GenAI has taken the world by storm, with organisations big and small eager to pilot use cases for automation and productivity boosts. Tech giants like Google, AWS, and Microsoft are offering cloud-based GenAI tools, but the demand is straining current infrastructure capabilities needed for training and deploying large language models (LLMs) like ChatGPT and Bard.

Understanding the Demand for Chips

The microchip manufacturing process is intricate, involving hundreds of steps and spanning up to four months from design to mass production. The significant expense and lengthy manufacturing process for semiconductor plants have led to global demand surpassing supply. This imbalance affects technology companies, automakers, and other chip users, causing production slowdowns.

Supply chain disruptions, raw material shortages (such as rare earth metals), and geopolitical situations have also had a fair role to play in chip shortages. For example, restrictions by the US on China’s largest chip manufacturer, SMIC, made it harder for them to sell to several organisations with American ties. This triggered a ripple effect, prompting tech vendors to start hoarding hardware, and worsening supply challenges.

As AI advances and organisations start exploring GenAI, specialised AI chips are becoming the need of the hour to meet their immense computing demands. AI chips can include graphics processing units (GPUs), application-specific integrated circuits (ASICs), and field-programmable gate arrays (FPGAs). These specialised AI accelerators can be tens or even thousands of times faster and more efficient than CPUs when it comes to AI workloads.

The surge in GenAI adoption across industries has heightened the demand for improved chip packaging, as advanced AI algorithms require more powerful and specialised hardware. Effective packaging solutions must manage heat and power consumption for optimal performance. TSMC, one of the world’s largest chipmakers, announced a shortage in advanced chip packaging capacity at the end of 2023, that is expected to persist through 2024.

The scarcity of essential hardware, limited manufacturing capacity, and AI packaging shortages have impacted tech providers. Microsoft acknowledged the AI chip crunch as a potential risk factor in their 2023 annual report, emphasising the need to expand data centre locations and server capacity to meet customer demands, particularly for AI services. The chip squeeze has highlighted the dependency of tech giants on semiconductor suppliers. To address this, companies like Amazon and Apple are investing heavily in internal chip design and production, to reduce dependence on large players such as Nvidia – the current leader in AI chip sales.

How are Chipmakers Responding?

NVIDIA, one of the largest manufacturers of GPUs, has been forced to pivot its strategy in response to this shortage. The company has shifted focus towards developing chips specifically designed to handle complex AI workloads, such as the A100 and V100 GPUs. These AI accelerators feature specialised hardware like tensor cores optimised for AI computations, high memory bandwidth, and native support for AI software frameworks.

While this move positions NVIDIA at the forefront of the AI hardware race, experts say that it comes at a significant cost. By reallocating resources towards AI-specific GPUs, the company’s ability to meet the demand for consumer-grade GPUs has been severely impacted. This strategic shift has worsened the ongoing GPU shortage, further straining the market dynamics surrounding GPU availability and demand.

Others like Intel, a stalwart in traditional CPUs, are expanding into AI, edge computing, and autonomous systems. A significant competitor to Intel in high-performance computing, AMD acquired Xilinx to offer integrated solutions combining high-performance central processing units (CPUs) and programmable logic devices.

Global Resolve Key to Address Shortages

Governments worldwide are boosting chip capacity to tackle the semiconductor crisis and fortify supply chains. Initiatives like the CHIPS for America Act and the European Chips Act aim to bolster domestic semiconductor production through investments and incentives. Leading manufacturers like TSMC and Samsung are also expanding production capacities, reflecting a global consensus on self-reliance and supply chain diversification. Asian governments are similarly investing in semiconductor manufacturing to address shortages and enhance their global market presence.

Japan is providing generous government subsidies and incentives to attract major foreign chipmakers such as TSMC, Samsung, and Micron to invest and build advanced semiconductor plants in the country. Subsidies have helped to bring greenfield investments in Japan’s chip sector in recent years. TSMC alone is investing over USD 20 billion to build two cutting-edge plants in Kumamoto by 2027. The government has earmarked around USD 13 billion just in this fiscal year to support the semiconductor industry.

Moreover, Japan’s collaboration with the US and the establishment of Rapidus, a memory chip firm, backed by major corporations, further show its ambitions to revitalise its semiconductor industry. Japan is also looking into advancements in semiconductor materials like silicon carbide (SiC) and gallium nitride (GaN) – crucial for powering electric vehicles, renewable energy systems, and 5G technology.

South Korea. While Taiwan holds the lead in semiconductor manufacturing volume, South Korea dominates the memory chip sector, largely due to Samsung. The country is also spending USD 470 billion over the next 23 years to build the world’s largest semiconductor “mega cluster” covering 21,000 hectares in Gyeonggi Province near Seoul. The ambitious project, a partnership with Samsung and SK Hynix, will centralise and boost self-sufficiency in chip materials and components to 50% by 2030. The mega cluster is South Korea’s bold plan to cement its position as a global semiconductor leader and reduce dependence on the US amidst growing geopolitical tensions.

Vietnam. Vietnam is actively positioning itself to become a major player in the global semiconductor supply chain amid the push to diversify away from China. The Southeast Asian nation is offering tax incentives, investing in training tens of thousands of semiconductor engineers, and encouraging major chip firms like Samsung, Nvidia, and Amkor to set up production facilities and design centres. However, Vietnam faces challenges such as a limited pool of skilled labour, outdated energy infrastructure leading to power shortages in key manufacturing hubs, and competition from other regional players like Taiwan and Singapore that are also vying for semiconductor investments.

The Potential of SLMs in Addressing Infrastructure Challenges

Small language models (SLMs) offer reduced computational requirements compared to larger models, potentially alleviating strain on semiconductor supply chains by deploying on smaller, specialised hardware.

Innovative SLMs like Google’s Gemini Nano and Mistral AI’s Mixtral 8x7B enhance efficiency, running on modest hardware, unlike their larger counterparts. Gemini Nano is integrated into Bard and available on Pixel 8 smartphones, while Mixtral 8x7B supports multiple languages and suits tasks like classification and customer support.

The shift towards smaller AI models can be pivotal to the AI landscape, democratising AI and ensuring accessibility and sustainability. While they may not be able to handle complex tasks as well as LLMs yet, the ability of SLMs to balance model size, compute power, and ethical considerations will shape the future of AI development.

If you have been following my insights and blogs at Ecosystm, it won’t come as a surprise that I am a fan of foldable devices. I have owned the Z Fold3 for over a year now. In that year, I found myself reaching for my tablet less often as the larger screen on the Z Fold3 was enough for most of my needs. Most apps were resized appropriately and provided an improved user experience, and the upgraded OS with a MacOS style application bar made it even easier to switch between applications.

