In the last few months, we have seen greater adoption of Fintech especially in the area of digital payments, as more organisations and consumers adopt eCommerce. However, Fintech also appears to grow in areas such as Regtech and blockchain for ease of reporting and enhanced transaction security. As we prepare for recovery, there will be a need for a more open and interconnected economy that is borderless and transparent and does not need counter-party trust to operate. Blockchain has a role to play in enabling that environment where transactions and processes are secure, interoperable and risk-free.

Australian Banking Leveraging Blockchain

Major Australian banks – ANZ Bank, the Commonwealth Bank of Australia (CBA) and Westpac – have joined hands with property management firm Scentre Group and IBM for the expansion and commercial launch of a Blockchain technology platform Lygon that manages end-to-end bank guarantees on retail property leases.

Financial guarantee is an essential part of retail property leases and involves a lot of paperwork such as payment assurances, financial guarantee, bank bonds, credit letters and other legal documents. Bank guarantees have primarily been issued through paper-based processes – digitalising the entire route will reduce the risks, manual errors and significantly speed up the complete procedure. The use of blockchain provides a trusted system of record for digitised documents, removes the risk of document loss and allows secure sharing of data. It also has a strong cryptography security aimed at eliminating fraud and enabling the sharing of key information across organisational boundaries.

Ecosystm Principal Advisor, Phil Hassey says, “This joint venture shows the value of applying new technology to bring legacy and overlooked business processes into the digital age. The ability to reduce the bank guarantee process time frame from one month to one hour, alongside a 15-minute onboarding highlights the speed and scale that can be gained from the technology.”

“It helps the landlord, retailer and bank alike. One of the key benefits for the retail tenant is that they can concentrate on running a business rather than the back-end administration required for the new lease. Furthermore, the blockchain technology will enable heightened security capabilities and reduce the risk to all parties of fraud and data loss.”

From this month, early adopters will be able to join the platform. The intention is to expand the services into New Zealand, with the view to creating a true cross-border solution. The platform will be open to the general public, along with new features, in early 2021.

A Successful Pilot

The platform was piloted in July 2019 and was proved successful later in the year. The outcomes reported to have been achieved include reduction of time to issue a bank guarantee from one month to one day; onboarding new applicants to the platform in less than 15 minutes; and supporting other common bank guarantee processes including amendments and cancellations. The pilot used live data and legal transactions from about 20 Australian businesses, with an aim to improve customer experience and process automation.

IBM, one of the 5 shareholders and the technology provider for the platform, is responsible for developing, operating, and maintaining the platform. The initial proof of concept (POC) was developed within the IBM Research division. The platform also runs on the IBM Blockchain Platform and IBM provides services such as the security.

Hassey says, “This initiative highlights that in a digital world – regardless of the platform – joint ventures can readily provide benefits to all stakeholders if digital enablement and technology is at the core of the execution.”

We are in the midst of an economic and social crisis. COVID-19 will have far-reaching effects on organisations and how they do business. It is expected to drive more investments in Fintech, especially in digital payments, as more organisations and consumers adopt eCommerce. Countries will also have to re-think the ways they trade with other countries, as travel restrictions continue. This is expected to boost the Fintech industry and July was witness to how Fintech organisations, financial institutions and governments are gearing up to leverage Fintech in their path to economic and social recovery.

Financial Industry Seeing More Open Banking Initiatives

The banking industry is fast moving towards collaboration and openness. July saw several initiatives that take the industry closer to open banking.

Late last year, South Korea piloted an open banking system with participation from local banks and lenders. The Financial Services Commission (FSC), South Korea’s top financial regulator reported in July that the initiative had participation from 72 companies including commercial banks and Fintech firms with 20 million subscribers using the open banking services.

Australia introduced an open banking initiative, monitored by the Australian Competition and Consumer Commission (ACCC). From July, Australia’s banking customers can share their financial and banking data with accredited businesses under Consumer Data Right Act to access a better suite of financial applications.

There is global expansion as well. Railsbank, a global open banking platform with a presence in Southeast Asia introduced their services in the US market. The company will offer Banking-as-a Service, Cards-as-a Service and Credit Card-as-a-Service in the US market. Khaleeji Commercial Bank (KHCB), an Islamic bank in Bahrain, launched their open banking service enabling a customer to link their bank accounts with other banks and manage through the ‘Khaleeji 360’ platform. The portal allows clients to view all their bank accounts, automate operations and conduct banking through a unified platform.

Financial Institutions Increasing Partnerships with Fintech

Financial institutions no longer look at Fintech as competition. They appreciate that customers are at the centre of their entire operation – and Fintech services can and will provide them with the solutions they need. As financial institutions re-think their transformation journeys and face increasingly stringent regulations, they no longer have the option of ignoring Fintechs.

American Express, Visa, Mastercard and Discover came together to roll out a global standard. The big four’s advanced digital checkout solution Click to Pay is an online checkout system based on EMV Secure Remote Commerce (SRC) to make online payments across websites, mobile applications and connected devices, frictionless.

With an aim to unify payment solutions, a group of 16 major European banks launched the European Payment Initiative (EPI) to create a unified pan-European payment solution leveraging Instant Payments/SEPA Instant Credit Transfer (SCT Inst), including a card, e-wallet and P2P payments.

We also saw financial institutions strengthen their cross-border payment services in July. Deutsche Bank partnered with Airwallex to offer virtual account collections and API-enabled foreign exchange services in Japan and Hong Kong. The service will enable merchants and traders to transact through virtual accounts and APIs without opening bank accounts in foreign markets. Mastercard and Bank of China partnered to enhance cross-border business payments into China. This will enable global businesses to send payments to China while accessing real-time exchange rates, reduce the need for unnecessary documentation between merchants, and reduce transaction hassles and costs.

Fintechs Facilitating Cross-border Trade

Seamless cross-border financial transactions will be key to economic recovery, whether easy remittance or the ability to reach a larger market and be able to trade beyond borders.

July saw the formalisation of the Digital Economy Partnership Agreement (DEPA) between New Zealand, Chile and Singapore, to facilitate end-to-end digital trade, which includes establishing digital identities, paperless trade and the development of Fintech solutions to support it. The initiative also intends to allow cross-border data flow and give access to necessary government data to small and medium enterprises (SMEs) enabling them to be digital-ready to explore newer markets.

Dubai International Financial Centre (DIFC) signed an MoU with Jiaozi Fintech Dreamworks based in China opening new opportunities for innovation and trade. The agreement will enable Fintech companies based in both cities to access each other’s markets. Primarily established to facilitate the ‘Belt and Road’ initiative, it is a critical component of the DIFC’s 2024 strategy to strengthen relationships with the international financial community and increase access to the South-South corridor. Over the last few years, DIFC has been associated with over 200 Fintech organisations, and last month invested in four Fintech startups through their accelerator program. The agreement with Jiaozi will look at collaboration opportunities in Blockchain, AI and Cloud and will facilitate cross-border workshops and training programs.

Continuing Interests in Emerging Economies

Fintechs have been a means to bring about financial inclusion and are increasingly being used to target the unbanked and underbanked. Emerging economies continue to be attractive for Fintech organisations and global financial institutions.

With much of Malaysia’s economy dependent on foreign workers, Instapay, regulated by the Bank Negara Malaysia (BNM), announced a collaboration with Mastercard, to provide e-wallet accounts to the migrant workers. The widespread use of e-wallets by the migrant worker community will bring benefits to both workers, as well as their employers. Interestingly, Fintech providers in emerging economies are also looking to expand into other emerging markets. Malaysia’s GHL Group received approval from Philippines Securities and Exchange Commission to operate a lending business through their new unit, GHL Philippines Financing Services. GHL has been diversifying its business and has been operating its lending business in Malaysia and Thailand since 2019.

Crown Agent Bank, a wholesale foreign exchange and cross-border payment services based in the UK, partnered with South Africa’s biometric-based payment company, Paycode. Together the companies are aiming to reach 100 million unbanked customers where Crown Agents Bank will use their FX and payment services to bolster Paycode’s product offering and support financial inclusion across Sub-Saharan Africa.

