Ransomware attacks have become a real threat to organisations world-wide – SonicWall reports that there were 304.7 million attacks globally in the first half of 2021, surpassing the full-year total for 2020. Organisations today are challenged with having the right cybersecurity measure in place, with cyber-attacks considered an inevitability.

This also challenges tech providers and cybersecurity vendors, as they have to constantly evolve their security offerings to protect their client organisations.

Ecosystm analysts, Alan Hesketh, Andrew Milroy and Claus Mortensen discuss the challenges tech providers face and how they are evolving their capabilities – organically, through acquisitions (Microsoft) and through partnerships (Google).

An Update (1 October 2021): This acquisition did not go through even after the boards of directors of both companies had approved it. It was voted down by Five9 shareholders, citing growth and valuation concerns. This is an unusual example of an acquisition not going through because of unwillingness of one of the companies. In recent times, regulators have stopped some acquisitions. Incidentally, there were some concerns raised by the by Federal Communications Commission (FCC) as Zoom is based in US. but has product development operations in China.

The partnership arrangement between the two companies will continue including support for integrations between their respective Unified Communications as a Service (UCaaS) and Contact Centre as a Service (CCaaS) solutions and joint go-to-market initiatives.

Zoom has announced their intention to acquire cloud contact centre service provider Five9 in an all-stock deal for about USD 14.7 Billion. This is Zoom’s largest-ever acquisition as the communications platform continues to expand their services and launch new products. The deal is expected to be completed in the first half of 2022 and Five9 will be an operating unit of Zoom.

The last year has seen Zoom scaling up their product offerings, including cloud calling solution – Zoom Phone, conference hosting solution – Zoom Rooms, and applications and productivity tools – Zoom Apps and Zoom Marketplace. Zoom also acquired real-time translation startup Kites GmbH to offer multi-language translation capabilities, and Keybase – a secure messaging and file-sharing service to build end-to-end encryption for its video conferencing platform.

Ecosystm Analysts share their thoughts on Zoom’s strategy and roadmap, how Five9 will augment Zoom’s capabilities, and the impact the acquisition will have on Zoom’s competitors and the market.

Why Contact Centre?

Ecosystm Principal Advisor Tim Sheedy says, “Zoom is moving beyond its period of ‘organic hypergrowth’ brought on by the pandemic. While the paying customer base for their core video collaboration service will continue to grow, growth rates are likely to begin to track the market. To grow beyond market rates, Zoom needs to move into new markets – through product development or acquisition.”

Talking about the importance of voice services, Sheedy adds, “Voice services are an obvious adjacent market to help drive growth, and Zoom already has seen some success with their Zoom phone service and associated devices – in fact, they already have 1.5 million users. The Five9 acquisition gives the company a stronger and deeper capability in the voice sector; buying them a significant chunk of the voice services in business – the contact centre. In many businesses, the contact centre already accounts for over 50% of their voice minute usage, so winning this space will go a long way towards winning the overall voice and collaboration supplier in enterprises.”

Ecosystm Principal Advisor Audrey William predicts exciting times ahead for Zoom. “With Zoom already having a platform for video, then bringing voice into that equation and now a contact centre solution, makes them take on their competitors in an all-native cloud stack. There is a still a large installed base of on-prem UC customers and with Zoom seeing success with Zoom phones in the short time frame since its launch, this is where this will get exciting for Zoom. The telephony piece is still important in the race to simplify how we work, communicate, and collaborate today. It is that same voice/telephony discussion that can lead to a routing discussion, which then leads to a contact centre discussion.”

Ecosystm research shows that 54% of organisations are challenged in their customer experience delivery because of integration issues between multiple platforms. William sees this as an opportunity for Zoom. “The use cases to integrate workflows into the video environment is going to be important for Zoom. Video is now being used to solve customer service issues like letting the agents take over the screen to see how to help solve the customer problem immediately by using video and contact centre applications. The ability to bring this natively together will be very powerful. Zoom is investing heavily into apps and working to partner with ISVs who can develop workflows suitable for easy customer communication in specific industries such as Healthcare and Financial Services.”

Why Five9?

