In recent years, businesses have faced significant disruptions. Organisations are challenged on multiple fronts – such as the continuing supply chain disruptions; an ongoing energy crisis that has led to a strong focus on sustainability; economic uncertainty; skills shortage; and increased competition from digitally native businesses. The challenge today is to build intelligent, data-driven, and agile businesses that can respond to the many changes that lie ahead.

Leading organisations are evaluating ways to empower the entire business with data, machine learning, automation, and AI to build agile, innovative, and customer-focused businesses.

Here are 7 steps that will help you deliver business value with data and AI:

- Understand the problems that need solutions. Before an organisation sets out on its data, automation, and AI journey, it is important to evaluate what it wants to achieve. This requires an engagement with the Tech/Data Teams to discuss the challenges it is trying to resolve.

- Map out a data strategy framework. Perhaps the most important part of this strategy are the data governance principles – or a new automated governance to enforce policies and rules automatically and consistently across data on any cloud.

- Industrialise data management & AI technologies. The cumulation of many smart, data-driven initiatives will ultimately see the need for a unified enterprise approach to data management, AI, and automation.

- Recognise the skills gap – and start closing it today. There is a real skills gap when it comes to the ability to identify and solve data-centric issues. Many businesses today turn to technology and business consultants and system integrators to help them solve the skills challenge.

- Re-start the data journey with a pilot. Real-world pilots help generate data and insights to build a business case to scale capabilities.

- Automate the outcomes. Modern applications have made it easier to automate actions based on insights. APIs let systems integrate with each other, share data, and trigger processes; and RPA helps businesses automate across applications and platforms.

- Learn and improve. Intelligent automation tools and adaptive AI/machine learning solutions exist today. What organisations need to do is to apply the learnings for continuous improvements.

Find more insights below.

Download The Future of Business: 7 Steps to Delivering Business Value with Data & AI as a PDF

It is true that the Retail industry is being forced to evolve the experiences they deliver to their customers. However, if Retail organisations are only focused on creating digital experiences, they are not creating the differentiation that will be required to leap ahead of the competition.

It is time for Retail organisations to leverage data to empower multiple roles across the organisation to prepare for the different ways customers want to engage with their brands.

So what are the phases of customer engagement? How are companies such as Singapore Airlines and TikTok preparing for the future of Retail?

Last week I wrote about the need to remove hype from reality when it comes to AI. But what will ensure that your AI projects succeed?

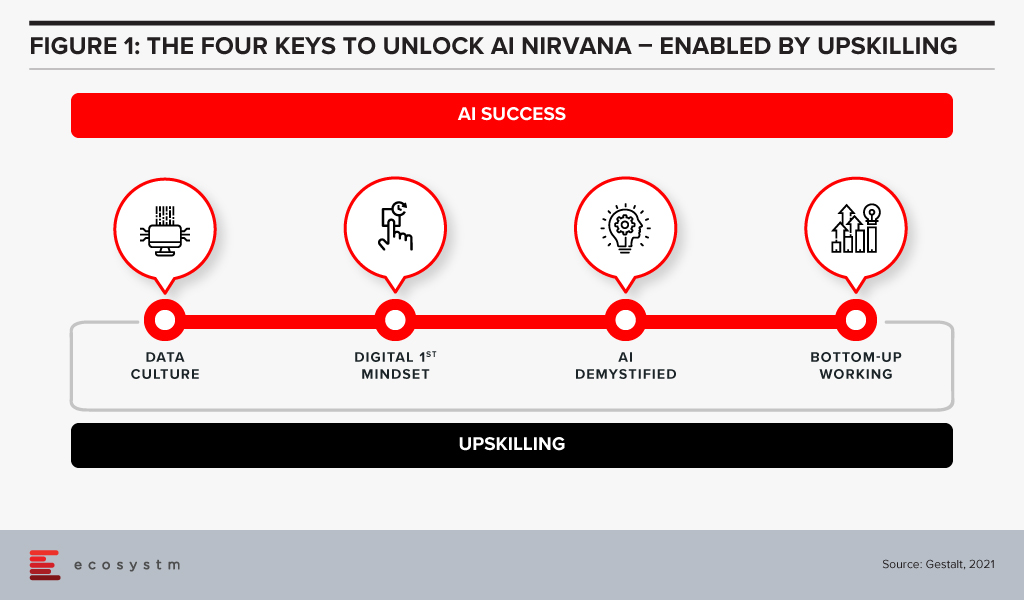

It is quite obvious that success is determined by human aspects rather than technological factors. We have identified four key organisational actions that enable successful AI implementation at scale (Figure 1).

#1 Establish a Data Culture

The traditional focus for companies has been on ensuring access to good, clean data sets and the proper use of that data. Ecosystm research shows that only 28% of organisations focused on customer service, also focus on creating a data-driven organisational culture. But our experience has shown that culture is more critical than having the data. Does the organisation have a culture of using data to drive decisions? Does every level of the organisation understand and use data insights to do their day-to-day jobs? Is decision-making data-driven and decentralised, needing to be escalated only when there is ambiguity or need for strategic clarity? Do business teams push for new data sources when they are not able to get the insights they need?

Without this kind of culture, it may be possible to implement individual pieces of automation in a specific area or process, applying brute force to see it through. In order to transform the business and truly extract the power of AI, we advise organisations to build a culture of data-driven decision-making first. That organisational mindset, will make you capable implementing AI at scale. Focusing on changing the organisational culture will deliver greater returns than trying to implement piecemeal AI projects – even in the short to mid-term.

