In today’s competitive business landscape, delivering exceptional customer experiences is crucial to winning new clients and fostering long-lasting customer loyalty. Research has shown that poor customer service can cost businesses around USD 75 billion in a year and that 1 in 3 customers is likely to abandon a brand after a single negative experience. Organisations excelling at personalised customer interactions across channels have a significant market edge.

In a recent webinar with Shivram Chandrasekhar, Solutions Architect at Twilio, we delved into strategies for creating this edge. How can contact centres optimise interactions to boost cost efficiency and customer satisfaction? We discussed the pivotal role of voice in providing personalised customer experiences, the importance of balancing AI and human interaction for enhanced satisfaction, and the operational advantages of voice intelligence in streamlining operations and improving agent efficiency.

The Voice Advantage

Despite the rise of digital channels, voice interactions remain crucial for organisations seeking to deliver exceptional customer experiences. Voice calls offer nuanced insights and strategic advantages, allowing businesses to address issues effectively and proactively meet customer needs, fostering loyalty and driving growth.

There are multiple reasons why voice will remain relevant including:

- In many countries it is mandatory in several industries such as Financial Services, Healthcare, & Government & Emergency Services.

- There are customers who simply favour it over other channels – the human touch is important to them.

- It proves to be the most effective when it comes to handling complex and recurrent issues, including facilitating effective negotiations and better sales closures; Digital and AI channels cannot do it alone yet.

- Analysing voice data reveals valuable patterns and customer sentiments, aiding in pinpointing areas for improvement. Unlike static metrics, voice data offers dynamic feedback, helping in proactive strategies and personalised opportunities.

AI vs the Human Agent

There has been a growing trend towards ‘agentless contact centres’, where businesses aim to pivot away from human agents – but there has also been increasing customer dissatisfaction with purely automated interactions. A balanced approach that empowers human agents with AI-driven insights and conversational AI can yield better results. In fact, the conversation should not be about one or the other, but rather about a combination of an AI + Human Agent.

Where organisations rely on conversational AI, there must be a seamless transitioning between automated and live agent interactions, maintaining a cohesive customer experience. Ultimately, the goal should be to avoid disruptions to customer journeys and ensure a smooth, integrated approach to customer engagement across different channels.

Exploring AI Opportunities in Voice Interactions

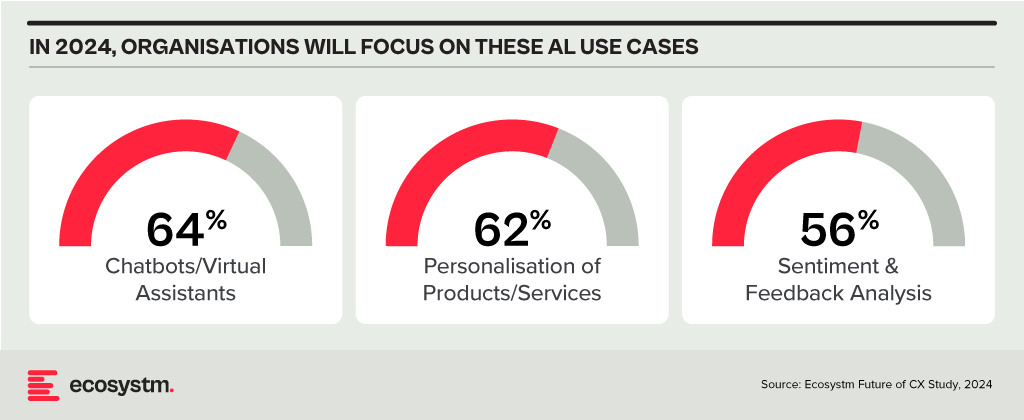

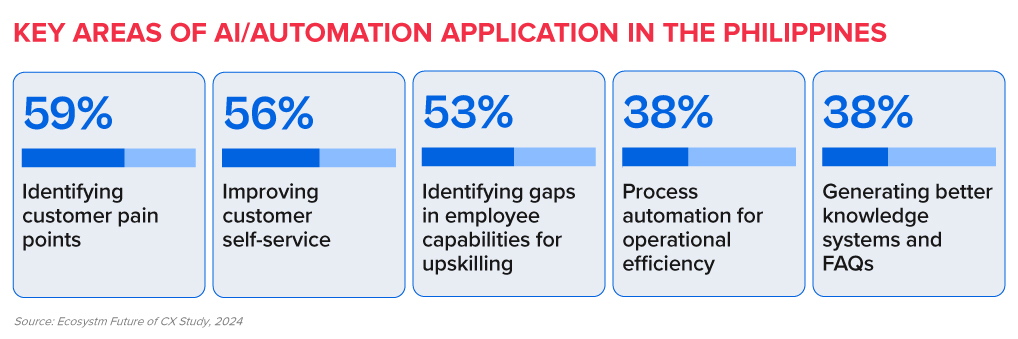

Contact centres in Asia Pacific are looking to deploy AI capabilities to enhance both employee and customer experiences.

