The semiconductor industry is 70-years old and has a prominent – and sometimes inconspicuous – presence in our daily lives. Many of us, however, have become more aware of the industry and the ramifications of its disruption, because of recent events. The pandemic, natural disasters, power outages, geo-political conflicts, and accelerated digital transformation have all combined to disrupt the semiconductor sector, leaving no organisation immune to the impacts of the continuing global chip crisis.

It is estimated that 200 downstream industries have failed to fulfill customer demands owing to the silicon scarcity, ranging from automotive, consumer electronics, utilities and even the supply of light fixtures.

This Ecosystm Bytes discusses the impact of the crisis and highlights major initiatives that chip manufacturers and governments are taking to combat it, including:

- The factors leading to the shortage in the semiconductor industry

- The impact on industry sectors such as Automotive, Consumer Electronics and MedTech

- How leading chip makers such as TSMC, Intel and Samsung are increasing their manufacturing capabilities

- The importance of Asia to the semiconductor industry

- How countries such as Malaysia and India are aiming to build self-sufficiency in the industry

Read on to find out more.

Last week, NVIDIA announced that it had agreed to acquire UK-based chip company Arm from Japanese conglomerate SoftBank in a deal estimated to be worth USD 40 billion. In 2016, SoftBank had acquired Arm for USD 32 billion. The deal is set to unite two major chip companies; power data centres and mobile devices for the age of AI and high-performance computing; and accelerate innovation in the enterprise and consumer market.

Rationale for the Deal

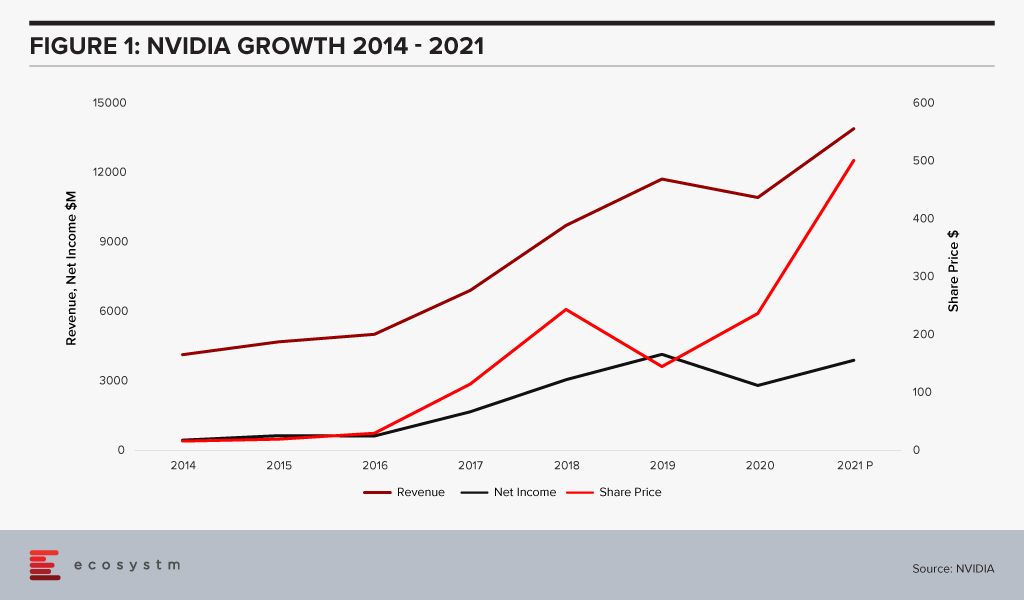

NVIDIA has long been the industry leader in graphics chips (GPUs), and a smaller but significantly profitable player in the chip stakes. With graphic processing being a key component in AI applications like facial recognition, NVIDIA was quick to capitalise. This allowed it to move into data centres – an area long dominated by Intel who still holds the lion’s share of this market. NVIDIA’s data centre business has grown tremendously – from near zero less than ten years ago to nearly USD 3 billion in the first two quarters of this fiscal year. It contributes 42% of the company’s total sales.

