In 2009 one of the foremost Financial Services industry experts was giving my team a deep dive into the Global Financial Crisis (GFS) and its ramifications. According to him, one of the key reasons why it happened was that most people in key positions in both industry and government had probably never seen a full downturn in their careers. There was a bit of a hiccup during the dot com bust but nothing that seriously interrupted the long boom that began somewhere in 1988. They had never experienced anything quite like 2008; so they never imagined that such a crisis could actually happen.

Similarly, 2020 was an unprecedented year – in our lives and certainly for the tech industry. The GFC (as the name suggests) was a financial crisis. A lot of people lost their jobs, but after the bailouts things went largely back to normal. COVID-19 is something different altogether – the impact will be felt for years and we don’t yet know the full implications of the crisis.

While we would like to start 2021 with a clean slate and never talk about the pandemic again, the reality is that COVID-19 will shape what we will see this year. In the first place it looks like the disease will still be around for a substantial part of the year. Secondly, all the changes it has brought in 2020 with entire workforces suddenly moving to operating from home will have profound implications for technology and customer experience this year.

As we ease into 2021, I look at some of the organisational and technology trends that are likely to impact customer experience (CX) in 2021.

#1 All Business is Now eBusiness

COVID-19 has ensured that the few businesses which did not have an online presence became acutely aware that they needed one. It created a need for many businesses to quickly initiate eCommerce. Forbes reported a 77% increase in eCommerce infrastructure spending YoY. This represents about 4 years of growth squeezed into the first 6 months of 2020!

From a CX point of view there is going to be far more interaction with brands and products through online channels. This is not just about eCommerce and buying from a portal. It is also about using tools like Instagram, Facebook and other social media platforms more widely. It is about learning to interact with the customer in multiple ways and touching their journeys at multiple points, all virtually using the web – mostly the mobile web.

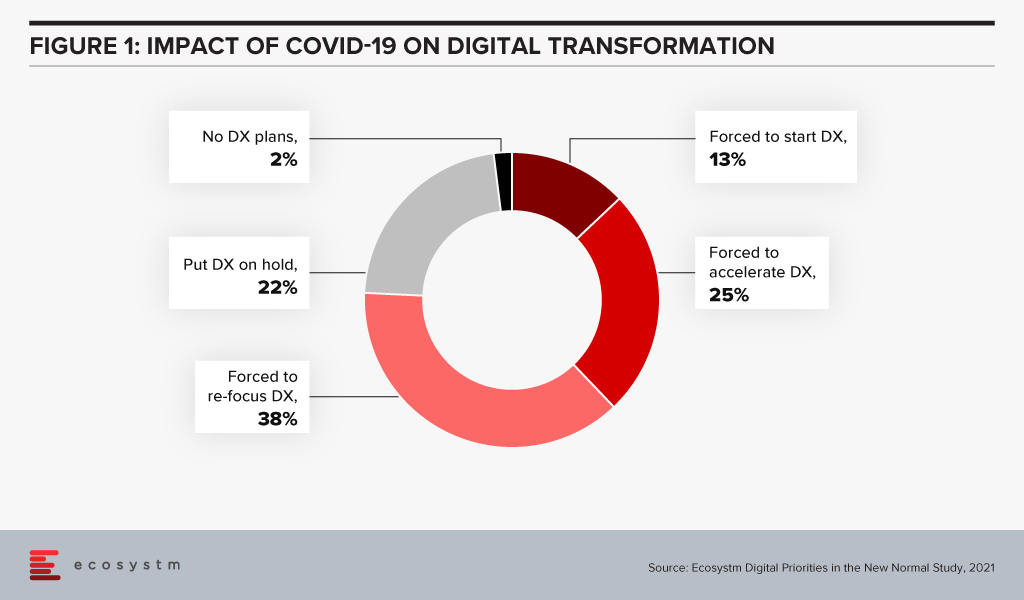

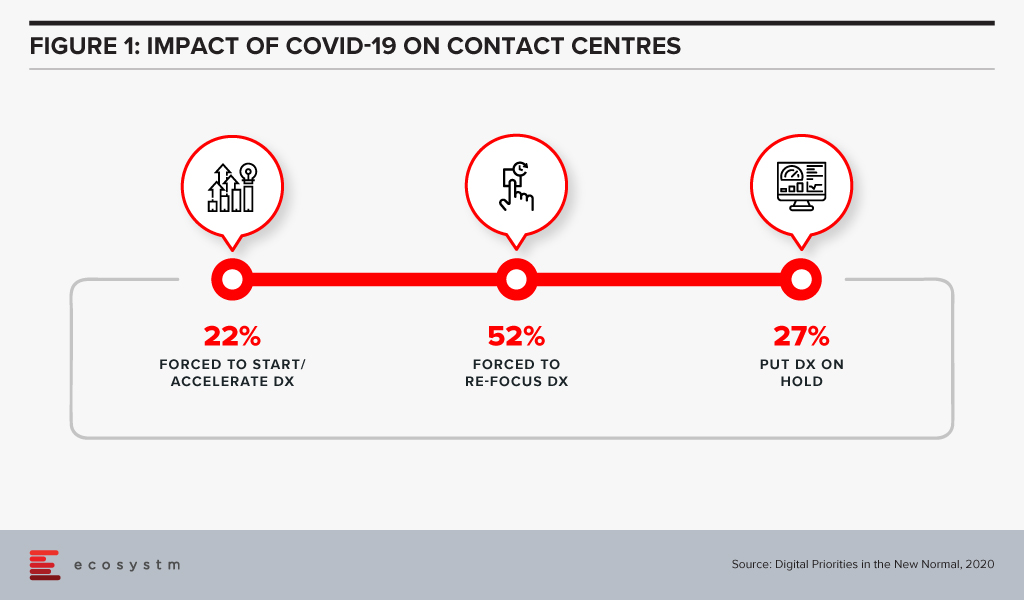

Ecosystm research shows that almost three out of four companies have decided on accelerating or modifying the digitalisation they were undergoing (Figure 1). It is fair to expect that this gives a further boost to moving to the cloud. For the customer it will mean being able to access information in many new ways and connect with products, services, brands at multiple points on the web.

Since interacting with the customer at multiple points is new for most services, I foresee a lot of missed opportunities as companies learn to navigate a completely different landscape. Customers pampered by digitally native organisations often react harshly to even a small mistake. It will become critical for companies to not just become a bigger presence online but also to manage their customers well.

New solutions such as Customer Data Platforms (CDP), as opposed to CRM will become common. Players who are into Customer Experience management are likely to see huge business growth and new players will rapidly enter this space. They will promise to affordably manage CX across the globe, leveraging the cloud.

#2 Virtual Merges with Real

Virtual and Augmented Reality are not new. They have been around for a while. This will now cross the early adoption stage and is likely to proliferate in terms of use cases and importance.

AR/VR has so far been seen mainly in games where one wears an unwieldy – though ever-improving – headset to transport oneself into a 3D virtual world. Or in certain industrial applications e.g., using a mobile device to look at some machinery; the device captures what the eye can see while providing graphical overlays with information. In 2021 I expect to see almost all industrial applications adopting some form of this technology. This will have an impact on how products are serviced and repaired.