Using predictive AI algorithms on customer data helps organisations forecast market trends and optimise resource allocation. Additionally, AI-driven identity validation swiftly confirms customer identities, mitigating fraud risks. By automating transactional tasks, particularly FAQs, contact centre operations are streamlined, ensuring that critical calls receive prompt attention. AI-powered quality assurance processes provide insights into all voice calls, facilitating continuous improvement, while AI-driven IVR systems enhance the customer experience by simplifying menu navigation.

Agent Assist solutions, integrated with GenAI, offer real-time insights before customer interactions, streamlining service delivery and saving valuable time. These solutions automate mundane tasks like call summaries, enabling agents to focus on high-value activities such as sales collaboration, proactive feedback management, and personalised outbound calls.

Actionable Data

Organisations possess a wealth of customer data from various touchpoints, including voice interactions. Accessing real-time, accurate data is essential for effective customer and agent engagement. Advanced analytics techniques can uncover hidden patterns and correlations, informing product development, marketing strategies, and operational improvements. However, organisations often face challenges with data silos and lack of interconnected data, hindering omnichannel experiences.

Integrating customer data with other organisational sources provides a holistic view of the customer journey, enabling personalised experiences and proactive problem-solving. A Customer Data Platform (CDP) breaks down data silos, providing insights to personalise interactions, address real-time issues, identify compliance gaps, and exceed customer expectations throughout their journeys.

Considerations for AI Transformation in Contact Centres

- Prioritise the availability of live agents and voice channels within Conversational AI deployments to prevent potential issues and ensure immediate human assistance when needed.

- Listen extensively to call recordings to ensure AI solutions sound authentic and emulate human conversations to enhance user adoption.

- Start with data you can trust – the quality of data fed into AI systems significantly impacts their effectiveness.

- Test continually during the solution testing phase for seamless orchestration across all communication channels and to ensure the right guardrails to manage risks effectively.

- Above all, re-think every aspect of your CX strategy – the engagement channels, agent roles, and contact centres – through an AI lens.

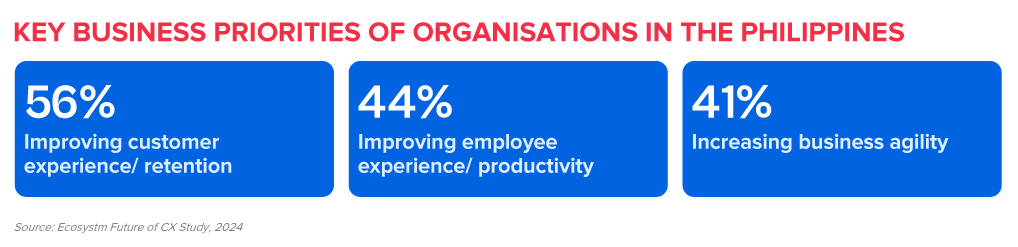

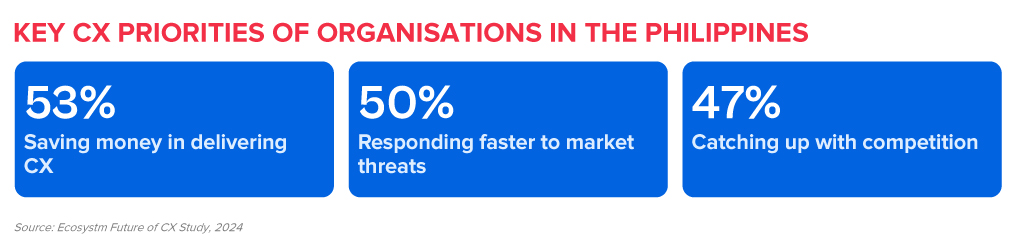

The Philippines, renowned as a global contact centre hub, is experiencing heightened pressure on the global stage, leading to intensified competition within the country. Smaller BPOs are driving larger players to innovate, requiring a stronger focus on empowering customer experience (CX) teams, and enhancing employee experience (EX) in organisations in the Philippines.

As the Philippines expands its global footprint, organisations must embrace progressive approaches to outpace rivals in the CX sector.

These priorities can be achieved through a robust data strategy that empowers CX teams and contact centres to glean actionable insights.

