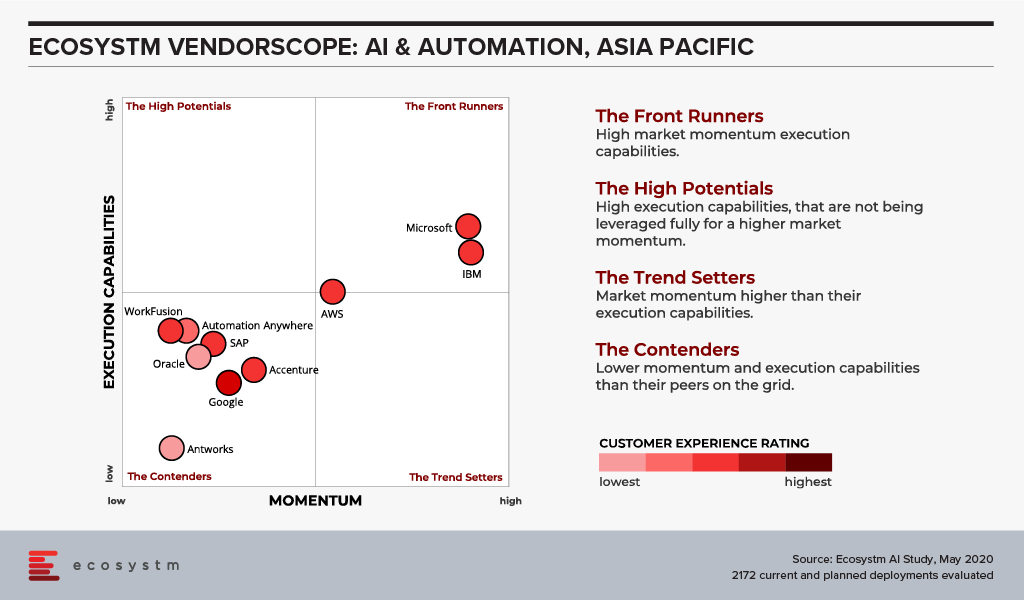

I’m really excited to launch our AI and Automation VendorScope! This new tool can help technology buyers understand which vendors are offering an exceptional customer experience, which ones have momentum and which are executing and delivering on their promised capabilities. The positioning of vendors in Ecosystm VendorScopes is independent of analyst bias or opinion or vendor influence – customers directly rate their suppliers in our ongoing market benchmarks and assessments.

The Evolution of the AI Market

The AI market has evolved significantly over the past few years. It has gone from a niche, poorly understood technology, to a mainstream one. Projects have moved from large, complex, moonshot-style “change the world” initiatives to small, focused capabilities that look to deliver value quickly. And they have moved from primarily internally focused projects to delivering value to customers and partners. Even the current pandemic is changing the lens of AI projects as 38% of the companies we benchmarked in Asia Pacific in the Ecosystm Business Pulse Study, are recalibrating their AI models for the significant change in trading conditions and customer circumstances.

Automation has changed too – from a heavily fragmented market with many specific – and often very simple tools – to comprehensive suites of automation capabilities. We are also beginning to see the use of machine learning within the automation platforms as this market matures and chases after the bigger automation opportunities where processes are not only simplified but removed through intelligent automation.

Cloud Platform Providers Continue to Lead

But what has changed little over the years is the dominance of the big cloud providers as the AI leaders. Azure, IBM and AWS continue to dominate customer mentions and intentions. And it is in customer mentions that the frontrunners in the VendorScope – Microsoft and IBM – set themselves apart. Not only are they important players today – but existing customers AND non-customers plan to use their services over the next 12-24 months. This gives them the market momentum over the other players. Even AWS and Google – the other two public cloud giants – who also have strong AI offerings – didn’t see the same proportions of customers and prospects planning to use their AI platforms and tools.

While Microsoft and IBM may have stolen the lead for now, they cannot expect the challengers to sit still. In the last few weeks alone we have seen several major launches of AI capabilities from some providers. And the Automation vendors are looking to new products and partnerships to take them forward.

Without the market momentum, Microsoft and IBM would still stand above the rest of the pack – just not as dramatically! Both companies are not just offering the AI building blocks, but also offer smart applications and services – this is possibly what sets them apart in an era where more and more customers want their applications to be smart out-of-the-box (or out-of-the-cloud). The appetite for long, expensive AI projects is waning – fast time to value will win deals today.

The biggest change in AI over the next few years will hopefully be more buyers demanding that their applications are smart out-of-the-box/cloud. AI and Automation shouldn’t be expensive add-ons – they should form the core of smart applications – applications that work for the business and for the customer. Applications that will deliver the next generation of employee and customer experiences.

Ecosystm Vendorscope: AI & Automation

Signup for Free to access the Ecosystm Vendorscope: AI & Automation report.

The current state of the world is alarming. The COVID-19 virus is not only disrupting businesses and economies – it is taking away loved ones, it is separating friends and families, it is disrupting the education of young adults and children and it is seeding fear in communities. But while the media is dominated with doom and gloom at the moment – and we do need these reports – I believe it is worth stopping for a moment to consider the fact that if the pandemic happened ten or fifteen years ago, many businesses – and government agencies – would have closed down. You could argue that the world wasn’t as globally connected then as it is now. And to an extent that is correct – the numbers of air travellers increased up until the end of 2019. But even in 2005, the world was still a very global place – economies relied on cross-border commerce as much then as they do now.

Depending on your business or industry 10-15 years ago:

- Staff couldn’t have effectively worked from home. And if they did, collaboration would have been hard (if not impossible outside of the usual voice services). Teleconference services would have needed to be booked.

