Over the past year of moderating AI roundtables, I’ve had a front-row seat to how the conversation has evolved. Early discussions often centred on identifying promising use cases and grappling with the foundational work, particularly around data readiness. More recently, attention has shifted to emerging capabilities like Agentic AI and what they mean for enterprise workflows. The pace of change has been rapid, but one theme has remained consistent throughout: ROI.

What’s changed is the depth and nuance of that conversation. As AI moves from pilot projects to core business functions, the question is no longer just if it delivers value, but how to measure it in a way that captures its true impact. Traditional ROI frameworks, focused on immediate, measurable returns, are proving inadequate when applied to AI initiatives that reshape processes, unlock new capabilities, and require long-term investment.

To navigate this complexity, organisations need a more grounded, forward-looking approach that considers not only direct gains but also enablement, scalability, and strategic relevance. Getting this right is key to both validating today’s investments and setting the stage for meaningful, sustained transformation.

Here is a summary of the key thoughts around AI ROI from multiple conversations across the Asia Pacific region.

1. Redefining ROI Beyond Short-Term Wins

A common mistake when adopting AI is using traditional ROI models that expect quick, obvious wins like cutting costs or boosting revenue right away. But AI works differently. Its real value often shows up slowly, through better decision-making, greater agility, and preparing the organisation to compete long-term.

AI projects need big upfront investments in things like improving data quality, upgrading infrastructure, and managing change. These costs are clear from the start, while the bigger benefits, like smarter predictions, faster processes, and a stronger competitive edge, usually take years to really pay off and aren’t easy to measure the usual way.

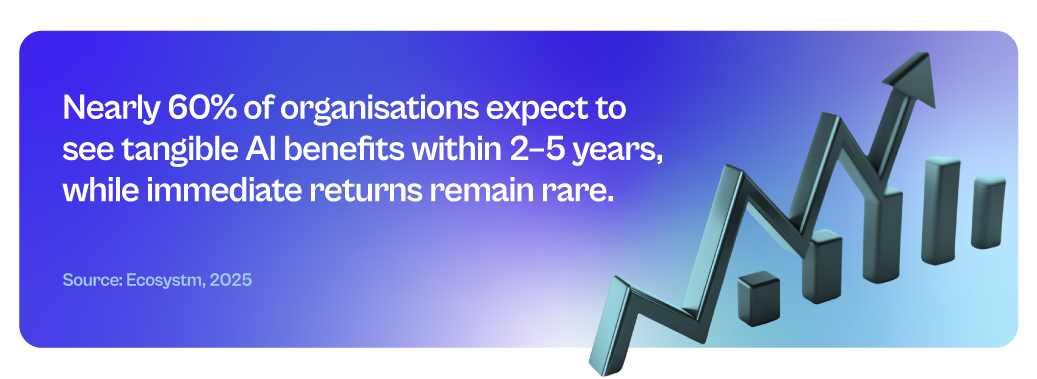

Ecosystm research finds that 60% of organisations in Asia Pacific expect to see AI ROI over two to five years, not immediately.

The most successful AI adopters get this and have started changing how they measure ROI. They look beyond just money and track things like explainability (which builds trust and helps with regulations), compliance improvements, how AI helps employees work better, and how it sparks new products or business models. These less obvious benefits are actually key to building strong, AI-ready organisations that can keep innovating and growing over time.

2. Linking AI to High-Impact KPIs: Problem First, Not Tech First

Successful AI initiatives always start with a clearly defined business problem or opportunity; not the technology itself. When a precise pain point is identified upfront, AI shifts from a vague concept to a powerful solution.

An industrial firm in Asia Pacific reduced production lead time by 40% by applying AI to optimise inspection and scheduling. This result was concrete, measurable, and directly tied to business goals.

This problem-first approach ensures every AI use case links to high-impact KPIs – whether reducing downtime, improving product quality, or boosting customer satisfaction. While this short-to-medium-term focus on results might seem at odds with the long-term ROI perspective, the two are complementary. Early wins secure executive buy-in and funding, giving AI initiatives the runway needed to mature and scale for sustained strategic impact.

Together, these perspectives build a foundation for scalable AI value that balances immediate relevance with future resilience.

3. Tracking ROI Across the Lifecycle

A costly misconception is treating pilot projects as the final success marker. While pilots validate concepts, true ROI only begins once AI is integrated into operations, scaled organisation-wide, and sustained over time.

Ecosystm research reveals that only about 32% of organisations rigorously track AI outcomes with defined success metrics; most rely on ad-hoc or incomplete measures.

To capture real value, ROI must be measured across the full AI lifecycle. This includes infrastructure upgrades needed for scaling, ongoing model maintenance (retraining and tuning), strict data governance to ensure quality and compliance, and operational support to monitor and optimise deployed AI systems.

A lifecycle perspective acknowledges the real value – and hidden costs – emerge beyond pilots, ensuring organisations understand the total cost of ownership and sustained benefits.

4. Strengthening the Foundations: Talent, Data, and Strategy

AI success hinges on strong foundations, not just models. Many projects fail due to gaps in skills, data quality, or strategic focus – directly blocking positive ROI and wasting resources.

Top organisations invest early in three pillars:

- Data Infrastructure. Reliable, scalable data pipelines and quality controls are vital. Poor data leads to delays, errors, higher costs, and compliance risks, hurting ROI.

- Skilled Talent. Cross-functional teams combining technical and domain expertise speed deployment, improve quality, reduce errors, and drive ongoing innovation – boosting ROI.

- Strategic Roadmap. Clear alignment with business goals ensures resources focus on high-impact projects, secures executive support, fosters collaboration, and enables measurable outcomes through KPIs.

Strengthening these fundamentals turns AI investments into consistent growth and competitive advantage.

5. Navigating Tool Complexity: Toward Integrated AI Lifecycle Management

One of the biggest challenges in measuring AI ROI is tool fragmentation. The AI lifecycle spans multiple stages – data preparation, model development, deployment, monitoring, and impact tracking – and organisations often rely on different tools for each. MLOps platforms track model performance, BI tools measure KPIs, and governance tools ensure compliance, but these systems rarely connect seamlessly.

This disconnect creates blind spots. Metrics sit in silos, handoffs across teams become inefficient, and linking model performance to business outcomes over time becomes manual and error prone. As AI becomes more embedded in core operations, the need for integration is becoming clear.

To close this gap, organisations are adopting unified AI lifecycle management platforms. These solutions provide a centralised view of model health, usage, and business impact, enriched with governance and collaboration features. By aligning technical and business metrics, they enable faster iteration, responsible scaling, and clearer ROI across the lifecycle.

Final Thoughts: The Cost of Inaction

Measuring AI ROI isn’t just about proving cost savings; it’s a shift in how organisations think about value. AI delivers long-term gains through better decision-making, improved compliance, more empowered employees, and the capacity to innovate continuously.

