The emergence of COVID-19 last year caused a rapid shift towards work and study from home, and a pickup in eCommerce and social media usage. Tech companies running large data centre-based “webscale” networks have eagerly exploited these changes. Already flush with cash, the webscalers invested aggressively in expanding their networks, in an effort to blanket the globe with rapid, responsive connectivity. Capital investments have soared. For the webscale sector, spending on data centres and related network technology accounts for over 40% of the total CapEx.

Here are the 3 key emerging trends in the data centre market:

#1 Top cloud providers drive webscale investment but are not alone

The webscale sector’s big cloud providers have accounted for much of the recent CapEx surge. AWS, Google, and Microsoft have been building larger facilities, expanding existing campuses and clusters, and broadening their cloud region footprint into smaller markets. These three account for just under 60% of global webscale tech CapEx over the last four quarters. Alibaba and Tencent have been reinforcing their footprints in China and expanding overseas, usually with partners. Numerous smaller cloud providers – notably Oracle and IBM – are also expanding their cloud services offerings and coverage.

Facebook and Apple, while they don’t provide cloud services, also continue to invest aggressively in networks to support large volumes of customer traffic. If we look at Facebook, the reason becomes clear: as of early 2021, they needed to support 65 billion WhatsApp messages per day, over 2 billion minutes of voice and video calls per day, and on a monthly basis their Messenger platform carries 81 billion messages.

The facilities these webscale players are building can be immense. For instance, Microsoft was scheduled to start construction this month on two new data centres in Des Moines Iowa, each of which costs over USD 1 billion and measures over 167 thousand square metres. And Microsoft is not alone in building these large facilities.

#2 Building it all alone is not an option for even the biggest players

The largest webscalers – Google, AWS, Facebook and Microsoft – clearly prefer to design and operate their own facilities. Each of them spends heavily on both external procurement and internal design for the technology that goes into their data centres. Custom silicon and the highest speed, most advanced optical interconnect solutions are key. As utility costs are a huge element of running a data centre, webscalers also seek out the lowest cost (and, increasingly, greenest) power solutions, often investing in new power sources directly. Webscalers aim to deploy facilities that are on the bleeding edge of technology. Nonetheless, in order to reach the far corners of the earth, they have to also rely on other providers’ network infrastructure. Most importantly, this means renting out space in data centres owned by carrier-neutral network operators (CNNOs) in which to install their gear.

The Big 4 webscalers do this as little as possible. For many smaller webscalers though, piggybacking on other networks is the norm. Of course, they want some of their own data centres – usually the largest ones closest to their main concentrations of customers and traffic generators. But leasing space – and functionalities like cloud on-ramps – in third-party facilities helps enormously with time to market.

Oracle is a case in point. They have expanded their cloud services business dramatically in the last few years and attracted some marquee names to their client list, including Zoom, FedEx and Cisco. To ramp up, Oracle reported a rise in CapEx, growing to USD 2.1 billion in the 12 months ended June 2021, which represents a 31% increase from the previous year. However, when compared to Microsoft’s spending this appears modest. Microsoft reported having spent USD 20.6 billion in the 12 months ended June 2021 – a 33% increase over the previous year – to help drive the growth of their Azure cloud service.

One reason behind Oracle’s more modest spending is how heavily the company has relied on colocation partners for their cloud buildouts. Oracle partners with Equinix, Digital Realty, and other providers of neutral data centre space to speed their cloud time to market. Oracle rents space in 29 Digital Realty locations, for instance, and while Equinix doesn’t quantify its partnership with Oracle, Oracle’s cloud regions across the globe access the Oracle Cloud Infrastructure (OCI) via the Equinix Cloud Exchange Fabric. Oracle also works with telecom providers; their Dubai cloud region, launched in October 2020, is hosted out of an Etisalat owned data centre.