India and Indonesia in the Asia Pacific continue to be popular markets because of the huge proportion of the unbanked population. Rapyd, a UK based global B2B Fintech-as-as-service provider partnered with major Indian e-payment providers – including Paytm, PhonePe, PayU, Citibank, DBS Bank, HDFC Bank, BharatPay, and Unimoni to launch an all-in-one payments solution that spans credit and debit cards, UPI, wallets, and cash. New registrations for digital banking in Indonesia are on the rise and Fintech startup Akulaku is capitalising on the potential digital banking overhaul to offer affordable and comprehensive financial services to consumers.

Fintechs benefiting other industries

The Fintech revolution has shown the path to several other industries – Healthcare and Agriculture are some of the industries that are hoping to benefit from Fintech organisations and their innovations. The MoU between Alibaba Cloud, Pfizer and Singapore’s Fintech Academy announced earlier in July, promises to give early and necessary guidance to Healthtech start-ups, and shows the deep connection between Healthtech and Fintech. In the Philippines, in an effort to improve financial services for farmers, AgriNurture acquired Fintech firm Pay8. By leveraging Pay8 e-wallet services, farmers will be able to access online payment services. This will enable the largely unbanked farmer community to become an active part of the economy.

The technology that these industries are looking to benefit from is Blockchain. South Korea brought Blockchain to their healthcare industry for better data management and storage. The 3 major telecommunications providers in the country – KT, SK Telecom and mobile carrier LG U+ – have also collaborated with KB Insurance to launch the blockchain-based mobile notification service (MNS) by matching customer data to their mobile subscription information. Oxfam Ireland – a charity organisation based in Ireland, received a sum of USD 1.18 million from the European Commission for a Blockchain-based pilot. The company is working on a project -The UnBlocked Cash – to help disaster-affected communities receive cash-based entitlements with more efficiency and traceability.

Fintech will continue to be a cornerstone of economic and social recovery in the future, and the financial industry will see more collaborations between Fintech organisations, financial institutions and governments. Other industries will continue to take learnings from Fintech.

As we move towards a digital economy, governments and industries are adopting AI to improve operational efficiencies and user experience. To do so, conventional AI requires to collect data – lots of it! And a large proportion of this data is personal data such as names, telephone numbers, email and physical addresses, marital status, age, and so on.

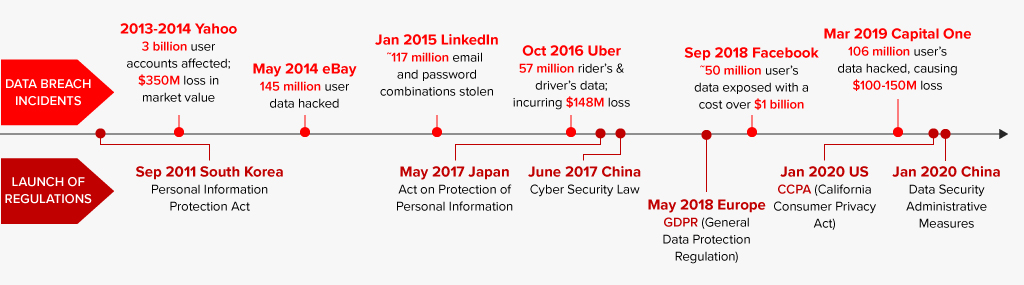

But over the past decade, countries have been boosting up their privacy laws. Singapore’s Personal Data Protection Act 2012 (PDPA), the European General Data Protection Regulation (GDPR), China’s Cyber Security Law and the California Consumer Privacy Act (CCPA) are some of the regulations enacted to protect personal data. Not surprisingly, renowned companies such as Facebook, Capital One and even Google, have been fined due to these laws. In some cases, companies have lost data due to security breaches or hacks, creating embarrassment and concern for governments, corporations, and customers or citizens.

Citizen Concerns Around Data Privacy

Yet, despite the presence of these regulatory frameworks, there is a growing lack of trust among citizens and consumers regarding how governments and organisations handle personal data. A survey on data privacy was conducted by Pew Research Center in June 2019 indicated that 79% of American adults are concerned about how companies use their data while 64% are concerned about how the government use their data. A whopping 70% of the adults think that their personal data is less secure now as compared to five years ago.

Public awareness of data privacy rights has also been improving worldwide. Surveying respondents in 12 of the world’s largest economies in Europe, Asia Pacific and the Americas, the Cisco Consumer Privacy Study conducted in May 2019 showed that 84% of these respondents care about privacy – of these, 80% stated that ‘they are willing to act to protect it’.

While both surveys convey strong sentiments about data privacy, findings also imply that beyond mere awareness, there is an insufficient understanding of privacy regulations on a deeper level. The study by Pew Research Center showed that 63% of American adults disclosed that they have ‘very little or no understanding of the laws and regulations’ that are set to protect their privacy. 33% of them stated that ‘they have some understanding’, while only 3% stated that they have a good comprehension of these laws. In the Cisco Consumer Privacy Study, only approximately one-third of all respondents knew about the regulations.

The Importance of Building Trust

These findings illustrate that more needs to be done to gain consumer trust in the digital realm. And if the majority of the consumers don’t trust how the government and organisations such as Google, Facebook, Microsoft, Amazon and the like, handle data, then will the doors shut on the large AI community that is focused on collecting data and helping create a better world for all citizens? How could government agencies and organisations drive operational efficiency and better user experience if they are unable to obtain value and insights from a collection of very limited dataset, with all the regulatory compliance requirements?

Lately, tech giants such as IBM, Google, Facebook and Microsoft have been researching and developing advancements towards a better AI world, while at the same time remaining compliant to any data privacy laws. Here in Singapore, institutions of higher learning such as the National University of Singapore (NUS), the Nanyang Technological University (NTU) and the Agency of Science, Technology and Research (A*STAR) are similarly researching and developing privacy preservation technologies (PP technologies).

At A*STAR, a programme team was formed and named the Trusted Data Vault (TDV) Programme, to research and develop a suite of PP technologies – be it as a standalone or in combination – to be commercialised by industry partners.

The Role of Privacy Preservation Technologies

Through intense research, technology development and industry collaborations, the TDV programme aims to advocate PP technologies towards applications that will unlock the potential of AI. This will create new value for digital services while ensuring compliance with privacy regulations and high ethical standards.

The heart of the TDV programme lies in the various PP technologies that have been garnering massive interest worldwide in resolving data privacy challenges, stemming from the rapid advancement of digital technology coupled with global privacy laws. The programme covers the research and development of federated learning (a technology coined by Google back in 2018), homomorphic encryption (a technology founded by Craig Gentry from IBM), secure multiparty computing, blockchain, and so on. Progressively, PP technologies have been a subject of interest for organisations who are pursuing ways to relieve privacy concerns of consumers and fulfil the terms of privacy laws. In short, PP technologies aim to keep sensitive data secure and protected while it is being used, as well as enhance the privacy of data when it is being analysed.

The traditional method used to preserve the data privacy is anonymisation where personal identifying information is disassociated from an individual’s record in a dataset. A dataset is anonymised through a combination of pseudonymisation (the replacement of clear identifiers with fictitious information) and de-identification.

This technique may have worked in the past, but it is not sufficient for dealing with the complexities of present technological advancements. Research has proved that anonymisation does not promise privacy. In some cases, researchers were able to re-identify individuals by using statistical techniques or cross-referencing them with publicly available datasets.

As datasets become larger, more complex and diversified, PP technologies have emerged as the most feasible solution to privacy issues. A patent analytics study conducted by Intellectual Property Office of Singapore (IPOS) stated that homomorphic encryption (HE), secure multiparty computing (MPC), differential privacy (DP) and federated learning (FL) have emerged as promising solutions among various the PP technologies developed. These are the same technologies that institutions such as NUS, NTU and A*STAR are pursuing.

In summary:

- Homomorphic encryption (HE) transforms data to a different dataset to protect sensitive information while allowing computation on its encrypted version, also known as cyphertext. This method, therefore, does not compromise any data integrity.

- Secure multiparty computing (MPC) is a cryptographic protocol that distributes computation across multiple parties where no individual party can see the other party’s data. MPC protocols can enable data scientists and analysts to compliantly, securely, and privately compute on distributed data without ever exposing or moving it.