- Remote access would have been painful and slow – relying heavily on VPNs over slower internet connections.

- Software would have mainly been running in company datacentres – with very little SaaS-based applications. These applications were often designed for LAN access…

- Those lucky few with a Blackberry or iPhone might have had access to email – everyone else would have needed to go into the office to get work done.

But worse than this would have been our customer engagements. While eCommerce had healthy adoption by 2005, it often relied on very manual processes – and it was mainly focused on consumer products and services – B2B adoption was still a number of years away. And, for many businesses, it represented a tiny proportion of their revenue. Small companies didn’t often have the web presence to compete with the big players. But if I look at the big fast-food giants in Australia (e.g. McDonalds and KFC) – these companies didn’t have a web or mobile ordering until a few years ago, and even more recently for home delivery services. Any company that had to shut down their face-to-face contact would have likely fallen back on their contact centres – but even these would have been impacted as the ability to route calls to remote or home-working call centre agents barely existed then – so they would have been understaffed or closed due to an infection being discovered…

Today’s digital connectivity has the opportunity to save lives. Less physical contact means less people being exposed to – and spreading – the virus.

If this pandemic had happened 10-15 years ago, many small AND large businesses would have had to shut their doors very quickly. Very early in the cycle, businesses would have had to make the decision to shut their doors straight away, or risk accelerating the infection rates by having staff continue to attend the office or contact centre. So if there is one small positive we can take away, it is that our digital investments are paying off very quickly. The ability to continue to trade, continue to sell, continue to do business in such a market as we are facing today and tomorrow is priceless. I can purchase goods and services online, register my car without leaving my desk, upgrade or change my health insurance without speaking to a single human being. Most businesses have the ability to have their employees access many of their critical applications wherever they are located. Our accountants can still pay and send bills, HR can hire for open positions, product teams can continue to innovate on the products and services they offer.

Don’t get me wrong – business survival is not guaranteed. This is why I implored governments to aim their stimulus spending towards small and medium businesses digital initiatives – as cafes, retailers, bars and restaurants close down across cities, states and countries, many are now lamenting their immature online presence, their lack of delivery and their lack of pre-ordering. If you have any doubt about this, check your local Facebook group – it is full of small businesses putting up images of menus in the hope that customers will reach out directly to keep their businesses running. If these businesses are given incentives to build digital services quickly, they might see less of a slowdown in business.

COVID-19 will definitely stress test our digital assets and strategies. Just recently, the Australian government’s citizen-facing portal crashed as too many citizens logged on to register for welfare. This forced many people out into government shop-fronts – putting themselves, the staff and all connected families and friends at risk of catching the virus. I also heard today of a bank that called many of its staff back to the office as the VPN could not cope with the number of users and volume of traffic! If you have not already, you will quickly find out how your digital capabilities are performing – where you need extra capacity, where services are running smoothly, where you need to rethink process design or where you need to consider re-crafting this approach for the fully digital era.

But stay safe – listen to the advice of medical experts and act on that advice. A senior medical officer recently stated that social distancing is the only way that we will overcome this virus – so stay safe and stay home (if you can!). But also take the time to review your digital capabilities – start making moves now to ensure they help your business stay afloat – or your government agency to keep serving citizens in times of restricted trading or shutdowns.

The last week or so has seen a numbers of central banks (such as the US and Australia) ease their monetary policies – lowering interest rates in order to stimulate investment and economic activity. But this alone won’t be enough to slow down economic growth – the generally accepted wisdom is that governments will need to quickly roll out stimulus packages to get money into the economy faster. Some countries, like Hong Kong, have already kicked off this process – others are likely be announce packages over the next few weeks.

Typically, these stimulus packages are designed to get the economy moving again – bringing forward existing spending plans or creating new spend. Good stimulus packages will have a broad impact but also drive improved business and employment outcomes. Some are targeted towards the sectors most impacted (e.g. in Australia the seafood export market has been impacted heavily by China’s decision to stop importing any seafood; in Thailand the tourism sector is hit hard by the slowdown in arrivals from China – that makes up a large percentage of the tourists in an economy where tourism is a significant sector).

But often they are not targeted. Some governments might just let businesses write off any investment faster than usual (such as within a single financial year instead of depreciating the spend over a number of years) or will just send a cheque to every income earner. The issue with these stimulus packages is that they don’t drive a specific outcome apart from getting spend into the economy faster. Stimulus packages have an opportunity to drive change – and the COVID-19 virus has shown that some businesses are not well equipped for the digital era. They are finding it hard managing the distributed workforce when they ask their staff to work at home. There are also many challenges that governments and businesses are facing in serving customers across digital channels.

This is the opportunity for governments to stimulate the economy and help businesses improve the digital experiences of customers and employees. The world is going digital – we all know what good digital experiences look like as we have them on our smartphones in our pockets. But we also know that most companies and government agencies we deal with are not offering great digital experiences… And while we all hope that virus outbreaks such as COVID-19 don’t happen that often, we know that something like this will happen again – so it would be great if businesses were prepared for such an outcome.

Therefore now is the chance to target the stimulus packages towards both the impacted sectors of the economy as well as the areas of spend that will drive better digital experiences for customers and employees. There could be incentives to spend more on software and cloud services, spend more with consultancies or spend more with digital marketing agencies. It will also help small businesses compete with larger businesses on an equal playing field (for example, the large takeaway food outlets have an app that lets you pre-order food, but many small ones do not).

