Woolworths have announced the adoption of a new Software-as-a-Service capability from One Door to support the quality and compliance of their in-store merchandising. There are some valuable lessons from this announcement for other retailers.

The power of data, particularly as the capability of specialist AI tools improves, continues to help retailers improve their offering to customers.

SaaS Capabilities Offer Performance Improvements

Woolworths are working on improving the compliance of product merchandising in-store using One Door Visual Merchandising solution.

One Door will improve the accuracy of data available to both the in-store teams and for the central supermarket merchandising team. The supply chain in Woolworths is already highly automated but getting the shelf presence right is dependent on the quality of data being captured. While store teams already use a range of electronic tools to capture this information, the compliance with store planograms and visual merchandising standards has been difficult to automate.

One Door’s solution provides a single source of this information in an easy to use digital format. The AI tools that One Door have developed appear to be able to show the degree of compliance of the actual shelf layout and stock position.

For store teams, One Door will simplify tracking layout changes by highlighting them and making the data available on the shop floor. This should deliver productivity benefits to the store – benefits that can be reinvested in new activities or on better customer service.

Store teams will be able to verify that third party merchandisers are compliant. Major product manufacturers often use their own merchandising teams in supermarkets and One Door will provide a simple mechanism to verify they have done their jobs properly.

The central merchandise teams will be able to quickly get data-driven feedback on how the stores are making planned changes, as well as verifying the quality of compliance with their store layouts.

All of these factors should mean that the product that is available in-store is presented in the manner that the merchandising teams have defined, and the customers will see a more consistent presentation of products.

Integration is Critical for Rapid Deployment

Effective integration with existing systems and new cloud capabilities is critical to support the real-time operation in Retail.

The ability to introduce and scale up new capabilities that can be delivered by cloud services such as One Door will only be effective if integration is simple and quick. This requires compatibility at a number of levels including data semantics and the ability to exchange data effectively. Woolworths have been growing their capability for managing and supporting APIs that will make this integration smoother.

In addition, the cloud service providers have made the development of integration capabilities an investment priority.

The introduction of One Door is showing how the company can integrate new capability and introduce it to almost 10% of their stores as a pilot capability, with the full deployment to be completed across their chain during 2022.

Other retailers who don’t have this capability to integrate cloud services quickly, reliably and cost-effectively are going to lag companies that have invested to achieve this capability.

CIOs and CDOs should be leading their organisations in the development of a rich and scalable set of APIs to enable the integration of this type of high-value specialised solution.

Deployment without Consistent Architectures will be Complex

Rapid deployment of new capabilities requires a well-architected cloud, network, and edge infrastructure – and a well-trained team.

It is highly likely that the deployment of the One Door solution will be delivered over the existing Woolworths infrastructure. The capability is delivered from the cloud, with little or no deployment costs or time required. With the existing network and hybrid cloud capabilities that Woolworths have developed this type of rollout will be a relatively simple technical activity.

The integration of the service into the Woolworths environment is likely to be the most complex activity to make sure accurate data is exchanged.

It doesn’t take long to identify a wide range of different digital initiatives that Woolworths are pursuing. With the platform that they have established, they are well-positioned to take advantage of new capabilities as start-ups and existing suppliers develop them.

Every retailer needs to maintain their focus on their digital capabilities. As companies such as One Door develop AI-based enhancements, CIOs and their teams need to be ready to integrate these capabilities quickly.

Strong architectures for both infrastructure and digital services are needed to achieve these outcomes.

Recommendations for Retailers

Retail organisations continue to find new ways to leverage the power of the data that they are able to collect. The flexibility that SaaS developments deliver will be essential to maintaining an organisation’s competitive positioning.

CIOs and their teams need to lead their organisations and ecosystems by:

- Identifying new SaaS capabilities that support the strategic positioning of their companies

- Preparing their environments by supporting a rich set of APIs to support the rapid integration of these new capabilities

- Developing and maintaining strong architectures that provide organisations a solid framework to develop within

Checkout Alan’s previous insight on Woolworths micro automation technology adopted to speed up the fulfilment of online grocery orders

Customer experience (CX) is a key business priority for all organisations – irrespective of the organisation size.

Many of the contact centre solutions in the market can be complex and expensive and may not be suitable for a family-owned business or for a business requiring less than 30 agents. What these businesses look for in a solution include: inbound, outbound, call recording, workforce optimisation and basic analytics capabilities. SMEs tend to use contact centre solutions that come with telecom services and have a one-off implementation fee. The overall cost of the solution – including agent licenses and other associated costs such as training – has to be affordable for the SMEs.

This whitepaper provides CX decision makers in Australia’s SMEs with global best practices, to help them understand the priorities of SMEs in running their day-to-day contact centre operations, including case studies. The data mentioned in the paper is from the global Ecosystm CX Study that is live and ongoing on the Ecosystm platform.

Click below to download

(Clicking on this link will take you to MaxContact website where you can download the document )

It is crucial that businesses engage with customers across multiple digital channels and move from being ‘’reactive’’ to ‘’proactive”. To deliver that proactive customer experience (CX), contact centres need to have the ability to predict the customer’s next move and/or send preemptive notifications before problems occur. When you start doing that, you are getting ahead in understanding how to deepen customer engagement.

