Organisations have had to transform and innovate to survive over the last two years. However, now when they look at their competitors, they see that everyone has innovated at about the same pace. The 7-year innovation cycle is history in today’s world – organisations need the right strategy and technologies to bring the time to market for innovations down to 1-2 years.

As they continue to innovate to stay ahead of the competition, here are 5 things organisations in India should keep in mind:

- The drivers of innovation will shift rapidly and industry trends need to be monitored continually to adapt to these shifts.

- Their biggest challenge in deploying Data & AI solutions will be identification of the right data for the right purpose – this will require a robust data architecture.

- While customer experience gives them immediate and tangible benefits, employee experience is almost equally – if not more – important.

- Cloud investments have helped build distributed enterprises – but streamlining investments needs a lot of focus now.

- There is a misalignment between organisations’ overall awareness of growing cyber threats and risks and their responses to them. A new cyber approach is urgently needed.

More insights into the India tech market are below.

Click here to download The Future of the Digital Enterprise – Southeast Asia as a PDF

Southeast Asia has evolved into an innovation hub with Singapore at the centre. The entrepreneurial and startup ecosystem has grown significantly across the region – for example, Indonesia now has the 5th largest number of startups in the world.

Organisations in the region are demonstrating a strong desire for tech-led innovation, innovation in experience delivery, and in evolving their business models to bring innovative products and services to market.

Here are 5 insights on the patterns of technology adoption in Southeast Asia, based on the findings of the Ecosystm Digital Enterprise Study, 2022.

- Data and AI investments are closely linked to business outcomes. There is a clear alignment between technology and business.

- Technology teams want better control of their infrastructure. Technology modernisation also focuses on data centre consolidation and cloud strategy

- Organisations are opting for a hybrid multicloud approach. They are not necessarily doing away with a ‘cloud first’ approach – but they have become more agnostic to where data is hosted.

- Cybersecurity underpins tech investments. Many organisations in the region do not have the maturity to handle the evolving threat landscape – and they are aware of it.

- Sustainability is an emerging focus area. While more effort needs to go in to formalise these initiatives, organisations are responding to market drivers.

More insights into the Southeast Asia tech market below.

Click here to download The Future of the Digital Enterprise – Southeast Asia as a PDF

Last month, Broadcom announced their intentions to acquire VMWare in a deal worth USD 61 billion – one of the biggest acquisitions in the tech world.

Broadcom has been actively looking to diversify away from their core business of chip manufacturing into enterprise software. Their previous acquisitions – CA Technologies for USD 18.9 billion in 2018, followed by Symantec for USD 10.7 billion the next year – have already indicated that. The VMware acquisition is the biggest – and arguably very different from the others.

Ecosystm Analysts, Alan Hesketh, Darian Bird, Niloy Mukherjee and Tim Sheedy comment on the implications for the companies and the market.

Download Ecosystm Snapshot: Broadcom’s Acquisition of VMware as a PDF

It is an incredible time of change for the city and regional governments where every strategic activity – especially in these globally challenging times – presents a significant opportunity for transformation. To continue to meet the changing needs of the communities they serve, every modern city government’s technology story is a work in progress. While this is the mantra for successful continuous improvement it also describes the best strategic approach for how municipalities should manage their corporate application replacement programs.

Unfortunately, significant systems upgrade and replacement programs are regularly approached as complex, multi-tasking activities that have a hard start, a defined program, and a date-stamped end. In taking this traditional project implementation approach, intuitively, many organisations believe that doing as much as possible, in as quick a time as possible, ultimately helps to achieve twice as much within the same time. The result is more likely to be half as much, and at lower levels of quality and enjoyment for all involved. This manifests as project scope creep and budget overruns.

Aside from these big bang approaches, thanks to large implementation costs and stringent regulatory oversight, local governments are also forced to think upfront about the potential future value created by a significant core system technology change. The pressure of moving at high speed, and with a dominant technology focus, can obscure both the true organisational cost and ultimate value of the program. This mentality prevails even when it is acknowledged that activities associated with a transformation program will eventually usher in a period of significant change – that is not limited to the changing core corporate applications environment itself.

