2024 and 2025 are looking good for IT services providers – particularly in Asia Pacific. All types of providers – from IT consultants to managed services VARs and systems integrators – will benefit from a few converging events.

However, amidst increasing demand, service providers are also challenged with cost control measures imposed in organisations – and this is heightened by the challenge of finding and retaining their best people as competition for skills intensifies. Providers that service mid-market clients might find it hard to compete and grow without significant process automation to compensate for the higher employee costs.

Why Organisations are Opting for IT Service

- Organisations are seeking further cost reductions. Managed services providers will see more opportunities to take cost and complexity out of organisation’s IT functions. The focus in 2024 will be less on “managing” services and more on “transforming” them using ML, AI, and automation to reduce cost and improve value.

- Big app upgrades are back on the agenda. SAP is going above and beyond to incentivise their customers and partners to migrate their on-premises and hyperscale hosted instances to true cloud ERP. Initiatives such as Rise with SAP have been further expanded and improved to accelerate the transition. Salesforce customers are also looking to streamline their deployments while also taking advantage of the new AI and data capabilities. But many of these projects will still be complex and time-consuming.

- Cloud deployments are getting more complex. For many organisations, the simple cloud migrations are done. This is the stage of replatforming, retiring, and refactoring applications to take advantage of public and hybrid cloud capabilities. These are not simple lift and shift – or switch to SaaS – engagements.

- AI will drive a greater need for process improvement and transformation. This will happen along with associated change management and training programs. While it is still early days for GenAI, before the end of 2024, many organisations will move beyond experimentation to department or enterprise wide GenAI initiatives.

- Increasing cybersecurity and data governance demands will prolong the security skill shortage. More organisations will turn to managed security services providers and cybersecurity consultants to help them develop their strategy and response to the rising threat levels.

Choosing the Right Cost Model for IT Services

Buyers of IT services must implement strict cost-control measures and consider various approaches to align costs with business and customer outcomes, including different cost models:

Fixed-Price Contracts. These contracts set a firm price for the entire project or specific deliverables. Ideal when project scope is clear, they offer budget certainty upfront but demand detailed specifications, potentially leading to higher initial quotes due to the provider assuming more risk.

Time and Materials (T&M) Contracts with Caps. Payment is based on actual time and materials used, with negotiated caps to prevent budget overruns. Combining flexibility with cost predictability, this model offers some control over total expenses.

Performance-Based Pricing. Fees are tied to service provider performance, incentivising achievement of specific KPIs or milestones. This aligns provider interests with client goals, potentially resulting in cost savings and improved service quality.

Retainer Agreements with Scope Limits. Recurring fees are paid for ongoing services, with defined limits on work scope or hours within a given period. This arrangement ensures resource availability while containing expenses, particularly suitable for ongoing support services.

Other Strategies for Cost Efficiency and Effective Management

Technology leaders should also consider implementing some of the following strategies:

Phased Payments. Structuring payments in phases, tied to the completion of project milestones, helps manage cash flow and provides a financial incentive for the service provider to meet deadlines and deliverables. It also allows for regular financial reviews and adjustments if the project scope changes.

Cost Transparency and Itemisation. Detailed billing that itemises the costs of labour, materials, and other expenses provides transparency to verify charges, track spending against the budget, and identify areas for potential savings.

Volume Discounts and Negotiated Rates. Negotiating volume discounts or preferential rates for long-term or large-scale engagements, makes providers to offer reduced rates for a commitment to a certain volume of work or an extended contract duration.

Utilisation of Shared Services or Cloud Solutions. Opting for shared or cloud-based solutions where feasible, offers economies of scale and reduces the need for expensive, dedicated infrastructure and resources.

Regular Review and Adjustment. Conducting regular reviews of the services and expenses with the provider to ensure alignment with the budget and objectives, prepares organisations to adjust the scope, renegotiate terms, or implement cost-saving measures as needed.

Exit Strategy. Planning an exit strategy that include provisions for contract termination, transition services, protects an organisation in case the partnership needs to be dissolved.

