Innovation is often fuelled by the evolution of technology, which unlocks greater potential for businesses. Artificial Intelligence (AI) is often considered the trendiest of today’s emerging technologies, viewed as the real enabler of innovation. Many businesses are adopting AI and investing in AI-based solutions. However, every emerging technology faces the same stumbling block – trust. AI has been no different and despite the growing adoption, not everyone is ready to jump on the AI bandwagon yet.

The other major stumbling block for AI has been the inability of the common man to grasp the implications of the technology and differentiate it from what has been depicted in Science Fiction and dystopian novels. There is also confusion in the mind of technologists on the definition of AI. Some experts will say that only Deep Learning with non-linear algorithms is AI, while most vendors promote their automation tools like AI. A few misconceptions have hence arisen regarding AI, its uses and its impact on the workforce and society.

#1 AI is a new technology

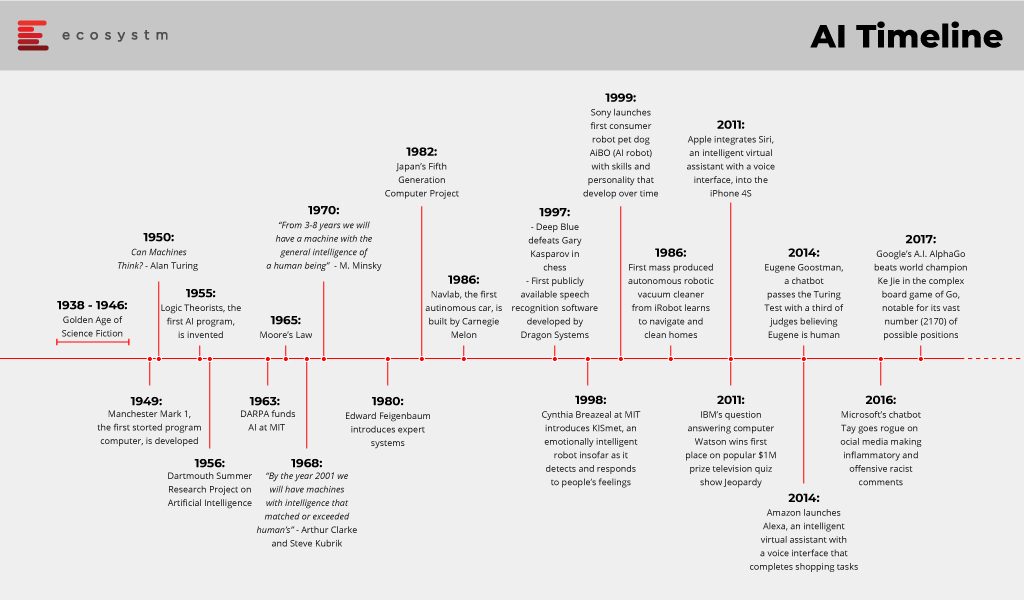

Despite recent hype around the technology, AI is not a new technology and not a product of this century’s innovations. The beginnings of AI can be traced to the middle of the 20th century and then it gained pace. During the second world war, an English mathematician and computer scientist, Alan Turing documented his ideas on creating an intelligent machine. Turing’s test theory proposed that if a machine could engage in full conversation with no detectable variances from a human, the machine could be deemed as a thinking machine. Turing worked to crack the German military’s encryption, the ‘Enigma’ code.

Later in 1956, American computer scientist John McCarthy organised the Dartmouth Conference, where the term ‘Artificial Intelligence’ was first used.

Today, AI is a much broader term and refers to a range of technologies from Automation to Deep Learning.

#2 AI can replace the human brain – completely

Humans have evolved over millions of years from being hunter-gatherers to agricultural societies to a modern-day man who can succeed in secondary and tertiary industries. We have adapted, evolved and became good at surviving in the real world. Despite this many people hold an opinion that AI will replace the driving force of one of the most complex machines on this planet – the human brain.

AI has clearly come a long way. Its ability to learn vast amounts of data, recognise patterns, and produce results is improving us in countless ways. However, the problem with achieving true AI is also its greatest strength – that it does not learn like a human. The technology behind AI is scientific and complex and building a competitive AI from scratch requires expensive specialised talent. For instance, a successful image recognition solution is more accurate than most humans, but the same coding cannot address another type of problem.

AI cannot replace a complex structure of neurons and humans will continue to use their intelligence for more innovation. Humans do and will continue to, play a major role in most AI applications, especially critical ones in research and medicine. Each of our innovations has made the race more productive, and that is what AI will further add to the human race.

#3 AI poses a threat to security & privacy

While the benefits of AI and Big Data technologies are being felt, people also consider them as a threat to their anonymity and privacy.

With online social accounts, digital identities and other digital data gathering entities – both private and government – privacy has become a pertinent question. With the emergence of sophisticated AI systems, these privacy concerns have been aggravated. AI brings the ability to fetch, combine, and analyse a huge quantity of data from varied sources. The impression is that AI can perform these designated operations with no supervision and there is fear that humans will lose control of a system entirely. Instances of data and privacy breaches heighten this fear.

This fear may be unfounded. Today, AI systems can simplify user privacy policies on websites, which most of the users do not bother to read and simply click on the ‘Accept’ box. Polisis is an AI-powered automated analysis tool for privacy policies. Polisis pulls a website’s privacy policy and takes around 30 seconds to interpret it, display a summary, and present a flowchart of the policy with highlights on how the online service will handle user data. An AI-powered chatbot called PriBot, answers questions about the privacy policy of any company.

In reality, AI technologies are being utilised to create a safer and more secure society. AI brings speed, scale, and automation to computing and is changing the way we work, live, and interact. We are guiding AI capabilities for better healthcare provision, citizen safety, research accuracy, and even enhanced cybersecurity. Very often, the data used by these algorithms are aggregated and anonymised.

#4 AI will replace jobs

There is an abundance of fear, uncertainty, and doubts about the risk and opportunity of AI. Will it create jobs or destroy them?

There is no doubt that AI is poised to transform jobs and will change the face of employment. It is easier to see existing jobs disrupted by new technology than to envision what new jobs the technology will enable. AI is poised to replace tasks, not jobs. Some functions – and sometimes all the functions – of an individual or team might be automated. Employees with no plans or desire to re-skill should be concerned, but those who are continuously improving and changing their skill sets need not be too concerned that automation will put them in an unemployment queue.

“While businesses will face pain, as they adjust to new lower cost and higher productivity expectations – and employees will need to continually update their skills – the overall assessment is for jobs growth. It is just that the jobs created will be different to the jobs that exist today”, as Tim Sheedy (Principal Analyst, AI & Automation, Ecosystm) puts it in his report Automation Will Transform Jobs – Plan for Change Now

Read Report – https://www.ecosystm360.com/#/link?type=report&id=155b38c6-3764-4715-a9ad-1ec6447260ac

A few businesses today are creating Automation Teams or Centres of Excellence – banks, telecommunications providers and utilities are leading this push. With continued effort, AI will eventually become intelligent enough to understand the tasks and make them easier for the workforce. Employees need to trust, use and maximise the full potential of the technology, and see its benefits for scaled implementation.

