API Exchange (APIX) will get a significant boost and play a crucial role in this emerging collaborative ecosystem. APIX was launched by AFIN, a non-profit organisation established in 2018 by the ASEAN Bankers Association (ABA), International Finance Corporation (IFC), a member of the World Bank Group, and the Monetary Authority of Singapore (MAS). Such platforms will create a level playing field across all tiers of the Financial Services innovation ecosystem by allowing industry participants to Discover, Design and rapidly Deploy innovative digital solutions and offerings.

#3 APIfication of Banking Will Become Mainstream

2020 was the year when banks accepted FinTechs into their product and services offerings – 2021 will see FinTech more established and their technology offerings becoming more sophisticated and consumer-led. These cutting-edge apps will have financial institutions seeking to establish partnerships with them, licensing their technologies and leveraging them to benefit and expand their customer base. This is already being called the “APIficiation” of banking. There will be more emphasis on the partnerships with regulated licensed banking entities in 2021, to gain access to the underlying financial products and services for a seamless customer experience.

This will see the growth of financial institutions’ dependence on third-party developers that have access to – and knowledge of – the financial institutions’ business models and data. But this also gives them an opportunity to leverage the existent Fintech innovations especially for enhanced customer engagement capabilities (Prediction #2).

#4 AI & Automation Will Proliferate in Back-Office Operations

From quicker loan origination to heightened surveillance against fraud and money laundering, financial institutions will push their focus on back-office automation using machine learning, AI and RPA tools (Figure 3). This is not only to improve efficiency and lower risks, but to further enhance the customer experience. AI is already being rolled out in customer-facing operations, but banks will actively be consolidating and automating their mid and back-office procedures for efficiency and automation transition in the post COVID-19 environment. This includes using AI for automating credit operations, policy making and data audits and using RPA for reducing the introduction of errors in datasets and processes.

There is enormous economic pressure to deliver cost savings and reduce risks through the adoption of technology. Financial Services leaders believe that insights gathered from compliance should help other areas of the business, and this requires a completely different mindset. Given the manual and semi-automated nature of current AML compliance, human-only efforts slow down processing timelines and impact business productivity. KYC will leverage AI and real-time environmental data (current accounts, mortgage payment status) and integration of third-party data to make the knowledge richer and timelier in this adaptive economic environment. This will make lending risk assessment more relevant.

#5 Driven by Post Pandemic Recovery, Collaboration Will Shape FinTech Regulation

Travel corridors across border controls have started to push the boundaries. Just as countries develop new processes and policies based on shared learning from other countries, FinTech regulators will collaborate to harmonise regulations that are similar in nature. These collaborative regulators will accelerate FinTech proliferation and osmosis i.e. proliferation of FinTechs into geographies with lower digital adoption.

Data corridors between countries will be the other outcome of this collaboration of FinTech regulators. Sharing of data in a regulated environment will advance data science and machine learning to new heights assisting credit models, AI, and innovations in general. The resulting ‘borderless nature’ of FinTech and the acceleration of policy convergence across several previously siloed regulators will result in new digital innovations. These Trusted Data Corridors between economies will be further driven by the desire for progressive governments to boost the Digital Economy in order to help the post-pandemic recovery.

Organisations are finding that the ways to do work and conduct business are evolving rapidly. It is evident that we cannot use the perspectives from the past as a guide to the future. As a consequence both leaders and employees are discovering and adapting both their work and their expectations from it. In general, while job security concerns still command a big mindshare, the simpler productivity measures are evolving to more nuanced wellness measures. This puts demands on the CHRO and the leadership team to think about company, customer and people strategy as one holistic way of working and doing business.

Organisations will have to re-think their people and technology to evolve their Future of Work policies and strategise their Future of Talent. There are multiple dimensions that will require attention.