Conclusion

Many businesses swing between insourcing and outsourcing technology capabilities – with the recent trend moving towards insourcing development and outsourcing infrastructure to the public cloud. But 2024 will see demand for all types of IT services across nearly every geography and industry. Tech services providers can bring significant value to your business – but improved management, monitoring, and governance will ensure that this value is delivered at a fair cost.

2024 has started cautiously for organisations, with many choosing to continue with tech projects that have already initiated, while waiting for clearer market conditions before starting newer transformation projects. This means that tech providers must continue to refine their market messaging and enhance their service/product offerings to strengthen their market presence in the latter part of the year. Ecosystm analysts present five key considerations for tech providers as they navigate evolving market and customer trends, this year.

Navigating Market Dynamics

Continuing Economic Uncertainties. Organisations will focus on ongoing projects and consider expanding initiatives in the latter part of the year. This means that tech providers should maintain visibility and trust with existing clients. They also need to help their customers meet multiple KPIs.

Popularity of Generative AI. For organisations, this will be the time to go beyond the novelty factor and assess practical business outcomes, allied costs, and change management. Tech providers need to include ROI discussions for short-term and mid-term perspectives as organisations move beyond pilots.

Infrastructure Market Disruption. Tech leaders will keep an eye out for advancements and disruptions in the market (likely to originate from the semiconductor sector). The disruptions might require tech vendors to re-assess the infrastructure partner ecosystem.

Need for New Tech Skills. Tech leaders will evaluate Generative AI’s impact on AIOps and IT Architecture; invest in upskilling for talent retention. Tech providers must prioritise creating user-friendly experiences to make technology accessible to business users. Training and partner enablement will also need a higher focus.

Increased Focus on Governance. Tech leaders will consult tech vendors on how to implement safeguards for data usage, sharing, and cybersecurity. This opens up opportunities in offering governance-related services.

5 Key Considerations for Tech Vendors

#1 Get Ready for the Year of the AI Startup

While many AI companies have been around for years, this will be the year that many of them make a significant play into enterprises in Asia Pacific. This comes at a time when many organisations are attempting to reduce tech debt and simplify their tech architecture.

For these AI startups to succeed, they will need to create watertight business cases, and do a lot of the hard work in pre-integrating their solutions with the larger platforms to reduce the time to value and simplify the systems integration work.

To respond to these emerging threats, existing tech providers will need to not only accelerate their own use of AI in their platforms, but also ramp up the education and promotion of these capabilities.

#2 Lead With Data, Not AI Capabilities

Organisations recognise the need for AI to enhance their workforce, improve customer experience, and automate processes. However, the initial challenge lies in improving data quality, as trust in early AI models hinges on high-quality training data for long-term success.

Tech vendors that can help with data source discovery, metadata analysis, and seamless data pipeline creation will emerge as trusted AI partners. Transformation tools that automate deduplication and quality assurance tasks empower data scientists to focus on high-value work. Automation models like Segment Anything enhance unstructured data labeling, particularly for images. Finally synthetic data will gain importance as quality sources become scarce.

Tech vendors will be tempted to capitalise on the Generative AI hype but for sake of positive early experiences, they should begin with data quality.

#3 Prepare Thoroughly for AI-driven Business Demand

Besides pureplay AI opportunities, AI will drive a renewed and increased interest in data and data management. Tech and service providers can capitalise on this by understanding the larger picture around their clients’ data maturity and governance. Initial conversations around AI can be door openers to bigger, transformational engagements.

Tech vendors should avoid the pitfall of downplaying AI risks. Instead, they should make all efforts to own and drive the conversation with their clients. They need to be forthcoming about their in-house responsible AI guidelines and understand what is happening in AI legislation world-wide (hint: a lot!)

Tech providers must establish strong client partnerships for AI initiatives to succeed. They must address risk and benefit equally to reap the benefits of larger AI-driven transformation engagements.

#4 Converge Network & Security Capabilities

Networking and security vendors will need to develop converged offerings as these two technologies increasingly overlap in the hybrid working era. Organisations are now entering a new phase of maturity as they evolve their remote working policies and invest in tools to regain control. They will require simplified management, increased visibility, and to provide a consistent user experience, wherever employees are located.

