While Vodafone remains one of the leading global telecommunications providers, they face the need to transform their services and reach out to a wider audience. The customer base of a typical telecom provider is shifting, and they can no longer afford to just focus on consumers and need to include enterprises in their go-to-market strategy. Beyond the usual offerings of connectivity and mobile plans, Vodafone Business has solutions for Unified Communications, IoT and Cloud, to help grow their enterprise customer base. Ecosystm Principal Advisor, Tim Sheedy says, “Vodafone is one of the most successful telecom providers in the business space. Vodafone Business already represents around 30% of the Vodafone Group revenue, and unlike most in the telecommunications sector, they are showing growth (albeit moderate!).”

The Role of Telecom Providers in the Cybersecurity Market

An area where enterprises continue to need guidance and support is cybersecurity. The results of the UK Government’s Cyber Security Breaches Survey 2019 found that 32% of UK businesses had experienced a cyber-attack in the previous 12 months. More than a third of UK organisations have made changes in their cyber policies because of the GDPR – a majority focusing on policies first. It is not surprising therefore that Vodafone should identify cybersecurity as the next area of focus for their enterprise offerings.

Sheedy says, ”Cybersecurity services are one of the fastest-growing areas in technology. But because of this, it is a also a crowded market with everyone – from the big telecom providers, IT services providers, big audit firms, mid-sized technology providers down to the smaller cybersecurity experts – playing for this growing spend. It can, however, be argued that telecom providers have some of the deepest experience in cybersecurity and managing the risks – their networks are probably the most targeted by hackers and malicious actors. Telecom providers have massive teams just to stop threats from one or two countries. With all the work they do to protect their own network, they should have the skills to help protect the networks and assets of their clients.”

Ecosystm Principal Advisor, Alex Woerndle concurs, “Telecom providers are perfectly positioned to transition into managed security service providers (MSSPs). They already have the experience in providing a range of managed services, the ability to scale to support clients and some ready-made expertise internally in their in-house cybersecurity capabilities.”

Vodafone’s Foray into Cybersecurity

Vodafone Cyber Enhanced focuses on selected cybersecurity areas – threat analysis and intelligence, managed firewall and managed security services. The global Ecosystm Cybersecurity study finds that the solutions that organisations will invest in most in 2020 are Security Operations (SecOps) & Incident Response (by a third of global organisations) and Threat Analysis & Intelligence (by 20% of global organisations).

Commenting on the areas Vodafone is focusing on, Woerndle says, “Threat analysis and intelligence is where a lot of established SecOps providers and MSSPs are really focusing now. Previously it was simply a matter of monitoring alerts and reporting. Businesses and in-house security teams are now seeking more proactive assistance in searching for threats, before they become attacks. The challenge they face is catching up – effectively jumping from just being another SecOps centre (SOC) monitoring and reporting alerts, to matching the more mature SOCs with proactive threat intelligence to help clients mitigate before an attack is launched. This takes time, as it needs maturity of the SOC and the team, and also data, which established providers have accrued plenty of, over an extended period. While a managed firewall is not really a new service, it makes some sense to couple it with other managed security services to deliver a broader program. Vodafone is absolutely targeting the areas that businesses are looking into presently.”

Woerndle adds, “MSSPs will be crucial to the security sector moving forward. There has been a rapid growth of vendor solutions creating a very confusing market for tech buyers. This is coupled with a tight labour market for skilled people who can manage the tools. It is not surprising , therefore, that 86% of organisations across the world will look to engage with an MSSP when deploying a cybersecurity solution, according to Ecosystm research.”

Sheedy sees an opportunity for Vodafone to go global with their cybersecurity capabilities. “If Vodafone can compete with the bigger players (and perhaps partner with or complement the offerings of the smaller ones), then they should find a significant opportunity, especially within their larger clients – particularly as they move into the software-defined networking space. However, given the confusion around cybersecurity, they should expand their focus beyond larger enterprises to businesses over about 100 employees. As one of the largest global telecom providers, with one of the largest networks, they can be an important player in the cybersecurity space – growing the spend in their business clients. And while this is a UK play for now, one assumes that they will look to expand across their operating countries as Vodafone Cyber Enhanced gains traction.”

In our blog, Artificial Intelligence – Hype vs Reality, published last month we explored why the buzz around AI and machine learning have got senior management excited about future possibilities of what technology can do for their business. AI – starting with automation – is being evaluated by organisations across industries. Several functions within an organisation can leverage AI and the technology is set to become part of enterprise solutions in the next few years. AI is fast becoming the tool which empowers business leaders to transform their organisations. However, it also requires a rethink on data integration and analysis, and the use of the intelligence generated. For a successful AI implementation, an organisation will have to leverage other enabling technologies.

Technologies Enabling AI

IoT

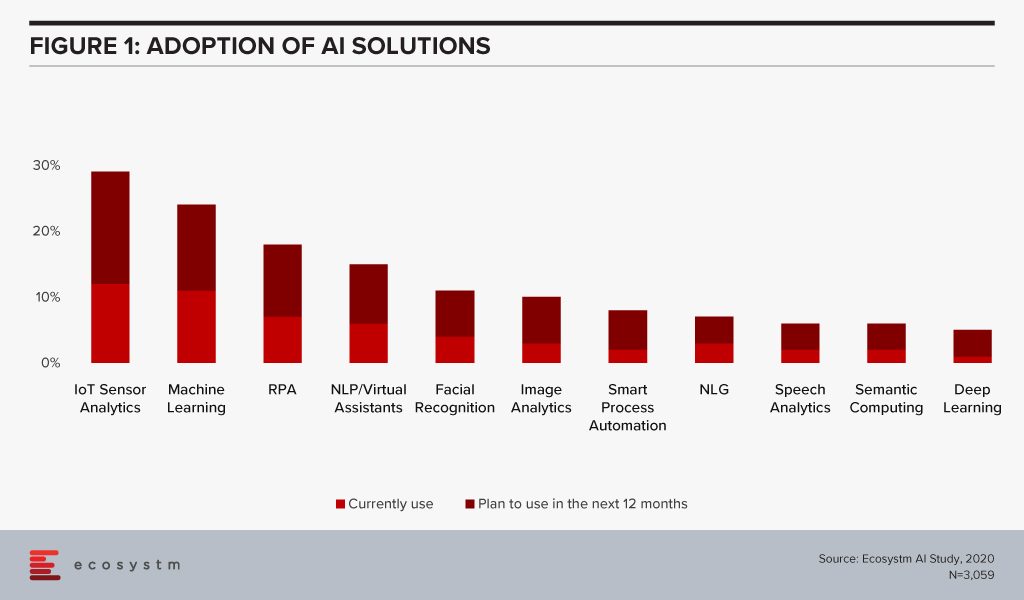

Organisations have been evaluating IoT – especially for Industry 4.0 – for the better part of the last decade. Many organisations, however, have found IoT implementations daunting for various reasons – concerns around security, technology integration challenges, customisation to meet organisational and system requirements and so on. As the hype around what AI can do for the organisation increases, they are being forced to re-look at their IoT investments. AI algorithms derive intelligence from real-time data collected from sensors, remote inputs, connected things, and other sources. No surprise then that IoT Sensor Analytics is the AI solution that is seeing most uptake (Figure 1).

This is especially true for asset and logistics-driven industries such as Resource & Primary, Energy & Utilities, Manufacturing and Retail. Of the AI solutions, the biggest growth in 2020 will also come from IoT Analytics – with Healthcare and Transportation ramping up their IoT spend. And industries will also look at different ways they can leverage the IoT data for operational efficiency and improved customer experience (CX). For instance, in Transportation, AI can use IoT sensor data from a fleet to help improve time, cost and fuel efficiency – suggesting less congested routes with minimal stops through GPS systems, maintaining speeds with automated speed limiters – and also in predictive fleet maintenance.

IoT sensors are already creating – and will continue to create large amounts of data. As organisations look to AI-enabled IoT devices, there will be a shift from one-way transactions (i.e. collecting and analysing data) to bi-directional transactions (i.e. sensing and responding). Eventually, IoT as a separate technology will cease to exist and will become subsumed by AI.

Cloud

AI is changing the way organisations need to store, process and analyse the data to derive useful insights and decision-making practices. This is pushing the adoption of cloud, even in the most conservative organisations. Cloud is no longer only required for infrastructure and back-up – but actually improving business processes, by enabling real-time data and systems access.

Over the next decades, IoT devices will grow exponentially. Today, data is already going into the cloud and data centres on a real-time basis from sensors and automated devices. However, as these devices become bi-directional, decisions will need to be made in real-time as well. This has required cloud environments to evolve as the current cloud environments are unable to support this. Edge Computing will be essential in this intelligent and automated world. Tech vendors are building on their edge solutions and tech buyers are increasingly getting interested in the Edge allowing better decision-making through machine learning and AI. Not only will AI drive cloud adoption, but it will also drive cloud providers to evolve their offerings.