Ecosystm research finds that 56% of organisations globally consider driving an omnichannel experience a key business priority. The need to repeat personal details and queries each time the customer is on a new channel continues to drive poor CX. Resolving the omnichannel dilemma is an arduous task. It requires a complete overhaul in bringing all channels together.

This whitepaper written by Ecosystm in partnership with Local Measure, discusses the multiple challenges that are hindering companies from delivering on their omnichannel vision and talks about the steps organisations should take to modernise their contact centres.

Find out why not integrating your customer channels is costing your contact centre.

Click below to download the Whitepaper

(Clicking on this link will take you to Local Measure website where you can download the Whitepaper )

The ways we connect, create, collaborate in our workplaces has seen major shifts in the last year. And the tech industry has continually supported that shift as they create new capabilities and upgrade existing ones. Technology providers will continue to revamp their product offerings to support the increase in adoption of the hybrid work model work – a fusion of remote and in-office. In the Top 5 Future of Work Trends for 2021, Ecosystm had predicted, “Every major digital workspace provider (such as Microsoft, Google, Zoom, Cisco, AWS and so on) will broaden their digital workplace capabilities and integrate them more effectively, making them easier to procure and use. Instead of a “tool-centric” approach to getting work done (chat vs video vs document sharing vs online meetings vs whiteboards and so on), it will become a platform play.”

Ecosystm Principal Advisor, Ravi Bhogaraju says, “It is becoming clear that companies and individuals are grappling with three issues – the changing size and composition of the workforce; the productivity of those who are driving the businesses; and attracting, reskilling and engaging the broader workforce.” These are the challenges that tech providers will have to help organisations with.

Google Upgrades its Collaboration Platform

The Google Workspace was launched in October last year, and last week saw the tech giant announce a series of upgrades and innovations to better support the flexibility needs of frontline and remote workers.

Workspace is Google’s office productivity suite comprising video conferencing, cloud storage, collaboration tools, security and management controls built into a cohesive environment. The new features announced by Google Workspaces include Focus Time to avoid distractions by limiting notifications, recurring out-of-office and location indicators to make colleagues aware if the person is working from home or office, support for Google voice assistant in workplaces, second-screen experiences to support multiple devices, and features for frontline workers designed to help mobile employees collaborate and communicate better with the rest of the organisation. Google is also working on a trimmed down version of Google Workspace – Google Workspace Essentials – which will provide support for Chat, Jamboard, and Calendar. Workspace is estimated to have 2.6 billion monthly active users.

Bhogaraju says, “One of the issues that is fast emerging as significant is not just the employee experience or customer experience but the complexity of the digital workplace as platforms introduce newer and advanced features. In the end, there has to be simplicity, clarity, and a clear focus on the goals – not just an overload of features that makes life more complex for the employee. It would be critical to enable these features thoughtfully and reskill staff adequately so that the adoption and impact to business process is felt in their day-to-day activities.”

Workspace Transformation across Industries

With many of Google’s employees and developers working remotely, the company has first-hand experience of the challenges of remote working and is leveraging the experience. Google Workspace is also working on custom solutions for various industries. In Retail for example, Woolworths, rolled out Google Workspace and Chrome for geographically dispersed teams to collaborate in real-time and adopt custom-made applications linked to global servers to allow managers to log and address tickets from the shop floor itself. Similarly in Aviation, All Nippon Airways uses Google Workspace to allow pilots, cabin attendants, HR and finance staff to communicate and collaborate in real-time across the globe, using Google Meet, Google Docs, Google Sheets and Google Slides from their PCs, smartphones or tablets. Google retains its focus on the Education industry – Google Workspace Education Fundamentals is free for all qualifying institutions. Solutions such as Google’s Classroom, Teach from Anywhere hub, roster sync, mobile grading and EdTech tools aim to enable better learning and teaching experience for students and educators.

Tech Companies Revamping their Collaboration Offerings

With more companies rethinking their work policies, leaders in the collaboration space are also stepping up their game to evolve their offerings for the hybrid norm. Microsoft’s Viva unifies the experience across Teams and Microsoft 365 for employee communications, wellbeing, learning and knowledge discovery. Similarly, Zoom too has upgraded and integrated various utility, sharing, and management features to support a hybrid workforce. Tech companies are being forced to invest in creating next-generation tools to stay relevant, as Future of Work models continue to shift and evolve.

As tech companies evolve their capabilities, Bhogaraju warns organisations on how they should leverage them. “While technology companies continue to deliver feature rich suites – in reality the uptake and embedding of these programs into the day-to-day business processes is still in its early stages. Business, HR and IT teams continue to struggle. They tend to operate within independent thought silos and there is limited consensus on which feature is really needed and how it can add to the productivity and efficiency. Without this crucial context and an effective change management program – they remain rich features and not impactful ones.”

The hybrid workplace model is gaining popularity in 2021. Check out Ecosytsm’s top 5 Future of Work Trends For 2021. Signup for Free to download the report.