For the mainstream, 2020 was the year of videoconferencing – as iconic as the shift to virtual meetings has been, there is much more to come. Meetings, conferences, events, classrooms have all gone virtual. Video interaction with multiple people and sharing information via shared applications is commonplace. Virtual backgrounds which hide where you are actually speaking from are also widely used and getting more creative by the day.

Imagine then a future where you get on one of these calls wearing a headset and are transported into a room where your colleagues who are joining the call also are. You see them as full 3D people, you see the furniture, and the room decor. You speak and everyone sees your 3D avatar speak, gesture (as you gesture from the comfort of your home office) and move around. It will seem like you are really in the conference room together! If this feels futuristic or unreal try this or look at how the virtual office can look in the very near future.

While the solutions may not look very sophisticated, they will rapidly improve. AR/VR will start to really make its presence felt in the lives of consumers. From being able to virtually “try” on clothes from a boutique to product launches going virtual, these technologies will deeply impact customer experience in 2021 and beyond

In the immortal words of Captain Kirk, we will be going where no man has gone before – enabled by AR / VR.

#3 Digital CX will involve Multiple Technologies

AI, IoT and 5G will continue to support wider CX initiatives.

The advances that I have mentioned will gain impetus from 5G networking, which will enable unprecedented bandwidth availability. To deliver an AR experience over the cloud, riding on a 5G network, will literally be a game changer compared to the capabilities of older networks.

Similarly, IoT will lead to massive changes in terms of product availability, customisation and so on. 5G-enabled IoT will allow a lot more data to be carried a lot faster; and more processing at the edge. IoT will have some initial use cases in Retail, Services and other non-manufacturing sectors – but perhaps not as strongly as some commentators seem to indicate.

AI continues to drive change. While AI may not transform CX in 2021, this is a technology which will be a component of most other CX offerings, and so will impact customer experience in the next few years. In fact, thinking of businesses in 2025 I cannot believe that there will be a single business to customer (B2C) interaction which will not feature some form of AI technology.

I’d be interested to hear your thoughts on the technologies which will impact CX in 2021 – Connect with me on the Ecosystm platform.

In 2020, much of the focus for organisations were on business continuity, and on empowering their employees to work remotely. Their primary focus in managing customer experience was on re-inventing their product and service delivery to their customers as regular modes were disrupted. As they emerge from the crisis, organisations will realise that it is not only their customer experience delivery models that have changed – but customer expectations have also evolved in the last few months. They are more open to digital interactions and in many cases the concept of brand loyalty has been diluted. This will change everything for organisations’ customer strategies. And digital technology will play a significant role as they continue to pivot to succeed in 2021 – across regions, industries and organisations.

Ecosystm Advisors Audrey William, Niloy Mukherjee and Tim Sheedy present the top 5 Ecosystm predictions for Customer Experience in 2021. This is a summary of the predictions – the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 Customer Experience Trends for 2021

- Customer Experience Will Go Truly Digital

COVID-19 made the few businesses that did not have an online presence acutely aware that they need one – yesterday! We have seen at least 4 years of digital growth squeezed into six months of 2020. And this is only the beginning. While in 2020, the focus was primarily on eCommerce and digital payments, there will now be a huge demand for new platforms to be able to interact digitally with the customer, not just to be able to sell something online.

Digital customer interactions with brands and products – through social media, online influencers, interactive AI-driven apps, online marketplaces and the like will accelerate dramatically in 2021. The organisations that will be successful will be the ones that are able to interact with their customers and connect with them at multiple touchpoints across the customer journey. Companies unable to do that will struggle.

- Digital Engagement Will Expand Beyond the Traditional Customer-focused Industries

One of the biggest changes in 2020 has been the increase in digital engagement by industries that have not traditionally had a strong eye on CX. This trend is likely to accelerate and be further enhanced in 2021.

Healthcare has traditionally been focused on improving clinical outcomes – and patient experience has been a byproduct of that focus. Many remote care initiatives have the core objective of keeping patients out of the already over-crowded healthcare provider organisations. These initiatives will now have a strong CX element to them. The need to disseminate information to citizens has also heightened expectations on how people want their healthcare organisations and Public Health to interact with them. The public sector will dramatically increase digital interactions with citizens, having been forced to look at digital solutions during the pandemic.

Other industries that have not had a traditional focus on CX will not be far behind. The Primary & Resources industries are showing an interest in Digital CX almost for the first time. Most of these businesses are looking to transform how they manage their supply chains from mine/farm to the end customer. Energy and Utilities and Manufacturing industries will also begin to benefit from a customer focus – primarily looking at technology – including 3D printing – to customise their products and services for better CX and a larger share of the market.

- Brands that Establish a Trusted Relationship Can Start Having Fun Again

Building trust was at the core of most businesses’ CX strategies in 2020 as they attempted to provide certainty in a world generally devoid of it. But in the struggle to build a trusted experience and brand, most businesses lost the “fun”. In fact, for many businesses, fun was off the agenda entirely. Soft drink brands, travel providers, clothing retailers and many other brands typically known for their fun or cheeky experiences moved the needle to “trust” and dialed it up to 11. But with a number of vaccines on the horizon, many CX professionals will look to return to pre-pandemic experiences, that look to delight and sometimes even surprise customers.

However, many companies will get this wrong. Customers will not be looking for just fun or just great experiences. Trust still needs to be at the core of the experience. Customers will not return to pre-pandemic thinking – not immediately anyway. You can create a fun experience only if you have earned their trust first. And trust is earned by not only providing easy and effective experiences, but by being authentic.

- Customer Data Platforms Will See Increased Adoption

Enterprises continue to struggle to have a single view of the customer. There is an immense interest in making better sense of data across every touchpoint – from mobile apps, websites, social media, in-store interactions and the calls to the contact centre – to be able to create deeper customer profiles. CRM systems have been the traditional repositories of customer data, helping build a sales pipeline, and providing Marketing teams with the information they need for lead generation and marketing campaigns. However, CRM systems have an incomplete view of the customer journey. They often collect and store the same data from limited touchpoints – getting richer insights and targeted action recommendations from the same datasets is not possible in today’s world. And organisations struggled to pivot their customer strategies during COVID-19. Data residing in silos was an obstacle to driving better customer experience.

We are living in an age where customer journeys and preferences are becoming complex to decipher. An API-based CDP can ingest data from any channel of interaction across multiple journeys and create unique and detailed customer profiles. A complete overhaul of how data can be segregated based on a more accurate and targeted profile of the customer from multiple sources will be the way forward in order to drive a more proactive CX engagement.

- Voice of the Customer Programs Will be Transformed

Designing surveys and Voice of Customer programs can be time-consuming and many organisations that have a routine of running these surveys use a fixed pattern for the data they collect and analyse. However, some organisations understand that just analysing results from a survey or CSAT score does not say much about what customers’ next plan of action will be. While it may give an idea of whether particular interactions were satisfactory, it gives no indication of whether they are likely to move to another brand; if they needed more assistance; if there was an opportunity to upsell or cross sell; or even what new products and services need to be introduced. Some customers will just tick the box as a way of closing off a feedback form or survey. Leading organisations realise that this may not be a good enough indication of a brand’s health.