Yet too often, the cost of doing nothing is overlooked. Failing to invest in AI leads to slower adaptation, inefficient processes, and lost competitive ground. Traditional ROI models, built for short-term, linear investments, don’t account for the strategic upside of early adoption or the risks of falling behind.

That’s why leading organisations are reframing the ROI conversation. They’re looking beyond isolated productivity metrics to focus on lasting outcomes: scalable governance, adaptable talent, and future-ready business models. In a fast-evolving environment, inaction carries its own cost – one that may not appear in today’s spreadsheet but will shape tomorrow’s performance.

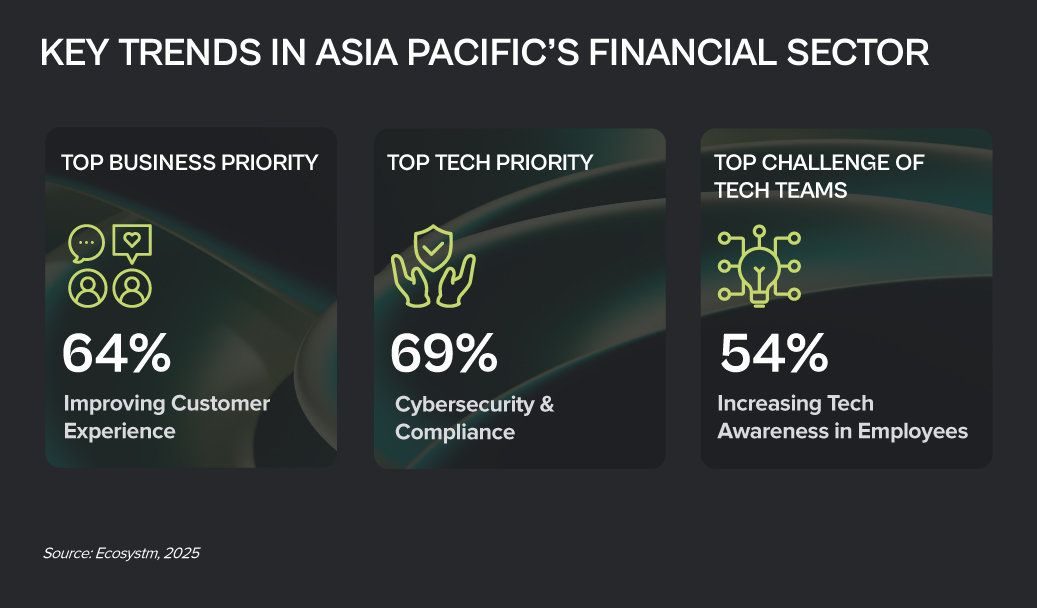

The financial services sector stands at a pivotal moment. Shaped by shifting customer expectations, fintech disruption, and rising demands for security and compliance, the industry is undergoing deep, ongoing transformation. From personalised digital engagement to AI-driven decisions and streamlined operations, BFSI is being fundamentally reshaped.

To thrive in this intelligent, interconnected future, financial organisations must embrace new strategies that turn challenges into opportunities.

Click here to download “Future Forward: Reimagining Financial Services” as a PDF.

Scaling for Impact

CreditAccess Grameen, a leading microfinance institution in India, struggled to scale its operations to meet the rising demand for microloans. Its manual processes were inefficient, causing delays and hindering its ability to serve an expanding customer base.

To overcome this, CreditAccess Grameen digitised its operations, automating processes to handle over 80,000 loans per day, streamlining loan approvals and improving operational efficiency.

This transformation significantly reduced loan processing times, from seven to ten days down to a more efficient, timely process. It also enhanced customer satisfaction, empowered financial independence, and strengthened CreditAccess Grameen’s position as a leader in financial inclusion, driving economic growth in rural India.

Seamless Operations, Improved Reporting

After merging three separate funds, Aware Super, one of Australia’s largest superannuation funds, faced fragmented operations, inconsistent documentation, and poor visibility into workflows. These inefficiencies hampered the organisation’s ability to optimise operations, ensure compliance, and deliver a seamless member experience.

To overcome this, Aware Super implemented a business process management suite to standardise and automate key processes, providing a unified platform for continuous improvement.

The transformation streamlined operations across all funds, improving reporting accuracy, reducing waste, and boosting procurement efficiency. The creation of a Centre of Excellence fostered a culture of ongoing process improvement and regulatory compliance, elevating Aware Super’s process maturity and solidifying its leadership in the financial services sector.

Empowering Employees and Improving Operations

The Norinchukin Bank, a major financial institution serving Japan’s agriculture, forestry, and fisheries sectors, struggled with outdated, paper-based processes and disconnected systems. Manual approvals and repetitive data entry were hindering operations and frustrating staff.

The digital team implemented a low-code platform that quickly automated approvals, integrated siloed systems, and streamlined processes into a single, efficient workflow.

The results were striking: approval times dropped, development cycles halved, and implementation costs fell by 30% compared to legacy upgrades. Employees gained real-time visibility over requests, cutting errors and speeding decisions. Crucially, the shift sparked a wave of digital adoption, with teams across the bank now embracing automation to drive further efficiency.

Eliminating Handoffs, Elevating Experience

Axis Bank, one of India’s largest private sector banks, struggled with slow, manual corporate onboarding processes, which hindered efficiency and customer satisfaction. The bank sought to streamline this process to keep up with growing demand for faster, digital services.

The bank implemented a robust API management solution, automating document handling and onboarding tasks, enabling a fully digital and seamless corporate client experience.

This transformation reduced corporate onboarding time by over 50%, eliminated manual handoffs, and enabled real-time monitoring of API performance, resulting in faster service delivery. As a result, Axis Bank saw a significant increase in customer satisfaction, a surge in API traffic, and a deeper, more loyal corporate client base.

Taming Latency, Unleashing Bandwidth

WebSpace, renowned for its in-store payment systems, faced challenges as it expanded to wholesalers. The migration to a new architecture required low-latency cloud connectivity, but its legacy network, relying on hardware routers, caused performance slowdowns, complexity, and high costs.

WebSpace adopted a cloud-based routing solution, replacing physical routers with a virtual, automated system for multicloud connectivity, enabling on-demand configuration changes from a central control point.

With the new solution, WebSpace achieved faster cloud connectivity, reducing latency and increasing bandwidth. The modern, agile network reduced management costs and complexity, while usage-based billing ensured that WebSpace only paid for the resources it used, supporting its strategic expansion and enhancing overall efficiency.

