Many years ago – back in 2003 – I spent some quality time with BMC at their global analyst event in Phoenix, Arizona and they introduced the concept of “Business Service Management” (BSM). I was immediately a convert – that businesses can focus their IT Service Management initiatives on the business and customer services that the technology supports. Businesses that use BSM can have an understanding of the impact and importance of technology systems and assets because there is a direct link between these assets and the systems they support. A router that supports a customer payment platform suddenly becomes a much higher priority than one that supports an employee expense platform.

But for most businesses, this promise was never delivered. Creating a BSM solution became a highly manual process – mapping processes, assets, and applications. Many businesses that undertook this challenge reported that by the time they had mapped their processes, the map was out of date – as processes had changed; assets had been retired, replaced, or upgraded; software had been moved to the cloud or new modules had been implemented; and architectures had changed. Effectively their BSM mapping was often a pointless task – sometimes only delivering value in the slow to change systems – back-end applications and infrastructure that delivers limited value and has a defined retirement date.

The Growth of Digital Business Strategies

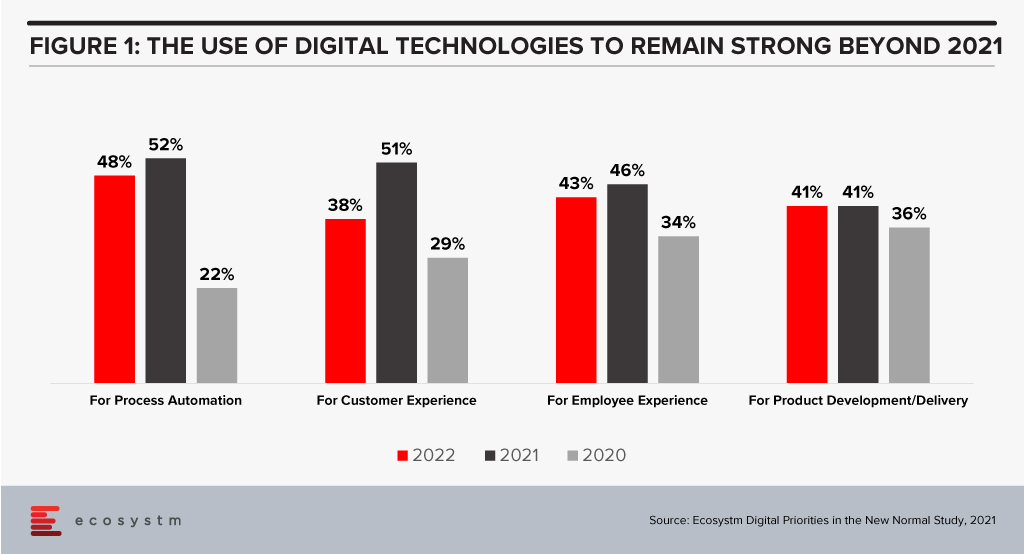

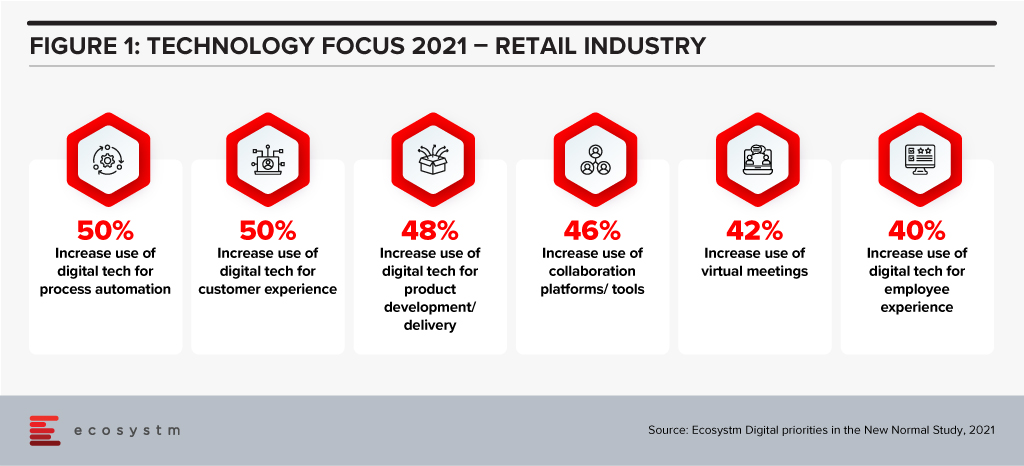

Our technology systems are becoming more important than ever as digital business strategies are realised and digital interactions with customers, employees, and partners significantly increase. Many businesses expect their digital investments to remain strong well into 2022 (Figure 1). More than ever, we need to understand the link between our tech systems and the business and customer services they support.

I recently had the opportunity to attend a briefing by ServiceNow regarding their new “AI-Powered Service Operations” that highlighted their service-aware CMDB – adding machine learning to their service mapping capabilities. The upgraded offering has the ability to map entire environments in hours or minutes – not months or weeks. And as a machine learning capability, it is only likely to get smarter – to learn from their customers’ use of the service and begin to recognise what applications, systems, and infrastructure are likely to be supporting each business service.

This heralds a new era in service management – one where the actual business and customer impact of outages is known immediately; where the decision to delay an upgrade or fix to a known problem can be made with a full understanding of the impacts. At one of my previous employers, email went down for about a week. It was finally attributed to an upgrade to network equipment that sat between the email system and the corporate network and the internet. The tech teams were scratching their heads for days as there was no documented link between this piece of hardware and the email system. The impact of the outage was certainly felt by the business – but had it happened at the end of the financial year, it could have impacted perhaps 10-20% of the business bookings as many deals came in at that time.

Being able to understand the link between infrastructure, cloud services, applications, databases, middleware and business processes and services is of huge value to every business – particularly as the percentage of business through digital channels and touchpoints continues to accelerate.

Back in 2019 – when life was simpler and customers only expected minor miracles from the brands they interacted with – personalisation of the customer experience (CX) was a “good idea but the time has not yet come” for the majority of marketing and CX professionals.

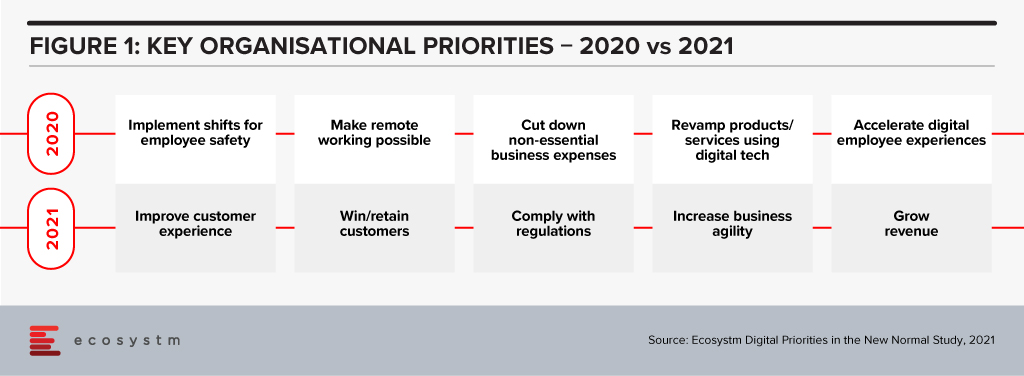

Fast forward 24 months and the world has changed – in more ways than we could have imagined! For a start, CX dropped off the top business priority during 2020 as businesses adapted to the changing market and employee experiences. But as some economies start to create a new sense of normal, CX has returned to the top of the list of business priorities (Figure 1) – renewing pressure on CX teams to create great experiences for customers.

In 2020 many marketing teams went back to the drawing board to create truly meaningful customer experiences. Suddenly “trust” was a core expectation of a brand, and that lens allowed marketers and CX teams to rethink what a personalised experience looks like. It is no longer about selling more products and creating more chances for commerce – it is now about creating an experience that makes brands easy to deal with. It is about understanding the customer and creating an optimised experience when they want or need to interact with the brand. A great personalised experience feels normal today – it has lost the “creepy” edge and is now about the brand giving customers the service, products, or levers that they need when and where they need them.