The NAB Cloud Guild is a good example of how organisations should provide training to not just technology staff but to any interested employee, on emerging technologies to equip their business for future demands.

#5 AI is implemented only by large vendors

AI is driving many Digital Transformation (DX) projects and large vendors, especially with platform and enterprise capabilities, have had the first movers’ advantage in AI deployments. Businesses are striving to make their systems more intelligent for better process automation and customer retention. After 40 years of automating manual tasks using enterprise applications (such as ERP, SCM, and CRM), intelligent systems will make many of these systems redundant – or at the least reduce business reliance on them.

One of the big challenges for large businesses – and their IT teams – today is to customise their AI to their organisations’ DX requirements. Many companies have made their first foray into the world of AI – often starting with technologies such as RPA, IoT sensor analytics, and chatbots. They are now looking to go beyond evolving their RPA solutions into Smart Process Automation (SPA) solutions. They are also going beyond basic chatbots/ virtual assistants to implement NLG and semantic computing, as their customer focus deepens. For these large enterprises, integration of AI solutions with internal systems and other AI solutions is the key challenge, and they often prefer to partner with their existent enterprise vendor or systems integrator for their AI implementations.

However, smaller organisations and start-ups are equally leveraging AI. Several tech start-ups also exclusively focus on AI and are developing a niche, industry-specific solutions. These smaller solution providers will probably be integrated into larger vendors’ partner ecosystems, as their capabilities deepen, and their customer base grows. Organisations need not look to only larger, established vendors for their AI implementations.

AI is still an emerging technology and it might take some time for AI to be trusted. The truth, however, is that AI opens up immense possibilities for individuals, enterprises, and governments.

Do the supposed threats outweigh the benefits of AI? We would very much love to hear your suggestions, ideas, and thoughts on this subject.

Apple and Intel have signed an agreement where Apple will acquire Intel’s smartphone modem business for a deal valued at $1 billion. Apple will gain Intel’s Intellectual Property, equipment, leases, and approximately 2200 Intel employees will join Apple.

The deal is Apple’s second-largest ever after its $3.2bn purchase of Beats Electronics in 2014. The deal is expected to close at the end of the year and Intel will continue to develop modems for non-smartphone applications such as industrial equipment, autonomous vehicles and personal computers.

What Apple has really acquired from Intel?

Beyond getting 2,200 employees from Intel’s modem group along with the accompanying 17,000 patents, Apple now has the intellectual property to develop a modem that can be integrated with Apple (system-on-a-chip) or SOC.

Commenting on Apple’s acquisition of Intel modem business, Ecosystm Executive Analyst, Vernon Turner said “given its performance-driven and highly vertically integrated product line, Apple had its own ambitions to build its own modem. However, despite being capable of building chips, Apple lacked the knowledge to build a modem. To solve that issue, it would always have had to license patents from a 3rd party, unless they buy the company that has the patents instead.”

Aligning with the fifth generation

The acquisition of Intel modem business displays Apple’s ambition to ramp up on 5G technology. The foothold in the 5G modem business is also expected to reduce Apple’s reliance on Qualcomm, its modem supplier. Speaking of the competition, Apple’s global rivals in the handset business – Samsung Electronics and Huawei – already produce their own modem chips.

“Apple has a lot of catching up to Samsung and Huawei in the 5G modem market, and while it has now gained technology from Intel, there is still a significant gap and it will be a haul for Apple to suddenly catch up and overtake them,” said Turner. “Apple’s modem supplier, Qualcomm isn’t likely to be worried by this news either – it too has a lead of several years. The bottom line is that Apple didn’t have a lot of options to turn too if it wanted to be in control of as much of the phone IP stack as possible. It purchased a modem supplier that was perhaps the weakest in the market and had already thrown in the towel on their mobile modem business.”

Apple will take some time to absorb the Intel team into its business and likewise with the modem roadmap. The deal is a step in Apple’s journey to make all of its own smartphone chips and having a more self-sufficient supply chain.

At the 7th Personal Data Protection Seminar, Minister for Communications and Information S. Iswaran announced a framework to bolster Singapore’s digital economy and to drive Singapore’s vision of turning the country into a regional data protection hub.

The Personal Data Protection Commission (PDPC), which oversees the country’s Personal Data Protection Act (PDPA), has developed a new framework to better support organisations in the hiring and training requirements of Data Protection Officers.

Why the Need?

PDPA has been around for a while and the new framework is brought into practice to enable a greater focus of government and organisations on data privacy. According to Ecosystm’s expert on GDPR and Data Privacy, Claus Mortensen, “the initiative reflects the difference between ‘theory’ and ‘practice’ when it comes to data security. PDPA is not making changes to the present regulatory framework, but they are putting together a program and guidelines for how companies can apply and abide by the present regulatory framework.”

Ensuring PDPA framework compliance

The PDPC plans to collaborate with the National Trades Union Congress (NTUC), Employment and Employability Institute (e2i) and NTUC LearningHub to create a year-long pilot training program to train at least 500 data protection officers in its first intake. The Data Protection Officers would help to manage the complex and highly sensitive task of data flows.

To ensure the data flow mechanisms and to ensure security, Infocomm Media Development Authority (IMDA) has been appointed as Singapore’s Accountability Agent (AA) for the Asia-Pacific Economic Cooperation (APEC) Cross Border Privacy Rules (CBPR) and Privacy Recognition for Processors (PRP) Systems certifications. IMDA will allow Singaporean organisations to be certified in APEC CBPR and PRP Systems for accountable data transfers.

“The PDPA requires a data protection officer to be appointed in every organisation. This framework is focused on educating and certifying these officers. However, it mostly makes it easier for slightly larger companies who can afford to send employees on longer training programs or who are able to hire people, who have taken the certificates. Smaller organisations – such as start-ups – would benefit more from detailed guidelines and from on-premises guidance. Establishing a framework for such services could be the next area of focus for the PDPC.” said Mortensen.

Legislature for the data handling and exchange practices

The private data has become an increased target of hackers as well as an international commodity. Attackers always mine the cyberspace for any leaks or financial information that they can exploit to their advantage.

“Managing sensitive data is notoriously complicated – especially for ‘legacy’ companies that still have or rely on non-digitised data. Even when all data is digital, employees may have copies on their PCs, they may have partial backups on removable media, some data may need to be shared with sub-contractors, moved around between cloud providers, etc. This can make it very difficult to map out PDPA relevant data in the organisation. Even when the data has been mapped, it can be difficult to ensure that all business and data processes are compliant. This is where on-premises guidance can make a difference,” said Mortensen. “While the government clearly aim the new framework initiatives at helping SMEs, it will help further protect consumer’s sensitive data.”

