Last week, HPE announced that they will acquire Silver Peak – the wide area networks (WAN) specialist, including WAN optimisation and Software-Defined (SD-WAN) – in a deal worth USD 925 million. The move is in line with HPE’s Intelligent Edge strategy and their intention to provide a comprehensive edge-to-cloud networking solution.

HPE Building Intelligent Edge Capabilities

In 2018, HPE announced their intention to invest USD 4 billion over the next 4 years, to build an Intelligent Edge offering. This acquisition will give them the ability to combine the Aruba Edge Services platform with Silver Peak’s SD-WAN platform, to provide next-generation networking solutions.

In 2015, HPE acquired Aruba for USD 3 billion to strengthen capabilities on integrated and secure wireless technology and to support the access to cloud application, at a faster speed. Bringing together the innovation and technology capabilities of both units will accelerate HPE’s edge-to-cloud strategy to enhance distributed cloud models for application and data services for users.

Ecosystm Principal Advisor, Ashok Kumar says, “HPE leaped into the wireless local area networks (WLAN) space with the acquisition of a major enterprise Wi-Fi network vendor Aruba Networks, five years ago. With the acquisition of SD-WAN vendor Silver Peak last week, HPE extends enterprises’ reach with its Intelligent Edge portfolio. The synergy of Aruba and Silver Peak provides a fuller enterprise networking portfolio of solutions for HPE.”

The acquisition has been announced as markets are gearing towards recovery and organisations are opting for a more distributed working environments with remote employees. Kumar says, “The convergence area of networking and security at the enterprise edge is a high growth area that has accelerated due to the COVID-19 pandemic to address the remote worker’s needs.”

The current situation, compounded by the 5G rollouts in several global markets, is also forcing telecom operators to transform their business models. Telecom providers will now have to increasingly target B2B opportunities. Last month also saw HPE announce their Edge Orchestrator, a SaaS offering bringing lower latency, optimised bandwidth and improved security and privacy for telecom providers and their own enterprise customers to take advantage of 5G. Aruba Networks also rolled out a cloud native platform, Aruba ESP that has AIOps, Zero Trust network security and a unified infrastructure for data centres capabilities, to support remote operations.

“HPE’s success in this area will be dependent upon the tight integration of the two product line portfolios, and the channels of distribution, to effectively address the needs of enterprises at the edge with smarter solutions,” says Kumar.

The Growing Importance of SD-WAN

In the report, The Top 5 Telecommunications & Mobility Trends for 2020, Ecosystm had noted the growing significance of SD-WAN for enterprises, as they undertake Digital Transformation (DX) journeys and require more responsive and self-sustaining networks. The entire network infrastructure will have to be software-centric allowing for agility, scalability, and normalising costs with business growth. This has proved to be especially true in the wake of the current crisis.

“The network is a foundation on which a significant amount of Digital Transformation (DX) becomes possible, so as companies move through their DX journeys, often changing course, the network will need to adapt with them. AI, virtualisation and SD-WAN will bring increasing levels of flexibility as they lessen the need for specialised hardware, centralise control, and speed up configuration changes.

The availability of high-bandwidth, low latency networks coupled with SD-WAN will allow enterprises to shift away from thinking of their network as a physical space and start seeing it as a set of capabilities, taking work beyond a physical address. Equipment will be increasingly centralised in data centres (possibly on the Edge) to provide the ability to truly work anywhere.”

Download Report: The Top 5 Cloud Trends For 2020

The full findings and implications of the report ‘Ecosystm Predicts: The Top 5 Cloud Trends For 2020’ are available for download from the Ecosystm website. Signup for Free to download the report and gain insight into ‘the top 5 Cloud trends for 2020’, implications for tech buyers, implications for tech vendors, insights, and more resources.

The National Australia Bank (NAB) and Microsoft announced a strategic partnership last week, to develop and architect a multicloud environment to be used by both NAB and its New Zealand counterpart, Bank of New Zealand (BNZ).

The five-year partnership will involve Microsoft and NAB sharing development costs and investments to migrate around 1,000 out of 2,600 applications from the NAB and BNZ stacks, on Microsoft Azure. By 2023, NAB aims to run 80% of its application on the cloud, build a robust cloud foundation, and enable customers to access applications and services on the cloud.

