The Manufacturing industry is at crossroads today. It faces challenges such as geopolitical risks, supply chain disruptions, changing regulatory environments, workforce shortages, and changing consumer demands. Overcoming these requires innovation, collaboration, and proactive adaptation.

Fortunately, many of these challenges can be mitigated by technology. The future of Manufacturing will be shaped by advanced technology, automation, and AI. We are seeing early evidence of how smart factories, robotics, and 3D printing are transforming production processes for increased efficiency and customisation.

Manufacturing is all set to become more agile, efficient, and sustainable.

Read on to find out the changing priorities and key trends in Manufacturing; about the World Economic Forum’s Global Lighthouse Network initiative; and where Ecosystm advisor Kaushik Ghatak sees as the Future of Manufacturing.

Click here to download ‘The Future of Manufacturing’ as a PDF

Since officially separating from IBM in November last year, Kyndryl has been busy cementing some heavyweight partnerships. The alliances with Microsoft, Google, and VMware demonstrate its intention to build hybrid cloud solutions with whoever it needs to, rather than favouring the Big Blue or Red Hat. The SAP tie-up hints at a future of migrating ERP workloads to the cloud and even an eye on moving up the application stack. Last week Kyndryl announced it is working with Nokia to provide private 5G and LTE networks to enable Industry 4.0 solutions. The first customer reference for the partnership is Dow, deploying both real-world and proof-of-concept applications for worker safety and collaboration and asset tracking.

The Partnership

Kyndryl has a competitive networking services unit, particularly in partnership with Cisco. Its focus has been on SD-WAN, campus networks, and network management as part of broader cloud services deals. This 5G partnership with Nokia is its first serious effort to work with one of the major carrier-grade vendors using cellular technology. It creates an opportunity for Kyndryl to position itself as a provider of services that underpin IoT and edge applications, rather than only cloud, which has until now been its main strength.

Prior to the Kyndryl announcement, Nokia was already developing private 5G solutions under the moniker Digital Automation Cloud (DAC). A key customer is Volkswagen, using the network to connect robots and wireless assembly tools. Over-the-air vehicle updates are also tested over the private network. Volkswagen operates in a dedicated 3.7-3.8 GHz band, which was allocated by the Federal Network Agency in Germany. This illustrates a third option for accessing spectrum, which will become an important consideration in private 5G rollouts.

Private 5G Use Cases

Private 5G has several benefits such as low latency, long-range, support for many users per access point, and provision for devices that are mobile due to handover. It is unlikely that it will completely replace other technologies, like wireless LAN, but it is very compelling for certain use cases.

Private 5G is useful on large sites, like mines, ports, farms, and warehouses where connected machines are moving about or some devices – like perimeter security cameras – are just out of reach. Utilities, like power, gas, and water, with infrastructure that needs to be monitored over long distances, will also start looking at it as a part of their predictive maintenance and resiliency systems. Low latency will become increasingly important as we see more and more customer-facing digital services delivered on-site and autonomous robots in the production environment.

Another major benefit of private 5G compared to operating on public service is that data can remain within the organisation’s own network for as long as possible, providing more security and control.

Private 5G Gaining Popularity

There has been a lot of activity over the last year in this space, with the hyperscalers, telecom providers and network equipment vendors developing private 5G offerings.

Last year, the AWS Private 5G was announced, a managed service that includes core network hardware, small-cell radio units, SIM cards, servers, and software. The service operates over a shared spectrum, like the Citizens Broadband Radio Service (CBRS) in the US, where the initial preview will be available. CBRS is considered a lightly licenced band. This builds on AWS’s private multi-access edge compute (MEC) solution, released in conjunction with Verizon to integrate AWS Outposts with private 5G operating in licenced spectrum. A customer reference highlighted was low latency, high throughput analysis of video feeds from manufacturing robots at Corning.

Similarly, Microsoft launched a private MEC offering last year, a cloud and software stack designed for operators, systems integrators, and ISVs to deploy private 5G solutions. The system is built up of components from Azure and its acquisition of Metaswitch. AT&T is an early partner bringing a solution to the market built on Microsoft’s technology and the operator’s licenced spectrum. Microsoft highlighted use cases such as asset tracking in logistics, factory operations in manufacturing, and experiments with AI-infused video analytics to improve worker safety.

The Future

Organisations are likely to begin testing private 5G this year for Industry 4.0 applications, either at single sites in the case of factories or in select geographic areas for Utilities. Early applications will mostly focus on simple connectivity for mobile machines or remote equipment. In the longer term, however, the benefits of private 5G will become more apparent as AI applications, such as video analysis and autonomous machines become more prevalent. This will require the full ecosystem of players, including telecom providers, network vendors, cloud hyperscalers, systems integrators, and IoT providers.

