The telecommunications industry has long been an enabler of Digital Transformation (DX) in other industries. Now it is time for the industry to transform in order to survive a challenging market, newer devices and networking capabilities, and evolving customer requirements. While the telecom industry market dynamics can be very local, we will see a widespread technology disruption in the industry as the world becomes globally connected.

Drivers of Transformation in the Telecom Industry

Remaining Competitive

Nokia Bell Labs expects global telecom operators to fall from 10 to 5 and local operators to fall from 800 to 100, between 2020 and 2025. Simultaneously, there are new players entering the market, many leveraging newer technologies and unconventional business models to gain a share of the pie. While previous DX initiatives happened mostly at the periphery (acquiring new companies, establishing disruptive business units), operators are now focusing on transforming the core – cost reduction, improving CX, capturing new opportunities, and creating new partner ecosystems – in order to remain competitive. There is a steady disaggregation in the retail space, driving consolidation in traditional network business models.

“The telecom industry is looking at gradual decline from traditional services and there has been a concerted effort in reducing costs and introducing new digital services,” says Ecosystm Principal Advisor, Shamir Amanullah. “Much of the telecom industry is unfortunately still associated with the “dumb pipe” tag as the over-the-top (OTT) players continue to rake in revenues and generate higher margins, using the telecom infrastructure to provide innovative services.”

Bringing Newer Products to Market

Industries and governments have shifted focus to areas such as smart energy, Industry 4.0, autonomous driving, smart buildings, and remote healthcare, to name a few. In the coming days, most initial commercial deployments will centre around network speed and latency. Technologies like GPON, 5G, Wifi 6, WiGig, Edge computing, and software-defined networking are bringing new capabilities and altering costs.

Ecosystm’s telecommunications and mobility predictions for 2020, discusses how 5G will transform the industry in multiple ways. For example, it will give enterprises the opportunity to incorporate fixed network capabilities natively to their mobility solutions, meaning less customisation of enterprise networking. Talking about the opportunity 5G gives to telecom service providers, Amanullah says, “With theoretical speeds of 20 times of 4G, low latency of 1 millisecond and a million connections per square kilometre, the era of mobile Internet of Everything (IoE) is expected to transform industries including Manufacturing, Healthcare and Transportation. Telecom operators can accelerate and realise their DX, as focus shifts to solutions for not just consumers but for enterprises and governments.”

Changing Customer Profile

Amanullah adds, “Telecom operators can no longer offer “basic” services – they must become customer-obsessed and customer experience (CX) must be at the forefront of their DX goals.” But the real challenge is that their traditional customer base has steadily diverged. On the one hand, their existent retail customers expect better CX – at par with other service providers, such as the banking sector. Building a customer-centric capability is not simple and involves a substantial operational and technological shift.

On the other hand, as they bring newer products to market and change their business models, they are being forced to shift focus away from horizontal technologies and connecting people – to industry solutions and connecting machines. As their business becomes more solution-based, they are being forced to address their offerings at new buying centres, beyond IT infrastructure and Facilities. Their new customer base within organisations wants to talk about a variety of managed services such as VoIP, IoT, Edge computing, AI and automation.