The partnership aims to support NAB’s commitment to continuous improvement and innovation, leveraging the Microsoft global engineering team. It also involves setting up of the NAB Cloud Guild program, where Microsoft will train 5,000 NAB and BNZ technologists to equip them on cloud and allied technology skills.

NAB and Microsoft have previously collaborated to improve the experience for NAB customers, through cloud-based applications. NAB’s cloud-based AI powered ATM was the result of a proof-of-concept (PoC) developed on Microsoft Azure’s cognitive services, in 2018. It involved general ATM security captures along with facial biometrics to enable customers to withdraw cash without a card or a phone.

Besides the partnership with Microsoft, NAB also uses Google Cloud for multicloud workloads as well as AWS for its AI competencies and resources across platforms. In February, NAB launched an AI-based voice service to boost the bank’s contact centre experience along with AWS.

Ecosystm Comments

Ecosystm Principal Advisor, Tim Sheedy says, “If ever there was a sign that multicloud is the predominant approach for businesses, this is it. NAB is a big AWS client – in Australia and New Zealand. They lead the way for businesses in training thousands of employees on AWS technologies through their Cloud Guild. But now Azure is also developing a strong foothold in NAB – the public cloud services market is not a one-horse race!”

“Many businesses that have standardised on – or preferred – a single cloud vendor will find that they will likely use multiple cloud environments, in the future. The key to enabling this will be the adoption of modern development environments and architectures. Containers, microservices, open-source, DevOps and other technologies and capabilities will help them run their applications, data and processes across the best cloud for them at the time – not just the one that they have used in the past.”

Sheedy thinks, “NAB’s competitive advantage will not come from whether they are using AWS or Azure – it will come from the significant time and effort they are investing in giving their employees the skills they need to take advantage of these environments to drive change at pace. Too many businesses are increasing their cloud usage without making the necessary investments to upskill their employees – if you know you are planning to spend more on the cloud, then start now in reskilling and upskilling your staff. There is already a real shortage of cloud skills and it is only going to get worse.”

Gain access to more insights from the Ecosystm Cloud Study

Last week industry leaders, SAP and Siemens, announced a partnership to bring together their respective expertise on creating integrated and enhanced solutions for product lifecycle management (PLM), supply chain, service and asset management, in a move that is expected to accelerate Industry 4.0 globally.

The partnership between SAP and Siemens aims to develop innovative business models to break silos between manufacturing, product development and service delivery teams to establish seamless customer-centric processes. It will provide users with real-time business information, customer insights and performance data over the entire product development cycle.

As the first step of this agreement, Siemens will offer SAP’s Intelligent Asset Management solution and Project and Portfolio Management applications and SAP will offer Siemens’ PLM suite Teamcenter software for product lifecycle collaboration and data management to manufacturers and business operators across the network – complementing each other’s solutions.

Ecosystm Principal Advisor, Kaushik Ghatak says, “The convergence of the Information Technology (IT) and the Operational Technology (OT) worlds is a must for companies to operate in the cyber physical world of Industry 4.0. Historically, these two worlds have operated in silos. This is a great partnership announcement aimed towards meeting the convergence goals by integrating the capabilities of Siemens (an OT leader), and SAP (an IT leader). Together they would be able to offer an exhaustive set of very valuable offerings in the Digital Supply Chain and Digital Manufacturing domain for customers worldwide.”

Ghatak says, “This is not the first such partnership for Siemens. A strategic alliance between Siemens and Atos has been in place since 2011. In 2018 the alliance was strengthened with plans to accelerate their joint business until 2020, with a focus on building innovative solutions by combining their capabilities. However, the difference this time is that SAP has very a deep and wide set of software offerings in the supply chain and manufacturing domains, which when stitched together with Siemens’ PLM solutions can provide true end-to-end digitalisation capabilities across the ‘Design, Source, Make, Deliver and Plan’ continuum of the value chain.”

Ecosystm Comments

Ghatak, however, cautions that while this is a great partnership announcement between two giants in their respective fields, they will need to collaborate actively on three key aspects for this partnership to deliver value for the customers.

- Product Development. Building-integrated solutions with heterogenous data models is not easy. It will require very open collaboration between their product development teams to identify the use cases and build solutions that can enable seamless information flow and actions across the different software modules owned by each.

