As organisations aim to maintain operations during the ongoing crisis, there has been an exponential increase in employees working from home and relying on the Workplace of the Future technologies. 41% of organisations in an ongoing Ecosystm study on the Digital Priorities in the New Normal cited making remote working possible as a key organisational measure introduced to combat current workplace challenges.

Ecosystm Principal Advisor, Audrey William says, “During the COVID-19 pandemic, people have become reliant on voice, video and collaboration tools and even when things go back to normal in the coming months, the blended way of work will be the norm. There has been a surge of video and collaboration technologies. The need to have good communication and collaboration tools whether at home or in the office has become a basic expectation especially when working from home. It has become non-negotiable.”

William also notes, “We are living in an ‘Experience Economy’ – if the user experience around voice, video and collaboration is poor, customers will find a platform that gives them the experience they like. To get that equation right is not easy and there is a lot of R&D, partnerships and user experience design involved.”

AWS and Slack Partnership

Amid a rapid increase in remote working requirements, AWS and Slack announced a multi-year partnership to collaborate on solutions to enable the Workplace of the Future. This will give Slack users the ability to manage their AWS resources within Slack, as well as replace Slack’s voice and video call features with AWS’s Amazon Chime. And AWS will be using Slack for their internal communication and collaboration.

Slack already uses AWS cloud infrastructure to support enterprise customers and have committed to spend USD 50 million a year over five years with AWS. However, the extended partnership is promising a new breed of solutions for the future workforce.

Slack and AWS are also planning to tightly integrate key features such as: AWS Key Management Service with Slack Enterprise Key Management (EKM) for better security and encryption; AWS Chatbot to push AWS Virtual machines notifications to Slack users; and AWS AppFlow to secure data flow between Slack, AWS S3 Storage and AWS Redshift data warehouse.

The Competitive Landscape

The partnership between AWS and Slack has enabled Slack to scale and compete with more tools in its arsenal. The enterprise communication and collaboration market is heating up with announcements such as Zoom ramping up its infrastructure on Oracle Cloud. The other major cloud platform players already have their own collaboration offerings, with Microsoft Teams and Google Meet. The AWS-Slack announcement is another example of industry players looking to improve their offerings through partnership agreements. Slack is already integrated with a number of Microsoft services such as OneDrive, Outlook and SharePoint and there was talk of being integrated with Microsoft Teams earlier this year. Similarly, Slack has also integrated some GSuite tools on its platform.

“There is a battle going on now in the voice, video and collaboration space and there are many players that offer rich enterprise grade capabilities in this space. AWS is already Slack’s “preferred” cloud infrastructure provider, and the two companies have a common rival in Microsoft, competing with its Azure and Teams products, respectively,” says William.

The Single Platform Approach

The competition in the video, voice and collaboration market in becoming increasingly intense and the ability to make it easy for users across all functions on one common platform is the ideal situation. This explains why we have seen vendors in recent months adding greater capabilities to their offerings. For instance, Zoom added Zoom phone functionality to expand its offerings to users. Avaya released Spaces – an integrated cloud meeting and team collaboration solution with chat, voice, video, online meetings, and content sharing capabilities. The market also has Cisco as an established presence, providing video and voice solutions to many large organisations.

Organisations want an all-in-one platform for voice, video and collaboration if possible as it makes it easier for management. Microsoft Teams is a single platform for enterprise communications and collaboration. William says, “Teams has seen steady uptake since its launch and for many IT managers the ability to capture all feedback, issues/logs on one platform is important. Other vendors are pushing the one vendor platform option heavily; for example, 8×8 has been able to secure wins in the market because of the one vendor platform push.”

“As the competition heats up, we can expect more acquisitions and partnerships in the communications and collaboration space, in an effort to provide all functions on a single platform,” says William. “However, irrespective of what IT Teams want, we are still seeing organisations use different platforms from multiple vendors. This is a clear indication that in the end there is only one benefit that organisations seek – quality of experience.”

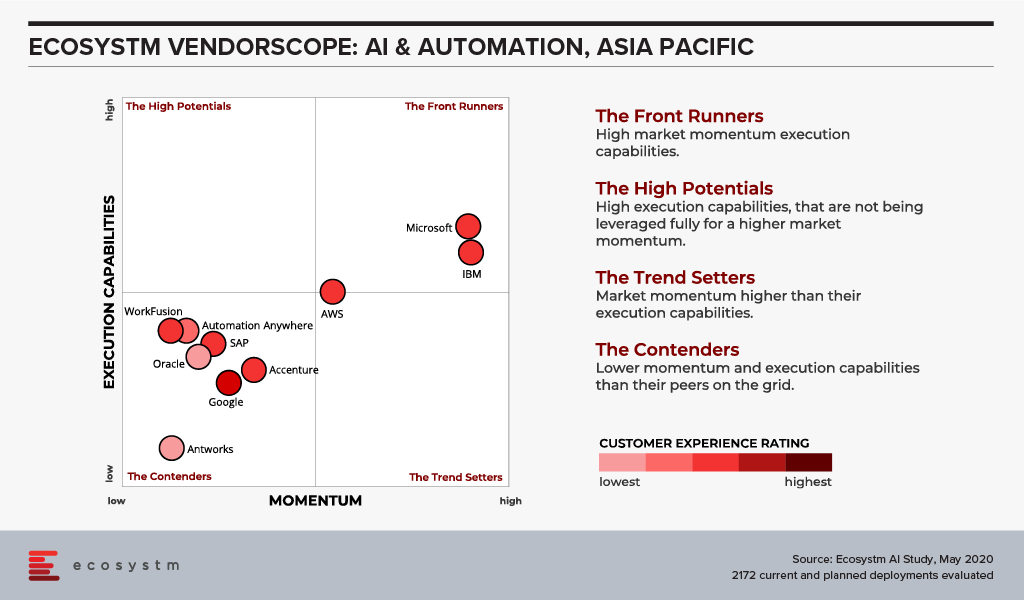

I’m really excited to launch our AI and Automation VendorScope! This new tool can help technology buyers understand which vendors are offering an exceptional customer experience, which ones have momentum and which are executing and delivering on their promised capabilities. The positioning of vendors in Ecosystm VendorScopes is independent of analyst bias or opinion or vendor influence – customers directly rate their suppliers in our ongoing market benchmarks and assessments.