#2 Ingrain a Digital-First Mindset

Assuming a firm has passed the data culture hurdle, it needs to consider whether it has adopted a digital-first mindset. AI is one of many technologies that impact businesses, along with AR/VR, IoT, 5G, cloud and Blockchain to name a few. Today’s environment requires firms to be capable of utilising a variety of these technologies – often together – and possessing a workforce capable of using these digital tools.

A workforce with the digital-first mindset looks for a digital solution to problems wherever appropriate. They have a good understanding of digital technologies relevant to their space and understand key digital methodologies – such as Customer 360 to deliver a truly superior customer experience or Agile methodologies to successfully manage AI at scale.

AI needs business managers at the operational levels to work with IT or AI tech teams to pinpoint processes that are right for AI. They need to make an estimation based on historical data of what specific problems require an AI solution. This is enabled by the digital-first mindset.

#3 Demystify AI

The next step is to get business leaders, functional leaders, and business operational teams – not just those who work with AI – to acquire a basic understanding of AI.

They do not need to learn the intricacies of programming or how to create neural networks or anything nearly as technical in nature. However, all levels from the leadership down should have a solid understanding of what AI can do, the basics of how it works, how the process of training data results in improved outcomes and so on. They need to understand the continuous learning nature of AI solutions, getting better over time. While AI tools may recommend an answer, human insight is often needed to make a correct decision off this recommendation.

#4 Drive Implementation Bottom-Up

AI projects need alignment, objectives, strategy – and leadership and executive buy-in. But a very important aspect of an AI-driven organisation that is able to build scalable AI, is letting projects run bottom up.

As an example, a reputed Life Sciences company embarked on a multi-year AI project to improve productivity. They wanted to use NLP, Discovery, Cognitive Assist and ML to augment clinical proficiency of doctors and expected significant benefits in drug discovery and clinical trials by leveraging the immense dataset that was built over the last 20 years.

The company ran this like any other transformation project, with a central program management team taking the lead with the help of an AI Centre of Competency. These two teams developed a compelling business case, and identified initial pilots aligned with the long-term objectives of the program. However, after 18 months, they had very few tangible outcomes. Everyone including doctors, research scientists, technicians, and administrators, who participated in the program had their own interpretation of what AI was not able to do.

Discussion revealed that the doctors and researchers felt that they were training AI to replace themselves. Seeing a tool trying to mimic the same access and understanding of numerous documents baffled them at best. They were not ready to work with AI programs step-by-step to help AI tools learn and discover new insights.

At this point, we suggested approaching the project bottom-up – wherein the participating teams would decide specific projects to take up. This developed a culture where teams collaborated as well as competed with each other, to find new ways to use AI. Employees were shown a roadmap of how their jobs would be enhanced by offloading routine decisions to AI. They were shown that AI tools augment the employees’ cognitive capabilities and made them more effective.

The team working on critical trials found these tools extremely useful and were able to collaborate with other organisations specialising in similar trials. They created the metadata and used ML algorithms to discover new insights. Working bottom-up led to a very successful AI deployment.

We have seen time and again that while leadership may set the strategy and objectives, it is best to let the teams work bottom-up to come up with the projects to implement.

#5 Invest in Upskilling

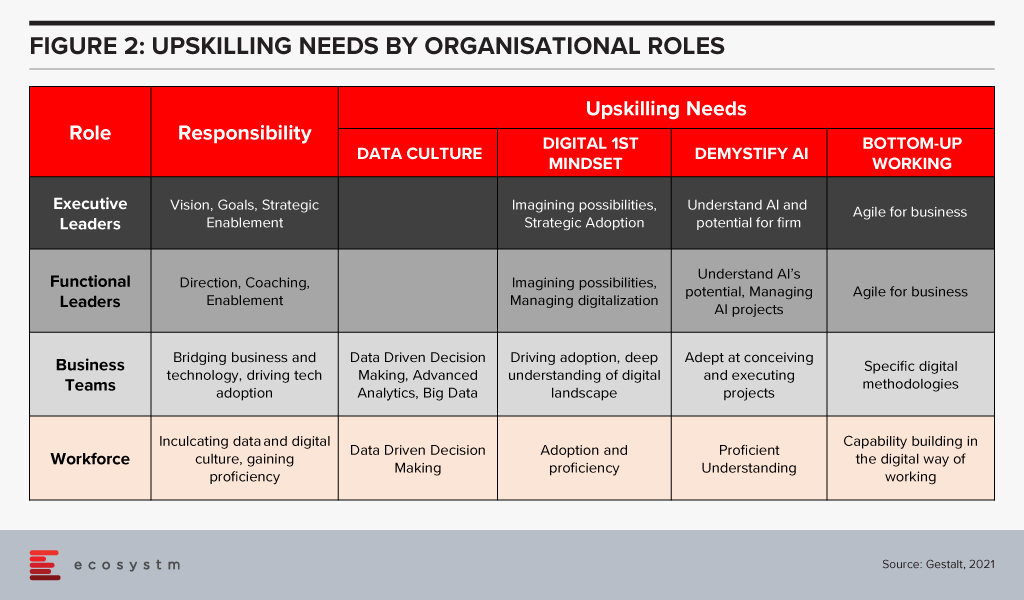

The four “keys” are important to build an AI-powered, future-proof enterprise. They are all human related – and when they come together to work as a winning formula is when organisations invest in upskilling. Upskilling is the common glue and each factor requires specific kinds of upskilling (Figure 2).

Upskilling needs vary by organisational level and the key being addressed. The bottom line is that upskilling is a universal requirement for driving AI at scale, successfully. And many organisations are realising it fast – Bosch and DBS Bank are some of the notable examples.

How much is your organisation invested in upskilling for AI implementation at scale? Share your stories in the comment box below.

