The impact of AI on Customer Experience (CX) has been profound and continues to expand. AI allows a a range of advantages, including improved operational efficiency, cost savings, and enhanced experiences for both customers and employees.

AI-powered solutions have the capability to analyse vast volumes of customer data in real-time, providing organisations with invaluable insights into individual preferences and behaviour. When executed effectively, the ability to capture, analyse, and leverage customer data at scale gives organisations significant competitive edge. Most importantly, AI unlocks opportunities for innovation.

Read on to discover the transformative impact of AI on customer experiences.

Click here to download ‘Customer Experience Redefined: The Role of AI’ as a PDF

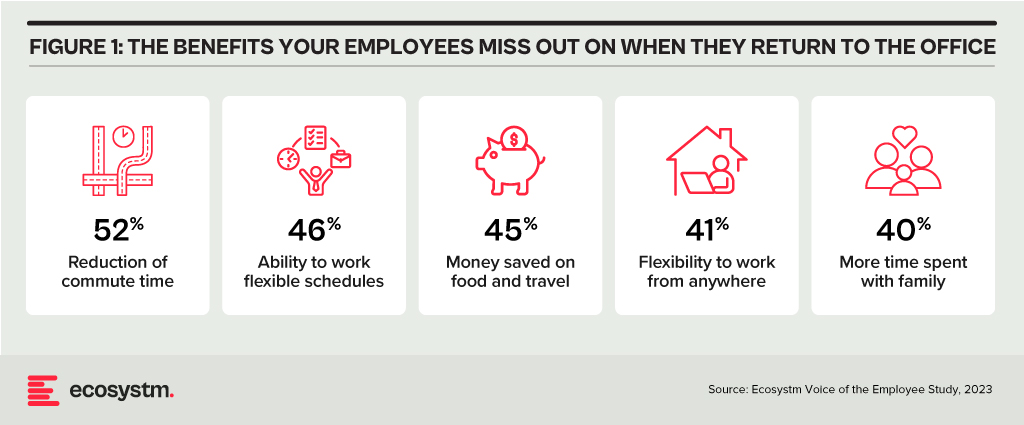

It seems for many employees, the benefits of working from home or even adopting a hybrid model are a thing of the past. Employees are returning to the grind of long commutes and losing hours in transit. What is driving this shift in sentiment? CEOs, who once rooted for remote work, have undergone a change of heart – many say that remote work hampers their ability to innovate.

That may not be the real reason, however. There is a good chance that the CEO and/or other managers feel they have lost control or visibility over their employees. Returning to a more traditional management approach, where everyone is within direct sight, might seem like a simpler solution.

The Myths of Workplace Innovation

I find it ironic that organisations say they want employees to come into the office because they cannot innovate at the same rate. What the last few years have demonstrated – and quite conclusively – is that employees can innovate wherever they are, if they are driven to it and have the right tools. So, organisations need to evaluate whether they have innovated on and evolved their hybrid and remote work solutions effectively, to continue to support hybrid work – and innovation.

What is confusing about this stance that many organisations are taking, is that when an organisation has multiple offices, they are effectively a hybrid business – they have had people working from different locations, but have never felt the need to get all their staff together for 3-5 days every week for organisation-wide innovation that is suddenly so important today.

The CEO of a tech research firm once said – the office used to be considered the place to get together to use the tools we need to innovate; but the reality is that the office is just one of the tools that businesses have, to drive their organisation forward. Ironically, this same CEO has recently called everyone back into the office 3 days a week!

Is Remote Work the Next Step in Employee Rights?

It has become clear that remote and hybrid work is the next step in employees getting greater rights. Many organisations fought against the five-day work weeks, claiming they wouldn’t make as much money as they did when employees worked whenever they were told. They fought against the 40-hour work week (in France some fought against the 35-hour work week!) They fight against the introduction of new public holidays, against increases to the minimum wages, against paid parental leave.

