Last week AT&T announced a partnership with Fortinet to expand their managed security services portfolio. This partnership provides global managed Secure Access Service Edge (SASE) solutions at scale. The solution uses Fortinet’s SASE stack which unifies software-defined wide-area network (SD-WAN) and network security capabilities into AT&T managed cybersecurity framework. Additionally, AT&T SASE and Fortinet will integrate with AT&T Alien Labs Threat Intelligence platform, a threat intelligence unit to enhance detection and response. AT&T has plans to update its managed SASE service during the year and will continue to bring more options.

Talking about the AT&T-Fortinet partnership, Ecosystm Principal Advisor, Ashok Kumar says, “This move continues the trend of the convergence of networking and security solutions. AT&T is positioning themselves well with their integrated offer of network and security services to address the needs of global enterprises.”

Convergence of Network & Security

AT&T’s improved global managed security service includes features such as secure web gateway, firewall-as-a service, cloud access security broker (CASB) and zero-trust access, which provides security teams and analysts with unified capabilities across the cloud, networks and endpoints. The solution aims to enable enterprises to create a more resilient network bringing the core capabilities of the two companies that will reduce operational costs and deliver a unified offering.

Last year AT&T also partnered with Cisco to expand its SD-WAN solution and to support AT&T Managed Services using Cisco’s vManage controller through a single management interface. Over the past years multiple vendors including Fortinet have developed comprehensive SASE solution capabilities through partnerships or acquisitions to provide a unified offering. Last year Fortinet acquired Opaq, a SASE cloud provider to bolster their security capabilities through OPAQ’s patented Zero Trust Network Access (ZTNA) cloud solution and to strengthen SD-WAN, security and edge package.

The Push Towards Flexible Networking

Kumar says, “The pandemic has created a higher demand and value for secure networking services. Enterprises experienced greater number of phishing and malware attacks last year with the sudden increase in work-from-home users. The big question enterprises need to ask themselves is whether legacy networks can support their evolving business priorities.”

“As global economies look to recover, securing remote users working from anywhere, with full mobility, will be a high priority for all enterprises. Enterprises need to evaluate mobile SASE services that provide frictionless identity management with seamless user experiences, and be compatible with the growing adoption of 5G services in 2021 and beyond.”

The Top 5 Telecommunications & Mobility Trends that will dominate the telecom industry to watch out for in 2021. Signup for Free to download the report.

BetterUp, a mobile-based professional learning and wellness platform that connects employees with career experts recently raised USD 125 million Series D funding backed by Salesforce Ventures, in partnership with ICONIQ Capital, Lightspeed Venture Partners, Threshold Ventures, and Sapphire Ventures among others, bringing the company’s valuation to USD 1.73 billion. Previously in 2012, the company had raised USD 43 million in venture capital funding with an additional Series B funding of USD 30 million in March 2018. The BetterUp platform combines behavioural science, AI, and human interaction to enhance employees’ personal and professional well-being. Recently, the company also revealed two new products – Identify AI, to help organisations determine the right people to invest in and the appropriate coaching needed through the use of AI; and Coaching Cloud for customised training for frontline, professional, and executive employees.

This announcement comes on the back of several wins for BetterUp. To boost employee performance and organisational growth NASA and the Federal Aviation Administration (FAA) partnered with BetterUp to support new ways of coaching and preparing a workforce for change. The world’s largest brewer, AB InBev has partnered with BetterUp to strengthen diversity and inclusion through BetterUp’s coaching platform.

The Need to Improve Employee Experience

The pandemic changed the working arrangement of millions of employees and industries across the globe who are now working remotely or in a hybrid environment.

Ecosystm Principal Advisor, Audrey William says, “Driving better employee experience (EX) should take centre stage this year with enterprises putting employees at the centre of all initiatives. We will see EX platforms get integrated further and deeper into workplace collaboration and HR applications. In the last 12 months, we have seen apps monitoring wellness and sleep, training and coaching, meditation, employee motivation, and so on sit within larger collaboration platforms such as Slack, Zoom, Microsoft, Cisco and others.”

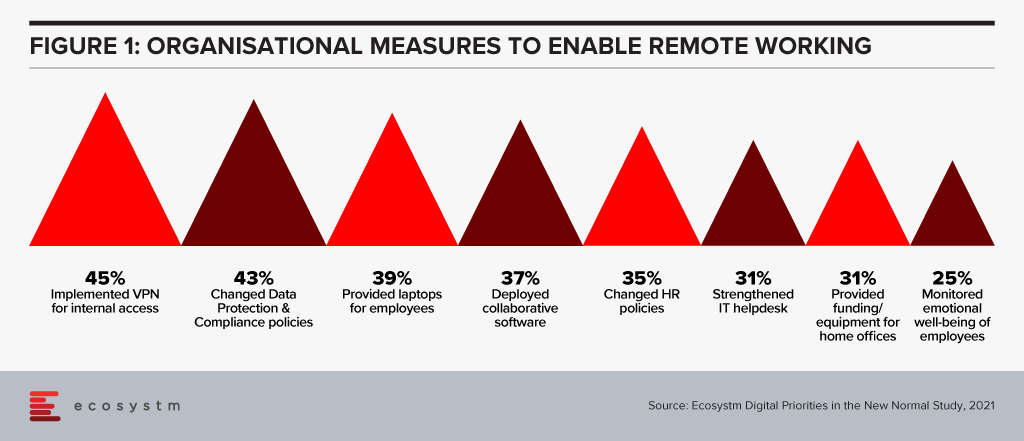

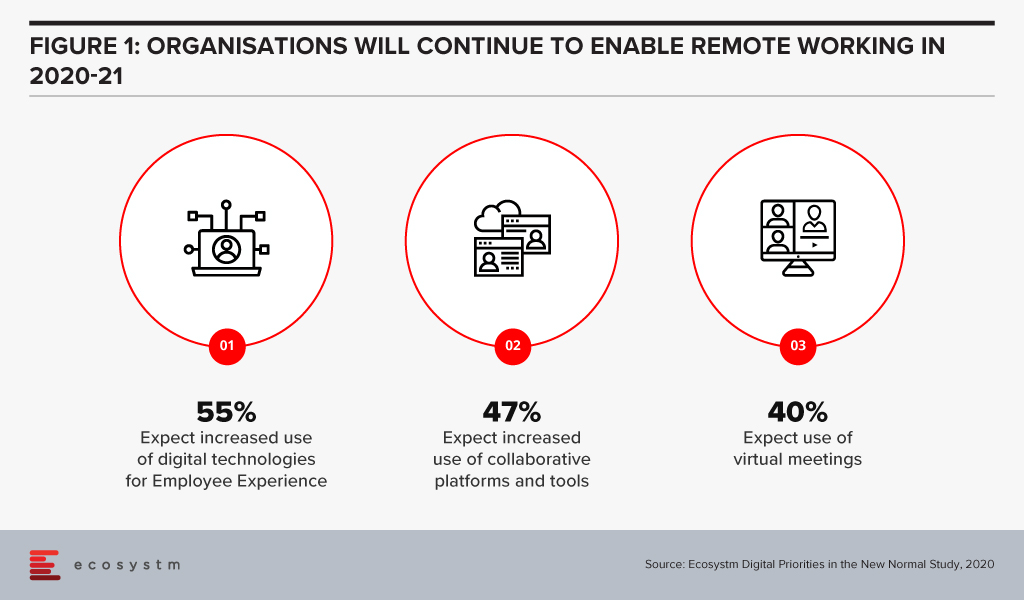

While the primary focus has been on optimising the work environment, it is time for organisations to start focusing on employee well-being. Ecosystm research shows that organisations implemented several measures to empower a remote workforce last year when the pandemic hit. But there was not enough focus on employee well-being (Figure 1).