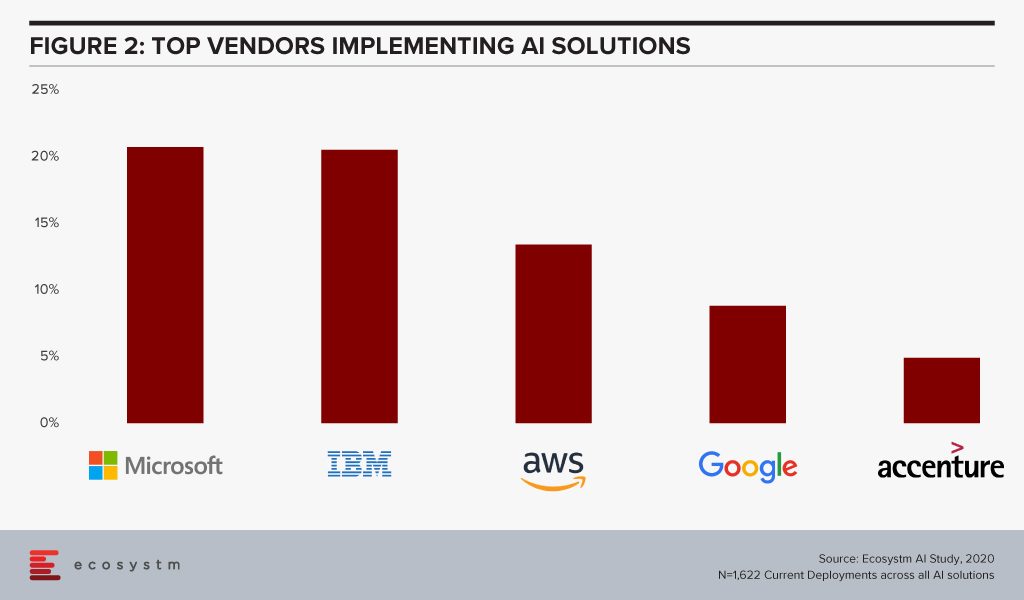

The global Ecosystm AI study finds that four of the top five vendors that organisations are using for their AI solutions (across data mining, computer vision, speech recognition and synthesis, and automation solutions) today, are also leading cloud platform providers (Figure 2).

The fact that intelligent solutions are often composed of multiple AI algorithms gives the major cloud platforms an edge – if they reside on the same cloud environment, they are more likely to work seamlessly and without much integration or security issues. Cloud platform providers are also working hard on their AI capabilities.

Cybersecurity & AI

The technology area that is getting impacted by AI most is arguably Cybersecurity. Security Teams are both struggling with cybersecurity initiatives as a result of AI projects – and at the same time are being empowered by AI to provide more secure solutions for their organisations.

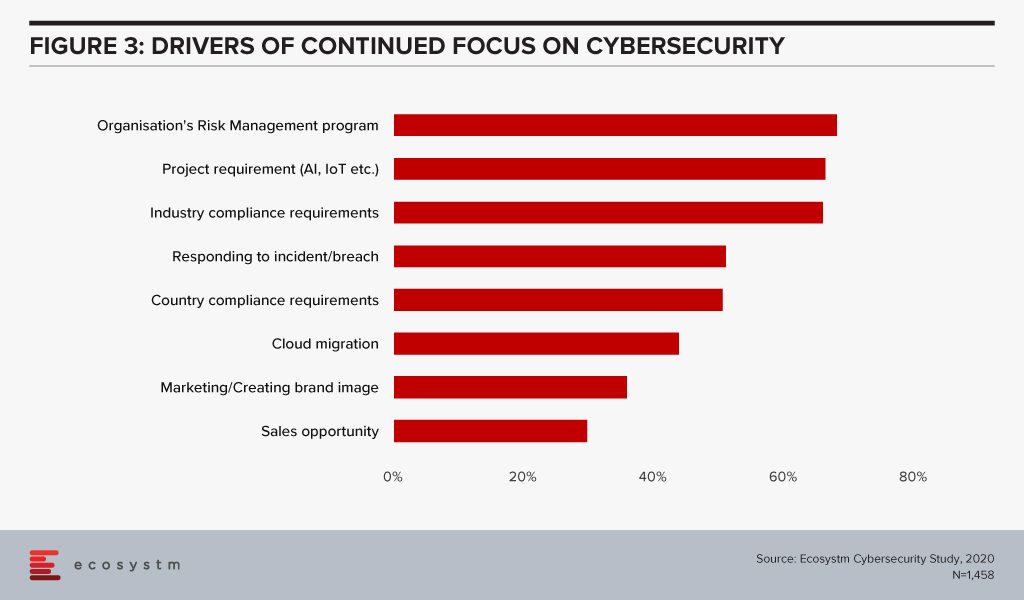

The global Ecosystm Cybersecurity study finds that one of the key drivers that is forcing Security Teams to keep an eye on their cybersecurity measures is the organisations’ needs to handle security requirements for their Digital Transformation (DX) projects involving AI and IoT deployments (Figure 3).

While AI deployments keep challenging Security Teams, AI is also helping cybersecurity professionals. Many businesses and industries are increasingly leveraging AI in their Security Operations (SecOps) solutions. AI analyses the inflow and outflow of data in a system and analyses threats based on the learnings. The trained AI systems and algorithms help businesses to curate and fight thousands of daily breaches, unsafe codes and enable proactive security and quick incident response. As organisations focus their attention on Data Security, SecOps & Incident Response and Threat Analysis & Intelligence, they will evaluate solutions with embedded AI.

AI and the Experience Economy

AI has an immense role to play in improving CX and employee experience (EX) by giving access to real-time data and bringing better decision-making capabilities.

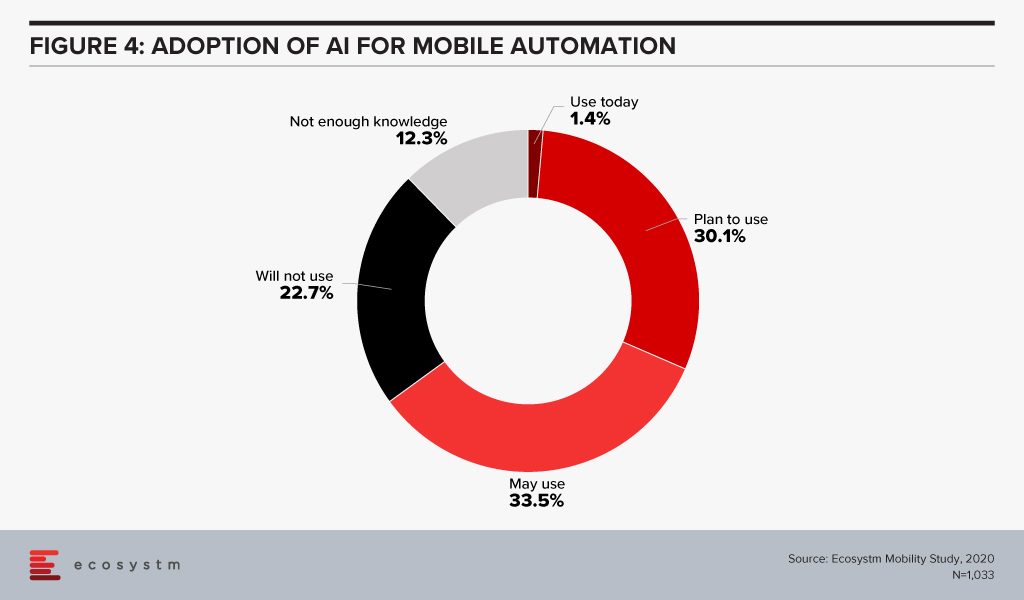

Enterprise mobility was a key area of focus when smartphones were introduced to the modern workplace. Since then enterprise mobility has evolved as business-as-usual for IT Teams. However, with the introduction of AI, organisations are being forced to re-evaluate and revamp their enterprise mobility solutions. As an example, it has made mobile app testing easier for tech teams. Mobile automation will help automate testing of a mobile app – across operating systems (Figure 4). While more organisations tend to outsource their app development functions today, mobile automation reduces the testing time cycle, allowing faster app deployments – both for internal apps (increasing employee productivity and agility) and for consumer apps (improving CX).