The gaming PC market has been the fastest-growing segment in the PC market. The rare shining light in an otherwise stagnant-to-slightly declining market. NVIDIA has benefited greatly from this with a huge jump in their graphics revenues. Its GeForce brand is one of the most desired in the industry. However, with their success in AI, NVIDIA’s ambition has now grown well beyond the graphics market. Last year NVIDIA acquired Mellanox – who makes specialised networking products especially in the area of high-performance computing, data centres, cloud computing – for almost USD 7 billion. There is clearly a desire to expand the company’s footprint and position itself as a broad-based player in the data centre and cloud space focused on AI computing needs.

The acquisition of Arm though adds a whole new dimension. Arm is the leading technology provider in the mobile chip market. A staggering 90% of smartphones are estimated to use Arm technology. Arm is the colossus of the small chip industry – having crossed 20 billion in unit shipments in 2019.

Acquiring Arm is likely to result in NVIDIA now having a play in the effervescent smartphone market. But the company is possibly eyeing a different prize. Jensen Huang, Founder and CEO of NVIDIA said “AI is the most powerful technology force of our time and has launched a new wave of computing. In the years ahead, trillions of computers running AI will create a new internet-of-things that is thousands of times larger than today’s internet-of-people. Our combination will create a company fabulously positioned for the age of AI.”

With thoughts of self-driving cars, connected homes, smartphones, IoT, edge computing – all seamlessly working with each other, the acquisition of Arm provides NVIDIA a unique position in this market. As the number of connected devices explodes, as many billions of sensors become an ubiquitous part of 21st century living, there is going to be a huge demand for low power processing everywhere. Having that market may turn out to be a larger prize than the smartphone market. The possibilities are endless.

While this deal is supposed to be worth around USD 40 billion, somewhere between USD 23-28 billion is going to be paid in the form of NVIDIA stock. This brings us to an extremely interesting dynamic. At the beginning of 2016 NVIDIA’s market cap was less than USD 20 billion. Mighty Intel was at USD 150 billion. AMD the other player in the market for chips who also sell graphics was at a mere USD 2 billion. In July this year, NVIDIA’s value passed Intel’s and today it is sitting at around USD 300 billion! Intel with a recent dip is now close to USD 200 billion. AMD too with all the tech-fueled growth in recent years has grown to just shy of USD 100 billion market cap.

What this tells us is that the stock portion of the deal is cheaper for NVIDIA today by around 55% compared to if this deal was consummated on 1st January 2020. If there was a right time for NVIDIA to buy – it is now. This also shows the way the company has grown revenue at a massive clip powered by Gaming PCs and AI. The deal to buy Arm appears to be a very good idea, which would establish NVIDIA as a leader in the chip industry moving forward.

Ecosystm Comments

While there appears to be some good reasons for this deal and there are some very exciting possibilities for both NVIDIA and Arm, there are some challenges.

The tech industry is littered with examples of large mergers and splits that did not pan out. Given that this is a large deal between two businesses without a large overlap, this partnership needs to be handled with a great deal of care and thought. The right people need to be retained. Customer trust needs to be retained.

Arm so far has been successful as a neutral provider of IP and design. It does not make chips, far less any downstream products. It therefore does not compete with any of the vendors licensing its technology. NVIDIA competes with Arm’s customers. The deal might create significant misgivings in the minds of many customers about sharing of information like roadmaps and pricing. Both companies have been making repeated statements that they will ensure separation of the businesses to avoid conflicts.

However, it might prove to be difficult for NVIDIA and Arm to do the delicate dance of staying at arm’s length (pun intended) while at the same time obtaining synergies. Collaborating on technology development might prove to be difficult as well, if customer roadmaps cannot be discussed.

Business today also cannot escape the gravitational force of geo-politics. Given the current US-China spat, the Chinese media and various other agencies are already opposing this deal. Chinese companies are going to be very wary of using Arm technology if there is a chance the tap can be suddenly shut down by the US government. China accounts for about 25% of Arm’s market in units. One of the unintended consequences which could emerge from this is the empowerment of a new competitor in this space.

NVIDIA and Arm will need to take a very strategic long-term view, get communication out well ahead of the market and reassure their customers, ensuring they retain their trust. If they manage this well then they can reap huge benefits from their merger.