For some brands and customers, a personalised experience is about getting out of the way of customers and just giving them the outcome they desire. For others it is about creating a memorable journey. Some customers require that extra hand holding along the way and need to be nudged in the right direction, and just need to be left alone to make their decisions – not requiring that extra EDM, alert or message.

In some sectors – such as Banking and eCommerce – if you are not personalising your CX you are a long way behind, but in others, such as Government and Insurance, personalisation is only beginning to gain traction today, and will see slow and steady growth over the next few years.

Good Data is Key to a Great Personalisation Strategy

Lack of data is the primary reason personalisation fails and why some marketing teams have abandoned their personalisation efforts. The right data may not exist completely within your business – you may need to partner or work with ecosystem providers to create a complete view of your customers – and new restrictions around the use of cookies is making this harder to achieve. Forward thinking businesses have already forged partnerships with third parties and partners to share relevant data to help them create the personalised experience their customers demand.

Personalisation Should Apply Across the Customer Journey

A clear understanding of brand values, customer desires and ideal customer journeys is also important to ensure personalised experiences meet the needs of customers. Creating a personalised experience that deviates from brand values means that either brands don’t understand their customers, or customer experience professionals don’t understand their brands (or both!).

Personalisation needs to focus on the entire customer journey – from prospect through to customer and even through to churn. While you have significantly more data about your customers than your prospects, a personalised experience for non-customers is still possible and sets the scene for better and easier CX once your prospects take the longer journey with your brand. Creating a personalised churn experience – making the departure from your brand memorable, friendly and easy – provides the perfect springboard for return and tells your customers that you care about them through the entire journey.

Build a Proof of Concept for Personalisation

If you have not yet started personalising your customer’s experience, now is the perfect time to build a Proof of Concept (POC) demonstrating the business and customer outcomes you can achieve. This will help the CX and/or marketing teams to understand what data you need to collect from existing systems and processes – or source externally to create the desired experience. Initially your personalisation experience may target a limited number of key personas – but it should have the capability to roll out to all customers and/or prospects, eventually considering many scenarios and requirements. It should continue to learn and adapt. Too many businesses discovered during the pandemic that static personalisation programs will fail when market conditions change.

The POC can provide the data that your senior leadership will need to deepen their investments in and think of personalisation as a business capability – not a single project. They can demonstrate the ROI (or lack of return) and will help to guide the larger spend should the POC be a success.

Invest in Behavioural Science Skills

Building a successful personalisation strategy often goes beyond simply listening to the experts within the business and even listening to your customers. Often your customers don’t know what affects their behaviour – and will mis-report motivations or mis-attribute actions. It is important to understand the science behind behaviour – what is possible, what can work, what is guidance and what is coercion. These experts, along with your legal or privacy teams, can help to set up the guide rails for the personalisation program to operate within, and help you create customer journeys where customers can achieve their desired outcomes.

Target Consent as a Key Customer KPI

Consent is a key enabler of deep personalisation capabilities. While some level of personalisation without formal consent can be created, the real benefits of personalised journeys come with consent to use customer data to offer better services. Many businesses ask for consent in the sign-up process, but often it feels like wishful thinking – not a serious attempt to offer a better customer experience. Businesses that make “Consent to Use Data” a CX KPI think more broadly of the customer journey, the brand promise and what that means to levels of consent. It isn’t a “tick-a-box” activity at sign-up – it considers what the customer wants to get out of the engagement or a longer relationship. It focuses on helping customers achieve their instant goals more effectively and the benefits the data can bring to nurture a longer-term relationship.

Businesses that seek a higher level of consent use more tangible outcomes, simpler language and no “sweeping statements” in their consent request. They are explicit how they will use data and what data they will use. Sometimes they don’t even ask for consent to use data at sign-up – they ask after they have formed a relationship and the customer has developed a level of trust in the brand or company.

Start Your Personalisation Journey Today

Your competitors are already thinking about personalisation – some have even implemented personalised elements within their existing or new customer journeys. Personalisation – while easier than ever – is still a significant capability to build within your business. You are likely to need new technology tools and/or platforms, new skills, and new budgets. The impact for your customers – and therefore for your business – can be significant. And the impact of no action can potentially be damaging. Start your personalisation journey today to help your business take the next step towards becoming a customer-obsessed, agile, and digital business.

Moving from a product or regional focus to an industry focus appears to be the “strategy du jour” for many technology vendors today. For some it is a new strategy – with the plan to improve customer focus and increase growth; for others it is the pendulum moving back to where they were five or ten years ago as they bounce from being industry-centric to product-centric to geography-centric and back again.

Getting your industry focus right is much harder than it seems – and has to be timed with client needs and market opportunity. The need to focus on the industry varies for different technology products, services and capabilities. For example, most technology buyers want their vendors to understand what their business does and how they add value to customers – that is a given and industry-aligned Sales teams make a lot of sense. Many tech buyers also want certain software functions to align directly to their processes – there is little appetite to customise ERP and financial suites to specific industry needs and processes – and tech vendors should support these out-of-the-box or cloud needs.

Industry Solutions May Not Drive Competitive Advantage

If the industry solution you are selling is the same as what any of their competitors can buy from you, then organisations get the exact same benefit as the market – no more, no less. For example, about 10-15 years ago, large telecom providers around the globe made significant investments in CRM platforms (often from Siebel) – bringing in one of a few large global systems integrators to deploy their standard processes and systems. These CRMs were supposed to provide business and customer benefit, and drive competitive advantage. And while they did deliver positive change (often at SIGNIFICANT cost!) when every telecom provider was using the same solution with the same or similar processes, any competitive advantage was lost.

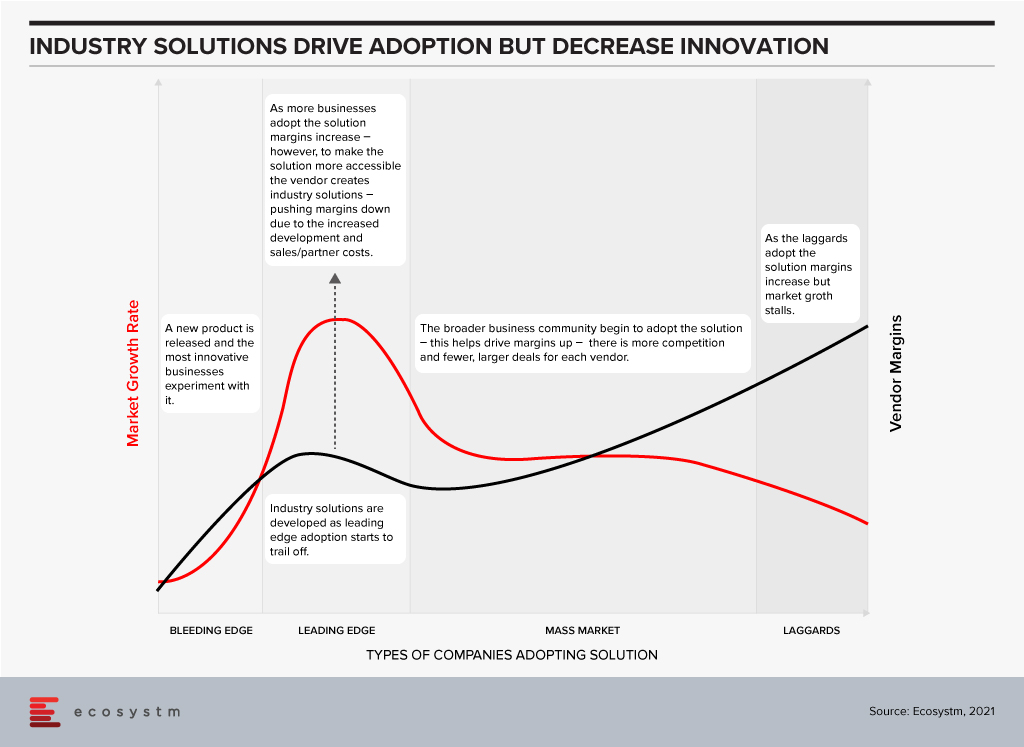

Industry Solutions are Often the Sign of a Mature Market

The widely accepted hypothesis is that the technology innovation and adoption happens in waves. The market has 5-7 year waves of innovation, followed by 5-7 year waves of deployment, adoption and consolidation.