- Differential privacy (DP) is an easier process compared to MPC and HE, and it involves introducing noise such that the query result cannot be used to infer much about any single individual and therefore provides privacy.

- Federated learning (FL) is an emerging PP technology, which is a machine learning technique that achieves computation and model training without exchanging data between data owners and data consumers. This prevents data leakage from the data owner’s premises.

Of these four PP technologies that were outlines, HE, MPC and FL are at the forefront of research and development in the A*STAR’s TDV programme.

On the whole, industrial implementation of these PP technologies are still at an early stage. It has been reflected in the patented inventions at IPOS that the financial sector is the top industry of interest, followed by healthcare, social media applications and logistics/supply chain.

On a global scale, patented inventions relating to PP technologies have been on the rise. From 2009 to 2018, over 23,000 PP-related inventions were being published worldwide, with high annual growth of 18% in the recent five years, according to IPOS. Due to strong market demands, innovations in these technologies are expected to grow even as more research and development works are needed to improve their capabilities and industrial applications.

The Role of Blockchain

A*STAR’s TDV programme also focuses on blockchain. As the literature shows these days, blockchain has grown to varying types since it was first mooted by Satoshi Nakamoto. Blockchain these days is classified into public blockchain, private blockchain, and consortium or sometimes known as a federated blockchain.

A*STAR’s TDV Programme is focussed on consortium/federated blockchain, which is deployed in a decentralised manner on multiple hardware managed by different owners and where authority is shared among members. Consortium/federated blockchain usually involves a group of enterprises collaborating to use the blockchain technology to improve businesses.

Ms. Angela Wang, the Programme Manager of TDV at A*STAR, says, ”The big difference between public blockchain and consortium/federated blockchain is that anyone, even those you don’t trust, can join the public blockchain, while consortium/federated blockchain considers each member as a trusted partner to begin with.”

The future appears bright for the privacy landscape worldwide, as researchers and top tech companies continue to invest their resources in PP technologies to create secure digital platforms, products and services. This will give rise to a healthy ecosystem of digital trust between organisations and consumers.

In the midst of the current global crisis, the Utilities industry has had to continue to provide essential public services – through supply chain disruption, reduction of demand in the commercial sector, demand spikes in the consumer sector, change in peak profiles, remote staff management, cyber-attacks and so on. Robust business continuity planning and technology adoption are key to the continued success of Utilities companies. The Ecosystm Business Pulse Study which aims to find how organisations are adapting to the New Normal finds that 6 out of 10 Utilities companies are accelerating or refocusing the Digital Transformation initiatives after the COVID-19 outbreak, underpinning the industry’s need for technology adoption to remain competitive.

Drivers of Transformation in the Utilities Industry

The Evolving Energy Industry. As consumers become more energy-conscious, many are making changes in their usage pattern to stay off the grid as much as possible, potentially reducing the customer base of Utilities companies. This increases their reliance on renewable energy sources (such as solar panels and wind turbines) and batteries, forcing Power companies to diversify and leverage other energy sources such as biomass, hydropower, solar, wind, and geothermal. The challenge is further heightened by the fast depletion of fossil fuels – it is estimated that the world will have run out of fossil fuels in 60 years. The industry is also mandated by government regulations and cleaner energy pacts that focus on climate change and carbon emission – there are strict mandates around how Utilities companies produce, deliver and consume energy.

Business Continuity & Disaster Management. Perhaps no other industry is as vulnerable to natural disasters as Utilities. One of the reasons why the industry has been better prepared to handle the current crisis is because their usual business requires them to have a strong focus on business continuity through natural disasters. This includes having real-time resource management systems and processes to evaluate the requirement of resources, as well as a plan for resource-sharing. There is also the danger of cyber-attacks which has been compounded recently by employees who have access to critical systems such as production and grid networks, working from home. The industry needs to focus on a multi-layered security approach, securing connections, proactively detecting threats and anomalies, and having a clearly-defined incident response process.

The Need to Upgrade Infrastructure. This has been an ongoing challenge for the industry – deciding when to upgrade ageing infrastructure to make production more efficient and to reduce the burden of ongoing maintenance costs. The industry has been one of the early adopters of IoT in its Smart Grid and Smart Meter adoption. With the availability of technology and advanced engineering products, the industry also views upgrading the infrastructure as a means to mitigate some of its other challenges such as the need to provide better customer service and business continuity planning. For example, distributed energy generation systems using ‘micro grids’ have the potential to reduce the impact of storms and other natural disasters – they can also improve efficiency and quality of service because the distance electricity travels is reduced, reducing the loss of resources.

The Evolving Consumer Profile. As the market evolves and the number of Energy retailers increases, the industry has had to focus more on their consumers. Consumers have become more demanding in the service that they expect from their Utilities provider. They are increasingly focused on energy efficiency and reduction of energy consumption. They also expect more transparency in the service they get – be it in the bills they receive or the information they need on outages and disruptions. The industry has traditionally been focused on maintaining supply, but now there is a need to evaluate their consumer base, to evolve their offerings and even personalise them to suit consumer needs.

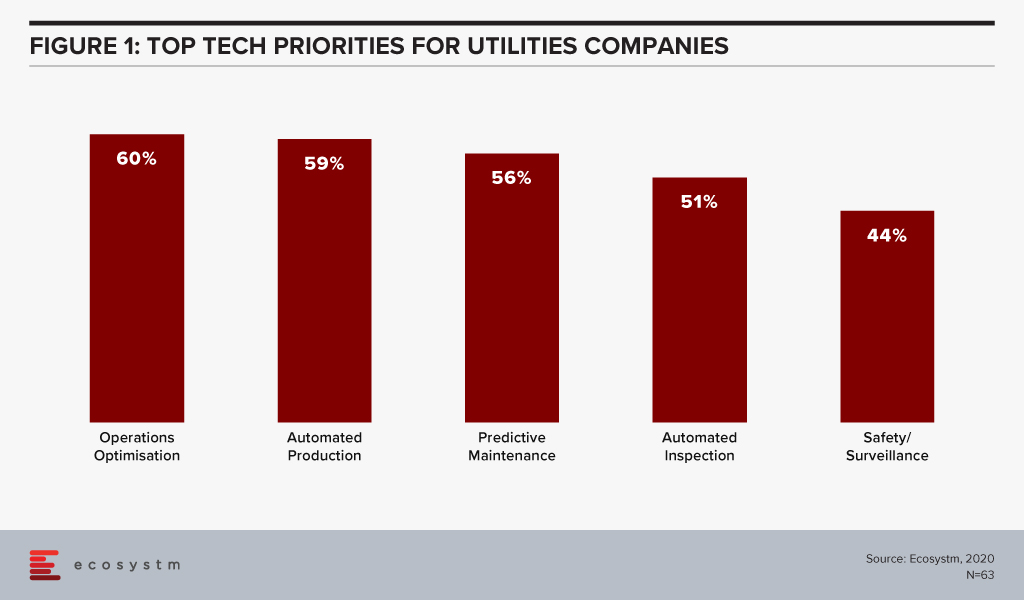

The global Ecosystm AI study reveals the top priorities for Utilities companies, that are focused on adopting emerging technologies (Figure 1). It is noticeably clear that the key areas of focus are cost optimisation (including automating production processes), infrastructure management and disaster management (including prevention).

Technology as an Enabler of Utilities Sector transformation

Utilities companies have been leveraging technology and adopting new business models for cost optimisation, employee management and improved customer experience. Here are some instances of how technology is transforming the industry:

Interconnected Systems and Operations using IoT

Utilities providers have realised that an intelligent, interconnected system can deliver both efficiency and customer-centricity. As mentioned earlier, the industry has been one of the early adopters of IoT both for better distribution management (Smart Grids) and for consumer services (Smart Meters). This has also given the organisations access to enormous data on consumer and usage patterns that can be used to make resource allocation more efficient.

For instance, the US Government’s Smart Grid Investment Grant (SGIG) program aims to modernise legacy systems through the installation of advanced meters supporting two-way communication, identification of demand through smart appliances and equipment in homes and factories, and exchange of energy usage information through smart communication systems.

