Two things happened recently that 99% of the ICT world would normally miss. After all microprocessor and chip interconnect technology is quite the geek area where we generally don’t venture into. So why would I want to bring this to your attention?

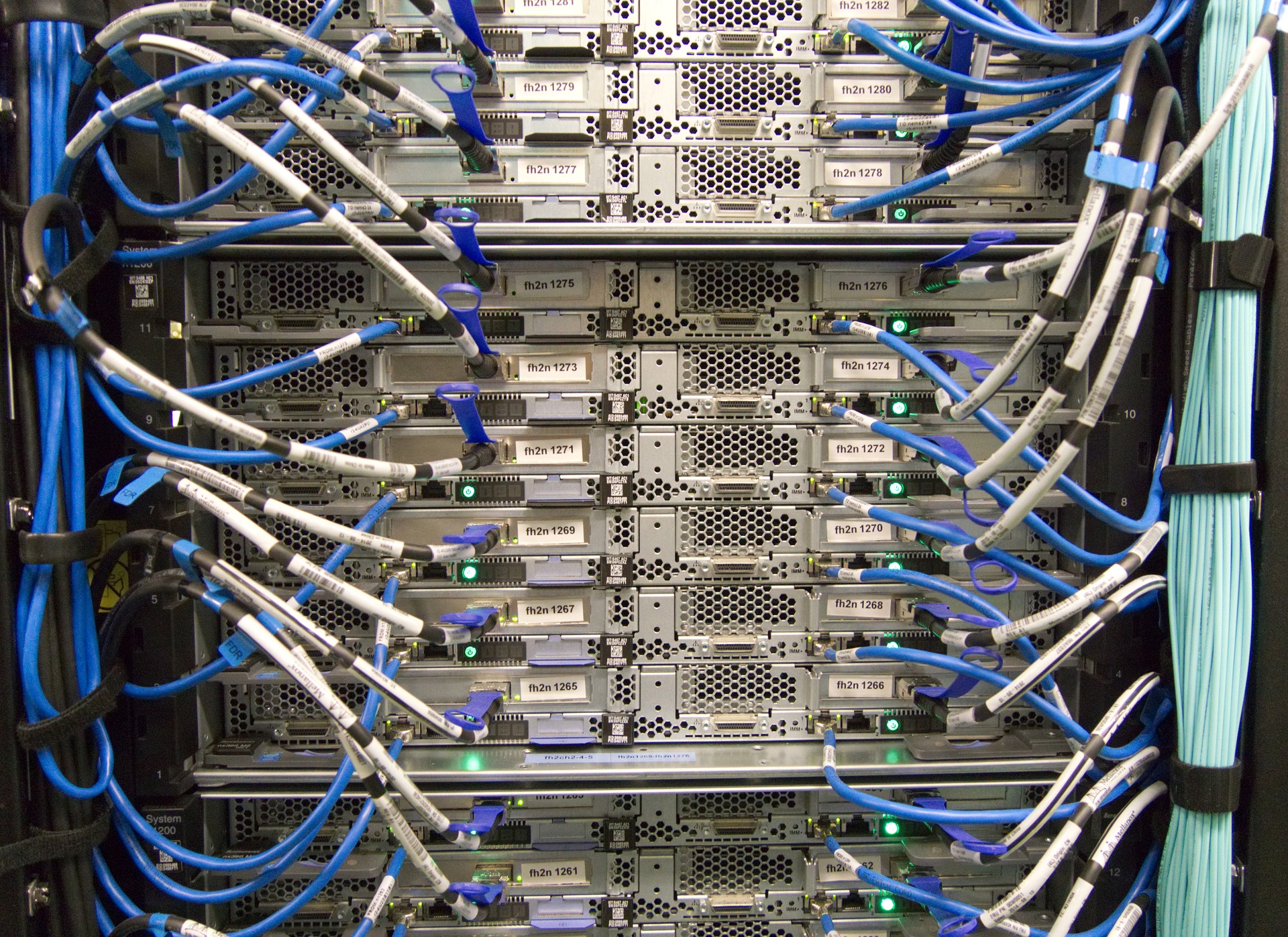

We are excited about the innovation that analytics, machine learning (ML) and all things real time processing will bring to our lives and the way we run our business. The data center, be it on an enterprise premise or truly on a cloud service provider’s infrastructure is being pressured to provide compute, memory, input/output (I/O) and storage requirements to take advantage of the hardware engineers would call ‘accelerators’. In its most simple form, an accelerator microprocessor does the specialty work for ML and analytics algorithms while the main microprocessor is trying to hold everything else together to ensure that all of the silicon parts are in sync. If we have a ML accelerator that is too fast with its answers, it will sit and wait for everyone else as its outcomes squeezed down a narrow, slow pipe or interconnect – in other words, the servers that are in the data center are not optimized for these workloads. The connection between the accelerators and the main components becomes the slowest and weakest link…. So now back to the news of the day.

A new high speed CPU-to-device interconnect standard, the Common Express Link (CXL) 1.0 was announced by Intel and a consortium of leading technology companies (Huawei and Cisco in the network infrastructure space, HPE and Dell EMC in the server hardware market, and Alibaba, Facebook, Google and Microsoft for the cloud services provider markets). CXL joins a crowded field of other standards already in the server link market including CAPI, NVLINK, GEN-Z and CCIX. CXL is being positioned to improve the performance of the links between FPGA and GPUs, the most common accelerators to be involved in ML-like workloads.

Of course there were some names that were absent from the launch – Arm, AMD, Nvidia, IBM, Amazon and Baidu. Each of them are members of the other standards bodies and probably are playing the waiting game.