The Innovation Phase. In this stage new companies emerge, new products or services are launched and leading/bleeding edge companies embrace these new technologies to drive competitive advantage and business growth. They experiment with new technologies that drive new business capabilities – sometimes failing, but always pushing the envelope for business innovation and forging the path for mass market adoption. In this stage there is often little demand for industry solutions – as both the providers and buyers of the solutions are still working out where the business benefit is; where the technology might be able to drive change or help them get ahead of competitors. If you examine the growth of a company such as Salesforce, you see that the early stage products are targeted towards a generic market – customers are expected to customise the solution based on their needs and individual requirements. In 2002 I worked for a challenger telecom provider that had deployed a traditional Peoplesoft CRM capability, and I was part of the team that brought Salesforce into the business – and as a cloud-based solution, we saw the competitive advantage was the pace at which we could customise the product (by excluding IT teams and processes). However, the solution was a “one-size-fits-all” product. The innovation stage is typically characterised by high growth of smaller vendors and technology service providers who challenge the status quo.

The Deployment, Adoption and Consolidation Phase. This stage of market growth is when the mass market starts to adopt these solutions. Many of these buyers walk the paths that have been forged before them by the more innovative, leading edge businesses. This stage typically sees less innovation, less experimentation, and more standard deployments. To make the solutions more palatable and easier to sell to the mass market tech vendors typically pre-configure or customise the solutions to specific needs – for business teams, roles or industries. It is usually in this stage of market growth and deployment that the industry solutions see significant interest and adoption. This is where the mass market gets access to the business benefits the more innovative businesses received many years earlier (and often profited from in this time). In my example of the Salesforce deployment in 2002, over the following years many partners started to create industry solutions, and eventually Salesforce themselves sold industry-specific solutions – or at least targeted certain products and capabilities at specific industries and provided accelerated deployment models to drive advantage at a faster rate. The deployment and consolidation stage of market growth is typically characterised by steady, slow growth across the entire market as benefits are being driven to all providers (product vendors and solutions or implementation providers). Legacy providers either play catch up or suffer declining business as they realise the solution they sell no longer provides the business and customer the benefits that it used to.

Industry Focus Should be Aligned to Customer Segments, Solution Type and Geography

The decision to sell industry-focused solutions should be driven by the type of solution you are selling; the business benefit you are promising; and the type of business you are targeting the solution towards. Businesses that are more innovative will still buy some pre-configured, industry-specific solutions that don’t differentiate their business or drive competitive advantage. But where they expect competitive advantage, they need to stand apart – to be the only business with that capability.

It is also worth understanding that an innovation in one market might be standard practice in another (and vice-versa). Countries across the globe and specifically here in Asia Pacific have different approaches to technology and innovation. China and parts of Southeast Asia are often innovators – pushing the boundaries of new and emerging tech to do things we never thought possible (in the same way Silicon Valley traditionally has done). Australia and India are traditional markets that adopt industry solutions after they have been tried and tested by others. Innovation in Japan seems to happen in stages and at pace but only once every 10-15 years or so. New Zealand and Singapore are generally more nimble economies where businesses often have to be innovative to gain global competitive advantage quickly.

Evidence indicates that the rate of innovation is increasing across the entire region – even in the less innovative economies. The window for industry solutions is much smaller regardless of location – as the next new innovation is just around the corner. Even the large, traditionally less agile businesses are driving innovation programs – for example, many of the big financial services “dinosaurs” such as DBS and Commonwealth Bank often win tech innovation awards and offer market-leading customer experiences.

Use this lens to better develop your industry approach. The depth of your industry solution or capability will dictate the opportunities that you will drive based on the type of customer and technology stage. Do you want to drive innovation or efficiency in your clients? Do you want to win the big “safer” deals – but be thought of as a technology solution provider; or win the smaller deals in companies that will become the market leaders of tomorrow – and be considered a market leader and king maker? Understanding your own business goals, the current sales and delivery capabilities, and the capacity to change will help your company create a go-to-market strategy that suits your current and future customers and will likely dictate the growth rate of your business over the next 5-7 years.

Keep yourself abreast with the latest industry trends

Ecosystm market insights, data, and reports are jam-packed with industry analysis and digital trends across several industry verticals to help you keep tabs on the fast-paced world of tech.

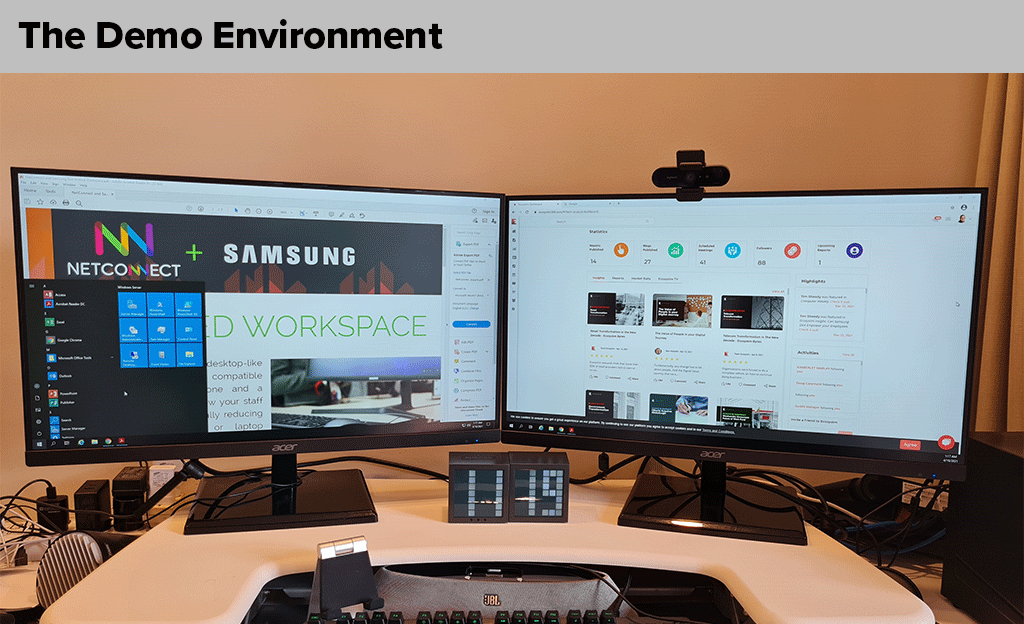

In March I published an analysis of Samsung DeX – which is a desktop environment which many businesses could benefit from deploying to specific teams, roles or employees. During my research, I found that one of the shortcomings is the lack of native support for dual screens. I know that many information workers in particular use dual-screen setups – and going back to a single screen feels highly unproductive!

Knowing this, a contact at Samsung pointed me to a company that has developed a dual-screen capability for a virtual desktop environment running on DeX – so I jumped at the opportunity to trial the environment in my own dual screen setup.