Last week saw 8×8 and Verint announce a partnership that aims to deliver integrated cloud-based contact centre services and workforce management applications to medium and large enterprises worldwide. The integrated solution will leverage 8×8’s expertise in unified communications as a service (UCaaS) and contact centre as a service (CCaaS) with Verint’s workforce management solutions.

The Need for Better Workforce Optimisation Solutions

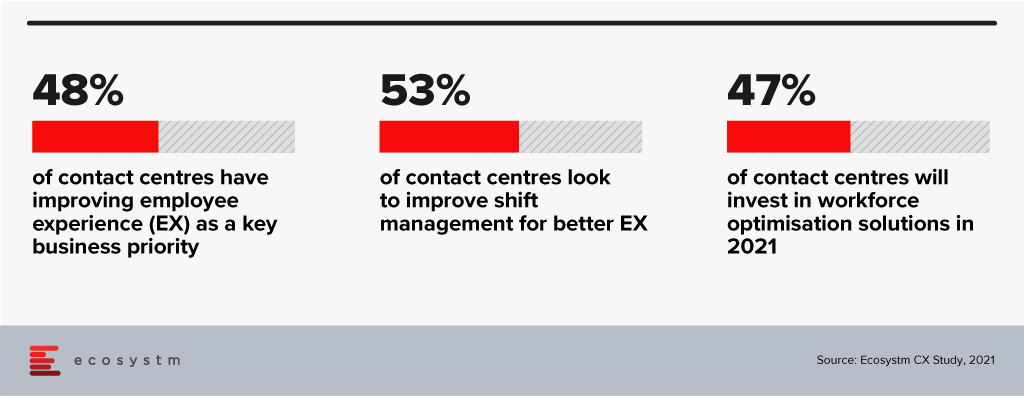

Talking about the need for integrated solutions such as this in the Contact Centre space, Ecosystm Principal Advisor for Enterprise Communications and Contact Centres, Audrey William, says, “With agents working from both their homes and the office, contact centres will be challenged with managing staffing requirements and scheduling. The key to delivering exceptional customer experience will be to have the right agent working on the right assignments, across the right channels. On top of that, contact centres have to manage shifts, flexible work hours and part-time agents working across multiple locations. This does not make workforce optmisation an easy task!”

“Driving better employee experience is a top priority for contact centres – and this will include investments in solutions that can alleviate stress for the agent. The industry continues to be challenged by agent attrition – the most common causes being work overload and stress. To provide a consistently good customer experience, contact centres have to listen better to their agents, understand their workloads better, show empathy, and monitor their emotional well-being A workforce optimisation solution will ensure that inbound enquiries are not impacted, and agents’ times are better utilised, through forecasting and better scheduling.”

Synergy between 8×8 and Verint

The single-vendor integrated communications and contact centre solution is anticipated to create better customer engagement and smoother remote operations by empowering employees and agents to plan, forecast and schedule contact centre activities and manage workloads through omnichannel routing.

William says, “8×8 has been establishing its presence in the unified communications and contact centre solutions space in Asia Pacific, particularly in small and medium enterprises (SMEs). Partnering with a market leader in workforce management such as Verint is a positive step. Verint’s strengths in gap analysis from historical data patterns and predicting will help 8×8’s customers to drive optimisation and accuracy in planning in the contact centre. This will have an impact on reducing overstaffing and overtime. Additionally, it will give agents greater control over their schedules and the flexibility to plan their shifts around their desired hours of work.”

“While 8×8 has its own workforce engagement solution, this partnership demonstrates how 8×8 is elevating its game and wants to offer its customers a more robust workforce management solution through Verint Monet and Verint Enterprise. This solution is also out of the box for 8×8’s customers without the need for professional services. That is a plus!”, says William.

In 2009 one of the foremost Financial Services industry experts was giving my team a deep dive into the Global Financial Crisis (GFS) and its ramifications. According to him, one of the key reasons why it happened was that most people in key positions in both industry and government had probably never seen a full downturn in their careers. There was a bit of a hiccup during the dot com bust but nothing that seriously interrupted the long boom that began somewhere in 1988. They had never experienced anything quite like 2008; so they never imagined that such a crisis could actually happen.

Similarly, 2020 was an unprecedented year – in our lives and certainly for the tech industry. The GFC (as the name suggests) was a financial crisis. A lot of people lost their jobs, but after the bailouts things went largely back to normal. COVID-19 is something different altogether – the impact will be felt for years and we don’t yet know the full implications of the crisis.

While we would like to start 2021 with a clean slate and never talk about the pandemic again, the reality is that COVID-19 will shape what we will see this year. In the first place it looks like the disease will still be around for a substantial part of the year. Secondly, all the changes it has brought in 2020 with entire workforces suddenly moving to operating from home will have profound implications for technology and customer experience this year.

As we ease into 2021, I look at some of the organisational and technology trends that are likely to impact customer experience (CX) in 2021.

#1 All Business is Now eBusiness

COVID-19 has ensured that the few businesses which did not have an online presence became acutely aware that they needed one. It created a need for many businesses to quickly initiate eCommerce. Forbes reported a 77% increase in eCommerce infrastructure spending YoY. This represents about 4 years of growth squeezed into the first 6 months of 2020!

