India’s digital economy is on a meteoric rise, expected to reach USD 1 trillion by 2025. This surge in digital activity is fuelling the rapid expansion of its data centre market, positioning the country as a global player. With a projected market value of USD 4.5 billion by 2025, India’s data centre industry is set to surpass traditional regional hubs like Malaysia, Hong Kong, and Singapore.

This growth is driven by factors such as the proliferation of smartphones, internet connectivity, and digital services, generating massive amounts of data that need storage and processing. Government initiatives like Digital India and the National e-Governance Plan have promoted digitalisation, while favourable market conditions, including cost-effective infrastructure, skilled talent, and a large domestic market, make India an attractive destination for data centre investments.

As companies continue to invest, India is solidifying its role as a critical hub for Asia’s digital revolution, driving economic development and creating new opportunities for innovation and job creation.

What is Fuelling India’s Data Centre Growth?

India’s data centre industry is experiencing rapid growth in 2024, driven by a combination of strategic advantages and increasing demand. The country’s abundance of land and skilled workforce are key factors contributing to this boom.

- Digitisation push. The digital revolution is fueling the need for more sophisticated data centre infrastructure. The rise of social media, online gaming, and streaming apps has created a surge in demand for faster networks, better data storage options, and increased data centre services.

- Internet and mobile penetration. With 1.1 billion mobile phone subscribers, Indians use an average of 8.3 GB of data per month. As more people come online, businesses need to expand their data infrastructure to handle increased traffic, enhance service delivery, and support a growing digital economy.

- Increasing tech adoption. India’s AI market is projected to reach around USD 17 billion by 2027. As businesses integrate AI, IoT, cloud, and other technologies, data centres will become instrumental in supporting the vast computational and storage requirements.

- Government & regulatory measures. Apart from India being one of the world’s largest data consumption economies, government initiatives have also accelerated the ‘data based’ environment in the country. Additionally, states like Maharashtra, Karnataka, and Tamil Nadu have implemented favourable real estate policies that reduce the costs of setting up data centres.

A Growing Network of Hubs

India’s data centre landscape is rapidly evolving, with major cities and emerging hotspots vying for a piece of the pie.

Mumbai-Navi Mumbai remains the undisputed leader, boasting a combined 39 data centres. Its strategic location with excellent submarine cable connectivity to Europe and Southeast Asia makes it a prime destination for global and domestic players.

Bangalore, India’s IT capital, is not far behind with 29 data centres. The city’s thriving tech ecosystem and skilled talent pool make it an attractive option for businesses looking to set up data centres.

Chennai, located on the east coast, has emerged as a crucial hub with 17 data centres. Its proximity to Southeast Asia and growing digital economy make it a strategic location. The Delhi-NCR region also plays a significant role, with 27 data centres serving the capital and surrounding areas.

Smaller cities like Pune, Jaipur, and Patna are rapidly emerging as data centre hotspots. As businesses seek to serve a growing but distributed user base across India, these cities offer more cost-effective options. Additionally, the rise of edge data centres in these smaller cities is further decentralising the data centre landscape.

A Competitive Market

India ranks 13th globally in the number of operational data centres, with 138 facilities in operation and an additional 45 expected to be completed by the end of 2025. Key initiatives include:

- AWS. AWS is investing USD 12.7 billion to establish four new data centres over the next two years.

- Meta. Meta is set to build a small data centre, potentially focused on cache with a 10-20 MW capacity.

- AdaniConnex. In partnership with EdgeConneX, AdaniConnex aims to develop a 1 GW network of hyperscale data centres over the next decade, all powered by 100% renewable energy.

- Google. Google is set to build an 80-storey data centre by 2025 and is in advanced talks to acquire a 22.5-acre land parcel for its first captive data centre.

- NTT. NTT is investing USD 241 million in a data campus, which will feature three data centres.

Data Centres: Driving Digital India’s Success

The Digital India initiative has transformed government services through improved online infrastructure and increased connectivity. Data centres play a pivotal role in supporting this vision by managing, storing, and processing the vast amounts of data that power essential services like Aadhaar and BharatNet.

Aadhaar, India’s biometric ID system, relies heavily on data centres to store and process biometric information, enabling seamless identification and authentication. BharatNet, the government’s ambitious project to connect rural areas with high-speed internet, also depends on data centres to provide the necessary infrastructure and support.

The impact of data centres on India’s digital transformation is far-reaching. Here are some key areas where data centres have made a significant contribution:

- Enabling Remote Work and Education. Data centres have been instrumental in supporting the surge in remote work and online learning during the pandemic. By providing the necessary infrastructure and connectivity, data centres have ensured business continuity and uninterrupted education.

