Last week AT&T announced a partnership with Fortinet to expand their managed security services portfolio. This partnership provides global managed Secure Access Service Edge (SASE) solutions at scale. The solution uses Fortinet’s SASE stack which unifies software-defined wide-area network (SD-WAN) and network security capabilities into AT&T managed cybersecurity framework. Additionally, AT&T SASE and Fortinet will integrate with AT&T Alien Labs Threat Intelligence platform, a threat intelligence unit to enhance detection and response. AT&T has plans to update its managed SASE service during the year and will continue to bring more options.

Talking about the AT&T-Fortinet partnership, Ecosystm Principal Advisor, Ashok Kumar says, “This move continues the trend of the convergence of networking and security solutions. AT&T is positioning themselves well with their integrated offer of network and security services to address the needs of global enterprises.”

Convergence of Network & Security

AT&T’s improved global managed security service includes features such as secure web gateway, firewall-as-a service, cloud access security broker (CASB) and zero-trust access, which provides security teams and analysts with unified capabilities across the cloud, networks and endpoints. The solution aims to enable enterprises to create a more resilient network bringing the core capabilities of the two companies that will reduce operational costs and deliver a unified offering.

Last year AT&T also partnered with Cisco to expand its SD-WAN solution and to support AT&T Managed Services using Cisco’s vManage controller through a single management interface. Over the past years multiple vendors including Fortinet have developed comprehensive SASE solution capabilities through partnerships or acquisitions to provide a unified offering. Last year Fortinet acquired Opaq, a SASE cloud provider to bolster their security capabilities through OPAQ’s patented Zero Trust Network Access (ZTNA) cloud solution and to strengthen SD-WAN, security and edge package.

The Push Towards Flexible Networking

Kumar says, “The pandemic has created a higher demand and value for secure networking services. Enterprises experienced greater number of phishing and malware attacks last year with the sudden increase in work-from-home users. The big question enterprises need to ask themselves is whether legacy networks can support their evolving business priorities.”

“As global economies look to recover, securing remote users working from anywhere, with full mobility, will be a high priority for all enterprises. Enterprises need to evaluate mobile SASE services that provide frictionless identity management with seamless user experiences, and be compatible with the growing adoption of 5G services in 2021 and beyond.”

The Top 5 Telecommunications & Mobility Trends that will dominate the telecom industry to watch out for in 2021. Signup for Free to download the report.

BetterUp, a mobile-based professional learning and wellness platform that connects employees with career experts recently raised USD 125 million Series D funding backed by Salesforce Ventures, in partnership with ICONIQ Capital, Lightspeed Venture Partners, Threshold Ventures, and Sapphire Ventures among others, bringing the company’s valuation to USD 1.73 billion. Previously in 2012, the company had raised USD 43 million in venture capital funding with an additional Series B funding of USD 30 million in March 2018. The BetterUp platform combines behavioural science, AI, and human interaction to enhance employees’ personal and professional well-being. Recently, the company also revealed two new products – Identify AI, to help organisations determine the right people to invest in and the appropriate coaching needed through the use of AI; and Coaching Cloud for customised training for frontline, professional, and executive employees.

This announcement comes on the back of several wins for BetterUp. To boost employee performance and organisational growth NASA and the Federal Aviation Administration (FAA) partnered with BetterUp to support new ways of coaching and preparing a workforce for change. The world’s largest brewer, AB InBev has partnered with BetterUp to strengthen diversity and inclusion through BetterUp’s coaching platform.

The Need to Improve Employee Experience

The pandemic changed the working arrangement of millions of employees and industries across the globe who are now working remotely or in a hybrid environment.

Ecosystm Principal Advisor, Audrey William says, “Driving better employee experience (EX) should take centre stage this year with enterprises putting employees at the centre of all initiatives. We will see EX platforms get integrated further and deeper into workplace collaboration and HR applications. In the last 12 months, we have seen apps monitoring wellness and sleep, training and coaching, meditation, employee motivation, and so on sit within larger collaboration platforms such as Slack, Zoom, Microsoft, Cisco and others.”