From a CX point of view there is going to be far more interaction with brands and products through online channels. This is not just about eCommerce and buying from a portal. It is also about using tools like Instagram, Facebook and other social media platforms more widely. It is about learning to interact with the customer in multiple ways and touching their journeys at multiple points, all virtually using the web – mostly the mobile web.

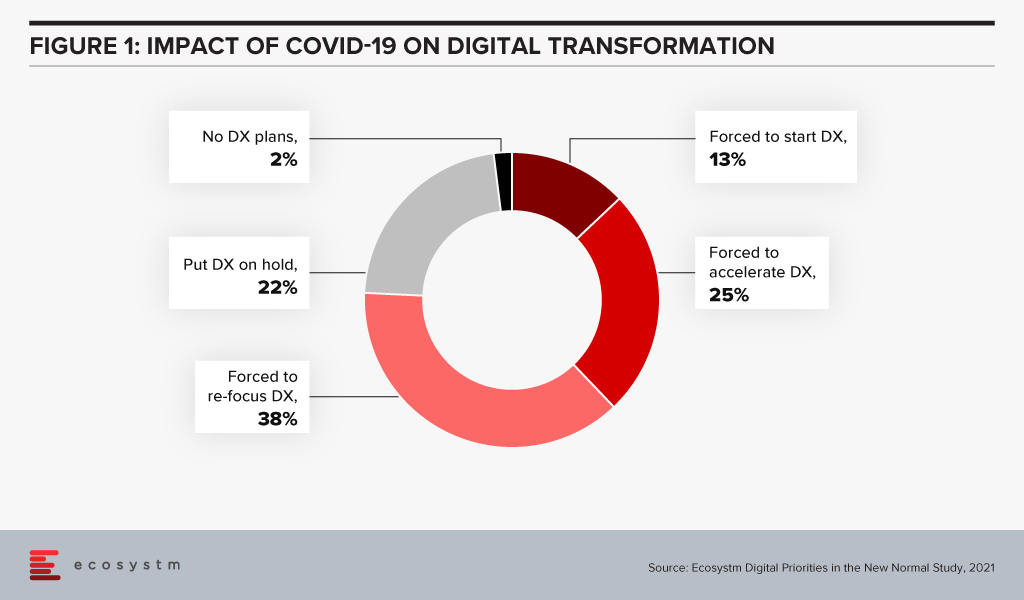

Ecosystm research shows that almost three out of four companies have decided on accelerating or modifying the digitalisation they were undergoing (Figure 1). It is fair to expect that this gives a further boost to moving to the cloud. For the customer it will mean being able to access information in many new ways and connect with products, services, brands at multiple points on the web.

Since interacting with the customer at multiple points is new for most services, I foresee a lot of missed opportunities as companies learn to navigate a completely different landscape. Customers pampered by digitally native organisations often react harshly to even a small mistake. It will become critical for companies to not just become a bigger presence online but also to manage their customers well.

New solutions such as Customer Data Platforms (CDP), as opposed to CRM will become common. Players who are into Customer Experience management are likely to see huge business growth and new players will rapidly enter this space. They will promise to affordably manage CX across the globe, leveraging the cloud.

#2 Virtual Merges with Real

Virtual and Augmented Reality are not new. They have been around for a while. This will now cross the early adoption stage and is likely to proliferate in terms of use cases and importance.

AR/VR has so far been seen mainly in games where one wears an unwieldy – though ever-improving – headset to transport oneself into a 3D virtual world. Or in certain industrial applications e.g., using a mobile device to look at some machinery; the device captures what the eye can see while providing graphical overlays with information. In 2021 I expect to see almost all industrial applications adopting some form of this technology. This will have an impact on how products are serviced and repaired.

For the mainstream, 2020 was the year of videoconferencing – as iconic as the shift to virtual meetings has been, there is much more to come. Meetings, conferences, events, classrooms have all gone virtual. Video interaction with multiple people and sharing information via shared applications is commonplace. Virtual backgrounds which hide where you are actually speaking from are also widely used and getting more creative by the day.

Imagine then a future where you get on one of these calls wearing a headset and are transported into a room where your colleagues who are joining the call also are. You see them as full 3D people, you see the furniture, and the room decor. You speak and everyone sees your 3D avatar speak, gesture (as you gesture from the comfort of your home office) and move around. It will seem like you are really in the conference room together! If this feels futuristic or unreal try this or look at how the virtual office can look in the very near future.

While the solutions may not look very sophisticated, they will rapidly improve. AR/VR will start to really make its presence felt in the lives of consumers. From being able to virtually “try” on clothes from a boutique to product launches going virtual, these technologies will deeply impact customer experience in 2021 and beyond

In the immortal words of Captain Kirk, we will be going where no man has gone before – enabled by AR / VR.

#3 Digital CX will involve Multiple Technologies

AI, IoT and 5G will continue to support wider CX initiatives.

The advances that I have mentioned will gain impetus from 5G networking, which will enable unprecedented bandwidth availability. To deliver an AR experience over the cloud, riding on a 5G network, will literally be a game changer compared to the capabilities of older networks.

