Healthcare has transformed rapidly in the last few years – processes have become more agile; clinicians, administrative staff, and patients have changed their views on how healthcare can and should be delivered; and there is a greater reliance on technology today.

Despite challenges such as healthcare inequality and limited access to care for underserved populations, the future of Healthcare looks promising.

We will see continued advancements in technology, increased collaboration between healthcare providers and patients, and a clear shift in focus on preventative care.

Read on to find out how South Australia Health, Tan Tock Seng Hospital in Singapore, Montana State University and Billings Clinic, Microsoft, Epic, Zuellig Pharma, and iHIS Singapore are innovating to improve patient and employee experiences and clinical outcomes.

Download “The Future of Healthcare” as a PDF

Southeast Asia has evolved into an innovation hub with Singapore at the centre. The entrepreneurial and startup ecosystem has grown significantly across the region – for example, Indonesia now has the 5th largest number of startups in the world.

Organisations in the region are demonstrating a strong desire for tech-led innovation, innovation in experience delivery, and in evolving their business models to bring innovative products and services to market.

Here are 5 insights on the patterns of technology adoption in Southeast Asia, based on the findings of the Ecosystm Digital Enterprise Study, 2022.

- Data and AI investments are closely linked to business outcomes. There is a clear alignment between technology and business.

- Technology teams want better control of their infrastructure. Technology modernisation also focuses on data centre consolidation and cloud strategy

- Organisations are opting for a hybrid multicloud approach. They are not necessarily doing away with a ‘cloud first’ approach – but they have become more agnostic to where data is hosted.

- Cybersecurity underpins tech investments. Many organisations in the region do not have the maturity to handle the evolving threat landscape – and they are aware of it.

- Sustainability is an emerging focus area. While more effort needs to go in to formalise these initiatives, organisations are responding to market drivers.

More insights into the Southeast Asia tech market below.

Click here to download The Future of the Digital Enterprise – Southeast Asia as a PDF

The 2021 United Nations Climate Change Conference (COP26, that was held in Glasgow in 2021, highlighted the need to mobilise public and private sector finance to support global net-zero emissions targets and to protect communities and habitats.

Sustainable Finance and Green Bonds present opportunities for lenders, investors, and borrowers. It allows borrowers to obtain funding at decreased and competitive costs. And as investor demands continue to rise, Government institutions have expressed keen interest in issuing green bonds to support ecologically beneficial initiatives.

Here are some recent global announcements.

- France announces the issuance of USD 4 billion green bond sale.

- Germany raises USD 4 billion in green bonds to finance green expenditures and investments.

- Singapore sets a roadmap for its first sovereign green bond with the Singapore Green Bond Framework.

- Austria launches its first green bond.

- The UK launches an inquiry into the role of the financial sector in the country’s net zero transition.

Download Building a Climate Resilient Future with Sustainable Finance as a PDF

Innovation is at the core of Singapore’s ethos. The country has perfected the art of ‘structured innovation’ where pilots and proof of concepts are introduced and the successful ones scaled up by recalibrating technology, delivery systems, legislation, and business models. The country has adopted a similar approach to achieving its sustainability goals.

The Singapore Green Plan 2030 outlines the strategies to become a sustainable nation. It is driven by five ministries: Education, National Development, Sustainability and the Environment, Trade and Industry, and Transport, and includes five key pillars: City in Nature, Sustainable Living, Energy Reset, Green Economy, and Resilient Future. We will see a slew of new programs and initiatives in green finance, sustainability, solar energy, electric vehicles (EVs), and innovation, in the next couple of years.

Singapore’s Intentions of Becoming a Green Finance Leader

Singapore is serious about becoming a world leader in green finance. The Green Bonds Programme Office was set up last year, to work with statutory boards to develop a framework along with industry and investor stakeholders. We have seen a number of sustainable finance initiatives last year, such as the National Environment Agency (NEA) collaborating with DBS to raise USD 1.23 billion from its first green bond issuance. The proceeds will fund new and ongoing sustainable waste management initiatives. Temasek collaborated with HSBC for a USD 110 million debt financing platform for sustainable projects and Sembcorp issued sustainability bonds worth USD 490 million.

