As the search for a COVID-19 vaccine intensifies, there is a global focus on the Life Sciences industry. The industry has been hit hard this year – having to deliver overtime through a disrupted supply chain, unexpected demand spikes, and reduction of revenues from their regular streams. Life sciences organisations are already challenged by the breadth of their focus – across R&D and clinical discovery; Manufacturing & Distribution; and Sales & Marketing. Increasingly, many pharmaceutical and medtech organisations choose to outsource some of these functions, which brings to fore the need for a robust compliance framework. In the Ecosystm Digital Priorities in the New Normal Study, two-thirds of life sciences organisations mention that they have either been forced to start, accelerate or refocus their Digital Transformation initiatives – the remaining one-third have put their Digital Transformation on hold. The industry is clearly at an inflection point.

Challenges of the Life Sciences Industry

Continued Focus on R&D. Life sciences companies operate in an extremely competitive global market where they have to work on new products against a backdrop of competition from generics and a global concern over rising healthcare expenditure. Apart from regulatory challenges, they also face immense competition from local manufacturers as they enter each new market.

Re-thinking their Distribution Strategy. Sales and distribution for many pharma and medtech organisations have been traditional – using agents, distributors, clinicians, and healthcare providers. But now they need to change their go-to-market strategies, target patients and consumers directly and package their product offerings into value-added services. This will require them to incorporate customer experience enhancers in their R&D, going beyond drug discovery and product innovation.

Tracking Global Regulations. Governments across the world are trying to manage their healthcare budgets. They are also more focused on chronic disease management. The focus has shifted to value-based medicine in general, but pharma and medtech products are being increasingly held accountable by health outcomes. Governments are increasingly implementing drug reforms around what clinicians can prescribe. Global Life Sciences organisations have to constantly monitor the regulations in the multiple countries where they operate and sell. They are also accountable for their entire supply chain, especially ensuring a high product quality and fraud prevention.

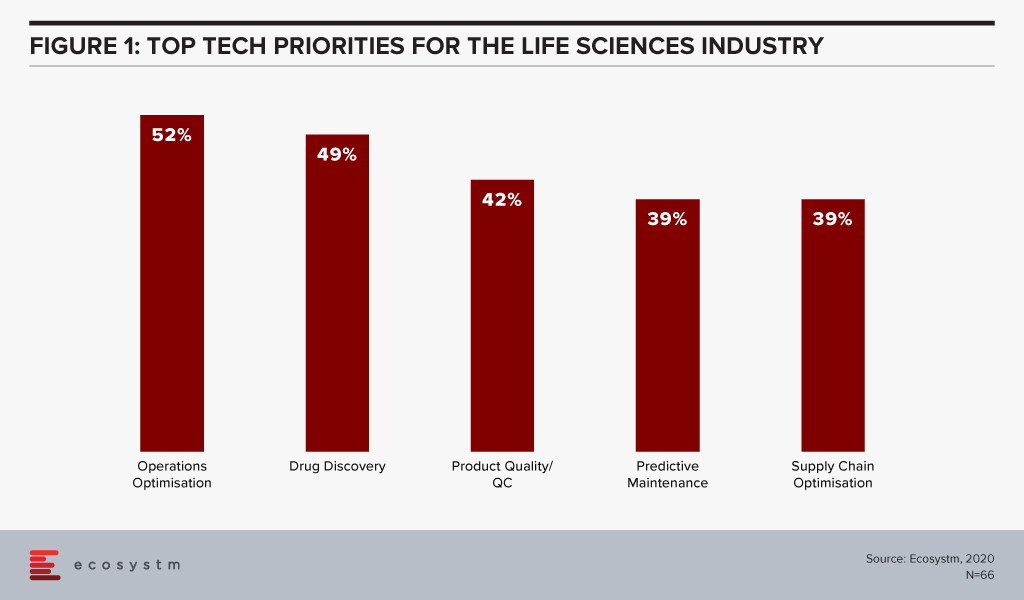

The global Ecosystm AI study reveals the top priorities for Life Sciences organisations, focused on adopting emerging technologies (Figure 1). They appear to be investing in emerging technology especially in their R&D and clinical discovery and Manufacturing functions.

Technology as an Enabler of Life Sciences Transformation

Discovery and Development

With the evolution of technology, Life Sciences organisations are able to automate much of the mundane tasks around drug discovery and apply AI and machine learning to transform their drug discovery and development process. They are increasingly leveraging their ecosystem of smaller pharma and medtech companies, research laboratories, academic institutions, and technology providers to make the process more time and cost efficient.

Using an AI algorithm, the researchers at the Massachusetts Institute of Technology have discovered an antibiotic compound that can kill many species of antibiotic-resistant bacteria. MIT’s algorithm screens millions of chemical compounds and chooses the antibiotics which have the potential to eliminate bacteria resistant to existing drugs. Harvard’s Wyss Institute for Biologically Inspired Engineering is manufacturing 3D printed organ-on-a-chip to give insights on cell, tissue, and organ biology to help the pharma sector with drug development, disease modelling and finally in the development of personalised medicine.

