Organisations are aware that they must reinvent themselves continually to remain relevant to their customers, engage their employees and be profitable – and yet they find it challenging to live with the present pace of change.

Achieving a new equilibrium requires organisations to have the right skills; execute effectively every day; drive the best priorities for change; and refresh and renew their capabilities. Organisations will require adaptable people, processes, technologies and data to position themselves to harness the future.

Here are 5 insights that will help you shape your change strategy.

- Productivity persists as a priority. Recruit, train and retain essential skills and look for partners who are leaders in their sphere to provide the other, less differentiating capabilities.

- Digital debt is not only technical. Continuous reinvention requires the identification of an organisation’s digital debt, and evolution of the processes, technology and data to reduce legacy constraints. This will support the reuse and refactoring of existing capabilities in new ways and the introduction of new capabilities.

- Both operations and the customer matter. Investment in both the customer experience and operational efficiency needs to be balanced keeping in mind organisations’ limited available resources.

- Technology must be adaptive. Establishing isolation zones between components to minimise the impact of changing components is becoming key to the rapid delivery of value.

- Tomorrow’s excellence will be driven by iterative reinvention. Iterative innovation will become easier with the adoption of intelligent automation and adaptive AI/ machine learning. However, not only will this require a debt-free technical environment, it will also need an adaptive and scalable infrastructure.

More insights are below.

Click here to download – The Future of Business: 5 Ways to Shape Your Change Strategy

Organisations have had to transform and innovate to survive over the last two years. However, now when they look at their competitors, they see that everyone has innovated at about the same pace. The 7-year innovation cycle is history in today’s world – organisations need the right strategy and technologies to bring the time to market for innovations down to 1-2 years.

As they continue to innovate to stay ahead of the competition, here are 5 things organisations in India should keep in mind:

- The drivers of innovation will shift rapidly and industry trends need to be monitored continually to adapt to these shifts.

- Their biggest challenge in deploying Data & AI solutions will be identification of the right data for the right purpose – this will require a robust data architecture.

- While customer experience gives them immediate and tangible benefits, employee experience is almost equally – if not more – important.

- Cloud investments have helped build distributed enterprises – but streamlining investments needs a lot of focus now.

- There is a misalignment between organisations’ overall awareness of growing cyber threats and risks and their responses to them. A new cyber approach is urgently needed.

More insights into the India tech market are below.

Click here to download The Future of the Digital Enterprise – Southeast Asia as a PDF

Organisations in Australia and New Zealand (ANZ) are focusing their digital transformation efforts on continued innovation in the experiences they deliver to their customers and employees.

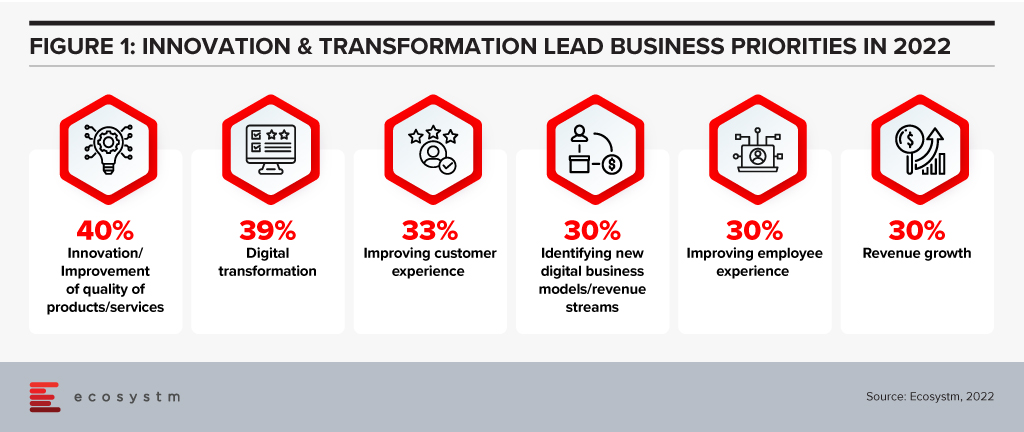

Innovation has been at the core of organisations’ survival strategies – now it will be the means to gain competitive advantage and is getting prioritised over resiliency, business continuity and compliance.

Here are 5 insights on where ANZ organisations are headed in the tech priorities and investments, based on the findings of the Ecosystm Digital Enterprise Study, 2022.

- Tech Teams in ANZ are restructuring after a two-year struggle and as they face skills shortage.

- Tech investments are focusing on experience and digital workplace and customer experience technologies are seeing continued growth.