The Evolution of the AI Market

The AI market has evolved significantly over the past few years. It has gone from a niche, poorly understood technology, to a mainstream one. Projects have moved from large, complex, moonshot-style “change the world” initiatives to small, focused capabilities that look to deliver value quickly. And they have moved from primarily internally focused projects to delivering value to customers and partners. Even the current pandemic is changing the lens of AI projects as 38% of the companies we benchmarked in Asia Pacific in the Ecosystm Business Pulse Study, are recalibrating their AI models for the significant change in trading conditions and customer circumstances.

Automation has changed too – from a heavily fragmented market with many specific – and often very simple tools – to comprehensive suites of automation capabilities. We are also beginning to see the use of machine learning within the automation platforms as this market matures and chases after the bigger automation opportunities where processes are not only simplified but removed through intelligent automation.

Cloud Platform Providers Continue to Lead

But what has changed little over the years is the dominance of the big cloud providers as the AI leaders. Azure, IBM and AWS continue to dominate customer mentions and intentions. And it is in customer mentions that the frontrunners in the VendorScope – Microsoft and IBM – set themselves apart. Not only are they important players today – but existing customers AND non-customers plan to use their services over the next 12-24 months. This gives them the market momentum over the other players. Even AWS and Google – the other two public cloud giants – who also have strong AI offerings – didn’t see the same proportions of customers and prospects planning to use their AI platforms and tools.

While Microsoft and IBM may have stolen the lead for now, they cannot expect the challengers to sit still. In the last few weeks alone we have seen several major launches of AI capabilities from some providers. And the Automation vendors are looking to new products and partnerships to take them forward.

Without the market momentum, Microsoft and IBM would still stand above the rest of the pack – just not as dramatically! Both companies are not just offering the AI building blocks, but also offer smart applications and services – this is possibly what sets them apart in an era where more and more customers want their applications to be smart out-of-the-box (or out-of-the-cloud). The appetite for long, expensive AI projects is waning – fast time to value will win deals today.

The biggest change in AI over the next few years will hopefully be more buyers demanding that their applications are smart out-of-the-box/cloud. AI and Automation shouldn’t be expensive add-ons – they should form the core of smart applications – applications that work for the business and for the customer. Applications that will deliver the next generation of employee and customer experiences.

Ecosystm Vendorscope: AI & Automation

Signup for Free to access the Ecosystm Vendorscope: AI & Automation report.

The COVID-19 crisis has forced countries to implement work from home policies and lockdowns. Since the crisis hit, uptake of cloud communication and collaboration solutions have seen a dramatic increase. Video conferencing provider, Zoom has emerged as a key player in the market, with a rapid increase in user base from 10 million daily active participants in December 2019 to 200 million in March 2020 – a growth in the number of users of nearly 200%!

Security Concerns around Zoom

The rapid increase in user base and the surge in traffic has required Zoom to re-evaluate its offerings and capacity. The platform was primarily built for enterprises and now is seeing unprecedented usage in conducting team meetings, webinars, virtual conferences, e-learning, and social events.

The one area where they were impacted most is security. In his report, Cybersecurity Considerations in the COVID-19 Era, Ecosystm Principal Advisor Andrew Milroy says, “The extraordinary growth of Zoom has made it a target for attackers. It has had to work remarkably hard to plug the security gaps, identified by numerous breaches. Many security vulnerabilities have been discovered with Zoom such as, a vulnerability to UNC path injection in the client chat feature, which allows hackers to steal Windows credentials, keeping decryption keys in the cloud which can potentially be accessed by hackers and the ability for trolls to ‘Zoombomb’ open and unprotected meetings.”

“Zoom largely responded to these disclosures quickly and transparently, and it has already patched many of the weaknesses highlighted by the security community. But it continues to receive rigorous stress testing by hackers, exposing more vulnerabilities.”

However, Milroy does not think that this issue is unique to Zoom. “Collaboration platforms tend to tread a fine line between performance and security. Too much security can cause performance and usability to be impacted negatively. Too little security, as we have seen, allows hackers to find vulnerabilities. If data privacy is critical for a meeting, then perhaps collaboration platforms should not be used, or organisations should not share critical information on them.”

Zoom to increase Capacity and Scalability

Zoom is aware that it has to increase its service capacity and scalability of its offerings, if it has to successfully leverage its current market presence, beyond the COVID-19 crisis. Last week Zoom announced that that it had selected Oracle as its cloud Infrastructure provider. One of the reasons cited for the choice is Oracle’s “industry-leading security”. It has been reported that Zoom is transferring more than 7 PB of data through Oracle Cloud Infrastructure servers daily.

In addition to growing their data centres, Zoom has been using AWS and Microsoft Azure as its hosting providers. Milroy says, “It makes sense for Zoom to use another supplier rather than putting ‘all its eggs in one or two baskets’. Zoom has not shared the commercial details, but it is likely that Oracle has offered more predictable pricing. Also, the security offered by the Oracle Cloud Infrastructure deal is likely to have impacted the choice and it is likely that Oracle has also priced its security features very competitively.”

“It must also be borne in mind that Google, Microsoft and Amazon are all competing directly with Zoom. They all offer video collaboration platforms and like Zoom, are seeing huge growth in demand. Zoom may not wish to contribute to the growth of its competitors any more than it needs to.”

Milroy sees another benefit to using Oracle. “Oracle is known to have a presence in the government sector – especially in the US. Working with Oracle might make it easier for Zoom to win large government contracts, to consolidate its market presence.”

Gain access to more insights from the Ecosystm Cloud Study

In The Top 5 Cloud trends for 2020, Ecosystm Principal Analyst, Claus Mortensen had predicted that in 2020, cloud and IoT will drive edge computing.

“Edge computing has been widely touted as a necessary component of a viable 5G setup, as it offers a more cost-effective and lower latency option than a traditional infrastructure. Also, with IoT being a major part of the business case behind 5G, the number of connected devices and endpoints is set to explode in the coming years, potentially overloading an infrastructure based fully on centralised data centres for processing the data,” says Mortensen.

Although some are positioning the Edge as the ultimate replacement of cloud, Mortensen believes it will be a complementary rather than a competing technology. “The more embedded major cloud providers like AWS and Microsoft can become with 5G providers, the better they can service customers, who want to access cloud resources via the mobile networks. This is especially compelling for customers who need very low latency access.”