William says, “A hybrid work environment may have negative impact on your employees. You may face issues such as longer working hours, employee burnout, lesser social engagements and connection, loneliness – and mental and emotional issues and depression”.

“Organisations that place an emphasis on the employees will see their revenues grow and also see less attrition. The more you invest in your people, the more you will get back in return. It is as simple as that! You can see that now in some organisations where employees are being given more flexibility, employers are not dictating how they should work, diversity and inclusion efforts have become mainstream, and efforts are being made to make employees feel like they belong.”

William adds, “However, Ecosystm research finds that organisations have gone back to putting customers and business growth first – losing focus on their employees. Only 27% of organisations globally say that they have improving employee experience as a key business priority in 2021. It is time for this culture and mindset to change. And solutions such as BetterUp can make a difference.”

Transform and be better prepared for future disruption, and the ever-changing competitive environment and customer, employee or partner demands in 2021. Download Ecosystm Predicts: The top 5 Future of Work Trends For 2021.

2020 has been a watershed year for Future of Work policies and technologies. Organisations are still evaluating their workplace strategies and 2021 is likely to see experiments in work models – every organisation will choose the model that works for their nature of work and their organisational culture. Against this backdrop of disruption and change, Ecosystm’s 360o Future of Work team – Audrey William, Mike Zamora, Ravi Bhogaraju and Tim Sheedy – present the top 5 Ecosystm predictions for the Future of Work in 2021.

This is a summary of the predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Future of Work Trends For 2021

- Human-centricity Will be Front and Centre of Organisational Priorities

2020 saw immense humanitarian disruption. Enabling remote work was a key component of business continuity. Both organisations and their employees have a better understanding now of the implications of remote working and how it can be made to work. They are also aware of the challenges of remote working. Monitoring productivity, maintaining the right work-life balance and ensuring employee emotional well-being have been challenging. Despite the challenges, hybrid/blended working is definitely here to stay. Employees will expect more options on the location of their work, often choosing to work where they are most productive.

All decisions related to the organisation, filtered through the lens of human-centricity, will drive better employee engagement – and engaged employees provide better customer experience. Organisations that will operationalise this at scale and across cultures will emerge as success stories.

- Technology Will Bond with Facilities and Operations – Connecting with HR Will be a Challenge

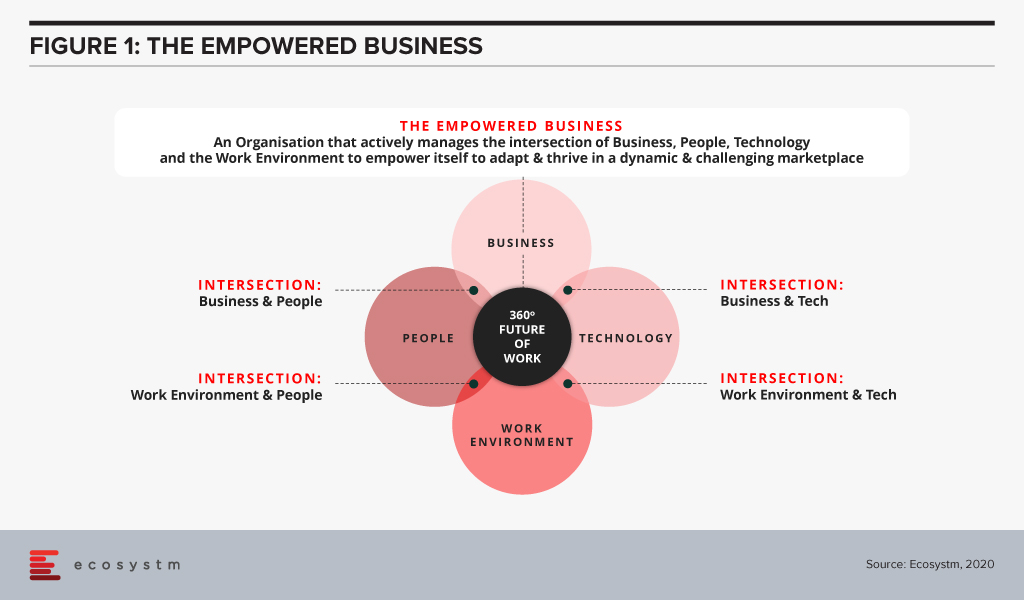

There has to be an alignment between the Business, People, Work Environment and Technology to make an organisation truly empowered to handle sudden pivots that will be required in 2021 as well (Figure 1).

This will require cross-departmental coordination and synergy. Tech teams have traditionally driven the Digital Workplace strategy; now they will have to work closely with Operations and Facilities Management teams on “Smart and Safe Office” strategies. That may not be the real challenge given that there are overlaps between these three teams – they have a shared language and similar KPIs. The real challenge will be the need for Tech teams and HR to work more closely to improve the overall employee experience, including a focus on employee productivity and wellness. Human-centricity makes the role of HR even more important – IT will find it challenging to find common grounds as there have traditionally been few shared KPIs between these two departments.

- Office Spaces Will Become Truly Digital

The hybrid/blended workplace model means that the physical workplace is not disappearing soon. Even as the model evolves for each organisation, what becomes clear is that employee expectations have changed drastically in the last year, and the traditional employee experience expectations of Salary, Recognition, and Job Satisfaction may not be enough. Employees will now expect flexibility, social cohesion, and effective communication. If they are to return to the physical office, they will expect the same benefits as working from home.

This will drive the adoption of digital tech to ensure the office space is safer, more effective and a productive environment for the employees and the business. Two key areas of focus will be on seamless access to information and employee control over work environment.

- Providers Will Deepen Digital Workplace Offerings, but the Market Will Not Consolidate

Key tech providers in the digital workspace space (such as Microsoft, Google, Zoom, Cisco, AWS and so on) will broaden their capabilities and make it easier to procure and use solutions. It will no longer be a “tool-centric” approach (chat, video, document sharing, online meetings, whiteboards and so on) – it will become a platform play. Information workers will be able to choose the approach that best fits the problem they are trying to resolve, without being limited by the capabilities of the tool. E.g. documents will be sharable and editable within chats; whiteboards will be integrated into all other communication services and so on.

Tech providers will deepen and strengthen their capabilities organically and acquisitions will mostly be about buying market share, customers and not the technology.

