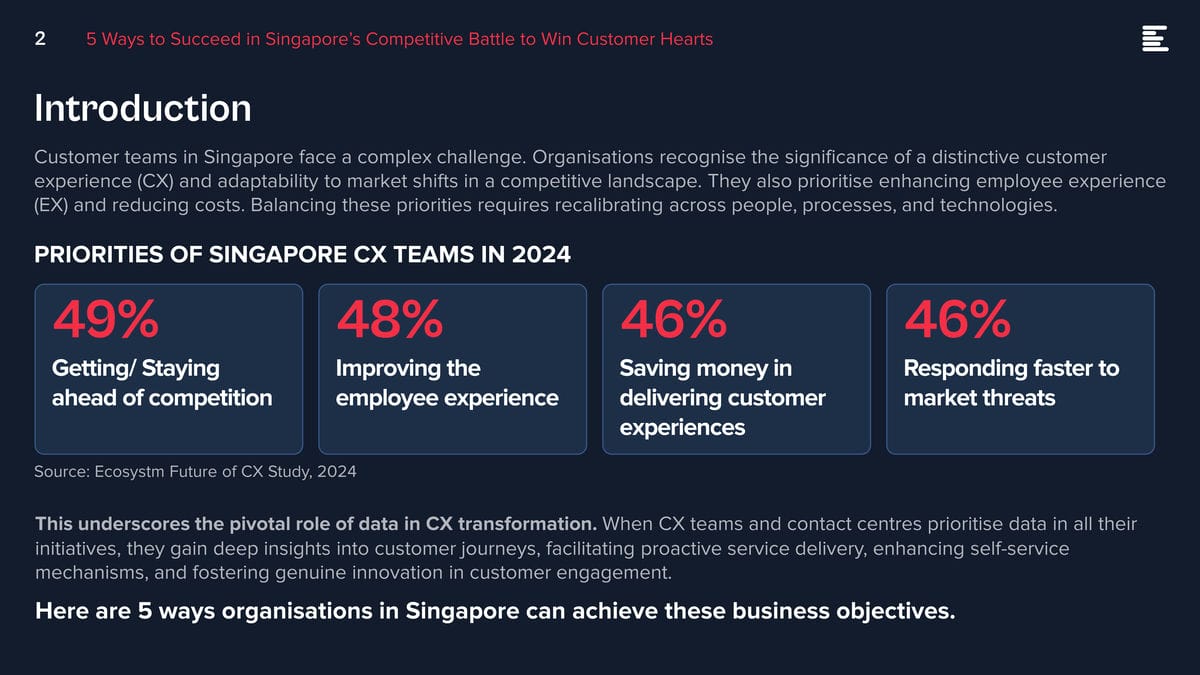

Customer teams in Singapore face a complex challenge. Organisations recognise the significance of a distinctive customer experience (CX) and adaptability to market shifts in a competitive landscape. They also prioritise enhancing employee experience (EX) and reducing costs. Balancing these priorities requires recalibrating across people, processes, and technologies.

This underscores the pivotal role of data in CX transformation. When CX teams and contact centres prioritise data in all their initiatives, they gain deep insights into customer journeys, facilitating proactive service delivery, enhancing self-service mechanisms, and fostering genuine innovation in customer engagement.

Here are 5 ways organisations in Singapore can achieve these business objectives.

Download ‘5 Ways to Succeed in Singapore’s Competitive Battle to Win Customer Hearts’ as a PDF.

#1 Build a Strategy around Voice & Omnichannel Orchestration

Customers seek flexibility to choose channels that suit their preferences, often switching between them. When channels are well-coordinated, customers enjoy consistent experiences, and CX teams and contact centre agents gain real-time insights into interactions, regardless of the chosen channel. This boosts key metrics like First Call Resolution (FCR) and reduces Average Handle Time (AHT).

This doesn’t diminish the significance of voice. Voice remains crucial, especially for understanding complex inquiries and providing an alternative when customers face persistent challenges on other channels. Regardless of the channel chosen, prioritising omnichannel orchestration is essential.

Ensure seamless orchestration from voice to back and front offices, including social channels, as customers switch between channels.

#2 Unify Customer Data through an Intelligent Data Hub

Accessing real-time, accurate data is essential for effective customer and agent engagement. However, organisations often face challenges with data silos and lack of interconnected data, hindering omnichannel experiences.