Now let’s pause for a moment and look at the other announcement that happened at the same time. Nvidia and Mellanox announced that the two companies had reached a definitive agreement under which Nvidia will acquire Mellanox for $6.9 billion. Nvidia puts the acquisition reasons as “The data and compute intensity of modern workloads in AI, scientific computing and data analytics is growing exponentially and has put enormous performance demands on hyperscale and enterprise datacenters. While computing demand is surging, CPU performance advances are slowing as Moore’s law has ended. This has led to the adoption of accelerated computing with Nvidia GPUs and Mellanox’s intelligent networking solutions.”

So to me it seems that despite Intel working on CXL for four years, it looks like they might have been outbid by Nvidia for Mellanox. Mellanox has been around for 20 years and was the major supplier of Infiniband, a high speed interconnect that is common in high performance workloads and very well accepted by the HPC industry. (Note: Intel was also one of the founders of the Infiniband Trade Association, IBTA, before they opted to refocus on the PCI bus). With the growing need for fast links between the accelerators and the microprocessors, it would seem like Mellanox persistence had paid off and now has the market coming to it. One can’t help but think that as soon as Intel knew that Nvidia was getting Mellanox, it pushed forward with the CXL announcement – rumors that have had no response from any of the parties.

Advice for Tech Suppliers:

The two announcements are great for any vendor who is entering the AI, intense computing world using graphics and floating point arithmetic functions. We know that more digital-oriented solutions are asking for analytics based outcomes so there will be a growing demand for broader commoditized server platforms to support them. Tech suppliers should avoid backing or picking one of either the CXL or Infiniband at the moment until we see how the CXL standard evolves and how nVidia integrates Mellanox.

Advice for Tech Users:

These two announcements reflect innovation that is generally so far away from the end user, that it can go unnoticed. However, think about how USB (Universal Serial Bus) has changed the way we connect devices to our laptops, servers and other mobile devices. The same will true for this connection as more and more data is both read and outcomes generated by the ‘accelerators’ for the way we drive our cars, digitize our factories, run our hospitals, and search the Internet. Innovation in this space just got a shot in the arm from these two announcements.

Vodafone and Arm announced a strategic agreement at MWC19 to work on simplifying IoT services and reduce the costs confronted by the organisations on the implementation of IoT.

The Vodafone-Arm agreement expands on the previous collaboration which was on integrated SIM (iSIM) technology, a system on chip(SOC) design which can be reprogrammed with respect to the requirements. The iSIM allows customers to remotely provision and manage IoT devices across the globe which proposes reduced complexities and offers significant cost reduction.

To carry on the existing relationships this agreement is expected to bring Vodafone’s IoT global platform and Arm’s IoT software services to offer organisations a world of connected systems. This characterises a major initiative enabling a wide ecosystem of manufacturers to tap into the potential of trillions of connected devices.

Speaking on the subject, Ecosystm’s Executive Analyst, Vernon Turner thinks that “this announcement will help customers who look to and need a cellular-based IoT solution. Traditionally, mobile devices require a physical process to change their SIM (Subscriber Identity Module) card when there is a change of ownership or carrier, but in a world of trillions of connected devices, this is just not practical.”

Arm’s announcement of its iSIM is the latest in a series of announcements to resolve the size, cost, and scalability of SIM cards. SIM cards are critical for secure identity so the challenge has been to create a cost-effective IoT System On Chip (SOC) that has the SIM function embedded on it. Through its Kigen product family, Arm’s tech buyers will be able to build solutions on the latest cellular standards and specification suitable to run on 5G and backward compatible networks.

Vodafone’s customers will now be able to create a cellular-based IoT solution that can be continuously connected and deployed globally, giving them better investment protection and reduced operational costs. In addition, customers will have the choice of managing these devices through a ‘single pane of glass’ on either Vodafone’s IoT platform or Arm’s Pelion IoT Platform.

“Any time complexity is removed from an IT or mobile solution, customers respond by deploying and using that solution more” says Vernon. “ SoC-based solutions tend to have more functionality that allows for innovation, so we should expect to see an uptick in cellular-based IoT deployments”

Globally, the HealthTech innovation ecosystem has many startups working at the intersection of IoT and AI to solve some of the tough problems faced by patients and other stakeholders in the healthcare space. Several factors have led to a proliferation of a class of devices in the health, fitness and wellness space – such as, miniaturisation of sensors, advancements in microcontroller design and power management, low cost and flexible circuit design The ubiquitous availability of smartphones and always-on connectivity has enabled real-time access to cloud-based AI capabilities to transform IoT data into meaningful insights that can be used anywhere and anytime.

The key objective of healthcare provision is to engage the multiple stakeholders involved within an ecosystem to deliver better and holistic clinical outcomes.

The Key Challenges to Widespread Stakeholder Acceptance

Despite the promises and great potential of IoT and AI in the healthcare industry, there are major gaps in adoption by stakeholders, especially clinicians. I believe there are three main reasons for the gap:

-

The Principle of Conservatism in Medicine

The basic premise of medicine is “Do NO Harm”. Due to the relative newness of both devices and apps, there is only a small body of knowledge and precedence for a clinician. This is too small to take a risk with using “new” data to make decisions, even though the new data may be better than other available “time-tested” options on hand.

Clinical diagnosis is based on years of medical training, time-tested knowledge and practice and clinician “Gestalt”. More often than not, the way an AI system performs the predictions is not fully understood by the clinician. Because of the relatively new field, any new AI-based prediction system will need to establish its credibility that it will NOT do any harm to the patient. Clinicians value their ability to do the right thing for the patient more than anything else.

Establishing the trust between the clinician and the black-box algorithm is critical for any successful adoption.

-

Features vs. Function

There is a lack of a common language and understanding between clinicians and technologists, especially when it comes to what “innovation” means for the other party. For a technologist, innovation lies mostly in the features and capabilities of the technology. Their mindset is that innovative technology can be easily adapted to healthcare, similar to the way mobile phones have been adopted by consumers. Their belief is that people and practices will change quickly when presented with better technology and insights. For a technologist, innovation is what transforms a practice in leaps and bounds.

