Ecosystm had predicted that in 2020, AI and analytics would be a top priority for organisations as they embarked or continued on their Digital Transformation journeys. What we saw instead was organisations collecting the right data – but handling more pressing matters this year. They focused more on cybersecurity frameworks, enabling remote employees and the shifts in product and service delivery. In 2021, as organisations work their way to recovery, they will re-evaluate their AI and automation roadmaps, more actively. Ecosystm Advisors Alea Fairchild, Andrew Milroy and Tim Sheedy present the top 5 Ecosystm predictions for AI & Automation in 2021.

This is a summary of the AI & Automation predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 AI & Automation Trends for 2021

- AI Will Move from a Competitive Advantage to a Must-Have

The best practices and leading-edge technology-centric implementations, over the years gives a very good indication of market trends. In 2018 and 2019 AI-centric engagements were few and far between – they were still in the “innovation stage” as trials and small projects. In 2020, AI was mentioned in most applications, showcased as best practices. AI is currently a competitive advantage for businesses. CIOs and their businesses are using AI to get ahead of their competitors and highlighting these practices for external recognition.

That also means that it is a matter of time before AI becomes a standard practice – processes are smart “out-of-the-box”; intelligent applications are an expectation, not the exception; systems learn because that is how they were designed, not as an overlay. If your competitors are using AI today to get ahead of you, then you need to also use AI to catch up and keep up. In 2021, having a smart business will not get you ahead of the pack – it will move you into it.

- AI Will Thrive in Areas where the Cost of Failure is Low

While organisations will be forced to adopt AI to remain competitive, initial exploration of AI solutions will be in areas that they consider low risk. The Financial Services, Retail, and other transaction-oriented industries will use AI to drive improved personalisation, increase customer retention, and improve their ability to lower risk and combat fraud. These are process-driven areas, where manual processes are being enhanced and enriched by AI. Although machine learning and other AI technologies will help improve the speed and quality of services, they will not be a replacement for many of the more complex business practices that companies and their employees frequently overlook to automate. The ‘low hanging fruit’ to add AI to will come first, with various degrees of success.

There will be industries and processes where organisations will be more skeptical about adopting AI. If Google finds a wrong translation or gives a wrong link, it is not a big concern, unlike a wrong diagnosis or wrong medication. In areas that are crucial to our well-being – such as healthcare – AI does not yet have the trust for acceptance of society. There are still questions around ethics and algorithm concerns.

- Technology Providers Will Stop Talking about AI

Technology vendors highlight what they consider their key differentiators, that show that they are ahead of the game. When every piece of software and hardware is intelligent, vendors will stop talking about the fact that they are intelligent. This may not fully happen in 2021 – but ENOUGH technology will be intelligent for those who have not yet made their software smart to understand that they cannot talk about its intelligent capabilities as that just shows they are behind the market.

The good news is that the less we hear about AI, the more intelligent applications will become. AI is quickly becoming a core capability and a base expectation. Systems that learn and adapt will be standard very soon – but be wary, as significant market changes can break these systems! Many companies learned that the pandemic broke their algorithms as times were no longer “normal”.

- Enterprises Will Seek Hyperautomation Solutions

RPA will increasingly become part of large enterprise application implementations. Technology vendors are adding RPA functionality either organically or through acquisitions to their enterprise application suites. RPA often works in conjunction with major software products provided by companies such as Salesforce, SAP, Microsoft, and IBM. Rather than having an operative enter data into multiple systems, a bot can be created to do this. Large software vendors are taking advantage of this opportunity by trying to own entire workflows. They are increasingly integrating RPA into their offerings as well as competing directly in the RPA market with pureplay RPA vendors.

As the RPA offerings continue to mature, enterprises seek to scale implementations and to automate non-repetitive processes, which require more intelligence. They will seek to automate more processes at scale. They will demand solutions that process unstructured data, handle exceptions, and continuously learn, further increasing productivity. Intelligent automation typically incorporates AI, particularly voice and vision capabilities and uses machine learning to optimise processes. Hyperautomation turbo charges intelligent automation by automating multiple processes at scale – and will become core to digital transformation initiatives in 2021.

- Businesses Will Put “Automation Targets” in Place

2020 was the year that many businesses started seeing some broad and tangible benefits from their automation initiatives. Automation was one of the big winners of the year, as many businesses took extra steps to take humans out of processes – particularly those humans that had to be in a specific location, such as a warehouse, the finance team, the front desk and so on (because of the pandemic, they were often working at home instead). Senior management is seeing the benefits of automation, and they will start to ask their teams why more processes are not automated Therefore we will start to see managers put targets around a certain percentage of tasks automated in an area – e.g. 70% of contact centre processes will be automated, 90% of the digital customer experience for a certain outcome will be automated and so on. Achieving these numbers may not be easy, but the targets will change the mindset of people designing, implementing, and improving processes.

Join this exclusive C-level virtual discussion, where alongside a handpicked gathering of your peers we will discuss:

- How application modernisation will have an immediate and long-term impact on your business

- Ensuring that app deployment and modernisation happens in a fast and agile manner by leveraging hybrid cloud environments

- Modernising technology implementations through APIs and containerisation

There has been a heightened interest in the cloud in EMEA in recent times, triggered by several regional and country level announcements.