There has already been a widespread adoption of SD-WAN and now organisations are starting to explore next generation SSE technologies. Procuring these capabilities from a single provider will help to remove complexity from networks as the number of endpoints continue to grow.

Tech providers should take a land and expand approach, getting a foothold with SASE modules that offer rapid ROI. They should focus on SWG and ZTNA deals with an eye to expanding in CASB and FWaaS, as customers gain experience.

#5 Double Down on Your Partner Ecosystem

The IT services market, particularly in Asia Pacific, is poised for significant growth. Factors, including the imperative to cut IT operational costs, the growing complexity of cloud migrations and transformations, change management for Generative AI capabilities, and rising security and data governance needs, will drive increased spending on IT services.

Tech services providers – consultants, SIs, managed services providers, and VARs – will help drive organisations’ tech spend and strategy. This is a good time to review partners, evaluating whether they can take the business forward, or whether there is a need to expand or change the partner mix.

Partner reviews should start with an evaluation of processes and incentives to ensure they foster desired behaviour from customers and partners. Tech vendors should develop a 21st century partner program to improve chances of success.

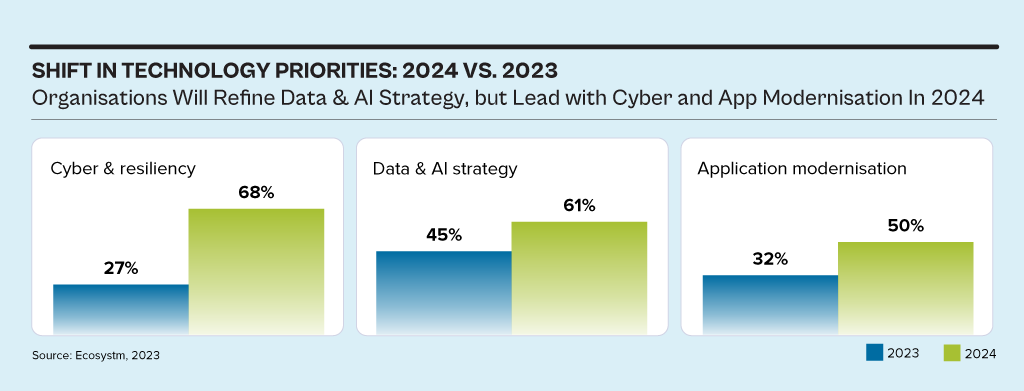

While the discussions have centred around AI, particularly Generative AI in 2023, the influence of AI innovations is extensive. Organisations will urgently need to re-examine their risk strategies, particularly in cyber and resilience practices. They will also reassess their infrastructure needs, optimise applications for AI, and re-evaluate their skills requirements.

This impacts the entire tech market, including tech skills, market opportunities, and innovations.

Ecosystm analysts Alea Fairchild, Darian Bird, Richard Wilkins, and Tim Sheedy present the top 5 trends in building an Agile & Resilient Organisation in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 Resilience Trends in 2024’ as a PDF.

#1 Gen AI Will See Spike in Infrastructure Innovation

Enterprises considering the adoption of Generative AI are evaluating cloud-based solutions versus on-premises solutions. Cloud-based options present an advantage in terms of simplified integration, but raise concerns over the management of training data, potentially resulting in AI-generated hallucinations. On-premises alternatives offer enhanced control and data security but encounter obstacles due to the unexpectedly high demands of GPU computing needed for inferencing, impeding widespread implementation. To overcome this, there’s a need for hardware innovation to meet Generative AI demands, ensuring scalable on-premises deployments.

The collaboration between hardware development and AI innovation is crucial to unleash the full potential of Generative AI and drive enterprise adoption in the AI ecosystem.

Striking the right balance between cloud-based flexibility and on-premises control is pivotal, with considerations like data control, privacy, scalability, compliance, and operational requirements.

#2 Cloud Migrations Will Make Way for Cloud Transformations

The steady move to the public cloud has slowed down. Organisations – particularly those in mature economies – now prioritise cloud efficiencies, having largely completed most of their application migration. The “easy” workloads have moved to the cloud – either through lift-and-shift, SaaS, or simple replatforming.