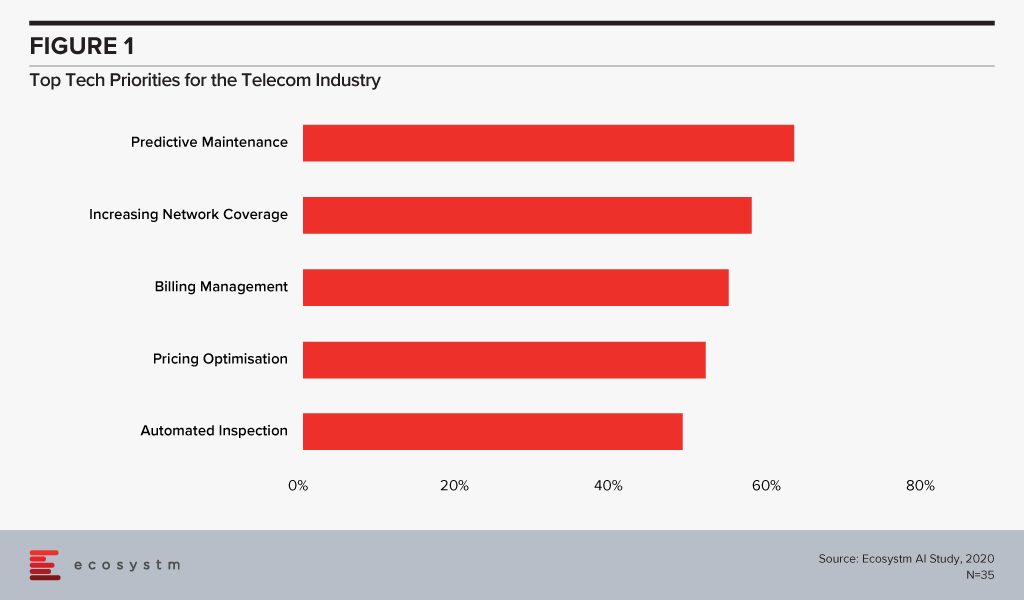

The global Ecosystm AI study reveals the top priorities for telecom service providers, focused on adopting emerging technologies (Figure 1). It is very clear that the top priorities are driving customer loyalty (through better coverage, smart billing and competitive pricing) and process optimisation (including asset maintenance).

Technology as an Enabler of Telecom Transformation

Several emerging technologies are being used internally by telecom service providers as they look towards DX to remain competitive. They are transforming both asset and customer management in the telecom industry.

IoT & AI

Telecom infrastructure includes expensive equipment, towers and data centres, and providers are embedding IoT devices to monitor and maintain the equipment while ensuring minimal downtime. The generators, meters, towers are being fitted with IoT sensors for remote asset management and predictive maintenance, which has cost as well as customer service benefits. AI is also unlocking advanced network traffic optimisation capabilities to extend network coverage intelligently, and dynamically distribute frequencies across users to improve network experience.

Chatbots and virtual assistants are used by operators to improve customer service and assist customers with equipment set-up, troubleshooting and maintenance. These AI investments see tremendous improvement in customer satisfaction. This also has an impact on employee experience (EX) as these automation tools free workforce from repetitive tasks and they be deployed to more advanced tasks.

Telecom providers have access to large volumes of customer data that can help them predict customer usage patterns. This helps them in price optimisation and last-minute deals, giving them a competitive edge. More data is being collected and used as several operators provide location-based services and offerings.

In the end, the IoT data and the AI/Analytics solutions are enabling telecom service providers to improve products and solutions and offer their customers the innovation that they want. For instance, Vodafone partnered with BMW to incorporate an in-built SIM that enables vehicle tracking and provides theft protection. In case of emergencies, alerts can also be sent to emergency services and contacts. AT&T designed a fraud detection application to look for patterns and detect suspected fraud, spam and robocalls. The system looks for multiple short-duration calls from a single source to numbers on the ‘Do Not Call’ registry. This enables them to block calls and prevent scammers, telemarketers and identity theft issues.

Cybersecurity

Talking about the significance of increasing investments in cybersecurity solutions by telecom service providers, Amanullah says, “Telecom operators have large customer databases and provide a range of services which gives criminals a great incentive to steal identity and payment information, damage websites and cause loss of reputation. They have to ramp up their investment in cybersecurity technology, processes and people. A telecom operator’s compromised security can have country-wide, and even global consequences. As networks become more complex with numerous partnerships, there is a need for strategic planning and implementation of security, with clear accountability defined for each party.”

One major threat to the users is the attack on infrastructure or network equipment, such as routers or DDoS attacks through communication lines. Once the equipment has been compromised, hackers can use it to steal data, launch other anonymous attacks, store exfiltrated data or access expensive services such as international phone calls. To avoid security breaches, telecom companies are enhancing cybersecurity in such devices. However, what has become even more important for the telecom providers is to actually let their consumers know the security features they have in place and incorporate it into their go-to-market messaging. Comcast introduced an advanced router to monitor connected devices, inform security threats and block online threats to provide automatic seamless protection to connected devices.

Blockchain

Blockchain can bring tremendous benefits to the telecom industry, according to Amanullah. “It will undeniably increase security, transparency and reduce fraud in areas including billing and roaming services, and in simply knowing your customer better. With possibilities of 5G, IoT and Edge computing, more and more devices are on the network – and identity and security are critical. Newer business models are expected, including those provided for by 5G network slicing, which involves articulation in the OSS and BSS.”

Blockchain will be increasingly used for supply chain and SLA management. Tencent and China Unicom launched an eSIM card which implements new identity authentication standards. The blockchain-based authentication system will be used in consumer electronics, vehicles, connected devices and smart city applications.

Adoption of emerging technologies for DX may well be the key to survival for many telecom operators, over the next few years.

Xiaomi Corporation – a Chinese electronics giant often dubbed the “Apple of China”, with specialisation in smartphones and smart devices – is now planning to focus on non-smartphone segments for growth. Last week the Beijing based company announced a planned investment of more than US$7 Billion in the areas of 5G, Artificial Intelligence (AI), and Artificial Internet of Things (AIoT). The announcement builds on last year’s pledge to invest US$1.5 billion over five years in an “All in AIoT” (AI+IoT) strategy.

