In recent years, businesses have faced significant disruptions. Organisations are challenged on multiple fronts – such as the continuing supply chain disruptions; an ongoing energy crisis that has led to a strong focus on sustainability; economic uncertainty; skills shortage; and increased competition from digitally native businesses. The challenge today is to build intelligent, data-driven, and agile businesses that can respond to the many changes that lie ahead.

Leading organisations are evaluating ways to empower the entire business with data, machine learning, automation, and AI to build agile, innovative, and customer-focused businesses.

Here are 7 steps that will help you deliver business value with data and AI:

- Understand the problems that need solutions. Before an organisation sets out on its data, automation, and AI journey, it is important to evaluate what it wants to achieve. This requires an engagement with the Tech/Data Teams to discuss the challenges it is trying to resolve.

- Map out a data strategy framework. Perhaps the most important part of this strategy are the data governance principles – or a new automated governance to enforce policies and rules automatically and consistently across data on any cloud.

- Industrialise data management & AI technologies. The cumulation of many smart, data-driven initiatives will ultimately see the need for a unified enterprise approach to data management, AI, and automation.

- Recognise the skills gap – and start closing it today. There is a real skills gap when it comes to the ability to identify and solve data-centric issues. Many businesses today turn to technology and business consultants and system integrators to help them solve the skills challenge.

- Re-start the data journey with a pilot. Real-world pilots help generate data and insights to build a business case to scale capabilities.

- Automate the outcomes. Modern applications have made it easier to automate actions based on insights. APIs let systems integrate with each other, share data, and trigger processes; and RPA helps businesses automate across applications and platforms.

- Learn and improve. Intelligent automation tools and adaptive AI/machine learning solutions exist today. What organisations need to do is to apply the learnings for continuous improvements.

Find more insights below.

Download The Future of Business: 7 Steps to Delivering Business Value with Data & AI as a PDF

Southeast Asia has evolved into an innovation hub with Singapore at the centre. The entrepreneurial and startup ecosystem has grown significantly across the region – for example, Indonesia now has the 5th largest number of startups in the world.

Organisations in the region are demonstrating a strong desire for tech-led innovation, innovation in experience delivery, and in evolving their business models to bring innovative products and services to market.

Here are 5 insights on the patterns of technology adoption in Southeast Asia, based on the findings of the Ecosystm Digital Enterprise Study, 2022.

- Data and AI investments are closely linked to business outcomes. There is a clear alignment between technology and business.

- Technology teams want better control of their infrastructure. Technology modernisation also focuses on data centre consolidation and cloud strategy

- Organisations are opting for a hybrid multicloud approach. They are not necessarily doing away with a ‘cloud first’ approach – but they have become more agnostic to where data is hosted.

- Cybersecurity underpins tech investments. Many organisations in the region do not have the maturity to handle the evolving threat landscape – and they are aware of it.

- Sustainability is an emerging focus area. While more effort needs to go in to formalise these initiatives, organisations are responding to market drivers.

More insights into the Southeast Asia tech market below.

Click here to download The Future of the Digital Enterprise – Southeast Asia as a PDF

There have been some long-term shifts in market dynamics in the telecom industry. Network traffic growth rates have accelerated; new business models emerged; and cloud services matured and spread to new verticals, applications and customer sizes. Networks are more important than ever. Revenue growth rates and profitability in the three segments – telecom, webscale, and carrier-neutral – have been stronger in recent quarters than anticipated.

Looking ahead, networks will increasingly revolve around data centres, which will continue to proliferate both at the core and edge.

Data centre innovation will be rapid, as webscalers push the envelope on network design and function, and telecom operators seek cheaper ways of running their networks. The telecom operator’s need for cost efficiency will increase as overhyped 5G-based opportunities fail to materialise in any big way. Carrier-neutral operators (CNNOs) will benefit from an ongoing wave of new capital which will help them transform to more integrated providers of “digital infrastructure” assets.