Similarly, IoT will lead to massive changes in terms of product availability, customisation and so on. 5G-enabled IoT will allow a lot more data to be carried a lot faster; and more processing at the edge. IoT will have some initial use cases in Retail, Services and other non-manufacturing sectors – but perhaps not as strongly as some commentators seem to indicate.

AI continues to drive change. While AI may not transform CX in 2021, this is a technology which will be a component of most other CX offerings, and so will impact customer experience in the next few years. In fact, thinking of businesses in 2025 I cannot believe that there will be a single business to customer (B2C) interaction which will not feature some form of AI technology.

I’d be interested to hear your thoughts on the technologies which will impact CX in 2021 – Connect with me on the Ecosystm platform.

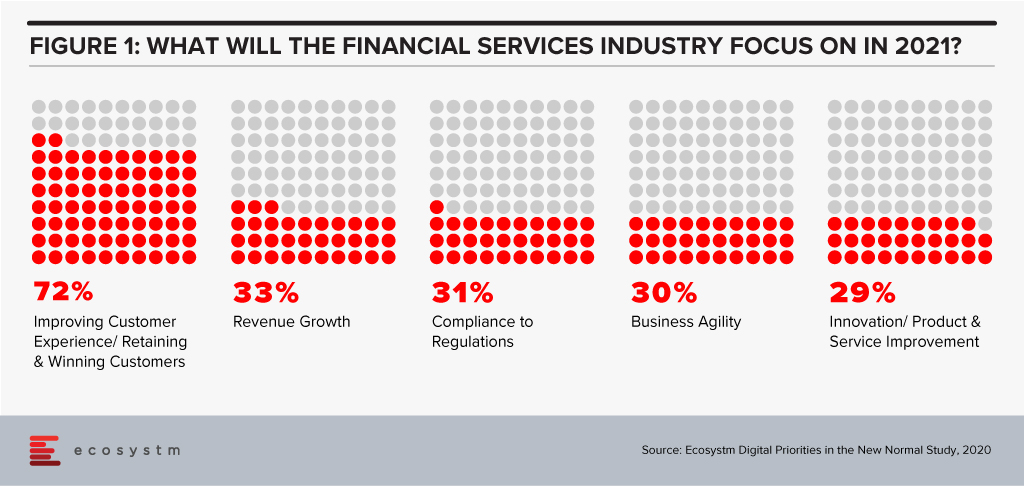

The disruption that we faced in 2020 has created a new appetite for adoption of technology and digital in a shorter period. Crises often present opportunities – and the FinTech and Financial Services industries benefitted from the high adoption of digital financial services and eCommerce. In 2021, there will be several drivers to the transformation of the Financial Services industry – the rise of the gig economy will give access to a larger talent pool; the challenges of government aid disbursement will be mitigated through tech adoption; compliance will come sharply back into focus after a year of ad-hoc technology deployments; and social and environmental awareness will create a greater appetite for green financing. However, the overarching driver will be the heightened focus on the individual consumer (Figure 1).

2021 will finally see consumers at the core of the digital financial ecosystem.

Ecosystm Advisors Dr. Alea Fairchild, Amit Gupta and Dheeraj Chowdhry present the top 5 Ecosystm predictions for FinTech in 2021 – written in collaboration with the Singapore FinTech Festival. This is a summary of the predictions; the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 FinTech Trends for 2021

#1 The New Decade of the ‘Empowered’ Consumer Will Propel Green Finance and Sustainability Considerations Beyond Regulators and Corporates

We have seen multiple countries set regulations and implement Emissions Trading Systems (ETS) and 2021 will see Environmental, Social and Governance (ESG) considerations growing in importance in the investment decisions for asset managers and hedge funds. Efforts for ESG standards for risk measurement will benefit and support that effort.

The primary driver will not only be regulatory frameworks – rather it will be further propelled by consumer preferences. The increased interest in climate change, sustainable business investments and ESG metrics will be an integral part of the reaction of the society to assist in the global transition to a greener and more humane economy in the post-COVID era. Individuals and consumers will demand FinTech solutions that empower them to be more environmentally and socially responsible. The performance of companies on their ESG ratings will become a key consideration for consumers making investment decisions. We will see corporate focus on ESG become a mainstay as a result – driven by regulatory frameworks and the consumer’s desire to place significant important on ESG as an investment criterion.

#2 Consumers Will Truly Be ‘Front and Centre’ in Reshaping the Financial Services Digital Ecosystems

Consumers will also shape the market because of the way they exercise their choices when it comes to transactional finance. They will opt for more discrete solutions – like microfinance, micro-insurances, multiple digital wallets and so on. Even long-standing customers will no longer be completely loyal to their main financial institutions. This will in effect take away traditional business from established financial institutions. Digital transformation will need to go beyond just a digital Customer Experience and will go hand-in-hand with digital offerings driven by consumer choice.