Importance of Cyber Security

A business harnessing digital technology can’t afford to gamble with sensitive data and rising cyber-attacks. The government is taking initiatives by forming guidelines and regulations to prevent cyber-attacks, but it is the responsibility of businesses to have a cybersecurity strategy in place to prevent a breach. If a business becomes a victim of hacking, it is perceived as a failure to the company.

The government passed the PDPA law and compliance to ensure that businesses understand the importance of cybersecurity. Therefore, every business, organisation or academic institution must ensure compliance with the data protection act and must have security best practices to safeguard the data of its customers.

The nature of the workplace has changed over the years and so has the number of devices being used by today’s employees. More and more organisations are adopting a ‘Mobile First’ strategy – designing an online experience for Mobile users before designing it for the desktop/ Web. This is a paradigm shift from the past, where enterprises modified or adapted their websites, business processes and digital means of communications, to fit Mobile users.

Mobile First Drives the Adoption of UEM

Mobile First application designs take into consideration that Mobile users are constantly on the move. Information needs to be presented to them on smaller screens/displays with multi-media interfaces (voice/video), and multiple network connectivity options (Wi-Fi, cellular, and so on).

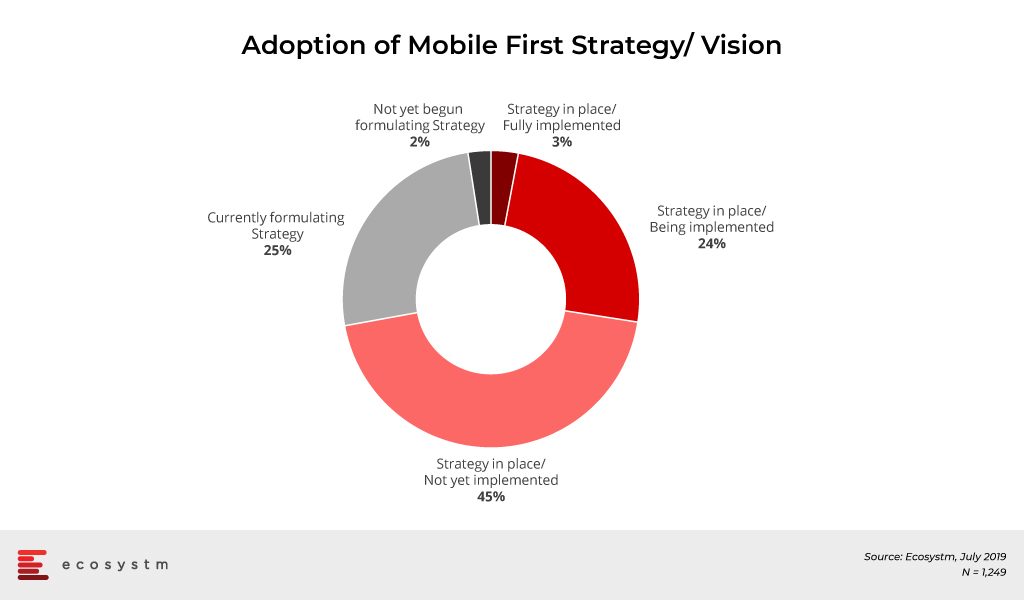

The global Ecosystm Mobility Study reveals that 73% of organisations have a Mobile First Strategy in place and are at various stages of implementation. About another 25% of organisations feel the need for a Mobile First vision and are formulating a strategy.

With Mobile First strategies, organisations are adding a wide range of devices and operating systems (OSs), regular innovative mobile-centric workload rollouts, new mobile apps across multiple functions, and IoT initiatives. As a result, organisations now have the need to support multiple devices and endpoints (including IoT sensors and wearables) multiple OSs, applications, and mobility policies such as BYOD. Organisations struggle to manage these devices, their data, apps and software updates across heterogeneous OSs and platforms. “The way companies are growing and fuelling their teams with devices now, shows the trend that these organisations will follow in the next few years, which will require a higher level of sophistication from the Unified Endpoint Management (UEM) solutions in the market,” says Amit Sharma, Principal Advisor, Ecosystm.

How does UEM Help?

An UEM solution can configure, monitor and manage multiple OSs, devices including IoT sensors, and gateways, and

- Unify application and configuration

- Manage profiles

- Monitor compliance

- Enforce Data Protection policies

- Provide a single view of multiple users

- Collate data for Analytics

It can ease the burden of management activity of internal IT teams and allow organisations to create a more streamlined lifecycle that secures mission-critical technology. It can also offer proactive threat monitoring, access control and identity, and patch management.

A good UEM solution provides IT managers with a transparent and traceable overview of all endpoints within the network as well as the power to manage all connected devices from a single platform. It maps out the network setup and structure by carrying out a complete inventory of all network devices, configurations, installed software, and the drivers for endpoint subsystems.

There are simply too many endpoints within Industrial IoT (IIoT) for IT managers to efficiently monitor manually. Mistakes will be made, and opportunities to stop breaches before they escalate will be missed. “An UEM solution not only shows the software and licensing situation but scans the IT environment for any irregularities or vulnerabilities and allows risk assessment and patch installation where it is necessary”, says Sharma. “Providing IT administrators with automated vulnerability management will enable them to filter and set search criteria by device, security vulnerability and threat level for the higher and most timely degree of protection.”

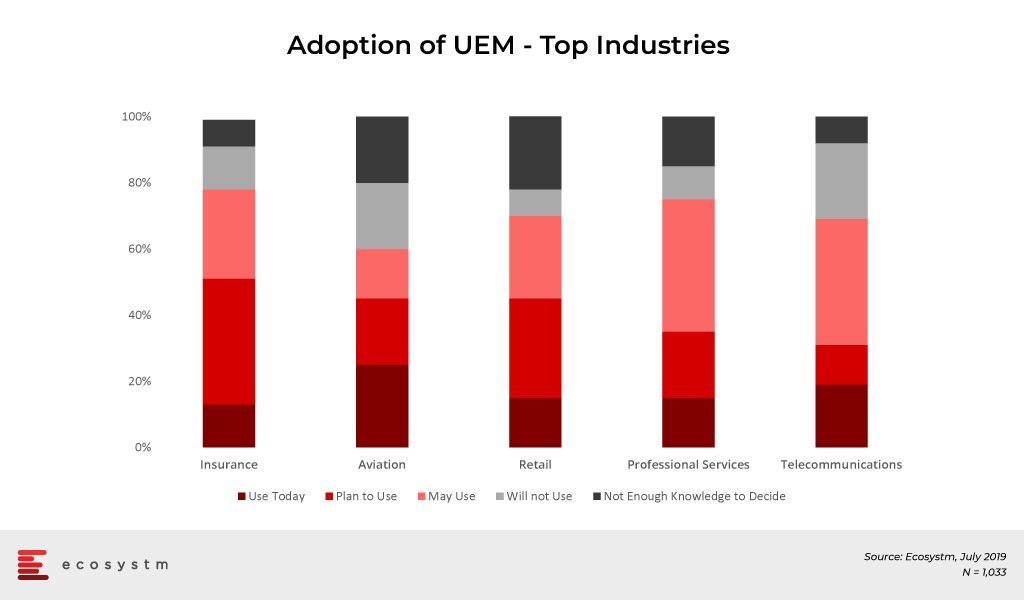

Industry Adoption of UEM

Customer-focused industries, with mobile workforces, are adopting UEM faster than other industries. The global Ecosystm Mobility study found the top industries that have implemented UEM or plan to in the near future. Most of the top industries cater to a high percentage of mobile workers. Their need to adopt UEM can come from different angles. According to the study, the Telecommunications industry leads in Mobile Content Management (MCM) adoption, and mobile apps for logistics and operations appear to be the key driver for the industry uptake of Mobile Applications Management (MAM).