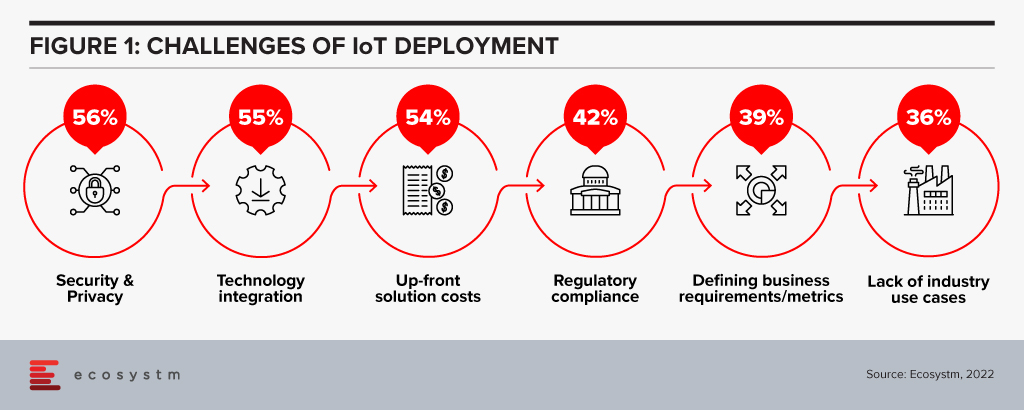

The Internet of Things (IoT) solutions require data integration capabilities to help business leaders solve real problems. Ecosystm research finds that the problem is that more than half of all organisations are finding integration a key challenge – right behind security (Figure 1). So, chances are, you are facing similar challenges.

This should not be taken as a criticism of IoT; just a wake-up call for all those seeking to implement what has long been test-lab technology into an enterprise environment. I love absolutely everything about IoT. IT is an essential technology. Contemporary sensor technologies are at the core of everything. It’s just that there are a lot of organisations not doing it right.

Like many technologists, I was hooked on IoT since I first sat in a Las Vegas AWS re: invent conference breakout session in 2015 and learned about MQTT protocols applied to any little thing, and how I could re-order laundry detergent or beer with an AWS button, that clumsy precursor to Alexa.

Parts of that presentation have stayed with me to this day. Predict and act. What business doesn’t want to be able to do that better? I can still see the room. I still have those notes. And I’m still working to help others embrace the full potential of this must-have enterprise capability.

There is no doubt that IoT is the Cinderella of smart cities. Even digital twinning. Without it, there is no story. It is critical to contemporary organisations because of the real-time decision-making data it can provide into significant (Industry 4.0) infrastructure and service investments. That’s worth repeating. It is critical to supporting large scale capital investments and anyone who has been in IT for any length of time knows that vindicating the need for new IT investments to capital holders is the most elusive of business demands.

But it is also a bottom-up technology that requires a top-down business case – a challenge also faced by around 40% of organisations in the Ecosystm study – and a number of other architectural components to realise its full cost-benefit or capital growth potential. Let’s not quibble, IoT is fundamental to both operational and strategic data insights, but it is not the full story.

If IoT is the belle of the smart cities ball, then integration is the glass slipper that ties the whole story together. After four years as head of technology for a capital city deeply committed to the Smart City vision, if there was one area of IoT investment I was constantly wishing I had more of, it was integration. We were drowning in data but starved of the skills and technology to deliver true strategic insights outside of single-function domains.

This reality in no way diminishes the value of IoT. Nor is it either a binary or chicken-and-egg question of whether to invest in IoT or integration. In fact, the symbiotic market potential for both IoT and integration solutions in asset-intensive businesses is not only huge but necessary.

IoT solutions are fundamental contemporary technologies that provide the opportunity for many businesses to do well in areas they would otherwise continue to do very poorly. They provide a foundation for digital enablement and a critical gateway to analytics for real-time and predictive decision making.

When applied strategically and at scale, IoT provides a magical technology capability. But the bottom line is that even magic technology can never carry the day when left to do the work of other solutions. If you have already plunged into IoT then chances are it has already become your next data silo. The question is now, what you are going to do about it?

Hitachi announced their plans to acquire US based software development company GlobalLogic for an estimated USD 9.6 billion, including debt repayment. The transaction is expected to close by end of July, after which GlobalLogic will function under Hitachi’s Global Digital Holdings.

GlobalLogic was founded in 2000, and the Canada Pension Plan Investment Board and Swiss investment firm Partners Group have 45% of ownership; with the remainder owned by the company’s management.

Hitachi’s Business Portfolio Expansion

The acquisition of GlobalLogic is a part of Hitachi’s move to focus and extend the range of Hitachi’s digital services business. As Hitachi aims to expand from electronics hardware to concentrate on digital services, they are looking to benefit from GlobalLogic’s range of expertise – from chips to cloud services. Silicon Valley-based GlobalLogic has a presence in 14 countries with more than 20,000 employees and 400 active clients in industries including telecommunications, healthcare, technology, finance and automotive. This will also expand Hitachi’s network outside Japan by providing them access to a global customer base and will boost their software and solutions platforms, including Hitachi IoT portfolio and data analytics.

The GlobalLogic deal follows another big acquisition of ABB’s power grid business by Hitachi in July 2020 to focus on clean energy and distributed energy frontiers. This makes Hitachi one of the largest global grid equipment and service providers in all regions.

