Technology is reshaping the Public Sector worldwide, optimising operations, improving citizen services, and fostering data-driven decision-making. Government agencies are also embracing innovation for effective governance in this digital era.

Public sector organisations worldwide recognise the need for swift and agile interventions. With citizen expectations resembling those of commercial customers, public sector organisations face mounting pressure to break down the barriers to provide seamless service experiences.

Read on to find out how public sector organisations in countries such as Australia, Vietnam, the Philippines, South Korea, and Singapore are innovating to stay ahead of the curve; and what Ecosystm VP Consulting, Peter Carr sees as the Future of Public Sector.

Click here to Download ‘The Future of the Public Sector’ as a PDF

The Manufacturing industry is at crossroads today. It faces challenges such as geopolitical risks, supply chain disruptions, changing regulatory environments, workforce shortages, and changing consumer demands. Overcoming these requires innovation, collaboration, and proactive adaptation.

Fortunately, many of these challenges can be mitigated by technology. The future of Manufacturing will be shaped by advanced technology, automation, and AI. We are seeing early evidence of how smart factories, robotics, and 3D printing are transforming production processes for increased efficiency and customisation.

Manufacturing is all set to become more agile, efficient, and sustainable.

Read on to find out the changing priorities and key trends in Manufacturing; about the World Economic Forum’s Global Lighthouse Network initiative; and where Ecosystm advisor Kaushik Ghatak sees as the Future of Manufacturing.

Click here to download ‘The Future of Manufacturing’ as a PDF

The idea of solar energy beamed back to earth from space was born a century ago by astronautics pioneer, Konstantin Tsiolkovsky, and then popularised by Isaac Asimov in his 1941 short story Reason. Although the first designs for a solar power satellite with microwave-based transmission were developed by Czech-born NASA engineer, Peter Glaser, in 1968, it has taken decades for complementary technologies to catch up to even make testing the concept feasible.

Space-based solar power (SBSP) uses photovoltaic panels on satellites to generate electricity and beam it back to Earth in microwave form. The energy is then converted back to electricity at a rectenna receiving station connected to the grid. By deploying a network of geostationary satellites, it is theoretically possible to transmit energy around the globe before beaming it back to Earth. The technology would be a breakthrough, generating abundant renewable energy 24 hours per day, regardless of the weather or season. This would overcome the primary challenge of renewables – intermittency – and reduce the need for storage.

Reusable Rockets and Small Satellites

One of the greatest hurdles to commercialising SBSP is the prohibitive cost to launch into orbit, but the advent of reusable rockets and small satellites has brought down the price dramatically. Private companies, like SpaceX and Rocket Lab, charge between USD 3,000-30,000 per kilogram of payload to low earth orbit, a fraction of the cost when launches were dominated by government space agencies.

The emergence of cheaper small satellites, or CubeSats, is also creating a landscape favourable to innovation in space. Researchers can afford to experiment with new technologies by launching prototypes into orbit and iterating quickly.

Caltech Experiment Proves Transmission is Possible

While the efficiency and durability of photovoltaic panels have improved exponentially and the cost of launching satellites into space has plummeted, transmitting power back to Earth remains a challenge. Electricity must be converted into microwaves, with the beams steered back through the earth’s atmosphere. Transmission can be degraded by factors, such as atmospheric absorption, diffraction, and weather.

Researchers from The California Institute of Technology (Caltech) recently achieved a milestone by demonstrating that the transmission of energy from space is possible. The Caltech Space Solar Power Project (SSPP) launched the Microwave Array for Power-transfer Low-orbit Experiment (MAPLE) onboard the Space Solar Power Demonstrator (SSPD-1) earlier this year. In progressively ambitious experiments, the researchers lit up two LEDs in orbit to test energy transfer in space. Next, they successfully transmitted a “detectable” amount of power to antennae on the roof of the Moore Laboratory at Caltech. This may prove to be the first step toward developing a commercially viable system.

Governments Recognise Space-based Solar Potential

With sustainability and energy security coming sharply into focus over the last year, governments have sat up and paid attention to the potential of SBSP. The UK’s energy security secretary, Grant Shapps, recently announced the winners of £4.3M in funding to develop the technology. The grants were devised to tap into the 10GW of space-based solar power potential that an independent study estimated would be available to the UK. Public entities in the EU, China, Japan, and the US have made similar announcements over the past 12 months, signalling a rapid shift in momentum for SBSP.