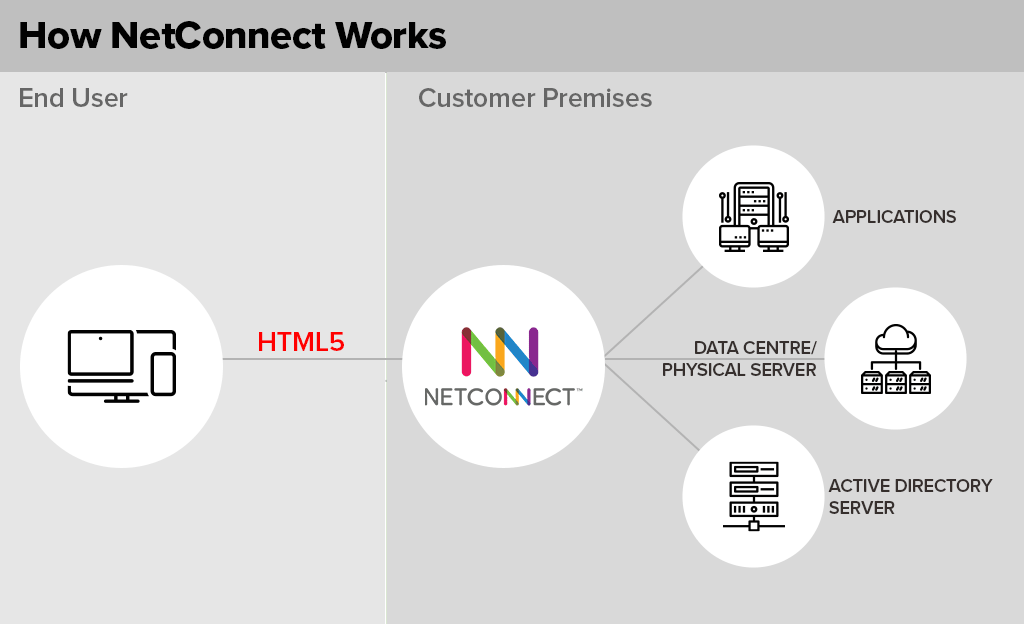

The product is called NetConnect – and is sold by VOIP. It is actually a Branch Of One style solution, which allows employees to access enterprise resources on any device. But one of its unique features is the ability to run a dual screen virtual desktop environment.

NetConnect’s Dual Screen Capabilities – An Analysis

DeX users that run the NetConnect app can extend the desktop to a second, internet connected monitor or screen. The key point here is “internet connected” – the screen is deployed across the internet – not across cables from the phone. This means any tablet, laptop or connected screen can be used as the second screen for the Windows virtual desktop running through NetConnect. In my particular demo environment, the software (both NetConnect and the Windows server) was running in a data centre in Singapore – but the company (VOIP) sells the solution to organisations to run in their own data centre environment.

The overall experience is seamless. The fact that one screen is running on a server in Singapore and being sent across the internet to my Samsung phone, and the other screen is running in Singapore and being sent across the internet to a completely different device is remarkable. The mouse moves across screens as if the desktop is running locally. While my demo environment was limited to web and a few desktop applications, I often found myself astonished that this entire environment was being driven by a smartphone (and a lot of clever technology behind the scenes!). Suddenly the limitations of only having a single screen for DeX disappeared – I now could run one application on my first screen and another on my second screen – and continue working, without the need to endlessly alt-tab between applications and screens.

There are some limitations – video streaming is not very smooth, and connected devices (cameras etc. for Zoom or Teams calls) are not recognised. These features are on the roadmap, but not available today. But the NetConnect solution really does open DeX up to a whole new community of users. Some of the VOIP employees I met at their office don’t have a laptop on their desk or a desktop underneath it – they are running their entire work environment from their Samsung phone!

And being a Branch of One solution, NetConnect also brings with it inherent security benefits – of not ever taking company data out of the data centre, reducing threats from viruses and malware that would normally run on the end-user computing device and others. It also improves the manageability of the desktop environment and makes it simple to deploy to users. Branch of One is about bringing all of the inherent benefits and capabilities that an office or branch would have and enabling a single user to get this power and security.

NetConnect is more than a dual screen solution – so working out which comes first is the interesting challenge. If your business is looking to run a solution like NetConnect, it is worth your while examining the opportunity to use DeX to extend full, dual screen desktop solutions to your employees. And if you are a business running DeX, NetConnect could open opportunities to extend DeX to more employees, roles or teams than originally planned.

Checkout Tim’s previous insight where he provides a detailed analysis on whether Samsung DeX is suitable for your employees. He bases his insights from using Samsung DeX as his primary desktop environment over the past 4 weeks.

2020 was a strange year for retail. Businesses witnessed significant disruption to supply chains, significant swings in demand for products (toilet paper, puzzles, bikes etc!) and then sometimes incredible growth – as disposable income increased as many consumers are no longer taking expensive holidays. Overall, it was a mixed year, with many retailers closing down and others reporting record sales. The grocery sector boomed – with many restaurants and fast-food providers closed, sometimes the supermarkets were some of the few remaining open retailers.

For many retailers, technology has become a key enabler to their transformation, survival and success (Figure 1).

Woolworths, Australia’s largest retailer, operates across the grocery, department store, drinks, and hospitality sectors. They hold a significant market share in most markets that they operate in. The company had a strong 2019/20 (financial year runs from July 2019 to June 2020) with sales up 8% – and in the first half of the 2020/21 financial year, sales were up nearly 11%. But the company is not resting on its laurels – one of its 6 key priorities is to “Accelerate Digital, eCom and convenience for our increasingly connected customers”. This requires more than just a deep technology investment, but a new culture, new skills, and new ways of working.

Woolworths’ Employee Focus

Woolworths has committed to invest AUD 50 million in upskilling and reskilling their employees in areas such as digital, data analytics, machine learning and robotics over the next three years. The move comes as a response to the way the Retail industry has been disrupted and the need to futureproof to stay relevant and successful. The training will be provided through online platforms and through collaborations with key learning institutions.

The supermarket giant is one of Australia’s largest private employers with more than 200,000 employees. Under Woolworths’ ‘Future of Work Fund’ their staff will be trained across supply chain, store operations, and support functions to enhance delivery and decision-making processes. The retailer will also create an online learning platform that will be accessible by Woolworths employees as well as by other retail and service companies to support the ecosystem. Woolworths has plans to upskill their staff in customer service abilities, leadership skills and agile ways of working.

Woolworths’ upskilling program will also support employees who were impacted by Woolworths planned closures of Minchinbury, Yennora, and Mulgrave distribution centres due in 2025.

Woolworths’ Tech Focus

Woolworths has been ramping up their technology investments and having tech-savvy employees will be key to their future success. In October 2020, Woolworths deployed micro automation technology to revamp their eCommerce facility in Melbourne to speed up the fulfilment of online grocery orders, and front and back-end operations. Woolworths also partnered with Dell Technologies in November 2020 to bring together their private and public cloud onto a single platform to improve mission-critical processes, applications and support inventory management operations across its retail stores.

Future of Work

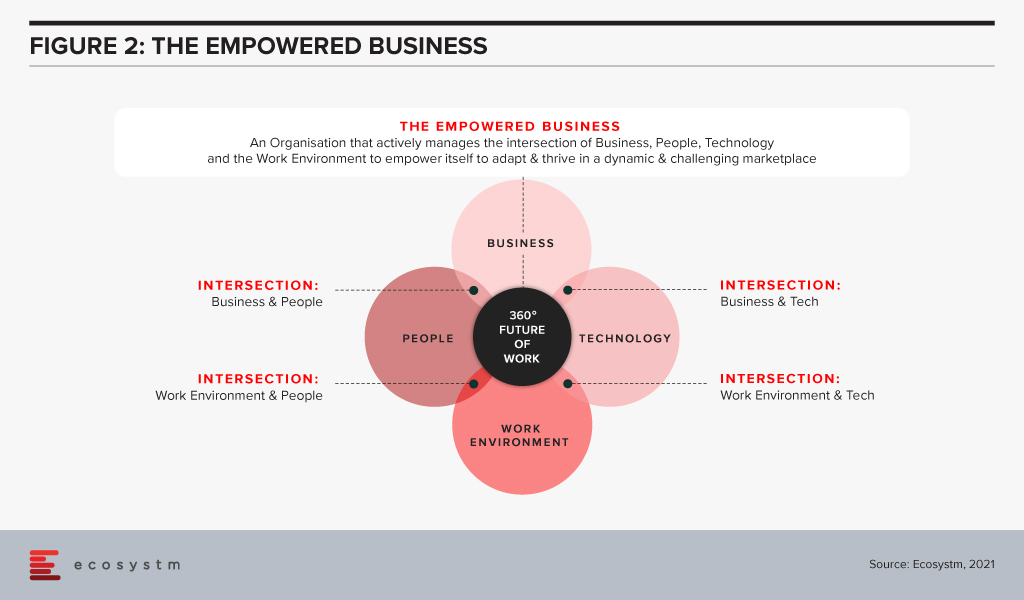

For many years, Ecosystm has been advising our clients to invest more in the skills of the business. Every business will be using more cloud next year than they are this year; they will suffer more cybersecurity incidents; they will use more AI and machine learning; they will automate more processes than are automated today. More of their customer engagements will be digital, and more insight will be required to drive better outcomes for customers and employees. This all needs new skills – or more people trained on skills that some in the business already understand. But too many businesses don’t train in advance – instead waiting for the need and paying external consultants or expensive new hires for their skills. Empowered businesses – ones that are creating a future-ready, agile business – invest in their people, work environment, business processes and technology to create an environment where innovation, transformation and business change are accepted and encouraged (Figure 2).

