AI has already had a significant impact on the tech industry, rapidly evolving software development, data analysis, and automation. However, its potential extends into all industries – from the precision of agriculture to the intricacies of life sciences research, and the enhanced customer experiences across multiple sectors.

While we have seen the widespread adoption of AI-powered productivity tools, 2025 promises a bigger transformation. Organisations across industries will shift focus from mere innovation to quantifiable value. In sectors where AI has already shown early success, businesses will aim to scale these applications to directly impact their revenue and profitability. In others, it will accelerate research, leading to groundbreaking discoveries and innovations in the years to come. Regardless of the specific industry, one thing is certain: AI will be a driving force, reshaping business models and competitive landscapes.

Ecosystm analysts Alan Hesketh, Clay Miller, Peter Carr, Sash Mukherjee, and Steve Shipley present the top trends shaping key industries in 2025.

Click here to download ‘AI’s Impact on Industry in 2025’ as a PDF

1. GenAI Virtual Agents Will Reshape Public Sector Efficiency

Operating within highly structured, compliance-driven environments, public sector organisations are well-positioned to benefit from GenAI Agents.

These agents excel when powered LLMs tailored to sector-specific needs, informed by documented legislation, regulations, and policies. The result will be significant improvements in how governments manage rising service demands and enhance citizen interactions. From automating routine enquiries to supporting complex administrative processes, GenAI Virtual Agents will enable public sector to streamline operations without compromising compliance. Crucially, these innovations will also address jurisdictional labour and regulatory requirements, ensuring ethical and legal adherence. As GenAI technology matures, it will reshape public service delivery by combining scalability, precision, and responsiveness.

2. Healthcare Will Lead in Innovation; Lag in Adoption

In 2025, healthcare will undergo transformative innovations driven by advancements in AI, remote medicine, and biotechnology. Innovations will include personalised healthcare driven by real-time data for tailored wellness plans and preventive care, predictive AI tackling global challenges like aging populations and pandemics, virtual healthcare tools like VR therapy and chatbots enhancing accessibility, and breakthroughs in nanomedicine, digital therapeutics, and next-generation genomic sequencing.

Startups and innovators will often lead the way, driven by a desire to make an impact.

However, governments will lack the will to embrace these technologies. After significant spending on crisis management, healthcare ministries will likely hesitate to commit to fresh large-scale investments.

3. Agentic AI Will Move from Bank Credit Recommendation to Approval

Through 2024, we have seen a significant upturn in Agentic AI making credit approval recommendations, providing human credit managers with the ability to approve more loans more quickly. Yet, it was still the mantra that ‘AI recommends—humans approve.’ That will change in 2025.

AI will ‘approve’ much more and much larger credit requests.

The impact will be multi-faceted: banks will greatly enhance client access to credit, offering 24/7 availability and reducing the credit approval and origination cycle to mere seconds. This will drive increased consumer lending for high-value purchases, such as major appliances, electronics, and household goods.

4. AI-Powered Demand Forecasting Will Transform Retail

There will be a significant shift away from math-based tools to predictive AI using an organisation’s own data. This technology will empower businesses to analyse massive datasets, including sales history, market trends, and social media, to generate highly accurate demand predictions. Adding external influencing factors such as weather and events will be simplified.

The forecasts will enable companies to optimise inventory levels, minimise stockouts and overstock situations, reduce waste, and increase profitability. Early adopters are already leveraging AI to anticipate fashion trends and adjust production accordingly.

No more worrying about capturing “Demand Influencing Factors” – it will all be derived from the organisation’s data.

5. AI-Powered Custom-Tailored Insurance Will Be the New Norm

Insurers will harness real-time customer data, including behavioural patterns, lifestyle choices, and life stage indicators, to create dynamic policies that adapt to individual needs. Machine learning will process vast datasets to refine risk predictions and deliver highly personalised coverage. This will produce insurance products with unparalleled relevance and flexibility, closely aligning with each policyholder’s changing circumstances. Consumers will enjoy transparent pricing and tailored options that reflect their unique risk profiles, often resulting in cost savings. At the same time, insurers will benefit from enhanced risk assessment, reduced fraud, and increased customer satisfaction and loyalty.