Setting the scene for AI, IoT and 5G

Facing stiff competition from the likes of Huawei (with 42% of China’s smartphone market share in Q3 2019), Xiaomi is aiming to sustain business growth in the face of a challenging smartphone market. Xiaomi Corp is well versed with 5G and not a newcomer in the AI space. They already make 5G devices, and AI has been embedded in Xiaomi’s technology ecosystem such as messaging, instore applications, smartphones, laptops, TVs, routers, speakers, and other smart devices. In fact, Xiaomi Corp claims to have the world’s largest consumer IoT platform with more than 213.2 million smart devices (excluding smartphones and laptops) connected to its IoT platform.

Commenting on the Xiaomi’s competitiveness amongst Chinese smartphone makers and market potential for AI, IoT and 5G globally, Ecosystm Principal Advisor, Tim Sheedy said “Xiaomi has had some recent successes as a smart device maker, with its robot vacuums and other devices quickly earning positive reviews and gaining market recognition. Xiaomi has been able to surpass many traditional players which demonstrates their capabilities of competing in the IoT/smart devices category.”

On the 5G capability aspect of Xiaomi Corp, Sheedy said, “it is early days for 5G – even in China – and the stated position of having many 5G devices in the market could put Xiaomi ahead of some of their competitors in relation to availability. Going forward, it will be interesting to look at the integration of AI, IoT and 5G by Xiaomi.”

Sheedy further added, “we can expect Xiaomi devices to get smarter and more interconnected. Xiaomi actually has the opportunity to take some of the home-centric device hubs out of the ecosystem as they connect straight to the 5G network, and are controlled by an intelligent cloud-based hub perhaps mostly accessed through Xiaomi mobile phones.”

Meeting the Cybersecurity standards

Cybersecurity concerns are common around Chinese device makers. Recently, Xiaomi wireless devices have been disabled from connecting to Google’s Nest devices due to security flaws. On top of this, there have been concerns over the last few years about how Chinese tech companies secure their products and who has access to the data.

“Privacy and security are concerns for consumers – but they are often trumped by convenience, features and off-course price. Xiaomi Corp is aiming to make some of the best devices in each category and as long as they respond quickly and openly to privacy issues, they are likely to continue to see success both inside and outside of China. Their focus on driving down costs in order to be a price leader will help them with this challenge too” said Sheedy. “Ultimately, the privacy and security issues will impact the entire market – not just Xiaomi or other Chinese vendors as the users will steer away from all “smart, connected devices” – not just those from specific suppliers.

Market Positioning Approach

Xiaomi Corporation’s philosophy is to do more business with smaller margins, which drove it to expand its smartphone market from China to other areas like India and Europe. The company is aiming to strengthen its positioning in the consumer electronics market with further tech investments.

Sheedy explains that “considering the fact that they are losing market share in handsets in China, I would imagine that they will double down their efforts to be better at what they do now – not enter entirely new markets. I expect that we will see them produce smarter, connected devices – getting into more of the home and consumer market rather than move into the enterprise market. The enterprise market requires different sales strategies and channels, different partners, different margins, different support mechanisms etc.”

Naturally, Xiaomi is not alone in investing heavily in next-generation technologies. For example, Huawei opened a dedicated IoT consumer lab at the end of 2018 and is continuing to commit resources to the development of this industry-changing technology.

“The 5G plus AIoT strategy is the right one for Xiaomi. They need to surround their competition and make their products better, smarter and more affordable. With the growth in 5G services, a product leadership in this space, beyond smartphones – in smart devices too – will set them up for continued success in what is a very competitive market” said Sheedy.

The benefits of cloud computing are well documented, and it is at the core of most organisations’ modernisation and transformation initiatives. With the predicted increase in IoT uptake, and the associated increase in data collection and processing, technology providers are looking at methods to simplify, secure and speed-up IoT devices connected to the cloud.

5G Edge computing

To this end, in order to provide data processing closer to where it is needed, Amazon Web Services (AWS) and Verizon recently announced a partnership to bring the power of cloud computing closer to the edge with 5G network edge computing.

Edge computing brings various cloud services such as computing, networking and applications closer to the devices for local processing. It allows complex processing at the point where the data enters the network and eliminates round-trips involved in sending data from the edge, to the data centre where it gets processed and back to the edge again. To accomplish this, Verizon will offer 5G network and high-volume connections between users, devices and applications and will use AWS’s Wavelength service to deploy applications and process data at the edge. It will then seamlessly connect back to the AWS cloud.

The providers are piloting the project and aiming to deliver a wide range of services which depend on millisecond latencies.