Hitachi is also planning to divest parts of their portfolio such as Hitachi Metals, their chemical unit and their medical equipment business.

Ecosystm Comments

“Hitachi’s move to acquire GlobalLogic is very interesting and is in line with the growing trend of global Operation Technology (OT) vendors riding the wave of Industry 4.0 and ‘Product as a Service’ models – essentially, to move up the margin ladder with more digital services added on to their already established equipment business. Siemens, Schneider Electric, Panasonic, ABB, Hitachi and Johnson Controls are some of the prominent vendors who have taken pole positions in their respective industry domains, in this race to digitally transform their businesses and business models. Last year, Panasonic made a very similar move, taking a 20% equity stake in Blue Yonder, a leading supply chain software provider.

With rapid advancements in computing and communications (5G), it is now possible to converge the IT (Information Technology supporting enterprise information flows), the OT (Operational Technology – machine level control of the physical equipment), and the ET (Engineering Technology in the Product Design and Development space such as CAD, CAM, PDM etc.) domains. Three worlds that were separate till now. The convergence of these three worlds enables high impact use cases in automation, product, process, and business model innovation in almost all sectors, such as autonomous vehicles, energy efficient buildings, asset tracking and monitoring, and predictive and prescriptive maintenance. For the OT vendors therefore, it becomes critical to acquire IT and ET capabilities to become successful in the new cyber physical world. Most OT vendors are choosing to acquire these capabilities through strategic partnerships (such as Siemens with Atos and SAP; Panasonic with Blue Yonder) or acquisitions (such as Hitachi and GlobalLogic) rather than develop such capabilities organically in completely new domains.“

Last week industry leaders, SAP and Siemens, announced a partnership to bring together their respective expertise on creating integrated and enhanced solutions for product lifecycle management (PLM), supply chain, service and asset management, in a move that is expected to accelerate Industry 4.0 globally.

The partnership between SAP and Siemens aims to develop innovative business models to break silos between manufacturing, product development and service delivery teams to establish seamless customer-centric processes. It will provide users with real-time business information, customer insights and performance data over the entire product development cycle.

As the first step of this agreement, Siemens will offer SAP’s Intelligent Asset Management solution and Project and Portfolio Management applications and SAP will offer Siemens’ PLM suite Teamcenter software for product lifecycle collaboration and data management to manufacturers and business operators across the network – complementing each other’s solutions.

Ecosystm Principal Advisor, Kaushik Ghatak says, “The convergence of the Information Technology (IT) and the Operational Technology (OT) worlds is a must for companies to operate in the cyber physical world of Industry 4.0. Historically, these two worlds have operated in silos. This is a great partnership announcement aimed towards meeting the convergence goals by integrating the capabilities of Siemens (an OT leader), and SAP (an IT leader). Together they would be able to offer an exhaustive set of very valuable offerings in the Digital Supply Chain and Digital Manufacturing domain for customers worldwide.”

Ghatak says, “This is not the first such partnership for Siemens. A strategic alliance between Siemens and Atos has been in place since 2011. In 2018 the alliance was strengthened with plans to accelerate their joint business until 2020, with a focus on building innovative solutions by combining their capabilities. However, the difference this time is that SAP has very a deep and wide set of software offerings in the supply chain and manufacturing domains, which when stitched together with Siemens’ PLM solutions can provide true end-to-end digitalisation capabilities across the ‘Design, Source, Make, Deliver and Plan’ continuum of the value chain.”

Ecosystm Comments

Ghatak, however, cautions that while this is a great partnership announcement between two giants in their respective fields, they will need to collaborate actively on three key aspects for this partnership to deliver value for the customers.

- Product Development. Building-integrated solutions with heterogenous data models is not easy. It will require very open collaboration between their product development teams to identify the use cases and build solutions that can enable seamless information flow and actions across the different software modules owned by each.

- Go-to-market. Going to market jointly will need strong collaboration too. In terms of the agreement on customer account ownership, pricing, sharing of pre-sales resources and so on.

- Implementation. And, last but not the least, it will require collaboration to ramp up the implementation capabilities of the jointly developed solutions.

As organisations stride towards digitalisation, re-evaluate their business continuity plans and define what the Future of Work will look for them, Cloud adoption is expected to surge. In June, there were several announcements that indicate the market is responding to this increased interest.

Cloud Providers Gearing up to Enable Economic Recovery

Global economies are slowly gearing up for a technology-led recovery phase and several organisations are taking advantage of the disruption to start or accelerate their digital transformation plans. Many are looking at this as a good opportunity to replace their legacy systems. Cloud providers are expected to lead from the front when it comes to helping the economy recover.

Government agencies have been immensely impacted by the COVID-19 crisis and will need to shift fast into the recovery mode. Salesforce launched a multi-tenant dedicated Cloud infrastructure for their US Federal, state and local government customers, government contractors, and federally funded research and development centres. Hosted on AWS GovCloud and FedRAMP compliant, it provides customers with a compliant and secure environment to deploy Salesforce’s CRM platform and industry solutions. The launch is expected to empower government agencies with the ability to deliver better services, scale to unprecedented demands and connect to citizens on their channel of choice.