In 2009, the Australian government rolled out a stimulus package – one that was ultimately one of the major reasons the economy came through the global financial crisis without falling into recession. They gave an immediate cash stimulus to taxpayers which helped get an immediate spend in the economy. They also had a housing insulation spend which promised roof insulation for 2.7 million homes – this provided stimulus to the economy in the mid-term. They then provided new school halls, social housing and roads – which provided the stimulus in the longer term. While it can be argued that the programs were not effectively administered, the stimulus got the economy moving and also helped the government hit some longer term goals – such as reducing greenhouse gas emissions (through better housing insulation therefore less use of electricity to heat and cool homes) and also upgrading aging infrastructure in schools across the country. For many businesses, the focus today is on providing great customer experiences – and many of those experiences will be digital. Governments have the chance to use their stimulus p to accelerate that outcome.

There have been several pilots and implementations of autonomous vehicles, mostly with the focus on asset management and supply chain efficiency. However, the recent trial by British Airways (BA) at the JFK airport is a good example of autonomous vehicles being used to improve customer experience. The trial involved using fully autonomous, electric mobility devices to assist their passengers with mobility challenges. These vehicles are equipped with anti-collision measures as well as map functions to take the passengers to their preferred destinations.

Businesses across all industries and sectors are looking to improve their customer experience. These initiatives are primarily meant to drive return business – but when done well, they can also drive down costs and drive up brand perception. This initiative from BA is a great example of a company looking to put the customer at the centre of their business and solve customer pain points – particularly one as sensitive as providing equal access to services regardless of physical ability.

Serving customers with mobility challenges is a minefield for airlines – it is difficult to know exactly when people with mobility challenges will arrive at the airport and need to check in – and in a low margin business like the airlines industry, you cannot afford to have staff deployed just to assist passengers to the right gate or location. Even keep track of the location of the mobility assets – such as wheelchairs – at any given time can be challenging. Taking a staff member off check-ins or baggage handling to transport the customer with mobility challenges to their gate can impact the experience of other customers too. Often it can turn out to be lose-lose outcome, despite the best intentions.

And the BIG risk is when you get it wrong, there is a high likelihood that you will be crucified on social media – you can be certain of many retweets and angry emojis of inconvenienced passengers missing flights, left stranded at gates or stuck in security. So even if you tried to do a good job, it has the potential to backfire.

BA has thought out of the box here with this solution, starting with the challenge of getting people with mobility issues to their flights on time. But the added benefit they will likely see is the ability to do this quickly. These wheelchairs being autonomous and equipped with map functions should be easier to track and requisition just-in-time. This means customers will have to wait less for their wheelchairs and also be less concerned they might miss their flights – it may even mean that mobility challenges customers can even have the same airport experience as other customers – without the need to allow extra time to arrive at the gate. These vehicles free staff to serve all customers without having to divert attention to the one passenger whose needs are greater. This is also likely to get a lot of good PR and social media activity – helping the brand and showing their willingness to invest to ensure equal access to services regardless of ability. I know if I saw such a device in an airport I would ask the person in the chair if I could snap their picture to put it on social media – and credit BA for being an inclusive airline. While they cannot control bad social media coverage – BA has thought of a service than can help strengthen their brand. And again – at the centre of this is a happy customer.

By focusing on solving a real customer problem, BA should be able to win more business from those with mobility issues – a market which is growing rapidly – and also strengthen their position as an inclusive air travel provider.

2020 was originally forecast as a good year for technology spend. Many categories took a hit in 2019 – hardware, telecommunications, datacentres – even the software and IT services segments came down from their high growth rates of previous years. The consensus for growth in IT spend in 2020 was somewhere between 3-4%. But that growth is now under threat by the COVID-19 virus that is spreading across the globe. The 26th February was a significant day, as the number of new infections outside of China is now greater than those in China. Furthermore, the growth in infections is not isolated. Iran, Italy and South Korea all have experienced significant growth and the virus has hit Brazil, directly from Italy.

With the situation changing every day it is hard to have a firm view on how it will impact broader economic growth as well as the technology spending. Much will depend on the ability of countries to control the spread of the virus along with the fiscal stimulus packages of governments across the globe. Some countries are in a better position than others to push money into economies to keep them growing.

But even with the uncertainty, it is worth noting some feedback we are getting from tech buyers, vendors and economists. While much of this feedback is anecdotal, we believe it is indicative of trends across the market. The next few weeks are critical. If China shows that they can stop the transmission of the virus, that will help global confidence which has been hurt by the newer outbreaks in Italy, Iran and Korea.

Overall Economic Spend is Slowing

Businesses across the globe – particularly those in heavily impacted economies (such as China, Italy, Japan & South Korea) and those impacted by the slowdown in China (Thailand, Australia etc) – are putting the brakes on spending across the board. And there are not too many initiatives in businesses today that don’t involve technology. We are seeing projects delayed and – more rarely – cancelled. Several central banks, such as those in Thailand and Singapore, have lowered their growth forecasts, as has the IMF and OECD. Ratings agencies and economists have also reduced their growth forecasts for heavily impacted economies. The USA is avoiding much of the slowdown although the Nasdaq High Tech Index was down around 8-9% on the 28th February – the market has priced potential future slowdown into share prices already.

Limited Face-to-Face Collaboration Will Slow Tech Spending

We are also seeing the projects that are underway slowing down: more staff are required to work from home; experts can’t fly in to help drive projects; and without teams meeting physically, collaboration has become harder than ever before.

This doesn’t mean the projects aren’t happening – the timelines are slipping. Will this impact the overall spending in 2020? Yes! But not by much at all, as many projects these days are delivered in 3-6 months – not 24 months like years gone by. So, delivery will mostly happen in 2020, but more in the second half than the first half. But again, with the situation changing every day, the scenario might change. As soon as growth in the number of infections slows down and the travel bans are lifted, we can expect activity to slowly return. But the further out that is, the more projects will decrease scope, be cancelled or be shelved for another day.