New Demand, New Markets

By using AWS Wavelength and Verizon 5G Edge, the resulting edge computing solution will enable developers to build applications that can deliver enhanced user experiences like near real-time analytics for instant decision-making, improve services such as immersive game streaming, and automate robotic systems in manufacturing facilities.

The Ecosystm top 5 IoT Trends For 2020 report authored by Ecosystm Principal Advisors Francisco Maroto and Kaushik Ghatak stated that organisations are currently generating about 10% of their data outside a traditional data centre or cloud. This is predicted to dramatically increase in 2020 with IoT deployments fuelling investments in edge computing. The next year will see a sharp increase in IoT adoption as 5G rollouts gather steam, and this partnership is another indication of the increased interest in edge computing.

“As devices multiply and become smarter, 5G technology will become progressively more important to transfer data at a faster rate and drive edge computing. Real-time analytics will be performed at so many places along the network and infrastructure that IT management will be forced to rethink their distributed and enterprise computing strategies,” the report states.

Another Ecosystm report, the Top 5 Cloud Trends for 2020 report authored by Ecosystm Principal Advisors Claus Mortensen and Craig Baty mentions that “with IoT being a major part of the business case behind 5G, the number of connected devices and endpoints is set to explode in the coming years, potentially overloading an infrastructure based fully on data centres for processing the data.”

Edge computing will allow Cloud providers such as AWS to better cater to companies that need low latency, quick access to data and data processing. On the mobile side, it will allow them to push workloads to the device, reducing the backend workload and potentially enhancing data privacy.

The full findings and implications of the report ‘Ecosystm Predicts: The Top 5 IoT Trends For 2020’ and ‘The Top 5 Cloud Trends for 2020‘, implications for tech buyers and tech vendors, insights, and more are available for download from the Ecosystm platform.

Singapore’s digital economy vision where every citizen tech and business is connected by a world-class infrastructure will be empowered by the introduction of 5G in 2020. In June this year, Singapore’s telecommunication regulator, Infocomm Media Development Authority (IMDA) unveiled plans to set aside SG$40 million to build up the supporting ecosystem to fuel 5G innovation, focusing on six key verticals including smart estates, urban mobility, and maritime.

Gearing up for 5G and in order to deliver the greatest value to the economy, (IMDA) recently called for 5G proposals from Singapore’s Mobile Network Operators.

Commenting on the rollout of 5G, Ecosystm Principal Advisor – Telecommunication, Peter Wise said “5G promises much faster, more reliable wireless connectivity that will bring applications such as augmented reality, higher quality video and eventually smart cars, to life. Moreover, IoT will also be enriched by the increased data carrying capacity that 5G enables.”

Singapore pushing for four 5G networks instead of two

Instead of the two initially planned networks for 5G, there are now four networks proposed to be rolled out. Two networks will be used for full-fledged 5G networks whereas the other two will be smaller ones that will provide limited coverage. The two smaller networks of 800MHz will leverage on Millimetre Airwaves and will be used in small ports and factories and be Singapore’s most immediate use of 5G technology. “More networks would likely bring more competition and deeper coverage. The designation of some spectrum for port usage appears to enable applications to get up and running quickly and not have to wait for a wider rollout” said Wise.

The IMDA has called for proposals from the interested operators rather than going for an airwave auction. Proposals will be assessed on telcos’ financial capability, as well as network security design.

The introduction of 5G will be a costly and time-consuming activity in order to set up the infrastructure and provide customers with sufficient coverage. “Some existing 4G cell sites will be able to be upgraded to 5G through software or card swap outs, which are comparatively cheaper than acquiring and building whole new cell sites. However, over time, 5G will require a denser network of smaller cell sites, and there may need to be infrastructure sharing arrangements between MNO’s for acquiring these new sites for practical and economic reasons,” said Wise.

Only half of Singapore will have 5G coverage initially

IMDA announced that at least 50% of Singapore will be covered with a standalone 5G network by the end of 2022 and full island-wide coverage by 2025. “Many users may not initially notice whether they are on 4G or 5G speeds. 4G is still more than adequate for most of today’s applications, including video” said Wise. “However, over time as heavy data applications are introduced or very high definition video becomes more mainstream the benefits of 5G will become more apparent.”

A standalone network will use 5G-specific technologies for developing newer applications around IoT, smart factories, and autonomous vehicles. “Another fascinating development will be whether any operators use 5G to compete with fibre” said Wise. “Singapore is well served by high-speed fibre broadband so while the Singapore population is high in density (making 5G economics better), it may be that having 5G as a competitor to fixed broadband is more successful in other countries where most fixed broadband is still provided over older, slower copper-based technology.”

