Southeast Asia’s banking sector is poised for significant digital transformation. With projected Net Interest Income reaching USD 148 billion by 2024, the market is ripe for continued growth. While traditional banks still hold a dominant position, digital players are making significant inroads. To thrive in this evolving landscape, financial institutions must adapt to rising customer expectations, stringent regulations, and the imperative for resilience. This will require a seamless collaboration between technology and business teams.

To uncover how banks in Southeast Asia are navigating this complex landscape and what it takes to succeed, Ecosystm engaged in in-depth conversations with senior banking executives and technology leaders as part of our research initiatives. Here are the highlights of the discussions with leaders across the region.

#1 Achieving Hyper-Personalisation Through AI

As banks strive to deliver highly personalised financial services, AI-driven models are becoming increasingly essential. These models analyse customer behaviour to anticipate needs, predict future behaviour, and offer relevant services at the right time. AI-powered tools like chatbots and virtual assistants further enhance real-time customer support.

Hyper-personalisation, while promising, comes with its challenges – particularly around data privacy and security. To deliver deeply tailored services, banks must collect extensive customer information, which raises the question: how can they ensure this sensitive data remains protected?

AI projects require a delicate balance between innovation and regulatory compliance. Regulations often serve as the right set of guardrails within which banks can innovate. However, banks – especially those with cross-border operations – must establish internal guidelines that consider the regulatory landscape of multiple jurisdictions.

#2 Beyond AI: Other Emerging Technologies

AI isn’t the only emerging technology reshaping Southeast Asian banking. Banks are increasingly adopting technologies like Robotic Process Automation (RPA) and blockchain to boost efficiency and engagement. RPA is automating repetitive tasks, such as data entry and compliance checks, freeing up staff for higher-value work. CIMB in Malaysia reports seeing a 35-50% productivity increase thanks to RPA. Blockchain is being explored for secure, transparent transactions, especially cross-border payments. The Asian Development Bank successfully trialled blockchain for faster, safer bond settlements. While AR and VR are still emerging in banking, they offer potential for enhanced customer engagement. Banks are experimenting with immersive experiences like virtual branch visits and interactive financial education tools.

The convergence of these emerging technologies will drive innovation and meet the rising demand for seamless, secure, and personalised banking services in the digital age. This is particularly true for banks that have the foresight to future-proof their tech foundation as part of their ongoing modernisation efforts. Emerging technologies offer exciting opportunities to enhance customer engagement, but they shouldn’t be used merely as marketing gimmicks. The focus must be on delivering tangible benefits that improve customer outcomes.

#3 Greater Banking-Fintech Collaboration

The digital payments landscape in Southeast Asia is experiencing rapid growth, with a projected 10% increase between 2024-2028. Digital wallets and contactless payments are becoming the norm, and platforms like GrabPay, GoPay, and ShopeePay are dominating the market. These platforms not only offer convenience but also enhance financial inclusion by reaching underbanked populations in remote areas.

The rise of digital payments has significantly impacted traditional banks. To remain relevant in this increasingly cashless society, banks are collaborating with fintech companies to integrate digital payment solutions into their services. For instance, Indonesia’s Bank Mandiri collaborated with digital credit services provider Kredivo to provide customers with access to affordable and convenient credit options.

Partnerships between traditional banks and fintechs are essential for staying competitive in the digital age, especially in areas like digital payments, data analytics, and customer experience.

While these collaborations offer opportunities, they also pose challenges. Banks must invest in advanced fraud detection, AI monitoring, and robust authentication to secure digital payments. Once banks adopt a mindset of collaboration with innovators, they can leverage numerous innovations in the cybersecurity space to address these challenges.

#4 Agile Infrastructure for an Agile Business

While the banking industry is considered a pioneer in implementing digital technologies, its approach to cloud has been more cautious. While interest remained high, balancing security and regulatory concerns with cloud agility impacted the pace. Hybrid multi-cloud environments has accelerated banking cloud adoption.

Leveraging public and private clouds optimises IT costs, offering flexibility and scalability for changing business needs. Hybrid cloud allows resource adjustments for peak demand or cost reductions off-peak. Access to cloud-native services accelerates innovation, enabling rapid application development and improved competitiveness. As the industry adopts GenAI, it requires infrastructure capable of handling vast data, massive computing power, advanced security, and rapid scalability – all strengths of hybrid cloud.

Replicating critical applications and data across multiple locations ensures disaster recovery and business continuity. A multi-cloud strategy also helps avoid vendor lock-in, diversifies cloud providers, and reduces exposure to outages.