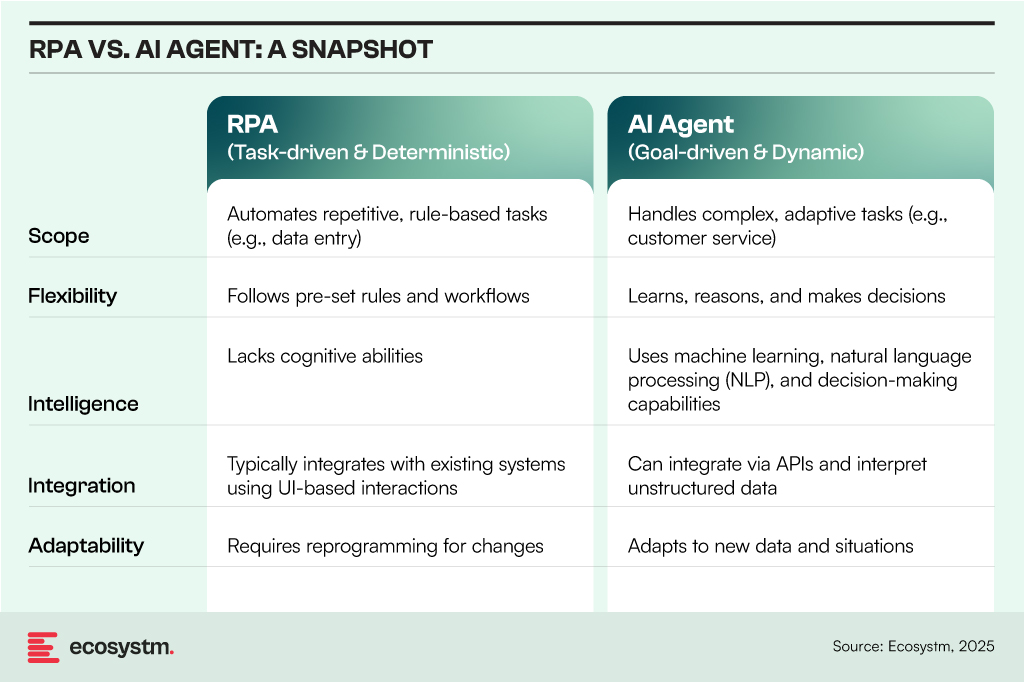

The promise of AI agents – intelligent programs or systems that autonomously perform tasks on behalf of people or systems – is enormous. These systems will augment and replace human workers, offering intelligence far beyond the simple RPA (Robotic Process Automation) bots that have become commonplace in recent years.

RPA and AI Agents both automate tasks but differ in scope, flexibility, and intelligence:

7 Lessons for AI Agents: Insights from RPA Deployments

However, in many ways, RPA and AI agents are similar – they both address similar challenges, albeit with different levels of automation and complexity. RPA adoption has shown that uncontrolled deployment leads to chaos, requiring a balance of governance, standardisation, and ongoing monitoring. The same principles apply to AI agent management, but with greater complexity due to AI’s dynamic and learning-based nature.

By learning from RPA’s mistakes, organisations can ensure AI agents deliver sustainable value, remain secure, and operate efficiently within a governed and well-managed environment.

#1 Controlling Sprawl with Centralised Governance

A key lesson from RPA adoption is that many organisations deployed RPA bots without a clear strategy, resulting in uncontrolled sprawl, duplicate bots, and fragmented automation efforts. This lack of oversight led to the rise of shadow IT practices, where business units created their own bots without proper IT involvement, further complicating the automation landscape and reducing overall effectiveness.

Application to AI Agents:

- Establish centralised governance early, ensuring alignment between IT and business units.

- Implement AI agent registries to track deployments, functions, and ownership.

- Enforce consistent policies for AI deployment, access, and version control.

#2 Standardising Development and Deployment

Bot development varied across teams, with different toolsets being used by different departments. This often led to poorly documented scripts, inconsistent programming standards, and difficulties in maintaining bots. Additionally, rework and inefficiencies arose as teams developed redundant bots, further complicating the automation process and reducing overall effectiveness.

Application to AI Agents:

- Standardise frameworks for AI agent development (e.g., predefined APIs, templates, and design patterns).

- Use shared models and foundational capabilities instead of building AI agents from scratch for each use case.

- Implement code repositories and CI/CD pipelines for AI agents to ensure consistency and controlled updates.

#3 Balancing Citizen Development with IT Control

Business users, or citizen developers, created RPA bots without adhering to IT best practices, resulting in security risks, inefficiencies, and technical debt. As a result, IT teams faced challenges in tracking and supporting business-driven automation efforts, leading to a lack of oversight and increased complexity in maintaining these bots.

Application to AI Agents:

- Empower business users to build and customise AI agents but within controlled environments (e.g., low-code/no-code platforms with governance layers).

- Implement AI sandboxes where experimentation is allowed but requires approval before production deployment.

- Establish clear roles and responsibilities between IT, AI governance teams, and business users.

#4 Proactive Monitoring and Maintenance

Organisations often underestimated the effort required to maintain RPA bots, resulting in failures when process changes, system updates, or API modifications occurred. As a result, bots frequently stopped working without warning, disrupting business processes and leading to unanticipated downtime and inefficiencies. This lack of ongoing maintenance and adaptation to evolving systems contributed to significant operational disruptions.

Application to AI Agents:

- Implement continuous monitoring and logging for AI agent activities and outputs.

- Develop automated retraining and feedback loops for AI models to prevent performance degradation.

- Create AI observability dashboards to track usage, drift, errors, and security incidents.

#5 Security, Compliance, and Ethical Considerations

Insufficient security measures led to data leaks and access control issues, with bots operating under overly permissive settings. Also, a lack of proactive compliance planning resulted in serious regulatory concerns, particularly within industries subject to stringent oversight, highlighting the critical need for integrating security and compliance considerations from the outset of automation deployments.

Application to AI Agents:

- Enforce role-based access control (RBAC) and least privilege access to ensure secure and controlled usage.

- Integrate explainability and auditability features to comply with regulations like GDPR and emerging AI legislation.

- Develop an AI ethics framework to address bias, ensure decision-making transparency, and uphold accountability.

#6 Cost Management and ROI Measurement

Initial excitement led to unchecked RPA investments, but many organisations struggled to measure the ROI of bots. As a result, some RPA bots became cost centres, with high maintenance costs outweighing the benefits they initially provided. This lack of clear ROI often hindered organisations from realising the full potential of their automation efforts.

Application to AI Agents:

- Define success metrics for AI agents upfront, tracking impact on productivity, cost savings, and user experience.

- Use AI workload optimisation tools to manage computing costs and avoid overconsumption of resources.

- Regularly review AI agents’ utility and retire underperforming ones to avoid AI bloat.

#7 Human Oversight and Hybrid Workflows

The assumption that bots could fully replace humans led to failures in situations where exceptions, judgment, or complex decision-making were necessary. Bots struggled to handle scenarios that required nuanced thinking or flexibility, often leading to errors or inefficiencies. The most successful implementations, however, blended human and bot collaboration, leveraging the strengths of both to optimise processes and ensure that tasks were handled effectively and accurately.