Five9 is considered a pioneer in cloud contact centre solutions and owns a comprehensive suite of applications for contact centre delivery and customer management operations across different channels. Five9 has made several acquisitions and enhancements to their CCaaS solution in recent years to make their stack more complete with richer AI offerings. They include Inference Solutions to offer their customers a Conversational AI solution and Whendu’s iPaaS platform which provides a no-code, visual application workflow tool.

William says, “More contact centres want to do away with monolithic IVR systems that confuse customers with too many long menus. The Agent Assist solutions are also gaining importance especially in the hybrid work model where agents face challenges working in isolation and not being on a floor with their colleagues and managers.”

Five9 has acquired a cloud workforce optimisation provider Virtual Observer. “So, we are not looking at just a basic level contact centre solution but an offering with important capabilities demanded by customers,” says William. “During the investor call this week, Zoom’s Eric Yuan and Rowan Trollope made it clear that they have been listening to customer feedback on how effective it would be to have a single platform that can accommodate UC and contact centres in the cloud. Zoom also sees Five9 as a good fit culturally; and their goal now will be to disrupt all legacy systems with cloud-native communications.”

What lies ahead?

William thinks that Zoom’s competitors will be watching this integration closely, especially those that lack an all-in-one native cloud UCaaS and CCaaS stack. “However, some of Zoom’s competitors have an established base of large enterprise customers and have done well to grow revenues and defend their base over the years. Working with in-country partners and ISVs will be critical for Zoom’s growth across regions.”

Sheedy thinks that the most important takeaway from this acquisition is not that Zoom is moving into the contact centre space. “It is that Zoom realises they have a “once in a generation” opportunity to grow beyond their core and cement their position as a supplier of collaboration and communication services – and that they are willing to flex their balance sheet and share price to create their future. The competition – from Microsoft in particular – will be strong. Google, AWS, Salesforce, and Facebook are also making a play for this market. Zoom has found themselves in their current position of strength due to good luck and good timing – and they appear to be telling the market that they aren’t going to give up their leadership without a significant battle.”

“Enterprises will be the true winners in this battle – with better, more integrated, lower cost and easier to implement communications and collaboration solutions for their employees and customers,” adds Sheedy.

“Cloud is universal – everything is going to be on the cloud soon! If you are not moving to the cloud, you are going extinct! AWS, Microsoft and Google are going to rule the world!” This has been the hyped narrative for some time now. But watch out New World – the Old World is fighting back!

Traditional vendors like HP Enterprise, Cisco, and Oracle are all deploying strategies to remain relevant in the new world. For these vendors – especially for HPE and Cisco that come from a predominantly hardware background – the future is hybrid. They picture a world in which the data centre – either on-prem or in a co-located facility – thrives on, in tandem with the cloud. This is a reasonably good bet. For most large enterprises with a huge repository of applications and data sitting in the data centre, migrating everything to the cloud is a nightmare – fraught with risk and very expensive.

Ecosystm research shows that 32% of organisations have deployed containerisation – and this percentage will only grow. The ability for firms to toggle between data centre bare metal based applications and completely on-the-cloud ones is becoming more manageable by the day. This enormous flexibility allows a firm that has large compute needs to keep some stable workloads in a data centre, whether on-prem or co-located, while simultaneously using cloud-based workloads, optimising spends and performance.

Here is a glimpse into the strategies of three key vendors.

HPE’s ‘as-a-service’ Messaging is Spot on

Two years ago, Antonio Neri boldly went where no HPE CEO had gone before, promising that HPE’s entire portfolio would be available ‘as-a-service’ within 3 years. At the recently concluded HPE Discover event, there were a flurry of announcements to showcase that GreenLake is indeed on its way to meet that ambitious goal in 2022.

HPE’s recent announcements show customers that GreenLake is an end-to-end solution for managing their IT infrastructure moving forward. It ticks all the boxes: providing flexibility and scalability; the advantage of using both data centre and cloud; and high manageability and security with a full suite of applications.

Examples are the partnership with Azure Stack HCI, to add to earlier ones with leading vendors like SAP, Citrix, and VMware. HPE is building a platform that provides customers with the comfort that they can adopt GreenLake and pretty much have access to any application they may choose to implement – offering full coverage from the Edge to the Cloud. It is extremely interesting that GreenLake allows the option of switching on and switching off processor cores as needed, and the customer pays based on usage. This is surely a first for the industry!