Here are 5 ways organisations in the Philippines can achieve their CX objectives.

Download ‘Securing the CX Edge: 5 Strategies for Organisations in the Philippines’ as a PDF.

#1 Modernise Voice and Omnichannel Orchestration

Ensuring that all channels are connected and integrated at the core is critical in delivering omnichannel experiences. Organisations must ensure that the conversation can be continued seamlessly irrespective of the channel the customer chooses, without losing the context.

Voice must be integrated within the omnichannel strategy. Even with the rise of digital and self-service, voice remains crucial, especially for understanding complex inquiries and providing an alternative when customers face persistent challenges on other channels.

Transition from a siloed view of channels to a unified and integrated approach.

#2 Empower CX Teams with Actionable Customer Data

An Intelligent Data Hub aggregates, integrates, and organises customer data across multiple data sources and channels and eliminates the siloed approach to collecting and analysing customer data.

Drive accurate and proactive conversations with your customers through a unified customer data platform.

- Unifies user history across channels into a single customer view.

- Enables the delivery of an omnichannel experience.

- Identifies behavioural trends by understanding patterns to personalise interactions.

- Spots real-time customer issues across channels.

- Uncovers compliance gaps and missed sales opportunities from unstructured data.

- Looks at customer journeys to proactively address their needs.

#3 Transform CX & EX with AI/Automation

AI and automation should be the cornerstone of an organisation’s CX efforts to positively impact both customers and employees.

Evaluate all aspects of AI/automation to enhance both customer and employee experience.

- Predictive AI algorithms analyse customer data to forecast trends and optimise resource allocation.

- AI-driven identity validation reduces fraud risk.

- Agent Assist Solutions offer real-time insights to agents, enhancing service delivery and efficiency.

- GenAI integration automates post-call activities, allowing agents to focus on high-value tasks.

#4 Augment Existing Systems for Success

Many organisations face challenges in fully modernising legacy systems and reducing reliance on multiple tech providers.

CX transformation while managing multiple disparate systems will require a platform that integrates desired capabilities for holistic CX and EX experiences.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

#5 Focus on Proactive CX

In the new CX economy, organisations must meet customers on their terms, proactively engaging them before they initiate interactions. This requires a re-evaluation of all aspects of CX delivery.

- Redefine the Contact Centre. Transforming it into an “Intelligent” Data Hub providing unified and connected experiences; leveraging intelligent APIs to proactively manage customer interactions seamlessly across journeys.

- Reimagine the Agent’s Role. Empowering agents to be AI-powered brand ambassadors, with access to prior and real-time interactions, instant decision-making abilities, and data-led knowledge bases.

- Redesign the Channel and Brand Experience. Ensuring consistent omnichannel experiences through unified and coherent data; using programmable APIs to personalise conversations and discern customer preferences for real-time or asynchronous messaging; integrating innovative technologies like video to enrich the channel experience.

In recent years, organisations have had to swiftly transition to providing digital experiences due to limitations on physical interactions; competed fiercely based on the customer experiences offered; and invested significantly in the latest CX technologies. However, in 2024, organisations will pivot their competitive efforts towards product innovation rather than solely focusing on enhancing the CX.

This does not mean that organisations will not focus on CX – they will just be smarter about it!

Ecosystm analysts Audrey William, Melanie Disse, and Tim Sheedy present the top 5 Customer Experience trends in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 CX Trends in 2024’ as a PDF.

#1 Customer Experience is Due for a Reset

Organisations aiming to improve customer experience are seeing diminishing returns, moving away from the significant gains before and during the pandemic to incremental improvements. Many organisations experience stagnant or declining CX and NPS scores as they prioritise profit over customer growth and face a convergence of undifferentiated digital experiences. The evolving digital landscape has also heightened baseline customer expectations.

In 2024, CX programs will be focused and measurable – with greater involvement of Sales, Marketing, Brand, and Customer Service to ensure CX initiatives are unified across the entire customer journey.

Organisations will reassess CX strategies, choosing impactful initiatives and aligning with brand values. This recalibration, unique to each organisation, may include reinvesting in human channels, improving digital experiences, or reimagining customer ecosystems.

#2 Sentiment Analysis Will Fuel CX Improvement

Organisations strive to design seamless customer journeys – yet they often miss the mark in crafting truly memorable experiences that forge emotional connections and turn customers into brand advocates.

Customers want on-demand information and service; failure to meet these expectations often leads to discontent and frustration. This is further heightened when organisations fail to recognise and respond to these emotions.

