In an era marked by heightened global awareness of environmental, social, and governance (ESG) issues, organisations find themselves at a crossroad where profitability converges with responsibility. The imperative to take resolute action on ESG fronts is underscored by a compelling array of statistics and evidence that highlight the profound impact of these considerations on long-term success.

A 2020 McKinsey report revealed that executives and investors value companies with robust ESG performance around 10% higher in valuations than laggards. Equally pivotal, workplace diversity is now recognised as a strategic advantage; a study in the Harvard Business Review finds that companies with above-average total diversity had both 19% higher innovation revenues and 9% higher EBIT margins, on average. Against this backdrop, organisations must recognise that embracing ESG principles is not merely an ethical gesture but a strategic imperative that safeguards resilience, reputation, and enduring financial prosperity.

The data from the ongoing Ecosystm State of ESG Adoption study was used to evaluate the status and maturity of organisations’ ESG strategy and implementation progress. A diverse representation across industries such as Financial Services, Manufacturing, and Retail & eCommerce, as well as from roles across the organisation has helped us with insights and an understanding of where organisations stand in terms of the maturity of their ESG strategy and implementation efforts.

A Tailored Approach to Improve ESG Maturity

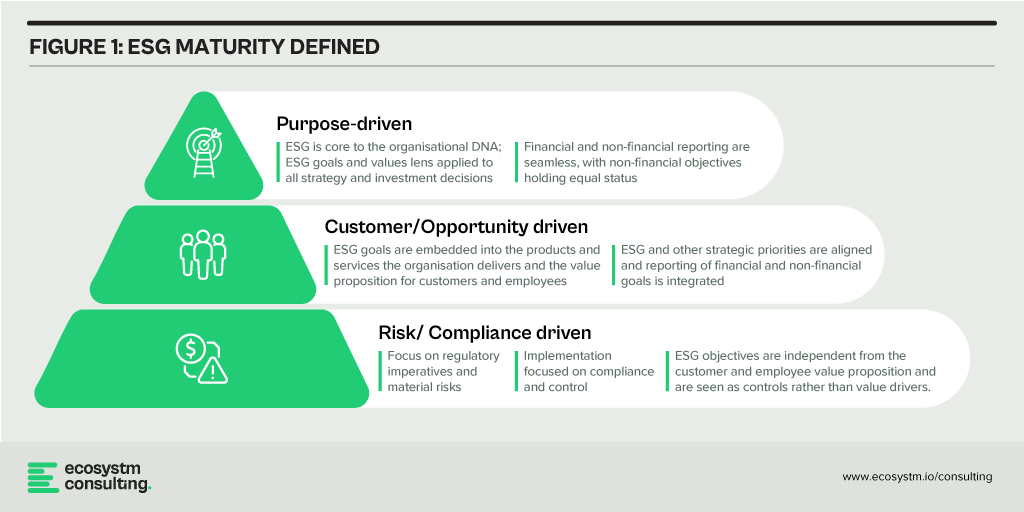

Ecosystm assists clients in driving greater impact through their ESG adoption. Our tools evaluate an organisation’s aspirations and roadmaps using a maturity model, along with a series of practical drivers that enhance ESG response maturity. The maturity of an organisation’s approach on ESG tends to progress from a reactive, or risk/compliance-based focus, to a customer, or opportunity driven approach, to a purpose led approach that is focused on embedding ESG into the core culture of the organisation. Our advisory, research and consulting offerings are customised to the transitions organisations are seeking to make in their maturity levels over time.