The 4-Part ERP Transformation Trap is All Too Common in City Government

An over-reliance on technology to deliver business transformation outcomes. Local governments everywhere continue to pursue strategic plans that are either wholly defined or implicitly reliant on world-class customer experience (CX), employee experience (EX), and digital transformation (DX) capabilities. Despite these being business-oriented strategies, organisations then pursue an over-reliance on technology – usually winner-take-all ERP led procurements – to achieve them.

Choosing an industry solution focused on the wrong business model. The chance of achieving these digital transformation outcomes is further obscured when the customer is not central to the data model. The core corporate application technology underpinning the sector’s leading ERP programs is largely based on a property-centric model – where the customer is a subordinate attribute of a property, and the property asset defines the business process and individual. It is a challenge for any council to deliver contemporary customer-first digital transformation with a property-centric approach. To realise customer and employee-centric outcomes, councils must therefore rethink their project’s business methodology and ask themselves, “what is our primary focus here?”. This is never more important than when replacing legacy systems.

Inability to realise that a winner-take-all ERP solution is not an architectural choice. ERP is important but it is not everything. The traditional council ERP is just one important part of an overall capability that allows authorities to longitudinally manage the impacts and opportunities of change across their organisation, communities, and stakeholder ecosystems. Having chosen a sector specific ERP solution, city governments realise too late that no single technology vendor has a best-of-breed solution to achieve the desired DX outcomes. That requires a more sophisticated architectural approach.

Failure to acknowledge there is no finish line to transformation. Like many worthwhile activities, the prize in DX is in the journey, not in the cup. While there can be an end to “project scope”, there should be no “end point” for an ERP transformation program. Only once these challenges are acknowledged and accepted, can transformation be assimilated into the organisation to ensure the council is technically capable of delivering the implicit outcome for the organisation. This could simply be defined as ‘a contemporary business approach to managing the money, the assets, the community, the customers, and the staff of regional government.’

A Better Way: Re-Architecting for Project Success

Where opportunities to meet increasing CX and EX demands arise, especially through ERP and corporate application renewal programs, successful projects in contemporary councils require a service-oriented architecture not found in contemporary or legacy ERP systems alone.

Beyond the property-centric challenges already outlined, even contemporary systems and suppliers can be among the least flexible to the changing data management requirements of many organisations which call for significantly more robust data, integration and application friendly infrastructure management environments.

Customer centricity, data management, integration and software infrastructure capabilities must take precedent over an aging view of single-vendor dominance in the city government sector, especially in middle- and back-office functions, which are typically void of true differentiation opportunities and prone to confining organisations to technology-led and locked projects.