Building an Ecosystm of Sustainable Organisations

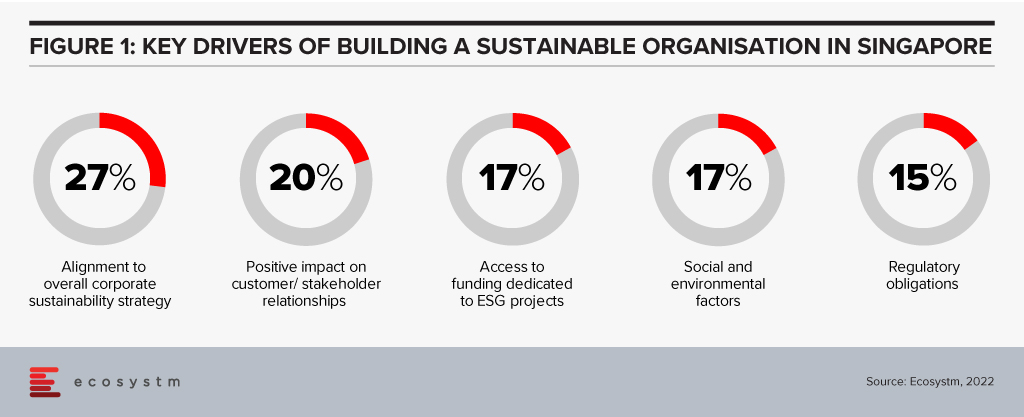

Sustainability has to be a collective goal that will require governments to work with enterprises, investors and consumers. To ensure that enterprises are focusing on Sustainability, governments have to keep in mind what drives these initiatives and the challenges organisations face in achieving their goals.

There are several reasons driving organisations in Singapore to adopt sustainability goals and ESG responsibilities (Figure 1)

It is equally important to address organisations’ challenges in building sustainability in their business processes. Last week, the Institute of Banking and Finance (IBF) and the Monetary Authority of Singapore (MAS) set out 12 Sustainable Finance Technical Skills and Competencies (SF TSCs) required by people in various roles in sustainable finance. This addresses the growing demand for sustainable finance talent in Singapore; and covers knowledge areas such as climate change policy developments, natural capital, green taxonomies, carbon markets and decarbonisation strategies. There are Financial Services related competencies as well, such as sustainability risk management, sustainability reporting, sustainable investment management, and sustainable insurance and reinsurance solutions. The SF TSCs are part of the IBF Skills Framework for Financial Services.

Sustainable Resources Initiatives

Singapore is not only focused on Sustainable Finance. If we look at NEA’s Green Bonds, there are specific criteria that projects must satisfy in order to qualify, including a focus on sustainable waste management.

Last week the Government announced that the National Research Fund (NRF) will allocate around USD 160 million to drive new initiatives in water, reuse and recycling technologies, as part of the Research, Innovation and Enterprise 2025 plan (RIE2025). Part of the fund will be allocated to the Closing the Resource Loop (CTRL) initiative, administered by the NEA that will fund sustainable resource recovery solutions.

Singapore faces severe resource constraints, and water security is not a new challenge for the country. The NRF funding will also be used partially for R&D in 3 water technology focus areas: desalination and water reuse; used water treatment; and waste reduction and resource recovery.

The Government is Leading the Way

The Government’s concerted efforts to make the Singapore Green Plan 2030 a success is seeing corporate participation in the vision. In February, Shell started supplying sustainable aviation fuel (SAF) to customers such as SIA Engineering Company and the Singapore Air Force in Singapore. Shell has also upgraded their Singapore facility to blend SAF at multiple, key locations. Last week, Atlas announced their commitment to Web 3.0 technologies and “tech for good”. They aim to increase their green energy use to 75% by 2022; 90% by 2023; and 100% by 2024. ESG consciousness is percolating down from the Government.

The success of Singapore’s Sustainability strategies will depend on innovation, the Government’s ongoing commitment, and the support provided to enterprises, investors, and consumers. The Singapore Government is poised to lead from the front in building a Sustainable Ecosystem.

Earlier this month, I had the privilege of attending Oracle’s Executive Leadership Forum, to mark the launch of the Oracle Cloud Singapore Region. Oracle now has 34 cloud regions worldwide across 17 countries and intends to expand their footprint further to 44 regions by the end of 2022. They are clearly aiming for rapid expansion across the globe, leveraging their customers’ need to migrate to the cloud. The new Singapore region aims to support the growing demand for enterprise cloud services in Southeast Asia, as organisations continue to focus on business and digital transformation for recovery and future success.

Here are my key takeaways from the session:

#1 Enabling the Digital Futures

The theme for the session revolved around Digital Futures. Ecosystm research shows that 77% of enterprises in Southeast Asia are looking at technology to pivot, shift, change and adapt for the Digital Futures. Organisations are re-evaluating and accelerating the use of digital technology for back-end and customer workloads, as well as product development and innovation. Real-time data access lies at the backbone of these technologies. This means that Digital & IT Teams must build the right and scalable infrastructure to empower a digital, data-driven organisation. However, being truly data-driven requires seamless data access, irrespective of where they are generated or stored, to unlock the full value of the data and deliver the insights needed. Oracle Cloud is focused on empowering this data-led economy through data sovereignty, lower latency, and resiliency.

