As the leader of the tech team, CIOs are working through many different strategies and initiatives to drive new digital initiatives and improve existing ones. They are often pulled into new initiatives by business leaders and have to make hard decisions on how to support a business that is increasingly digitalised.

But there are five initiatives that all CIOs should have on their list for 2022 as they will deliver impactful results quickly and will make future investments more manageable and reliable.

In 2022, these 3 technology investments will give you a fast start:

- AIOps. This will be an easy business case to build if you evaluate the benefits

- Hybrid Cloud Management. Even if your business is racing towards the public cloud, you will have some hybrid cloud services.

- Federated Data Management. Because your infrastructure and applications will be hybrid, your data needs to be too.

These strategic initiatives will also be crucial this year:

- Resolve technical debt. Improve architectures and increase agility.

- Improve Talent Recruitment and Employee Retention. Be aware that the “great resignation” is a reality

Click here to download 5 IT Initiatives to Jumpstart Your Digital Business in 2022 as a PDF.

Consistent customer and brand experiences should be at the heart of every digital strategy. In the first part of this feature, we explored the barriers to creating memorable customer experience (CX). Here we look at what organisations who have mastered the art of great CX have in common.

Best Practices

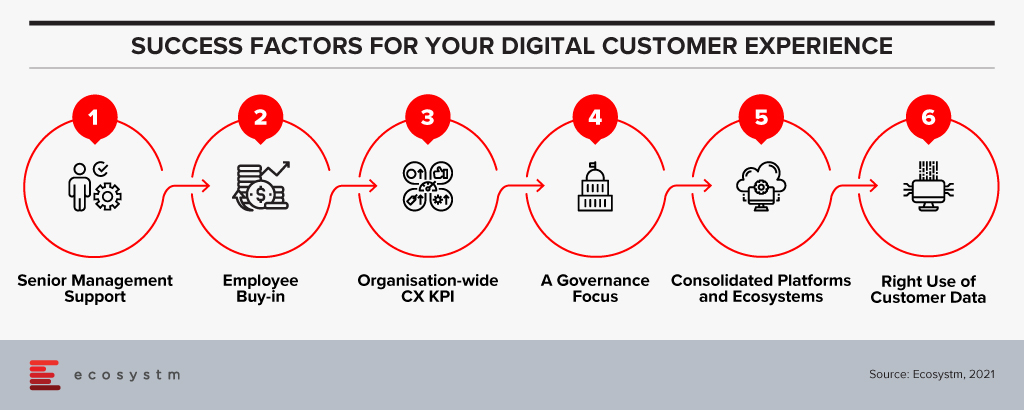

Through Ecosystm research and interviews with organisations we have found that businesses that are already creating a consistent, effective, and memorable digital customer experience have these traits in common:

Had CEO and Board-level support for their strategy. Your ability to create a memorable and consistent digital experience lives and dies by the support of your senior management team. Without the CEO telling the rest of the business that this is a priority, the employees simply won’t come along for the ride.

Gained Employee support for the strategy. There is no point in creating a digital customer strategy at the Board and senior management level if it is not consistent with the lived experience of employees. An Australian bank made the mistake of making all their digital experience decisions at the most senior levels without taking the employees on the journey too. Change needs buy-in from all levels of the business – so make sure all levels are heard and that they understand why and how you will change the way they work and deliver customer value.

Made the delivery of a brand-consistent experience into a key KPI. In these businesses, a consistent CX is a given. That doesn’t mean they are not personalising their customer experiences or optimising them for specific touchpoints – it means that collaboration with other teams and channels is a base expectation. Changes are not made without the knowledge of other teams.

Prioritised governance over management. The risk of collaboration and including many people in decisions is that it slows decisions down and impacts business agility. To enable their collaborative approach to digital experience delivery, these businesses have set rules and guardrails into their decision-making processes to ensure they continue to deliver on-brand and consistent experiences. Many also have created cross-channel teams or sewn their digital skills across the different channel teams to ensure consistency of customer experience.

Consolidated on fewer platforms and CX ecosystems. Five years ago, businesses needed to source smaller, more innovative CX software and cloud components just to keep up with customer expectations. The trendsetters had built their own CX capabilities and weren’t relying on the traditional ISVs for their CX innovation. Smaller providers were emerging to fill these gaps for businesses who were not digitally native. Sourcing best-practice solutions is much easier today. Some of those smaller vendors have emerged to create their own platforms and CX ecosystems, and other suppliers have acquired and innovated their own software to meet and exceed customer requirements. For example, you no longer need multiple content management systems or platforms – a single content source can now meet the different needs of your different channel teams and feed consistent content to all customers tailored to their journey stage or chosen touchpoint.