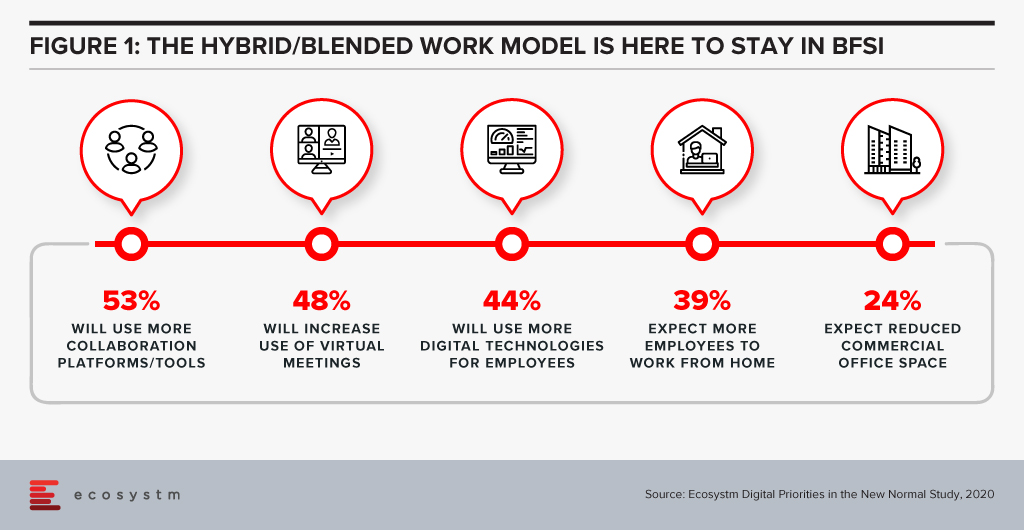

Hybrid is Becoming Mainstream

It is clear that hybrid workplaces are here to stay. Ecosystm research finds that in 2021 BFSI organisations will use more collaboration tools and platforms, and virtual meetings (Figure 1). Nearly 40% expect more employees to work from home, but only about a quarter of organisations are looking to reduce their physical workspaces. Organisations will give more choice to employees in the location of their work – and employees will choose to work from where they are more productive. The Hybrid model will be more mainstream than it has been in the last few months.

Companies are coming to terms with the fact that there is no single answer to operating in the new world. Experimentation and learnings are continuously captured to create the right workforce and workplace model that works best. Agility both in terms of being able to undersand the market as well as quickly adapt is becoming quite important. Thus being able to use different models and ways of working at the same time is the new norm.

Technology and Talent are Core

Talent and tech are the two core pillars that companies need to look at to be successful against their competition. It is becoming imperative to create synergy between the two to deliver a superior value proposition to customers. Companies that are able to bring the customer and employee experience journeys together will be able to create better value. HR tech stacks need to evolve to be more deliberate in the way they link the employee experience, customer experience, and the culture of the organisation. That’s how the Employee Value Proposition (EVP) comes to life on a day-to-day basis to the employers. With evolving work models, the tech stack is a key EVP pillar.

Governments will also need to partner with industry to make such talent available. Singapore is rolling out a new “Tech.Pass” to support the entry of up to 500 proven founders, leaders and experts from top tech companies into Singapore. Its an extension of the Tech@SG program launched in 2019, to provide fast-growing companies greater assurance and access to the talent they need. The EDB will administer the pass, supported by the Ministry of Manpower.

Attracting the Right Talent

Talent has always been difficult to find. Even with globalisation, significant investment of time and resources is needed to find and relocate talent to the right geography. In many instances this was not possible given the preferences of the candidates and/or the hiring managers. COVID-19 has changed this drastically. Remote working and distributed teams have become acceptable. With limitations on immigration and travel for work, there is a lot more openness to finding and hiring talent from outside the traditional talent pool.