For a clinician, innovation is incremental to start with, and it evolves with time. There is a widely-held belief that if a new technology is not easy to understand, then it probably will not be good. Features and capabilities do not mean much to them. Innovation MUST be simple to understand, reliable, repeatable and MUST solve a problem that they cannot solve by themselves. The arguments in the public domain whether or not AI will replace clinicians adds to the skepticism.

-

Evidence through Clinical Trials

Perhaps the biggest factor of all is that clinicians demand evidence of safety and efficacy of new technology through the lens of time-tested processes of randomised clinical trials. Unless there is evidence created by the technologists through well-designed and robust clinical trials, adoption of new technology will be a hit and miss. Technology companies interested in transforming healthcare should have a solid understanding of the clinical trials process and should create adequate scientific evidence to positively influence clinicians.

The most important aspect of gathering clinical evidence is to identify the relevant data for decision making. Many clinicians do not readily utilize the data collected from connected healthcare devices into their diagnosis and decision processes due to the lack of connections between data and clinical practice. While 10,000 steps a day might be a good benchmark for exercising right, that number means nothing if it is not connected to a clinical decision framework.

The Way Forward for Stakeholder Adoption

Healthcare leaders predict that the implementation of healthcare IoT and AI solutions on a scale will transform their industry. The next few years will see more interconnected IoT devices and reliable applications based on deep learning. To achieve adoption and impact of new technology, the innovators and healthcare stakeholder ecosystem leaders should address the need for trust and evidence. Real World Evidence and Randomised Clinical trials are effective ways to bridge the gap and to establish a common framework to address the user adoption issue.

Arun Sethuraman, Principal Advisor MedTech, Ecosystm is also the founder and CEO of Crely Healthcare, a MedTech startup based in Boston and Singapore. Infection of the surgical site, post-surgery, if not detected and treated early, leads to high incidence of mortality in patients, poor health outcomes, poor patient experience, higher healthcare costs, and loss of reputation and reduced profitability for healthcare providers. Crely’s mission is to provide an early warning and clinical decision support system for surgical site infections (SSI), post-surgery. Crely generates an early warning of SSI by algorithms based on biomarker data collected from patients using an IP-protected, secure, non-invasive, continuously wearable, clinical grade medical device.

When I wrapped up my visit to this year’s Mobile World Congress (MWC) in Barcelona, I had wondered if my pre-trip question of what would the 5G story be after several years of being told that each preceding year was ‘the’ year. However, this year had a very distinct vibe to it, and I was rewarded for my pilgrimage to the Grand Fira.

Let’s not forget that technology takes longer to roll out that all of us want to think and 5G is no different. We have had no excuses since we only have to look at how long it took 3G and LTE to become mainstream and how long the transition from the prior technology took to move to the next generation.

However, the mobile and telecom industry is not the same as it was when earlier telecommunication tech was being upgraded. In the past hardware, benchmarks feeds and speeds dominated the marketing messages, but now it is about software, cloud and ecosystem collaboration. Gone are the days when the telecom equipment vendors ruled the conversation about their technology – that has clearly been replaced by IT companies leading the charge with topics such as virtualization, IoT, analytics and new services. Once there was a US automobile commercial that touted the latest edition of its cars was ‘This is not your father’s Oldsmobile’. Well, 5G is not your father’s telecom infrastructure!

This time around, operator and equipment vendors may have to take the collaborative partner role in any new digital solution. Instead of 5G projects being dominated by Ericsson or Huawei for example, there is a role for the likes of VMware, Microsoft, and Salesforce to be the lead company. In some cases, it could be Bosch, PTC, or Siemens while in others it could be Audi, BMW or Mercedes. The overall trend here is that all of these companies are being digitally driven to deliver new services to a customer that is firmly at the center of an ecosystem. The one industry sector who might lose out could be the telco operators who could be squeezed by the surge from IT vendor relevance, despite them investing heavily on 5G licenses. However, this time the operators are in a much stronger position to be the perfect channel for the massive amount of intelligence-laden data being created by smart connected devices that are not typical mobile devices.

So what was the outcome at MWC? I visited both the Huawei and Ericsson booths following pre-MWC briefing sessions to see if the customer buzz was there – and indeed it was.

Ericsson may have won the prize for the most crowded booth, while Huawei’s sprawling booth wins the most lavish and largest booth. The two company’s 5G messages could not have been more different.

The Big Two

For me, Huawei had invested heavily in making its hardware products very compelling for operators to install. Clearly, there had been a lot of research had gone into replacing existing infrastructure with massive performance upgrades and deployment friendly attributes e.g. size and weight of base stations that could be mounted by individuals rather than by cranes. The result of this strategy is that Huawei’s customers can quickly deploy 5G platforms with lower CapEx and OpEx thus creating significant incentives for operators to migrate to 5G networks.

Ericsson’s leading story was about migrating to 5G by highlighting its key enablers (i.e. carrier aggregation, LTE-NR spectrum sharing, and dual mode 5G cloud core). It appeared that Ericsson had moved its message off hardware (which, by the way, is still table stakes in any selection process and Ericsson had plenty of new 5G related offerings) and onto a strategy of smooth evolution and deployment at scale – a much more business leader discussion than a network, driven by software. Finally, both companies had strong messages around their AI capabilities to help their service providers make sense of the growing complexity of services that will be generated by the connected smart IoT devices.

The Importance of IT Software On 5G

IT and industrial companies played an increasingly important role at this year’s MWC as service providers and they became involved in deeper partnerships. 2019 was the year when the gaps for 5G between the network and IT services were being filled in. For example, I saw AR (augmented reality) solutions by PTC supported by Microsoft and being fed by data off a 5G network. This showed how industry, cloud and network service providers will accelerate new technologies.