- Hybrid cloud investments are focused on augmenting existing infrastructure – whether public or on-prem

- Sales & Marketing are leveraging data & AI solutions the most; IT Ops and SecOps will see un uptick in 2023

- Cybersecurity practices are not evolving fast enough with only 9% of organisations having implemented Zero Trust

More insights into the ANZ tech market below.

Click here to download The Future of the Digital Enterprise – Australia & New Zealand as a PDF

The last few months have been full of bad news for some of the organisations currently recognised as the most innovative firms on the planet. Netflix has been losing subscribers, Amazon’s revenue growth is slowing dramatically, and Tesla now has serious competition in the EV market, with its dominance beginning to wane. In Australia – my home country – some of the “fintech” banks have closed their virtual doors over the past six months, leaving the market to the traditional players.

And many of the traditional businesses are turning themselves around. Foxtel, the “legacy” cable TV provider in Australia, has grown its subscriber base by 19% off the back of its streaming services – where subscriber numbers are growing at over 60% YoY. ComfortDelgro – a transport provider based out of Singapore – is seeing its revenue start to increase again after being hit hard by digital competitors and the pandemic. CBA’s “Ceba” virtual assistant is winning plaudits in Australia and globally.

It’s Not Too Late to Catch-up!

In many respects, the fact that the digital disruptors got SO far ahead is an indication of just how slow the rest of the market was to respond, and a credit to the significant investments these innovators made to get ahead. But now that the rest of the market is catching up shows that there is no secret sauce when it comes to innovation. What Uber, Tesla, Amazon and every other digital innovator has done is replicable. Your business just needs to make the necessary changes to give you the ability to catch up to the digital innovators in your industry – do it well and you will even keep up with them or get ahead. And innovation is the leading business priority for most organisations today!

What all of the digital disruptors did fifteen years ago, and many other businesses have done since then, is develop the ability to create and improve digital customer experiences at pace. Nearly every customer experience is digital – at least in part. So creating great digital experiences will go a long way to creating great customer experiences. Sounds easy right?

However, what this actually means is they changed their culture, structure, KPIs, technology, skills and the nature of their business. Many organisations have beaten the path to becoming digital businesses – in fact, it is a well-worn path. When you set off on the journey you are no longer taking risks or heading out alone. There is a very clear playbook as to how to become a digital business today.

What Does a Digital Business Look Like?

If you are part of your organisation’s tech team and wondering how digital your business is, ask these questions:

- Do you mainly deploy new technology services with the Waterfall project methodology?

- Do all of the development work with the IT team (and not in business or customer teams)?

- Does it take months or years to deploy new services?

- Are your KPIs the same as they were 5-10 years ago?

If the answer to some or all of these questions is YES, then it is likely that you are working for a business that will not catch up with or get ahead of your competitors. You might have a few initiatives that see you make some ground on them – but innovation today is not about leaps and bounds – it is about continual improvement. If you catch up today but don’t have the ability to continually improve, you will have fallen behind again tomorrow…

The good news is it is never too late to start this journey. It typically starts from the top of your business – the CIO cannot make the entire business agile. The head of the digital cannot change the culture of the entire organisation. But the IT and digital teams can get the ball rolling by changing their structure and work processes. Start by moving some developers into the Customer Experience team (if you have one!). Stop funding projects and start funding squads, tribes and teams. Structure the team around the customer journey – or at least make it easier for customers to get value from the digital assets and services you offer. Hopefully, someone will notice the fact that the tech team is helping a business unit or team to operate with agility and they’ll start asking why they cannot have that same ability?

And by then the ball is rolling down the hill and you are on your way to being a digital business – and on your way to giving customers the products, services and experiences they demand today and tomorrow.

In comparison to the golden days of the second half of the 20th century, the last two decades have been hard hit. The fragility of globalisation and that prosperous economic model so beautifully enabled by a 70-year technology revolution, have tested business continuity and disaster recovery plans like never before.

Looking Back

During this time the global community has lurched through tech and property driven financial crisis. It has endured endemic terrorism, and a crippling pandemic. And it has been fragmented by the existential threats of energy and climate, world order dislocation, and challenges to once unshakable fiat money. The wonderfully efficient business models and supply chains enabled by W. Edwards Deming following World War II are fractured and broken. Despite all these challenges, the desire for a hopeful return to a golden age of global prosperity is clearly evident. Just maybe not as we know it.

The period between W. Edwards Deming and Dotcom (let’s say 1950-2000) ushered in ERP and the modern software revolution. Over decades, highly refined processes and perfected workflows shifted from paper and clipboards into mainframe environments – from conveyor belts to computing and from ledgers to LANs.