IoT is also being used for predictive maintenance and in enhancing employee safety. Smart sensors can monitor parameters such as vibrations, temperature and moisture, and detect abnormal behaviours in equipment – helping field workers to make maintenance decisions in real-time, enhancing their safety.

GIS is being used to get spatial data and map project distribution plans for water, sewage, and electricity. For instance, India’s Restructured Accelerated Power Development & Reforms Program (R-APDRP) government project involves mapping of project areas through GIS for identification of energy distribution assets including transformers and feeders with actual locations of high tension and low tension wires to provide data and maintain energy distribution over a geographical region. R-APDRP is also focused on reducing power loss.

Transparency and Efficiency using Blockchain

Blockchain-based systems are helping the Utilities industry in centralising consumer data, enabling information sharing across key departments and offering more transparent services to consumers.

Energy and Utilities companies are also using the technology to redistribute power from a central location and form smart contracts on Blockchain for decisions and data storage. This is opening opportunities for the industry to trade on energy, and create contracts based on their demand and supply. US-based Brooklyn Microgrid, for example, is a local energy marketplace in New York City based on Blockchain for solar panel owners to trade excess energy generated to commercial and domestic consumers. In an initiative launched by Singapore’s leading Power company, SP Group, companies can purchase Renewable Energy Certificates (RECs) through a Blockchain-powered trading platform, from renewable producers in a transparent, centralised and inexpensive way.

Blockchain is also being used to give consumers the transparency they demand. Spanish renewable energy firm Acciona Energía allows its consumers to track the origin of electricity from its wind and solar farms in real-time providing full transparency to certify renewable energy origin.

Intelligence in Products and Services using AI

Utilities companies are using AI & Automation to both transform customer experience and automate backend processes. Smart Meters, in itself, generate a lot of data which can be used for intelligence based on demographics, usage patterns, demand and supply. This is used for load forecasting and balancing supply and demand for yield optimisation. It is also being leveraged for targeted marketing including personalised messages on Smart Energy usage.

Researchers in Germany have developed a machine learning program called EWeLiNE which is helping grid operators with a program that can calculate renewable energy generation over 48 hours from the data taken from solar panels and wind turbines, through an early warning system.

Niche providers of Smart Energy products have been working with providing energy intelligence to consumers. UK start-up Verv, as an example, uses an AI-based assistant to guide consumers on energy management by tracing the energy usage data from appliances through meters and assisting in reducing costs. Increasingly, Utilities companies will partner with such niche providers to offer similar services to their customers.

Utilities companies have started using chatbots and conversational AI to improve customer experience. For instance, Exelon in the US is using a chatbot to answer common customer queries on power outages and billing.

While the predominant technology focus of Utilities companies is still on cost optimisation, infrastructure management and disaster management, the industry is fast realising the power of having an interconnected system that can transform the entire value chain.

The ongoing global crisis is expected to drive more investments in Fintech, especially in the area of digital payments, as more organisations and consumers adopt eCommerce. Fintech will also continue to grow in areas such as Regtech and Blockchain for ease of reporting and enhanced transaction security.

Ecosystm Principal Advisor, Paul Gestro says, “In the environment, we find ourselves in now – and will be for some time – we have likely already switched to a number of new online channels, or at the very least increased the use of them. Fintech has played a big role already with online shopping & delivery, contactless payments and the general reduction in face to face transacting. Small and medium enterprises (SMEs) may gain the most as Fintech has enabled credit to be approved and distributed faster, either by banks or governments.”

“Fintech have been able to develop bespoke applications based on their open platforms to provide immediate channels to get much-needed capital flowing through the economy. Governments have often turned to the Fintechs first rather than traditional financial institutions. If Fintechs can still access investment capital to survive and keep growing, they will continue to disrupt the intermediaries across all sectors. It is yet to be seen if this will accelerate or be curtailed, but that will depend on how the financial institutions react to whatever the new normal will be.”

The Role of Blockchain in Financial Services

Talking about the role of Blockchain in Financial Services, Gestro says, “Overall Blockchain will lead to a more open and interconnected economy that is borderless, transparent and does not need counter-party trust to operate. To date, banks and other financial institutions have been the intermediary to make this happen but, in many areas, it can be slow and costly. Blockchain has the advantage of eliminating the intermediary or ‘middleman’.”

“One particular area is the use of ‘Smart Contracts’. Financial contracts involve legal work, document handling, sighting, signing and sending them to the right people. All of this involves both time and people and proves to be an expensive option eventually. Blockchain can speed this process up in a secure (with no failure points), interoperable and risk-free environment. Trade finance, lending and Islamic Banking are all potential areas that will benefit immensely.”

However, Gestro also extends a word of caution. “On paper, a cross-border Blockchain ecosystem makes perfect sense. However financial institutions have strict and long-standing governance and compliance boundaries that do not make it so easy to ‘switch’ to Blockchain overnight. The entire rationale of Blockchain is decentralising the legacy of competing rules and regulations and different agendas – this would mean that without a decision-maker, bottlenecks will form,” says Gestro. “On the other hand, financial institutions have also developed rapid transactional processing capability and Blockchain technology may be a long way from replicating that speed. So, even though Blockchain will prove immensely beneficial, scalability, risk management and compliance are the three areas that are inhibiting financial institutions from a full-blown adoption.”

Blockchain in Islamic Banking

One of the key benefits of Fintech is to drive financial inclusion. This is particularly true when it comes to widespread access to Islamic Banking facilities. With Fintech, Islamic Banking becomes more accessible to a larger population who do not bank because the banking and financial practices are not Shariah-compliant. Gestro sees a clear role of Blockchain in Islamic Banking. “The two key principles of Islamic Banking are the sharing of profit/loss and the prohibition of interest collection/payment. A key principle of Blockchain finance is smart contracts. With smart contracts, the entire contractual process can be automated quickly and transparently with the terms of each contract enforced as it should. A smart contract will be in compliance with the Shariah objective of ensuring transparency in a deal with clear asset definitions, payment terms and enforcement – all aligned with the principles of trust.”

UAE has been the hub of global Islamic financial services and there have been a few initiatives in 2019 to drive the adoption of Fintech in Banking and Financial Services. Etisalat Digital – the digital arm of Etisalat focused on transformational technologies – has developed the UAE Trade Connect (UTC), a nationwide platform that uses disruptive technologies to digitalise trade in the UAE. The initial phase will focus on addressing the risks of double financing and invoice fraud before turning to other key areas of trade finance. Created in partnership with First Abu Dhabi Bank (FAB) and Avanza Innovations, the platform has since seen the participation of 7 other major banks in the UAE. The goal of UTC is to drive transformation in trading practices by enabling banks, enterprises and governments to collaboratively evaluate technologies such as Blockchain, AI, machine learning and robotics.

Later in the year, during the Middle East Banking Forum in Abu Dhabi, the Central Bank of the UAE (CBUAE) announced the formation of a Fintech office to develop countrywide regulations for financial technology firms. The country has clearly been evaluating Fintech as a means of growth in the financial sector. Last week, the Abu Dhabi Islamic Bank (ADIB), in the UAE announced that they had successfully executed a Digital Ledger Technology (DLT) trade transaction with TradeAssets, a trade finance e-marketplace powered by Blockchain technology. It became the first Islamic Bank to transact on DLT.

As the global Islamic banking market heats up – with countries such as Malaysia openly vying to be a market leader – we will see higher adoption of Regtech and Blockchain in this sector.

Blockchain in China’s Financial Industry

Gestro says, “China is at the forefront of Blockchain technology development. Xi Jinping has announced that Blockchain is one of China’s technological priorities with the impending launch of the Blockchain Service Network (BCN). This is similar to the Belt and Road Initiative to provide infrastructure for the world to use, be a first mover and gain a strong foothold. It is no coincidence that China has filed the most Blockchain patents in the world. It has the collective power of the banking system, telecommunications behemoths and internet giants – all collaborating to realise China’s Blockchain vision.”