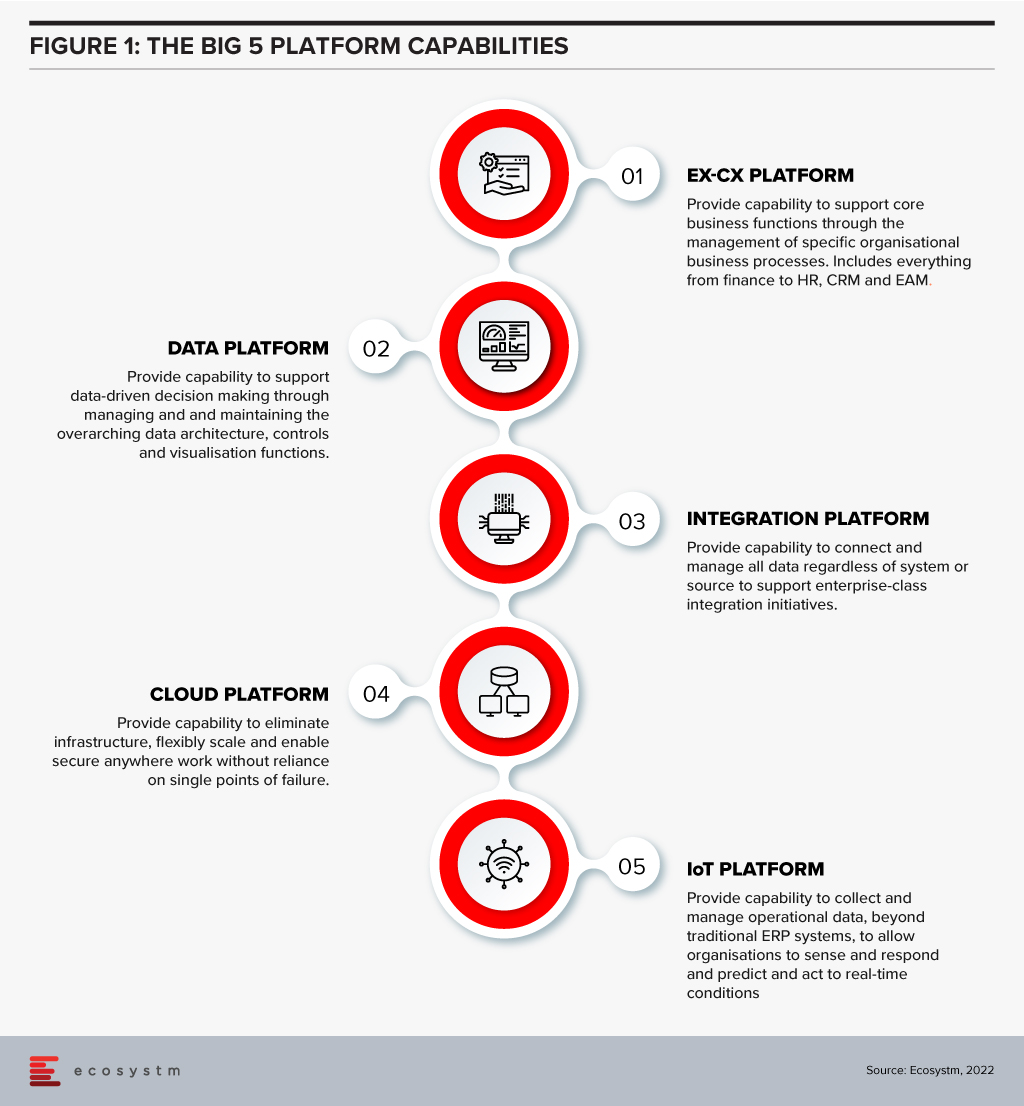

Rather than tendering for a single software provider or platform, contemporary city governments must ditch the old approach to procuring a winning ERP vendor and take steps to establish the following Big 5 platform capabilities (Figure 1). And then foster the contemporary workforce to support them.

For several decades now many organisations have attempted to short-circuit the city government ERP challenge. Fundamentally, technology transformation is not possible without technology change. A non-negotiable part of that change is a shift away from the psychology of brand-based procurement towards a new architectural approach which, like all businesses, is adaptable to change over a long period of time.

When non-organic (man-made) fabric was introduced into fashion, there were a number of harsh warnings about using polyester and man-made synthetic fibres, including their flammability.

In creating non-organic data sets, should we also be creating warnings on their use and flammability? Let’s look at why synthetic data is used in industries such as Financial Services, Automotive as well as for new product development in Manufacturing.

Synthetic Data Defined

Synthetic data can be defined as data that is artificially developed rather than being generated by actual interactions. It is often created with the help of algorithms and is used for a wide range of activities, including as test data for new products and tools, for model validation, and in AI model training. Synthetic data is a type of data augmentation which involves creating new and representative data.

Why is it used?

The main reasons why synthetic data is used instead of real data are cost, privacy, and testing. Let’s look at more specifics on this:

- Data privacy. When privacy requirements limit data availability or how it can be used. For example, in Financial Services where restrictions around data usage and customer privacy are particularly limiting, companies are starting to use synthetic data to help them identify and eliminate bias in how they treat customers – without contravening data privacy regulations.

- Data availability. When the data needed for testing a product does not exist or is not available to the testers. This is often the case for new releases.

