The term “intranet” won’t die. It should. I don’t think I have ever seen a good intranet in 24 years since I first started writing about business intranets in 1997 (yes – by writing about this market I was a part of the problem!). I’d even argue that there is no such concept as a “good intranet” – as it is an inherently flawed idea. An intranet effectively tries to bring together all the stuff that employees don’t access or don’t want to access and puts it somewhere that employees might actually use.

Intranets don’t help employees do their jobs

Why don’t we access these systems? Because they are generally not “core” to our jobs. Employees will find and access the systems and applications that are core to getting their jobs done – even if they are terrible to use (even in this “designed for humans, SaaS-world” there are still plenty of core systems that are terrible to use). Some companies try to integrate their intranet and core applications; making employees access the intranet to login to their essential apps. This might make life easier for IT responsible for deploying, managing and securing the applications. It also excites HR as they hope that along the way to accessing these systems, a “schmear” of company culture or information might rub off on them. But many employees quickly work out ways around these systems by bookmarking sites or using dedicated applications.

One of the reasons that company intranets are generally so poor is because they don’t actually help people do their job. There are often no guided processes or checklists to ensure follow through on tasks. Remember how many salespeople didn’t (or still don’t) use the CRM system because it didn’t help them actually sell? Well, intranets suffer from the same problem.

Some software providers looked to solve this problem by bringing the company intranet and core application together into a single interface. Salesforce has limited success with Chatter – but many users of Chatter spent much of their energy telling employees they “weren’t using Chatter the right way” – which sounds awfully like a design problem, not a user one.

Now is a good time to review your company intranet

Why now? Because the big collaboration players (Microsoft in particular) are improving their offerings in this space, creating partnerships, and painting a vision of a world where employees might actually WANT to access company intranets.

Which brings me to Microsoft Viva. We wrote about Viva when it was initially launched as a concept and businesses (and more importantly, their employees) can now experience the capabilities. Viva helps resolve some of the challenges with business intranets:

- It makes some of the collaboration systems more usable and insightful

- It actually provides outcomes for employees (through the learning module in particular)

- It integrates with existing processes and exposes these application-centric processes through Teams

At the same time, it is trying to be a “cultural change agent” by having a single place to go to view company news and announcements. This is similar to many company intranets, and like many of them, is likely to be an abandoned sideshow – the only time many employees visit it will be when they are forced to – like when the CEO sends an all-company email saying that there is an announcement on the company intranet that everyone needs to see. Which is the digital equivalent of posting you a letter to inform you that you have an email!

The challenge for Viva is that employees need to be using Teams to get the most out of it – and I don’t just mean “using Teams for chat and calling” but using the collaboration elements effectively – ALL the time. And the challenge with this is that (a) many employees don’t EVER use these features of Teams (or use them sporadically), and (b) some companies (and teams within companies) have multiple platforms for collaboration and sharing (Slack, Trello, Basecamp, Jira etc).

But either way, Viva looks like a positive step forward for collaboration – and more importantly, it gives businesses some guidelines on how to improve their existing intranet.

How to Make your Intranet work?

Integrate the work that people have KPIs on, with collaboration and intranet systems

Design processes so the intranet makes it EASIER for people to do their jobs – by removing unnecessary handing of information, copying and pasting, multiple levels of authentication and moving between many applications or screens. Leave requests or approving invoices have already been integrated into email – so managers can click a button in the email to send the approval. But what if there were a page on the intranet where all the leave requests or approvals for funding or payment were in a single spot? What if the system provided insight around these requests (such as Mary Singh only has 1 day leave left, or Company ABC takes 90 days to pay on average)? And if all leave requests could be approved with a single click, it actually makes the employees life easier.

Build processes into the systems to solve employee pain points

Many intranets are ostensibly used for helping employees find each other or find experts on specific topics. But they don’t guide this process – they just say “there’s lots of information here – use the search tool and good luck!”. Design guided processes for outcomes people actually want to achieve. Survey your employees to find out what they’d like the intranet to help them achieve – and build some employee journey maps across various roles to understand the challenges and pain points. If it makes sense, use the intranet to help resolve those pain points.

Make your existing tools more powerful and easier to use

Your employees generally want to collaborate. Don’t get me wrong – many don’t wake up each morning thinking that they’d love to share some documents with unknown team members today – but they do want to work together more easily than they do today. So take a look at what stops them from achieving this and look to solve those problems by making existing tools more powerful and easier to use. Adding analytics helps employees and their managers better manage their time and their interactions. Automating file sharing and discovery will help employees find the information they need without adding additional work for the content creator.

Businesses need to think of their intranets as “places to get things done”

Too many intranets seem to be designed for 4pm on Friday afternoon versus 9am Monday morning. And if this is yours, then don’t be surprised that employees don’t use it that often or give it little time. The more you can use an intranet to make employees lives easier, the more likely that you will be creating a resource which improves the productivity and happiness of the employees you serve.

An Update (1 October 2021): This acquisition did not go through even after the boards of directors of both companies had approved it. It was voted down by Five9 shareholders, citing growth and valuation concerns. This is an unusual example of an acquisition not going through because of unwillingness of one of the companies. In recent times, regulators have stopped some acquisitions. Incidentally, there were some concerns raised by the by Federal Communications Commission (FCC) as Zoom is based in US. but has product development operations in China.

The partnership arrangement between the two companies will continue including support for integrations between their respective Unified Communications as a Service (UCaaS) and Contact Centre as a Service (CCaaS) solutions and joint go-to-market initiatives.

Zoom has announced their intention to acquire cloud contact centre service provider Five9 in an all-stock deal for about USD 14.7 Billion. This is Zoom’s largest-ever acquisition as the communications platform continues to expand their services and launch new products. The deal is expected to be completed in the first half of 2022 and Five9 will be an operating unit of Zoom.