In the progression to slightly less monolithic server-based business applications, millions of lines of customised code are transferred into configurable data fields, coupled with ready-made workflow connections, and processes based on standards set by leading companies and their representative bodies. The standardisation of business systems lowered the entry point for new enterprises, spawned new industries, and ultimately allowed SaaS to proliferate.

ERP was a true revolution in automating process and quality management systems and building the modern world. Cloud was then a transformation for ERP. It was an innovation on an original idea, but it wasn’t the next revolution. In many ways, by standardising business systems, we went too far. The vendor market over-estimated what configuration over customisation could achieve and ultimately set unachievable expectations in relation to client outcomes. On the client side, end-user organisations seized on vanilla processes and workflows and got lazy about working out solutions to their own problems. In chasing out-of-the-box software they sought to expedite, and even outsource, the hard work. In doing so, the core driver of 20th century post war economic prosperity was forgotten.

Looking Ahead

In business transformations there are no short cuts to results

One of the defining social drivers of the 21st century is a move towards the concept of individualism. We see it everywhere. In the transformation of traditional marriage, family, and identity structures. In the migration away from the concept of houses and homes, in the rise of the gig economy, and even in the regulatory schemes of government, financial and insurance services. The individual sits at the centre of new globalisation economic design and is giving rise to the next business systems revolution. At ServiceNow Knowledge 2022 I was fortunate to hear Dr Catriona Wallace and the Hon Victor Dominello MP discuss it in the context of their recent research. Dr Wallace described the trend as, “know me and care about me”, and discussed the requirements to operate within a world of both hyper-personalisation and ethical restraint.

This time however the business systems revolution to support this change is not being driven by process efficiencies and quality management, though they remain important tools. It is being driven by the pursuit of Experiential Excellence. You’ve heard it many times before and once you’ve seen it you can’t unsee it – Customer Experience, Employee Experience, Digital Experience. These are all ambitions of populist organisational and service transformation agendas with Experiential Excellence at their core.

For business and technology leaders it requires a mental shift. Traditional ERP alone will not get us there. It means a new business systems methodology is required to accompany, and reflect the challenges of the modern world, not one created more than 70 years ago.

An Experiential Excellence platform isn’t just a new ERP. It’s a new type of system capable of operating at speed and with breakthrough power; but it is also capable of breaking the intellectual shackles of pre-configuration to help organisations recapture the essence of what Deming started so long ago and we somehow lost along the way: The ability to think about and solve any kind of complex, innovative and multi-objective, multi-stakeholder problem. And I think that ServiceNow, and the Now Platform, is the first company (and business system) to do it.

The sense of something special was clearly evident among ServiceNow staff and partners, at the event. But I don’t think they have yet nailed the messaging. And the reason is because there is still such a strong gravitational pull towards the old ERP model among end-user clients. This reinforces a need for ServiceNow to still define itself by the last 50 years of system technology rather than the next 50.

That needs to change. So, next time when a client asks, is ServiceNow an ERP or is it an RPA platform or something else, the answer is – it is neither, and both, and all, and sometimes at the same time. This wonderful superposition, the same quantum computing characteristic that allows a particle to be one thing, or either, or both, all at the same time, is the very essence of their opportunity – should they wish to take it.

To be a leader in the new quantum age of computing will mean taking the brave step of unshackling themselves from the 20th century view of ERP and lead the redefinition of business systems for the quantum age. Let the revolution begin.

It is an incredible time of change for the city and regional governments where every strategic activity – especially in these globally challenging times – presents a significant opportunity for transformation. To continue to meet the changing needs of the communities they serve, every modern city government’s technology story is a work in progress. While this is the mantra for successful continuous improvement it also describes the best strategic approach for how municipalities should manage their corporate application replacement programs.

Unfortunately, significant systems upgrade and replacement programs are regularly approached as complex, multi-tasking activities that have a hard start, a defined program, and a date-stamped end. In taking this traditional project implementation approach, intuitively, many organisations believe that doing as much as possible, in as quick a time as possible, ultimately helps to achieve twice as much within the same time. The result is more likely to be half as much, and at lower levels of quality and enjoyment for all involved. This manifests as project scope creep and budget overruns.

Aside from these big bang approaches, thanks to large implementation costs and stringent regulatory oversight, local governments are also forced to think upfront about the potential future value created by a significant core system technology change. The pressure of moving at high speed, and with a dominant technology focus, can obscure both the true organisational cost and ultimate value of the program. This mentality prevails even when it is acknowledged that activities associated with a transformation program will eventually usher in a period of significant change – that is not limited to the changing core corporate applications environment itself.