Initiatives such as the UK Crown Commercial Service (CCS) and Google Cloud agreement will also help in the recovery phase. This allows qualified public sector agencies to avail of a discounted price for their Google Cloud deployments. Earlier in the year CCS entered into a price arrangement with Microsoft as well. If Cloud has to be the vehicle for economic recovery, such arrangements will benefit cash-strapped public sector organisations.

The recovery will also require the entire technology ecosystem to engage not only with large enterprises but also small and medium enterprises (SMEs). Alibaba Cloud announced an investment of US$ 283 million to revamp its global partner program. They plan to introduce new partner-customer communication processes to enhance response time and bring more opportunities to independent software vendors (ISVs) managed service providers (MSPs) and system integrators (SIs) as partners.

Europe Emerging as a Cloud Hub

As a fallout of the current political scenario, Europe is pushing for more cloud independence and to become an innovation hub as a vendor-neutral network for cloud computing providers and their customers.

GAIA-X Foundation is a federated data infrastructure project initiated to build a unified system of cloud and data services to be protected by EU Laws – including GDPR, the free flow of non-personal data regulation and the Cybersecurity Act. France and Germany kicked off the GAIA-X cloud project last year and the system is open for participation to national and European initiatives for exchange of data across industries and services such as AI, IoT and data analytics. GAIA-X took another step towards becoming a real option for European organisations with the establishment as a legal entity in June. Various organisations – including Dassault, Orange, Siemens, SAP, Atos, Scaleway and Deutsche Telekom are a part of this non-profit platform, working together on Cloud applications, high-performance computing as well as edge systems. The project is expecting to release a working model by early 2021 and will be further enhanced in phases.

Global Cloud leaders are also focusing on expanding their presence in Europe. In February, Microsoft announced a new data centre in Spain leveraging Telefónica infrastructure. In a similar move, Google Cloud announced its plans to expand in the region in partnership with Telefónica. Telefonica and Google are expected to jointly work on Spain’s digitalisation through edge infrastructure and 5G for consumers and telecom infrastructure.

Cloud Providers Bolstering their Cybersecurity Capabilities

2020 has witnessed a host of cybersecurity threats and data breaches. While Cloud providers have always evolved their cybersecurity capabilities, it has become important for them to become vocal about these measures to build trust in the industry.

To complement the Microsoft Azure IoT security, Microsoft acquired IoT security specialist CyberX, last month. The acquisition will enable greater security for the IoT devices connected to the Microsoft network and will help their customers to gain visibility through a map of devices thus allowing them to gather information on security risks associated with thousands of sensors and connected devices. This will enhance smart grid, smart manufacturing and digital assets and profiles and reduce vulnerabilities across production and supply chain.

In another move which will benefit the ISV and SI ecosystem, NetFoundry’s zero trust networking API is now available on RapidAPI. RapidAPI’s marketplace enables developers to easily find, connect to, and manage the APIs they need to build a range of applications. Now the ISV and developer community can access NetFoundry’s software-only, zero trust models on RapidAPI.

More Partnerships between Software/Industry Solutions Providers and Cloud Providers

The COVID-19 crisis has had a far-reaching impact on several industries. The technologies that are expected to see the most uptake are IoT and Future of Work technologies.

Ecosystm Principal Advisor, Kaushik Ghatak says, “COVID-19 has brought to the fore the need for managing risks better. And the key to managing risks is to have better visibility and drive data-driven decisions; the sweet spot for IoT technologies.”

Last week, Microsoft and Hitachi announced a strategic alliance to accelerate the digital transformation of the Manufacturing and Logistics industries across Southeast Asia, Japan and North America. The first solutions are expected to be made available in Thailand as early as this month. Hitachi brings to the table their industry solutions, such as Lumada, and their IoT-ready industrial controllers HX Series. These solutions will be fully integrated with the Microsoft cloud platform, leveraging Azure, Dynamics 365 and Microsoft 365.

Another sector that has seen significant disruption is Real Estate. Ecosystm Principal Advisor, Andrew Milroy in his blog Proptech: Driving Digital Transformation in the Wake of COVID-19 sees a real opportunity for the sector to transform. “Many activities within the property ecosystem have remained unchanged for decades. There are several opportunities for digital engagement and automation in this sector, ranging from the use of robots in construction to the ‘uberisation’ of the residential property customer journey.”

June saw Honeywell and SAP partner to create a joint cloud-based solution based on Honeywell Forge and SAP cloud. The cloud solution is aimed at real estate operators and customers providing aggregated financial and operational insights in real-time. The solution leverages the Honeywell Forge autonomous buildings solution and the SAP Cloud for Real Estate solution, enabling facility managers and building owners to reposition their real estate portfolios through parameters such as cost savings and energy efficiency and help improve the tenant experience.