The last year has seen Zoom scaling up their product offerings, including cloud calling solution – Zoom Phone, conference hosting solution – Zoom Rooms, and applications and productivity tools – Zoom Apps and Zoom Marketplace. Zoom also acquired real-time translation startup Kites GmbH to offer multi-language translation capabilities, and Keybase – a secure messaging and file-sharing service to build end-to-end encryption for its video conferencing platform.

Ecosystm Analysts share their thoughts on Zoom’s strategy and roadmap, how Five9 will augment Zoom’s capabilities, and the impact the acquisition will have on Zoom’s competitors and the market.

Why Contact Centre?

Ecosystm Principal Advisor Tim Sheedy says, “Zoom is moving beyond its period of ‘organic hypergrowth’ brought on by the pandemic. While the paying customer base for their core video collaboration service will continue to grow, growth rates are likely to begin to track the market. To grow beyond market rates, Zoom needs to move into new markets – through product development or acquisition.”

Talking about the importance of voice services, Sheedy adds, “Voice services are an obvious adjacent market to help drive growth, and Zoom already has seen some success with their Zoom phone service and associated devices – in fact, they already have 1.5 million users. The Five9 acquisition gives the company a stronger and deeper capability in the voice sector; buying them a significant chunk of the voice services in business – the contact centre. In many businesses, the contact centre already accounts for over 50% of their voice minute usage, so winning this space will go a long way towards winning the overall voice and collaboration supplier in enterprises.”

Ecosystm Principal Advisor Audrey William predicts exciting times ahead for Zoom. “With Zoom already having a platform for video, then bringing voice into that equation and now a contact centre solution, makes them take on their competitors in an all-native cloud stack. There is a still a large installed base of on-prem UC customers and with Zoom seeing success with Zoom phones in the short time frame since its launch, this is where this will get exciting for Zoom. The telephony piece is still important in the race to simplify how we work, communicate, and collaborate today. It is that same voice/telephony discussion that can lead to a routing discussion, which then leads to a contact centre discussion.”

Ecosystm research shows that 54% of organisations are challenged in their customer experience delivery because of integration issues between multiple platforms. William sees this as an opportunity for Zoom. “The use cases to integrate workflows into the video environment is going to be important for Zoom. Video is now being used to solve customer service issues like letting the agents take over the screen to see how to help solve the customer problem immediately by using video and contact centre applications. The ability to bring this natively together will be very powerful. Zoom is investing heavily into apps and working to partner with ISVs who can develop workflows suitable for easy customer communication in specific industries such as Healthcare and Financial Services.”

Why Five9?

Five9 is considered a pioneer in cloud contact centre solutions and owns a comprehensive suite of applications for contact centre delivery and customer management operations across different channels. Five9 has made several acquisitions and enhancements to their CCaaS solution in recent years to make their stack more complete with richer AI offerings. They include Inference Solutions to offer their customers a Conversational AI solution and Whendu’s iPaaS platform which provides a no-code, visual application workflow tool.

William says, “More contact centres want to do away with monolithic IVR systems that confuse customers with too many long menus. The Agent Assist solutions are also gaining importance especially in the hybrid work model where agents face challenges working in isolation and not being on a floor with their colleagues and managers.”

Five9 has acquired a cloud workforce optimisation provider Virtual Observer. “So, we are not looking at just a basic level contact centre solution but an offering with important capabilities demanded by customers,” says William. “During the investor call this week, Zoom’s Eric Yuan and Rowan Trollope made it clear that they have been listening to customer feedback on how effective it would be to have a single platform that can accommodate UC and contact centres in the cloud. Zoom also sees Five9 as a good fit culturally; and their goal now will be to disrupt all legacy systems with cloud-native communications.”

What lies ahead?

William thinks that Zoom’s competitors will be watching this integration closely, especially those that lack an all-in-one native cloud UCaaS and CCaaS stack. “However, some of Zoom’s competitors have an established base of large enterprise customers and have done well to grow revenues and defend their base over the years. Working with in-country partners and ISVs will be critical for Zoom’s growth across regions.”

Sheedy thinks that the most important takeaway from this acquisition is not that Zoom is moving into the contact centre space. “It is that Zoom realises they have a “once in a generation” opportunity to grow beyond their core and cement their position as a supplier of collaboration and communication services – and that they are willing to flex their balance sheet and share price to create their future. The competition – from Microsoft in particular – will be strong. Google, AWS, Salesforce, and Facebook are also making a play for this market. Zoom has found themselves in their current position of strength due to good luck and good timing – and they appear to be telling the market that they aren’t going to give up their leadership without a significant battle.”

“Enterprises will be the true winners in this battle – with better, more integrated, lower cost and easier to implement communications and collaboration solutions for their employees and customers,” adds Sheedy.

In this first edition of Ecosystm RNx we rank the Top 10 Global Cloud Vendors.

Ecosystm RNx is an objective vendor ranking based on in-depth and quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an technology user, this Cloud Vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are a Cloud Vendor, this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

Moving from a product or regional focus to an industry focus appears to be the “strategy du jour” for many technology vendors today. For some it is a new strategy – with the plan to improve customer focus and increase growth; for others it is the pendulum moving back to where they were five or ten years ago as they bounce from being industry-centric to product-centric to geography-centric and back again.

Getting your industry focus right is much harder than it seems – and has to be timed with client needs and market opportunity. The need to focus on the industry varies for different technology products, services and capabilities. For example, most technology buyers want their vendors to understand what their business does and how they add value to customers – that is a given and industry-aligned Sales teams make a lot of sense. Many tech buyers also want certain software functions to align directly to their processes – there is little appetite to customise ERP and financial suites to specific industry needs and processes – and tech vendors should support these out-of-the-box or cloud needs.