Some industries, companies, unions, and countries are looking to (or already have) formalised hybrid and remote work in their policies and regulations. More unions and businesses will do this – and employees will have choice.

People will have the option to work for an employer who wants their employees to come into the office – or work for someone else. And this will depend on preferences and working styles – some employees enjoy the time spent away from home and like the social nature of office environments. But many also like the extra time, money, and flexibility that remote work allows.

There might be many reasons why leadership teams would want employees to come into the office – and establishing and maintaining a common corporate culture would be a leading reason. But what they need to do is stop pretending it is about “innovation”. Innovation is possible while working remotely, as it is when working from separate offices or even different floors within the same building.

Evolving Employee Experience & Collaboration Needs

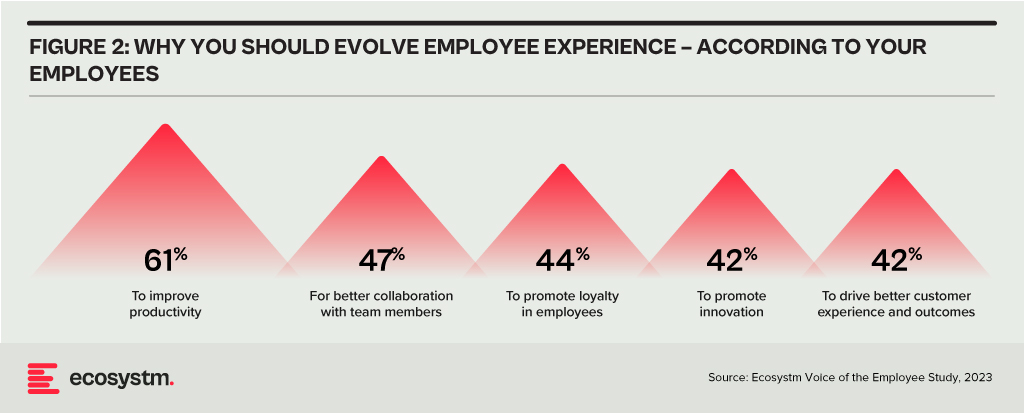

Organisations today face a challenge – and it is not the inability to innovate in a hybrid work environment! It is in their ability to deliver the employee experience that their employees want. This is more challenging now because there are more preferences, options, and technologies available. But it is established that organisations need to continue to evolve their employee experience.

Technology does and will continue to play an important role in keeping our employees connected and productive. AI – such as Microsoft Copilot – will continue to improve our productivity. But the management needs to evolve with the technology. If the senior management feels that connecting people will help to solve the current growth challenges in the business, then it becomes the role of managers to better connect people – not just teams in offices, but virtual teams across the entire organisation.

Organisations that have focused their energies on connecting their employees better, regardless of their location (such as REA in Australia), find that productivity and innovation rates are better than when people are physically together. What do they do differently?

- Managers find their roles have moved from supporting individual employees to connecting employees

- Documentation of progress and challenges means that everyone knows where to focus their energies

- Managed virtual (and in-person) meetings mean that everyone has a voice and gets to contribute (not the loudest, most talkative or most senior person)

Remote and hybrid workers are often well-positioned to come up with new and innovative ideas. Senior management can encourage innovation and risk-taking by creating a safe environment for employees to share their ideas and by providing them with the resources they need to develop and implement their ideas. Sometimes these resources are in an office – but they don’t have to be. Manufacturers are quickly moving to complete digital development, prototyping, and testing of their new and improved products and services. Digital is often faster, better, and more innovative than physical – but employees need to be allowed to embrace these new platforms and tools to drive better organisational and customer outcomes.

What the pandemic has taught us is that people are good at solving problems; they are good at innovating irrespective of whether their managers are watching or not.