Used data for their customers – not against them. Many personalisation or automation attempts have failed. Not because they used the wrong data, but because they were driving the wrong outcome. They were designed to corner a customer into a decision, versus helping them make the best decision for their circumstance. We all know what that looks like – if an interaction feels “creepy” like they are following you around the web and across touchpoints, or they seem to know too much about you. This is when a business is using data against you to try to force an action. Smart businesses use data to help customers achieve their goals – in the knowledge that happy customers will not only return to the business or brand, but also tell their friends and family about the experience.

Creating a consistent and on-brand digital experience will drive many positive outcomes for your customers and your business. Your customers will know what to expect and be comfortable in their interactions with your brand in whatever channel or touchpoint they desire – with the knowledge that the experience will be consistent and integrated and their time will not be wasted. They’ll return to your business over and over again. The consistent experience will also drive down your costs – with less rework, fewer platforms to support, more automation and hopefully a simpler technology architecture. Done right, it will also create a single unifying digital initiative across the business that will help to break down barriers, improve collaboration, and unlock innovation in and between your business teams.

More than ever before you are having to cater to digital-savvy customers and create a competitive edge through the customer experience (CX) that you provide. In this two-part feature, I explore the barriers organisations face in their goal to create a memorable CX; and what the organisations that are getting it right have in common.

Spend on digital services, technologies, platforms, and solutions is skyrocketing. As businesses adapt to a new normal, they are increasing their spend on digital strategies and initiatives well beyond the increase they witnessed in 2020 when all customer and employee experiences went digital-only. But many digital and technology professionals I meet or interview maintain that their digital experiences are poor – offering inconsistent and fragmented experiences.

The Barriers

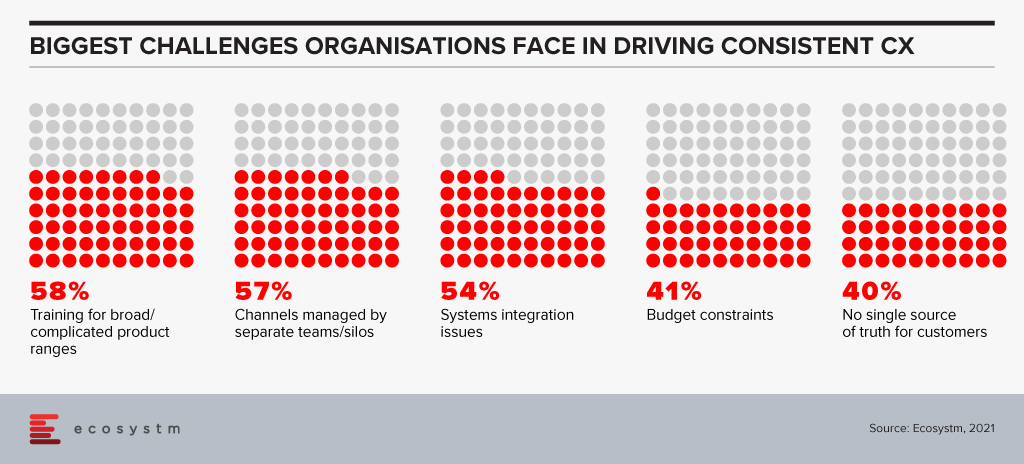

Digital, CX and tech leaders highlight their laundry list of challenges in getting their digital experiences to deliver a desired and on-brand customer experience:

A poorly informed view of the customer and their journey. Sometimes the customer personas and journey maps are simply wrong – they were developed by people with an agenda or a fixed idea of what problems need solving.

Inconsistent data. Too much, too little, or plain incorrect data means that automation or personalisation initiatives will fail. Poor access to data or lack of data sharing between teams, applications and processes means that businesses cannot even begin to build a consistent CX.

Too many applications and platforms. As digital initiatives took hold, technology teams witnessed an explosion of applications and platforms all conquering small elements of the digital journey. While they might be great at what they do, they sometimes make it impossible to create a simple and consistent customer journey. Some are beyond the control of the technology team – some are even introduced by partners and agencies.