New skills will be needed as organisations adopt public and hybrid cloud for their entire application and workload portfolio.

- Cloud-native development frameworks like Spring Boot and ASP.NET Core make it easier to develop cloud-native applications

- Cloud-native databases like MongoDB and Cassandra are designed for the cloud and offer scalability, performance, and reliability

- Cloud-native storage like Snowflake, Amazon S3 and Google Cloud Storage provides secure and scalable storage

- Cloud-native messaging like Amazon SNS and Google Cloud Pub/Sub provide reliable and scalable communication between different parts of the cloud-native application

#3 2024 Will be a Good Year for Technology Services Providers

Several changes are set to fuel the growth of tech services providers (systems integrators, consultants, and managed services providers).

There will be a return of “big apps” projects in 2024.

Companies are embarking on significant updates for their SAP, Oracle, and other large ERP, CRM, SCM, and HRM platforms. Whether moving to the cloud or staying on-premises, these upgrades will generate substantial activity for tech services providers.

The migration of complex apps to the cloud involves significant refactoring and rearchitecting, presenting substantial opportunities for managed services providers to transform and modernise these applications beyond traditional “lift-and-shift” activities.

The dynamic tech landscape, marked by AI growth, evolving security threats, and constant releases of new cloud services, has led to a shortage of modern tech skills. Despite a more relaxed job market, organisations will increasingly turn to their tech services partners, whether onshore or offshore, to fill crucial skill gaps.

#4 Gen AI and Maturing Deepfakes Will Democratise Phishing

As with any emerging technology, malicious actors will be among the fastest to exploit Generative AI for their own purposes. The most immediate application will be employing widely available LLMs to generate convincing text and images for their phishing schemes. For many potential victims, misspellings and strangely worded appeals are the only hints that an email from their bank, courier, or colleague is not what it seems. The ability to create professional-sounding prose in any language and a variety of tones will unfortunately democratise phishing.

The emergence of Generative AI combined with the maturing of deepfake technology will make it possible for malicious agents to create personalised voice and video attacks. Digital channels for communication and entertainment will be stretched to differentiate between real and fake.

Security training that underscores the threat of more polished and personalised phishing is a must.

#5 A Holistic Approach to Risk and Operational Resilience Will Drive Adoption of VMaaS

Vulnerability management is a continuous, proactive approach to managing system security. It not only involves vulnerability assessments but also includes developing and implementing strategies to address these vulnerabilities. This is where Vulnerability Management Platforms (VMPs) become table stakes for small and medium enterprises (SMEs) as they are often perceived as “easier targets” by cybercriminals due to potentially lesser investments in security measures.

Vulnerability Management as a Service (VMaaS) – a third-party service that manages and controls threats to automate vulnerability response to remediate faster – can improve the asset cybersecurity management and let SMEs focus on their core activities.

In-house security teams will particularly value the flexibility and customisation of dashboards and reports that give them enhanced visibility over all assets and vulnerabilities.

“Cloud is universal – everything is going to be on the cloud soon! If you are not moving to the cloud, you are going extinct! AWS, Microsoft and Google are going to rule the world!” This has been the hyped narrative for some time now. But watch out New World – the Old World is fighting back!

Traditional vendors like HP Enterprise, Cisco, and Oracle are all deploying strategies to remain relevant in the new world. For these vendors – especially for HPE and Cisco that come from a predominantly hardware background – the future is hybrid. They picture a world in which the data centre – either on-prem or in a co-located facility – thrives on, in tandem with the cloud. This is a reasonably good bet. For most large enterprises with a huge repository of applications and data sitting in the data centre, migrating everything to the cloud is a nightmare – fraught with risk and very expensive.

Ecosystm research shows that 32% of organisations have deployed containerisation – and this percentage will only grow. The ability for firms to toggle between data centre bare metal based applications and completely on-the-cloud ones is becoming more manageable by the day. This enormous flexibility allows a firm that has large compute needs to keep some stable workloads in a data centre, whether on-prem or co-located, while simultaneously using cloud-based workloads, optimising spends and performance.