Organisations will look beyond CSAT to other parameters and attributes. It is the time to pay greater attention to the Voice of the Customer – and old methods alone will not suffice. They want a 360-degree view of their customers’ opinions.

2020 saw a shutdown in both supply and demand which has effectively put the brakes on many economic activities and forced a complete rethink on how to continue doing business and maintain social interactions. The COVID-19 pandemic has accelerated digitalisation of consumers and enterprises, and the telecommunications industry has been the pillar which has kept the world ticking over. The rise in data use coupled with the fervent growth of the digital economy augurs well for the telecom sector in 2021.

Ecosystm Advisors Claus Mortensen, Rahul Gupta, and Shamir Amanullah present the top 5 Ecosystm predictions for Telecommunications & Mobility trends for 2021. This is a summary of the predictions – the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 Telecommunications & Mobility Trends for 2021

- The 5G Divide – Reality for Some and Hype for Others

Despite the economic challenges in 2020, GSMA reports that the global 5G subscriptions doubled QoQ in Q2 2020 to hit at least 137.7 million subscribers. This accounts for 1.5% of total subscribers – and is expected to rise to 30% by 2025.

The value of 5G will become increasingly mainstream in the next few years. 5G offers a tailored user-centric approach to network services, low latency and significantly higher number of connections which will power a new era of mobile Internet of Everything (IoE).

However, there are many operators who are still sceptical about 5G. In the US, many operators failed to get any tangible positives from 5G. In the near term, many operators will continue to evolve their 5G capabilities – a full grown standalone 5G technology implementation in some verticals might take longer.

The unsuccessful launch of 5G by the US operators does not mean that 5G is a failure, however. It also implies that we need to look at other geographies to lead us into 5G – and Asia Pacific may well emerge as a leader in this space. China, for example, leads the drive in 5G adoption; and 5G smartphones account for more than half of global sales in recent months.

- Telecom Operators Will Accelerate Digital Transformation

Telecom operators are facing increasing demands for cutting-edge services and top-notch customer experience (CX). The global pandemic has caused revenue loss, due to struggling economies and many operators will aim to reduce OpEX to circumvent these financial pressures, raise the quality of CX and retain existing customers. To realise this, there will be much focus on improvement in efficiencies, better operations management as well as improving the IT stack. These digital transformation efforts will enable rapid and flexible services provisioning, which will be better prepared for the tailored services customers now demand.

Many operators are increasingly incorporating cloudification alongside the 5G network deployment. Operators are moving towards transforming their operations and business support systems to a more virtualised and software-defined infrastructure. 5G will operate across a range of frequencies and bands – with significantly more devices and connections becoming software-defined with computing power at the Edge. Operators will also harness the power of AI to analyse massive volumes of data from the networks accessed by millions of devices in order to improve CX, ramp up operational efficiencies as well as introduce new services tailored to customer needs to increase revenue.

- Remote Working Will Transform Telecommunications Networks

The changing patterns in peak network traffic and the substantial movement of traffic from central business districts to residential areas require a fundamental rethink in network traffic management. In addition, many businesses continue to ramp up digital transformation efforts to conduct business online as physical channels will remain limited. Consumer onboarding will also be fervent, as organisations look at business recovery – resulting in increase in bandwidth requirements.

The increasing remote working trend is amplifying the need for greater cybersecurity. Cybersecurity has catapulted in importance as the pandemic has seen a worrying increase in attacks on banks, cloud servers and mobile devices, among others. Cyber-attack incidents specifically due to remote working, has seen a rise. A telecom operator’s compromised security can have country-wide, and even global consequences.

- SASE Will Grow – and Sprawl

Although it was perhaps originally seen as an Over-The-Top (OTT) provisioned competitive service to operators’ MPLS services, many telecom service providers have been embracing SD-WAN over the years as part of their managed services portfolio. “Traditional” SD-WAN offers some of the flexibility needed to address the change towards a more distributed access and the workload requirements that the pandemic has accelerated – the technology does not address all of the issues related to this transformed workspace.

Employees are now working from a variety of locations and workloads are becoming increasingly distributed. To address this change, organisations are challenged to move workloads and applications between platforms, potentially compromising security. Despite all the challenges that the pandemic brought with it – both human and technical – it has also provided organisations with an opportunity to rethink their IT and WAN architectures and to adopt an approach that has security at its core.

We believe that secure access service edge (SASE), which is a model for combining SD-WAN and security in a cloud-based environment, will see a drastic rise in adoption in 2021 and beyond.

- OTT Players Will Continue their Expansion in the Telecommunications Space

Facebook, Google, Amazon are no longer considered as web companies as they moved from standalone ‘web’ companies to become OTT providers and are now significant players in telecom space. With the Facebook-Jio deal in India earlier this year, and with Google and Amazon actively eyeing the telecom space, these players will continue to explore this space especially in the emerging markets of Asia and Africa. There are telecom providers in these countries which will be prime targets for partnerships. These operators could be those that have a large customer base, are struggling with their bottom lines or are already looking at exit routes. OTT players were already offering services like voice, messaging, video calling and so on which have been the domain expertise of mobile operators for a long time. The market will see instances where telecom providers will sell small stakes to OTT players at a premium and get access to the vast array of services that these OTT providers offer.

Public sector organisations are looking at 2021 as the year where they either hobble back to normalcy or implement their successful pilots (that were honed under tremendous pressure). Ecosystm research finds that 60% of government agencies are looking at 2021 as the year they make a recovery to normal – or the normal that finally emerges. The path to recovery will be technology-driven, and this time they will look at scalability and data-driven intelligence.

Ecosystm Advisors Alan Hesketh, Mike Zamora and Sash Mukherjee present the top 5 Ecosystm predictions for Cities of the Future in 2021. This is a summary of our Cities of the Future predictions – the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Cities of the Future Trends for 2021

#1 Cities Will Re-start Their Transformation Journey by Taking Stock

In 2021 the first thing that cities will do is introspect and reassess. There have been a lot of abrupt policy shifts, people changes, and technology deployments. Most have been ad-hoc, without the benefit of strategy planning, but many of the services that cities provide have been transformed completely. Government agencies in cities have seen rapid tech adoption, changes in their business processes and in the mindset of how their employees – many who were at the frontline of the crisis – provide citizen services.

Technology investments, in most cases, took on an unexpected trajectory and agencies will find that they have digressed from their technology and transformation roadmap. This also provides an opportunity, as many solutions would have gone through an initial ‘proof-of-concept’ without the formal rigours and protocols. Many of these will be adopted for longer term applications. In 2021, they will retain the same technology priorities as 2020, but consolidate and strengthen on their spend.

#2 Cities Will be Instrumented Using Intelligent Edge Devices

The capabilities of edge devices continue to increase dramatically, while costs decline. This reduces the barriers to entry for cities to collect and analyse significantly more data about the city and its people. Edge devices move computational power and data storage as close to the point of usage as possible to provide good performance. Devices range from battery powered IoT devices for data collection through to devices such as smart CCTV cameras with embedded pattern recognition software.

Cities will develop many use cases for intelligent edge devices. These uses will range from enhancing old assets using newer approaches to data collection – through to accelerating the speed and quality of the build of a new asset. The move to data-driven maintenance and decision-making will improve outcomes.