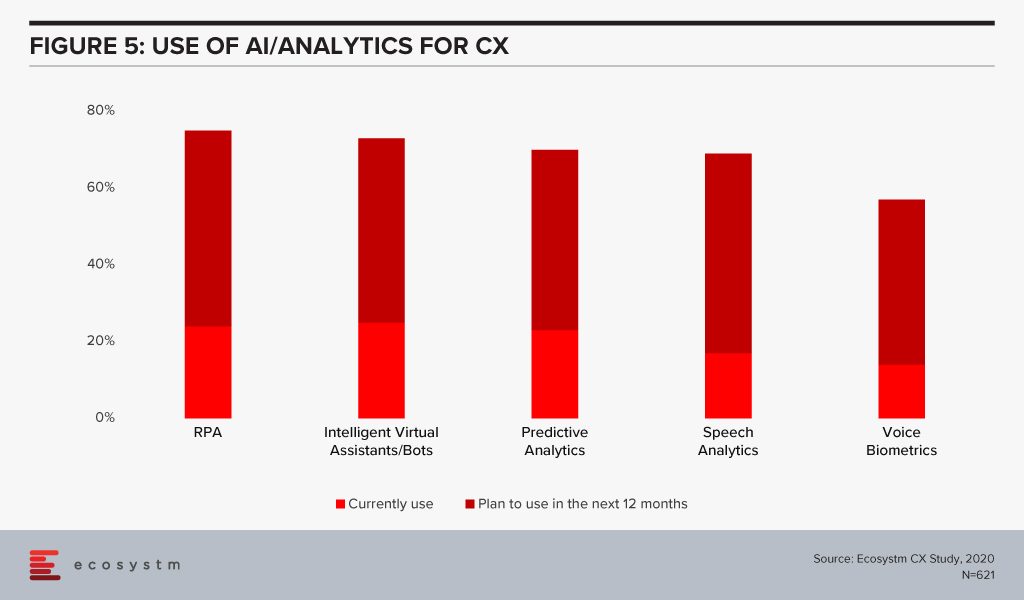

CX Teams within organisations are especially evaluating AI technologies. Visual and voice engagement technologies such as NLP, virtual assistants and chatbots enable efficient services, real-time delivery and better customer engagement. AI also allows organisations to offer personalised services to customers providing spot offers, self-service solutions and custom recommendations. Customer centres are re-evaluating their solutions to incorporate more AI-based solutions (Figure 5).

The buzz around AI is forcing tech teams to evaluate how AI can be leveraged in their enterprise solutions and at enabling technologies that will make AI adoption seamless. Has your organisation started re-evaluating other tech areas because of your AI requirements? Let us know in the comments below.

Authored by Ullrich Loeffler and Kaushik Ghatak

Technology has been identified as a key enabler of innovation and transformation with great potential to disrupt and reshape entire industries. At the same time, the technology industry itself has been at the forefront of disruption with thousands of promising start-ups emerging in areas such as artificial intelligence (AI), Blockchain, cloud and cybersecurity to name a few.

In February 2020, Ecosystm had the opportunity to meet the executive team of Avanseus, an AI solution provider that promises to reshape traditional maintenance processes by leveraging AI-based algorithms for predictive maintenance and failure detection.

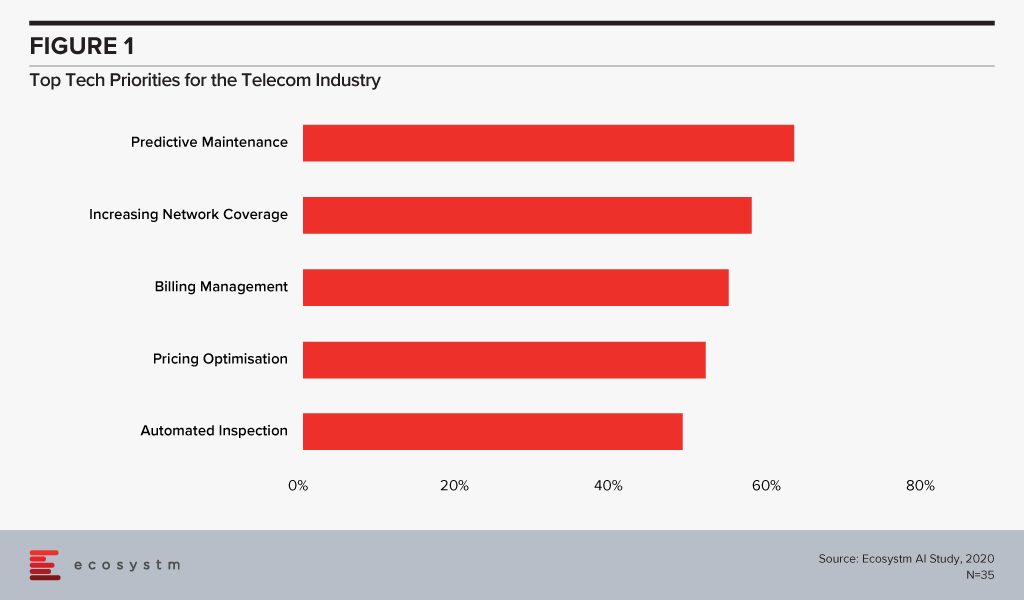

Avanseus is not the newest kid on the block having been launched in June 2015 with headquarters in Singapore. The founding team has extensive experience in the telecommunications sector from executive careers in both the operator and the network provider segments. The problem statement and value proposition that Avanseus was founded on is to support telecom companies to tackle the costly challenge of maintaining their increasingly complex networks and to ensure network performance and customer satisfaction. Ecosystm research finds that predictive maintenance is a key priority for telecom providers looking to invest in newer technologies (Figure 1).

The solution Avanseus offers aims to be simple in the way that its proprietary AI-enabled algorithms can assess and predict network performance and network failures with as little as 6 months of network data history to achieve a high degree of prediction accuracy across telecom networks. The simplicity of the solution further allows cost-effective proofs of concept (PoCs) which lets telecom prospects experience first-hand its potential to drive down maintenance cost and ensure network performance.

Avanseus had secured seed capital of US$2.5 million till the middle of 2017. At the end of 2018, Avanseus secured funding via convertible notes of US$1.3m – main noteholders being TNB Spring and SEEDS Capital (Enterprise Singapore). A global network equipment manufacturer and managed services provider became its first commercial customer in 2016. From there Avanseus has demonstrated steady growth achieving revenue of US$1 million in 2018 and US$2.3 million in 2019. 2020 is forecast to be a milestone year with predictions to become cash-flow positive and to achieve revenue growth of 150% over 2019.

As of February 2020, Avanseus employs 41 staff across multiple international locations including its headquarters in Singapore, its development centre in Bangalore and sales offices in Delhi, North and Latin America and Italy to grow its global presence. The team is complemented by 8 part-time consultants and a growing partner ecosystem which includes major consulting firms as well as technology partners such as Dell, Splunk and Siemens. Expanding its partnerships globally is a key part of its strategy in order to scale up on the opportunities it can contest.

Avanseus’ Potential Growth Path

Considering its young history, Avanseus has shown an impressive growth path which can be credited to staying true to its game plan and its original value proposition and solution design. A new fund-raising round had been kicked off at the end of 2019 with the aim to secure sufficient capital to accelerate growth over the coming years. Half of the anticipated funding will be invested into on-site consultants and sales teams while the other half will be invested in R&D to expand automation into APIs and other machine learning technologies. R&D has been a key focus from its early days which has led to the filing of 8 patents, 2 of which have been granted.

In order to accelerate growth further, Avanseus is also re-assessing the industries that could benefit from its predictive maintenance solutions. As with many startups and growth companies, innovation is often not a straight path and new opportunities and ideas arise as the market and customers are engaged. Several industries face similar challenges and benefit from reduced maintenance cost, reduced downtime, extended equipment lifecycles and improved services quality. To transfer the value proposition across use cases and industry applications Avanseus is looking to leverage approximately 80% of its existing solution and apply 20% of industry-specific domain expertise. This has opened up new growth opportunities in a number of areas such as Industrial IoT, Utilities, Manufacturing and supply chain. There are also opportunities in customer-focused industries such as Banking in niche areas such as maintenance of data centre operations.

Ecosystm Comments

As companies collect and manage an exploding amount of data assets within their operations or from their customers, there is an increasing opportunity for innovative technology vendors to support these companies in driving value from their data assets. Avanseus has demonstrated a clear vision and execution in addressing one of these opportunities by focusing on a clear problem statement and offering a ‘simple’ solution that presents a strong business case. As with every growth company, the challenge is to leverage this opportunity and secure the right funding and resources to scale up as quickly as possible.

Partnerships will be critical in its growth path but signing up partners alone may not translate to creating value. The challenge for Avanseus will be to achieve partner commitment and enablement across different geographies. This will require time and a dedicated channel strategy beyond opportunistic partnerships that are born out of specific client engagements.

Another opportunity that could turn into a challenge is the new range of solution applications that Avanseus has identified. Being a high growth company, the greater challenge is often to decide what not to do rather than what can be done. Avanseus is well advised to carefully select which industries it wants to expand into and focus on. Each new solution set will present a magnet for additional resources and funding and may well be a distraction.

Talking about the top 5 global cloud players – Microsoft, AWS, Google, Alibaba and IBM – in the Ecosystm Predicts: The Top 5 Cloud Trends for 2020, Ecosystm Principal Analyst, Claus Mortensen had said, “their ability to compete will increasingly come down to expansion of their service capabilities beyond their current offerings. Ecosystm expects these players to further enhance their focus on expanding their services, management and integration capabilities through global and in-country partnerships.” Google Cloud is doing just that. The last week has been busy for Google Cloud with a few announcements that show that it is ramping up – adding both depth and breadth to their portfolio.