Read on to find out about

- The interdependence of network operators

- The growth potential of the telecom, webscale, and CNNO markets

- How webscalers such as Facebook and Alibaba are leveraging scale

- Acquisition and deals in the CNNO market such as the American Tower-CoreSite acquisition and the Digital Realty deal with Ciena.

- The growth of environmental consciousness in the telecom industry

Click here to download The Future of Telecom: Industry Outlook for 2022 and Beyond slides as a PDF.

Oracle is clearly prioritising a rapid expansion across the globe. The company is in a race to catch up with the big 3 (AWS, Google, and Microsoft), and recognises that many of their customers are eager to migrate to the cloud, and they have other options. Their strategy appears to be to rely on third-party co-location providers for most of their data centres, and build a single availability zone per region, at least to start.

Oracle Cloud Rollout Ramps Up

Let us consider the following:

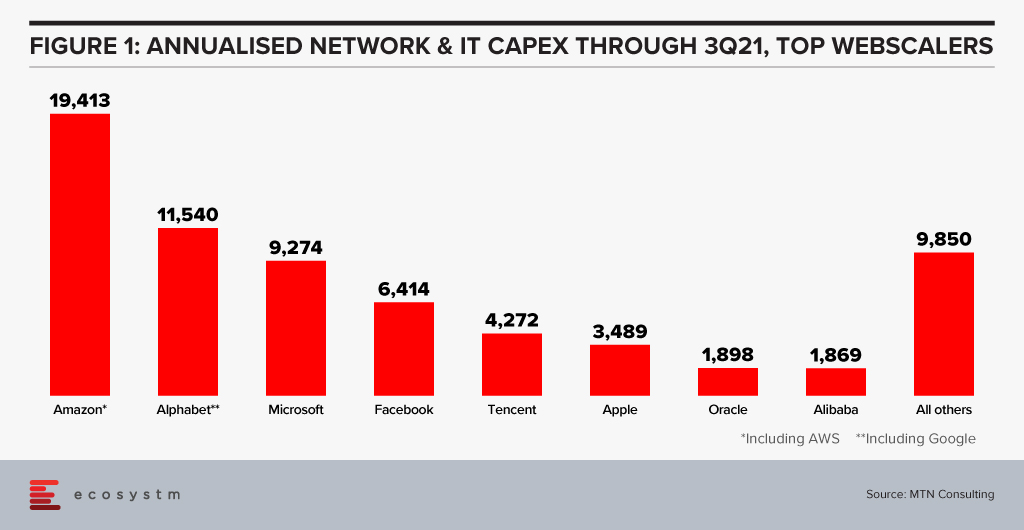

- Oracle’s network spending level puts it in the range of other webscalers. Focusing only on the Network and IT portion of their CapEx, Oracle has now passed Alibaba. Oracle is also ahead of both IBM and Baidu, which are included in the “All others” category in Figure 1.

- The coverage of the Oracle Cloud Infrastructure (OCI) is impressive. It has 36 regions today (some dedicated for government use), with a plan to reach 44 by year-end 2022. That compares to 27 overall for AWS, 65 for Azure, 29 for GCP; regional competitors Tencent and Huawei have 27 regions each, and Alibaba 25 regions. The downside is that Oracle has only one availability zone in most of its regions, while the Big 3 usually have 2 or 3 per region. Oracle needs to build out its local resiliency rapidly over the next year or two or risk losing business to the big 3, especially to AWS; but the company knows this and is budgeting CapEx aggressively to address the problem.

- Oracle’s initial reliance on leased facilities may be an interim step. The rapid growth of AWS, Azure, and GCP in the late 2010s was a surprise and Oracle started to see serious risks of losing customers to these cloud platforms. Building out their own cloud base on new data centres would have taken years and cost them business. So, Oracle did the smart thing and leaped into the cloud as fast as possible with the resources and time available. The company has scaled their OCI operations at an impressive rate. It expects capital expenditures to double YoY for the fiscal year ending May 2022, as it increases “data centre capacities and geographic locations to meet current and expected customer demand” for OCI.