This evolution will redefine the customer-insurer relationship, making insurance a more dynamic and responsive service that adjusts to life’s changes in real-time.

Southeast Asia’s banking sector is poised for significant digital transformation. With projected Net Interest Income reaching USD 148 billion by 2024, the market is ripe for continued growth. While traditional banks still hold a dominant position, digital players are making significant inroads. To thrive in this evolving landscape, financial institutions must adapt to rising customer expectations, stringent regulations, and the imperative for resilience. This will require a seamless collaboration between technology and business teams.

To uncover how banks in Southeast Asia are navigating this complex landscape and what it takes to succeed, Ecosystm engaged in in-depth conversations with senior banking executives and technology leaders as part of our research initiatives. Here are the highlights of the discussions with leaders across the region.

#1 Achieving Hyper-Personalisation Through AI

As banks strive to deliver highly personalised financial services, AI-driven models are becoming increasingly essential. These models analyse customer behaviour to anticipate needs, predict future behaviour, and offer relevant services at the right time. AI-powered tools like chatbots and virtual assistants further enhance real-time customer support.

Hyper-personalisation, while promising, comes with its challenges – particularly around data privacy and security. To deliver deeply tailored services, banks must collect extensive customer information, which raises the question: how can they ensure this sensitive data remains protected?

AI projects require a delicate balance between innovation and regulatory compliance. Regulations often serve as the right set of guardrails within which banks can innovate. However, banks – especially those with cross-border operations – must establish internal guidelines that consider the regulatory landscape of multiple jurisdictions.

#2 Beyond AI: Other Emerging Technologies

AI isn’t the only emerging technology reshaping Southeast Asian banking. Banks are increasingly adopting technologies like Robotic Process Automation (RPA) and blockchain to boost efficiency and engagement. RPA is automating repetitive tasks, such as data entry and compliance checks, freeing up staff for higher-value work. CIMB in Malaysia reports seeing a 35-50% productivity increase thanks to RPA. Blockchain is being explored for secure, transparent transactions, especially cross-border payments. The Asian Development Bank successfully trialled blockchain for faster, safer bond settlements. While AR and VR are still emerging in banking, they offer potential for enhanced customer engagement. Banks are experimenting with immersive experiences like virtual branch visits and interactive financial education tools.

The convergence of these emerging technologies will drive innovation and meet the rising demand for seamless, secure, and personalised banking services in the digital age. This is particularly true for banks that have the foresight to future-proof their tech foundation as part of their ongoing modernisation efforts. Emerging technologies offer exciting opportunities to enhance customer engagement, but they shouldn’t be used merely as marketing gimmicks. The focus must be on delivering tangible benefits that improve customer outcomes.

#3 Greater Banking-Fintech Collaboration

The digital payments landscape in Southeast Asia is experiencing rapid growth, with a projected 10% increase between 2024-2028. Digital wallets and contactless payments are becoming the norm, and platforms like GrabPay, GoPay, and ShopeePay are dominating the market. These platforms not only offer convenience but also enhance financial inclusion by reaching underbanked populations in remote areas.

The rise of digital payments has significantly impacted traditional banks. To remain relevant in this increasingly cashless society, banks are collaborating with fintech companies to integrate digital payment solutions into their services. For instance, Indonesia’s Bank Mandiri collaborated with digital credit services provider Kredivo to provide customers with access to affordable and convenient credit options.

Partnerships between traditional banks and fintechs are essential for staying competitive in the digital age, especially in areas like digital payments, data analytics, and customer experience.

While these collaborations offer opportunities, they also pose challenges. Banks must invest in advanced fraud detection, AI monitoring, and robust authentication to secure digital payments. Once banks adopt a mindset of collaboration with innovators, they can leverage numerous innovations in the cybersecurity space to address these challenges.

#4 Agile Infrastructure for an Agile Business

While the banking industry is considered a pioneer in implementing digital technologies, its approach to cloud has been more cautious. While interest remained high, balancing security and regulatory concerns with cloud agility impacted the pace. Hybrid multi-cloud environments has accelerated banking cloud adoption.