Written with contributions from Ravi Pattamatta and Ratnesh Prasad

Woolworths have announced the adoption of a new Software-as-a-Service capability from One Door to support the quality and compliance of their in-store merchandising. There are some valuable lessons from this announcement for other retailers.

The power of data, particularly as the capability of specialist AI tools improves, continues to help retailers improve their offering to customers.

SaaS Capabilities Offer Performance Improvements

Woolworths are working on improving the compliance of product merchandising in-store using One Door Visual Merchandising solution.

One Door will improve the accuracy of data available to both the in-store teams and for the central supermarket merchandising team. The supply chain in Woolworths is already highly automated but getting the shelf presence right is dependent on the quality of data being captured. While store teams already use a range of electronic tools to capture this information, the compliance with store planograms and visual merchandising standards has been difficult to automate.

One Door’s solution provides a single source of this information in an easy to use digital format. The AI tools that One Door have developed appear to be able to show the degree of compliance of the actual shelf layout and stock position.

For store teams, One Door will simplify tracking layout changes by highlighting them and making the data available on the shop floor. This should deliver productivity benefits to the store – benefits that can be reinvested in new activities or on better customer service.

Store teams will be able to verify that third party merchandisers are compliant. Major product manufacturers often use their own merchandising teams in supermarkets and One Door will provide a simple mechanism to verify they have done their jobs properly.

The central merchandise teams will be able to quickly get data-driven feedback on how the stores are making planned changes, as well as verifying the quality of compliance with their store layouts.

All of these factors should mean that the product that is available in-store is presented in the manner that the merchandising teams have defined, and the customers will see a more consistent presentation of products.

Integration is Critical for Rapid Deployment

Effective integration with existing systems and new cloud capabilities is critical to support the real-time operation in Retail.

The ability to introduce and scale up new capabilities that can be delivered by cloud services such as One Door will only be effective if integration is simple and quick. This requires compatibility at a number of levels including data semantics and the ability to exchange data effectively. Woolworths have been growing their capability for managing and supporting APIs that will make this integration smoother.

In addition, the cloud service providers have made the development of integration capabilities an investment priority.

The introduction of One Door is showing how the company can integrate new capability and introduce it to almost 10% of their stores as a pilot capability, with the full deployment to be completed across their chain during 2022.

Other retailers who don’t have this capability to integrate cloud services quickly, reliably and cost-effectively are going to lag companies that have invested to achieve this capability.

CIOs and CDOs should be leading their organisations in the development of a rich and scalable set of APIs to enable the integration of this type of high-value specialised solution.

Deployment without Consistent Architectures will be Complex

Rapid deployment of new capabilities requires a well-architected cloud, network, and edge infrastructure – and a well-trained team.

It is highly likely that the deployment of the One Door solution will be delivered over the existing Woolworths infrastructure. The capability is delivered from the cloud, with little or no deployment costs or time required. With the existing network and hybrid cloud capabilities that Woolworths have developed this type of rollout will be a relatively simple technical activity.

The integration of the service into the Woolworths environment is likely to be the most complex activity to make sure accurate data is exchanged.

It doesn’t take long to identify a wide range of different digital initiatives that Woolworths are pursuing. With the platform that they have established, they are well-positioned to take advantage of new capabilities as start-ups and existing suppliers develop them.

Every retailer needs to maintain their focus on their digital capabilities. As companies such as One Door develop AI-based enhancements, CIOs and their teams need to be ready to integrate these capabilities quickly.

Strong architectures for both infrastructure and digital services are needed to achieve these outcomes.

Recommendations for Retailers

Retail organisations continue to find new ways to leverage the power of the data that they are able to collect. The flexibility that SaaS developments deliver will be essential to maintaining an organisation’s competitive positioning.

CIOs and their teams need to lead their organisations and ecosystems by:

- Identifying new SaaS capabilities that support the strategic positioning of their companies

- Preparing their environments by supporting a rich set of APIs to support the rapid integration of these new capabilities

- Developing and maintaining strong architectures that provide organisations a solid framework to develop within

Checkout Alan’s previous insight on Woolworths micro automation technology adopted to speed up the fulfilment of online grocery orders

Much has been written (and discussed on webinars) about the demands of managing the work-from-anywhere experience. We were all thrown into this last year, and are still working our way through the challenges. For most employees it has been a positive experience – but there is still a lot more we can and should do to improve experiences for employees and their managers.

Workplace Analytics Gains Significance

At the start of 2020, my colleague Audrey William and I discussed the need for workplace analytics when predicting workplace trends for the year, but the pandemic delayed many of these investments. As working from home (or from anywhere) becomes a long-term trend, we are learning that managers need tools to better empower their employees to deliver what the business needs. There are many reports of employees working overtime; working longer days; not taking breaks; being in back-to-back meetings for days on end; skipping meals; and wearing themselves out.

There are many benefits of remote work – employees have the freedom to manage the day as they choose, they have no commute and (conceptually) more harmony between work and home duties. But there are also many processes that are harder. It is not as easy to find the right person to connect to or learn from, get the best information or answer to a question, and get coaching and new skills. Managers need to understand their employee work experience because they don’t sit with or supervise them all day. Self-service for employees used to mean walking around the office and having a conversation or meeting. Today, we need to make these outcomes easier for every worker regardless of location.

Microsoft Lauches Viva

Microsoft has announced the release of Viva – a new product suite to help businesses overcome these challenges. They have published a “Future of Employee Experience” video here as part of the launch – but don’t watch it – or if you do, be prepared to be disappointed when you see the actual products… The good news is that we have moved from oval-shaped phones in Future of Work videos in 2000 (because all web content is designed for round screens right?) to transparent phones in 2010 (who needs to be able to see what’s on the screen?) to virtual screens in Future of Work videos in 2021… Guess they’ll never become a reality either!