As organisations struggle to maintain operations during the ongoing crisis, there has been an exponential increase in employees working from home and relying on the Future of Work technologies. Ecosystm principal Advisor, Audrey William says, “During the COVID-19 pandemic, people have become reliant on voice, video and collaboration tools and even when things go back to normal in the coming months, the blended way of work will be the norm. There has been a surge of video and collaboration technologies. The need to have good communication and collaboration tools whether at home or in the office has become a basic expectation especially when working from home. It has become non-negotiable.”

AWS and Slack announced a multi-year partnership to collaborate on solutions to enable the Workplace of the Future. This will give Slack users the ability to manage their AWS resources within Slack, as well as replace Slack’s voice and video call features with AWS’s Amazon Chime. And AWS will be using Slack for their internal communication and collaboration.

Delivering excellent customer experience in the midst of the crisis has proved to be difficult for organisations. Customer care centres have been especially impacted by high volumes of customer interactions – through voice and non-voice channels. This will see a major rise in adoption of cloud contact centre solutions. Contact centre providers are ramping up their capabilities in anticipation. Genesys selected AWS as their preferred cloud partner to deliver new features to customers and build a global and secure infrastructure.

The industry can expect more news from Cloud providers in the next few months as they ramp up their capabilities and channel their go-to-market messaging.

Gain access to more insights from the Ecosystm Cloud Study

Manufacturing is estimated to account for a fifth of Singapore’s GDP and is one of its growth pillars. Singapore has been talking about re-inventing the Manufacturing industry since 2017, when the Industry 4.0 initiatives to enable digitalisation and process automation of processes and to ensure global competitiveness were first launched. As part of the long-term strategy, the Government had spoken about investment into research and development (R&D) projects, developing transformation roadmaps and strengthening the skill sets of the workforce.

Singapore’s 5G Rollout

Last month, the Infocomm Media Development Authority (IMDA) announced that Singtel and JVCo (formed by Starhub and M1) has won the 5G Call for Proposal. They will be required to provide coverage for at least half of Singapore by end-2022, scaling up to nationwide coverage by end 2025. While Singtel and JVCo will be allocated radio frequency spectrum to deploy nationwide 5G networks, other mobile operators, including MVNOs, can access these network services through a wholesale arrangement. The networks will also be supplemented by localised mmWave deployments that will provide high capacity 5G hotspots.

In October 2019, IMDA and the National Research Foundation had set aside $40 million to support 5G trials in strategic sectors such as maritime, aviation, smart estates, consumer applications, Industry 4.0 and government applications. Ecosystm Principal Advisor, Jannat Maqbool says, “Reach, performance and robustness of connectivity and devices have long held back the ability to scale with the IoT as well as successful deployment of some solutions altogether. The integration of 5G with IoT has the potential to change that immensely. However, and possibly even more importantly, 5G will see the emergence of a true ‘Internet’, defined as ‘interconnected networks using standardised communication protocols’, made up of ‘things’ enabling never-before contemplated innovation – supporting economic development and community well-being.”

“While 5G offers enormous potential to produce economic and social benefits, to reach that potential we need to evaluate from a strategic perspective what it could mean for industries, employers and communities – then we need to invest in the infrastructure, innovation and associated development required to leverage the technology.”

Singapore’s Industry 4.0 Transformation

The Government is also focused on getting the industry ready for the transformation that 5G will bring. Last week, Singapore announced its first Industry 4.0 trial, where IMDA collaborates with IBM, M1 and Samsung to design, develop, test and benchmark 5G-enabled Industry 4.0 solutions that can be applied across various industries. The trials will begin at IBM’s facility in Singapore and involve open source infrastructure solutions from Red Hat to test Industry 4.0 use cases.

The project will test 5G-enabled use cases for Manufacturing, focusing on areas such as automated visual inspection using image recognition and video analytics, equipment monitoring and predictive maintenance, and the use of AR in increasing productivity and quality. The focus is also on leveraging 5G to reduce the cost of processing, by shifting the load from the edge device to centralised systems.

Ecosystm Principal Advisor, Kaushik Ghatak says, “For some time now, the Singapore Manufacturing industry has been in the quest for higher productivity in order to regain its foothold as a destination of choice for global manufacturing outsourcing. The 5G Industry 4.0 trial is a great initiative to fast-track identification and adoption of the right use cases in Manufacturing, in the areas of automation, visibility, analytics, as well as for opening new revenue streams through servitisation of smart products.”

5G will see increased collaboration in the Tech industry

With the advent of 5G, the market will see more collaboration between government agencies, telecom providers and cloud platform providers and network equipment providers. Governments globally have invested in 5G and so have the network and communications equipment providers. However, telecom providers are unsure of how to monetise 5G and cater to the shift in their customer profile from consumers to enterprises. IBM and Samsung had already announced the launch of a joint platform in late 2019. Collaborations such as these will be key to widespread 5G deployment and uptake.

Talking about the benefits of collaborative efforts such as this, Maqbool says, “Robustness and security built into 5G deployment from the outset is essential to enable the applications and innovation that many are promising the technology will deliver, including the ability to self-scale, automate fault management and support edge processing.”

