The semiconductor industry is 70-years old and has a prominent – and sometimes inconspicuous – presence in our daily lives. Many of us, however, have become more aware of the industry and the ramifications of its disruption, because of recent events. The pandemic, natural disasters, power outages, geo-political conflicts, and accelerated digital transformation have all combined to disrupt the semiconductor sector, leaving no organisation immune to the impacts of the continuing global chip crisis.

It is estimated that 200 downstream industries have failed to fulfill customer demands owing to the silicon scarcity, ranging from automotive, consumer electronics, utilities and even the supply of light fixtures.

This Ecosystm Bytes discusses the impact of the crisis and highlights major initiatives that chip manufacturers and governments are taking to combat it, including:

- The factors leading to the shortage in the semiconductor industry

- The impact on industry sectors such as Automotive, Consumer Electronics and MedTech

- How leading chip makers such as TSMC, Intel and Samsung are increasing their manufacturing capabilities

- The importance of Asia to the semiconductor industry

- How countries such as Malaysia and India are aiming to build self-sufficiency in the industry

Read on to find out more.

It is an incredible time of change for the city and regional governments where every strategic activity – especially in these globally challenging times – presents a significant opportunity for transformation. To continue to meet the changing needs of the communities they serve, every modern city government’s technology story is a work in progress. While this is the mantra for successful continuous improvement it also describes the best strategic approach for how municipalities should manage their corporate application replacement programs.

Unfortunately, significant systems upgrade and replacement programs are regularly approached as complex, multi-tasking activities that have a hard start, a defined program, and a date-stamped end. In taking this traditional project implementation approach, intuitively, many organisations believe that doing as much as possible, in as quick a time as possible, ultimately helps to achieve twice as much within the same time. The result is more likely to be half as much, and at lower levels of quality and enjoyment for all involved. This manifests as project scope creep and budget overruns.

Aside from these big bang approaches, thanks to large implementation costs and stringent regulatory oversight, local governments are also forced to think upfront about the potential future value created by a significant core system technology change. The pressure of moving at high speed, and with a dominant technology focus, can obscure both the true organisational cost and ultimate value of the program. This mentality prevails even when it is acknowledged that activities associated with a transformation program will eventually usher in a period of significant change – that is not limited to the changing core corporate applications environment itself.

The 4-Part ERP Transformation Trap is All Too Common in City Government

An over-reliance on technology to deliver business transformation outcomes. Local governments everywhere continue to pursue strategic plans that are either wholly defined or implicitly reliant on world-class customer experience (CX), employee experience (EX), and digital transformation (DX) capabilities. Despite these being business-oriented strategies, organisations then pursue an over-reliance on technology – usually winner-take-all ERP led procurements – to achieve them.

Choosing an industry solution focused on the wrong business model. The chance of achieving these digital transformation outcomes is further obscured when the customer is not central to the data model. The core corporate application technology underpinning the sector’s leading ERP programs is largely based on a property-centric model – where the customer is a subordinate attribute of a property, and the property asset defines the business process and individual. It is a challenge for any council to deliver contemporary customer-first digital transformation with a property-centric approach. To realise customer and employee-centric outcomes, councils must therefore rethink their project’s business methodology and ask themselves, “what is our primary focus here?”. This is never more important than when replacing legacy systems.

Inability to realise that a winner-take-all ERP solution is not an architectural choice. ERP is important but it is not everything. The traditional council ERP is just one important part of an overall capability that allows authorities to longitudinally manage the impacts and opportunities of change across their organisation, communities, and stakeholder ecosystems. Having chosen a sector specific ERP solution, city governments realise too late that no single technology vendor has a best-of-breed solution to achieve the desired DX outcomes. That requires a more sophisticated architectural approach.

Failure to acknowledge there is no finish line to transformation. Like many worthwhile activities, the prize in DX is in the journey, not in the cup. While there can be an end to “project scope”, there should be no “end point” for an ERP transformation program. Only once these challenges are acknowledged and accepted, can transformation be assimilated into the organisation to ensure the council is technically capable of delivering the implicit outcome for the organisation. This could simply be defined as ‘a contemporary business approach to managing the money, the assets, the community, the customers, and the staff of regional government.’

