In today’s competitive business landscape, delivering exceptional customer experiences is crucial to winning new clients and fostering long-lasting customer loyalty. Research has shown that poor customer service can cost businesses around USD 75 billion in a year and that 1 in 3 customers is likely to abandon a brand after a single negative experience. Organisations excelling at personalised customer interactions across channels have a significant market edge.

In a recent webinar with Shivram Chandrasekhar, Solutions Architect at Twilio, we delved into strategies for creating this edge. How can contact centres optimise interactions to boost cost efficiency and customer satisfaction? We discussed the pivotal role of voice in providing personalised customer experiences, the importance of balancing AI and human interaction for enhanced satisfaction, and the operational advantages of voice intelligence in streamlining operations and improving agent efficiency.

The Voice Advantage

Despite the rise of digital channels, voice interactions remain crucial for organisations seeking to deliver exceptional customer experiences. Voice calls offer nuanced insights and strategic advantages, allowing businesses to address issues effectively and proactively meet customer needs, fostering loyalty and driving growth.

There are multiple reasons why voice will remain relevant including:

- In many countries it is mandatory in several industries such as Financial Services, Healthcare, & Government & Emergency Services.

- There are customers who simply favour it over other channels – the human touch is important to them.

- It proves to be the most effective when it comes to handling complex and recurrent issues, including facilitating effective negotiations and better sales closures; Digital and AI channels cannot do it alone yet.

- Analysing voice data reveals valuable patterns and customer sentiments, aiding in pinpointing areas for improvement. Unlike static metrics, voice data offers dynamic feedback, helping in proactive strategies and personalised opportunities.

AI vs the Human Agent

There has been a growing trend towards ‘agentless contact centres’, where businesses aim to pivot away from human agents – but there has also been increasing customer dissatisfaction with purely automated interactions. A balanced approach that empowers human agents with AI-driven insights and conversational AI can yield better results. In fact, the conversation should not be about one or the other, but rather about a combination of an AI + Human Agent.

Where organisations rely on conversational AI, there must be a seamless transitioning between automated and live agent interactions, maintaining a cohesive customer experience. Ultimately, the goal should be to avoid disruptions to customer journeys and ensure a smooth, integrated approach to customer engagement across different channels.

Exploring AI Opportunities in Voice Interactions

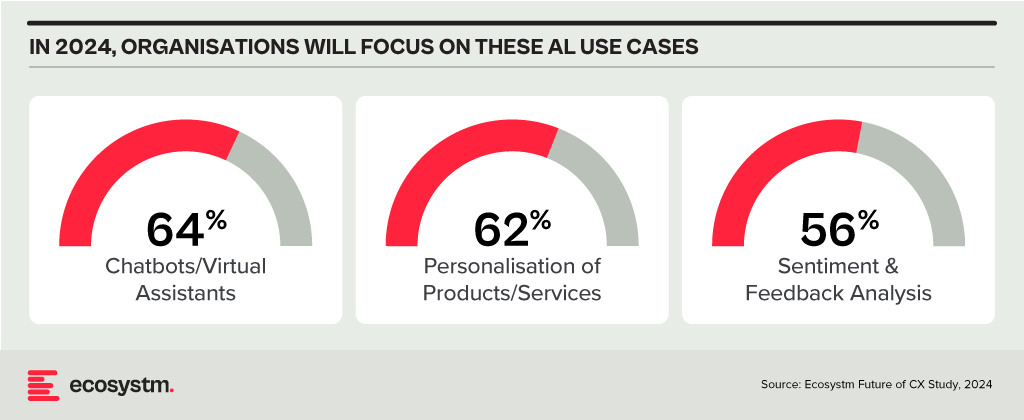

Contact centres in Asia Pacific are looking to deploy AI capabilities to enhance both employee and customer experiences.

Using predictive AI algorithms on customer data helps organisations forecast market trends and optimise resource allocation. Additionally, AI-driven identity validation swiftly confirms customer identities, mitigating fraud risks. By automating transactional tasks, particularly FAQs, contact centre operations are streamlined, ensuring that critical calls receive prompt attention. AI-powered quality assurance processes provide insights into all voice calls, facilitating continuous improvement, while AI-driven IVR systems enhance the customer experience by simplifying menu navigation.

Agent Assist solutions, integrated with GenAI, offer real-time insights before customer interactions, streamlining service delivery and saving valuable time. These solutions automate mundane tasks like call summaries, enabling agents to focus on high-value activities such as sales collaboration, proactive feedback management, and personalised outbound calls.

Actionable Data

Organisations possess a wealth of customer data from various touchpoints, including voice interactions. Accessing real-time, accurate data is essential for effective customer and agent engagement. Advanced analytics techniques can uncover hidden patterns and correlations, informing product development, marketing strategies, and operational improvements. However, organisations often face challenges with data silos and lack of interconnected data, hindering omnichannel experiences.

Integrating customer data with other organisational sources provides a holistic view of the customer journey, enabling personalised experiences and proactive problem-solving. A Customer Data Platform (CDP) breaks down data silos, providing insights to personalise interactions, address real-time issues, identify compliance gaps, and exceed customer expectations throughout their journeys.

Considerations for AI Transformation in Contact Centres

- Prioritise the availability of live agents and voice channels within Conversational AI deployments to prevent potential issues and ensure immediate human assistance when needed.

- Listen extensively to call recordings to ensure AI solutions sound authentic and emulate human conversations to enhance user adoption.

- Start with data you can trust – the quality of data fed into AI systems significantly impacts their effectiveness.

- Test continually during the solution testing phase for seamless orchestration across all communication channels and to ensure the right guardrails to manage risks effectively.

- Above all, re-think every aspect of your CX strategy – the engagement channels, agent roles, and contact centres – through an AI lens.

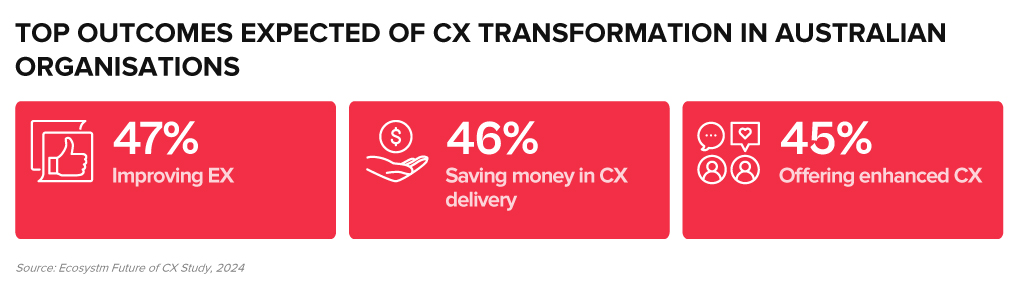

CX leaders in Australia are actively refining their customer and employee strategies. Due to high contact centre operational costs, outsourcing to countries like the Philippines, Fiji, and South Africa has gained popularity. However, compliance issues restrict some organisations from outsourcing. Despite cost constraints, elevating customer experience (CX) through AI, self-service, and digital channels remains crucial. High agent attrition also highlights the need to enhance employee experience (EX).