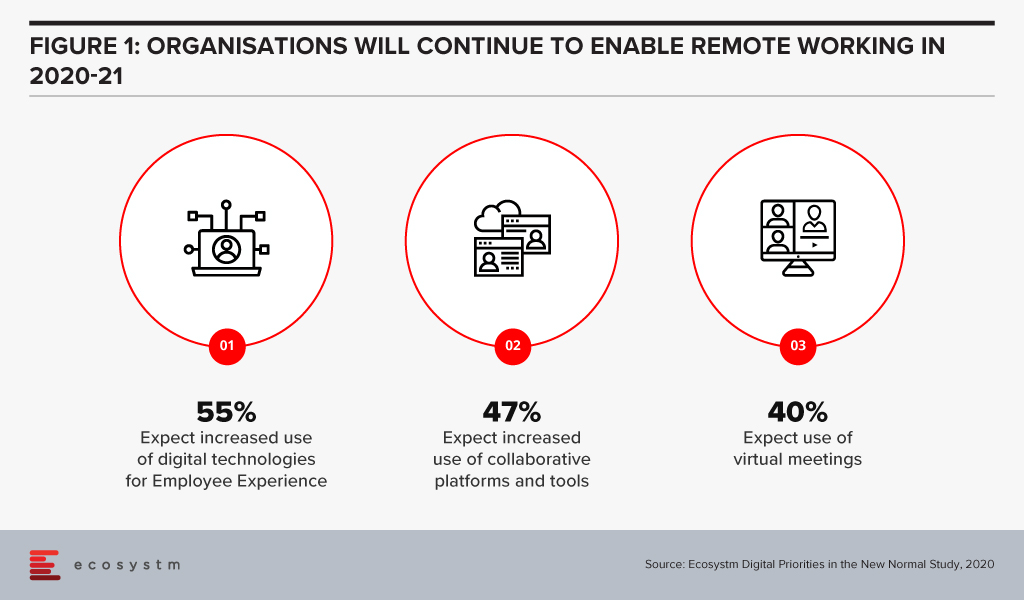

The Future of Work is here, now. Organisations were faced with unprecedented challenges of coping with the work-from-home model, when COVID-19 hit earlier this year. Many organisations managed the pivot very successfully, but all organisations were impacted in some way. Various trends have emerged over the last few months, that are likely to persist long after the immediate COVID-19 measures are removed by countries. In the Ecosystm Digital Priorities in the New Normal study, we find that organisations will continue to cater for remote employees (Figure 1) and keep a firm eye on employee experience (EX).

August has seen these clear trends in the Future of Work

#1 Tech companies leading from the front in embracing the Future of Work

As the pandemic continued to spread across the globe, various companies adopted the work from home model at a scale never seen before. While it is still unclear how the work model will look like, many companies continue to extend their remote working policies for the remaining year, and some are even thinking of making it a permanent move.

Tech companies appear to be the most proactive in extending remote working. Google, Microsoft, and AWS have all extended their work from home model till the end of the year or till the middle of next year. Earlier in the month Facebook extended its work from home program until mid-2021 and are also giving employees USD 1,000 to equip their home offices. This appears to be a long-term policy, with the company announcing in May that in the next 5-10 years, they expect 50% of their employees to be remote. Similarly, Salesforce and Uber also announced that they would be extending remote working till the mid-next year, and are providing funding for employees to set up the right work environment.

In Australia, Atlassian has made work from home a permanent option for their employees. They will continue to operate their physical offices but have given employees the option to choose where they want to work from.

Some organisations have gone beyond announcing these measures. Slack has talked about how they are evolving their corporate culture. For example, they have evolved their hiring policies and most new roles are open to remote candidates. Going forward, they are evaluating a more asynchronous work environment where employees can work the hours that make sense for them. In their communique, they are open about the fluid nature of the work environment and the challenges that employees and organisations might face as their shift their work models.

Organisations will have to evaluate multiple factors before coming up with the right model that suits their corporate culture and nature of work, but it appears that tech companies are showing the industry how it can be done.

#2 Tech companies evolve their capabilities to enable the Future of Work

Right from the start of the crisis, we have seen organisations make technology-led pivots. Technology providers are responding – and fast – to the changing environment and are evolving their capabilities to help their customers embrace the digital Future of Work.