In another example, Salesforce showed how Edge Computing events triggered Salesforce SaaS-based enterprise management services while being supported by AT&T’s 5G network and the modules being designed and tested at AT&T’s Foundry. Here, AT&T 5G network was being used as a high-value channel for Salesforce’s customers to run their business functions at the edge of the network.

Digital twins have shown up as a digital representation of a physical device or asset. However, this year, I saw a Wipro example of how 5G could drive digital twin concepts beyond physical assets and into the workflow, supply chain management, logistics and worker safety. Every ‘asset’ that was to be used in a factory floor was digitized into a digital twin and then a 5G network was used to monitor and manage every aspect of the factory. It seemed that Industry 4.0 had arrived in its full glory.

Finally, VMware continues to be the IT company that service providers will either love or dislike – I still don’t know which one it will be. VMware’s virtualization and cloud management capabilities have been extended right into 5G networks. For example, NFV (Network Function Virtualization) is critical to operators as they slice the 5G bandwidth into the appropriate services. VMware has its strategy correct when it says that it could virtualize the network just as it has with the cloud, but in doing so is making itself either a partner or a competitor of the operators for their 5G services revenues. 2018 was the year when VMware made a big splash at MWC, 2019 was the year when they showed that they have something to offer – will 2020 be the year when they take over the network software virtualization profit pools just as they did with the enterprise server virtualization market?

Crawl, Walk, Run

In conclusion, MWC 2019 was the year that the 5G gaps to make end-to-end infrastructure solutions where clearly being filled in. Service providers had stepped up their willingness to be part of the customer-centric ecosystem that is almost certainly being led by IT software companies. Telecom equipment vendors were offering technology solutions to speed up 5G deployments while making forward compatible solutions much easier. Finally, 5G-supported applications remain the last piece of the puzzle that MWC hasn’t addressed fully. As a result of the massively varied 5G use cases, there is still a look of curiosity on which industry will be the lead for 5G – will it be the auto industry with autonomous cars, will it be Industry 4.0 and the smart factory, or will it be smart cities with video surveillance. In addition, it is certain that IoT is still very much a necessary part of any 5G strategy just as AI outcomes continue to fuel IoT-based sensors in technologies such as the self-driving cars, AR, and digital twins. 2019 may have been the year that decided that it won’t matter whether the connected IoT device used licensed (NB-IoT) or unlicensed (LoRa) spectrum protocols as both will be seamlessly connected to a 5G network. IoT was not dead, it had simply grown up and was now integrated with more valuable solutions.

At last, the Mobile World Congress (MWC) – the world’s largest exhibition for the mobile industry – is moving back to its origins. 5G technology has been a star in this year’s conference and I must say that it still has almost the same number of defenders as detractors. Opinions from both sides – the proponents and the critics – have been heard this week in Barcelona and while in the middle I have adopted an easy and not very brave opinion on this aspect. I still think that 5G can bring great advances in many sectors such as healthcare or transport, but contrary to this I don’t think that we will be using 5G in Virtual Reality multi-player games. That’s like, too much investment for a few general use cases of the technology.

I went to Barcelona to discover about happenings on the Internet of Things (IoT), start-ups and to discuss advances on IoT strategies with Operators, Manufacturers and System Integrators who were present at this Congress.

The gist of my visit at the end of my three days time and impressive 70,000 steps on my Fitbit tracker, is that the role of IoT at MWC has been diluted. A couple of years ago almost all the exhibitors used the word IoT on their stalls, many without knowing anything about what it was and today, it hardly appears on a few. There are no longer innovations, nor new use cases that attract visitors.

IoT and Operators

In the long-wait of 5G, IoT operators are torn between several technologies such as NB-IoT or LTE-M o LPWAN networks. The LoRA alliance had a booth in Hall #8 (the Hall of the poor’s, I call this Hall). SigFox did not even attend this year’s conference, which further increased the rumors among the attendees on the possible precarious situation of the French Operator.

Analysts should revise their estimates downwards based on data from new connections announced by Vodafone or Telefonica this year. I agree with Allen Proithis, Global Tech Executive: IoT, Digital Transformation, Strategic Partnerships, Emerging Technology, he said “the lack of emphasis on IoT reflects the struggle of mobile operators to monetize IoT outside of connections, especially at the SaaS or data level”

Winner MWC2019 – Deutsche Telekom – IoT Solution Optimiser

IoT and Network Infrastructure Vendors

This section is reserved for a few players – Ericsson, Huawei, and Nokia share most of the pie around the network infrastructure. A suspicion of Huawei security and doubts on the Operator’s role in election outcomes can delay 5G deployments in Europe. The Americans and the Chinese have already placed their decisions.

Only Huawei granted me an opportunity to meet their VP, a friend of mine.

I tried several times to reach Nokia whereas I did not even try to reach Ericsson this year, I already heard its strategy three times in the last year.

By far, Nokia has gained in terms of its connectivity offer with Nokia Wing, the ecosystem and the use cases (somewhat more advanced than those presented last year).

Winner MWC2019 – Nokia – Nokia Wing

IoT and IT Technology Vendors

The technology behemoth Microsoft revealed its second-generation HoloLens AR and all I can say is that it left a ridiculous gap for IoT. Other IT giants such as Dell-EMC-VMware, SAP, Cisco, Oracle, SAS or SAG-Cumulocity did not showcase anything new.

Moving towards the System Integrators, they are not even expected at this fair in relation to IoT. Neither the Cloud, nor the Edge IIoT, nor the IoT Platforms, nor the IoT applications had any new ideas that could have attracted the interest of veterans and novices. Where are the millions of dollars going in the industry, which they say are being spent on IoT?