- Fostering Start-Up Innovation. Data centres provide the essential infrastructure for start-ups to thrive. By offering reliable and scalable computing resources, data centres enable rapid growth and innovation, contributing to the expansion of India’s SaaS market.

- Supporting Government Services. Data centres underpin key government initiatives, including e-governance platforms and digital identity systems. They enhance the accessibility, transparency, and efficiency of government services, bridging the urban-rural divide and improving public service delivery.

Securing India’s Data Centre Future

Data centres are the backbone of India’s digital transformation, fuelling economic growth, government services, innovation, remote work, and technological progress. The Indian government’s ambitious plan to invest over USD 1 billion in hyperscale data centres over the next five years underscores the country’s commitment to building a robust digital infrastructure.

To secure the long-term success of India’s data centre industry, alignment with global standards and strategic investment are crucial. Prioritising reliability, efficiency, and sustainability will attract global providers and position India as a prime destination for digital infrastructure investments. Addressing challenges like legacy upgrades, modernisation, and cybersecurity risks will require collaboration across stakeholders, with government support and technological innovation playing key roles.

A unified effort from central and state governments is vital to enhance competitiveness. By fostering a favourable regulatory environment and offering incentives, the government can accelerate the development of world-class data centres. As India advances digitally, data centres will be instrumental in driving economic growth, improving quality of life, and solidifying India’s status as a global digital leader.

Exiting the North-South Highway 101 onto Mountain View, California, reveals how mundane innovation can appear in person. This Silicon Valley town, home to some of the most prominent tech giants, reveals little more than a few sprawling corporate campuses of glass and steel. As the industry evolves, its architecture naturally grows less inspiring. The most imposing structures, our modern-day coliseums, are massive energy-rich data centres, recursively training LLMs among other technologies. Yet, just as the unassuming exterior of the Googleplex conceals a maze of shiny new software, GenAI harbours immense untapped potential. And people are slowly realising that.

It has been over a year that GenAI burst onto the scene, hastening AI implementations and making AI benefits more identifiable. Today, we see successful use cases and collaborations all the time.

Finding Where Expectations Meet Reality

While the data centres of Mountain View thrum with the promise of a new era, it is crucial to have a quick reality check.

Just as the promise around dot-com startups reached a fever pitch before crashing, so too might the excitement surrounding AI be entering a period of adjustment. Every organisation appears to be looking to materialise the hype.

All eyes (including those of 15 million tourists) will be on Paris as they host the 2024 Olympics Games. The International Olympic Committee (IOC) recently introduced an AI-powered monitoring system to protect athletes from online abuse. This system demonstrates AI’s practical application, monitoring social media in real time, flagging abusive content, and ensuring athlete’s mental well-being. Online abuse is a critical issue in the 21st century. The IOC chose the right time, cause, and setting. All that is left is implementation. That’s where reality is met.

While the Googleplex doesn’t emanate the same futuristic aura as whatever is brewing within its walls, Google’s AI prowess is set to take centre stage as they partner with NBCUniversal as the official search AI partner of Team USA. By harnessing the power of their GenAI chatbot Gemini, NBCUniversal will create engaging and informative content that seamlessly integrates with their broadcasts. This will enhance viewership, making the Games more accessible and enjoyable for fans across various platforms and demographics. The move is part of NBCUniversal’s effort to modernise its coverage and attract a wider audience, including those who don’t watch live television and younger viewers who prefer online content.

From Silicon Valley to Main Street

While tech giants invest heavily in GenAI-driven product strategies, retailers and distributors must adapt to this new sales landscape.

Perhaps the promise of GenAI lies in the simple storefronts where it meets the everyday consumer. Just a short drive down the road from the Googleplex, one of many 37,000-square-foot Best Buys is preparing for a launch that could redefine how AI is sold.

In the most digitally vogue style possible, the chain retailer is rolling out Microsoft’s flagship AI-enabled PCs by training over 30,000 employees to sell and repair them and equipping over 1,000 store employees with AI skillsets. Best Buy are positioning themselves to revitalise sales, which have been declining for the past ten quarters. The company anticipates that the augmentation of AI skills across a workforce will drive future growth.

The Next Generation of User-Software Interaction

We are slowly evolving from seeking solutions to seamless integration, marking a new era of User-Centric AI.

The dynamic between humans and software has mostly been transactional: a question for an answer, or a command for execution. GenAI however, is poised to reshape this. Apple, renowned for their intuitive, user-centric ecosystem, is forging a deeper and more personalised relationship between humans and their digital tools.

Apple recently announced a collaboration with OpenAI at its WWDC, integrating ChatGPT into Siri (their digital assistant) in its new iOS 18 and macOS Sequoia rollout. According to Tim Cook, CEO, they aim to “combine generative AI with a user’s personal context to deliver truly helpful intelligence”.