However it is not as simple as it seems. The cost per applicant (CPA) – the cost to convert a job seeker to a job applicant – had been averaging US$11-12 throughout 2019 according to recruiting benchmark data from programmatic recruitment advertising provider, Appcast. But, the impact of COVID-19 saw the CPA reach US$19 in June – a 60% increase. I expect that finding right talent is going to be a “needle in a haystack” issue. But this is only one side of the coin – the other aspect is that the talent profile needed to be successful in roles that are all remote or hybrid is also significantly different from what it was before. Companies need to pay special attention to what kind of people they would like to hire in these new roles. Without this due consideration it is very likely that there would be difficulty in on-boarding and making these new hires successful within the organisation.

Automation Augmentation and Skills

The pace at which companies are choosing to automate or apply AI is increasing. This is changing the work patterns and job requirements for many roles within the industry. According to the BCG China AI study on the financial sector 23% of the roles will be replaced by AI by 2027. The roles that will not be replaced will need a higher degree of soft skills, critical thinking and creativity. However, automation is not the endgame. Firms that go ahead with automation without considering the implications on the business process, and the skills and roles it impacts will end up disrupting the business and customer experience. Firms will have to really design their customer journeys, their business processes along with roles and capabilities needed. Job redesign and reskilling will be key to ensuring a great customer experience

Analytics is Inadequate Without the Right Culture

Data-driven decision-making as well as modelling is known to add value to business. We have great examples of analytics and data modelling being used successfully in Attrition, Recruitment, Talent Analytics, Engagement and Employee Experience. The next evolution is already underway with advanced analytics, sentiment analysis, organisation network analysis and natural language processing (NLP) being used to draw better insights and make people strategies predictive. Being able to use effective data models to predict and and draw insights will be a key success factor for leadership teams. Data and bots do not drive engagement and alignment to purpose – leaders do. Working to promote transparency of data insights and decisions, for faster response, to champion diversity, and give everyone a voice through inclusion will lead to better co-creation, faster innovation and an overall market agility.

Creating a Synergy

We are seeing a number of resets to what we used to know, believe and think about the ways of working. It is a good time to rethink what we believe about the customer, business talent and tech. Just like customer experience is not just about good sales skills or customer service – the employee experience and role of Talent is also evolving rapidly. As companies experiment with work models, technology and work environment, there will a need to constantly recalibrate business models, job roles, job technology and skills. With this will come the challenge of melding the pieces together within the context of the entire business without falling into the trap of siloed thinking. Only by bringing together businesses processes, talent, capability evolution, culture and digital platforms together as one coherent ecosystem can firms create a winning formula to create a competitive edge.

Singapore FinTech Festival 2020: Talent Summit

For more insights, attend the Singapore FinTech Festival 2020: Infrastructure Summit which will cover topics on Founders success and failure stories, pandemic impact on founders and talent development, upskilling and reskilling for the future of work.

2020 saw a shutdown in both supply and demand which has effectively put the brakes on many economic activities and forced a complete rethink on how to continue doing business and maintain social interactions. The COVID-19 pandemic has accelerated digitalisation of consumers and enterprises, and the telecommunications industry has been the pillar which has kept the world ticking over. The rise in data use coupled with the fervent growth of the digital economy augurs well for the telecom sector in 2021.

Ecosystm Advisors Claus Mortensen, Rahul Gupta, and Shamir Amanullah present the top 5 Ecosystm predictions for Telecommunications & Mobility trends for 2021. This is a summary of the predictions – the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 Telecommunications & Mobility Trends for 2021

- The 5G Divide – Reality for Some and Hype for Others

Despite the economic challenges in 2020, GSMA reports that the global 5G subscriptions doubled QoQ in Q2 2020 to hit at least 137.7 million subscribers. This accounts for 1.5% of total subscribers – and is expected to rise to 30% by 2025.

The value of 5G will become increasingly mainstream in the next few years. 5G offers a tailored user-centric approach to network services, low latency and significantly higher number of connections which will power a new era of mobile Internet of Everything (IoE).