- Industry-centric Digital Workplace Services Will Emerge and Witness Rapid Growth

The Services industry has been leading in the adoption of digital workplaces – but blue-collar roles and front-line employees will also start benefiting from these technologies. In 2021, new digital workplace capabilities will extend beyond the employee base to systems that drive better connectivity and communication with customers. This will open the market up for smaller, niche players (and this may well run counter to the previous trend). Tech teams will focus on employees and a platform-based approach to collaboration, while Customer teams and others will implement tools and platforms to better communicate outside of the business. The next few years will bring the traditional “employee-centric” collaboration players into direct competition with the “customer-centric” ones. Those that play across both today (such as Google) will be better positioned to win the enterprise-wide “Future of Work” style deals.

The Future of Work is here, now. Organisations were faced with unprecedented challenges of coping with the work-from-home model, when COVID-19 hit earlier this year. Many organisations managed the pivot very successfully, but all organisations were impacted in some way. Various trends have emerged over the last few months, that are likely to persist long after the immediate COVID-19 measures are removed by countries. In the Ecosystm Digital Priorities in the New Normal study, we find that organisations will continue to cater for remote employees (Figure 1) and keep a firm eye on employee experience (EX).

August has seen these clear trends in the Future of Work

#1 Tech companies leading from the front in embracing the Future of Work

As the pandemic continued to spread across the globe, various companies adopted the work from home model at a scale never seen before. While it is still unclear how the work model will look like, many companies continue to extend their remote working policies for the remaining year, and some are even thinking of making it a permanent move.

Tech companies appear to be the most proactive in extending remote working. Google, Microsoft, and AWS have all extended their work from home model till the end of the year or till the middle of next year. Earlier in the month Facebook extended its work from home program until mid-2021 and are also giving employees USD 1,000 to equip their home offices. This appears to be a long-term policy, with the company announcing in May that in the next 5-10 years, they expect 50% of their employees to be remote. Similarly, Salesforce and Uber also announced that they would be extending remote working till the mid-next year, and are providing funding for employees to set up the right work environment.

In Australia, Atlassian has made work from home a permanent option for their employees. They will continue to operate their physical offices but have given employees the option to choose where they want to work from.

Some organisations have gone beyond announcing these measures. Slack has talked about how they are evolving their corporate culture. For example, they have evolved their hiring policies and most new roles are open to remote candidates. Going forward, they are evaluating a more asynchronous work environment where employees can work the hours that make sense for them. In their communique, they are open about the fluid nature of the work environment and the challenges that employees and organisations might face as their shift their work models.

Organisations will have to evaluate multiple factors before coming up with the right model that suits their corporate culture and nature of work, but it appears that tech companies are showing the industry how it can be done.

#2 Tech companies evolve their capabilities to enable the Future of Work

Right from the start of the crisis, we have seen organisations make technology-led pivots. Technology providers are responding – and fast – to the changing environment and are evolving their capabilities to help their customers embrace the digital Future of Work.

Many of these responses have included strengthening their ecosystems and collaborating with other technology providers. Wipro and Intel announced a collaboration between Wipro’s LIVE Workspace digital workspace solution and the Intel vPro platform to enable remote IT support and solution. The solution provides enhanced protection and security against firmware-level attacks. Slack and Atlassian strengthened their alliance with app integrations and an account ‘passport’ in a joint go-to-market move, to reduce the time spent logging into separate services and products. This will enable both vendors to focus on their strengths in remote working tools and provide seamless services to their customers.

Tech companies have also announced product enhancements and new capabilities. CBTS has evolved their cloud-based unified communications, collaboration and networking solutions, with an AI-powered Secure Remote Collaboration solution, powered by Cisco Webex. With seamless integration of Cisco Webex software, Cisco Security software, and endpoints that combine high-definition cameras, microphones, and speakers, with automatic noise reduction, the solution now offers features such real-time transcription, closed captioning, and recording for post-meeting transcripts.

Communication and Collaboration tools have been in the limelight since the start of the crisis with providers such as Zoom, Microsoft Teams and Slack introducing new features throughout. In August Microsoft enhanced the capabilities of Teams and introduced a range of new features to the Teams Business Communications System. It now offers the option to host calls of up to 20,000 participants with a limit to 1,000 for interactive meetings, after which the call automatically shifts to a “view only” mode. With the possibility of remote working becoming a reality even after the crisis is over, Microsoft is looking to make Teams relevant for a range of meeting needs – from one-on-one meetings up to large events and conferences. In the near future, the solution will also allow organisations to add corporate branding, starting with branded meeting lobbies, followed by branded meeting experiences.

While many of these solutions are aimed at large enterprises, tech providers are also aware that they are now receiving a lot of business from small and medium enterprises (SMEs), struggling to make changes to their technology environment with limited resources. Juniper has expanded their WiFi 6 access points to include 4 new access points aimed at outdoor environments, SMEs, retail sites, K-12 schools, medical clinics and even the individual remote worker. While WiFi 6 is designed for high-density public or private environments, it is also designed for IoT deployments and in workplaces that use videoconferencing and other applications that require high bandwidth.

#3 The Future of Work is driving up hardware sales

Ecosystm research shows that at the start of the crisis, 76% of organisations increased investments in hardware – including PCs, devices, headsets, and conferencing units – and 67% of organisations expect their hardware spending to go up in 2020-21. Remote working remains a reality across enterprises. Despite the huge increase in demand, it became difficult for hardware providers to fulfil orders initially, with a disrupted supply chain, store closures and a rapid shift to eCommerce channels. This quarter has seen a steady rise in hardware sales, as providers overcome some of their initial challenges.

Apart from enterprise sales, there has been a surge in the consumer demand for PCs and devices. While remote working is a key contributor, online education and entertainment are mostly prompting homebound people to invest more in hardware. Even accessories such as joysticks are in short supply – a trend that seems to have been accelerated by the Microsoft Flight Simulator launch earlier this month.

The demand for both iPad and Mac saw double-digit growth in this quarter. Around half of the customers purchasing these devices were new to the product. Apple sees the rise in demand from remote workers and students. Lenovo reported a 31% increase in Q1 net profits with demand surges in China, Europe, the Middle East and Africa.

#4 The impact on Real Estate is beginning to show

The demand for prime real estate has been hit by remote working and organisations not renewing leases or downsizing – both because most employees are working remotely and because of operational cost optimisation during the crisis. This is going to have a longer-term impact on the market, as organisations re-evaluate their need for physical office space. Some organisations will reduce office space, and many will re-design their offices to cater to virtual interactions (Figure 1). While now, Ecosystm research shows that only 16% of enterprises are expecting a reduction of commercial space, this might well change over the months to come. Organisations might even feel the need to have multiple offices in suburbs to make it convenient for their hybrid workers to commute to work on the days they have to. Amazon is offering employees additional choices for smaller offices outside the city of Seattle.

But the Future of Work and the rise of a distributed workforce is beginning to show an initial impact on the real estate industry. Last week saw Pinterest cancel a large office lease at a building to be constructed near its headquarters in San Francisco. The company felt that it might not be the right time to go ahead with the deal, as they are re-evaluating where employees would like to work from in the future. Even the termination fees of USD 89.5 million did not discourage them. They will continue to maintain their existing work premises but do not see feel that it is the right time to make additional real estate investments, as they re-evaluate where employees would like to work from in the future.