The 4-Part ERP Transformation Trap is All Too Common in City Government

An over-reliance on technology to deliver business transformation outcomes. Local governments everywhere continue to pursue strategic plans that are either wholly defined or implicitly reliant on world-class customer experience (CX), employee experience (EX), and digital transformation (DX) capabilities. Despite these being business-oriented strategies, organisations then pursue an over-reliance on technology – usually winner-take-all ERP led procurements – to achieve them.

Choosing an industry solution focused on the wrong business model. The chance of achieving these digital transformation outcomes is further obscured when the customer is not central to the data model. The core corporate application technology underpinning the sector’s leading ERP programs is largely based on a property-centric model – where the customer is a subordinate attribute of a property, and the property asset defines the business process and individual. It is a challenge for any council to deliver contemporary customer-first digital transformation with a property-centric approach. To realise customer and employee-centric outcomes, councils must therefore rethink their project’s business methodology and ask themselves, “what is our primary focus here?”. This is never more important than when replacing legacy systems.

Inability to realise that a winner-take-all ERP solution is not an architectural choice. ERP is important but it is not everything. The traditional council ERP is just one important part of an overall capability that allows authorities to longitudinally manage the impacts and opportunities of change across their organisation, communities, and stakeholder ecosystems. Having chosen a sector specific ERP solution, city governments realise too late that no single technology vendor has a best-of-breed solution to achieve the desired DX outcomes. That requires a more sophisticated architectural approach.

Failure to acknowledge there is no finish line to transformation. Like many worthwhile activities, the prize in DX is in the journey, not in the cup. While there can be an end to “project scope”, there should be no “end point” for an ERP transformation program. Only once these challenges are acknowledged and accepted, can transformation be assimilated into the organisation to ensure the council is technically capable of delivering the implicit outcome for the organisation. This could simply be defined as ‘a contemporary business approach to managing the money, the assets, the community, the customers, and the staff of regional government.’

A Better Way: Re-Architecting for Project Success

Where opportunities to meet increasing CX and EX demands arise, especially through ERP and corporate application renewal programs, successful projects in contemporary councils require a service-oriented architecture not found in contemporary or legacy ERP systems alone.

Beyond the property-centric challenges already outlined, even contemporary systems and suppliers can be among the least flexible to the changing data management requirements of many organisations which call for significantly more robust data, integration and application friendly infrastructure management environments.

Customer centricity, data management, integration and software infrastructure capabilities must take precedent over an aging view of single-vendor dominance in the city government sector, especially in middle- and back-office functions, which are typically void of true differentiation opportunities and prone to confining organisations to technology-led and locked projects.