Apple aims to prioritise user personalisation and control. Operating directly on the user’s device, it ensures their data remains secure while assimilating AI into their daily lives. For example, Siri now leverages “on-screen awareness” to understand both voice commands and the context of the user’s screen, enhancing its ability to assist with any task. This marks a new era of personalised GenAI, where technology understands and caters to individual needs.

We are beginning to embrace a future where LLMs assume customer-facing roles. The reality is, however, that we still live in a world where complex issues are escalated to humans.

The digital enterprise landscape is evolving. Examples such as the Salesforce Einstein Service Agent, its first fully autonomous AI agent, aim to revolutionise chatbot experiences. Built on the Einstein 1 Platform, it uses LLMs to understand context and generate conversational responses grounded in trusted business data. It offers 24/7 service, can be deployed quickly with pre-built templates, and handles simple tasks autonomously.

The technology does show promise, but it is important to acknowledge that GenAI is not yet fully equipped to handle the nuanced and complex scenarios that full customer-facing roles need. As technology progresses in the background, companies are beginning to adopt a hybrid approach, combining AI capabilities with human expertise.

AI for All: Democratising Innovation

The transformations happening inside the Googleplex, and its neighbouring giants, is undeniable. The collaborative efforts of Google, SAP, Microsoft, Apple, and Salesforce, amongst many other companies leverage GenAI in unique ways and paint a picture of a rapidly evolving tech ecosystem. It’s a landscape where AI is no longer confined to research labs or data centres, but is permeating our everyday lives, from Olympic broadcasts to customer service interactions, and even our personal devices.

The accessibility of AI is increasing, thanks to efforts like Best Buy’s employee training and Apple’s on-device AI models. Microsoft’s Copilot and Power Apps empower individuals without technical expertise to harness AI’s capabilities. Tools like Canva and Uizard empower anybody with UI/UX skills. Platforms like Coursera offer certifications in AI. It’s never been easier to self-teach and apply such important skills. While the technology continues to mature, it’s clear that the future of AI isn’t just about what the machines can do for us—it’s about what we can do with them. The on-ramp to technological discovery is no longer North-South Highway 101 or the Googleplex that lays within, but rather a network of tools and resources that’s rapidly expanding, inviting everyone to participate in the next wave of technological transformation.

As AI evolves, the supporting infrastructure has become a crucial consideration for organisations and technology companies alike. AI demands massive processing power and efficient data handling, making high-performance computing clusters and advanced data management systems essential. Scalability, efficiency, security, and reliability are key to ensuring AI systems handle increasing demands and sensitive data responsibly.

Data centres must evolve to meet the increasing demands of AI and growing data requirements.

Equinix recently hosted technology analysts at their offices and data centre facilities in Singapore and Sydney to showcase how they are evolving to maintain their leadership in the colocation and interconnection space.

Equinix is expanding in Latin America, Africa, the Middle East, and Asia Pacific. In Asia Pacific, they recently opened data centres in Kuala Lumpur and Johor Bahru, with capacity additions in Mumbai, Sydney, Melbourne, Tokyo, and Seoul. Plans for the next 12 months include expanding in existing cities and entering new ones, such as Chennai and Jakarta.

Ecosystm analysts comment on Equinix’s growth potential and opportunities in Asia Pacific.

Small Details, Big Impact

TIM SHEEDY. The tour of the new Equinix data centre in Sydney revealed the complexity of modern facilities. For instance, the liquid cooling system, essential for new Nvidia chipsets, includes backup cold water tanks for redundancy. Every system and process is designed with built-in redundancy.

As power needs grow, so do operational and capital costs. The diesel generators at the data centre, comparable to a small power plant, are supported by multiple fuel suppliers from several regions in Sydney to ensure reliability during disasters.

Security is critical, with some areas surrounded by concrete walls extending from the ceiling to the floor, even restricting access to Equinix staff.

By focusing on these details, Equinix enables customers to quickly set up and manage their environments through a self-service portal, delivering a cloud-like experience for on-premises solutions.

Equinix’s Commitment to the Environment

ACHIM GRANZEN. Compute-intensive AI applications challenge data centres’ “100% green energy” pledges, prompting providers to seek additional green measures. Equinix addresses this through sustainable design and green energy investments, including liquid cooling and improved traditional cooling. In Singapore, one of Equinix’s top 3 hubs, the company partnered with the government and Sembcorp to procure solar power from panels on public buildings. This improves Equinix’s power mix and supports Singapore’s renewable energy sector.

TIM SHEEDY Building and operating data centres sustainably is challenging. While the basics – real estate, cooling, and communications – remain, adding proximity to clients, affordability, and 100% renewable energy complicates matters. In Australia, reliant on a mixed-energy grid, Equinix has secured 151 MW of renewable energy from Victoria’s Golden Plains Wind Farm, aiming for 100% renewable by 2029.