Last year, China unveiled plans to adopt and develop Blockchain to reduce banking fraud, offer secure loans, and streamline transactions in the financial industry. A Blockchain committee called the National Blockchain and Distributed Accounting Technology Standardisation Technical Committee was set up to explore the possibilities. The primary goal of the committee is to set standards for the adoption of Blockchain and involved big tech companies, such as Huawei, Tencent, Baidu, Ant Financial Services, and JD.com.

Ant Financial Services – Alibaba’s Fintech arm – recently created a new consortium Blockchain platform called Open Alliance Chain aimed at SMEs and developers. The available Blockchain tools would be able to help supply chain, invoices, donations, financial transactions and promote various other Blockchain uses across financial services.

There appears to be an interest in global financial services around Blockchain. It will be interesting to watch this space to see if Blockchain adoption in the Financial Services industry becomes mainstream, as the global economy adjusts to the new normal.

Governments face multiple challenges which are further getting highlighted by the ongoing global crisis. They have to manage the countries’ financial performances, reducing fiscal deficits. Every economy – whether emerging or mature – face challenges in bridging economic and social divides and ensuring equal access to infrastructure across the population. Most governments have challenges associated with the changes in demographics – whether because of rapid urbanisation, a fast ageing population or those associated with immigration policies.

Government agencies have the task of ensuring reliable public service, keeping their citizens safe, and striving for cost optimisation. In this constantly evolving world, agencies need to rely on technology to manage ever-growing citizen expectations and rising costs. Several government agencies have started their digital transformation (DX) journey replacing their legacy systems to transform the way they deliver services to their citizens.

Drivers of Transformation in Public Sector

Creating cross-agency synergies

Government agencies have access to enormous quantities of citizen data. But much of that data resides with individual agencies, often with no real synergies between them. For improved cost management and better utilisation of the data, it is imperative for governments to think of cross-agency collaboration systems and tools which give the larger entity a better visibility of their resources, contracts and citizen information. This involves, developing procedures, frameworks and working beyond their limited boundaries, leveraging technology to share information, applications, platform and processes. While this has been in discussion for nearly a decade now, most government agencies still work in departmental siloes and find it hard to work as a networked entity. The Ecosystm AI study finds that nearly three-quarters of public sector organisations find data access a challenge for their AI projects.

Improving citizen engagement

Increasingly, citizens are becoming tech-savvy and are expecting digital services from their government agencies. Not only that, but they are also ready to have conversations with agencies and provide feedback on matters of convenience and public safety. With the popularity of social media, citizens now have the capability to take their feedback to a wider open forum, if the agency fails to engage with them. Public sector organisations have to streamline and automate the services they provide, including payments, and provide real-time services that require collaborative feedback and increased participation from citizens. Smart governments are successfully able to leverage their citizen engagement to use open data platforms – Data.gov and data.gov.uk, are allowing communities to target and solve problems for which governments do not have the bandwidth. With citizen centricity and open government policies, there is also an ever-increasing need for greater accountability and transparency.

Managing project performance and costs

Most government projects involve several stakeholders and are complex in terms of the data, infrastructure and investments required. To take better decisions in terms of project complexity, risks and investments, public sector agencies need to have a structured project management framework, using an optimum mix of physical. technical, financial and human resources. In an environment where citizens expect more accountability and transparency, and where projects are often funded by citizens’ taxes, running these projects become even more complicated. Government agencies struggle to get funding, optimise costs (especially in projects that run over multiple years and political environments), and demonstrate some form of ROI. There is also an overwhelming requirement to detect and prevent frauds.

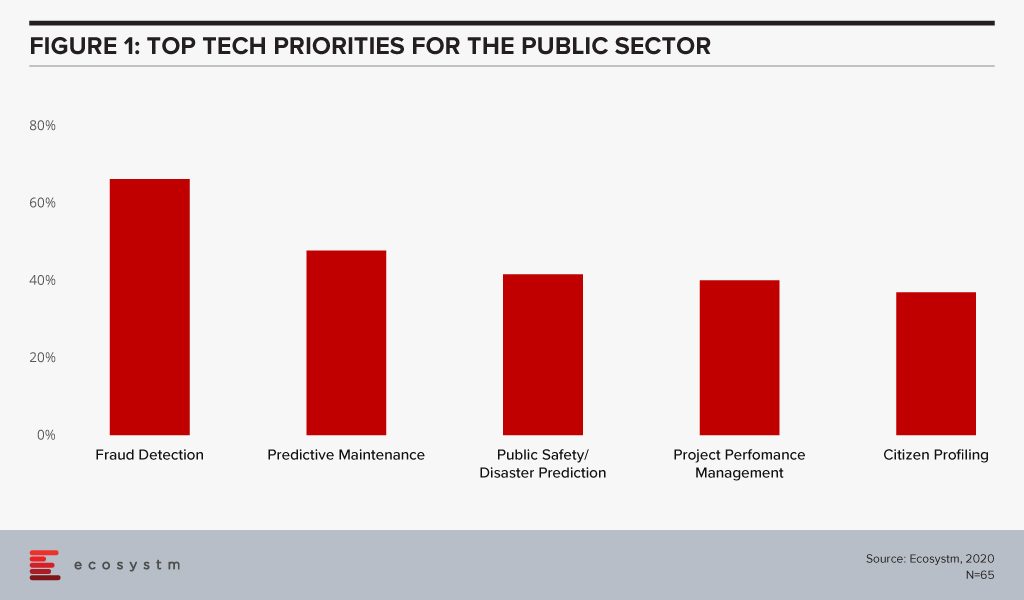

The global Ecosystm AI study reveals the top priorities for public sector, that are focused on adopting emerging technologies (Figure 1). It is very clear that the key areas of focus are cost optimisation (including fraud detection and project performance management) and having access to better data to provide improved citizen services (such as public safety and predicting citizen behaviour).

Technology as an Enabler of Public Sector transformation

Several emerging technologies are being used by government agencies as they look towards DX in the public sector.

The Push to Adopt Cloud

To prepare for the data surge that governments are facing and will continue to face, there is a push towards replacing legacy systems and obsolete infrastructure. The adoption of cloud services for data processing and storage is helping governments to provide efficient services, improve productivity, and reduce maintenance costs. Moreover, cloud infrastructure and services help governments provide open citizen services. The Government of India has built MeghRaj, India’s national cloud initiative to host government services and applications including local government services to promote eGovernance and better citizen services. The New Zealand Government has sent a clear directive to public sector organisations that public cloud services are preferred over traditional IT systems, in order to enhance customer experiences, streamline operations and create new delivery models. The objective is to use public cloud services for Blockchain, IoT, AI and data analytics.

Transparency through Communication & Collaboration technologies

Since the 1990s, the concept of eGovernment has required agencies to not only digitise citizen services but also work on how they communicate better with their citizens. While earlier modes of communication with citizens were restricted to print, radio or television, digital government initiatives have introduced more active communication using mobile applications, discussion forums, online feedback forms, eLearning, social media, and so on. Australia’s Just Ask Once allows citizens to access information on various government services at one place for better accessibility. More and more government agencies are implementing an omnichannel communication platform, which allows them to disseminate information across channels such as web, mobile apps, social media and so on. In the blog The Use of Technology in Singapore’s COVID-19 Response, Ecosystm analysts spoke about the daily updates shared by the Government through mobile phones. Demonstrating cross-agency collaboration, the information disseminated comes from multiple government agencies – the same channel is also used to drip-feed hygiene guidelines and the evolving government policies on travel, trade and so on.

AI & Automation for Process Efficiency and Actionable Intelligence

Governments are focusing on leveraging centralised resources and making processes smarter through the adoption of AI platforms. Initiatives such as the Singapore Government’s concept of Single Sources of Truth (SSOT), where all decision-making agencies have access to the same data, is the first step in efficient AI adoption. Singapore’s government agencies also have three data aggregators – Trusted Centers (TCs). This enables initiatives such as Vault-Gov.SG which allows government officials to browse a metadata catalogue and download sample data to run exploratory analytics. To push the adoption of AI, several governments are focusing on roadmaps and strategies such as Singapore’s National AI Strategies to transform the country by 2030, and the Government of Australia’s AI Roadmap and framework to help in the field of industry, science, energy, and education.