The larger screen of the foldable form factor boosted my productivity too – I could use multiple applications and respond to an email with the content’s source (PDF, Excel file, website, etc.) also open – meaning far less flicking between apps, which isn’t as easy on a smartphone compared to a laptop or a desktop computer. The computer style view for messages and emails (with the email list on the left and the actual email on the right) was brilliant. And I enjoyed using the external screen as a preview screen for taking selfies (I already have my work cut out in making selfies look good! So, being able to see the picture in advance helps a lot).

However, Fold3 had its imperfections. The slightly narrow front screen made typing difficult when the device was folded – I primarily used it to check the status of things (such as turning my coffee machine on/off, checking my solar production, etc.). The inside screen also had durability issues. After a year, Samsung installed screen protector was coming off, and then, the right inner screen gave up completely on me. That said, Samsung has been excellent at fixing these issues under warranty.

Samsung Galaxy Z Fold4 – Enhanced Features

With the launch of the new Z Fold4, I was keen to get my hands on a trial device, and the good people at Samsung and their PR agency arranged that for me. I have now spent two weeks with this device. Despite it being similar in size to the Z Fold3, the upgrades do make a real difference:

- The few extra mm of width on the front screen makes it much more usable – I can now use this screen for typing messages and entering data. I still prefer the larger screen for things such as consuming content and typing longer emails. But the outside screen is usable for more than just checking the status of systems or apps.

- The shorter height and the wider screen mean that the inside screen now feels more “expansive” – more of a tablet experience – and is getting closer to an iPad mini. This makes consuming and creating content easier and more enjoyable. As an avid tablet user, even with the Z Fold3, I would hesitate when going out, wondering if I needed to take my iPad with me. I noticed that I did not hesitate with the Z Fold4 – I was fine without my tablet.

- Typically, newer phones feature improved cameras. This is certainly the case with the Z Fold4 – the camera feels faster than the Fold3, taking lesser time to focus and take pictures. And the images too are sharper and richer.

- The screen warranty has also improved – perhaps in acknowledgement of the issues with the Z Fold3 screen. There are specials offering screen replacements for a low cost, even if you damage the screen, as well as discounts on Samsung Care+, which offers two replacement devices in 24 months.

The only comment I have is that it is the most slippery phone I have used so far! It didn’t come with a protective case and in two weeks, I have dropped this phone more times than I have dropped any other phone in the past few years! It has slipped off seats and desks as well as out of my pocket and hands. Although, it does claim to “stand up to life’s bumps and fumbles” and this has been accurate so far (as it does not even have a scratch on it yet – which is a surprise as it has hit wood, tiles, and concrete pretty hard!). But if I were keeping the device for any longer, I would immediately purchase a case!

Who Will Use It Most?

Whether this device is right for you depends on your device use patterns. I do believe there is a case for businesses to invest in foldables – particularly for employees who share content one on one with clients or prospects, or those who want to be more productive and be away from their desks without lugging a laptop. Anyone who is considering a flagship phone with a larger screen (iPhone Pro Max or Pixel 7 Pro) should take a look at the Samsung Galaxy Z Fold4. You will be pleasantly surprised with the quality and capability of this device. I know I will be sad to see it go when I hand it back to Samsung!

The semiconductor industry is 70-years old and has a prominent – and sometimes inconspicuous – presence in our daily lives. Many of us, however, have become more aware of the industry and the ramifications of its disruption, because of recent events. The pandemic, natural disasters, power outages, geo-political conflicts, and accelerated digital transformation have all combined to disrupt the semiconductor sector, leaving no organisation immune to the impacts of the continuing global chip crisis.

It is estimated that 200 downstream industries have failed to fulfill customer demands owing to the silicon scarcity, ranging from automotive, consumer electronics, utilities and even the supply of light fixtures.

This Ecosystm Bytes discusses the impact of the crisis and highlights major initiatives that chip manufacturers and governments are taking to combat it, including:

- The factors leading to the shortage in the semiconductor industry

- The impact on industry sectors such as Automotive, Consumer Electronics and MedTech

- How leading chip makers such as TSMC, Intel and Samsung are increasing their manufacturing capabilities

- The importance of Asia to the semiconductor industry

- How countries such as Malaysia and India are aiming to build self-sufficiency in the industry

Read on to find out more.

Over the past 3-4 weeks I have spent some time using Samsung DeX (shortened from “Desktop eXperience”) as my primary desktop environment. DeX has been around for a number of years, and I have dabbled with it from time-to-time – but I have never really taken it seriously. My (incorrect!) opinion was that a mobile chipset isn’t powerful enough for a PC-like experience. But for most of the last year, I have been using a Samsung Galaxy Book S laptop as my primary computing device – and this Windows 10 laptop runs an ARM processor which is the very same processor that powers many Samsung and other Android phones. Microsoft also has an ARM-based PC that I have used successfully (the Surface Pro X) which prompted me to rethink the opportunities for DeX. A number of clients also asked for my thoughts on DeX so I figured it is time to take it seriously as a potential end-user computing environment.

This Ecosystm Insight is a summary of the client report and is the first of a few Insights into DeX. In future, I plan to trial the dual-monitor ability for DeX (developed by VoIP – an Australian ICT consultancy). These Ecosystm Insights won’t cover how to use Samsung DeX. If you are looking for this information, Gizmodo has published a good piece here.

The Trial

In trialling Samsung DeX I attempted to cover all usage scenarios, including:

- Native DeX with the phone connected to a DeX station and both wired and wireless keyboard/mouse, using both wi-fi and 4G (I live literally 50 metres outside of 5G coverage!)

- DeX through Windows 10 using both wi-fi and 4G and a wired mouse and keyboard

- Native DeX connected to a monitor using the Microsoft wireless display adapter (again using both wi-fi and 4G)

In the native DeX environment I worked in the traditional Microsoft productivity apps, collaboration apps (such as Teams, Zoom, Webex, Google Meet), Google productivity apps, web applications (sales, CRM & ERP), file sharing applications (OneDrive, Google Drive), imaging applications (photos, video, image sharing), social applications (Twitter, LinkedIn, Facebook, Instagram etc) and other native Android apps – some of which were optimised for DeX, and some of which were not. I tried to imitate the information worker’s experience; and that of a site or specialist user. I used it as a primary computing environment for most of my work for 3-4 weeks. I didn’t just consume content, but also created content – I needed to be able to sign and attach Adobe documents, create new reports, conduct deep data analysis in Excel and create figures and move them between Excel, Word and PowerPoint. I created and shared leads in CRM systems, did company accounting in a financial application and even had some time to try out some gaming applications.

I have also trialled a Citrix and Amazon virtual desktop in all environments – running productivity applications, finance applications, graphics intensive applications and web apps.

Findings

My broad finding is that DeX is not a desktop replacement for power users – but there are plenty of roles within your business who would find that DeX is a capable environment that will allow them to get their job done.

I was planning to discuss the positive features of DeX, but the reality is that it is simpler to understand its limitations. And, most limitations are related to the Android applications or network lag introduced in virtual desktop environments using 4G.