Affirmed Networks Brings Microsoft to the 5G Infrastructure Table

Microsoft recently announced that they were in discussions to acquire Affirmed Networks, a provider of network functions virtualisation (NFV) software for telecom operators. The company’s existing enterprise customer base is impressive with over 100 major telecom customers including big names such as AT&T, Orange and Vodafone. Affirmed Networks’ recently appointed CEO, Anand Krishnamurthy says that their virtualised cloud-native network, Evolved Packet Core, allows for scale on demand with a range of automation capabilities, at 70% of the cost of traditional networks. The telecom industry has been steadily moving away from proprietary hardware-based infrastructure, opting for open, software-defined networking (SDN). This acquisition will potentially allow Microsoft to leverage their Azure platform for 5G infrastructure and for cloud-based edge computing applications.

Ecosystm Principal Advisor, Shamir Amanullah says, “The telecommunications industry is suffering from a decline in traditional services leading to a concerted effort in reducing costs and introducing new digital services. To do this in preparation for 5G, carriers are working towards transforming their operations and business support systems to a more virtualised and software-defined infrastructure. 5G will be dynamic, more than ever before, for a number of reasons. 5G will operate across a range of frequencies and bands, with significantly more devices and connections, highly software-defined with computing power at the Edge.”

Microsoft is by no means the only tech giant that is exploring this space. Google recently announced a new solution, Anthos for Telecom and a new service called the Global Mobile Edge Cloud (GMEC), aimed at giving telecom providers compute power on the Edge. At about the same time, HPE announced a new portfolio of as-a-service offering to help telecom companies build and deploy open 5G networks. Late last year, AWS had launched AWS Wavelength that promises to bring compute and storage services at the edge of telecom providers’ 5G networks. Microsoft’s acquisition of Affirmed Networks brings them to the 5G infrastructure table.

Microsoft Continues to Focus on 5G Offerings

The acquisition of Affirmed Networks is not the only Microsoft initiative to improve their 5G offerings. Last week also saw Microsoft announce Azure Edge Zones aimed at reducing latency for both public and private networks. AT&T is a good example of how public carriers will use the Azure Edge Zones. As part of the ongoing partnership with Microsoft, AT&T has already launched a Dallas Edge Zone, with another one planned for Los Angeles, later in the year. Microsoft also intends to offer the Azure Edge Zones, independent of carriers in denser areas. They also launched Azure Private Edge Zones for private enterprise networks suitable for delivering ultra low latency performance for IoT devices.

5G will remain a key area of focus for cloud and software giants. Amanullah sees this trend as a challenge to infrastructure providers such as Huawei, Ericsson and Nokia. “History has shown how these larger software providers can be fast, nimble, innovative, and extremely customer-centric. Current infrastructure providers should not take this challenge lightly.”

In our blog, Artificial Intelligence – Hype vs Reality, published last month we explored why the buzz around AI and machine learning have got senior management excited about future possibilities of what technology can do for their business. AI – starting with automation – is being evaluated by organisations across industries. Several functions within an organisation can leverage AI and the technology is set to become part of enterprise solutions in the next few years. AI is fast becoming the tool which empowers business leaders to transform their organisations. However, it also requires a rethink on data integration and analysis, and the use of the intelligence generated. For a successful AI implementation, an organisation will have to leverage other enabling technologies.

Technologies Enabling AI

IoT

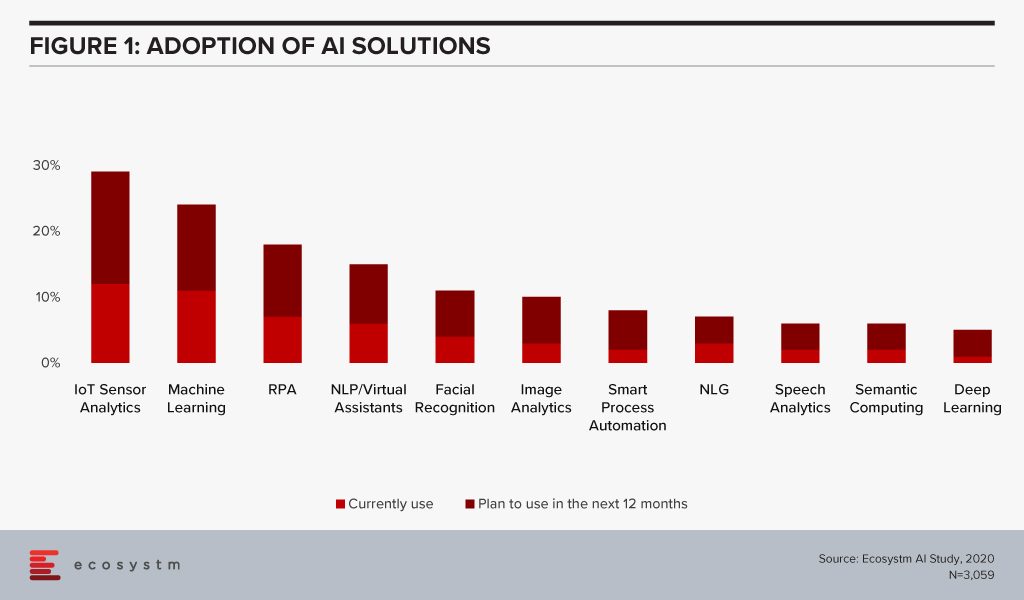

Organisations have been evaluating IoT – especially for Industry 4.0 – for the better part of the last decade. Many organisations, however, have found IoT implementations daunting for various reasons – concerns around security, technology integration challenges, customisation to meet organisational and system requirements and so on. As the hype around what AI can do for the organisation increases, they are being forced to re-look at their IoT investments. AI algorithms derive intelligence from real-time data collected from sensors, remote inputs, connected things, and other sources. No surprise then that IoT Sensor Analytics is the AI solution that is seeing most uptake (Figure 1).

This is especially true for asset and logistics-driven industries such as Resource & Primary, Energy & Utilities, Manufacturing and Retail. Of the AI solutions, the biggest growth in 2020 will also come from IoT Analytics – with Healthcare and Transportation ramping up their IoT spend. And industries will also look at different ways they can leverage the IoT data for operational efficiency and improved customer experience (CX). For instance, in Transportation, AI can use IoT sensor data from a fleet to help improve time, cost and fuel efficiency – suggesting less congested routes with minimal stops through GPS systems, maintaining speeds with automated speed limiters – and also in predictive fleet maintenance.

IoT sensors are already creating – and will continue to create large amounts of data. As organisations look to AI-enabled IoT devices, there will be a shift from one-way transactions (i.e. collecting and analysing data) to bi-directional transactions (i.e. sensing and responding). Eventually, IoT as a separate technology will cease to exist and will become subsumed by AI.

