The pandemic crisis has rapidly accelerated digitalisation across all industries. Organisations have been forced to digitalise entire processes more rapidly, as face-to-face engagement becomes restricted or even impossible.

The most visible areas where face-to-face activity is being swiftly replaced by digital alternatives include conferencing and collaboration, and the use of digital channels to engage with customers, suppliers, and other stakeholders.

For example, the crisis has made it difficult – even impossible, sometimes – for contact centre agents to physically work in contact centres, and they often do not have the tools to work effectively from home. This challenge is particularly apparent for offshore contact centres in the Philippines and India. The creation of chatbots has reduced the need for customer service staff and enabled data to by entered into front-office systems, and analysed immediately.

Less visible are back-office processes which are commonly inefficient and labour-intensive. Remote working makes some back-office workflows challenging or impossible. For example, some essential finance and accounting workflows involve a mix of digital communications, printing, scanning, copying and storage of physical documents – making these workflows inefficient, difficult to scale and labour-intensive. This has been highlighted during the pandemic. RPA adoption has grown faster than expected as organisations seek to resolve these and other challenges – often caused by inefficient workflows being scrambled by the crisis.

The RPA Market in Asia Pacific

There are many definitions of the RPA market, but it can broadly be defined as the use of software bots to execute processes which involve high volumes of repeatable tasks, that were previously executed by humans. When processes are automated, the physical location of employees and other stakeholders becomes less important. RPA makes these processes more agile and flexible and makes businesses more resilient. It can also increase operational efficiency, drive business growth, and enhance customer and employee experience.

RPA is a comparatively new and fast-growing market – this is leading to rapid change. In its infancy, it was basically the digitalisation of BPO. It was viewed as a way of automating repetitive tasks, many of which had been outsourced. While its cost saving benefits remain important as with BPOs, customers are now seeking more. They want RPA to help them to improve or transform front-office, back-office and industry-specific processes throughout the organisation. RPA vendors are addressing these enhanced requirements by blending RPA with AI and re-branding their offerings as intelligent automation or hyper-automation.

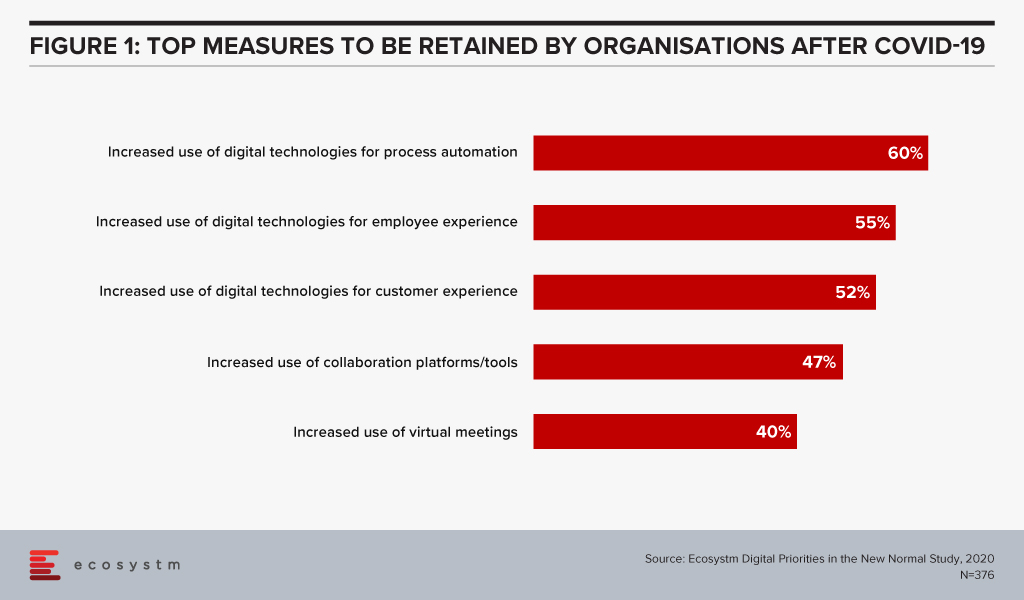

Asia Pacific organisations have been relatively slow to adopt RPA, but this is changing fast. The findings of the Ecosystm Digital Priorities in the New Normal study show that in the next 12 months, organisations will continue to focus on digital technologies for process automation (Figure 1).

The market is growing rapidly with large global RPA specialists such as UiPath, Automation Anywhere, Blue Prism and AntWorks experiencing high rates of growth in the region.

RPA vendors in Asia Pacific, are typically addressing immediate, short-term requirements. For example, healthcare companies are automating the reporting of COVID-19 tests and ordering supplies. Chatbots are being widely used to address unprecedented call centre volumes for airlines, travel companies, banks and telecom providers. Administrative tasks increasingly require automation as workflows become disrupted by remote working.

Companies can also be expected to scale their current deployments and increase the rate at which AI capabilities are integrated into their offerings

RPA often works in conjunction with major software products provided by companies such as Salesforce, SAP, Microsoft and IBM. For example, some invoicing processes involve the use of Salesforce, SAP and Microsoft products. Rather than having an operative enter data into multiple systems, a bot can be created to do this.

Large software vendors such as IBM, Microsoft, Salesforce and SAP are taking advantage of this opportunity by trying to own entire workflows. They are increasingly integrating RPA into their offerings as well as competing directly in the RPA market with pureplay RPA vendors. RPA may soon be integrated into larger enterprise applications, unless pureplay RPA vendors can innovate and continually differentiate their offerings.