- The Microsoft productivity applications in Android are all scaled back versions of the desktop applications. They do not contain many of the features and functions that the desktop versions have. For example, when I needed to format headings in a report, the fast format options (e.g. to make text a “heading 2”) don’t exist in the Android version of Microsoft Word. Power users will find these applications don’t deliver all of the functions they need to get their job done.

- Those who need broader functionality beyond the Android applications will benefit from a virtual desktop environment. Both Citrix Workspace and Amazon Workspaces delivered a very usable Windows 10 experience (although I found the base configuration to be a little slow). For existing users of virtual desktops, it is a no-brainer to roll them out to mobile devices if required. But would you add a virtual desktop environment to your existing desktop fleet just to enable DeX? I can’t answer that – as it is another environment to manage and support for your end-user computing and IT support teams. But again, for power users, this is not an ideal environment. It does EVERYTHING you want it to do – but it might not do it fast enough to satisfy all users.

- It’s not a mobile environment. This isn’t something you use on your phone (although I believe you can use it on some Samsung tablets). You need a monitor, keyboard, and ideally a separate mouse for DeX to work. It doesn’t replace a laptop for a mobile worker.

- DeX does not natively support dual screens or monitors. I found that I would switch back to my PC when I needed the productivity of two screens, as I personally find application switching on a single screen to be a productivity killer. BUT – this is changing – VoIP has developed a capability to run DeX across dual monitors (I will be testing this shortly and will post the results).

- When using DeX natively and not using a virtual desktop, the screen sharing features of collaboration apps don’t work in the way you expect. The screen that is shared is NOT the DeX desktop screen but the horizontal mobile phone screen. This is a significant issue if you want to share a Word, PowerPoint, or Excel file or another “full desktop screen” application. DeX users can view other people’s shared screens, but not share the screen effectively themselves.

- DeX introduces a new environment for your helpdesk to support. DeX isn’t Windows, it isn’t cloud, and it isn’t exactly native Android. Your tech support team will need to be trained on DeX and be required to learn a new user environment. It introduces an additional OS into the mix. That means at least some service desk technicians will need to be trained on the environment. As it is still running in Android, it doesn’t particularly require specific QA or testing for your business mobile applications. But to take full advantage of the larger screen real estate that DeX facilitates, you may need to make some changes to how applications perform in DeX.

Despite these challenges, DeX is a very capable environment. Running a virtual desktop was a breeze and performed far better than I would have imagined. I was worried about lag and had introduced many opportunities for it to run slowly – a wireless mouse and keyboard, wireless display adapter, running over wi-fi, and 4G using a virtual desktop in the cloud – and the lag was barely noticeable. I was impressed with this and understand how DeX could even be used to support legacy applications and environments too.

The convenience of having your phone at your fingertips – being able to respond to text messages on the large screen, taking calls using the same Bluetooth headphones that you use to watch video content on the larger screen, not to mention the security of taking your “PC” with you in your pocket when you head out to lunch or home for the day – adds to the value of DeX. The concept of a “PC in your pocket” has been around for a while – however most Samsung mobile users don’t realise that they have one there already!

Target Roles

Who are the business roles or personas who could benefit from it? The simple answer is that anyone who uses a desktop part-time would benefit from DeX. Many businesses have shared PCs for multiple users or dedicated PCs for users who don’t use a PC full-time. These might be site managers in constriction, store managers in retail, nurses, security staff, librarians, government or council workers. The significant factors that define potential DeX users are:

- They spend a fair amount of time away from a PC

- They still need a PC for reporting, document sharing, content creation etc

- They return to a fixed site regularly (like a store, office, site office etc)

Again, it is worth noting that DeX doesn’t replace a laptop or tablet. It is not for mobile computing – it replicates fixed computing environments in a more mobile and potentially cost-effective form factor. Remember that the employees need a screen, mouse, and keyboard (you can use the phone as a mouse, but it is not ideal). They also need the charging cable to connect to the computer. If they are making regular video calls then I suggest a phone holder that allows the charging cable to stay connected and the phone to be angled so as others can see their face (wireless chargers tend to sit too far back).

And while DeX is a secure solution, and can benefit from Samsung’s Knox security platform and capabilities, pairing DeX with a secure branch of one style solution – such as that offered by Asavie, now a part of Akamai – has the ability to add end-to-end security and secure application/data access that your employees desire and your business needs.

The opportunities for DeX outweigh the challenges. I am certain that most businesses have potential DeX users – employees who reluctantly carry around a laptop, or who have to come back to a location for their computing. They might be employees who use their phones for image capture and spend much of their time transferring photos to a PC to store them into a corporate system (such as an OH&S team member, or a repair and maintenance provider for a company). It could be a brand salesperson who spends time in various retailers or on the road but still need computing for product training, entering sales figures, and other administrative tasks.

If your business already offers Samsung devices to your employees, switching on DeX is a no-brainer. Start with a trial in a limited employee pool to determine the specific challenges and opportunities within your business. If you are already using virtual desktops, then this is the easiest way to start – roll out the app to your Samsung mobile devices and you have a ready-made portable computer in your employees’ pockets.

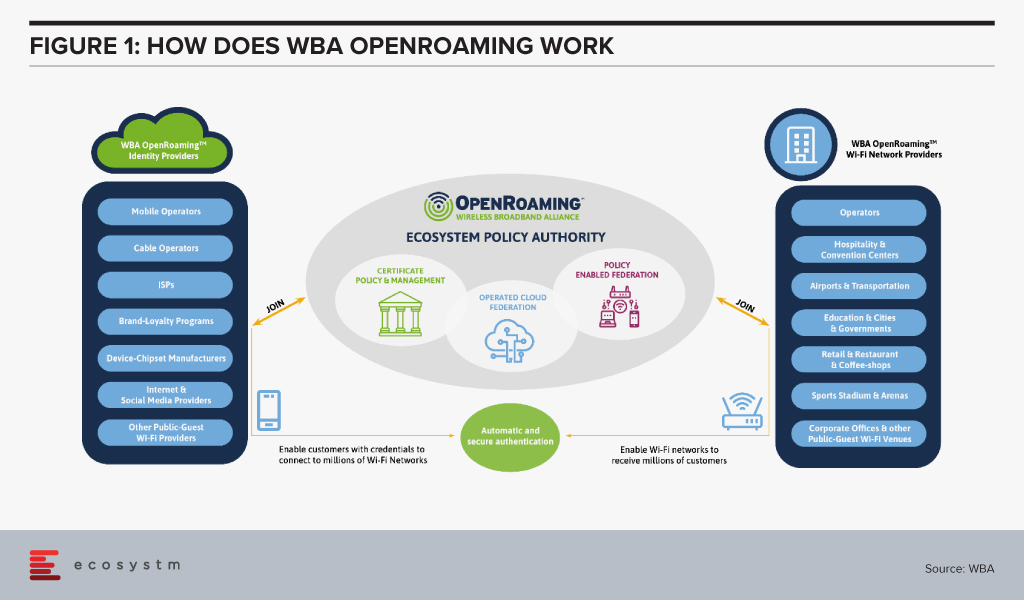

The Wireless Broadband Alliance (WBA) was formed in 2003 to enable a seamless and interoperable Wi-Fi experience across the global wireless ecosystem. The key objective of the alliance was to bring together multiple stakeholders – such as telecom providers, technology vendors and enterprises – to work on areas such as industry guidelines, pilot projects, standards to promote end-to-end services and drive adoption in Wi-Fi, 5G, IoT and others.