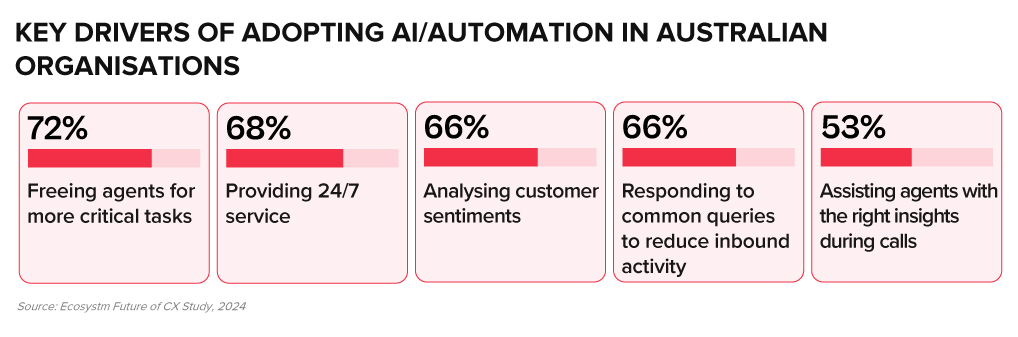

Meeting these challenges has prompted organisations to assess AI and automation solutions to enhance efficiency, cut costs, and improve EX. Australian CX teams hold extensive data from diverse applications, underscoring the need for a robust data strategy – that can provide deeper insights into customer journeys, proactive service, improved self-service options, and innovative customer engagement.

Here are 5 ways organisations in Australia can achieve their CX objectives.

Download ‘Australian CX Dynamics: Balancing Cost, Compliance, and Employee Experience‘ as a PDF.

#1 Prioritise Omnichannel Orcheshtration

Customers want the flexibility to select a channel that aligns with their preferences – often switching between channels – prompting organisations to offer more engagement channels.

Aim for unified customer context across channels for deeper customer engagement.

Coordinating all channels ensures consistent experiences for customers, with CX teams and agents accessing real-time information across channels. This boosts key metrics like First Call Resolution (FCR) and reduces Average Handle Time (AHT).

It is important not to overlook voice when crafting an omnichannel strategy. Despite digital growth, human interaction remains crucial for complex inquiries and persistent challenges. Context is vital for understanding customer needs, and without it, experiences suffer. This contributes to long waiting times, a common customer complaint in Australia.

#2 Eliminate Data Silos

Despite having access to customer information from multiple interactions, organisations often struggle to construct a comprehensive customer data profile capable of transforming all available data into actionable intelligence.

A Customer Data Platform (CDP) can eliminate data silos and provide actionable insights.

- Identify behavioural trends by understanding patterns to personalise interactions.

- Spot real-time customer issues across channels.

- Uncover compliance gaps and missed sales opportunities from unstructured data.

- Look at customer journeys to proactively address their needs and exceed expectations.

#3 Embed AI into CX Strategies

The emergence of GenAI and Large Language Models (LLMs) has thrust AI into the spotlight, promising to humanise its capabilities. However, there’s untapped potential for AI and automation beyond this.

Australian organisations are primarily considering AI to address key CX priorities: enhancing efficiency, cutting costs, and improving EX.

Agent Assist solutions offer real-time insights before customer interactions, improving CX and saving time. Integrated with GenAI, these solutions automate tasks like call summaries, freeing agents to focus on high-value activities such as sales collaboration, proactive feedback management, personalised outbound calls, and skill development. Predictive AI algorithms go beyond chatbots and Agent Assist solutions, leveraging customer data to forecast trends and optimise resource allocation.

#4 Keep a Firm Eye on Compliance

Compliance in contact centres is more than just a legal requirement; it is core to maintaining customer trust and safeguarding brand’s reputation.

Maintaining compliance in contact centres is challenging due to factors such as the need to follow different industry guidelines, constantly changing regulatory environment, and the shift to hybrid work.

Organisations should focus on:

- Limiting individual stored data

- Segregating data from core business applications

- Encrypting sensitive customer data

- Employing access controls

- Using multi-factor authentication and single sign-on systems

- Updating security protocols consistently

- Providing ongoing training to agents

#5 Implement New Technologies with Ease

Organisations often struggle to modernise legacy systems and integrate newer technologies, hindering CX transformation.

Delivering CX transformation while managing multiple disparate systems requires a platform that can integrate desired capabilities for holistic CX and EX experiences.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

Ecosystm Opinion

Organisations in Australia must pivot to meet customers on their terms, and it will require a comprehensive re-evaluation of their CX strategy.

This includes transforming the contact centre into an “Intelligent” Data Hub, leveraging intelligent APIs for seamless customer interaction management; evolving agents into AI-powered brand ambassadors, armed with real-time insights and decision-making capabilities; and redesigning channels and brand experiences for consistency and personalisation, using innovative technologies.

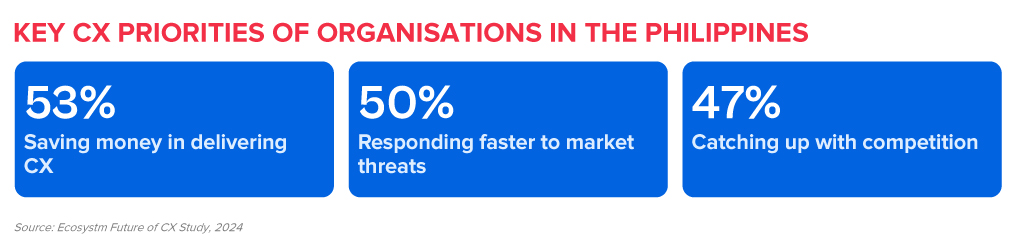

The Philippines, renowned as a global contact centre hub, is experiencing heightened pressure on the global stage, leading to intensified competition within the country. Smaller BPOs are driving larger players to innovate, requiring a stronger focus on empowering customer experience (CX) teams, and enhancing employee experience (EX) in organisations in the Philippines.

As the Philippines expands its global footprint, organisations must embrace progressive approaches to outpace rivals in the CX sector.

These priorities can be achieved through a robust data strategy that empowers CX teams and contact centres to glean actionable insights.

Here are 5 ways organisations in the Philippines can achieve their CX objectives.

Download ‘Securing the CX Edge: 5 Strategies for Organisations in the Philippines’ as a PDF.

#1 Modernise Voice and Omnichannel Orchestration

Ensuring that all channels are connected and integrated at the core is critical in delivering omnichannel experiences. Organisations must ensure that the conversation can be continued seamlessly irrespective of the channel the customer chooses, without losing the context.

Voice must be integrated within the omnichannel strategy. Even with the rise of digital and self-service, voice remains crucial, especially for understanding complex inquiries and providing an alternative when customers face persistent challenges on other channels.

Transition from a siloed view of channels to a unified and integrated approach.

#2 Empower CX Teams with Actionable Customer Data

An Intelligent Data Hub aggregates, integrates, and organises customer data across multiple data sources and channels and eliminates the siloed approach to collecting and analysing customer data.

Drive accurate and proactive conversations with your customers through a unified customer data platform.

- Unifies user history across channels into a single customer view.