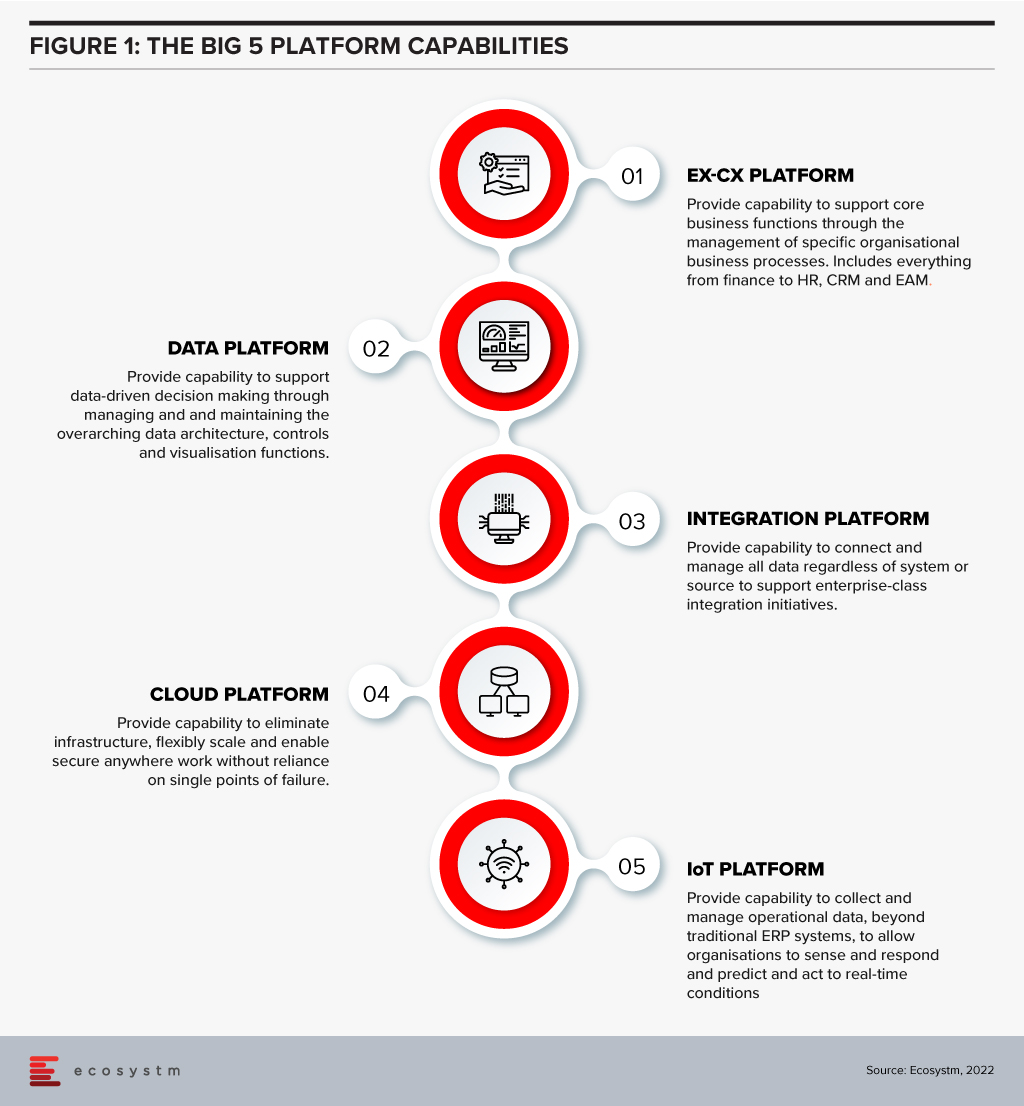

Rather than tendering for a single software provider or platform, contemporary city governments must ditch the old approach to procuring a winning ERP vendor and take steps to establish the following Big 5 platform capabilities (Figure 1). And then foster the contemporary workforce to support them.

For several decades now many organisations have attempted to short-circuit the city government ERP challenge. Fundamentally, technology transformation is not possible without technology change. A non-negotiable part of that change is a shift away from the psychology of brand-based procurement towards a new architectural approach which, like all businesses, is adaptable to change over a long period of time.

Over the last 2 years, the primary focus for Retail & eCommerce organisations has been on creating the right customer experience and digital engagements – mainly to survive.

In 2022 the focus will be on creating market differentiation. This will extend to business strategies and process optimisation. The Retail & eCommerce industry will explore ways to leverage data to empower multiple roles across the organisation and engage with customers irrespective of where they are on their customer journeys.

Read on to find out what Ecosystm Analysts Alan Hesketh, Niloy Mukherjee and Tim Sheedy think will be the leading trends in the Retail & eCommerce industry in 2022.

COVID-19 has been a major disruption for people-intensive industries and the BPO sector is no exception. However, some of the forward-looking BPO organisations are using this disruption as an opportunity to re-evaluate how they do business and how they can make themselves resilient and future-proof. In many of these conversations, technology and process reengineering are emerging as the two common themes in their journey to transform into a New Age BPO provider.

In 2022 BPO providers will focus on mitigating their key challenges around handling client expectations, better people management and investing in the right technologies for their own transformation journeys.

Read on to find out what Ecosystm Advisors Audrey William and Venu Reddy think will be the key trends for the New Age BPO in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for the New Age BPO in 2022 as PDF

Recognising FinTechs that are changing lives, creating impact, demonstrating innovation, and building ecosystems to shape the Digital Future.

CATEGORIES:

Global Platform. Organisations that provide a platform to bring together industry stakeholders such as financial services institutions and FinTechs to drive ease of collaboration and innovation by accelerating proof of concept deployments

Financial Inclusion Impact. Organisations that promote financial inclusion in the unbanked and the underbanked with a focus on bridging the economic divide

Sustainable Finance Impact. Organisations that promote sustainable finance and have ESG values

Global Banking. Banks and financial services organisations that embrace digital technology for excellence in customer experience, process efficiency and/or compliance

Global Payments. Innovative use of technology and business models in payment areas

Global Lending. Innovation in alternative finance in areas such as microfinance for individuals and small & medium enterprises, P2P lending and crowdfunding

Customer Experience. Organisations that are driving an exceptional experience for their customers and setting new benchmarks within the industry

Global InsureTech. Excellence and innovation in InsureTech in areas such as micro-insurance, usage-based pricing, process optimisation and underwriting efficiency

To find out about the winners, read on.

To download Ecosystm Red: Global Digital Futures Awards for FinTech Awards Winners as a PDF, please click here.