A Better Way: Re-Architecting for Project Success

Where opportunities to meet increasing CX and EX demands arise, especially through ERP and corporate application renewal programs, successful projects in contemporary councils require a service-oriented architecture not found in contemporary or legacy ERP systems alone.

Beyond the property-centric challenges already outlined, even contemporary systems and suppliers can be among the least flexible to the changing data management requirements of many organisations which call for significantly more robust data, integration and application friendly infrastructure management environments.

Customer centricity, data management, integration and software infrastructure capabilities must take precedent over an aging view of single-vendor dominance in the city government sector, especially in middle- and back-office functions, which are typically void of true differentiation opportunities and prone to confining organisations to technology-led and locked projects.

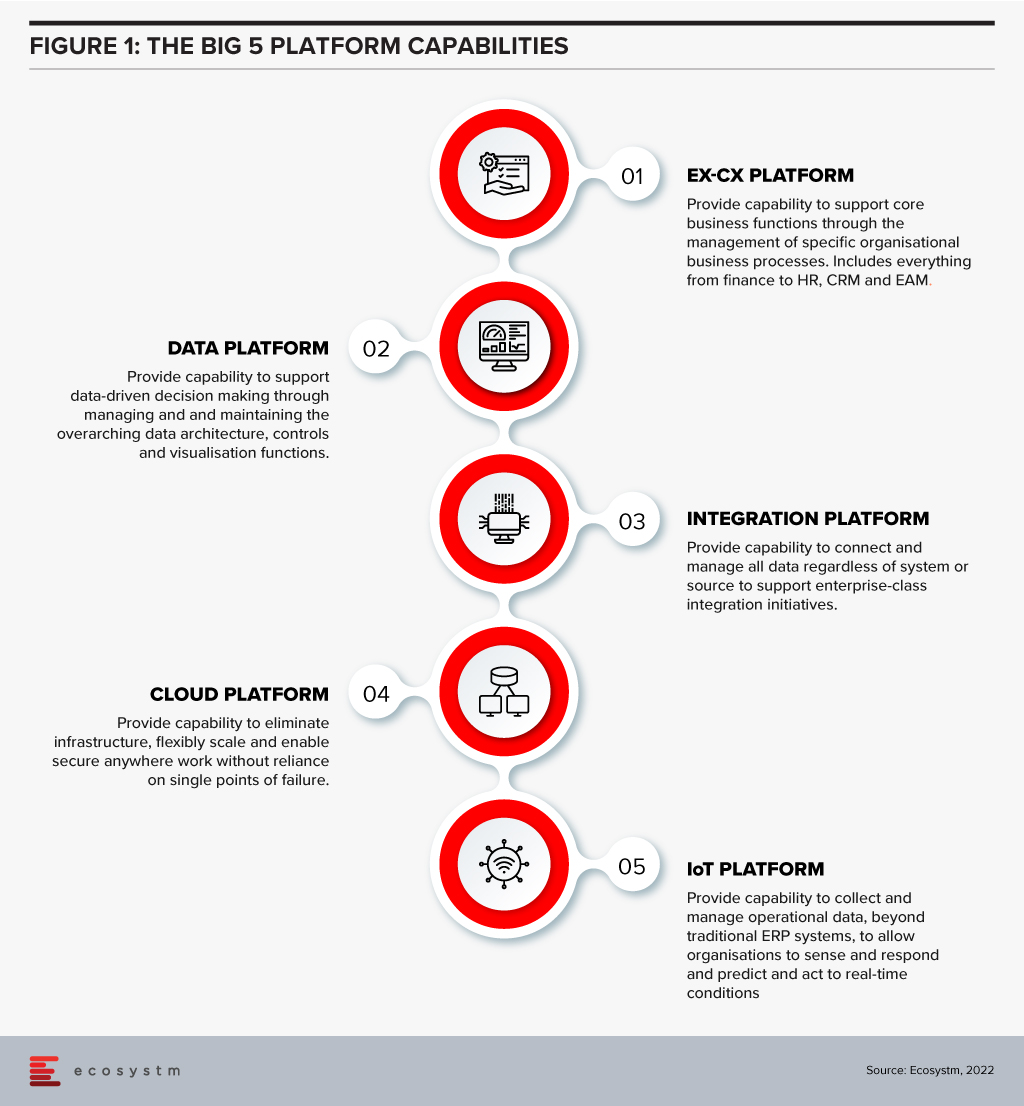

Rather than tendering for a single software provider or platform, contemporary city governments must ditch the old approach to procuring a winning ERP vendor and take steps to establish the following Big 5 platform capabilities (Figure 1). And then foster the contemporary workforce to support them.

