The semiconductor industry is 70-years old and has a prominent – and sometimes inconspicuous – presence in our daily lives. Many of us, however, have become more aware of the industry and the ramifications of its disruption, because of recent events. The pandemic, natural disasters, power outages, geo-political conflicts, and accelerated digital transformation have all combined to disrupt the semiconductor sector, leaving no organisation immune to the impacts of the continuing global chip crisis.

It is estimated that 200 downstream industries have failed to fulfill customer demands owing to the silicon scarcity, ranging from automotive, consumer electronics, utilities and even the supply of light fixtures.

This Ecosystm Bytes discusses the impact of the crisis and highlights major initiatives that chip manufacturers and governments are taking to combat it, including:

- The factors leading to the shortage in the semiconductor industry

- The impact on industry sectors such as Automotive, Consumer Electronics and MedTech

- How leading chip makers such as TSMC, Intel and Samsung are increasing their manufacturing capabilities

- The importance of Asia to the semiconductor industry

- How countries such as Malaysia and India are aiming to build self-sufficiency in the industry

Read on to find out more.

The Healthcare industry has had to pivot completely this year and 2021 will see it emerge a transformed industry. The impact will be seen on policies, how ecosystems evolve, and most obviously on healthcare provider organisations. COVID-19 has shifted the business priorities of healthcare providers and how these organisations invest and use technology. There will be another reset in 2021. However, given the immense impact of the pandemic, it would be near-impossible to restrict the prediction to only one year; and several of the trends will firmly define the industry way beyond 2021.

Ecosystm Advisors Aga Manhao, Arun Sethuraman, Krish Krishnan and Sash Mukherjee present the top 5 Ecosystm predictions for Healthcare Trends in 2021. This is a summary of the Healthcare predictions – the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 Healthcare Trends for 2021

- The Impact of COVID-19 on Public Health Will Create New Opportunities Well Beyond 2021

The impact of COVID-19 will be on all levels. Increasing pressure from patients will challenge healthcare providers (from primary through to tertiary) throughout 2021. There will be larger global impacts as well – average nourishment is likely to go down in most countries, and there will be lower average (seasonal) immune health in many countries.

This is not all doom and gloom – there will be new business opportunities. Enterprises and innovators will find opportunities in:

- Supply Chain Arbitrage. Continued asymmetrical supply and demand will drive the movement of healthcare related goods and services across geographies.

- Investment. Investments in pharma/ vaccine/ diagnostics manufacturing and distribution will be driven more by short-term horizons, defensive capacity building, and supply security concerns. Technology and IP acquisition by pharma and medtech leaders will also accelerate.

- Innovation. COVID-linked gaps in health, immunity, nourishment, and lifestyles will lead to new products within foods, supplements, medications, and pharmaceuticals; and in tech-enabled personal devices and health monitoring apps or systems.

- New Businesses. We will see an upsurge in demand and supply of alternative medicines and devices as well, although these may still not be accepted in conventional medicine.

- Healthcare Policies Will Focus on Product & Manufacturing Security and Supply Chain Control

The COVID-19 crisis has exposed the need for better collaboration and visibility of external resources to handle unprecedented scenarios. Governments in countries that have done well to manage the crisis took the vital step of encouraging and being the hub for cross-agency collaboration. Having a siloed view of resources and the supply chain is not sufficient in combating larger challenges. Healthcare policy makers will work towards a more collaborative, AI-driven, supply chain.

Some of the world’s largest economies have already begun to take steps to reduce manufacturing and supply chain dependencies in pharma, vaccines, diagnostics and medical devices. What has shown up as opportunistic stockpiling or supply chain arbitrage will become more entrenched. Various governments will either incentivise or centralise the establishment of manufacturing and long-term supply contracts for their countries.

- 2021 Will be a Breakout Year for Community Health

COVID-19 has significantly disrupted current standards of care for chronic diseases world-wide. Frequency and necessity of patient visits to hospitals and clinics for routine checkups and minor interventions are being evaluated by healthcare planners and providers. There are concerns about the increasing cost of providing basic services, allocation of healthcare capacity to higher priority needs, and the need to reduce risk of exposure to the vulnerable population.