Another example is Lighthouse, which allows the customer to rapidly configure, and provision workloads based on dynamic needs. While all the hyperscalers provide similar services when the workload is on the cloud, Lighthouse allows the same flexibility and speed for cloud services which can be run in the data centre, on-prem, co-located, or even at the Edge.

A third example was the announcement of Project Aurora which will add an additional security layer from validating the input data all the way to verifying the workload at the start and then as it is running. It appears to use an AI/ML system that checks for unexpected behaviours to detect any kind of malware.

It makes good sense for HPE to push GreenLake and move to offering ‘everything-as-a-service’. As one of the incumbent enterprise hardware business leaders, this is a good response rather than to watch one’s business continue to shrink YoY. GreenLake is HPE’s way of futureproofing themselves and making sure they stay relevant in the new cloud world.

Cisco Secures the Hybrid Workplace

Cisco has been active launching Cisco Plus earlier this year, as their bridge to the as-a-service model with a network-as-a-service (NaaS) offering. Somewhat like GreenLake, Cisco Plus offers flexible consumption for compute, storage, and networking. They are committed to offering most of their portfolio as-a-service over time.

Cisco has shown some resilience in terms of revenue but has still been struggling to grow. After a steady growth since 2017, the revenues dropped by 7% in 2020 almost as a direct impact of COVID-19. The post-pandemic world has the potential of being a bigger threat for Cisco. Many estimates show the number of people working from home is likely to go up dramatically and Cisco’s key networking offering could rapidly become redundant. However, at Ecosystm we believe that the hybrid work model will be predominant.

Cisco is also betting on a hybrid world. No matter where one works from, there are networking needs. Cisco’s focus, therefore, is on security – this will be on the mind of virtually any enterprise as it chalks out its future strategy. With a hybrid environment, making everything secure becomes more complex while continuing to be vital. Cisco has a heavy emphasis on Secure Access Service Edge (SASE) – the idea that the security envelope now has to be a flexible form that has a presence everywhere that the enterprise needs to be. This will make a lot of sense to most enterprises as they tread the hybrid path.

Cisco will offer a portfolio of tools to make it increasingly easier for customers to use multi-cloud, multi-vendor environments, offering the best of both worlds.

Oracle Incentivises Cloud Migration

Oracle has a different approach because they are trying to solve a different problem. They are competing with the hyperscalers, while fully acknowledging a hybrid world. However, as a company with less legacy in hardware, it makes sense for them to focus on migrating to cloud rather than on hybridisation. Oracle has just announced that they will subsidise existing customers who add cloud workloads with them, by providing discounts on the existing licensing fees that the customer is paying Oracle. This discount appears to be around 25% to 33%. In essence, this means that if a customer spends about USD 100k with Oracle on licensing and decides to start moving workloads to the Oracle Cloud worth somewhere between USD 300-400k, they can potentially write off the entire license fees they are currently paying!

Conclusion

There is a strong effort from every vendor right now to retain and consolidate their customer share and build a vision that convinces the customer that they are the way to go. For the traditional hardware players that vision is of a hybrid world – attractive to today’s large enterprise. For the likes of AWS, Microsoft, Google, and Oracle it is all about moving the customer to their cloud. The assumption of course is that moving someone to your cloud will lead to more of your apps being used by the customer. For the hardware vendors like Cisco and HPE, it is all about moving the customer to their own platforms which empower hybridisation. In all cases, a necessary component is to offer ‘everything-as-a-service’ upending the traditional models of selling.

In my opinion, with time the IaaS portion of the cloud is likely to gradually devolve into something like a utility. There will be a lot of upheavals and market disruption before we get there, but eventually, software and other services are likely to stand separate from the infrastructure provider. All the vendors are therefore depending on capturing the customer at the platform-as-a-service (PaaS) level, but even this is likely to get commoditised over time. Eventually, the winners will be disparate providers of the best applications for different functions. Meanwhile, we are in for an extremely interesting ride as we see all the vendors jockeying for space!