- Go-to-market. Going to market jointly will need strong collaboration too. In terms of the agreement on customer account ownership, pricing, sharing of pre-sales resources and so on.

- Implementation. And, last but not the least, it will require collaboration to ramp up the implementation capabilities of the jointly developed solutions.

Singapore is committed to empower its small and medium enterprises (SMEs) to make better financial decisions and avail of seamless trade and financial transactions across the larger global economy. In June, the Digital Economic Partnership Agreement (DEPA) was signed between New Zealand, Singapore and Chile. The initiative includes facilitating end-to-end digital trade – by creating digital identities, allowing paperless trade and developing Fintech solutions – and ensuring a trusted cross-border data flow. To learn more about the DEPA agreement, register for the “Re-image the Digital Economy” webinar on the 29th July at 10am SGT.

This follows the announcement that was made last year by the Monetary Authority of Singapore (MAS) and Infocomm Media Development Authority (IMDA); of the successful completion of phase 1 of the proof-of-concept (POC) for its Business sans Borders (BSB). BSB is meant to be a “meta-hub” connecting several SME-centric platforms (starting within the Philippines, India and Singapore) giving SMEs seamless access to a larger ecosystem of buyers, sellers, logistics service providers, financing, and digital solution providers; and allowing them to be part of the larger global marketplace. The PoC involved a collaboration with private sector partners such as GlobalLinker, Mastercard, PwC, SAP and Yellow Pages.

AMTD Aligns with the BSB Objective

Hongkong-based investment banking firm AMTD Group leads a consortium that includes Xiaomi Finance, Singapore’s SP Group, and Funding Societies, that is a contender for one of Singapore’s digital wholesale banking licenses. While announcing their bid, they had clearly stated that they aimed to focus on SMEs in the region and globally. They continue to focus on SMEs by strengthening their partner ecosystem.

Last week AMTD announced a partnership with GlobalLinker making them the preferred financial services partner on the GlobalLinker’s SME-focused platform. AMTD intends to make available their entire ecosystem to SMEs including their virtual bank in Hong Kong, Airstar and their potential digital wholesale bank consortium in Singapore (which is to be called Singa Bank). In line with Singapore’s BSB objective, the partnership will see GlobalLinker join AMTD’s network which includes Fintech companies, regional banks and enterprises – SpiderNet. SpiderNet is a cross-sector ecosystem which is continuously expanding to connect and collaborate with shareholders, government bodies, industry associations, and clients. GlobalLinker’s AI-powered SME networking platform fosters SME digitalisation and helps members and customers connect with each other and use digital solutions. AMTD will be part of this network and bring the breadth of their partner ecosystem onto GlobalLinker’s platform.

Ecosystm Principal Advisor, Dheeraj Chowdhry says, “This marks the deepening of the trend of convergence between the established industry players and the Fintechs. The inefficiency of the obsession to ‘build’ and the associated resource and cost effort has perhaps been recognised on both sides and hence the path of coexistence and synergy seems more pragmatic. Fintechs are not competing but, in fact, complementing industry players by accelerating customer adoption of new digital formats for the entire landscape.”

AMTD Continues to Strengthen Partner Ecosystem

Last week also saw AMTD announce a collaboration with Singapore’s CIMB Bank and Funding Societies, to explore opportunities to create a wide range of banking and capital market services to aid SMEs with a one-stop solution for cross-regional and financial products.

Such partnerships by AMTD provides a glimpse of the group’s strong focus on Singapore. In April this year, AFIN and AMTD partnered to establish the USD 36 million AMTD ASEAN-Solidarity Fund. In May, AMTD, MAS, and Singapore FinTech Association (SFA) announced the launch of a USD 4.3 million MAS-SFA-AMTD FinTech Solidarity Grant to support Singapore-based FinTech firms.

AMTD remains committed to evolving their capabilities and ecosystem to empower the SME market in Singapore and the region. AMTD Digital announced their intention of acquiring a controlling stake in PolicyPal, Singapore’s InsureTech pioneer, and CapBridge Financial, a leading private capital platform for investing in growth companies globally. They have also expressed their intentions to acquire a controlling stake in FOMO Pay, a Singapore-based QR code and digital payment solution provider.