For several decades now many organisations have attempted to short-circuit the city government ERP challenge. Fundamentally, technology transformation is not possible without technology change. A non-negotiable part of that change is a shift away from the psychology of brand-based procurement towards a new architectural approach which, like all businesses, is adaptable to change over a long period of time.

COVID-19 has been a major disruption for people-intensive industries and the BPO sector is no exception. However, some of the forward-looking BPO organisations are using this disruption as an opportunity to re-evaluate how they do business and how they can make themselves resilient and future-proof. In many of these conversations, technology and process reengineering are emerging as the two common themes in their journey to transform into a New Age BPO provider.

In 2022 BPO providers will focus on mitigating their key challenges around handling client expectations, better people management and investing in the right technologies for their own transformation journeys.

Read on to find out what Ecosystm Advisors Audrey William and Venu Reddy think will be the key trends for the New Age BPO in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for the New Age BPO in 2022 as PDF

When the FinTech revolution started, traditional banking felt the heat of competition from the ‘new kid on the block’. FinTechs promised (and often delivered) fast turnarounds and personalised services. Banks were forced to look at their operations through the lens of customer experience, constantly re-evaluating risk exposures to compete with FinTechs.

But traditional banks are giving their ‘neo-competitors’ a run for their money. Many have transformed their core banking for operational efficiency. They have also taken lessons from FinTechs and are actively working on their customer engagements. This Ecosystm Snapshot looks at how banks (such as Standard Chartered Bank, ANZ Bank, Westpac, Commonwealth Bank of Australia, Timo, and Welcome Bank) are investing in tech-led transformation and the ways tech vendors (such as IBM, Temenos, Mambu, TCS and Wipro) are empowering them.

To download this Ecosystm Bytes as a pdf for easier sharing and to access the hyperlinks, please click here.

COVID-19 has been a major disruption for people-intensive industries and the BPO sector is no exception. However, some of the forward-looking BPO organisations are using this disruption as an opportunity to re-evaluate how they do business and how they can make themselves resilient and future-proof. In many of these conversations, technology and process reengineering are emerging as the two common vectors in their journey to transform into a “New Age BPO” company.

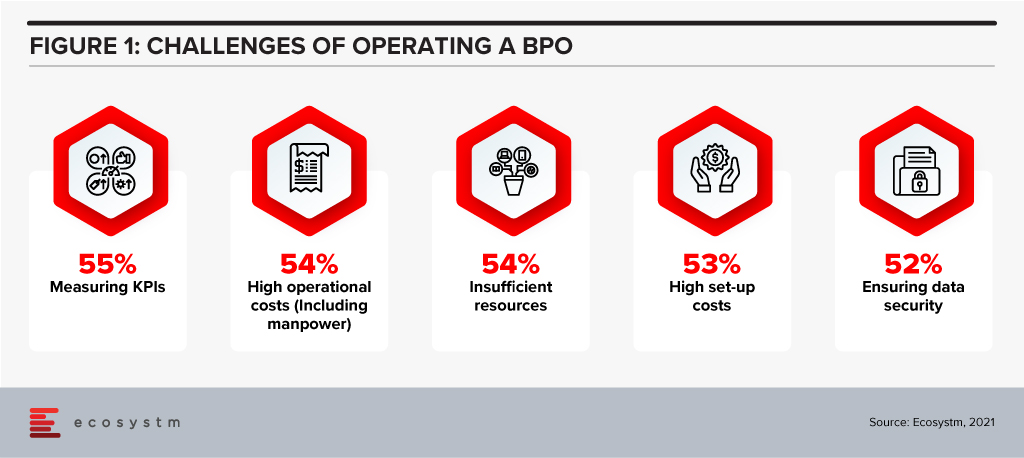

Ecosystm research finds that running large, people-intensive centres can have a diverse range of challenges (Figure 1).