Telehealth and Digital Health technologies have seen a marked increase in adoption during the pandemic, but the real effectiveness of these solutions to solve a healthcare delivery problem is still emerging. We predict 2021 will be a breakout year for Community Health, powered by these two technologies. There will be an increased focus on building resilient communities and early warning systems. Number of visits to hospitals and clinics for routine observations will drop by 15-20% or even more. Privacy and Data security concerns will increase, and this will also lead to better policy and practices to address these concerns. 2021 promises to be a better year for coordinated community care.

- Healthcare Providers Will be More Tech-Dependent Than Ever

In 2020, healthcare providers’ technology investments took off on unexpected trajectories and they have digressed from their technology and transformation roadmap. Many solutions would have gone through an initial ‘proof-of-concept’ without the formal rigours and protocols. Many of these will be adopted for longer term applications.

Healthcare organisations had to pivot their technology spending when COVID-19 hit. There were several changes that were required to be made, including implementing operational measures to ensure staff safety and cutting down on non-essential expenses. When it comes to digital initiatives, the key focus areas were evolving service delivery and empowering employees with the right technology for care delivery – often remote. What providers did not have the time or resources for was to digitalise processes and retain focus on their entire patient demography – and not just those impacted by COVID-19. In 2021, we see a clear indication that not only will their priorities be different, healthcare providers will ramp up their technology investments in all areas.

- Medtech and Providers Will Find New Synergies

Medical devices which generate clinical data and/or are driven by clinical data will attract greater investment and higher R&D expenditure; and will either dominate or begin to set the direction for future consumer devices in the Healthcare space.

The popularity of telehealth and digital health will put pressure on healthcare providers to further draw data-driven insights from personal devices. They are likely to mandate the devices that they would be willing to use the data from They will have greater power to demand Interoperability and operating system convergences in the next few years from device developers and manufacturers.

2021 will see an increased use of devices such phones, bracelets and even anklets to track the spread of COVID-19. It will also see the transition of the smartphone to a medical device. The collection, sharing of data, running AI/machine learning will make our smartphones an integral part of remote patient management.

I recently came across an article which makes 7 predictions for a post COVID world. Upon reflection, I agree with the predictions to varying degrees and decided to comment further.

First, let me share a couple of general observations. Currently, we are still in the eye of the storm. Many are unable to see any light at the end of the tunnel. There is quite a bit of negative sentiments, and some fail to see that the situation will ever improve. I am sure similar thoughts occurred during other crises: the 1918 Pandemic (Spanish Flu); the Great Depression of the 1930s; the Dot.com bust of 2001; SARS in 2003; and the Global Financial Crisis/Great US Recession of 2007. During each of these events, a sense of impending Armageddon came over much of the population. Certainly, in each instance, people did experience some personal and social permanent changes, with which they learned to adapt and cope. But, inevitably, the world did go on and Armageddon did not occur.

One of the basic truths I believe, is that humans require and crave interaction with other humans. Think about the videoconferencing applications. The use of these apps grew exponentially as the main communication channel. Instead of just audio, it was audio and video. These mediums greatly assisted society in coping and adapting. Mankind, and the Natural World, will always find a way.

Here are the predictions from the article:

- Companies that traffic in digital services and e-commerce will make immediate and lasting gains

- Remote work will become the default

- Many jobs will be automated, and the rest will be made remote-capable

- Telemedicine will become the new normal, signaling an explosion in med-tech innovation

- The nationwide student debt crisis will finally abate as higher education begins to move online

- Goods and people will move less often and less freely across national and regional borders