- Data for testing. When training data is needed for machine learning algorithms. However, in many instances, such as in the case of autonomous vehicles, the data is expensive to generate in real life.

- Training across third parties using cloud. When moving private data to cloud infrastructures involves security and compliance risks. Moving synthetic versions of sensitive data to the cloud can enable organisations to share data sets with third parties for training across cloud infrastructures.

- Data cost. Producing synthetic data through a generative model is significantly more cost-effective and efficient than collecting real-world data. With synthetic data, it becomes cheaper and faster to produce new data once the generative model is set up.

Why should it cause concern?

If real dataset contains biases, data augmented from it will contain biases, too. So, identification of optimal data augmentation strategy is important.

If the synthetic set doesn’t truly represent the original customer data set, it might contain the wrong buying signals regarding what customers are interested in or are inclined to buy.

Synthetic data also requires some form of output/quality control and internal regulation, specifically in highly regulated industries such as the Financial Services.

Creating incorrect synthetic data also can get a company in hot water with external regulators. For example, if a company created a product that harmed someone or didn’t work as advertised, it could lead to substantial financial penalties and, possibly, closer scrutiny in the future.

Conclusion

Synthetic data allows us to continue developing new and innovative products and solutions when the data necessary to do so wouldn’t otherwise be present or available due to volume, data sensitivity or user privacy challenges. Generating synthetic data comes with the flexibility to adjust its nature and environment as and when required in order to improve the performance of the model to create opportunities to check for outliers and extreme conditions.

On 4 November Kyndryl completed the spin-off from IBM and began trading as an independent company on the New York Stock Exchange. It is effectively a USD 19 Billion start-up, and the industry will be tracking its journey keenly. Kyndryl has the ability to disrupt markets as it reinvents its business to embrace growth areas and help clients through their tech-led transformations.

Ecosystm Analysts Darian Bird, Peter Carr, Sash Mukherjee, Tim Sheedy, Ullrich Loeffler, and Venu Reddy comment on Kyndryl’s strategy going forward and the associated opportunities.

To download this Vendorsphere as a pdf for offline use, please click here.

In this Insight, guest author Anupam Verma talks about how a smart combination of technologies such as IoT, edge computing and AI/machine learning can be a game changer for the Financial Services industry. “With the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.”

The number of IoT devices have now crossed the population of planet earth. The buzz around the Internet of Things (IoT) refuses to go down and many believe that with 5G rollouts and edge computing, the adoption will rise exponentially in the next 5 years.

The IoT is described as the network of physical objects (“things”) embedded with sensors and software to connect and exchange data with other devices over the internet. Edge computing allows IoT devices to process data near the source of generation and consumption. This could be in the device itself (e.g. sensors), or close to the device in a small data centre. Typically, edge computing is advantageous for mission-critical applications which require near real-time decision making and low latency. Other benefits include improved data security by avoiding the risk of interception of data in transfer channels, less network traffic and lower cost. Edge computing provides an alternative to sending data to a centralised cloud.

In the 5G era, a smart combination of technologies such as IoT, edge computing and AI/machine learning will be a game changer. Multiple uses cases from self-driving vehicles to remote monitoring and maintenance of machinery are being discussed. How do we see IoT and the Edge transforming Financial Services?