Industry Solutions May Not Drive Competitive Advantage

If the industry solution you are selling is the same as what any of their competitors can buy from you, then organisations get the exact same benefit as the market – no more, no less. For example, about 10-15 years ago, large telecom providers around the globe made significant investments in CRM platforms (often from Siebel) – bringing in one of a few large global systems integrators to deploy their standard processes and systems. These CRMs were supposed to provide business and customer benefit, and drive competitive advantage. And while they did deliver positive change (often at SIGNIFICANT cost!) when every telecom provider was using the same solution with the same or similar processes, any competitive advantage was lost.

Industry Solutions are Often the Sign of a Mature Market

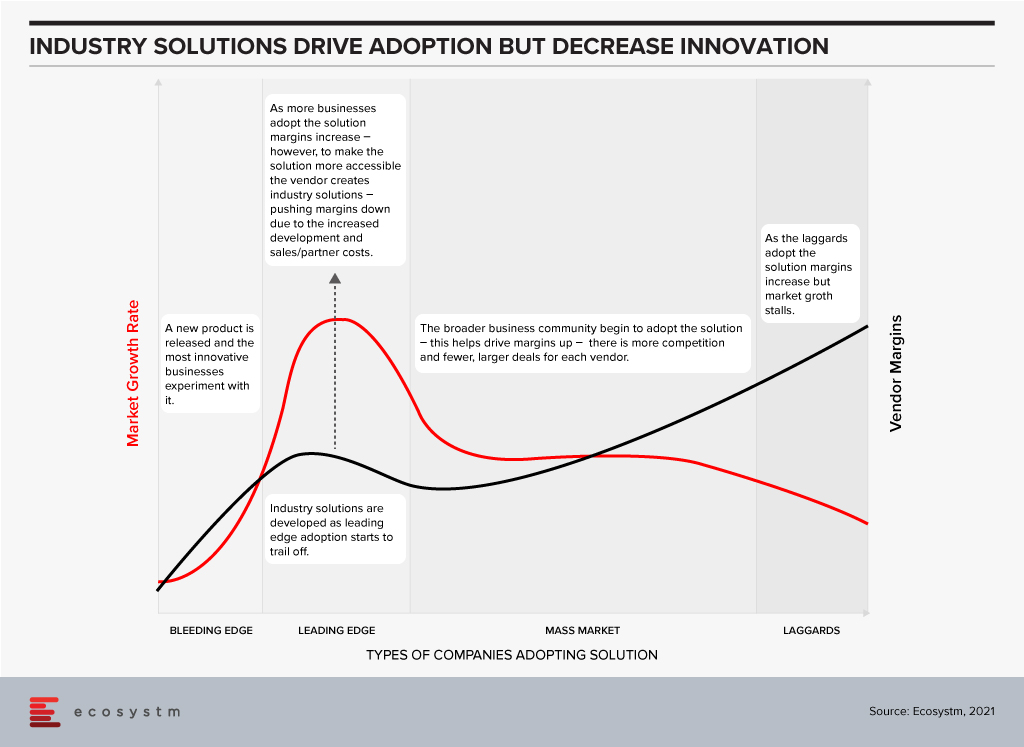

The widely accepted hypothesis is that the technology innovation and adoption happens in waves. The market has 5-7 year waves of innovation, followed by 5-7 year waves of deployment, adoption and consolidation.

The Innovation Phase. In this stage new companies emerge, new products or services are launched and leading/bleeding edge companies embrace these new technologies to drive competitive advantage and business growth. They experiment with new technologies that drive new business capabilities – sometimes failing, but always pushing the envelope for business innovation and forging the path for mass market adoption. In this stage there is often little demand for industry solutions – as both the providers and buyers of the solutions are still working out where the business benefit is; where the technology might be able to drive change or help them get ahead of competitors. If you examine the growth of a company such as Salesforce, you see that the early stage products are targeted towards a generic market – customers are expected to customise the solution based on their needs and individual requirements. In 2002 I worked for a challenger telecom provider that had deployed a traditional Peoplesoft CRM capability, and I was part of the team that brought Salesforce into the business – and as a cloud-based solution, we saw the competitive advantage was the pace at which we could customise the product (by excluding IT teams and processes). However, the solution was a “one-size-fits-all” product. The innovation stage is typically characterised by high growth of smaller vendors and technology service providers who challenge the status quo.

The Deployment, Adoption and Consolidation Phase. This stage of market growth is when the mass market starts to adopt these solutions. Many of these buyers walk the paths that have been forged before them by the more innovative, leading edge businesses. This stage typically sees less innovation, less experimentation, and more standard deployments. To make the solutions more palatable and easier to sell to the mass market tech vendors typically pre-configure or customise the solutions to specific needs – for business teams, roles or industries. It is usually in this stage of market growth and deployment that the industry solutions see significant interest and adoption. This is where the mass market gets access to the business benefits the more innovative businesses received many years earlier (and often profited from in this time). In my example of the Salesforce deployment in 2002, over the following years many partners started to create industry solutions, and eventually Salesforce themselves sold industry-specific solutions – or at least targeted certain products and capabilities at specific industries and provided accelerated deployment models to drive advantage at a faster rate. The deployment and consolidation stage of market growth is typically characterised by steady, slow growth across the entire market as benefits are being driven to all providers (product vendors and solutions or implementation providers). Legacy providers either play catch up or suffer declining business as they realise the solution they sell no longer provides the business and customer the benefits that it used to.