Ecosystm RNx is an objective vendor ranking based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform. In this edition, we rank the Top 10 Global AI & Automation Vendors.

If you are an End-User, you are realising that the right investments in Data & AI now will be the key to your future success. This vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are an AI & Automation Vendor, it’s an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

In this first edition of Ecosystm RNx we rank the Top 10 Global Cloud Vendors.

Ecosystm RNx is an objective vendor ranking based on in-depth and quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an technology user, this Cloud Vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are a Cloud Vendor, this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

Last week Zoom announced a USD 100 million Zoom Apps Fund to promote the development of Zoom’s ecosystem of Zoom applications, integrations, video, developer tools, and hardware.

As part of Zoom Apps Fund, the company will invest in a portfolio of companies that are promoting and innovating on Zoom’s video conferencing platform. The portfolio companies will receive initial investments between USD 250,000 and USD 2.5 million to build solutions. To support the practice, Zoom is providing its tools and expertise to various start-ups, entrepreneurs, and industry players to build applications and integrate Zoom’s functionality and native interface in their products.

In March, Zoom introduced an SDK designed to help programmers embed Zoom functionality inside their applications. Zoom SDK is a component of Zoom Developer platform which includes SDKs, APIs, webhooks, chatbots, and distribution for applications and integration. Last year Zoom launched Zoom Apps and Zoom Marketplace at its Zoomtopia virtual conference to bring applications and productivity into the Zoom experience.

Zoom is not alone in evolving their Unified communications as a service (UCaaS) capabilities and market. Tencent rolled out their video conferencing solution for the global market, Facebook expanded their offerings in videoconferencing applications through the integration of new features, Google announced a series of upgrades and innovations to better support the flexibility needs of frontline and remote workers in Google Workspaces, and Microsoft introduced Viva that aims to bring together communications, knowledge, learning, resources, and insights together.

“Ecosystm research shows that 50% of organisations will continue to increase use of collaboration platforms and tools in 2021. However, if videoconferencing remains just a tool to log in to for meetings without purpose-built workflows and functionality that suit worker profiles, then it will start losing its attractiveness. Vendors need to work on user interface, UX, the lighting, security, audio quality and many other aspects that draws users to the platform.

The big question is what next for videoconferencing vendors? How can engineering teams innovate to build the capabilities organisations want when they use drawing tools, share images, have chats and discussions within collaboration platforms? How do you make the experience real so employees can “live and breathe” in the environment?

Zoom investing in understanding what apps and workflows are suited for a particular vertical or business is fundamental to the future of video and collaboration and will be a big game changer.”

“Zoom is continuing to expand the markets in which they operate and investing in start-ups increases their opportunities to grow as a platform. Their App Marketplace already offers a rich source of innovations, with Zoom themselves appearing to develop integration with market leaders such as Salesforce and HubSpot in the CRM category. This has led to Zoom integrations in close to 80 CRM products – including integrations developed in-house by Salesforce and HubSpot to supplement Zoom capabilities.

They are promoting an open web and audio-conferencing platform that does not limit users to the walled-garden approach of competitors such as Microsoft Teams.

Zoom’s strategy creates the opportunity for CIOs to access a widely used, rich functionality, digital collaboration channel – one they can integrate seamlessly into their existing digital channels knowing that their customers are likely to be highly familiar with the user experience.”

Get more insights on the impact of the COVID-19 pandemic and technology areas that will see innovations, as organisations get into the recovery phase.

Last week Microsoft announced the acquisition of Nuance for an estimated USD 19.7 billion. This is Microsoft’s second largest acquisition ever, after they acquired LinkedIn in 2016. Nuance is an established name in the Healthcare industry and is said to have a presence in 10,000 healthcare organisations globally. Apart from Healthcare, Nuance has strong capabilities in Conversational AI and speech solutions to support other industries. This acquisition is in line with Microsoft’s go-to-market roadmap and strategies.

Microsoft’s Healthcare Focus

Microsoft announced their Healthcare Cloud last year and this acquisition will bolster their Healthcare offerings and market presence. Nuance’s product portfolio includes clinical speech recognition SaaS offerings – Dragon Ambient eXperience, Dragon Medical One and PowerScribe One for radiology reporting – on Microsoft Azure. The acquisition builds on already existing integrations and partnerships that were in place over the years.