Empowered businesses can adapt to new challenges, new market conditions and respond to new competitive threats. By taking these steps to upskill and empower their employees, Woolworths is building towards empowering their own business for long term success.

Transform and be better prepared for future disruption, and the ever-changing competitive environment and customer, employee or partner demands in 2021. Download Ecosystm Predicts: The top 5 Future of Work Trends For 2021.

Over the past 3-4 weeks I have spent some time using Samsung DeX (shortened from “Desktop eXperience”) as my primary desktop environment. DeX has been around for a number of years, and I have dabbled with it from time-to-time – but I have never really taken it seriously. My (incorrect!) opinion was that a mobile chipset isn’t powerful enough for a PC-like experience. But for most of the last year, I have been using a Samsung Galaxy Book S laptop as my primary computing device – and this Windows 10 laptop runs an ARM processor which is the very same processor that powers many Samsung and other Android phones. Microsoft also has an ARM-based PC that I have used successfully (the Surface Pro X) which prompted me to rethink the opportunities for DeX. A number of clients also asked for my thoughts on DeX so I figured it is time to take it seriously as a potential end-user computing environment.

This Ecosystm Insight is a summary of the client report and is the first of a few Insights into DeX. In future, I plan to trial the dual-monitor ability for DeX (developed by VoIP – an Australian ICT consultancy). These Ecosystm Insights won’t cover how to use Samsung DeX. If you are looking for this information, Gizmodo has published a good piece here.

The Trial

In trialling Samsung DeX I attempted to cover all usage scenarios, including:

- Native DeX with the phone connected to a DeX station and both wired and wireless keyboard/mouse, using both wi-fi and 4G (I live literally 50 metres outside of 5G coverage!)

- DeX through Windows 10 using both wi-fi and 4G and a wired mouse and keyboard

- Native DeX connected to a monitor using the Microsoft wireless display adapter (again using both wi-fi and 4G)

In the native DeX environment I worked in the traditional Microsoft productivity apps, collaboration apps (such as Teams, Zoom, Webex, Google Meet), Google productivity apps, web applications (sales, CRM & ERP), file sharing applications (OneDrive, Google Drive), imaging applications (photos, video, image sharing), social applications (Twitter, LinkedIn, Facebook, Instagram etc) and other native Android apps – some of which were optimised for DeX, and some of which were not. I tried to imitate the information worker’s experience; and that of a site or specialist user. I used it as a primary computing environment for most of my work for 3-4 weeks. I didn’t just consume content, but also created content – I needed to be able to sign and attach Adobe documents, create new reports, conduct deep data analysis in Excel and create figures and move them between Excel, Word and PowerPoint. I created and shared leads in CRM systems, did company accounting in a financial application and even had some time to try out some gaming applications.

I have also trialled a Citrix and Amazon virtual desktop in all environments – running productivity applications, finance applications, graphics intensive applications and web apps.

Findings

My broad finding is that DeX is not a desktop replacement for power users – but there are plenty of roles within your business who would find that DeX is a capable environment that will allow them to get their job done.

I was planning to discuss the positive features of DeX, but the reality is that it is simpler to understand its limitations. And, most limitations are related to the Android applications or network lag introduced in virtual desktop environments using 4G.

- The Microsoft productivity applications in Android are all scaled back versions of the desktop applications. They do not contain many of the features and functions that the desktop versions have. For example, when I needed to format headings in a report, the fast format options (e.g. to make text a “heading 2”) don’t exist in the Android version of Microsoft Word. Power users will find these applications don’t deliver all of the functions they need to get their job done.

- Those who need broader functionality beyond the Android applications will benefit from a virtual desktop environment. Both Citrix Workspace and Amazon Workspaces delivered a very usable Windows 10 experience (although I found the base configuration to be a little slow). For existing users of virtual desktops, it is a no-brainer to roll them out to mobile devices if required. But would you add a virtual desktop environment to your existing desktop fleet just to enable DeX? I can’t answer that – as it is another environment to manage and support for your end-user computing and IT support teams. But again, for power users, this is not an ideal environment. It does EVERYTHING you want it to do – but it might not do it fast enough to satisfy all users.

- It’s not a mobile environment. This isn’t something you use on your phone (although I believe you can use it on some Samsung tablets). You need a monitor, keyboard, and ideally a separate mouse for DeX to work. It doesn’t replace a laptop for a mobile worker.

- DeX does not natively support dual screens or monitors. I found that I would switch back to my PC when I needed the productivity of two screens, as I personally find application switching on a single screen to be a productivity killer. BUT – this is changing – VoIP has developed a capability to run DeX across dual monitors (I will be testing this shortly and will post the results).

- When using DeX natively and not using a virtual desktop, the screen sharing features of collaboration apps don’t work in the way you expect. The screen that is shared is NOT the DeX desktop screen but the horizontal mobile phone screen. This is a significant issue if you want to share a Word, PowerPoint, or Excel file or another “full desktop screen” application. DeX users can view other people’s shared screens, but not share the screen effectively themselves.

- DeX introduces a new environment for your helpdesk to support. DeX isn’t Windows, it isn’t cloud, and it isn’t exactly native Android. Your tech support team will need to be trained on DeX and be required to learn a new user environment. It introduces an additional OS into the mix. That means at least some service desk technicians will need to be trained on the environment. As it is still running in Android, it doesn’t particularly require specific QA or testing for your business mobile applications. But to take full advantage of the larger screen real estate that DeX facilitates, you may need to make some changes to how applications perform in DeX.

Despite these challenges, DeX is a very capable environment. Running a virtual desktop was a breeze and performed far better than I would have imagined. I was worried about lag and had introduced many opportunities for it to run slowly – a wireless mouse and keyboard, wireless display adapter, running over wi-fi, and 4G using a virtual desktop in the cloud – and the lag was barely noticeable. I was impressed with this and understand how DeX could even be used to support legacy applications and environments too.

The convenience of having your phone at your fingertips – being able to respond to text messages on the large screen, taking calls using the same Bluetooth headphones that you use to watch video content on the larger screen, not to mention the security of taking your “PC” with you in your pocket when you head out to lunch or home for the day – adds to the value of DeX. The concept of a “PC in your pocket” has been around for a while – however most Samsung mobile users don’t realise that they have one there already!

Target Roles

Who are the business roles or personas who could benefit from it? The simple answer is that anyone who uses a desktop part-time would benefit from DeX. Many businesses have shared PCs for multiple users or dedicated PCs for users who don’t use a PC full-time. These might be site managers in constriction, store managers in retail, nurses, security staff, librarians, government or council workers. The significant factors that define potential DeX users are:

- They spend a fair amount of time away from a PC

- They still need a PC for reporting, document sharing, content creation etc

- They return to a fixed site regularly (like a store, office, site office etc)

Again, it is worth noting that DeX doesn’t replace a laptop or tablet. It is not for mobile computing – it replicates fixed computing environments in a more mobile and potentially cost-effective form factor. Remember that the employees need a screen, mouse, and keyboard (you can use the phone as a mouse, but it is not ideal). They also need the charging cable to connect to the computer. If they are making regular video calls then I suggest a phone holder that allows the charging cable to stay connected and the phone to be angled so as others can see their face (wireless chargers tend to sit too far back).