Expanding Data Centre Footprint

This year Google Cloud is set to expand the number of locations to 26 countries. Earlier in the year, Google CEO Sundar Pichai had promised to invest more than US$ 10 billion in expanding their data centre footprints in the USA and they have recently opened their Salt Lake City data centre. Last week Google announced four new data centre locations in Doha (Qatar), Toronto (Canada), Melbourne (Australia), and Delhi (India). With Australia, Canada and India, Google appears to be following the same policy they followed in Japan – where locations in Osaka and Tokyo give customers the option to have an in-country disaster recovery solution. Doha marks Google Cloud’s first foray into the Middle East. While the data centre will primarily cater to global clients, Google has noted a substantial interest from customers in the Middle East and Africa.

Mortensen says, “Google’s new data centres can be seen as an organic geographical expansion of their cloud services but there are a few more factors at play. With data privacy laws getting stricter across the globe, the ability to offer localised data storage is becoming more important – and India is a very good example of a market where keeping data within the geographical borders will become a must.”

“The expansion will also help the development of Google’s own edge computing services going forward. As we noted in our Ecosystm Predicts document, we believe that Cloud and IoT will drive edge computing (which is tightly tied to 5G). Edge computing will function in a symbiotic relationship with centralised data centres where low latency is important. The geographical expansion of Google’s data centre presence will thus also help their push towards edge computing services.”

Google offers their cloud infrastructure and digital transformation (DX) solutions to customers in 150 countries. Not only are they expanding their data centre footprint, but they are also creating industry differentiation. They have targeted industry-specific solutions that deliver new digital capabilities in 6 key verticals – financial services; telecommunications media and entertainment; retail; healthcare and life sciences; manufacturing and industrial; and public sector.

Partnering with Telecom Providers

Last week also saw the unveiling of the Global Mobile Edge Cloud (GMEC) aimed at the telecom industry’s need to transform and the challenges it faces. The telecom industry – long considered an enabler of DX in other industries – stands at a crossroads now. It is time for the industry to transform in order to succeed in a challenging market, newer devices and networking capabilities, and evolving customer requirements – both consumer and enterprise. Talking about the impact of 5G on telecom providers, Ecosystm Principal Advisor, Shamir Amanullah says, “5G is an enterprise play and leading tech giants, carriers and the companies in the ecosystem are collaborating and inking partnerships in order to create solutions and monetise 5G opportunities across industries.”

Google Cloud announced a partnership with AT&T, which is meant to leverage AT&T’s 5G network and Google Cloud’s edge compute technologies (AI and machine learning, analytics, Kubernetes and networking) to develop a joint portfolio of 5G edge computing solutions. This is part of Google’s larger strategy of supporting telecom providers in their efforts to monetise 5G as a business services platform. Through the GMEC, Google Cloud will partner with carriers to offer a suite of applications and services at the edge via 5G networks.

The telecom industry is a key focus as Google aims to help operators take 5G to market, by creating solutions and services that can be offered to enterprises. This includes better customer engagement through data-driven experiences, and improvement of operational efficiencies across core telecom systems. Telecom providers such as Vodafone and Wind Tre are leveraging Google to improve customer experience through data-driven insights.

Amanullah says, “Google Cloud already has thousands of edge nodes inside the carrier networks which will be enabled for use by enterprises, providing access to data analytics, AI and machine learning capabilities. Carriers can offer enterprises these data-driven solutions, to transform the customer experience they offer. Google will also create solutions which will enable carriers and enterprises to improve infrastructure and operational efficiencies through modern cloud-based Operations Support Systems (OSS) and Business Support Systems (BSS).”

Mortensen also thinks that the data centre expansion should be seen in the light of Google’s GMEC push. “Both India and the Middle East are big potential markets via the local telecom providers.”

Industry 4.0 has been driving technology adoption and innovation. Technologies such as the Internet of Things (IoT) are being evaluated by Operations and IT teams especially in manufacturing, primary industries and logistics. As we stand on the threshold of widespread 5G rollouts, the industry expects a larger uptake of IoT. However, organisations have found IoT implementations daunting for various reasons – concerns around security, technology integration challenges, customisation, system requirements and so on. The Global Ecosystm IoT Study finds that more than 70% of organisations implementing an IoT solution do not have an IoT strategy team. This has been the key barrier to successful IoT deployments. What is required is a separate IoT solutions team within organisations that reports to the CEO – either directly or through the COO or CFO.

Why should a CEO get involved in and have visibility into an organisation’s IoT projects? There are a few important reasons.

#1 IoT benefits go deeper than process automation

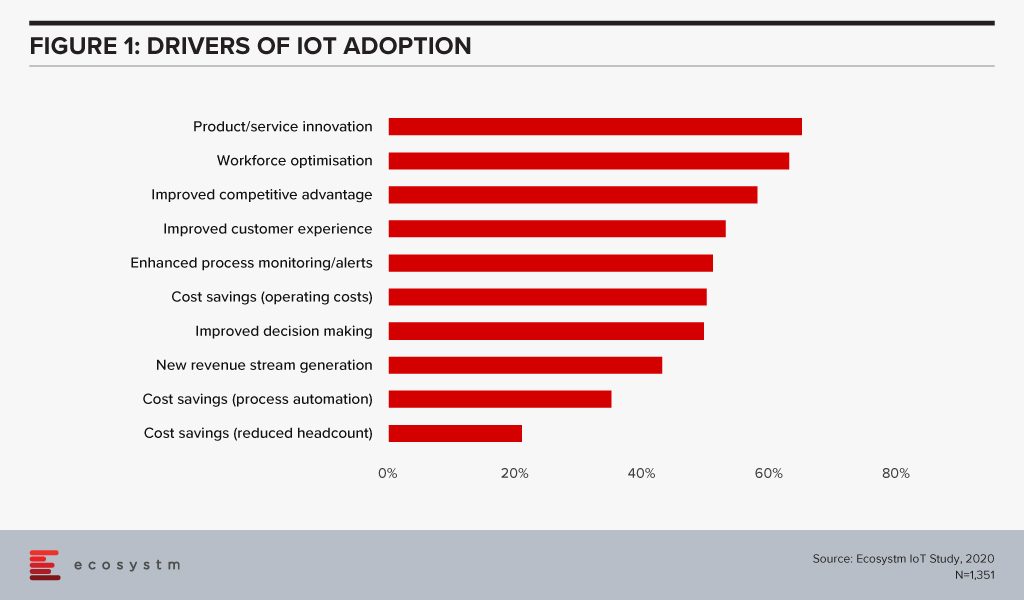

If we look at the top 5 drivers of IoT adoption, we realise immediately that organisations want to do more than automate processes through their IoT deployments (Figure 1). They want to innovate and are looking at IoT adoption to give them an edge over their competition – whether through cost optimisation or through improving the brand image. This cannot be done if organisations look at IoT as a one-off implementation to address one organisational issue – it often becomes a key component of their Digital Transformation (DX) journey.

This will require organisations to have conversations that go beyond process automation. The conversation should be about IoT as an enabler of broad corporate initiatives and should be tied back to an overall long-term strategy. The discussions cannot be asset-driven alone, focusing on enabling assets or devices to generate data with no long-term plan on how to use the data. The metrics have to shift to a ‘business outcomes’ group that includes data scientists, corporate marketing, and operations – with the direct involvement of the CEO. The outcomes can be innovative solutions, faster time to market, value-added services or competitive differentiation.

The high volume of real-time data generated by IoT devices can be analysed to develop customised services and solutions. IoT Analytics is driving decisions not just in inventory management and logistics – but in departments such as HR and marketing. Certainly, the CEO would want visibility of that intelligence and should be able to define the intelligence that will help him do his job better.

#2 In some industries at least, IoT will become mainstream

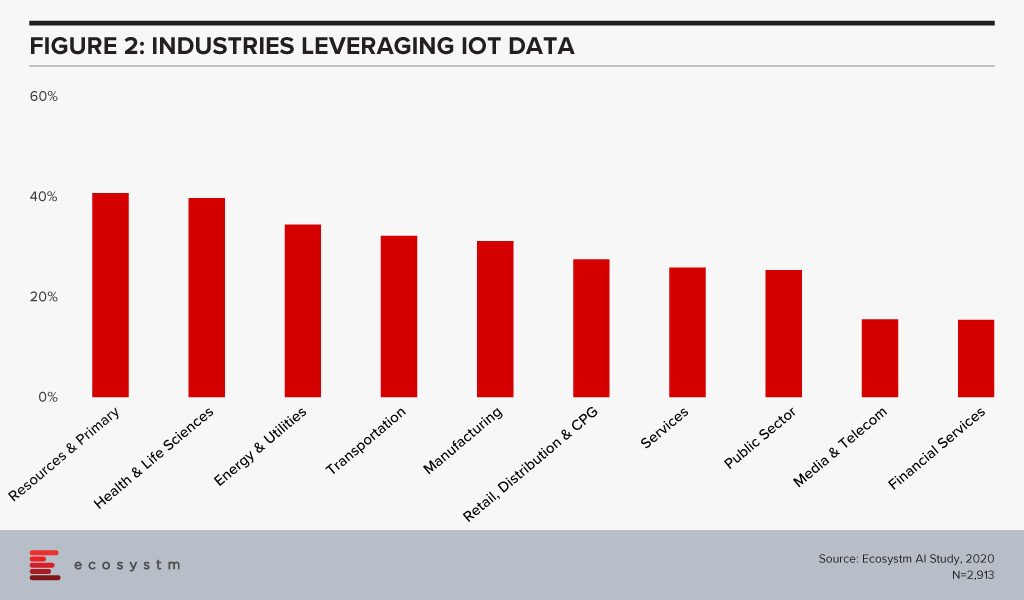

In some industries, IoT solutions have become mainstream – even if there has not been widespread adoption, the discussions about the impact of IoT certainly have (Figure 2). There are early adopters in these industries who have already seen a shift in organisational priorities and benefits derived.