Inconsistent content. For many businesses, content is at the heart of their digital experience and commerce strategy. But too often, that content is poorly planned, managed, and coordinated. Different teams and individuals create content; this content is then inconsistently delivered across customer touchpoints; the content is created for a single channel or touchpoint; and delivers to customers at the wrong stage of the journey.

Little co-ordination across channels. Contact centres, retail or other physical locations and digital teams often don’t sing from the same songbook. Not only is the customer experience inconsistent across different physical and digital touchpoints, but it may even be inconsistent across digital touchpoints – chat, web and mobile offer different experiences – even different parts of the web experience can be inconsistent!

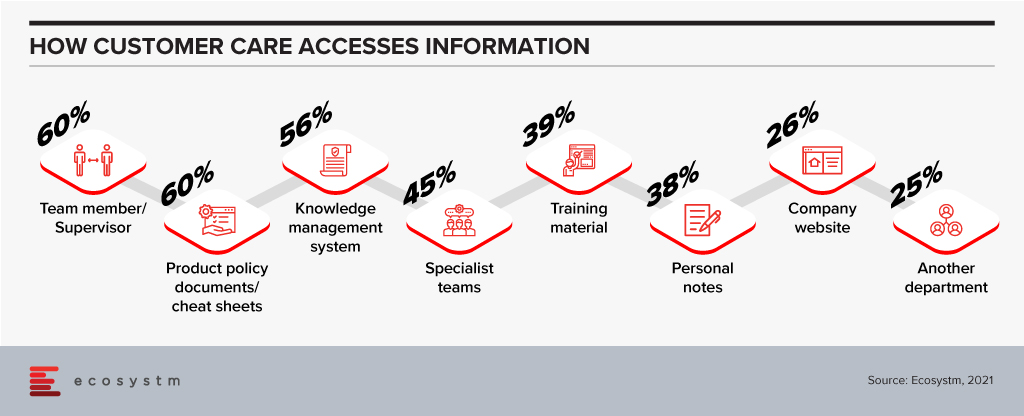

Knowledge is not shared between channels. Smart customers will “game” a company – finding the best offer across different customer touchpoints. But more often than not, inconsistent knowledge leads to very poor customer experiences. For example, a telecom provider might give different or conflicting information about their plans across web, mobile, contact centre and retail outlets; and with the increasing popularity of marketplaces, customers receive inconsistent product information when they deal with the brand directly than through the marketplace. Knowledge systems are often created to serve individual channels and are not trusted by customer service or retail representatives. We see this in Ecosystm data – when customer service agents are asked a question, they don’t know the answer to, the first place they look is NOT their Knowledge Management tool.

Poor prioritisation of customer pain points. Customer teams may find that it is easier to tackle the small customer challenges and score easy points – and just deprioritise the bigger ones that will take significant effort and require considerable change. Unifying the customer journey between the contact centre and digital is one big challenge that many businesses continue to delay.

And it gets worse… According to Ecosystm data, 55% of organisations consider getting board and management buy-in as their biggest CX challenge. This means that Chief Digital Officers, CX professionals and digital teams are still spending a disproportionate amount of time selling their vision and strategy to the senior management teams!

But some organisations are getting it right – creating a memorable digital experience that retains their customers and attracts more. I will talk about what is working for them in the next feature.

The term “intranet” won’t die. It should. I don’t think I have ever seen a good intranet in 24 years since I first started writing about business intranets in 1997 (yes – by writing about this market I was a part of the problem!). I’d even argue that there is no such concept as a “good intranet” – as it is an inherently flawed idea. An intranet effectively tries to bring together all the stuff that employees don’t access or don’t want to access and puts it somewhere that employees might actually use.

Intranets don’t help employees do their jobs

Why don’t we access these systems? Because they are generally not “core” to our jobs. Employees will find and access the systems and applications that are core to getting their jobs done – even if they are terrible to use (even in this “designed for humans, SaaS-world” there are still plenty of core systems that are terrible to use). Some companies try to integrate their intranet and core applications; making employees access the intranet to login to their essential apps. This might make life easier for IT responsible for deploying, managing and securing the applications. It also excites HR as they hope that along the way to accessing these systems, a “schmear” of company culture or information might rub off on them. But many employees quickly work out ways around these systems by bookmarking sites or using dedicated applications.

One of the reasons that company intranets are generally so poor is because they don’t actually help people do their job. There are often no guided processes or checklists to ensure follow through on tasks. Remember how many salespeople didn’t (or still don’t) use the CRM system because it didn’t help them actually sell? Well, intranets suffer from the same problem.