There is a need for organisations to prepare themselves for the Future of Work – now! Ecosystm has launched a new 360o Future of Work practice, leveraging real-time market data from our platform combined with insights from our industry practitioners and experienced analysts, to guide organisations as they shift and define their new workplace strategies.

This week, Vodafone New Zealand launched a contact centre solution known as Vodafone Connect that runs on AWS cloud infrastructure. The solution is designed for contact centres and customer service providers to reduce their operating cost and deliver an improved customer experience (CX).

The move comes as many businesses and governments are witnessing a spike in inbound contact centre volumes since the outbreak of the pandemic. The telecom company aims to help the contact centre industry through its on-demand contact centre suite of solutions that can be scaled up or down according to the organisations’ requirements. It can be combined with existing CRM platforms in a single dashboard for better access to data and resolution support.

Vodafone Connect is built on the AWS Connect cloud contact centre solution and uses data analytics and machine learning tools to automate customer interactions across multiple channels – email, messaging and social media – to support the contact centre agents with real-time information.

COVID-19 has accelerated the move to the cloud

The recent pandemic has seen many organisations make a leap almost overnight to cloud contact centre technologies. Many organisations that previously had concerns around data privacy, and securing customer data – and were thus hesitant about deploying cloud contact centre solutions – have moved to the cloud model. The cloud model helped get agents that were forced to work from home up and running in a short duration. The immediate urgency was primarily due to a massive spike in voice calls and non-voice activity such as emails. During the COVID-19 crisis, many organisations used Virtual Private Network (VPN) connections to their legacy on-premises phone system to enable the remote agents. However, there have been challenges reported by many organisations with that approach such as increases to IT budget, difficulty in scaling easily, and the requirement for more IT support that could have been avoided.

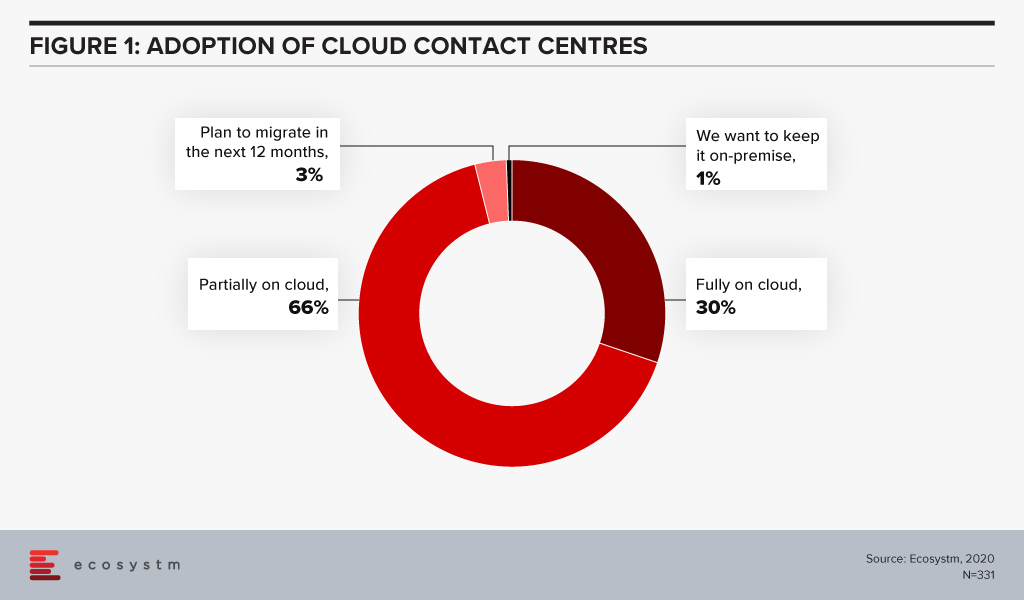

Ecosystm research finds that only 30% of organisations have fully migrated their cloud contact centre solutions on the cloud.

This indicates a market opportunity for vendors in the cloud contact centre space. The COVID-19 pandemic has definitely triggered a strong move towards the cloud model. It has become imperative for vendors and solutions providers to strengthen their cloud capabilities.

Driving an Omni-Channel Experience has become increasingly difficult

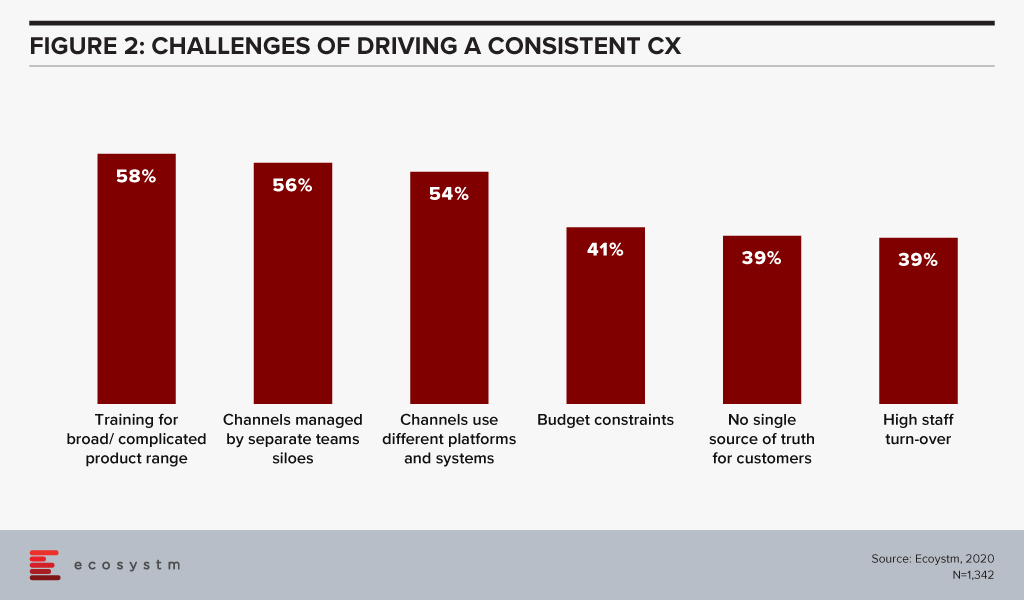

Ecosystm research also finds that organisations find siloed organisational data as one of the biggest challenges in driving consistent customer experience.

This has been further exacerbated by the high volume of interactions that organisations have been having with their customers, and the need to accommodate work-from-home policies for their customer care agents. At the same time, nearly 60% of organisations want to drive an omni-channel experience to improve CX. This provides a huge opportunity for contact centre vendors and partners to offer consulting services to help organisations bridge the gaps in achieving an omni-channel experience. For many organisations there has been a greater push to integrate CRM, the voice of the customer/surveys, customer journey analytics to the contact centre technologies and this is not an easy task as it involves different stakeholders with different sets of KPIs. Having a single platform that can manage this omni-channel experience will be a huge benefit for many organisations.