It is the CEO’s job to track the developments and disrupters in their industries. It is the CEO’s job to decide whether the organisation will adopt IoT or not – but it has to be an informed decision. It has to take into consideration the organisation’s culture and capabilities – again that falls under the purview of the CEO.

CEOs in primary industries have to be aware that there are organisations in the industry that are leveraging AI-enabled IoT for cost savings through process automation and for greater visibility of the entire supply chain. Not only are these companies benefitting financially but are also being able to increase the traceability of their products. In agriculture ‘farm-to-fork’ has become a best practice that has the potential to disrupt the industry. Similarly, healthcare CEOs must know that IoT empowers the clinicians immensely, through asset performance management, workforce optimisation and also through the ability to deliver better health outcomes. Again the role of IoT in value-based healthcare is something that CEOs should familiarise themselves with.

#3 Technology disruption will continue to be part of the conversation

No CEO can only focus on business and leave technology to the CIO in today’s disruptive world. There are many technologies that will be part of the larger conversation – and many of these will work in sync with the IoT systems. IoT implementations do not end with installing sensors. While devices, protocols and networks will be handled by CIOs, there are areas where CEOs will have to be consulted, for example, adoption of 5G. Smart Manufacturing and Industry 4.0 initiatives will look to use 5G to gain real-time information to address demand, supply and customer requirements. However, telecom operators are also expected to evolve their existing business models when engaging with enterprises. Changes such as this will require the attention of the CEO.

Another area that will require the CEO’s attention is cybersecurity – millions of devices producing massive data are not only difficult to manage but would also be prone to hacking, network security issues, security breaches and attacks. IoT and other technologies, and the cyber risks associated require the Board and the CEO to evaluate the organisation’s risk exposure including financial remediation. Many organisations have a dedicated responsibility for their cybersecurity practice – the Chief Information Security Officer (CISO) is the key data protection lead and reports directly to the CEO and not to the CIO to avoid a conflict of interest.

As has been mentioned earlier, organisations looking to derive intelligence from their IoT data will need the CEO to play an active role in deciding the nature of the intelligence that is likely to benefit the organisation best. Another area that CEOs will need to have oversight on is the wide range of social, ethical and legal issues that could arise due to the sheer volume of the data collected and the organisation’s data handling practices. Governments across the globe have implemented strict data security and privacy compliance laws. CEOs should be aware of the implications of the data they collect, store, process and use.

#4 IoT projects are not always successful

Implementing and harnessing the true potential of IoT is a big challenge from a CEO’s perspective. Investing in technology and not deriving any benefits could be disastrous for a company in terms of time, effort and cost. CEOs should understand the technology, its integration with the processes and ways to optimise the implementation.

Once the organisation has evaluated the need for an IoT system, it should look at the common reasons why IoT projects fail in other organisations. One of the main reasons is that 98% of organisations have IT teams lead their IoT projects. When you compare this to the 38% of organisations that involve Operations – and that is the function that benefits most from IoT implementations currently – it becomes apparent that key stakeholders are not often involved.

The biggest challenge that IoT implementations face is change management and user adoption. This often gets overshadowed by predominant concerns on technology and cost challenges. The involvement of the CEO and the business functions at an early stage of any IoT deployment helps mitigate that challenge. It would help in not only identifying the right use cases and a better business case but also in higher user adoption because of their involvement (and buy-in) from an early stage. This organisation-wide mandate has to be led by the CEO.

No longer can the CEO focus merely on the business and leave technology to the office of the CIO. Today’s CEO has to be aware of the benefits of technology, the implications for the organisations and the challenges associated with the implementation.

Deep Tech companies are aiming to transform the world through scientific, engineering and technological advances. As technology evolves, researchers are looking to apply engineering and technological advances in areas such as processing and computing architecture, semiconductors and electronics, materials science, vision and speech technologies, artificial intelligence (AI) and machine learning, and so on – for the greater good. For example, finding a cure to a disease, developing new medical devices, sensors and analytics to help farmers increase yield, or developing clean energy solutions to reduce the environmental impact are some of the areas that Deep Tech is finding real-world applications.

Deep Tech Impacting Industries Today

There are several industries that are benefitting from Deep Tech innovations today. Here are only a few examples of Deep Tech innovations in some industries:

Healthcare

The combination of computational and biotechnology is accelerating the development of new cures, augmenting R&D and improving health outcomes. Deep Tech in healthcare has multiple applications from the manufacturing of affordable medical devices to redefining healthcare. Vibrosonic, has designed what they call a “contact lens for the ear” which can be directly placed on the eardrum. Unlike other hearing aids speakers are not used to transport sound through the ear canal but the eardrums are stimulated through electric impulses. A Singapore-based biotech company X Zell has patented a “liquid biopsy”- detecting cancer from a 10ml blood sample by measuring the presence of tumour-derived Circulating Endothelial Cells (tCEC) – which reduces the need for invasive cancer detection processes.

Food and Agriculture

Food crisis is a reality today with factors such as overpopulation, urbanisation, decreasing land per capita, extreme climates and so on impacting the food and agriculture industry immensely. Deep Tech companies are working to bring us sustainable food options and building climate resilience. Cell-based meat options are being researched globally, and companies such as foodtech start-up Shiok Meats is producing meat by harvesting cells from animals with a view to be environmentally friendly and to reduce the impact on biodiversity. In agriculture, Deep Tech companies are working on technologies to develop better farming methods to improve yield and precision sensors for weather forecasting. Examples such as UbiQD, that has worked on a greenhouse quantum dot film that improves crop quality by optimising sunlight spectrum for plants to improve production, show how Deep Tech will continue to transform the industry.

Environment and Energy

Deep Tech continues to come up with solutions that will help us in climate change mitigation, development of sustainable energy and energy efficiency. Innovations include Carbon Upcycling Technologies’ solution to capture and neutralise carbon dioxide. The carbon dioxide-enriched nanoparticles are used to make commercial construction materials and even consumer products such as jewellery. Celadyne Technologies has developed hydrogen fuel cells and electrolysers with nanocomposite membranes for a more efficient, cost-effective and eco-friendly energy source.

Advanced Computing

As technology evolves, there will be a need to support even greater compute and data-intensive tasks. Deep Tech has impacted and will continue to impact advanced computing. The semiconductor and microchip industry is getting disrupted by cutting-edge global research, many by the top universities. MIT, for example, has developed a process called “remote epitaxy” to manufacture flexible chips. Potential use cases include VR-enabled contact lenses, electronic fabrics that respond to the weather, and other flexible electronics. Atom Computing is working on scalable quantum computing that will be able to scale millions of qubits using individual atoms – without scaling up the physical resources – in a single architecture.

Communication and Security

Communication and connectivity have seen a sea change in the last decade. As we wait for 5G to take off, this industry has become a playground for inventions. Aircision, is working on making 5G more accessible using its laser-based communications technology. The technology is developed to enable high-bandwidth communication and beam data between buildings thus aiming to eliminate the need for optical fibre installations and microwave. Another area that will keep getting a lot of attention from Deep Tech firms is communication security. Speqtral is working on space-based quantum networks to deliver secure encryption keys.

Examples such as these are an indication that Deep Tech is a reality today and has the potential to disrupt several industries and impact the lives of millions.

Where is Deep Tech Headed?

Government Interest in Deep Tech

Since Deep Tech is aimed at leveraging technology and engineering for sustainability and greater good, several countries are promoting Deep Tech R&D and initiatives. From emerging to mature economies, governments are supporting their Deep Tech industry. The New Zealand Government has formed a Deep Tech Incubator program. The program is headed by the Government’s innovation agency to help Deep Tech companies and to create new tech jobs.