The European Union (EU) founded the GAIA-X Foundation to build a unified system of cloud and data services to be protected by EU Laws – including GDPR, the free flow of non-personal data regulation and the Cybersecurity Act. France and Germany kicked off the GAIA-X cloud project last year and the system is open for participation to national and European initiatives for exchange of data across industries and services such as AI, IoT and data analytics. GAIA-X took another step towards becoming a real option for European organisations with the establishment as a legal entity in June. Founding members of GAIA-X include Atos, Bosch, BMW, Deutsche Telekom, EDF, German Edge Cloud, Orange, OVHcloud, SAP, and Siemens. Non-European providers, such as AWS, Microsoft, Google, and IBM will also have the opportunity to join GAIA-X. The UK Crown Commercial Service (CCS) has also been entering into agreements with public cloud platform providers to encourage increased cloud adoption in cash-strapped public sector organisations. It is a good time to evaluate organisations’ perception on cloud and their adoption patterns.

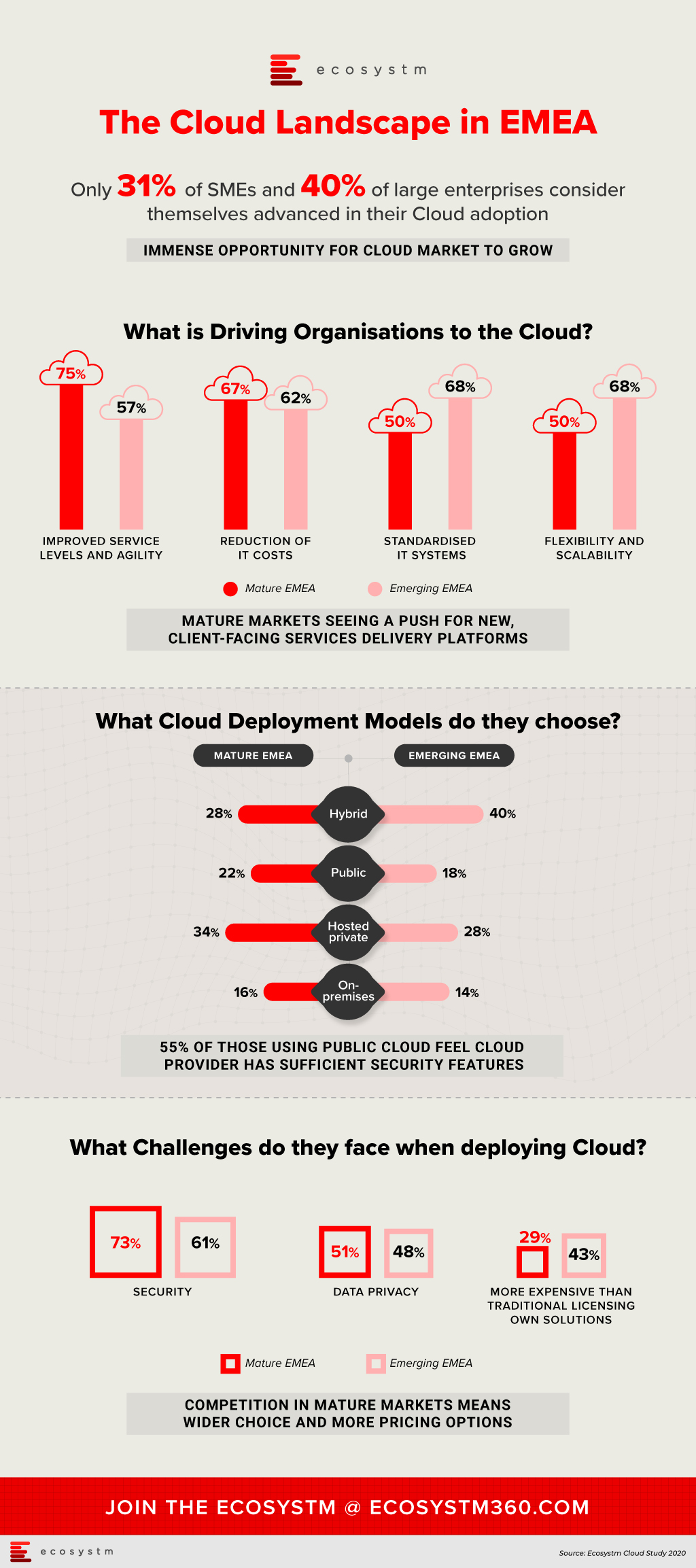

Ecosystm research finds that while most organisations have migrated at least some simple workloads to the cloud, the sophistication of these systems ranges from SaaS deployed as shadow IT, all the way up to cloud-native applications that are core to a digital business strategy. When asked about the maturity of their cloud deployments, 36% of organisations in EMEA consider themselves advanced, leaving the remaining 64% with more basic environments. These figures vary by business size with only 31% of SMEs considering their deployments advanced, rising to 40% for large enterprises.

Cloud technology providers should segment the market according to the maturity of their client’s systems. Those in the early stages of modernising their infrastructure will be seeking different benefits and will have different concerns than those already using cloud to underpin their digital transformation.

In the mature economies in the region, 75% of those with advanced deployments, considered improved service levels and agility as a key benefit of cloud. These organisations have moved beyond simply replacing legacy systems with cloud infrastructure and now look to the IT department to provide a platform on which new, client-facing services can be delivered. In the emerging economies, the most-reported benefits of cloud are flexibility and scalability, and standardised systems, both at 68% of respondents. These could be viewed as benefits expected from organisations not as far along in the cloud journey. The benefit of reduced IT costs was important in both mature EMEA (67%) and emerging EMEA (62%).

Looking at those who consider their cloud deployments as still basic, security is the leading challenge to greater adoption and by a large margin. Of those respondents in mature EMEA, 73% cited security as a key challenge, more than 20 percentage points higher than the next greatest difficulty. In emerging EMEA, a similar trend was evident, with 61% of respondents considering security as a key challenge. Moreover, data privacy is the second-most significant concern for those who do not consider their cloud deployments advanced. This was visible in both mature EMEA (51%) and emerging EMEA (48%). As organisations look to shift more critical workloads to the cloud, they will be increasing their attack surfaces and at the same time will face greater consequences if a breach does occur.