Some software providers looked to solve this problem by bringing the company intranet and core application together into a single interface. Salesforce has limited success with Chatter – but many users of Chatter spent much of their energy telling employees they “weren’t using Chatter the right way” – which sounds awfully like a design problem, not a user one.

Now is a good time to review your company intranet

Why now? Because the big collaboration players (Microsoft in particular) are improving their offerings in this space, creating partnerships, and painting a vision of a world where employees might actually WANT to access company intranets.

Which brings me to Microsoft Viva. We wrote about Viva when it was initially launched as a concept and businesses (and more importantly, their employees) can now experience the capabilities. Viva helps resolve some of the challenges with business intranets:

- It makes some of the collaboration systems more usable and insightful

- It actually provides outcomes for employees (through the learning module in particular)

- It integrates with existing processes and exposes these application-centric processes through Teams

At the same time, it is trying to be a “cultural change agent” by having a single place to go to view company news and announcements. This is similar to many company intranets, and like many of them, is likely to be an abandoned sideshow – the only time many employees visit it will be when they are forced to – like when the CEO sends an all-company email saying that there is an announcement on the company intranet that everyone needs to see. Which is the digital equivalent of posting you a letter to inform you that you have an email!

The challenge for Viva is that employees need to be using Teams to get the most out of it – and I don’t just mean “using Teams for chat and calling” but using the collaboration elements effectively – ALL the time. And the challenge with this is that (a) many employees don’t EVER use these features of Teams (or use them sporadically), and (b) some companies (and teams within companies) have multiple platforms for collaboration and sharing (Slack, Trello, Basecamp, Jira etc).

But either way, Viva looks like a positive step forward for collaboration – and more importantly, it gives businesses some guidelines on how to improve their existing intranet.

How to Make your Intranet work?

Integrate the work that people have KPIs on, with collaboration and intranet systems

Design processes so the intranet makes it EASIER for people to do their jobs – by removing unnecessary handing of information, copying and pasting, multiple levels of authentication and moving between many applications or screens. Leave requests or approving invoices have already been integrated into email – so managers can click a button in the email to send the approval. But what if there were a page on the intranet where all the leave requests or approvals for funding or payment were in a single spot? What if the system provided insight around these requests (such as Mary Singh only has 1 day leave left, or Company ABC takes 90 days to pay on average)? And if all leave requests could be approved with a single click, it actually makes the employees life easier.

Build processes into the systems to solve employee pain points

Many intranets are ostensibly used for helping employees find each other or find experts on specific topics. But they don’t guide this process – they just say “there’s lots of information here – use the search tool and good luck!”. Design guided processes for outcomes people actually want to achieve. Survey your employees to find out what they’d like the intranet to help them achieve – and build some employee journey maps across various roles to understand the challenges and pain points. If it makes sense, use the intranet to help resolve those pain points.

Make your existing tools more powerful and easier to use

Your employees generally want to collaborate. Don’t get me wrong – many don’t wake up each morning thinking that they’d love to share some documents with unknown team members today – but they do want to work together more easily than they do today. So take a look at what stops them from achieving this and look to solve those problems by making existing tools more powerful and easier to use. Adding analytics helps employees and their managers better manage their time and their interactions. Automating file sharing and discovery will help employees find the information they need without adding additional work for the content creator.

Businesses need to think of their intranets as “places to get things done”

Too many intranets seem to be designed for 4pm on Friday afternoon versus 9am Monday morning. And if this is yours, then don’t be surprised that employees don’t use it that often or give it little time. The more you can use an intranet to make employees lives easier, the more likely that you will be creating a resource which improves the productivity and happiness of the employees you serve.