Equinix leads with AIA-rated data centres that operate in warmer conditions, reducing cooling needs and boosting energy efficiency. Focusing on efficient buildings, sustainable water management, and a circular economy, Equinix aims for climate neutrality by 2030, demonstrating strong environmental responsibility.

Equinix’s Private AI Value Proposition

ACHIM GRANZEN. Most AI efforts, especially GenAI, have occurred in the public cloud, but there’s rising demand for Private AI due to concerns about data availability, privacy, governance, cost, and location. Technology providers in a position to offer alternative AI stacks (usually built on top of a GPU-as-a-service model) to the hyperscalers find themselves in high interest. Equinix, in partnership with providers such as Nvidia, offers Private AI solutions on a global turnkey AI infrastructure. These solutions are ideal for industries with large-scale operations and connectivity challenges, such as Manufacturing, or those slow to adopt public cloud.

SASH MUKHERJEE. Equinix’s Private AI value proposition will appeal to many organisations, especially as discussions on AI cost efficiency and ROI evolve. AI unites IT and business teams, and Equinix understands the need for conversations at multiple levels. Infrastructure leaders focus on data strategy capacity planning; CISOs on networking and security; business lines on application performance, and the C-suite on revenue, risk, and cost considerations. Each has a stake in the AI strategy. For success, Equinix must reshape its go-to-market message to be industry-specific (that’s how AI conversations are shaping) and reskill its salesforce for broader conversations beyond infrastructure.

Equinix’s Growth Potential

ACHIM GRANZEN. In Southeast Asia, Malaysia and Indonesia provide growth opportunities for Equinix. Indonesia holds massive potential as a digital-savvy G20 country. In Malaysia, the company’s data centres can play a vital part in the ongoing Mydigital initiative, having a presence in the country before the hyperscalers. Also, the proximity of the Johor Bahru data centre to Singapore opens additional business opportunities.

TIM SHEEDY. Equinix is evolving beyond being just a data centre real estate provider. By developing their own platforms and services, along with partner-provided solutions, they enable customers to optimise application placement, manage smaller points of presence, enhance cloud interconnectivity, move data closer to hyperscalers for backup and performance, and provide multi-cloud networking. Composable services – such as cloud routers, load balancers, internet access, bare metal, virtual machines, and virtual routing and forwarding – allow seamless integration with partner solutions.

Equinix’s focus over the last 12 months on automating and simplifying the data centre management and interconnection services is certainly paying dividends, and revenue is expected to grow above tech market growth rates.

ASEAN, poised to become the world’s 4th largest economy by 2030, is experiencing a digital boom. With an estimated 125,000 new internet users joining daily, it is the fastest-growing digital market globally. These users are not just browsing, but are actively engaged in data-intensive activities like gaming, eCommerce, and mobile business. As a result, monthly data usage is projected to soar from 9.2 GB per user in 2020 to 28.9 GB per user by 2025, according to the World Economic Forum. Businesses and governments are further fuelling this transformation by embracing Cloud, AI, and digitisation.

Investments in data centre capacity across Southeast Asia are estimated to grow at a staggering pace to meet this growing demand for data. While large hyperscale facilities are currently handling much of the data needs, edge computing – a distributed model placing data centres closer to users – is fast becoming crucial in supporting tomorrow’s low-latency applications and services.

The Big & the Small: The Evolving Data Centre Landscape

As technology pushes boundaries with applications like augmented reality, telesurgery, and autonomous vehicles, the demand for ultra-low latency response times is skyrocketing. Consider driverless cars, which generate a staggering 5 TB of data per hour and rely heavily on real-time processing for split-second decisions. This is where edge data centres come in. Unlike hyperscale data centres, edge data centres are strategically positioned closer to users and devices, minimising data travel distances and enabling near-instantaneous responses; and are typically smaller with a capacity ranging from 500 KW to 2 MW. In comparison, large data centres have a capacity of more than 80MW.

While edge data centres are gaining traction, cloud-based hyperscalers such as AWS, Microsoft Azure, and Google Cloud remain a dominant force in the Southeast Asian data centre landscape. These facilities require substantial capital investment – for instance, it took almost USD 1 billion to build Meta’s 150 MW hyperscale facility in Singapore – but offer immense processing power and scalability. While hyperscalers have the resources to build their own data centres in edge locations or emerging markets, they often opt for colocation facilities to familiarise themselves with local markets, build out operations, and take a “wait and see” approach before committing significant investments in the new market.