Based off the early reviews and commentary about Viva, I believe Microsoft is really onto a winner here:

- Managers need better analytics about how their team spends their days and employees need insights as to how to increase their productivity or find a better balance in their life.

- Employees need to find the people and information in their business to connect with and learn from – how often do employees reach out to others to ask for help or information when the answers they were looking for weren’t too far away. This information needs to be easier to find – even surfaced to employees before they go looking for it.

- Everyone in your business needs to keep learning within their flow of work – the formal training programs offered by most businesses today are useless if employees are too busy to take the course.

- Business leaders need to drive cultural change more effectively or support their broader business initiatives by linking employees with the information and insights that can help reinforce or change organisational culture.

Viva should support these outcomes. Microsoft is partnering with many other businesses to make this work (systems integrators, training providers, workplace and HR platforms etc). If the products deliver as promised, they might provide the missing link that many businesses need today to keep their employees safe, productive, happy and connected.

Learn about the factors that have been accelerating the shift towards the new ways of working. The top 5 Future of Work Trends For 2021 are available for download from the Ecosystm platform. Signup for Free to download the report.

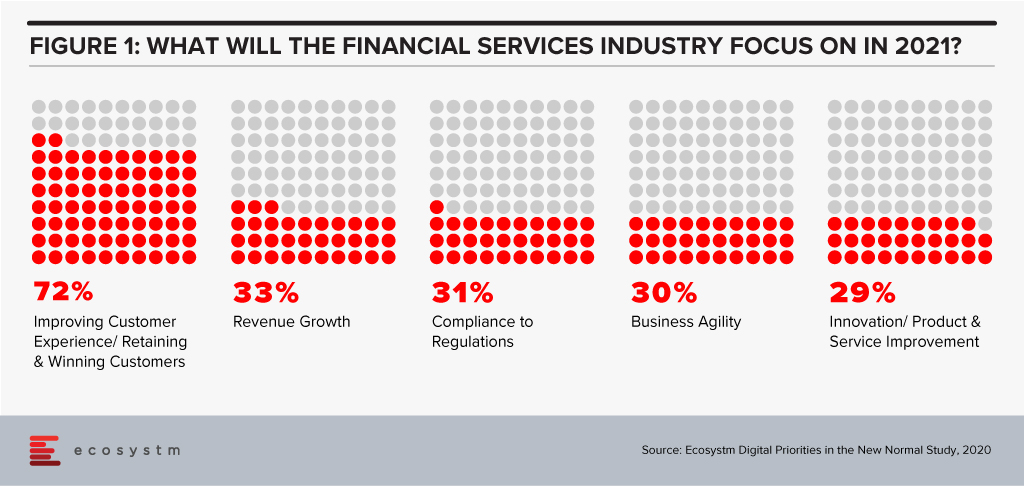

The disruption that we faced in 2020 has created a new appetite for adoption of technology and digital in a shorter period. Crises often present opportunities – and the FinTech and Financial Services industries benefitted from the high adoption of digital financial services and eCommerce. In 2021, there will be several drivers to the transformation of the Financial Services industry – the rise of the gig economy will give access to a larger talent pool; the challenges of government aid disbursement will be mitigated through tech adoption; compliance will come sharply back into focus after a year of ad-hoc technology deployments; and social and environmental awareness will create a greater appetite for green financing. However, the overarching driver will be the heightened focus on the individual consumer (Figure 1).

2021 will finally see consumers at the core of the digital financial ecosystem.

Ecosystm Advisors Dr. Alea Fairchild, Amit Gupta and Dheeraj Chowdhry present the top 5 Ecosystm predictions for FinTech in 2021 – written in collaboration with the Singapore FinTech Festival. This is a summary of the predictions; the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 FinTech Trends for 2021

#1 The New Decade of the ‘Empowered’ Consumer Will Propel Green Finance and Sustainability Considerations Beyond Regulators and Corporates

We have seen multiple countries set regulations and implement Emissions Trading Systems (ETS) and 2021 will see Environmental, Social and Governance (ESG) considerations growing in importance in the investment decisions for asset managers and hedge funds. Efforts for ESG standards for risk measurement will benefit and support that effort.

The primary driver will not only be regulatory frameworks – rather it will be further propelled by consumer preferences. The increased interest in climate change, sustainable business investments and ESG metrics will be an integral part of the reaction of the society to assist in the global transition to a greener and more humane economy in the post-COVID era. Individuals and consumers will demand FinTech solutions that empower them to be more environmentally and socially responsible. The performance of companies on their ESG ratings will become a key consideration for consumers making investment decisions. We will see corporate focus on ESG become a mainstay as a result – driven by regulatory frameworks and the consumer’s desire to place significant important on ESG as an investment criterion.

#2 Consumers Will Truly Be ‘Front and Centre’ in Reshaping the Financial Services Digital Ecosystems

Consumers will also shape the market because of the way they exercise their choices when it comes to transactional finance. They will opt for more discrete solutions – like microfinance, micro-insurances, multiple digital wallets and so on. Even long-standing customers will no longer be completely loyal to their main financial institutions. This will in effect take away traditional business from established financial institutions. Digital transformation will need to go beyond just a digital Customer Experience and will go hand-in-hand with digital offerings driven by consumer choice.

As a result, we will see the emergence of stronger digital ecosystems and partnerships between traditional financial institutions and like-minded FinTechs. As an example, platforms such as the API Exchange (APIX) will get a significant boost and play a crucial role in this emerging collaborative ecosystem. APIX was launched by AFIN, a non-profit organisation established in 2018 by the ASEAN Bankers Association (ABA), International Finance Corporation (IFC), a member of the World Bank Group, and the Monetary Authority of Singapore (MAS). Such platforms will create a level playing field across all tiers of the Financial Services innovation ecosystem by allowing industry participants to Discover, Design and rapidly Deploy innovative digital solutions and offerings.