- Finally, Oracle has invested heavily in designing the servers to be installed in its data centres (even if most of them are leased). Oracle was an early investor in Ampere Computing, which makes Arm-based processors, sidestepping the Intel ecosystem. In May 2021, Oracle rolled out its first Arm-based compute offering, OCI Ampere A1 Compute, based on the Ampere Altra processor. Oracle says this allows OCI customers to run “cloud-native and general-purpose workloads on Arm-based instances with significant price-performance benefits.” Microsoft and Tencent also deploy the Ampere Altra in some locations.

Reaching Global Scale

Once Oracle decided to launch into the cloud, its goal was to both grow revenues and also protect its legacy base from slipping away to the Big 3, which already had a growing global footprint. Oracle chose to quickly build cloud regions in its key markets, with the understanding that it would have to fill out individual regions as time passed. This is not that different from the big 3, in fact, but Oracle started its buildout much later. It also has lesser availability zones per region.

Oracle has not ignored this disparity. It recognises that reliability is key for its clients in trusting OCI. For example, the company emphasises that:

- Each Oracle Cloud region contains at least three fault domains, which are “groupings of hardware that form logical data centers for high availability and resilience to hardware and network failures.” Fault domains allow a customer to distribute instances so “the instances are not on the same physical hardware within a single availability domain.”

- OCI has a network of 70 “FastConnect” partners which offer dedicated connectivity to OCI regions and services (comparable to AWS DirectConnect)

- OCI and Microsoft Azure have a partnership allowing “joint customers” to run workloads across the two clouds, providing low latency, cross-cloud interconnect between OCI and Azure in eight specific regions. Customers can migrate existing applications or develop cloud native applications using a mix of OCI and Azure.

- Oracle allows customers to deploy OCI completely within their own data centers, with Dedicated Region and Exadata Cloud@Customer, deploy cloud services locally with public cloud-based management, or deploy cloud services remotely on the edge with Roving Edge Infrastructure.

- Further, Oracle clearly tries to differentiate around its Arm-based Ampere processors. Reliability is not necessarily the focus, though. The main focus is contrasting Ampere with the x86 ecosystem around overall price-performance, with highlights on power efficiency, scalability and ease of development.

Ultimately the market will decide whether Oracle’s approach makes it truly competitive with the big 3. The company continues to announce some big wins, including with Deutsche Bank, FedEx, NEC, Toyota, and Zoom. The latter is probably the company’s biggest cloud win given Zoom’s rise to prominence amidst the pandemic. Not surprisingly, Oracle’s recent Singapore cloud region launch was hosted by Zoom.

Conclusion

Over the long run, the webscale market is getting more concentrated in the hands of a few players; some companies tracked as webscalers, such as HPE and SAP, will fall by the wayside as they can’t keep up with the infrastructure spending requirements of being a top player. Oracle is aiming to remain in the race, however. CEO Larry Ellison addressed this in an earnings call, arguing the global cloud market is not just the “big 3” (AWS, Azure, and GCP), but is a “big 4” due in part to Oracle’s database strengths. Ellison also argued that the OCI is “much better for security, for performance, for reliability” and cost: “we’re cheaper.” The market will ultimately decide these things, but Oracle is off to a strong start. Its asset light approach to network buildout, and limited depth within regions, clearly have downfalls. But the company has a deep roster of long-term customers across many regions, and it is moving fast to secure their business as they migrate operations to the cloud.

Earlier this month, I had the privilege of attending Oracle’s Executive Leadership Forum, to mark the launch of the Oracle Cloud Singapore Region. Oracle now has 34 cloud regions worldwide across 17 countries and intends to expand their footprint further to 44 regions by the end of 2022. They are clearly aiming for rapid expansion across the globe, leveraging their customers’ need to migrate to the cloud. The new Singapore region aims to support the growing demand for enterprise cloud services in Southeast Asia, as organisations continue to focus on business and digital transformation for recovery and future success.