“AMTD’s early cognizance of the need for a strong ecosystem has led the organisation to their foray into partnerships and stakes in PolicyPal, FOMO Pay and now GlobalLinker. This strengthens AMTD’s commitment to the Fintech space including stakes in AirStar Digital Bank in Hong Kong and the Digital Bank application in Singapore,” says Chowdhry. “The Fintechs in AMTD’s stable will be part of the ‘AMTD web’ associated companies cutting across geographies and accelerate the ‘Business sans Borders’ objective of MAS and IMDA.”

In the blog, The Top 5 Fintech Trends for 2020, we had spoken about the impact of Fintech on financial inclusion. “Fintech will have a much greater impact than we realise, and we will continue to see it drive the induction of the unbanked into the mainstream economy. The growth in mobile phone penetration, however, continues to grow at a faster pace than banking accessibility across emerging economies. We will continue to see Fintech play a significant role in driving greater inclusion, especially to bring in the underserved in the emerging economies and reducing the gender gap when it comes to adoption of financial services – creating greater inclusion overall.”

Fintech Driving Financial Inclusion in Malaysia

Much of Malaysia’s economy is dependent on foreign workers with an estimate of 3-4 million migrants that roughly contribute to about 30% of the country’s labour force. Instapay, regulated by the Bank Negara Malaysia (BNM), caters to the underbanked community of foreign migrant workers, and recently announced a collaboration with Mastercard, to provide e-wallet accounts to Malaysian migrant workers. The app supports 9 languages and aims to have 100,000 users in the first year.

The widespread use of e-wallets by the migrant worker community is meant to bring benefits to both them, as well as their employers. It enables employers to use digital technologies for payroll management, reducing their dependence on cash handling, reducing costs and eliminating downtime as their employees no longer need to queue up on paydays.

The Instapay e-wallet also gives a largely underbanked segment of the society access to affordable financial products and services. The partnership with Mastercard gives Instapay’s customers access to the global network of merchants and ATMs, allowing easier access to financial services.

Ecosystm Principal Advisor, Dheeraj Chowdhry says, “Instapay’s foray into e-wallets furthers and supports the country’s objective of democratising banking and moving to a cashless economy. Collaboration with an international player like Mastercard helps a domestic Fintech to deliver a product that is country agnostic. The migrant worker can not only use the Instapay wallet within Malaysia but also in their home country.”

Malaysia’s Focus on Fintech

The Malaysia Government aims to create a cashless society, lower transaction costs and provide access to the underserved customers. There are two kinds of financial inclusion – for the lower income group as well as for the small and medium enterprises (SMEs) – and Malaysia is committed to both. Digital payments and e-wallets aimed at the lower income group receives an estimated 36% of Fintech funding. The stumbling block is that about a third of the country’s population does not have smartphones, so funds transfer using mobile phone messages is still relevant in the country. Development of the SME sector and eCommerce are twin focus areas for the Digital Economy vision. This provides a ready market for digital payments. Also, while the SME community will still have access to traditional funding, there is expected to be a greater push towards crowdfunding and peer-to-peer financing. It is expected that the share of Fintech funding for alternative funding will grow beyond the estimated 6% that it receives now.

According to a Mastercard Impact Study 2020, Malaysia has the highest e-wallet usage in Southeast Asia. As the country moves towards creating a cashless society, the Government is hoping e-wallet adoption increases. Several initiatives and schemes have been rolled out to promote e-wallets adoption. Last month, Malaysia announced the intention to spend an estimated USD 176 million in 2020 to encourage e-wallet adoption. Earlier this year, the Government announced the e-Tunai Rakyat program to boost the adoption of e-wallets, supported by Grab, Boost and Touch ‘n Go. Chowdhry says, “Instapay e-wallet is yet another manifestation of the amplified focus on e-wallets in Malaysia. BNM has set aside an estimated USD 108 million and has introduced a scheme to give USD $7.25 in credit for every adoption of any of the top 3 e-wallets. This scheme has accelerated e-wallets in the country that has set an adoption target of 15 million i.e. half of its population.”

“This push is backed by a structured approach of increasing the number of small merchants accepting card payments. With BNM’s focus, there are as many as half a million POS terminals out there for both credit cards and QR codes.”

“Malaysia’s regulators have to be applauded for having a well-coordinated, holistic and converging strategy on creating a cashless economy. The issuance, acceptance and regulatory policies have been completely synergised to deliver.”