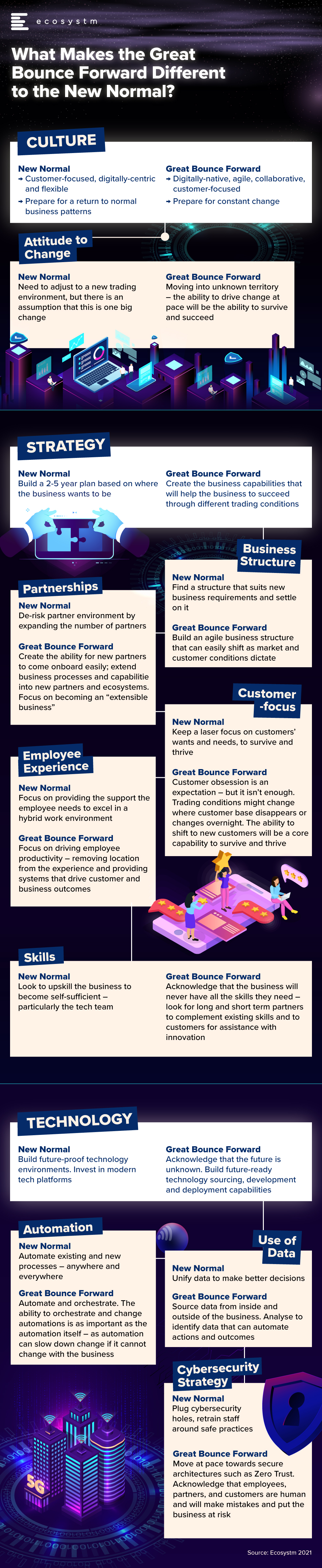

One of the main questions that I have faced over the past week, since I wrote the Ecosystm Insight – Welcome to the Great Bounce Forward – is “How is this different to the “New Normal”? Many have commented that the concept of the Great Bounce Forward is more descriptive and more positive than the term “New Normal” – but I believe they are different, and require different strategies and mindsets.

This is a brief summary of some of the major differences between the New Normal and the Great Bounce Forward. I look forward with excitement and some trepidation towards this future. One where business success will be dictated not only by our customer obsession, but also the ability of our business to pivot, shift, change and adapt.

I can’t tell you what will happen in the future – a green revolution? Another pandemic? A major war? A global recession? Market hypergrowth? All the people living life in peace? Imagine that…

What I can tell you is what your organisation needs to do to be able to meet all of these challenges head-on and set yourself up for success. And to me, that won’t look like the new normal. There is nothing normal about these business capabilities at all.

Customer Experience teams are focused on creating a great omnichannel experience for their customers – allowing customers to choose their preferred channel or touchpoint. And many of these teams are aware of the challenges of omnichannel – often trying to prise the experience from one channel into another. Too often we create sub-optimal experiences, forcing customers to work harder for the outcome than if they were using other channels.

I know there have been times when I have found it easier to jump in the car and drive to a store or service centre, rather than filling in a convoluted online form or navigating a complex online buying process. I constantly crave larger screens as full web experiences are often better than mobile web experiences (although perhaps that is my ageing eyes!).

One of the factors that came out in a study conducted by Ecosystm and Sitecore is that customers don’t just want personalised experiences – they want optimised experiences. They want to have the right experience on the right device or touchpoint. It is not about the same experience everywhere – the focus should be on optimising experiences for each channel.

We call this “opti-channel”.

Use an Opti-Channel Strategy to Guide Investment and Effort

This is what you are probably doing already – but by accident. I suggest you formalise that strategy. Design customer experiences that are optimised for the right channel or touchpoint – and personalised for each customer. Stop forcing customers into sub-optimal experiences because you were told to make every customer experience an omnichannel one.

The move towards opti-channel accelerates your ability to provide the best experience for each customer, as you ask the important question “Does this channel suit this experience for this customer?” before the fact – not after the experience has been designed. It also eliminates the rework of existing experiences for new channels and provides clear guidance on the next-best action for each employee.

There Will be Conflict Between Opti-Channel and Personalisation

The challenge for opti-channel strategies will be to align them to your personalisation strategy. How will it work when you have analytics driving your personalisation strategy that say customer X wants a fully digital experience but your opti-channel strategy says part of the digital experience is sub-standard? And the answer to this lies in understanding the scope of your experience creation – are you trying to improve the existing experience or are you looking to create a new improved experience?

- If you are improving the existing experience, then you have less license to shift transactions and customer between channels – even if it is a better experience.

- If you are creating a new experience, you have the opportunity to start again with the overall experience and prove to customers that the new experience is actually a better one.

For example, when airlines moved away from in-person check-in to self-check-in kiosks, there was an initial uproar from customers who had not yet experienced it – claiming that it was less personal and less human. But the reality is that the airlines took the check-in screen that the agents were using and made it customer-facing. Travellers can now see the seats and configuration and select what is best for them.

This experience was reinvented again when the check-in moved to web and mobile. By turning the screen around to the customer, the experience actually felt more human and personal – not less. And by scattering agents around the screens and including a human check-in desk for the “exceptions”, the airlines could continue to optimise AND personalise the experience as required.