The transformation must address the top three pain points that have been plaguing the BPO industry:

- Staff scheduling and growing cost due to resource shortage in metro cities

- Managing physical and IT security with data security and industry best practices in mind

- Work/performance metrics that drive cost pressure and minimise differentiation

The New Age BPO

The wave of movement of the BPO centres away from expensive metro locations to tier 2 and tier 3 towns will now become even more significant – across all countries. This will enable BPOs to tap into a larger resources pool and at a much lower cost to the business. This will mean investments in process re-engineering and technology. But, before this journey starts, it is very important for these organisations to reimagine themselves in the context of value and differentiation – and it can no longer just be “I can do it faster and cheaper”!

Becoming a New Age BPO will mean replacing the traditional mindset of ferrying a large number of employees to the office around 24-hour shifts, by technology-enabled processes. Technology will enable these organisations to be a lot more agile, put the same (or better) safeguards on data and privacy, and drive better work efficiency.

For this transformation to happen, it is important for the BPO organisation to not just bounce back to what they have been used to, but should show a willingness to “bounce forward”, as my colleague Tim Sheedy puts it. This means that they take this disruption as an opportunity to relook at their staffing plans, business processes, and customer engagement – and leverage the right technologies to address areas of improvement in all three fronts. At the same time, technology adoption should not be done in silos. The comprehensive technology adoption plan must be designed to address all three areas (staffing, process, and customer engagement) simultaneously. The technology should also be architected to be scalable (by geography and staff levels) and allow better manageability in terms of real-time reporting and work allocation.

It will be a fine balance. But the good news is that the technology is not only available to address these areas but is also mature enough to be cost-effective. Of course, this will require the organisation to view technology as a strategic investment.

Another aspect of technology-led transformation that will benefit BPO organisations is the transparency that technology can provide and the opportunity to build better trust. This will be driven by full visibility of what is actually happening and the ability to provide real-time progress reports on issues raised. This means that quarterly site visits by clients to “show and tell” can be avoided. The discussions can be about specific points of interest and improvement rather than the “feel good factors” that these visits usually provide.

So, in many ways COVID-19 has accelerated the evolution of the “New Age BPO sector” and the intersection of this wave with the digital transformation wave will have a positive long-term impact on the BPO sectors in popular destinations such as India, the Philippines, Brazil, Mexico and others across the world.

Without this transformation, BPO organisations will keep pushing themselves into a tight corner and eventually be replaced by nimble and technology-savvy competitors that are focused on process and industry differentiation.