However, there are many operators who are still sceptical about 5G. In the US, many operators failed to get any tangible positives from 5G. In the near term, many operators will continue to evolve their 5G capabilities – a full grown standalone 5G technology implementation in some verticals might take longer.

The unsuccessful launch of 5G by the US operators does not mean that 5G is a failure, however. It also implies that we need to look at other geographies to lead us into 5G – and Asia Pacific may well emerge as a leader in this space. China, for example, leads the drive in 5G adoption; and 5G smartphones account for more than half of global sales in recent months.

- Telecom Operators Will Accelerate Digital Transformation

Telecom operators are facing increasing demands for cutting-edge services and top-notch customer experience (CX). The global pandemic has caused revenue loss, due to struggling economies and many operators will aim to reduce OpEX to circumvent these financial pressures, raise the quality of CX and retain existing customers. To realise this, there will be much focus on improvement in efficiencies, better operations management as well as improving the IT stack. These digital transformation efforts will enable rapid and flexible services provisioning, which will be better prepared for the tailored services customers now demand.

Many operators are increasingly incorporating cloudification alongside the 5G network deployment. Operators are moving towards transforming their operations and business support systems to a more virtualised and software-defined infrastructure. 5G will operate across a range of frequencies and bands – with significantly more devices and connections becoming software-defined with computing power at the Edge. Operators will also harness the power of AI to analyse massive volumes of data from the networks accessed by millions of devices in order to improve CX, ramp up operational efficiencies as well as introduce new services tailored to customer needs to increase revenue.

- Remote Working Will Transform Telecommunications Networks

The changing patterns in peak network traffic and the substantial movement of traffic from central business districts to residential areas require a fundamental rethink in network traffic management. In addition, many businesses continue to ramp up digital transformation efforts to conduct business online as physical channels will remain limited. Consumer onboarding will also be fervent, as organisations look at business recovery – resulting in increase in bandwidth requirements.

The increasing remote working trend is amplifying the need for greater cybersecurity. Cybersecurity has catapulted in importance as the pandemic has seen a worrying increase in attacks on banks, cloud servers and mobile devices, among others. Cyber-attack incidents specifically due to remote working, has seen a rise. A telecom operator’s compromised security can have country-wide, and even global consequences.

- SASE Will Grow – and Sprawl

Although it was perhaps originally seen as an Over-The-Top (OTT) provisioned competitive service to operators’ MPLS services, many telecom service providers have been embracing SD-WAN over the years as part of their managed services portfolio. “Traditional” SD-WAN offers some of the flexibility needed to address the change towards a more distributed access and the workload requirements that the pandemic has accelerated – the technology does not address all of the issues related to this transformed workspace.

Employees are now working from a variety of locations and workloads are becoming increasingly distributed. To address this change, organisations are challenged to move workloads and applications between platforms, potentially compromising security. Despite all the challenges that the pandemic brought with it – both human and technical – it has also provided organisations with an opportunity to rethink their IT and WAN architectures and to adopt an approach that has security at its core.

We believe that secure access service edge (SASE), which is a model for combining SD-WAN and security in a cloud-based environment, will see a drastic rise in adoption in 2021 and beyond.

- OTT Players Will Continue their Expansion in the Telecommunications Space

Facebook, Google, Amazon are no longer considered as web companies as they moved from standalone ‘web’ companies to become OTT providers and are now significant players in telecom space. With the Facebook-Jio deal in India earlier this year, and with Google and Amazon actively eyeing the telecom space, these players will continue to explore this space especially in the emerging markets of Asia and Africa. There are telecom providers in these countries which will be prime targets for partnerships. These operators could be those that have a large customer base, are struggling with their bottom lines or are already looking at exit routes. OTT players were already offering services like voice, messaging, video calling and so on which have been the domain expertise of mobile operators for a long time. The market will see instances where telecom providers will sell small stakes to OTT players at a premium and get access to the vast array of services that these OTT providers offer.