Application to AI Agents:

- Integrate AI agents into human-in-the-loop (HITL) systems, allowing humans to provide oversight and validate critical decisions.

- Establish AI escalation paths for situations where agents encounter ambiguity or ethical concerns.

- Design AI agents to augment human capabilities, rather than fully replace roles.

The lessons learned from RPA’s journey provide valuable insights for navigating the complexities of AI agent deployment. By addressing governance, standardisation, and ethical considerations, organisations

can shift from reactive problem-solving to a more strategic approach, ensuring AI tools deliver value while operating within a responsible, secure, and efficient framework.

Operations leaders are on the front lines of the AI revolution. They see the transformative potential of AI and are actively driving its adoption to streamline processes, boost efficiency, and unlock new levels of performance. The value is clear: AI is no longer a futuristic concept, but a present-day necessity.

Over the past two years, Ecosystm’s research – including surveys and deep dives with business and tech leaders has confirmed this: AI is the dominant theme.

Here are some insights for Operations Leaders from our research.

Click here to download “AI Stakeholders: The Operations Perspective” as a PDF

From Streamlined Workflows to Smarter Decisions

AI is already making a tangible difference in operations. A significant 60% of operations leaders are currently leveraging AI for intelligent document processing, freeing up valuable time and resources. But this is just the beginning. The vision extends far beyond, with plans to expand AI’s reach into crucial areas like workflow analysis, fraud detection, and streamlining risk and compliance processes. Imagine AI optimising transportation routes in real-time, predicting equipment maintenance needs before they arise, or automating complex scheduling tasks. This is the operational reality AI is creating.

Real-World Impact, Real-World Examples

The impact of AI is not just theoretical. Operations leaders are witnessing firsthand how AI is driving tangible improvements. “With AI-powered vision and sensors, we’ve boosted efficiency, accuracy, and safety in our manufacturing processes,” shares one leader. Others highlight the security benefits: “From fraud detection to claims processing, AI is safeguarding our transactions and improving trust in our services.” Even complex logistical challenges are being conquered: “Our AI-driven logistics solution has cut costs, saved time, and turned complex operations into seamless processes.” These real-world examples showcase the power of AI to deliver concrete results across diverse operational functions.

Operations Takes a Seat at the AI Strategy Table (But Faces Challenges)

With 54% of organisations prioritising cost savings from AI, operations leaders are rightfully taking a seat at the AI strategy table, shaping use cases and driving adoption. A remarkable 56% of operations leaders are actively involved in defining high-value AI applications. However, a disconnect exists. Despite their influence on AI strategy, only a small fraction (7%) of operations leaders have direct data governance responsibilities. This lack of control over the very fuel that powers AI – data – creates a significant hurdle.

Further challenges include data access across siloed systems, limiting the ability to gain a holistic view, difficulty in identifying and prioritising the most impactful AI use cases, and persistent skills shortages. These barriers, while significant, are not deterring operations leaders.

The Future is AI-Driven

Despite these challenges, operations leaders are doubling down on AI. A striking 7 out of 10 plan to prioritise AI investments in 2025, driven by the pursuit of greater cost savings. And the biggest data effort on the horizon? Identifying and prioritising better use cases for AI. This focus on practical applications demonstrates a clear understanding: the future of operations is inextricably linked to the power of AI. By addressing the challenges they face and focusing on strategic implementation, operations leaders are poised to unlock the full potential of AI and transform their organisations.

The Asia Pacific region is rapidly emerging as a global economic powerhouse, with AI playing a key role in driving this growth. The AI market in the region is projected to reach USD 244B by 2025, and organisations must adapt and scale AI effectively to thrive. The question is no longer whether to adopt AI, but how to do so responsibly and effectively for long-term success.

The APAC AI Outlook 2025 highlights how Asia Pacific enterprises are moving beyond experimentation to maximise the impact of their AI investments.

Here are 5 key trends that will impact the AI landscape in 2025.

Click here to download “The Future of AI-Powered Business: 5 Trends to Watch” as a PDF.

1. Strategic AI Deployment

AI is no longer a buzzword, but Asia Pacific’s transformation engine. It’s reshaping industries and fuelling growth. Initially, high costs and complex ROI pushed leaders toward quick wins. Now, the game has changed. As AI adoption matures, the focus is shifting from short-term gains to long-term, innovation-driven strategies.

GenAI is is at the heart of this shift, moving beyond the periphery to power core business functions and deliver competitive advantage.

Organisations are rethinking AI investments, looking beyond pure financials to consider the impact on jobs, governance, and data readiness. The AI journey is about balancing ambition with practicality.

2. Optimising AI: Tailored Open-Source Models

Smaller, open-source, and specialised AI models will gain momentum as organisations seek efficiency, flexibility, and sustainability in their AI strategies.

Unlike LLMs, which require high computational power, smaller, task-specific models offer comparable performance while being more resource-efficient. This makes them ideal for organisations working with proprietary data or limited computational resources.

Beyond cost and performance, these models are more energy-efficient, addressing growing concerns about AI’s environmental impact.

3. Centralised Tools for Responsible Innovation

Navigating the increasingly complex AI landscape demands unified management and governance. Organisations will prioritise centralised frameworks to tame the chaos of diverse AI solutions, ensuring compliance (think EU AI Act) while boosting transparency and security.

Automated AI lifecycle management tools will streamline oversight, providing real-time tracking of model performance, usage, and issues like drift.

By using flexible developer toolkits and vendor-agnostic strategies, organisations can accelerate innovation while maintaining adaptability, as the technology evolves.

4. Supercharging Workflows With Agentic AI

Organisations will embrace Agentic AI to automate complex workflows and drive business value. Traditional automation tools struggle with real-world dynamism, but AI-powered agents offer a flexible solution. They empower autonomous task execution, intelligent decision-making, and adaptability to changing circumstances.

These agents, often using GenAI, understand complex instructions and learn from experience. They collaborate with humans, boosting efficiency, and adapt to disruptions, unlike rigid traditional automation.

Agentic workflows are key to redefining work, enabling agility and innovation.

5. From Productivity to People

The focus of AI conversations will shift from simply boosting productivity to using AI for human-centric innovation that transforms both employee roles and customer experiences.

For employees, AI will handle routine tasks, enabling them to focus on creativity and innovation. Education and training will be crucial for a smooth transition to AI-powered workflows.

For customers, AI is evolving to offer more empathetic, personalised interactions by understanding individual emotions, motivations, and preferences. Organisations are recognising the need for transparent, explainable AI to build trust, tailor solutions, and deepen engagement.

Hit or miss AI experiments have leaders demanding results. In this breakneck AI landscape, strategy and realism are your survival tools. A pragmatic approach? High-impact, achievable goals. Know your capabilities, prioritise manageable projects, and stay flexible. The AI winners will be those who champion human-AI collaboration, bake in ethics, and never stop researching.