A Customer Data Platform (CDP) can eliminate data silos and provide actionable insights.

- Identify behavioural trends by understanding patterns to personalise interactions.

- Spot real-time customer issues across channels.

- Uncover compliance gaps and missed sales opportunities from unstructured data.

- Look at customer journeys to proactively address their needs and exceed expectations.

#3 Transform CX & EX with AI

GenAI and Large Language Models (LLMs) is revolutionising how brands address customer and employee challenges, boosting efficiency, and enhancing service quality.

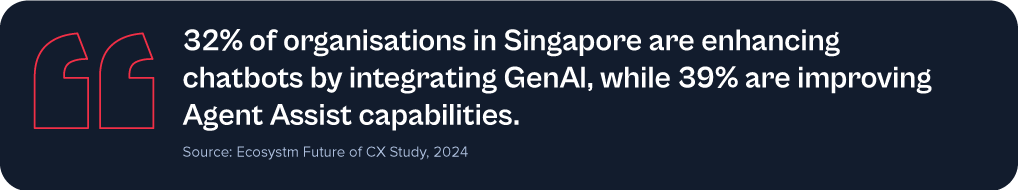

Despite 62% of Singapore organisations investing in virtual assistants/conversational AI, many have yet to integrate emerging technologies to elevate their CX & EX capabilities.

Agent Assist solutions provide real-time insights before customer interactions, optimising service delivery and saving time. With GenAI, they can automate mundane tasks like call summaries, freeing agents to focus on high-value tasks such as sales collaboration, proactive feedback management, personalised outbound calls, and upskilling.

Going beyond chatbots and Agent Assist solutions, predictive AI algorithms leverage customer data to forecast trends and optimise resource allocation. AI-driven identity validation swiftly confirms customer identities, mitigating fraud risks.

#4 Augment Existing Systems for Success

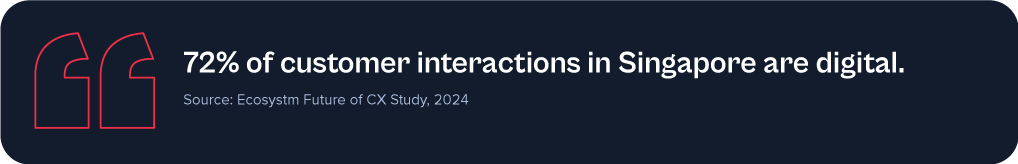

Despite the rise in digital interactions, many organisations struggle to fully modernise their legacy systems.

For those managing multiple disparate systems yet aiming to lead in CX transformation, a platform that integrates desired capabilities for holistic CX and EX experiences is vital.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

#5 Focus on Proactive CX

In the new CX economy, organisations must meet customers on their terms, proactively engaging them before they initiate interactions. This will require organisations to re-evaluate all aspects of their CX delivery.

- Redefine the Contact Centre. Transform it into an “Intelligent” Data Hub providing unified and connected experiences. Leverage intelligent APIs to proactively manage customer interactions seamlessly across journeys.

- Reimagine the Agent’s Role. Empower agents to be AI-powered brand ambassadors, with access to prior and real-time interactions, instant decision-making abilities, and data-led knowledge bases.

- Redesign the Channel and Brand Experience. Ensure consistent omnichannel experiences through data unification and coherency. Use programmable APIs to personalise conversations and identify customer preferences for real-time or asynchronous messaging. Incorporate innovative technologies such as video to enhance the channel experience.

Technological innovation is dramatically changing how organisations interact with modern consumers in the rapidly evolving banking, financial services, and insurance (BFSI) industry. The growing dependence on digital communication tools and platforms lies at the core of this transformation. These tools have become vital for BFSI organisations to meet the dynamic needs of today’s customers, enabling agile, responsive Sales & Support teams that can use real-time data to sustain customer engagement, ensure data security, comply with regulations, and streamline operations.

Customer Engagement Challenges in BFSI Organisations

Security Concerns. Customers in the BFSI industry are increasingly concerned about the security of their financial transactions and Personal Identifiable Information (PII). With the rise of cyber threats, customers expect robust security measures to protect their accounts and sensitive information. BFSI organisations need to continually invest in cybersecurity infrastructure and technologies to reassure customers and maintain their trust.