It is interesting that the solutions developed will be featured at IBM’s Industry 4.0 Studio 5G Solutions Showcase, and that IBM and Samsung will evaluate successful solutions developed during the project for possible use in their operations in a broad range of markets and sectors. “Availability of proven use cases at IBM’s Solutions Showcase centre would benefit local manufactures greatly; in terms of easy access to right skills and proven technology architectures,” says Ghatak. “This initiative is a huge step towards realising the promise of the cyber physical world. The collaboration between the leaders in communications, equipment and software will ensure that the use case development is truly cutting edge.”

IoT, Industry 4.0, Industrial IoT (IIoT), odds are that you have heard these terms used around you recently. IoT in the consumer space is a pretty straightforward concept to understand. IoT is an interconnected world of computing, mechanical and digital devices such as in a smart home consisting of thermostats, webcams, smoke detectors, smart doorbells who can talk to each other and managed from the internet or a smartphone.

On the other hand, when we look at things at a larger scale or we can say, an “industrial scale” then it is a whole new IoT world. Industrial internet of things (IIoT) is an extension of IoT and is the use of IoT largely in manufacturing applications, and supply chain management. IIoT is driving the next wave of the industrial revolution or we can say it’s opening a gateway to ‘Industry 4.0’. The key idea driving Industry 4.0 is a connected world comprising humans, machines, sensors and data working together in real-time to transform business and manufacturing processes.

A traditional manufacturing environment application works by connecting machines to a centralised data centre. The pain points here are there isn’t any interconnection between machines, the latency rate is high and processes are manual and thus prone to errors. Contrary to this, IIoT puts a modern approach and makes processes decentralised. IIoT makes machine interconnection possible converting them into automated and smart processing units. With IIoT machines have the ability to talk to each other in their own Machine to Machine(M2M) language.

The basic components that drive an IIoT system are:

- Secure intelligent assets such as sensors and smart controllers – that can sense, communicate, store and transmit information

- Communication and data storage infrastructure – often cloud-enabled

- Data analytics and smart business apps that generate information from the data

- Skilled workforce

How IIoT Can Revolutionise an Industry

IIoT is transforming the manufacturing industry and other supply chain intensive industries by maximising efficiency, reducing downtime and increasing the overall production. While IIoT adoption is still in a nascent stage, there are some industries that have taken the first mover advantage and have started demonstrating readiness use cases.

The Smart Factory

The adoption of IIoT has reshaped traditional factories to create smart factories. The systems work with interconnected machines and real-time data exchange that merge the departmental communications along with unified operations and information systems.

How is IIoT making factories ‘smart’?

IIoT has revamped how the traditional units worked. The slow and manual processes are now automated processes with M2M communication. This can be easily demonstrated through an example of how Smart Factories deal with preventive maintenance.

A smart factory has machines, sensors, databases, and humans all working in sync with each other. Sensors within machines can automatically notice a fault and the software logic sends an automatic alert to the right human to analyse the cause behind the fault. With Artificial Intelligence incorporated, machines determine the cause of the faults and go beyond predictive to prescriptive approach pre-empting problems before they exist. This in return reduces the maintenance cost and increases uptime of the factory by introducing parameters to fix machines with accuracy. In-return this leads to increased shelf-life of components and less-time involved in problem detection and rectification.

Energy & Utilities

The Oil & Gas industry is embracing IIoT with a multitude of benefits. Now the energy and utilities have an ability to easily sync data and simultaneously operate across multiple locations. This is made possible with the adoption of cloud, and installation of sensors that capture real-time data on the operating conditions of assets, monitor physical conditions such as temperature, pressure and humidity, and even environmental conditions. The practical scenario here is that Oil & Gas companies are remotely controlling their drills and monitoring the earth’s crust by remote control sensors and maintaining the flow of resources.

Logistics

With so many moving parts in a logistics system, from factories, collection points, and the transport network, it was difficult to maintain and manage a single view of the entire process. Through an ecosystem of sensors on the machines and vehicles covering the entire supply chain, it is now possible to access real-time data. It allows advanced functionalities such as virtually positioning hundreds of vehicles and optimising their route. In the process saving energy and reducing the time for delivery. The consequence is reduced costs for fuel, vehicle maintenance, and staff, plus increased customer experience through shorter and more accurate delivery times.

Other Industries – Promising the change

The adoption of IIoT will go beyond the early adopters and revolutionise several other industries. The Transportation industry is ripe for transformation given that infrastructure is being strained and margins reduced. The challenges of demand and aging infrastructure can be best handled by IIoT.

“The success of smart cars will eventually depend on how ‘smart’ the infrastructure is,” opines Vernon Turner, Executive Analyst, Ecosystm. “Several smart cities are already thinking along these lines, and adoption of IoT in Transportation is set to rise exponentially.”

Another industry that will benefit immensely from IIoT adoption is Healthcare. At the moment, asset management IoT systems have been adopted by several organisations, as in-patient remote monitoring systems that allow clinicians to monitor and analyse patient data remotely.

“The real value of IoT will be realised when clinicians have a clear workflow that allows them to monitor patients outside the hospitals,” says Sash Mukherjee, Principal Analyst, Ecosystm. “In the past, healthcare organisations have been influenced by the Manufacturing industry – by Lean and Six Sigma. They will benefit from implementing Industry 4.0 technologies, that will transform not just the provider organisations, but healthcare in general.”