Another factor impacting innovation and the resulting technology projects is the lack of face-to-face collaboration between management teams. Some businesses have already put into place initiatives to ensure their board and executive management do not meet face-to-face. This is because they are considered the most valuable assets to the business – and are often likely to be in the age group most heavily impacted by the coronavirus (over 50). While not suggesting that collaboration cannot happen in virtual environments, it is sometimes a shared experience or non-business interaction that might drive a new idea for the business. And that idea might end up driving tens of millions of dollars of technology spending.

Cash Flow is Impacted – Which Slows Business Investment

Cash flow is already being impacted. Small and medium enterprises (SMEs) are already feeling the pinch, and they don’t have access to the funding tools that many large businesses use to get through tough times. SMEs really represent the biggest threat to spending: if a large business has to lay off some staff, they can then get a project going as soon as the economy or their sector recovers and employ the people they need, as required. But in countries like Australia and the US, small businesses represent almost 40-50% of economic activity. If SMEs shut down or even restrict spending, it takes some time for new businesses to start up and fill in the gap they leave. SMEs don’t tend to buy software or services from the large vendors – they tend to use small and medium services and software providers – so it is these smaller technology businesses that are immediately threatened if the coronavirus spread continues. The multiplier effect quickly comes into play here to reduce consumption, employment and economic activity.

We are also aware that some businesses that are directly impacted by the virus (such as those in the travel sector) have informed their suppliers that they won’t be paying any bills until mid-year. This could also put a small technology provider under – whereas a larger one should be able to survive the cash-flow crisis. Despite most economies having a low interest rate environment, the access to capital is not easy, particularly given the risk to the overall economy. A further challenge to global expenditure and an accelerated recovery is the US elections which provide distraction to businesses in the US and globally.

Cancellation of Customer Events Will Limit Technology-Led Innovation

Many vendors have cancelled or postponed their customer events, even in relatively unaffected markets such as Australia. And nearly every vendor will attest to the spike in opportunities and deals that get signed after these events. The coming together of potential and existing customers with thought leaders, tech evangelists, bleeding edge customers and the partner ecosystem drives new ideas. Individuals get inspired to act – they hear about best and next practice and kick off conversations within their businesses. They see how technologies can impact other businesses and use those assumptions within their own business cases. Sceptical customers become converts, and those already considering projects sometimes accelerate them.

With these events cancelled tech spending will not collapse. Companies still have budgets and these budgets will be, for the most part, spent. But it is the innovative initiatives that will suffer – the exploration of new technologies or services, the experimentation and testing that won’t happen because people simply won’t know about it. This is the spending that is typically not budgeted for – the new spend that often has a big impact on business results and customer outcomes. These customer events are learning opportunities – without the events the learning will be harder and slower to push out. So, this will likely have more of an impact on spending in calendar Q2-Q4. But without other assets in the market or other chances to educate clients and prospects, this spend simply won’t happen.

The COVID-19 virus is also impacting the technology supply chain. Many technology products are manufactured in China – or rely on components manufactured in China. Factories across China have been shut down – and while some are coming back online, it is hard to know how long it will take them to get back to full capacity. Transport services in China are impacted –globally 200,000 flights have been cancelled since the public emergence of the coronavirus. Some products are waiting but just cannot be shipped. A number of vendors have flagged the impact of the slowdown to the supply chain on their revenues, including Apple and Microsoft. With limited supply, prices are rising, which slows down demand. While this may show some short-term opportunity for the cloud providers, the hardware companies and the software providers that rely on the availability of hardware will feel the impact. In the longer term, it may lead to business reviewing their supply chain and risk analysis. This presents an opportunity for India, Vietnam and other potential manufacturing hubs.

The Overall Impact of the COVID-19 Will be Real and Measurable

Ultimately, we believe that the coronavirus will wipe up to 1.5% off the total tech spending for 2020 – bringing the overall average down to between 1.5% and 2.5%. Part of this is based on the fact that technology spending is coming off a poor year. Confidence was just starting to climb with some of the hardest hit segments expected to return to growth in 2020. This confidence will disappear – and could lead to further price competition. Which is good for the buyer but bad for the whole vendor supply chain!

But again, this depends on the response of central banks and the ability of countries to control the spread of the virus. The development of a vaccine would be ideal but appears to be highly unlikely. The sooner it is brought under control – along with effective targeting of fiscal stimulus packages – the lower the impact on overall economies and the technology spending of businesses.

Some sectors will witness growth – telecoms providers, collaboration software and tool providers, remote and online education providers, cloud providers and healthtech will all witness growth – in fact many are already! Digital spending will increase as face-to-face opportunities plummet – this will drive opportunities for advertisers, digital agencies and developers.

Now is the time to make contingencies – vendors need to get better at digital marketing and selling and simpler implementation. Tech buyers and implementers need to put in place best practices for remote working – many companies witness an increase in productivity when they get remote working right.

Please let us know your feedback or thoughts in the comments section – we look forward to keeping the analysis going – and stay healthy!

This post was authored by Tim Sheedy, with valuable assistance from Phil Hassey, Sash Mukherjee and Claus Mortensen.