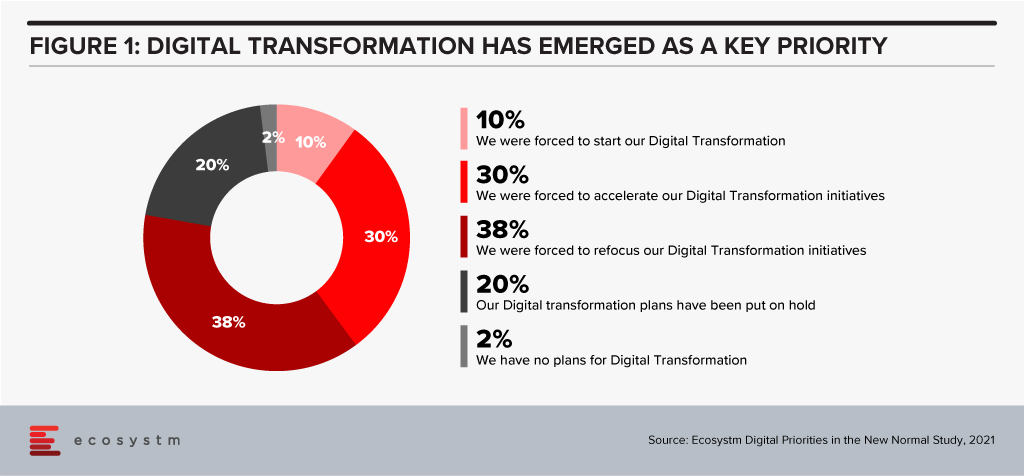

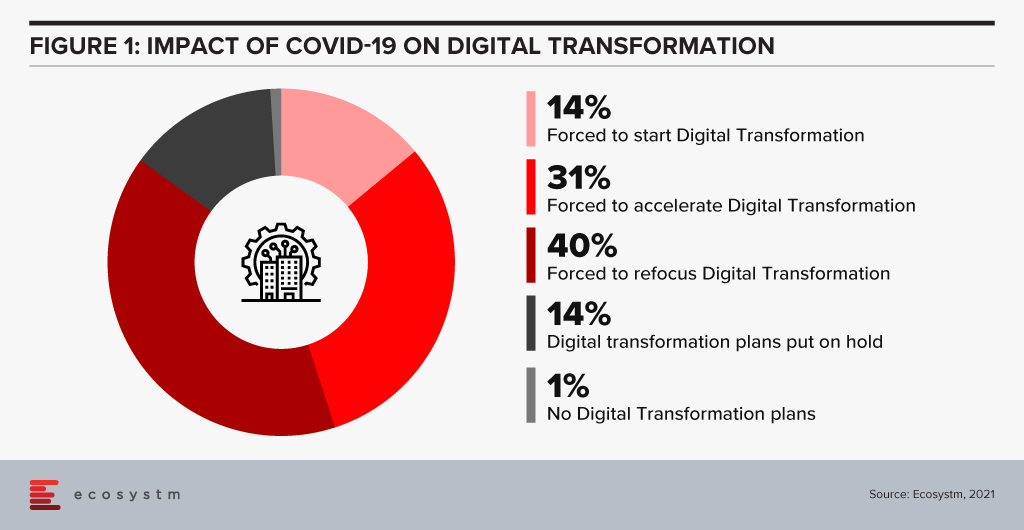

As the world has had to cope with a scenario never seen before in modern times, technology has been at the forefront of the response. This means hardware – computers, servers and the like – flew off the shelves. Cloud infrastructure and migration have been top of mind. “Digital Transformation” and the adoption of digital tools is expanding like a house on fire! We found that over 3 in 4 companies accelerated their digital plans in some way. Another 20% put plans on hold, largely because they felt the need to evaluate the old plans which became inadequate.

As vendors, channel partners and organisations scramble to put their new digital houses together and build the best digital castles possible, there is a major talent crunch. There are few who can deeply understand customer needs and recommend the right solution. While this affects all parties, the channel partners are feeling this more acutely. In my recent conversations with channel partners, it became evident that they are facing difficulties in finding and retaining good Sales and Solutions talent. There have also been complaints about talent being poached by the tech vendors they partner with!

The standard response to this problem is vendor certification and training. However, this is inadequate, due to three main reasons.

The Pace of Technological Change

The latest technology and what is possible with it changes on almost a daily basis. In this environment, for a person to keep up with everything is almost impossible. The ways in which a specific technology can be applied and the solutions it can deliver change, based on the ecosystem that forms around the technology and with the improvements in capability with time.

Small changes in different applications can cascade to create a solution (in terms of meeting a user need) which was not possible a short time ago. This may then compete with a completely different technology that has been considered satisfactory till date for the same user need. If the new option performs better, the old option is gone before you can snap your fingers.

For a salesperson to be across all this requires a solid understanding of the industry and its environment at a conceptual level. Given the pace of change, such people have become increasingly rare. They can be trained on a specific technology, not on perspectives, conceptual clarity or industry depth – that would require a formal degree!

The Limits of Lecture Style Training

Unfortunately, there is a key shortcoming in the whole certification program. A person going through any kind of classroom type training is limited in how much they can understand. This includes any kind of knowledge download or dump – videos, online courses, virtual classrooms, reading, webinars or physical classes. With technology that changes every day, the depth of knowledge imparted through such knowledge downloads is woefully inadequate. Expertise in technology is difficult to attain without getting one’s hands dirty.

Trying to make the training more “practical”, involving more exercises is good and does lead to better-trained personnel. But this is a long process and does not fit in with the timelines of most certification programs.