The Oracle Cloud Singapore Region brings to Southeast Asia an integrated suite of applications and the Oracle Cloud Infrastructure (OCI) platform that aims to help run native applications, migrate, and modernise them onto cloud. There has been a growing interest in hybrid cloud in the region, especially in large enterprises. Oracle’s offering will give companies the flexibility to run their workloads on their cloud and/or on premises. With the disruption that the pandemic has caused, it is likely that Oracle customers will increasingly use the local region for backup and recovery of their on-premises workloads.

#2 Partnering for Success

Oracle has a strong partner ecosystem of collaboration platforms, consulting and advisory firms and co-location providers, that will help them consolidate their global position. To begin with they rely on third-party co-location providers such as Equinix and Digital Realty for many of their data centres. While Oracle will clearly benefit from these partnerships, the benefit that they can bring to their partners is their ability to build a data fabric – the architecture and services. Organisations are looking to build a digital core and layer data and AI solutions on top of the core; Oracle’s ability to handle complex data structures will be important to their tech partners and their route to market.

#3 Customers Benefiting from Oracle’s Core Strengths

The session included some customer engagement stories, that highlight Oracle’s unique strengths in the enterprise market. One of Oracle’s key clients in the region, Beyonics – a precision manufacturing company for the Healthcare, Automotive and Technology sectors – spoke about how Oracle supported them in their migration and expansion of ERP platform from 7 to 22 modules onto the cloud. Hakan Yaren, CIO, APL Logistics says, “We have been hosting our data lake initiative on OCI and the data lake has helped us consolidate all these complex data points into one source of truth where we can further analyse it”.

In both cases what was highlighted was that Oracle provided the platform with the right capacity and capabilities for their business growth. This demonstrates the strength of Oracle’s enterprise capabilities. They are perhaps the only tech vendor that can support enterprises equally for their database, workloads, and hardware requirements. As organisations look to transform and innovate, they will benefit from the strength of these enterprise-wide capabilities that can address multiple pain points of their digital journeys.

#4 Getting Front and Centre of the Start-up Ecosystem

One of the most exciting announcements for me was Oracle’s focus on the start-up ecosystem. They make a start with a commitment to offer 100 start-ups in Singapore USD 30,000 each, in Oracle Cloud credits over the next two years. This is good news for the country’s strong start-up community. It will be good to see Oracle build further on this support so that start-ups can also benefit from Oracles’ enterprise offerings. This will be a win-win for Oracle. The companies they support could be “soonicorns” – the unicorns of tomorrow; and Oracle will get the opportunity to grow their accounts as these companies grow. Given the momentum of the data economy, these start-ups can benefit tremendously from the core differentiators that OCI can bring to their data fabric design. While this is a good start, Oracle should continue to engage with the start-up community – not just in Singapore but across Southeast Asia.

#5 Commitment to Sustainability at the Core of the Digital Futures

Another area where Oracle is aligning themselves to the future is in their commitment to sustainability. Earlier this year they pledged to power their global operations with 100% renewable energy by 2025, with goals set for clean cloud, hardware recycling, waste reduction and responsible sourcing. As Jacqueline Poh, Managing Director, EDB Singapore pointed out, sustainability can no longer be an afterthought and must form part of the core growth strategy. Oracle has aligned themselves to the SG Green Plan that aims to achieve sustainability targets under the UN’s 2030 Sustainable Development Agenda.

Cloud infrastructure is going to be pivotal in shaping the future of the Digital Economy; but the ability to keep sustainability at its core will become a key differentiator. To quote Sir David Attenborough from his speech at COP26, “In my lifetime, I’ve witnessed a terrible decline. In yours, you could and should witness a wonderful recovery”

Conclusion

Oracle operates in a hyper competitive world – AWS, Microsoft and Google have emerged as the major hyperscalers over the last few years. With their global expansion plans and targeted offerings to help enterprises achieve their transformation goals, Oracle is positioned well to claim a larger share of the cloud market. Their strength lies in the enterprise market, and their cloud offerings should see them firmly entrenched in that segment. I hope however, that they will keep an equal focus on their commitment to the start-up ecosystem. Most of today’s hyperscalers have been successful in building scale by deeply entrenching themselves in the core innovation ecosystem – building on the ‘possibilities’ of the future rather than just on the ‘financial returns’ today.