Other industries to look out for in the future are Banking and Healthcare, as they lead the pack when it comes to MDM adoption. Banks are incorporating technologies, such as mobile banking, and enabling payments via smartphones to provide enhanced services to customers. We have also seen the advent of Smart Point of Sale devices which are managed remotely on cloud infrastructure and these millions of devices will also be required to be managed by the banks that issued the devices.

The healthcare industry is another vertical where we can expect a higher uptake of UEM in the coming years. Clinicians and care providers are increasingly mobile, switching from device to device, depending on the task and location. Accessing mHealth applications and patient data from any device securely enables caregivers to focus on patients and outcomes. It also allows them to complete critical tasks from any device whether they are on call or off work. UEM makes HIPAA, SOC 2 and other healthcare regulation compliance easy for the providers.

Challenges of UEM Implementation

User experience must be at the centre of any mobility initiative. If the device, app management, or content is not something users want or are able to use, then it simply will not be adopted. The success of an UEM solution lies in the ability of users to quickly authenticate and gain seamless access to corporate apps and data from their devices. Users should also have access to self-service tools that help them manage basic device features and troubleshoot problems quickly.

“We can expect most Enterprise Mobility Management (EMM) and MDM suites to migrate to complete UEM suites that manage personal computers, mobile devices and Internet of Things (IoT) and Enterprise of Things (EoT) deployments,” forecasts Sharma. “Organisations should look for a purpose-built UEM solution which is platform-neutral and which cultivates a thriving ecosystem of complimentary mobile solution providers.”

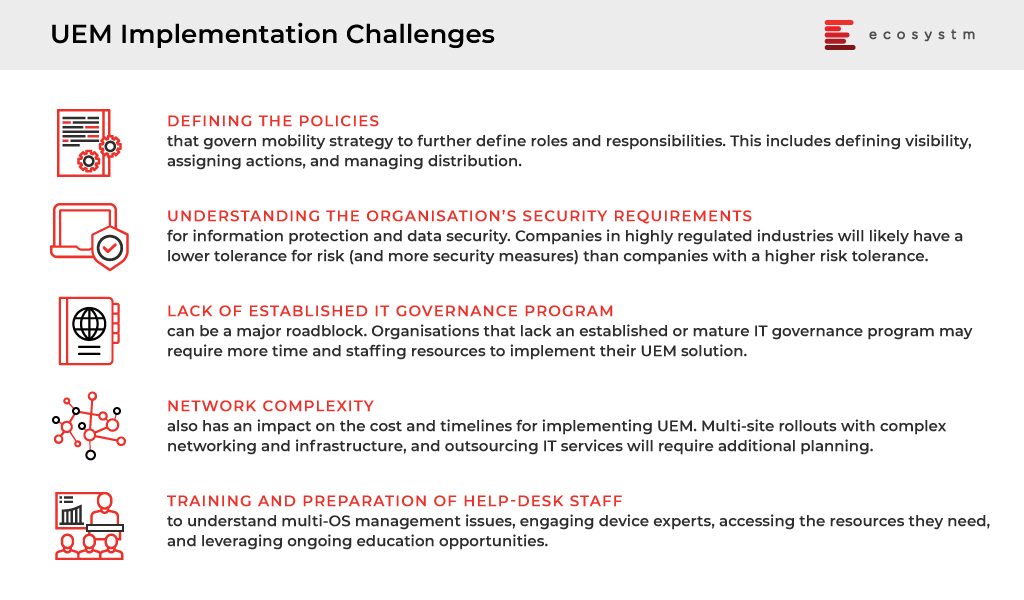

However, there are several challenges that organisations face when they are developing and deploying an UEM solution. Sharma lists the top UEM implementation challenges that can be broadly classified into the following five categories.

“As AI finds its way into mobile devices and virtual personal assistants proliferate in offices and boardrooms, IT admins will have to manage more – and more sophisticated – endpoints. AI will continue its push into mobile hardware and enterprise communication devices, challenging IT shops’ EMM capabilities while at the same time offering potential security benefits.” Sharma adds. “Also, in 2019, voice-activated assistants such as Amazon Alexa and Cisco Spark Assistant will find their way into more corporate offices and conference rooms – becoming yet one more enterprise device encouraging the adoption of an UEM strategy.”

Have you adopted an UEM strategy in your organisation yet? Share your experience with us in the comments section.

Cisco is on a mission of market acceleration, market expansion, and new market entry points.

On 9th July 2019, Cisco announced it’s intention to acquire Acacia Communications in a deal worth USD2.6 billion. Acacia communications make optical interconnect technology and is an existing supplier to Cisco. This was Cisco’s biggest acquisition since its USD3.7 billion purchase of AppDynamics in 2017. Acquiring Acacia will enable its customers to drive more data over high-speed optical interconnect and the company is also looking to take advantage of the company’s optics, digital signal processing, transceivers and other gear used in networking equipment. The deal is expected to close in the second half of Cisco’s current fiscal year following which Acacia will become Cisco’s Optical Systems business.

In June 2019, Cisco announced that they will acquire Sentryo – a French industrial IoT company. The acquisition of Sentryo’s platform will combine their capabilities with Cisco’s offerings in order to better manage the challenges that customers face while deploying IoT projects, scaling production, and managing and securing infrastructure.

Similarly, in February 2019, Cisco acquired Singularity Networks – an analytics platform. Cisco has integrated Singularity Networks platform into its Cross Network Automation portfolio, a solution that embraces multi-vendor networks.

In 2018, Cisco completed the acquisition of a cybersecurity firm, Duo Security for USD2.35 billion and also announced that it will acquire Luxtera, a semiconductor company, for USD660 million which was fully acquired in Feb 2019.

Cisco’s underlying strategy

As technology evolves so quickly, new ideas can come from anywhere and its companies are always on the lookout for business models which may shape their future markets and direction.