And while DeX is a secure solution, and can benefit from Samsung’s Knox security platform and capabilities, pairing DeX with a secure branch of one style solution – such as that offered by Asavie, now a part of Akamai – has the ability to add end-to-end security and secure application/data access that your employees desire and your business needs.

The opportunities for DeX outweigh the challenges. I am certain that most businesses have potential DeX users – employees who reluctantly carry around a laptop, or who have to come back to a location for their computing. They might be employees who use their phones for image capture and spend much of their time transferring photos to a PC to store them into a corporate system (such as an OH&S team member, or a repair and maintenance provider for a company). It could be a brand salesperson who spends time in various retailers or on the road but still need computing for product training, entering sales figures, and other administrative tasks.

If your business already offers Samsung devices to your employees, switching on DeX is a no-brainer. Start with a trial in a limited employee pool to determine the specific challenges and opportunities within your business. If you are already using virtual desktops, then this is the easiest way to start – roll out the app to your Samsung mobile devices and you have a ready-made portable computer in your employees’ pockets.

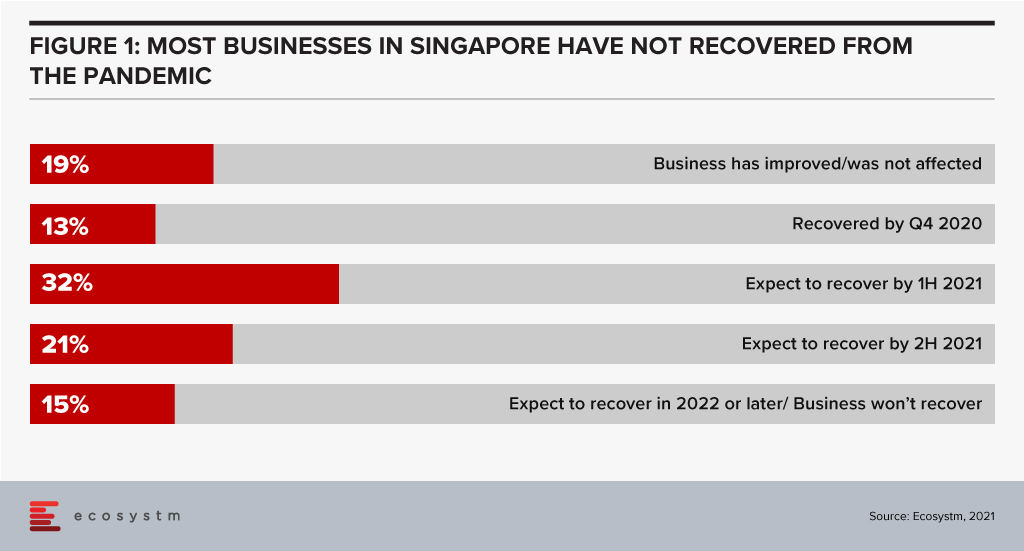

The past twelve months have been tough. Most businesses in Singapore (68%) still haven’t seen revenue recover to pre-pandemic levels. Many budgets are down and you are likely to have a long list of spending options that might help you grow revenue and pull your business out of the pandemic-induced slump. Even if your business is doing well, the pressure on budgets is real.

Increasing your CX Spend

Despite the pressure on budgets Ecosystm data makes a strong case to not cut your customer experience (CX) spend! Businesses in Singapore that are cutting their CX spend are less likely to return to growth, more likely to be competing on price (hence cutting margins), not focused on their digital and omnichannel customers, and have lower levels of innovation. Funnily enough, these are also the businesses with complex, legacy systems which need more focus to provide an improved CX! To be quite frank, businesses in Singapore who are cutting CX spend are setting themselves up for failure. With other businesses increasing CX spend, the gap between the customer experiences will grow to a point where customers will leave and it will be hard to catch up.

Prioritising your CX Spend

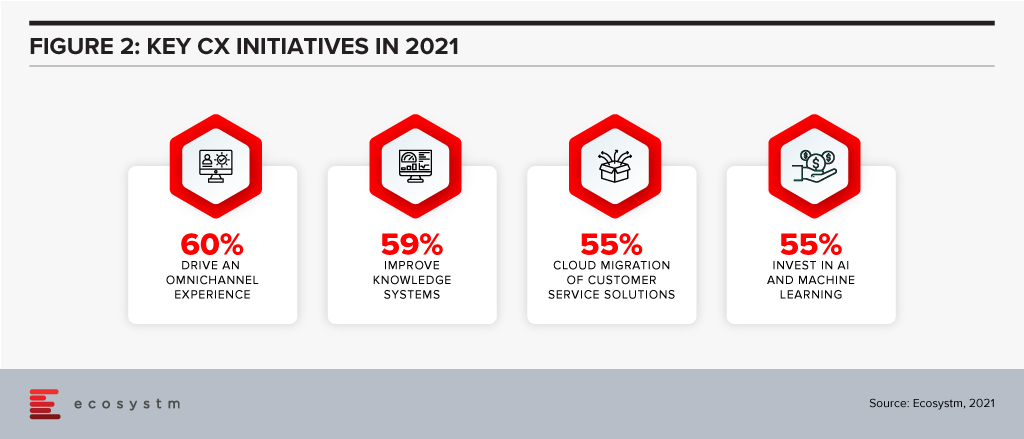

So now that you have secured your CX spend, where will you get the biggest bang for your buck? Let’s look at where businesses in Singapore are focusing their CX initiatives in 2021.

Offering an omnichannel experience. Your customers expect more than just a great digital experience – they want the right experience at the right touchpoint. The CX leaders in Singapore (who, unsurprisingly are often the market leaders) are already offering great omnichannel experiences, so this is quickly becoming about catching up – and not about getting ahead. Providing a consistent, personalised, and optimised experience across your digital touchpoints needs to be a top priority for your business today. If you are not offering conversational commerce solutions, start that strategy as soon as possible – you need to be where your customers are today. Extending this to physical channels and broader ecosystem partners should also be on your agenda.

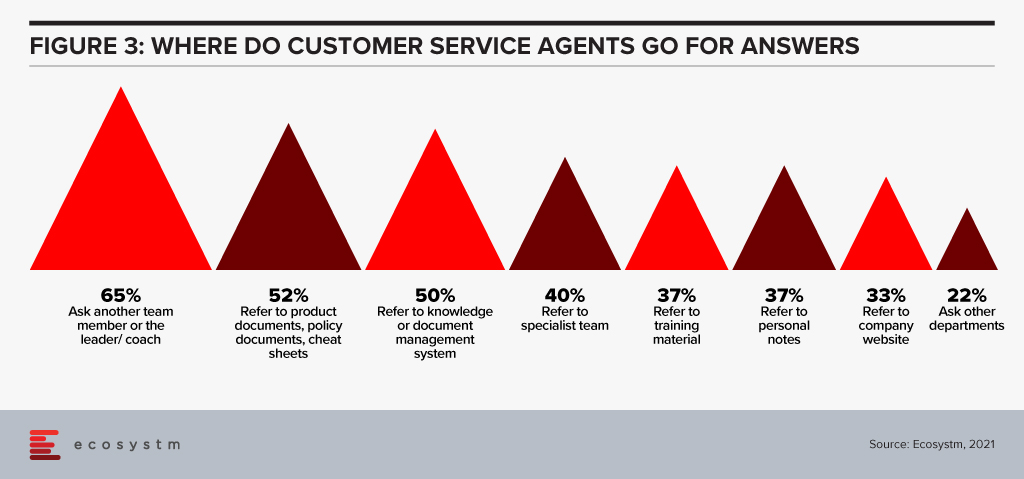

Improving knowledge systems. Your knowledge systems don’t do what they say on the box. They don’t provide answers to questions – for employees or customers. In fact, if your customer service agents get asked a question they don’t know the answer to, their number one source for answers is actually their colleagues or team leaders – NOT the knowledge management system! Start investing in systems – or ideally a single system – that help your employees get better, faster answers to questions. Make sure that the system is providing the same answers to both your employees and your customers across all touchpoints – physical and digital.