New Players in the Competitive Landscape

AWS is a relatively new player in the contact centre market, but it is starting to disrupt the existing players, with a global installed base. However, it is worth noting that Avaya, Cisco and Genesys have a higher installed base and they continue to win new deals. The move to the cloud is witnessing more service providers, telecom providers and other contact centre partners push more cloud-based solutions in the market. Apart from AWS, other important players include NICEinContact, 8×8, Talkdesk, Twillio, Five9, and UJet. The competitive battleground is heating up and there are a lot of options for customers to choose from. It will all come down to working with a vendor that can help them achieve their desired CX outcomes.

There are other important elements in CX that are growing in importance and these include conversational AI, voice biometrics, knowledge management systems, machine learning and CX management solutions. Contact centre solution providers are having discussions around these areas with tech buyers. This will mean that we can expect deeper partnerships and acquisitions in the short to medium term. Security has also emerged as an important issue to be resolved, especially with agents working from home. This is from a compliance perspective and pertaining to how agents are viewing and handling customer data. These new trends indicate that customers will need to work with different vendors to solve the variety of issues they are facing.

The Vodafone Connect solution on AWS Connect is one of the many examples of how more partners of contact centre solutions are gearing up for the rapid move to the cloud. Globally, Vodafone also sells contact centre solutions from Cisco and Genesys. The next 3 years will see a great movement in the market and this will include vendors from North America that will set up operations to push their offerings across Europe and the Asia Pacific.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

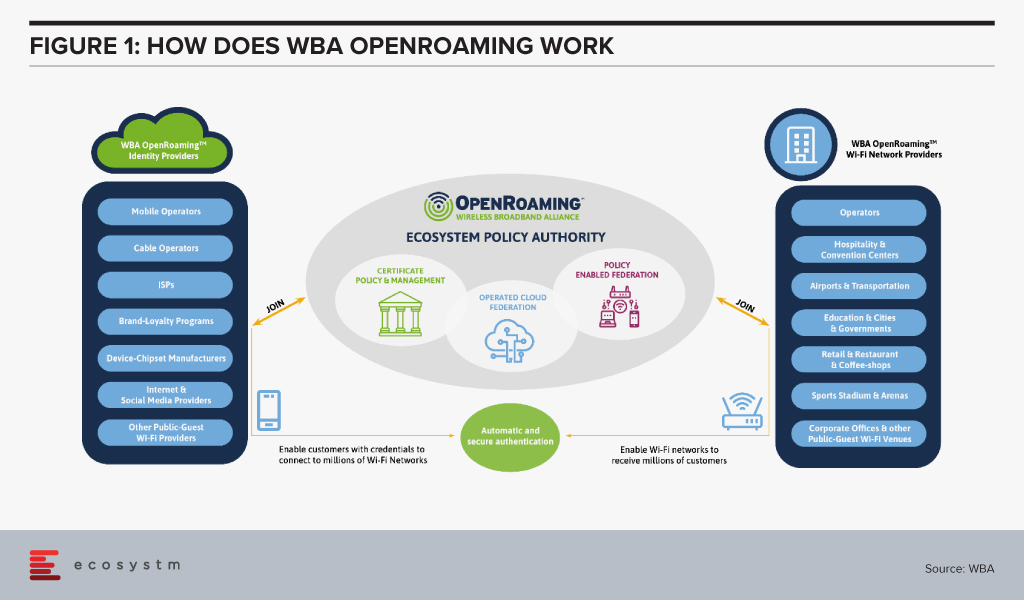

The Wireless Broadband Alliance (WBA) was formed in 2003 to enable a seamless and interoperable Wi-Fi experience across the global wireless ecosystem. The key objective of the alliance was to bring together multiple stakeholders – such as telecom providers, technology vendors and enterprises – to work on areas such as industry guidelines, pilot projects, standards to promote end-to-end services and drive adoption in Wi-Fi, 5G, IoT and others.

WBA OpenRoaming™

Ecosystm Principal Advisor, Ashok Kumar says, “Wi-Fi has gained increasing popularity worldwide over the last two decades and has now become an essential network technology with ubiquitous service that it is utilitarian. However, it has been viewed as a collection of islands of heterogenous networks, requiring re-authentication each time a mobile user transits from one network and re-connects with another Wi-Fi network, with the associated hurdles of logging back in, making it cumbersome.”

“The lack of interoperability between Wi-Fi networks has been a drawback for service providers, compared to the ease of use associated with global mobile networks, such as 4G, LTE, 5G, and so on, which offer seamless roaming connectivity.”

The WBA OpenRoaming™ initiative was announced last month, to create a globally available Wi-Fi ecosystem that offers a federation of automatic and secure connections for billions of devices to millions of Wi-Fi networks. It provides a new global standards-led approach, removing public-guest Wi-Fi connectivity barriers and brings greater convenience and security to the wireless ecosystem. WBA OpenRoaming™ removes the need to search for Wi-Fi networks, to repeatedly enter or create login credentials, or to constantly reconnect or re-register to public Wi-Fi networks.

Several leading technology companies and telecom service providers have extended support to WBA OpenRoaming™ standards – Samsung, Google, Cisco, Intel, Aptilo, AT&T, Boingo Wireless, Broadcom, Comcast, Deutsche Telekom and Orange to name a few.

“Wi-Fi is arguably the most ground-breaking wireless technology of our time. From the first public Wi-Fi hotspots in the early 2000s which enabled radically increased productivity on the move, through to the role Wi-Fi has in today’s pandemic environment. With WBA OpenRoaming™ we want to revolutionise how individual users as well as businesses engage with Wi-Fi, removing the need to repeatedly log in, re-connect, share passwords or re-register for Wi-Fi networks as we travel locally, nationally or internationally”, said Tiago Rodrigues, CEO of the WBA, “Instead, no matter where we are, the new framework automates how users connect to Wi-Fi while seamlessly aligning to cellular network connectivity. It does so by bringing together a federation of trusted identity providers so that individual users are allowed to automatically join any network managed by a federation member.”

WBA OpenRoaming™ can simplify Wi-Fi, much like the cellular roaming experience. Kumar says, “ The WBA OpenRoaming™, with support from major global service providers, network solution vendors, and authentication & security firms, has the potential to address the issue of seamless interoperability in the Wi-Fi networks ecosystem with ease-of-use and security.”

WBA OpenRoaming™ Framework

The framework and standards are based on cloud federation, consisting of a global database of networks and identities, dynamic discovery and the Wireless Roaming Intermediary Exchange (WRIX); cybersecurity consisting of Public Key Infrastructure a RadSec providing the certificate policy, management and brokerage services; and network automation facilitated by an automated roaming consortium framework and policy and Wi-Fi CERTIFIED Passpoint®*.

The Impact of WBA OpenRoaming™

“Enterprises are expected to benefit enormously from the opportunity to create new commercial business models and innovative services with speed and simplicity,” says Kumar.

Maturing mobile technologies such as 5G and Wi-Fi 6 along with next generation wireless devices, could make OpenRoaming™ more seamless and extend its applications further.

Cisco in particular has been leading the charge with several pilots that showcase the benefits of OpenRoaming™. Earlier this year, it partnered with Oxbotica, an autonomous vehicle software provider, to demonstrate how OpenRoaming™ can unlock the potential of autonomous vehicle fleets, allowing a seamless and secure sharing of high-volume data while on the move.