Services providers targeting organisations with less developed cloud environments should include security early in the conversation to push them along to the next stage of maturity.

The challenge that varied most according to market maturity and business size was the concern that cloud-based services were more expensive that traditional licencing or in-house solutions. Only 29% of respondents with basic cloud deployments in the mature economies, held this view, while in emerging economies the figure rose to 43%. Competition in those mature markets has in some cases put pressure on prices or at least resulted in wider choice. While 29% of SME respondents considered cost a key challenge, 41% of large enterprises did. Migrating larger, more complex environments to cloud will be viewed as more costly than the status quo due to organisational inertia.

The perception that cloud can be more costly, provides an opportunity for cloud management including expense optimisation services.

Organisations looking to move from a basic cloud environment to one that adopts a cloud-first model should begin with a maturity assessment. Understand what your systems will look like at the next stage, what the benefits will be, and what are the risks. More importantly, decide on the long-term business goal that you are trying to achieve, particularly how IT can be a critical player in the organisation’s digital strategy.

Note: Mature economies – France, Germany and the UK/ Emerging economies – Middle Eastern countries, Russia and South AfricaIdentify emerging cloud computing trends that can help you drive digital business decision making, vendor and technology platform selection and investment strategies.Gain access to more insights from the Ecosystm Cloud Study.

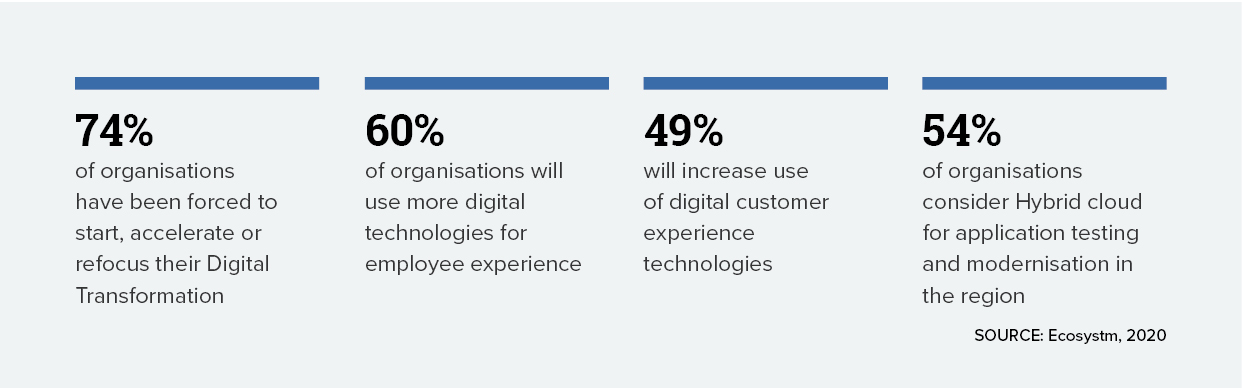

The pandemic crisis has rapidly accelerated digitalisation across all industries. Organisations have been forced to digitalise entire processes more rapidly, as face-to-face engagement becomes restricted or even impossible.

The most visible areas where face-to-face activity is being swiftly replaced by digital alternatives include conferencing and collaboration, and the use of digital channels to engage with customers, suppliers, and other stakeholders.

For example, the crisis has made it difficult – even impossible, sometimes – for contact centre agents to physically work in contact centres, and they often do not have the tools to work effectively from home. This challenge is particularly apparent for offshore contact centres in the Philippines and India. The creation of chatbots has reduced the need for customer service staff and enabled data to by entered into front-office systems, and analysed immediately.

Less visible are back-office processes which are commonly inefficient and labour-intensive. Remote working makes some back-office workflows challenging or impossible. For example, some essential finance and accounting workflows involve a mix of digital communications, printing, scanning, copying and storage of physical documents – making these workflows inefficient, difficult to scale and labour-intensive. This has been highlighted during the pandemic. RPA adoption has grown faster than expected as organisations seek to resolve these and other challenges – often caused by inefficient workflows being scrambled by the crisis.

The RPA Market in Asia Pacific

There are many definitions of the RPA market, but it can broadly be defined as the use of software bots to execute processes which involve high volumes of repeatable tasks, that were previously executed by humans. When processes are automated, the physical location of employees and other stakeholders becomes less important. RPA makes these processes more agile and flexible and makes businesses more resilient. It can also increase operational efficiency, drive business growth, and enhance customer and employee experience.

RPA is a comparatively new and fast-growing market – this is leading to rapid change. In its infancy, it was basically the digitalisation of BPO. It was viewed as a way of automating repetitive tasks, many of which had been outsourced. While its cost saving benefits remain important as with BPOs, customers are now seeking more. They want RPA to help them to improve or transform front-office, back-office and industry-specific processes throughout the organisation. RPA vendors are addressing these enhanced requirements by blending RPA with AI and re-branding their offerings as intelligent automation or hyper-automation.