#3 COVID-19 Will Impact City Design

The world has received a powerful reminder of the vulnerability of densely populated cities, and the importance of planning and regulating public health. COVID-19 will continue to have an impact on city design in 2021.

A critical activity in controlling the pandemic in this environment is the test-and-trace capabilities of the local public health authorities. Technology to provide automated, accurate, contact tracing to replace manual efforts is now available. Scanning of QR codes at locations visited is proving to be the most widely adopted approach. The willingness of citizens to track their travels will be a crucial aid in managing the spread of COVID-19.

Early detection of new disease outbreaks, or other high-risk environmental events, is essential to minimise harm. Intelligent edge devices that detect the presence of viruses will become crucial tools in a city’s defence.

Intelligent edge devices will also play a role in managing building ventilation. Well-ventilated spaces are an important factor in controlling virus transmission. But a limited number of buildings have ventilation systems that are capable of meeting those requirements. Property owners will begin to refit their facilities to provide better air movement.

#4 Technology Vendors Will Emerge as the Conductors of Cities of the Future

The built environment comprises not only of the physical building, but also the space around the buildings and building operations. The real estate developer/investor owns the building – the urban fabric, the relationship of buildings to each other, the common space and the common services provided to the city, is owned by the City. The question is who will coordinate the players, e.g. business, citizens, government and the built environment. Ideally the government should be the conductor. However, they may not have sufficient experience or knowledge to properly implement this role. This means a capable and knowledgeable neutral consultant will at least initially fill this role. There is an opportunity for a technology vendor to fill that consulting role and impact the city fabric. This enhanced city environment will be requested by the Citizen, driven by the City, and guided by Technology Vendors. 2021 will see leading technology vendors working very closely with cities.

#5 Compliance Will be at the Core of Citizen Engagement Initiatives

Many Smart Cities have long focused on online services – over the last couple of years mobile apps have further improved citizen services. In 2020, the pandemic challenged government agencies to continue to provide services to citizens who were housebound and had become more digital savvy almost overnight. And many cities were able to scale up to fulfill citizen expectations.

However, in 2021 there will be a need to re-evaluate measures that were implemented this year – and one area that will be top priority for public sector agencies is compliance, security and privacy.

The key drivers for this renewed focus on security and privacy are:

- The need to temper the focus of ‘service delivery at any cost’ and further remind agencies and employees that security and privacy must comply with standard to allow the use of government data.

- The rise of cyberattacks that target not only essential infrastructure, but also individual citizens and small and medium enterprises (SMEs).

- The rise of app adoption by city agencies – many that have been developed by third parties. It will become essential to evaluate their compliance to security and privacy requirements.

Artificial Intelligence (AI) is becoming embedded in financial services across consumer interactions and core business processes, including the use of chatbots and natural language processing (NLP) for KYC/AML risk assessment.

But what does AI mean for financial regulators? They are also consuming increasing amounts of data and are now using AI to gain new insights and inform policy decisions.

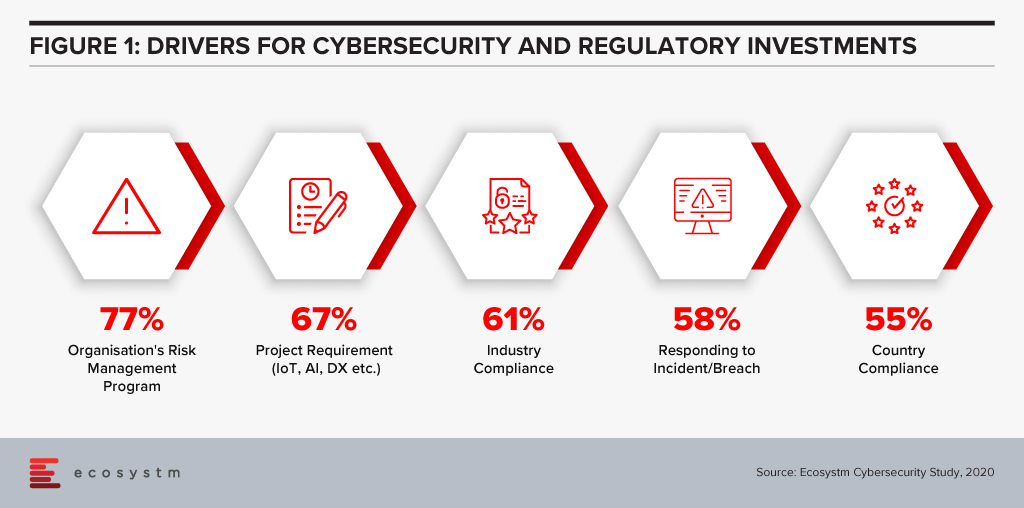

The efficiencies that AI offers can be harnessed in support of compliance within both financial regulation (RegTech) and financial supervision (SupTech). Authorities and regulated institutions have both turned to AI to help them manage the increased regulatory requirements that were put in place after the 2008 financial crisis. Ecosystm research finds that compliance is key to financial institutions (Figure 1).

SupTech is maturing with more robust safeguards and frameworks, enabling the necessary advancements in technology implementation for AI and Machine Learning (ML) to be used for regulatory supervision. The Bank of England and the UK Financial Conduct Authority surveyed the industry in March 2019 to understand how and where AI and ML are being used, and their results indicated 80% of survey respondents were using ML. The most common application of SupTech is ML techniques, and more specifically NLP to create more efficient and effective supervisory processes.

Let us focus on the use of NLP, specifically on how it has been used by banking authorities for policy decision making during the COVID-19 crisis. AI has the potential to read and comprehend significant details from text. NLP, which is an important subset of AI, can be seen to have supported operations to stay updated with the compliance and regulatory policy shifts during this challenging period.

Use of NLP in Policy Making During COVID-19

The Financial Stability Board (FSB) coordinates at the international level, the work of national financial authorities and international standard-setting bodies in order to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies. A recent FSB report delivered to G20 Finance Ministers and Central Bank Governors for their virtual meeting in October 2020 highlighted a number of AI use cases in national institutions.

We illustrate several use cases from their October report to show how NLP has been deployed specifically for the COVID-19 situation. These cases demonstrate AI aiding supervisory team in banks and in automating information extraction from regulatory documents using NLP.

De Nederlandsche Bank (DNB)

The DNB is developing an interactive reporting dashboard to provide insight for supervisors on COVID-19 related risks. The dashboard that is in development, enables supervisors to have different data views as needed (e.g. over time, by bank). Planned SupTech improvements include incorporating public COVID-19 information and/or analysing comment fields with text analysis.

Monetary Authority of Singapore (MAS)

MAS deployed automation tools using NLP to gather international news and stay abreast of COVID-19 related developments. MAS also used NLP to analyse consumer feedback on COVID-19 issues, and monitor vulnerabilities in the different customer and product segments. MAS also collected weekly data from regulated institutions to track the take-up of credit relief measures as the pandemic unfolded. Data aggregation and transformation were automated and visualised for monitoring.

US Federal Reserve Bank Board of Governors

One of the Federal Reserve Banks in the US is currently working on a project to develop an NLP tool used to analyse public websites of supervised regulated institutions to identify information on “work with your customer” programs, in response to the COVID-19 crisis.