WBA OpenRoaming™

Ecosystm Principal Advisor, Ashok Kumar says, “Wi-Fi has gained increasing popularity worldwide over the last two decades and has now become an essential network technology with ubiquitous service that it is utilitarian. However, it has been viewed as a collection of islands of heterogenous networks, requiring re-authentication each time a mobile user transits from one network and re-connects with another Wi-Fi network, with the associated hurdles of logging back in, making it cumbersome.”

“The lack of interoperability between Wi-Fi networks has been a drawback for service providers, compared to the ease of use associated with global mobile networks, such as 4G, LTE, 5G, and so on, which offer seamless roaming connectivity.”

The WBA OpenRoaming™ initiative was announced last month, to create a globally available Wi-Fi ecosystem that offers a federation of automatic and secure connections for billions of devices to millions of Wi-Fi networks. It provides a new global standards-led approach, removing public-guest Wi-Fi connectivity barriers and brings greater convenience and security to the wireless ecosystem. WBA OpenRoaming™ removes the need to search for Wi-Fi networks, to repeatedly enter or create login credentials, or to constantly reconnect or re-register to public Wi-Fi networks.

Several leading technology companies and telecom service providers have extended support to WBA OpenRoaming™ standards – Samsung, Google, Cisco, Intel, Aptilo, AT&T, Boingo Wireless, Broadcom, Comcast, Deutsche Telekom and Orange to name a few.

“Wi-Fi is arguably the most ground-breaking wireless technology of our time. From the first public Wi-Fi hotspots in the early 2000s which enabled radically increased productivity on the move, through to the role Wi-Fi has in today’s pandemic environment. With WBA OpenRoaming™ we want to revolutionise how individual users as well as businesses engage with Wi-Fi, removing the need to repeatedly log in, re-connect, share passwords or re-register for Wi-Fi networks as we travel locally, nationally or internationally”, said Tiago Rodrigues, CEO of the WBA, “Instead, no matter where we are, the new framework automates how users connect to Wi-Fi while seamlessly aligning to cellular network connectivity. It does so by bringing together a federation of trusted identity providers so that individual users are allowed to automatically join any network managed by a federation member.”

WBA OpenRoaming™ can simplify Wi-Fi, much like the cellular roaming experience. Kumar says, “ The WBA OpenRoaming™, with support from major global service providers, network solution vendors, and authentication & security firms, has the potential to address the issue of seamless interoperability in the Wi-Fi networks ecosystem with ease-of-use and security.”

WBA OpenRoaming™ Framework

The framework and standards are based on cloud federation, consisting of a global database of networks and identities, dynamic discovery and the Wireless Roaming Intermediary Exchange (WRIX); cybersecurity consisting of Public Key Infrastructure a RadSec providing the certificate policy, management and brokerage services; and network automation facilitated by an automated roaming consortium framework and policy and Wi-Fi CERTIFIED Passpoint®*.

The Impact of WBA OpenRoaming™

“Enterprises are expected to benefit enormously from the opportunity to create new commercial business models and innovative services with speed and simplicity,” says Kumar.

Maturing mobile technologies such as 5G and Wi-Fi 6 along with next generation wireless devices, could make OpenRoaming™ more seamless and extend its applications further.

Cisco in particular has been leading the charge with several pilots that showcase the benefits of OpenRoaming™. Earlier this year, it partnered with Oxbotica, an autonomous vehicle software provider, to demonstrate how OpenRoaming™ can unlock the potential of autonomous vehicle fleets, allowing a seamless and secure sharing of high-volume data while on the move.

Last year, Cisco also showcased the benefits of OpenRoaming™ in a pilot at the Mobile World Congress in Barcelona with Samsung as the identity provider. Attendees were connected to the network throughout the venue, with connectivity extended to even local train stations and the airport. This unified experience was possible despite the fact that at least three network providers were involved. Pilots such as these gives the industry a glimpse of what benefits lie ahead.

Kumar sees the impact being extended across industries. “The impact of WBA OpenRoaming™ will be in the introduction of innovative services for consumers and enterprise users in public Wi-Fi networks in industries such as Hospitality, Transportation (airport and rail), Retail outlets, Smart City solutions, and local community networks.”

Learn more about WBA OpenRoaming™, visit www.openroaming.org

*Wi-Fi CERTIFIED Passpoint® is a registered trademark of the Wi-Fi Alliance

In his blog, The Cybercrime Pandemic, Ecosystm Principal Advisor, Andrew Milroy says, “Remote working has reached unprecedented levels as organisations try hard to keep going. This is massively expanding the attack surface for cybercriminals, weakening security and leading to a cybercrime pandemic. Hacking activity and phishing, inspired by the COVID-19 crisis, are growing rapidly.” Remote working has seen an increase in adoption of cloud applications and collaborative tools, and organisations and governments are having to re-think their risk management programs.

We are seeing the market respond to this need and May saw initiatives from governments and enterprises on strengthening risk management practices and standards. Tech vendors have also stepped up their game, strengthening their Cybersecurity offerings.

Market Consolidation through M&As Continues

The Cybersecurity market is extremely fragmented and is ripe for consolidation. The last couple of years has seen some consolidation of the market, especially through acquisitions by larger platform players (wishing to provide an end-to-end solution) and private equity firms (who have a better view of the Cybersecurity start-up ecosystem). Cybersecurity providers continue to acquire niche providers to strengthen their end-to-end offering and respond to market requirements.

As organisations cope with remote working, network security, threat identification and identity and access management are becoming important. CyberArk acquired Identity as a Service provider Idaptive to work on an AI-based identity solution. The acquisition expands its identity management offerings across hybrid and multi-cloud environments. Quick Heal invested in Singapore-based Ray, a start-up specialising in next-gen wireless and network technology. This would benefit Quick Heal in building a safe, secure, and seamless digital experience for users. This investment also shows Quick Heal’s strategy of investing in disruptive technologies to maintain its market presence and to develop a full-fledged integrated solution beneficial for its users.