Turning IIoT into a Profit Engine

Given all of this information about IIoT you may be thinking about the ROI, associated costs, benefits and the industry-wide exposure of the Industrial IoT. It is imperative that companies large & small are embracing Industry 4.0 change. IIoT is benefitting businesses through differentiated offerings, a creation of newer revenue streams and increased monetisation of existing offerings.

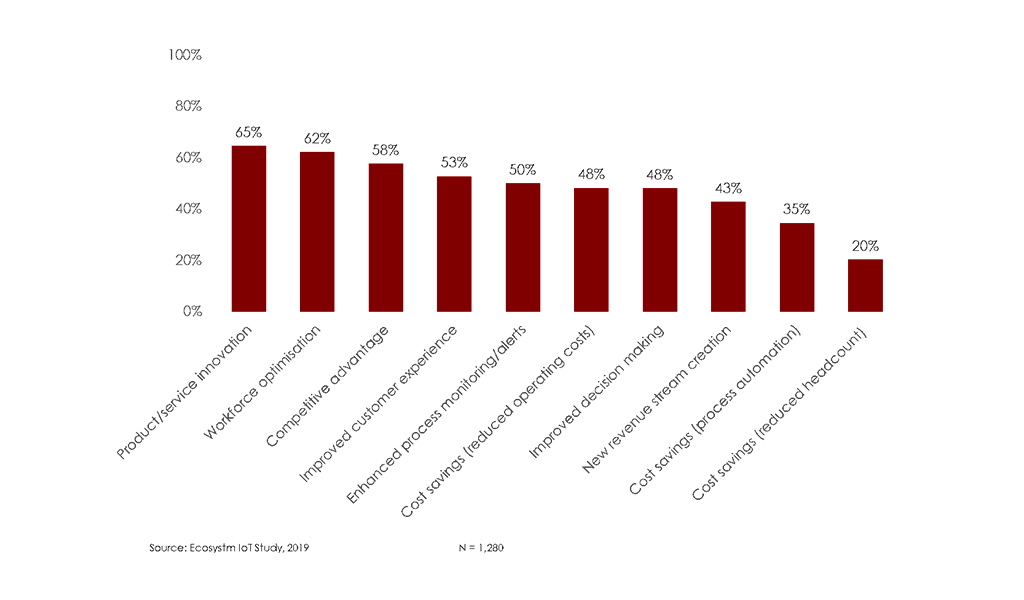

The Ecosystm IoT Study, 2019 looks at the drivers of IoT adoption across industries.

The data shows that the key drivers of IoT adoption can all affect the profit margin of an organisation.

- Innovation. In today’s competitive world, innovation in product designing and service delivery is directly related to a positive impact on profit margins. Organisations are looking beyond cost savings through their investments in IoT and are using IIoT to bring new, innovative products and services to the market. They are looking at creating innovative businesses that can leverage technology and offer cost savings.

- Workforce Optimisation. It is impossible to bring change without workforce optimisation. Organisations are working on the valuable insights offered by IIoT systems which further provide ways to optimise the workforce and accelerate productivity. Implementation of automated production units and the reduction of manual labour is bringing both productivity gains and increased profits. It is also boosting employee morale – happier employees impact the profitability of organisations, reduces turnover, improves customer interactions, and promotes more job ownership.

- Customer Experience. Customer expectations have gone up and so have methods to improve customer experience. Organisations are taking IIoT seriously, as it’s unleashing capabilities to improve processes throughout the product life cycle while also improving product quality through better QCs. Feedback to product improvement time has reduced – customer features and product improvement requests can now be handled more efficiently, based on customer data.

Businesses that fully capitalise on IIoT systems are successfully building a competitive edge through their innovative products, optimised workforce, and differentiated products and service offerings to enhance customer experience.

What Lies Ahead?

As IIoT percolates into other industries, we will potentially see a new industrial revolution. This has obviously been attracting investment and technology companies quickly to offer related technology offerings that tech buyers would do well to consider along with IoT.

Cloud

Data management will become an obvious challenge with IIoT-driven data proliferation. Already the industry has been talking about going beyond cloud to “fog” computing. The real value of IIoT will be realised when the solutions become able to operate on the Edge. This will see an increased uptake of SaaS offerings that will be required for quick and accurate data-driven decisions.

AI

AI will eventually go further than basic machine learning and incorporate deep learning for better predictive and prescriptive analysis. IoT devices with embedded AI will truly revolutionise industries. This is another technology area that tech buyers should keep an eye on, irrespective of the industry.

Security and Risk Management

An explosion of IIoT devices and data will bring new risks. Cybersecurity experts and teams will be required to constantly monitor vulnerabilities, follow security best practices and eventually predict breaches.

The Future

Industry 4.0 is very much a buzzword in certain industries, with several advanced organisations already following the business and technology practices. Naturally, there are still many companies that do not see the need for new technology or would rather invest in other areas.