The first step of AI adoption is often through automation tools, such as virtual assistants and chatbots. The US Citizen and Immigration Service (USCIS) introduced an AI powered chatbot Emma to better support citizens through self-service options and reduce the workload of their customer service agents. The department of Human Services in Australia rolled out various chatbots named Roxy, Sam, Oliver, Charles and the most latest in progress PIPA (Platform Independent Personal Assistant) to provide information on various services and assist on queries.

Real-time data access with IoT

Governments have the responsibility of enforcing law and order, infrastructure management and disaster management. Real-time information data access is key to these initiatives. IoT sensors are being used in various government applications in object detection, and risk assessment in cities as well as remote areas. For example, IoT-enabled traffic monitoring and surveillance systems are embedded to provide real-time updates and continuous monitoring that can be used to solve issues, as well as provide real-time information to citizens. In a futuristic step, the US Department of Transportation (USDOT) is working with auto manufacturers on embedding vehicle to vehicle communication capabilities in all vehicles to avoid collision with emergency braking and vehicle speed monitoring. In an effort to promoting smart city initiatives and for infrastructure maintenance, New Zealand has installed smart cameras with automated processing capabilities, and IoT based street lighting system. IoT has tremendously benefited the supply chain and logistics sector. The US Army’s Logistics Support Activity (LOGSA) is using IoT for one of the Government’s biggest logistics systems. and military hardware with on-board sensors to analyse data directly from the vehicles for better asset maintenance. Again like in AI, there is a need for a clear roadmap for government adoption of emerging technologies, especially considering the safety and ethics angle. The Government of UK has introduced IoTUK, a program to help the public sector and private enterprises to come together and develop IoT technologies considering aspects such as privacy, security, and reliability.

Blockchain enabled Traceability & Transparency

Moving paper-based systems to digitised systems makes processes efficient to a degree. However, more is required for full traceability and transparency. Managing the data flow and safeguarding the information is vital for government organisations, especially as there is an increase in cross-agency collaboration. Government agencies and departments across the globe are increasingly collaborating using Blockchain technology, while at the same time maintaining the security of the data. For instance, in Georgia, the government department of Land, Property and Housing Management is using Blockchain to maintain land and property records. The blockchain-based land registry allows speedier approvals with no involvement of paperwork or multi-party signatures on physical documents. This is enhancing service quality while offering better security measures as the data is digitally stored in the National Agency of Public Registry’s land title database. Estonia is using Blockchain to protect their digital services such as electronic health records, legal records, police records, banking information, covering data and devices from attacks, misuse, and corruption.

Technology-led digital transformation has become the norm for public sector organisations across both emerging and mature economies. However, agencies need to create clear roadmaps and frameworks, including RoI considerations (which may not only be financial but should include citizen experience) and avoid ad-hoc implementations. The key consideration that government agencies should keep in mind is citizen security and ethics when adopting emerging technologies.

The next phase of a post-COVID world will be one of reduced physical contact, tighter regulations, and new habits and hygiene practices. This will translate into significant process changes which will be deeply enabled by mobile technology. All mobile form factors will be more integrated into how we interact. Interactional changes will be found in our homes, offices, public spaces and services.

In this blog post I address two fundamental questions as a technologist on the underpinnings of this shift:

- How can enterprises find ways of rebuilding and cementing trusted relationships using mobile technology?

- How does our infrastructural foundations support mobile technology for contactless transactions? (privacy, two-factor authentication, data quality and so on)

Situational shift to mobile

Given the rapid shifts in the last six months in how we can interact with each other, enterprises will have to be agile and flexible in process design going forward to optimize opportunities for customer engagements.

We will continue to have further disruptions on how we live and work in the next 12 to 18 months and potentially beyond. Some of the shifts towards mobile have been expected for a while, yet this crisis has pushed the timeline ahead as to how we engage.

Use cases in the “new normal”

Here are some use case examples in this next phase of business where mobile enables the transaction between consumer and environment:

Education. The reskilling and training certification that will be necessary to address unemployment, will be on Mobile First. Because of bandwidth, learner attention span, and form factor, there will be retooling of educational programs to be bite-sized and more media oriented.

Retail. Retail and delivery businesses shifting to remote first, with drop-off points that use mobile for contactless signatory and payment.

Healthcare. Telemedicine primarily by mobile devices (phone, laptop, phablet). Personal medical data sharing over mobile will require enhanced data encryption and two-factor authentication, which needs addressing via encryption and authentication.

Entrepreneurship. More side hustles that are mobile-based and mobile administered. Any authorization and transaction-oriented activities will be driven by mobile.

Government. Requests for document renewal or identity authentication for approval or submission of materials, with one-touch request.

Supply chain. Visibility and tracking of inbound and outbound materials. One-click reordering, and contactless payment verification.

Workplace. Contactless engagement with mobile as authentication of actions (coffee machine payment, copier usage, keyless office, meeting room allocation).

Facilities management. Hygiene controls with personnel health detail tracking (who cleans what room when). Deep cleaning management tools for audit trails, liability.

Role of mobile in creating engagement

Building trust

As we filter through the level of rubbish coming at us via social media, websites and our email, most of us are looking for a trusted information source. Our mobile is our window to the world, and many are applying appropriate filtration to make that world a bit more manageable.

The reason that people did previously download an app was partly based on what information had to be handed over in terms of permissions. The app builder needs to build a trusted relationship on benefit, not on what can be leveraged from the consumer.

To build that trust and create a closer engagement – albeit driven by situational need vs. consumer want – app developers need to consider these consumer needs:

- Level of trust in quality of information provided (e.g. weather info vs something more critical)

- Trust in app data usage and functionality (does it work?)

- Privacy of data being used and being held (statements and auditability)

- Location of data (on whose device: client or server)

- Speed and reaction time (Is there edge computing or the use of IoT to help push mobile information quickly?)

- Loss of data or loss of device and the impact on app access (More than lost passwords, lost processes and lost data)

Technological foundations for mobile usage

Network and bandwidth

We have all experienced bandwidth issues in the last few months, either sharing bandwidth with loved ones in lockdown to peak periods of video conferencing activity across geographic regions. Entertainment content providers such as Netflix and Disney+ were asked to lower the quality of the data streaming.

But then what online activity will take priority? Will we start to see pricing differentials for guarantees of availability? What about subscription models with platinum, gold and silver memberships (as in frequent flyer programmes) as to the network bandwidth you or your activity is allocated? Will things be done over VPN not only for privacy but for priority? I also see VPN as a possible solution towards issues like Zoom bombing and other intrusions to daily business operations.

We come to the role of a pandemic in 5G investment, which is similar to the role of investment in R&D during an economic downturn. Clearly, the world needs better bandwidth with more agility and future-proofed for functionality. You cannot drive a fast car on a bumpy road with potholes.

But for countries losing thousands of citizens to a virus with critical infrastructure at risk, where is the priority of a better telecom infrastructure? My colleague Shamir Amanullah wrote a report prior to the pandemic about the Race for 5G in Southeast Asia which is a good barometer for other regions. There is a good CNBC article from Todd Wassermann on the US situation, and a rather excellent survey on consumer sentiment on 5G from February 2020 by Politico.

Role of data quality and its security

Going back to my previous statement about rubbish and social media, the validation and quality of data exchange is part of the value proposition of using mobile technology.

What aspects of our current IT infrastructure create that ‘data value add’?

IoT and Edge Computing. Most of us are not going to be comfortable in crowds going forward. If I can reserve a space, or I can use a sensor to see how full an environment currently is, it will impact my decision to go somewhere. The faster that real-time information is processed and available, the better the outcome.

Blockchain technology is functioning enough to address the challenge of how to secure the data and prevent malicious cyber-attacks. This includes medical data hacking, supply chain theft, and other data-oriented safety issues on hygiene and product providence that we are experiencing now.

Final thoughts

At Ecosystm, we highlight how and where enterprises plan to invest and adopt technology while adding insights and expertise on to the use cases and trends. We are also able to reflect upon the agility of the same enterprises to make that technology investment count towards the next phase of their business model. In a post-COVID situation we see inventive ways enterprises are using technology. This is not only for societal benefit, but to make a difference in the marketplace. And mobile plays a key role in this next phase of engagements.