Last week industry leaders, SAP and Siemens, announced a partnership to bring together their respective expertise on creating integrated and enhanced solutions for product lifecycle management (PLM), supply chain, service and asset management, in a move that is expected to accelerate Industry 4.0 globally.

The partnership between SAP and Siemens aims to develop innovative business models to break silos between manufacturing, product development and service delivery teams to establish seamless customer-centric processes. It will provide users with real-time business information, customer insights and performance data over the entire product development cycle.

As the first step of this agreement, Siemens will offer SAP’s Intelligent Asset Management solution and Project and Portfolio Management applications and SAP will offer Siemens’ PLM suite Teamcenter software for product lifecycle collaboration and data management to manufacturers and business operators across the network – complementing each other’s solutions.

Ecosystm Principal Advisor, Kaushik Ghatak says, “The convergence of the Information Technology (IT) and the Operational Technology (OT) worlds is a must for companies to operate in the cyber physical world of Industry 4.0. Historically, these two worlds have operated in silos. This is a great partnership announcement aimed towards meeting the convergence goals by integrating the capabilities of Siemens (an OT leader), and SAP (an IT leader). Together they would be able to offer an exhaustive set of very valuable offerings in the Digital Supply Chain and Digital Manufacturing domain for customers worldwide.”

Ghatak says, “This is not the first such partnership for Siemens. A strategic alliance between Siemens and Atos has been in place since 2011. In 2018 the alliance was strengthened with plans to accelerate their joint business until 2020, with a focus on building innovative solutions by combining their capabilities. However, the difference this time is that SAP has very a deep and wide set of software offerings in the supply chain and manufacturing domains, which when stitched together with Siemens’ PLM solutions can provide true end-to-end digitalisation capabilities across the ‘Design, Source, Make, Deliver and Plan’ continuum of the value chain.”

Ecosystm Comments

Ghatak, however, cautions that while this is a great partnership announcement between two giants in their respective fields, they will need to collaborate actively on three key aspects for this partnership to deliver value for the customers.

- Product Development. Building-integrated solutions with heterogenous data models is not easy. It will require very open collaboration between their product development teams to identify the use cases and build solutions that can enable seamless information flow and actions across the different software modules owned by each.

- Go-to-market. Going to market jointly will need strong collaboration too. In terms of the agreement on customer account ownership, pricing, sharing of pre-sales resources and so on.

- Implementation. And, last but not the least, it will require collaboration to ramp up the implementation capabilities of the jointly developed solutions.

Google recently announced its ‘Google Cloud Acceleration Program’ to support SAP customers in simplifying their transition to the cloud.

Earlier this year, Google initiated a program known as Lighthouse, in partnership with system integrators, to streamline its customers’ SAP journeys to the cloud. The Google Cloud Acceleration Program is a progression of Lighthouse and will provide technical resource, blueprints, employee training and consulting services to partners and customers for migrating SAP to the cloud, as well as upgrading to SAP S/4HANA.

Google Cloud Acceleration Program Partners’ contributions

Several ISV’s and technology providers are already participating in the program. One of these providers, HCL Technologies, recently announced plans for a 5,000-employee division which will focus entirely on helping enterprise customers plan and execute large-scale migration of workloads and applications to Google Cloud. Accenture and Google set up a similar collaboration earlier this year.

Google’s Cloud Acceleration Program will be supported by partners such as Accenture, Atos, Deloitte, and HCL to help migrate workloads. In addition, these partners will also work alongside Capgemini, DXC Technologies, Hitachi oXya, Infosys, NTT, TCS, and Wipro, to create SAP centres of Excellence for Google Cloud.

Commenting on Google’s Cloud Acceleration Program for SAP platform, Principal Analyst at Ecosystm Claus Mortensen said, “Migrating SAP to the cloud has proven to be a notoriously complex task over the years. To help the migration to Google’s Cloud, Google launched its SAP Lighthouse program. The Cloud Acceleration Program can be seen as an evolution of Lighthouse.”

Mortensen added, “Google Cloud Acceleration Program is intended to make migration as simple as it can be under the circumstances – but I don’t think it will ever be easy to migrate SAP to the cloud – it is too complex a system to become simple to migrate. Whether it will succeed in convincing SAP customers to migrate much depends on how well the program partners perform.”

The primary aim of the Cloud Acceleration Program is to boost the adoption of Google cloud services and benefit customers with greater innovation, operational efficiency, and risk mitigation. Google has been active in promoting the programme and in the same spirit, Google recently acquired CloudSimple, a provider of secure, dedicated environments to run VMware workloads in the Cloud. Many organisations are running VMware in their on-premises environments to run a variety of workloads and this acquisition will boost abilities to run VMware on Google Cloud Platform.

As we recently stated in our predictions for ‘the top 5 cloud trends for 2020′, the ability for even the top cloud players to compete will increasingly come down to their ability to expand their service capabilities beyond their current offerings. Ecosystm expects these players to further enhance their focus on expanding their services, management and integration capabilities through global and in-country partnerships. One particular area might be partnerships focusing on Cloud migration between Clouds and from Cloud to on-premises. Google’s Cloud Acceleration program is a prime example of a framework, that has such partnerships in mind.

Speaking on the benefits of Google Cloud acceleration program for SAP customers, Mortensen said “cloud offers a lot of flexibility and agility that would be hard to achieve using an on-premises deployment. So, from that perspective, the Google Cloud Acceleration program should be good news to both new customers and existing customers, who see a benefit from migrating partly or fully to the cloud.”