As a result, we will see the emergence of stronger digital ecosystems and partnerships between traditional financial institutions and like-minded FinTechs. As an example, platforms such as the API Exchange (APIX) will get a significant boost and play a crucial role in this emerging collaborative ecosystem. APIX was launched by AFIN, a non-profit organisation established in 2018 by the ASEAN Bankers Association (ABA), International Finance Corporation (IFC), a member of the World Bank Group, and the Monetary Authority of Singapore (MAS). Such platforms will create a level playing field across all tiers of the Financial Services innovation ecosystem by allowing industry participants to Discover, Design and rapidly Deploy innovative digital solutions and offerings.

#3 APIfication of Banking Will Become Mainstream

2020 was the year when banks accepted FinTechs into their product and services offerings – 2021 will see FinTech more established and their technology offerings becoming more sophisticated and consumer-led. These cutting-edge apps will have financial institutions seeking to establish partnerships with them, licensing their technologies and leveraging them to benefit and expand their customer base. This is already being called the “APIficiation” of banking. There will be more emphasis on the partnerships with regulated licensed banking entities in 2021, to gain access to the underlying financial products and services for a seamless customer experience.

This will see the growth of financial institutions’ dependence on third-party developers that have access to – and knowledge of – the financial institutions’ business models and data. But this also gives them an opportunity to leverage the existent Fintech innovations especially for enhanced customer engagement capabilities (Prediction #2).

#4 AI & Automation Will Proliferate in Back-Office Operations

From quicker loan origination to heightened surveillance against fraud and money laundering, financial institutions will push their focus on back-office automation using machine learning, AI and RPA tools (Figure 3). This is not only to improve efficiency and lower risks, but to further enhance the customer experience. AI is already being rolled out in customer-facing operations, but banks will actively be consolidating and automating their mid and back-office procedures for efficiency and automation transition in the post COVID-19 environment. This includes using AI for automating credit operations, policy making and data audits and using RPA for reducing the introduction of errors in datasets and processes.

There is enormous economic pressure to deliver cost savings and reduce risks through the adoption of technology. Financial Services leaders believe that insights gathered from compliance should help other areas of the business, and this requires a completely different mindset. Given the manual and semi-automated nature of current AML compliance, human-only efforts slow down processing timelines and impact business productivity. KYC will leverage AI and real-time environmental data (current accounts, mortgage payment status) and integration of third-party data to make the knowledge richer and timelier in this adaptive economic environment. This will make lending risk assessment more relevant.

#5 Driven by Post Pandemic Recovery, Collaboration Will Shape FinTech Regulation

Travel corridors across border controls have started to push the boundaries. Just as countries develop new processes and policies based on shared learning from other countries, FinTech regulators will collaborate to harmonise regulations that are similar in nature. These collaborative regulators will accelerate FinTech proliferation and osmosis i.e. proliferation of FinTechs into geographies with lower digital adoption.

Data corridors between countries will be the other outcome of this collaboration of FinTech regulators. Sharing of data in a regulated environment will advance data science and machine learning to new heights assisting credit models, AI, and innovations in general. The resulting ‘borderless nature’ of FinTech and the acceleration of policy convergence across several previously siloed regulators will result in new digital innovations. These Trusted Data Corridors between economies will be further driven by the desire for progressive governments to boost the Digital Economy in order to help the post-pandemic recovery.

Organisations are finding that the ways to do work and conduct business are evolving rapidly. It is evident that we cannot use the perspectives from the past as a guide to the future. As a consequence both leaders and employees are discovering and adapting both their work and their expectations from it. In general, while job security concerns still command a big mindshare, the simpler productivity measures are evolving to more nuanced wellness measures. This puts demands on the CHRO and the leadership team to think about company, customer and people strategy as one holistic way of working and doing business.

Organisations will have to re-think their people and technology to evolve their Future of Work policies and strategise their Future of Talent. There are multiple dimensions that will require attention.

Hybrid is Becoming Mainstream

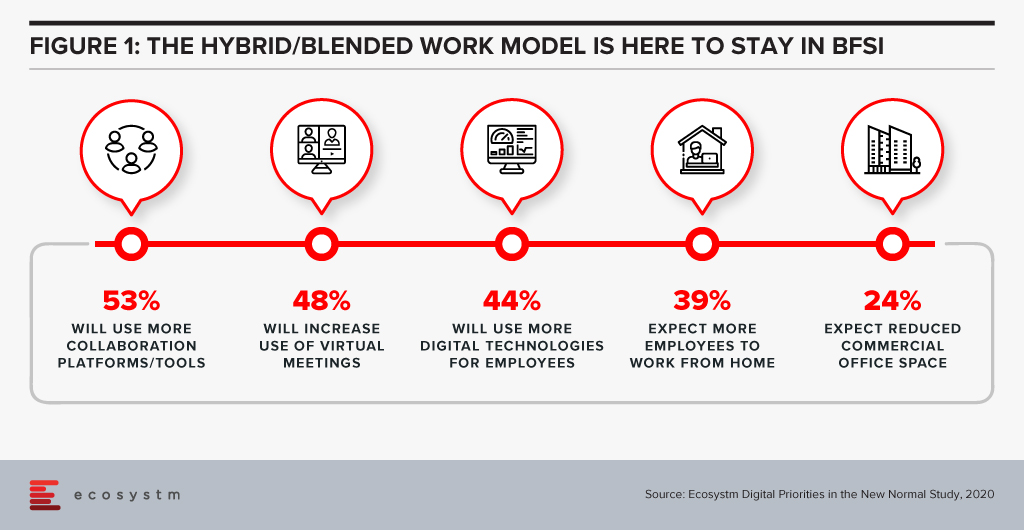

It is clear that hybrid workplaces are here to stay. Ecosystm research finds that in 2021 BFSI organisations will use more collaboration tools and platforms, and virtual meetings (Figure 1). Nearly 40% expect more employees to work from home, but only about a quarter of organisations are looking to reduce their physical workspaces. Organisations will give more choice to employees in the location of their work – and employees will choose to work from where they are more productive. The Hybrid model will be more mainstream than it has been in the last few months.