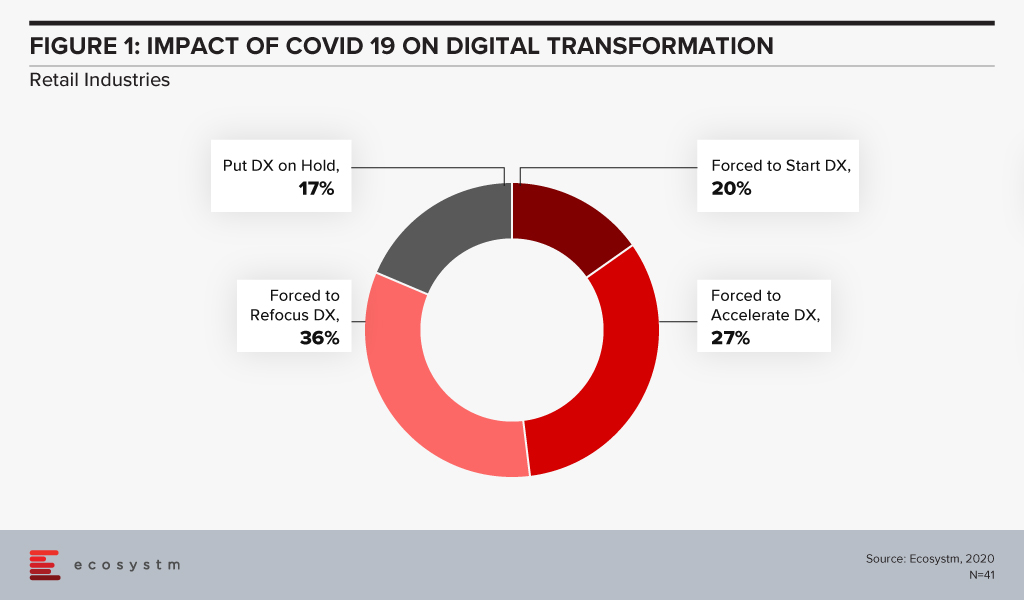

The Retail industry has been one of the hardest-hit industries during the COVID-19 crisis. The industry had to pivot faster than many to cater to an evolving market need and customer expectation, amidst social distancing measures and supply chain disruption. Ecosystm’s Digital Priorities in the New Normal study finds that nearly 83% of organisations in Asia Pacific’s Retail industries were forced to work on digital transformation (DX) in the aftermath of the crisis (Figure 1).

Retail organisations that had not walked the DX path found themselves struggling to cope in recent times. Ecosystm Principal Advisor, Alan Hesketh says, “Digital transformation in retail, as represented by deep customer understanding and omnichannel operations, is far from new. Industry leaders launched these activities almost 20 years ago and continue to aggressively develop these capabilities. Retailers not actively leveraging these capabilities to understand their customer preferences are at a massive competitive disadvantage.”

Anta Group Accelerates DX

The Anta Group, a sports products manufacturer based in China with over 12,500 stores, has launched a group-wide digital platform designed and deployed by IBM Services based on SAP S/4HANA. The initial phase of Anta Group’s DX included creating intelligent workflows and was completed in January 2020. This enabled the company to adjust its retail operations and switch to quickly to online channels during the COVID-19 pandemic.

Like any retail organisation, the Anta Group realised that their product offerings had to be diverse to cater to an evolving customer base. This growth required an upgrade to a group-level management platform to help the business run more efficiently across the entire value chain of procurement, supply, production and sales. The SAP S/4HANA platform gives the senior management a single view of data across business units to help with better decision making regarding production and sales optimisation. The company claims to have improved its supply chain efficiency by 80%, that has led to faster delivery and business growth even in these difficult times.

IBM Services has a role to play in providing the business intelligence required for agile decision-making. By integrating data from multiple sources – retail stores, multi-brand products, channels, customers, suppliers and finance teams – on the one platform can help Anta Group to settle accounts quickly and issue business analysis reports for different entities as well as a real-time view of the operation across the organisation.

Hesketh says, “Retailers must have an accurate, timely understanding of their customers’ behaviour and resulting sales performance. COVID-19 has dramatically increased the volatility of sales, making rapid recognition of changes essential. For those lagging in their digital transformation to acquire this understanding, an attractive option is partnering with organisations with demonstrated relevant capabilities; in this case with SAP, for the capabilities and performance of their in-memory product, and IBM for their configuration and implementation expertise.”

