In my previous insights, I explained why organisations need to rethink their End-User Computing (EUC) strategies and shared a simple checklist to help them build smarter, more responsible plans tailored to their goals, users, and regions.

As that foundation is laid, it’s critical to put sustainability at the core. From laptops and desktops to peripherals and accessories, the choices made around devices impact not only IT budgets and user productivity but also environmental footprints and regulatory compliance.

Sustainable EUC means selecting devices that align with your company’s climate goals, regulatory mandates, and ethical commitments, while delivering reliability and performance in diverse working environments.

This guide offers a comprehensive sustainability checklist to help IT leaders embed responsible sourcing and lifecycle management into their EUC strategy.

What to Demand from Vendors & Devices

- Specify recognised eco-label tiers (e.g., TCO Gen 9, EPEAT Climate+). Ensures devices meet verified environmental and social standards, reducing overall carbon footprint.

- Request embodied-carbon disclosures (ISO 14067, PAS 2050). To understand full lifecycle emissions to inform refresh cycle decisions.

- Insist on vendor-funded take-back in all deployment regions. Supports responsible recycling and circular economy for end-user devices.

- Audit supply-chain ethics (latest RBA VAP score, Modern Slavery compliance). Certifies devices against verified environmental and social standards, cutting their overall carbon footprint.

- Set minimum firmware support periods and repairability targets. Extends usable device lifespan, lowering total cost of ownership and e-waste.

- Test devices for local climate conditions (humidity, altitude). Guarantees device reliability and energy efficiency in diverse workplaces.

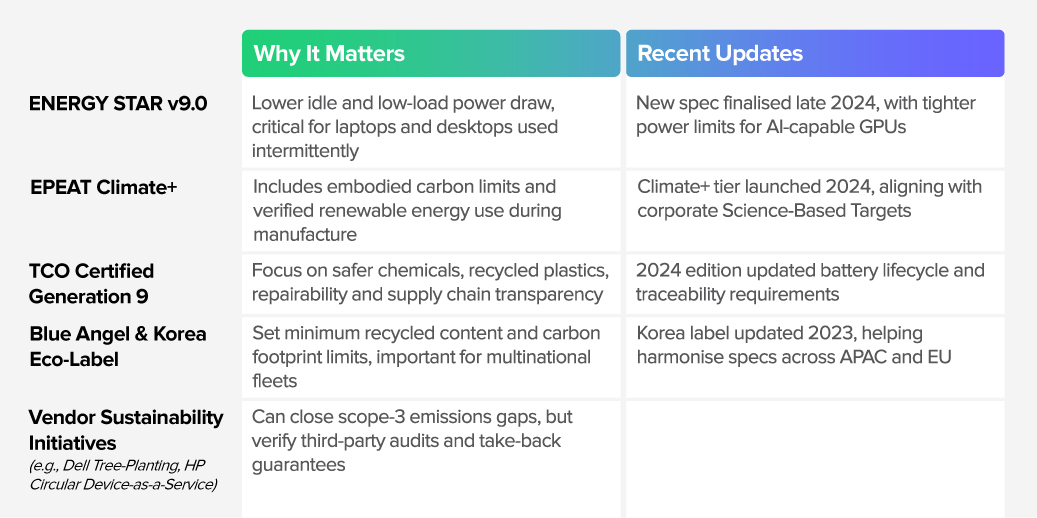

Key Eco-Labels & Certifications for EUC Devices

Not all certifications are created equal. Here are the most relevant for end-user devices, what they mean, and recent updates to watch:

Regional Regulations & Compliance for EUC

EUC devices often span multiple jurisdictions; understanding regional regulations helps avoid compliance risks and future-proofs procurement:

Australia & New Zealand. Minimum Energy Performance Standards (MEPS) for monitors and power supplies; NTCRS take-back requirements; Modern Slavery Act disclosures

Singapore. Resource Sustainability Act (EPR for IT equipment) since 2021; green procurement guidelines for public sector

Japan. Minimum Energy Performance Standards (MEPS) for monitors and power supplies; NTCRS take-back requirements; Modern Slavery Act disclosures

China. China RoHS 2 with new 2024 testing standards for restricted substances

India. E-Waste (Management) Rules 2022 requiring OEMs/importers to collect 80% of products sold; ongoing amendments under legal review

South Korea. Eco-Label expansion to tablets and mini-PCs; EPR scheme in public tenders

Embedding Ethical Sourcing in Your EUC Strategy

Ethics matter beyond environmental impact; responsible sourcing reduces risk and protects brand reputation:

Responsible Business Alliance (RBA) Code of Conduct v8.0. Check for vendor audit results to ensure compliance.

Conflict Minerals / Responsible Minerals Initiative. Especially relevant for supply chains feeding US/EU markets.

Modern Slavery Legislation. Mandate supplier disclosures and risk assessments, especially in Australia and New Zealand.

Public Sector Procurement & EUC Sustainability

Many government buyers set strong sustainability expectations, which can serve as best-practice benchmarks:

Australia (Commonwealth & States). Preference for EPEAT Silver+, NTCRS take-back, and Modern Slavery compliance statements

Singapore GovTech. ENERGY STAR compliance, Resource Sustainability Act adherence, and use of low-halogen plastics

Japan National Procurement. Top Runner energy efficiency, Eco-Mark or equivalent certification

Why Sustainability Matters for End-User Computing

Sustainability in your EUC strategy drives more than just environmental benefits. It:

- Reduces Total Cost of Ownership (TCO) by extending device lifecycles and lowering energy consumption

- Mitigates Supply Chain Risks by ensuring ethical sourcing and regulatory compliance

- Supports Corporate Climate Commitments with transparent carbon accounting and circular economy practices

- Enhances User Satisfaction and Reliability by testing devices for local conditions and durability

By integrating these sustainability criteria into procurement, IT leaders can transform their EUC strategy into a powerful enabler of business value and responsible growth.