Here are my key takeaways from the session:

#1 Enabling the Digital Futures

The theme for the session revolved around Digital Futures. Ecosystm research shows that 77% of enterprises in Southeast Asia are looking at technology to pivot, shift, change and adapt for the Digital Futures. Organisations are re-evaluating and accelerating the use of digital technology for back-end and customer workloads, as well as product development and innovation. Real-time data access lies at the backbone of these technologies. This means that Digital & IT Teams must build the right and scalable infrastructure to empower a digital, data-driven organisation. However, being truly data-driven requires seamless data access, irrespective of where they are generated or stored, to unlock the full value of the data and deliver the insights needed. Oracle Cloud is focused on empowering this data-led economy through data sovereignty, lower latency, and resiliency.

The Oracle Cloud Singapore Region brings to Southeast Asia an integrated suite of applications and the Oracle Cloud Infrastructure (OCI) platform that aims to help run native applications, migrate, and modernise them onto cloud. There has been a growing interest in hybrid cloud in the region, especially in large enterprises. Oracle’s offering will give companies the flexibility to run their workloads on their cloud and/or on premises. With the disruption that the pandemic has caused, it is likely that Oracle customers will increasingly use the local region for backup and recovery of their on-premises workloads.

#2 Partnering for Success

Oracle has a strong partner ecosystem of collaboration platforms, consulting and advisory firms and co-location providers, that will help them consolidate their global position. To begin with they rely on third-party co-location providers such as Equinix and Digital Realty for many of their data centres. While Oracle will clearly benefit from these partnerships, the benefit that they can bring to their partners is their ability to build a data fabric – the architecture and services. Organisations are looking to build a digital core and layer data and AI solutions on top of the core; Oracle’s ability to handle complex data structures will be important to their tech partners and their route to market.

#3 Customers Benefiting from Oracle’s Core Strengths

The session included some customer engagement stories, that highlight Oracle’s unique strengths in the enterprise market. One of Oracle’s key clients in the region, Beyonics – a precision manufacturing company for the Healthcare, Automotive and Technology sectors – spoke about how Oracle supported them in their migration and expansion of ERP platform from 7 to 22 modules onto the cloud. Hakan Yaren, CIO, APL Logistics says, “We have been hosting our data lake initiative on OCI and the data lake has helped us consolidate all these complex data points into one source of truth where we can further analyse it”.

In both cases what was highlighted was that Oracle provided the platform with the right capacity and capabilities for their business growth. This demonstrates the strength of Oracle’s enterprise capabilities. They are perhaps the only tech vendor that can support enterprises equally for their database, workloads, and hardware requirements. As organisations look to transform and innovate, they will benefit from the strength of these enterprise-wide capabilities that can address multiple pain points of their digital journeys.

#4 Getting Front and Centre of the Start-up Ecosystem

One of the most exciting announcements for me was Oracle’s focus on the start-up ecosystem. They make a start with a commitment to offer 100 start-ups in Singapore USD 30,000 each, in Oracle Cloud credits over the next two years. This is good news for the country’s strong start-up community. It will be good to see Oracle build further on this support so that start-ups can also benefit from Oracles’ enterprise offerings. This will be a win-win for Oracle. The companies they support could be “soonicorns” – the unicorns of tomorrow; and Oracle will get the opportunity to grow their accounts as these companies grow. Given the momentum of the data economy, these start-ups can benefit tremendously from the core differentiators that OCI can bring to their data fabric design. While this is a good start, Oracle should continue to engage with the start-up community – not just in Singapore but across Southeast Asia.

#5 Commitment to Sustainability at the Core of the Digital Futures

Another area where Oracle is aligning themselves to the future is in their commitment to sustainability. Earlier this year they pledged to power their global operations with 100% renewable energy by 2025, with goals set for clean cloud, hardware recycling, waste reduction and responsible sourcing. As Jacqueline Poh, Managing Director, EDB Singapore pointed out, sustainability can no longer be an afterthought and must form part of the core growth strategy. Oracle has aligned themselves to the SG Green Plan that aims to achieve sustainability targets under the UN’s 2030 Sustainable Development Agenda.