Contact centres were already on a path to modernisation – which got accelerated by the COVID-19 crisis. The need for omnichannel delivery and better insights from customer data has forced contact centres to adopt cloud solutions. Ecosystm Principal Advisor Audrey William says, “There is still a disconnect between integrating and synchronising customer data between Sales, Marketing and Customer Teams. However, the market is starting to see contact centre vendors work closer with vendors in customer experience management segment.”

Genesys and Adobe are collaborating on integrating Genesys cloud and the Adobe Experience Platform. The deeper integration of both platforms is aimed to give organisations a better omnichannel presence. The platform is live for users and Genesys and Adobe will introduce other features and capabilities throughout 2020. Genesys is already a partner of Adobe’s Exchange Program designed for technology partners to supplement Exchange Marketplace with extensions and applications for Adobe Creative Cloud users.

Augmenting the CX journey through Data Synchronization

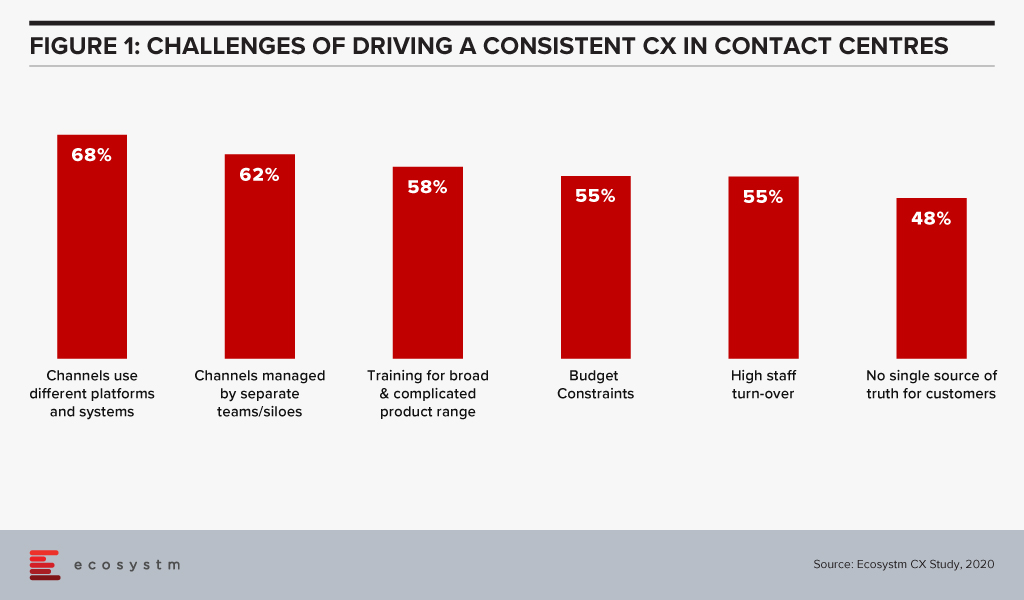

Ecosystm data finds that 62% of contact centres have driving omnichannel experience as a key customer experience (CX) priority and 57% want to analyse data across multiple data repositories. However, when asked about the challenges of driving consistent CX, data access and integration appears to be a barrier in achieving their priorities. These challenges are the reason why getting a “true view” of the customer data has been an arduous task and achieving consistent CX continues to be a struggle.

William says. “The customer data collected by a particular service or department does not always move along in real-time with the customer interactions across different touchpoints. This complicates maintaining a real-time customer profile and impacts the CX.”

“Sales and Marketing have different KPIs and tend to view customer data from different angles. The data from in-store, Marketing and Sales interactions sits within departmental silos. They may deal with the same customers and not follow them through their entire journey. This leads to missed opportunities in reaching out to them at the right time with the right products to upsell, resell or provide better CX. Data synchronisation across channels, would solve that problem.”