#3 Carrier-neutral data centre investment is surging in concert with webscale/cloud growth

As the webscale sector has raced to expand over the last 2 years, companies that specialise in carrier-neutral data centres have benefited. Industry sources estimate that as much as 50% or more of the cloud sector’s total data centre footprint is actually in these third-party data centres. That is unlikely to change, especially as some CNNOs are explicitly aiming to build out their networks in areas where webscalers have less incentive to devote resources. It’s not just about the webscalers’ need for space; the need for highly responsive, low latency networks is also key, and interconnection closer to the end-user is a driver.

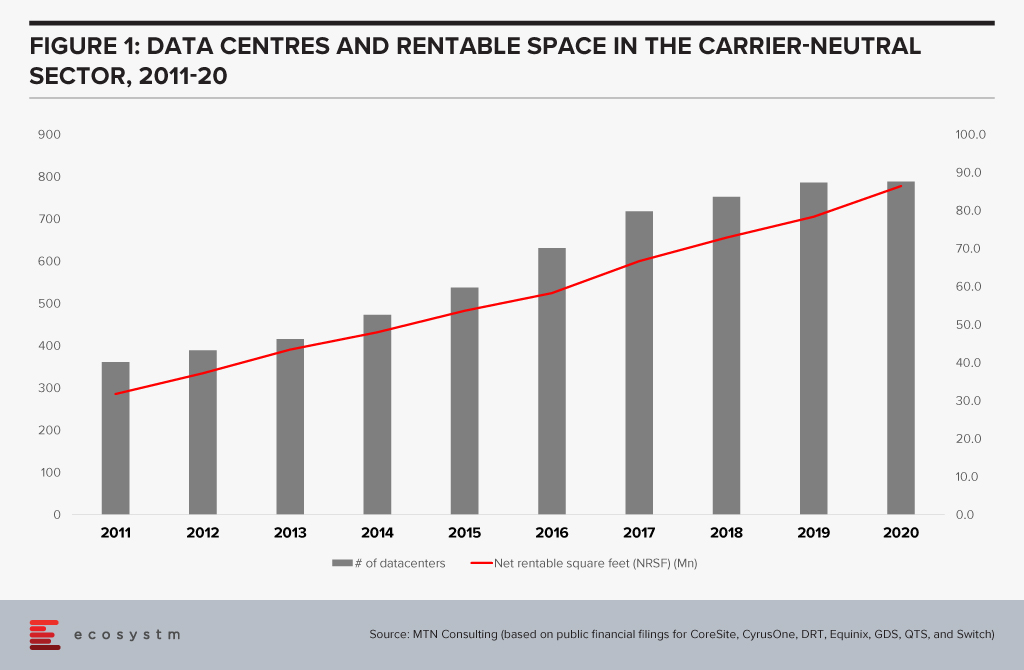

Looking at the biggest publicly traded carrier-neutral providers in the data centre sector shows that their capacity has expanded significantly in the last few years (Figure 1)

By my estimation, for the first 6 months of 2021, CapEx reported publicly for these CNNOs increased 18% against 1H20, to an estimated USD 4.1 Billion. Beyond the big public names, private equity investment is blossoming in the data centre market, in part aimed at capturing some of the demand growth generated by webscalers. Examples include Blackstone’s acquisition of QTS Realty Trust, Goldman Sachs setting up a data centre-focused venture called Global Compute Infrastructure; and Macquarie Capital’s strategic partnership with Prime Data Centers.

Some of this new investment target core facilities in the usual high-traffic clusters, but some also target smaller country markets (e.g. STT’s new Bangkok-based data centre), and the network edge (e.g. EdgeConneX, a portfolio company of private equity fund EQT Infrastructure).

EdgeConneX is a good example of the flexibility required by the market. They build smaller size facilities and deploy infrastructure closer to the edge of the network, including a PoP in Boston’s Prudential Tower. The company offers data centre solutions “ranging from 40kW to 40MW or more.” They have built over 40 data centres in recent years, including both edge data centres and a number of regional and hyperscale facilities across North America, Europe, and South America. Notably, EdgeConneX recently created a joint venture with India’s property group Adani – AdaniConneX – which looks to leverage India’s status of being the current hotspot for carrier-neutral data centre investment.