Sentiment analysis will shape CX improvements – and technological advancements such as in neural network, promise higher accuracy in sentiment analysis by detecting intricate relationships between emotions, phrases, and words.

These models explore multiple permutations, delving deeper to interpret the meaning behind different sentiment clusters.

#3 AI Will Elevate VoC from Surveys to Experience Improvement

In 2024, AI technologies will transform Voice of Customer (VoC) programs from measurement practices into the engine room of the experience improvement function.

The focus will move from measurement to action – backed by AI. AI is already playing a pivotal role in analysing vast volumes of data, including unstructured and unsolicited feedback. In 2024, VoC programs will shift gear to focus on driving a customer centric culture and business change. AI will augment insight interpretation, recommend actions, and predict customer behaviour, sentiment, and churn to elevate customer experiences (CX).

Organisations that don’t embrace an AI-driven paradigm will get left behind as they fail to showcase and deliver ROI to the business.

#4 Generative AI Platforms Will Replace Knowledge Management Tools

Most organisations have more customer knowledge management tools and platforms than they should. They exist in the contact centre, on the website, the mobile app, in-store, at branches, and within customer service. There are two challenges that this creates:

- Inconsistent knowledge. The information in the different knowledge bases is different and sometimes conflicting.

- Difficult to extract answers. The knowledge contained in these platforms is often in PDFs and long form documents.

Generative AI tools will consolidate organisational knowledge, enhancing searchability.

Customers and contact centre agents will be able to get actual answers to questions and they will be consistent across touchpoints (assuming they are comprehensive, customer-journey and organisation-wide initiatives).

#5 Experience Orchestration Will

Accelerate

Despite the ongoing effort to streamline and simplify the CX, organisations often implement new technologies, such as conversational AI, digital and social channels, as independent projects. This fragmented approach, driven by the desire for quick wins using best-in-class point solutions results in a complex CX technology architecture.

With the proliferation of point solution vendors, it is becoming critical to eliminate the silos. The fragmentation hampers CX teams from achieving their goals, leading to increased costs, limited insights, a weak understanding of customer journeys, and inconsistent services.

Embracing CX unification through an orchestration platform enables organisations to enhance the CX rapidly, with reduced concerns about tech debt and legacy issues.

During tough economic times, organisations need to be even more attentive to their customers’ needs and find creative ways to deliver high-quality customer experiences while keeping costs under control.

Tim Sheedy – VP Research, Ecosystm presents the best practices that organisations can use to modify their customer experience during these uncertain times.

- Bring back the empathy. While people might have stopped worrying about their health, economic concerns are real.

- Focus on customer retention. Customer attraction takes more effort and investments than customer retention.

- Invest in customer support. This can be done through digital touchpoints as well as in-person interactions.

- Continue to simplify the purchasing process. Even the slightest friction in the purchase process is enough to drive potential customers away.

- Focus on value over discounts. Customers look for value more than they look for discounts.

Read on to find out more.

Download Modify Your CX for Tough Economic Times as a PDF

Over the last 2 years, the primary focus for Retail & eCommerce organisations has been on creating the right customer experience and digital engagements – mainly to survive.

In 2022 the focus will be on creating market differentiation. This will extend to business strategies and process optimisation. The Retail & eCommerce industry will explore ways to leverage data to empower multiple roles across the organisation and engage with customers irrespective of where they are on their customer journeys.

Read on to find out what Ecosystm Analysts Alan Hesketh, Niloy Mukherjee and Tim Sheedy think will be the leading trends in the Retail & eCommerce industry in 2022.

Since early 2020 nearly all organisations have strengthened their online presence and commerce abilities – irrespective of their industry. They have come to terms with the fact that the ability to win and retain customers, is largely linked to the digital customer experience (CX) they are able to deliver.

They have invested heavily in their CX roadmaps and technologies; but will find themselves solving for the same challenges they have faced the last 2 years – continued growth of digital experiences; gaining insights from customer data; customer churn; and catering to customer channel preferences.

2022 will be the time to consolidate and build the capabilities required to analyse the immense amount of customer data that they have access to – to finally be able to offer personalised customer experience.

Read on to find out what Ecosystm Advisors Audrey William and Tim Sheedy think will be the leading CX trends in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for Customer Experience in 2022 as a PDF

Consistent customer and brand experiences should be at the heart of every digital strategy. In the first part of this feature, we explored the barriers to creating memorable customer experience (CX). Here we look at what organisations who have mastered the art of great CX have in common.