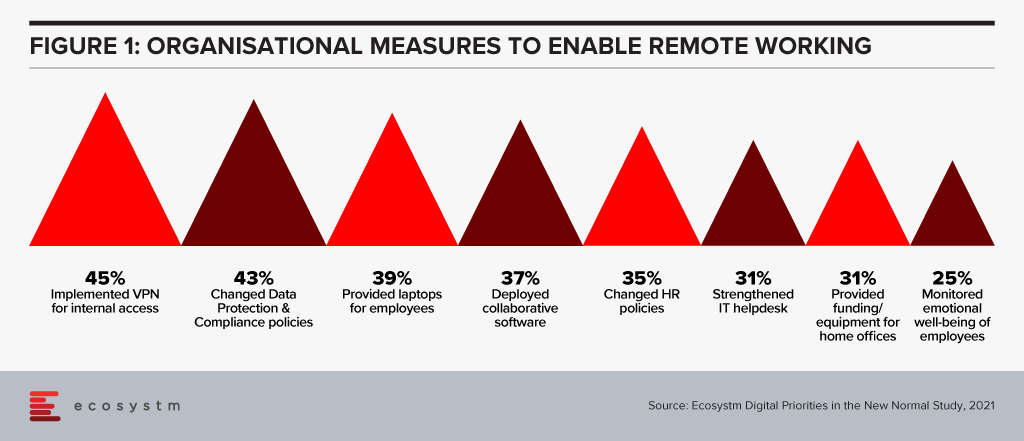

While the primary focus has been on optimising the work environment, it is time for organisations to start focusing on employee well-being. Ecosystm research shows that organisations implemented several measures to empower a remote workforce last year when the pandemic hit. But there was not enough focus on employee well-being (Figure 1).

William says, “A hybrid work environment may have negative impact on your employees. You may face issues such as longer working hours, employee burnout, lesser social engagements and connection, loneliness – and mental and emotional issues and depression”.

“Organisations that place an emphasis on the employees will see their revenues grow and also see less attrition. The more you invest in your people, the more you will get back in return. It is as simple as that! You can see that now in some organisations where employees are being given more flexibility, employers are not dictating how they should work, diversity and inclusion efforts have become mainstream, and efforts are being made to make employees feel like they belong.”

William adds, “However, Ecosystm research finds that organisations have gone back to putting customers and business growth first – losing focus on their employees. Only 27% of organisations globally say that they have improving employee experience as a key business priority in 2021. It is time for this culture and mindset to change. And solutions such as BetterUp can make a difference.”

Transform and be better prepared for future disruption, and the ever-changing competitive environment and customer, employee or partner demands in 2021. Download Ecosystm Predicts: The top 5 Future of Work Trends For 2021.

As the Knowledge Partner for the Singapore Fintech Festival, Ecosystm has a finger on the pulse of the Financial Services industry.

In this Ecosystm Bytes, we focus on how the Banking industry will look in the decade ahead, why it continues to struggle with compliance and customer experience, and where technology is helping.

Ecosystm Predicts: The Top 5 FinTech Trends for 2021

In 2021, one of the prevalent shifts we are witnessing in banking services is the switch towards automation to enhance the services and customer experience. Want to know more? Create your free account on the Ecosystm platform to access The Top 5 FinTech Trends for 2021 and more from the Ecosystm Predicts Series.

The ways we connect, create, collaborate in our workplaces has seen major shifts in the last year. And the tech industry has continually supported that shift as they create new capabilities and upgrade existing ones. Technology providers will continue to revamp their product offerings to support the increase in adoption of the hybrid work model work – a fusion of remote and in-office. In the Top 5 Future of Work Trends for 2021, Ecosystm had predicted, “Every major digital workspace provider (such as Microsoft, Google, Zoom, Cisco, AWS and so on) will broaden their digital workplace capabilities and integrate them more effectively, making them easier to procure and use. Instead of a “tool-centric” approach to getting work done (chat vs video vs document sharing vs online meetings vs whiteboards and so on), it will become a platform play.”

Ecosystm Principal Advisor, Ravi Bhogaraju says, “It is becoming clear that companies and individuals are grappling with three issues – the changing size and composition of the workforce; the productivity of those who are driving the businesses; and attracting, reskilling and engaging the broader workforce.” These are the challenges that tech providers will have to help organisations with.

Google Upgrades its Collaboration Platform

The Google Workspace was launched in October last year, and last week saw the tech giant announce a series of upgrades and innovations to better support the flexibility needs of frontline and remote workers.

Workspace is Google’s office productivity suite comprising video conferencing, cloud storage, collaboration tools, security and management controls built into a cohesive environment. The new features announced by Google Workspaces include Focus Time to avoid distractions by limiting notifications, recurring out-of-office and location indicators to make colleagues aware if the person is working from home or office, support for Google voice assistant in workplaces, second-screen experiences to support multiple devices, and features for frontline workers designed to help mobile employees collaborate and communicate better with the rest of the organisation. Google is also working on a trimmed down version of Google Workspace – Google Workspace Essentials – which will provide support for Chat, Jamboard, and Calendar. Workspace is estimated to have 2.6 billion monthly active users.