“While we saw an acquisition and merger strategy by media companies to acquire content companies, the same holds true for Cisco but from the perspective of network traffic data management. Cisco’s response to this is to buy companies that will ensure that Cisco’s network performance can scale for the predicted massive amount of IoT-based data from smart cities, 5G, Industry 4.0 and of course A.I,” says Ecosystm Executive Analyst, Vernon Turner. “Having stronger network and application performance analytics also feeds into its broader Intent-Based Networking strategy which recently has been extended to include Edge network devices as well as the Enterprise based devices.”

Cisco has established a highly structured innovation strategy consisting of 5 pillars – build, buy, partner, invest and co-develop – to drive its innovation engine.

Turner commented “Cisco has always based its network strategy on architectures and frameworks. This compliments CIO’s strategies on how to build a multi-cloud based infrastructure and they will look to Cisco for a single solution provider. Application and device management are the topics that companies generally don’t like to farm out to multiple vendors.”.

Market Gaps

Despite all the growth and acquisitions, there are still areas that Cisco can look at, in order to further strengthen their position.

“The market is looking for full end-to-end solutions to manage devices, their network and application data traffic, security across multi-cloud service providers and communication services providers. Cisco has to look to companies such as VMware, and RedHat to take the discussion to levels such as container and bare metal server management. In addition, there are emerging needs within software-defined networks that will require Cisco to consider further acquisitions,” explains Turner.

It can often be difficult to keep track of assets and transactions in a business, and that is where Blockchain is unleashing its potential. It is revolutionising enterprises with its shared ledger technology. There are numerous, and specialised, use cases of Blockchain but the adoption is nascent in most industries. There are a few early adoption use cases of Blockchain, however, which have the potential to replace traditional systems and processes.

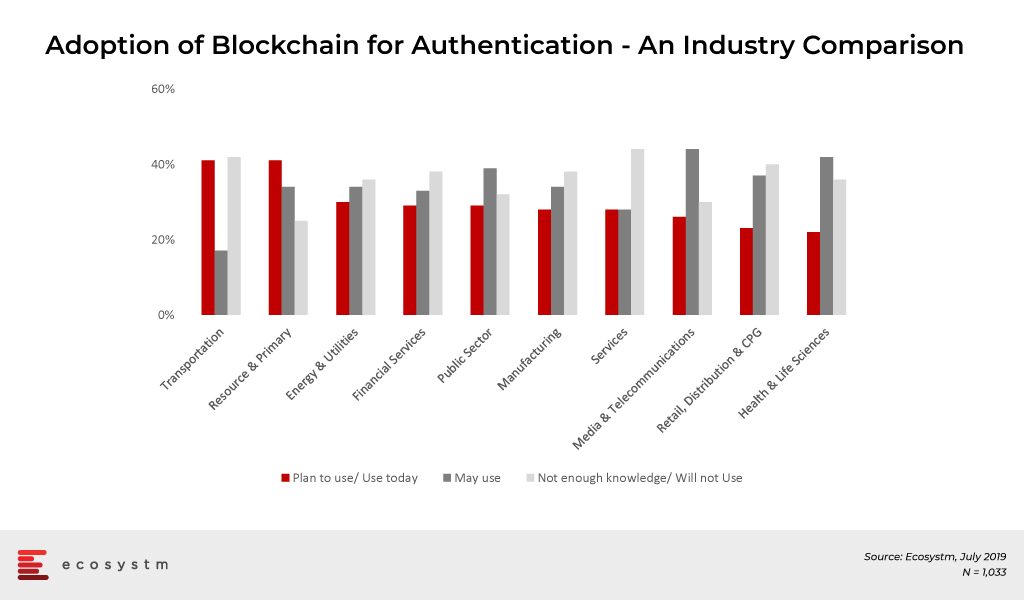

In the global Ecosystm Mobility study, organisations are asked about the adoption of Blockchain as a means of authentication. Industries that appear most open to Blockchain adoption are those that have also embraced IoT for tracking and traceability.

Adoption of Blockchain for Authentication – An Industry Comparison

Across industries Blockchain technology is being used primarily for these use cases:

Supply Chain Traceability

Supply chain traceability allows producers, retailers, and consumers to track products from source to consumer. It connects all points in the supply chain, creating transparency and trust in the product. When a business comprises complex processes, a large and dispersed workforce, multiple locations and different operations, a lot of administrative and regulatory frameworks are required to manage and control the supply chain. Functions such as order management, procurement, import, delivery, tracking, and invoicing have their own unique set of requirements and processes. In several cases, especially across primary and retail industries, business complexity has been reduced with the use of Blockchain. The technology allows for improving digital assets and inventory tracking for better services and processes.

Blockchain is ensuring food safety by providing a complete view of the supply chain and creating a real-time trail of products – allowing a ‘farm to fork’ view. Walmart is a good example of how retailers can use Blockchain technology to ensure that they sell fresh produce. Fresh produce shipments can be tracked as they change hands from the farmers to the middlemen, to the distributor and finally to the store. This can have an enormous impact on containing food-borne diseases and food contamination. Not only does Blockchain increase food safety, it ensures fresher food since it secures production and packing dates.

Intellectual Property Intermediary (IPI), an organisation established under Singapore’s Ministry of Trade and Industry, is an affiliate of Enterprise Singapore and focuses on technology innovations in the industry that can empower enterprises to develop new processes, products, and services. IPI has identified Blockchain Technology for Food as an area where the industry can benefit from innovation. The ecosystem will also benefit from the information gathered, with the potential to further improve the production chain.

Fraud Prevention

Taking supply chain visibility a step further, Blockchain technology is being used for fraud prevention – especially payment fraud. Financial transactions are complex and involve multi-step processes and human intervention – involving collaterals, settlement, currency denominations, third-party mediation, and so on. It is often the prime target for fraudsters. The most common instances of fraud involve bank to bank transactions, mobile payments, and digital identity fraud, essentially by tampering with ID or using it an unsanctioned way – providing unauthorised access to digital systems and falsifying information.

Blockchain helps automate preventive measures enabling real-time information sharing which is transmitted on a chain of connected devices where all the nodes in a system verify the transaction. Since it stores the data on several nodes and every other user on the network has a copy of the entire data on the Blockchain, it is virtually impossible to hack or destroy it completely.

Earlier this year, Standard Chartered Singapore showcased their cross-border trade finance transaction which digitalises trade processes and financing documentation. Blockchain enabled the transaction between parties by digitally streamlining the documentation process while providing security and transparency between the partners. Not only does it support the clients’ entire supply chain, but it also creates a transparent way to provide same-day trade financing.

Non-profit organisation BitGive Foundation uses Blockchain technology to provide greater visibility to their donors into the receipt of funds and how they are used by sharing financial information and project results in real-time. The GiveTrack project is built on Bitcoin and Blockchain and is a user-friendly, data-centered and comprehensive user interface. People making donations can precisely track the donations and how the funds were used.