Bank of England

The Bank developed a Policy Response Tracker using web scraping (targeted at the English versions of each authority/government website) and NLP for the extraction of key words, topics and actions taken in each jurisdiction. The tracker pulls information daily from the official COVID-19 response pages then runs it through specific criteria (e.g. user-defined keywords, metrics and risks) to sift and present a summary of the information to supervisors.

Market Implications

Even with its enhanced efficiencies, NLP in SupTech is still an aid to decision making and cannot replace the need for human judgement. NLP in policy decision is performing clearly defined information gathering tasks with greater efficiency and speed. But NLP cannot change the quality of the data provided, so data selection and choice are still critical to effective policy making.

For authorities, the use of SupTech could improve oversight, surveillance, and analytical capabilities. These efficiency gains and possible improvement in quality arising from automation of previously manual processes could be consideration for adoption.

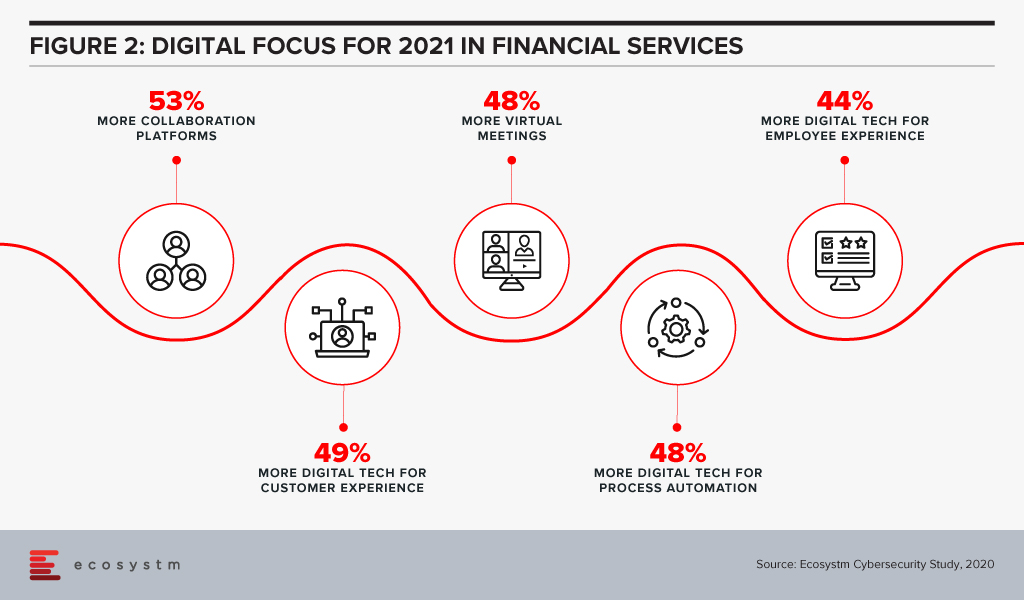

Attention will be paid in 2021 to focusing on automation of processes using AI (Figure 2).

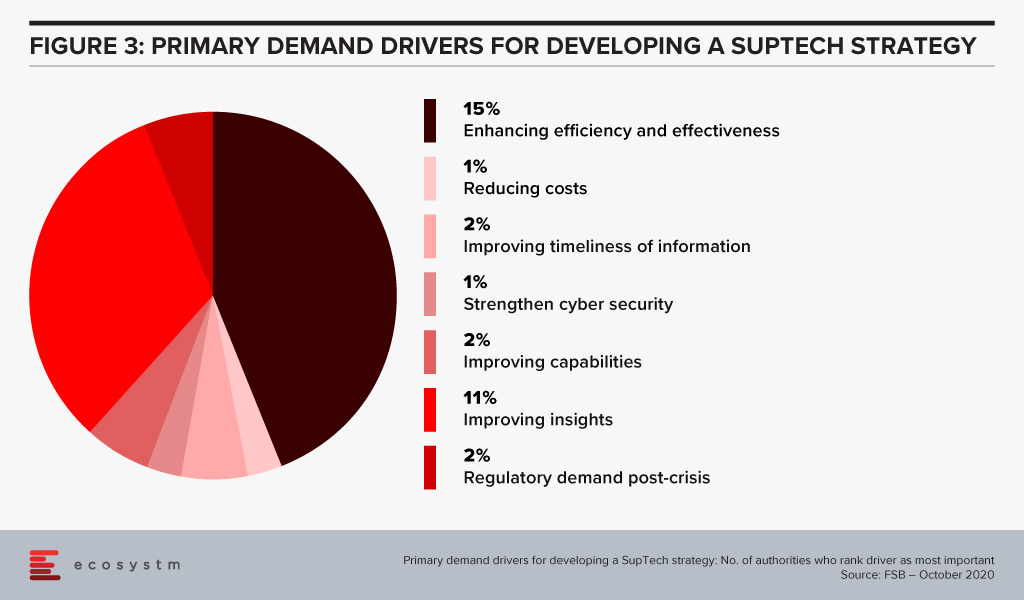

Based on a survey done by the FSB of its members (Figure 3), the majority of their respondents had a SupTech innovation or data strategy in place, with the use of such strategies growing significantly since 2016.

Summary

For more mainstream adoption, data standards and use of effective governance frameworks will be important. As seen from the FSB survey, SupTech applications are now used in reporting, data management and virtual assistance. But institutions still send the transaction data history in different reporting formats which results in a slower process of data analysing and data gathering. AI, using NLP, can help with this by streamlining data collection and data analytics. While time and cost savings are obvious benefits, the ability to identify key information (the proverbial needle in the haystack) can be a significant efficiency advantage.

Singapore FinTech Festival 2020: Infrastructure Summit

For more insights, attend the Singapore FinTech Festival 2020: Infrastructure Summit which will cover topics tied to creating infrastructure for a digital economy; and RegTech and SupTech policies to drive innovation and efficiencies in a co-Covid-19 world.

Running a contact centre has been extremely challenging in 2020. Contact centres have had to ensure business continuity, keep the focus on customer experience, and manage and motivate a largely remote workforce. Since the outbreak of COVID-19, not only have contact centres seen high inbound activity, but they have also had to manage agents who are dispersed and working remotely. 2020 has seen many contact centres starting, accelerating or re-focusing their digital transformation initiatives (Figure 1).

2021 will see contact centres focusing on transformation, not only to survive but also because their organisations and clients will expect more process efficiency and better customer experience. Ecosystm Advisors Audrey William and Ravi Bhogaraju present the top 5 Ecosystm predictions for Contact Centres Trends in 2021.

This is a summary of our predictions on the top 5 Contact Centre Trends for 2021 – the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Contact Centre Trends for 2021

- Remote Working Will Force Contact Centres to Re-evaluate Security Measures

Security has always been a concern for contact centre leaders. Improper data use by agents and agents breaching confidentiality are the biggest security challenges for contact centres. This has been further heightened, especially the fear of agents purposely breaching confidentiality while working from home.

Contact centres are still trying to figure out the best security measures when managing customer data, especially in the work-from-home environment. There is greater scrutiny over security and compliance measures – what agents view, how agents access the data, when agents log in and out of the system. Outsourcing providers will also have to guarantee high levels of security – a trusted relationship and defining the best practices on working from home will not be sufficient.