Cloud infrastructure is going to be pivotal in shaping the future of the Digital Economy; but the ability to keep sustainability at its core will become a key differentiator. To quote Sir David Attenborough from his speech at COP26, “In my lifetime, I’ve witnessed a terrible decline. In yours, you could and should witness a wonderful recovery”

Conclusion

Oracle operates in a hyper competitive world – AWS, Microsoft and Google have emerged as the major hyperscalers over the last few years. With their global expansion plans and targeted offerings to help enterprises achieve their transformation goals, Oracle is positioned well to claim a larger share of the cloud market. Their strength lies in the enterprise market, and their cloud offerings should see them firmly entrenched in that segment. I hope however, that they will keep an equal focus on their commitment to the start-up ecosystem. Most of today’s hyperscalers have been successful in building scale by deeply entrenching themselves in the core innovation ecosystem – building on the ‘possibilities’ of the future rather than just on the ‘financial returns’ today.

One of the biggest impacts of the pandemic has been the uptick in cloud adoption. Ecosystm research shows that more than half the organisations are either building cloud native applications or have a Cloud-First strategy. Cloud infrastructure, platforms and software became a key enabler of the business agility and innovation that organisations needed to survive and succeed.

However, as organisations look to become data-driven and digital, they will require seamless access to their data, irrespective of where they are generated (enterprise systems, IoT devices or AI solutions) and where they are stored (public cloud, Edge, on-premises or data centres) to unlock the full value of the data and deliver the insights needed. This will shape the Cloud and Data Centre ecosystem in 2022.

Read on to find out what Ecosystm Analysts, Claus Mortensen, Darian Bird, Peter Carr and Tim Sheedy think will be the leading Cloud & Data Centre trends in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for Cloud & Data Centre in 2022 as PDF

Last week, NVIDIA announced that it had agreed to acquire UK-based chip company Arm from Japanese conglomerate SoftBank in a deal estimated to be worth USD 40 billion. In 2016, SoftBank had acquired Arm for USD 32 billion. The deal is set to unite two major chip companies; power data centres and mobile devices for the age of AI and high-performance computing; and accelerate innovation in the enterprise and consumer market.

Rationale for the Deal

NVIDIA has long been the industry leader in graphics chips (GPUs), and a smaller but significantly profitable player in the chip stakes. With graphic processing being a key component in AI applications like facial recognition, NVIDIA was quick to capitalise. This allowed it to move into data centres – an area long dominated by Intel who still holds the lion’s share of this market. NVIDIA’s data centre business has grown tremendously – from near zero less than ten years ago to nearly USD 3 billion in the first two quarters of this fiscal year. It contributes 42% of the company’s total sales.

The gaming PC market has been the fastest-growing segment in the PC market. The rare shining light in an otherwise stagnant-to-slightly declining market. NVIDIA has benefited greatly from this with a huge jump in their graphics revenues. Its GeForce brand is one of the most desired in the industry. However, with their success in AI, NVIDIA’s ambition has now grown well beyond the graphics market. Last year NVIDIA acquired Mellanox – who makes specialised networking products especially in the area of high-performance computing, data centres, cloud computing – for almost USD 7 billion. There is clearly a desire to expand the company’s footprint and position itself as a broad-based player in the data centre and cloud space focused on AI computing needs.

The acquisition of Arm though adds a whole new dimension. Arm is the leading technology provider in the mobile chip market. A staggering 90% of smartphones are estimated to use Arm technology. Arm is the colossus of the small chip industry – having crossed 20 billion in unit shipments in 2019.

Acquiring Arm is likely to result in NVIDIA now having a play in the effervescent smartphone market. But the company is possibly eyeing a different prize. Jensen Huang, Founder and CEO of NVIDIA said “AI is the most powerful technology force of our time and has launched a new wave of computing. In the years ahead, trillions of computers running AI will create a new internet-of-things that is thousands of times larger than today’s internet-of-people. Our combination will create a company fabulously positioned for the age of AI.”