5G is still in the early phase of its lifecycle and is at the centre of an ongoing telco development, we are yet to see how it may become crucial to economic growth.

Apple and Intel have signed an agreement where Apple will acquire Intel’s smartphone modem business for a deal valued at $1 billion. Apple will gain Intel’s Intellectual Property, equipment, leases, and approximately 2200 Intel employees will join Apple.

The deal is Apple’s second-largest ever after its $3.2bn purchase of Beats Electronics in 2014. The deal is expected to close at the end of the year and Intel will continue to develop modems for non-smartphone applications such as industrial equipment, autonomous vehicles and personal computers.

What Apple has really acquired from Intel?

Beyond getting 2,200 employees from Intel’s modem group along with the accompanying 17,000 patents, Apple now has the intellectual property to develop a modem that can be integrated with Apple (system-on-a-chip) or SOC.

Commenting on Apple’s acquisition of Intel modem business, Ecosystm Executive Analyst, Vernon Turner said “given its performance-driven and highly vertically integrated product line, Apple had its own ambitions to build its own modem. However, despite being capable of building chips, Apple lacked the knowledge to build a modem. To solve that issue, it would always have had to license patents from a 3rd party, unless they buy the company that has the patents instead.”

Aligning with the fifth generation

The acquisition of Intel modem business displays Apple’s ambition to ramp up on 5G technology. The foothold in the 5G modem business is also expected to reduce Apple’s reliance on Qualcomm, its modem supplier. Speaking of the competition, Apple’s global rivals in the handset business – Samsung Electronics and Huawei – already produce their own modem chips.

“Apple has a lot of catching up to Samsung and Huawei in the 5G modem market, and while it has now gained technology from Intel, there is still a significant gap and it will be a haul for Apple to suddenly catch up and overtake them,” said Turner. “Apple’s modem supplier, Qualcomm isn’t likely to be worried by this news either – it too has a lead of several years. The bottom line is that Apple didn’t have a lot of options to turn too if it wanted to be in control of as much of the phone IP stack as possible. It purchased a modem supplier that was perhaps the weakest in the market and had already thrown in the towel on their mobile modem business.”

Apple will take some time to absorb the Intel team into its business and likewise with the modem roadmap. The deal is a step in Apple’s journey to make all of its own smartphone chips and having a more self-sufficient supply chain.

Roll Out of 5G will Contribute $900 Bn to APAC Economy over the next 15 years

According to a forecast by the GSMA Foundation, 5G will contribute almost $900 billion to APAC’s economy over the next 15 years. APAC’s edition of the GSMA’s Mobile Economy series published at MWC19 Shanghai revealed that Asia’s mobile operators will invest $370 billion – two-thirds of their overall investment in new networks – in building new 5G networks between 2018 and 2025. The report forecasts that the number of subscribers is expected to increase to 3.1 billion by 2025 with the main contributions coming from India, China, Pakistan, Indonesia, Bangladesh, and the Philippines.

The Roadmap for 5G

Every major Asia Pacific country has announced its intent or made the commitment to roll out 5G. The upside for an Asia Pacific digital economy is huge which will be driven by massive amounts of cross-cloud, inter-cloud, and smart infrastructure giving rise to the need for high-density connectivity between businesses and consumers.

“Take a step back and look at the key attributes of 5G – speed, latency, and density. Now take a step forward and look at global urban development. The explosion of bigger and more modern cities makes the telecom infrastructure a scaling issue for which 5G will be the right technology,” says Ecosystm Executive Analyst, Vernon Turner.

Working closely with the mobile operators pioneering 5G, governments are also engaging in the preparation and roll out of 5G Networks. Recently, the Singapore government announced to set aside SG$40 million to build up a 5G ecosystem. To promote digital transformation and economic growth, IMDA and the National Research Foundation (NRF) has allocated this funding for innovation, trials, R&D and enterprise use-cases in the 5G technology.

Similarly, the Vietnamese government awarded its first 5G trial licence to its largest telecommunications company, Viettel, to uplift the economy. Thailand is also seeking to deploy 5G and aims to start commercial 5G service next year.

“By 2022, 5G will be ‘the rising tide that lifts all boats’, making the Asia-Pacific region the biggest network offering network services that could give it an economic advantage,” says Turner. “But before that, some challenges for 5G belongs to regulatory approvals and the cost to build the next generation wireless network. For example, 5G networks operate on ‘millimetre waves’, a high radio frequency able to transmit large amounts of data but only over a short distance. To overcome this issue, governments have to approve large numbers of 5G small cells for operators to deploy.”

Is this an opportunity to skip out 4G altogether and leapfrog to 5G?