Bhogaraju says, “One of the issues that is fast emerging as significant is not just the employee experience or customer experience but the complexity of the digital workplace as platforms introduce newer and advanced features. In the end, there has to be simplicity, clarity, and a clear focus on the goals – not just an overload of features that makes life more complex for the employee. It would be critical to enable these features thoughtfully and reskill staff adequately so that the adoption and impact to business process is felt in their day-to-day activities.”

Workspace Transformation across Industries

With many of Google’s employees and developers working remotely, the company has first-hand experience of the challenges of remote working and is leveraging the experience. Google Workspace is also working on custom solutions for various industries. In Retail for example, Woolworths, rolled out Google Workspace and Chrome for geographically dispersed teams to collaborate in real-time and adopt custom-made applications linked to global servers to allow managers to log and address tickets from the shop floor itself. Similarly in Aviation, All Nippon Airways uses Google Workspace to allow pilots, cabin attendants, HR and finance staff to communicate and collaborate in real-time across the globe, using Google Meet, Google Docs, Google Sheets and Google Slides from their PCs, smartphones or tablets. Google retains its focus on the Education industry – Google Workspace Education Fundamentals is free for all qualifying institutions. Solutions such as Google’s Classroom, Teach from Anywhere hub, roster sync, mobile grading and EdTech tools aim to enable better learning and teaching experience for students and educators.

Tech Companies Revamping their Collaboration Offerings

With more companies rethinking their work policies, leaders in the collaboration space are also stepping up their game to evolve their offerings for the hybrid norm. Microsoft’s Viva unifies the experience across Teams and Microsoft 365 for employee communications, wellbeing, learning and knowledge discovery. Similarly, Zoom too has upgraded and integrated various utility, sharing, and management features to support a hybrid workforce. Tech companies are being forced to invest in creating next-generation tools to stay relevant, as Future of Work models continue to shift and evolve.

As tech companies evolve their capabilities, Bhogaraju warns organisations on how they should leverage them. “While technology companies continue to deliver feature rich suites – in reality the uptake and embedding of these programs into the day-to-day business processes is still in its early stages. Business, HR and IT teams continue to struggle. They tend to operate within independent thought silos and there is limited consensus on which feature is really needed and how it can add to the productivity and efficiency. Without this crucial context and an effective change management program – they remain rich features and not impactful ones.”

The hybrid workplace model is gaining popularity in 2021. Check out Ecosytsm’s top 5 Future of Work Trends For 2021. Signup for Free to download the report.

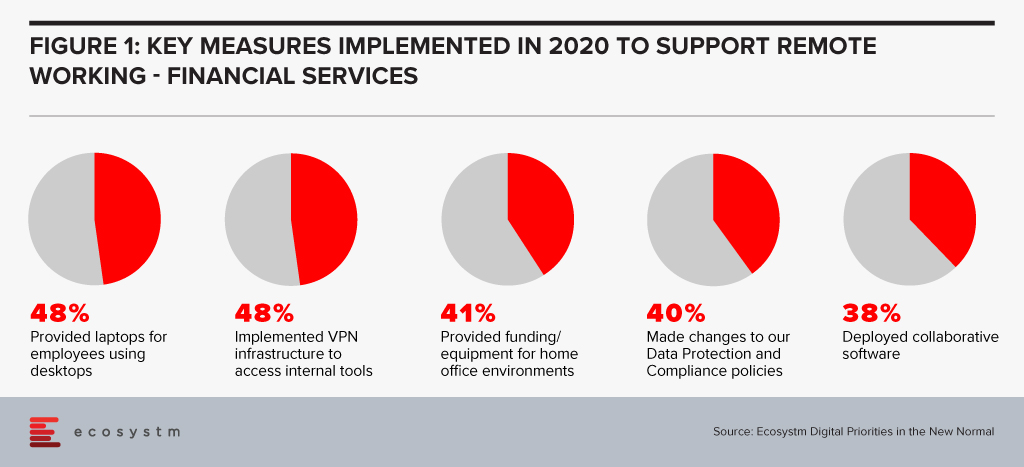

Financial services institutions made a fast switch to remote working when the pandemic forced widespread lockdowns across the globe. The adoption of remote working was nascent in the industry, and there was a need for a fast pivot by both the organisations and employees (Figure 1).