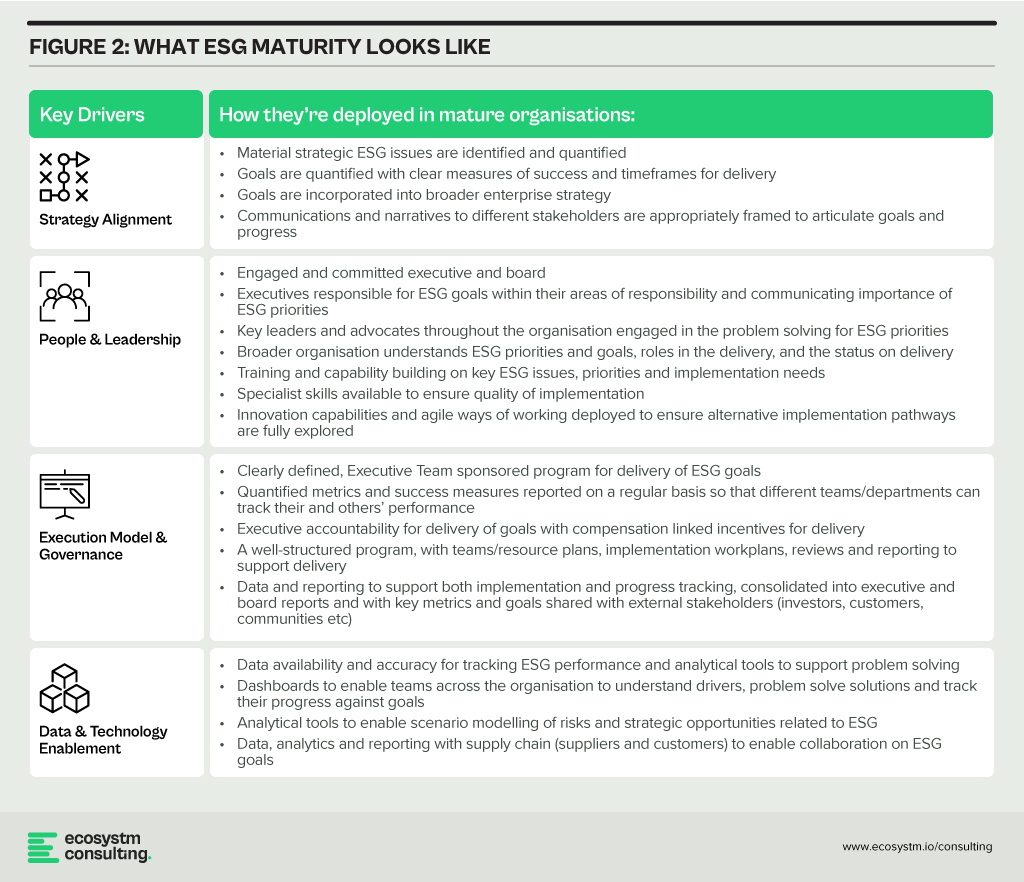

Within the maturity framework outlined above, Ecosystm has identified the key organisational drivers to improve maturity and adoption. The Ecosystm ESG Consulting offerings are configured to both support the development of ESG strategy and the delivery and ‘story telling’ around ESG programs based on the goals of the customer (maturity aspiration) and the gaps they need to close to deliver the aspiration.

Key Findings of the Ecosystm State of ESG Study

89% of respondents self-reported that their organisation had an ESG strategy; however, a notable 60% also identified that a lack of alignment of sustainability goals to enterprise strategy was a key issue in implementation. This reflects many of the client discussions we’ve had, where customers share that ESG goals that have not been fully tested against other organisational priorities can create tensions and make it difficult to solve trade-offs across the organisation during implementation.

People & Leadership/Execution & Governance

Capabilities are still emerging. 40% of respondents mentioned that a lack of a governance framework for ESG was a barrier to adoption, and 56% mentioned that immature metrics and reporting maturity slowed adoption. 64% of respondents also mentioned that a lack of specialised resources as a key barrier to ESG adoption.

In our discussions with customers, we understand that there is good support for ESG across organisations, but there needs to be a simple narrative compelling them to action on a few clearly articulated priorities, a clear mandate from senior leadership and credible resourcing and governance to ensure follow through.

Data and Technology Enablement

There is a strong opportunity for improvement. “We can’t manage what we cannot measure” has been the common refrain from the clients we have spoken to and the survey reflected this. Only 47% of respondents say that preparing data, analytics, reporting, and metrics for internal consumption is a priority for their tech teams.

ESG is rapidly emerging as a key priority for customers, investors, talent, and other stakeholders who seek a comprehensive and genuine commitment from the organisations they interact with. Successfully determining the right priorities and effectively mobilising your organisation and external collaborators for implementation are pivotal. It’s crucial to acknowledge the intricacy and extent of effort needed for this endeavour.

With our timely research findings complementing our ESG maturity and implementation frameworks, analyst insights and consulting support, Ecosystm is well-positioned to help you to navigate your journey to ESG maturity.