Industry Focus Should be Aligned to Customer Segments, Solution Type and Geography

The decision to sell industry-focused solutions should be driven by the type of solution you are selling; the business benefit you are promising; and the type of business you are targeting the solution towards. Businesses that are more innovative will still buy some pre-configured, industry-specific solutions that don’t differentiate their business or drive competitive advantage. But where they expect competitive advantage, they need to stand apart – to be the only business with that capability.

It is also worth understanding that an innovation in one market might be standard practice in another (and vice-versa). Countries across the globe and specifically here in Asia Pacific have different approaches to technology and innovation. China and parts of Southeast Asia are often innovators – pushing the boundaries of new and emerging tech to do things we never thought possible (in the same way Silicon Valley traditionally has done). Australia and India are traditional markets that adopt industry solutions after they have been tried and tested by others. Innovation in Japan seems to happen in stages and at pace but only once every 10-15 years or so. New Zealand and Singapore are generally more nimble economies where businesses often have to be innovative to gain global competitive advantage quickly.

Evidence indicates that the rate of innovation is increasing across the entire region – even in the less innovative economies. The window for industry solutions is much smaller regardless of location – as the next new innovation is just around the corner. Even the large, traditionally less agile businesses are driving innovation programs – for example, many of the big financial services “dinosaurs” such as DBS and Commonwealth Bank often win tech innovation awards and offer market-leading customer experiences.

Use this lens to better develop your industry approach. The depth of your industry solution or capability will dictate the opportunities that you will drive based on the type of customer and technology stage. Do you want to drive innovation or efficiency in your clients? Do you want to win the big “safer” deals – but be thought of as a technology solution provider; or win the smaller deals in companies that will become the market leaders of tomorrow – and be considered a market leader and king maker? Understanding your own business goals, the current sales and delivery capabilities, and the capacity to change will help your company create a go-to-market strategy that suits your current and future customers and will likely dictate the growth rate of your business over the next 5-7 years.

Keep yourself abreast with the latest industry trends

Ecosystm market insights, data, and reports are jam-packed with industry analysis and digital trends across several industry verticals to help you keep tabs on the fast-paced world of tech.

Last week Zoom announced a USD 100 million Zoom Apps Fund to promote the development of Zoom’s ecosystem of Zoom applications, integrations, video, developer tools, and hardware.

As part of Zoom Apps Fund, the company will invest in a portfolio of companies that are promoting and innovating on Zoom’s video conferencing platform. The portfolio companies will receive initial investments between USD 250,000 and USD 2.5 million to build solutions. To support the practice, Zoom is providing its tools and expertise to various start-ups, entrepreneurs, and industry players to build applications and integrate Zoom’s functionality and native interface in their products.

In March, Zoom introduced an SDK designed to help programmers embed Zoom functionality inside their applications. Zoom SDK is a component of Zoom Developer platform which includes SDKs, APIs, webhooks, chatbots, and distribution for applications and integration. Last year Zoom launched Zoom Apps and Zoom Marketplace at its Zoomtopia virtual conference to bring applications and productivity into the Zoom experience.

Zoom is not alone in evolving their Unified communications as a service (UCaaS) capabilities and market. Tencent rolled out their video conferencing solution for the global market, Facebook expanded their offerings in videoconferencing applications through the integration of new features, Google announced a series of upgrades and innovations to better support the flexibility needs of frontline and remote workers in Google Workspaces, and Microsoft introduced Viva that aims to bring together communications, knowledge, learning, resources, and insights together.

“Ecosystm research shows that 50% of organisations will continue to increase use of collaboration platforms and tools in 2021. However, if videoconferencing remains just a tool to log in to for meetings without purpose-built workflows and functionality that suit worker profiles, then it will start losing its attractiveness. Vendors need to work on user interface, UX, the lighting, security, audio quality and many other aspects that draws users to the platform.

The big question is what next for videoconferencing vendors? How can engineering teams innovate to build the capabilities organisations want when they use drawing tools, share images, have chats and discussions within collaboration platforms? How do you make the experience real so employees can “live and breathe” in the environment?

Zoom investing in understanding what apps and workflows are suited for a particular vertical or business is fundamental to the future of video and collaboration and will be a big game changer.”

“Zoom is continuing to expand the markets in which they operate and investing in start-ups increases their opportunities to grow as a platform. Their App Marketplace already offers a rich source of innovations, with Zoom themselves appearing to develop integration with market leaders such as Salesforce and HubSpot in the CRM category. This has led to Zoom integrations in close to 80 CRM products – including integrations developed in-house by Salesforce and HubSpot to supplement Zoom capabilities.

They are promoting an open web and audio-conferencing platform that does not limit users to the walled-garden approach of competitors such as Microsoft Teams.

Zoom’s strategy creates the opportunity for CIOs to access a widely used, rich functionality, digital collaboration channel – one they can integrate seamlessly into their existing digital channels knowing that their customers are likely to be highly familiar with the user experience.”

Get more insights on the impact of the COVID-19 pandemic and technology areas that will see innovations, as organisations get into the recovery phase.

BetterUp, a mobile-based professional learning and wellness platform that connects employees with career experts recently raised USD 125 million Series D funding backed by Salesforce Ventures, in partnership with ICONIQ Capital, Lightspeed Venture Partners, Threshold Ventures, and Sapphire Ventures among others, bringing the company’s valuation to USD 1.73 billion. Previously in 2012, the company had raised USD 43 million in venture capital funding with an additional Series B funding of USD 30 million in March 2018. The BetterUp platform combines behavioural science, AI, and human interaction to enhance employees’ personal and professional well-being. Recently, the company also revealed two new products – Identify AI, to help organisations determine the right people to invest in and the appropriate coaching needed through the use of AI; and Coaching Cloud for customised training for frontline, professional, and executive employees.