A Revolution of Space-based Power and Communications

Although SBSP is still undeniably an experimental technology, recent developments hint at a future where clean energy could be beamed down to Earth. Even accounting for transmission loss, each solar power satellite is estimated to deliver the equivalent of a nuclear power station to the grid.

Access to power remains a major obstacle to data centre operators, whether they are hyperscale cloud providers, city-based facilities at capacity, or small regional edge data centres. In recent years, cloud hubs, such as Singapore and Ireland, have imposed strict controls on new data centre builds due to concerns about escalating power consumption. Rising prices for natural gas have made the business case for renewable sources for data centre power even more attractive and space-based solar is an alluring candidate to add to the future mix.

Power transmitted to Earth could be coupled with low latency connectivity provided by satellites in low earth orbit from the likes of Starlink. The pairing of power and connectivity from satellites means even remote locations could be served. Advances in energy and communications have ignited progress since the discovery of fire and the emergence of language and these space-based innovations will undoubtedly play a key role in the next industrial revolution.

There is no doubt that 2023 is off to an uncertain start. However, despite the economic headwinds we expect that some areas of technology will see continued growth. In fact, from our conversations with business and technology leaders, it appears that many organisations will take the opportunity to right-size their businesses, remove excess fat and waste, and accelerate their transformation efforts. The plan is to emerge from a global slowdown – leaner, smarter and better.

Where there is an opportunity to automate organisations will take it – and technology spend will trump people spend in 2023.

But it won’t all be smooth sailing as technology buyers become more discerning than ever and manage costs closely.

Here is what tech providers should focus on to remain resilient in these uncertain times.

- Be prepared to work harder – especially cloud and SaaS providers

- Help customers optimise costs

- Accelerate innovation to stay ahead of M&A activity

- Employ security to manage risk

- Prepare for product-led growth

Read on to find out why.

Download Be Alert – Not Alarmed: Analyst Guidance for Tech Providers as a PDF

Ecosystm and Bitstamp, conducted an invitation-only Executive ThinkTank at the Point Zero Forum in Zurich. A select group of regulators and senior leaders from financial institutions from across the globe came together to share their insights and experiences on Decentralised Finance (DeFi), innovations in the industry, and the outlook for the future.

Here are the 5 key takeaways from the ThinkTank.

- Regulators: Perception vs. Reality. Regulators are generally perceived as having a bias against innovations in the Financial Services industry. In reality, they want to encourage innovation, and the industry players welcome these regulations as guardrails against unscrupulous practices.

- Institutional Players’ Interest in DeFi. Many institutional players are interested in DeFi to enable the smooth running of processes and products and to reduce costs. It is being evaluated in areas such as lending, borrowing, and insurance.

- Evolving Traditional Regulations. In a DeFi world, participants and actors are connected by technology. Hence, setting the framework and imposing good practices when building projects will be critical. Regulations need to find the right balance between flexibility and rigidity.

- The Importance of a Digital Asset Listing Framework. There has been a long debate on who should be the gatekeeper of digital asset listings. From a regulator’s perspective, the liability of projects needs to shift from the consumer to the project and the gatekeeper.

- A Simplified Disclosure Document. Major players are willing to work with regulators to develop a simple disclosure document that describes the project for end-users or investors.

Read below to find out more.

Download Pathways for Aligning Innovation and Regulation in a DeFi World as a PDF