The FMCG industry has always been competitive given the need to drive high sales volume because of the low profit margins of the products. As the industry faces changes – such as the demographics of the consumer base and the need to introduce newer sales channels – technology is playing an important role in ensuring that the organisations can remain competitive.

eCommerce Disrupting the FMCG Industry

The concept of online retail is said to have originated in some form in the 1960s. But with the growth of the access to the Internet in the 1990s and Amazon’s competitive business model, it has disrupted the retail and FMCG industries. As we see a steady growth in smartphone usage, digital payments, online banking and app-based platforms, online retail is becoming mainstream. While initially thought to be ideal for the purchase of durables and entertainment products and services (where price comparison is key), it has become common for FMCG companies to use eCommerce platforms. Even perishables are being purchased online with the rise in the number of online grocery stores. This is impacting the FMCG industry in a number of ways:

Change in Marketing Strategy

FMCG companies need to continue their traditional marketing strategy for in-store consumers. But at the same time, they need to reach out to a wider base of consumers who shop online. The profile of these consumers is different – younger and technologically savvier. They do not necessarily believe in brand loyalty. While the browse-to-buy ratio for FMCG products is high, they are having to invest in digital marketing strategies including personalised campaigns and presence in social media and online forums. Even packaging for in-store and online products need to be different for some products.

Increased Competition

An online presence means that your brand can reach a wider audience – this also means that the competition becomes tougher. Now global brands compete with brands from other countries as well as local brands on the same online platform. This raises the bar, with companies competing not only on price and product but also on delivery services and better customer feedback.

Increased Complexity of the Supply Chain

No longer can an FMCG company depend solely on trucks delivering their products to stores at a fixed time of day. As they play increasingly in the B2C space, they have to constantly be aware of seasonality and spikes. This means that their supply chain operations become that much more complicated, and they are having to spend more on logistics and transportation. There is also the need to handle a larger volume of data.

Changing Consumer Profile

As mentioned earlier, the consumer profile of the FMCG industry has changed to include younger consumers who want to shop online. It also includes consumers in newer markets made possible by eCommerce platforms. FMCG companies also have to cater to consumers who are conscious about product quality, the environment and ethics. This means they want to know where the products were grown or manufactured, their carbon footprints and generally want more traceability of the products they are purchasing. This has led governments to come up with guidelines to protect consumer rights. Recently, the UK government issued guidelines on the quality, labelling, standards and food safety including the right logos, health and identification marks.

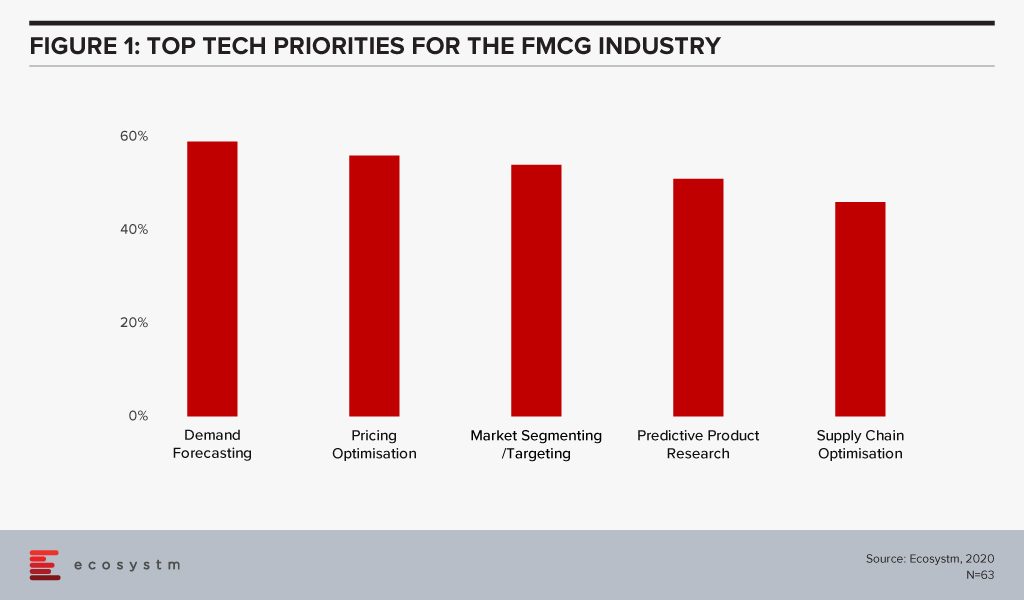

The global Ecosystm AI study reveals the top priorities for FMCG companies, focused on adopting emerging technologies (Figure 1). It is clear that their key priority is to handle the competitive market by focusing both on the consumer and the supply chain. Supply chain optimisation through demand forecasting ensures that they are not managing extra stock, and simultaneously not losing out on customers because of lack of stock. This just-in-time inventory management includes initiatives such as pricing optimisation in response to market demand, competition and – especially in the case of perishables – ensuring that stock closer to the use by date is cleared.

Technology as an Enabler of FMCG Transformation

The one advantage that FMCG companies have today is they have access to enormous customer and inventory data. As a result, they are able to leverage several emerging technologies to transform.

Digital Marketing

One area that is transforming the industry is digital marketing which includes multiple aspects such as search engine marketing, video marketing, social media activity and email marketing. While several technologies come together for a digital marketing solution and AI is a key component of the solutions, there are platforms that provide an end-to-end solution.

Digital marketing is most effective with a targeted group of customers and when organisations can identify digital or social champions. Johnson & Johnson’s Babycenter.com is a good example of how creating a digital community can help market products. The core idea behind the website is to give expecting and new mothers advice on early childhood. While on the surface it appears disassociated from Johnson & Johnson, the site almost exclusively carries their advertisements. This gives them a targeted base to push their products to. Dollar Shave Club is another example of how brands can leverage digital marketing. Their social media engagement has been so successful that they got bought over by Unilever. The digital campaign includes incentivising members with their products for posting about them on Instagram or Facebook.

Blockchain

FMCG companies are investing in Blockchain and digital ledger technologies for track and trace functionalities and operational efficiency. The technology not only helps manage the supply chain better by effective shipping timelines maintenance, delivery management and inventory management; it also helps build trust in a brand. It helps in compliance management, reduces the number or need for middlemen, easier handling of cross-border transactions and brings about an end-to-end accountability.

Danone initiated a Track & Connect service for their baby formula using Blockchain for transparency and traceability to show the authenticity of their products to parents and for a better customer experience. FMCG companies will benefit immensely from the farm-to-fork accountability concept initiated by Agriculture.

AI

From predictive analysis to machine learning to deep learning, AI is bringing a lot of benefits to FMCG companies. AI is enabling companies to discover gaps (both in their consumer interactions and in the supply chain) and make their processes intelligent – including demand forecasting, supply chain optimisation, personalised product offerings, social media analytics, consumer sentiment analytics and recommendation engines.

FMCG organisations are analysing internal and external data sources for both sales and improved customer experience. As FMCGs are forced to sell online to remain competitive, they have access to a high volume of the consumer as well as supply chain and inventory management data. Coca-Cola remains one of the leaders in the FMCG market by leveraging this data, including product research and social data mining. Even their vending machines are looking to leverage AI for personalised offerings and for loyalty programs.

The need to enhance the customer experience has also seen innovations like the Maggi Chatbot – “Kim”- that helps customers learn about Maggi recipes, ingredients, and dietary requirements, through Facebook Messenger.

FMCG companies that cannot afford to invest in technologies such as AI also have the option of leveraging the technology offerings of their online retail platform. eBay offers analytics as a service to the sellers – offering them data, metrics, and analytics to help them succeed. They also introduced computer vision technology to help sellers create clearer and more attractive images for the platform.

In this competitive market, we will see FMCG companies – and not just the big global brands but also the local producers – embrace more technology.