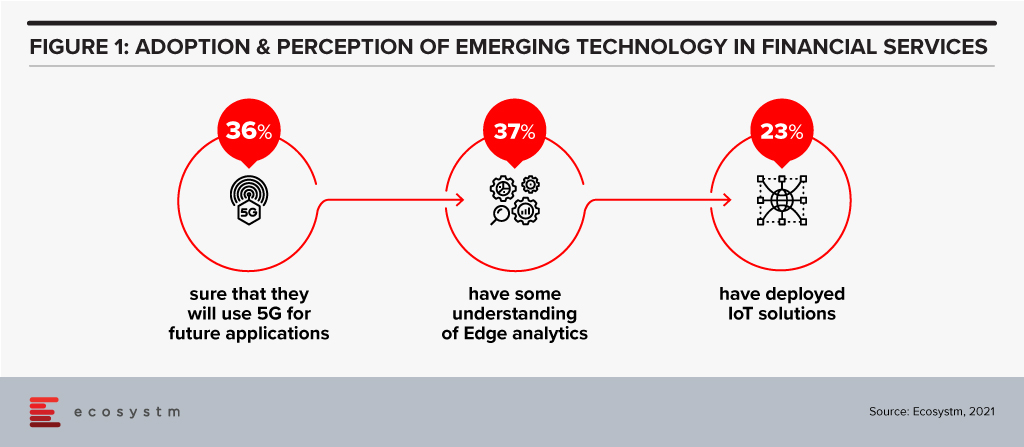

Before we go into how these technologies can transforming the industry, let us look at current levels of perception and adoption (Figure 1).

There is definitely a need for greater awareness of the capabilities and limitations of these emerging technologies in the Financial Services.

Transformation of Financial Services

The BFSI sector is increasingly moving away from selling a product to creating a seamless customer journey. Financial transactions, whether it is payment, transfer of money, or a loan can be invisible, and Edge computing will augment the customer experience. This cannot be achieved without having real-time data and analytics to create an updated 360-degree profile of the customer at all times. This data could come from multiple IoT devices, channels and partners that can interface and interact with the customer. A lot of use cases around personalisation would not be possible without edge computing. The Edge here would mean faster processing and smoother experience leading to customer delight and a higher trust quotient.

With IoT, customers can bank anywhere anytime using connected devices like wearables (smartwatches, fitness trackers etc). People can access account details, contextual offers at their current location or make payments without even needing a smartphone.

Use Cases of IoT & Edge in Financial Services

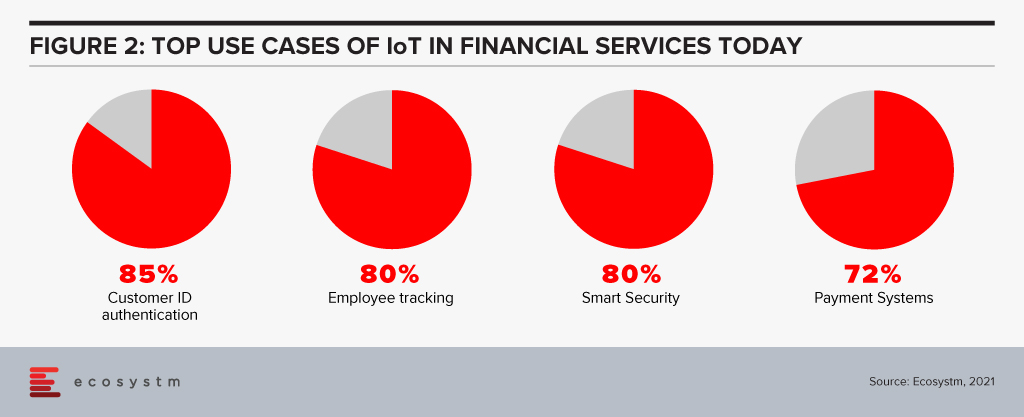

IT and Digital Leaders in Financial Services are aware of the benefits of IoT and there are some use cases that most of them think will help transform Financial Services (Figure 2).

However, there are many more potential use cases. Here are some use cases whose volume will only grow every day to fuel incessant data generation, consumption and processing at the Edge.

- Smart Homes. IoT devices like Alexa/Google Home have capabilities to become “bank in a speaker” with edge computing.

- In-Sync Omnichannels. IoT devices can be synced with other banking channels. A customer may start a transaction on an IoT device and complete it in a branch. Facial recognition can be used to identify the customer after he/she walks in and synced IoT devices will ensure that the transaction is completed without any steps repeated (zero re-work) thereby enhancing customer satisfaction.

- Virtual Relationship Managers. In a digital branch, the customer may use Virtual Reality (VR) headsets to engage with virtual relationship managers and relevant experts. Gamification using VR can be amazingly effective in the area of financial literacy and financial planning.