Legal & Compliance

In industries that have higher Compliance & Regulatory requirements, Blockchain can enable safe, secure, and scalable data-sharing. The industry is seeing instances of self-executing contracts, smart registries, secure and time-stamped documents with Blockchain. Blockchain is introducing abilities to record events for a long duration which might include indisputable claims, criminal records, case procedures to support the potential legal work.

Dubai launched a city wide blockchain strategy. Dubai Land Department is implementing blockchain to make property transactions secure, transparent and immutable, thereby reducing fraud and eliminating reams of physical documents. This impacts the entire ecosystem – customers, developers, the land department, utility providers, payment channels, and municipalities – to work in collaboration.

Shipping companies that need to enforce global contracts daily are also benefitting from Blockchain. However, the biggest use cases will eventually come from the Public Sector – across citizen services and criminal justice systems. For instance, National Stock Exchange of India (NSE) is testing Blockchain e-voting facilities. The project is still at the pilot stage and aims to tokenised voting which makes it easy to conduct test and audit for the votes. This allows the regulating authorities to access real-time data, and at the same time, provides means to audit the regulators.

Cybersecurity

73% of global organisations believe that a data breach is inevitable, according to the Ecosystem Cybersecurity Study, and only 18% of them use some form of tokenisation and other cryptographic tools. Blockchain technology offers several capabilities in mitigating cybersecurity risks and detecting and combating cyber attacks. For example, Blockchain can be used to prevent DDoS attacks, and crypto secured biometric keys can replace passwords providing robust ID authentication systems, more secure DNS and decentralised storage. Blockchain implementation can also prevent man-in-the-middle (MITM) attacks by encrypting the data in transit so it is not manipulated during the transmission or accessed by unauthorised parties – thus maintaining data integrity and confidentiality.

Lockheed Martin, a US security company, is implementing Blockchain into their protocol. The company is enhancing Blockchain cybersecurity protocol measures in engineering systems, supply chain risk management, and software development. This includes researching on expanding on Blockchain capabilities protect their weapons development unit and make it incorruptible.

eGovernment initiatives will also benefit from Blockchain. The biggest stumbling block for providing eservices has always been cybersecurity, where the Government cannot be sure that the citizens are able to access their own records in a secure manner. It has always been a question of responsibility and liability – is the Government liable for a data breach that happens because of a citizen’s fault? Estonia is using Blockchain to protect their digital services such as electronic health records, legal records, police records, banking information, covering data and devices from attacks, misuse, and corruption.

Customer Experience

The ultimate benefit of Blockchain will be realised when it is used to enhance Customer Experience (CX). It brings transparency in doing business, gives on-demand data visibility and fosters trust in customers. A company that shows all transactions between the company and the customer, and in a secure manner, can create a better relationship, increase overall customer satisfaction and retain their customers in a competitive market. For example, Blockchain technology can allow more secure and transparent loyalty programmes, through token creation that can be redeemed on-demand, without customer service intervention. Singapore Airlines’ KrisFlyer structures their payments and loyalty programme with Blockchain. Their digital wallet enables members to convert KrisFlyer miles into KrisPay miles instantly to pay for their purchases at partner merchants. The users can pay through an application by scanning a QR code at a merchant’s location .

Customers will increasingly look for ease of use and security in their transactions. Bank of America has filed a patent for Blockchain powered ATM, for securing records and authenticating business and personal data. This will boost the transaction rate and facilitate various transaction experience with full encryption and security. Blockchain-enabled transactions can be registered and completed with greater easy while lowering the transaction costs for customers and keeping the network safe.

While Blockchain technology is continuing to evolve for a range of applications and industries, it comes with its own share of risks. Adoption should not be based on the hype around the technology but should be evaluated carefully. The starting point should obviously be a real business needs analysis.

Speak with an expert today to evaluate whether your organisation can benefit from Blockchain.

To drive its digital transformation initiatives, the Government of New Zealand recently published a roadmap ‘Growing innovative industries in New Zealand: From the knowledge wave to the digital age’, which outlines the strategic objectives of the Government to uplift and drive innovation for the country’s industries. The policy is focused on achieving a sustainable and productive economy for the country. The central elements for the plan were developed in consultation with all the key industry players and include the ideas necessary for transitioning the economy.

The Government will primarily focus on four significant sectors for its Industry Transformation Plans: food and beverage, agritech, forestry and wood processing, and digital technologies. For this, the government will work with businesses, workforce, and Māori to determine the best path towards to achieve their goals.

Agritech Industry Transformation Plan

New Zealand’s agritech sector spans across a range of technologies including genetics, information and communications technology, machinery and equipment, including robotics. The government is working with industry body ‘Agritech NZ’ and other relevant entities to draft a strategy and action plan for agritech transformation in New Zealand. The objective is to support production, drive innovation and increase exports for New Zealand’s industry.

Commenting on the NZ’s digital transformation Ecosystm Principal Advisor, New Zealand-based Jannat Maqbool, said “the agriculture sector needs to focus on innovation in order to compete and thrive as global trends and consumer demand presents challenges in feeding the growing global population. Investment in programmes driving investment in technologies and related initiatives to boost innovation and productivity in the sector will support the growing Agritech sector including work to scale Agritech businesses internationally.”

Digital technology opportunities

To support the ongoing development of New Zealand’s technology and industrial sector, the NZ government is taking several actions. The government has plans for more coordinated action between industry and the Government. Including:

- Continuing work with the IoT Alliance and the AI Forum to drive applications of digital technologies;

- Implementing Industry 4.0 programmes to increase uptake technologies and processes across manufacturing sectors, improving productivity and competitiveness;

- Coordinating, developing and rolling out a National Digital Infrastructure Model to generate value from data for all aspects of the economy–e.g. infrastructure management and development;

- Supporting New Zealand digital technology firms by providing a level playing field for New Zealand firms to compete for government business;

- Working through the Digital Skills Forum to ensure the digital technology sector, and the industries that rely on digital technology workers, can access the tech talent needed to support the growth of these sectors and the economy.

With Government setting itself for the fourth industrial revolution, there will be certain challenges and opportunities in the implementation, “the opportunity is for increased productivity and to focus more on value add to compete internationally whereas a key challenge will be finding the skilled employees that will be required as industry 4.0 is adopted” said Maqbool.

Journey of NZ industries for digital transformation

SMEs make up over 97 percent of enterprises in New Zealand and digital transformation presents an opportunity for accelerated growth and competitiveness, potentially contributing US$7 billion to New Zealand’s GDP. “Digital transformation requires awareness, adoption and effective change management but before all of this there needs to be a shift in mindset of those in charge or a changing of the guard so to speak to understand and appreciate that the move is necessary, not only for the business itself but for bridging the digital skills gap and supporting a region’s productivity and economic growth ” said Maqbool.

The Government has also created plans for tourism, creative industries, aerospace, renewable energy and health technologies for the digital push. These advances will facilitate the development of new industries in New Zealand.