Winner MWC2019 – No Conclusión

IoT and Countries

Finding an IoT gem among the many tiny cubicles of various countries was similar to finding a needle in a haystack. To me, there was hardly any interest to go through the dozens of small companies that used this event as a stage to make themselves visible to the world. The umbrella allows them to be here but attracting visitors between so much noise and variety to their booth was a big and miraculous task.

Every year, I get in touch with IoT companies and know companies from Israel, UK, Sweden, Canada or France. However, this year to my surprise, I found an interesting company in the pavilion of Belgium. They have developed another league of IoT platform and I liked what they have achieved with Orange. They are my winner of this year.

My special regards to the Colombia pavilion and my friend Edgar Salas.

Winner MWC2019 – AllThingsTalk

IoT and Start-ups

I could not visit 4YFN, but I went to IoT Stars. My friend Marc Pous and his colleagues always do a great job, who comes as a jury every year. It was a good time spent with them over a beer while sharing impressions of the IoT and discussing new ideas to accelerate this market once and for all.

In my opinion, there was no great achievement this year and I still notice a gap in the Industrial IoT start-up space. Most ideas are like “Déjà vu” applications for Consumer IoT which reminds me of the post-years after the Internet boom. Much remains to be done here and it will take time for Universities to train innovators and entrepreneurs of IoT.

Winner MWC2019 – No Conclusión

P.S. The IoT Stars jury awarded two prizes

Key Takeaway:

It does not matter; this Congress was as soporific as the Oscars ceremony but for some strange reasons I keep coming back every year. Although after the fiasco of 2019, my expectations were set to find progress and opportunities in IoT but considering the after-effects, I think next year I will reduce my stay to only two days.

It has become clear that the MWC no longer holds anything interesting with respect to IoT to attract visitors, exhibitors, companies. Instead, IoT enthusiasts should probably look to other – more focussed – industry events.

If you want me to cover anything specific on IoT from MWC,19 then let me know in your comments.

Rightly so, the first day of the Mobile World Conference was taken up by more and more air time on the ever coming 5G networks. Was 2019 going to be the year when operators around the world would finally deploy 5G in volume? The booths in the halls at the Fira Grand would indicate that ‘if you build it, they will come’. Indeed the speculation that 5G is the next big game changer is over – it is the game changer for this next turn of the technology dial.

However, let’s assume that the 5G hype is in the rear view mirror and we look to see what could be ahead of us in the mobile and telecom industry. At the end of the first day of this year’s MWC, I may have seen the future opportunity – and it is awesome! Pat Gelsinger asked the question “why can’t we build the telco networks like the clouds have been built for with scalability, flexibility, efficiency, and agility”? It’s a very fair question. After all, we do have Network Function Virtualization (NFV), and we will have new 5G services, so why not a new telco cloud?

I spent time with two companies that may show us a glimpse of the future network and cloud infrastructure. The first is the Israeli software startup, DriveNets with its solution “Network Cloud”. DriveNets is focused on helping service providers disaggregate proprietary routers from their networks as they move to 5G. DRiveNet’s Network Cloud solution aims to disrupt the current network business model by separating network costs (e.g. proprietary hardware functions) to create network functions from its software stack and two ‘white label’ hardware building blocks. The entire network infrastructure is software-centric allowing for agility, scalability, and normalizing costs with business growth.

However, Network DriveNets is an unusual startup in that it came out of stealth mode with $110 million in its first round of funding. The company was founded in 2015 by Ido Susan who should be familiar to Cisco watchers as he sold his first startup, Intucell (self-optimising network technology), to them for $475 million in 2013. DriveNets other co-founder, Hillel Kobrinsky founded Interwise (web conferencing) which was snapped up by AT&T for $121 million. To that end, the company is well funded and has the ability to sustain itself long enough to potentially disrupt the $50 billion network hardware business.

The second is Rakuten Mobile, a well-known name in Japan, but the first mobile virtual network operator (MVNO) to launch there in over 10 years. MNOs are not new so what makes Rakuten different? The company’s CTO, Tareq Amen explained to me that they are building the world’s first end-to-end fully virtualized cloud-native network running all of its workloads in the cloud. Being a fully virtualized network enables Network Function Virtualization to take advantage of cloud computing basis assets where a service delivery platform can be implemented, customized and scaled at speed. Finally, all of Rakuten’s core technology including its Radio Access Network (RAN – a topic that has been highly discussed at this year’s MWC) on 5G thus delivering immediate and actual 5G services. This compares to most of the rest of the industry who will have to build an uncomfortable transformation roadmap from 2/3G and LTE to 5G. While Amen’s strategy is compelling, there are a few technical hurdles to overcome. For example, enterprise-grade 5G indoor coverage isn’t fully there yet so Amen will have to rely on the operators that he is competing against who have that real estate.

So why highlight DriveNet and Rakuten in the same blog? In Rakuten’s case the CAPEX and OPEX business models for operators may be turned on their heads by the fact that its network is taking all of the competitive advantages of 5G while offering customers as disruptive pricing models and services. In a country such as Japan where traditional operators have struggled to modernize their networks, this could be a competitive threat. Equally, there could be a global rise in copy-cat pure 5G/cloud-based MVNOs spring up and fiercely compete against the incumbent local operators as well as give other MVNOs a tough time. As for DriveNets – it’s simple…it’s software and virtualization of the switch and router market which is very appealing to the service providers. It will commoditize the hardware, lowering their costs while allowing them to continue to focus on new 5G services.

Recently IBM and Vodafone announced a new strategic commercial agreement, as a joint venture, to provide their clients with the ability to integrate multiple clouds that have a need to access emerging technologies such as 5G, AI, Edge Computing and Software Defined Networking. Under an eight-year engagement valued $550 million (€480 million), IBM will provide managed services to Vodafone Business’ cloud and hosting unit.