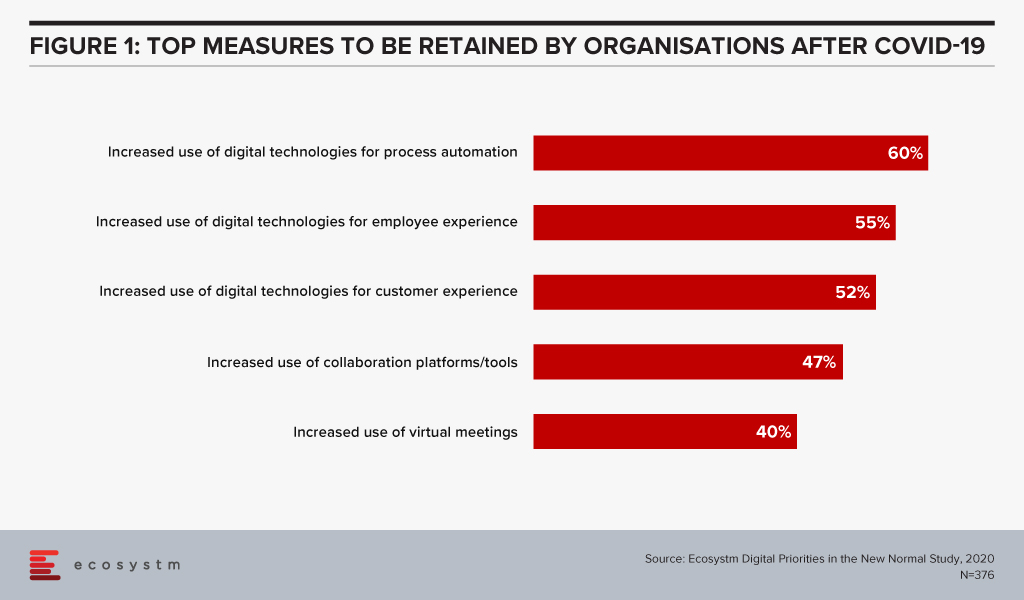

Asia Pacific organisations have been relatively slow to adopt RPA, but this is changing fast. The findings of the Ecosystm Digital Priorities in the New Normal study show that in the next 12 months, organisations will continue to focus on digital technologies for process automation (Figure 1).

The market is growing rapidly with large global RPA specialists such as UiPath, Automation Anywhere, Blue Prism and AntWorks experiencing high rates of growth in the region.

RPA vendors in Asia Pacific, are typically addressing immediate, short-term requirements. For example, healthcare companies are automating the reporting of COVID-19 tests and ordering supplies. Chatbots are being widely used to address unprecedented call centre volumes for airlines, travel companies, banks and telecom providers. Administrative tasks increasingly require automation as workflows become disrupted by remote working.

Companies can also be expected to scale their current deployments and increase the rate at which AI capabilities are integrated into their offerings

RPA often works in conjunction with major software products provided by companies such as Salesforce, SAP, Microsoft and IBM. For example, some invoicing processes involve the use of Salesforce, SAP and Microsoft products. Rather than having an operative enter data into multiple systems, a bot can be created to do this.

Large software vendors such as IBM, Microsoft, Salesforce and SAP are taking advantage of this opportunity by trying to own entire workflows. They are increasingly integrating RPA into their offerings as well as competing directly in the RPA market with pureplay RPA vendors. RPA may soon be integrated into larger enterprise applications, unless pureplay RPA vendors can innovate and continually differentiate their offerings.

As organisations come to terms with the “new normal”, technology companies are presenting unique offerings to help them tide over the situation and lead them towards economic and social recovery. These companies are also leading from the front and demonstrating how to transform with agility and pace – evolving their business and delivery models.

Organisations are dependent on digital technologies more than ever before. In 2020, we have already seen unprecedented and rapid adoption of technologies such as audio and video conferencing, collaboration tools to engage with employees and clients, contactless services, and AI/automation. This will have a wider impact on the technology industry, community, and redefining the workplace of the future.

Ecosystm Principal Advisor, Tim Sheedy hosted a virtual roundtable with business leaders from some of the world’s largest technology service providers to discuss how they managed the challenges during the pandemic; and the measures they implemented to support not only their business operations and working environment, but also to help their customers negotiate these difficult times.

The Role of Technology During the COVID-19 Crisis

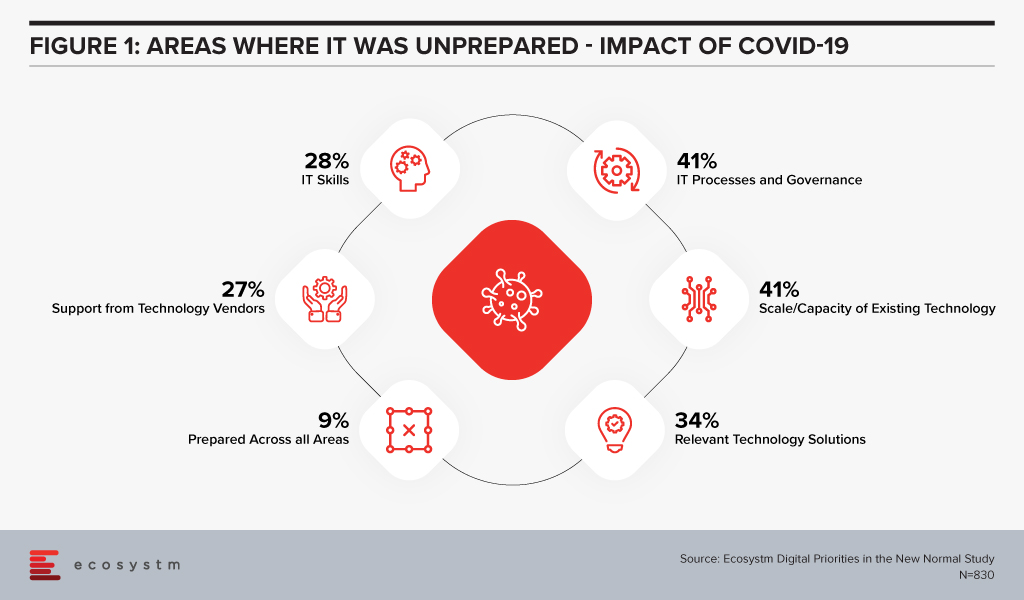

When the COVID-19 crisis hit, IT teams found themselves largely unprepared. Ecosystm research finds that only 9% of organisations considered their IT fully prepared for the changes that had to be implemented (Figure 1). More than a third did not have the right technology solutions and 41% were unprepared for the scale of the changes required and the capacity to extend the existing technology to meet client and employee needs.