Leveraging public and private clouds optimises IT costs, offering flexibility and scalability for changing business needs. Hybrid cloud allows resource adjustments for peak demand or cost reductions off-peak. Access to cloud-native services accelerates innovation, enabling rapid application development and improved competitiveness. As the industry adopts GenAI, it requires infrastructure capable of handling vast data, massive computing power, advanced security, and rapid scalability – all strengths of hybrid cloud.

Replicating critical applications and data across multiple locations ensures disaster recovery and business continuity. A multi-cloud strategy also helps avoid vendor lock-in, diversifies cloud providers, and reduces exposure to outages.

Hybrid cloud adoption offers benefits but also presents challenges for banks. Managing the environment is complex, needing coordination across platforms and skilled personnel. Ensuring data security and compliance across on-prem and public cloud infrastructure is demanding, requiring robust measures. Network latency and performance issues can arise, making careful design and optimisation crucial. Integrating on-prem systems with public cloud services is time-consuming and needs investment in tools and expertise.

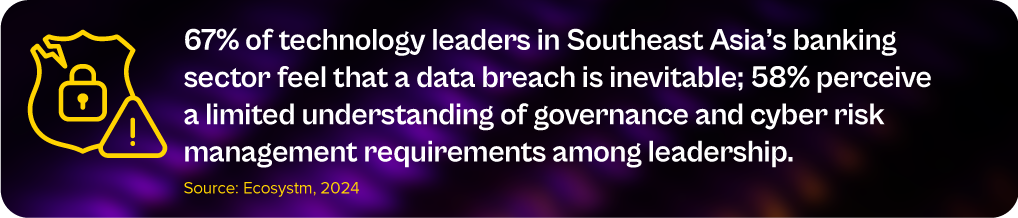

#5 Cyber Measures to Promote Customer & Stakeholder Trust

The banking sector is undergoing rapid AI-driven digital transformation, focusing on areas like digital customer experiences, fraud detection, and risk assessment. However, this shift also increases cybersecurity risks, with the majority of banking technology leaders anticipate inevitable data breaches and outages.

Key challenges include expanding technology use, such as cloud adoption and AI integration, and employee-related vulnerabilities like phishing. Banks in Southeast Asia are investing heavily in modernising infrastructure, software, and cybersecurity.

Banks must update cybersecurity strategies to detect threats early, minimise damage, and prevent lateral movement within networks.

Employee training, clear security policies, and a culture of security consciousness are critical in preventing breaches.

Regulatory compliance remains a significant concern, but banks are encouraged to move beyond compliance checklists and adopt risk-based, intelligence-led strategies. AI will play a key role in automating compliance and enhancing Security Operations Centres (SOCs), allowing for faster threat detection and response. Ultimately, the BFSI sector must prioritise cybersecurity continuously based on risk, rather than solely on regulatory demands.

Breaking Down Barriers: The Role of Collaboration in Banking Transformation

Successful banking transformation hinges on a seamless collaboration between technology and business teams. By aligning strategies, fostering open communication, and encouraging cross-functional cooperation, banks can effectively leverage emerging technologies to drive innovation, enhance customer experience, and improve efficiency.

A prime example of the power of collaboration is the success of AI initiatives in addressing specific business challenges.

This user-centric approach ensures that technology addresses real business needs.

By fostering a culture of collaboration, banks can promote continuous learning, idea sharing, and innovation, ultimately driving successful transformation and long-term growth in the competitive digital landscape.

In the Ecosystm Predicts: Building an Agile & Resilient Organisation: Top 5 Trends in 2024, Principal Advisor Darian Bird said, “The emergence of Generative AI combined with the maturing of deepfake technology will make it possible for malicious agents to create personalised voice and video attacks.” Darian highlighted that this democratisation of phishing, facilitated by professional-sounding prose in various languages and tones, poses a significant threat to potential victims who rely on misspellings or oddly worded appeals to detect fraud. As we see more of these attacks and social engineering attempts, it is important to improve defence mechanisms and increase awareness.