The Oil and Gas industry has seen volatile times and is affected by its own set of unique challenges ranging from commodity price fluctuations, a potential supply crunch, geo-political events, and energy policies including energy transition. Moreover, the challenges and requirements are distinct at different stages of operations – upstream, midstream and downstream. The industry has been an early adopter of a few emerging technologies and is looking to leverage them to remain competitive and better employee management.

Drivers of Transformation in the Oil and Gas Industry

Remaining competitive in an evolving market

Oil and Gas companies are having to clean up old processes, as the market gets increasingly competitive. Ecosystm research finds that the top business priorities for Oil and Gas companies do not stop at cost reduction and revenue growth. The industry also has to focus on employee experience and safety, compliance, and increasingly even customer experience. And they must remain competitive through potential disruption in supply, demand and production; the rising costs of processes; and ongoing exploration costs. Oil and Gas companies are also focusing more on their downstream operations including retail in order to remain competitive.

Shortage of skilled workforce

The industry also faces the challenge of skills shortage. A survey conducted by the Global Energy Talent Index (GETI) found that nearly 70% of Oil and Gas professionals think the industry is already facing skills shortage or will be hit by it within the next 5 years. This is due to a number of reasons, including a reluctance of younger professionals to commit to a profession that has harsher conditions than many. Moreover, as energy transition becomes a topic of global discussion, many have a perception that the industry is not sustainable in the future. The industry also goes through cycles where they cut back on exploration and production, which results in the loss of skills and inadequate knowledge transfer. It has a long-term challenge around knowledge management.

Safety and environmental regulations

The industry has to contend with green energy movements and environmental regulations. There are several country-level regulations around air and water quality. Most Oil and Gas companies have cross-border operations and have to comply with a number of regulations on harmful emissions, greenhouse gases and offshore activities, in several countries. Increasingly, all leading Oil and Gas companies have to work in alignment with the Paris Agreement when developing solutions across functions – exploration, extraction and supply chain. There are also worker safety regulations and standards that they have to comply with.

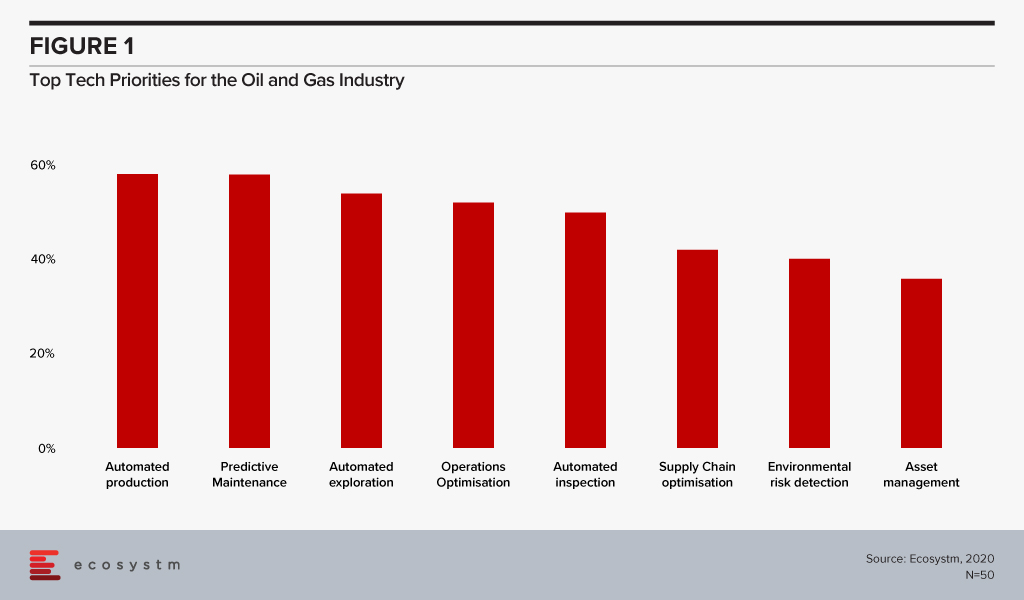

The global Ecosystm AI study reveals the top priorities for Oil and Gas companies that are focused on adopting emerging technologies (Figure 1). It is very clear that the key areas of focus are process automation, asset and supply chain management and compliance.

Technology as an Enabler of Oil and Gas Transformation

Several emerging technologies are being used by the Oil and Gas industry as they continue their struggle to remain competitive across the different stages of operations – upstream, midstream and downstream.

IIoT

As the costs of sensors go down, connectivity widens and computing power increases, the industry is seeing greater uptake of Industrial IoT (IIoT) solutions. From wearables (to monitor employee safety) to drones with smart cameras (for remote inspections, environmental monitoring), IoT solutions have an immense role to play in the Oil and Gas industry. The industry has had to be cautious about the choice of devices, however, due to pervasive inflammable hydrocarbons and the related regulations.

Not only are they implementing sensors, Ecosystm research finds that 30% of Oil and Gas companies are also leveraging the IoT sensor data for analytics and intelligence. A common application is in predictive maintenance. Two years ago, Chevron launched predictive maintenance solutions in its oil fields and refineries. While the pilot ran on heat exchangers, the company aims to connect all assets by 2024 and expects to save millions on asset management.

AI

AI and machine learning have applications across Oil and Gas operations, leveraging IoT sensor data. “Smart fields” where production is monitored centrally, has a high level of automated controls. AI/Analytics is allowing companies to run simulations, use predictive data models and identify patterns to gauge risks associated with new projects. This has an impact on production, exploration and making efficient use of existing infrastructure. Oilfield services company Baker Hughes has worked on an AI-based application that allows well operators to view real-time production data and predict future production with more accuracy.

AI is also helping organisations monitor environmental risk and has the potential to help Oil and Gas companies with their compliance requirements. Gazprom Neft, one of the largest suppliers of natural gas to Europe and Seismotech are exploring using AI for seismic data processing, for solutions that are specific to the needs of the industry.

While the applications of AI in the industry are often focused on upstream activities, AI has applications across all operations. In the midstream, transporting crude oil to refineries has always had its unique challenges. Since transport lead times are long and prices fluctuate based on the availability of products, organisations benefit from demand forecasting and price risk modelling. While the common perception of the industry does not include customer interactions, the truth is that the industry is increasingly focusing on the retail space. The need is enough for Shell to begin experimenting with virtual assistants as far back as in 2015, to interact with their retail customers. In fact, the company anticipates a higher adoption of AI in the industry and is collaborating with Udacity to bridge the skills gap.

Technologies empowering employees

As discussed earlier, one of the key challenges of the industry is the inability to manage a reliable knowledge management system that can help consistent knowledge and skills transfer. A single source of truth that can be accessed by all employees on processes, including safety requirements has an immense role to play to help with the skills shortage in the industry.

Enterprise mobility is another tech area that holds immense potential for the industry, with its huge proportion of mobile workers, many in remote locations. Mobility solutions can help in productivity, process optimisation and monitoring of health and safety of the employees and are increasingly incorporating wearables and location-based services. GIS and GPS systems are helping employees with accurate directions, easier access to drilling locations and more. Given the number of devices, platforms and OSs, the industry is seeing an increased interest in unified enterprise mobility (UEM) solutions. Ecosystm finds that more than a third of Oil and Gas companies have implemented or are evaluating UEM, while another 20% are expressing early interests.

Blockchain

The sheer quantity of documents, transaction records and contracts that a typical Oil and Gas company has to manage – including cross-border transactions – poses some difficulty for the industry. The companies have to reconcile and handle issues involving multiple contractors, sub-contractors, and suppliers. Supply chain and inventory management is also a challenge. With the adoption of Blockchain, the industry can automate the management of purchase orders, change orders, receipts, and other trade-related documentation, as well as inventory data with more efficiency and transparency. Blockchain is enabling a seamless supply chain, improved project management and simplifying contractual obligations at each point along the way. Gazprom Neft’s aviation refuelling business is an early adopter of Blockchain-based smart contracts. All refuelling operations are undertaken exclusively on the basis of digital contracts approved by both parties near real-time and eliminates the possibility of any breach of contract and makes the accounting process more transparent.

As the market continues to be volatile for Oil and Gas companies and uncertainties loom in the future, the industry will increasingly depend on technology to remain competitive.