“It essential that efforts through government initiatives align with other approaches already driving the move to digital in order to ensure available resources are effectively utilised and for ongoing sustainability,” says Maqbool.

Roll Out of 5G will Contribute $900 Bn to APAC Economy over the next 15 years

According to a forecast by the GSMA Foundation, 5G will contribute almost $900 billion to APAC’s economy over the next 15 years. APAC’s edition of the GSMA’s Mobile Economy series published at MWC19 Shanghai revealed that Asia’s mobile operators will invest $370 billion – two-thirds of their overall investment in new networks – in building new 5G networks between 2018 and 2025. The report forecasts that the number of subscribers is expected to increase to 3.1 billion by 2025 with the main contributions coming from India, China, Pakistan, Indonesia, Bangladesh, and the Philippines.

The Roadmap for 5G

Every major Asia Pacific country has announced its intent or made the commitment to roll out 5G. The upside for an Asia Pacific digital economy is huge which will be driven by massive amounts of cross-cloud, inter-cloud, and smart infrastructure giving rise to the need for high-density connectivity between businesses and consumers.

“Take a step back and look at the key attributes of 5G – speed, latency, and density. Now take a step forward and look at global urban development. The explosion of bigger and more modern cities makes the telecom infrastructure a scaling issue for which 5G will be the right technology,” says Ecosystm Executive Analyst, Vernon Turner.

Working closely with the mobile operators pioneering 5G, governments are also engaging in the preparation and roll out of 5G Networks. Recently, the Singapore government announced to set aside SG$40 million to build up a 5G ecosystem. To promote digital transformation and economic growth, IMDA and the National Research Foundation (NRF) has allocated this funding for innovation, trials, R&D and enterprise use-cases in the 5G technology.

Similarly, the Vietnamese government awarded its first 5G trial licence to its largest telecommunications company, Viettel, to uplift the economy. Thailand is also seeking to deploy 5G and aims to start commercial 5G service next year.

“By 2022, 5G will be ‘the rising tide that lifts all boats’, making the Asia-Pacific region the biggest network offering network services that could give it an economic advantage,” says Turner. “But before that, some challenges for 5G belongs to regulatory approvals and the cost to build the next generation wireless network. For example, 5G networks operate on ‘millimetre waves’, a high radio frequency able to transmit large amounts of data but only over a short distance. To overcome this issue, governments have to approve large numbers of 5G small cells for operators to deploy.”

Is this an opportunity to skip out 4G altogether and leapfrog to 5G?

“The challenge for operators is to find workloads and applications that need 5G and at a price point that customers will pay. In my everyday travels, I have been underwhelmed by the number of customers ready to take advantage of 5G. Existing networks have the speed and capacity to run much of their businesses. I can see a scenario whereby operators will be forced to roll up 3G and LTE network functionality into 5G networks without being able to raise prices – despite being able to offer more benefits” says Turner.

How will 5G impact industries?

The future of interconnected ecosystems runs through IoT. The data that IoT sensors will create will be more valuable the faster it is analysed to produce business outcomes. Turner commented “Innovation accelerators such as VR (Virtual Reality) and AR (Augmented Reality) will generate new services for both consumers and industrial uses cases. The potential for asset management and services is ripe for disruption as 5G will bring more valuable information to workers through more efficient platforms. The knowledge-based worker and the future of work is here.”

Ultimately, APAC has the same possibilities and challenges as the rest of the world. Overall, the involvement of telecom companies, government organisations, infrastructure upgrades and the adoption of devices by consumers can affect the development and only after that can 5G become a reality.

The Retail industry faces constant disruption because of unpredictability and seasonality for reasons ranging from economic uncertainties to festive seasons. Technology adoption has emerged as a key differentiator between the success stories and the also-rans in the industry. The biggest example of this would probably be eCommerce heavyweights in China, that were revolutionised by digital technology, forcing global Retail counterparts to transform to compete. Emerging technologies are helping organisations drive customer loyalty and improve their supply chain for better cost efficiency.

Drivers of Technology Adoption in Retail

There are several factors that have made the Retail industry one of the leaders in technology adoption.

- Evolving Customer Preferences. Understandably, customers are kings in the Retail industry and their preferences drive the industry. For many years, customer loyalty was implemented through ‘loyalty programmes’ but today’s customers are not bound by cards and points, and factors such as same-day delivery, multiple payment options, on-the-spot problem resolution, and even invitations for exclusive events have a role to play in customer retention. The focus has shifted to better customer experience (CX). Retailers have access to immense data on their customers (which in turn raises concerns around data handling and compliance – requiring further investments in cybersecurity solutions), which is collected at every point of interaction and can be analysed for personalised and just-in-time offerings.

- Maturity of the Omnichannel. Omnichannel retailing has been gaining grounds since the advent of eCommerce. However, the proliferation of mobile apps enabled not only easy access and monitoring of loyalty programmes, but also advanced capabilities such as the real-time view of inventory, and incorporation of virtual assistants for CX – and are pushing traditional players in the Retail industry to innovate and adopt the technology. However, as omnichannel has become the norm, retailers are evaluating the channels they want a presence on. While experts predicted that a brick-and-mortar presence would become redundant, retailers are realising that while consumers do research on the Internet and apps, many prefer to inspect and buy at a physical shop. This requires better integration and supply chain visibility across all touchpoints.

- Globalisation of the Market. No longer can a retailer be sure of where the actual competition lies. One just has to look at the number of platforms and websites originating from Japan that have a presence across the globe to understand that competition can come from outside your country and very easily. Nor can they be sure of the best place to source their products as the world becomes one global market. In this global world, it is very important for retailers to have complete visibility of their supply chain, whether for a brick-and-mortar store or for eCommerce.

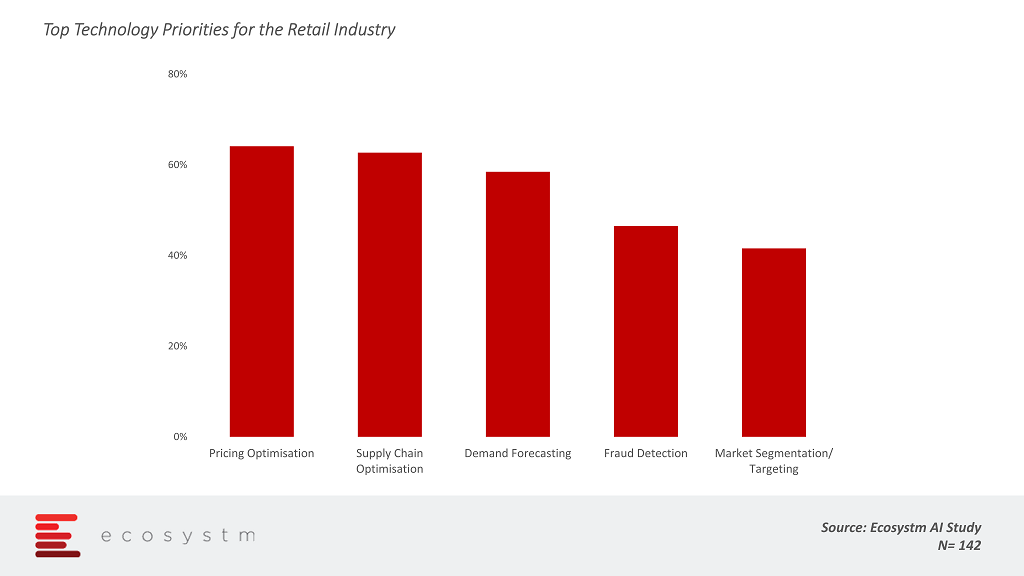

The global Ecosystm AI study reveals the top priorities for retailers (and etailers), focused on adopting emerging technologies (Figure 1). It is very clear that the top priorities are driving customer loyalty (through initiatives such as market segmentation and pricing optimisation) and supply chain optimisation (including demand forecasting and fraud detection, as procurement widens).