- Enables the delivery of an omnichannel experience.

- Identifies behavioural trends by understanding patterns to personalise interactions.

- Spots real-time customer issues across channels.

- Uncovers compliance gaps and missed sales opportunities from unstructured data.

- Looks at customer journeys to proactively address their needs.

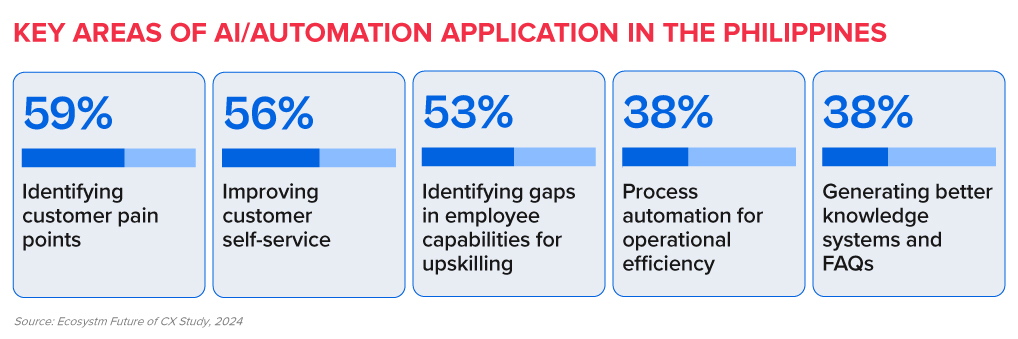

#3 Transform CX & EX with AI/Automation

AI and automation should be the cornerstone of an organisation’s CX efforts to positively impact both customers and employees.

Evaluate all aspects of AI/automation to enhance both customer and employee experience.

- Predictive AI algorithms analyse customer data to forecast trends and optimise resource allocation.

- AI-driven identity validation reduces fraud risk.

- Agent Assist Solutions offer real-time insights to agents, enhancing service delivery and efficiency.

- GenAI integration automates post-call activities, allowing agents to focus on high-value tasks.

#4 Augment Existing Systems for Success

Many organisations face challenges in fully modernising legacy systems and reducing reliance on multiple tech providers.

CX transformation while managing multiple disparate systems will require a platform that integrates desired capabilities for holistic CX and EX experiences.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

#5 Focus on Proactive CX

In the new CX economy, organisations must meet customers on their terms, proactively engaging them before they initiate interactions. This requires a re-evaluation of all aspects of CX delivery.

- Redefine the Contact Centre. Transforming it into an “Intelligent” Data Hub providing unified and connected experiences; leveraging intelligent APIs to proactively manage customer interactions seamlessly across journeys.

- Reimagine the Agent’s Role. Empowering agents to be AI-powered brand ambassadors, with access to prior and real-time interactions, instant decision-making abilities, and data-led knowledge bases.

- Redesign the Channel and Brand Experience. Ensuring consistent omnichannel experiences through unified and coherent data; using programmable APIs to personalise conversations and discern customer preferences for real-time or asynchronous messaging; integrating innovative technologies like video to enrich the channel experience.

In my previous Ecosystm Insights, I covered how to choose the right database for the success of any application or project. Often organisations select cloud-based databases for the scalability, flexibility, and cost-effectiveness.

Here’s a look at some prominent cloud-based databases and guidance on the right cloud-based database for your organisational needs.

Click here to download ‘Databases Demystified. Cloud-Based Databases’ as a PDF.

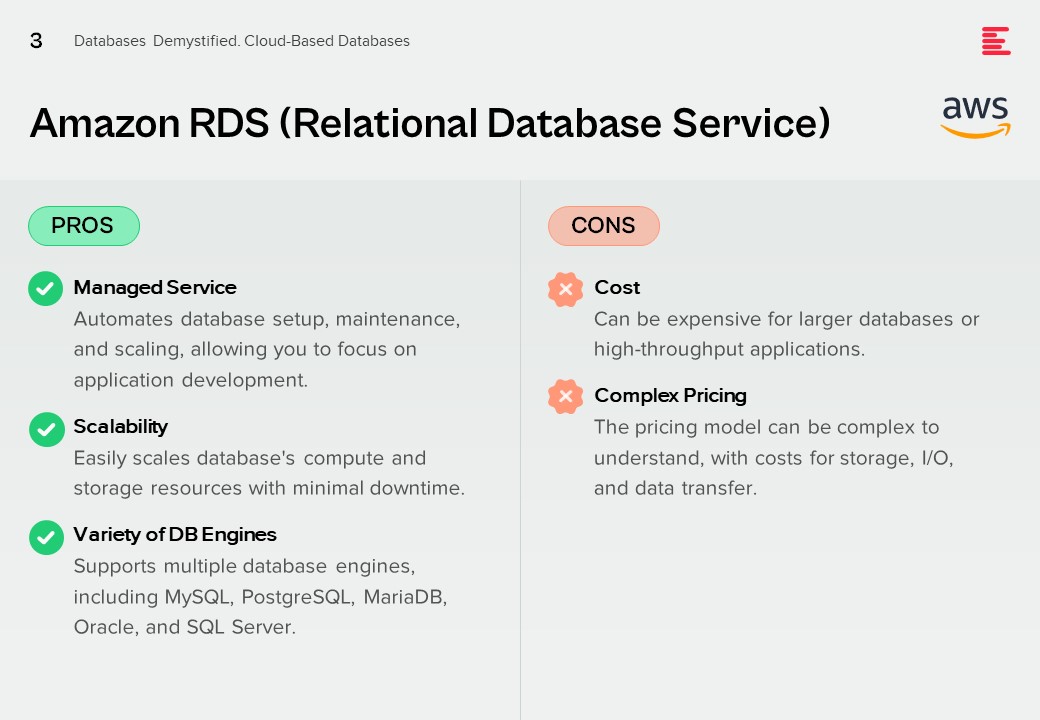

Amazon RDS (Relational Database Service)

Pros.

Managed Service. Automates database setup, maintenance, and scaling, allowing you to focus on application development.

Scalability. Easily scales database’s compute and storage resources with minimal downtime.

Variety of DB Engines. Supports multiple database engines, including MySQL, PostgreSQL, MariaDB, Oracle, and SQL Server.

Cons.

Cost. Can be expensive for larger databases or high-throughput applications.

Complex Pricing. The pricing model can be complex to understand, with costs for storage, I/O, and data transfer.