With thoughts of self-driving cars, connected homes, smartphones, IoT, edge computing – all seamlessly working with each other, the acquisition of Arm provides NVIDIA a unique position in this market. As the number of connected devices explodes, as many billions of sensors become an ubiquitous part of 21st century living, there is going to be a huge demand for low power processing everywhere. Having that market may turn out to be a larger prize than the smartphone market. The possibilities are endless.

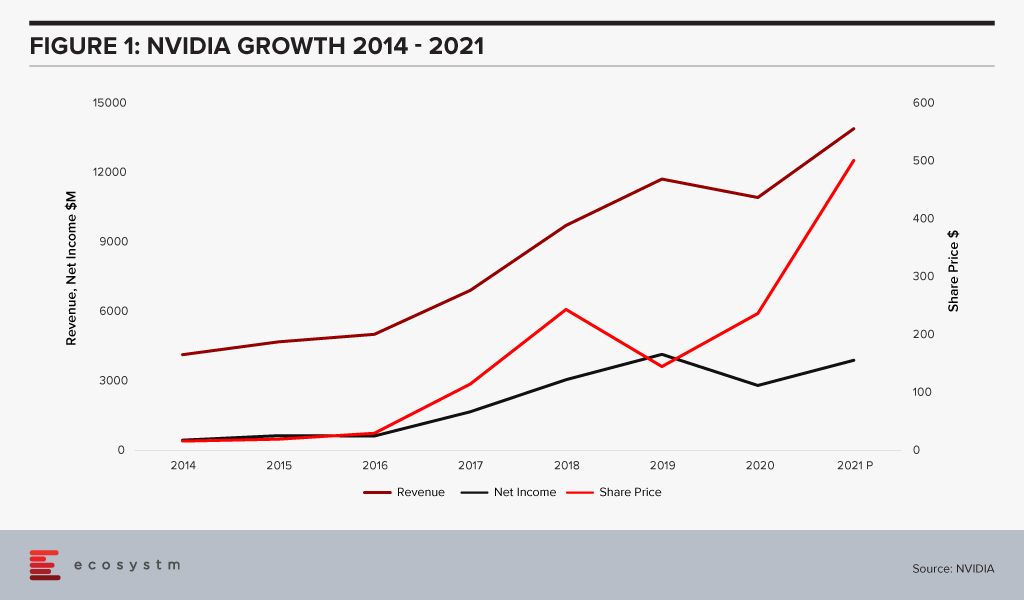

While this deal is supposed to be worth around USD 40 billion, somewhere between USD 23-28 billion is going to be paid in the form of NVIDIA stock. This brings us to an extremely interesting dynamic. At the beginning of 2016 NVIDIA’s market cap was less than USD 20 billion. Mighty Intel was at USD 150 billion. AMD the other player in the market for chips who also sell graphics was at a mere USD 2 billion. In July this year, NVIDIA’s value passed Intel’s and today it is sitting at around USD 300 billion! Intel with a recent dip is now close to USD 200 billion. AMD too with all the tech-fueled growth in recent years has grown to just shy of USD 100 billion market cap.

What this tells us is that the stock portion of the deal is cheaper for NVIDIA today by around 55% compared to if this deal was consummated on 1st January 2020. If there was a right time for NVIDIA to buy – it is now. This also shows the way the company has grown revenue at a massive clip powered by Gaming PCs and AI. The deal to buy Arm appears to be a very good idea, which would establish NVIDIA as a leader in the chip industry moving forward.

Ecosystm Comments

While there appears to be some good reasons for this deal and there are some very exciting possibilities for both NVIDIA and Arm, there are some challenges.

The tech industry is littered with examples of large mergers and splits that did not pan out. Given that this is a large deal between two businesses without a large overlap, this partnership needs to be handled with a great deal of care and thought. The right people need to be retained. Customer trust needs to be retained.