Integrating Genesys and Adobe Experience Platform will give organisations the capability to provide contact centre agents with real-time customer data and profiles from a single point to provide an personalised experience. The platform is powered by Genesys Predictive Engagement that uses AI to provide more intelligence based on past interactions to drive effective, data-driven conversations. In addition to this, the partnership also enables businesses and marketing departments to customise campaigns and extend their digital and voice capabilities for optimal conversions. William says, “The ability to use AI to understand customer intent, behaviour and patterns is critical as it will allow brands to re-look at how to design the customer journey. When you keep using the same and outdated profile, it will be hard to have discussions around intent, customer interest and assess how customer priorities have changed. Accurate and automate data profiling will lead to more targeted and accurate marketing campaigns.”

Genesys Deepening Industry Partnerships

Genesys is re-shaping its strategy on Contact Centre as a Service (CCaaS) offerings through partnerships and working on its vision of providing Experience as a Service to its global clients. The need for CCaaS has been accelerated by the pandemic. Last month Genesys signed a five year deal with Infosys to develop and deploy cloud CX and contact centre solutions.

Earlier this year, Genesys partnered with MAXIMUS, a US Government services provider to set up the MAXIMUS Genesys Engagement Platform, an integrated, cloud-based omnichannel contact centre solution driven by the government requirement for public sector organisations to provide seamless customer experiences similar to those offered in the private sector.

The company has also partnered with various other industry leaders like Microsoft, Google Cloud, and Zoom to roll out cloud-based innovations to benefit customers.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

The COVID-19 crisis has required major resets in how organisations function – across industries and economies. In this environment of intense changes, businesses that have been agile in their operations and were better digitally enabled have thrived, while others have struggled. Irrespective of whether an organisation has been able to pivot fast to thrive or struggled to cope, it is very clear that the Future of Work is here now. Every organisation has had to make some changes to their People and work practices. It is time to (re) focus on employee experience holistically so that organisations can be ready for whatever model of work becomes prevalent in the future. I have recently published a report offering guidance to business leaders and HR Teams on how to make holistic workplace shifts, with inputs from Ecosystm Principal Advisors, Tim Sheedy and Audrey William.

Employee Experience at the Core of Customer Strategies

It has become increasingly clear that customer experience (CX) is not just about good sales skills or customer service. It is about the overall experience of the customer from start to post-purchase. Customers are focused on not just what they are buying but also on how they are treated along their entire journey. Good CX has consistently shown to help increase price premium, impulse buying, and loyalty. Consequently, one bad experience can drive a customer away forever. Customers pay for your products or services, but it is your people who can really deliver the experience.

Audrey says, “As it becomes clear that we are headed for a hybrid/blended model of work, employee experience (EX) has to be a key focus area for organisations. Organisations will have to support remote work and simultaneously evolve their physical workplaces so that employees have the choice to come into work. But business leaders and HR will definitely have to come together to re-evaluate their policies around employees and improving EX – irrespective of where they choose to work from.”

The Role of Productivity in the Digital Workplace

Productivity has been at the core of an organisation’s desire to be a digital workplace. Tim says, “A digital workplace is one that has the capability to support any employee to access the process, information or system they need on their device of choice, in their moment and location of need. In the wake of the pandemic, the digital workplace went from being a ‘good idea’ to an ‘absolute necessity’ – and the seeds were sown to build true digital workplaces, years ahead of plan.”

This is the time to retain that focus on productivity. A lot of energy is being spent in defining and measuring productivity. The focus seems to have shifted to how to get the best out of the remote/hybrid workforce. It is time for business leaders and HR to go back to the drawing board to re-define what productivity means to their organisations.

Tim says, “The focus should be on enabling productivity rather than on monitoring activity. Productivity is an outcome, not a process. So, measure the outcome, improve the process. Productivity will be driven at an organisational level through removing friction from overall operational processes, to make things more streamlined and effective to create more value.”