The growth of data centres in Southeast Asia – whether edge, cloud, hyperscale, or colocation – can be attributed to a range of factors. The region’s rapidly expanding digital economy and increasing internet penetration are the prime reasons behind the demand for data storage and processing capabilities. Additionally, stringent data sovereignty regulations in many Southeast Asian countries require the presence of local data centres to ensure compliance with data protection laws. Indonesia’s Personal Data Protection Law, for instance, allows personal data to be transferred outside of the country only where certain stringent security measures are fulfilled. Finally, the rising adoption of cloud services is also fuelling the need for onshore data centres to support cloud infrastructure and services.

Notable Regional Data Centre Hubs

Singapore. Singapore imposed a moratorium on new data centre developments between 2019 to 2022 due to concerns over energy consumption and sustainability. However, the city-state has recently relaxed this ban and announced a pilot scheme allowing companies to bid for permission to develop new facilities.

In 2023, the Singapore Economic Development Board (EDB) and the Infocomm Media Development Authority (IMDA) provisionally awarded around 80 MW of new capacity to four data centre operators: Equinix, GDS, Microsoft, and a consortium of AirTrunk and ByteDance (TikTok’s parent company). Singapore boasts a formidable digital infrastructure with 100 data centres, 1,195 cloud service providers, and 22 network fabrics. Its robust network, supported by 24 submarine cables, has made it a global cloud connectivity leader, hosting major players like AWS, Azure, IBM Softlayer, and Google Cloud.

Aware of the high energy consumption of data centres, Singapore has taken a proactive stance towards green data centre practices. A collaborative effort between the IMDA, government agencies, and industries led to the development of a “Green Data Centre Standard“. This framework guides organisations in improving data centre energy efficiency, leveraging the established ISO 50001 standard with customisations for Singapore’s context. The standard defines key performance metrics for tracking progress and includes best practices for design and operation. By prioritising green data centres, Singapore strives to reconcile its digital ambitions with environmental responsibility, solidifying its position as a leading Asian data centre hub.

Malaysia. Initiatives like MyGovCloud and the Digital Economy Blueprint are driving Malaysia’s public sector towards cloud-based solutions, aiming for 80% use of cloud storage. Tenaga Nasional Berhad also established a “green lane” for data centres, solidifying Malaysia’s commitment to environmentally responsible solutions and streamlined operations. Some of the big companies already operating include NTT Data Centers, Bridge Data Centers and Equinix.

The district of Kulai in Johor has emerged as a hotspot for data centre activity, attracting major players like Nvidia and AirTrunk. Conditional approvals have been granted to industry giants like AWS, Microsoft, Google, and Telekom Malaysia to build hyperscale data centres, aimed at making the country a leading hub for cloud services in the region. AWS also announced a new AWS Region in the country that will meet the high demand for cloud services in Malaysia.

Indonesia. With over 200 million internet users, Indonesia boasts one of the world’s largest online populations. This expanding internet economy is leading to a spike in the demand for data centre services. The Indonesian government has also implemented policies, including tax incentives and a national data centre roadmap, to stimulate growth in this sector.

Microsoft, for instance, is set to open its first regional data centre in Thailand and has also announced plans to invest USD 1.7 billion in cloud and AI infrastructure in Indonesia. The government also plans to operate 40 MW of national data centres across West Java, Batam, East Kalimantan, and East Nusa Tenggara by 2026.

Thailand. Remote work and increasing online services have led to a data centre boom, with major industry players racing to meet Thailand’s soaring data demands.

In 2021, Singapore’s ST Telemedia Global Data Centres launched its first 20 MW hyperscale facility in Bangkok. Soon after, AWS announced a USD 5 billion investment plan to bolster its cloud capacity in Thailand and the region over the next 15 years. Heavyweights like TCC Technology Group, CAT Telecom, and True Internet Data Centre are also fortifying their data centre footprints to capitalise on this explosive growth. Microsoft is also set to open its first regional data centre in the country.

Conclusion

Southeast Asia’s booming data centre market presents a goldmine of opportunity for tech investment and innovation. However, navigating this lucrative landscape requires careful consideration of legal hurdles. Data protection regulations, cross-border data transfer restrictions, and local policies all pose challenges for investors. Beyond legal complexities, infrastructure development needs and investment considerations must also be addressed. Despite these challenges, the potential rewards for companies that can navigate them are substantial.