Arm so far has been successful as a neutral provider of IP and design. It does not make chips, far less any downstream products. It therefore does not compete with any of the vendors licensing its technology. NVIDIA competes with Arm’s customers. The deal might create significant misgivings in the minds of many customers about sharing of information like roadmaps and pricing. Both companies have been making repeated statements that they will ensure separation of the businesses to avoid conflicts.

However, it might prove to be difficult for NVIDIA and Arm to do the delicate dance of staying at arm’s length (pun intended) while at the same time obtaining synergies. Collaborating on technology development might prove to be difficult as well, if customer roadmaps cannot be discussed.

Business today also cannot escape the gravitational force of geo-politics. Given the current US-China spat, the Chinese media and various other agencies are already opposing this deal. Chinese companies are going to be very wary of using Arm technology if there is a chance the tap can be suddenly shut down by the US government. China accounts for about 25% of Arm’s market in units. One of the unintended consequences which could emerge from this is the empowerment of a new competitor in this space.

NVIDIA and Arm will need to take a very strategic long-term view, get communication out well ahead of the market and reassure their customers, ensuring they retain their trust. If they manage this well then they can reap huge benefits from their merger.

Alibaba has been actively expanding its global reach over the last year. There have been several announcements this year to indicate that the cloud provider is looking to benefit from the recent uptick in cloud adoption and support the global recovery initiatives. In April, Alibaba announced its plans to invest USD 28 billion, focusing on infrastructure and technologies related to operating systems, servers, chips and networks, over the next three years. Later in June, Alibaba announced the intention to recruit 5,000 people globally showing serious intentions to become a global cloud player. It is also strengthening capabilities in markets where they already have a strong market presence. By 2021 Alibaba intends to have 64 availability zones with 21 regions across the globe.

Consolidating Partnership with Equinix

Alibaba’s partnership with Equinix, the interconnection and data centre company dates back a few years. In 2017 the partnership started providing enterprises with direct, scalable access to Alibaba Cloud via the Equinix Cloud Exchange in 5 of their global data centres.

Last week the partnership was further strengthened by Equinix extending the reach of Alibaba Cloud via its network of Equinix Cloud Exchange Fabric (ECX Fabric) Cloud interconnection platform. The deal will widen Alibaba’s cloud reach in the US, EMEA, and the Asia Pacific region for customers to privately connect with Alibaba’s cloud. Under the partnership, Alibaba will integrate its API with Equinix ECX Fabric to facilitate direct and secured connections to Alibaba Cloud, across these regions:

- 9 US metros. Chicago, Dallas, Denver, Los Angeles, Miami, New York, Seattle, Silicon Valley and Washington DC

- 5 Asia Pacific hubs. Hong Kong, Jakarta, Singapore, Sydney and Tokyo

- 3 hubs in EMEA. Dubai, Frankfurt and London

The deal also gives Alibaba direct access to Equinix’s interconnected ecosystem of over 9,700 customers including enterprises, cloud and network operators, and IT service providers.

The Hybrid Cloud Push

In the last 18 months or so, the industry has seen a greater push in private/hybrid cloud or multi-cloud adoption. Ecosystm Principal Advisor Andrew Milroy says, “As enterprises move to hybrid cloud infrastructures, the world’s leading IaaS providers, including Alibaba Cloud, are expanding their private cloud and hybrid cloud services.”

Many of these IaaS providers may not have the capabilities to provide a hybrid cloud offering at a global level. Partnerships such as the one between Equinix and Alibaba Cloud may well be the solution. Milroy says, “Equinix offers interconnection services from multiple sites across the globe. These interconnection services are necessary for the provision of private and hybrid cloud services, on a global scale, offering the level of performance and security that organisations want.”

“In order to compete with AWS, GCP and Microsoft, Alibaba Cloud needs to be able to scale its private and hybrid cloud offerings globally. Equinix can enable them to do this. At the same time, Equinix will also benefit from Alibaba Cloud’s growth into newer markets, which will lead to an increased demand for its interconnection services.”