As an industry, the tech sector tends to jump on keywords and terms – and sometimes reshapes their meaning and intention. “Sustainable” is one of those terms. Technology vendors are selling (allegedly!) “sustainable software/hardware/services/solutions” – in fact, the focus on “green” or “zero carbon” or “recycled” or “circular economy” is increasing exponentially at the moment. And that is good news – as I mentioned in my previous post, we need to significantly reduce greenhouse gas emissions if we want a future for our kids. But there is a significant disconnect between the way tech vendors use the word “sustainable” and the way it is used in boardrooms and senior management teams of their clients.

Defining Sustainability

For organisations, Sustainability is a broad business goal – in fact for many, it is the over-arching goal. A sustainable organisation operates in a way that balances economic, social, and environmental (ESG) considerations. Rather than focusing solely on profits, a sustainable organisation aims to meet the needs of the present without compromising the ability of future generations to meet their own needs.

This is what building a “Sustainable Organisation” typically involves:

Economic Sustainability. The organisation must be financially stable and operate in a manner that ensures long-term economic viability. It doesn’t just focus on short-term profits but invests in long-term growth and resilience.

Social Sustainability. This involves the organisation’s responsibility to its employees, stakeholders, and the wider community. A sustainable organisation will promote fair labour practices, invest in employee well-being, foster diversity and inclusion, and engage in ethical decision-making. It often involves community engagement and initiatives that support societal growth and well-being.

Environmental Sustainability. This facet includes the responsible use of natural resources and minimising negative impacts on the environment. A sustainable organisation seeks to reduce its carbon footprint, minimise waste, enhance energy efficiency, and often supports or initiates activities that promote environmental conservation.

Governance and Ethical Considerations. Sustainable organisations tend to have transparent and responsible governance. They follow ethical business practices, comply with laws and regulations, and foster a culture of integrity and accountability.

Security and Resilience. Sustainable organisations have the ability to thwart bad actors – and in the situation that they are breached, to recover from these breaches quickly and safely. Sustainable organisations can survive cybersecurity incidents and continue to operate when breaches occur, with the least impact.

Long-Term Focus. Sustainability often requires a long-term perspective. By looking beyond immediate gains and considering the long-term impact of decisions, a sustainable organisation can better align its strategies with broader societal goals.

Stakeholder Engagement. Understanding and addressing the needs and concerns of different stakeholders (including employees, customers, suppliers, communities, and shareholders) is key to sustainability. This includes open communication and collaboration with these groups to foster relationships based on trust and mutual benefit.

Adaptation and Innovation. The organisation is not static and recognises the need for continual improvement and adaptation. This might include innovation in products, services, or processes to meet evolving sustainability standards and societal expectations.

Alignment with the United Nations’ Sustainable Development Goals (UNSDGs). Many sustainable organisations align their strategies and operations with the UNSDGs which provide a global framework for addressing sustainability challenges.

Organisations Appreciate Precise Messaging

A sustainable organisation is one that integrates economic, social, and environmental considerations into all aspects of its operations. It goes beyond mere compliance with laws to actively pursue positive impacts on people and the planet, maintaining a balance that ensures long-term success and resilience.

These factors are all top of mind when business leaders, boards and government agencies use the word “sustainable”. Helping organisations meet their emission reduction targets is a good starting point – but it is a long way from all businesses need to become sustainable organisations.

Tech providers need to reconsider their use of the term “sustainable” – unless their solution or service is helping organisations meet all of the features outlined above. Using specific language would be favoured by most customers – telling them how the solution will help them reduce greenhouse gas emissions, meet compliance requirements for CO2 and/or waste reduction, and save money on electricity and/or management costs – these are all likely to get the sale over the line faster than a broad “sustainability” messaging will.