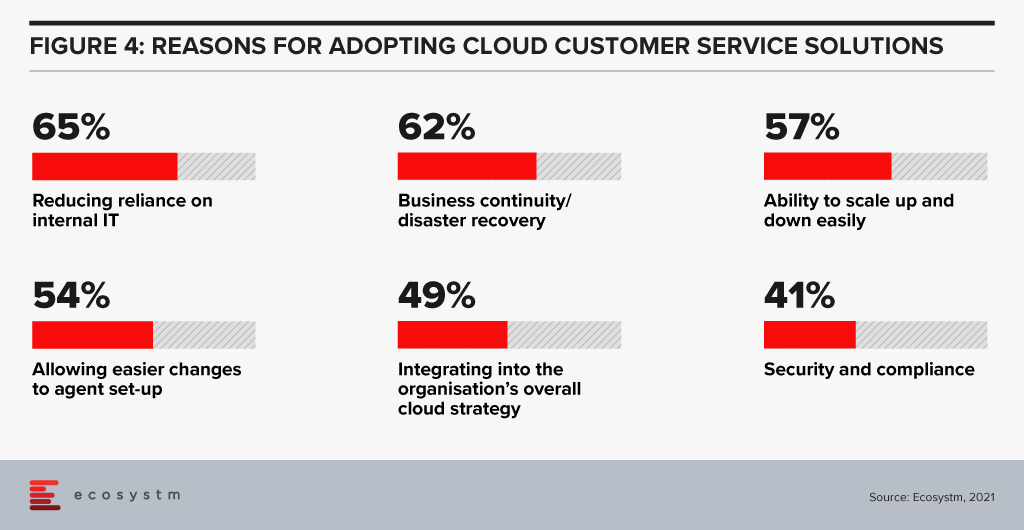

Migrating customer service platforms to the cloud. Over half the businesses in Singapore that we assessed have this as a top CX priority. Cloud solutions offer faster time to value, lower management costs, give access to more regular improvements and often provide the ability to easily integrate with partners who offer product extensions and customisations. This trend will continue in 2021 and 2022 as more businesses realise that their legacy customer service or contact centre platform is inhibiting their ability to innovate their customer experience. These systems also help businesses to stay compliant and reduce the reliance on internal IT – which has traditionally struggled to keep up with the fast-changing nature of the contact centre and customer service teams.

Investing in AI and machine learning. Many businesses are using AI to provide the personalised and optimised customer experiences they aspire to. AI and machine learning are allowing businesses to create personalised offers, offer a next-best action and automate services. Advanced banks in Singapore can create interest rate offers for each individual customer based on their credit profile and history. 46% of businesses in Singapore are already using AI to offer recommendations for customer service agents, 44% to optimise or test messaging and campaigns and 43% to provide faster, more accurate access to information and knowledge. 18 months ago, AI was a business differentiator – allowing your business to create a stand-out CX. Today AI is quickly becoming a standard practice – the battle now is around using AI to create personalised and optimised experiences.

A great customer experience will be the most important factor in lifting your business to pre-pandemic growth levels and helping your business remain competitive in today’s tough business conditions. When it comes to CX, there is no such thing as “saving your way to growth”.

Your opportunity to drive greater business success lies in your ability to better win, serve and retain your customers. Refresh your customer strategy and capability today to make 2021 an exceptional year for your business.

Much has been written (and discussed on webinars) about the demands of managing the work-from-anywhere experience. We were all thrown into this last year, and are still working our way through the challenges. For most employees it has been a positive experience – but there is still a lot more we can and should do to improve experiences for employees and their managers.

Workplace Analytics Gains Significance

At the start of 2020, my colleague Audrey William and I discussed the need for workplace analytics when predicting workplace trends for the year, but the pandemic delayed many of these investments. As working from home (or from anywhere) becomes a long-term trend, we are learning that managers need tools to better empower their employees to deliver what the business needs. There are many reports of employees working overtime; working longer days; not taking breaks; being in back-to-back meetings for days on end; skipping meals; and wearing themselves out.

There are many benefits of remote work – employees have the freedom to manage the day as they choose, they have no commute and (conceptually) more harmony between work and home duties. But there are also many processes that are harder. It is not as easy to find the right person to connect to or learn from, get the best information or answer to a question, and get coaching and new skills. Managers need to understand their employee work experience because they don’t sit with or supervise them all day. Self-service for employees used to mean walking around the office and having a conversation or meeting. Today, we need to make these outcomes easier for every worker regardless of location.

Microsoft Lauches Viva

Microsoft has announced the release of Viva – a new product suite to help businesses overcome these challenges. They have published a “Future of Employee Experience” video here as part of the launch – but don’t watch it – or if you do, be prepared to be disappointed when you see the actual products… The good news is that we have moved from oval-shaped phones in Future of Work videos in 2000 (because all web content is designed for round screens right?) to transparent phones in 2010 (who needs to be able to see what’s on the screen?) to virtual screens in Future of Work videos in 2021… Guess they’ll never become a reality either!

Based off the early reviews and commentary about Viva, I believe Microsoft is really onto a winner here:

- Managers need better analytics about how their team spends their days and employees need insights as to how to increase their productivity or find a better balance in their life.

- Employees need to find the people and information in their business to connect with and learn from – how often do employees reach out to others to ask for help or information when the answers they were looking for weren’t too far away. This information needs to be easier to find – even surfaced to employees before they go looking for it.

- Everyone in your business needs to keep learning within their flow of work – the formal training programs offered by most businesses today are useless if employees are too busy to take the course.

- Business leaders need to drive cultural change more effectively or support their broader business initiatives by linking employees with the information and insights that can help reinforce or change organisational culture.

Viva should support these outcomes. Microsoft is partnering with many other businesses to make this work (systems integrators, training providers, workplace and HR platforms etc). If the products deliver as promised, they might provide the missing link that many businesses need today to keep their employees safe, productive, happy and connected.

Learn about the factors that have been accelerating the shift towards the new ways of working. The top 5 Future of Work Trends For 2021 are available for download from the Ecosystm platform. Signup for Free to download the report.

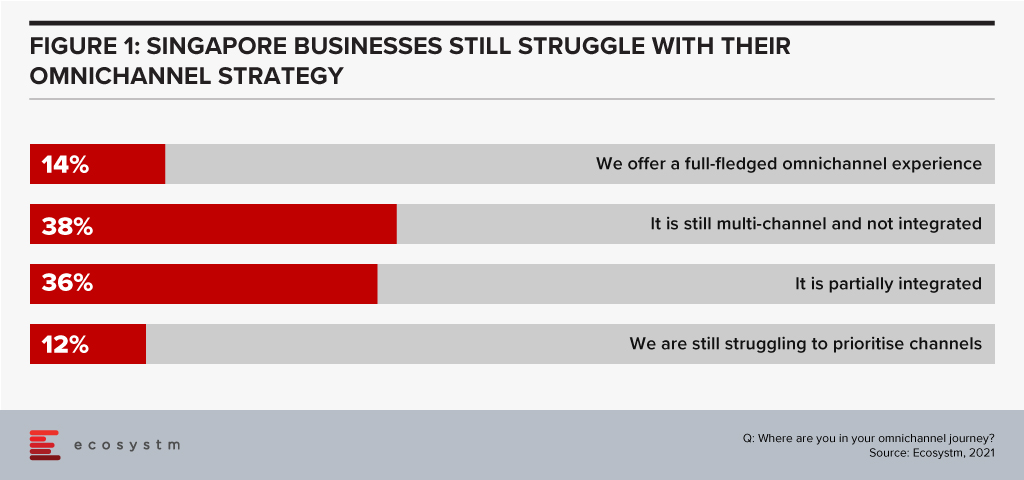

Customer needs are changing. Quickly. In 2020 having a great digital strategy went from being a nice-to-have to an absolute necessity. And in 2021, businesses that have great omnichannel experiences will go from a small minority to a majority as customers demand that they are served on their terms in their chosen platform. Only 14% of businesses in Singapore offer a complete omnichannel experience today – serving customers on their terms regardless of the location or platform (Figure 1). These businesses are setting the benchmark that the rest of the market needs to meet soon.