Customer Expectations. In the competitive landscape of the BFSI industry, customer retention and attraction are critical to sustaining profitability. Organisations must prioritise an agile approach that adapts swiftly to market changes. Central to this strategy is the delivery of personalised experiences aligned with individual preferences and needs, driven by advancements in digitalisation. To achieve this, BFSI organisations have to increase investments in AI-driven solutions to gain deep insights into customer behaviour, enabling them to accurately anticipate and meet evolving needs.

Regulatory Compliance. The industry operates in a highly regulated environment with strict compliance requirements imposed by various regulatory bodies. Ensuring compliance with constantly evolving regulations such as GDPR, PSD2, Dodd-Frank, etc., poses a significant challenge for organisations. To complicate the landscape further, institutions with cross-border operations need to consider the laws in different countries. Compliance efforts often result in additional operational complexities and costs, which can impact the overall customer experience if not managed effectively.

Digital Transformation. Rapid technological advancements and changing customer preferences are driving BFSI organisations to undergo digital transformation initiatives. However, legacy systems and processes hinder their ability to innovate and adapt to digital trends quickly. Transitioning to modern, agile architectures while ensuring uninterrupted services and minimal disruption to customers is a complex undertaking for many BFSI organisations.

Customer Education and Communication. Financial products and services can be complex, and customers often require guidance to make informed decisions. Sales & Support teams in BFSI organisations struggle to effectively educate their customers about the features, benefits, and risks associated with various products. Clear and transparent communication regarding fees, terms, and conditions is essential for building trust and maintaining customer satisfaction. Balancing regulatory requirements with the need for transparent communication can be challenging.

5 Ways to Empower Sales & Support Teams in BFSI

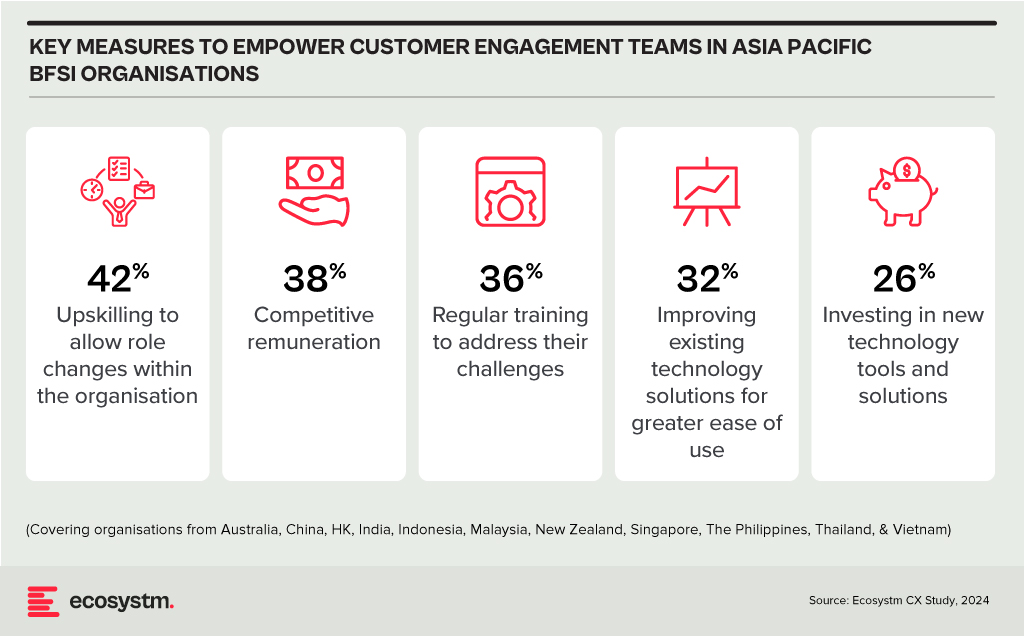

BFSI organisations in Asia Pacific often overlook technology enablement for the empowerment of their Sales & Support and other customer engagement teams. Key measures to empower these teams include upskilling for role flexibility and offering competitive remuneration for better employee retention.

Organisations should prioritise upgrading Sales & Support tools and solutions to address the team’s key pain points.