Opti-Channel Opens Many New Business Opportunities

Your end-state experience should consider what is the best channel or touchpoint for each step in a journey – then determine the logic or ability to shift channels. Pushing customers from a chatbot to web chat is easy. Moving from in-store to online might be harder, but there are currently some retailers looking to merge the in-store and digital experience – from endless aisle solutions to nearly 100% digital in-store. Some shoe and clothing stores offer digital foot and body scans in-store that help customers choose the right size when they shop online. And we are beginning to see the rollout of “magic mirrors” – such as one retailer who has installed them in fitting rooms and you can virtually try different colours of the same item without actually getting them off the shelf.

Businesses are trying to change customer behaviour – whether it is getting them into stores or mainly shopping online or encouraging them to call the contact centre or to even visit a service centre. Creating reasons for why that might be a better option, while also providing scaled-back omnichannel options is a great way to meet the needs of existing customers, create brand loyalty and attract new customers to your company or brand.

As economies around the world are beginning to recover from the recessions and slowdowns caused by the pandemic, we are beginning to witness, what I like to call, the “Great Bounce Forward”.

Why the Great Bounce Forward? Because too many businesses, journalists and economists are talking about businesses “bouncing back”. But there is no bounce back. We are bouncing into the “economic unknown”. The trading conditions we see today are nothing like what they were at the beginning of 2020. While many people refer to the “new normal” I have heard few talks about how they are or will benefit from these new market conditions.

Bouncing back may not be relevant as we negotiate the economic unknown – it is time to evaluate how we can bounce forward!

Leaping Ahead Through Digital First

Customer interactions have changed – digital-first is now a requirement – and many customers expect a personalised and optimised experience. Many companies are starting to personalise experiences today – thinking they are “delighting customers” through personalised transactions and journeys. But you don’t delight customers by giving them what they want – you disappoint them if you don’t offer a true personalised experience.

Digital changes are coming thick and fast. For example, Australia Post has announced that online sales are currently 20% higher than what they were at the previous highest peak in December 2020. Yes – much of Australia is in a lockdown, but online sales are dwarfing what they were during lockdowns in 2020.

But it is not just about offering online sales. In the digital world, customers now expect to be able to track packages, get alerts when they are delivered, and have access to easy and free returns. Again – if you don’t do this today, you are creating poor customer experiences and are most likely losing business to those that offer great experiences.

Here is what organisations are witnessing:

The need to evolve their CRM solution. Salespeople expect the CRM to give them insights on who to sell to, why to sell to them and what approach will work best. CRM systems that don’t provide this analysis are letting businesses and salespeople down.

Analytics has to be turned into actions. More businesses are telling their analytics partners to stop telling them what to do, and just do it! Automating the outcomes of BI and analytics is beginning to be expected.

Ease of use has become essential. Interactions and processes need to be intelligent and easy to automate. We no longer throw teams of people at challenges – we automate the outcomes and use technology to deliver entirely new experiences without teams of employees pulling strings behind the scenes.

Process and technology changes happen quickly and seamlessly. We have been taught this by Zoom, Microsoft, AWS and Google. If you aren’t doing this today, you are behind the market and behind the expectations of your employees and customers.

Ecosystems are emerging to enable this agility and innovation. We can now innovate with a growing range of partners. Companies can partner for a single sale and move on. Start-ups are being embraced by dinosaurs, and competitors are becoming partners. More companies than ever are involving their own customers in their innovation processes. Ecosystems are changing the ability of technology and business teams to offer new and improved services to customers and employees.

Time for a Shift in Organisational Culture

Seemingly, the world changed overnight. But many of these changes have been in the works for years. It just took a global crisis to highlight how important they are and how much organisations need to change to embrace these opportunities. The only thing holding businesses back from thriving in the Great Bounce Forward are their people and culture. If you can embrace these changes, your businesses will move forward and emerge as different companies to the ones that entered the pandemic in early 2020. You’ll be more open, agile, innovative and digitally aware. You’ll be able to move in new, unheralded directions, driving improved customer, shareholder, or citizen value.

So stop thinking about how your business will bounce back. Make plans for it to bounce forward into the unknown.

As a technology analyst – primarily focused on how businesses use tech-based solutions to improve the customer and business outcomes – it is important to look across to the consumer tech world every now and then. Consumer trends end up driving many business technology initiatives. To that end, I keep one eye firmly on the mobile device segment – as consumer devices are the same devices that end up in businesses (as BlackBerry discovered the hard way!).