#3 APIfication of Banking Will Become Mainstream

2020 was the year when banks accepted FinTechs into their product and services offerings – 2021 will see FinTech more established and their technology offerings becoming more sophisticated and consumer-led. These cutting-edge apps will have financial institutions seeking to establish partnerships with them, licensing their technologies and leveraging them to benefit and expand their customer base. This is already being called the “APIficiation” of banking. There will be more emphasis on the partnerships with regulated licensed banking entities in 2021, to gain access to the underlying financial products and services for a seamless customer experience.

This will see the growth of financial institutions’ dependence on third-party developers that have access to – and knowledge of – the financial institutions’ business models and data. But this also gives them an opportunity to leverage the existent Fintech innovations especially for enhanced customer engagement capabilities (Prediction #2).

#4 AI & Automation Will Proliferate in Back-Office Operations

From quicker loan origination to heightened surveillance against fraud and money laundering, financial institutions will push their focus on back-office automation using machine learning, AI and RPA tools (Figure 3). This is not only to improve efficiency and lower risks, but to further enhance the customer experience. AI is already being rolled out in customer-facing operations, but banks will actively be consolidating and automating their mid and back-office procedures for efficiency and automation transition in the post COVID-19 environment. This includes using AI for automating credit operations, policy making and data audits and using RPA for reducing the introduction of errors in datasets and processes.

There is enormous economic pressure to deliver cost savings and reduce risks through the adoption of technology. Financial Services leaders believe that insights gathered from compliance should help other areas of the business, and this requires a completely different mindset. Given the manual and semi-automated nature of current AML compliance, human-only efforts slow down processing timelines and impact business productivity. KYC will leverage AI and real-time environmental data (current accounts, mortgage payment status) and integration of third-party data to make the knowledge richer and timelier in this adaptive economic environment. This will make lending risk assessment more relevant.

#5 Driven by Post Pandemic Recovery, Collaboration Will Shape FinTech Regulation

Travel corridors across border controls have started to push the boundaries. Just as countries develop new processes and policies based on shared learning from other countries, FinTech regulators will collaborate to harmonise regulations that are similar in nature. These collaborative regulators will accelerate FinTech proliferation and osmosis i.e. proliferation of FinTechs into geographies with lower digital adoption.

Data corridors between countries will be the other outcome of this collaboration of FinTech regulators. Sharing of data in a regulated environment will advance data science and machine learning to new heights assisting credit models, AI, and innovations in general. The resulting ‘borderless nature’ of FinTech and the acceleration of policy convergence across several previously siloed regulators will result in new digital innovations. These Trusted Data Corridors between economies will be further driven by the desire for progressive governments to boost the Digital Economy in order to help the post-pandemic recovery.

Organisations are finding that the ways to do work and conduct business are evolving rapidly. It is evident that we cannot use the perspectives from the past as a guide to the future. As a consequence both leaders and employees are discovering and adapting both their work and their expectations from it. In general, while job security concerns still command a big mindshare, the simpler productivity measures are evolving to more nuanced wellness measures. This puts demands on the CHRO and the leadership team to think about company, customer and people strategy as one holistic way of working and doing business.

Organisations will have to re-think their people and technology to evolve their Future of Work policies and strategise their Future of Talent. There are multiple dimensions that will require attention.

Hybrid is Becoming Mainstream

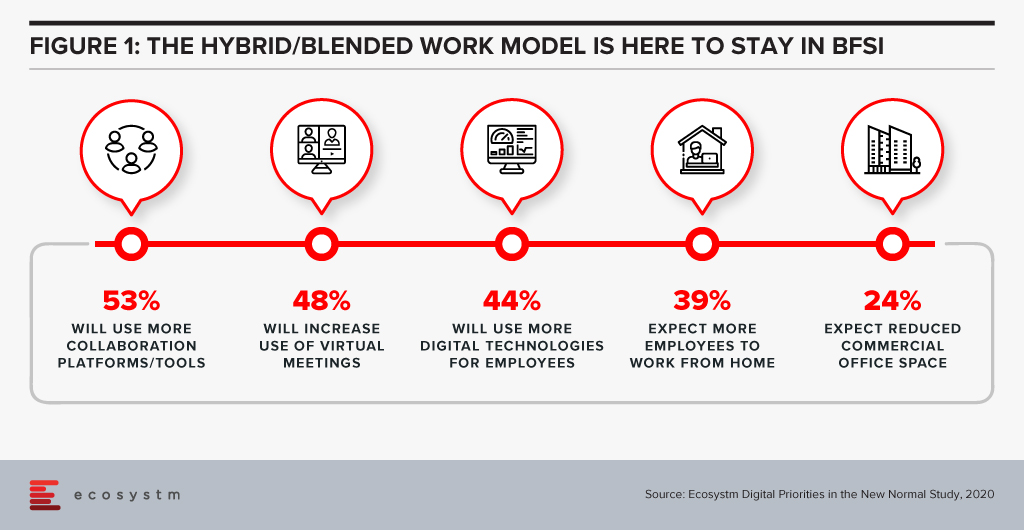

It is clear that hybrid workplaces are here to stay. Ecosystm research finds that in 2021 BFSI organisations will use more collaboration tools and platforms, and virtual meetings (Figure 1). Nearly 40% expect more employees to work from home, but only about a quarter of organisations are looking to reduce their physical workspaces. Organisations will give more choice to employees in the location of their work – and employees will choose to work from where they are more productive. The Hybrid model will be more mainstream than it has been in the last few months.