“The challenge for operators is to find workloads and applications that need 5G and at a price point that customers will pay. In my everyday travels, I have been underwhelmed by the number of customers ready to take advantage of 5G. Existing networks have the speed and capacity to run much of their businesses. I can see a scenario whereby operators will be forced to roll up 3G and LTE network functionality into 5G networks without being able to raise prices – despite being able to offer more benefits” says Turner.

How will 5G impact industries?

The future of interconnected ecosystems runs through IoT. The data that IoT sensors will create will be more valuable the faster it is analysed to produce business outcomes. Turner commented “Innovation accelerators such as VR (Virtual Reality) and AR (Augmented Reality) will generate new services for both consumers and industrial uses cases. The potential for asset management and services is ripe for disruption as 5G will bring more valuable information to workers through more efficient platforms. The knowledge-based worker and the future of work is here.”

Ultimately, APAC has the same possibilities and challenges as the rest of the world. Overall, the involvement of telecom companies, government organisations, infrastructure upgrades and the adoption of devices by consumers can affect the development and only after that can 5G become a reality.

When I wrapped up my visit to this year’s Mobile World Congress (MWC) in Barcelona, I had wondered if my pre-trip question of what would the 5G story be after several years of being told that each preceding year was ‘the’ year. However, this year had a very distinct vibe to it, and I was rewarded for my pilgrimage to the Grand Fira.

Let’s not forget that technology takes longer to roll out that all of us want to think and 5G is no different. We have had no excuses since we only have to look at how long it took 3G and LTE to become mainstream and how long the transition from the prior technology took to move to the next generation.

However, the mobile and telecom industry is not the same as it was when earlier telecommunication tech was being upgraded. In the past hardware, benchmarks feeds and speeds dominated the marketing messages, but now it is about software, cloud and ecosystem collaboration. Gone are the days when the telecom equipment vendors ruled the conversation about their technology – that has clearly been replaced by IT companies leading the charge with topics such as virtualization, IoT, analytics and new services. Once there was a US automobile commercial that touted the latest edition of its cars was ‘This is not your father’s Oldsmobile’. Well, 5G is not your father’s telecom infrastructure!

This time around, operator and equipment vendors may have to take the collaborative partner role in any new digital solution. Instead of 5G projects being dominated by Ericsson or Huawei for example, there is a role for the likes of VMware, Microsoft, and Salesforce to be the lead company. In some cases, it could be Bosch, PTC, or Siemens while in others it could be Audi, BMW or Mercedes. The overall trend here is that all of these companies are being digitally driven to deliver new services to a customer that is firmly at the center of an ecosystem. The one industry sector who might lose out could be the telco operators who could be squeezed by the surge from IT vendor relevance, despite them investing heavily on 5G licenses. However, this time the operators are in a much stronger position to be the perfect channel for the massive amount of intelligence-laden data being created by smart connected devices that are not typical mobile devices.

So what was the outcome at MWC? I visited both the Huawei and Ericsson booths following pre-MWC briefing sessions to see if the customer buzz was there – and indeed it was.

Ericsson may have won the prize for the most crowded booth, while Huawei’s sprawling booth wins the most lavish and largest booth. The two company’s 5G messages could not have been more different.

The Big Two

For me, Huawei had invested heavily in making its hardware products very compelling for operators to install. Clearly, there had been a lot of research had gone into replacing existing infrastructure with massive performance upgrades and deployment friendly attributes e.g. size and weight of base stations that could be mounted by individuals rather than by cranes. The result of this strategy is that Huawei’s customers can quickly deploy 5G platforms with lower CapEx and OpEx thus creating significant incentives for operators to migrate to 5G networks.

Ericsson’s leading story was about migrating to 5G by highlighting its key enablers (i.e. carrier aggregation, LTE-NR spectrum sharing, and dual mode 5G cloud core). It appeared that Ericsson had moved its message off hardware (which, by the way, is still table stakes in any selection process and Ericsson had plenty of new 5G related offerings) and onto a strategy of smooth evolution and deployment at scale – a much more business leader discussion than a network, driven by software. Finally, both companies had strong messages around their AI capabilities to help their service providers make sense of the growing complexity of services that will be generated by the connected smart IoT devices.

The Importance of IT Software On 5G

IT and industrial companies played an increasingly important role at this year’s MWC as service providers and they became involved in deeper partnerships. 2019 was the year when the gaps for 5G between the network and IT services were being filled in. For example, I saw AR (augmented reality) solutions by PTC supported by Microsoft and being fed by data off a 5G network. This showed how industry, cloud and network service providers will accelerate new technologies.

