The global economy remains fragile due to multiple factors; and banking organisations will need to weather the storm. While large and well-capitalised banks are expected to fare better, there is a need for the industry to pursue new sources of value beyond traditional boundaries.

Banking industry leaders should be bold, proactive, and envision possibilities beyond current uncertainties. Technology has a key role to play in turning their innovation and resiliency goals into reality.

Read on to find out how the National Australia Bank, the Scottish National Investment Bank, the ANZ Bank, the Swiss National Bank, Mastercard, and the French banking group Crédit Agricole are leading the charge in driving innovation within the banking industry by investing in new technologies and exploring business models to better serve their customers.

Download ‘The Future of Banking’ as a PDF

The Retail industry has faced significant challenges in recent times. Retailers have had to deliver digital experiences and delivery models; navigate global supply chain disruptions; accommodate the remote work needs of their employees; and keep up with rapidly changing customer expectations. To remain competitive, many retailers have made significant investments in technology.

However, despite these investments, many retailers have struggled to create market differentiation. The need for innovation and constant evolution remains.

As retailers cope with hypersonalisation trends, supply chain vulnerabilities, and the rise of ESG consciousness, the industry is seeing several instances on innovation.

Read on to find out how brands such as Clinique, Gucci, Tommy Hilfiger, Nike, Woolworths, Prada, Levi Strauss, Mahsenei Hashuk and Instacart are using emerging technologies such as the Metaverse and Generative AI to create the much-needed market edge.

Download “The Future of Retail” as a PDF

Ecosystm supported by their partner EY, conducted an invitation-only Executive ThinkTank at the Point Zero Forum in Zurich. A select group of regulators, investors, technology providers, and senior leaders from financial institutions from across the globe came together to share their insights and experiences on the practicability, regulatory support, and implications of sustainable finance portfolios.

Here are some of the key takeaways from the ThinkTank.

- The Barriers to a Sustainable Future. The first step towards a sustainable future is recognising the challenges organisations face when pursuing Net Zero targets. Often, Net Zero targets are looked upon as additional costs.

- Overcoming the Challenges. It is important to connect Net Zero back to business goals, given that there might be sudden shifts in regulations and because of the emergence of environment-conscious consumers.

- A Sustainable Future Requires a Collaborative Approach. Global governments, regulators, Financial Services institutions, other enterprises, and technology providers need to collaborate on building a sustainable future.

- A Time for Simplification. Clear mandates on reporting climate aspects similar to how financial aspects are reported, will result in greater adoption of sustainability and ESG measures.

- The Role of Digital Architecture. The path to a Net Zero, decarbonised world will be technology-led.

Read below to find out more.

Download Risks and Opportunities of Net Zero Commitments and Decarbonisation Pathways as a PDF

A partner event of our annual flagship Singapore FinTech Festival, Point Zero Forum represents a unique collaboration between Elevandi (an entity set up by MAS), and the Swiss Secretariat for International Finance (SIF), organised in cooperation with the BIS Innovation Hub, Monetary Authority of Singapore, and Swiss National Bank. The inaugural Forum will be graced by Singapore’s Deputy Prime Minister, Heng Swee Keat, Switzerland’s Federal Councillor and the Head of the Federal Department of Finance, Ueli Maurer, as well as leading CEOs (UBS, Julius Baer, Six Group); and innovative founders (FTX Group, wefox). The Forum will serve as the starting point for engaging investors and policymakers with innovators to advance the future of financial services (FOFS).

This invite-only forum aims to bring together investors, influencers, thinkers and decision-makers from the public and private sector to exchange ideas, share knowledge, develop a network, with the purpose of:

- Developing new ideas to advance the FOFS – decentralised finance and Web 3.0, embedded finance and sustainable finance.

- Driving investment activity by bringing together leading founders with VCs, private banking clients, family offices and PE houses

- Dissecting regulatory considerations related to each FOFS development by bringing together public and private sector leaders

Three days of in-depth plenary sessions, deep-dive private roundtables and workshops, and exclusive sessions will focus on significant new market opportunities built on Web 3.0 architecture (June 22) – Tokenisation (June 23) and Sustainable Finance (June 23).

Ecosystm ThinkTank: Risks and Opportunities of Net Zero Committments and Decarbonisation Pathways is a closed door and confidential dialogue for a very limited number of hand-selected participants.

ESG is increasingly becoming an area of focus and Net Zero Commitments have taken centre stage across all industries. With the ‘Net Zero Intent’ gaining traction, questions around practicability, regulatory support and implications sustainable finance portfolios remain unanswered.

This ThinkTank will aim to find answers and solutions to further foster Net Zero commitments and to build practical decarbonisation pathways. Topics to address will include:

- What are the decarbonising pathways for lending, underwriting or other products? And what are the best practices in eliminate ‘Net Zero Laggards’ from financial portfolios?