This announcement comes on the back of several wins for BetterUp. To boost employee performance and organisational growth NASA and the Federal Aviation Administration (FAA) partnered with BetterUp to support new ways of coaching and preparing a workforce for change. The world’s largest brewer, AB InBev has partnered with BetterUp to strengthen diversity and inclusion through BetterUp’s coaching platform.

The Need to Improve Employee Experience

The pandemic changed the working arrangement of millions of employees and industries across the globe who are now working remotely or in a hybrid environment.

Ecosystm Principal Advisor, Audrey William says, “Driving better employee experience (EX) should take centre stage this year with enterprises putting employees at the centre of all initiatives. We will see EX platforms get integrated further and deeper into workplace collaboration and HR applications. In the last 12 months, we have seen apps monitoring wellness and sleep, training and coaching, meditation, employee motivation, and so on sit within larger collaboration platforms such as Slack, Zoom, Microsoft, Cisco and others.”

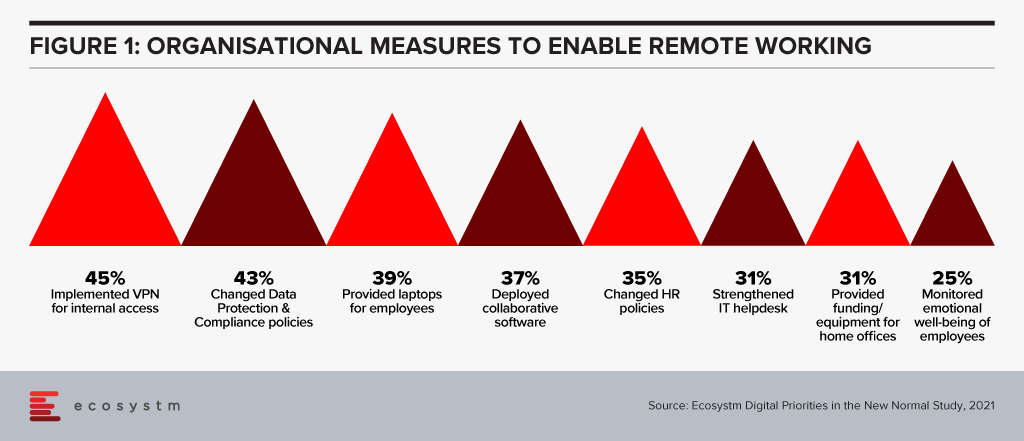

While the primary focus has been on optimising the work environment, it is time for organisations to start focusing on employee well-being. Ecosystm research shows that organisations implemented several measures to empower a remote workforce last year when the pandemic hit. But there was not enough focus on employee well-being (Figure 1).

William says, “A hybrid work environment may have negative impact on your employees. You may face issues such as longer working hours, employee burnout, lesser social engagements and connection, loneliness – and mental and emotional issues and depression”.

“Organisations that place an emphasis on the employees will see their revenues grow and also see less attrition. The more you invest in your people, the more you will get back in return. It is as simple as that! You can see that now in some organisations where employees are being given more flexibility, employers are not dictating how they should work, diversity and inclusion efforts have become mainstream, and efforts are being made to make employees feel like they belong.”

William adds, “However, Ecosystm research finds that organisations have gone back to putting customers and business growth first – losing focus on their employees. Only 27% of organisations globally say that they have improving employee experience as a key business priority in 2021. It is time for this culture and mindset to change. And solutions such as BetterUp can make a difference.”

Transform and be better prepared for future disruption, and the ever-changing competitive environment and customer, employee or partner demands in 2021. Download Ecosystm Predicts: The top 5 Future of Work Trends For 2021.

As organisations stride towards digitalisation, re-evaluating their business continuity plans and defining how the Future of Work will look for them, cloud adoption is expected to surge. Almost all technologies being evaluated by organisations today have cloud as their pillar. Cloud will the key enabler for ease of doing business, real-time data access for productivity increase, and process automation.

Ecosystm Advisors Claus Mortensen, Darian Bird and Tim Sheedy present the top 5 Ecosystm predictions for Cloud Trends in 2021. This is a summary of our cloud predictions – the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Cloud Trends for 2021

- 2021 Will be All About SaaS

2020 was a breakout year for SaaS providers – and a tough one for a lot of on-premises software vendors. SaaS (or mainly SaaS) providers like Salesforce, Zoom, Microsoft had record growth and some of the best quarters in their history, while other mainly on-premises software providers have had poor quarters. SAP is even accelerating the transition to a 100% cloud-based business as their revenue suffers. The race to deploy SaaS tools and platforms is well and truly happening. Many of the usual ROI models and business cases have been abandoned as the need for agility – to drive business change at pace trumps most other business needs. Ecosystm data validates this

This trend will continue in 2021 – in fact, we expect it to accelerate. Most SaaS solutions (such as CRM, ERP, SCM, HRM etc.) are implemented by less than 30% of businesses today – which means the upside for the SaaS providers is huge.

- Hybrid Cloud Will Finally Become Mainstream

The sudden move to remote working in 2020 forced most organisations to increase their use and reliance on cloud-based applications. Employees have relied on collaborative tools such as Zoom, Microsoft Teams and WebEx to conduct virtual meetings, call centre workers had to respond to calls from home – most if not all relying on cloud-based apps and platforms. This trend is set to continue going forward. Ecosystm research finds that 44% of organisations will spend more on cloud-based collaboration tools in the next 6-12 months.

But the forced adoption of these tools has also prompted many – especially larger organisations – to worry about losing control of their IT resources, including worries related to security and compliance, cost, and reliability. As for the latter, both Microsoft Azure and Zoom experienced outages after the pandemic hit and this has made many organisations wary of relying too much on a single public cloud platform. Ecosystm therefore expects a sharp increase in focus on hybrid cloud platforms in 2021 as IT Teams seek to regain control of the apps and services their employees rely the most upon.