Cloud

AI is changing the way organisations need to store, process and analyse the data to derive useful insights and decision-making practices. This is pushing the adoption of cloud, even in the most conservative organisations. Cloud is no longer only required for infrastructure and back-up – but actually improving business processes, by enabling real-time data and systems access.

Over the next decades, IoT devices will grow exponentially. Today, data is already going into the cloud and data centres on a real-time basis from sensors and automated devices. However, as these devices become bi-directional, decisions will need to be made in real-time as well. This has required cloud environments to evolve as the current cloud environments are unable to support this. Edge Computing will be essential in this intelligent and automated world. Tech vendors are building on their edge solutions and tech buyers are increasingly getting interested in the Edge allowing better decision-making through machine learning and AI. Not only will AI drive cloud adoption, but it will also drive cloud providers to evolve their offerings.

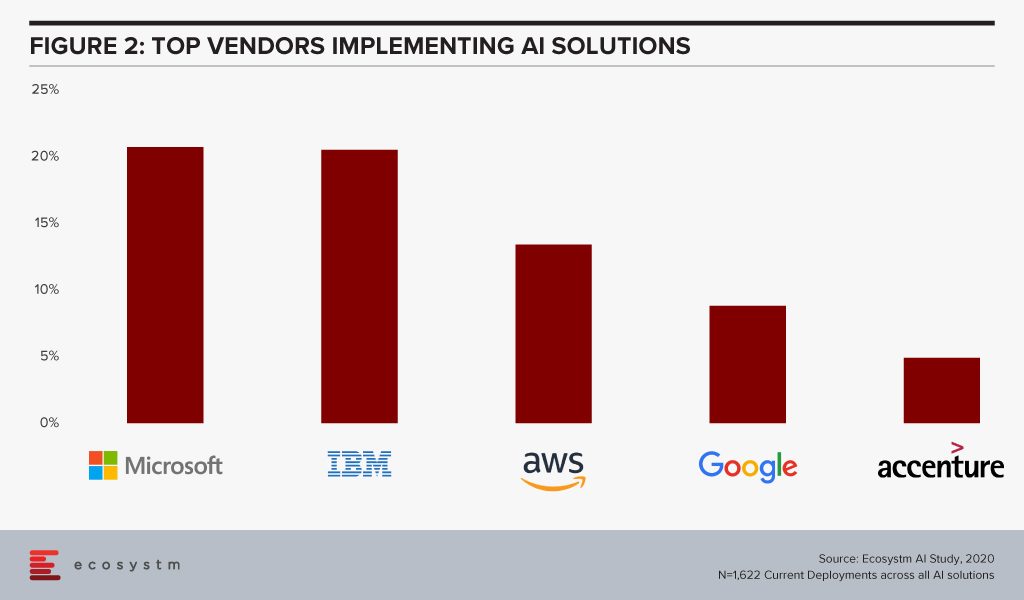

The global Ecosystm AI study finds that four of the top five vendors that organisations are using for their AI solutions (across data mining, computer vision, speech recognition and synthesis, and automation solutions) today, are also leading cloud platform providers (Figure 2).

The fact that intelligent solutions are often composed of multiple AI algorithms gives the major cloud platforms an edge – if they reside on the same cloud environment, they are more likely to work seamlessly and without much integration or security issues. Cloud platform providers are also working hard on their AI capabilities.

Cybersecurity & AI

The technology area that is getting impacted by AI most is arguably Cybersecurity. Security Teams are both struggling with cybersecurity initiatives as a result of AI projects – and at the same time are being empowered by AI to provide more secure solutions for their organisations.

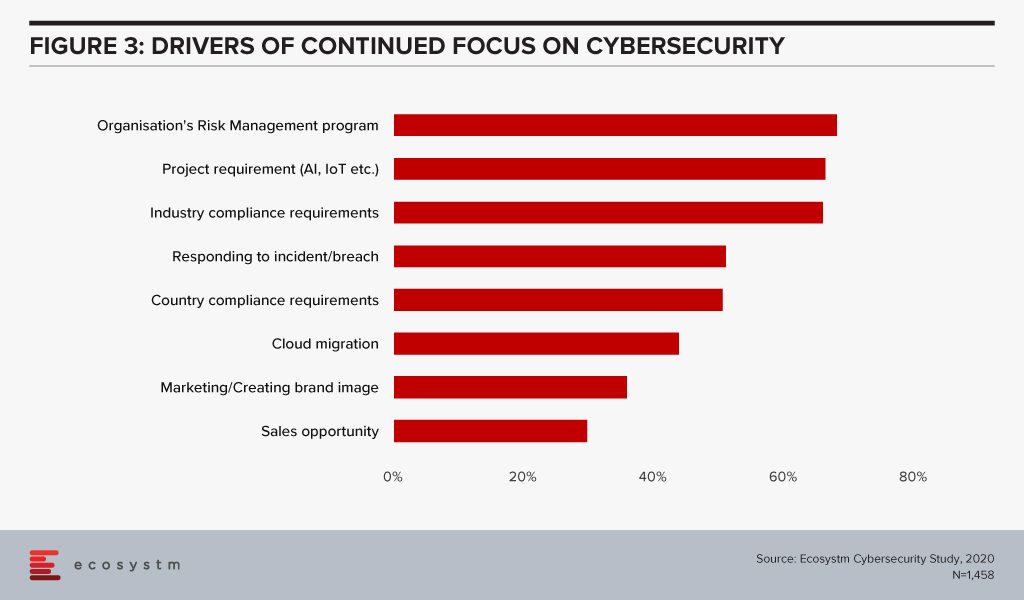

The global Ecosystm Cybersecurity study finds that one of the key drivers that is forcing Security Teams to keep an eye on their cybersecurity measures is the organisations’ needs to handle security requirements for their Digital Transformation (DX) projects involving AI and IoT deployments (Figure 3).

While AI deployments keep challenging Security Teams, AI is also helping cybersecurity professionals. Many businesses and industries are increasingly leveraging AI in their Security Operations (SecOps) solutions. AI analyses the inflow and outflow of data in a system and analyses threats based on the learnings. The trained AI systems and algorithms help businesses to curate and fight thousands of daily breaches, unsafe codes and enable proactive security and quick incident response. As organisations focus their attention on Data Security, SecOps & Incident Response and Threat Analysis & Intelligence, they will evaluate solutions with embedded AI.