As enterprises across many vertical markets continue to adopt cloud services, and their requirements grow more stringent, the investment climate for new data centre capacity is likely to remain strong. Webscale providers will provide much of this capacity, but carrier-neutral specialists have an important role to play.

“Cloud is universal – everything is going to be on the cloud soon! If you are not moving to the cloud, you are going extinct! AWS, Microsoft and Google are going to rule the world!” This has been the hyped narrative for some time now. But watch out New World – the Old World is fighting back!

Traditional vendors like HP Enterprise, Cisco, and Oracle are all deploying strategies to remain relevant in the new world. For these vendors – especially for HPE and Cisco that come from a predominantly hardware background – the future is hybrid. They picture a world in which the data centre – either on-prem or in a co-located facility – thrives on, in tandem with the cloud. This is a reasonably good bet. For most large enterprises with a huge repository of applications and data sitting in the data centre, migrating everything to the cloud is a nightmare – fraught with risk and very expensive.

Ecosystm research shows that 32% of organisations have deployed containerisation – and this percentage will only grow. The ability for firms to toggle between data centre bare metal based applications and completely on-the-cloud ones is becoming more manageable by the day. This enormous flexibility allows a firm that has large compute needs to keep some stable workloads in a data centre, whether on-prem or co-located, while simultaneously using cloud-based workloads, optimising spends and performance.

Here is a glimpse into the strategies of three key vendors.

HPE’s ‘as-a-service’ Messaging is Spot on

Two years ago, Antonio Neri boldly went where no HPE CEO had gone before, promising that HPE’s entire portfolio would be available ‘as-a-service’ within 3 years. At the recently concluded HPE Discover event, there were a flurry of announcements to showcase that GreenLake is indeed on its way to meet that ambitious goal in 2022.

HPE’s recent announcements show customers that GreenLake is an end-to-end solution for managing their IT infrastructure moving forward. It ticks all the boxes: providing flexibility and scalability; the advantage of using both data centre and cloud; and high manageability and security with a full suite of applications.

Examples are the partnership with Azure Stack HCI, to add to earlier ones with leading vendors like SAP, Citrix, and VMware. HPE is building a platform that provides customers with the comfort that they can adopt GreenLake and pretty much have access to any application they may choose to implement – offering full coverage from the Edge to the Cloud. It is extremely interesting that GreenLake allows the option of switching on and switching off processor cores as needed, and the customer pays based on usage. This is surely a first for the industry!

Another example is Lighthouse, which allows the customer to rapidly configure, and provision workloads based on dynamic needs. While all the hyperscalers provide similar services when the workload is on the cloud, Lighthouse allows the same flexibility and speed for cloud services which can be run in the data centre, on-prem, co-located, or even at the Edge.

A third example was the announcement of Project Aurora which will add an additional security layer from validating the input data all the way to verifying the workload at the start and then as it is running. It appears to use an AI/ML system that checks for unexpected behaviours to detect any kind of malware.

It makes good sense for HPE to push GreenLake and move to offering ‘everything-as-a-service’. As one of the incumbent enterprise hardware business leaders, this is a good response rather than to watch one’s business continue to shrink YoY. GreenLake is HPE’s way of futureproofing themselves and making sure they stay relevant in the new cloud world.

Cisco Secures the Hybrid Workplace

Cisco has been active launching Cisco Plus earlier this year, as their bridge to the as-a-service model with a network-as-a-service (NaaS) offering. Somewhat like GreenLake, Cisco Plus offers flexible consumption for compute, storage, and networking. They are committed to offering most of their portfolio as-a-service over time.

Cisco has shown some resilience in terms of revenue but has still been struggling to grow. After a steady growth since 2017, the revenues dropped by 7% in 2020 almost as a direct impact of COVID-19. The post-pandemic world has the potential of being a bigger threat for Cisco. Many estimates show the number of people working from home is likely to go up dramatically and Cisco’s key networking offering could rapidly become redundant. However, at Ecosystm we believe that the hybrid work model will be predominant.