Singapore has created a strong Deep Tech ecosystem leveraging the funding ecosystem, the presence of global corporations, research and higher learning organisations and the Government that promotes innovation and entrepreneurship. Agencies such as SGInnovate and Enterprise Singapore are working with Deep Tech startups in advanced manufacturing, urban solutions and sustainability, and healthcare and biomedical sciences. Partnerships between universities, industry bodies and research organisations further fuel this ecosystem – the Critical Analytics for Manufacturing Personalised-Medicine (CAMP) is a partnership between Singapore-MIT Alliance for Research and Technology (SMART) and A*STAR for cell therapy manufacturing. The Government also funds and incentivises Deep Tech startups. The 2020 budget announced additional funding to support Deep Tech companies under the Start-up SG Equity scheme.

As global governments get serious about the quality of their citizens’ lives and sustainability goals, they will invest in Deep Tech research.

Challenges of the Deep Tech Industry

While Deep Tech has enormous potential, mainstream adoption is still some way off. There are some unique challenges that the industry faces today. Future uptake will depend heavily on how fast the industry can circumvent these challenges. The key challenges are:

- Securing Finances. Despite initiatives by several global governments, Deep Tech projects often find it difficult to secure funding. Very often the research duration can stretch without any real guarantee of success. Funding is likelier to go to organisations developing consumer products as the ROI are seen earlier and are easier to quantify, especially in the early stages.

- Identifying Market Opportunities. Researchers who develop Deep Tech solutions and products might not be able to identify opportunities to present their development from a marketing as well as an economic perspective. Very often these companies rely on other channels or third-party services for a proper marketing and planning strategy. This is where working with incubators or government bodies becomes crucial – countries that give that opportunity through a well-defined ecosystem, will lead the Deep Tech revolution.

- Scalable Development. Many Deep Tech innovations get stuck at the proof-of-concept stage – not because they are not innovative enough, but because they are not scalable to mass production. That requires the right infrastructure as well as a deep understanding of how the products and services can be commercialised.

There are several global companies trying to disrupt entire industries with their inventive offerings. We are witnessing some novel innovations in autonomous vehicles, foodtech, computer vision, AI, weather predictions, Clean Energy solutions – the list continues – that we will benefit from in the future.

Let us know which Deep Tech companies have impressed you in the comments below.

In the Top 5 Cybersecurity and Compliance Trends for 2020, Ecosystm predicted that 2020 will witness a significant uplift in mergers and acquisition (M&As) activities in the cybersecurity market. Like the consolidation activity in previous booms (such as digital media and web services in the early 2000s), the cybersecurity market is booming globally and creating opportunities for cashed up vendors and private equity firms. The fragmented security market has thousands of vendors and consultancies globally. Every day a swathe of new start-ups announces their ground-breaking new technology. Coupled with significant investments globally in tertiary education and industry certifications for a growing workforce, the next generation of cybersecurity entrepreneurs are entering with force.

Earlier this month, a consortium led by private equity firm Symphony Technology Group (STG) entered into an agreement with Dell Technologies to acquire RSA for an estimated amount of USD 2 billion. Dell Technologies had expressed interest in selling RSA in November 2019, and industry sources say that the deal will be finalised at more than their initial expectations.

Dell has been focusing on their partner program and on simplifying their product portfolio offerings. The Dell Technologies Partner Program announced last year, allows enterprises to seamlessly access partner products and solutions. Regardless of the partner, all solutions under the Dell portfolio count toward the tier status and tier revenue requirements for clients. Selling RSA allows them to streamline their product portfolio and by their own assertion, Dell has not lost focus on the significance of cybersecurity. They reinforced their commitment to build automated and intelligent security into infrastructure, platforms and devices. Claus Mortensen, Principal Analyst Ecosystm says, “Dell never really figured out what to do with RSA or how to position RSA’s products relative to Dell’s and VMWare’s own products. For example, Dell has its own endpoint protection product with SecureWorks and this has a great deal of overlap with RSA.”

RSA has been one of the pathbreakers in the cybersecurity market with their SecurID offering. They also host the largest security conference. RSA Conference gets together leading experts from across the industry to discuss the current trends and challenges, as well as shape the industry through innovations. Talking about the impact of the acquisition on RSA’s brand image, Mortensen says, “It depends on what STG intends to do with the company going forward. Arguably, RSA has been a bit in the shadows of previous owners – EMC and Dell – but if the new owners have a distinct plan for RSA, the brand will benefit”.

The members of the consortium acquiring RSA is interesting in its diversity. It includes the Ontario Teachers’ Pension Plan Board (Ontario Teachers’) and AlpInvest, another private equity firm. STG’s recent acquisitions include RedSeal, a security risk management provider. Mortensen predicts that the key player in this consortium will be STG, who will bring the know-how as well as money to the table. “Ontario Teachers’ and AlpInvest appear to primarily be financial backers. In fact, less involved these two partners are in the management of RSA, the easier it will be to secure a steady future focus for the company.”

As Ecosystm has observed previously, private equity firms will play a role in consolidating the cybersecurity market. “RSA is an almost textbook candidate for an equity firm or an investment bank takeover – a company with a good line of products but with a lack of strategic focus or leadership,” says Mortensen. “If STG can provide that focus – and from that USD 2 billion payment, one would assume that they can – they should have a good chance of increasing the value of RSA. If not, chances are that RSA’s products will be sold off piecemeal in the years to come.”

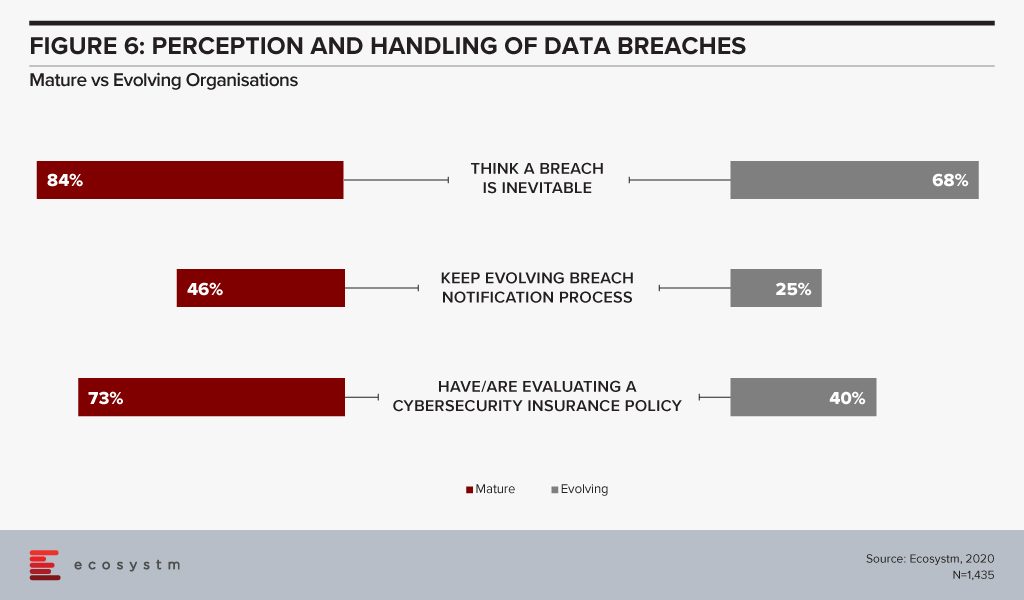

One of the questions that organisations are asked in the global Ecosystm Cybersecurity Study, is how they rate their cybersecurity measures and controls (on a scale of 1-10, where 10 is extremely mature). Organisations that rate themselves at an 8-10, are considered ‘mature’ in their cybersecurity measures while those that rate themselves at 1-7 are evolving their cybersecurity practices. Clear differences in priorities and investments can be seen between the mature and evolving adopters of cybersecurity measures.

Here are the key differences that emerge and should allow organisations to benchmark their cybersecurity practices against those of the mature adopters of cybersecurity solutions.

#1 Do you have the Right Motives?

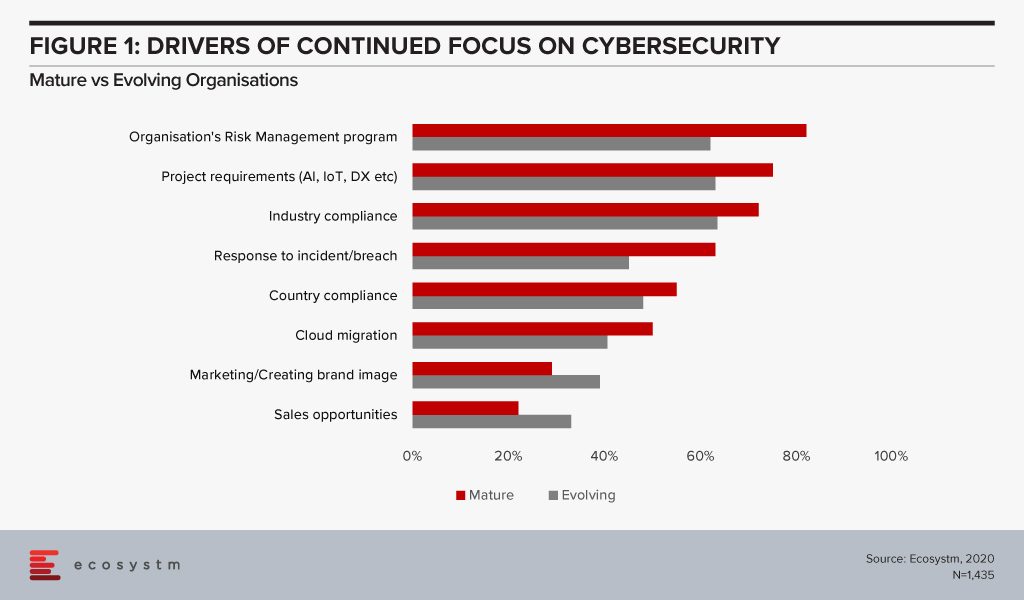

There is no denying that organisations have to continue to evolve their cybersecurity measures with the evolving threat landscape. There is a need to have a continued focus on cybersecurity. However, are they doing it to address the right issues and threats? Mature organisations have their cybersecurity measures entrenched within the organisation’s risk management programs which help them align their investments to their risk position (Figure 1). Very often these programs have their technology landscape – special projects for digital transformation (DX) – and industry compliance laws built into them. Mature organisations also have a proactive approach to incidents and breaches, continuing to evolve their cybersecurity practices.