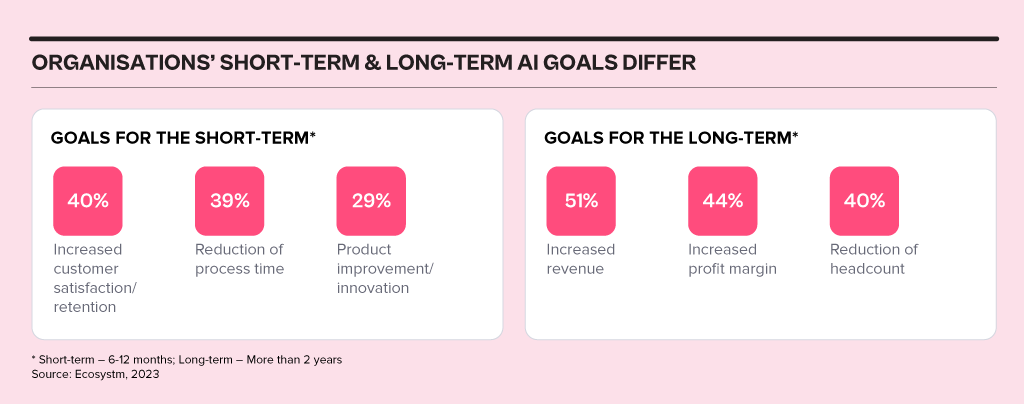

In 2024, business and technology leaders will leverage the opportunity presented by the attention being received by Generative AI engines to test and integrate AI comprehensively across the business. Many organisations will prioritise the alignment of their initial Generative AI initiatives with broader AI strategies, establishing distinct short-term and long-term goals for their AI investments.

AI adoption will influence business processes, technology skills, and, in turn, reshape the product/service offerings of AI providers.

Ecosystm analysts Achim Granzen, Peter Carr, Richard Wilkins, Tim Sheedy, and Ullrich Loeffler present the top 5 AI trends in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 AI Trends in 2024.

#1 By the End of 2024, Gen AI Will Become a ‘Hygiene Factor’ for Tech Providers

AI has widely been commended as the ‘game changer’ that will create and extend the divide between adopters and laggards and be the deciding factor for success and failure.

Cutting through the hype, strategic adoption of AI is still at a nascent stage and 2024 will be another year where companies identify use cases, experiment with POCs, and commit renewed efforts to get their data assets in order.

The biggest impact of AI will be derived from integrated AI capability in standard packaged software and products – and this will include Generative AI. We will see a plethora of product releases that seamlessly weave Generative AI into everyday tools generating new value through increased efficiency and user-friendliness.

Technology will be the first industry where AI becomes the deciding factor between success and failure; tech providers will be forced to deliver on their AI promises or be left behind.

#2 Gen AI Will Disrupt the Role of IT Architects

Traditionally, IT has relied on three-tier architectures for applications, that faced limitations in scalability and real-time responsiveness. The emergence of microservices, containerisation, and serverless computing has paved the way for event-driven designs, a paradigm shift that decouples components and use events like user actions or data updates as triggers for actions across distributed services. This approach enhances agility, scalability, and flexibility in the system.

The shift towards event-driven designs and advanced architectural patterns presents a compelling challenge for IT Architects, as traditionally their role revolved around designing, planning and overseeing complex systems.

Generative AI is progressively demonstrating capabilities in architectural design through pattern recognition, predictive analytics, and automated decision-making.

With the adoption of Generative AI, the role of an IT Architect will change into a symbiotic relationship where human expertise collaborates with AI insights.

#3 Gen AI Adoption Will be Confined to Specific Use Cases

A little over a year ago, a new era in AI began with the initial release of OpenAI’s ChatGPT. Since then, many organisations have launched Generative AI pilots.

In its second-year enterprises will start adoption – but in strictly defined and limited use cases. Examples such as Microsoft Copilot demonstrate an early adopter route. While productivity increases for individuals can be significant, its enterprise impact is unclear (at this time).

But there are impactful use cases in enterprise knowledge and document management. Organisations across industries have decades (or even a century) of information, including digitised documents and staff expertise. That treasure trove of information can be made accessible through cognitive search and semantic answering, driven by Generative AI.

Generative AI will provide organisations with a way to access, distill, and create value out of that data – a task that may well be impossible to achieve in any other way.

#4 Gen AI Will Get Press Inches; ‘Traditional’ AI Will Do the Hard Work

While the use cases for Generative AI will continue to expand, the deployment models and architectures for enterprise Generative AI do not add up – yet.

Running Generative AI in organisations’ data centres is costly and using public models for all but the most obvious use cases is too risky. Most organisations opt for a “small target” strategy, implementing Generative AI in isolated use cases within specific processes, teams, or functions. Justifying investment in hardware, software, and services for an internal AI platform is challenging when the payback for each AI initiative is not substantial.

“Traditional AI/ML” will remain the workhorse, with a significant rise in use cases and deployments. Organisations are used to investing for AI by individual use cases. Managing process change and training is also more straightforward with traditional AI, as the changes are implemented in a system or platform, eliminating the need to retrain multiple knowledge workers.

#5 AI Will Pioneer a 21st Century BPM Renaissance

As we near the 25-year milestone of the 21st century, it becomes clear that many businesses are still operating with 20th-century practices and philosophies.