Last year, Cisco also showcased the benefits of OpenRoaming™ in a pilot at the Mobile World Congress in Barcelona with Samsung as the identity provider. Attendees were connected to the network throughout the venue, with connectivity extended to even local train stations and the airport. This unified experience was possible despite the fact that at least three network providers were involved. Pilots such as these gives the industry a glimpse of what benefits lie ahead.

Kumar sees the impact being extended across industries. “The impact of WBA OpenRoaming™ will be in the introduction of innovative services for consumers and enterprise users in public Wi-Fi networks in industries such as Hospitality, Transportation (airport and rail), Retail outlets, Smart City solutions, and local community networks.”

Learn more about WBA OpenRoaming™, visit www.openroaming.org

*Wi-Fi CERTIFIED Passpoint® is a registered trademark of the Wi-Fi Alliance

As organisations aim to maintain operations during the ongoing crisis, there has been an exponential increase in employees working from home and relying on the Workplace of the Future technologies. 41% of organisations in an ongoing Ecosystm study on the Digital Priorities in the New Normal cited making remote working possible as a key organisational measure introduced to combat current workplace challenges.

Ecosystm Principal Advisor, Audrey William says, “During the COVID-19 pandemic, people have become reliant on voice, video and collaboration tools and even when things go back to normal in the coming months, the blended way of work will be the norm. There has been a surge of video and collaboration technologies. The need to have good communication and collaboration tools whether at home or in the office has become a basic expectation especially when working from home. It has become non-negotiable.”

William also notes, “We are living in an ‘Experience Economy’ – if the user experience around voice, video and collaboration is poor, customers will find a platform that gives them the experience they like. To get that equation right is not easy and there is a lot of R&D, partnerships and user experience design involved.”

AWS and Slack Partnership

Amid a rapid increase in remote working requirements, AWS and Slack announced a multi-year partnership to collaborate on solutions to enable the Workplace of the Future. This will give Slack users the ability to manage their AWS resources within Slack, as well as replace Slack’s voice and video call features with AWS’s Amazon Chime. And AWS will be using Slack for their internal communication and collaboration.

Slack already uses AWS cloud infrastructure to support enterprise customers and have committed to spend USD 50 million a year over five years with AWS. However, the extended partnership is promising a new breed of solutions for the future workforce.

Slack and AWS are also planning to tightly integrate key features such as: AWS Key Management Service with Slack Enterprise Key Management (EKM) for better security and encryption; AWS Chatbot to push AWS Virtual machines notifications to Slack users; and AWS AppFlow to secure data flow between Slack, AWS S3 Storage and AWS Redshift data warehouse.

The Competitive Landscape

The partnership between AWS and Slack has enabled Slack to scale and compete with more tools in its arsenal. The enterprise communication and collaboration market is heating up with announcements such as Zoom ramping up its infrastructure on Oracle Cloud. The other major cloud platform players already have their own collaboration offerings, with Microsoft Teams and Google Meet. The AWS-Slack announcement is another example of industry players looking to improve their offerings through partnership agreements. Slack is already integrated with a number of Microsoft services such as OneDrive, Outlook and SharePoint and there was talk of being integrated with Microsoft Teams earlier this year. Similarly, Slack has also integrated some GSuite tools on its platform.

“There is a battle going on now in the voice, video and collaboration space and there are many players that offer rich enterprise grade capabilities in this space. AWS is already Slack’s “preferred” cloud infrastructure provider, and the two companies have a common rival in Microsoft, competing with its Azure and Teams products, respectively,” says William.

The Single Platform Approach

The competition in the video, voice and collaboration market in becoming increasingly intense and the ability to make it easy for users across all functions on one common platform is the ideal situation. This explains why we have seen vendors in recent months adding greater capabilities to their offerings. For instance, Zoom added Zoom phone functionality to expand its offerings to users. Avaya released Spaces – an integrated cloud meeting and team collaboration solution with chat, voice, video, online meetings, and content sharing capabilities. The market also has Cisco as an established presence, providing video and voice solutions to many large organisations.

Organisations want an all-in-one platform for voice, video and collaboration if possible as it makes it easier for management. Microsoft Teams is a single platform for enterprise communications and collaboration. William says, “Teams has seen steady uptake since its launch and for many IT managers the ability to capture all feedback, issues/logs on one platform is important. Other vendors are pushing the one vendor platform option heavily; for example, 8×8 has been able to secure wins in the market because of the one vendor platform push.”

“As the competition heats up, we can expect more acquisitions and partnerships in the communications and collaboration space, in an effort to provide all functions on a single platform,” says William. “However, irrespective of what IT Teams want, we are still seeing organisations use different platforms from multiple vendors. This is a clear indication that in the end there is only one benefit that organisations seek – quality of experience.”

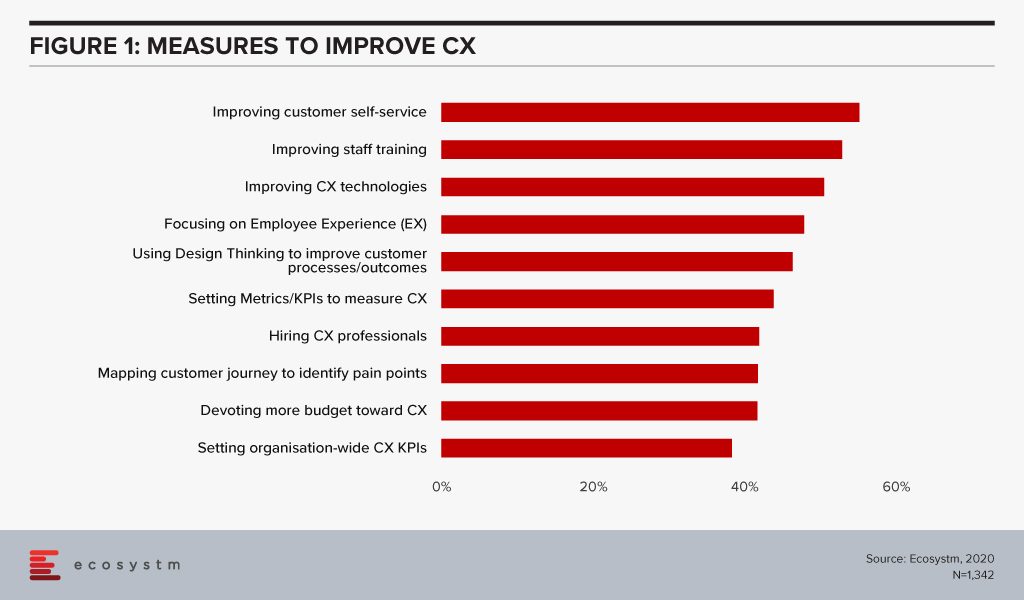

In the ‘Top 5 Customer Experience Trends for 2020’ that I authored with Tim Sheedy, we had spoken about the need for businesses to understand the end-to-end journey of each customer and to evaluate how to personalise it. To be able to personalise customer experience (CX), organisations need to get feedback from their customers. However, today’s customers are experiencing survey fatigue! Surveys are always the best way to measure how customers feel after they have interacted with a brand. Already, many will not participate unless there is a discount or incentive, which eats into future margins. Smart businesses will begin to use AI to detect emotions and mood, and analytics to measure experiences.