Companies are coming to terms with the fact that there is no single answer to operating in the new world. Experimentation and learnings are continuously captured to create the right workforce and workplace model that works best. Agility both in terms of being able to undersand the market as well as quickly adapt is becoming quite important. Thus being able to use different models and ways of working at the same time is the new norm.

Technology and Talent are Core

Talent and tech are the two core pillars that companies need to look at to be successful against their competition. It is becoming imperative to create synergy between the two to deliver a superior value proposition to customers. Companies that are able to bring the customer and employee experience journeys together will be able to create better value. HR tech stacks need to evolve to be more deliberate in the way they link the employee experience, customer experience, and the culture of the organisation. That’s how the Employee Value Proposition (EVP) comes to life on a day-to-day basis to the employers. With evolving work models, the tech stack is a key EVP pillar.

Governments will also need to partner with industry to make such talent available. Singapore is rolling out a new “Tech.Pass” to support the entry of up to 500 proven founders, leaders and experts from top tech companies into Singapore. Its an extension of the Tech@SG program launched in 2019, to provide fast-growing companies greater assurance and access to the talent they need. The EDB will administer the pass, supported by the Ministry of Manpower.

Attracting the Right Talent

Talent has always been difficult to find. Even with globalisation, significant investment of time and resources is needed to find and relocate talent to the right geography. In many instances this was not possible given the preferences of the candidates and/or the hiring managers. COVID-19 has changed this drastically. Remote working and distributed teams have become acceptable. With limitations on immigration and travel for work, there is a lot more openness to finding and hiring talent from outside the traditional talent pool.

However it is not as simple as it seems. The cost per applicant (CPA) – the cost to convert a job seeker to a job applicant – had been averaging US$11-12 throughout 2019 according to recruiting benchmark data from programmatic recruitment advertising provider, Appcast. But, the impact of COVID-19 saw the CPA reach US$19 in June – a 60% increase. I expect that finding right talent is going to be a “needle in a haystack” issue. But this is only one side of the coin – the other aspect is that the talent profile needed to be successful in roles that are all remote or hybrid is also significantly different from what it was before. Companies need to pay special attention to what kind of people they would like to hire in these new roles. Without this due consideration it is very likely that there would be difficulty in on-boarding and making these new hires successful within the organisation.

Automation Augmentation and Skills

The pace at which companies are choosing to automate or apply AI is increasing. This is changing the work patterns and job requirements for many roles within the industry. According to the BCG China AI study on the financial sector 23% of the roles will be replaced by AI by 2027. The roles that will not be replaced will need a higher degree of soft skills, critical thinking and creativity. However, automation is not the endgame. Firms that go ahead with automation without considering the implications on the business process, and the skills and roles it impacts will end up disrupting the business and customer experience. Firms will have to really design their customer journeys, their business processes along with roles and capabilities needed. Job redesign and reskilling will be key to ensuring a great customer experience

Analytics is Inadequate Without the Right Culture

Data-driven decision-making as well as modelling is known to add value to business. We have great examples of analytics and data modelling being used successfully in Attrition, Recruitment, Talent Analytics, Engagement and Employee Experience. The next evolution is already underway with advanced analytics, sentiment analysis, organisation network analysis and natural language processing (NLP) being used to draw better insights and make people strategies predictive. Being able to use effective data models to predict and and draw insights will be a key success factor for leadership teams. Data and bots do not drive engagement and alignment to purpose – leaders do. Working to promote transparency of data insights and decisions, for faster response, to champion diversity, and give everyone a voice through inclusion will lead to better co-creation, faster innovation and an overall market agility.

Creating a Synergy

We are seeing a number of resets to what we used to know, believe and think about the ways of working. It is a good time to rethink what we believe about the customer, business talent and tech. Just like customer experience is not just about good sales skills or customer service – the employee experience and role of Talent is also evolving rapidly. As companies experiment with work models, technology and work environment, there will a need to constantly recalibrate business models, job roles, job technology and skills. With this will come the challenge of melding the pieces together within the context of the entire business without falling into the trap of siloed thinking. Only by bringing together businesses processes, talent, capability evolution, culture and digital platforms together as one coherent ecosystem can firms create a winning formula to create a competitive edge.

Singapore FinTech Festival 2020: Talent Summit

For more insights, attend the Singapore FinTech Festival 2020: Infrastructure Summit which will cover topics on Founders success and failure stories, pandemic impact on founders and talent development, upskilling and reskilling for the future of work.