Companies are coming to terms with the fact that there is no single answer to operating in the new world. Experimentation and learnings are continuously captured to create the right workforce and workplace model that works best. Agility both in terms of being able to undersand the market as well as quickly adapt is becoming quite important. Thus being able to use different models and ways of working at the same time is the new norm.

Technology and Talent are Core

Talent and tech are the two core pillars that companies need to look at to be successful against their competition. It is becoming imperative to create synergy between the two to deliver a superior value proposition to customers. Companies that are able to bring the customer and employee experience journeys together will be able to create better value. HR tech stacks need to evolve to be more deliberate in the way they link the employee experience, customer experience, and the culture of the organisation. That’s how the Employee Value Proposition (EVP) comes to life on a day-to-day basis to the employers. With evolving work models, the tech stack is a key EVP pillar.

Governments will also need to partner with industry to make such talent available. Singapore is rolling out a new “Tech.Pass” to support the entry of up to 500 proven founders, leaders and experts from top tech companies into Singapore. Its an extension of the Tech@SG program launched in 2019, to provide fast-growing companies greater assurance and access to the talent they need. The EDB will administer the pass, supported by the Ministry of Manpower.

Attracting the Right Talent

Talent has always been difficult to find. Even with globalisation, significant investment of time and resources is needed to find and relocate talent to the right geography. In many instances this was not possible given the preferences of the candidates and/or the hiring managers. COVID-19 has changed this drastically. Remote working and distributed teams have become acceptable. With limitations on immigration and travel for work, there is a lot more openness to finding and hiring talent from outside the traditional talent pool.

However it is not as simple as it seems. The cost per applicant (CPA) – the cost to convert a job seeker to a job applicant – had been averaging US$11-12 throughout 2019 according to recruiting benchmark data from programmatic recruitment advertising provider, Appcast. But, the impact of COVID-19 saw the CPA reach US$19 in June – a 60% increase. I expect that finding right talent is going to be a “needle in a haystack” issue. But this is only one side of the coin – the other aspect is that the talent profile needed to be successful in roles that are all remote or hybrid is also significantly different from what it was before. Companies need to pay special attention to what kind of people they would like to hire in these new roles. Without this due consideration it is very likely that there would be difficulty in on-boarding and making these new hires successful within the organisation.

Automation Augmentation and Skills

The pace at which companies are choosing to automate or apply AI is increasing. This is changing the work patterns and job requirements for many roles within the industry. According to the BCG China AI study on the financial sector 23% of the roles will be replaced by AI by 2027. The roles that will not be replaced will need a higher degree of soft skills, critical thinking and creativity. However, automation is not the endgame. Firms that go ahead with automation without considering the implications on the business process, and the skills and roles it impacts will end up disrupting the business and customer experience. Firms will have to really design their customer journeys, their business processes along with roles and capabilities needed. Job redesign and reskilling will be key to ensuring a great customer experience

Analytics is Inadequate Without the Right Culture

Data-driven decision-making as well as modelling is known to add value to business. We have great examples of analytics and data modelling being used successfully in Attrition, Recruitment, Talent Analytics, Engagement and Employee Experience. The next evolution is already underway with advanced analytics, sentiment analysis, organisation network analysis and natural language processing (NLP) being used to draw better insights and make people strategies predictive. Being able to use effective data models to predict and and draw insights will be a key success factor for leadership teams. Data and bots do not drive engagement and alignment to purpose – leaders do. Working to promote transparency of data insights and decisions, for faster response, to champion diversity, and give everyone a voice through inclusion will lead to better co-creation, faster innovation and an overall market agility.

Creating a Synergy

We are seeing a number of resets to what we used to know, believe and think about the ways of working. It is a good time to rethink what we believe about the customer, business talent and tech. Just like customer experience is not just about good sales skills or customer service – the employee experience and role of Talent is also evolving rapidly. As companies experiment with work models, technology and work environment, there will a need to constantly recalibrate business models, job roles, job technology and skills. With this will come the challenge of melding the pieces together within the context of the entire business without falling into the trap of siloed thinking. Only by bringing together businesses processes, talent, capability evolution, culture and digital platforms together as one coherent ecosystem can firms create a winning formula to create a competitive edge.

Singapore FinTech Festival 2020: Talent Summit

For more insights, attend the Singapore FinTech Festival 2020: Infrastructure Summit which will cover topics on Founders success and failure stories, pandemic impact on founders and talent development, upskilling and reskilling for the future of work.

“Innovation is seeing what everybody has seen and thinking what nobody has thought”- Dr. Albert Szent-Györgyi (Discovered Vitamin C)

Innovation over the last 200 years has catapulted the human race into a world that is quite different from where it was 2 million years ago. So, what is the next wave in innovation? The answer seems to be in the interspace between industries, technologies, countries, domains and more.

Fusion innovation is a lateral innovation technique involving fruitful collision and fusion of different industries, fields, markets/countries, organisational silos, technologies, personalities, experiences, and skillsets towards creating radical, high-value outputs – newer ideas, products, and even industries. This is groundbreaking when it comes to digital innovation and its application in new ways.

Results have been big. Here are some examples:

- Crafting the world’s first digital music deal with Nokia ringtones to spawn the USD 2 billion ringtone industry

- Fusing satellite technology in radio is now a $24 billion enterprise – SiriusXM

- Ted Saad and team fusing art and business, technology and teams, and cultures and lifestyles – to win multiple Emmy awards

- Quantum chemistry, mathematical modeling, anthropology and management, fusing to create a new field – social network analysis

The Success Factor of Fusion Innovation

One secret of success of such radical innovation is a fundamental of design thinking – empathy. A lot of digital innovations either fail at the drawing board due to lack of purpose or at the budget approval stage due to lack of a business case and scalability. Successful digital innovations that have seen large scale adoption are pretty good at addressing end-user pain points, are scalable, and have a strong return on investment.