With the advancements in the technology landscape, the CIO’s role has become increasingly complex. One of the key challenges they face is in emerging and newer technology implementations, which require them to identify and partner with newer tech vendors. The common challenges that tech buyers face today include:

- The emergence of newer technologies that are catching the fancy of the C-suite and they are expected to adopt and deliver

- Getting management buy-in for IT investments (increasingly including discussions on ROI)

- Need to involve business stakeholders in tech decision-making

- Lack of sufficiently skilled internal IT

- Engagement with multiple tech vendors (including newer vendors that they have to establish a relationship with)

- Digital transformation projects that might require an overhaul (or at least a re-think) of IT systems

- Backdrop of compliance and risk management mandates

Many of these challenges will require the sourcing of new technology or a new tech partner and rethinking their vendor selection criteria. And selecting a tech vendor can be hard. The mere fact that there is an industry whose sole purpose is to help businesses select tech vendors goes to show the massive gap between what these providers sell and what businesses want. If there was easy alignment, the Tech Sourcing professionals and businesses would not have existed.

But over my time working with Tech Sourcing professionals, CIOs and business leaders, I have picked up on a few key factors that you should incorporate in your vendor selection process best practices. First and foremost, you are looking for a partner – someone who will be with you through the good and bad. Someone whose skills, products, services – and most importantly – culture, match your business and its needs.

I believe that the technology ecosystem is not really as competitive as we think. Yes, in practice Google competes with Microsoft in the office productivity space. But I often hear about companies moving from one to the other not for features, function or even price – but for a cultural match. Some traditional businesses were hoping Google can help them become more innovative, but in reality, their business culture smothered Google and meant they could not benefit from the difference in the ways of working. And I am not suggesting Microsoft is not innovative – more that Office represents the traditional ways of working – and perhaps can help a business take a more stepwise approach to change its own culture.

And I regularly hear about IT services deals (managed services, systems integration, consulting etc) going to the company that made the most sense from a cultural fit – where they were willing to take on the culture of their customer and embrace that way of working. In fact, I have been brought into many deals where a company hired a strategic consultant to create a new digital strategy or AI strategy, only to receive a document that is unworkable in their business and their culture.

So, I believe every strategic technology relationship should start and end with a cultural match. This company is a partner – not just a provider. How do you determine if they are a partner and measure cultural match? Well, that is the topic of an upcoming report of mine, so watch this space!

Questions You Should Ask Before Stepping in the Ring

There are also a number of questions that you should ask along with the partnership discussion:

- How will this solution change the organisation?

- What are the risks either way (of implementing or not implementing the solution)?

- Does the solution solve a key business problem?

- Is it likely to have more impact than the solution it is replacing?

- Where will the funding for the implementation come from?

- Have you calculated the ROI and the time to deployment?

- Have you baselined the current scenario so that you can measure improvement?

These can inform you of the business impact of the solution – and what you need to do to prepare for successful implementation (if you plan for success, you are more likely to be able to get faster benefits than if you do not plan for the change!)

Engagement Criteria for Your Shortlisting Process

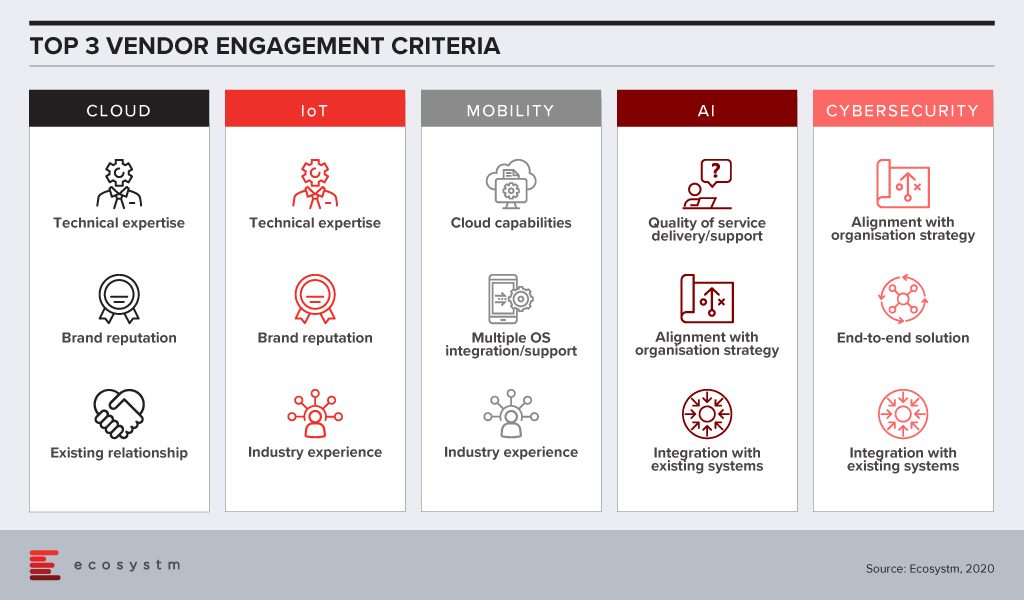

In order to determine vendor selection process best practices, Ecosystm research tries to unearth the top criteria that organisations employ when shortlisting the vendors that they want to engage, across multiple technologies.

There is still a skills gap in internal IT and organisations want technical guidance from their Cloud and IoT vendors. With the plethora of options available in these tech areas, CIOs and IT teams also tend to look at the brand reputation when engaging with the vendor. Very often, organisations looking to migrate their on-prem solutions on the cloud engage with existing infrastructure providers or systems integrators for guidance, and existing relationships are significant. IoT solutions tend to be very industry-specific and a portfolio of specific industry use cases (actual deployments – not proofs of concept) can be impactful when selecting a vendor for planned deployments.

Artificial intelligence (AI) deployments are often linked with digital transformation (DX). Organisations look for a vendor that can understand the organisational strategy and customise the AI solutions to help the organisation achieve its goal. Adoption of AI is still at a nascent stage globally across all industries. Many organisations do not have the right skills, such as data scientists, yet. They appreciate that integration with internal systems will be key to reap the full benefits of the solutions, especially if the entire organisation has to benefit from the deployments. They also anticipate that they would have to have a continuous period of engagement with their vendors, right from identifying the right data set, data cleaning to the right algorithms that keep learning. Organisations will look at vendor partners who are known for delivering better customer experience.