Cybersecurity is essential to every organisation’s resilience, yet it often fails to resonate with business leaders focused on growth, innovation, and customer satisfaction. The challenge lies in connecting cybersecurity with these strategic goals. To bridge this gap, it is important to shift from a purely technical view of cybersecurity to one that aligns directly with business objectives.

Here are 5 impactful strategies to make cybersecurity relevant and valuable at the executive level.

1. Elevate Cybersecurity as a Pillar of Business Continuity

Cybersecurity is not just a defensive strategy; it is a proactive investment in business continuity and success. Leaders who see cybersecurity as foundational to business continuity protect more than just digital assets – they safeguard brand reputation, customer trust, and operational resilience. By framing cybersecurity as essential to keeping the business running smoothly, leaders can shift the focus from reactive problem-solving to proactive resilience planning.

For example, rather than viewing cybersecurity incidents as isolated IT issues, organisations should see them as risks that could disrupt critical business functions, halt operations, and destroy customer loyalty. By integrating cybersecurity into continuity planning, executives can ensure that security aligns with growth and operational stability, reinforcing the organisation’s ability to adapt and thrive in a constantly evolving threat landscape.

2. Translate Cyber Risks into Business-Relevant Insights

To make cybersecurity resonate with business leaders, technical risks need to be expressed in terms that directly impact the organisation’s strategic goals. Executives are more likely to respond to cybersecurity concerns when they understand the financial, reputational, or operational impacts of cyber threats. Reframing cybersecurity risks into clear, business-oriented language that highlights potential disruptions, regulatory implications, and costs helps leadership see cybersecurity as part of broader risk management.

For instance, rather than discussing a “data breach vulnerability”, frame it as a “threat to customer trust and a potential multi-million-dollar regulatory liability”. This approach contextualises cyber risks in terms of real-world consequences, helping leadership to recognise that cybersecurity investments are risk mitigations that protect revenue, brand equity, and shareholder value.

3. Build Cybersecurity into the DNA of Innovation and Product Development

Cybersecurity must be a foundational element in the innovation process, not an afterthought. When security is integrated from the early stages of product development – known as “shifting left” – organisations can reduce vulnerabilities, build customer trust, and avoid costly fixes post-launch. This approach helps businesses to innovate with confidence, knowing that new products and services meet both customer expectations and regulatory requirements.

By embedding security in every phase of the development lifecycle, leaders demonstrate that cybersecurity is essential to sustainable innovation. This shift also empowers product teams to create solutions that are both user-friendly and secure, balancing customer experience with risk management. When security is seen as an enabler rather than an obstacle to innovation, it becomes a powerful differentiator that supports growth.

4. Foster a Culture of Shared Responsibility and Continuous Learning

The most robust cybersecurity strategies extend beyond the IT department, involving everyone in the organisation. Creating a culture where cybersecurity is everyone’s responsibility ensures that each employee – from the front lines to the boardroom – understands their role in protecting the organisation. This culture is built through continuous education, regular simulations, and immersive training that makes cybersecurity practical and engaging.

Awareness initiatives, such as cyber escape rooms and live demonstrations of common attacks, can be powerful tools to engage employees. Instead of passive training, these methods make cybersecurity tangible, showing employees how their actions impact the organisation’s security posture. By treating cybersecurity as an organisation-wide effort, leaders build a proactive culture that treats security not as an obligation but as an integral part of the business mission.

5. Leverage Industry Partnerships and Regulatory Compliance for a Competitive Edge

As regulations around cybersecurity tighten, especially for critical sectors like finance and infrastructure, compliance is becoming a competitive advantage. By proactively meeting and exceeding regulatory standards, organisations can position themselves as trusted, compliant partners for clients and customers. Additionally, building partnerships across the public and private sectors offers access to shared knowledge, best practices, and support systems that strengthen organisational security.

Leaders who engage with regulatory requirements and industry partnerships not only stay ahead of compliance but also benefit from a network of resources that can enhance their cybersecurity strategies. Proactive compliance, combined with strategic partnerships, strengthens organisational resilience and builds market trust. In doing so, cybersecurity becomes more than a safeguard; it’s an asset that supports brand credibility, customer loyalty, and competitive differentiation.

Conclusion

For cybersecurity to be truly effective, it must be woven into the fabric of an organisation’s mission and strategy. By reframing cybersecurity as a foundational aspect of business continuity, expressing cyber risks in business language, embedding security in innovation, building a culture of shared responsibility, and leveraging compliance as an advantage, leaders can transform cybersecurity from a technical concern to a strategic asset. In an age where digital threats are increasingly complex, aligning cybersecurity with business priorities is essential for sustainable growth, customer trust, and long-term resilience.

The global data protection landscape is growing increasingly complex. With the proliferation of privacy laws across jurisdictions, organisations face a daunting challenge in ensuring compliance.

From the foundational GDPR, the evolving US state-level regulations, to new regulations in emerging markets, businesses with cross-border presence must navigate a maze of requirements to protect consumer data. This complexity, coupled with the rapid pace of regulatory change, requires proactive and strategic approaches to data management and protection.

GDPR: The Catalyst for Global Data Privacy

At the forefront of this global push for data privacy stands the General Data Protection Regulation (GDPR) – a landmark legislation that has reshaped data governance both within the EU and beyond. It has become a de facto standard for data management, influencing the creation of similar laws in countries like India, China, and regions such as Southeast Asia and the US.

However, the GDPR is evolving to tackle new challenges and incorporate lessons from past data breaches. Amendments aim to enhance enforcement, especially in cross-border cases, expedite complaint handling, and strengthen breach penalties. Amendments to the GDPR in 2024 focus on improving enforcement efficiency. The One-Stop-Shop mechanism will be strengthened for better handling of cross-border data processing, with clearer guidelines for lead supervisory authority and faster information sharing. Deadlines for cross-border decisions will be shortened, and Data Protection Authorities (DPAs) must cooperate more closely. Rules for data transfers to third countries will be clarified, and DPAs will have stronger enforcement powers, including higher fines for non-compliance.

For organisations, these changes mean increased scrutiny and potential penalties due to faster investigations. Improved DPA cooperation can lead to more consistent enforcement across the EU, making it crucial to stay updated and adjust data protection practices. While aiming for more efficient GDPR enforcement, these changes may also increase compliance costs.

GDPR’s Global Impact: Shaping Data Privacy Laws Worldwide

Despite being drafted by the EU, the GDPR has global implications, influencing data privacy laws worldwide, including in Canada and the US.

Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA) governs how the private sector handles personal data, emphasising data minimisation and imposing fines of up to USD 75,000 for non-compliance.