Understanding Deepfake Technology

The term Deepfake is a combination of the words ‘deep learning’ and ‘fake’. Deepfakes are AI-generated media, typically in the form of images, videos, or audio recordings. These synthetic content pieces are designed to appear genuine, often leading to the manipulation of faces and voices in a highly realistic manner. Deepfake technology has gained spotlight due to its potential for creating convincing yet fraudulent content that blurs the line of reality.

Deepfake algorithms are powered by Generative Adversarial Networks (GANs) and continuously enhance synthetic content to closely resemble real data. Through iterative training on extensive datasets, these algorithms refine features such as facial expressions and voice inflections, ensuring a seamless emulation of authentic characteristics.

Deepfakes Becoming Increasingly Convincing

Hyper-realistic deepfakes, undetectable to the human eye and ear, have become a huge threat to the financial and technology sectors. Deepfake technology has become highly convincing, blurring the line between real and fake content. One of the early examples of a successful deepfake fraud was when a UK-based energy company lost USD 243k through a deepfake audio scam in 2019, where scammers mimicked the voice of their CEO to authorise an illegal fund transfer.

Deepfakes have evolved from audio simulations to highly convincing video manipulations where faces and expressions are altered in real-time, making it hard to distinguish between real and fake content. In 2022, for instance, a deepfake video of Elon Musk was used in a crypto scam that resulted in a loss of about USD 2 million for US consumers. This year, a multinational company in Hong Kong lost over USD 25 million when an employee was tricked into sending money to fraudulent accounts after a deepfake video call by what appeared to be his colleagues.

Regulatory Responses to Deepfakes

Countries worldwide are responding to the challenges posed by deepfake technology through regulations and awareness campaigns.

- Singapore’s Online Criminal Harms Act, that will come into effect in 2024, will empower authorities to order individuals and Internet service providers to remove or block criminal content, including deepfakes used for malicious purposes.

- The UAE National Programme for Artificial Intelligence released a deepfake guide to educate the public about both harmful and beneficial applications of this technology. The guide categorises fake content into shallow and deep fakes, providing methods to detect deepfakes using AI-based tools, with a focus on promoting positive uses of advanced technologies.

- The proposed EU AI Act aims to regulate them by imposing transparency requirements on creators, mandating them to disclose when content has been artificially generated or manipulated.

- South Korea passed a law in 2020 banning the distribution of harmful deepfakes. Offenders could be sentenced to up to five years in prison or fined up to USD 43k.

- In the US, states like California and Virginia have passed laws against deepfake pornography, while federal bills like the DEEP FAKES Accountability Act aim to mandate disclosure and counter malicious use, highlighting the diverse global efforts to address the multifaceted challenges of deepfake regulation.

Detecting and Protecting Against Deepfakes

Detecting deepfake becomes increasingly challenging as technology advances. Several methods are needed – sometimes in conjunction – to be able to detect a convincing deepfake. These include visual inspection that focuses on anomalies, metadata analysis to examine clues about authenticity, forensic analysis for pattern and audio examination, and machine learning that uses algorithms trained on real and fake video datasets to classify new videos.

However, identifying deepfakes requires sophisticated technology that many organisations may not have access to. This heightens the need for robust cybersecurity measures. Deepfakes have seen an increase in convincing and successful phishing – and spear phishing – attacks and cyber leaders need to double down on cyber practices.

Defences can no longer depend on spotting these attacks. It requires a multi-pronged approach which combines cyber technologies, incidence response, and user education.

Preventing access to users. By employing anti-spoofing measures organisations can safeguard their email addresses from exploitation by fraudulent actors. Simultaneously, minimising access to readily available information, particularly on websites and social media, reduces the chance of spear-phishing attempts. This includes educating employees about the implications of sharing personal information and clear digital footprint policies. Implementing email filtering mechanisms, whether at the server or device level, helps intercept suspicious emails; and the filtering rules need to be constantly evaluated using techniques such as IP filtering and attachment analysis.

Employee awareness and reporting. There are many ways that organisations can increase awareness in employees starting from regular training sessions to attack simulations. The usefulness of these sessions is often questioned as sometimes they are merely aimed at ticking off a compliance box. Security leaders should aim to make it easier for employees to recognise these attacks by familiarising them with standard processes and implementing verification measures for important email requests. This should be strengthened by a culture of reporting without any individual blame.