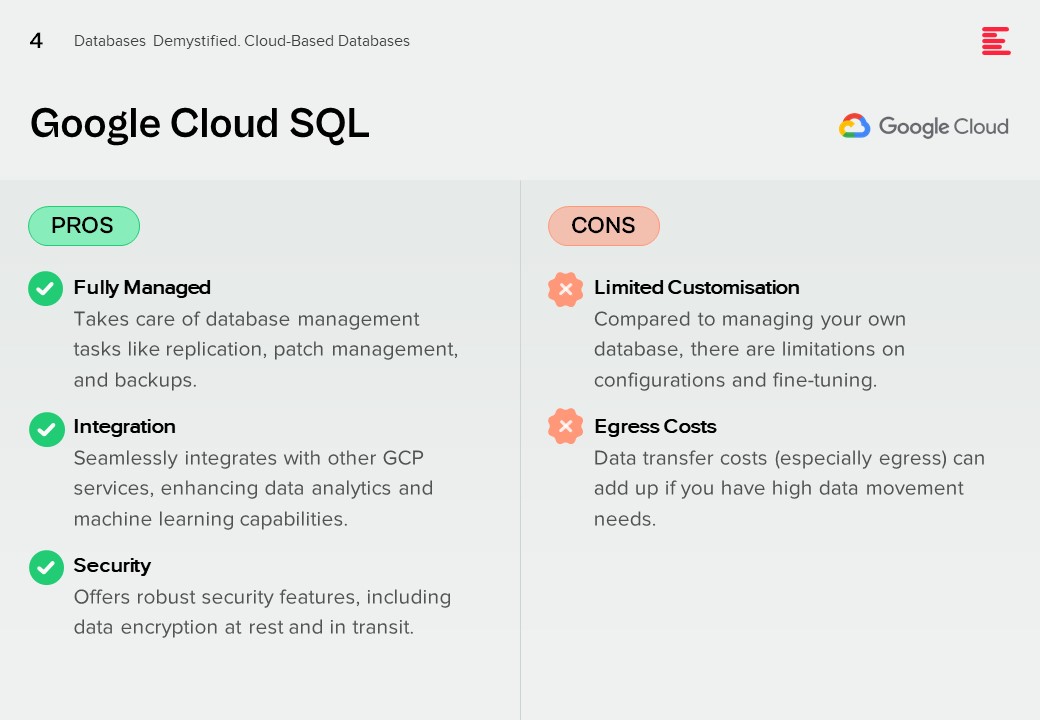

Google Cloud SQL

Pros.

Fully Managed. Takes care of database management tasks like replication, patch management, and backups.

Integration. Seamlessly integrates with other GCP services, enhancing data analytics and machine learning capabilities.

Security. Offers robust security features, including data encryption at rest and in transit.

Cons.

Limited Customisation. Compared to managing your own database, there are limitations on configurations and fine-tuning.

Egress Costs. Data transfer costs (especially egress) can add up if you have high data movement needs.

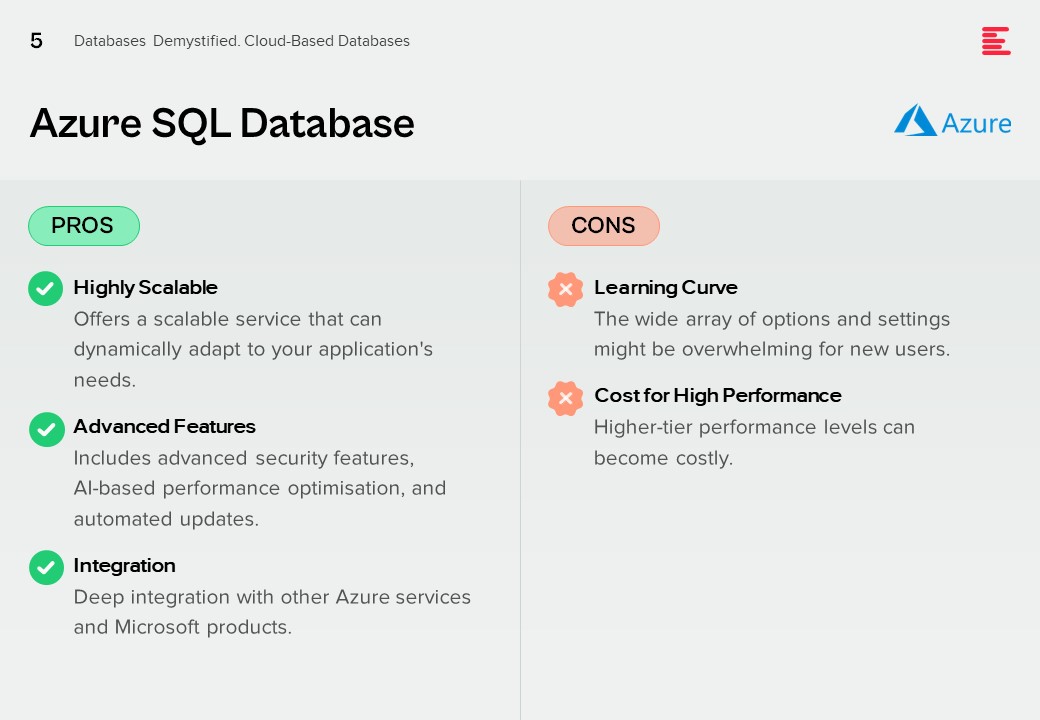

Azure SQL Database

Pros.

Highly Scalable. Offers a scalable service that can dynamically adapt to your application’s needs.

Advanced Features. Includes advanced security features, AI-based performance optimisation, and automated updates.

Integration. Deep integration with other Azure services and Microsoft products.

Cons.

Learning Curve. The wide array of options and settings might be overwhelming for new users.

Cost for High Performance. Higher-tier performance levels can become costly.

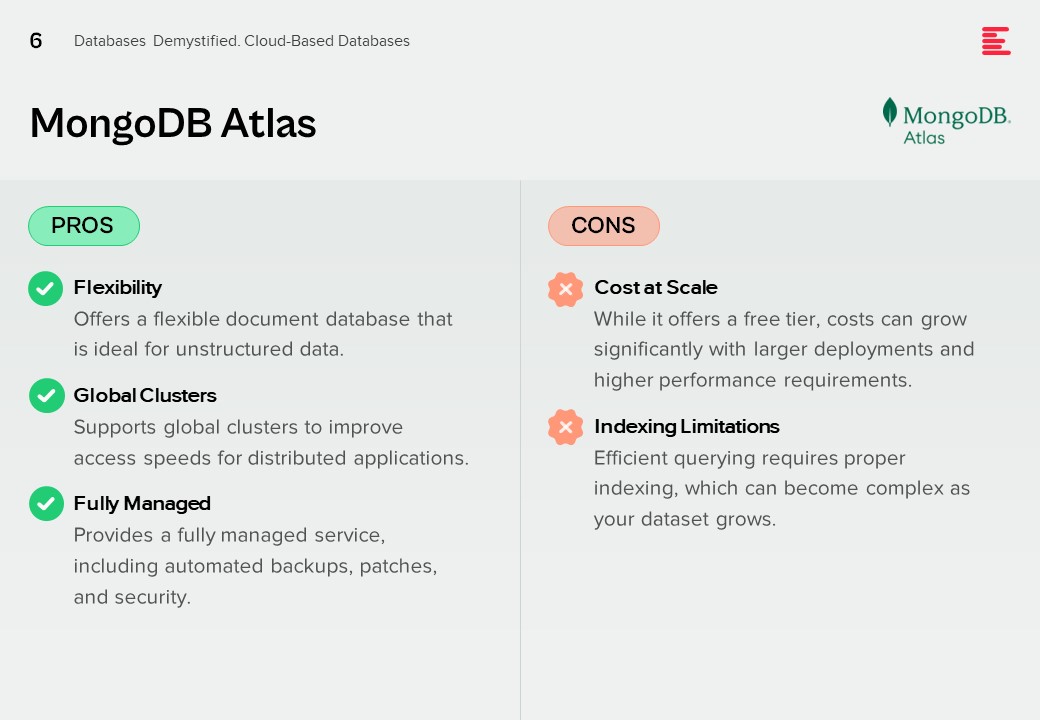

MongoDB Atlas

Pros.