Many of these responses have included strengthening their ecosystems and collaborating with other technology providers. Wipro and Intel announced a collaboration between Wipro’s LIVE Workspace digital workspace solution and the Intel vPro platform to enable remote IT support and solution. The solution provides enhanced protection and security against firmware-level attacks. Slack and Atlassian strengthened their alliance with app integrations and an account ‘passport’ in a joint go-to-market move, to reduce the time spent logging into separate services and products. This will enable both vendors to focus on their strengths in remote working tools and provide seamless services to their customers.

Tech companies have also announced product enhancements and new capabilities. CBTS has evolved their cloud-based unified communications, collaboration and networking solutions, with an AI-powered Secure Remote Collaboration solution, powered by Cisco Webex. With seamless integration of Cisco Webex software, Cisco Security software, and endpoints that combine high-definition cameras, microphones, and speakers, with automatic noise reduction, the solution now offers features such real-time transcription, closed captioning, and recording for post-meeting transcripts.

Communication and Collaboration tools have been in the limelight since the start of the crisis with providers such as Zoom, Microsoft Teams and Slack introducing new features throughout. In August Microsoft enhanced the capabilities of Teams and introduced a range of new features to the Teams Business Communications System. It now offers the option to host calls of up to 20,000 participants with a limit to 1,000 for interactive meetings, after which the call automatically shifts to a “view only” mode. With the possibility of remote working becoming a reality even after the crisis is over, Microsoft is looking to make Teams relevant for a range of meeting needs – from one-on-one meetings up to large events and conferences. In the near future, the solution will also allow organisations to add corporate branding, starting with branded meeting lobbies, followed by branded meeting experiences.

While many of these solutions are aimed at large enterprises, tech providers are also aware that they are now receiving a lot of business from small and medium enterprises (SMEs), struggling to make changes to their technology environment with limited resources. Juniper has expanded their WiFi 6 access points to include 4 new access points aimed at outdoor environments, SMEs, retail sites, K-12 schools, medical clinics and even the individual remote worker. While WiFi 6 is designed for high-density public or private environments, it is also designed for IoT deployments and in workplaces that use videoconferencing and other applications that require high bandwidth.

#3 The Future of Work is driving up hardware sales

Ecosystm research shows that at the start of the crisis, 76% of organisations increased investments in hardware – including PCs, devices, headsets, and conferencing units – and 67% of organisations expect their hardware spending to go up in 2020-21. Remote working remains a reality across enterprises. Despite the huge increase in demand, it became difficult for hardware providers to fulfil orders initially, with a disrupted supply chain, store closures and a rapid shift to eCommerce channels. This quarter has seen a steady rise in hardware sales, as providers overcome some of their initial challenges.

Apart from enterprise sales, there has been a surge in the consumer demand for PCs and devices. While remote working is a key contributor, online education and entertainment are mostly prompting homebound people to invest more in hardware. Even accessories such as joysticks are in short supply – a trend that seems to have been accelerated by the Microsoft Flight Simulator launch earlier this month.

The demand for both iPad and Mac saw double-digit growth in this quarter. Around half of the customers purchasing these devices were new to the product. Apple sees the rise in demand from remote workers and students. Lenovo reported a 31% increase in Q1 net profits with demand surges in China, Europe, the Middle East and Africa.

#4 The impact on Real Estate is beginning to show

The demand for prime real estate has been hit by remote working and organisations not renewing leases or downsizing – both because most employees are working remotely and because of operational cost optimisation during the crisis. This is going to have a longer-term impact on the market, as organisations re-evaluate their need for physical office space. Some organisations will reduce office space, and many will re-design their offices to cater to virtual interactions (Figure 1). While now, Ecosystm research shows that only 16% of enterprises are expecting a reduction of commercial space, this might well change over the months to come. Organisations might even feel the need to have multiple offices in suburbs to make it convenient for their hybrid workers to commute to work on the days they have to. Amazon is offering employees additional choices for smaller offices outside the city of Seattle.