This is true for cybersecurity solutions as well, as organisations are driven to continue their investments to adhere to the internal risk management requirements. Given how fragmented the cybersecurity landscape has become, organisations will also wish to engage with vendors that have an end-to-end offering, especially a managed security service provider (MSSP). Cybersecurity vendors are increasingly strengthening their partner ecosystem so that they can provide their client with the single-point-of-contact that they want.

Of the technologies mentioned in the figure, mobility is arguably the most mature. As organisations revisit their enterprise mobility solution as they go increasingly ‘Mobile First’, their requirements from their mobility vendors are more specific. They have decided over the years which OSs they want to support their enterprise applications and are looking for vendors with robust cloud offerings.

The vendor selection criteria will likely be different for each technology area. And as your knowledge and understanding of the technology increases, you should be able to drill the requirements down to the solution level, while making sure you engage with a vendor with the right culture.

Tim Sheedy’s upcoming report, ‘Best Practices for Vendor Evaluation and Selection’ is due to be published in February 2020.

As a technology analyst I have followed HCL for many years – and their capabilities have changed over that time – particularly in Australia and New Zealand. When they entered the ANZ market they were somewhat unique – an Indian IT Service provider with views and opinions. One who was not just good at meeting RFP requirements and delivering technology projects, but also individuals who were empowered to challenge the status quo in their clients – to challenge clients to be better. But as several large managed services providers lost their way in ANZ, HCL stepped in and – for a number of years – became all about outsourcing and managed services. They grew their business significantly, but what seemed to be lost was that factor that set them apart. In focusing on good delivery they seemed to lose their differentiator.

However, I recently spent a few days with HCL and their clients in Adelaide and I can report that they are back. They are winning digital transformation deals. They are driving a technology industry agenda and are becoming an important force in the education and evolution of the high tech sector in Australia and New Zealand. Adelaide was chosen for the event as HCL wanted to showcase how they are making real investments in the local market, and how they are helping South Australia to transform itself and create new job opportunities both in Adelaide and in the regions. Their managed services contract with Elders is a great starting point for them – and in meeting and interviewing the Elders stakeholders, it is clear that it is a partnership – HCL has collocated to ensure that the HCL staff are side-by-side with the Elders teams – and they are doing a good job in driving innovation into the Elders business.

The Cricket Australia digital transformation contract is a big deal, and is really a great indicator of their capabilities. HCL won the contract from Accenture – showing that they can compete against and beat the best (Accenture is the biggest IT services provider in Australia today – and for good reason). Building off their success with Manchester United, HCL has won another important digital transformation deal with a global sporting brand. Personally, as a fan of the Australian women’s and men’s cricket team, I look forward to engaging with the fruits of their endeavours soon!

The main take away from the time spent with HCL is that they are growing their business here in Australia and across the entire Asia Pacific region – and that the growth is coming from many areas – not just traditional outsourcing contracts but also across the spectrum of digital transformation. Importantly they are also taking responsibility for that growth – bringing the market along with them as they look to help educate and employ the next generation of technology professionals.

HCL also seem to have mastered the ability to both respond to the standardised processes of the sourcing deal advisors as well as stand out as an individual company. While deal advisors play an important role, I often hear clients say that they can sometimes take the personality out of a deal. They bring comparisons between vendors to standard and measurable metrics – but you sign a deal with a person, you negotiate with a person, and it is people who deliver the solution. Winning deals is not just about proving the ability to deliver, but also convincing the client that they want or need to partner with the IT services business. Based on client feedback, HCL is mastering both sides of this process, and are earning the right to be considered in a broader range of deals.

If you are dealing with HCL, it may also warrant looking beyond the traditional measurable metrics. Speak to their leadership team both locally and globally, especially given their emphasis to bring in local leadership in their key markets . Get a feel for the culture of the company and whether or not it matches your culture or even sometimes challenges your business to be better. Services deals are ultimately about people, so spend time with the people – challenge them to come to the party. Put them under stress and see how they respond, as it is typically the hard times that define the longer term success of a partnership.

I recently attended a briefing with Ramco Systems – if you haven’t heard of them, they are one of an emerging group of software vendors who are challenging the big application software companies – SAP and Oracle. They put innovation at the centre of their business – aiming to constantly drive improvement for their customers, and bringing companies the benefits of systems that consumers see in their web-based and mobile apps but have been sorely missing from the enterprise application market. To be honest they are a breath of fresh air in a market that needs it – and their endeavours are seeing results both in plaudits from analyst firms and new customer wins.

At the briefing, Ramco demonstrated some of the AI capabilities they have been weaving into their software platforms. And in doing so they have shown the gap between today’s systems and systems that actually work for their clients. ERP, HR, Payroll and other enterprise applications are data sinks – they demand constant input, and while they do a good job in automating business processes, they could do so much more.

Within Ramco they have moved away from email completely for employee inquiries – all interactions now happen with their transactional chatbot, including scheduling meetings, checking leave balances, discovering and understanding personal achievements, raising a travel request and claiming travel expenses – as well as understanding company policies and supporting employees with speculative queries. This same bot is available for clients as they aim towards a zero-UI interface – no more logging onto systems and interrogating applications, running searches. Now you ask a question and get an answer – using an IM client or a voice interface (such as Google Home or Amazon Alexa devices). This is the way systems should serve employees.