Securing against malware. Malware is often distributed through these attacks, making it crucial to ensure devices are well-configured and equipped with effective endpoint defences to prevent malware installation, even if users inadvertently click on suspicious links. Specific defences may include disabling macros and limiting administrator privileges to prevent accidental malware installation. Strengthening authentication and authorisation processes is also important, with measures such as multi-factor authentication, password managers, and alternative authentication methods like biometrics or smart cards. Zero trust and least privilege policies help protect organisation data and assets.

Detection and Response. A robust security logging system is crucial, either through off-the shelf monitoring tools, managed services, or dedicated teams for monitoring. What is more important is that the monitoring capabilities are regularly updated. Additionally, having a well-defined incident response can swiftly mitigate post-incident harm post-incident. This requires clear procedures for various incident types and designated personnel for executing them, such as initiating password resets or removing malware. Organisations should ensure that users are informed about reporting procedures, considering potential communication challenges in the event of device compromise.

Conclusion

The rise of deepfakes has brought forward the need for a collaborative approach. Policymakers, technology companies, and the public must work together to address the challenges posed by deepfakes. This collaboration is crucial for making better detection technologies, establishing stronger laws, and raising awareness on media literacy.

Ecosystm research reveals a stark reality: 75% of technology leaders in Financial Services anticipate data breaches.

Given the sector’s regulatory environment, data breaches carry substantial financial implications, emphasising the critical importance of giving precedence to cybersecurity. This is compelling a fresh cyber strategy focused on early threat detection and reduction of attack impact.

Read on to find out how tech leaders are building a culture of cyber-resilience, re-evaluating their cyber policies, and adopting technologies that keep them one step ahead of their adversaries.

Download ‘Cyber-Resilience in Finance: People, Policy & Technology’ as a PDF

As an industry, the tech sector tends to jump on keywords and terms – and sometimes reshapes their meaning and intention. “Sustainable” is one of those terms. Technology vendors are selling (allegedly!) “sustainable software/hardware/services/solutions” – in fact, the focus on “green” or “zero carbon” or “recycled” or “circular economy” is increasing exponentially at the moment. And that is good news – as I mentioned in my previous post, we need to significantly reduce greenhouse gas emissions if we want a future for our kids. But there is a significant disconnect between the way tech vendors use the word “sustainable” and the way it is used in boardrooms and senior management teams of their clients.

Defining Sustainability

For organisations, Sustainability is a broad business goal – in fact for many, it is the over-arching goal. A sustainable organisation operates in a way that balances economic, social, and environmental (ESG) considerations. Rather than focusing solely on profits, a sustainable organisation aims to meet the needs of the present without compromising the ability of future generations to meet their own needs.

This is what building a “Sustainable Organisation” typically involves:

Economic Sustainability. The organisation must be financially stable and operate in a manner that ensures long-term economic viability. It doesn’t just focus on short-term profits but invests in long-term growth and resilience.

Social Sustainability. This involves the organisation’s responsibility to its employees, stakeholders, and the wider community. A sustainable organisation will promote fair labour practices, invest in employee well-being, foster diversity and inclusion, and engage in ethical decision-making. It often involves community engagement and initiatives that support societal growth and well-being.

Environmental Sustainability. This facet includes the responsible use of natural resources and minimising negative impacts on the environment. A sustainable organisation seeks to reduce its carbon footprint, minimise waste, enhance energy efficiency, and often supports or initiates activities that promote environmental conservation.

Governance and Ethical Considerations. Sustainable organisations tend to have transparent and responsible governance. They follow ethical business practices, comply with laws and regulations, and foster a culture of integrity and accountability.

Security and Resilience. Sustainable organisations have the ability to thwart bad actors – and in the situation that they are breached, to recover from these breaches quickly and safely. Sustainable organisations can survive cybersecurity incidents and continue to operate when breaches occur, with the least impact.

Long-Term Focus. Sustainability often requires a long-term perspective. By looking beyond immediate gains and considering the long-term impact of decisions, a sustainable organisation can better align its strategies with broader societal goals.