AI and the Experience Economy

AI has an immense role to play in improving CX and employee experience (EX) by giving access to real-time data and bringing better decision-making capabilities.

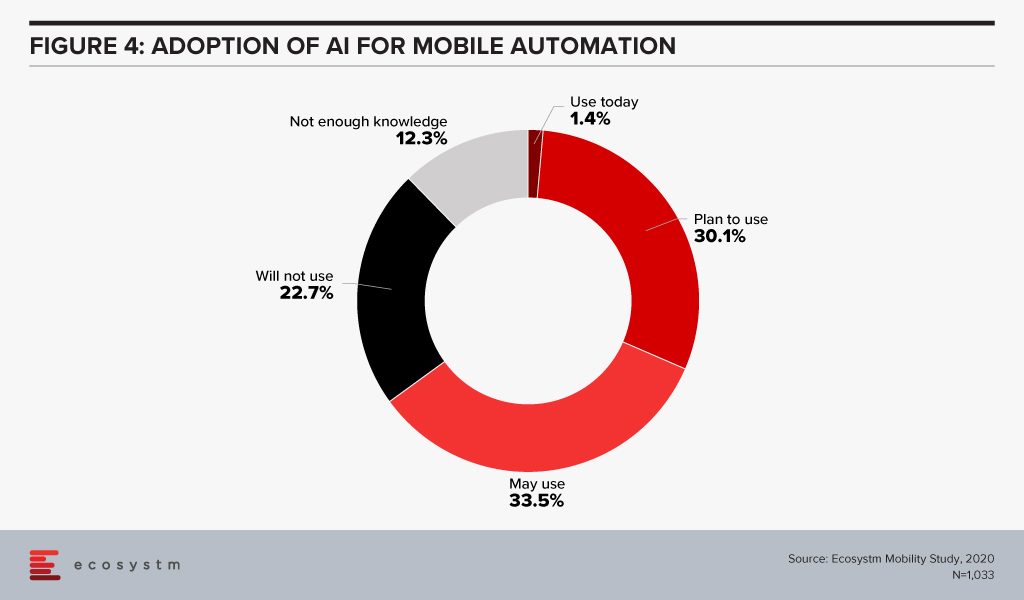

Enterprise mobility was a key area of focus when smartphones were introduced to the modern workplace. Since then enterprise mobility has evolved as business-as-usual for IT Teams. However, with the introduction of AI, organisations are being forced to re-evaluate and revamp their enterprise mobility solutions. As an example, it has made mobile app testing easier for tech teams. Mobile automation will help automate testing of a mobile app – across operating systems (Figure 4). While more organisations tend to outsource their app development functions today, mobile automation reduces the testing time cycle, allowing faster app deployments – both for internal apps (increasing employee productivity and agility) and for consumer apps (improving CX).

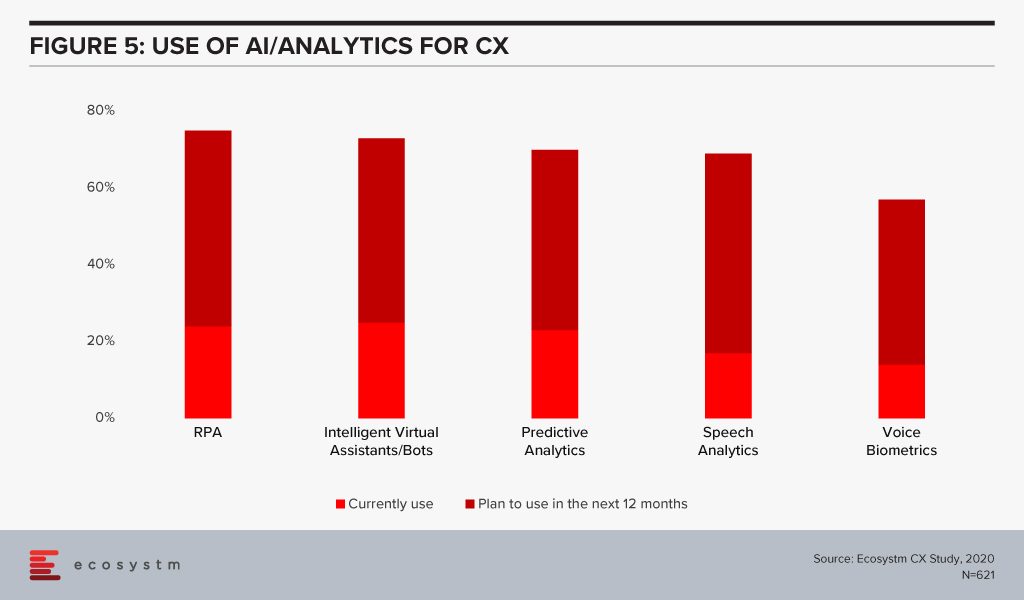

CX Teams within organisations are especially evaluating AI technologies. Visual and voice engagement technologies such as NLP, virtual assistants and chatbots enable efficient services, real-time delivery and better customer engagement. AI also allows organisations to offer personalised services to customers providing spot offers, self-service solutions and custom recommendations. Customer centres are re-evaluating their solutions to incorporate more AI-based solutions (Figure 5).

The buzz around AI is forcing tech teams to evaluate how AI can be leveraged in their enterprise solutions and at enabling technologies that will make AI adoption seamless. Has your organisation started re-evaluating other tech areas because of your AI requirements? Let us know in the comments below.

Innovation is quite an apt subject to write about – given we are coming to the close of an extremely innovative decade. Contrary to popular conception however, the word innovation is not limited to startups – corporates have ample opportunities to innovate and there are plenty of examples to inspire us.

In the technology industry, the turning point was the rapid scale-up of Amazon Web Services (AWS) – originating from the mothership, they defied all odds and forever changed the way we consume technology, making it more accessible through their cloud offerings. While AWS took the world by storm, most competitors have struggled because they are slow to adapt and transform. For them, this age of innovation has become a burden. The one exception is Microsoft – perhaps the true giant of the industry – that pivoted, and now constant innovation is seeing them consistently jostle for the leadership position. The underlying success factor for innovations is speed – it is of the essence when innovating.