- Carrier Investment in 5G Will Give Edge Computing a Boost

The gap between the hype around edge computing and the actual capabilities it offers will narrow in 2021 as 5G networks are built out. One of the most promising methods of deploying edge computing involves carriers embedding cloud capacity in their own data centres connected to their 5G networks. This ensures data does not unnecessarily leave the network, reducing latency and preserving bandwidth. This combination of 5G and the Edge will be of particular benefit to applications that until now have faced a trade-off between mobility and connectivity. Over the last twelve months, the major hyperscalers announced their 5G edge computing offerings, and some of the major global telecom providers have served as test cases by partnering with at least one hyperscaler and will likely add more over the next year. Expect this ecosystem to expand greatly in 2021.

Cloud environments can benefit from pushing computing-heavy workloads to the Edge in much the same way as IoT and provides a great platform for managing the edge computing endpoints. The flipside of pushing containers to the Edge will be the increased complexity and the fact that the number of attack surfaces will increase. Containerisation must therefore be deployed with security at its core.

- Stateful Applications Will Move to the Cloud with Containers and Orchestration

As organisations seek to migrate workloads and applications between platforms in an increasingly hybrid cloud environment, the need for “lifting and shifting”, refactoring and partitioning applications will increase. These approaches all have their shortcomings, however. Lifting and shifting an application may limit its functionality now or in the future; refactoring may take too long or be too costly; and partitioning is often not feasible or possible. A better approach to this task is to modernise the applications to make use of application containers like Docker, Windows Server Containers, Linux VServer and so on, to enable a faster and more seamless way to migrate applications between platforms. We also see container orchestration environments like Kubernetes and containerised development and deployment platforms like IBM’s Cloud Paks.

How these technologies are used to deploy stateful applications in multicloud environments will evolve. A raft of container management platforms, based on Kubernetes, are being released to simplify what was once a complex DIY process. New entrants will look to challenge the cloud hyperscalers, virtualisation giants, and Kubernetes specialists. The emerging features that previously required cobbling together third-party tools, like service mesh, data fabric, and machine learning, will speed up containerisation of stateful core applications. The deployment of containers on bare metal rather than in virtualised environments will also gather pace. The most challenging task will be delivering containerised applications at the Edge, forcing developers and platform providers to create inventive solutions.

- Serverless will take us a step closer to NoOps

As the application lifecycle speeds up and the distinction between development and operations shrinks, the motivation to adopt serverless computing will grow in 2021. While NoOps, the concept that operations could become so automated that it fades into the background, is still a distant goal, serverless computing will make a stride in that direction by abstracting the application from the infrastructure. Having seen the agility benefits of a microservices architecture, many DevOps teams will experiment with breaking services down further into functions. Moreover, the pay-as-you-go model of serverless will appeal to OpEx driven organisations. Expect stories of bill shock, however, as were seen in the early days of cloud adoption. While AWS Lambda is currently considered the serverless industry standard, it is likely that in 2021, Microsoft, Google, and IBM will ramp up efforts in this space. Each of these providers will build out their offering in terms of languages supported, event triggers, consumption plans, machine learning/AI options, observability, and user experience.

Ecosystm had predicted that in 2020, AI and analytics would be a top priority for organisations as they embarked or continued on their Digital Transformation journeys. What we saw instead was organisations collecting the right data – but handling more pressing matters this year. They focused more on cybersecurity frameworks, enabling remote employees and the shifts in product and service delivery. In 2021, as organisations work their way to recovery, they will re-evaluate their AI and automation roadmaps, more actively. Ecosystm Advisors Alea Fairchild, Andrew Milroy and Tim Sheedy present the top 5 Ecosystm predictions for AI & Automation in 2021.

This is a summary of the AI & Automation predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 AI & Automation Trends for 2021

- AI Will Move from a Competitive Advantage to a Must-Have

The best practices and leading-edge technology-centric implementations, over the years gives a very good indication of market trends. In 2018 and 2019 AI-centric engagements were few and far between – they were still in the “innovation stage” as trials and small projects. In 2020, AI was mentioned in most applications, showcased as best practices. AI is currently a competitive advantage for businesses. CIOs and their businesses are using AI to get ahead of their competitors and highlighting these practices for external recognition.

That also means that it is a matter of time before AI becomes a standard practice – processes are smart “out-of-the-box”; intelligent applications are an expectation, not the exception; systems learn because that is how they were designed, not as an overlay. If your competitors are using AI today to get ahead of you, then you need to also use AI to catch up and keep up. In 2021, having a smart business will not get you ahead of the pack – it will move you into it.

- AI Will Thrive in Areas where the Cost of Failure is Low

While organisations will be forced to adopt AI to remain competitive, initial exploration of AI solutions will be in areas that they consider low risk. The Financial Services, Retail, and other transaction-oriented industries will use AI to drive improved personalisation, increase customer retention, and improve their ability to lower risk and combat fraud. These are process-driven areas, where manual processes are being enhanced and enriched by AI. Although machine learning and other AI technologies will help improve the speed and quality of services, they will not be a replacement for many of the more complex business practices that companies and their employees frequently overlook to automate. The ‘low hanging fruit’ to add AI to will come first, with various degrees of success.

There will be industries and processes where organisations will be more skeptical about adopting AI. If Google finds a wrong translation or gives a wrong link, it is not a big concern, unlike a wrong diagnosis or wrong medication. In areas that are crucial to our well-being – such as healthcare – AI does not yet have the trust for acceptance of society. There are still questions around ethics and algorithm concerns.