Like other enterprise application vendors, they have added an AI capability to their platform – but they are taking the extra step to make that AI work out of the box (or the cloud). For example, with all the information in your HR systems (employee skills, time and attendance, incentives, expenses, payroll) they are looking at making that information accessible and actionable for potential users – creating systems that understand the context and anticipate needs.

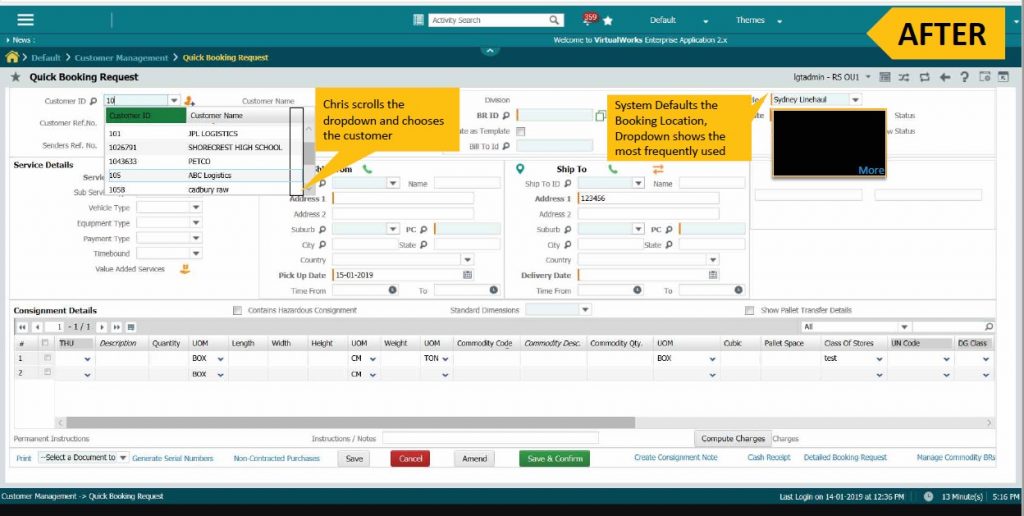

In your finance or ordering systems, they are applying machine learning so it understands that ‘client A’ tends to order specific items from specific locations – so ordering agents are guided towards those options versus having to scroll through long lists.

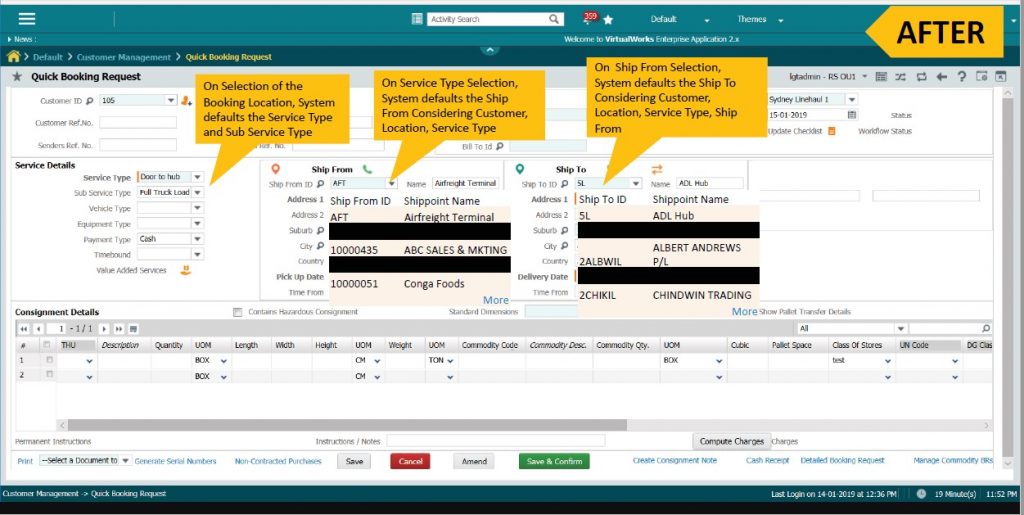

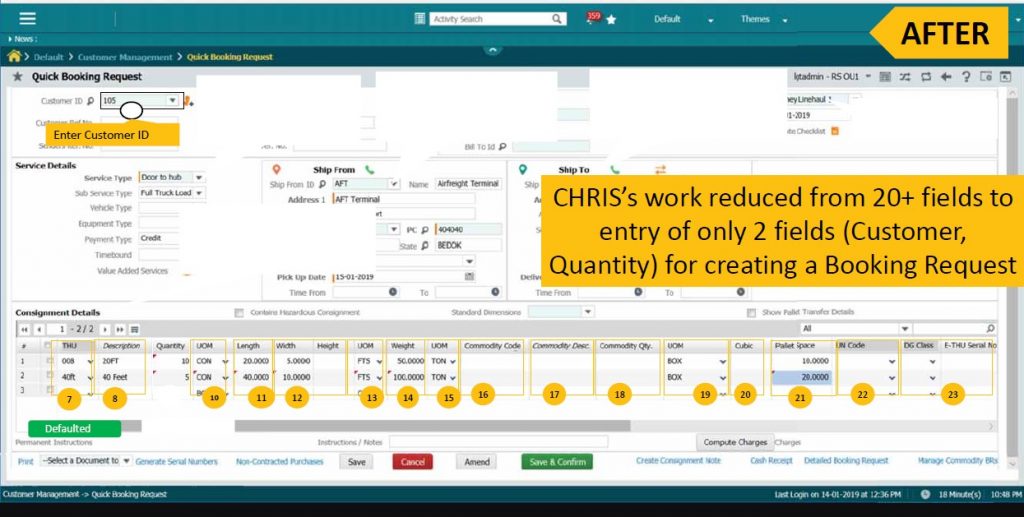

(see images for an example of that in the process)

They are recommending where costs should be allocated or validating inputs based on historical learnings. The systems can catch a mistake, errors or even fraud – saving the business significant amounts of money and of time in error correction or re-work.