IBM and SAP evolving their partnership

In 2016, IBM and SAP had expressed intentions of increasing investments to help their customers on their DX journeys. As some economies move into the recovery phase, all businesses will be forced to transform – or keep transforming if they are already along that path. Last month saw IBM and SAP announce the evolution of their partnership with new offerings to help businesses transform faster. The next evolution of the IBM and SAP partnership aims to focus on faster DX time to value, innovation through industry-specific offerings, customer and employee experiences and providing flexibility and choice to organisations to run their workloads in hybrid cloud environments.

Hesketh adds, “But the product and implementation partners are, while important, not the real determinant of the success of DX activity and time to value. Retailers must recognise and commit to the strategic reshaping of their business, taking their large workforces with them on the journey. This is a high-risk change. A strong relationship between product vendor and implementation partner, as SAP and IBM demonstrate here, assists in reducing, not removing, this risk.”

According to the Ecosystm Digital Priorities in the New Normal study, 78% of organisations in the Asia Pacific have started, re-evaluated, or accelerated their Digital Transformation (DX). As many markets move into the recovery mode, it is time for these organisations to evaluate whether they can move ahead with these DX initiatives as their organisations’ needs evolve over the next few months.

IT teams have scrambled to empower their remote workforce with investments in several technology areas – 87% of organisations have made additional investments in Cybersecurity and Cloud solutions.

Ecosystm will continue to evaluate the business and technological pulse of the market impacted by the COVID-19 pandemic and bring insights on technology areas that will see continued investments, as organisations get into the recovery phase.

Alibaba has been actively expanding its global reach over the last year. There have been several announcements this year to indicate that the cloud provider is looking to benefit from the recent uptick in cloud adoption and support the global recovery initiatives. In April, Alibaba announced its plans to invest USD 28 billion, focusing on infrastructure and technologies related to operating systems, servers, chips and networks, over the next three years. Later in June, Alibaba announced the intention to recruit 5,000 people globally showing serious intentions to become a global cloud player. It is also strengthening capabilities in markets where they already have a strong market presence. By 2021 Alibaba intends to have 64 availability zones with 21 regions across the globe.

Consolidating Partnership with Equinix

Alibaba’s partnership with Equinix, the interconnection and data centre company dates back a few years. In 2017 the partnership started providing enterprises with direct, scalable access to Alibaba Cloud via the Equinix Cloud Exchange in 5 of their global data centres.

Last week the partnership was further strengthened by Equinix extending the reach of Alibaba Cloud via its network of Equinix Cloud Exchange Fabric (ECX Fabric) Cloud interconnection platform. The deal will widen Alibaba’s cloud reach in the US, EMEA, and the Asia Pacific region for customers to privately connect with Alibaba’s cloud. Under the partnership, Alibaba will integrate its API with Equinix ECX Fabric to facilitate direct and secured connections to Alibaba Cloud, across these regions:

- 9 US metros. Chicago, Dallas, Denver, Los Angeles, Miami, New York, Seattle, Silicon Valley and Washington DC

- 5 Asia Pacific hubs. Hong Kong, Jakarta, Singapore, Sydney and Tokyo

- 3 hubs in EMEA. Dubai, Frankfurt and London

The deal also gives Alibaba direct access to Equinix’s interconnected ecosystem of over 9,700 customers including enterprises, cloud and network operators, and IT service providers.

The Hybrid Cloud Push

In the last 18 months or so, the industry has seen a greater push in private/hybrid cloud or multi-cloud adoption. Ecosystm Principal Advisor Andrew Milroy says, “As enterprises move to hybrid cloud infrastructures, the world’s leading IaaS providers, including Alibaba Cloud, are expanding their private cloud and hybrid cloud services.”

Many of these IaaS providers may not have the capabilities to provide a hybrid cloud offering at a global level. Partnerships such as the one between Equinix and Alibaba Cloud may well be the solution. Milroy says, “Equinix offers interconnection services from multiple sites across the globe. These interconnection services are necessary for the provision of private and hybrid cloud services, on a global scale, offering the level of performance and security that organisations want.”