But the Future of Work and the rise of a distributed workforce is beginning to show an initial impact on the real estate industry. Last week saw Pinterest cancel a large office lease at a building to be constructed near its headquarters in San Francisco. The company felt that it might not be the right time to go ahead with the deal, as they are re-evaluating where employees would like to work from in the future. Even the termination fees of USD 89.5 million did not discourage them. They will continue to maintain their existing work premises but do not see feel that it is the right time to make additional real estate investments, as they re-evaluate where employees would like to work from in the future.

There is a need for organisations to prepare themselves for the Future of Work – now! Ecosystm has launched a new 360o Future of Work practice, leveraging real-time market data from our platform combined with insights from our industry practitioners and experienced analysts, to guide organisations as they shift and define their new workplace strategies.

In his blog, The Cybercrime Pandemic, Ecosystm Principal Advisor, Andrew Milroy says, “Remote working has reached unprecedented levels as organisations try hard to keep going. This is massively expanding the attack surface for cybercriminals, weakening security and leading to a cybercrime pandemic. Hacking activity and phishing, inspired by the COVID-19 crisis, are growing rapidly.” Remote working has seen an increase in adoption of cloud applications and collaborative tools, and organisations and governments are having to re-think their risk management programs.

We are seeing the market respond to this need and May saw initiatives from governments and enterprises on strengthening risk management practices and standards. Tech vendors have also stepped up their game, strengthening their Cybersecurity offerings.

Market Consolidation through M&As Continues

The Cybersecurity market is extremely fragmented and is ripe for consolidation. The last couple of years has seen some consolidation of the market, especially through acquisitions by larger platform players (wishing to provide an end-to-end solution) and private equity firms (who have a better view of the Cybersecurity start-up ecosystem). Cybersecurity providers continue to acquire niche providers to strengthen their end-to-end offering and respond to market requirements.

As organisations cope with remote working, network security, threat identification and identity and access management are becoming important. CyberArk acquired Identity as a Service provider Idaptive to work on an AI-based identity solution. The acquisition expands its identity management offerings across hybrid and multi-cloud environments. Quick Heal invested in Singapore-based Ray, a start-up specialising in next-gen wireless and network technology. This would benefit Quick Heal in building a safe, secure, and seamless digital experience for users. This investment also shows Quick Heal’s strategy of investing in disruptive technologies to maintain its market presence and to develop a full-fledged integrated solution beneficial for its users.

Another interesting deal was Venafi acquiring Jetstack. Jetstack’s open-source Kubernetes certificate manager controller – cert-manager – with a thriving developer community of over 200 contributors, has been used by many global organisations as the go-to tool for using certificates in the Kubernetes space. The community has provided feedback through design discussion, user experience reports, code and documentation contributions as well as serving as a source for free community support. The partnership will see Venafi’s Machine Identity Protection having cloud-native capabilities. The deal came a day after VMware announced its intent to acquire Octarine to extend VMware’s Intrinsic Security Capabilities for Containers and Kubernetes and integrate Octarine’s technology to VMware’s Carbon Black, a security company which VMware bought last year.

Cybersecurity vendors are not the only ones that are acquiring niche Cybersecurity providers. In the wake of a rapid increase in user base and a surge in traffic, that exposed it to cyber-attacks (including the ‘zoombombing’ incidents), Zoom acquired secure messaging service Keybase, a secure messaging and file-sharing service to enhance their security and to build end-to-end encryption capability to strengthen their overall security posture.

Governments actively working on their Cyber Standards

Governments are forging ahead with digital transformation, providing better citizen services and better protection of citizen data. This has been especially important in the way they have had to manage the COVID-19 crisis – introducing restrictions fast, keeping citizens in the loop and often accessing citizens’ health and location data to contain the disaster. Various security guidelines and initiatives were announced by governments across the globe, to ensure that citizen data was being managed and used securely and to instil trust in citizens so that they would be willing to share their data.

Singapore, following its Smart Nation initiative, introduced a set of enhanced data security measures for public sector. There have been a few high-profile data breaches (especially in the public healthcare sector) in the last couple of years and the Government rolled out a common security framework for public agencies and their officials making them all accountable to a common code of practice. Measures include clarifying the roles and responsibilities of public officers involved in managing data security, and mandating that top public sector leadership be accountable for creating a strong organisational data security regime. The Government has also empowered citizens to raise a flag against unauthorised data disclosures through a simple incident report form available on Singapore’s Smart Nation Website.