Examining the breeding grounds of digital innovations driving todays’ world – especially Artificial Intelligence (AI), automation, big data, blockchain and Internet of Things (IoT), we realise that the human potential to co-create stands out as the ultimate game changer.

Dr. C J Meadows, a pioneer in studying Fusion Innovation notes the following traits in “fusioney” people:

- Outward openness. This involves scanning broadly (including outside your industry) for ideas and technologies, engaging with an eclectic variety of people inside and outside the organisation. This is important especially in identifying unique opportunities for collaboration with cross-industry thought leaders. An excellent example of this would be the many emerging use cases in resource management using IoT in smart cities.

- Inward openness. This relates to people in an organisation exhibiting curiosity, depth and play and discovering their own inner design. The transformation story of graphics group to Pixar animations is an example of innovation driven by inward openness.

- Collecting. This involves ideating, curating, indexing and sharing ideas within and across functional divisions in a group or organisation. This not only enables lateral innovation, it also triggers “fusioneers” to see patterns and connections which others might have missed. Team wiki is an example of knowledge sharing within and across teams in an organisation that has revolutionised the art of problem solving in the technology industry.

- Sensing. This involves a great deal of empathy as well as having a deep appreciation of ideas that can propel the human race forward. Most automation use cases in contact centre operations that address repetitive and mundane tasks are a result of design thinking workshops that focus on the human pain points.

- Fusing. This involves absorbing many things around us and combining it in new ways. Hackathons conducted by many technology corporations have brought many interesting cross-functional solutions in the digital space that have been unique yet amazingly effective.

The future of digital innovation holds exciting possibilities with advancements in computational power, fusion of technologies and ideas, advancements in digital contracts. Lateral innovation techniques like Fusion can be expected to have a significant role in fueling this space for the years to come.

This is a contributed article from Nandakumar Kumar, a DBA Scholar at SP Jain School of Global Management.

Probe Group, a Business Process Outsourcing (BPO) solutions provider and Stellar – a customer experience (CX) management organisation announced a merger to create Australia’s largest and most diverse CX provider group. The partnership will combine the experience and expertise of both companies and will employ 12,600 people to provide outsourcing of business process services for customers across six countries. Probe Group is backed by Quadrant Private Equity and Five V Capital.

Probe Group has been expanding its business presence since being acquired by Five V Capital in early 2018. At the time, Probe acquired Salmat’s Contact business, a broad-based CX operation which helped Probe expand their presence in Australia, New Zealand and the Philippines. Looking out for further opportunities, in December last year Probe Group acquired Australia-based and Philippines-focused Beepo and quickly followed this with an acquisition in January this year of the Philippines outsourcing agency MicroSourcing, a counterpart to Beepo which greatly expanded Probe’s Philippines offering. These acquisitions helped Probe extend their service offering from CX into Shared Services and Knowledge Services.

This is a brilliant move as Stellar is one of the most successful contact centre outsourcing providers in Australia. With successive growth for 22 years and having a strong footprint in both the public and private sectors, the acquisition will give Probe Group entry into some large accounts. Additionally, Probe will gain a large pool of well-trained agents in Australia and other locations across the globe.

The merger comes at an interesting time when we are seeing several organisations re-evaluate their outsourcing strategy. There is also an active interest in enhancing CX through AI/automation. Both the Probe Group and Stellar understand the Australian market and consumer sentiments and the merger is expected to drive better customer outcomes in the Australia market.

Prior to COVID-19, Probe Group employed 8,500 agents. With this acquisition, they will have 12,600 agents and an expected turnover of USD 420 million. That is not only impressive but will help Probe offer a variety of services including both onshore and offshore, to take on their rivals.

Rise of Onshore Activity will see New Shifts in CX Delivery Models

The COVID-19 pandemic has brought about several changes to the outsourcing sector. The disruption caused by services in many key offshore markets led to organisations re-evaluating their contact centre outsourcing strategy and some have started moving contact centre jobs back to Australia. Westpac is the latest organisation to announce that they are moving 1,000 jobs back to Australia. They have stated that while they expect productivity benefits over time, there is clearly a cost to adding 1,000 roles – likely an uplift of around $45 million per annum in its costs by the end of 2021.