Flexibility. Offers a flexible document database that is ideal for unstructured data.

Global Clusters. Supports global clusters to improve access speeds for distributed applications.

Fully Managed. Provides a fully managed service, including automated backups, patches, and security.

Cons.

Cost at Scale. While it offers a free tier, costs can grow significantly with larger deployments and higher performance requirements.

Indexing Limitations. Efficient querying requires proper indexing, which can become complex as your dataset grows.

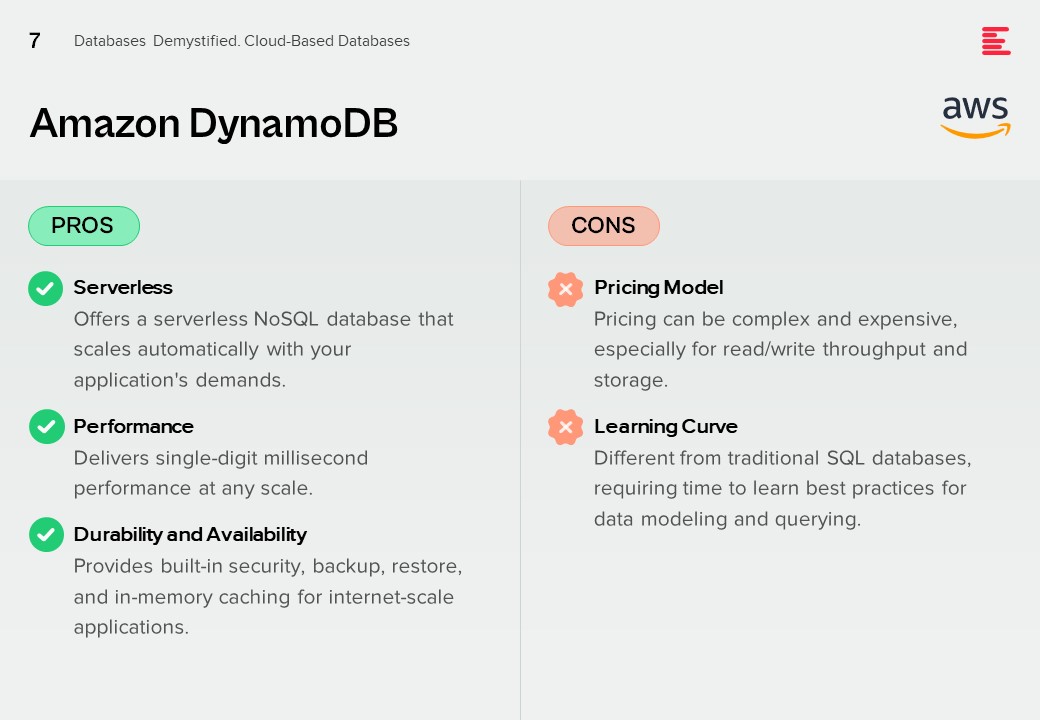

Amazon DynamoDB

Pros.

Serverless. Offers a serverless NoSQL database that scales automatically with your application’s demands.

Performance. Delivers single-digit millisecond performance at any scale.

Durability and Availability. Provides built-in security, backup, restore, and in-memory caching for internet-scale applications.

Cons.

Pricing Model. Pricing can be complex and expensive, especially for read/write throughput and storage.

Learning Curve. Different from traditional SQL databases, requiring time to learn best practices for data modeling and querying.

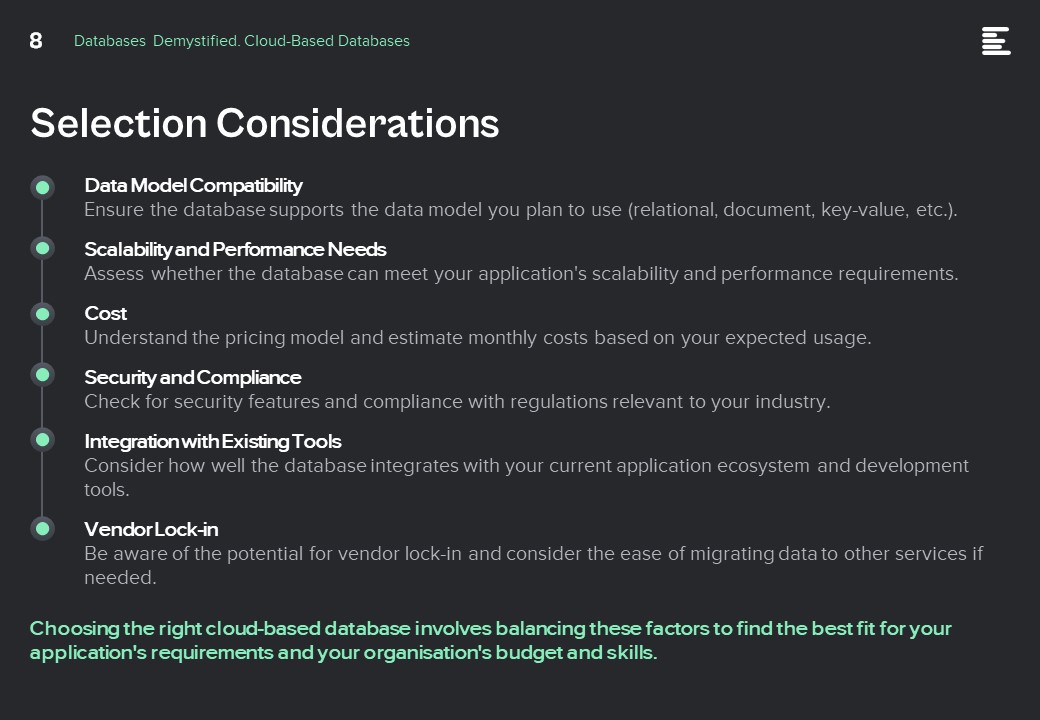

Selection Considerations

Data Model Compatibility. Ensure the database supports the data model you plan to use (relational, document, key-value, etc.).

Scalability and Performance Needs. Assess whether the database can meet your application’s scalability and performance requirements.

Cost. Understand the pricing model and estimate monthly costs based on your expected usage.

Security and Compliance. Check for security features and compliance with regulations relevant to your industry.

Integration with Existing Tools. Consider how well the database integrates with your current application ecosystem and development tools.

Vendor Lock-in. Be aware of the potential for vendor lock-in and consider the ease of migrating data to other services if needed.

Choosing the right cloud-based database involves balancing these factors to find the best fit for your application’s requirements and your organisation’s budget and skills.