While cybersecurity practices can help with an organisation’s go-to-market messaging, the reasons for investing in robust cybersecurity practices should be more aligned to the organisation’s risk strategies. Also, it should not be restricted to compliance alone and should be much more proactive than merely ticking the right boxes.

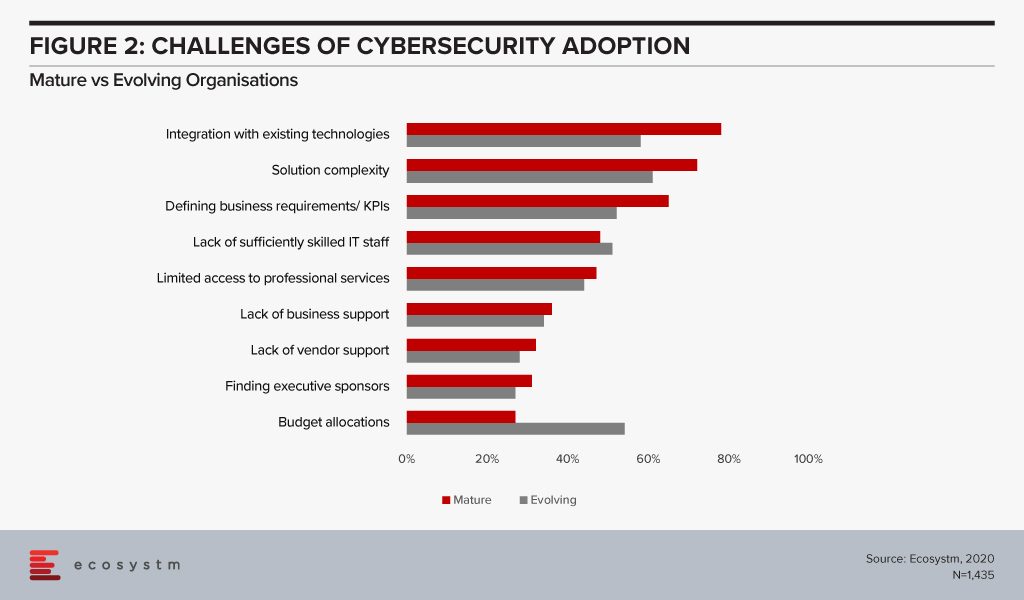

#2 Are you focusing on the Right Challenges?

As solution complexity increases, organisations are challenged by their cybersecurity deployments (Figure 2). Cybersecurity measures must be applied across the entire organisation and systems, including applications, database, and storage whether on-prem or on cloud (public, private or hybrid). This adds to the complexity of the solutions and the associated integration challenges.

While it is not possible to have an unlimited budget for cybersecurity measures, once it is treated like a business issue, and the risks associated (including financial and reputational) are conveyed to the key stakeholders cybersecurity budgets become part of the organisational strategy consideration. If your security team is still struggling to procure what they think is the right budget, there is a mismatch in expectations and miscommunication between the security team and executive management. “A risk focussed approach enables organisations to understand the ROI on security measures and therefore invest in the most impactful areas of cyber risk for their business”, says Alex Woerndle, Principal Advisor Ecosystm.

A real challenge that all organisations face is skills shortage. However, it is time to align business and security strategies and look beyond IT for security analysts – professionals who can translate what the Board’s priorities are into defining the security strategy.

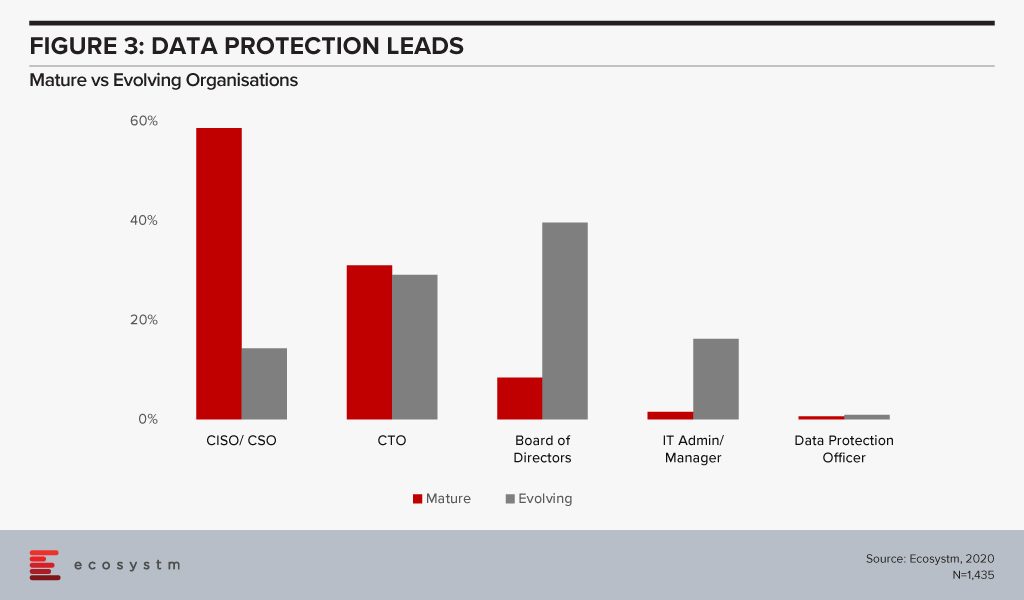

#3 Do you have a dedicated Cybersecurity Role?

While the Board will often be involved in evaluating the risk exposure of an organisation, there is need for a dedicated role that can traverse both the business and the technological needs in deciding the right cybersecurity framework.

Organisations should have a dedicated responsibility for their cybersecurity practice – the CISO/CSO is the key data protection lead in mature organisations (Figure 3). CISOs should be reporting into the CFO, Chief Risk Officer or the CEO and not the CIO to avoid a conflict of interest. Alex says, “While the most common reporting line for CISOs is still to the CIO, there is a fundamental conflict of interest with this model – being part of the risk function, or reporting directly to the CEO, provides the level of independence required for good governance of cyber risk.”

The reality is that many organisations – especially small and medium enterprises that have small dedicated security teams – will find it difficult to appoint a dedicated CSO/CISO. The study also finds that 80% of evolving organisations have less than 10 employees in their security teams as compared to only a third of mature organisations. Carl Woerndle, Principal Advisor Ecosystm, suggests these organisations look at the option of hiring a vCISO (virtual CISO). “A vCISO can help your organisation deliver a full security program within a fixed budget. Hiring someone external also has the added benefits of bringing objectivity to your security strategies and providing guidance on newer skills and technologies to your security teams.”

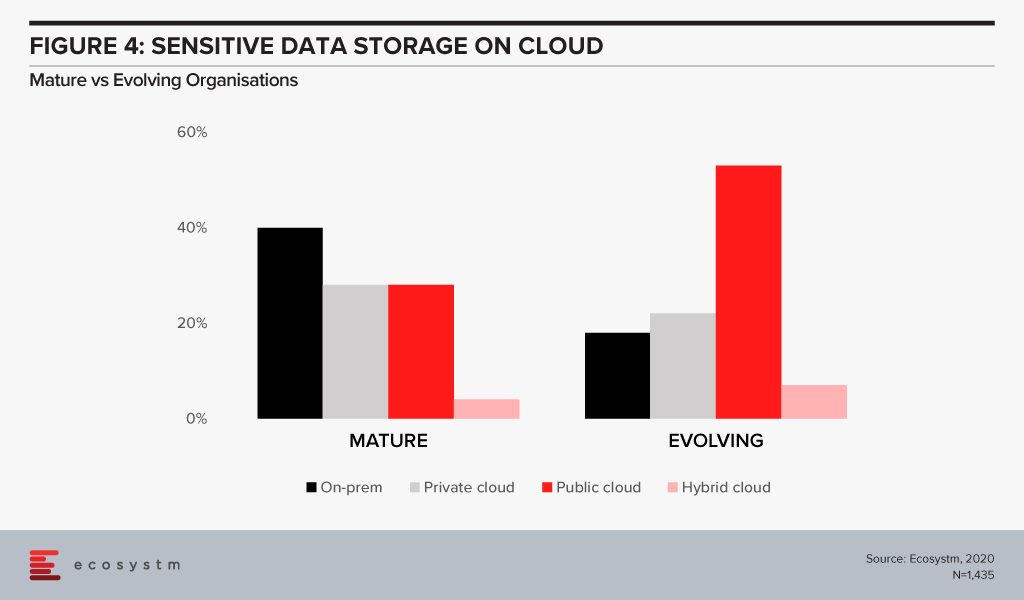

#4 Are you aware of Cloud Risk?