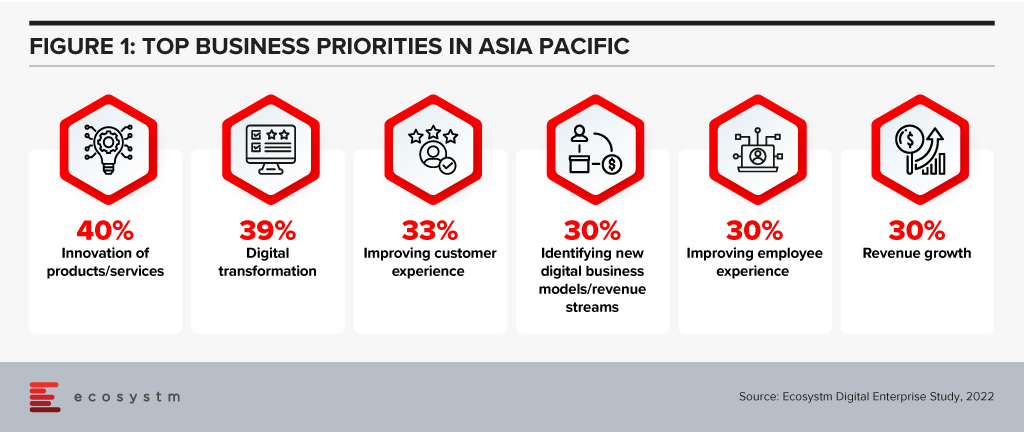

Life never gets any easier for the digital and information technology teams in organisations. The range and reach of the different technologies continue to open new opportunities for organisations that have the foresight and strategy to chase them. Improving offers for existing customers and reaching new segments depend on the organisation’s ability to innovate.

But the complexity of the digital ecosystem means this ability to innovate will be heavily constrained, causing improvements to take longer and cost more in many cases. Addressing the top business priorities expressed in the Ecosystm Digital Enterprise Study, 2022, will need tech teams to look to simplify as well as add features.

Complexity is Not Just an IT Issue

Many parts of an organisation have been making decisions on implementing new digital capabilities, particularly those involved in remote working. Frequently, the IT organisation has not been involved in the selection, implementation and use of these new facilities.

The number of start-up organisations delivering SaaS has continued to explode. A particular area has been the expansion of co-creation tools used by teams to deliver outcomes. In many cases, these have been introduced by enthusiastic users looking to improve their immediate working environment without the understanding of single-sign-on requirements, security and privacy of information or the importance of backup and business continuity planning.

SaaS tools such as Notion, monday.com and ClickUp (amongst many, many others), are being used to coordinate and manage teams across organisations of all sizes. While these are all cloud services, the support and maintenance of them ultimately will fall to the IT organisation. And they won’t be integrated at all with the tools the IT organisation uses to manage and improve user experience.

Every new component adds to the complexity of the tech environment – but with that complexity comes increased dependencies between components, which slows an organisation’s ability to adapt and evolve. This means each change needs more work to deliver, costs increase, and it takes longer to deliver value.

And this increasing complexity causes further problems with cybersecurity. Without regular attention, legacy systems will increase the attack surface of organisations, making it easier to compromise an organisation’s environment. At a recent executive forum with CISOs, attendees rated the risks caused by their legacy systems as their most significant concern.

An organisation’s leadership needs to both simplify and advance their organisation’s digital capabilities to remain competitive. This balance should not be left to the IT organisation to achieve as they will not be able to deliver both without wider support and recognition of the problems.

Discriminate on Differentiating Skills

One thing we can be sure of is that we won’t be able to employ all the skills we need for our future capabilities. We are not training enough people in the skills that we need now and for the future, and the range of technologies continues to expand, increasing the number of skills that we will need to keep an organisation running.

Most organisations are not removing or replacing ageing systems, preferring to keep them running at an apparently low cost. Often these legacy systems are fully depreciated, have low maintenance costs and have few changes made to them, as other areas of the organisation offer better investment options. But this also means that the old skills remain necessary.

So organisational leaders are adding new skills requirements on top of old, with the older skills being less attractive with so many new languages, frameworks and databases becoming available. Wikipedia has a very long list of languages that have been developed over the years. Some from the 1950s, like FORTRAN and LISP, continue to be used today.

Organisations will not be in a position to employ all the skills it needs to implement, develop and maintain for its digital infrastructure and applications. The choice is going to be which skills are most important to an organisation. This selection needs to be very discriminating and focus on differentiating skills – those that really make a difference within your ecosystem, particularly for your customers and employees.

Organisations will need a great partner who can deliver generic skills and more services. They will have better economies of scale and skill and will free management to attend to those things most important to customers and employees.

Hybrid Cloud has an Edge

Almost every organisation has a hybrid cloud environment. This is not a projection – it has already happened. And most organisations are not well equipped to deal with this situation.