Stakeholder Engagement. Understanding and addressing the needs and concerns of different stakeholders (including employees, customers, suppliers, communities, and shareholders) is key to sustainability. This includes open communication and collaboration with these groups to foster relationships based on trust and mutual benefit.

Adaptation and Innovation. The organisation is not static and recognises the need for continual improvement and adaptation. This might include innovation in products, services, or processes to meet evolving sustainability standards and societal expectations.

Alignment with the United Nations’ Sustainable Development Goals (UNSDGs). Many sustainable organisations align their strategies and operations with the UNSDGs which provide a global framework for addressing sustainability challenges.

Organisations Appreciate Precise Messaging

A sustainable organisation is one that integrates economic, social, and environmental considerations into all aspects of its operations. It goes beyond mere compliance with laws to actively pursue positive impacts on people and the planet, maintaining a balance that ensures long-term success and resilience.

These factors are all top of mind when business leaders, boards and government agencies use the word “sustainable”. Helping organisations meet their emission reduction targets is a good starting point – but it is a long way from all businesses need to become sustainable organisations.

Tech providers need to reconsider their use of the term “sustainable” – unless their solution or service is helping organisations meet all of the features outlined above. Using specific language would be favoured by most customers – telling them how the solution will help them reduce greenhouse gas emissions, meet compliance requirements for CO2 and/or waste reduction, and save money on electricity and/or management costs – these are all likely to get the sale over the line faster than a broad “sustainability” messaging will.

The ongoing Ecosystm State of ESG Study throws up some interesting data about organisations in Asia Pacific.

We see ESG more firmly entrenched in organisational strategies; organisations leading with Social and Governance initiatives that are easily integrated within their CSR policies; and supply chain partners driving change.

Download ‘Sustainable Asia Pacific: The ESG Growth Story’ as a PDF

It is not hyperbole to state that AI is on the cusp of having significant implications on society, business, economies, governments, individuals, cultures, politics, the arts, manufacturing, customer experience… I think you get the idea! We cannot understate the impact that AI will have on society. In times gone by, businesses tested ideas, new products, or services with small customer segments before they went live. But with AI we are all part of this experiment on the impacts of AI on society – its benefits, use cases, weaknesses, and threats.

What seemed preposterous just six months ago is not only possible but EASY! Do you want a virtual version of yourself, a friend, your CEO, or your deceased family member? Sure – just feed the data. Will succession planning be more about recording all conversations and interactions with an executive so their avatar can make the decisions when they leave? Why not? How about you turn the thousands of hours of recorded customer conversations with your contact centre team into a virtual contact centre team? Your head of product can present in multiple countries in multiple languages, tailored to the customer segments, industries, geographies, or business needs at the same moment.

AI has the potential to create digital clones of your employees, it can spread fake news as easily as real news, it can be used for deception as easily as for benefit. Is your organisation prepared for the social, personal, cultural, and emotional impacts of AI? Do you know how AI will evolve in your organisation?

When we focus on the future of AI, we often interview AI leaders, business leaders, futurists, and analysts. I haven’t seen enough focus on psychologists, sociologists, historians, academics, counselors, or even regulators! The Internet and social media changed the world more than we ever imagined – at this stage, it looks like these two were just a rehearsal for the real show – Artificial Intelligence.

Lack of Government or Industry Regulation Means You Need to Self-Regulate

These rapid developments – and the notable silence from governments, lawmakers, and regulators – make the requirement for an AI Ethics Policy for your organisation urgent! Even if you have one, it probably needs updating, as the scenarios that AI can operate within are growing and changing literally every day.

- For example, your customer service team might want to create a virtual customer service agent from a real person. What is the policy on this? How will it impact the person?

- Your marketing team might be using ChatGPT or Bard for content creation. Do you have a policy specifically for the creation and use of content using assets your business does not own?

- What data is acceptable to be ingested by a public Large Language Model (LLM). Are are you governing data at creation and publishing to ensure these policies are met?

- With the impending public launch of Microsoft’s Co-Pilot AI service, what data can be ingested by Co-Pilot? How are you governing the distribution of the insights that come out of that capability?

If policies are not put in place, data tagged, staff trained, before using a tool such as Co-Pilot, your business will be likely to break some privacy or employment laws – on the very first day!