#1 Boost Customer Engagement with Omnichannel Support

BFSI organisations need to work on a suite of API-driven solutions to create a comprehensive omnichannel presence. This enables engagement with customers via their preferred channels, such as SMS, email, voice, chat, or video. Such flexibility enhances customer satisfaction and loyalty by ensuring personalised and convenient interactions. This includes capabilities such as the ability to deploy messaging and voice services to dispatch timely account activity alerts, secure transactions with two-factor authentication, and deliver customised financial advice through chatbots or direct communications.

#2 Streamline Customer Service with AI and Virtual Assistants

Integrating AI and virtual assistants allows BFSI companies to automate standard inquiries and transactions, freeing Sales & Support teams to tackle more sophisticated customer needs. These AI tools can interpret and process natural language, facilitating conversational interactions with automated services. This boosts efficiency and shortens response times, elevating the customer engagement experience. Also, consistently integrating these virtual assistants across various channels ensures a uniform customer experience – and brand image.

#3 Enhance Security Measures and Compliance Standards

Adhering to stringent security and compliance requirements is essential for BFSI organisations. A secure platform complies with critical global and country-level standards and regulations. The voice and video communication services must include comprehensive encryption, protecting all customer interactions. There is also a need to have a suite of tools for monitoring and auditing communications to meet compliance requirements, allowing BFSI organisations to protect sensitive data while providing secure communication options.

#4 Leverage Insights for Personalised Customer Interactions

BFSI organisations must focus on aggregating, harmonising, and scrutinising customer interactions across various channels. This holistic view of customer behaviour allows for more targeted and personalised services, enhancing customer engagement and loyalty. By leveraging insights into customers’ interaction histories, preferences, and financial objectives, companies can customise their outreach and recommendations, improving upselling, cross-selling, and retention strategies.

#5 Increase Operational Efficiency with Cloud-Based Solutions

Cloud-based communication solutions offer BFSI organisations the scalability and flexibility needed to respond swiftly to market shifts and customer demands. This adaptability is vital for fostering growth in a dynamic industry. A customisable solution supports organisations in refining their operations, from automating workflows to integrating CRM systems, enabling Sales & Support teams to operate more smoothly and effectively. Cloud technology helps reduce operational expenses, elevate service quality, and spur innovation.

Digital communication and collaboration tools have the power to revolutionise BFSI, enhancing engagement, security, and efficiency. Through APIs, AI, and cloud, organisations can meet evolving market needs, driving growth and innovation. Embracing these solutions ensures competitiveness and agility in a changing landscape.

In my last Ecosystm Insights, I spoke about the implications of the shift from Predictive AI to Generative AI on ROI considerations of AI deployments. However, from my discussions with colleagues and technology leaders it became clear that there is a need to define and distinguish between Predictive AI and Generative AI better.

Predictive AI analyses historical data to predict future outcomes, crucial for informed decision-making and strategic planning. Generative AI unlocks new avenues for innovation by creating novel data and content. Organisations need both – Predictive AI for enhancing operational efficiencies and forecasting capabilities and Generative AI to drive innovation; create new products, services, and experiences; and solve complex problems in unprecedented ways.

This guide aims to demystify these categories, providing clarity on their differences, applications, and examples of the algorithms they use.

Predictive AI: Forecasting the Future

Predictive AI is extensively used in fields such as finance, marketing, healthcare and more. The core idea is to identify patterns or trends in data that can inform future decisions. Predictive AI relies on statistical, machine learning, and deep learning models to forecast outcomes.

Key Algorithms in Predictive AI

- Regression Analysis. Linear and logistic regression are foundational tools for predicting a continuous or categorical outcome based on one or more predictor variables.

- Decision Trees. These models use a tree-like graph of decisions and their possible consequences, including chance event outcomes, resource costs and utility.

- Random Forest (RF). An ensemble learning method that operates by constructing a multitude of decision trees at training time to improve predictive accuracy and control over-fitting.

- Gradient Boosting Machines (GBM). Another ensemble technique that builds models sequentially, each new model correcting errors made by the previous ones, used for both regression and classification tasks.

- Support Vector Machines (SVM). A supervised machine learning model that uses classification algorithms for two-group classification problems.