Organisations may not be aware that they are using multiple public clouds. Many of the niche SaaS applications used by an organisation will use Microsoft Azure, AWS or GCP, so it is highly likely organisations are already using multiple public clouds. Not to mention the offerings from vendors such as Oracle, Salesforce, SAP and IBM. IT teams need to be able to monitor, manage and maintain this complex set of environments. But we are only in the early stages of integrating these different services and systems.

But there is a third leg to this digital infrastructure stool that is becoming increasingly important – what we call “the Edge” – where applications are deployed as part of the sensors that collect data in different environments. This includes applications such as pattern recognition systems embedded in cameras so that network and server delays cannot affect the performance of the edge systems. We can see this happening even in our homes. Google supports their Nest domestic products, while Alexa uses AWS. Not to mention Amazon’s Ring home security products.

With the sheer number of these edge devices that already exist, the complexity it adds to the hybrid environment is huge. And we expect IT organisations to be able to support and manage these.

Simplify, Specialise, Scale

The lessons for IT organisations are threefold:

- Simplify as much as possible while you are implementing new features and facilities. Retiring legacy infrastructure elements should be consistently included in the IT Team objectives. This should be done as part of implementing new capabilities in areas that are related to the legacy.

- Specialise in the skills that are the differentiators for your organisation with its customers and employees. Find great partners who can provide the more generic skills and services to take this load off your team.

- Scale your hybrid management environment so that you can automate as much of the running of your infrastructure as possible. You need to make your IT Team as productive as possible, and they will need power tools.

For IT vendors, the lessons are similar.

- Simplify customer offers as much as possible so that integration with your offering is fast and frugal. Work with them to reduce and retire as much of their legacy as possible as you implement your services. Duplication of even part of your offer will complicate your delivery of high-quality services.

- Understand where your customers have chosen to specialise and look to complement their skills. And consistently demonstrate that you are the best in delivering these generic capabilities.

- Scale your integration capabilities so that your customers can operate through that mythical single pane of glass. They will be struggling with the complexities of the hybrid infrastructure that include multiple cloud vendors, on-premises equipment, and edge services.

–

Innovation is at the core of Singapore’s ethos. The country has perfected the art of ‘structured innovation’ where pilots and proof of concepts are introduced and the successful ones scaled up by recalibrating technology, delivery systems, legislation, and business models. The country has adopted a similar approach to achieving its sustainability goals.

The Singapore Green Plan 2030 outlines the strategies to become a sustainable nation. It is driven by five ministries: Education, National Development, Sustainability and the Environment, Trade and Industry, and Transport, and includes five key pillars: City in Nature, Sustainable Living, Energy Reset, Green Economy, and Resilient Future. We will see a slew of new programs and initiatives in green finance, sustainability, solar energy, electric vehicles (EVs), and innovation, in the next couple of years.

Singapore’s Intentions of Becoming a Green Finance Leader

Singapore is serious about becoming a world leader in green finance. The Green Bonds Programme Office was set up last year, to work with statutory boards to develop a framework along with industry and investor stakeholders. We have seen a number of sustainable finance initiatives last year, such as the National Environment Agency (NEA) collaborating with DBS to raise USD 1.23 billion from its first green bond issuance. The proceeds will fund new and ongoing sustainable waste management initiatives. Temasek collaborated with HSBC for a USD 110 million debt financing platform for sustainable projects and Sembcorp issued sustainability bonds worth USD 490 million.