AI, however, represents more than a technological breakthrough; it offers a new perspective on how businesses operate and is akin to a modern interpretation of Business Process Management (BPM). This development carries substantial consequences for digital transformation strategies. To fully exploit the potential of AI, organisations need to commit to an extensive and ongoing process spanning the collection, organisation, and expansion of data, to integrating these insights at an application and workflow level.

The role of AI will transcend technological innovation, becoming a driving force for substantial business transformation. Sectors that specialise in workflow, data management, and organisational transformation are poised to see the most growth in 2024 because of this shift.

While there has been much speculation about AI being a potential negative force on humanity, what we do know today is that the accelerated use of AI WILL mean an accelerated use of energy. And if that energy source is not renewable, AI will have a meaningful negative impact on CO2 emissions and will accelerate climate change. Even if the energy is renewable, GPUs and CPUs generate significant heat – and if that heat is not captured and used effectively then it too will have a negative impact on warming local environments near data centres.

Balancing Speed and Energy Efficiency

While GPUs use significantly more energy than CPUs, they run many AI algorithms faster than CPUs – so use less energy overall. But the process needs to run – and these are additional processes. Data needs to be discovered, moved, stored, analysed, cleansed. In many cases, algorithms need to be recreated, tweaked and improved. And then that algorithm itself will kick off new digital processes that are often more processor and energy-intensive – as now organisations might have a unique process for every customer or many customer groups, requiring more decisioning and hence more digitally intensive.

The GPUs, servers, storage, cabling, cooling systems, racks, and buildings have to be constructed – often built from raw materials – and these raw materials need to be mined, transported and transformed. With the use of AI exploding at the moment, so is the demand for AI infrastructure – all of which has an impact on the resources of the planet and ultimately on climate change.

Sustainable Sourcing

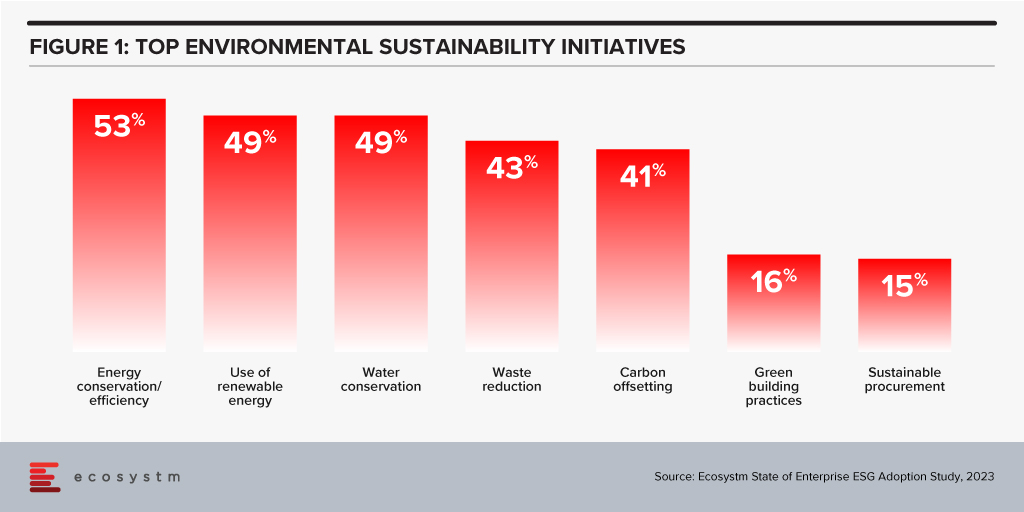

Some organisations understand this already and are beginning to use sustainable sourcing for their technology services. However, it is not a top priority with Ecosystm research showing only 15% of organisations focus on sustainable procurement.

Technology Providers Can Help

Leading technology providers are introducing initiatives that make it easier for organisations to procure sustainable IT solutions. The recently announced HPE GreenLake for Large Language Models will be based in a data centre built and run by Qscale in Canada that is not only sustainably built and sourced, but sits on a grid supplying 99.5% renewable electricity – and waste (warm) air from the data centre and cooling systems is funneled to nearby greenhouses that grow berries. I find the concept remarkable and this is one of the most impressive sustainable data centre stories to date.

The focus on sustainability needs to be universal – across all cloud and AI providers. AI usage IS exploding – and we are just at the tip of the iceberg today. It will continue to grow as it becomes easier to use and deploy, more readily available, and more relevant across all industries and organisations. But we are at a stage of climate warming where we cannot increase our greenhouse gas emissions – and offsetting these emissions just passes the buck.