IoT as an Enabler of Retail Transformation

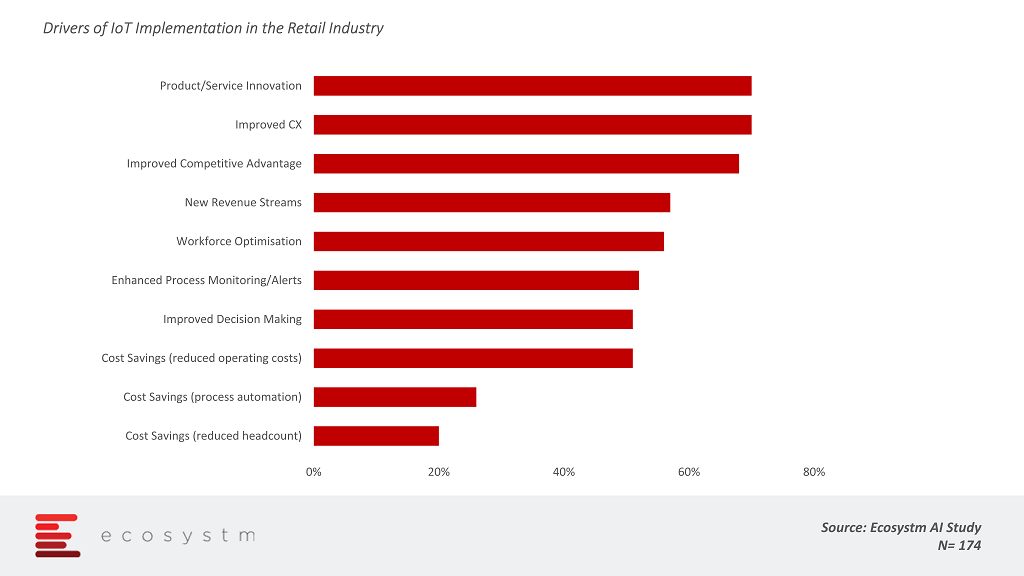

The Retail industry is particularly leveraging IoT as they are faced with the overwhelming need to transform. The global Ecosystm IoT study reveals the areas that organisations are looking to benefit from IoT implementations (Figure 2). Retail organisations are essentially looking to creating a competitive edge – cost savings are not high on the list of benefits they are looking at.

Several Retail organisations are deploying customer management IoT solutions such as payment systems, customer identity authentication (especially in eCommerce), Digital Signage, customer satisfaction measurement through smart buttons, and location-based marketing. Asset management IoT solutions such as IoT-based inventory and warehouse management are also gaining traction.

Examples of IoT Use in Retail

IoT for Customer Experience

- Automated POS terminals. Customers are put off by long queues, and automated checkout systems are improving CX. Caper’s plug-and-play cart-system is a shopping cart with a built-in barcode scanner and credit card swiper which automatically scans items when they are dropped in, with the help of image recognition cameras and weight measuring sensors.

- Smart Mirrors. Smart fitting rooms are transforming the way customers browse, try out and shop. Smart Mirrors enhance customers’ shopping experience through interactive fitting rooms which connect retailers and customers digitally. Rebecca Minkoff reinvented the dressing room using Smart Mirrors.

IoT for Marketing

- Digital Signage. Digital Signage has proved to be an effective way of target marketing, eliminating the need for employees to put up physical signs and enabling dissemination of the latest product news and promotions to the consumers. Advanced Digital Signs include heat-mapping to upsell items based on high-traffic areas. Prendi, an Australian design agency created an interactive retail experience that is intended for store managers to showcase the most popular products, provide information, and simplify the overall sales and purchase process. Customers can take time to easily navigate through store inventory on a single screen, order for items digitally, which is then sent to a salespersons’ handheld devices, allowing them to take the items over to the customers.

- Location-Based Marketing. Many retailers are collaborating with financial institutions and location-enabled apps to send push notifications on latest deals and offers straight to the customers’ devices, once they enter a demarcated location. This provides just-in-time data that increases app engagement and retention. Ukrainian hypermarket, Auchan, started a beacon pilot in Dec 2016 and kept adding new campaigns to strengthen the offerings in 2017. The hypermarket makes use of beacons to enable customers to receive notifications on navigation and promotions as they move through the store.

IoT for Supply Chain Optimisation

- Smart Shelves. Shelves have turned out to be more than just a surface for displaying and storing objects. Retail stores are utilising RFID readers, weight sensors, proximity sensors, and 3D cameras for real-time visibility on inventory, layout, and shopper preferences. For FMCG products, monitoring the shelf life of perishable goods and proactive reorder alerts are extremely useful. Kroger Smart shelves are designed to offer digital support – they show ads, digital coupons that consumers can easily add to their mobile devices and changed prices as stores calibrate their product pricing. The shelves are built on top of sensors that keep track of products and real-time in-store inventory counts.

- Remote Supply Chain. Retailers are looking to create a competitive edge and grow profits by optimising and digitising their supply chain management through IoT. Tive helps users keep real-time tabs on the condition of their shipped goods, notifying them about shock, vibration, tilt and other factors that might detrimentally affect those goods. Doing so allows retailers to expedite a replacement shipment and give customers a heads-up, and also tells when and where the delay occurred so future shipping routes can be adjusted if necessary.

- Warehouse Automation. Devices, sensors and RFID tags help warehouse managers to know the exact details, location, and progress of any product at any time. This gives higher visibility into the inventory and the entire supply chain. UPS is using smart glasses in test programmes to reduce the amount of labelling on packages. Robots are used by the worldwide shipping company DHL in some of the company’s more modern facilities to reduce labour costs and improve order fulfillment speed and accuracy, all without disrupting ongoing warehouse operations.

The Retail industry already has several IoT use cases and AI-enabled IoT will further transform the industry. What are some interesting use cases that you can think of for the Retail and allied industries? Let us know in your comments below.