Cisco is also betting on a hybrid world. No matter where one works from, there are networking needs. Cisco’s focus, therefore, is on security – this will be on the mind of virtually any enterprise as it chalks out its future strategy. With a hybrid environment, making everything secure becomes more complex while continuing to be vital. Cisco has a heavy emphasis on Secure Access Service Edge (SASE) – the idea that the security envelope now has to be a flexible form that has a presence everywhere that the enterprise needs to be. This will make a lot of sense to most enterprises as they tread the hybrid path.

Cisco will offer a portfolio of tools to make it increasingly easier for customers to use multi-cloud, multi-vendor environments, offering the best of both worlds.

Oracle Incentivises Cloud Migration

Oracle has a different approach because they are trying to solve a different problem. They are competing with the hyperscalers, while fully acknowledging a hybrid world. However, as a company with less legacy in hardware, it makes sense for them to focus on migrating to cloud rather than on hybridisation. Oracle has just announced that they will subsidise existing customers who add cloud workloads with them, by providing discounts on the existing licensing fees that the customer is paying Oracle. This discount appears to be around 25% to 33%. In essence, this means that if a customer spends about USD 100k with Oracle on licensing and decides to start moving workloads to the Oracle Cloud worth somewhere between USD 300-400k, they can potentially write off the entire license fees they are currently paying!

Conclusion

There is a strong effort from every vendor right now to retain and consolidate their customer share and build a vision that convinces the customer that they are the way to go. For the traditional hardware players that vision is of a hybrid world – attractive to today’s large enterprise. For the likes of AWS, Microsoft, Google, and Oracle it is all about moving the customer to their cloud. The assumption of course is that moving someone to your cloud will lead to more of your apps being used by the customer. For the hardware vendors like Cisco and HPE, it is all about moving the customer to their own platforms which empower hybridisation. In all cases, a necessary component is to offer ‘everything-as-a-service’ upending the traditional models of selling.

In my opinion, with time the IaaS portion of the cloud is likely to gradually devolve into something like a utility. There will be a lot of upheavals and market disruption before we get there, but eventually, software and other services are likely to stand separate from the infrastructure provider. All the vendors are therefore depending on capturing the customer at the platform-as-a-service (PaaS) level, but even this is likely to get commoditised over time. Eventually, the winners will be disparate providers of the best applications for different functions. Meanwhile, we are in for an extremely interesting ride as we see all the vendors jockeying for space!

As organisations stride towards digitalisation, re-evaluating their business continuity plans and defining how the Future of Work will look for them, cloud adoption is expected to surge. Almost all technologies being evaluated by organisations today have cloud as their pillar. Cloud will the key enabler for ease of doing business, real-time data access for productivity increase, and process automation.

Ecosystm Advisors Claus Mortensen, Darian Bird and Tim Sheedy present the top 5 Ecosystm predictions for Cloud Trends in 2021. This is a summary of our cloud predictions – the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Cloud Trends for 2021

- 2021 Will be All About SaaS

2020 was a breakout year for SaaS providers – and a tough one for a lot of on-premises software vendors. SaaS (or mainly SaaS) providers like Salesforce, Zoom, Microsoft had record growth and some of the best quarters in their history, while other mainly on-premises software providers have had poor quarters. SAP is even accelerating the transition to a 100% cloud-based business as their revenue suffers. The race to deploy SaaS tools and platforms is well and truly happening. Many of the usual ROI models and business cases have been abandoned as the need for agility – to drive business change at pace trumps most other business needs. Ecosystm data validates this

This trend will continue in 2021 – in fact, we expect it to accelerate. Most SaaS solutions (such as CRM, ERP, SCM, HRM etc.) are implemented by less than 30% of businesses today – which means the upside for the SaaS providers is huge.