While 27% of organisations felt that they needed more support from their IT provider, further questioning reveals that only 4% switched technology providers for better support during these difficult times. Organisations are looking to their technology partners for guidance, as they negotiate the new normal.

Here are some of the discussion points that emerged in the conversation with the technology providers.

Business Continuity Planning is Still Evolving

One of the early impacts on businesses was due to their dependence on outsourced services and offshore models. Several concerns emerged – how could their provider continue to operate offsite; would they be able to access the network remotely; how should fully remote teams be managed and so on. In addition to this, there were other challenges such as supply chain disruptions and a sudden change in business. Even technology providers felt that they were navigating uncharted territory.

“Remote project delivery is not new, it’s been going on for a few years; but I think that there’s been a lot of non-believers out there. This experience has moved a lot of those non-believers to the believer category. A lot of our delivery can be done from home – think of the savings of time and money that can be realised through this.” – Andrew Campbell, Partner Asia Pacific for Talent and Transformation, IBM

Moreover, the rising workload and client expectation has led businesses to move towards exploring automation and AI.

“The thing that is changing now is, when we approach a new opportunity or an existing customer with a new requirement, we look at using automation. Typically, when you go in to design a solution you always think of the human aspect. We’re working very hard to move our thinking to automation first and then supplementing it with the human side as a backup.” – Michael Horton, Executive VP, ANZ, HCL Technologies

Data has become paramount in this time of crisis. The right use of data is helping organisations fulfil customer requirements, enhance their experience, and optimise services and products.

“Those organisations that have a good understanding of the data within their business, and how that data can be used to understand the impact on their business, are starting to have much better clarity on future requirements.” – Peter Lawther, Oceania Regional Technology Officer, Fujitsu

Organisations should take the learnings from managing this situation to keep evolving their business continuity plans – keeping in mind individual business needs and growth and business strategies.

Having the Right Infrastructure Means Employees are Productive

The lockdown and social distancing measures forced organisations to focus on the infrastructure that can support their remote and hybrid work environment.

“Before the pandemic around 20-30% of our staff logged on to a VPN, but with remote working, all of a sudden, we were at 90%.” – Lawther

The adoption of digital tools and online infrastructure led businesses to re-think how they were delivering their services. While some organisations had the tools, governance and the protocols in place, there is still a long way to go for organisations to solve their infrastructure and networking challenges.

“It gets down to the quality of the equipment that the staff use – which ranges from decent laptops, phones, and network connections. If you don’t have that now, people cannot work effectively.” – Horton

Several of these organisations, focused on ergonomics as well, when evaluating their employees’ infrastructural needs when working from home. This extra focus on infrastructural needs – with the employees firmly on their mind – ensured that there was minimal impact on delivery.

Caring for Your People is More Important than Ever

The pandemic has changed the way people work, socialise, and interact. While this appears to have become the new norm, adjusting to it can create emotional stress. Simultaneously, as organisations focus on survival and recovery, workloads have increased. Employees are working extended hours, without taking adequate hours. There is an immediate need to involve organisations’ HR practices in evaluating the emotional well-being of employees and finding better ways to engage with remote staff, to reduce stress.

“A key aspect of handling the crisis has been empathy, transparency and engagement with employees. In a business environment, we have all sorts of teams, cultures, clients, and so on. The common thread in this model is that everyone’s just become a lot friendlier, more empathic, more transparent.” – Sumit Nurpuri, COO, SE Asia Hong Kong and Taiwan, Capgemini

Organisations will have to be innovative in the way they manage these people challenges. For example, a common problem that has emerged is employees attending meetings, with interruptions from family, especially children.

“One of the things that we did as a part of our team meetings is that we assigned tasks to children at the beginning of the call and in the last few minutes, the children presented back to the teams on what they’ve been up to. It was a mechanism for us to make sure that we were involving our staff and understanding their current situation – and trying to make it as easy for them to work, as possible.” – Lawther

Taking the Opportunity to Drive Positive Outcomes

The other aspect businesses are trying to overcome is meeting the rising expectations of clients. This has led them to focus on skills training, mostly delivered through e-learning platforms. Organisations find that this has translated into increased employee performance and a future-ready workforce.

The crisis disrupted economies and societies across the globe, with business and industry coming to a standstill in most countries. Unexpected business benefits emerged from the necessity to comply with country regulations. By and large, employees have been more productive. Also, many organisations re-evaluated their commercial property requirements and many were able to reduce expenses on office rentals (for many this will not be immediate, but there is a future potentiality). Similarly, there were other areas where businesses saw reduced expenses – operational costs such as equipment maintenance and travel expenses.

“When you start global projects and global implementations, you typically do some kind of global design work and maybe fly in people from all over the world, typically to a centralised location. This has changed to virtual meetings and collaborative interactions on online global design. The amount of time and money that was saved – that would typically be spent on people traveling to manage these global design workshops – was great” – Campbell

Most organisations, across industries, will have to make considerable changes to their IT environment. The Ecosystm Digital Priorities in the New Normal study finds that 70% expect considerable to significant changes to their IT environment, going forward. Technology providers will remain a significant partner in organisations’ journey to transformation, recovery and success.

We have all felt the effects of the global pandemic and experienced the profound effects on the way we work – at least those of us who are fortunate enough to still be working despite the pandemic.