Most companies are unable to promote a culture of innovation into their system, fast enough. Mainly because they are afraid of stumbling on the classic difficulties: “cannibalisation” of the existing business, impossibility to predict with certainty the results of innovation, lack of funding, internal conflict and one-upmanship, lack of understanding of technologies or the challenges of innovation management. Not to mention that taking risks isn’t well regarded in most companies. Most leaders fall in the long-standing tradition of annual P&L management. It’s that temptation of getting by another year of achieving targets. In the end, we are what we measure. The final metric always has to be increased profitability – but it’s all about defining the timescale. Once that’s sorted, the milestones and metrics make Success easier to measure.

The reality is also that the one rarest commodity for innovation is the vision and managed risk-taking ability of the leadership. For this reason, many companies prefer to create a dedicated independent team of corporate mavericks, specifically aimed at innovation. But eventually, the success of these teams is based on rapidly incorporating the innovations into the business – it must reflect in the core corporate ethos of the organisation. Experts debate the benefits of centralised versus decentralised innovation, but what’s most important is to have a dedicated capacity. If innovation is 10% of 100 people’s responsibility, you can rest assured that little innovation will take place. But if it’s 100% of 10 people’s jobs, things will start to happen. Speed is partly born of the priority that is put on it, so assigning - and incentivising - a dedicated team with the job of moving fast is an essential organisational step to innovation.

Easier said than done you say? It becomes even more challenging when you’re trying to achieve this in a large corporate environment. What AWS achieved is world-changing, and one cannot comprehend the vision, capabilities and execution par excellence of the leadership and the team. However, they were building from scratch with a blank canvas – they had the capital, a proven organisational culture of building and arguably one of the strongest leaderships in our generation. But for Microsoft, the storyboard was different. In order to innovate, they had to change the status quo. Yes, they had capital – tons of it – however, they also carried tremendous ‘baggage’. Ironically, it’s this baggage that corporations strive to achieve and only some manage – it’s called ‘legacy’. It can come back to bite you and hold you back when you need to rapidly adapt and innovate. But that is what Microsoft achieved – they overcame the fear of cannibalisation, put aside all the internal posturing and one-upmanship and more importantly, built a culture of innovation. Something that was led impeccably by Satya Nadella who allowed rapid innovation and ensured that the entire organisation got behind the ‘cloud-first’ vision.

Companies that are built for speed react more quickly to competitor moves or market shifts with their own product innovations. Fast innovators test prototypes with customers, worrying less about the imperfections that they know are there and focusing more on the insights they may gain from consumer reactions and feedback. They also fail several times – but they fail fast and cheap.

To sum it up, organisations that innovate successfully are fast to respond to the market, are led by a vision, have a culture of innovation, are not afraid to fail and they don’t ever let perfect get in the way of better!

As published in the tabla! (An SPH Publication)

On December 18, AWS launched Amazon Connect in ASEAN from the Singapore region. I was invited to the ASEAN launch of Connect in Singapore 3 weeks ago where Pasquale DeMaio, GM of Amazon Connect and Robert Killory, ASEAN Solutions Lead presented to analysts.

Pasquale told the audience that the Amazon Connect solution used today has been built over 10 years ago to serve Amazon’s internal needs of servicing millions of customer interactions for their e-commerce transactions. At that time Amazon could not find a solution that was pure cloud-based, cost-effective, scalable and that was easy to use. Since launching Amazon Connect a few years ago, AWS has seen not just small and medium enterprises using Connect – larger organisations have embraced the solution as well.

Amazon Connect has a list of notable clients – Intuit, Rackspace, John Hancock, CapitalOne, GE Appliances, Subway and many others. Intuit, as an example, has had difficulties running experiments in the past and proofs of concept were expensive, complex and time-consuming. With Amazon Connect these run on a test environment allowing their engineers to experiment and if they do not work out, it does not cost Intuit a lot of money to spin up a proof of concept. Philippines telecommunications provider, Globe Telecom wanted to automate and improve their services for their broadband and residential services. It was taking about 2-3 days from payment to the restoration of services. Amazon Connect was deployed to solve this problem by understanding the customer data when calls came through to the contact centre and by using APIs and the Connect suite of applications, there was deep integration with the CRM systems and other platforms that held various pools of data. This produced a faster and scalable way of integrating the payment process and customer service.

The demo of the solution showcased how features such as Amazon Lex can build conversational interfaces for an organisation’s applications powered by the same deep learning technologies like Alexa. With Amazon Lex and Polly, organisations can now build a chatbot without knowing or understanding code.

The Amazon Connect Solution – scaling to become more feature-rich

At ReInvent in Las Vegas in December 2019, Andy Jassy the CEO of AWS unveiled a new offering for their contact centre customers called Contact Lens. The solution is a set of machine learning capabilities integrated into Amazon Connect. The service can be activated through a single click in Connect and can analyse, transcribe calls including previously recorded calls. Jassy also talked about how it allows users to determine the sentiment of the call, pick up on long periods of silence, and times when an agent and customer are talking over the top of each other. These additions can help supervisors understand the challenges faced by agents that can then be addressed during training and coaching sessions. The machine learning models that power Contact Lens for Amazon Connect have been trained specifically to understand the nuances of contact centre conversations including multiple languages and custom vocabularies.

Several other announcements have also been made recently:

- Web and Mobile Chat for customers is a single unified contact centre service for voice and chat. Agents have a single user interface for both voice and chat, reducing the number of screens they have to interact with.

- Amazon Transcribe now supports 31 languages including Indonesian, Malay, Japanese, Korean, and several Indian languages. These are important languages as they expand further across ASEAN and the rest of Asia, given the diversity of languages spoken in the region. Contact centres can convert call recordings into text and analyse the data for actionable intelligence.

Deepening their relationship with Salesforce

At Dreamforce 2019 late last year, Salesforce announced that they will be offering AWS telephony and call transcription services with Amazon Connect as part of their Service Cloud call centre solution. The announcement indicates how the CRM world and the contact centre segments are starting to get closer. CRM vendors are starting to realise that whilst they own the agent at the desktop who have access to the CRM solution, the data from the calls and the actual calls are important. Voice/Telephony is also witnessing greater innovation with vendors in the contact centre space applying machine learning and AI to voice so that intelligence is gathered prior to the call coming to the contact centre and the agent is further empowered through prompts that they can apply when speaking to a customer. As CRM integrates deeper with contact centre solutions, the tight integration between these two solutions cannot be ignored. Salesforce is partnering to innovate in the voice space by applying machine learning at the core of all they do. This is a big announcement given the sheer size of both companies and how both companies are innovating in the contact centre space.