The challenge for years has been that customer teams have focused on the traditional inbound and outbound customer interactions. Ecosystm research finds that while organisations are investing in improving customer self-service, not all of these organisations focus on customer journey mapping and analysis (Figure 1).

Brands now need to understand and personalise the experience before the customer interacts with the brand and after they are done interacting with the brand. The ability to apply machine learning and AI to offer insights to predict the movement and journey of the customer will be a significant focus – and challenge – for customer teams. Customer Journey Analytics will allow brands to deliver that “frictionless” service.

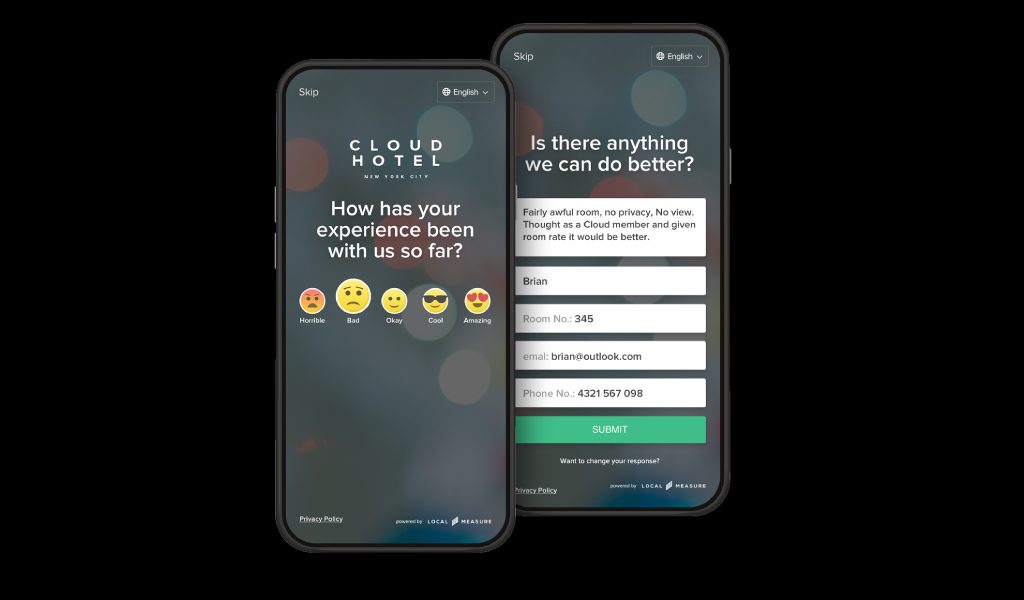

Detecting the problem earlier in the CX loop or before the call is placed to the contact centre has significant benefits. The emotion of the customer at every part of their journey and not just when they call the contact centre needs to be captured in real-time and analysed to address the problem as soon as it arises. For example, if it can be identified prior to the customer calling the airlines to complain about a booking, the agent can call the customer preemptively to inform the customer the problem will be fixed and even go the extra mile to give the customer a discount or a good seat. Another scenario is when a hotel customer has had a bad experience with the meal they ordered, their feedback to the frontline staff earlier in the loop can be passed on and before they check out of the hotel, incentives such as free vouchers can be used to improve the CX. When such measures are taken earlier in the CX journey, the customer will go a long way to buy more products and services from the organisation. This can have an impact too on post-experience surveys or Net promoter scores (NPS).

As organisations design, customer feedback platforms for customers such as simple surveys through an app or as a prompt on the mobile device or laptop, the look and feel of the platform combined with simplicity cannot be ignored. The design has to be carefully thought about and should be intuitive and also easy for the customer to enter the feedback.

Niche Vendors will play a crucial role in connecting the missing dots in CX

There are niche vendors emerging in this space and we can expect more players to emerge that will develop applications that can address CX issues very early in the journey of the customer. For example, Australian vendor Local Measure’s solution is used to capture feedback during the different points of a customer’s journey, especially in the tourism, hospitality, retail and entertainment industries. One of their solutions, Pulse is a real-time feedback tool to help improve satisfaction while customers are still on site. The company works in collaboration with Cisco and when customers log on to wifi on a site, a pop up appears on their screen to ask customers how their experience has been so far. By rating the experience using emojis (happy, sad, etc), the front desk staff or personnel within the premises, can see the feedback in real time. This can send alerts that will trigger that something has gone wrong to frontline staff or the contact centre team. The idea is to drive a positive outcome for the customer, identify problems early in the journey and address the problems immediately for higher customer satisfaction.

Figure 2: Local Measure’s Real-Time Customer Feedback Tool

The company has clients such as Dubai-based Majid Al Futtaim that includes 13 major entertainment and retail-focused hotels, serving 1.6 million guests annually. Instead of giving feedback only at check-out, the Pulse feedback screen displays on guests’ computers or mobile devices as they log in to the hotel’s Wi-Fi, asking them to leave feedback on their experience. Novotel Bangkok Sukhumvit 20 has also implemented the solution so that staff can view feedback immediately as responses come through on their mobile devices, and after addressing the issues they can mark each response as ‘actioned’, providing visibility to the whole team.

The Local Measure solution integrates into Cisco’s Wifi offering and when the customer opts a pop up will appear on their screen to lead the customer to the Local Measure platform. Products such as this help fill the gaps where the complaint by the customer can be escalated to the contact centre very early in the journey of the customer. Contact centre vendors have not addressed this space in a dedicated manner and we can expect more niche vendors to make their mark in this space. The data collected include real-time feedback, social media alerts, post-event experience and location analytics. When this data is further integrated into CRM and with the data gathered from the contact centre channels, organisations will be able to gain a better understanding of the customer journeys and analyse what should be done better.

As larger contact centre solution providers realise the value of such niche offerings that help connect the CX dots, they will look to acquire some of these niche solution providers in the customer experience segment. Cisco’s acquisition of Cloud Cherry last year, is an example. The solution allows organisations to listen to their customers across 17 different channels (e.g. email, chat, web) along the entire journey and leverage the Cisco’s contact centre solution to drive better. NICE acquired Satmetrix two years ago, to further enhance its presence in the CX management space.