COVID-19 has – at least for a while – changed how we work and how IT systems can safely support this new work style.

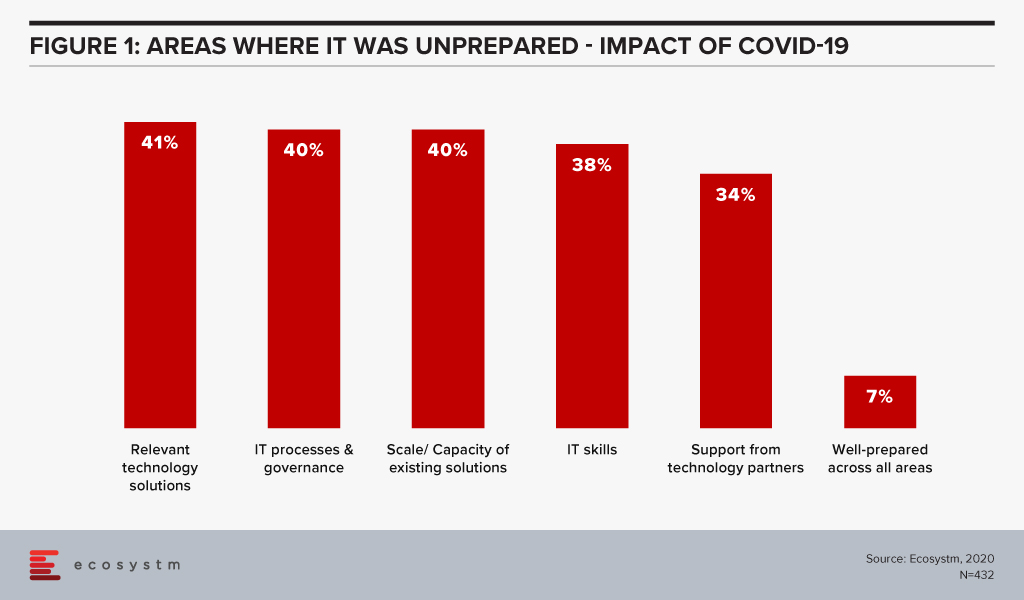

Our ongoing Ecosystm study on Digital Priorities in the New Normal shows how the crisis has forced organisations to re-evaluate their cybersecurity risks and measures. It also showed that the IT environment of most organisations was woefully unprepared for the changes that occurred (Figure 1). Perhaps unsurprisingly, fewer than 7% said that their IT environment was fully prepared and close to 40% reported lacking scale, capacity and IT skills in-house.

We are here to help you!

The combination of these shortcomings may very well push more organisations to outsource their security management to Managed Security Service Providers (MSSPs) – a service space that has been growing rapidly in recent years.

Many IT organisations are fairly familiar with MSSPs, but COVID-19 may have forced many to re-evaluate their choices as the work and threat landscapes have changed.

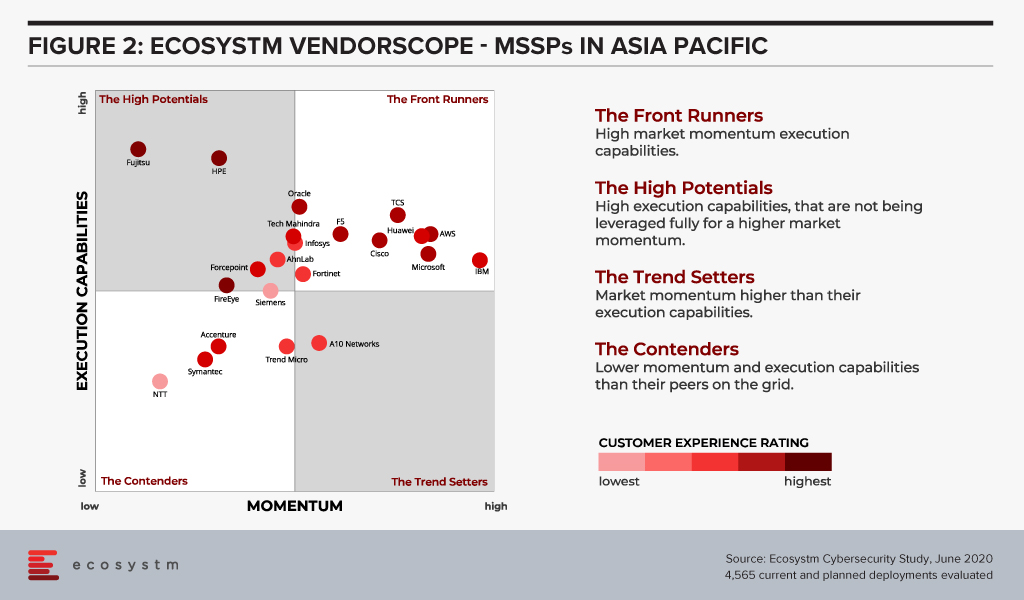

To help organisations evaluate their options going forward, we at Ecosystm are extremely excited to launch our Managed Security Service Providers VendorScope for the Asia Pacific region.

This new tool can help technology buyers understand which vendors are leading this space, which are the ones that have market momentum and which are executing and delivering on their promised capabilities. Unlike similar vendor evaluations on the market, the positioning of vendors in Ecosystm VendorScopes is based solely on quantifiable feedback given by the Tech Buyer community, in the global Ecosystm Cybersecurity Study, that is live and ongoing on the Ecosystm platform. It is thus independent of analyst bias or opinion or vendor influence – customers directly rate their suppliers in our ongoing market benchmarks and assessments.

It is also free to access and share for all Ecosystm subscribers!