- Technology Providers Will Stop Talking about AI

Technology vendors highlight what they consider their key differentiators, that show that they are ahead of the game. When every piece of software and hardware is intelligent, vendors will stop talking about the fact that they are intelligent. This may not fully happen in 2021 – but ENOUGH technology will be intelligent for those who have not yet made their software smart to understand that they cannot talk about its intelligent capabilities as that just shows they are behind the market.

The good news is that the less we hear about AI, the more intelligent applications will become. AI is quickly becoming a core capability and a base expectation. Systems that learn and adapt will be standard very soon – but be wary, as significant market changes can break these systems! Many companies learned that the pandemic broke their algorithms as times were no longer “normal”.

- Enterprises Will Seek Hyperautomation Solutions

RPA will increasingly become part of large enterprise application implementations. Technology vendors are adding RPA functionality either organically or through acquisitions to their enterprise application suites. RPA often works in conjunction with major software products provided by companies such as Salesforce, SAP, Microsoft, and IBM. Rather than having an operative enter data into multiple systems, a bot can be created to do this. Large software vendors are taking advantage of this opportunity by trying to own entire workflows. They are increasingly integrating RPA into their offerings as well as competing directly in the RPA market with pureplay RPA vendors.

As the RPA offerings continue to mature, enterprises seek to scale implementations and to automate non-repetitive processes, which require more intelligence. They will seek to automate more processes at scale. They will demand solutions that process unstructured data, handle exceptions, and continuously learn, further increasing productivity. Intelligent automation typically incorporates AI, particularly voice and vision capabilities and uses machine learning to optimise processes. Hyperautomation turbo charges intelligent automation by automating multiple processes at scale – and will become core to digital transformation initiatives in 2021.

- Businesses Will Put “Automation Targets” in Place

2020 was the year that many businesses started seeing some broad and tangible benefits from their automation initiatives. Automation was one of the big winners of the year, as many businesses took extra steps to take humans out of processes – particularly those humans that had to be in a specific location, such as a warehouse, the finance team, the front desk and so on (because of the pandemic, they were often working at home instead). Senior management is seeing the benefits of automation, and they will start to ask their teams why more processes are not automated Therefore we will start to see managers put targets around a certain percentage of tasks automated in an area – e.g. 70% of contact centre processes will be automated, 90% of the digital customer experience for a certain outcome will be automated and so on. Achieving these numbers may not be easy, but the targets will change the mindset of people designing, implementing, and improving processes.

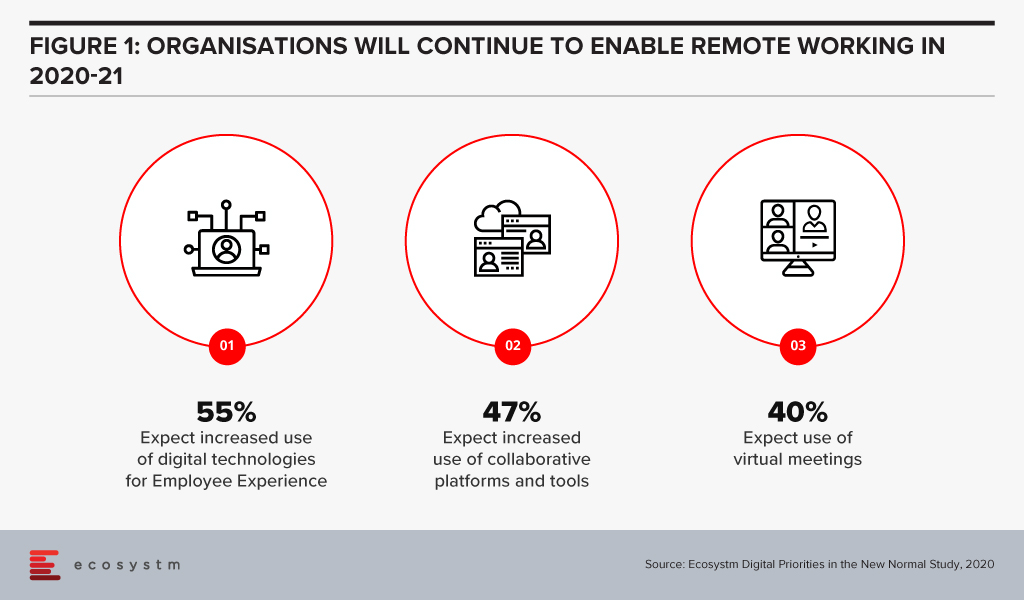

The Future of Work is here, now. Organisations were faced with unprecedented challenges of coping with the work-from-home model, when COVID-19 hit earlier this year. Many organisations managed the pivot very successfully, but all organisations were impacted in some way. Various trends have emerged over the last few months, that are likely to persist long after the immediate COVID-19 measures are removed by countries. In the Ecosystm Digital Priorities in the New Normal study, we find that organisations will continue to cater for remote employees (Figure 1) and keep a firm eye on employee experience (EX).

August has seen these clear trends in the Future of Work

#1 Tech companies leading from the front in embracing the Future of Work

As the pandemic continued to spread across the globe, various companies adopted the work from home model at a scale never seen before. While it is still unclear how the work model will look like, many companies continue to extend their remote working policies for the remaining year, and some are even thinking of making it a permanent move.

Tech companies appear to be the most proactive in extending remote working. Google, Microsoft, and AWS have all extended their work from home model till the end of the year or till the middle of next year. Earlier in the month Facebook extended its work from home program until mid-2021 and are also giving employees USD 1,000 to equip their home offices. This appears to be a long-term policy, with the company announcing in May that in the next 5-10 years, they expect 50% of their employees to be remote. Similarly, Salesforce and Uber also announced that they would be extending remote working till the mid-next year, and are providing funding for employees to set up the right work environment.