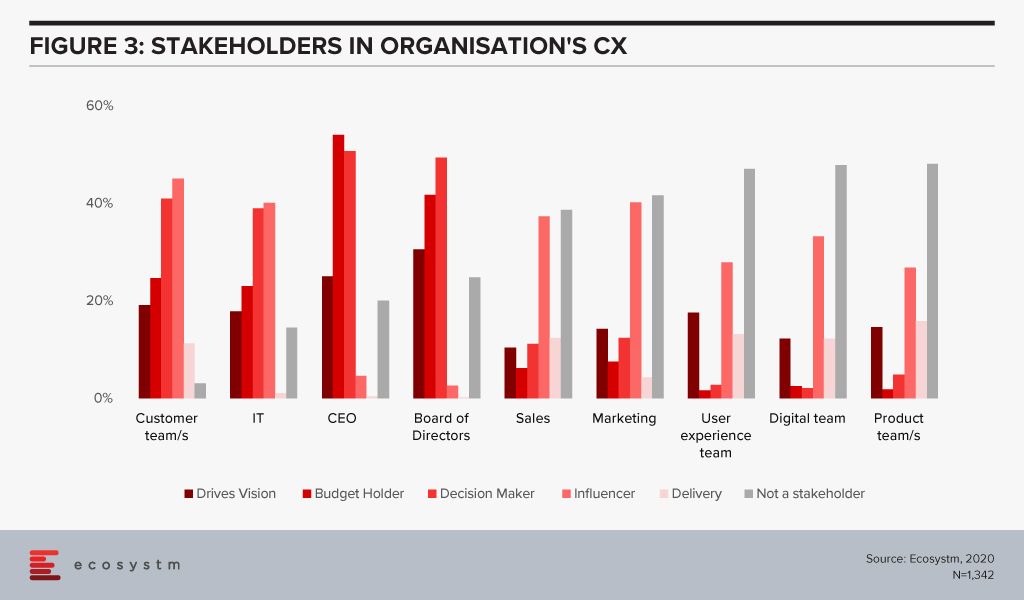

CX is becoming a company-wide initiative

Technologies across customer journey analytics and CX management have often been sold to the marketing and sales teams. As companies look to complete the full loop of understanding the customer journey, the solution must be integrated into the contact centre teams. Based on the global Ecosystm CX Study, the marketing, sales, product, customer service, digital and UX teams are becoming influencers in CX (Figure 3). The Board and CEO are starting to play an important role in decision making. As organisations look to further drive greater CX, more teams across the organisation are starting to realise the need to collaborate to deliver on the vision.

Moving the needle from being Reactive to Proactive in CX will be important

The traditional way of getting feedback after the customer has had the experience or after the customer has spoken to the agent is one of the reasons why organisations are finding it hard to deal with customer frustrations. Being proactive rather than reactive is how customer journey analytics and CX management technologies can help organisations address these issues. AI and machine learning will play an important part in this area moving forward as after the call is placed to the customer, data around customer emotions, sentiments, tone of the voice and keywords used in the discussion, can help in better understanding of how to provide a solution or solve the customers’ challenges.

Cisco announced their plans to acquire CloudCherry to bolster their contact centre portfolio. Launched in Chennai in 2014, CloudCherry is a customer experience (CX) management startup that helps organisations understand the various factors influencing CX. CloudCherry has employees in Chennai, Bengaluru, Singapore and Malaysia, besides the US and their team of around 90 employees will join Cisco’s contact centre solution practice as part of the acquisition

Using artificial intelligence (AI) as the underlying solution to CloudCherry’s open API platform allows for various customer data sets from CRM systems to other communication touchpoints in the contact centre to be analysed in real-time for the organisation to deliver a personalised CX. When agents can understand what is taking place in real-time and when the contact centre team has one integrated point of data injecting analytics, improving the ability to drive greater loyalty and eventually higher revenues.

Some of CloudCherry’s offerings are:

- Measuring customer journeys. CloudCherry provides the opportunity to follow the customer across 17 different channels, driving contextual real-time conversations with customers on the channels they choose. It is important to understand the micro journeys – for example, their customer PUMA sells products online and in physical stores and may have two micro journeys in addition to an overall customer journey map for:

- Online customers

- In-store customers

- Blended customers

- Predictive Analytics. Their predictive engine is based on customer feedback, their actions and their purchasing data. With advanced predictive analytics, CX teams can derive what is needed to increase the ROI.

- Questionnaire builder. They have the capability to respond to feedback collected from surveys in real-time. There are set conditions for survey questions so that when triggered by customer response, the concerned employee or department is quickly notified regarding it. For instance, when a customer gives a low rating on store cleanliness or staff behaviour, an alert can be immediately sent to the concerned employee to follow up and take corrective action. At the same time, even positive feedback can be noted in order to recognise and reward employees.

- Sentiment Analysis. This helps organisations tap into machine learning and deep learning to identify customer sentiment associated with open-text responses and brand conversations.

These are just some of the applications and tools the CloudCherry platform offers to their customers.

Leading with data will be critical to driving personalised CX

CX decision-makers and buyers of contact centre and CX technologies have an important role to play in the next few years to look at re-inventing how they view CX. This means re-looking at the ways they have been running contact centres in the traditional way and making investments towards the cloud, machine learning and predictive analytics.

- By having rich analytics, mobile conversation through the app can be richer. A Mobile-led CX approach is key in today’s world where most people spend hours on a phone.

- Issues can be prevented before they happen if in-store transactions are monitored and dissatisfied customers can be identified. The organisation has the ability to reach out to the customer through any touchpoint to mention proactively that they are aware of the issues that just happened and what they can do to help solve the negative experience. Proactive notifications demonstrate how a brand takes it, customers, seriously

- Leveraging AI as the underlying platform to understand customer behaviour is going to be the next battleground for CX vendors. The challenge so far has been that many organisations have invested in several data and CRM tools from various vendors. When agents have to view customer information, they are dealing with data in an unsynchronised format. This explains why when we contact a contact centre, we sometimes have to repeat ourselves and state the problem we are facing. Or worse than that, the agent has no idea that we had a problem a week ago and spoke to 2 agents. These frustrations are real and still happen today.

- Contact centre of the future will not be reactive but proactive in helping understand customer sentiment in real-time to make the necessary adjustments and actions needed to solve the issue the customer is facing. The deep analytics platform for CX also means that agents will be empowered with information and bots can be placed to help agents say the right things or make suggestions to customers. The use cases to help deliver personalised CX are enormous.

Ecosystm comment

This is an important and good acquisition for Cisco. Cisco has a vast set of customers globally and in the Asia Pacific region in the collaboration, voice and contact centre space. This acquisition marks how they are investing in enhancing their existing contact centre portfolio to use machine learning, cognitive and predictive analytics to alleviate their offerings. The contact centre is a key part of Cisco’s larger collaboration portfolio.

According to the company, Cisco products support more than 30,000 contact centre customers and more than 3 million contact centre agents around the world. Vasili Triant, VP and GM of Cisco Contact Centre solutions mentioned in a blog recently that the acquisition will augment Cisco’s contact centre portfolio with advanced analytics, journey mapping and sophisticated survey capabilities whether their customers are using Webex Contact Centre in the cloud or their hosted and on-premises solutions.

The market for predictive analytics and customer analytics in the contact centre and across the CX segment will be big and we are at the beginning of a new era of organisations using data as the platform to deliver a new way of engaging with customers. CloudCherry offers a CX management platform that uses predictive analytics to derive insights for contact centre agents. The market for deep analytics is becoming an important area of investment for organisations as a way to decrease customer frustration. It is by applying analytics before, during and after the call that will allow contact centres to deliver a personalised CX as was mentioned in my last blog. This is the reason why a data-driven culture will be key to driving rich outcomes for the contact centre. Contact centres will have to lead with analytics so that every experience across every single touchpoint the customer has with the brand is analysed and observed in real-time. We will see many contact centre vendors and players in the CRM space acquire companies with capabilities like what CloudCherry offers.