Businesses are becoming more and more challenged to run their operations and business processes in a seamless manner as data is distributed and managed across more and more clouds. Together, Vodafone Business and IBM aim to remove these complexities to support the basis of any digital transformation and enable a company to share data freely and securely across its organization.

On the surface, this announcement makes sense if you are a Vodafone business customer who wants to take the next step in a digital transformation journey. The convergence of multi-clouds has the ability for companies to enrich their own data management systems with external sources. With the purchase of Red Hat late in 2018, IBM now has the ability and credibility to offer that capability. However, as many IoT-based solutions create the data to fuel these cloud processes, IBM has not had a clear Edge Computing or network connectivity strategy. This is where Vodafone can help IBM connect the edge of the network to the enterprise systems. This announcement seems like a complimentary win-win situation for both sets of IBM and Vodafone customers.

Red Hat is undoubtedly one of the premier cloud management companies and IBM invested heavily in its multi-cloud connectivity assets. IBM is hoping that the deeper that Red Hat is involved in the multi-cloud connectivity market, the more it will pull through IBM’s high-value business services in cognitive computing and machine learning and other compute-intensive technologies.

However, this market is still shaking itself out and there are many other competitive offerings to Red Hat. There are startups such as RightScale and Morpheus who can offer up multi-cloud management. Alternatively, as a mature company, VMware competes head to head with Red Hat and has had a long-standing partnership with Vodafone. In particular, VMware and Vodafone have partnered in telco specific functions such as NFV and 5G.

To understand the importance of VMware in the midst of this announcement is to appreciate the end-to-end customer experience that VMware can bring to telco customers such as Vodafone. As 5G rolls out and NFV-based network slicing becomes a valuable onboarding differentiator VMware could offer its vCloud NFV solution to Vodafone’s customers. Vodafone’s customers could have access to the same multi-cloud services from VMware and not IBM while obtaining AI, cognitive and ML services available from the major public cloud providers (such as AWS, Google and Microsoft). VMware’s position at the edge of the network would, therefore, appear to leapfrog IBM’s position. Vodafone Business’ customers could bypass IBM and its cloud services strategy. At the end of the day, IBM could be left with only the managed services contract while missing out on analytics and cognitive business services.

To negate this scenario, IBM will have to lead more and more with Red Hat and be willing to downplay the cognitive and machine learning services. Business solutions in vertical markets such as agriculture are extremely price sensitive and customers will look closely at the cost of connectivity followed by the cost of data acquisition to enrich their business outcomes. We believe that if the cost to run data science and cognitive services are too expensive, then Vodafone customers will seek the same tools and services from other cloud service providers and not IBM.

Finally

Our advice to tech buyers who are in the midst of business transformation should consider how they fuel their decision-making engines for analytics, machine learning, and cognitive computing. Real-time processing and dissemination of business outcomes is one of the table stakes for a successful digital company. As a result of that, seamless end-to-end processing across a complex and distributed enterprise infrastructure is a challenge that needs to be overcome. Tech buyers should ask if IBM’s edge computing strategy and Vodafone’s connectivity are mature enough to funnel IoT-data generated smart data to a broad inter-cloud infrastructure.

My return to CES, the Consumer Electronic Show, was something that I had been looking forward to for some time. After all, it had been almost 4 years since I attended the last CES when the Internet of Things (IoT) was the latest solution looking for problems to be solved. As an industry analyst whose passion for IoT is well known, I was frustrated at the weak offerings, poor quality demos and wasted money at the booths. CES had halls and halls of IoT ‘stuff’ that made little or no sense to me, with almost no chance of these startups being around in 2019. But, that’s what these shows are meant to do.

Roll forward to 2019 and my mission was very specific. I was only interested in two major things – 5G and autonomous/self driving vehicles. I was determined not to get soaked up in the awesome glory of 8K televisions, and kitchens that would even scare off Chef Gordon Ramsey! 5G has been positioned as the natural platform for IoT innovation – fast, high capacity connectivity for applications such as autonomous vehicles, video and medical services. However, at this year’s CES, it seemed that the technology world and the trade press had finally gotten into the same room and realized (just like IoT) that 5G can mean many things. To that point, businesses were keen to call their new technology offerings that can be called 5G, 5G. I could see history repeating itself – hype and confusion this year, followed by disillusion and disappointment next year.

Let’s start with AT&T. When is 5G not 5G – when it is 5G E? AT&T insists on using the term 5G for its advanced 4G LTE network. I assume that if AT&T’s commercials say that 5G E is 5G then who are we to doubt them! In my humble opinion it is misleading and muddies the waters into convincing customers that they already have 5G. (By the way the ‘E’ stands for Evolution, or as one journalist put it “it’s a work in progress towards 5G’. Other global operators also made claims that they too were the first to market or the first to have a customer. However, 5G from a marketing aspect was a bust at this year’s CES. It was supposed to be a leading theme, but in reality it lacked reality. Perhaps selling to consumers is easier than selling to enterprise customers who know that 5G will require an upgrade of the entire network infrastructure, which in turn will take time.

Despite the marketing and messaging confusion, 5G is the underpinning technology of some very exciting technologies being shown at CES – in particular in the transportation industry. Here there was proof that progress has been made in the last 4 years. It was clear that core technologies such as mapping and location tracking have made it possible for the auto industry to think about services both inside the vehicle and outside it. Companies such as TomTom, Naver Labs and HERE showed the levels of progress that they have made in navigation, mobility services, and fleet management. Adjacent technologies for EV (Electric Vehicle) combined with advanced high quality mapping, make it possible to know better where to recharge and how to accurately navigate highways as efficiently as possible.