However, this has also exposed the industry to technology-related risks. Ecosystm Principal Advisor, Gerald Mackenzie says, “The move to a more virtualised working environment has been a trend taking shape for many years and like so many trends, it needed an impetus to make it a norm; in this case COVID-19.”

“Many, if not most, financial institutions have been shifting to more cloud-based and modularised Banking-as-a-Service (BaaS) models and these trends will only accelerate as we need to manage risks inherent in conducting financial services via remote working environments. For example, critical capabilities such as Advisor to Client communications need to be verifiable and auditable whether they are happening inside or outside of the office and I predict regulators will be pushing financial institutions to ensure these standards become the norm rather than the exception.”

Singapore Addresses Risk in the Financial Industry

To manage and mitigate risks that could emerge from the extensive remote working adoptions by FIs, The Monetary Authority of Singapore (MAS) and The Association of Banks in Singapore (ABS) jointly released a paper titled Risk Management and Operational Resilience in a Remote Working Environment. This is also in line with the previous collaboration between MAS and ABS in May 2020 to establish the Return to Onsite Operations Taskforce (ROOT). ROOT sought to strengthen and implement safe management and operational resilience measures as well as endorsement of industry best practices.

The paper seeks to create awareness amongst financial institutions on key remote working risks in the domains of technology, operations, security, fraud, staff misconduct, legal and regulatory risks. MAS encourages them to take pre-emptive measures to adopt good practices on managing risks.

Mackenzie adds, “Of course, some of the issues are difficult to solve. For example, staff accessing client data from their homes creates inherent vulnerabilities and the ways to ensure staff have suitable ‘in-home’ working environments to effectively manage these risks can be challenging and expensive. There are great opportunities for innovators to adapt solutions to solve these problems in what will undoubtedly be a growing investment area for many Financial Institutions.” The paper also examines various controls on the people and culture leveraging examples drawn from the experiences of ABS member banks to address evolving risks. For instance, FIs can implement security controls on staff infrastructure including their personal devices, verify in-person meetings against original documents, timely response strategies for recovery teams, legal risks and more.

To keep pace with the changing trends in technology deployment, risk management, and cybersecurity, MAS has been regularly working and engaging with experts to introduce guidelines, principles and best practices for financial institutions. In February, MAS issued a consultation paper proposing revisions to enhance the current requirements for enterprise risk management, investment risk management and public disclosure practices for insurers. Similarly, in January, MAS issued risk management best practice and standards to guide financial institutions in managing technology risk and maintain IT and cyber resilience.

Get insights on the technology areas in the Financial services industry that will see continued investments, as organisations get into the recovery phase.

The COVID-19 pandemic has brought various changes in the healthcare processes. Many healthcare providers are transforming their practices with new trends and trying to stay at the forefront of healthcare innovation.

Ecosystm Healthcare experts and leaders give their verdict on what to expect in 2021.

Ecosystm Predicts – Key trends that will shape healthcare in 2021

The Healthcare industry has had to pivot completely this year and 2021 will see it emerge a transformed industry. The impact will be seen on policies, how ecosystems evolve, and most obviously on healthcare provider organisations. The Top 5 Ecosystm predictions for Healthcare Trends in 2021 is available to download for free on the Ecosystm platform.

Listen to the latest #EcosystmPodcast where Ecosystm Principal Advisor Tim Sheedy talks to Sash Mukherjee about the need to prioritise your spending on customer experience on the right technologies.

Ecosystm research finds that organisations in Singapore are prioritising omnichannel experience and robust knowledge management systems.

Download the eBook here: https://info.ecosystm360.com/drive-better-business-outcomes

Podcast: Play in new window | Download (4.1MB)

Subscribe Spotify | Amazon Music | JioSaavn | Podchaser | RSS | More

Tech providers have largely performed well in the last year, as they support organisations’ transformation and business needs. However, the market becomes increasingly competitive and fragmented.

What should tech vendors focus on to increase their market share in 2021 and beyond?

Keep yourself abreast with the latest latest digital trends

Ecosystm market reports are jam-packed with market research, industry analysis and digital trends across several industry verticals to help you keep tabs on the fast-paced world of tech.

If you are a technology decision-maker for your organisation, 2021 may be a confusing year. You have negotiated the challenges thrown at you in 2020 – but the organisation’s business model and technology roadmap might have changed drastically.

Here is what our panel of technology and industry experts think you should keep in mind in 2021.

Keep yourself abreast with the latest digital trends

Ecosystm market reports are jam-packed with market research, industry analysis and digital trends across several industry verticals to help you keep tabs on the fast-paced world of tech.