We need more companies like HPE and Qscale to build this Sustainable Future – and we need to be thinking the same way in our own data centres and putting pressure on our own AI and overall technology value chain to think more sustainably and act in the interests of the planet and future generations. Cloud providers – like AWS – are committed to the NetZero goal (by 2040 in their case) – but this is meaningless if our requirement for computing capacity increases a hundred-fold in that period. Our businesses and our tech partners need to act today. It is time for organisations to demand it from their tech providers to influence change in the industry.

In recent years, businesses have faced significant disruptions. Organisations are challenged on multiple fronts – such as the continuing supply chain disruptions; an ongoing energy crisis that has led to a strong focus on sustainability; economic uncertainty; skills shortage; and increased competition from digitally native businesses. The challenge today is to build intelligent, data-driven, and agile businesses that can respond to the many changes that lie ahead.

Leading organisations are evaluating ways to empower the entire business with data, machine learning, automation, and AI to build agile, innovative, and customer-focused businesses.

Here are 7 steps that will help you deliver business value with data and AI:

- Understand the problems that need solutions. Before an organisation sets out on its data, automation, and AI journey, it is important to evaluate what it wants to achieve. This requires an engagement with the Tech/Data Teams to discuss the challenges it is trying to resolve.

- Map out a data strategy framework. Perhaps the most important part of this strategy are the data governance principles – or a new automated governance to enforce policies and rules automatically and consistently across data on any cloud.

- Industrialise data management & AI technologies. The cumulation of many smart, data-driven initiatives will ultimately see the need for a unified enterprise approach to data management, AI, and automation.

- Recognise the skills gap – and start closing it today. There is a real skills gap when it comes to the ability to identify and solve data-centric issues. Many businesses today turn to technology and business consultants and system integrators to help them solve the skills challenge.

- Re-start the data journey with a pilot. Real-world pilots help generate data and insights to build a business case to scale capabilities.

- Automate the outcomes. Modern applications have made it easier to automate actions based on insights. APIs let systems integrate with each other, share data, and trigger processes; and RPA helps businesses automate across applications and platforms.

- Learn and improve. Intelligent automation tools and adaptive AI/machine learning solutions exist today. What organisations need to do is to apply the learnings for continuous improvements.

Find more insights below.

Download The Future of Business: 7 Steps to Delivering Business Value with Data & AI as a PDF

Southeast Asia has evolved into an innovation hub with Singapore at the centre. The entrepreneurial and startup ecosystem has grown significantly across the region – for example, Indonesia now has the 5th largest number of startups in the world.

Organisations in the region are demonstrating a strong desire for tech-led innovation, innovation in experience delivery, and in evolving their business models to bring innovative products and services to market.

Here are 5 insights on the patterns of technology adoption in Southeast Asia, based on the findings of the Ecosystm Digital Enterprise Study, 2022.

- Data and AI investments are closely linked to business outcomes. There is a clear alignment between technology and business.

- Technology teams want better control of their infrastructure. Technology modernisation also focuses on data centre consolidation and cloud strategy

- Organisations are opting for a hybrid multicloud approach. They are not necessarily doing away with a ‘cloud first’ approach – but they have become more agnostic to where data is hosted.

- Cybersecurity underpins tech investments. Many organisations in the region do not have the maturity to handle the evolving threat landscape – and they are aware of it.

- Sustainability is an emerging focus area. While more effort needs to go in to formalise these initiatives, organisations are responding to market drivers.

More insights into the Southeast Asia tech market below.

Click here to download The Future of the Digital Enterprise – Southeast Asia as a PDF

There have been some long-term shifts in market dynamics in the telecom industry. Network traffic growth rates have accelerated; new business models emerged; and cloud services matured and spread to new verticals, applications and customer sizes. Networks are more important than ever. Revenue growth rates and profitability in the three segments – telecom, webscale, and carrier-neutral – have been stronger in recent quarters than anticipated.

Looking ahead, networks will increasingly revolve around data centres, which will continue to proliferate both at the core and edge.

Data centre innovation will be rapid, as webscalers push the envelope on network design and function, and telecom operators seek cheaper ways of running their networks. The telecom operator’s need for cost efficiency will increase as overhyped 5G-based opportunities fail to materialise in any big way. Carrier-neutral operators (CNNOs) will benefit from an ongoing wave of new capital which will help them transform to more integrated providers of “digital infrastructure” assets.

Read on to find out about

- The interdependence of network operators

- The growth potential of the telecom, webscale, and CNNO markets

- How webscalers such as Facebook and Alibaba are leveraging scale

- Acquisition and deals in the CNNO market such as the American Tower-CoreSite acquisition and the Digital Realty deal with Ciena.

- The growth of environmental consciousness in the telecom industry

Click here to download The Future of Telecom: Industry Outlook for 2022 and Beyond slides as a PDF.