The True Implication of Flexibility

There has been a rapid shift in practices around working from home and flexibility. But it is time now for organisations to create a framework (policy, performance expectation and management) to manage these practices. Many companies do not really understand the implications of flexible working to their business. In fact, they may be unaware of shifts in work patterns that have taken place in the last few months and the impact these shifts are having on the business.

Framework around flexible working should be backed by data and an understanding of the feasibility of such practices. If your employee has to work on her compulsory day off, then you do not have a truly flexible work practice. This will have a negative impact on employee experience and ultimately on your business.

The Evolution of Employee Engagement

Audrey says, “One of the areas that business leaders and HR will have to bear in mind is that despite flexible working hours, employees might be overworked – it is emerging as a common problem with working from home. It is common that many employees are working longer hours.”

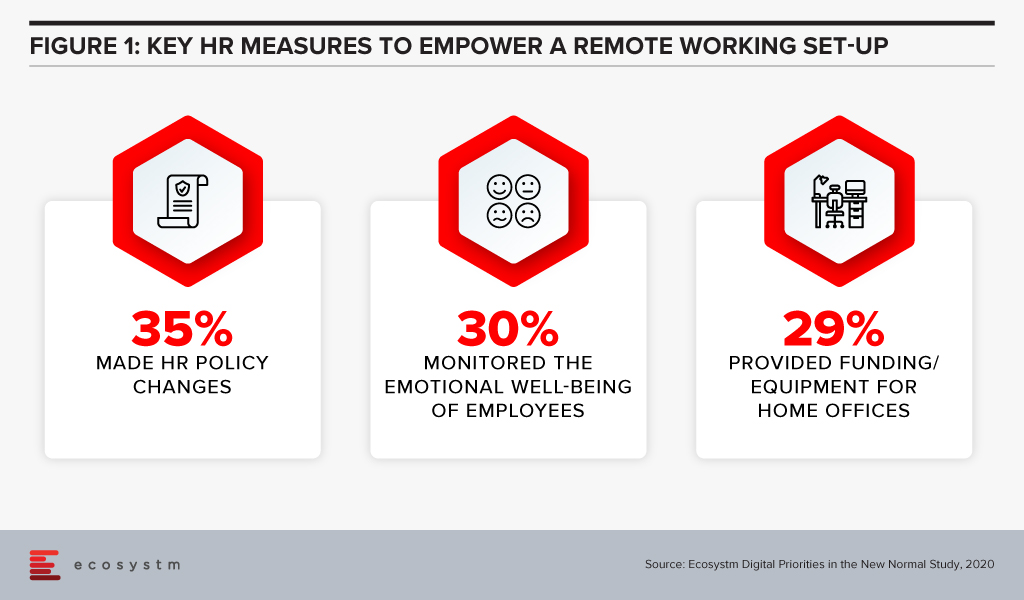

Ecosystm research finds that some organisations have been evolving their HR practices, since the start of this crisis (Figure 1).

But more needs to be done. Organisations have to work really hard to replicate their employee engagement and social hours in the virtual world. It is critical that organisations design mechanisms of keeping employees connected – to each other, as well as to the organisation. “Virtual social groups” not only provide this connection, it can also be a rich source of input for HR and wellness teams to quickly adapt their programs to meet the changing needs of employees.

Shift in Managerial Styles

Performance management has been traditionally done through annual cycles, and by monitoring and tracking. In the Future of Work, organisations will have to increasingly give their employees the choice of working from home. Meetings, check-ins, 1:1 and team huddles for close monitoring will not work in this remote/hybrid model.

It is time to stop close monitoring and really focus on outcome-based management. And this will have to start with re-skilling people managers. Training should be provided on softer skills such as emotional intelligence, being able to sense across boundaries and digital spaces, and being able to be responsive to employees’ needs. The people manager must evolve into being a coach and a mentor – internal coaching and mentoring networks will have to be established. Line managers, business leaders and HR teams will need to collaborate more to ensure that these skills are developed and that the right support system is in place.