Building an Ecosystm of Sustainable Organisations

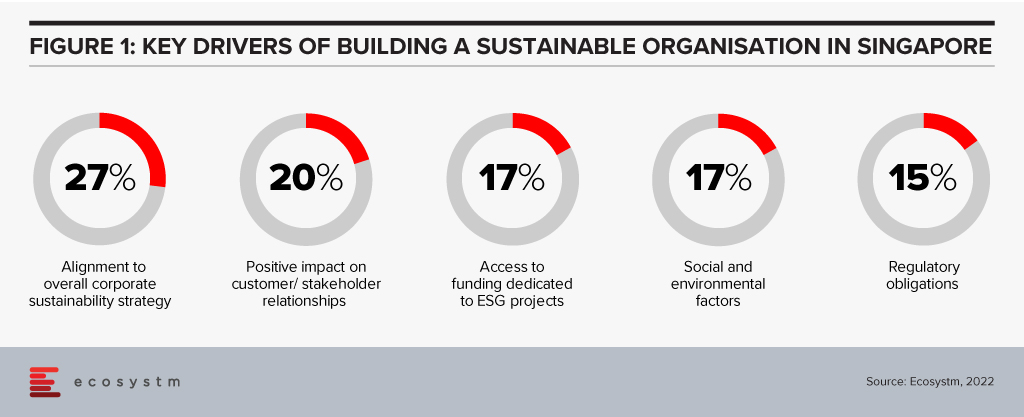

Sustainability has to be a collective goal that will require governments to work with enterprises, investors and consumers. To ensure that enterprises are focusing on Sustainability, governments have to keep in mind what drives these initiatives and the challenges organisations face in achieving their goals.

There are several reasons driving organisations in Singapore to adopt sustainability goals and ESG responsibilities (Figure 1)

It is equally important to address organisations’ challenges in building sustainability in their business processes. Last week, the Institute of Banking and Finance (IBF) and the Monetary Authority of Singapore (MAS) set out 12 Sustainable Finance Technical Skills and Competencies (SF TSCs) required by people in various roles in sustainable finance. This addresses the growing demand for sustainable finance talent in Singapore; and covers knowledge areas such as climate change policy developments, natural capital, green taxonomies, carbon markets and decarbonisation strategies. There are Financial Services related competencies as well, such as sustainability risk management, sustainability reporting, sustainable investment management, and sustainable insurance and reinsurance solutions. The SF TSCs are part of the IBF Skills Framework for Financial Services.

Sustainable Resources Initiatives

Singapore is not only focused on Sustainable Finance. If we look at NEA’s Green Bonds, there are specific criteria that projects must satisfy in order to qualify, including a focus on sustainable waste management.

Last week the Government announced that the National Research Fund (NRF) will allocate around USD 160 million to drive new initiatives in water, reuse and recycling technologies, as part of the Research, Innovation and Enterprise 2025 plan (RIE2025). Part of the fund will be allocated to the Closing the Resource Loop (CTRL) initiative, administered by the NEA that will fund sustainable resource recovery solutions.

Singapore faces severe resource constraints, and water security is not a new challenge for the country. The NRF funding will also be used partially for R&D in 3 water technology focus areas: desalination and water reuse; used water treatment; and waste reduction and resource recovery.

The Government is Leading the Way

The Government’s concerted efforts to make the Singapore Green Plan 2030 a success is seeing corporate participation in the vision. In February, Shell started supplying sustainable aviation fuel (SAF) to customers such as SIA Engineering Company and the Singapore Air Force in Singapore. Shell has also upgraded their Singapore facility to blend SAF at multiple, key locations. Last week, Atlas announced their commitment to Web 3.0 technologies and “tech for good”. They aim to increase their green energy use to 75% by 2022; 90% by 2023; and 100% by 2024. ESG consciousness is percolating down from the Government.

The success of Singapore’s Sustainability strategies will depend on innovation, the Government’s ongoing commitment, and the support provided to enterprises, investors, and consumers. The Singapore Government is poised to lead from the front in building a Sustainable Ecosystem.

Since the start of this millennium, no region has transformed as much as Asia. There has been significant paradigm shifts in the region and the perception that innovation starts in the US or in Europe and percolates through to Asia after a time lag, has been shattered. Asia is constantly demonstrating how dynamic, and technology-focused it is. This is getting fueled by the impact of the growing middle class on consumerism and the spirit of innovation across the region. The region has also seen a surge in new and upcoming business leaders who are embracing change and looking beyond success to creating impact.

What is Driving Innovation in Asia?

The “If you ain’t got it, build it” attitude. One of the key drivers of this shift is the age of the average population in Asia. According to the UN the Asia Pacific region has nearly 60% of the world’s youth population (between the age of 17-24). With youth comes dynamism, a desire to change the world, and innovation. As this age group enters the workforce, they will transform their lives and the companies they work in. They are already showing a spirit of agility when it comes to solving challenges – they will build what they do not have.