Innovation in this space takes on a new meaning when the vehicle isn’t a concept car, but rather a fully laden truck. At CES there was no shortage of trucking companies showing off their highly connected vehicles. For example, Paccar Inc., the parent of Peterbilt Motors Co. and Kenworth Truck Co. had an exhibit that featured a pair of battery-electric Peterbilt models and a hydrogen-electric truck from Kenworth and Toyota. Autonomous truck startup TuSimple also returned to CES, where it offered demonstrations of the sensors and machine vision behind its self-driving technology and announced plans to expand its US fleet to 40 trucks by June.

At CES, autonomous vehicle concepts from all of the global car brands were on display. Typically the German and Asian manufacturers showed a wide range of vehicles that continued to look like ‘travel pods’ or people movers rather than traditional automobiles, while US-based brands tended to focus on the infotainment services within the car. In summary, CES’s auto offerings showed that there is a very strong ecosystem of partners determined to change the way that we get from point A to point B in a safe and sustainable manner. In parallel, the ability to extend vehicle ride sharing across multiple modes of transportation including bicycles and helicopters (Bell’s Nexus product) is driven by high speed, real-time and accurate data fed from thousands of intelligent sensors.

At CES, autonomous vehicle concepts from all of the global car brands were on display. Typically the German and Asian manufacturers showed a wide range of vehicles that continued to look like ‘travel pods’ or people movers rather than traditional automobiles, while US-based brands tended to focus on the infotainment services within the car. In summary, CES’s auto offerings showed that there is a very strong ecosystem of partners determined to change the way that we get from point A to point B in a safe and sustainable manner. In parallel, the ability to extend vehicle ride sharing across multiple modes of transportation including bicycles and helicopters (Bell’s Nexus product) is driven by high speed, real-time and accurate data fed from thousands of intelligent sensors.

In conclusion, CES confirmed for me that despite the technical greatness of 5G, telecom operators continue to appear to be lost in their positioning of the product. Part of this may be stemming from the significant investment and consequently the risk of return on that investment. Part of it may be – like IoT – defining what 5G is really all about. Early IoT success stories have shown that it’s as much about positioning the business value around the data as it is about connectivity. Finally, CES showed me that while fully autonomous driving societies are several decades away, the strong industrial ecosystems that exist today are making significant progress towards that future.

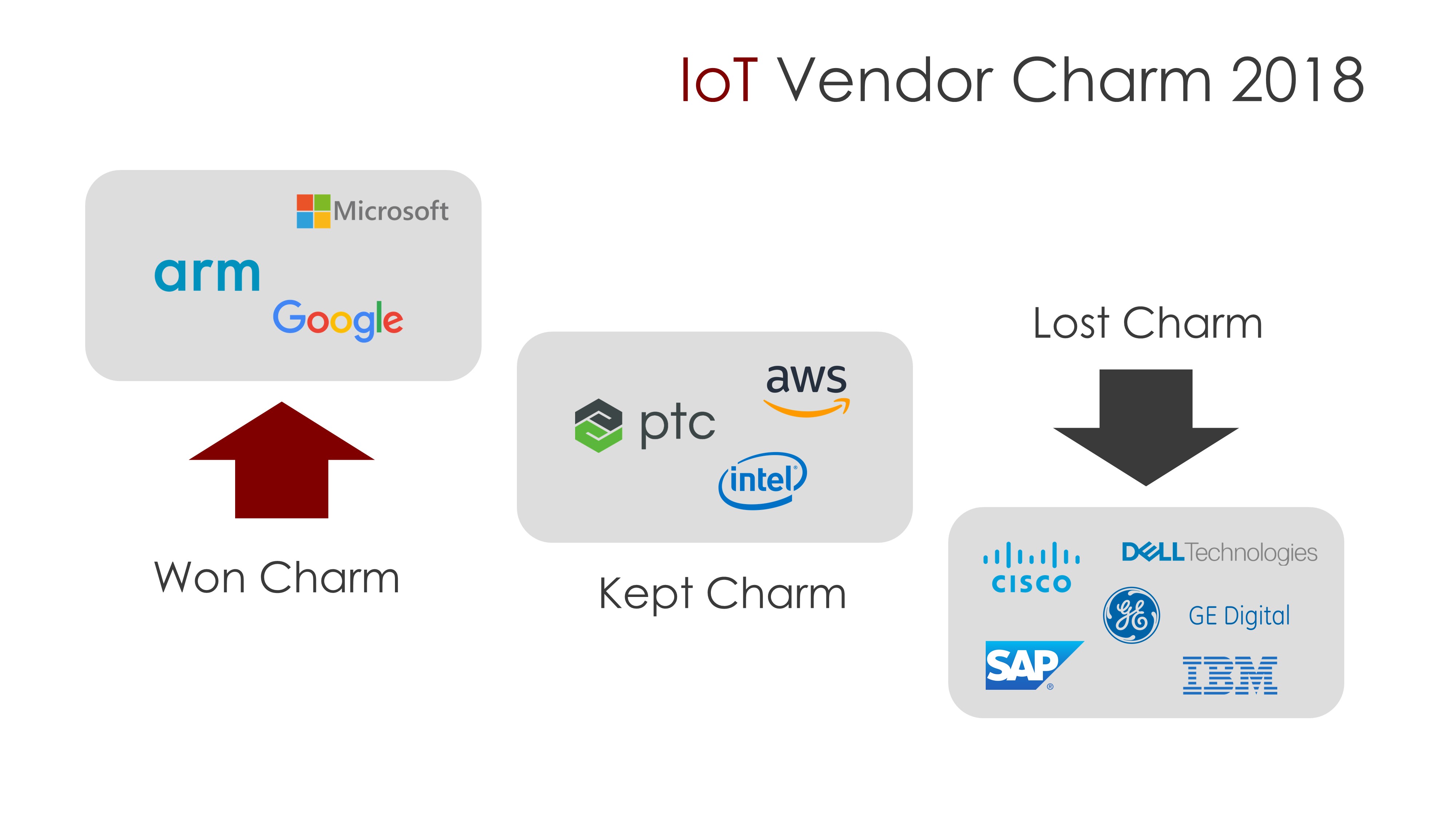

In my article “Which Top IoT companies are losing, keeping or winning its Charm in 2017?”, I reviewed the Top 10 IoT companies that lost, maintained or gained Charm in the IoT sector in 2017. Here are my updates for 2018.