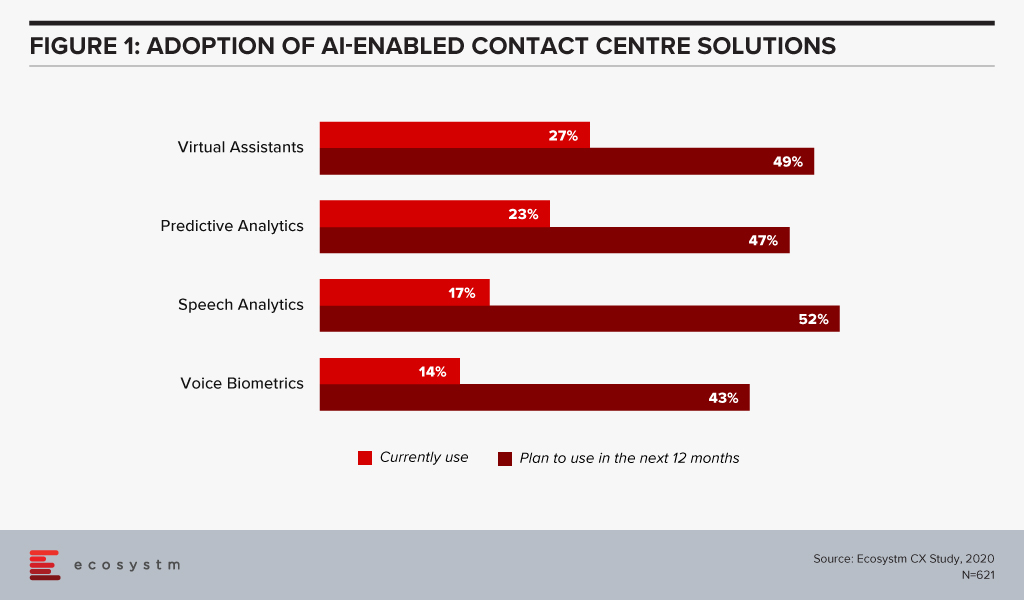

The cost element is bound to creep in over time and contact centres will ask outsourcing providers to help drive costs down. Options would include moving some services offshore, while the critical remain onshore. Striking that balance to manage costs will be important and so will be the ability to offer various options for customers. Additionally, we can expect to see an increased demand for self-service technologies. Many organisations are in the midst of re-evaluating the use of AI and automation technologies not only as a way to drive great CX but as a way to also reduce costs (Figure 1).

Contact centres are starting to realise that to modernise their contact centre, the ability to lead with machine learning and AI technologies are critical. It will drive the deployment of natural language understanding (NLU) and conversational AI, sentiment analysis, transcription capabilities – and ultimately provide intelligence about the call even prior to the call being fielded. However, it is worth noting that whilst automation is on the rise, the role of the agent is not going away anytime soon and will grow in importance. We will see the rise of the “super-agent’’ and the agent’s role will evolve over time and AI/automation will generate rich insights to help aid the agent and the contact centre team to better predict customer behaviour and patterns.

The Next Generation of Outsourcing Providers must Drive Innovation for their Customers

Companies today are not outsourcing just to save labour costs. While cost remains an important angle, it will not often be the main driver for outsourcing in the future. The next generation of outsourcing providers will have to build rich solution capabilities, customer journey maps and help customers understand how to align all channels. This involves working with many different technology providers to build the right capabilities for their client organisations. Organisations are keen to modernise their contact centre operations to achieve excellence in CX. Outsourcing providers must have the capability to deliver that innovation.

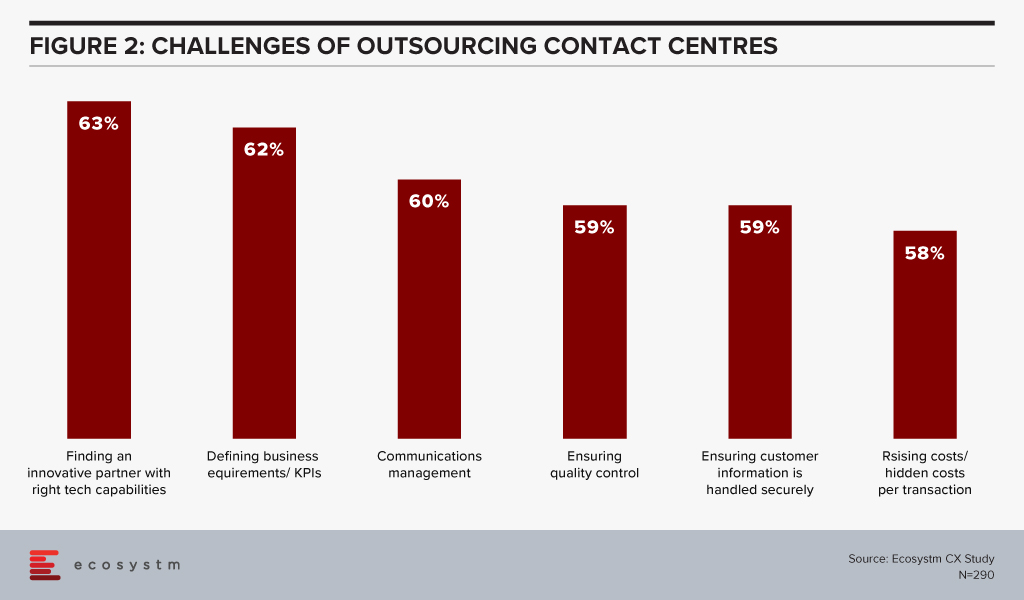

Ecosystm research finds that 63% of organisations that outsource their contact centre functions are challenged with finding the right partner that can drive innovations (Figure 2).

Contact centre outsourcing providers have a role to play in some of the following areas:

- The ability to adapt to change and take on risks together with the client

- Ensuring that all forms of security and governance measures are in place. This includes considering factors such as data security, data handling, and security features enabled across devices, applications, and the network. This is especially true for Government and Financial services contracts. Additionally, with some organisations preferring the work from a home model, there are security issues that must be addressed for the scenario.

- Helping the move from a traditional contact centre to a contact centre that delivers the highest levels of CX for its customers. Applying technologies such as AI and machine learning, NLU, biometrics, speech analytics, customer journey analytics and robotic process automation (RPA) will be key to modernisation.

- Being able to build a business continuity plan (BCP) for their customers in the event of another crisis.

Ecosystm Comment

Probe Group started off as a business specialising in outsourcing services in the credit and collections segment. Their customers in 2016 ranged from organisations across Financial Services, Utilities, and Federal and State Government. At that time, Probe employed about 300 people and their turnover was about USD 25 million. They did not rest on their laurels and realised that organic growth combined with strategic acquisitions would give them a foothold across various geographies and add new capabilities to their portfolio. With the rise in onshore activity, they will now be in a strong position to offer their customers various services and models of engagement to help drive CX excellence. The acquisition of Stellar will help Probe Group propel to greater heights and we see a new CX outsourcing giant being born.