Cloud adoption has become mainstream, especially as organisations ramp up their digitalisation initiatives. It adds scale and agility to the organisation’s transformation investments. While security remains a key concern when it comes to cloud adoption, cloud is often regarded as a more secure option than on-premise. Cloud providers have dedicated security focus, constantly upgrade their security capabilities in response to newer threats and evolve their partner ecosystem. There is also better traceability with cloud as every virtual activity can be tracked, monitored, and is loggable.

However, mature organisations not only use on-prem options more for their sensitive data storage (Figure 4), they are also more skeptical about relying only on public cloud security features. Only 34% of mature organisations feel that public cloud security features do not need to be complemented while 52% of evolving organisations share that perception.

The cloud is as secure as an organisation makes it. The perception that there is no need to supplement public cloud security features can have disastrous outcomes. It is important to supplement the cloud provider’s security with event-driven security measures within an organisation’s applications and cloud interface. Alex says, “Assuming the big cloud providers have security covered for you is a huge mistake. Understanding the shared responsibility model is crucial in your public cloud adoption journey. The tools are available – but typically at an extra cost, and you need to employ, configure and continually manage them for effective security.”

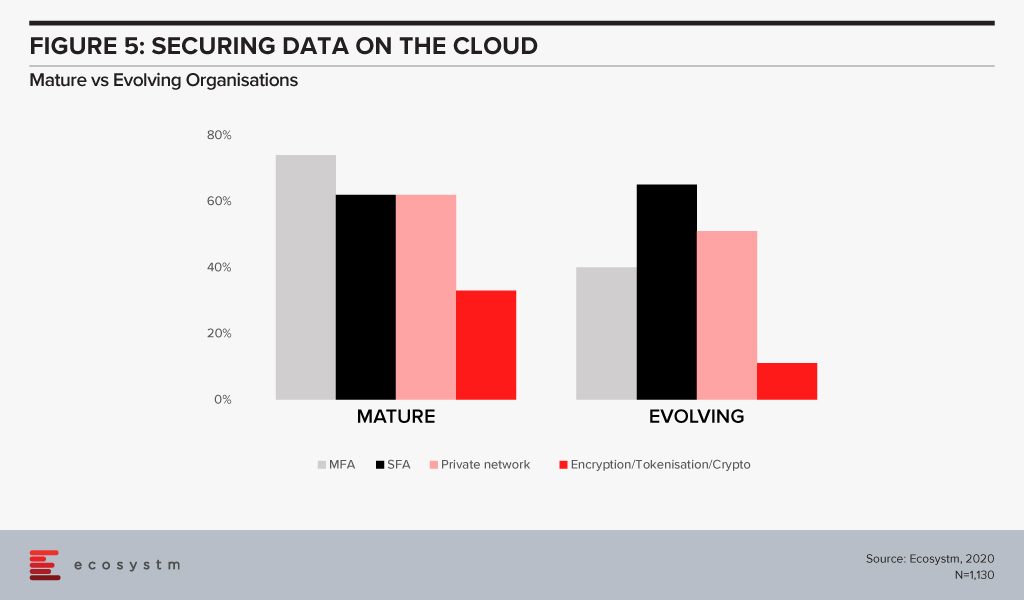

The big differentiator between mature and evolving organisations in securing cloud environments is in the use of multi-factor authentication (Figure 5). With 3/4th of mature organisations employing this as a control, it highlights that passwords – even strong passwords – alone, are not sufficient in 2020. Mature organisations are increasingly investing in encryption. But the perception of the complexity in deploying and managing encryption (and the keys) has been a challenge especially for organisations with smaller teams and less in-house technical capabilities.

#5 Are you Breach Ready?

Global organisations generally consider a data breach as inevitable – largely believing that “it is not about if, but when”(Figure 6). All organisations will face some incident, attempted breach or a breach, at some point. It is necessary to have the right cybersecurity measures to avoid breaches – but it is equally important to be prepared for when a breach actually happens. A majority of organisations, regardless of maturity, are worried about (and expect) a breach. For evolving organisations this is a troubling statistic given their use of public cloud with limited security understanding or controls – better education is needed from the public cloud providers but also the security industry.

Breach notification processes need to keep evolving – and they must also include employees. Organisations should be aware of the need for people management during an incident. Policies might be clear and adhered to, but it is substantially harder to train the stakeholders involved, on how they will handle the breach emotionally. It extends to how an organisation manages their welfare both during an incident, and long after the incident response has been closed off.

“Cyber insurance has rapidly become a must-have as part of an organisation’s layered defence. While it provides a layer of support in the event of a breach, you should not rely on it as your only safety net,” Carl adds. “It is also important to ensure that your cyber cover is appropriate to your risks and organisational needs and policies should be evaluated carefully.”

The Malaysia Digital Economy Corporation (MDEC) has estimated that the country’s Digital Economy is worth USD3 trillion. Several initiatives have been introduced to promote the vision of a Digital Economy including: creating the Malaysia Tech Entrepreneur Programme (MTEP) aimed at tech founders who want to make Malaysia their base; the Malaysia Innovation Policy Council for industry collaboration on digital technology initiatives and streamlining policy/regulatory issues to support innovation; and the National eCommerce Roadmap aimed at small and medium enterprises (SMEs) to promote cross-border eCommerce.

Data Protection Laws for a Digital Economy

However, any country that aspires to be a Digital Economy, must have robust data protection laws that safeguards its citizens’ data. Malaysia’s Personal Data Protection Act 2010 (PDPA), was passed by the Malaysian Parliament in 2010 and came into force in late 2013. While the PDPA does provide guidelines for personal data protection to some extent, in light of technological advances, newer laws such as GDPR that are shaping the industry, and to keep up with the aspirations of creating a Digital Economy, there is a need for more comprehensive privacy laws.

“Growing the Digital Economy is a key agenda for Malaysia and a revised PDPA is a key component in ensuring trust and transparency,” says Shamir Amanullah, Principal Advisor Ecosystm. “The increasing and complex use of data and the proliferation of devices pose serious challenges which the data protection laws have to address. The recent US Federal Trade Commission’s hefty fines on Facebook and Equifax highlight the need to protect data of consumers and businesses alike.”

The PDPA is clearly a work in progress where while fast-growing areas such as electronic marketing and online privacy are mentioned in the act, there are no specific provisions to deal with breaches in these areas.

Updating the PDPA

In the last few years, Malaysia has realised that the PDPA fails to cover some areas. As an example, it does not take into consideration the proliferation of biometric data. The national ID card (MyKad) stores data using biometrics (thumbprints) and there is a clear rise in use of facial recognition technology in the country. Grab partnered with the Ministry of Transport last year, to use facial recognition technology to protect their drivers.

Malaysia is committed to their Digital Economy vision and is looking to update the PDPA, to make it more appropriate for contemporary needs and technology. The Government is consulting its citizens on possible ways to improve the PDPA. Between 14-28 February, the public can provide feedback on their thoughts and requirements on data privacy, through the Ministry of Communications and Multimedia’s web portal.

Some of the areas that have been found lacking and where feedback is being sought are expanding applications of the PDPA to data processors, making it compulsory to notify data breaches and simplifying cross-border personal data transfer.

Speaking about the areas that are likely to be addressed, Amanullah notes, “The review of the PDPA and the ongoing public consultation will deliberate extending the PDPA to non-commercial transactions. The existing PDPA does not cover non-commercial transactions involving charities, religious activities and even social media. The EU, Japan and – closer home – the Philippines have data protection acts which regulate both commercial and non-commercial transactions.”

Malaysia’s Communications & Multimedia Minister, Gobind Singh Deo, has from the start spoken about the need to update and bring the PDPA up to speed. “The goal of the Digital Economy is to take Malaysian enterprises beyond the country to Southeast Asian and global markets,” says Amanullah. “The EU GDPR is recognised as a leading global framework for data protection and is set to play a big role in the revised PDPA, to ensure that Malaysian companies adhere to the same data protection standards as global organisations.”

“The appointment of Data Protection Officers will be a major move to ensure that companies that hold sensitive private data have the necessary skills, processes and technology in place to comply with data protection laws.”