Defining Charm. The power of pleasing or attracting through their strategy, investments, innovation, teams, products, events and media presence. Their attractiveness is well received all-round – by investors, customers, developers and analysts.

Which Ones Lost Charm in 2018?

The 5 Top companies that have lost IoT charm in 2018 are:

- Cisco. According to a Cisco study in 2017, only 26% of companies surveyed say they have achieved success with their IoT initiatives. And maybe executives at Cisco considered that it was time to go back to the basic. Cisco has taken their intent-based networking concept, which they first revealed in June 2017, and extended it to IoT. Maybe a cohesive IoT Strategy has begun to take shape at Cisco last year, but I did not see expected results of their Cisco Kinetic platform. I do not see any merits in the company gaining their Charm.

- GE Digital. In 2018, GE Digital´s leadership in Industrial IoT has remained in question. The parent company GE is expected to spin off the division into a standalone firm and is selling a majority stake in ServiceMax, considered a strategic acquisition only 2 years ago. All the turbulence around GE has negatively affected the sales of the Predix IoT Platform during 2018. No doubt that GE Digital lost their Charm in 2018.

- IBM. In spite of IBM Watson being named a leader in Worldwide IoT Platforms for 2017 by the IDC MarketScape, the results of IoT investment in 2016 did not show expected results. IBM continues to lose relevance in 2018 against other Cloud IoT vendors. IBM is pushing to be the driving force in IoT and become once again the most recognisable name in the IoT technology industry. I am confident that after IBM’s acquisition of Red Hat the company has the potential to recover their Charm in 2019. Great expectations for next year but in 2018 they lost their Charm.

- Dell Technologies. Dell Technologies’ Edge and IoT Solutions Division announcements in 2018 have particular resonance for channels. But maybe because the company is launching specific IoT solutions in phases with the appropriate reseller partners, I did not see the scale I had expected. Dell could not repeat the momentum of 2017 and lost their Charm in 2018.

- SAP Leonardo. After investing $2.2 billion in IoT and partner opportunities, SAP rolled out new applications and services around IoT and is making efforts to reduce the complexity of developing and deploying IoT solutions. However I did not see increased market share and new customers wins. SAP Leonardo could not keep their Charm in 2018.

Which Ones are Keeping their Charm?

The 3 Top companies that have kept their IoT Charm in 2018 are:

- PTC. Since Rockwell and PTC announced their partnership earlier 2018 at Rockwell – including a $1 billion equity investment from Rockwell into PTC – the two companies have been hard at work to bring their respective offerings into alignment. And before the end of the year they released their first collaborative offering: FactoryTalk InnovationSuite, which provides improved data insights through a single source of operations visibility and systems status. PTC also partners with Microsoft to help customers accelerate Digital Transformation in IoT. The company announced in fall 2018 that it is preparing an $18 million restructuring plan in 2019. We will probably see the impact in 2019, but PTC deserves to keep the Charm in 2018.

- Intel. IoTSWC 2018 awarded Intel-ARM-Pelion for innovative solutions jointly developed by Intel, ARM and Pelion enabling users to connect any IoT device to the cloud in a matter of seconds. Reducing the complexity of IoT development, Intel revamped their IoT roadmap to benefit developers and integrators in 2018. Other news through 2018 that helps Intel keep their charm were: Intel Capital pumps $72 million into AI, IoT, cloud and silicon startups, $115 million invested so far in 2018. Dell Technologies is combining tools from its broad portfolio with technology from Intel and partners in the Dell Technologies IoT Solutions Partner Program. Intel deserves to keep their Charm in 2018.

- AWS. In AWS re:Invent 2018, Amazon announced a variety of AWS IoT releases. Also, AWS IoT Greengrass extended functionality with connectors to external applications, hardware root of trust security, and isolation configurations , AWS IoT Device Management Now Provides New Features for Fleet Indexing and Jobs and Announcing AWS IoT SiteWise, Now Available in Preview. No doubt AWS has kept their Charm in 2018.

Which Ones are Winning Charm?

The 3 Top companies that have won IoT Charm in 2018 are:

- Microsoft. Microsoft is now the world’s most valuable company. The company made a major statement earlier in 2018 when they announced a $5 billion commitment to IoT projects for the next 4 years. That new investment has already resulted in new products, such as Azure Sphere and Azure Digital Twins. The company also launched their IoT deployment and management platform Axure IoT Central to the general public. New customers, new partners and good analyst recommendations makes them win the Charm in 2018.

- ARM. The list of ARM’s acquisitions in 2018, includes enterprise data management leader, Treasure Data (enabling device-to-data IoT platform), Stream Technologies (to expands IoT connectivity and device management capabilities) and ChaoLogix. These acquisitions and the new Pelion IoT Platform will give ARM businesses super powers. For the second consecutive year, ARM is in the Top winners of the IoT Charm list.

- Google. Google I/O 2018 marks a new era for IoT devices with new Google Assistant capabilities. In 2018 Google bought Xively to improve their IoT platform. The company invested in creating a strong ecosystem adding new IoT partners. Finally Google forays into edge computing with cloud IoT Edge and TPU. Good reasons to include Google in the winners list.

Thanks in advance for your Likes and Shares