Hybrid cloud adoption offers benefits but also presents challenges for banks. Managing the environment is complex, needing coordination across platforms and skilled personnel. Ensuring data security and compliance across on-prem and public cloud infrastructure is demanding, requiring robust measures. Network latency and performance issues can arise, making careful design and optimisation crucial. Integrating on-prem systems with public cloud services is time-consuming and needs investment in tools and expertise.

#5 Cyber Measures to Promote Customer & Stakeholder Trust

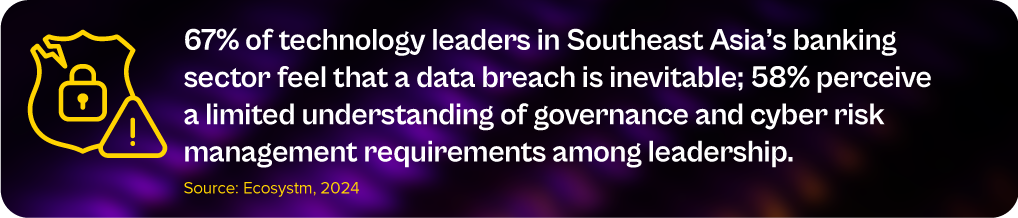

The banking sector is undergoing rapid AI-driven digital transformation, focusing on areas like digital customer experiences, fraud detection, and risk assessment. However, this shift also increases cybersecurity risks, with the majority of banking technology leaders anticipate inevitable data breaches and outages.

Key challenges include expanding technology use, such as cloud adoption and AI integration, and employee-related vulnerabilities like phishing. Banks in Southeast Asia are investing heavily in modernising infrastructure, software, and cybersecurity.

Banks must update cybersecurity strategies to detect threats early, minimise damage, and prevent lateral movement within networks.

Employee training, clear security policies, and a culture of security consciousness are critical in preventing breaches.

Regulatory compliance remains a significant concern, but banks are encouraged to move beyond compliance checklists and adopt risk-based, intelligence-led strategies. AI will play a key role in automating compliance and enhancing Security Operations Centres (SOCs), allowing for faster threat detection and response. Ultimately, the BFSI sector must prioritise cybersecurity continuously based on risk, rather than solely on regulatory demands.

Breaking Down Barriers: The Role of Collaboration in Banking Transformation

Successful banking transformation hinges on a seamless collaboration between technology and business teams. By aligning strategies, fostering open communication, and encouraging cross-functional cooperation, banks can effectively leverage emerging technologies to drive innovation, enhance customer experience, and improve efficiency.

A prime example of the power of collaboration is the success of AI initiatives in addressing specific business challenges.

This user-centric approach ensures that technology addresses real business needs.

By fostering a culture of collaboration, banks can promote continuous learning, idea sharing, and innovation, ultimately driving successful transformation and long-term growth in the competitive digital landscape.

Organisations are moving beyond digitalisation to a focus on building market differentiation. It is widely acknowledged that customer-centric strategies lead to better business outcomes, including increased customer satisfaction, loyalty, competitiveness, growth, and profitability.

AI is the key enabler driving personalisation at scale. It has also become key to improving employee productivity, empowering them to focus on high-value tasks and deepening customer engagements.

Over the last month – at the Salesforce World Tour and over multiple analyst briefings – Salesforce has showcased their desire to solve customer challenges using AI innovations. They have announced a range of new AI innovations across Data Cloud, their integrated CRM platform.

Ecosystm Advisors Kaushik Ghatak, Niloy Mukherjee, Peter Carr, and Sash Mukherjee comment on Salesforce’s recent announcements and messaging.

Read on to find out more.

Download Ecosystm VendorSphere: Salesforce AI Innovations Transforming CRM as a PDF

The Retail industry has faced significant challenges in recent times. Retailers have had to deliver digital experiences and delivery models; navigate global supply chain disruptions; accommodate the remote work needs of their employees; and keep up with rapidly changing customer expectations. To remain competitive, many retailers have made significant investments in technology.

However, despite these investments, many retailers have struggled to create market differentiation. The need for innovation and constant evolution remains.

As retailers cope with hypersonalisation trends, supply chain vulnerabilities, and the rise of ESG consciousness, the industry is seeing several instances on innovation.

Read on to find out how brands such as Clinique, Gucci, Tommy Hilfiger, Nike, Woolworths, Prada, Levi Strauss, Mahsenei Hashuk and Instacart are using emerging technologies such as the Metaverse and Generative AI to create the much-needed market edge.

Download “The Future of Retail” as a PDF

In good times and in bad, a great customer experience (CX) differentiates your company from your competitors and creates happy customers who turn into brand advocates. While some organisations in Asia Pacific are just starting out on their CX journey, many have made deep investments. But in the fast-paced world of digital, physical and omnichannel experience improvement, if you stand still, you fall behind.