Here is a glimpse into the strategies of three key vendors.

HPE’s ‘as-a-service’ Messaging is Spot on

Two years ago, Antonio Neri boldly went where no HPE CEO had gone before, promising that HPE’s entire portfolio would be available ‘as-a-service’ within 3 years. At the recently concluded HPE Discover event, there were a flurry of announcements to showcase that GreenLake is indeed on its way to meet that ambitious goal in 2022.

HPE’s recent announcements show customers that GreenLake is an end-to-end solution for managing their IT infrastructure moving forward. It ticks all the boxes: providing flexibility and scalability; the advantage of using both data centre and cloud; and high manageability and security with a full suite of applications.

Examples are the partnership with Azure Stack HCI, to add to earlier ones with leading vendors like SAP, Citrix, and VMware. HPE is building a platform that provides customers with the comfort that they can adopt GreenLake and pretty much have access to any application they may choose to implement – offering full coverage from the Edge to the Cloud. It is extremely interesting that GreenLake allows the option of switching on and switching off processor cores as needed, and the customer pays based on usage. This is surely a first for the industry!

Another example is Lighthouse, which allows the customer to rapidly configure, and provision workloads based on dynamic needs. While all the hyperscalers provide similar services when the workload is on the cloud, Lighthouse allows the same flexibility and speed for cloud services which can be run in the data centre, on-prem, co-located, or even at the Edge.

A third example was the announcement of Project Aurora which will add an additional security layer from validating the input data all the way to verifying the workload at the start and then as it is running. It appears to use an AI/ML system that checks for unexpected behaviours to detect any kind of malware.

It makes good sense for HPE to push GreenLake and move to offering ‘everything-as-a-service’. As one of the incumbent enterprise hardware business leaders, this is a good response rather than to watch one’s business continue to shrink YoY. GreenLake is HPE’s way of futureproofing themselves and making sure they stay relevant in the new cloud world.

Cisco Secures the Hybrid Workplace

Cisco has been active launching Cisco Plus earlier this year, as their bridge to the as-a-service model with a network-as-a-service (NaaS) offering. Somewhat like GreenLake, Cisco Plus offers flexible consumption for compute, storage, and networking. They are committed to offering most of their portfolio as-a-service over time.

Cisco has shown some resilience in terms of revenue but has still been struggling to grow. After a steady growth since 2017, the revenues dropped by 7% in 2020 almost as a direct impact of COVID-19. The post-pandemic world has the potential of being a bigger threat for Cisco. Many estimates show the number of people working from home is likely to go up dramatically and Cisco’s key networking offering could rapidly become redundant. However, at Ecosystm we believe that the hybrid work model will be predominant.

Cisco is also betting on a hybrid world. No matter where one works from, there are networking needs. Cisco’s focus, therefore, is on security – this will be on the mind of virtually any enterprise as it chalks out its future strategy. With a hybrid environment, making everything secure becomes more complex while continuing to be vital. Cisco has a heavy emphasis on Secure Access Service Edge (SASE) – the idea that the security envelope now has to be a flexible form that has a presence everywhere that the enterprise needs to be. This will make a lot of sense to most enterprises as they tread the hybrid path.

Cisco will offer a portfolio of tools to make it increasingly easier for customers to use multi-cloud, multi-vendor environments, offering the best of both worlds.

Oracle Incentivises Cloud Migration

Oracle has a different approach because they are trying to solve a different problem. They are competing with the hyperscalers, while fully acknowledging a hybrid world. However, as a company with less legacy in hardware, it makes sense for them to focus on migrating to cloud rather than on hybridisation. Oracle has just announced that they will subsidise existing customers who add cloud workloads with them, by providing discounts on the existing licensing fees that the customer is paying Oracle. This discount appears to be around 25% to 33%. In essence, this means that if a customer spends about USD 100k with Oracle on licensing and decides to start moving workloads to the Oracle Cloud worth somewhere between USD 300-400k, they can potentially write off the entire license fees they are currently paying!