- After an initial wave of isolationism, multilateral cooperation may flourish

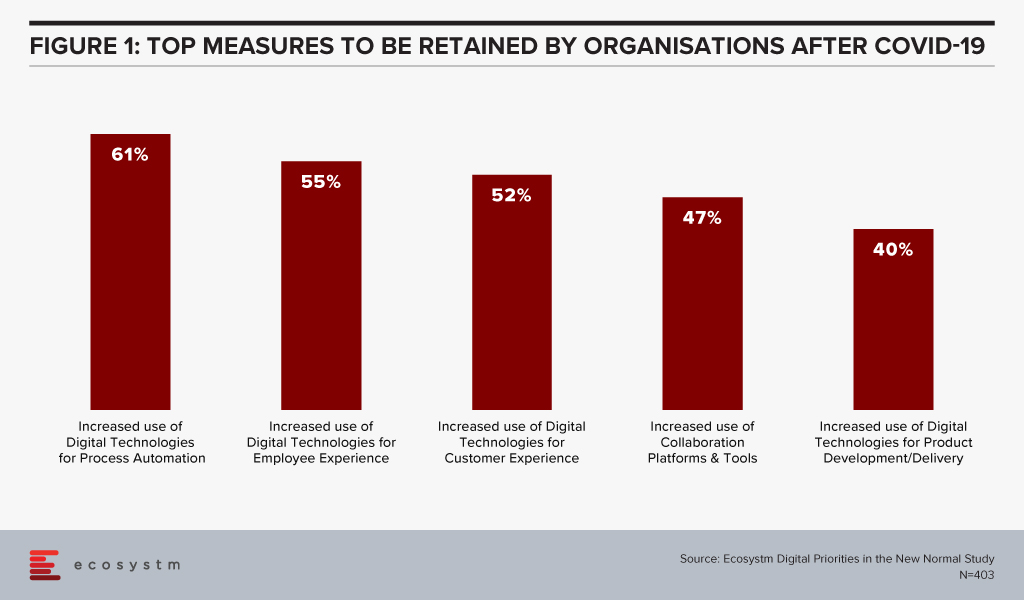

I very much agree with the author’s first prediction. This one is fairly obvious, as it has proven true throughout the crisis with providers such as Amazon, Zoom and others. It is expected to continue into the post COVID world. This is also evident from the findings of the Ecosystm research on the impacts of COVID-19. Organisations intend to continue to use digital technologies, even after the immediate crisis is over (Figure 1).

A Natural State of Equilibrium will Emerge

I believe for each of the areas described in the predictions, there will be various levels of long-term modification. None of them will return to their pre COVID-19 state, as we have all experienced going down the rabbit hole. During the pandemic, due largely to the lockdowns, the pendulum swung significantly towards one side. Many times, when people predict a new view, the current state is considered the New Normal. For me, the relevant question is: Will things stay as they are now, or will there be a new natural state of equilibrium? If so, what will it look like, in each of these areas? I don’t believe there is one answer, or one New Normal for all the dimensions being discussed. I believe a new normal state will potentially be different for each individual, each company/entity and each condition. In a post COVID-19 world there could be 50 shades of grey in each of these areas.

One of the predictions states that remote work will become the default. It must be remembered that part of work is a collaborative effort. While video conferencing has enabled collaborative efforts, the importance of the accidental interaction at the break room, printer, etc. can’t be under-estimated. It is these unscheduled interactions that enable accidental collaboration which can lead to great solutions. Thus, there will be many shades to the Future of Work – there will not be one absolute.

A similar example is a prediction for higher education. Part of the learning process a university offers is interacting with people who are not similar to your background or beliefs. That is one of the benefits of a diverse university. Similar to the corporate environment, many different types of learning environments will enable a person to gain great experiences from the time at university.

The advantage of all these alternatives will be the additional options and benefits to people post COVID compared to the pre COVID-19 world. It will present many great opportunities for entrepreneurs and innovators, as well as end-users and consumers. It will create new and iterative ‘middle spaces’. It will be possible for a David to emerge and challenge a Goliath(s).

The two Chinese characters for the word ‘crisis’ are “danger” and “opportunity”. Just as we are in a dangerous time now, it has also presented new and different opportunities. Those opportunities will continue to exist even when the danger has passed. I am also reminded of the old expression “May you live in interesting times”. It very much applies to all of us now and in the future. I wish the same for all of you.

Stay Safe. Stay Healthy. Stay Mentally Positive.

As the search for a COVID-19 vaccine intensifies, there is a global focus on the Life Sciences industry. The industry has been hit hard this year – having to deliver overtime through a disrupted supply chain, unexpected demand spikes, and reduction of revenues from their regular streams. Life sciences organisations are already challenged by the breadth of their focus – across R&D and clinical discovery; Manufacturing & Distribution; and Sales & Marketing. Increasingly, many pharmaceutical and medtech organisations choose to outsource some of these functions, which brings to fore the need for a robust compliance framework. In the Ecosystm Digital Priorities in the New Normal Study, two-thirds of life sciences organisations mention that they have either been forced to start, accelerate or refocus their Digital Transformation initiatives – the remaining one-third have put their Digital Transformation on hold. The industry is clearly at an inflection point.