The US data protection landscape is a patchwork of state laws influenced by the GDPR and PIPEDA. The California Privacy Rights Act (CPRA) and other state laws like Virginia’s CDPA and Colorado’s CPA reflect GDPR principles, requiring transparency and limiting data use. Proposed federal legislation, such as the American Data Privacy and Protection Act (ADPPA), aims to establish a national standard similar to PIPEDA.

The GDPR’s impact extends beyond EU borders, significantly influencing data protection laws in non-EU European countries. Countries like Switzerland, Norway, and Iceland have closely aligned their regulations with GDPR to maintain data flows with the EU. Switzerland, for instance, revised its Federal Data Protection Act to ensure compatibility with GDPR standards. The UK, post-Brexit, retained a modified version of GDPR in its domestic law through the UK GDPR and Data Protection Act 2018. Even countries like Serbia and North Macedonia, aspiring for EU membership, have modeled their data protection laws on GDPR principles.

Data Privacy: A Local Flavour in Emerging Markets

Emerging markets are recognising the critical need for robust data protection frameworks. These countries are not just following in the footsteps of established regulations but are creating laws that address their unique economic and cultural contexts while aligning with global standards.

Brazil has over 140 million internet users – the 4th largest in the world. Any data collection or processing within the country is protected by the Lei Geral de Proteção de Dados (or LGPD), even from data processors located outside of Brazil. The LGPD also mandates organisations to appoint a Data Protection Officer (DPO) and establishes the National Data Protection Authority (ANPD) to oversee compliance and enforcement.

Saudi Arabia’s Personal Data Protection Law (PDPL) requires explicit consent for data collection and use, aligning with global norms. However, it is tailored to support Saudi Arabia’s digital transformation goals. The PDPL is overseen by the Saudi Data and Artificial Intelligence Authority (SDAIA), linking data protection with the country’s broader AI and digital innovation initiatives.

Closer Home: Changes in Asia Pacific Regulations

The Asia Pacific region is experiencing a surge in data privacy regulations as countries strive to protect consumer rights and align with global standards.

Japan. Japan’s Act on the Protection of Personal Information (APPI) is set for a major overhaul in 2025. Certified organisations will have more time to report data breaches, while personal data might be used for AI training without consent. Enhanced data rights are also being considered, giving individuals greater control over biometric and children’s data. The government is still contemplating the introduction of administrative fines and collective action rights, though businesses have expressed concerns about potential negative impacts.

South Korea. South Korea has strengthened its data protection laws with significant amendments to the Personal Information Protection Act (PIPA), aiming to provide stronger safeguards for individual personal data. Key changes include stricter consent requirements, mandatory breach notifications within 72 hours, expanded data subject rights, refined data processing guidelines, and robust safeguards for emerging technologies like AI and IoT. There are also increased penalties for non-compliance.

China. China’s Personal Information Protection Law (PIPL) imposes stringent data privacy controls, emphasising user consent, data minimisation, and restricted cross-border data transfers. Severe penalties underscore the nation’s determination to safeguard personal information.

Southeast Asia. Southeast Asian countries are actively enhancing their data privacy landscapes. Singapore’s PDPA mandates breach notifications and increased fines. Malaysia is overhauling its data protection law, while Thailand’s PDPA has also recently come into effect.

Spotlight: India’s DPDP Act

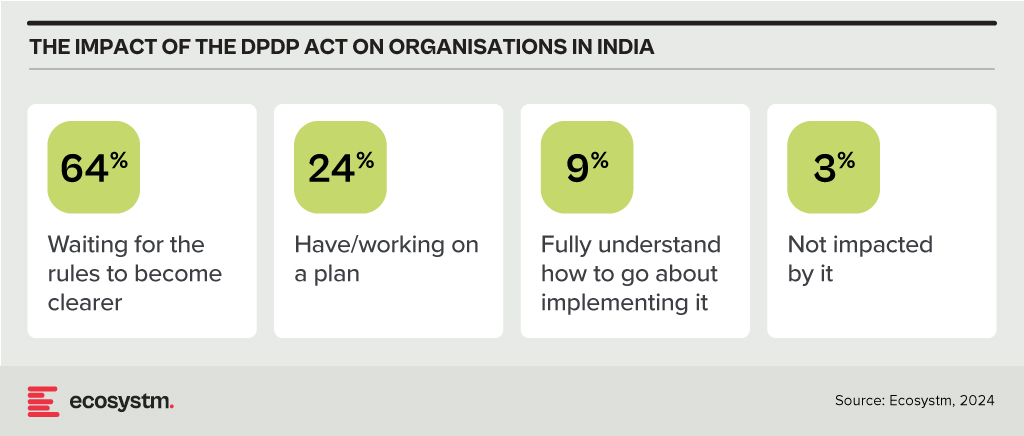

The Digital Personal Data Protection Act, 2023 (DPDP Act), officially notified about a year ago, is anticipated to come into effect soon. This principles-based legislation shares similarities with the GDPR and applies to personal data that identifies individuals, whether collected digitally or digitised later. It excludes data used for personal or domestic purposes, aggregated research data, and publicly available information. The Act adopts GDPR-like territorial rules but does not extend to entities outside India that monitor behaviour within the country.

Consent under the DPDP Act must be free, informed, and specific, with companies required to provide a clear and itemised notice. Unlike the GDPR, the Act permits processing without consent for certain legitimate uses, such as legal obligations or emergencies. It also categorises data fiduciaries based on the volume and sensitivity of the data they handle, imposing additional obligations on significant data fiduciaries while offering exemptions for smaller entities. The Act simplifies cross-border data transfers compared to the GDPR, allowing transfers to all countries unless restricted by the Indian Government. It also provides broad exemptions to the State for data processing under specific conditions. Penalties for breaches are turnover agnostic, with considerations for breach severity and mitigating actions. The full impact of the DPDP Act will be clearer once the rules are finalised and the Board becomes operational, but 97% of Indian organisations acknowledge that it will affect them.

Conclusion

Data breaches pose significant risks to organisations, requiring a strong data protection strategy that combines technology and best practices. Key technological safeguards include encryption, identity access management (IAM), firewalls, data loss prevention (DLP) tools, tokenisation, and endpoint protection platforms (EPP). Along with technology, organisations should adopt best practices such as inventorying and classifying data, minimising data collection, maintaining transparency with customers, providing choices, and developing comprehensive privacy policies. Training employees and designing privacy-focused processes are also essential. By integrating robust technology with informed human practices, organisations can enhance their overall data protection strategy.

At the Nutanix .NEXT 2024 event in Barcelona, it became clear that the discourse around cloud computing has evolved significantly. The debate that once polarised organisations over whether on-prem/co-located data centres or public cloud was better has been decisively settled. Both cloud providers and on-prem equipment providers are thriving, as evident from their earnings reports.

Hybrid cloud has emerged as the clear victor, offering the flexibility and control that organisations demand. This shift is particularly relevant for tech buyers in the Asia Pacific region, where diverse market maturities and unique business challenges require a more adaptable approach to IT infrastructure.