Fragmented Asia Pacific MSSP Market

The VendorScope clearly shows how fragmented the MSSP market is. Not only is the number of vendors that have a customer base significant enough to appear on the grid very large (22) – but about half of them are in, or verging on being in, the “Front Runner” segment (Figure 2).

There are a few key factors that contribute to this picture:

- The services they offer tend to align well with the customers’ organisational strategies and to integrate well with existing systems. This, basically, can be boiled down to one word: Cloud. Most organisations have IT strategies revolving around multiple and/hybrid cloud deployments and using MSSPs makes a lot of sense.

- Momentum for this service segment is generally high. The MSSP space is experiencing high growth these days and we see a fairly high number of mentions for both current and planned deployments with many of the vendors in the study.

Despite the large number of vendors in the “Front Runner” segment, a famous few stick out. IBM appears to have a higher market momentum than its competitors and together with Microsoft, they have the largest share of mind with potential customers in this space.

But other vendors are hot on their heels. AWS and F5 stand out with their relatively high presence in the region, and TCS and Huawei appear to have stronger than average pipelines.

Where we do see weak spots with most vendors is in quality of service and the connected customer experience, which historically have proven to be a potential Achilles’ heel for many vendors in high growth areas. As the MSSP space matures, we would expect customer experience to become increasingly important when customers choose a service provider.

We would certainly encourage any organisation that is looking into managed security to not ignore or downplay the customer service and support aspect. IT security is a complex area – even if it is managed by a service provider – and the service providers’ ability and flexibility in this area can make a huge difference.

Fujitsu and HPE stick out with regards to QoS and customer service. These two are also good examples of how the vendors differ and seemingly could complement each other. In a sense, one could almost see the MSSP VendorScope as an early blueprint for which mergers and acquisitions (M&As) would make sense – at least for those that are driven by the pursuit of skill sets and competencies and not just market share.

In the Top 5 Cybersecurity and Compliance Trends for 2020, Ecosystm predicted that 2020 will witness a significant uplift in M&A activities in the cybersecurity market. Of course, with the global pandemic, all bets are off, and the predicted M&A wave may have been delayed by a year or so.

But the MSSP space certainly appears ripe for consolidation.

Ecosystm Vendorscope: Managed Security Service Providers

Signup for Free to download the Ecosystm Vendorscope: Managed Security Service Providers report

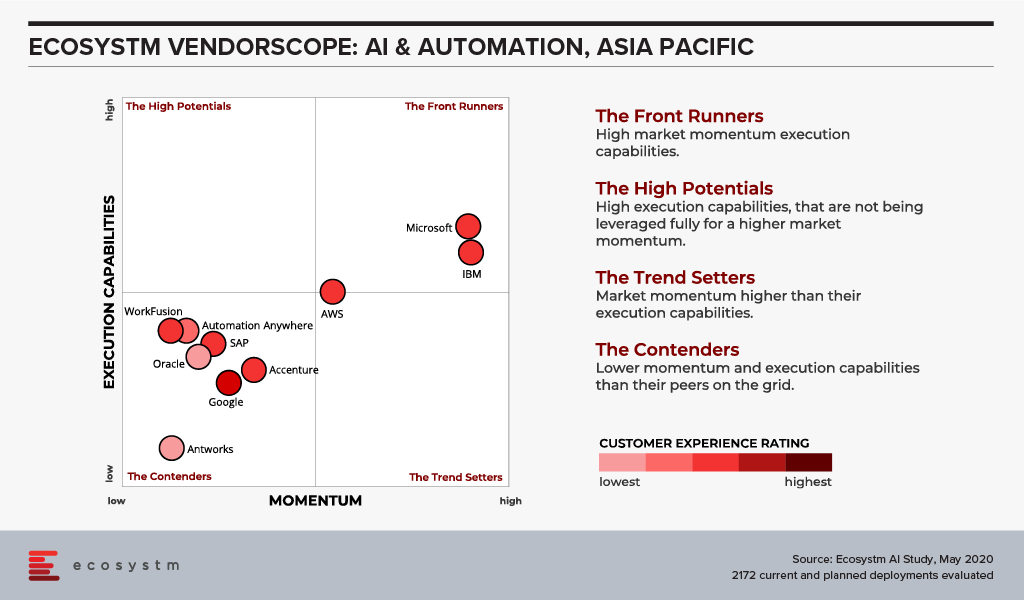

I’m really excited to launch our AI and Automation VendorScope! This new tool can help technology buyers understand which vendors are offering an exceptional customer experience, which ones have momentum and which are executing and delivering on their promised capabilities. The positioning of vendors in Ecosystm VendorScopes is independent of analyst bias or opinion or vendor influence – customers directly rate their suppliers in our ongoing market benchmarks and assessments.

The Evolution of the AI Market

The AI market has evolved significantly over the past few years. It has gone from a niche, poorly understood technology, to a mainstream one. Projects have moved from large, complex, moonshot-style “change the world” initiatives to small, focused capabilities that look to deliver value quickly. And they have moved from primarily internally focused projects to delivering value to customers and partners. Even the current pandemic is changing the lens of AI projects as 38% of the companies we benchmarked in Asia Pacific in the Ecosystm Business Pulse Study, are recalibrating their AI models for the significant change in trading conditions and customer circumstances.

Automation has changed too – from a heavily fragmented market with many specific – and often very simple tools – to comprehensive suites of automation capabilities. We are also beginning to see the use of machine learning within the automation platforms as this market matures and chases after the bigger automation opportunities where processes are not only simplified but removed through intelligent automation.