Generative AI: Creating New Data

Generative AI, on the other hand, focuses on generating new data that is similar but not identical to the data it has been trained on. This can include anything from images, text, and videos to synthetic data for training other AI models. GenAI is particularly known for its ability to innovate, create, and simulate in ways that predictive AI cannot.

Key Algorithms in Generative AI

- Generative Adversarial Networks (GANs). Comprising two networks – a generator and a discriminator – GANs are trained to generate new data with the same statistics as the training set.

- Variational Autoencoders (VAEs). These are generative algorithms that use neural networks for encoding inputs into a latent space representation, then reconstructing the input data based on this representation.

- Transformer Models. Originally designed for natural language processing (NLP) tasks, transformers can be adapted for generative purposes, as seen in models like GPT (Generative Pre-trained Transformer), which can generate coherent and contextually relevant text based on a given prompt.

Comparing Predictive and Generative AI

The fundamental difference between the two lies in their primary objectives: Predictive AI aims to forecast future outcomes based on past data, while Generative AI aims to create new, original data that mimics the input data in some form.

The differences become clearer when we look at these examples.

Predictive AI Examples

- Supply Chain Management. Analyses historical supply chain data to forecast demand, manage inventory levels, reduces costs and improve delivery times.

- Healthcare. Analysing patient records to predict disease outbreaks or the likelihood of a disease in individual patients.

- Predictive Maintenance. Analyse historical and real-time data and preemptively identifies system failures or network issues, enhancing infrastructure reliability and operational efficiency.

- Finance. Using historical stock prices and indicators to predict future market trends.

Generative AI Examples

- Content Creation. Generating realistic images or art from textual descriptions using GANs.

- Text Generation. Creating coherent and contextually relevant articles, stories, or conversational responses using transformer models like GPT-3.

- Chatbots and Virtual Assistants. Advanced GenAI models are enhancing chatbots and virtual assistants, making them more realistic.

- Automated Code Generation. By the use of natural language descriptions to generate programming code and scripts, to significantly speed up software development processes.

Conclusion

Organisations that exclusively focus on Generative AI may find themselves at the forefront of innovation, by leveraging its ability to create new content, simulate scenarios, and generate original data. However, solely relying on Generative AI without integrating Predictive AI’s capabilities may limit an organisation’s ability to make data-driven decisions and forecasts based on historical data. This could lead to missed opportunities to optimise operations, mitigate risks, and accurately plan for future trends and demands. Predictive AI’s strength lies in analysing past and present data to inform strategic decision-making, crucial for long-term sustainability and operational efficiency.

It is essential for companies to adopt a dual-strategy approach in their AI efforts. Together, these AI paradigms can significantly amplify an organisation’s ability to adapt, innovate, and compete in rapidly changing markets.

The impact of AI on Customer Experience (CX) has been profound and continues to expand. AI allows a a range of advantages, including improved operational efficiency, cost savings, and enhanced experiences for both customers and employees.

AI-powered solutions have the capability to analyse vast volumes of customer data in real-time, providing organisations with invaluable insights into individual preferences and behaviour. When executed effectively, the ability to capture, analyse, and leverage customer data at scale gives organisations significant competitive edge. Most importantly, AI unlocks opportunities for innovation.

Read on to discover the transformative impact of AI on customer experiences.