Best Practices

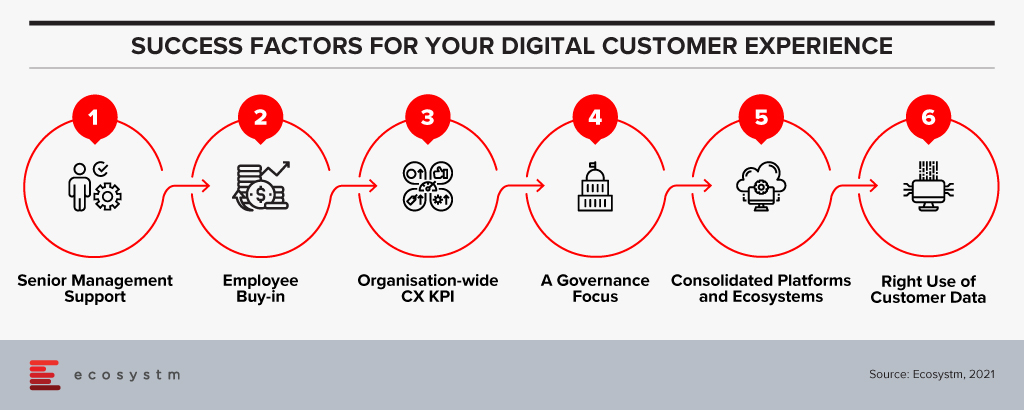

Through Ecosystm research and interviews with organisations we have found that businesses that are already creating a consistent, effective, and memorable digital customer experience have these traits in common:

Had CEO and Board-level support for their strategy. Your ability to create a memorable and consistent digital experience lives and dies by the support of your senior management team. Without the CEO telling the rest of the business that this is a priority, the employees simply won’t come along for the ride.

Gained Employee support for the strategy. There is no point in creating a digital customer strategy at the Board and senior management level if it is not consistent with the lived experience of employees. An Australian bank made the mistake of making all their digital experience decisions at the most senior levels without taking the employees on the journey too. Change needs buy-in from all levels of the business – so make sure all levels are heard and that they understand why and how you will change the way they work and deliver customer value.

Made the delivery of a brand-consistent experience into a key KPI. In these businesses, a consistent CX is a given. That doesn’t mean they are not personalising their customer experiences or optimising them for specific touchpoints – it means that collaboration with other teams and channels is a base expectation. Changes are not made without the knowledge of other teams.

Prioritised governance over management. The risk of collaboration and including many people in decisions is that it slows decisions down and impacts business agility. To enable their collaborative approach to digital experience delivery, these businesses have set rules and guardrails into their decision-making processes to ensure they continue to deliver on-brand and consistent experiences. Many also have created cross-channel teams or sewn their digital skills across the different channel teams to ensure consistency of customer experience.

Consolidated on fewer platforms and CX ecosystems. Five years ago, businesses needed to source smaller, more innovative CX software and cloud components just to keep up with customer expectations. The trendsetters had built their own CX capabilities and weren’t relying on the traditional ISVs for their CX innovation. Smaller providers were emerging to fill these gaps for businesses who were not digitally native. Sourcing best-practice solutions is much easier today. Some of those smaller vendors have emerged to create their own platforms and CX ecosystems, and other suppliers have acquired and innovated their own software to meet and exceed customer requirements. For example, you no longer need multiple content management systems or platforms – a single content source can now meet the different needs of your different channel teams and feed consistent content to all customers tailored to their journey stage or chosen touchpoint.

Used data for their customers – not against them. Many personalisation or automation attempts have failed. Not because they used the wrong data, but because they were driving the wrong outcome. They were designed to corner a customer into a decision, versus helping them make the best decision for their circumstance. We all know what that looks like – if an interaction feels “creepy” like they are following you around the web and across touchpoints, or they seem to know too much about you. This is when a business is using data against you to try to force an action. Smart businesses use data to help customers achieve their goals – in the knowledge that happy customers will not only return to the business or brand, but also tell their friends and family about the experience.

Creating a consistent and on-brand digital experience will drive many positive outcomes for your customers and your business. Your customers will know what to expect and be comfortable in their interactions with your brand in whatever channel or touchpoint they desire – with the knowledge that the experience will be consistent and integrated and their time will not be wasted. They’ll return to your business over and over again. The consistent experience will also drive down your costs – with less rework, fewer platforms to support, more automation and hopefully a simpler technology architecture. Done right, it will also create a single unifying digital initiative across the business that will help to break down barriers, improve collaboration, and unlock innovation in and between your business teams.

In this Insight, guest author Anupam Verma talks about how a smart combination of technologies such as IoT, edge computing and AI/machine learning can be a game changer for the Financial Services industry. “With the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.”