In Australia, Atlassian has made work from home a permanent option for their employees. They will continue to operate their physical offices but have given employees the option to choose where they want to work from.

Some organisations have gone beyond announcing these measures. Slack has talked about how they are evolving their corporate culture. For example, they have evolved their hiring policies and most new roles are open to remote candidates. Going forward, they are evaluating a more asynchronous work environment where employees can work the hours that make sense for them. In their communique, they are open about the fluid nature of the work environment and the challenges that employees and organisations might face as their shift their work models.

Organisations will have to evaluate multiple factors before coming up with the right model that suits their corporate culture and nature of work, but it appears that tech companies are showing the industry how it can be done.

#2 Tech companies evolve their capabilities to enable the Future of Work

Right from the start of the crisis, we have seen organisations make technology-led pivots. Technology providers are responding – and fast – to the changing environment and are evolving their capabilities to help their customers embrace the digital Future of Work.

Many of these responses have included strengthening their ecosystems and collaborating with other technology providers. Wipro and Intel announced a collaboration between Wipro’s LIVE Workspace digital workspace solution and the Intel vPro platform to enable remote IT support and solution. The solution provides enhanced protection and security against firmware-level attacks. Slack and Atlassian strengthened their alliance with app integrations and an account ‘passport’ in a joint go-to-market move, to reduce the time spent logging into separate services and products. This will enable both vendors to focus on their strengths in remote working tools and provide seamless services to their customers.

Tech companies have also announced product enhancements and new capabilities. CBTS has evolved their cloud-based unified communications, collaboration and networking solutions, with an AI-powered Secure Remote Collaboration solution, powered by Cisco Webex. With seamless integration of Cisco Webex software, Cisco Security software, and endpoints that combine high-definition cameras, microphones, and speakers, with automatic noise reduction, the solution now offers features such real-time transcription, closed captioning, and recording for post-meeting transcripts.

Communication and Collaboration tools have been in the limelight since the start of the crisis with providers such as Zoom, Microsoft Teams and Slack introducing new features throughout. In August Microsoft enhanced the capabilities of Teams and introduced a range of new features to the Teams Business Communications System. It now offers the option to host calls of up to 20,000 participants with a limit to 1,000 for interactive meetings, after which the call automatically shifts to a “view only” mode. With the possibility of remote working becoming a reality even after the crisis is over, Microsoft is looking to make Teams relevant for a range of meeting needs – from one-on-one meetings up to large events and conferences. In the near future, the solution will also allow organisations to add corporate branding, starting with branded meeting lobbies, followed by branded meeting experiences.

While many of these solutions are aimed at large enterprises, tech providers are also aware that they are now receiving a lot of business from small and medium enterprises (SMEs), struggling to make changes to their technology environment with limited resources. Juniper has expanded their WiFi 6 access points to include 4 new access points aimed at outdoor environments, SMEs, retail sites, K-12 schools, medical clinics and even the individual remote worker. While WiFi 6 is designed for high-density public or private environments, it is also designed for IoT deployments and in workplaces that use videoconferencing and other applications that require high bandwidth.

#3 The Future of Work is driving up hardware sales

Ecosystm research shows that at the start of the crisis, 76% of organisations increased investments in hardware – including PCs, devices, headsets, and conferencing units – and 67% of organisations expect their hardware spending to go up in 2020-21. Remote working remains a reality across enterprises. Despite the huge increase in demand, it became difficult for hardware providers to fulfil orders initially, with a disrupted supply chain, store closures and a rapid shift to eCommerce channels. This quarter has seen a steady rise in hardware sales, as providers overcome some of their initial challenges.

Apart from enterprise sales, there has been a surge in the consumer demand for PCs and devices. While remote working is a key contributor, online education and entertainment are mostly prompting homebound people to invest more in hardware. Even accessories such as joysticks are in short supply – a trend that seems to have been accelerated by the Microsoft Flight Simulator launch earlier this month.

The demand for both iPad and Mac saw double-digit growth in this quarter. Around half of the customers purchasing these devices were new to the product. Apple sees the rise in demand from remote workers and students. Lenovo reported a 31% increase in Q1 net profits with demand surges in China, Europe, the Middle East and Africa.

#4 The impact on Real Estate is beginning to show

The demand for prime real estate has been hit by remote working and organisations not renewing leases or downsizing – both because most employees are working remotely and because of operational cost optimisation during the crisis. This is going to have a longer-term impact on the market, as organisations re-evaluate their need for physical office space. Some organisations will reduce office space, and many will re-design their offices to cater to virtual interactions (Figure 1). While now, Ecosystm research shows that only 16% of enterprises are expecting a reduction of commercial space, this might well change over the months to come. Organisations might even feel the need to have multiple offices in suburbs to make it convenient for their hybrid workers to commute to work on the days they have to. Amazon is offering employees additional choices for smaller offices outside the city of Seattle.

But the Future of Work and the rise of a distributed workforce is beginning to show an initial impact on the real estate industry. Last week saw Pinterest cancel a large office lease at a building to be constructed near its headquarters in San Francisco. The company felt that it might not be the right time to go ahead with the deal, as they are re-evaluating where employees would like to work from in the future. Even the termination fees of USD 89.5 million did not discourage them. They will continue to maintain their existing work premises but do not see feel that it is the right time to make additional real estate investments, as they re-evaluate where employees would like to work from in the future.

There is a need for organisations to prepare themselves for the Future of Work – now! Ecosystm has launched a new 360o Future of Work practice, leveraging real-time market data from our platform combined with insights from our industry practitioners and experienced analysts, to guide organisations as they shift and define their new workplace strategies.