We interviewed CX leaders across the region, and here are the top 5 top actions that they are taking to stay ahead of the curve.

#1 Better Governance of Customer Data

Most businesses accelerate their CX journeys by collecting and analysing data. They copy data from one channel to another, share data across touchpoints, create data silos to better understand data, and attempt to create a single view of the customer. Without effective governance, every time create copies of customer data are created, moved, and shared with partners, it increases the attack surface of the business. And there is nothing worse than telling customers that their data was accessed, stolen or compromised – and that they need to get a new credit card, driver’s license or passport.

To govern customer data effectively, it is essential to collaborate with different stakeholders, such as legal, risk, IT, and CX leaders – data owners, consumers, and managers, analytics leaders, data owners, and data managers – in the strategy discussions.

#2 Creating Human Experiences

To create a human-centric experience, it is important to understand what humans want. However, given that each brand has different values, the expectations of customers may not always be consistent.

Much of the investment in CX by Asian companies over the past five years have been focused on making transactions easy and effective – but ultimately it is the emotional attachment which brings customers back repeatedly. In creating human experiences, brands create a brand voice that is authentic, relatable, empathetic and is consistent across all channels.

Humanising the experience and brand requires:

- Hyperpersonalisation of customer interactions. By efforts such as using names, understanding location requirements, remembering past purchases, and providing tailored recommendations based on their expectations, businesses can make customers feel valued and understood. Understanding the weather, knowing whether the customer’s favourite team won or lost on the weekend, mentioning an important birthday, etc. can all drive real, human experiences – with or without an actual human involved in the process!

- Transparency. Honesty and transparency can go a long way in building trust with customers. Businesses should be open about their processes, pricing, and policies. Organisations should be transparent about mistakes and what they are doing to fix the problem.

#3 Building Co-creation Opportunities

Co-creation is a collaborative approach where organisations involve their customers in the development and improvement of products, services, and experiences. This process can foster innovation, enhance customer satisfaction, and contribute to long-term business success. Co-creation can increase customer satisfaction and loyalty, drive innovation, enhance brand reputation, boost market relevance, and reduce risks and costs.

Strategies for co-creation include:

- Creating open innovation platforms where customers can submit ideas, feedback, and suggestions

- Organising workshops or focus groups that bring together customers, designers, and developers to brainstorm and generate new ideas

- Running contests or crowdsourcing initiatives to engage customers in problem-solving and idea generation

- Establishing feedback loops and engaging customers in the iterative development process

- Partnering with customers or external stakeholders, such as suppliers or distributors, to co-create new products or services

#4 Collecting Data – But Telling Stories

Organisations use storytelling as a powerful CX tool to connect with their customers, convey their brand values, and build trust.

Here are some ways organisations share stories with their customers:

- Brand storytelling. Creating narratives around their brand that showcase their mission, vision, and values

- Customer testimonials and case studies. Sharing real-life experiences of satisfied customers to showcase the value of a product or service

- Content marketing. Creating engaging content in the form of blog posts, articles, videos, podcasts, and more to educate, entertain, and inform their customers

- Social media. Posting photos, videos, or updates that showcase the brand’s personality, to strengthen relationships with the audience

- Packaging and in-store experiences. Creative packaging and well-designed in-store experiences to tell a brand story and create memorable customer interactions

- Corporate social responsibility (CSR) initiatives. Helping customers understand the values the organisation stands for and build trust

#5 Finally – Not Telling Just Positive Stories!

Many companies focus on telling the good stories: “Here’s what happens when you use our products”; “Our customers are super-successful” and; “Don’t just take it from us, listen to what our customers say.”

But memorable stories are created with contrast – like telling the story of what happened when someone didn’t use the product or service. Successful brands don’t want to just leave the audience with a vision of what could be possible, but also what will be likely if they don’t invest. Advertisers have understood this for years, but customers don’t just hear stories through advertisements – they hear it through social media, word of mouth, traditional media, and from sales and account executives.

In today’s digital world, data is an essential part of almost everything we do. From making informed business decisions to providing the best customer outcomes, data plays a crucial role in shaping organisations’ actions and strategies. With the increasing availability of customer data, companies can now gain valuable insights into customer behaviour, preferences, and expectations; and offer personalised experiences to build long-lasting relationships.

Ecosystm Principal Advisor, Audrey William talks about 5 things to keep in mind when working on your data strategy to improve customer experience.

- Build a data-driven CX culture. If you don’t have a Chief Experience Officer, appoint one.

- Understand your data needs. Blindly gathering data without evaluating significance or utilisation, can cost you.

- Evaluate your data repositories. Invest in a CDP or an Intelligent Data Platform for a unified view of customer data.