Life Sciences are also engaging more with technology partners – whether emerging start-ups or established players. Pfizer and Saama are working together on AI clinical data mining. The companies are developing and deploying an AI-based analytical tool where Pfizer provides clinical data and domain knowledge to train models on the Saama Life Science Analytics Cloud (LSAC). Saama was identified as a partner at a hackathon. Sanofi and Google have established a new virtual Innovation Lab to develop scientific and commercial solutions, using multiple Google capabilities from cloud computing to AI.

Tech providers also keep evolving their capabilities in the Life Sciences industry for more efficient drug discovery and better treatment protocols. Microsoft’s Project Hanover uses machine learning to develop a personalised drug protocol to manage acute myeloid leukaemia. Similarly, Apple’s ResearchKit – an open-source framework is meant to help researchers and developers create iOS-based applications in the field of medical research.

Manufacturing and Logistics

The industry also faces the challenges faced by any Manufacturing organisation and has the need to deploy manufacturing analytics, and advanced supply chain technology for better process and optimisation and agility. There is also the need for complete visibility over their supply chain and inventory for traceability, safety, and fraud prevention. Emerging technologies such as Blockchain will become increasingly relevant for real-time track and trace capability.

The MediLedger Network was established as an open network to the entire pharma supply chain. The project brings a consortium of some of the world’s largest pharmaceutical companies, and logistics providers to improve drug supply chain management.

Since the data on the distributed ledger is encrypted, it creates a secure system without any vulnerabilities. This eliminates counterfeit products and ultimately ensures the quality of the pharma products and promotes increased patient safety. To foster security and improve the supply chain, the United States Food and Drug Administration (USFDA) successfully completed a pilot with a group including IBM, KPMG, Merck and Walmart to support U.S. Drug Supply Chain Security Act (DSCSA) to trace vaccines and prescription medicines throughout the country.

Diagnostics and Personalised Healthcare

As more devices (consumer and enterprise) and applications enter the market, people will take ownership and interest in their own health outcomes. This is seeing a continued growth in online communities and comparison sites (on physicians, hospitals, and pharmaceutical products). Increasingly, insurance providers will use data from wearable devices for a more personalised approach; promoting and rewarding good health practices.

Beyond the use of wearables and health and wellness apps, we will also see an exponential increase of home-based healthcare products and services – whether for primary care and chronic disease management, or long-term and palliative care. As patients become more engaged with their care, the life sciences industry is beginning to serve them through personalised approach, medicines, right diagnosis and through advanced medical devices and products.

An online tool developed by the University of Virginia Health Systems helps identify patients that have a high risk of getting a stroke and helps them reduce that risk. This tool calculates the patient’s probability of suffering a stroke by measuring the severity of their metabolic syndrome – taking into account a number of conditions that include high blood pressure, abnormal cholesterol levels and excess body fat. Life Sciences organisations are increasingly having to invest in customer-focused solutions such as these.

Wearables with special smart software to monitor health parameters, gauge drug compatibility and monitor complications are being implemented by Life Sciences organisations. The US FDA approved a pill called Abilify MyCite fitted with a tiny ingestible sensor that communicates with a patch worn by the patient to transmit data on a smartphone. Medtech companies continue to develop FDA approved health devices that can monitor chronic conditions. Smart continuous glucose monitoring (CGM) and insulin pens send blood glucose level data to smartphone applications allowing the wearer to easily check their information and detect trends.

Technologies such as AR/VR are also enabling Life Sciences companies with their diagnostics. Regeneron Pharmaceuticals has created an AR/VR app called “In My Eyes” to better diagnose vision impairment in patients.

What is interesting about these personalised products is that not only do they improve clinical outcomes, they also give Life Sciences companies access to rich data that can be used for further product development and improvement.

The Life Sciences industry will continue to operate in an unpredictable and competitive market. This is evident by the several mergers and acquisitions that we witness in the industry. As they continue to use cutting-edge technology for their R&D practices, they will leverage technology to transform other functions as well.

The next phase of a post-COVID world will be one of reduced physical contact, tighter regulations, and new habits and hygiene practices. This will translate into significant process changes which will be deeply enabled by mobile technology. All mobile form factors will be more integrated into how we interact. Interactional changes will be found in our homes, offices, public spaces and services.

In this blog post I address two fundamental questions as a technologist on the underpinnings of this shift:

- How can enterprises find ways of rebuilding and cementing trusted relationships using mobile technology?

- How does our infrastructural foundations support mobile technology for contactless transactions? (privacy, two-factor authentication, data quality and so on)

Situational shift to mobile

Given the rapid shifts in the last six months in how we can interact with each other, enterprises will have to be agile and flexible in process design going forward to optimize opportunities for customer engagements.