- What support is needed from policymakers to support Net Zero execution?

- How do governments and financial institutions engage with high emitters that are key pillars to the economy?

Innovation is at the core of Singapore’s ethos. The country has perfected the art of ‘structured innovation’ where pilots and proof of concepts are introduced and the successful ones scaled up by recalibrating technology, delivery systems, legislation, and business models. The country has adopted a similar approach to achieving its sustainability goals.

The Singapore Green Plan 2030 outlines the strategies to become a sustainable nation. It is driven by five ministries: Education, National Development, Sustainability and the Environment, Trade and Industry, and Transport, and includes five key pillars: City in Nature, Sustainable Living, Energy Reset, Green Economy, and Resilient Future. We will see a slew of new programs and initiatives in green finance, sustainability, solar energy, electric vehicles (EVs), and innovation, in the next couple of years.

Singapore’s Intentions of Becoming a Green Finance Leader

Singapore is serious about becoming a world leader in green finance. The Green Bonds Programme Office was set up last year, to work with statutory boards to develop a framework along with industry and investor stakeholders. We have seen a number of sustainable finance initiatives last year, such as the National Environment Agency (NEA) collaborating with DBS to raise USD 1.23 billion from its first green bond issuance. The proceeds will fund new and ongoing sustainable waste management initiatives. Temasek collaborated with HSBC for a USD 110 million debt financing platform for sustainable projects and Sembcorp issued sustainability bonds worth USD 490 million.

Building an Ecosystm of Sustainable Organisations

Sustainability has to be a collective goal that will require governments to work with enterprises, investors and consumers. To ensure that enterprises are focusing on Sustainability, governments have to keep in mind what drives these initiatives and the challenges organisations face in achieving their goals.

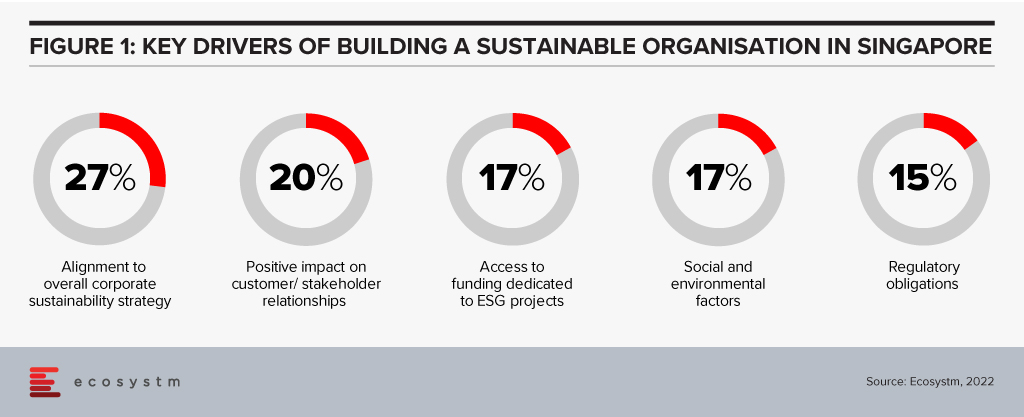

There are several reasons driving organisations in Singapore to adopt sustainability goals and ESG responsibilities (Figure 1)

It is equally important to address organisations’ challenges in building sustainability in their business processes. Last week, the Institute of Banking and Finance (IBF) and the Monetary Authority of Singapore (MAS) set out 12 Sustainable Finance Technical Skills and Competencies (SF TSCs) required by people in various roles in sustainable finance. This addresses the growing demand for sustainable finance talent in Singapore; and covers knowledge areas such as climate change policy developments, natural capital, green taxonomies, carbon markets and decarbonisation strategies. There are Financial Services related competencies as well, such as sustainability risk management, sustainability reporting, sustainable investment management, and sustainable insurance and reinsurance solutions. The SF TSCs are part of the IBF Skills Framework for Financial Services.

Sustainable Resources Initiatives

Singapore is not only focused on Sustainable Finance. If we look at NEA’s Green Bonds, there are specific criteria that projects must satisfy in order to qualify, including a focus on sustainable waste management.

Last week the Government announced that the National Research Fund (NRF) will allocate around USD 160 million to drive new initiatives in water, reuse and recycling technologies, as part of the Research, Innovation and Enterprise 2025 plan (RIE2025). Part of the fund will be allocated to the Closing the Resource Loop (CTRL) initiative, administered by the NEA that will fund sustainable resource recovery solutions.