Many contact centres will trial different methods – from installing video surveillance cameras, desktop monitoring tools and access controls. Others will test technologies that can mask the information captured through mobile devices. This presents immense opportunities for vendors, as contact centres will rely heavily on technology to re-invent their security practices.

- Contact Centres will Invest in Conversational AI – Chatbots will No Longer be Enough

Many enterprises have rushed into deploying chatbots with expectations that these engines can solve the problem of high call volumes. The outcomes have often been poor, leaving customers frustrated and opting to interact with a live agent instead. Implementing a basic chatbot does not fully solve the problem and will force companies back to the drawing board.

Conversational AI offers a different experience by designing multiple forms of dialogues and conversations. It requires conversational design and the algorithms go through rigour from the start. The aim should be to make the channel irresistible – one that customers have confidence in, and that can reduce the need to email or call an agent. Successful uses cases have shown that conversational AI can reduce calls and repetitive queries by 70-90%. Ecosystm research finds that contact centres are ramping up their self-service capabilities and their adoption of AI and machine learning.

- Offshore Centres will Re-invent Themselves and Make a Comeback

2020 has seen contact centres in offshore locations struggle to offer services to global clients. Many of these operators have been plagued by poor internet connectivity at agents’ homes, and unfavourable home working environments. These outsourcing locations remain vital however, for multiple reasons – for example the range of services offered, agent specialisation, costs or diversity in agent profile.

Contact centre outsourcing providers will make a comeback in 2021 and we can expect new models to appear. Many providers across the globe have been running successful work-from-home only operations for years – other outsourcing providers will learn from these best practices. Organisations will find that bringing jobs back to high-cost locations will incur more costs. A full onshore model may not be the right model for business continuity, and organisations will prefer to have back-up locations to ensure continuity of services if another pandemic or catastrophe happens. Organisations will want to see the outsourcing providers offer them a choice of location – they will prefer some services to be delivered from offshore locations and others to remain onshore.

- Digital and Mobile will be the Cornerstone of Deeper Customer Engagement

COVID-19 has changed how customers want to be served, and organisations have had to re-evaluate how they use their channels – e.g. email, web, chat and voice. Customer profiles and expectations have changed over the year and they are more digital savvy and are more likely to interact with brands through digital and mobile apps. They will expect a single point of interaction – for their enquiries and to complete their transactions. For instance, they will expect to chat while filling up shopping carts. Introducing chat capabilities within mobile apps is a good way to impress customers – this can be an effective way to push promotions and upsell. Capabilities such as the ability to directly place a call from a website will make the customer experience exceptional. Customers will expect to move between channels easily when interacting with a brand.

- Workplace Collaboration Will be Fully Integrated into Contact Centres

Contact centres will reassess their business and talent models. The focus on employees will be in two major areas:

- Productivity. The contact centre floor dynamics have changed in how agents are spread out across outsourcing locations and in-house contact centres. Agents are no longer located in the same room or floor and do not have access to their usual way of work – continual training, digital signage that provides guidance and demonstrates KPIs, conversations with supervisors, managers, and team members for guidance or assistance, easy access to back-office functions and so on. This can impact their productivity.

- Engagement. Contact centre staff often work in high-stress environments -chasing sales targets and deadlines, handling complaints – and it is important for managers and supervisors to be able to engage and motivate them constantly. Remote working has further exacerbated the stress for those agents who do not have a conducive working environment at home.

Contact centres will increasingly look to workplace collaboration platforms and tools to improve employee productivity and experience.

Ecosystm had predicted that in 2020, AI and analytics would be a top priority for organisations as they embarked or continued on their Digital Transformation journeys. What we saw instead was organisations collecting the right data – but handling more pressing matters this year. They focused more on cybersecurity frameworks, enabling remote employees and the shifts in product and service delivery. In 2021, as organisations work their way to recovery, they will re-evaluate their AI and automation roadmaps, more actively. Ecosystm Advisors Alea Fairchild, Andrew Milroy and Tim Sheedy present the top 5 Ecosystm predictions for AI & Automation in 2021.

This is a summary of the AI & Automation predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 AI & Automation Trends for 2021

- AI Will Move from a Competitive Advantage to a Must-Have

The best practices and leading-edge technology-centric implementations, over the years gives a very good indication of market trends. In 2018 and 2019 AI-centric engagements were few and far between – they were still in the “innovation stage” as trials and small projects. In 2020, AI was mentioned in most applications, showcased as best practices. AI is currently a competitive advantage for businesses. CIOs and their businesses are using AI to get ahead of their competitors and highlighting these practices for external recognition.

That also means that it is a matter of time before AI becomes a standard practice – processes are smart “out-of-the-box”; intelligent applications are an expectation, not the exception; systems learn because that is how they were designed, not as an overlay. If your competitors are using AI today to get ahead of you, then you need to also use AI to catch up and keep up. In 2021, having a smart business will not get you ahead of the pack – it will move you into it.

- AI Will Thrive in Areas where the Cost of Failure is Low

While organisations will be forced to adopt AI to remain competitive, initial exploration of AI solutions will be in areas that they consider low risk. The Financial Services, Retail, and other transaction-oriented industries will use AI to drive improved personalisation, increase customer retention, and improve their ability to lower risk and combat fraud. These are process-driven areas, where manual processes are being enhanced and enriched by AI. Although machine learning and other AI technologies will help improve the speed and quality of services, they will not be a replacement for many of the more complex business practices that companies and their employees frequently overlook to automate. The ‘low hanging fruit’ to add AI to will come first, with various degrees of success.

There will be industries and processes where organisations will be more skeptical about adopting AI. If Google finds a wrong translation or gives a wrong link, it is not a big concern, unlike a wrong diagnosis or wrong medication. In areas that are crucial to our well-being – such as healthcare – AI does not yet have the trust for acceptance of society. There are still questions around ethics and algorithm concerns.

- Technology Providers Will Stop Talking about AI

Technology vendors highlight what they consider their key differentiators, that show that they are ahead of the game. When every piece of software and hardware is intelligent, vendors will stop talking about the fact that they are intelligent. This may not fully happen in 2021 – but ENOUGH technology will be intelligent for those who have not yet made their software smart to understand that they cannot talk about its intelligent capabilities as that just shows they are behind the market.

The good news is that the less we hear about AI, the more intelligent applications will become. AI is quickly becoming a core capability and a base expectation. Systems that learn and adapt will be standard very soon – but be wary, as significant market changes can break these systems! Many companies learned that the pandemic broke their algorithms as times were no longer “normal”.

- Enterprises Will Seek Hyperautomation Solutions

RPA will increasingly become part of large enterprise application implementations. Technology vendors are adding RPA functionality either organically or through acquisitions to their enterprise application suites. RPA often works in conjunction with major software products provided by companies such as Salesforce, SAP, Microsoft, and IBM. Rather than having an operative enter data into multiple systems, a bot can be created to do this. Large software vendors are taking advantage of this opportunity by trying to own entire workflows. They are increasingly integrating RPA into their offerings as well as competing directly in the RPA market with pureplay RPA vendors.