- Home and Auto Purchase. VR may also find use in home and auto purchase processes with financing built into it. The entire customer journey will have a much smoother experience with edge computing.

- Auto and Health Insurance. Companies can use IoT (device installed in the vehicle) plus edge computing to monitor and improve driving behaviour, eventually rewarding safety with lower premiums. The growth in electric mobility will continue to provide the basis for auto insurance. Companies can use wearables to monitor crucial health parameters and exercising habits. The creation of real-time dynamic rewards around it can change behaviour towards a healthier lifestyle. Awareness, longevity, rising costs and pandemic will only fuel this sector’s growth.

- Payments. Device to device contactless payment protocol is picking up and IoT and edge computing can create next-gen revolution in payments. Your EV could have an embedded wallet and pay for its parking and toll.

- Branch/ATM. IoT sensors and CCTV footage from branches/ATMs can be utilised in real-time to improve branch productivity as well as customer engagement, at the same time enhancing security. It could also help in other situations like low cash levels in ATMs and malfunctions. Sending live video streams for video analytics to the cloud can be expensive. By processing data within the device or on-premises, the Edge can help lower costs and reduce latency.

- Trading in Securities. Another area where response time matters is algorithmic trading. Edge computing will help to quickly process and analyse a large amount of data streaming real-time from multiple feeds and react appropriately.

- Trade Finance. Real-time tracking of goods may add a different dimension to the risk, pricing and transparency of supply chains.

Cloud vs Edge

The decision to use cloud or edge will depend on multiple considerations. At the same time, all the data from IoT devices need not go to the cloud for processing and choke network bandwidth. In fact, some of this data need not be stored forever (like video feeds etc). As a result, with the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

Over the past year we have seen global systems integrators (SIs) – Accenture, IBM, Deloitte, Fujitsu, Capgemini and others – make many acquisitions, particularly in the public cloud, AI, cybersecurity and data space. Much of the growth in spending over the past few years have been driven by these categories: in 2020 if a software company was purely or mainly SaaS, they are likely to have witnessed strong growth. If they were on-premises software, they were lucky not to see declining revenues. While it is normal for the larger SIs and consultants to play catch up through acquisition, it is becoming harder for them to gain traction in these new areas.

Technology Shifts Drive Market Fragmentation

With every technology-driven business change new SIs, consultants, and managed services providers emerge. It happened with the move to big ERP systems, the move towards Business Intelligence, the emergence of SaaS etc. But I think we are now seeing something different. More than just the smaller players going after opportunities earlier, I believe we are seeing a changing buying behaviour from tech and business buyers – a greater willingness for larger enterprises to give their most important, business-critical strategies and implementations to smaller, less established players.

And I am not suggesting that the larger SIs are not performing well. Many are growing at 10-25% YoY – but at the same time, many are also growing at a slower rate than the markets they play in. The Ecosystm RNx for global IT services and consulting providers shows that the global providers continue to power ahead. But they need to adapt to changing market conditions.

New Cloud/AI Partners Winning Consulting and Implementation Deals

We have seen a new community of partners emerge with tech changes, such as the hyperscale cloud platforms and AI/machine learning tools. Traditionally, these companies would be good at one thing – and would learn slowly. For example, in the SAP ERP growth period, the projects were large and long. A single, mid-sized SI might only be working with 2-3 clients at a time. Therefore, the IP that they collected was limited – and they would find themselves with focused or niche skills. The large SIs had done many large, long projects across the globe and had much best-practice IP to call upon, giving them a broader and deeper knowledge of the technology and industries. Smaller providers had limited IP and industry experience.

But in this cloud and AI era, specialist providers work on hundreds of smaller projects with dozens or hundreds of clients. With the technology constantly evolving, the skills are constantly improving. While the global SIs are working on many cloud and AI engagements, they are often part of longer engagements – giving the consultants and tech teams less exposure to the new and evolving cloud platforms.