Samsung Device Launch

Samsung just launched their third generation of foldable devices – the Galaxy Z Fold3 and Galaxy Z Flip3 (both 5G devices). The VERY clear message that Samsung gave through the pre-launch content and launch event is that foldable devices are no longer a niche segment. Samsung expects them to go mainstream over the next 12-24 months. They made some significant changes to the pricing and availability of their new devices to get them into more stores and retailers, to put them in front of potential buyers. They also reduced the prices by 15-20% (although they are still premium devices). By adding pen support to the Z Fold3 they indicated that this is their new “hero” device – (allegedly) taking the place of the Note series in Samsung’s line-up.

Samsung has made changes to make the phone more acceptable to the mass market – making it more durable, introducing IPX8 water resistance, improving speaker and sound quality, improving the brightness of the screens, and removing the “camera hole”. But some of the biggest changes have come in the software. They provide an experience that is designed for the larger screen – not just taking the existing content and stretching it. They have also taken an idea from Samsung DeX and introduced the ability for all apps to be stretched to the larger screen. While this is not a perfect solution, it works pretty well in the DeX world – and I’ll reserve my judgement on the Z Fold3 until I have some hands-on time with it.

The Z Flip3 appears to be targeting iPhone owners along with premium Android device users. The price is very similar to the iPhone 12, and it is a well spec’d device with a large screen but a small form factor when folded. It needs to rely less on software to make the form factor usable but has a few tricks that will appeal to teenagers in particular (such as the ability to do a video call with the phone partly folded).

Samsung Should Witness Strong Growth of these Devices

So will we see more foldable phones over the next twelve months? Samsung has gone a long way to (a) get more foldable phones into the hands of consumers, and (b) make that experience one that they recommend to friends and family – which was an issue with previous generation devices. Consumers who tend towards the “hero” device will be more tempted by this phone than ever before. Some previous Samsung Galaxy Note move to the Z Fold3 – others to the Galaxy S series. We will even see some Apple users make the switch towards Samsung to take advantage of the big screen on the Z Fold3 or the smaller form factor of the Z Flip3. Every iPhone user who is also carrying an iPad is a target for the Z Fold3 – they are (a) used to spending a lot of money on a device (b) already lugging around a lot of hardware.

So while it will be a slow burn to get the penetration of foldable devices higher, I believe Samsung has got close to the sweet spot. And while I don’t expect Apple will release a foldable device this year, if Samsung is successful, we can expect their development efforts to ramp up for a future device next year. And maybe it won’t be what we expect (maybe a foldable iPad mini?). But as batteries get smaller and more powerful, flexible screens get more durable and demand for larger screens continues, it feels like the opportunity for foldable devices will only continue to grow.

Enterprises Need to Prepare for Foldable Devices

This is important to enterprises:

- Users with foldable screens will be your customers – they will expect an experience that takes advantage of the extra real estate. This might be a shopping app that has the items on the left and the cart on the right, or a transport app that has a map on the right and information about the transport services on the left; and

- Your employees will bring these foldable screens into your business – and you will want them to use their devices to help them do their job better than they do today.

As discussed in my previous analysis when the original Fold was released – any employee that uses a tablet now could be a potential foldable device user. These might be truck drivers, warehouse employees or information workers. There may be an opportunity to save money and buy just one device for your employees – not two. Or there may be a business case to improve the user experience with a foldable device.

Samsung Should Seed the Foldable Developer Space

My advice to Samsung is to seed the development of Android apps that take advantage of foldable devices. Put a fund together that developers can access to improve the performance and experience of apps on foldable devices. Also, share knowledge between developers on best practices and shortcuts to make it easier to take advantage of this extra real estate. And understand that creating an app that works well on foldable devices is not a one-off activity. Microsoft originally gave money to app developers to create apps for Windows Mobile devices – but these apps were never updated and soon looked dated compared to their iOS and Android counterparts. So provide continued funding until the percentage of foldable devices reaches a tipping point and developers are incentivised to create apps for foldable devices because a significant proportion of their customers own foldable devices.

Over the past year we have seen global systems integrators (SIs) – Accenture, IBM, Deloitte, Fujitsu, Capgemini and others – make many acquisitions, particularly in the public cloud, AI, cybersecurity and data space. Much of the growth in spending over the past few years have been driven by these categories: in 2020 if a software company was purely or mainly SaaS, they are likely to have witnessed strong growth. If they were on-premises software, they were lucky not to see declining revenues. While it is normal for the larger SIs and consultants to play catch up through acquisition, it is becoming harder for them to gain traction in these new areas.