The Need to enable Foundational Shifts. The younger generation is more aware of environmental, social and governance issues that the world continues to face. Many of the countries in the region are emerging economies, where these issues become more apparent. COVID-19 has also inculcated an empathy in people and they are thinking of future success in terms of impact. The desire to enable foundational shifts is giving direction to the transformation journey in the region. The wonderful new paradigm that is the Digital Economy allows us to cut across all segments; and technology and its advancements has immense potential to create a more sustainable and inclusive future for the world.

Realising the Power of Momentum. The pandemic has caused major disruptions in the region. But every crisis also presents an opportunity to perhaps re-imagine a brighter world through a digital lens. The other thing that the pandemic has done is made people and organisations realise that to succeed they need to be open to change – and that momentum is important. As organisations had to pivot fast, they realised what I have been saying for years – we shouldn’t “let perfect get in the way of better”. This adaptability and the readiness to fail fast and learn from the mistakes early for eventual success, is leading to faster and more agile transformation journeys.

Where are we seeing the most impact?

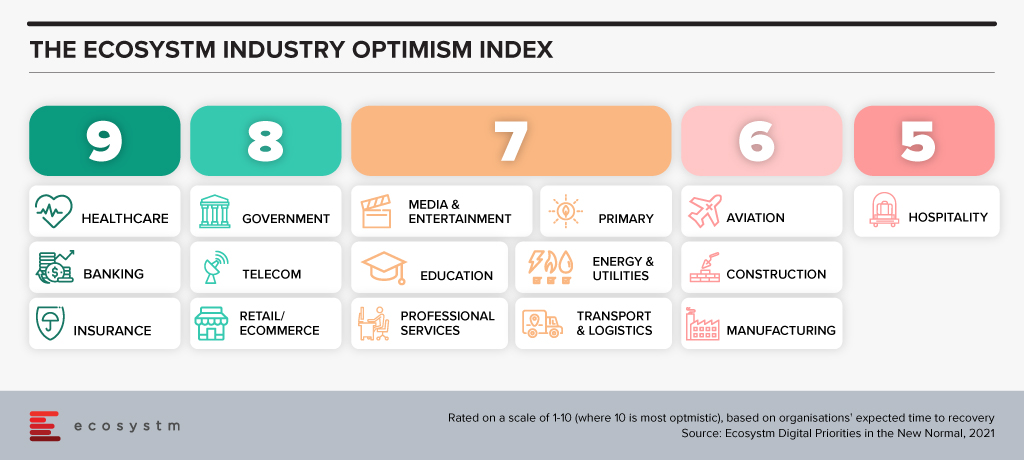

Industries are Transforming. There are industries such as Healthcare and Education that had to transform out of a necessity and urgency brought about by the COVID-19 pandemic. This has led to a greater impetus for change and optimism in these industries. These industries will continue to transform as governments focus significantly on creating “Social Safety Nets” and technology plays a key role in enabling critical services across Health, Education and Food Security. Then there are industries, such as the Financial Services and Retail, that had a strong customer focus and were well on their digital journeys before the pandemic. The pandemic boosted these efforts.

But these are not the only industries that are transforming. There are industries that have been impacted more than others. There are several instances of how organisations in these industries are demonstrating not only resilience but innovation. The Travel & Hospitality industry has had several such instances. As business models evolve the industry will see significant changes in digital channels to market, booking engines, corporate service offerings and others, as the overall Digital Strategy is overhauled.

Technologies are Evolving. Organisations depended on their tech partners to help them make the fast pivot required to survive and succeed in the last year – and tech companies have not disappointed. They have evolved their capabilities and continue to offer innovative solutions that can solve many of the ongoing business challenges that organisations face in their innovation journey. More and more technologies such as AI, machine learning, robotics, and digital twins are getting enmeshed together to offer better options for business growth, process efficiency and customer engagement. And the 5G rollouts will only accelerate that. The initial benefits being realized from early adoption of 5G has been for consumers. But there is a much bigger impact that is waiting to be realised as 5G empowers governments and businesses to make critical decisions at the edge.