The number of IoT devices have now crossed the population of planet earth. The buzz around the Internet of Things (IoT) refuses to go down and many believe that with 5G rollouts and edge computing, the adoption will rise exponentially in the next 5 years.

The IoT is described as the network of physical objects (“things”) embedded with sensors and software to connect and exchange data with other devices over the internet. Edge computing allows IoT devices to process data near the source of generation and consumption. This could be in the device itself (e.g. sensors), or close to the device in a small data centre. Typically, edge computing is advantageous for mission-critical applications which require near real-time decision making and low latency. Other benefits include improved data security by avoiding the risk of interception of data in transfer channels, less network traffic and lower cost. Edge computing provides an alternative to sending data to a centralised cloud.

In the 5G era, a smart combination of technologies such as IoT, edge computing and AI/machine learning will be a game changer. Multiple uses cases from self-driving vehicles to remote monitoring and maintenance of machinery are being discussed. How do we see IoT and the Edge transforming Financial Services?

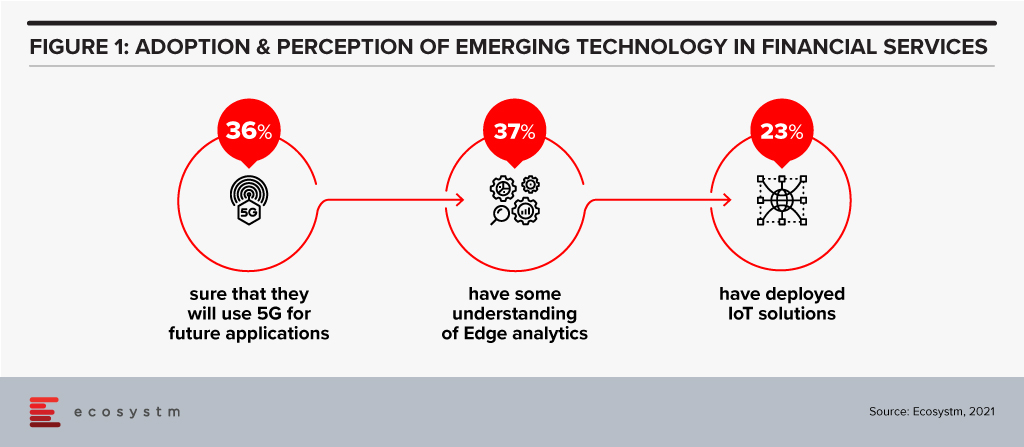

Before we go into how these technologies can transforming the industry, let us look at current levels of perception and adoption (Figure 1).

There is definitely a need for greater awareness of the capabilities and limitations of these emerging technologies in the Financial Services.

Transformation of Financial Services

The BFSI sector is increasingly moving away from selling a product to creating a seamless customer journey. Financial transactions, whether it is payment, transfer of money, or a loan can be invisible, and Edge computing will augment the customer experience. This cannot be achieved without having real-time data and analytics to create an updated 360-degree profile of the customer at all times. This data could come from multiple IoT devices, channels and partners that can interface and interact with the customer. A lot of use cases around personalisation would not be possible without edge computing. The Edge here would mean faster processing and smoother experience leading to customer delight and a higher trust quotient.

With IoT, customers can bank anywhere anytime using connected devices like wearables (smartwatches, fitness trackers etc). People can access account details, contextual offers at their current location or make payments without even needing a smartphone.

Use Cases of IoT & Edge in Financial Services

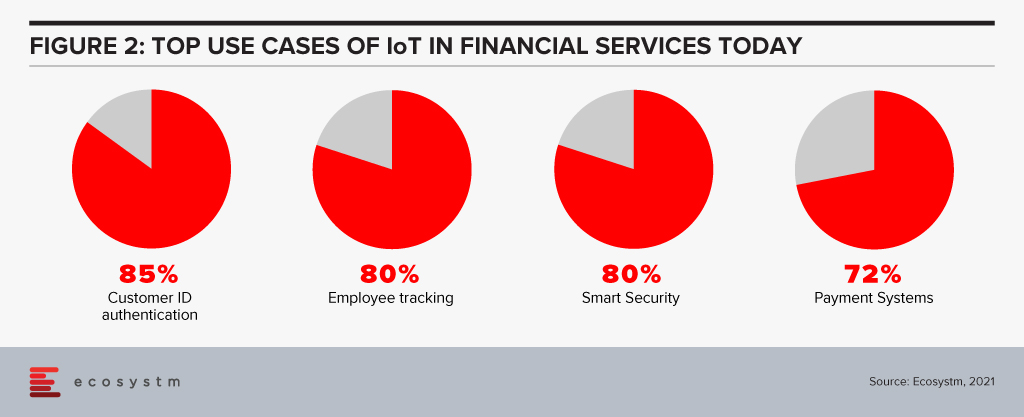

IT and Digital Leaders in Financial Services are aware of the benefits of IoT and there are some use cases that most of them think will help transform Financial Services (Figure 2).