Technology Shifts Drive Market Fragmentation

With every technology-driven business change new SIs, consultants, and managed services providers emerge. It happened with the move to big ERP systems, the move towards Business Intelligence, the emergence of SaaS etc. But I think we are now seeing something different. More than just the smaller players going after opportunities earlier, I believe we are seeing a changing buying behaviour from tech and business buyers – a greater willingness for larger enterprises to give their most important, business-critical strategies and implementations to smaller, less established players.

And I am not suggesting that the larger SIs are not performing well. Many are growing at 10-25% YoY – but at the same time, many are also growing at a slower rate than the markets they play in. The Ecosystm RNx for global IT services and consulting providers shows that the global providers continue to power ahead. But they need to adapt to changing market conditions.

New Cloud/AI Partners Winning Consulting and Implementation Deals

We have seen a new community of partners emerge with tech changes, such as the hyperscale cloud platforms and AI/machine learning tools. Traditionally, these companies would be good at one thing – and would learn slowly. For example, in the SAP ERP growth period, the projects were large and long. A single, mid-sized SI might only be working with 2-3 clients at a time. Therefore, the IP that they collected was limited – and they would find themselves with focused or niche skills. The large SIs had done many large, long projects across the globe and had much best-practice IP to call upon, giving them a broader and deeper knowledge of the technology and industries. Smaller providers had limited IP and industry experience.

But in this cloud and AI era, specialist providers work on hundreds of smaller projects with dozens or hundreds of clients. With the technology constantly evolving, the skills are constantly improving. While the global SIs are working on many cloud and AI engagements, they are often part of longer engagements – giving the consultants and tech teams less exposure to the new and evolving cloud platforms.

In a world where technology is changing at pace, the traditional global SI practice of “learning from peers across the globe” doesn’t happen at the pace the market requires. By the time your peers in the business have completed a project, documented it, and shared learnings, the market has moved on and technology has changed. Today it is easier and faster to learn directly from the tech vendors and cloud platform providers and their training partners. The network effect of knowledge in a team on the opposite side of the globe for a global SI is less valuable to clients. Often the smaller and mid-sized SIs have a deeper, broader knowledge of the technology platforms and toolsets than the larger providers – giving them a competitive advantage. For example, if you want the actual experience of moving SAP to Azure, or Oracle to AWS – you’ll often find the smaller providers have more experience. And this continues to play out. In many markets in the world, the top 5-10 SIs for cloud, AI and cybersecurity has a high proportion of local specialist providers.

Tech Buyers No Longer Look for Culturally Aligned Partners

Tech buyers themselves are changing too. In years gone by, the smaller tech partners would tell us that they felt they were included in bids to drive down the price from the global SIs. But today the story is different. Smaller partners are admired for their agility and innovation. Large enterprise customers will choose small providers because the small SI is NOT like them. In the past, they chose the global SI because they were just like them!

Because of this, the large SIs are mopping up their smaller competitors across the globe. Accenture has acquired 40 companies in the past 10-11 months, IBM has acquired over 10, Atos and Cognizant have also acquired many companies in the past 12 months. They are doing this for the skills as much as for the clients, along with getting a foothold in a new market or strengthening their position in geography. The challenge will be to hang on to the clients, culture, and the IP of the acquired business. Often these smaller competitors are growing at a significant pace – and the biggest risk is that the acquiring company takes their eyes off the prize.

Global SIs Still Own the Industry Play

Despite these challenges, one of the areas that the global SIs will continue to dominate is the industry play. I have discussed how as technologies mature, industry plays become more relevant.

Smaller and mid-sized SIs and consultants find it hard to create deep pools of expertise across multiple industries. While some may have a deep focus on a single or two industries, only the large players have broad and deep geography and industry experience. This puts many of the acquisitions into context – the global SIs will take these acquisitions and use that deep and broad technical and business knowledge and add it to their industry knowledge to create a more compelling offering.

Their challenge will still be one of cultural alignment. As discussed, many companies seek out tech partners who represent what they want to be, not what they are. The ability for the Global SIs to retain the culture, agility and innovation of the acquired business will determine their ability to continue to see similar or improved levels of growth from the acquired business. Using their IP in the context of industries will be the key to their ongoing success.