Tech Start-ups are Flourishing. There are immense opportunities for technology start-ups to grow their market presence through innovative products and services. To succeed these companies need to have a strong investment roadmap; maintain a strong focus on customer engagement; and offer technology solutions that can fulfil the global needs of their customers. Technologies that promote efficiency and eliminate mundane tasks for humans are the need of the hour. However, as the reliance on technology-led transformation increases, tech vendors are becoming acutely aware that they cannot be best-in-class across the different technologies that an organisation will require to transform. Here is where having a robust partner ecosystem helps. Partnerships are bringing innovation to scale in Asia.

We can expect Asia to emerge as a powerhouse as businesses continue to innovate, embed technology in their product and service offerings – and as tech start-ups continue to support their innovation journeys.

Ecosystm CEO Amit Gupta gets face to face with Garrett Ilg, President Asia Pacific & Japan, Oracle to discuss the rise of the Asia Digital economies, the impact of the growing middle class on consumerism and the spirit of innovation across the region.

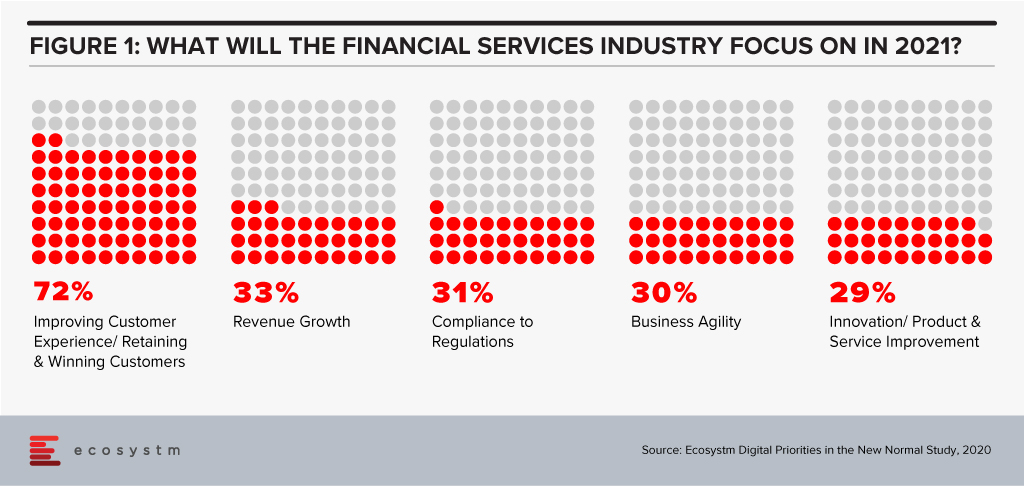

The disruption that we faced in 2020 has created a new appetite for adoption of technology and digital in a shorter period. Crises often present opportunities – and the FinTech and Financial Services industries benefitted from the high adoption of digital financial services and eCommerce. In 2021, there will be several drivers to the transformation of the Financial Services industry – the rise of the gig economy will give access to a larger talent pool; the challenges of government aid disbursement will be mitigated through tech adoption; compliance will come sharply back into focus after a year of ad-hoc technology deployments; and social and environmental awareness will create a greater appetite for green financing. However, the overarching driver will be the heightened focus on the individual consumer (Figure 1).

2021 will finally see consumers at the core of the digital financial ecosystem.

Ecosystm Advisors Dr. Alea Fairchild, Amit Gupta and Dheeraj Chowdhry present the top 5 Ecosystm predictions for FinTech in 2021 – written in collaboration with the Singapore FinTech Festival. This is a summary of the predictions; the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 FinTech Trends for 2021

#1 The New Decade of the ‘Empowered’ Consumer Will Propel Green Finance and Sustainability Considerations Beyond Regulators and Corporates

We have seen multiple countries set regulations and implement Emissions Trading Systems (ETS) and 2021 will see Environmental, Social and Governance (ESG) considerations growing in importance in the investment decisions for asset managers and hedge funds. Efforts for ESG standards for risk measurement will benefit and support that effort.