- Use Speech Analytics to truly understand your customer. Go beyond traditional metrics to gather data-driven insights.

- Aim to achieve hyperpersonalisation. Make it the goal and core of your data and customer strategies.

Read on to find more.

Download Putting Data at the Core of CX Transformation

In comparison to the golden days of the second half of the 20th century, the last two decades have been hard hit. The fragility of globalisation and that prosperous economic model so beautifully enabled by a 70-year technology revolution, have tested business continuity and disaster recovery plans like never before.

Looking Back

During this time the global community has lurched through tech and property driven financial crisis. It has endured endemic terrorism, and a crippling pandemic. And it has been fragmented by the existential threats of energy and climate, world order dislocation, and challenges to once unshakable fiat money. The wonderfully efficient business models and supply chains enabled by W. Edwards Deming following World War II are fractured and broken. Despite all these challenges, the desire for a hopeful return to a golden age of global prosperity is clearly evident. Just maybe not as we know it.

The period between W. Edwards Deming and Dotcom (let’s say 1950-2000) ushered in ERP and the modern software revolution. Over decades, highly refined processes and perfected workflows shifted from paper and clipboards into mainframe environments – from conveyor belts to computing and from ledgers to LANs.

In the progression to slightly less monolithic server-based business applications, millions of lines of customised code are transferred into configurable data fields, coupled with ready-made workflow connections, and processes based on standards set by leading companies and their representative bodies. The standardisation of business systems lowered the entry point for new enterprises, spawned new industries, and ultimately allowed SaaS to proliferate.

ERP was a true revolution in automating process and quality management systems and building the modern world. Cloud was then a transformation for ERP. It was an innovation on an original idea, but it wasn’t the next revolution. In many ways, by standardising business systems, we went too far. The vendor market over-estimated what configuration over customisation could achieve and ultimately set unachievable expectations in relation to client outcomes. On the client side, end-user organisations seized on vanilla processes and workflows and got lazy about working out solutions to their own problems. In chasing out-of-the-box software they sought to expedite, and even outsource, the hard work. In doing so, the core driver of 20th century post war economic prosperity was forgotten.

Looking Ahead

In business transformations there are no short cuts to results

One of the defining social drivers of the 21st century is a move towards the concept of individualism. We see it everywhere. In the transformation of traditional marriage, family, and identity structures. In the migration away from the concept of houses and homes, in the rise of the gig economy, and even in the regulatory schemes of government, financial and insurance services. The individual sits at the centre of new globalisation economic design and is giving rise to the next business systems revolution. At ServiceNow Knowledge 2022 I was fortunate to hear Dr Catriona Wallace and the Hon Victor Dominello MP discuss it in the context of their recent research. Dr Wallace described the trend as, “know me and care about me”, and discussed the requirements to operate within a world of both hyper-personalisation and ethical restraint.

This time however the business systems revolution to support this change is not being driven by process efficiencies and quality management, though they remain important tools. It is being driven by the pursuit of Experiential Excellence. You’ve heard it many times before and once you’ve seen it you can’t unsee it – Customer Experience, Employee Experience, Digital Experience. These are all ambitions of populist organisational and service transformation agendas with Experiential Excellence at their core.

For business and technology leaders it requires a mental shift. Traditional ERP alone will not get us there. It means a new business systems methodology is required to accompany, and reflect the challenges of the modern world, not one created more than 70 years ago.

An Experiential Excellence platform isn’t just a new ERP. It’s a new type of system capable of operating at speed and with breakthrough power; but it is also capable of breaking the intellectual shackles of pre-configuration to help organisations recapture the essence of what Deming started so long ago and we somehow lost along the way: The ability to think about and solve any kind of complex, innovative and multi-objective, multi-stakeholder problem. And I think that ServiceNow, and the Now Platform, is the first company (and business system) to do it.

The sense of something special was clearly evident among ServiceNow staff and partners, at the event. But I don’t think they have yet nailed the messaging. And the reason is because there is still such a strong gravitational pull towards the old ERP model among end-user clients. This reinforces a need for ServiceNow to still define itself by the last 50 years of system technology rather than the next 50.

That needs to change. So, next time when a client asks, is ServiceNow an ERP or is it an RPA platform or something else, the answer is – it is neither, and both, and all, and sometimes at the same time. This wonderful superposition, the same quantum computing characteristic that allows a particle to be one thing, or either, or both, all at the same time, is the very essence of their opportunity – should they wish to take it.

To be a leader in the new quantum age of computing will mean taking the brave step of unshackling themselves from the 20th century view of ERP and lead the redefinition of business systems for the quantum age. Let the revolution begin.