In a world where technology is changing at pace, the traditional global SI practice of “learning from peers across the globe” doesn’t happen at the pace the market requires. By the time your peers in the business have completed a project, documented it, and shared learnings, the market has moved on and technology has changed. Today it is easier and faster to learn directly from the tech vendors and cloud platform providers and their training partners. The network effect of knowledge in a team on the opposite side of the globe for a global SI is less valuable to clients. Often the smaller and mid-sized SIs have a deeper, broader knowledge of the technology platforms and toolsets than the larger providers – giving them a competitive advantage. For example, if you want the actual experience of moving SAP to Azure, or Oracle to AWS – you’ll often find the smaller providers have more experience. And this continues to play out. In many markets in the world, the top 5-10 SIs for cloud, AI and cybersecurity has a high proportion of local specialist providers.

Tech Buyers No Longer Look for Culturally Aligned Partners

Tech buyers themselves are changing too. In years gone by, the smaller tech partners would tell us that they felt they were included in bids to drive down the price from the global SIs. But today the story is different. Smaller partners are admired for their agility and innovation. Large enterprise customers will choose small providers because the small SI is NOT like them. In the past, they chose the global SI because they were just like them!

Because of this, the large SIs are mopping up their smaller competitors across the globe. Accenture has acquired 40 companies in the past 10-11 months, IBM has acquired over 10, Atos and Cognizant have also acquired many companies in the past 12 months. They are doing this for the skills as much as for the clients, along with getting a foothold in a new market or strengthening their position in geography. The challenge will be to hang on to the clients, culture, and the IP of the acquired business. Often these smaller competitors are growing at a significant pace – and the biggest risk is that the acquiring company takes their eyes off the prize.

Global SIs Still Own the Industry Play

Despite these challenges, one of the areas that the global SIs will continue to dominate is the industry play. I have discussed how as technologies mature, industry plays become more relevant.

Smaller and mid-sized SIs and consultants find it hard to create deep pools of expertise across multiple industries. While some may have a deep focus on a single or two industries, only the large players have broad and deep geography and industry experience. This puts many of the acquisitions into context – the global SIs will take these acquisitions and use that deep and broad technical and business knowledge and add it to their industry knowledge to create a more compelling offering.

Their challenge will still be one of cultural alignment. As discussed, many companies seek out tech partners who represent what they want to be, not what they are. The ability for the Global SIs to retain the culture, agility and innovation of the acquired business will determine their ability to continue to see similar or improved levels of growth from the acquired business. Using their IP in the context of industries will be the key to their ongoing success.

In this Insight, our guest author Anupam Verma talks about how the Global Capability Centres (GCCs) in India are poised to become Global Transformation Centres. “In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be ‘Digital Transformation Centres’ for global businesses.”

India has a lot to offer to the world of technology and transformation. Attracted by the talent pool, enabling policies, digital infrastructure, and competitive cost structure, MNCs have long embraced India as a preferred destination for Global Capability Centres (GCCs). It has been reported that India has more than 1,700 GCCs with an estimated global market share of over 50%.

GCCs employ around 1 million Indian professionals and has an immense impact on the economy, contributing an estimated USD 30 billion. US MNCs have the largest presence in the market and the dominating industries are BSFI, Engineering & Manufacturing, Tech & Consulting.

GCC capabilities have always been evolving

The journey began with MNCs setting up captives for cost optimisation & operational excellence. GCCs started handling operations (such as back-office and business support functions), IT support (such as app development and maintenance, remote IT infrastructure, and help desk) and customer service contact centres for the parent organisation.

In the second phase, MNCs started leveraging GCCs as centers of excellence (CoE). The focus then was product innovation, Engineering Design & R&D. BFSI and Professional Services firms started expanding the scope to cover research, underwriting, and consulting etc. Some global MNCs that have large GCCs in India are Apple, Microsoft, Google, Nissan, Ford, Qualcomm, Cisco, Wells Fargo, Bank of America, Barclays, Standard Chartered, and KPMG.

In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be “Digital Transformation Centres” for global businesses.