The Hybrid Cloud Advantage

Hybrid cloud architecture combines the best of both worlds. It provides the scalability and agility of public cloud services while retaining the control and security of on-prem systems. For Asia Pacific organisations, that often operate across various regulatory environments and face unique data sovereignty issues, this dual capability is invaluable. The ability to seamlessly move workloads between on-prem, private cloud, and public cloud environments enables enterprises to optimise their IT strategies, balancing cost, performance, and compliance.

Market Maturity and Adoption in Asia Pacific

The region shows a wide spectrum of technological maturity among its markets. Countries like Australia, Japan, and Singapore lead with advanced cloud adoption and robust IT infrastructures, while emerging markets such as Vietnam, Indonesia, and the Philippines are still in the nascent stages of cloud integration.

However, regardless of their current maturity levels, organisations in Asia Pacific are recognising the benefits of a hybrid cloud approach. Mature markets are leveraging hybrid cloud to refine their IT strategies, focusing on enhancing business agility and driving innovation.

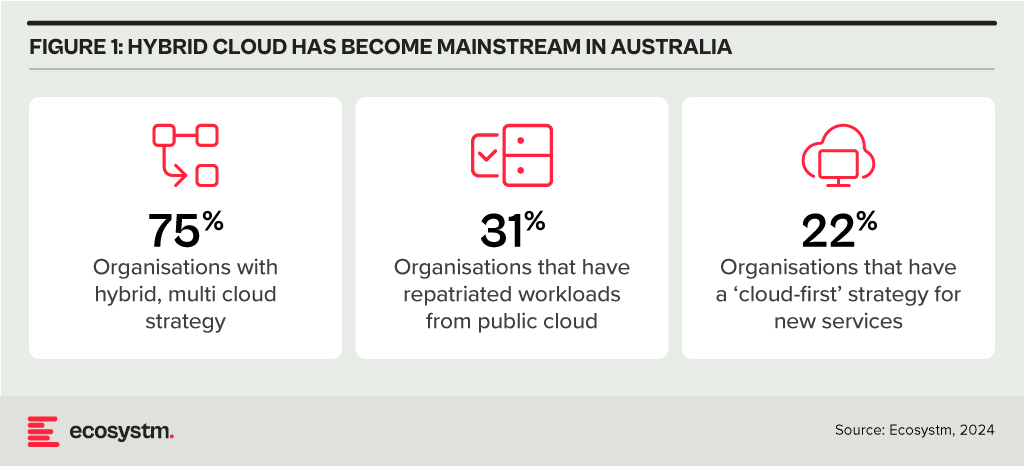

Ecosystm research shows that 75% of organisations in Australia have a hybrid, multi-cloud strategy. Over 30% of organisations have repatriated workloads from the public cloud, and only 22% employ a “cloud first” strategy when deploying new services.

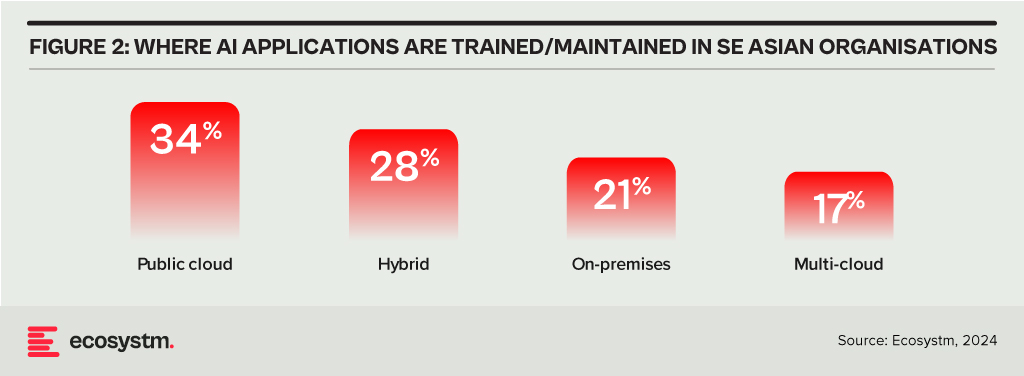

Meanwhile, emerging markets see hybrid cloud as a pathway to accelerate their digital transformation journeys without the need for extensive upfront investments in on-prem infrastructure. Again, Ecosystm data shows that when it comes to training large AI models and applications, organisations across Southeast Asia use a mix of public, private, hybrid, and multi-cloud environments.

Strategic Flexibility Without Compromise

One of the most compelling messages from the Nutanix .NEXT 2024 event is that hybrid cloud eliminates the need for compromise when deciding where to place workloads – and that is what the data above represents. The location of the workload is no longer a limiting factor. Being “cloud first” locks organisations into a tech provider, whereas agility was once exclusively in favour of public cloud providers. Whether it’s for performance optimisation, cost efficiency, or regulatory compliance, tech leaders can now choose the best environment for every workload without being constrained by location.

For example, an organisation might keep sensitive customer data within a private cloud to comply with local data protection laws while leveraging public cloud resources for less sensitive applications to take advantage of its scalability and cost benefits. I recently spoke to an organisation in the gaming space that had 5 different regulatory bodies to appease – which required data to be stored in 5 different locations! This strategic flexibility ensures that IT investments are fully aligned with business objectives, enhancing overall operational efficiency.

Moving Forward: Actionable Insights for Asia Pacific Tech Leaders

To fully capitalise on the hybrid cloud revolution, APAC tech leaders should:

- Assess Workload Requirements. Evaluate the specific needs of each workload to determine the optimal environment, considering factors like latency, security, and compliance.

- Invest in Integration Tools. Ensure seamless interoperability between on-premises and cloud environments by investing in advanced integration and management tools.

- Focus on Skill Development. Equip IT teams with the necessary skills to manage hybrid cloud infrastructures, emphasising continuous learning and certification.

- Embrace a Multi-Cloud Strategy. Consider a multi-cloud approach within the hybrid model to avoid vendor lock-in and enhance resilience.

Conclusion

The hybrid cloud has definitively won the battle for enterprise IT infrastructure, particularly in the diverse Asia Pacific region. By enabling organisations to place their workloads wherever they make the most sense without compromising on performance, security, or compliance, hybrid cloud empowers tech leaders to drive their digital transformation agendas forward with confidence. Based on everything we know today*, the future of cloud is hybrid. Reform your sourcing practices to put business needs, not cloud service providers or data centres, at the centre of your data decisions.

*In this fast-changing world, it seems naïve to make sweeping statements about the future of technology!