Conclusion

There is a strong effort from every vendor right now to retain and consolidate their customer share and build a vision that convinces the customer that they are the way to go. For the traditional hardware players that vision is of a hybrid world – attractive to today’s large enterprise. For the likes of AWS, Microsoft, Google, and Oracle it is all about moving the customer to their cloud. The assumption of course is that moving someone to your cloud will lead to more of your apps being used by the customer. For the hardware vendors like Cisco and HPE, it is all about moving the customer to their own platforms which empower hybridisation. In all cases, a necessary component is to offer ‘everything-as-a-service’ upending the traditional models of selling.

In my opinion, with time the IaaS portion of the cloud is likely to gradually devolve into something like a utility. There will be a lot of upheavals and market disruption before we get there, but eventually, software and other services are likely to stand separate from the infrastructure provider. All the vendors are therefore depending on capturing the customer at the platform-as-a-service (PaaS) level, but even this is likely to get commoditised over time. Eventually, the winners will be disparate providers of the best applications for different functions. Meanwhile, we are in for an extremely interesting ride as we see all the vendors jockeying for space!

Google recently announced its ‘Google Cloud Acceleration Program’ to support SAP customers in simplifying their transition to the cloud.

Earlier this year, Google initiated a program known as Lighthouse, in partnership with system integrators, to streamline its customers’ SAP journeys to the cloud. The Google Cloud Acceleration Program is a progression of Lighthouse and will provide technical resource, blueprints, employee training and consulting services to partners and customers for migrating SAP to the cloud, as well as upgrading to SAP S/4HANA.

Google Cloud Acceleration Program Partners’ contributions

Several ISV’s and technology providers are already participating in the program. One of these providers, HCL Technologies, recently announced plans for a 5,000-employee division which will focus entirely on helping enterprise customers plan and execute large-scale migration of workloads and applications to Google Cloud. Accenture and Google set up a similar collaboration earlier this year.

Google’s Cloud Acceleration Program will be supported by partners such as Accenture, Atos, Deloitte, and HCL to help migrate workloads. In addition, these partners will also work alongside Capgemini, DXC Technologies, Hitachi oXya, Infosys, NTT, TCS, and Wipro, to create SAP centres of Excellence for Google Cloud.

Commenting on Google’s Cloud Acceleration Program for SAP platform, Principal Analyst at Ecosystm Claus Mortensen said, “Migrating SAP to the cloud has proven to be a notoriously complex task over the years. To help the migration to Google’s Cloud, Google launched its SAP Lighthouse program. The Cloud Acceleration Program can be seen as an evolution of Lighthouse.”

Mortensen added, “Google Cloud Acceleration Program is intended to make migration as simple as it can be under the circumstances – but I don’t think it will ever be easy to migrate SAP to the cloud – it is too complex a system to become simple to migrate. Whether it will succeed in convincing SAP customers to migrate much depends on how well the program partners perform.”

The primary aim of the Cloud Acceleration Program is to boost the adoption of Google cloud services and benefit customers with greater innovation, operational efficiency, and risk mitigation. Google has been active in promoting the programme and in the same spirit, Google recently acquired CloudSimple, a provider of secure, dedicated environments to run VMware workloads in the Cloud. Many organisations are running VMware in their on-premises environments to run a variety of workloads and this acquisition will boost abilities to run VMware on Google Cloud Platform.

As we recently stated in our predictions for ‘the top 5 cloud trends for 2020′, the ability for even the top cloud players to compete will increasingly come down to their ability to expand their service capabilities beyond their current offerings. Ecosystm expects these players to further enhance their focus on expanding their services, management and integration capabilities through global and in-country partnerships. One particular area might be partnerships focusing on Cloud migration between Clouds and from Cloud to on-premises. Google’s Cloud Acceleration program is a prime example of a framework, that has such partnerships in mind.

Speaking on the benefits of Google Cloud acceleration program for SAP customers, Mortensen said “cloud offers a lot of flexibility and agility that would be hard to achieve using an on-premises deployment. So, from that perspective, the Google Cloud Acceleration program should be good news to both new customers and existing customers, who see a benefit from migrating partly or fully to the cloud.”