An actual customer implementation is probably the best teacher available right now. However, this leads to an unintended consequence – channel partners tend to stick with the vendor solutions that they have implemented before. Even if they can partner with other tech providers for better options they prefer to stick to what they know.

Vendor Bias in Training Programs

Certification is done, quite understandably, from the vendor’s point of view. The program is not built to generate an understanding of the tech world that we live in. That is taken as a given. Expertise in the vendor’s solution is the focus, and rightfully so. Talking points refer to that solution’s strengths and gloss over the weaknesses. There is no reason for a vendor to teach the participant the advantages of the competitor’s technology. Or explain the shortcomings of their own.

When the certified salesperson, however, is in front of the customer, this certification does not help them address all the queries. They are unable to clear the doubts or provide a complete (and objective) view that would satisfy a probing customer.

But there are ways in which this skills gap can be bridged – it will require both vendors and their channel partners to change how they view and grow talent. Stay tuned for the next feature where I share how the tech talent landscape can be changed.

BHP – the multinational mining giant – has signed agreements with AWS and Microsoft Azure as their long-term cloud providers to support their digital transformation journey. This move is expected to accelerate BHP’s cloud journey, helping them deploy and scale their digital operations to the workforce quickly while reducing the need for on-premises infrastructure.

Ecosystm research has consistently shown that many large organisations are using the learnings from how the COVID-19 pandemic impacted their business to re-evaluate their Digital Transformation strategy – leveraging next generation cloud, machine learning and data analytics capabilities.

BHP’s Dual Cloud Strategy

BHP is set to use AWS’s analytics, machine learning, storage and compute platform to deploy digital services and improve operational performance. They will also launch an AWS Cloud Academy Program to train and upskill their employees on AWS cloud skills – joining other Australian companies supporting their digital workforce by forming cloud guilds such as National Australia Bank, Telstra and Kmart Group.

Meanwhile, BHP will use Microsoft’s Azure cloud platform to host their global applications portfolio including SAP S/4 HANA environment. This is expected to enable BHP to reduce their reliance on regional data centres and leverage Microsoft’s cloud environment, licenses and SAP applications. The deal extends their existing relationship with Microsoft where BHP is using Office 365, Dynamics 365 and HoloLens 2 platforms to support their productivity and remote operations.

Ecosystm principal Advisor, Alan Hesketh says, “This dual sourcing is likely to achieve cost benefits for BHP from a competitive negotiation stand-point, and positions BHP well to negotiate further improvements in the future. With their scale, BHP has negotiating power that most cloud service customers cannot achieve – although an effective competitive process is likely to offer tech buyers some improvements in pricing.”

Can this Strategy Work for You?

Hesketh thinks that the split between Microsoft for Operations and AWS for Analytics will provide some interesting challenges for BHP. “It is likely that high volumes of data will need to be moved between the two platforms, particularly from Operations to Analytics and AI. The trend is to run time-critical analytics directly from the operational systems using the power of in-memory databases and the scalable cloud platform.”

“As BHP states, using the cloud reduces the need to put hardware on-premises, and allows the faster deployment of digital innovations from these cloud platforms. While achieving technical and cost improvements in their Operations and Analytics domains, it may compromise the user experience (UX). The UX delivered by the two clouds is quite different – so delivering an integrated experience is likely to require an additional layer that is capable of delivering a consistent UX. BHP already has a strong network infrastructure in place, so they are likely to achieve this within their existing platforms. If there is a need to build this UX layer, it is likely to reduce the speed of deployment that BHP is targeting with the dual cloud procurement approach.”

Many businesses that have previously preferred a single cloud vendor will find that they will increasingly evaluate multiple cloud environments, in the future. The adoption of modern development environments and architectures such as containers, microservices, open-source, and DevOps will help them run their applications and processes on the most suitable cloud option.

While this strategy may well work for BHP, Hesketh adds, “Tech buyers considering a hybrid approach to cloud deployment need to have robust enterprise and technology architectures in place to make sure the users get the experience they need to support their roles.”

In this Insight, our guest author Anupam Verma talks about how the Global Capability Centres (GCCs) in India are poised to become Global Transformation Centres. “In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be ‘Digital Transformation Centres’ for global businesses.”