What do the LLMs Say About AI Ethics Policies?

So where do you go when looking for an AI Ethics policy? ChatGPT and Bard of course! I asked the two for a modern AI Ethics policy.

You can read what they generated in the graphic below.

I personally prefer the ChatGPT4 version as it is more prescriptive. At the same time, I would argue that MOST of the AI tools that your business has access to today don’t meet all of these principles. And while they are tools and the ethics should dictate the way the tools are used, with AI you cannot always separate the process and outcome from the tool.

For example, a tool that is inherently designed to learn an employee’s character, style, or mannerisms cannot be unbiased if it is based on a biased opinion (and humans have biases!).

LLMs take data, content, and insights created by others, and give it to their customers to reuse. Are you happy with your website being used as a tool to train a startup on the opportunities in the markets and customers you serve?

By making content public, you acknowledge the risk of others using it. But at least they visited your website or app to consume it. Not anymore…

A Policy is Useless if it Sits on a Shelf

Your AI ethics policy needs to be more than a published document. It should be the beginning of a conversation across the entire organisation about the use of AI. Your employees need to be trained in the policy. It needs to be part of the culture of the business – particularly as low and no-code capabilities push these AI tools, practices, and capabilities into the hands of many of your employees.

Nearly every business leader I interview mentions that their organisation is an “intelligent, data-led, business.” What is the role of AI in driving this intelligent business? If being data-driven and analytical is in the DNA of your organisation, soon AI will also be at the heart of your business. You might think you can delay your investments to get it right – but your competitors may be ahead of you.

So, as you jump head-first into the AI pool, start to create, improve and/or socialise your AI Ethics Policy. It should guide your investments, protect your brand, empower your employees, and keep your business resilient and compliant with legacy and new legislation and regulations.

With organisations facing an infrastructure, application, and end-point sprawl, the attack surface continues to grow; as do the number of malicious attacks. Cyber breaches are also becoming exceedingly real for consumers, as they see breaches and leaks in brands and services they interact with regularly. 2023 will see CISOs take charge of their cyber environment – going beyond a checklist.

Here are the top 5 trends for Cybersecurity & Compliance for 2023 according to Ecosystm analysts Alan Hesketh, Alea Fairchild, Andrew Milroy, and Sash Mukherjee.

- An Escalating Cybercrime Flood Will Drive Proactive Protection

- Incident Detection and Response Will Be the Main Focus

- Organisations Will Choose Visibility Over More Cyber Tools

- Regulations Will Increase the Risk of Collecting and Storing Data

- Cyber Risk Will Include a Focus on Enterprise Operational Resilience

Read on for more details.

Download Ecosystm Predicts: The Top 5 Trends for Cybersecurity & Compliance in 2023 as a PDF

Ecosystm and Bitstamp, conducted an invitation-only Executive ThinkTank at the Point Zero Forum in Zurich. A select group of regulators and senior leaders from financial institutions from across the globe came together to share their insights and experiences on Decentralised Finance (DeFi), innovations in the industry, and the outlook for the future.

Here are the 5 key takeaways from the ThinkTank.

- Regulators: Perception vs. Reality. Regulators are generally perceived as having a bias against innovations in the Financial Services industry. In reality, they want to encourage innovation, and the industry players welcome these regulations as guardrails against unscrupulous practices.

- Institutional Players’ Interest in DeFi. Many institutional players are interested in DeFi to enable the smooth running of processes and products and to reduce costs. It is being evaluated in areas such as lending, borrowing, and insurance.

- Evolving Traditional Regulations. In a DeFi world, participants and actors are connected by technology. Hence, setting the framework and imposing good practices when building projects will be critical. Regulations need to find the right balance between flexibility and rigidity.

- The Importance of a Digital Asset Listing Framework. There has been a long debate on who should be the gatekeeper of digital asset listings. From a regulator’s perspective, the liability of projects needs to shift from the consumer to the project and the gatekeeper.

- A Simplified Disclosure Document. Major players are willing to work with regulators to develop a simple disclosure document that describes the project for end-users or investors.

Read below to find out more.

Download Pathways for Aligning Innovation and Regulation in a DeFi World as a PDF