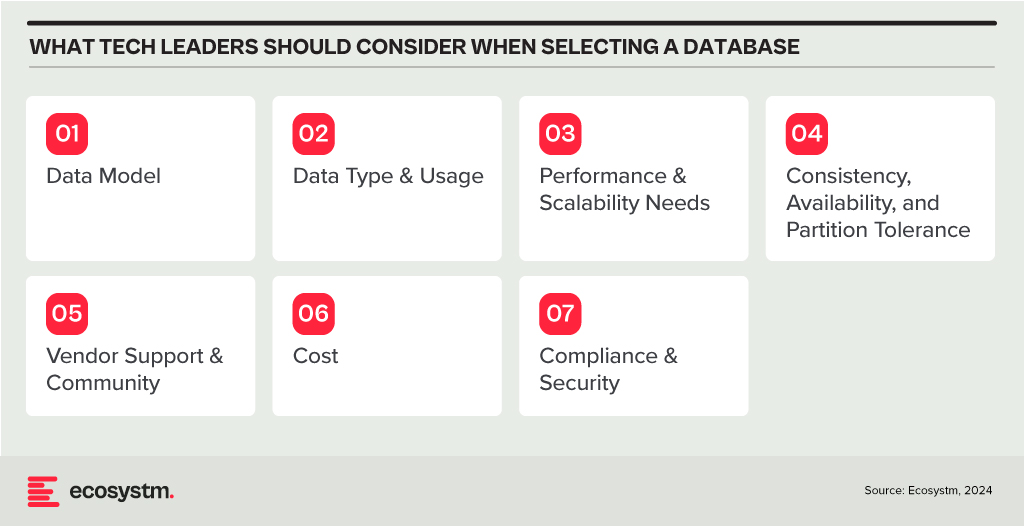

In my last Ecosystm Insights, I outlined various database options available to you. The challenge lies in selecting the right one. Selecting the right database is crucial for the success of any application or project. It involves understanding your data, the operations you’ll perform, scalability requirements, and more. Here is a guide that will walk you through key considerations and steps to choose the most suitable database from the list I shared last week.

Understand Your Data Model

Relational (RDBMS) vs. NoSQL. Choose RDBMS if your data is structured and relational, requiring complex queries and transactions with ACID (Atomicity, Consistency, Isolation, Durability) properties. Opt for NoSQL if you have unstructured or semi-structured data, need to scale horizontally, or require flexibility in your schema design.

Consider the Data Type and Usage

Document Databases are ideal for storing, retrieving, and managing document-oriented information. They’re great for content management systems, ecommerce applications, and handling semi-structured data like JSON, XML.

Key-Value Stores shine in scenarios where quick access to data is needed through a key. They’re perfect for caching and storing user sessions, configurations, or any scenario where the lookup is based on a unique key.

Wide-Column Stores offer flexibility and scalability for storing and querying large volumes of data across many servers, suitable for big data applications, real-time analytics, and high-speed transactions.

Graph Databases are designed for data intensely connected through relationships, ideal for social networks, recommendation engines, and fraud detection systems where relationships between data points are key.

Time-Series Databases are optimised for storing and querying sequential data points indexed in time order. Use them for monitoring systems, IoT applications, and financial trading systems where time-stamped data is critical.

Spatial Databases support spatial data types and queries, making them suitable for geographic information systems (GIS), location-based services, and applications requiring spatial indexing and querying capabilities.

Assess Performance and Scalability Needs

In-Memory Databases like Redis offer high throughput and low latency for scenarios requiring rapid access to data, such as caching, session storage, and real-time analytics.

Distributed Databases like Cassandra or CouchDB are designed to run across multiple machines, offering high availability, fault tolerance, and scalability for applications with global reach and massive scale.

Evaluate Consistency, Availability, and Partition Tolerance (CAP Theorem)

Understand the trade-offs between consistency, availability, and partition tolerance. For example, if your application requires strong consistency, consider databases that prioritise consistency and partition tolerance (CP) like MongoDB or relational databases. If availability is paramount, look towards databases that offer availability and partition tolerance (AP) like Cassandra or CouchDB.

Other Considerations

Check for Vendor Support and Community. Evaluate the support and stability offered by vendors or open-source communities. Established products like Oracle Database, Microsoft SQL Server, and open-source options like PostgreSQL and MongoDB have robust support and active communities.

Cost. Consider both initial and long-term costs, including licenses, hardware, maintenance, and scalability. Open-source databases can reduce upfront costs, but ensure you account for support and operational expenses.

Compliance and Security. Ensure the database complies with relevant regulations (GDPR, HIPAA, etc.) and offers robust security features to protect sensitive data.

Try Before You Decide. Prototype your application with shortlisted databases to evaluate their performance, ease of use, and compatibility with your application’s requirements.

Conclusion

Selecting the right database is a strategic decision that impacts your application’s functionality, performance, and scalability. By carefully considering your data model, type of data, performance needs, and other factors like cost, support, and security, you can identify the database that best fits your project’s needs. Always stay informed about the latest developments in database technologies to make educated decisions as your requirements evolve.

Banks, insurers, and other financial services organisations in Asia Pacific have plenty of tech challenges and opportunities including cybersecurity and data privacy management; adapting to tech and customer demands, AI and ML integration; use of big data for personalisation; and regulatory compliance across business functions and transformation journeys.

Modernisation Projects are Back on the Table

An emerging tech challenge lies in modernising, replacing, or retiring legacy platforms and systems. Many banks still rely on outdated core systems, hindering agility, innovation, and personalised customer experiences. Migrating to modern, cloud-based systems presents challenges due to complexity, cost, and potential disruptions. Insurers are evaluating key platforms amid evolving customer needs and business models; ERP and HCM systems are up for renewal; data warehouses are transforming for the AI era; even CRM and other CX platforms are being modernised as older customer data stores and models become obsolete.

For the past five years, many financial services organisations in the region have sidelined large legacy modernisation projects, opting instead to make incremental transformations around their core systems. However, it is becoming critical for them to take action to secure their long-term survival and success.

Benefits of legacy modernisation include:

- Improved operational efficiency and agility

- Enhanced customer experience and satisfaction

- Increased innovation and competitive advantage

- Reduced security risks and compliance costs

- Preparation for future technologies

However, legacy modernisation and migration initiatives carry significant risks. For instance, TSB faced a USD 62M fine due to a failed mainframe migration, resulting in severe disruptions to branch operations and core banking functions like telephone, online, and mobile banking. The migration failure led to 225,492 complaints between 2018 and 2019, affecting all 550 branches and required TSB to pay more than USD 25M to customers through a redress program.