Challenges of the Life Sciences Industry

Continued Focus on R&D. Life sciences companies operate in an extremely competitive global market where they have to work on new products against a backdrop of competition from generics and a global concern over rising healthcare expenditure. Apart from regulatory challenges, they also face immense competition from local manufacturers as they enter each new market.

Re-thinking their Distribution Strategy. Sales and distribution for many pharma and medtech organisations have been traditional – using agents, distributors, clinicians, and healthcare providers. But now they need to change their go-to-market strategies, target patients and consumers directly and package their product offerings into value-added services. This will require them to incorporate customer experience enhancers in their R&D, going beyond drug discovery and product innovation.

Tracking Global Regulations. Governments across the world are trying to manage their healthcare budgets. They are also more focused on chronic disease management. The focus has shifted to value-based medicine in general, but pharma and medtech products are being increasingly held accountable by health outcomes. Governments are increasingly implementing drug reforms around what clinicians can prescribe. Global Life Sciences organisations have to constantly monitor the regulations in the multiple countries where they operate and sell. They are also accountable for their entire supply chain, especially ensuring a high product quality and fraud prevention.

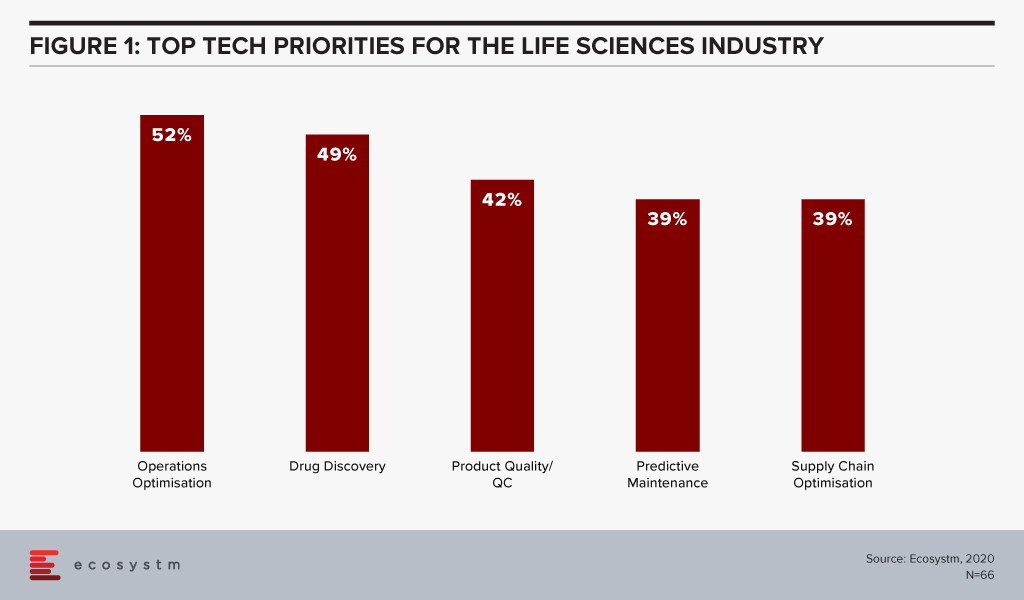

The global Ecosystm AI study reveals the top priorities for Life Sciences organisations, focused on adopting emerging technologies (Figure 1). They appear to be investing in emerging technology especially in their R&D and clinical discovery and Manufacturing functions.

Technology as an Enabler of Life Sciences Transformation

Discovery and Development

With the evolution of technology, Life Sciences organisations are able to automate much of the mundane tasks around drug discovery and apply AI and machine learning to transform their drug discovery and development process. They are increasingly leveraging their ecosystem of smaller pharma and medtech companies, research laboratories, academic institutions, and technology providers to make the process more time and cost efficient.