The Growing Importance of Social Media in Delivering Customer Experience

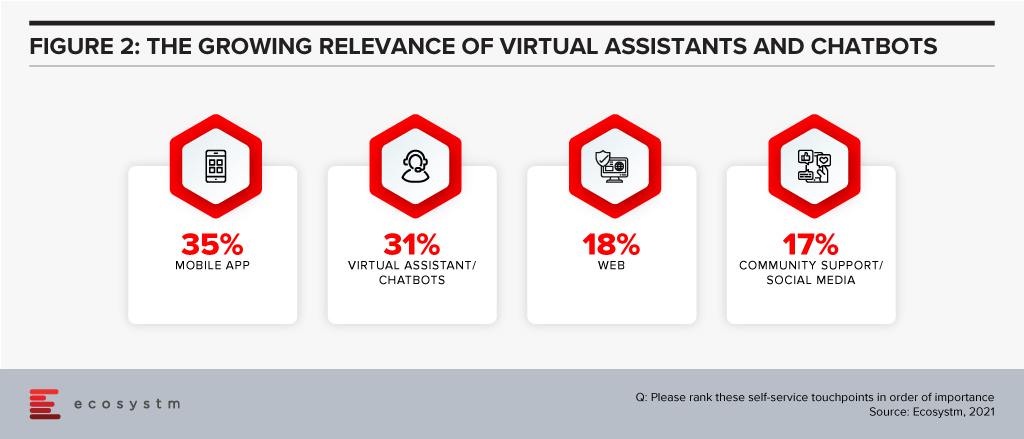

Chat and messaging are quickly becoming the normal way to interact with businesses – the view of a few years ago that “no one wants to chat with a bot” has quickly turned around. Now virtual assistants and chatbots are the second most important self-service channel for businesses in Singapore (Figure 2).

In fact, Zendesk’s global study shows that most customers (45%) use embedded messaging over social messaging apps (31%) and text/SMS (20%). That might be great for self-service, but for commerce, boundless opportunities exist to move to where the customer lives, communicates, and socialises today.

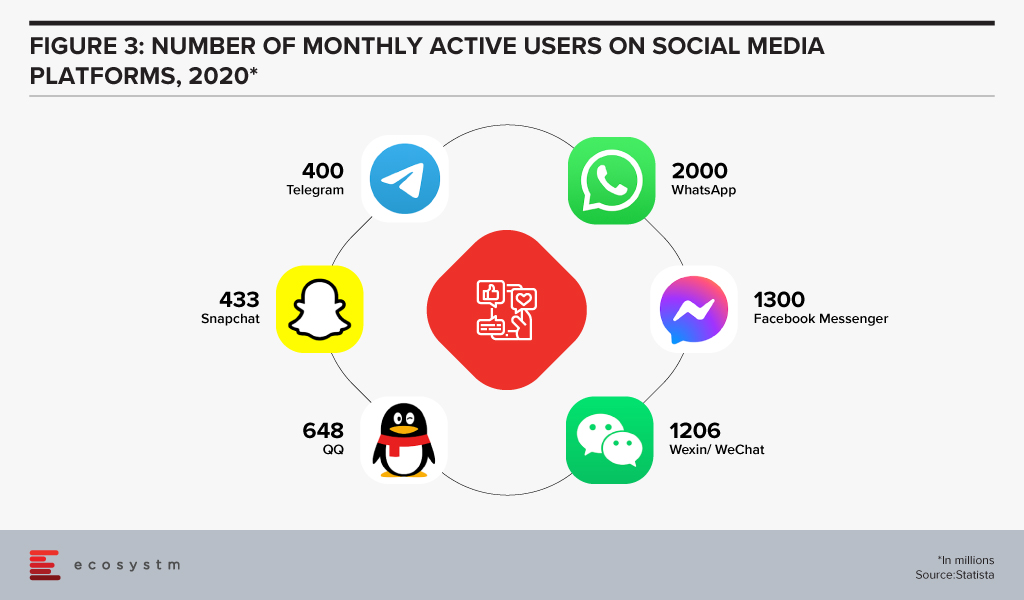

Smart businesses understand that customers spend their lives in other chat and social media platforms – such as Facebook Messenger, TikTok, Instagram, WeChat, Discord and WhatsApp. More customers expect to be served in these channels; they expect to be able to transact with their brands of choice. Why should they go to a mobile banking app to find their balance? Why can’t they get it in WhatsApp? They are often learning about the next Jordan or Yeezy shoe drop from their social network in Messenger – so why not transact with them there? Consider all your own personal WhatsApp, Messenger and other messaging platform groups discussing social activities, sporting teams, school activities or the latest fashion – these are ALL opportunities for commerce (Figure 3).

And there are use cases now. Airlines – such as KLM and Etihad Airways – are engaging customers on WeChat, Kakao Talk, and WhatsApp, helping them reschedule flights and answering customer service queries. Telecommunications providers are allowing customers to raise issues on messaging platforms – and are also using them to upsell and cross-sell new services. Transportation providers are making it easier to find a car or the the next scheduled bus right there in the messaging platforms. Retailers – such as 1-800 Flowers and Culture Kings – are not only serving customers but finding new customers on these messaging platforms.

Going beyond the messaging platforms, businesses are also looking to serve customers on their smart devices – such as Amazon Alexa/Echo and Google Nest/Home devices. Alerting customers to order updates, shipping details and product promotions is becoming standard practice for leading businesses. Digitally-savvy banks are allowing customers to not only track their balance but also make transfers and payments using these smart platforms.

Customers are more comfortable with these conversational commerce options – and they actually expect you to offer such services on your site, in your app, on their smart devices, and on their messaging platforms of choice. Your ability to provide outstanding customer experiences will not only be your ticket back to revenue growth but the recipe for long term business success. Meeting customer needs on their terms is a good place to start.

Delivering a Personalised Conversational Customer Experience

Customer experience (CX) decision-makers will have to rethink how they approach building richer CX capabilities to deliver personalised conversational interactions with customers.

Messaging should become part of a wider AI, Data, and Mobile strategy. Contact centre teams might feel that this is too ambitious a project and would prefer to continue to serve customers through the more traditional channels only. So, it is important to identify the key stakeholder/s who will drive the initiative. And the contact centre team should work with the Digital, Innovation and Marketing teams.

Designing the mobile experience and in app messaging for CX should have some of the following features:

- Ability to click a button to request for a service or escalate an issue that will, in turn, result in the company contacting the customer either by messaging or calling.

- Giving customers the option to contact through popular messaging platforms such as Facebook Messenger, WhatsApp, LINE, WeChat, and others. Unifying these systems in a single interface that integrates with your customer service application is best practice.

- Having one single interface to manage and make payments – within the app itself or on the social messaging platform. Conversational commerce is about creating an ongoing relationship with customers throughout the entire customer journey. Don’t just focus on the sale or the post-sales experience – customers expect to be able to interact with your business from their platform of choice regardless of their need or stage in the customer journey.

- Embed deep analytics into the communication services to help the organisation better deliver a personalised CX.

- Ensure you have a solid, unified knowledge management interface at the backend so that all questions lead to the same answers regardless of channel, platform or touchpoint.

Your opportunity to drive greater business success lies in your ability to better win, serve and retain your customers. Refresh your customer strategy and capability today to make 2021 an exceptional year for your business.