Australia is also ramping up measures to protect the public sector and the country’s data against threats and breaches by issuing guidelines to Australia’s critical infrastructure providers from cyber-attacks. The Australian Cyber Security Centre (ACSC) especially aims key employees working in services such as power and water distribution networks, and transport and communications grids. In the US agencies such as the Cybersecurity and Infrastructure Security Agency (CISA) and the Department of Energy (DOE) have issued guidelines on safeguarding the country’s critical infrastructure. Similarly, UK’s National Cyber Security Centre (NCSC) issued cybersecurity best practices for Industrial Control Systems (ICS).

Cyber Awareness emerges as the need of the hour

While governments will continue to strengthen their Cybersecurity standards, the truth is Cybersecurity breaches often happen because of employee actions – sometimes deliberate, but often out of unawareness of the risks. As remote working becomes a norm for more organisations, there is a need for greater awareness amongst employees and Cybersecurity caution should become part of the organisational culture.

Comtech received a US$8.4 million in additional orders from the US Federal Government for a Joint Cyber Analysis Course. The company has been providing cyber-training to government agencies in the communications sector. Another public-private partnership to raise awareness on Cybersecurity announced in May was the MoU between Europol’s European Cybercrime Centre (EC3) and Capgemini Netherlands. With this MoU, Capgemini and Europol are collaborating on activities such as the development of cyber simulation exercises, capacity building, and prevention and awareness campaigns. They are also partnered on a No More Ransomware project by National High Tech Crime Unit of the Netherlands’ Police, Kaspersky and McAfee to help victims fight against ransomware threats.

The Industry continues to gear up for the Future

Technology providers, including Cybersecurity vendors, continue to evolve their offerings and several innovations were reported in May. Futuristic initiatives such as these show that technology vendors are aware of the acute need to build AI-based cyber solutions to stay ahead of cybercriminals.

Samsung introduced a new secure element (SE) Cybersecurity chip to protect mobile devices against security threats. The chip received an Evaluation Assurance Level (EAL) 6+ certification from CC EAL – a technology security evaluation agency which certifies IT products security on a scale of EAL0 to EAL7. Further applications of the chip could include securing e-passports, crypto hardware wallets and mobile devices based on standalone hardware-level security. Samsung also introduced a new smartphone in which Samsung is using a chipset from SK Telecom with quantum-crypto technology. This involves Quantum Random Number Generator (QRNG) to enhance the security of applications and services instead of using normal random number generators. The technology uses LED and CMOS sensor to capture quantum randomness and produce unpredictable strings and patterns which are difficult to hack. This is in line with what we are seeing in the findings of an Ecosystm business pulse study to gauge how organisations are prioritising their IT investments to adapt to the New Normal. 36% of organisations in the Asia Pacific region invested significantly in Mobile Security is a response to the COVID-19 crisis.

The same study reveals that nearly 40% of organisations in the region have also increased investments in Threat Analysis & Intelligence. At the Southern Methodist University in Texas, engineers at Darwin Deason Institute for Cybersecurity have created a software to detect and prevent ransomware threats before they can occur. Their detection method known as sensor-based ransomware detection can even spot new ransomware attacks and terminates the encryption process without relying on the signature of past infections. The university has filed a patent for this technique with the US Patent and Trademark Office.

Microsoft and Intel are working on a project called STAMINA (static malware-as-image network analysis). The project involves a new deep learning approach that converts malware into grayscale images to scan the text and structural patterns specific to malware. This works by converting a file’s binary form into a stream of raw pixel data (1D) which is later converted into a photo (2D) to feed into image analysis algorithms based on a pre-trained deep neural network to scan and classify images as clean or infected.

Thriving in the New Normal – Overcoming Our Challenges Together

In this webinar, we will discuss how we can help you and your organisation during these difficult times. To keep your business running, remote workplace solutions have become essential. We want to share capabilities on how to stay connected—and stay secure—while we work remotely.