“Microsoft Cloud for Healthcare offers its solution capabilities to healthcare providers using a ‘modular’ approach. Given how diverse healthcare providers are in their technology maturity and appetite for change, the more diverse the ‘modules’, the greater the opportunities for Microsoft. This partnership with Nuance also brings to the table established relationships with EHR vendors, which will be useful for Microsoft globally.

The Healthcare industry continues to struggle as the world negotiates the challenges of mass vaccination. But on the upside, the ongoing Healthcare crisis has given remote care a much-needed shot in the arm. Clinicians today will be more open to documentation and transcription services for process automation and compliance. The acquisition of Nuance’s Healthcare capabilities will definitely boost Microsoft’s market presence in provider organisations.

However, Healthcare is not the only industry that Microsoft and Nuance are focused on. The Microsoft Cloud for Retail that was launched earlier this year aims to offer integrated and intelligent capabilities to retailers and brands to improve their end-to-end customer journey. Nuance has omnichannel customer engagement solutions that can be leveraged in Retail and other industries. As Microsoft continues to verticalise their offerings, they will consider more acquisitions that will complement their value proposition.“

Microsoft’s Focus on Conversational AI

Microsoft already has several speech recognition offerings, speech to text services, and chatbots; and they continue to invest in the Conversational AI space. They have created an open-source template for creating virtual assistants to help Bot Framework developers. In February, Microsoft announced their industry specific cloud offerings for Financial services, Manufacturing, and Non-Profit, and also introduced a series of AI and natural language features in Microsoft Outlook, Microsoft Teams, Microsoft Office Lens and Microsoft Office mobile to deliver interactive, voice forward assistive experiences.

“There is no slowing down in this space and the acquisition clearly demonstrates the vision that Microsoft is building with Nuance – a vendor that has made speech recognition, text to speech, conversational AI the foundation of the company. This is a brilliant move by Microsoft in the Conversational AI space and a win-win for both companies.

This move could also mark further inroads for Microsoft into the contact centre space. With Teams now being integrated into contact centre technologies, working with large customers using speech and conversational AI, Dynamics 365 could herald the start of more acquisitions for Microsoft to bolster a wider customer engagement vision.

The Conversational AI war is heating up and various other cloud vendors such as Google and AWS are starting to get aggressive and have made investments in recent years to enhance their Conversational AI capabilities. Google Dialogflow has been seeing rapid uptake and they now have deep partnerships with Genesys, Avaya, Cisco and other contact centre players. Microsoft coming into the game and acquiring a company with years of history and IP in the speech space, demonstrates how the cloud battle and the war between Google, Microsoft and AWS is heating up in the Conversational AI. All of a sudden you have Microsoft as a powerhouse in this game.”

ServiceNow announced their intention to acquire robotic process automation (RPA) provider, Intellibot, for an undisclosed sum. Intellibot is a significant tier 2 player in the RPA market, that is rapidly consolidating into the hands of the big three – UiPath, Automation Everywhere, and Blue Prism – and other acquisition-hungry software providers. This is unlikely to be the last RPA acquisition that we see this year with smaller players looking to either go niche or sell out while the market is hot.

Expanding AI/Automation Capabilities

Intellibot is the latest in a string of purchases by ServiceNow that reveals their intention to embed AI and machine learning into offerings. In 2020, they acquired Loom Systems, Passage AI (both January), Sweagle (June), and Element AI (November) in addition to Attivio in 2019. These acquisitions were integrated into the latest version of their Now Platform, code-named Quebec, which was launched earlier this month. As a result, Predictive AIOps and AI Search were newly added to the platform while the low-code tools were expanded upon and became Creator Workflows. This means ServiceNow now offers four primary solutions – IT Workflows, Employee Workflows, Customer Workflows, and Creator Workflows – demonstrating the importance they are placing on low-code and RPA.