As they continue to promote innovation in the Financial Services industry, the Monetary Authority of Singapore (MAS) introduced the Financial Sector Technology and Innovation Scheme 3.0 (FSTI 3.0) earlier this week, pledging up to SGD 150 million over three years. FSTI 3.0 aims to boost innovation by supporting projects that use cutting-edge technologies or have a regional scope, while strengthening the technology ecosystem in the industry. This initiative includes three tracks:

- Enhanced Centre of Excellence track to expand grant funding to corporate venture capital entities

- Innovation Acceleration track to support emerging tech based FinTech solutions, and

- Environmental, Social, and Governance (ESG) FinTech track to accelerate ESG adoption in fintech

Additionally, FSTI 3.0 will continue to support areas like AI, data analytics, and RegTech while emphasising talent development. We can expect to see transformative financial innovation through greater industry collaboration.

MAS’ Continued Focus on Innovation

Over the years, the MAS has consistently been a driving force behind innovation in the Financial Services industry. They have actively promoted and supported technological advancements to enhance the industry’s competitiveness and resilience.

The FinTech Regulatory Sandbox framework offers a controlled space for financial institutions and FinTech innovators to test new financial products and services in a real-world setting, with tailored regulatory support. By temporarily relaxing specific regulatory requirements, the sandbox encourages experimentation, while ensuring safeguards to manage risks and uphold the financial system’s stability. Upon successful experimentation, entities must seamlessly transition to full compliance with relevant regulations.

Innovation Labs serve as incubators for new ideas, fostering a culture of experimentation and collaboration. They collaborate with disruptors, startups, and entrepreneurs to develop groundbreaking solutions. Labs like Accenture Innovation Hub, Allianz Asia Lab, Aviva Digital Garage, ANZ Innovation Lab, and AXA Digital Hive drive create prototypes, and roll out market solutions.

Building an Ecosystem

Partnerships between financial institutions, technology companies, startups, and academia contribute to Singapore’s economic growth and global competitiveness while ensuring adaptive regulation in an evolving landscape. By creating a vibrant ecosystem, MAS has facilitated knowledge exchange, collaborative projects, and the development of innovative solutions. For instance, in 2022, MAS partnered with United Nations Capital Development Fund (UNCDF) to build digital financial ecosystems for MSMEs in emerging economies.

This includes supporting projects that address environmental, social, and governance (ESG) concerns within the financial sector. For instance, MAS worked with the People’s Bank of China to establish the China-Singapore Green Finance Taskforce (GFTF) to enhance collaboration in green and transition finance. The aim is to focus on taxonomies, products, and technology to support the transition to a low-carbon future in the region, co-chaired by representatives from both countries.

MAS has also promoted Open Banking and API Frameworks to encourage financial institutions to adopt open banking practices enabling easier integration of financial services and encouraging innovation by third-party developers. This also empowers customers to have greater control over their financial data while fostering the development of new financial products and services by FinTech companies.

Regulators in Asia Pacific Taking a Proactive Approach

While Singapore is at the forefront of financial innovations, other regulatory and government bodies in Asia Pacific are also taking on an increasingly proactive role in nurturing innovation. This stance is being driven by a twofold objective – to accelerate economic growth through technological advancements and to ensure that innovative solutions align with regulatory requirements and safeguard consumer interests.

Recognising the potential of fintech to enhance financial services and drive economic growth, the Hong Kong Monetary Authority (HKMA) established the Fintech Facilitation Office (FFO) to facilitate communication between the fintech industry and traditional financial institutions. The central bank’s Smart Banking Initiatives, including the Faster Payment System, Open API Framework, and the Banking Made Easy initiative that reduces regulatory frictions help to enhance the efficiency and interoperability of digital payments.

The Financial Services Agency of Japan (FSA) has been actively working on creating a regulatory framework to facilitate fintech innovation, including revisions to existing laws to accommodate new technologies like blockchain. In 2020, FSA launched the Blockchain Governance Initiative Network (BGIN) to facilitate collaboration between the government, financial institutions, and the private sector to explore the potential of blockchain technology in enhancing financial services.