In another example, Salesforce showed how Edge Computing events triggered Salesforce SaaS-based enterprise management services while being supported by AT&T’s 5G network and the modules being designed and tested at AT&T’s Foundry. Here, AT&T 5G network was being used as a high-value channel for Salesforce’s customers to run their business functions at the edge of the network.

Digital twins have shown up as a digital representation of a physical device or asset. However, this year, I saw a Wipro example of how 5G could drive digital twin concepts beyond physical assets and into the workflow, supply chain management, logistics and worker safety. Every ‘asset’ that was to be used in a factory floor was digitized into a digital twin and then a 5G network was used to monitor and manage every aspect of the factory. It seemed that Industry 4.0 had arrived in its full glory.

Finally, VMware continues to be the IT company that service providers will either love or dislike – I still don’t know which one it will be. VMware’s virtualization and cloud management capabilities have been extended right into 5G networks. For example, NFV (Network Function Virtualization) is critical to operators as they slice the 5G bandwidth into the appropriate services. VMware has its strategy correct when it says that it could virtualize the network just as it has with the cloud, but in doing so is making itself either a partner or a competitor of the operators for their 5G services revenues. 2018 was the year when VMware made a big splash at MWC, 2019 was the year when they showed that they have something to offer – will 2020 be the year when they take over the network software virtualization profit pools just as they did with the enterprise server virtualization market?

Crawl, Walk, Run

In conclusion, MWC 2019 was the year that the 5G gaps to make end-to-end infrastructure solutions where clearly being filled in. Service providers had stepped up their willingness to be part of the customer-centric ecosystem that is almost certainly being led by IT software companies. Telecom equipment vendors were offering technology solutions to speed up 5G deployments while making forward compatible solutions much easier. Finally, 5G-supported applications remain the last piece of the puzzle that MWC hasn’t addressed fully. As a result of the massively varied 5G use cases, there is still a look of curiosity on which industry will be the lead for 5G – will it be the auto industry with autonomous cars, will it be Industry 4.0 and the smart factory, or will it be smart cities with video surveillance. In addition, it is certain that IoT is still very much a necessary part of any 5G strategy just as AI outcomes continue to fuel IoT-based sensors in technologies such as the self-driving cars, AR, and digital twins. 2019 may have been the year that decided that it won’t matter whether the connected IoT device used licensed (NB-IoT) or unlicensed (LoRa) spectrum protocols as both will be seamlessly connected to a 5G network. IoT was not dead, it had simply grown up and was now integrated with more valuable solutions.

At last, the Mobile World Congress (MWC) – the world’s largest exhibition for the mobile industry – is moving back to its origins. 5G technology has been a star in this year’s conference and I must say that it still has almost the same number of defenders as detractors. Opinions from both sides – the proponents and the critics – have been heard this week in Barcelona and while in the middle I have adopted an easy and not very brave opinion on this aspect. I still think that 5G can bring great advances in many sectors such as healthcare or transport, but contrary to this I don’t think that we will be using 5G in Virtual Reality multi-player games. That’s like, too much investment for a few general use cases of the technology.

I went to Barcelona to discover about happenings on the Internet of Things (IoT), start-ups and to discuss advances on IoT strategies with Operators, Manufacturers and System Integrators who were present at this Congress.

The gist of my visit at the end of my three days time and impressive 70,000 steps on my Fitbit tracker, is that the role of IoT at MWC has been diluted. A couple of years ago almost all the exhibitors used the word IoT on their stalls, many without knowing anything about what it was and today, it hardly appears on a few. There are no longer innovations, nor new use cases that attract visitors.

IoT and Operators

In the long-wait of 5G, IoT operators are torn between several technologies such as NB-IoT or LTE-M o LPWAN networks. The LoRA alliance had a booth in Hall #8 (the Hall of the poor’s, I call this Hall). SigFox did not even attend this year’s conference, which further increased the rumors among the attendees on the possible precarious situation of the French Operator.

Analysts should revise their estimates downwards based on data from new connections announced by Vodafone or Telefonica this year. I agree with Allen Proithis, Global Tech Executive: IoT, Digital Transformation, Strategic Partnerships, Emerging Technology, he said “the lack of emphasis on IoT reflects the struggle of mobile operators to monetize IoT outside of connections, especially at the SaaS or data level”

Winner MWC2019 – Deutsche Telekom – IoT Solution Optimiser

IoT and Network Infrastructure Vendors

This section is reserved for a few players – Ericsson, Huawei, and Nokia share most of the pie around the network infrastructure. A suspicion of Huawei security and doubts on the Operator’s role in election outcomes can delay 5G deployments in Europe. The Americans and the Chinese have already placed their decisions.