Using an AI algorithm, the researchers at the Massachusetts Institute of Technology have discovered an antibiotic compound that can kill many species of antibiotic-resistant bacteria. MIT’s algorithm screens millions of chemical compounds and chooses the antibiotics which have the potential to eliminate bacteria resistant to existing drugs. Harvard’s Wyss Institute for Biologically Inspired Engineering is manufacturing 3D printed organ-on-a-chip to give insights on cell, tissue, and organ biology to help the pharma sector with drug development, disease modelling and finally in the development of personalised medicine.

Life Sciences are also engaging more with technology partners – whether emerging start-ups or established players. Pfizer and Saama are working together on AI clinical data mining. The companies are developing and deploying an AI-based analytical tool where Pfizer provides clinical data and domain knowledge to train models on the Saama Life Science Analytics Cloud (LSAC). Saama was identified as a partner at a hackathon. Sanofi and Google have established a new virtual Innovation Lab to develop scientific and commercial solutions, using multiple Google capabilities from cloud computing to AI.

Tech providers also keep evolving their capabilities in the Life Sciences industry for more efficient drug discovery and better treatment protocols. Microsoft’s Project Hanover uses machine learning to develop a personalised drug protocol to manage acute myeloid leukaemia. Similarly, Apple’s ResearchKit – an open-source framework is meant to help researchers and developers create iOS-based applications in the field of medical research.

Manufacturing and Logistics

The industry also faces the challenges faced by any Manufacturing organisation and has the need to deploy manufacturing analytics, and advanced supply chain technology for better process and optimisation and agility. There is also the need for complete visibility over their supply chain and inventory for traceability, safety, and fraud prevention. Emerging technologies such as Blockchain will become increasingly relevant for real-time track and trace capability.

The MediLedger Network was established as an open network to the entire pharma supply chain. The project brings a consortium of some of the world’s largest pharmaceutical companies, and logistics providers to improve drug supply chain management.

Since the data on the distributed ledger is encrypted, it creates a secure system without any vulnerabilities. This eliminates counterfeit products and ultimately ensures the quality of the pharma products and promotes increased patient safety. To foster security and improve the supply chain, the United States Food and Drug Administration (USFDA) successfully completed a pilot with a group including IBM, KPMG, Merck and Walmart to support U.S. Drug Supply Chain Security Act (DSCSA) to trace vaccines and prescription medicines throughout the country.

Diagnostics and Personalised Healthcare

As more devices (consumer and enterprise) and applications enter the market, people will take ownership and interest in their own health outcomes. This is seeing a continued growth in online communities and comparison sites (on physicians, hospitals, and pharmaceutical products). Increasingly, insurance providers will use data from wearable devices for a more personalised approach; promoting and rewarding good health practices.

Beyond the use of wearables and health and wellness apps, we will also see an exponential increase of home-based healthcare products and services – whether for primary care and chronic disease management, or long-term and palliative care. As patients become more engaged with their care, the life sciences industry is beginning to serve them through personalised approach, medicines, right diagnosis and through advanced medical devices and products.

An online tool developed by the University of Virginia Health Systems helps identify patients that have a high risk of getting a stroke and helps them reduce that risk. This tool calculates the patient’s probability of suffering a stroke by measuring the severity of their metabolic syndrome – taking into account a number of conditions that include high blood pressure, abnormal cholesterol levels and excess body fat. Life Sciences organisations are increasingly having to invest in customer-focused solutions such as these.

Wearables with special smart software to monitor health parameters, gauge drug compatibility and monitor complications are being implemented by Life Sciences organisations. The US FDA approved a pill called Abilify MyCite fitted with a tiny ingestible sensor that communicates with a patch worn by the patient to transmit data on a smartphone. Medtech companies continue to develop FDA approved health devices that can monitor chronic conditions. Smart continuous glucose monitoring (CGM) and insulin pens send blood glucose level data to smartphone applications allowing the wearer to easily check their information and detect trends.

Technologies such as AR/VR are also enabling Life Sciences companies with their diagnostics. Regeneron Pharmaceuticals has created an AR/VR app called “In My Eyes” to better diagnose vision impairment in patients.

What is interesting about these personalised products is that not only do they improve clinical outcomes, they also give Life Sciences companies access to rich data that can be used for further product development and improvement.

The Life Sciences industry will continue to operate in an unpredictable and competitive market. This is evident by the several mergers and acquisitions that we witness in the industry. As they continue to use cutting-edge technology for their R&D practices, they will leverage technology to transform other functions as well.