Australia’s data centre market has grown exponentially, to a large part due to the Government’s strong policies around cloud adoption. This is in line with the vision of creating a Digital Economy by 2025. Australia’s Tech Future talks about technological changes in 4 key areas including building infrastructure and providing secure access to high-quality data. Availability of local data centres is key to building better infrastructure to support the Digital Economy.

Cloud adoption, especially in the small and medium enterprise (SME) sector is expected to continue to rise. The Ecosystm Business Pulse Study shows that only 16% of Australian organisations had not increased their cloud investments after the COVID-19 crisis and its impact on the economy.

Ecosystm Principal Advisor, Tim Sheedy says, “The current pandemic has highlighted the digital ‘haves and have nots’ in Australia. The NBN has helped to narrow the gap, but too many in rural and regional Australia continue to suffer the tyranny of distance. Businesses and government departments have been reluctant to relocate outside of the major cities due to the lack of internet and data centre infrastructure. Investing in data centres in rural and regional locations will not only help to close the digital divide but also remove a significant barrier that stops businesses from investing in and relocating to locations out of cities.”

Growing Australia’s Data Centre Footprint

This week, Australia’s Leading Edge Data Centres and Schneider Electric announced a AU$30 million project where Schneider Electric will provide Tier-3-designed prefabricated data centre modules for Leading Edge’s six locations in Australia. Each site will host 75 racks with 5kW power density to support computing operations and minimise data exchange delays. Ecosystm Principal Advisor, Darian Bird says, “The inaccessible nature of some sites makes them suitable for prefabricated data centres, which are plug-and-play containers that can be set up and maintained by a relatively small IT team. Standardisation in edge data centres and automation are key to remote management for anyone deploying distributed infrastructure.”

This announcement follows the news that Leading Edge has secured an investment of AU$20 million from Washington H. Soul Pattinson to construct 20 Tier-3 data centres across Australia. They have also received funding from the SparkLabs Cultiv8 2020 accelerator group. The funding will be used to build more than 20 Tier 3 data centres across regional Australia to provide faster internet speeds and direct cloud connectivity.

This will impact businesses that host mission-critical applications, and stricter uptime requirements, and is expected to benefit IoT, AgriTech and telecom industry applications.

Impact on Industry

Edge connectivity will create a seamless experience for the users to take advantage of faster computing with a local host, lower latency by taking connectivity to where operations reside, and data sovereignty by keeping data within the region, aiding in the development of Australia’s Digital Economy.

Sheedy sees this as an opportunity for primary industries. “One of the real challenges for farms and other agribusinesses investing in IoT and other tech-based solutions has been the lack of local or nearby computing infrastructure that will support applications that require low latency. Leading Edge’s investments in providing data centres in rural and regional Australia will mean these businesses can accelerate their digital transformations.”

With the simultaneous rollout of 5G, Smart City initiatives will also benefit from edge data centres. “Investment in edge infrastructure is likely to take off and follow the 5G coverage map across Australia. We will see operators take advantage of their vast network footprint and combine micro data centres with some 5G antenna locations,” says Bird. “Smart City initiatives will be made possible by 5G connected IoT devices but computing at the edge will be needed to keep, for example, public safety systems, operating in real-time. Many monitoring systems will require local data analysis to be effective.”

Bird also sees potential impacts on the Entertainment industry. “The COVID-19 restrictions and the launch of new services such as Disney+ and Binge in Australia will ensure streaming video continues its impressive growth trajectory. Even facilities such as sports stadiums are beginning to deliver in-person digital experiences to grab back attention from their online competitors. Positive user experience is crucial here and low latency is a must. We’ll see a shift towards edge computing delivered on-site as part of a distributed network. Regional data centres and local caching have always been vital for content delivery to ensure the quality of service and reduce bandwidth costs but the scale is unprecedented.”

Bird talks about potential retail opportunities in the future. “We may see anchor tenants at malls offering their excess capacity to smaller, nearby stores that need the benefits of edge but can’t justify the investment, similar to the way Amazon launched AWS.”