As the RPA offerings continue to mature, enterprises seek to scale implementations and to automate non-repetitive processes, which require more intelligence. They will seek to automate more processes at scale. They will demand solutions that process unstructured data, handle exceptions, and continuously learn, further increasing productivity. Intelligent automation typically incorporates AI, particularly voice and vision capabilities and uses machine learning to optimise processes. Hyperautomation turbo charges intelligent automation by automating multiple processes at scale – and will become core to digital transformation initiatives in 2021.

- Businesses Will Put “Automation Targets” in Place

2020 was the year that many businesses started seeing some broad and tangible benefits from their automation initiatives. Automation was one of the big winners of the year, as many businesses took extra steps to take humans out of processes – particularly those humans that had to be in a specific location, such as a warehouse, the finance team, the front desk and so on (because of the pandemic, they were often working at home instead). Senior management is seeing the benefits of automation, and they will start to ask their teams why more processes are not automated Therefore we will start to see managers put targets around a certain percentage of tasks automated in an area – e.g. 70% of contact centre processes will be automated, 90% of the digital customer experience for a certain outcome will be automated and so on. Achieving these numbers may not be easy, but the targets will change the mindset of people designing, implementing, and improving processes.

The Retail industry has had to do a sharp re-think of its digital roadmap and transformation journey – Ecosystm research shows that about 75% of retail organisations had to start, accelerate, or re-focus their digital transformation initiatives. However, that will not be enough as organisations move beyond survival to recovery – and future successes. While retailers will focus on the shift in customer expectations, a mere focus on customer experience will not be enough in 2021. Ecosystm Principal Advisors, Alan Hesketh and Alea Fairchild present the top 5 Ecosystm predictions for Retail & eCommerce in 2021.

This is a summary of the predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Retail & eCommerce Trends for 2021

- There Will Only be Omnichannel Retailers

The value of an omnichannel offer in Retail has become much clearer during the COVID-19 pandemic. Retailers that do not have the ability to deliver using the channel customers prefer will find it hard to compete. As the physical channel becomes less important new revenue opportunities will open up for businesses operating in adjacent market sectors – companies such as food and grocery wholesalers will increasingly sell direct to consumers, leveraging their existing online and distribution capabilities.

Most customers transact on mobile device – either a mobile phone or tablet. New capabilities will remove some of the barriers to using these mobile devices. For one, technologies such as Progressive Web Apps (PWA) and Accelerated Mobile Pages (AMP) will provide a better customer experience on mobile platforms than existing websites, while delivering a user experience at par or better than mobile apps. Also, as retailers become AI-enabled, machine learning engines will provide purchase recommendations through smartwatches or in-home, voice-enabled, smart devices.

- COVID-19 Will Continue to be an Influence Forcing Radical Shifts

In driving the economic recovery in 2021, we will see ‘glocal’ consumption – emphasis on local retailers and global players taking local actions to win the hearts and minds of local consumers. There will be significant actions within local communities to drive consumers to support local retailers. Location-based services (LBS) will be used extensively as consumers on the high street carry more LBS-enabled devices than ever before. Bluetooth beacon technology and proximity marketing will drive these efforts. Consumers will have to opt-in for this to work, so privacy and relationship management are also important to consider.

But people still want to “physically” browse, and design aesthetics of a store are still part of the attraction. In the next 18 months, the concept of virtual stores that are digital twins will take off, particularly in the holiday and Spring clearance sales. Innovators like Matterport can help local retailers gain a more global audience with a digital twin with a limited technological investment. At a minimum, Shopify or other intermediaries will be necessary for a digital shop window.

- The Industry will See Artificial Intelligence in Everything

AI will increase its impact on Retail with an uptake in two key areas.

- Customer interactions. Retail AI will use customer data to deliver much richer and targeted experiences. This may include the ability to get to a ‘segment of one’. Tools will include chatbots that are more functional and support for voice-based commerce using mobile and in-home edge devices. Also, in-store recognition of customers will become easier through enhanced device or facial recognition. Markets where privacy is less respected will lead in this area – other markets will also innovate to achieve the same outcomes without compromising privacy but will lag in their delivery. This mismatch of capability may allow early adopters to enter other geographic markets with competitive offers while meeting the privacy requirements of these markets.

- Supply chain and pricing capabilities. AI-based machine learning engines using both internal and increased sources of external data will replace traditional math-based forecasting and replenishment models. These engines will enable the identification of unexpected and unusual demand influencing factors, particularly from new sources of external data. Modelling of price elasticity using machine learning will be able to handle more complex models. Retailers using this capability will be in a better position to optimise their customer offers based on their pricing strategies. Supply chains will be re-engineered so products with high demand volatility are manufactured close to markets, and the procurement of products with stable demands will be cost-based.

- Distribution Woes Will Continue

Third party delivery platforms such as Wish and RoseGal are recruiting additional international non-Asian suppliers to expand their portfolios. Amazon and AliExpress are leaders here, but there are many niche eCommerce platforms taking up the slack due to the uneven distribution patterns from the ongoing economic situation. Expect to see a number of new entrants taking up niche spaces in the second half of 2021, sponsored by major retail product brands, to give Amazon a run for their money on a more local basis.

As the USPS continues to be under strain, delivery companies like FedEx in the US who partner with the USPS are already suffering from the USPS’s operational slowdown, in both their customer reputation and delivery speed. In 2021, COVID-19 – and workers’ unions – will continue to impact distribution activities. Increased spending in warehouse automation and new retail footprints such as dark stores will be seen to make up for worker shortfalls.

- China’s Retail Models Will Expand into Other Markets

China’s online businesses operate in a large domestic market that is comparatively free of international competitors. Given the scale of the domestic market, these online companies have been able to grow to become substantial businesses using advanced technologies. All the Chinese tech giants – among them Alibaba, ByteDance, DiDi Chuxing, and Tencent – are expanding internationally.

China’s rapidly recovering economy puts those businesses in a strong position to fund a competitive expansion into international markets using their domestic base, particularly with their Government’s promotion of the country’s tech sector. It is harder to impose restrictions on software-based businesses, unlike the approach that we have witnessed the US Government take for hardware companies such as Huawei – placing constraints on mobile phone components and operating systems.

These tech giants also have significant experience in a Big Data environment that provides little privacy protection, as well as leading-edge AI capabilities. While they will not be able to operate with the same freedom in global markets, and there will be other large challenges in translating Chinese experience to other markets – these tech players will be able to compete very effectively with incumbent global companies. Chinese companies also continue to raise capital from US stock exchanges with The Economist reporting Chinese listings have raised close to USD 17 billion since January 2020.

Authored by Alea Fairchild and Mike Zamora

There have been a few articles recently about investment companies looking to buy large national US retail companies, for example, JC Penney and Dillards. Their historical approach was to purchase the land and develop the sites as a retail centre and operate their stores. They then lease the remaining retail space to other retailers. It is a business model which has been in use for many decades.

Historically a long and deep negative economic cycle has caused some retail operators/developers to sell part of their operations. This happened in the US in 1995 with Sears. The real estate development and investment companies’ interest is in exploring if there is a higher and better use for the properties. That is the essence of land economics, going from a lower economic use to a higher income/value use.

A key difference this time is the use of advanced technology. We see this in many dimensions: building systems and operations; retail management, social media, entertainment and food and beverage (F&B) operations.