AI tools have become a game-changer for the technology industry, enhancing developer productivity and software quality. Leveraging advanced machine learning models and natural language processing, these tools offer a wide range of capabilities, from code completion to generating entire blocks of code, significantly reducing the cognitive load on developers. AI-powered tools not only accelerate the coding process but also ensure higher code quality and consistency, aligning seamlessly with modern development practices. Organisations are reaping the benefits of these tools, which have transformed the software development lifecycle.

Impact on Developer Productivity

AI tools are becoming an indispensable part of software development owing to their:

- Speed and Efficiency. AI-powered tools provide real-time code suggestions, which dramatically reduces the time developers spend writing boilerplate code and debugging. For example, Tabnine can suggest complete blocks of code based on the comments or a partial code snippet, which accelerates the development process.

- Quality and Accuracy. By analysing vast datasets of code, AI tools can offer not only syntactically correct but also contextually appropriate code suggestions. This capability reduces bugs and improves the overall quality of the software.

- Learning and Collaboration. AI tools also serve as learning aids for developers by exposing them to new or better coding practices and patterns. Novice developers, in particular, can benefit from real-time feedback and examples, accelerating their professional growth. These tools can also help maintain consistency in coding standards across teams, fostering better collaboration.

Advantages of Using AI Tools in Development

- Reduced Time to Market. Faster coding and debugging directly contribute to shorter development cycles, enabling organisations to launch products faster. This reduction in time to market is crucial in today’s competitive business environment where speed often translates to a significant market advantage.

- Cost Efficiency. While there is an upfront cost in integrating these AI tools, the overall return on investment (ROI) is enhanced through the reduced need for extensive manual code reviews, decreased dependency on large development teams, and lower maintenance costs due to improved code quality.

- Scalability and Adaptability. AI tools learn and adapt over time, becoming more efficient and aligned with specific team or project needs. This adaptability ensures that the tools remain effective as the complexity of projects increases or as new technologies emerge.

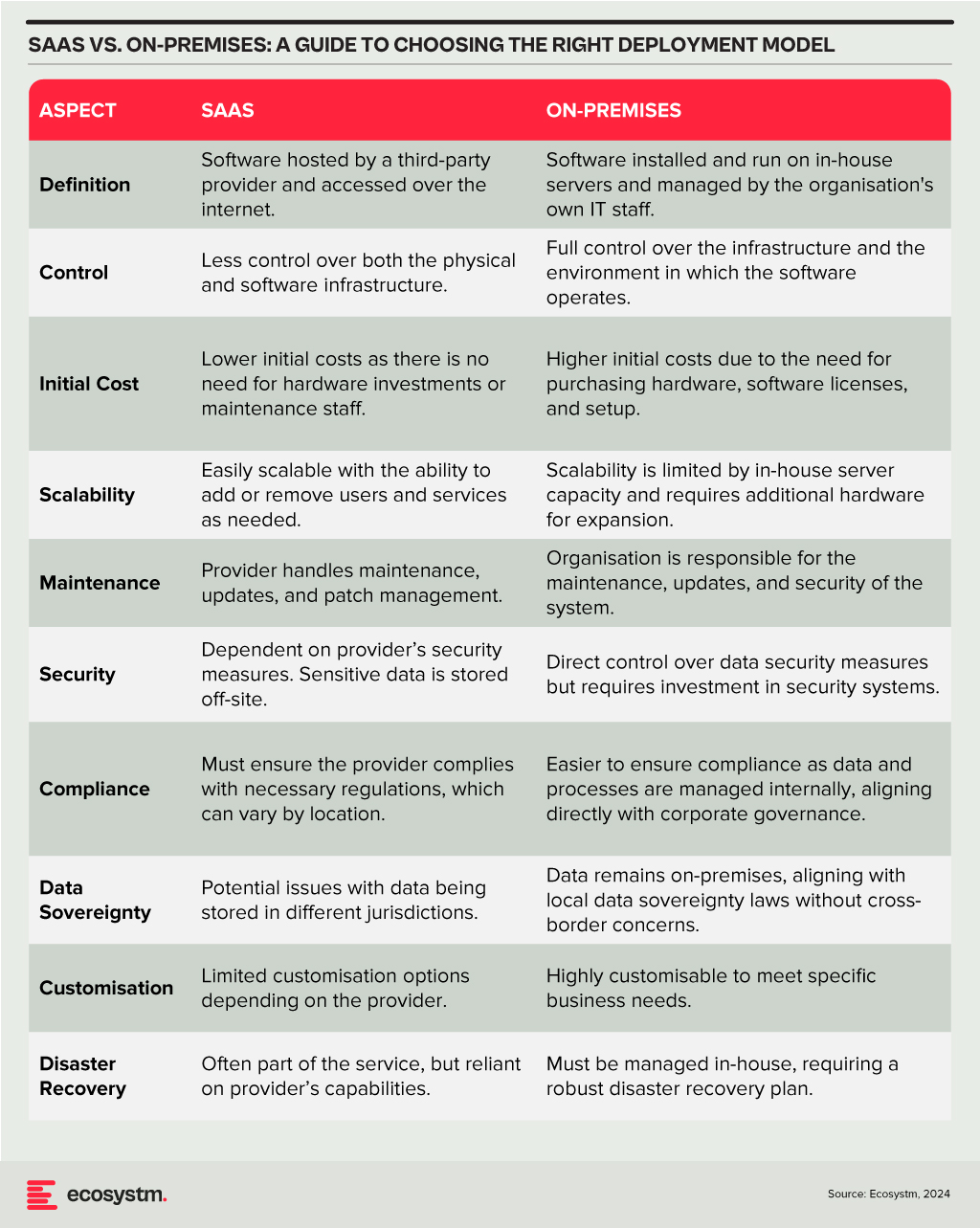

Deployment Models

The choice between SaaS and on-premises deployment models involves a trade-off between control, cost, and flexibility. Organisations need to consider their specific requirements, including the level of control desired over the infrastructure, sensitivity of the data, compliance needs, and available IT resources. A thorough assessment will guide the decision, ensuring that the deployment model chosen aligns with the organisation’s operational objectives and strategic goals.

Technology teams must consider challenges such as the reliability of generated code, the potential for generating biased or insecure code, and the dependency on external APIs or services. Proper oversight, regular evaluations, and a balanced integration of AI tools with human oversight are recommended to mitigate these risks.

A Roadmap for AI Integration

The strategic integration of AI tools in software development offers a significant opportunity for companies to achieve a competitive edge. By starting with pilot projects, organisations can assess the impact and utility of AI within specific teams. Encouraging continuous training in AI advancements empowers developers to leverage these tools effectively. Regular audits ensure that AI-generated code adheres to security standards and company policies, while feedback mechanisms facilitate the refinement of tool usage and address any emerging issues.

Technology teams have the opportunity to not only boost operational efficiency but also cultivate a culture of innovation and continuous improvement in their software development practices. As AI technology matures, even more sophisticated tools are expected to emerge, further propelling developer capabilities and software development to new heights.