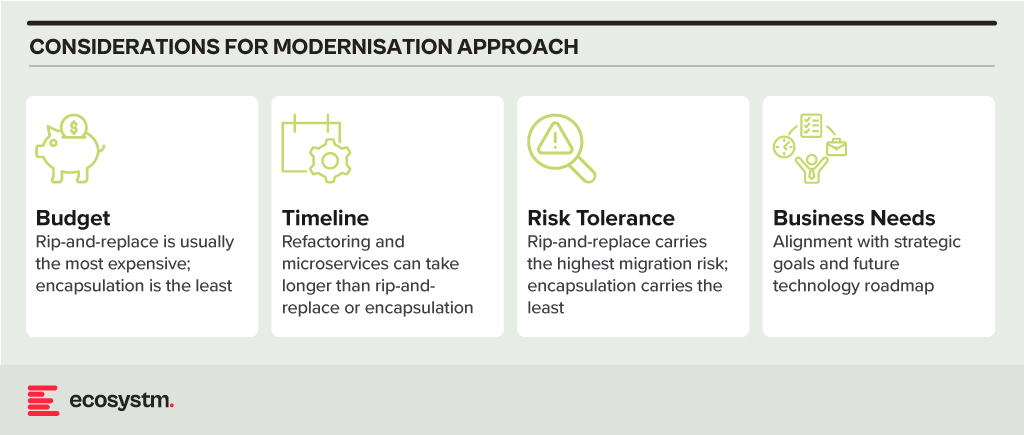

Modernisation Options

- Rip and Replace. Replacing the entire legacy system with a modern, cloud-based solution. While offering a clean slate and faster time to value, it’s expensive, disruptive, and carries migration risks.

- Refactoring. Rewriting key components of the legacy system with modern languages and architectures. It’s less disruptive than rip-and-replace but requires skilled developers and can still be time-consuming.

- Encapsulation. Wrapping the legacy system with a modern API layer, allowing integration with newer applications and tools. It’s quicker and cheaper than other options but doesn’t fully address underlying limitations.

- Microservices-based Modernisation. Breaking down the legacy system into smaller, independent services that can be individually modernised over time. It offers flexibility and agility but requires careful planning and execution.

Financial Systems on the Block for Legacy Modernisation

Data Analytics Platforms. Harnessing customer data for insights and targeted offerings is vital. Legacy data warehouses often struggle with real-time data processing and advanced analytics.

CRM Systems. Effective customer interactions require integrated CRM platforms. Outdated systems might hinder communication, personalisation, and cross-selling opportunities.

Payment Processing Systems. Legacy systems might lack support for real-time secure transactions, mobile payments, and cross-border transactions.

Core Banking Systems (CBS). The central nervous system of any bank, handling account management, transactions, and loan processing. Many Asia Pacific banks rely on aging, monolithic CBS with limited digital capabilities.

Digital Banking Platforms. While several Asia Pacific banks provide basic online banking, genuine digital transformation requires mobile-first apps with features such as instant payments, personalised financial management tools, and seamless third-party service integration.

Modernising Technical Approaches and Architectures

Numerous technical factors need to be addressed during modernisation, with decisions needing to be made upfront. Questions around data migration, testing and QA, change management, data security and development methodology (agile, waterfall or hybrid) need consideration.

Best practices in legacy migration have taught some lessons.

Adopt a data fabric platform. Many organisations find that centralising all data into a single warehouse or platform rarely justifies the time and effort invested. Businesses continually generate new data, adding sources, and updating systems. Managing data where it resides might seem complex initially. However, in the mid to longer term, this approach offers clearer benefits as it reduces the likelihood of data discrepancies, obsolescence, and governance challenges.

Focus modernisation on the customer metrics and journeys that matter. Legacy modernisation need not be an all-or-nothing initiative. While systems like mainframes may require complete replacement, even some mainframe-based software can be partially modernised to enable services for external applications and processes. Assess the potential of modernising components of existing systems rather than opting for a complete overhaul of legacy applications.

Embrace the cloud and SaaS. With the growing network of hyperscaler cloud locations and data centres, there’s likely to be a solution that enables organisations to operate in the cloud while meeting data residency requirements. Even if not available now, it could align with the timeline of a multi-year legacy modernisation project. Whenever feasible, prioritise SaaS over cloud-hosted applications to streamline management, reduce overhead, and mitigate risk.

Build for customisation for local and regional needs. Many legacy applications are highly customised, leading to inflexibility, high management costs, and complexity in integration. Today, software providers advocate minimising configuration and customisation, opting for “out-of-the-box” solutions with room for localisation. The operations in different countries may require reconfiguration due to varying regulations and competitive pressures. Architecting applications to isolate these configurations simplifies system management, facilitating continuous improvement as new services are introduced by platform providers or ISV partners.

Explore the opportunity for emerging technologies. Emerging technologies, notably AI, can significantly enhance the speed and value of new systems. In the near future, AI will automate much of the work in data migration and systems integration, reducing the need for human involvement. When humans are required, low-code or no-code tools can expedite development. Private 5G services may eliminate the need for new network builds in branches or offices. AIOps and Observability can improve system uptime at lower costs. Considering these capabilities in platform decisions and understanding the ecosystem of partners and providers can accelerate modernisation journeys and deliver value faster.

Don’t Let Analysis Paralysis Slow Down Your Journey!

Yes, there are a lot of decisions that need to be made; and yes, there is much at stake if things go wrong! However, there’s a greater risk in not taking action. Maintaining a laser-focus on the customer and business outcomes that need to be achieved will help align many decisions. Keeping the customer experience as the guiding light ensures organisations are always moving in the right direction.

AI has become a business necessity today, catalysing innovation, efficiency, and growth by transforming extensive data into actionable insights, automating tasks, improving decision-making, boosting productivity, and enabling the creation of new products and services.

Generative AI stole the limelight in 2023 given its remarkable advancements and potential to automate various cognitive processes. However, now the real opportunity lies in leveraging this increased focus and attention to shine the AI lens on all business processes and capabilities. As organisations grasp the potential for productivity enhancements, accelerated operations, improved customer outcomes, and enhanced business performance, investment in AI capabilities is expected to surge.

In this eBook, Ecosystm VP Research Tim Sheedy and Vinod Bijlani and Aman Deep from HPE APAC share their insights on why it is crucial to establish tailored AI capabilities within the organisation.

“AI Guardrails” are often used as a method to not only get AI programs on track, but also as a way to accelerate AI investments. Projects and programs that fall within the guardrails should be easy to approve, govern, and manage – whereas those outside of the guardrails require further review by a governance team or approval body. The concept of guardrails is familiar to many tech businesses and are often applied in areas such as cybersecurity, digital initiatives, data analytics, governance, and management.

While guidance on implementing guardrails is common, organisations often leave the task of defining their specifics, including their components and functionalities, to their AI and data teams. To assist with this, Ecosystm has surveyed some leading AI users among our customers to get their insights on the guardrails that can provide added value.

Data Security, Governance, and Bias

- Data Assurance. Has the organisation implemented robust data collection and processing procedures to ensure data accuracy, completeness, and relevance for the purpose of the AI model? This includes addressing issues like missing values, inconsistencies, and outliers.

- Bias Analysis. Does the organisation analyse training data for potential biases – demographic, cultural and so on – that could lead to unfair or discriminatory outputs?

- Bias Mitigation. Is the organisation implementing techniques like debiasing algorithms and diverse data augmentation to mitigate bias in model training?

- Data Security. Does the organisation use strong data security measures to protect sensitive information used in training and running AI models?

- Privacy Compliance. Is the AI opportunity compliant with relevant data privacy regulations (country and industry-specific as well as international standards) when collecting, storing, and utilising data?

Model Development and Explainability

- Explainable AI. Does the model use explainable AI (XAI) techniques to understand and explain how AI models reach their decisions, fostering trust and transparency?

- Fair Algorithms. Are algorithms and models designed with fairness in mind, considering factors like equal opportunity and non-discrimination?