The Central Bank of the Philippines (Bangko Sentral ng Pilipinas – BSP) has launched an e-payments project to overcome challenges hindering electronic retail purchases, such as limited interbank transfer facilities, high bank fees, and low levels of trust among merchants and consumers. The initiative included the establishment of the National Retail Payment System, a framework for retail payment, and the introduction of automated clearing houses like PESONet and InstaPay. These efforts have increased the percentage of retail purchases made electronically from 1% to over 10% within five years, demonstrating the positive impact of effective cooperation and innovative policies in driving a shift towards a cash-lite economy.

The promotion of fintech innovation highlights a collective belief in its potential to transform finance and boost economies. As regulations adapt for technologies like blockchain and open banking, the Asia Pacific region is promoting collaboration between traditional financial institutions and emerging fintech players. This approach underscores a commitment to balance innovation with responsible oversight, ensuring that advanced financial solutions comply with regulatory standards.

Technology has been reshaping the Real Estate industry landscape. Advancements in manufacturing technologies, digital tools, AI & analytics, and IoT – coupled with customer and employee expectations – are revolutionising how properties are built, bought, sold, managed, and experienced.

The evolution of RealTech and PropTech has a far-reaching impact on the industry, streamlining processes, improving customer experiences, and driving innovation across the entire sector.

Read on to find out how technology impacts the entire value chain; the key drivers of Real Estate evolution; the strong influence of “smart consumers”; and what Ecosystm VP Industry Insights Sash Mukherjee thinks where the industry is headed.

Download ‘The Future of Real Estate’ as a PDF

Technology is reshaping the Public Sector worldwide, optimising operations, improving citizen services, and fostering data-driven decision-making. Government agencies are also embracing innovation for effective governance in this digital era.

Public sector organisations worldwide recognise the need for swift and agile interventions. With citizen expectations resembling those of commercial customers, public sector organisations face mounting pressure to break down the barriers to provide seamless service experiences.

Read on to find out how public sector organisations in countries such as Australia, Vietnam, the Philippines, South Korea, and Singapore are innovating to stay ahead of the curve; and what Ecosystm VP Consulting, Peter Carr sees as the Future of Public Sector.

Click here to Download ‘The Future of the Public Sector’ as a PDF

The Manufacturing industry is at crossroads today. It faces challenges such as geopolitical risks, supply chain disruptions, changing regulatory environments, workforce shortages, and changing consumer demands. Overcoming these requires innovation, collaboration, and proactive adaptation.

Fortunately, many of these challenges can be mitigated by technology. The future of Manufacturing will be shaped by advanced technology, automation, and AI. We are seeing early evidence of how smart factories, robotics, and 3D printing are transforming production processes for increased efficiency and customisation.

Manufacturing is all set to become more agile, efficient, and sustainable.

Read on to find out the changing priorities and key trends in Manufacturing; about the World Economic Forum’s Global Lighthouse Network initiative; and where Ecosystm advisor Kaushik Ghatak sees as the Future of Manufacturing.

Click here to download ‘The Future of Manufacturing’ as a PDF

The idea of solar energy beamed back to earth from space was born a century ago by astronautics pioneer, Konstantin Tsiolkovsky, and then popularised by Isaac Asimov in his 1941 short story Reason. Although the first designs for a solar power satellite with microwave-based transmission were developed by Czech-born NASA engineer, Peter Glaser, in 1968, it has taken decades for complementary technologies to catch up to even make testing the concept feasible.

Space-based solar power (SBSP) uses photovoltaic panels on satellites to generate electricity and beam it back to Earth in microwave form. The energy is then converted back to electricity at a rectenna receiving station connected to the grid. By deploying a network of geostationary satellites, it is theoretically possible to transmit energy around the globe before beaming it back to Earth. The technology would be a breakthrough, generating abundant renewable energy 24 hours per day, regardless of the weather or season. This would overcome the primary challenge of renewables – intermittency – and reduce the need for storage.