The primary driver will not only be regulatory frameworks – rather it will be further propelled by consumer preferences. The increased interest in climate change, sustainable business investments and ESG metrics will be an integral part of the reaction of the society to assist in the global transition to a greener and more humane economy in the post-COVID era. Individuals and consumers will demand FinTech solutions that empower them to be more environmentally and socially responsible. The performance of companies on their ESG ratings will become a key consideration for consumers making investment decisions. We will see corporate focus on ESG become a mainstay as a result – driven by regulatory frameworks and the consumer’s desire to place significant important on ESG as an investment criterion.

#2 Consumers Will Truly Be ‘Front and Centre’ in Reshaping the Financial Services Digital Ecosystems

Consumers will also shape the market because of the way they exercise their choices when it comes to transactional finance. They will opt for more discrete solutions – like microfinance, micro-insurances, multiple digital wallets and so on. Even long-standing customers will no longer be completely loyal to their main financial institutions. This will in effect take away traditional business from established financial institutions. Digital transformation will need to go beyond just a digital Customer Experience and will go hand-in-hand with digital offerings driven by consumer choice.

As a result, we will see the emergence of stronger digital ecosystems and partnerships between traditional financial institutions and like-minded FinTechs. As an example, platforms such as the API Exchange (APIX) will get a significant boost and play a crucial role in this emerging collaborative ecosystem. APIX was launched by AFIN, a non-profit organisation established in 2018 by the ASEAN Bankers Association (ABA), International Finance Corporation (IFC), a member of the World Bank Group, and the Monetary Authority of Singapore (MAS). Such platforms will create a level playing field across all tiers of the Financial Services innovation ecosystem by allowing industry participants to Discover, Design and rapidly Deploy innovative digital solutions and offerings.

#3 APIfication of Banking Will Become Mainstream

2020 was the year when banks accepted FinTechs into their product and services offerings – 2021 will see FinTech more established and their technology offerings becoming more sophisticated and consumer-led. These cutting-edge apps will have financial institutions seeking to establish partnerships with them, licensing their technologies and leveraging them to benefit and expand their customer base. This is already being called the “APIficiation” of banking. There will be more emphasis on the partnerships with regulated licensed banking entities in 2021, to gain access to the underlying financial products and services for a seamless customer experience.

This will see the growth of financial institutions’ dependence on third-party developers that have access to – and knowledge of – the financial institutions’ business models and data. But this also gives them an opportunity to leverage the existent Fintech innovations especially for enhanced customer engagement capabilities (Prediction #2).

#4 AI & Automation Will Proliferate in Back-Office Operations

From quicker loan origination to heightened surveillance against fraud and money laundering, financial institutions will push their focus on back-office automation using machine learning, AI and RPA tools (Figure 3). This is not only to improve efficiency and lower risks, but to further enhance the customer experience. AI is already being rolled out in customer-facing operations, but banks will actively be consolidating and automating their mid and back-office procedures for efficiency and automation transition in the post COVID-19 environment. This includes using AI for automating credit operations, policy making and data audits and using RPA for reducing the introduction of errors in datasets and processes.

There is enormous economic pressure to deliver cost savings and reduce risks through the adoption of technology. Financial Services leaders believe that insights gathered from compliance should help other areas of the business, and this requires a completely different mindset. Given the manual and semi-automated nature of current AML compliance, human-only efforts slow down processing timelines and impact business productivity. KYC will leverage AI and real-time environmental data (current accounts, mortgage payment status) and integration of third-party data to make the knowledge richer and timelier in this adaptive economic environment. This will make lending risk assessment more relevant.

#5 Driven by Post Pandemic Recovery, Collaboration Will Shape FinTech Regulation

Travel corridors across border controls have started to push the boundaries. Just as countries develop new processes and policies based on shared learning from other countries, FinTech regulators will collaborate to harmonise regulations that are similar in nature. These collaborative regulators will accelerate FinTech proliferation and osmosis i.e. proliferation of FinTechs into geographies with lower digital adoption.

Data corridors between countries will be the other outcome of this collaboration of FinTech regulators. Sharing of data in a regulated environment will advance data science and machine learning to new heights assisting credit models, AI, and innovations in general. The resulting ‘borderless nature’ of FinTech and the acceleration of policy convergence across several previously siloed regulators will result in new digital innovations. These Trusted Data Corridors between economies will be further driven by the desire for progressive governments to boost the Digital Economy in order to help the post-pandemic recovery.