2020 saw a shutdown in both supply and demand which has effectively put the brakes on many economic activities and forced a complete rethink on how to continue doing business and maintain social interactions. The COVID-19 pandemic has accelerated digitalisation of consumers and enterprises, and the telecommunications industry has been the pillar which has kept the world ticking over. The rise in data use coupled with the fervent growth of the digital economy augurs well for the telecom sector in 2021.

Ecosystm Advisors Claus Mortensen, Rahul Gupta, and Shamir Amanullah present the top 5 Ecosystm predictions for Telecommunications & Mobility trends for 2021. This is a summary of the predictions – the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 Telecommunications & Mobility Trends for 2021

- The 5G Divide – Reality for Some and Hype for Others

Despite the economic challenges in 2020, GSMA reports that the global 5G subscriptions doubled QoQ in Q2 2020 to hit at least 137.7 million subscribers. This accounts for 1.5% of total subscribers – and is expected to rise to 30% by 2025.

The value of 5G will become increasingly mainstream in the next few years. 5G offers a tailored user-centric approach to network services, low latency and significantly higher number of connections which will power a new era of mobile Internet of Everything (IoE).

However, there are many operators who are still sceptical about 5G. In the US, many operators failed to get any tangible positives from 5G. In the near term, many operators will continue to evolve their 5G capabilities – a full grown standalone 5G technology implementation in some verticals might take longer.

The unsuccessful launch of 5G by the US operators does not mean that 5G is a failure, however. It also implies that we need to look at other geographies to lead us into 5G – and Asia Pacific may well emerge as a leader in this space. China, for example, leads the drive in 5G adoption; and 5G smartphones account for more than half of global sales in recent months.

- Telecom Operators Will Accelerate Digital Transformation

Telecom operators are facing increasing demands for cutting-edge services and top-notch customer experience (CX). The global pandemic has caused revenue loss, due to struggling economies and many operators will aim to reduce OpEX to circumvent these financial pressures, raise the quality of CX and retain existing customers. To realise this, there will be much focus on improvement in efficiencies, better operations management as well as improving the IT stack. These digital transformation efforts will enable rapid and flexible services provisioning, which will be better prepared for the tailored services customers now demand.

Many operators are increasingly incorporating cloudification alongside the 5G network deployment. Operators are moving towards transforming their operations and business support systems to a more virtualised and software-defined infrastructure. 5G will operate across a range of frequencies and bands – with significantly more devices and connections becoming software-defined with computing power at the Edge. Operators will also harness the power of AI to analyse massive volumes of data from the networks accessed by millions of devices in order to improve CX, ramp up operational efficiencies as well as introduce new services tailored to customer needs to increase revenue.

- Remote Working Will Transform Telecommunications Networks

The changing patterns in peak network traffic and the substantial movement of traffic from central business districts to residential areas require a fundamental rethink in network traffic management. In addition, many businesses continue to ramp up digital transformation efforts to conduct business online as physical channels will remain limited. Consumer onboarding will also be fervent, as organisations look at business recovery – resulting in increase in bandwidth requirements.

The increasing remote working trend is amplifying the need for greater cybersecurity. Cybersecurity has catapulted in importance as the pandemic has seen a worrying increase in attacks on banks, cloud servers and mobile devices, among others. Cyber-attack incidents specifically due to remote working, has seen a rise. A telecom operator’s compromised security can have country-wide, and even global consequences.

- SASE Will Grow – and Sprawl

Although it was perhaps originally seen as an Over-The-Top (OTT) provisioned competitive service to operators’ MPLS services, many telecom service providers have been embracing SD-WAN over the years as part of their managed services portfolio. “Traditional” SD-WAN offers some of the flexibility needed to address the change towards a more distributed access and the workload requirements that the pandemic has accelerated – the technology does not address all of the issues related to this transformed workspace.

Employees are now working from a variety of locations and workloads are becoming increasingly distributed. To address this change, organisations are challenged to move workloads and applications between platforms, potentially compromising security. Despite all the challenges that the pandemic brought with it – both human and technical – it has also provided organisations with an opportunity to rethink their IT and WAN architectures and to adopt an approach that has security at its core.

We believe that secure access service edge (SASE), which is a model for combining SD-WAN and security in a cloud-based environment, will see a drastic rise in adoption in 2021 and beyond.

- OTT Players Will Continue their Expansion in the Telecommunications Space

Facebook, Google, Amazon are no longer considered as web companies as they moved from standalone ‘web’ companies to become OTT providers and are now significant players in telecom space. With the Facebook-Jio deal in India earlier this year, and with Google and Amazon actively eyeing the telecom space, these players will continue to explore this space especially in the emerging markets of Asia and Africa. There are telecom providers in these countries which will be prime targets for partnerships. These operators could be those that have a large customer base, are struggling with their bottom lines or are already looking at exit routes. OTT players were already offering services like voice, messaging, video calling and so on which have been the domain expertise of mobile operators for a long time. The market will see instances where telecom providers will sell small stakes to OTT players at a premium and get access to the vast array of services that these OTT providers offer.