We will continue to have further disruptions on how we live and work in the next 12 to 18 months and potentially beyond. Some of the shifts towards mobile have been expected for a while, yet this crisis has pushed the timeline ahead as to how we engage.

Use cases in the “new normal”

Here are some use case examples in this next phase of business where mobile enables the transaction between consumer and environment:

Education. The reskilling and training certification that will be necessary to address unemployment, will be on Mobile First. Because of bandwidth, learner attention span, and form factor, there will be retooling of educational programs to be bite-sized and more media oriented.

Retail. Retail and delivery businesses shifting to remote first, with drop-off points that use mobile for contactless signatory and payment.

Healthcare. Telemedicine primarily by mobile devices (phone, laptop, phablet). Personal medical data sharing over mobile will require enhanced data encryption and two-factor authentication, which needs addressing via encryption and authentication.

Entrepreneurship. More side hustles that are mobile-based and mobile administered. Any authorization and transaction-oriented activities will be driven by mobile.

Government. Requests for document renewal or identity authentication for approval or submission of materials, with one-touch request.

Supply chain. Visibility and tracking of inbound and outbound materials. One-click reordering, and contactless payment verification.

Workplace. Contactless engagement with mobile as authentication of actions (coffee machine payment, copier usage, keyless office, meeting room allocation).

Facilities management. Hygiene controls with personnel health detail tracking (who cleans what room when). Deep cleaning management tools for audit trails, liability.

Role of mobile in creating engagement

Building trust

As we filter through the level of rubbish coming at us via social media, websites and our email, most of us are looking for a trusted information source. Our mobile is our window to the world, and many are applying appropriate filtration to make that world a bit more manageable.

The reason that people did previously download an app was partly based on what information had to be handed over in terms of permissions. The app builder needs to build a trusted relationship on benefit, not on what can be leveraged from the consumer.

To build that trust and create a closer engagement – albeit driven by situational need vs. consumer want – app developers need to consider these consumer needs:

- Level of trust in quality of information provided (e.g. weather info vs something more critical)

- Trust in app data usage and functionality (does it work?)

- Privacy of data being used and being held (statements and auditability)

- Location of data (on whose device: client or server)

- Speed and reaction time (Is there edge computing or the use of IoT to help push mobile information quickly?)

- Loss of data or loss of device and the impact on app access (More than lost passwords, lost processes and lost data)

Technological foundations for mobile usage

Network and bandwidth

We have all experienced bandwidth issues in the last few months, either sharing bandwidth with loved ones in lockdown to peak periods of video conferencing activity across geographic regions. Entertainment content providers such as Netflix and Disney+ were asked to lower the quality of the data streaming.

But then what online activity will take priority? Will we start to see pricing differentials for guarantees of availability? What about subscription models with platinum, gold and silver memberships (as in frequent flyer programmes) as to the network bandwidth you or your activity is allocated? Will things be done over VPN not only for privacy but for priority? I also see VPN as a possible solution towards issues like Zoom bombing and other intrusions to daily business operations.

We come to the role of a pandemic in 5G investment, which is similar to the role of investment in R&D during an economic downturn. Clearly, the world needs better bandwidth with more agility and future-proofed for functionality. You cannot drive a fast car on a bumpy road with potholes.

But for countries losing thousands of citizens to a virus with critical infrastructure at risk, where is the priority of a better telecom infrastructure? My colleague Shamir Amanullah wrote a report prior to the pandemic about the Race for 5G in Southeast Asia which is a good barometer for other regions. There is a good CNBC article from Todd Wassermann on the US situation, and a rather excellent survey on consumer sentiment on 5G from February 2020 by Politico.

Role of data quality and its security

Going back to my previous statement about rubbish and social media, the validation and quality of data exchange is part of the value proposition of using mobile technology.

What aspects of our current IT infrastructure create that ‘data value add’?

IoT and Edge Computing. Most of us are not going to be comfortable in crowds going forward. If I can reserve a space, or I can use a sensor to see how full an environment currently is, it will impact my decision to go somewhere. The faster that real-time information is processed and available, the better the outcome.

Blockchain technology is functioning enough to address the challenge of how to secure the data and prevent malicious cyber-attacks. This includes medical data hacking, supply chain theft, and other data-oriented safety issues on hygiene and product providence that we are experiencing now.

Final thoughts

At Ecosystm, we highlight how and where enterprises plan to invest and adopt technology while adding insights and expertise on to the use cases and trends. We are also able to reflect upon the agility of the same enterprises to make that technology investment count towards the next phase of their business model. In a post-COVID situation we see inventive ways enterprises are using technology. This is not only for societal benefit, but to make a difference in the marketplace. And mobile plays a key role in this next phase of engagements.