Cloud Contact Centre is high on the agenda in Asia Pacific

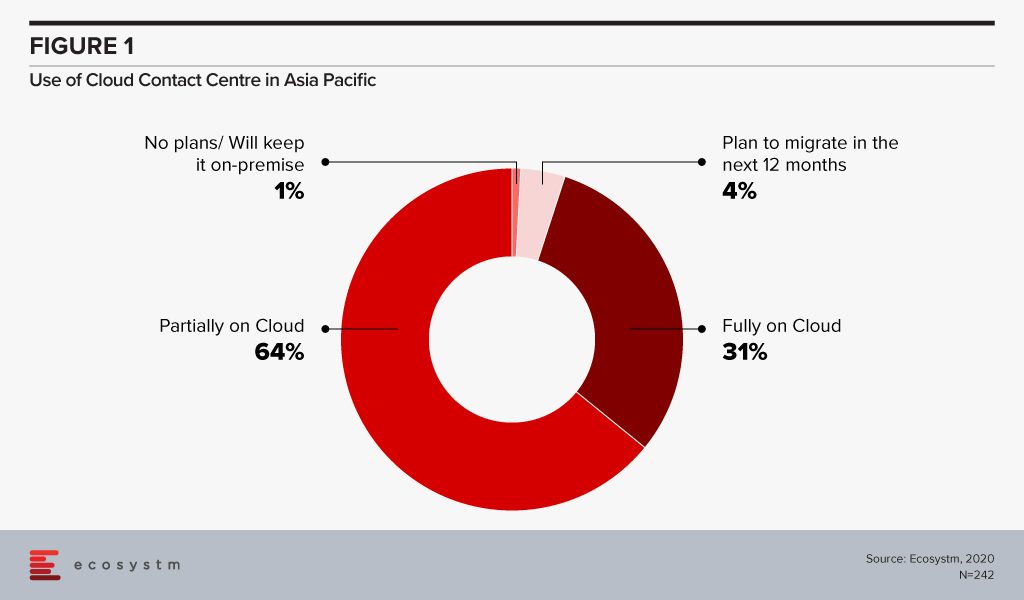

Ecosystm’s CX research finds that most organisations in Asia Pacific are at the inflection point of moving from an on-premise environment to a cloud model. Only 1% of CX decision-makers want to keep their contact centres on-premise – many organisations are evaluating which contact centre vendor they should use to migrate to the cloud. Some countries may see higher adoption than others. Australia and New Zealand have higher cloud contact centre adoption. In ASEAN many organisations are starting to build a wider CX strategy beyond the contact centre including areas such as customer journey analytics and data-driven personalised CX.

Ecosystm comments

In Australia, Amazon Connect has grown its customer base and these include some large enterprises. Big wins in the last 2 years include National Australia Bank and NSW Health. NSW Health shifted its IT service desk and shared services contact centres onto a new cloud-based contact centre platform as part of a broader digital transformation.

AWS has been gearing up for the launch in ASEAN over the last 6 months. The region is very competitive with some long-standing contact centre players having a large share and installed base in the large and medium enterprise accounts. The launch indicates how serious they are about growing their contact centre business in the region. There has been good progress so far in Singapore and the Philippines. Amazon Connect will look to grow its presence in Indonesia, Malaysia, Thailand, and Vietnam in the months to come. The market dynamics in each Asian country is unique and AWS will work with partners such as Accenture, Deloitte, DXC, ECS, NTT and VoiceFoundry to grow their presence in the region. Some of the more traditional partners will need education and upskilling to understand the Amazon Connect value proposition

The benefits of cloud computing are well documented, and it is at the core of most organisations’ modernisation and transformation initiatives. With the predicted increase in IoT uptake, and the associated increase in data collection and processing, technology providers are looking at methods to simplify, secure and speed-up IoT devices connected to the cloud.

5G Edge computing

To this end, in order to provide data processing closer to where it is needed, Amazon Web Services (AWS) and Verizon recently announced a partnership to bring the power of cloud computing closer to the edge with 5G network edge computing.

Edge computing brings various cloud services such as computing, networking and applications closer to the devices for local processing. It allows complex processing at the point where the data enters the network and eliminates round-trips involved in sending data from the edge, to the data centre where it gets processed and back to the edge again. To accomplish this, Verizon will offer 5G network and high-volume connections between users, devices and applications and will use AWS’s Wavelength service to deploy applications and process data at the edge. It will then seamlessly connect back to the AWS cloud.

The providers are piloting the project and aiming to deliver a wide range of services which depend on millisecond latencies.

New Demand, New Markets

By using AWS Wavelength and Verizon 5G Edge, the resulting edge computing solution will enable developers to build applications that can deliver enhanced user experiences like near real-time analytics for instant decision-making, improve services such as immersive game streaming, and automate robotic systems in manufacturing facilities.

The Ecosystm top 5 IoT Trends For 2020 report authored by Ecosystm Principal Advisors Francisco Maroto and Kaushik Ghatak stated that organisations are currently generating about 10% of their data outside a traditional data centre or cloud. This is predicted to dramatically increase in 2020 with IoT deployments fuelling investments in edge computing. The next year will see a sharp increase in IoT adoption as 5G rollouts gather steam, and this partnership is another indication of the increased interest in edge computing.

“As devices multiply and become smarter, 5G technology will become progressively more important to transfer data at a faster rate and drive edge computing. Real-time analytics will be performed at so many places along the network and infrastructure that IT management will be forced to rethink their distributed and enterprise computing strategies,” the report states.

Another Ecosystm report, the Top 5 Cloud Trends for 2020 report authored by Ecosystm Principal Advisors Claus Mortensen and Craig Baty mentions that “with IoT being a major part of the business case behind 5G, the number of connected devices and endpoints is set to explode in the coming years, potentially overloading an infrastructure based fully on data centres for processing the data.”

Edge computing will allow Cloud providers such as AWS to better cater to companies that need low latency, quick access to data and data processing. On the mobile side, it will allow them to push workloads to the device, reducing the backend workload and potentially enhancing data privacy.

The full findings and implications of the report ‘Ecosystm Predicts: The Top 5 IoT Trends For 2020’ and ‘The Top 5 Cloud Trends for 2020‘, implications for tech buyers and tech vendors, insights, and more are available for download from the Ecosystm platform.

Authored by attending Ecosystm analysts, Sash Mukherjee (Principal Analyst, Government & Healthcare) and Sid Bhandari (Director, Consulting & Advisory Services)

The recently held AWS Public Sector Summit in Singapore showcased some of the regional AWS implementations, and how organisations are leveraging the Public Cloud differently.