Only Huawei granted me an opportunity to meet their VP, a friend of mine.

I tried several times to reach Nokia whereas I did not even try to reach Ericsson this year, I already heard its strategy three times in the last year.

By far, Nokia has gained in terms of its connectivity offer with Nokia Wing, the ecosystem and the use cases (somewhat more advanced than those presented last year).

Winner MWC2019 – Nokia – Nokia Wing

IoT and IT Technology Vendors

The technology behemoth Microsoft revealed its second-generation HoloLens AR and all I can say is that it left a ridiculous gap for IoT. Other IT giants such as Dell-EMC-VMware, SAP, Cisco, Oracle, SAS or SAG-Cumulocity did not showcase anything new.

Moving towards the System Integrators, they are not even expected at this fair in relation to IoT. Neither the Cloud, nor the Edge IIoT, nor the IoT Platforms, nor the IoT applications had any new ideas that could have attracted the interest of veterans and novices. Where are the millions of dollars going in the industry, which they say are being spent on IoT?

Winner MWC2019 – No Conclusión

IoT and Countries

Finding an IoT gem among the many tiny cubicles of various countries was similar to finding a needle in a haystack. To me, there was hardly any interest to go through the dozens of small companies that used this event as a stage to make themselves visible to the world. The umbrella allows them to be here but attracting visitors between so much noise and variety to their booth was a big and miraculous task.

Every year, I get in touch with IoT companies and know companies from Israel, UK, Sweden, Canada or France. However, this year to my surprise, I found an interesting company in the pavilion of Belgium. They have developed another league of IoT platform and I liked what they have achieved with Orange. They are my winner of this year.

My special regards to the Colombia pavilion and my friend Edgar Salas.

Winner MWC2019 – AllThingsTalk

IoT and Start-ups

I could not visit 4YFN, but I went to IoT Stars. My friend Marc Pous and his colleagues always do a great job, who comes as a jury every year. It was a good time spent with them over a beer while sharing impressions of the IoT and discussing new ideas to accelerate this market once and for all.

In my opinion, there was no great achievement this year and I still notice a gap in the Industrial IoT start-up space. Most ideas are like “Déjà vu” applications for Consumer IoT which reminds me of the post-years after the Internet boom. Much remains to be done here and it will take time for Universities to train innovators and entrepreneurs of IoT.

Winner MWC2019 – No Conclusión

P.S. The IoT Stars jury awarded two prizes

Key Takeaway:

It does not matter; this Congress was as soporific as the Oscars ceremony but for some strange reasons I keep coming back every year. Although after the fiasco of 2019, my expectations were set to find progress and opportunities in IoT but considering the after-effects, I think next year I will reduce my stay to only two days.

It has become clear that the MWC no longer holds anything interesting with respect to IoT to attract visitors, exhibitors, companies. Instead, IoT enthusiasts should probably look to other – more focussed – industry events.

If you want me to cover anything specific on IoT from MWC,19 then let me know in your comments.

Commonwealth Bank of Australia (CBA) has entered into a partnership kicking off trials of 5G and edge computing with telecommunication majors Telstra and Ericsson to explore the benefits of 5G in the banking sector.

The partnership agreement was signed at the annual Mobile World Congress (MWC) 2019, in Barcelona. The trials are projected to showcase what banking in the future might look like, and how 5G technology and edge computing can help to lower the requirements of the infrastructure presently required for banking operations.

Speaking on the subject, Ecosystm’s, Principal Advisor, Tim Sheedy, thinks that “this trial will help all parties better understand where the opportunities are for users of the mobile networks, and for the telco and equipment providers too. They will understand the potential demand for specific network slices and capabilities and get a better idea of what they need to deliver and whether or not there may be demand for these services”.

5G edge computing is still in nascent stages and there’s not much present in the market. Whether it minimises infrastructure or distributes it differently is yet to be seen. “The trials will likely determine what the shape of the new distributed architecture looks like (how close to the “edge” do the data centres need to be?)” says Tim, “There are unknowns of 5G at the moment – so the trials are invaluable to all parties to help them know where and what they need to invest in to make 5G services commercially viable.”

For a layman, 5G edge computing is all about delivering the reliability, speed, and latency that they need – or more likely – a sensor needs in order to get its job done. Once the technology becomes mainstream the end-users/banking customers will reap benefits from it. “5G is not just about delivering faster speed but it is about delivering them intelligently”, says Tim, “5G will help Telco’s to prioritise traffic AND network services – meaning that the end user can achieve their goals.”

While it’s too early to tell at this stage how will 5G benefit the banking sector, it should help banks offer their customers more reliable and relevant services – but what services need to be distributed at what times, and what can remain at the core are not yet understood.