Another interesting deal was Venafi acquiring Jetstack. Jetstack’s open-source Kubernetes certificate manager controller – cert-manager – with a thriving developer community of over 200 contributors, has been used by many global organisations as the go-to tool for using certificates in the Kubernetes space. The community has provided feedback through design discussion, user experience reports, code and documentation contributions as well as serving as a source for free community support. The partnership will see Venafi’s Machine Identity Protection having cloud-native capabilities. The deal came a day after VMware announced its intent to acquire Octarine to extend VMware’s Intrinsic Security Capabilities for Containers and Kubernetes and integrate Octarine’s technology to VMware’s Carbon Black, a security company which VMware bought last year.

Cybersecurity vendors are not the only ones that are acquiring niche Cybersecurity providers. In the wake of a rapid increase in user base and a surge in traffic, that exposed it to cyber-attacks (including the ‘zoombombing’ incidents), Zoom acquired secure messaging service Keybase, a secure messaging and file-sharing service to enhance their security and to build end-to-end encryption capability to strengthen their overall security posture.

Governments actively working on their Cyber Standards

Governments are forging ahead with digital transformation, providing better citizen services and better protection of citizen data. This has been especially important in the way they have had to manage the COVID-19 crisis – introducing restrictions fast, keeping citizens in the loop and often accessing citizens’ health and location data to contain the disaster. Various security guidelines and initiatives were announced by governments across the globe, to ensure that citizen data was being managed and used securely and to instil trust in citizens so that they would be willing to share their data.

Singapore, following its Smart Nation initiative, introduced a set of enhanced data security measures for public sector. There have been a few high-profile data breaches (especially in the public healthcare sector) in the last couple of years and the Government rolled out a common security framework for public agencies and their officials making them all accountable to a common code of practice. Measures include clarifying the roles and responsibilities of public officers involved in managing data security, and mandating that top public sector leadership be accountable for creating a strong organisational data security regime. The Government has also empowered citizens to raise a flag against unauthorised data disclosures through a simple incident report form available on Singapore’s Smart Nation Website.

Australia is also ramping up measures to protect the public sector and the country’s data against threats and breaches by issuing guidelines to Australia’s critical infrastructure providers from cyber-attacks. The Australian Cyber Security Centre (ACSC) especially aims key employees working in services such as power and water distribution networks, and transport and communications grids. In the US agencies such as the Cybersecurity and Infrastructure Security Agency (CISA) and the Department of Energy (DOE) have issued guidelines on safeguarding the country’s critical infrastructure. Similarly, UK’s National Cyber Security Centre (NCSC) issued cybersecurity best practices for Industrial Control Systems (ICS).

Cyber Awareness emerges as the need of the hour

While governments will continue to strengthen their Cybersecurity standards, the truth is Cybersecurity breaches often happen because of employee actions – sometimes deliberate, but often out of unawareness of the risks. As remote working becomes a norm for more organisations, there is a need for greater awareness amongst employees and Cybersecurity caution should become part of the organisational culture.

Comtech received a US$8.4 million in additional orders from the US Federal Government for a Joint Cyber Analysis Course. The company has been providing cyber-training to government agencies in the communications sector. Another public-private partnership to raise awareness on Cybersecurity announced in May was the MoU between Europol’s European Cybercrime Centre (EC3) and Capgemini Netherlands. With this MoU, Capgemini and Europol are collaborating on activities such as the development of cyber simulation exercises, capacity building, and prevention and awareness campaigns. They are also partnered on a No More Ransomware project by National High Tech Crime Unit of the Netherlands’ Police, Kaspersky and McAfee to help victims fight against ransomware threats.

The Industry continues to gear up for the Future

Technology providers, including Cybersecurity vendors, continue to evolve their offerings and several innovations were reported in May. Futuristic initiatives such as these show that technology vendors are aware of the acute need to build AI-based cyber solutions to stay ahead of cybercriminals.

Samsung introduced a new secure element (SE) Cybersecurity chip to protect mobile devices against security threats. The chip received an Evaluation Assurance Level (EAL) 6+ certification from CC EAL – a technology security evaluation agency which certifies IT products security on a scale of EAL0 to EAL7. Further applications of the chip could include securing e-passports, crypto hardware wallets and mobile devices based on standalone hardware-level security. Samsung also introduced a new smartphone in which Samsung is using a chipset from SK Telecom with quantum-crypto technology. This involves Quantum Random Number Generator (QRNG) to enhance the security of applications and services instead of using normal random number generators. The technology uses LED and CMOS sensor to capture quantum randomness and produce unpredictable strings and patterns which are difficult to hack. This is in line with what we are seeing in the findings of an Ecosystm business pulse study to gauge how organisations are prioritising their IT investments to adapt to the New Normal. 36% of organisations in the Asia Pacific region invested significantly in Mobile Security is a response to the COVID-19 crisis.

The same study reveals that nearly 40% of organisations in the region have also increased investments in Threat Analysis & Intelligence. At the Southern Methodist University in Texas, engineers at Darwin Deason Institute for Cybersecurity have created a software to detect and prevent ransomware threats before they can occur. Their detection method known as sensor-based ransomware detection can even spot new ransomware attacks and terminates the encryption process without relying on the signature of past infections. The university has filed a patent for this technique with the US Patent and Trademark Office.

Microsoft and Intel are working on a project called STAMINA (static malware-as-image network analysis). The project involves a new deep learning approach that converts malware into grayscale images to scan the text and structural patterns specific to malware. This works by converting a file’s binary form into a stream of raw pixel data (1D) which is later converted into a photo (2D) to feed into image analysis algorithms based on a pre-trained deep neural network to scan and classify images as clean or infected.

Manufacturing is estimated to account for a fifth of Singapore’s GDP and is one of its growth pillars. Singapore has been talking about re-inventing the Manufacturing industry since 2017, when the Industry 4.0 initiatives to enable digitalisation and process automation of processes and to ensure global competitiveness were first launched. As part of the long-term strategy, the Government had spoken about investment into research and development (R&D) projects, developing transformation roadmaps and strengthening the skill sets of the workforce.

Singapore’s 5G Rollout

Last month, the Infocomm Media Development Authority (IMDA) announced that Singtel and JVCo (formed by Starhub and M1) has won the 5G Call for Proposal. They will be required to provide coverage for at least half of Singapore by end-2022, scaling up to nationwide coverage by end 2025. While Singtel and JVCo will be allocated radio frequency spectrum to deploy nationwide 5G networks, other mobile operators, including MVNOs, can access these network services through a wholesale arrangement. The networks will also be supplemented by localised mmWave deployments that will provide high capacity 5G hotspots.

In October 2019, IMDA and the National Research Foundation had set aside $40 million to support 5G trials in strategic sectors such as maritime, aviation, smart estates, consumer applications, Industry 4.0 and government applications. Ecosystm Principal Advisor, Jannat Maqbool says, “Reach, performance and robustness of connectivity and devices have long held back the ability to scale with the IoT as well as successful deployment of some solutions altogether. The integration of 5G with IoT has the potential to change that immensely. However, and possibly even more importantly, 5G will see the emergence of a true ‘Internet’, defined as ‘interconnected networks using standardised communication protocols’, made up of ‘things’ enabling never-before contemplated innovation – supporting economic development and community well-being.”