Cloud Platform Providers Continue to Lead

But what has changed little over the years is the dominance of the big cloud providers as the AI leaders. Azure, IBM and AWS continue to dominate customer mentions and intentions. And it is in customer mentions that the frontrunners in the VendorScope – Microsoft and IBM – set themselves apart. Not only are they important players today – but existing customers AND non-customers plan to use their services over the next 12-24 months. This gives them the market momentum over the other players. Even AWS and Google – the other two public cloud giants – who also have strong AI offerings – didn’t see the same proportions of customers and prospects planning to use their AI platforms and tools.

While Microsoft and IBM may have stolen the lead for now, they cannot expect the challengers to sit still. In the last few weeks alone we have seen several major launches of AI capabilities from some providers. And the Automation vendors are looking to new products and partnerships to take them forward.

Without the market momentum, Microsoft and IBM would still stand above the rest of the pack – just not as dramatically! Both companies are not just offering the AI building blocks, but also offer smart applications and services – this is possibly what sets them apart in an era where more and more customers want their applications to be smart out-of-the-box (or out-of-the-cloud). The appetite for long, expensive AI projects is waning – fast time to value will win deals today.

The biggest change in AI over the next few years will hopefully be more buyers demanding that their applications are smart out-of-the-box/cloud. AI and Automation shouldn’t be expensive add-ons – they should form the core of smart applications – applications that work for the business and for the customer. Applications that will deliver the next generation of employee and customer experiences.

Ecosystm Vendorscope: AI & Automation

Signup for Free to access the Ecosystm Vendorscope: AI & Automation report.

Manufacturing is estimated to account for a fifth of Singapore’s GDP and is one of its growth pillars. Singapore has been talking about re-inventing the Manufacturing industry since 2017, when the Industry 4.0 initiatives to enable digitalisation and process automation of processes and to ensure global competitiveness were first launched. As part of the long-term strategy, the Government had spoken about investment into research and development (R&D) projects, developing transformation roadmaps and strengthening the skill sets of the workforce.

Singapore’s 5G Rollout

Last month, the Infocomm Media Development Authority (IMDA) announced that Singtel and JVCo (formed by Starhub and M1) has won the 5G Call for Proposal. They will be required to provide coverage for at least half of Singapore by end-2022, scaling up to nationwide coverage by end 2025. While Singtel and JVCo will be allocated radio frequency spectrum to deploy nationwide 5G networks, other mobile operators, including MVNOs, can access these network services through a wholesale arrangement. The networks will also be supplemented by localised mmWave deployments that will provide high capacity 5G hotspots.

In October 2019, IMDA and the National Research Foundation had set aside $40 million to support 5G trials in strategic sectors such as maritime, aviation, smart estates, consumer applications, Industry 4.0 and government applications. Ecosystm Principal Advisor, Jannat Maqbool says, “Reach, performance and robustness of connectivity and devices have long held back the ability to scale with the IoT as well as successful deployment of some solutions altogether. The integration of 5G with IoT has the potential to change that immensely. However, and possibly even more importantly, 5G will see the emergence of a true ‘Internet’, defined as ‘interconnected networks using standardised communication protocols’, made up of ‘things’ enabling never-before contemplated innovation – supporting economic development and community well-being.”

“While 5G offers enormous potential to produce economic and social benefits, to reach that potential we need to evaluate from a strategic perspective what it could mean for industries, employers and communities – then we need to invest in the infrastructure, innovation and associated development required to leverage the technology.”

Singapore’s Industry 4.0 Transformation

The Government is also focused on getting the industry ready for the transformation that 5G will bring. Last week, Singapore announced its first Industry 4.0 trial, where IMDA collaborates with IBM, M1 and Samsung to design, develop, test and benchmark 5G-enabled Industry 4.0 solutions that can be applied across various industries. The trials will begin at IBM’s facility in Singapore and involve open source infrastructure solutions from Red Hat to test Industry 4.0 use cases.

The project will test 5G-enabled use cases for Manufacturing, focusing on areas such as automated visual inspection using image recognition and video analytics, equipment monitoring and predictive maintenance, and the use of AR in increasing productivity and quality. The focus is also on leveraging 5G to reduce the cost of processing, by shifting the load from the edge device to centralised systems.

Ecosystm Principal Advisor, Kaushik Ghatak says, “For some time now, the Singapore Manufacturing industry has been in the quest for higher productivity in order to regain its foothold as a destination of choice for global manufacturing outsourcing. The 5G Industry 4.0 trial is a great initiative to fast-track identification and adoption of the right use cases in Manufacturing, in the areas of automation, visibility, analytics, as well as for opening new revenue streams through servitisation of smart products.”

5G will see increased collaboration in the Tech industry

With the advent of 5G, the market will see more collaboration between government agencies, telecom providers and cloud platform providers and network equipment providers. Governments globally have invested in 5G and so have the network and communications equipment providers. However, telecom providers are unsure of how to monetise 5G and cater to the shift in their customer profile from consumers to enterprises. IBM and Samsung had already announced the launch of a joint platform in late 2019. Collaborations such as these will be key to widespread 5G deployment and uptake.

Talking about the benefits of collaborative efforts such as this, Maqbool says, “Robustness and security built into 5G deployment from the outset is essential to enable the applications and innovation that many are promising the technology will deliver, including the ability to self-scale, automate fault management and support edge processing.”

It is interesting that the solutions developed will be featured at IBM’s Industry 4.0 Studio 5G Solutions Showcase, and that IBM and Samsung will evaluate successful solutions developed during the project for possible use in their operations in a broad range of markets and sectors. “Availability of proven use cases at IBM’s Solutions Showcase centre would benefit local manufactures greatly; in terms of easy access to right skills and proven technology architectures,” says Ghatak. “This initiative is a huge step towards realising the promise of the cyber physical world. The collaboration between the leaders in communications, equipment and software will ensure that the use case development is truly cutting edge.”