ServiceNow was quick to remind the market that although they will be able to offer RPA functionality natively once Intellibot is integrated into their platform, they are still willing to work with competitors. They specifically highlighted that they would continue partnering with UiPath, Automation Anywhere, and Blue Prism, suggesting they plan to use RPA as a complementary technology to their current offerings rather than going head-to-head with the Big Three. Only a month ago, UiPath announced deeper integration with ServiceNow, by expanding automation capabilities for Test Management 2.0 and Agile Development projects.

Expansion in India

The acquisition of Intellibot, based in Hyderabad, is part of ServiceNow’s expansion strategy in India – one of their fastest growing markets. The country is already home to their largest R&D centre outside of the US and they intend to launch a couple of data centres there by March 2022. The company plans to double their local staff levels by 2024, having already tripled the number of employees there in the last two years. The expansion in India means they can increasingly offer services from there to global customers.

Market Consolidation Accelerates

In the Ecosystm Predicts: The Top 5 AI & AUTOMATION Trends for 2021, Ecosystm had talked about technology vendors adding RPA functionality either organically or through acquisitions, this year.

“Buyers will find that many of the automation capabilities that they currently purchase separately will increasingly be integrated in their enterprise applications. This will resolve integration challenges and will be more cost-effective.”

ServiceNow’s purchase is one of several recent examples of low-code vendors acquiring their way into the RPA space. Last year, Appian acquired Novayre Solutions for their Jidoka product and Microsoft snapped up Softomotive. Speculation continues to build that Salesforce could also be assessing RPA targets. Considering RPA market leader, UiPath recently announced that their Series F funding round values the company at USD 35 billion, there is pressure on acquirers to gobble up the remaining smaller players before they are all gone or become prohibitively expensive.

The cloud hyperscalers are also likely to play a growing role in the RPA market over the next year. Microsoft and IBM have already entered the market, coming from the angle of office productivity and business process management (BPM), respectively. Google announced just last week that they will work closely with Automation Anywhere to integrate RPA into their cloud offerings, such as Apigee, AppSheet, and AI Platform. More interestingly, they plan to co-develop new solutions, which might for now satisfy Google’s appetite for RPA rather than requiring an acquisition.

Here are some of the trends to watch for RPA, AI and Automation in 2021. Signup for Free to download Ecosystm’s Top 5 AI & Automation Trends Report.

2020 has been a watershed year for Future of Work policies and technologies. Organisations are still evaluating their workplace strategies and 2021 is likely to see experiments in work models – every organisation will choose the model that works for their nature of work and their organisational culture. Against this backdrop of disruption and change, Ecosystm’s 360o Future of Work team – Audrey William, Mike Zamora, Ravi Bhogaraju and Tim Sheedy – present the top 5 Ecosystm predictions for the Future of Work in 2021.

This is a summary of the predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Future of Work Trends For 2021

- Human-centricity Will be Front and Centre of Organisational Priorities

2020 saw immense humanitarian disruption. Enabling remote work was a key component of business continuity. Both organisations and their employees have a better understanding now of the implications of remote working and how it can be made to work. They are also aware of the challenges of remote working. Monitoring productivity, maintaining the right work-life balance and ensuring employee emotional well-being have been challenging. Despite the challenges, hybrid/blended working is definitely here to stay. Employees will expect more options on the location of their work, often choosing to work where they are most productive.

All decisions related to the organisation, filtered through the lens of human-centricity, will drive better employee engagement – and engaged employees provide better customer experience. Organisations that will operationalise this at scale and across cultures will emerge as success stories.

- Technology Will Bond with Facilities and Operations – Connecting with HR Will be a Challenge