“While 5G offers enormous potential to produce economic and social benefits, to reach that potential we need to evaluate from a strategic perspective what it could mean for industries, employers and communities – then we need to invest in the infrastructure, innovation and associated development required to leverage the technology.”

Singapore’s Industry 4.0 Transformation

The Government is also focused on getting the industry ready for the transformation that 5G will bring. Last week, Singapore announced its first Industry 4.0 trial, where IMDA collaborates with IBM, M1 and Samsung to design, develop, test and benchmark 5G-enabled Industry 4.0 solutions that can be applied across various industries. The trials will begin at IBM’s facility in Singapore and involve open source infrastructure solutions from Red Hat to test Industry 4.0 use cases.

The project will test 5G-enabled use cases for Manufacturing, focusing on areas such as automated visual inspection using image recognition and video analytics, equipment monitoring and predictive maintenance, and the use of AR in increasing productivity and quality. The focus is also on leveraging 5G to reduce the cost of processing, by shifting the load from the edge device to centralised systems.

Ecosystm Principal Advisor, Kaushik Ghatak says, “For some time now, the Singapore Manufacturing industry has been in the quest for higher productivity in order to regain its foothold as a destination of choice for global manufacturing outsourcing. The 5G Industry 4.0 trial is a great initiative to fast-track identification and adoption of the right use cases in Manufacturing, in the areas of automation, visibility, analytics, as well as for opening new revenue streams through servitisation of smart products.”

5G will see increased collaboration in the Tech industry

With the advent of 5G, the market will see more collaboration between government agencies, telecom providers and cloud platform providers and network equipment providers. Governments globally have invested in 5G and so have the network and communications equipment providers. However, telecom providers are unsure of how to monetise 5G and cater to the shift in their customer profile from consumers to enterprises. IBM and Samsung had already announced the launch of a joint platform in late 2019. Collaborations such as these will be key to widespread 5G deployment and uptake.

Talking about the benefits of collaborative efforts such as this, Maqbool says, “Robustness and security built into 5G deployment from the outset is essential to enable the applications and innovation that many are promising the technology will deliver, including the ability to self-scale, automate fault management and support edge processing.”

It is interesting that the solutions developed will be featured at IBM’s Industry 4.0 Studio 5G Solutions Showcase, and that IBM and Samsung will evaluate successful solutions developed during the project for possible use in their operations in a broad range of markets and sectors. “Availability of proven use cases at IBM’s Solutions Showcase centre would benefit local manufactures greatly; in terms of easy access to right skills and proven technology architectures,” says Ghatak. “This initiative is a huge step towards realising the promise of the cyber physical world. The collaboration between the leaders in communications, equipment and software will ensure that the use case development is truly cutting edge.”

April saw the disruption of normal business operations due to the COVID-19 crisis. However, telecommunications companies continued initiatives to identify the best ways to serve customers and enterprises. The month saw a lot of activity in the 5G space across the globe, including partnerships, innovation in productisation and identifying 5G use cases.

Telecom providers building their 5G capabilities

Ecosystm Principal Advisor, Shamir Amanullah noted in his blog that in the new normal telecom providers have fast evolved as the backbone of business and social interactions. Telecom operators are fervently working towards 5G network and services deployment in order to be an early mover in the market. In China, China Mobile has been one of the leaders in rolling out country-wide 5G. The tender to build around 250,000 fifth-generation wireless network base stations across 28 provincial regions was put out in March and in early April, Huawei emerged as the key winner with the contract to build nearly 60% of the base stations. ZTE also won nearly a third of the contract. Global network equipment providers will find entering the China market as challenge for a number of reasons, including the strength of their local players.

Huawei continues to be under scrutiny in the global market, however British telecom provider chose Ericsson to build the core of its 5G network. BT hopes to create and define a future roadmap of new services such as mobile edge computing, network slicing, enhanced mobile broadband and various enterprise services. The US market is another arena where the battle for 5G will be fought out. The T-Mobile – Sprint merger was finalised in early April. The New T-Mobile is committed to building the world’s best nationwide 5G network, which will bring lightning-fast speeds to urban areas and underserved rural communities alike. Other vendors are also vying for a larger share of the US market. Nex-Tech Wireless, a smaller rural telecom provider based in Kansas, is planning to transition from 4G to 5G by using Ericsson’s Dynamic Spectrum Sharing (DSS) to deploy 5G on existing bands. This will help Next-Tech wireless to leverage existing assets instead of building 5G capabilities from the ground-up – enabling them to seamlessly transfer from 4G to 5G.

The 5G developments are by no means limited mostly to the US and China. Korea’s telecom provider, KT and Far EasTone Taiwan (FET) signed an MOU to collaborate and jointly develop 5G services and digital content. With this deal, KT plans to boost its 5G powered content and services presence through FET.

Tech Vendors evolving their 5G offerings

Network and communications equipment providers have much to gain and more to lose as organisations look to leverage 5G for their IoT use cases. If 5G uptake does not take off, the bigger losers will be the network and communications equipment providers – the real investors in the technology. Also, as telecom providers look to monetise 5G they will find themselves dealing with a completely different customer base – they will take help from tech vendors that have more experience in the enterprise space, as well as industry expertise. Both network equipment vendors and other tech vendors are actively evolving their product offerings. There were numerous examples of this in April.

Microsoft’s decision to acquire Affirmed Networks is an example of how the major cloud providers are trying to be better embedded with 5G capabilities. This month also saw Microsoft announce Azure Edge Zones aimed at reducing latency for both public and private networks. AT&T is a good example of how public carriers will use the Azure Edge Zones. As part of the ongoing partnership with Microsoft, AT&T has already launched a Dallas Edge Zone, with another one planned for Los Angeles, later in the year. Microsoft also intends to offer the Azure Edge Zones, independent of carriers in denser areas. They also launched Azure Private Edge Zones for private enterprise networks suitable for delivering ultra-low latency performance for IoT devices.

The examples go beyond the cloud platform providers. Samsung and Xilinx, have joined forces to enable 5G deployments, with Samsung aiming to use the Xilinx Versal adaptive compute acceleration platform (ACAP) for worldwide 5G commercial deployments. Versal ACAP offers the compute density at low power consumption to perform the real-time, low-latency signal processing needed by 5G. Following the successful pilot of 450 MHz proof of concept 5G network, Nokia has partnered with PGE Systemy, a large energy sector company in Poland to deploy industrial grade 5G solutions and to support energy distribution for its next gen power grid. It is the band of choice for machine-to-machine communications in the energy sector, including smart meters. Nokia also released an AI-as-a-service offering – Nokia AVA 5G cognitive operations – to help telecom providers transform their services with AI-based solutions to support, network, business and operations.