In her keynote address, Teresa Carlson, Vice President, Worldwide Public Sector set the tone for the industry show cases by saying that a successful Digital Transformation (DX) starts from a radical rethinking of how an organisation uses cloud computing technology, people, and processes to fundamentally change business performance.

AWS Empowering the Public Sector

Carlson is clear on what Public Sector organisations must do and where AWS can help them:

- Define what Cloud refers to in the organisation. The first step in bringing about a Cloud First transformation is to be clear on the true definition of cloud computing.

- Create a “Cloud First” policy. To adopt a Cloud First policy, it is imperative to have leaders with a clear vision who really drive technology initiatives forward for all the right reasons like security, cost reduction, scalability, privacy and rapid acceleration of citizen services.

- Focus on Security & Compliance. AWS has global compliance certifications with 200+ services and key features focused on security, compliance and governance. New services such as the use of AI for threat detection have been implemented and are quickly evolving into a mainstream feature.

- Modify your Procurement vehicle. A formal cloud procurement model must be adopted instead of creating ad-hoc processes and a rush to adopt cloud to meet the specific needs of individual departments. AWS has the expertise to assist government IT leaders in selecting the right acquisition approach for their agency.

- Do not ignore Skills Development. Investing in cloud skills development – whether at the central IT level or in the individual business units in the Public Sector – is imperative, as roles evolve and new roles emerge. AWS has over the years offered free courses and industry certifications to Public Sector employees interested in learning the foundations of cloud computing, storage, and networking on AWS to advanced skills courses in emerging technologies such as AI.

Ecosystm Comment:

While cloud may have started off as a means of offsetting CapEx, its role has since evolved into being a major vehicle for DX. Several governments across the world have adopted Cloud First policies to spearhead innovation, increase agility, and improve citizen services. Cloud is increasingly seen as a foundation for many emerging technologies that governments are experimenting with and implementing such as AI, automation, Big Data analytics and Smart Nation initiatives.

The skepticism around Public Cloud security seems to have diminished over the years, with the perception that cloud providers use state-of-the-art technologies to protect their environment and continue to upgrade their security features in the face of new and evolving threats. However, the Ecosystm Cybersecurity study finds that nearly 53% of Public Sector and allied organisations that use Public Cloud feel that the security measures offered are sufficient. Leading cloud providers such as AWS should make it clear that essentially it is a shared responsibility and impress on organisations that the responsibility to secure their own applications and the interface with the Public Cloud ultimately lies with the deploying organisations.

Industry Use Cases

There were several industry use cases presented over the 2 days and it was heartening to see so many Asia Pacific examples of transformation. Tan Kok Yam, Deputy Secretary, Smart Nation & Digital Government Office shared that the key to a successful Smart Nation initiative is to build user-centric services rather than having an agency-centric approach, in his presentation on Singapore’s “The Moments of Life” app. Edwin H. Chaidir, IT Manager at WWF Indonesia presented on how AWS’s machine learning capabilities has helped the organisation to automate identification of specific orangutans in the wild, freeing up resources (money and time) to reinvest in other wildlife protection initiatives.

One of the implementation stories that impressed the Ecosystm analysts was the one shared by Rookie Nagtalon, Consultant for Digital Transformation at the Chinese General Hospital and Medical Center (CGHMC) in the Philippines, where he spoke about how they were able to bring about transformation in their patient life-cycle management. Healthcare in Asia Pacific is a diverse and disparate market with organisations at different levels of IT and business maturity – against a backdrop of different country-level goals and healthcare policies. It was encouraging to hear about a transformation project in a not-for-profit organisation from an emerging economy.

The challenges that healthcare organisations face are unique in many ways:

- Legacy systems that still work and hence there is no business case for replacing them

- Approximately 2/3rd of the IT budget going into running the basics, leaving limited resources for emerging technology adoption and transformation projects

- The shift to value-based healthcare and the need for data-driven insights to support it

- The unpredictability of the workload and the need for an agile IT infrastructure

- Security and compliance mandates that protect patient data and require storage of records over extended periods

Working with these challenges, how does a healthcare organisation bring about Digital Transformation?

Nagtalon’s team was assigned the task to bring about this transformation within a 10-month timeframe.

- The key challenge. An awareness that no one vendor can provide the entire gamut of functionalities required for patient lifecycle management. In spite of recent trends of multi-capability vendors, hospitals need multiple vendors for the hospital information system (HIS), ERP, HR system, document management systems, auxiliary department systems and so on. Each of these vendors have their own development team and infrastructure requirement, which stresses the internal IT resources. DX involving multiple legacy systems requires a step-by-step approach. The challenge is to identify the right systems to start the journey with.

- Vendor selection criteria. The need to find one solution that would enable seamless data sharing across the disparate systems. The vendor selection criteria that were used focused on ease of use and speed especially when working with multiple data sources. In keeping with the industry, the ability of the vendor to support mission-critical applications was put through the filter of what was referred to as ‘Code Blue’.

- The solution choice. A cloud solution that can empower teams and remove worries about the infrastructure. The hospital chose AWS as their transformation partner, who used a system interface blueprint to integrate data from their SAP ERP system, Medcurial’s MeRx HIS, 128 HR system, Canon’s documentation system and multiple diagnostics systems.

- The future roadmap. Enabling the organisation to be a Digital Hospital. The solution was implemented in 7 months and hit the right ROI requirements, reducing billing time and impacting the bottom line in terms of both recovery and revenue. It has created the base foundation for future plans such as device integration and the provider is well set on its journey of Cloud, IoT and Robotics.

Ecosystm Comment:

Nagtalon raised an important point when he was asked the key reason for the success of the project – executive buy-in. Transformation projects work best when it is enterprise-wide and senior management sponsorship is a must to enable that. However, he also mentioned humorously that he had become extremely unpopular during the implementation. This is where a centre-of-excellence with ‘champions to the cause’ from each key department helps. Organisations should look to engaging with the stakeholders early and to get their buy-in as well as the executive’s.

AWS’s marketing message to healthcare providers includes allowing them to focus on their mission and create their differentiation, and enabling them to incorporate new and emerging technologies. This implementation certainly ticked those boxes. What was particularly positive was the big thumbs up the AWS implementation team received. Organisations will increasingly partner with platform providers in their transformation journeys and implementation capabilities and best practice guidance will be the key differentiators for vendors.