Reusable Rockets and Small Satellites

One of the greatest hurdles to commercialising SBSP is the prohibitive cost to launch into orbit, but the advent of reusable rockets and small satellites has brought down the price dramatically. Private companies, like SpaceX and Rocket Lab, charge between USD 3,000-30,000 per kilogram of payload to low earth orbit, a fraction of the cost when launches were dominated by government space agencies.

The emergence of cheaper small satellites, or CubeSats, is also creating a landscape favourable to innovation in space. Researchers can afford to experiment with new technologies by launching prototypes into orbit and iterating quickly.

Caltech Experiment Proves Transmission is Possible

While the efficiency and durability of photovoltaic panels have improved exponentially and the cost of launching satellites into space has plummeted, transmitting power back to Earth remains a challenge. Electricity must be converted into microwaves, with the beams steered back through the earth’s atmosphere. Transmission can be degraded by factors, such as atmospheric absorption, diffraction, and weather.

Researchers from The California Institute of Technology (Caltech) recently achieved a milestone by demonstrating that the transmission of energy from space is possible. The Caltech Space Solar Power Project (SSPP) launched the Microwave Array for Power-transfer Low-orbit Experiment (MAPLE) onboard the Space Solar Power Demonstrator (SSPD-1) earlier this year. In progressively ambitious experiments, the researchers lit up two LEDs in orbit to test energy transfer in space. Next, they successfully transmitted a “detectable” amount of power to antennae on the roof of the Moore Laboratory at Caltech. This may prove to be the first step toward developing a commercially viable system.

Governments Recognise Space-based Solar Potential

With sustainability and energy security coming sharply into focus over the last year, governments have sat up and paid attention to the potential of SBSP. The UK’s energy security secretary, Grant Shapps, recently announced the winners of £4.3M in funding to develop the technology. The grants were devised to tap into the 10GW of space-based solar power potential that an independent study estimated would be available to the UK. Public entities in the EU, China, Japan, and the US have made similar announcements over the past 12 months, signalling a rapid shift in momentum for SBSP.

A Revolution of Space-based Power and Communications

Although SBSP is still undeniably an experimental technology, recent developments hint at a future where clean energy could be beamed down to Earth. Even accounting for transmission loss, each solar power satellite is estimated to deliver the equivalent of a nuclear power station to the grid.

Access to power remains a major obstacle to data centre operators, whether they are hyperscale cloud providers, city-based facilities at capacity, or small regional edge data centres. In recent years, cloud hubs, such as Singapore and Ireland, have imposed strict controls on new data centre builds due to concerns about escalating power consumption. Rising prices for natural gas have made the business case for renewable sources for data centre power even more attractive and space-based solar is an alluring candidate to add to the future mix.

Power transmitted to Earth could be coupled with low latency connectivity provided by satellites in low earth orbit from the likes of Starlink. The pairing of power and connectivity from satellites means even remote locations could be served. Advances in energy and communications have ignited progress since the discovery of fire and the emergence of language and these space-based innovations will undoubtedly play a key role in the next industrial revolution.

There is no doubt that 2023 is off to an uncertain start. However, despite the economic headwinds we expect that some areas of technology will see continued growth. In fact, from our conversations with business and technology leaders, it appears that many organisations will take the opportunity to right-size their businesses, remove excess fat and waste, and accelerate their transformation efforts. The plan is to emerge from a global slowdown – leaner, smarter and better.

Where there is an opportunity to automate organisations will take it – and technology spend will trump people spend in 2023.

But it won’t all be smooth sailing as technology buyers become more discerning than ever and manage costs closely.

Here is what tech providers should focus on to remain resilient in these uncertain times.

- Be prepared to work harder – especially cloud and SaaS providers

- Help customers optimise costs

- Accelerate innovation to stay ahead of M&A activity

- Employ security to manage risk

- Prepare for product-led growth

Read on to find out why.

Download Be Alert – Not Alarmed: Analyst Guidance for Tech Providers as a PDF