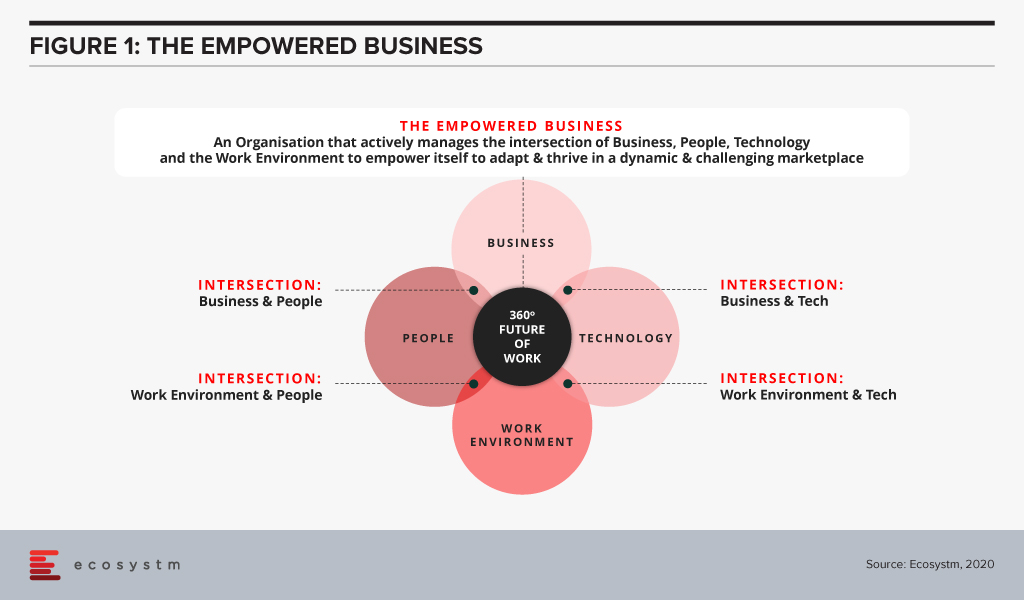

There has to be an alignment between the Business, People, Work Environment and Technology to make an organisation truly empowered to handle sudden pivots that will be required in 2021 as well (Figure 1).

This will require cross-departmental coordination and synergy. Tech teams have traditionally driven the Digital Workplace strategy; now they will have to work closely with Operations and Facilities Management teams on “Smart and Safe Office” strategies. That may not be the real challenge given that there are overlaps between these three teams – they have a shared language and similar KPIs. The real challenge will be the need for Tech teams and HR to work more closely to improve the overall employee experience, including a focus on employee productivity and wellness. Human-centricity makes the role of HR even more important – IT will find it challenging to find common grounds as there have traditionally been few shared KPIs between these two departments.

- Office Spaces Will Become Truly Digital

The hybrid/blended workplace model means that the physical workplace is not disappearing soon. Even as the model evolves for each organisation, what becomes clear is that employee expectations have changed drastically in the last year, and the traditional employee experience expectations of Salary, Recognition, and Job Satisfaction may not be enough. Employees will now expect flexibility, social cohesion, and effective communication. If they are to return to the physical office, they will expect the same benefits as working from home.

This will drive the adoption of digital tech to ensure the office space is safer, more effective and a productive environment for the employees and the business. Two key areas of focus will be on seamless access to information and employee control over work environment.

- Providers Will Deepen Digital Workplace Offerings, but the Market Will Not Consolidate

Key tech providers in the digital workspace space (such as Microsoft, Google, Zoom, Cisco, AWS and so on) will broaden their capabilities and make it easier to procure and use solutions. It will no longer be a “tool-centric” approach (chat, video, document sharing, online meetings, whiteboards and so on) – it will become a platform play. Information workers will be able to choose the approach that best fits the problem they are trying to resolve, without being limited by the capabilities of the tool. E.g. documents will be sharable and editable within chats; whiteboards will be integrated into all other communication services and so on.

Tech providers will deepen and strengthen their capabilities organically and acquisitions will mostly be about buying market share, customers and not the technology.

- Industry-centric Digital Workplace Services Will Emerge and Witness Rapid Growth

The Services industry has been leading in the adoption of digital workplaces – but blue-collar roles and front-line employees will also start benefiting from these technologies. In 2021, new digital workplace capabilities will extend beyond the employee base to systems that drive better connectivity and communication with customers. This will open the market up for smaller, niche players (and this may well run counter to the previous trend). Tech teams will focus on employees and a platform-based approach to collaboration, while Customer teams and others will implement tools and platforms to better communicate outside of the business. The next few years will bring the traditional “employee-centric” collaboration players into direct competition with the “customer-centric” ones. Those that play across both today (such as Google) will be better positioned to win the enterprise-wide “Future of Work” style deals.