Click here to download ‘Customer Experience Redefined: The Role of AI’ as a PDF

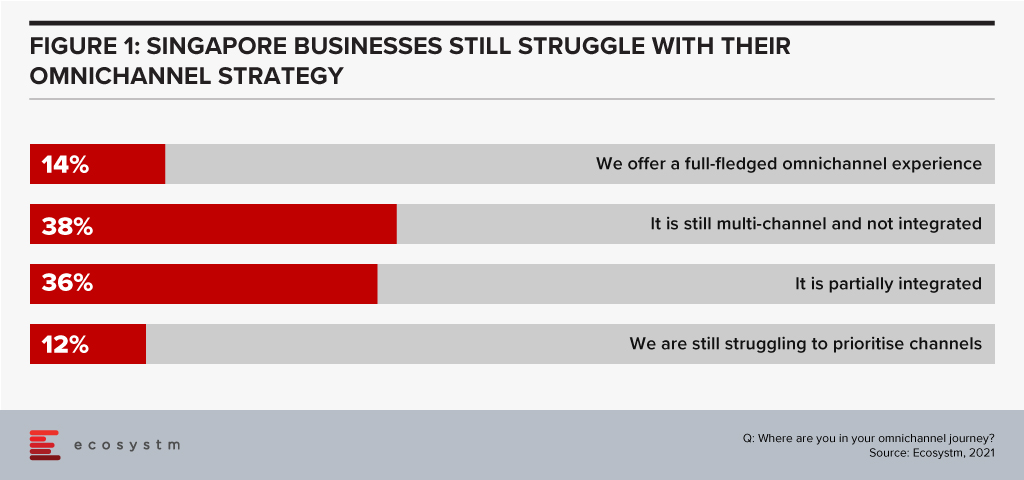

Customer needs are changing. Quickly. In 2020 having a great digital strategy went from being a nice-to-have to an absolute necessity. And in 2021, businesses that have great omnichannel experiences will go from a small minority to a majority as customers demand that they are served on their terms in their chosen platform. Only 14% of businesses in Singapore offer a complete omnichannel experience today – serving customers on their terms regardless of the location or platform (Figure 1). These businesses are setting the benchmark that the rest of the market needs to meet soon.

The Growing Importance of Social Media in Delivering Customer Experience

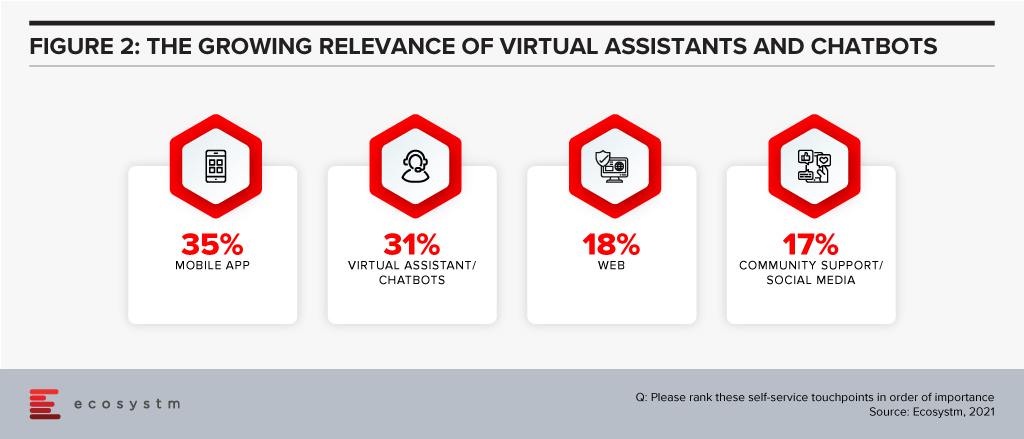

Chat and messaging are quickly becoming the normal way to interact with businesses – the view of a few years ago that “no one wants to chat with a bot” has quickly turned around. Now virtual assistants and chatbots are the second most important self-service channel for businesses in Singapore (Figure 2).

In fact, Zendesk’s global study shows that most customers (45%) use embedded messaging over social messaging apps (31%) and text/SMS (20%). That might be great for self-service, but for commerce, boundless opportunities exist to move to where the customer lives, communicates, and socialises today.