“In order to compete with AWS, GCP and Microsoft, Alibaba Cloud needs to be able to scale its private and hybrid cloud offerings globally. Equinix can enable them to do this. At the same time, Equinix will also benefit from Alibaba Cloud’s growth into newer markets, which will lead to an increased demand for its interconnection services.”

In the report, Ecosystm Predicts: The Top Healthcare Trends for 2020, we had noted the similarities between the healthcare and the financial services industries and that Healthtech will take lessons from the Fintech industry.

In the report, Ecosystm Principal Analyst, Sash Mukherjee said, “Fintech plays a significant role in driving greater inclusion, especially to drive the induction of the unbanked into the mainstream economy, give the underbanked more options to leverage the broader financial services available, and reduce disparity in the adoption of financial services by bridging the gender gap and differences based on ethnicity and socio-economic status. It is not hard to imagine a similar fate for Healthtech. As the industry focuses on value-based outcomes, governments put in more regulations around accountability and transparency in the industry, and people expect the customer experience that they get out of their retail interactions, Healthtech start-ups will become as mainstream as Fintech start-ups.”

However, Mukherjee notes that there might be some pitfalls in this journey, especially when organisations focus more on the technology and less on the actual application and benefits of the technology. “Innovators and start-ups need to align themselves early, with corporates and technology providers to gain a better understanding of the market and regulatory landscape.”

Singapore bringing key industry stakeholders together

The MoU between Alibaba Cloud, Pfizer and Singapore’s Fintech Academy announced yesterday, is a move in the right direction that promises to give early and necessary guidance to Healthtech start-ups. Under the newly formed Healthcare Fintech Alliance (HFA), Alibaba will provide infrastructural support and technological mentorship to the Healthtech and Fintech start-ups to help them leverage cloud, AI and other technologies for their future requirements. The Fintech Academy will guide these start-ups through talent management and venture building programs. Pfizer will provide thought leadership through its network of healthcare experts and opinion leaders, including guidance on commercialisation of the products and services. The Healthcare Fintech Alliance initiative will begin with a pilot in Singapore, Indonesia, and Vietnam before expanding to other regions – Malaysia and the Philippines.

Mukherjee says, “The healthcare industry, for all the cutting-edge research, that it represents, has been remarkably slow to transform. But the COVID-19 crisis has forced the industry to transform, without the luxury or time to think about it. While the implications on the life sciences and provider organisations is clearer, there has simultaneously emerged a need for transformation in the healthcare payer industry. There will be greater demand from consumers for micro-financing to tide over sudden healthcare crises and greater transparency in how these funds are managed. Again, there is an immense potential here for the industry to learn from Fintech.”

Healthcare Fintech Alliance Focus Areas

The focus areas for Healthcare Fintech Alliance shows the deep connection between Healthtech and Fintech.

- Healthcare Affordability. Micro-financing and other financial models involving patients, family members, payers, and other healthcare stakeholders

- Value Based Healthcare. Linking payment schemes to a drug’s effectiveness, health outcomes or utilisation

- Outcome Monitoring. Tracking and reporting of outcomes derived from patients, wearables, healthcare providers, R&D databases and real-world evidence.

- Personalised Healthcare. Using digital technology to tailor healthcare to individual needs

- Innovative Healthtech Devices. Driving adoption in digital tools, such as diagnostic tools linked to medicine access and reimbursement

- Population Health Management. Leveraging patient and associated data in a compliant way to better understand population health characteristics, for effective wellness programs, treatment protocols and cost management.

“Alliances such as these have potential benefits for the industry stakeholders such as Alibaba and Pfizer. Alibaba has been focusing on the Southeast Asia market – earlier in the month the Alibaba Cloud Philippines Ecosystem Alliance was formed to support digital transformation in start-ups and small and medium enterprises. Initiatives such as this is an effective way to associate themselves with the evolving start-up community in the region,” says Mukherjee. “Life sciences companies operate in an extremely competitive global market where they have to work on new products against a backdrop of competition from generics and global concern over rising healthcare expenditure. Against that backdrop, this alliance is the right go-to-market messaging for Pfizer as well.”

“However, the deepest positive impact of alliances such as these will be on the Healthcare industry as a whole. It makes concepts such as value-based healthcare, remote care and personalised healthcare achievable in the near future.”