- Hybrid Cloud Will Finally Become Mainstream

The sudden move to remote working in 2020 forced most organisations to increase their use and reliance on cloud-based applications. Employees have relied on collaborative tools such as Zoom, Microsoft Teams and WebEx to conduct virtual meetings, call centre workers had to respond to calls from home – most if not all relying on cloud-based apps and platforms. This trend is set to continue going forward. Ecosystm research finds that 44% of organisations will spend more on cloud-based collaboration tools in the next 6-12 months.

But the forced adoption of these tools has also prompted many – especially larger organisations – to worry about losing control of their IT resources, including worries related to security and compliance, cost, and reliability. As for the latter, both Microsoft Azure and Zoom experienced outages after the pandemic hit and this has made many organisations wary of relying too much on a single public cloud platform. Ecosystm therefore expects a sharp increase in focus on hybrid cloud platforms in 2021 as IT Teams seek to regain control of the apps and services their employees rely the most upon.

- Carrier Investment in 5G Will Give Edge Computing a Boost

The gap between the hype around edge computing and the actual capabilities it offers will narrow in 2021 as 5G networks are built out. One of the most promising methods of deploying edge computing involves carriers embedding cloud capacity in their own data centres connected to their 5G networks. This ensures data does not unnecessarily leave the network, reducing latency and preserving bandwidth. This combination of 5G and the Edge will be of particular benefit to applications that until now have faced a trade-off between mobility and connectivity. Over the last twelve months, the major hyperscalers announced their 5G edge computing offerings, and some of the major global telecom providers have served as test cases by partnering with at least one hyperscaler and will likely add more over the next year. Expect this ecosystem to expand greatly in 2021.

Cloud environments can benefit from pushing computing-heavy workloads to the Edge in much the same way as IoT and provides a great platform for managing the edge computing endpoints. The flipside of pushing containers to the Edge will be the increased complexity and the fact that the number of attack surfaces will increase. Containerisation must therefore be deployed with security at its core.

- Stateful Applications Will Move to the Cloud with Containers and Orchestration

As organisations seek to migrate workloads and applications between platforms in an increasingly hybrid cloud environment, the need for “lifting and shifting”, refactoring and partitioning applications will increase. These approaches all have their shortcomings, however. Lifting and shifting an application may limit its functionality now or in the future; refactoring may take too long or be too costly; and partitioning is often not feasible or possible. A better approach to this task is to modernise the applications to make use of application containers like Docker, Windows Server Containers, Linux VServer and so on, to enable a faster and more seamless way to migrate applications between platforms. We also see container orchestration environments like Kubernetes and containerised development and deployment platforms like IBM’s Cloud Paks.

How these technologies are used to deploy stateful applications in multicloud environments will evolve. A raft of container management platforms, based on Kubernetes, are being released to simplify what was once a complex DIY process. New entrants will look to challenge the cloud hyperscalers, virtualisation giants, and Kubernetes specialists. The emerging features that previously required cobbling together third-party tools, like service mesh, data fabric, and machine learning, will speed up containerisation of stateful core applications. The deployment of containers on bare metal rather than in virtualised environments will also gather pace. The most challenging task will be delivering containerised applications at the Edge, forcing developers and platform providers to create inventive solutions.

- Serverless will take us a step closer to NoOps

As the application lifecycle speeds up and the distinction between development and operations shrinks, the motivation to adopt serverless computing will grow in 2021. While NoOps, the concept that operations could become so automated that it fades into the background, is still a distant goal, serverless computing will make a stride in that direction by abstracting the application from the infrastructure. Having seen the agility benefits of a microservices architecture, many DevOps teams will experiment with breaking services down further into functions. Moreover, the pay-as-you-go model of serverless will appeal to OpEx driven organisations. Expect stories of bill shock, however, as were seen in the early days of cloud adoption. While AWS Lambda is currently considered the serverless industry standard, it is likely that in 2021, Microsoft, Google, and IBM will ramp up efforts in this space. Each of these providers will build out their offering in terms of languages supported, event triggers, consumption plans, machine learning/AI options, observability, and user experience.