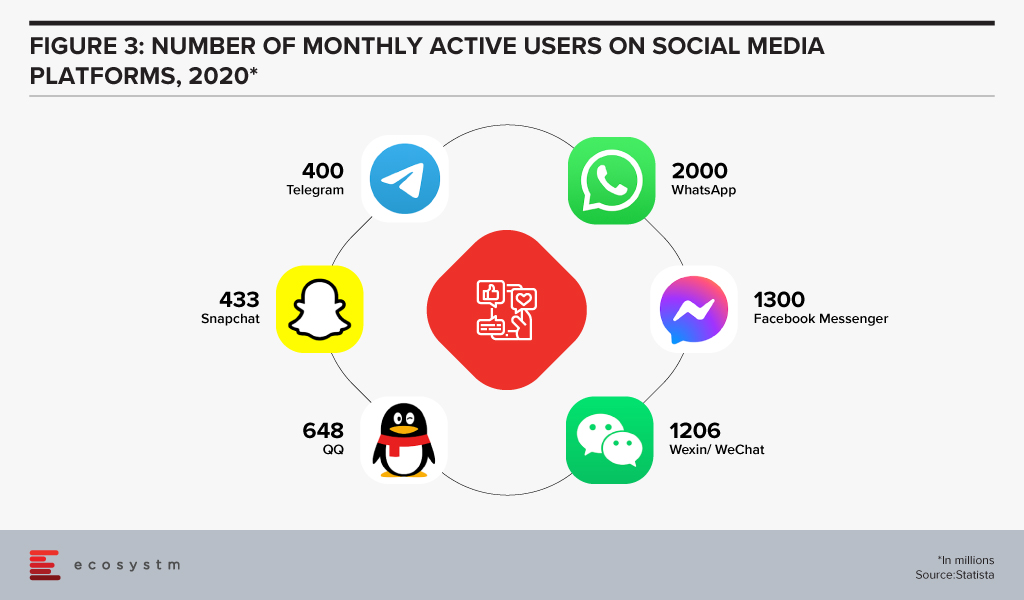

Smart businesses understand that customers spend their lives in other chat and social media platforms – such as Facebook Messenger, TikTok, Instagram, WeChat, Discord and WhatsApp. More customers expect to be served in these channels; they expect to be able to transact with their brands of choice. Why should they go to a mobile banking app to find their balance? Why can’t they get it in WhatsApp? They are often learning about the next Jordan or Yeezy shoe drop from their social network in Messenger – so why not transact with them there? Consider all your own personal WhatsApp, Messenger and other messaging platform groups discussing social activities, sporting teams, school activities or the latest fashion – these are ALL opportunities for commerce (Figure 3).

And there are use cases now. Airlines – such as KLM and Etihad Airways – are engaging customers on WeChat, Kakao Talk, and WhatsApp, helping them reschedule flights and answering customer service queries. Telecommunications providers are allowing customers to raise issues on messaging platforms – and are also using them to upsell and cross-sell new services. Transportation providers are making it easier to find a car or the the next scheduled bus right there in the messaging platforms. Retailers – such as 1-800 Flowers and Culture Kings – are not only serving customers but finding new customers on these messaging platforms.

Going beyond the messaging platforms, businesses are also looking to serve customers on their smart devices – such as Amazon Alexa/Echo and Google Nest/Home devices. Alerting customers to order updates, shipping details and product promotions is becoming standard practice for leading businesses. Digitally-savvy banks are allowing customers to not only track their balance but also make transfers and payments using these smart platforms.

Customers are more comfortable with these conversational commerce options – and they actually expect you to offer such services on your site, in your app, on their smart devices, and on their messaging platforms of choice. Your ability to provide outstanding customer experiences will not only be your ticket back to revenue growth but the recipe for long term business success. Meeting customer needs on their terms is a good place to start.

Delivering a Personalised Conversational Customer Experience

Customer experience (CX) decision-makers will have to rethink how they approach building richer CX capabilities to deliver personalised conversational interactions with customers.

Messaging should become part of a wider AI, Data, and Mobile strategy. Contact centre teams might feel that this is too ambitious a project and would prefer to continue to serve customers through the more traditional channels only. So, it is important to identify the key stakeholder/s who will drive the initiative. And the contact centre team should work with the Digital, Innovation and Marketing teams.

Designing the mobile experience and in app messaging for CX should have some of the following features:

- Ability to click a button to request for a service or escalate an issue that will, in turn, result in the company contacting the customer either by messaging or calling.

- Giving customers the option to contact through popular messaging platforms such as Facebook Messenger, WhatsApp, LINE, WeChat, and others. Unifying these systems in a single interface that integrates with your customer service application is best practice.

- Having one single interface to manage and make payments – within the app itself or on the social messaging platform. Conversational commerce is about creating an ongoing relationship with customers throughout the entire customer journey. Don’t just focus on the sale or the post-sales experience – customers expect to be able to interact with your business from their platform of choice regardless of their need or stage in the customer journey.

- Embed deep analytics into the communication services to help the organisation better deliver a personalised CX.

- Ensure you have a solid, unified knowledge management interface at the backend so that all questions lead to the same answers regardless of channel, platform or touchpoint.

Your opportunity to drive greater business success lies in your ability to better win, serve and retain your customers. Refresh your customer strategy and capability today to make 2021 an exceptional year for your business.