The New Age GCC in the post-COVID world

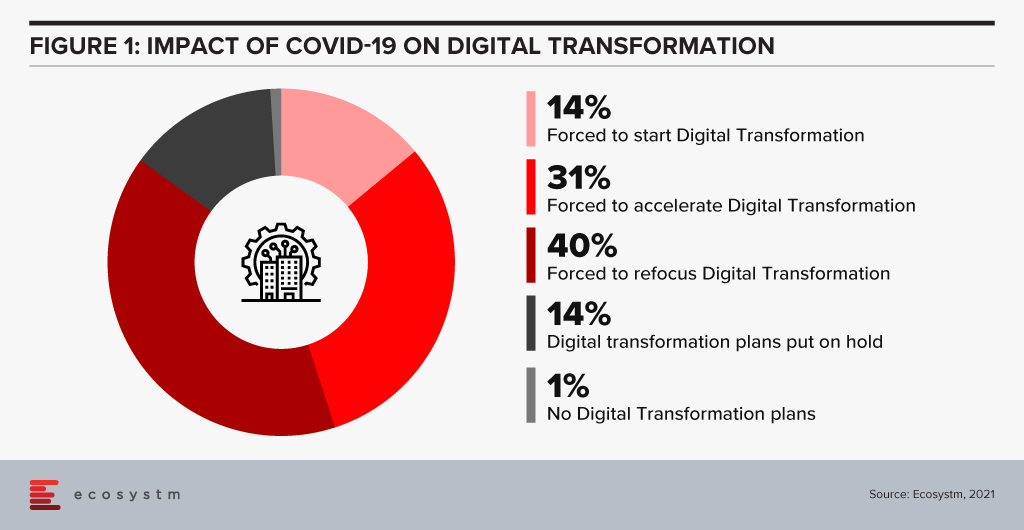

On one hand, the pandemic broke through cultural barriers that had prevented remote operations and work. The world became remote everything! On the other hand, it accelerated digital adoption in organisations. Businesses are re-imagining customer experiences and fast-tracking digital transformation enabled by technology (Figure 1). High digital adoption and rising customer expectations will also be a big catalyst for change.

In last few years, India has seen a surge in talent pool in emerging technologies such as data analytics, experience design, AI/ML, robotic process automation, IoT, cloud, blockchain and cybersecurity. GCCs in India will leverage this talent pool and play a pivotal role in enabling digital transformation at a global scale. GCCs will have direct and significant impacts on global business performance and top line growth creating long-term stakeholder value – and not be only about cost optimisation.

GCCs in India will also play an important role in digitisation and automation of existing processes, risk management and fraud prevention using data analytics and managing new risks like cybersecurity.

More and more MNCs in traditional businesses will add GCCs in India over the next decade and the existing 1,700 plus GCCs will grow in scale and scope focussing on innovation. Shift of supply chains to India will also be supported by Engineering R & D Centres. GCCs passed the pandemic test with flying colours when an exceptionally large workforce transitioned to the Work from Home model. In a matter of weeks, the resilience, continuity, and efficiency of GCCs returned to pre-pandemic levels with a distributed and remote workforce.

A Final Take

Having said that, I believe the growth spurt in GCCs in India will come from new-age businesses. Consumer-facing platforms (eCommerce marketplaces, Healthtechs, Edtechs, and Fintechs) are creating digital native businesses. As of June 2021, there are more than 700 unicorns trying to solve different problems using technology and data. Currently, very few unicorns have GCCs in India (notable names being Uber, Grab, Gojek). However, this segment will be one of the biggest growth drivers.

Currently, only 10% of the GCCs in India are from Asia Pacific organisations. Some of the prominent names being Hitachi, Rakuten, Panasonic, Samsung, LG, and Foxconn. Asian MNCs have an opportunity to move fast and stay relevant. This segment is also expected to grow disproportionately.

New age GCCs in India have the potential to be the crown jewel for global MNCs. For India, this has a huge potential for job creation and development of Smart City ecosystems. In this decade, growth of GCCs will be one of the core pillars of India’s journey to a USD 5 trillion economy.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Senior Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.