The Smart Building revolution in Retail is about changing the management philosophy of buildings and using technology to aid in the process. The defining characteristic of building smarter is not the application of technology or a function of outcomes on energy use or maintenance. Instead, it is a commitment to leveraging the overall footprint to achieve the goals that perhaps inspired the building in the first place.

Evolution of Space for Retail Activities

The old axiom of real estate is location, location, location. This means that every retail centre will have to be assessed for its best purpose for its locations and surrounding environment. Retail has been morphing in the past few years from a traditional purpose of picking something up to an intersection of shopping and entertainment. This combines on-premise activities with a buying transaction which can be handled either onsite or online. Technology infrastructure investment opportunities are driven by optimising the customer retail experience.

Retail centres are seeking new functionality, including the adaptation of both design and use. Below are four approaches we believe can be used to assess each retail centre.

Reuse: Retail Lifecycle – Consumption to Redemption

There is a shift from consumers discovering and experiencing products in a physical retail space to retailers delivering on-demand. Many smaller retailers have capitalised on this by becoming pick-up points for online orders. They hope to increase footfall by drawing the customer into their own premises when retrieving their online delivery.

Retail centres need to expand on this trend to become a fulfilment location rather than a retail shopping space. Consumers could pick up online orders, recycle used goods, get products maintained and repaired, have appointments for personal services (dental, eye, hair, dry cleaning, etc.), try and test goods in mini-showrooms and collect points and benefits from gamification activities. By having a centralised exchange facility with multiple functionalities, consumer data can be leveraged to create marketing pull activities such as exclusive shopping events, and personalised customer service based on preferences and purchase history.

The current square meterage can be reallocated for distribution including the use of dark stores, green recycling centres for 3D printed product disposal and retail pick-up and exchange points. Staff will not be salespeople, but customer delivery service managers. The technology opportunities in this area would be re-allocation of network resources; focus on efficiency in delivery and customer satisfaction; and automation tools for customer service staff.

Redesign: Blended – Community Environment and Retail Experience

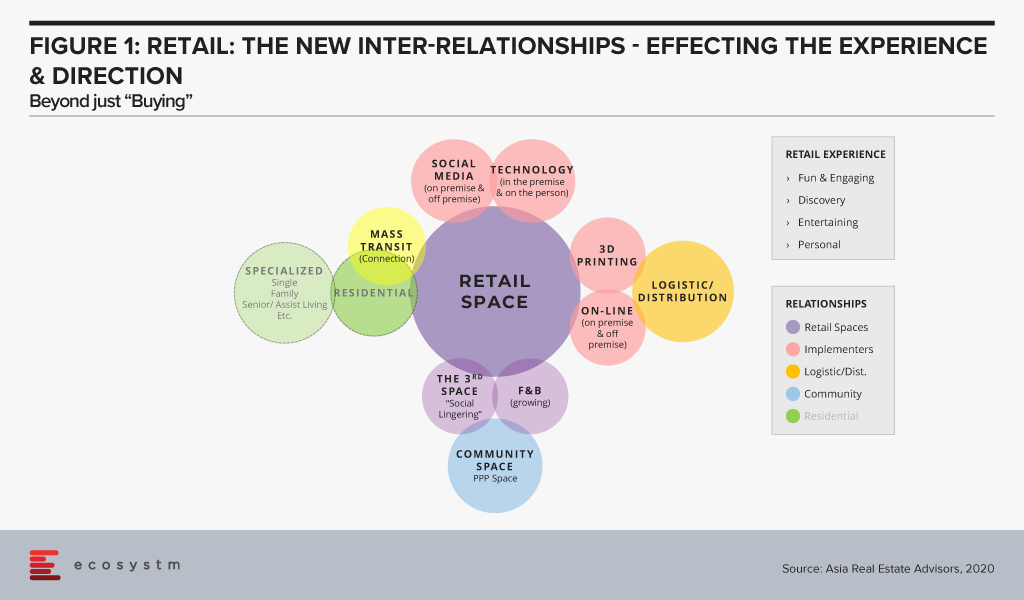

An alternative and more involved development approach would be to redesign the retail centre with deeper use cases to get more customers to come and stay longer. If a consumer stays onsite longer, there is a higher probability they will spend more at the retail centre. The future retail centre (Figure 1) would include additional space usages for a community space, a distribution centre for pick-ups, expanded F&B and remote working.

The technology opportunities are in two areas: customer experience and building operations. From a customer perspective, some technology examples would include entertainment and gaming in the F&B area, digital signage and mobile device technology to further engage people. For building operations examples could include technologies to control climate, lighting, security, energy management and building management.

Redevelop – Living Space for a Quality of Life

In some locations, the retail environment could have an oversupply of newly development retail centres. This means the optimal use for the centre would be to change it to a ‘Village Community’ – a community where people can live, work, learn and play. It would encompass multiple uses – multi-family residential units, a community centre, learning centres for younger children and a co-working area. The technology opportunies would be identical to a connected Smart City – at a lesser scale. Smart residential solutions would make the living environmental more user friendly. Retail could include digital media, mobile push features, enhanced and operational technology, energy management, climate control and security. Schools could include interactive and collaborative tools. Parks would have Wi-Fi and enhanced security. Connected Services (eg utilities, fire life safety, security and communications) could include operational technology systems for utilities, audio and video security systems and communication.

Repurpose: Knowledge & Learning Environment

For some retail centres a redevelopment may not be required, but would instead need a major repurposing of the space. The repurpose could be as a learning or healthcare centre. Learning environments require large open spaces with high ceilings for auditoriums or class rooms; common areas for gathering in between classes; onsite housing for students; food courts; and adequate parking for commuters. A healthcare environment would require patient reception, examination rooms, inpatient rooms, surgical units, and administrative offices. It could also include a medical learning centre.

The technology opportunities would be to develop a 24×7 site, with technologies to support the key purpose of the centre. The learning environment could include collaborative audio/video tools for Smart Classrooms. The social areas could including advanced food ordering and delivery systems and multiple player gaming centres for entertainment. The living areas would include systems and technology for smart living. The parking area could include enhanced security and surveillance systems, and smart parking systems. Behind the scenes, the building operations would need to upgrade energy management, building maintenance and management, digital food court operations, and a wellness air quality system.

The Future of Sustainable Retail Space

The decline of a retail centre is not necessarily a bad thing for a community. It is just the “Circle of Life” as an area evolves. Locations morph over the long-term. This has been seen in all the large cities around the world which have stood the test of time, eg. London, Paris, Amsterdam, New York, Tokyo and Beijing. The transformation also breathes fresh air into the surrounding environment. There are multiple layers of technology available to provide for an incredible Sustainable and Smart Community. It is large opportunity, not only for real estate developers, but also for technology vendors who understand the transformation process into the multiple variations of smart environments. Large real estate players and REITs will buy these retail portfolios and begin to transform older, low revenue, semi-vacant shopping centres into vibrant destination centres. Technology vendors should bring their ideas and systems to the attention of retail real estate owners early on in the the process. This will increase their chances of having their systems incorporated into the overall design concept and operational approach. It is a physical and digital transformation which improves neighborhoods, businesses and the city. It is a win for all.