For organisations that are looking to modernise, innovate and remain competitive, Industry 4.0 is a good benchmark of how technology can be leveraged. IIoT is a key enabler of Industry 4.0 and has the potential to deliver benefits to majority industries through increased intelligence and curated data – the question is how soon we can witness it on a scale.

Which are the other industries that you think will benefit from IIoT? Leave your comments below

Is IIoT Edge Computing solution a real Internet of Things (IoT) trend for 2019?

As large hardware manufacturers like Cisco, HPE, Dell and more are building specific, robust and secure infrastructure for the edge, it is believed that there will be a lot of money flowing in the IIoT Edge computing world.

The Development and implementation of Edge-Machine Learning solutions is a complex process and requires a combination of rich industry experience, knowledge of automation (PLCs, SCADAS, HMIs), electrical & mechanical engineering along with unique Edge Computing distributed system. This is used by Data Scientists to develop Machine Learning algorithms which can be utilised by IIoT applications in the manufacturing industry.

For organisations looking to implement these solutions, it is always a good idea to know more on adoption and ask for the continuation of a pilot project for more than a year.

Below are the top 5 things that one should follow to accelerate implementation of IIoT edge computing solutions in the Manufacturing industry –

1) Get help to find the needle in the haystack

With the fragmented ecosystem of IIoT vendors and companies talking about the Industrial Internet or Industry 4.0, the challenge that always appears in front of the customers is to ask for free pilots from the manufacturers.

It is not just finding the needle (IIoT best or cheaper solution) in the haystack (ecosystem), it is how this needle matches with your business and technology strategies.

I know, I am selling myself, but my recommendation to you is to get advice from independent IIoT experts.

2) Avoid OT Vendor Lock-In: We need machine data availability

Powerful Edge Analytics-Machine Learning applications require data exchange with the Programmable Logic Controllers (PLCs) of the manufacturers. By looking at the specifications we may think that it will be an easy task to extract the data from PLCs going through different ways or manufacturer’s help-guides. However, the problem is vendor lock-ins, most of the top PLC manufacturer’s do not allow “easy” data access and extraction methods neither to the customers nor to any third parties.

It is not a question of protocols, it is a question of vendor lock-in and data availability.

Customers must seek and claim for open-source solutions to avoid vendor lock-in during the long run. The open source can better lead to the path of innovation in their manufacturing plants.

3) Edge Computing and Machine Learning: The last frontier to break between IT/OT

In my article “IT and OT, Friends or Foes in the Industrial Internet of Things?” I was optimistic about the quick convergence of Information Technology (IT) and Operations Technology (OT), I was wrong. If you visit and inspect a manufacturing plant floor, you will see how much progress is still to be made.

Edge Analytics is a key component in the integration of IT & OT and requires a knowledge of both to make it work. The lack of skills & knowledge in the IT and OT fields impact the business & operations and creates a dilemma on which department should lead the Edge Analytics projects.

Manufacturing companies need a role with authority (Chief IIoT Officer or CIIoT) and resources to lead the IT/OT convergence strategy.

4) Do not stop by the dilemma of Edge: To Cloud or NOT to Cloud

When I wrote in 2016 “Do not let the fog hide the clouds in the Internet of Things”, the hype around Edge Computing and Machine Learning started. There was a confusion about fog computing and edge computing and how this layer will impact the IoT architecture, especially cloud workloads.

Today, many cloud vendors offer IoT platforms and tools that combine the Cloud and the Edge application development, machine learning and analytics at the edge, governance, and end to end security. On the OT side, companies like Siemens have launched MindSphere, an open cloud-based IoT operating system based on the SAP HANA cloud platform.

Manufacturers should continue to deploy and develop Edge Computing – Machine Learning applications to monitor the health of their machines or to improve their asset maintenance or to monitor the quality control of their plant floor processes and shouldn’t stop because of the fear of the integration of their platform with the Public or Hybrid Cloud environment.

Edge Computing solutions help manufacturers to improve their competitiveness without the Clouds but make sure your Edge IIoT solution is ready for easy integration with the Clouds.

5) Connected Machines is the only way for new Business Models

Security is another major obstacle for the adoption of IIoT in the manufacturing industry. Manufacturers have been reluctant to open their manufacturing facilities to the Internet because of the risks of cyber-attacks.

In a fast-moving era where platforms and services require products and machines connected, every manufacturing factory should be able to tap into machine data remotely and make it available for Machine vendors. This requires every Edge Computing / Machine Learning system to be built with the capability to share data remotely via open and secure protocols/standards like MTConnect and OPC-UA.

Having machines connected is the first step to make machines smarter, to build smarter factories and to flourish new business models as Remote Equipment Monitoring.

Key Takeaway

The benefits of using Edge Computing / Machine Learning solutions are very attractive to the manufacturers because it offers minimal latency, conserve network bandwidth, improve operations reliability, offers quick decision-making ability, gather data, and process the collected data to gain insights. The ROI in such IIoT solutions is very attractive.

To get these benefits and to grace IIoT journey, manufacturers have to step-up and accept to receive tangible and innovative business value.