Use cases for 5G adoption firming up

5G promises to revolutionise various industry solutions based on required data rates, low latency, reliability, and machine-type communications. Telecom providers and tech vendors alike are working on developing industry use cases to drive up adoption.

Vodafone Qatar and Dreama Orphan Care Centre and Protection Social Rehabilitation Centre (AMAN) have collaborated to support remote learning and education using 5G technology. This is aimed to enhance virtual education through e-learning, online schools, and connecting teachers and students through high-speed learning environment. In the post-COVID 19 era remote learning is expected to become a key sector and there is immense potential for uptake.

The Manufacturing industry remains a top focus area for 5G providers, with their early adoption of sensors and sensor data analytics. The Smart Internet Lab at the University of Bristol, UK has been awarded a 2 years project by UK’s Department for Digital, Culture, Media and Sport (DCMS) to enable 5G connectivity for the manufacturing sector. The project will primarily work on improving productivity and manufacturing, easy asset tracking and management with involvement of AR/VR technologies and industrial system management.

Gaming is another sector with huge potential for 5G adoption. With cloud gaming, gamers can access a library of popular high-quality games minus the need for expensive hardware which has been the case in the past. China Mobile Hong Kong and Ubitus teamed up to launch a 5G cloud gaming service – UGAME. The application is available for download from the Google Play store. While still at a beta phase, the telecom provider promises a revolutionary gaming experience, where the need for computers or consoles will be lessened by augmented smartphone capabilities.

In the midst of the uncertainties, telecom, network equipment providers and cloud platform providers appear to be gearing up for 5G in enabling a contactless and remote economy.

Artificial Intelligence (AI), machine learning and deep learning are buzz words that have organisations – especially the C-Suite – excited about future possibilities of what technology can do for their business. However, these are not merely buzz words and are actually being leveraged by early adopters. At the same time, there are organisations that are keen to adopt the technologies but are unsure of the benefits and the associated challenges act as a barrier to adoption. So, is AI over-hyped or is it a reality for enterprises today? Ecosystm research provides some answers.

The Buzz Around Artificial Intelligence

There are several factors that contribute to the curiosity around AI and why several organisations are evaluating the adoption of AI:

Promotion by large tech vendors

The world’s leading technology providers are in a race to incorporate innovations (mostly driven by AI) within their product and service offerings. Heavy investments in R&D and new patents are aimed at increased market share, as the top tech vendors continue to compete to consolidate and grow their global presence. The perception is that AI-related patents are directly proportional to future market potential. It is not uncommon for the providers to promote these future capabilities – long before they hit the market – as part of their go-to-market messaging. There has been a surge in the number of AI patent filings in recent years with Microsoft leading with more than 18,300 patents followed by IBM (more than 15,000) and Samsung (more than 11,000). As these tech giants keep investing in R&D, apply for newer patents and publicise them, it creates a positive buzz in the market.

Consumerisation of AI

Just like any emerging technology, AI is still, to some extent, an enigma. However, the consumer market gets constant glimpses of how AI can have a positive impact on people’s lifestyle. Amazon, Samsung, Microsoft, Apple – to name a few – have all introduced smart AI solutions to their consumer products. From smart voice assistants that help us with our voice searches to controlling homes with digital assistants, users have been impressed with their early interactions with AI. Many think that the same way as AI has percolated into their personal lives, it will one day be pervasive in enterprises as well. The requirements of an enterprise AI solution is completely different and complex. For example, wearables and wellness mobile apps can help you take control of your health, but for them to become part of the healthcare system, they require FDA approval, a well-documented workflow and policy implementations. But, wearables get people curious and create a buzz about the role of AI in healthcare.

Government initiatives

Several governments are engaging and getting serious about AI and are investing in AI R&D. Many have created an AI roadmap including governance, to promote the adoption of AI. AI.gov was launched by the US Government to centralise AI efforts, share knowledge on AI and drive adoption across government agencies and departments. Some departments have already adopted AI. The US National Oceanic and Atmospheric Administration (NOAA) has been using AI to improve their forecasts. This helps in better prediction of high-impact weather events. Smart city applications are also seeing increased adoption of AI, including in citizen engagement. Cities and government departments are investing in AI-based call centres to answer repeated or routine queries. For example, the United States Army uses an interactive virtual assistant to check qualifications and answer questions with more accuracy. When governments back a technology area, it creates an interest in the citizens.

Success stories

Every day we read about some AI implementation that has positively impacted an organisation or its customers. Twitter’s use of AI-driven text and image analytics to detect hate speeches and terrorist activities has been well-publicised. Gaming companies are actively using AI to improve user experience through Mixed Reality and AI technologies. The recent coronavirus outbreak was first detected by BlueDot, a Canadian company using AI technologies. Such success stories encourage other enterprises to evaluate the technology.

Beyond the Buzz

While we are adopting AI/automation as part of our consumer goods (such as phones, smart home systems) and services (such as search engines, online maps) the enterprise adoption of AI does not really match up to the hype around it.

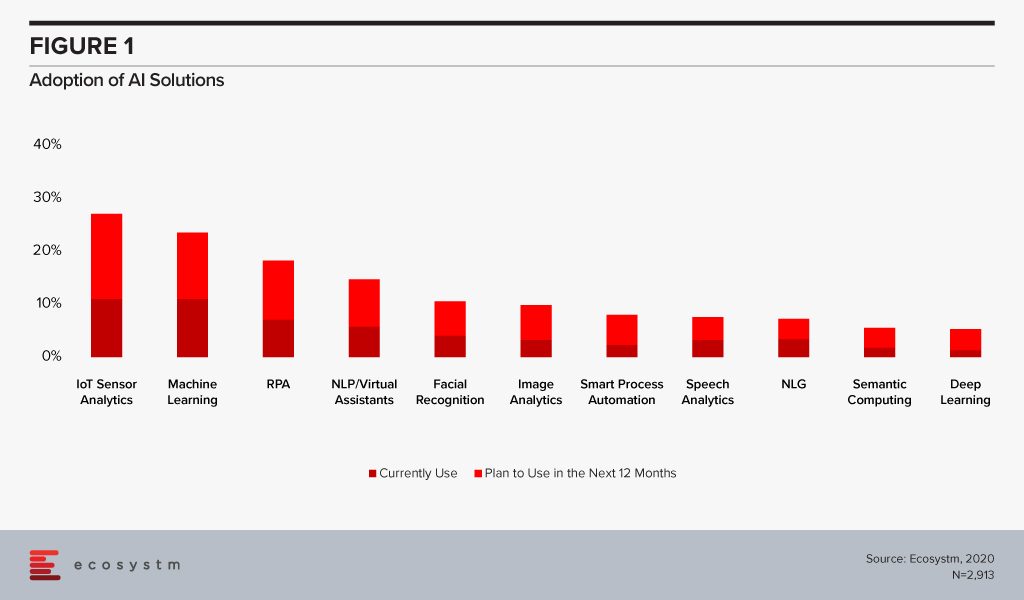

Ecosystm research shows us what the popular AI solutions are and what their current adoption is globally, as well as what it is likely to be at the end of the year (Figure 1). While some solutions have become popular, especially in industries such as Manufacturing, Mining & Resources and Construction, the reality is that we have not yet reached mass adoption. Of the organisations that are planning to implement some AI solutions, 44% consider the investment as strategic to their organisational goal. The rest are mostly looking at ad-hoc implementations to test the waters.