Singapore faces severe resource constraints, and water security is not a new challenge for the country. The NRF funding will also be used partially for R&D in 3 water technology focus areas: desalination and water reuse; used water treatment; and waste reduction and resource recovery.

The Government is Leading the Way

The Government’s concerted efforts to make the Singapore Green Plan 2030 a success is seeing corporate participation in the vision. In February, Shell started supplying sustainable aviation fuel (SAF) to customers such as SIA Engineering Company and the Singapore Air Force in Singapore. Shell has also upgraded their Singapore facility to blend SAF at multiple, key locations. Last week, Atlas announced their commitment to Web 3.0 technologies and “tech for good”. They aim to increase their green energy use to 75% by 2022; 90% by 2023; and 100% by 2024. ESG consciousness is percolating down from the Government.

The success of Singapore’s Sustainability strategies will depend on innovation, the Government’s ongoing commitment, and the support provided to enterprises, investors, and consumers. The Singapore Government is poised to lead from the front in building a Sustainable Ecosystem.

COP26 has firmly put environmental consciousness as a leading global priority. While we have made progress in the last 30 odd years since climate change began to be considered as a reality, a lot needs to be done.

No longer is it enough for only governments to lead on green initiatives. Now is the time for non-profit organisations, investors, businesses – corporate and SMEs – and consumers to come together to ensure we leave a safer planet for our children.

February saw examples of how technology providers and large corporates are delivering on their environmental consciousness and implementing meaningful change.

Here are some announcements that show how tech providers and corporates are strengthening the Sustainability cause:

- IBM launches Sustainability Accelerator Program

- Microsoft boosts their Sustainability offerings by extending extend their EID tool for Microsoft 365

- Salesforce officially announce sustainability as a core company value

- Google enables Sustainable AIOps

- The Aviation industry (Southwest Airlines, ANA, Norwegian Air and Singapore Airlines) appears to be making a concerted effort to reduce carbon footprint.

Read on to find more.

Click here to download a copy of The Future of Sustainability as a PDF.

There have been some long-term shifts in market dynamics in the telecom industry. Network traffic growth rates have accelerated; new business models emerged; and cloud services matured and spread to new verticals, applications and customer sizes. Networks are more important than ever. Revenue growth rates and profitability in the three segments – telecom, webscale, and carrier-neutral – have been stronger in recent quarters than anticipated.

Looking ahead, networks will increasingly revolve around data centres, which will continue to proliferate both at the core and edge.

Data centre innovation will be rapid, as webscalers push the envelope on network design and function, and telecom operators seek cheaper ways of running their networks. The telecom operator’s need for cost efficiency will increase as overhyped 5G-based opportunities fail to materialise in any big way. Carrier-neutral operators (CNNOs) will benefit from an ongoing wave of new capital which will help them transform to more integrated providers of “digital infrastructure” assets.

Read on to find out about

- The interdependence of network operators

- The growth potential of the telecom, webscale, and CNNO markets

- How webscalers such as Facebook and Alibaba are leveraging scale

- Acquisition and deals in the CNNO market such as the American Tower-CoreSite acquisition and the Digital Realty deal with Ciena.

- The growth of environmental consciousness in the telecom industry

Click here to download The Future of Telecom: Industry Outlook for 2022 and Beyond slides as a PDF.

Our financial system plays a central role in crystallising priorities and incentives for businesses and other stakeholders across the globe. So, many of us breathed a sigh of relief as the financial community got behind the Environmental, Social and Governance (ESG) movement in recent years, signalling a very visible acceleration in ESG as a hot button issue for investors and lenders.

Unfortunately, the growth of ESG as a priority for investors, lenders and consumers has driven many companies to oversell their green and/or social credentials in order to burnish their brands and attract investment. This is referred to as “greenwashing” and “social washing”.

As sustainability becomes a critical pillar for investors and consumers in their decision-making, data, analytics and technology play an increasingly critical role in enabling better decisions based on credible, accurate and more real-time information.

Read on to find out the three themes for technology enablement in sustainable finance, together with examples and potential use cases including companies such as IBM, Triodos Bank, Alipay, Floodmapp, and Data Gumbo.

We are seeing a rise in social and environmental consciousness – especially in the younger generation. Their awareness of human rights, the environment and inclusion is growing exponentially – they want to create impact. Organisations are being driven to develop and demonstrate an Environmental, Social and Governance (ESG) consciousness in their actions and investments.

In this Ecosystm Snapshot, we cover some of the recent examples of how governments and individual advocates are creating a difference; and how financial organisations and tech providers are embracing ESG.

Read how organisations such as Sun Cable, Equinix, Microsoft, NVIDIA, Prologis, Zensung, Ergo, Munich Re, Natwest, JPMorgan, Credit Suisse and others are working to make the world a better place.