However, there are many more potential use cases. Here are some use cases whose volume will only grow every day to fuel incessant data generation, consumption and processing at the Edge.

- Smart Homes. IoT devices like Alexa/Google Home have capabilities to become “bank in a speaker” with edge computing.

- In-Sync Omnichannels. IoT devices can be synced with other banking channels. A customer may start a transaction on an IoT device and complete it in a branch. Facial recognition can be used to identify the customer after he/she walks in and synced IoT devices will ensure that the transaction is completed without any steps repeated (zero re-work) thereby enhancing customer satisfaction.

- Virtual Relationship Managers. In a digital branch, the customer may use Virtual Reality (VR) headsets to engage with virtual relationship managers and relevant experts. Gamification using VR can be amazingly effective in the area of financial literacy and financial planning.

- Home and Auto Purchase. VR may also find use in home and auto purchase processes with financing built into it. The entire customer journey will have a much smoother experience with edge computing.

- Auto and Health Insurance. Companies can use IoT (device installed in the vehicle) plus edge computing to monitor and improve driving behaviour, eventually rewarding safety with lower premiums. The growth in electric mobility will continue to provide the basis for auto insurance. Companies can use wearables to monitor crucial health parameters and exercising habits. The creation of real-time dynamic rewards around it can change behaviour towards a healthier lifestyle. Awareness, longevity, rising costs and pandemic will only fuel this sector’s growth.

- Payments. Device to device contactless payment protocol is picking up and IoT and edge computing can create next-gen revolution in payments. Your EV could have an embedded wallet and pay for its parking and toll.

- Branch/ATM. IoT sensors and CCTV footage from branches/ATMs can be utilised in real-time to improve branch productivity as well as customer engagement, at the same time enhancing security. It could also help in other situations like low cash levels in ATMs and malfunctions. Sending live video streams for video analytics to the cloud can be expensive. By processing data within the device or on-premises, the Edge can help lower costs and reduce latency.

- Trading in Securities. Another area where response time matters is algorithmic trading. Edge computing will help to quickly process and analyse a large amount of data streaming real-time from multiple feeds and react appropriately.

- Trade Finance. Real-time tracking of goods may add a different dimension to the risk, pricing and transparency of supply chains.

Cloud vs Edge

The decision to use cloud or edge will depend on multiple considerations. At the same time, all the data from IoT devices need not go to the cloud for processing and choke network bandwidth. In fact, some of this data need not be stored forever (like video feeds etc). As a result, with the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

More than ever before you are having to cater to digital-savvy customers and create a competitive edge through the customer experience (CX) that you provide. In this two-part feature, I explore the barriers organisations face in their goal to create a memorable CX; and what the organisations that are getting it right have in common.

Spend on digital services, technologies, platforms, and solutions is skyrocketing. As businesses adapt to a new normal, they are increasing their spend on digital strategies and initiatives well beyond the increase they witnessed in 2020 when all customer and employee experiences went digital-only. But many digital and technology professionals I meet or interview maintain that their digital experiences are poor – offering inconsistent and fragmented experiences.

The Barriers

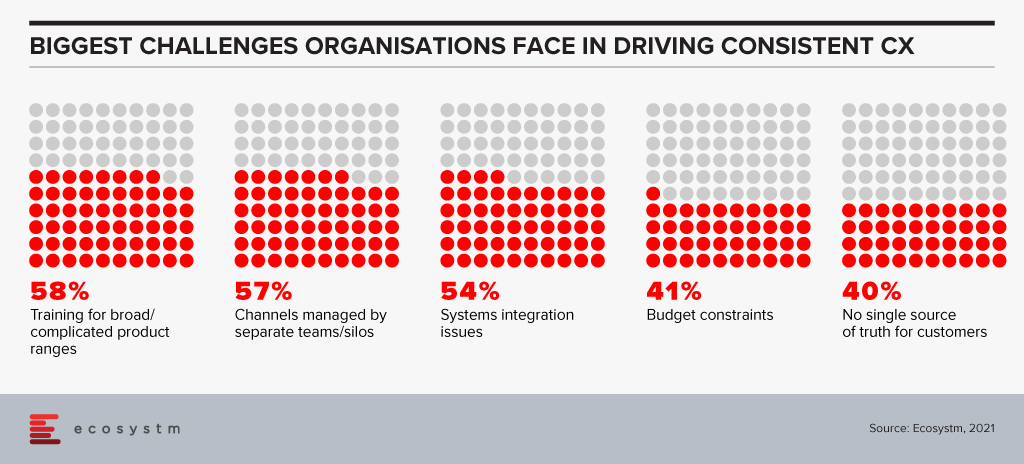

Digital, CX and tech leaders highlight their laundry list of challenges in getting their digital experiences to deliver a desired and on-brand customer experience:

A poorly informed view of the customer and their journey. Sometimes the customer personas and journey maps are simply wrong – they were developed by people with an agenda or a fixed idea of what problems need solving.

Inconsistent data. Too much, too little, or plain incorrect data means that automation or personalisation initiatives will fail. Poor access to data or lack of data sharing between teams, applications and processes means that businesses cannot even begin to build a consistent CX.

Too many applications and platforms. As digital initiatives took hold, technology teams witnessed an explosion of applications and platforms all conquering small elements of the digital journey. While they might be great at what they do, they sometimes make it impossible to create a simple and consistent customer journey. Some are beyond the control of the technology team – some are even introduced by partners and agencies.

Inconsistent content. For many businesses, content is at the heart of their digital experience and commerce strategy. But too often, that content is poorly planned, managed, and coordinated. Different teams and individuals create content; this content is then inconsistently delivered across customer touchpoints; the content is created for a single channel or touchpoint; and delivers to customers at the wrong stage of the journey.

Little co-ordination across channels. Contact centres, retail or other physical locations and digital teams often don’t sing from the same songbook. Not only is the customer experience inconsistent across different physical and digital touchpoints, but it may even be inconsistent across digital touchpoints – chat, web and mobile offer different experiences – even different parts of the web experience can be inconsistent!

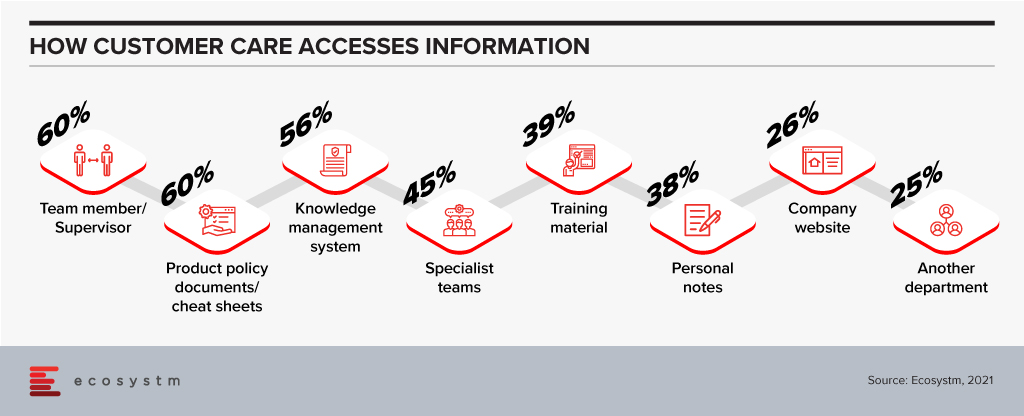

Knowledge is not shared between channels. Smart customers will “game” a company – finding the best offer across different customer touchpoints. But more often than not, inconsistent knowledge leads to very poor customer experiences. For example, a telecom provider might give different or conflicting information about their plans across web, mobile, contact centre and retail outlets; and with the increasing popularity of marketplaces, customers receive inconsistent product information when they deal with the brand directly than through the marketplace. Knowledge systems are often created to serve individual channels and are not trusted by customer service or retail representatives. We see this in Ecosystm data – when customer service agents are asked a question, they don’t know the answer to, the first place they look is NOT their Knowledge Management tool.

Poor prioritisation of customer pain points. Customer teams may find that it is easier to tackle the small customer challenges and score easy points – and just deprioritise the bigger ones that will take significant effort and require considerable change. Unifying the customer journey between the contact centre and digital is one big challenge that many businesses continue to delay.

And it gets worse… According to Ecosystm data, 55% of organisations consider getting board and management buy-in as their biggest CX challenge. This means that Chief Digital Officers, CX professionals and digital teams are still spending a disproportionate amount of time selling their vision and strategy to the senior management teams!

But some organisations are getting it right – creating a memorable digital experience that retains their customers and attracts more. I will talk about what is working for them in the next feature.