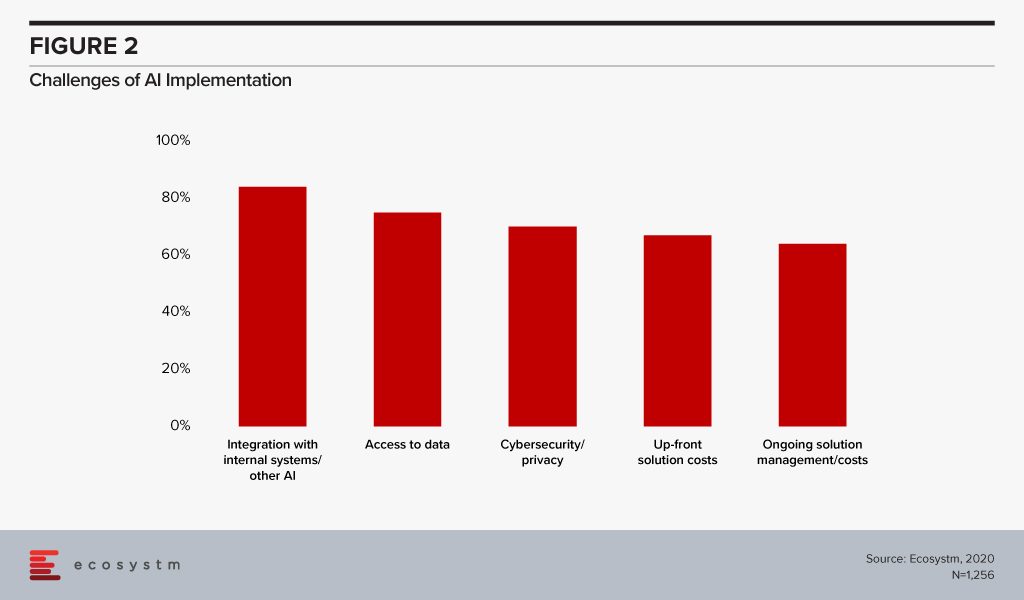

What is hampering more widespread adoption of AI? For both organisations that have embarked on their AI journeys and those who plan to in 2020, the challenges are the same (Figure 2).

AI integration is a complex process. The more organisations want to integrate AI investments into their transformation journey, the more complicated the integration becomes. There needs to be an identification of the expected outcomes, mapping of the data that will be required to help the algorithms, real-time or near real-time data sources and consistency in data infrastructure and sources. Organisations have legacy systems that run in siloes. Integration requires a clear roadmap and dedicated resources, often a third party.

Even in industries that have access to huge organisational data repositories, data access can be a challenge, for technological or compliance reasons. AI requires a huge amount of data to train and run algorithms. Data scientists are often challenged with access to quality training data at the scale required to train the AI systems.

Cybersecurity concerns are natural for any emerging technology area. AI systems have access to enormous organisational data. With threats ranging from ransomware, data breaches to hackers tampering with physical and industrial systems, it is dangerous if AI system falls in the hands of cybercriminals. Instances such as when criminals used an AI-based software to impersonate the voice of a company CEO to commit a €220,000 fraud, also add to the concerns around cybersecurity and AI.

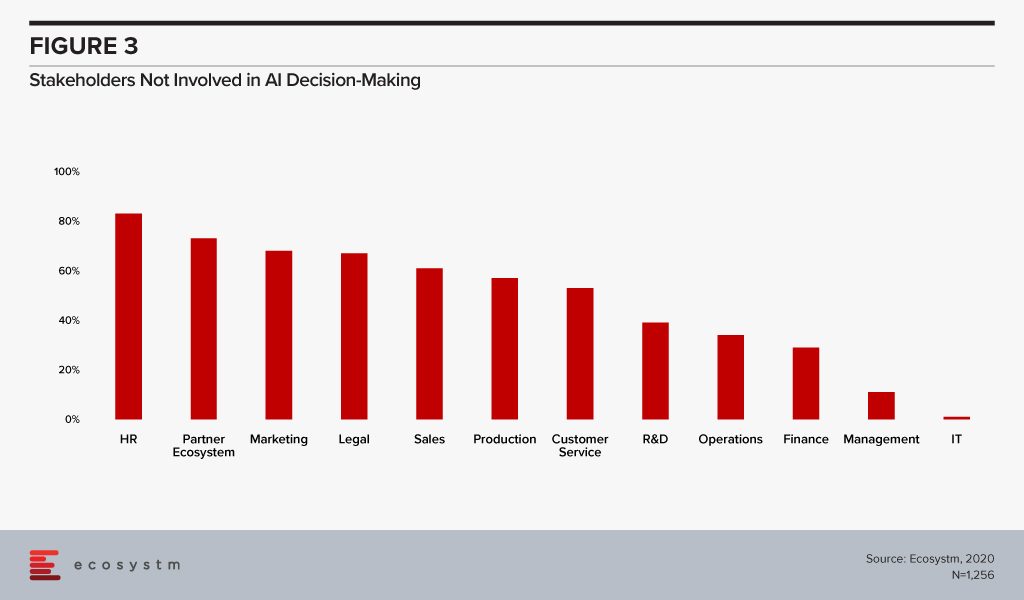

Another reason why organisations find deploying AI solutions difficult is that they do not involve the right organisational stakeholders in the AI decision-making process (Figure 3). While IT is likely to know where the data resides and have a better understanding of the systems implemented, the true success of AI deployments will be measured in user acceptance. An AI solution will obviously impact the existent workflows in an organisation, and if the stakeholders are not convinced, or are unsure of the benefits, it will be difficult for AI to have an organisation-wide impact.

Moreover, internal IT may not have the right skills to implement and maintain an AI solution. It will become important for organisations to involve strategic partners who can guide the implementations, at least in the initial stages. While 51% of organisations that have an AI solution engage an external strategic partner, only 33% of organisations that are planning to adopt AI have planned for a strategic partner to guide them. A strategic partner – with the right technical expertise and business experience – can help combat some of the challenges around integration issues and provide guidance on cybersecurity best practices.

AI clearly has immense possibilities and indeed is a revolutionary technology that will bring value to almost all industries. What is required for a successful AI implementation however is a roadmap – including a cross-departmental Centre of Excellence (CoE), a clear timeframe and KPIs to measure both business and technological success of the AI models. Unless organisations can plan their AI investments, the technology will not translate from hype to reality.