- Rigorous Testing. Does the organisation conduct thorough testing and validation of AI models before deployment, ensuring they perform as intended, are robust to unexpected inputs, and avoid generating harmful outputs?

AI Deployment and Monitoring

- Oversight Accountability. Has the organisation established clear roles and responsibilities for human oversight throughout the AI lifecycle, ensuring human control over critical decisions and mitigation of potential harm?

- Continuous Monitoring. Are there mechanisms to continuously monitor AI systems for performance, bias drift, and unintended consequences, addressing any issues promptly?

- Robust Safety. Can the organisation ensure AI systems are robust and safe, able to handle errors or unexpected situations without causing harm? This includes thorough testing and validation of AI models under diverse conditions before deployment.

- Transparency Disclosure. Is the organisation transparent with stakeholders about AI use, including its limitations, potential risks, and how decisions made by the system are reached?

Other AI Considerations

- Ethical Guidelines. Has the organisation developed and adhered to ethical principles for AI development and use, considering areas like privacy, fairness, accountability, and transparency?

- Legal Compliance. Has the organisation created mechanisms to stay updated on and compliant with relevant legal and regulatory frameworks governing AI development and deployment?

- Public Engagement. What mechanisms are there in place to encourage open discussion and engage with the public regarding the use of AI, addressing concerns and building trust?

- Social Responsibility. Has the organisation considered the environmental and social impact of AI systems, including energy consumption, ecological footprint, and potential societal consequences?

Implementing these guardrails requires a comprehensive approach that includes policy formulation, technical measures, and ongoing oversight. It might take a little longer to set up this capability, but in the mid to longer term, it will allow organisations to accelerate AI implementations and drive a culture of responsible AI use and deployment.

The tech industry tends to move in waves, driven by the significant, disruptive changes in technology, such as cloud and smartphones. Sometimes, it is driven by external events that bring tech buyers into sync – such as Y2K and the more recent pandemic. Some tech providers, such as SAP and Microsoft, are big enough to create their own industry waves. The two primary factors shaping the current tech landscape are AI and the consequential layoffs triggered by AI advancements.

While many of the AI startups have been around for over five years, this will be the year they emerge as legitimate solutions providers to organisations. Amidst the acceleration of AI-driven layoffs, individuals from these startups will go on to start new companies, creating the next round of startups that will add value to businesses in the future.

Tech Sourcing Strategies Need to Change

The increase in startups implies a change in the way businesses manage and source their tech solutions. Many organisations are trying to reduce tech debt, by typically consolidating the number of providers and tech platforms. However, leveraging the numerous AI capabilities may mean looking beyond current providers towards some of the many AI startups that are emerging in the region and globally.

The ripple effect of these decisions is significant. If organisations opt to enhance the complexity of their technology architecture and increase the number of vendors under management, the business case must be watertight. There will be less of the trial-and-error approach towards AI from 2023, with a heightened emphasis on clear and measurable value.

AI Startups Worth Monitoring

Here is a selection of AI startups that are already starting to make waves across Asia Pacific and the globe.

- ADVANCE.AI provides digital transformation, fraud prevention, and process automation solutions for enterprise clients. The company offers services in security and compliance, digital identity verification, and biometric solutions. They partner with over 1,000 enterprise clients across Southeast Asia and India across sectors, such as Banking, Fintech, Retail, and eCommerce.

- Megvii is a technology company based in China that specialises in AI, particularly deep learning. The company offers full-stack solutions integrating algorithms, software, hardware, and AI-empowered IoT devices. Products include facial recognition software, image recognition, and deep learning technology for applications such as consumer IoT, city IoT, and supply chain IoT.

- I’mCloud is based in South Korea and specialises in AI, big data, and cloud storage solutions. The company has become a significant player in the AI and big data industry in South Korea. They offer high-quality AI-powered chatbots, including for call centres and interactive educational services.

- H2O.ai provides an AI platform, the H2O AI Cloud, to help businesses, government entities, non-profits, and academic institutions create, deploy, monitor, and share data models or AI applications for various use cases. The platform offers automated machine learning capabilities powered by H2O-3, H2O Hydrogen Torch, and Driverless AI, and is designed to help organisations work more efficiently on their AI projects.

- Frame AI provides an AI-powered customer intelligence platform. The software analyses human interactions and uses AI to understand the driving factors of business outcomes within customer service. It aims to assist executives in making real-time decisions about the customer experience by combining data about customer interactions across various platforms, such as helpdesks, contact centres, and CRM transcripts.

- Uizard offers a rapid, AI-powered UI design tool for designing wireframes, mockups, and prototypes in minutes. The company’s mission is to democratise design and empower non-designers to build digital, interactive products. Uizard’s AI features allow users to generate UI designs from text prompts, convert hand-drawn sketches into wireframes, and transform screenshots into editable designs.

- Moveworks provides an AI platform that is designed to automate employee support. The platform helps employees to automate tasks, find information, query data, receive notifications, and create content across multiple business applications.

- Tome develops a storytelling tool designed to reduce the time required for creating slides. The company’s online platform creates or emphasises points with narration or adds interactive embeds with live data or content from anywhere on the web, 3D renderings, and prototypes.

- Jasper is an AI writing tool designed to assist in generating marketing copy, such as blog posts, product descriptions, company bios, ad copy, and social media captions. It offers features such as text and image AI generation, integration with Grammarly and other Chrome extensions, revision history, auto-save, document sharing, multi-user login, and a plagiarism checker.

- Eightfold AI provides an AI-powered Talent Intelligence Platform to help organisations recruit, retain, and grow a diverse global workforce. The platform uses AI to match the right people to the right projects, based on their skills, potential, and learning ability, enabling organisations to make informed talent decisions. They also offer solutions for diversity, equity, and inclusion (DEI), skills intelligence, and governance, among others.

- Arthur provides a centralised platform for model monitoring. The company’s platform is model and platform agnostic, and monitors machine learning models to ensure they deliver accurate, transparent, and fair results. They also offer services for explainability and bias mitigation.

- DNSFilter is a cloud-based, AI-driven content filtering and threat protection service, that can be deployed and configured within minutes, requiring no software installation.

- Spot AI specialises in building a modern AI Camera System to create safer workplaces and smarter operations for every organisation. The company’s AI Camera System combines cloud and edge computing to make video footage actionable, allowing customers to instantly surface and resolve problems. They offer intelligent video recorders, IP cameras, cloud dashboards, and advanced AI alerts to proactively deliver insights without the need to manually review video footage.

- People.ai is an AI-powered revenue intelligence platform that helps customers win more revenue by providing sales, RevOps, marketing, enablement, and customer success teams with valuable insights. The company’s platform is designed to speed up complex enterprise sales cycles by engaging the right people in the right accounts, ultimately helping teams to sell more and faster with the same headcount.

These examples highlight a few startups worth considering, but the landscape is rich with innovative options for organisations to explore. Similar to other emerging tech sectors, the AI startup market will undergo consolidation over time, and incumbent providers will continue to improve and innovate their own AI capabilities. Till then, these startups will continue to influence enterprise technology adoption and challenge established providers in the market.