India has a lot to offer to the world of technology and transformation. Attracted by the talent pool, enabling policies, digital infrastructure, and competitive cost structure, MNCs have long embraced India as a preferred destination for Global Capability Centres (GCCs). It has been reported that India has more than 1,700 GCCs with an estimated global market share of over 50%.

GCCs employ around 1 million Indian professionals and has an immense impact on the economy, contributing an estimated USD 30 billion. US MNCs have the largest presence in the market and the dominating industries are BSFI, Engineering & Manufacturing, Tech & Consulting.

GCC capabilities have always been evolving

The journey began with MNCs setting up captives for cost optimisation & operational excellence. GCCs started handling operations (such as back-office and business support functions), IT support (such as app development and maintenance, remote IT infrastructure, and help desk) and customer service contact centres for the parent organisation.

In the second phase, MNCs started leveraging GCCs as centers of excellence (CoE). The focus then was product innovation, Engineering Design & R&D. BFSI and Professional Services firms started expanding the scope to cover research, underwriting, and consulting etc. Some global MNCs that have large GCCs in India are Apple, Microsoft, Google, Nissan, Ford, Qualcomm, Cisco, Wells Fargo, Bank of America, Barclays, Standard Chartered, and KPMG.

In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be “Digital Transformation Centres” for global businesses.

The New Age GCC in the post-COVID world

On one hand, the pandemic broke through cultural barriers that had prevented remote operations and work. The world became remote everything! On the other hand, it accelerated digital adoption in organisations. Businesses are re-imagining customer experiences and fast-tracking digital transformation enabled by technology (Figure 1). High digital adoption and rising customer expectations will also be a big catalyst for change.

In last few years, India has seen a surge in talent pool in emerging technologies such as data analytics, experience design, AI/ML, robotic process automation, IoT, cloud, blockchain and cybersecurity. GCCs in India will leverage this talent pool and play a pivotal role in enabling digital transformation at a global scale. GCCs will have direct and significant impacts on global business performance and top line growth creating long-term stakeholder value – and not be only about cost optimisation.

GCCs in India will also play an important role in digitisation and automation of existing processes, risk management and fraud prevention using data analytics and managing new risks like cybersecurity.

More and more MNCs in traditional businesses will add GCCs in India over the next decade and the existing 1,700 plus GCCs will grow in scale and scope focussing on innovation. Shift of supply chains to India will also be supported by Engineering R & D Centres. GCCs passed the pandemic test with flying colours when an exceptionally large workforce transitioned to the Work from Home model. In a matter of weeks, the resilience, continuity, and efficiency of GCCs returned to pre-pandemic levels with a distributed and remote workforce.

A Final Take

Having said that, I believe the growth spurt in GCCs in India will come from new-age businesses. Consumer-facing platforms (eCommerce marketplaces, Healthtechs, Edtechs, and Fintechs) are creating digital native businesses. As of June 2021, there are more than 700 unicorns trying to solve different problems using technology and data. Currently, very few unicorns have GCCs in India (notable names being Uber, Grab, Gojek). However, this segment will be one of the biggest growth drivers.

Currently, only 10% of the GCCs in India are from Asia Pacific organisations. Some of the prominent names being Hitachi, Rakuten, Panasonic, Samsung, LG, and Foxconn. Asian MNCs have an opportunity to move fast and stay relevant. This segment is also expected to grow disproportionately.

New age GCCs in India have the potential to be the crown jewel for global MNCs. For India, this has a huge potential for job creation and development of Smart City ecosystems. In this decade, growth of GCCs will be one of the core pillars of India’s journey to a USD 5 trillion economy.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Senior Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

Organisations are increasingly investing in digital. However, they are at different stages of their digital maturity. Some companies are in the early transitional stages while others are investing to upgrade capabilities they instituted long ago. An understanding of the digital maturity of a typical organisation in your market/industry can help you benchmark your technology and. digital roadmap.

This ebook presents some key findings for financial services within Indonesia. You will get insights on impact of COVID-19 on transformation journeys, key business priorities for 2021, and the shift in engagement strategies and channels.

Click below to download the eBook

(Clicking on this link will take you to Sitecore website where you can download the eBook)