Ramco’s vision is that agents only have to manage exceptions in enterprise applications – not every single detail. Complete automation is still an unrealistic expectation, but businesses should aim for 85% automation, with 12% of processes needing intervention for mild intervention and 3% needing deep intervention. In Ecosystm’s experience speaking to businesses that have automated to such a degree, an 85% automation does NOT lead to an 85% saving – as you typically automate the easier cases anyway. But the savings should be real and measurable – up to 50% time saving for accounts receivable or payable teams, for payroll teams, for help desks or for other highly manual processes should be achievable.

And while the business case can be built on the saving, the pay-off also comes in happier and more engaged employees who have the information right at their fingertips to make better business decisions or drive smarter business processes.

So why highlight Ramco’s AI capabilities? For a number of reasons:

- For AI to be widely adopted, it needs to be easy and accessible – Many other vendors (the big cloud players in particular) are making AI tools and assets available for customers, but they still have to do the hard work – find a business problem, gather the data, train the algorithm, deploy the algorithm and then train users on the new process. There are hundreds – or even thousands of examples of processes in business that can be made smarter and easier through the use of machine learning and AI – and vendors should be building these capabilities into the products and platforms. Ramco is doing that – they are by no means alone – but they are a good example of a software vendor that is disrupting a market by focusing on helping their customer succeed.

- I believe there is a bigger trend going on in the way businesses buy software (and look out for an upcoming report on this topic). More and more I see businesses adopt the best solution for their needs – NOT the one that does 80% of what they want. And the best software is often built by smaller, more agile companies. They build for specific business needs and specific niches – and they focus on providing exactly what customers want. I am seeing a general move away from the big platform providers towards the smaller ISVs. Partly because they cost less (I regularly hear companies say they saved up to 90% by using a specialist provider!) – but also because they provide the best solution – and businesses can no longer compromise when it comes to driving the best customer and employee experiences. Again, Ramco is a part of this change.

You should demand more from your applications provider – an AI platform is not enough. They need to make your actual application smart – they need to be able to automate processes you are already doing. If you have data the system should be able to learn, they need to focus on making the system work for you, your employees and your customers – not the other way around (as is too often the case). AI needs to be a core component of your business applications, not a bolt-on.

In a move that feels “back to the future”, Salesforce has agreed to acquire Tableau Software Inc for US$15.3 billion in a deal that is expected to close in the third quarter of 2019. It seems all independent BI and analytics companies (except SAS!) eventually get snapped up – Business Objects by SAP, Hyperion by Oracle, Cognos by IBM. The move comes less than a week after Google acquired BI and analytics provider Looker.

Today, many businesses use Tableau (over 86,000), including a lot of Salesforce customers. They have chosen Tableau because it is easy to deploy and use, and like Salesforce own applications, it targets the ultimate decision maker – the business user – and sometimes even the consumer. Recent research into the BI systems integrators in Asia Pacific shows that Tableau is one of the leading analytics platforms for the partner community in the region – the big SIs have many people focused on Tableau. But that dominance is being challenged by a re-energised Microsoft, whose Power BI is also witnessing strong growth – and who is typically the price leader in the market.

For Salesforce customers, there is some overlap between products – their own Einstein Analytics tools do much of what Tableau can do – although Tableau helps customers see insights from data stored both on the cloud and inside their own data centres. It also moves Salesforce closer to the Customer 360 vision – the ability to get a view of customers across the Commerce, Marketing and Service Clouds. Salesforce customers not using Tableau today will get a better user experience by using Tableau as the visualisation platform.

History has shown that it is hard to make such acquisitions successful. Tableau was a huge success because it was independent. The same was for Business Objects and Cognos before their acquisitions. History has shown that when the large BI and analytics vendors are acquired, others move into that space. While Salesforce has announced they will run Tableau as a separate business, it will no longer be independent. Partners will need to be maintained and provided a growth path – and partners are the cornerstone of Tableau’s success. Some of these partners might have strong ties to other software or cloud platforms too such as SAP, Oracle, AWS or Google. Customers of Tableau might feel sales pressure to move to a Salesforce environment – and will likely see Salesforce integration happen at a deeper level than on other platforms.

Tableau’s independence will disappear. However keeping Tableau as a separate business may not be the long term goal for Salesforce – it might be to offer the best application and analytics solution in the market – to make the entire suite more attractive to more potential buyers and users. It may be to take Salesforce beyond the current users in their customers to many other users who may not need the full application but need the analytics and visualisations that the data can provide. If this is the case, then the company is onto a winner with the Tableau acquisition.

BUT…

The long term goal is not analytics reports delivered to employees. It is not visualisation. It is automation. It is applications doing smart, AI-driven analysis, and deciding for employees. It is about taking the human out of the process. In a factory you don’t need a report to tell you a machine is down – you need to book a repair person automatically – or a service technician to visit before the machine has even broken down. And you don’t need a visualised report to show that a machine is beyond its life expectancy. You need the machine replaced before it fails catastrophically.

Too often, we are putting humans in processes where they are not required. We are making visualisations more attractive and easier to consume when, in reality, we just needed the task automated. While we employ humans, there will be a need to make decisions more effectively, and we will still require tools like Tableau. But don’t let the pretty pictures distract you from the main prize – intelligent automation.

If you would like to speak to Tim Sheedy or another analyst at Ecosystm about what the acquisition Tableau by Salesforce might mean to your business or industry, please feel free to schedule an inquiry call on the profile page.