At the Agentforce World Tour in Singapore, Salesforce presented their vision for Agentic AI – showcasing how they’re helping customers stay ahead of rapid technological change and unlock stronger business outcomes with speed, trust, and agility.

Ecosystm Advisors, Ullrich Loeffler, Sash Mukherjee, Achim Granzen, and Manish Goenka share their take on Salesforce’s announcements, demos, and messaging, highlighting what resonated, what stood out, and what it means for the future.

Click here to download “Agentforce World Tour: Highlights from Singapore” as a PDF.

What truly stood out in Salesforce’s messaging?

ULLRICH LOEFFLER, CEO & Co-Founder

What stood out at the Salesforce event was their pragmatic, integrated approach to scaling AI. They made it clear AI isn’t plug-and-play, emphasising the complexity and cost involved in what they call ‘self-plumbing’ AI – spanning infrastructure, data management, model development, governance, and application integration. Their answer is a unified platform that lowers costs, accelerates time to market, and reduces risk by removing the need to manage multiple disconnected tools. This seamless environment tackles the real challenge of building and running a layered AI stack.

Equally notable is their view of Agentic AI as a capability refined through iteration, not a sudden overhaul. By urging businesses to start with the right use cases for faster adoption, less disruption, and tangible impact, they show a realistic grasp of enterprise change.

Salesforce offers a clear, practical path to AI: simplifying complexity through integration and driving adoption with measured, value-focused steps.

SASH MUKHERJEE, VP Industry Insights

What truly stood out at the Salesforce event was their unwavering commitment to Trust. They understand that AI agents are only as reliable as the data they use, and they’ve built their platform to address this head-on. Salesforce emphasises that building trusted AI means more than just powerful models; it requires a secure and well-governed data foundation. They highlighted how their platform, with 25 years of embedded security, ensures data resilience, protects sensitive information during development and testing, and provides robust visibility into how AI interacts with your data.

A key assurance is their Trust Layer, a unique innovation that safeguards your data when interacting with AI models. This layer automatically masks sensitive data, ensures zero data retention by LLM providers, and detects harmful language. This means organisations can leverage GenAI’s power without compromising sensitive information.

Ultimately, Salesforce is empowering organisations to confidently deploy AI by making trust non-negotiable, ensuring organisational data is used responsibly and securely to drive real business value.

How does Salesforce differentiate their approach to Agentic AI?

ACHIM GRANZEN, Principal Advisor

Salesforce’s focus on Agentic AI focus stands out for its clarity and depth. The Agentforce platform takes centre stage, demonstrating how clients can now build Agentic AI with little or no code and deploy agents seamlessly across the Salesforce environment.

But beyond the polished demos and compelling customer stories, the most critical takeaway risked being overlooked: Agentforce is not a standalone capability. It’s tightly integrated with Data Cloud and the broader Salesforce platform. That layered architecture is more than just a technical decision; it’s what ensures every AI agent is governed, auditable, and constrained to what’s been provisioned in Data Cloud. It’s the foundational safeguard that makes Agentic AI viable in the enterprise.

And that’s the message that needs greater emphasis. As organisations move from experimentation to real-world deployment, trust and control become just as vital as ease of use. Salesforce’s architecture delivers both – and that balance is a key differentiator in the crowded enterprise AI space.

MANISH GOENKA, Principal Advisor

Salesforce has moved beyond passive AI assistance to autonomous agents that can take meaningful action within trusted boundaries. Rather than focusing solely on chat-based copilots, Salesforce emphasises intelligent agents embedded into business workflows, capable of executing tasks like claims processing or personalised service without human intervention.

What sets Salesforce apart is how deeply this vision is integrated into their platform. With Einstein Copilot and Copilot Studio, customers can build their own cross-system agents, not just those limited to Salesforce apps. And by enabling partners to create and monetise agents via AppExchange, Salesforce is building a full-fledged AI ecosystem, positioning themselves as a platform for enterprise AI, not just a CRM.

Trust is a cornerstone of this approach. Salesforce’s focus on governance, auditability, and ethical AI ensures that Agentic AI is not only powerful, but also secure and accountable – key concerns as agents become more autonomous.

In a crowded AI space, Salesforce stands out by offering a grounded, scalable vision of Agentic AI, anchored in real use cases, platform extensibility, and responsible innovation.

Where are Salesforce’s biggest growth opportunities in APAC?

MANISH GOENKA

Salesforce has significant growth opportunities across Asia Pacific, with Singapore playing a pivotal role in its regional strategy. The company’s USD 1 billion investment and the launch of their first overseas AI research hub firmly position Singapore as more than just a sales market. It becomes a core engine for product innovation and a key driver of Salesforce’s long-term AI leadership.

Across the region, public sector transformation and SME digitisation represent major areas of opportunity. Salesforce’s secure and compliant Government Cloud is well suited to support Smart Nation goals and modernise public digital services. At the same time, governments are actively pushing SME digitisation, creating demand for scalable, modular platforms that can grow from basic CRM solutions to AI-enabled automation.

Sustainability is also emerging as a strong growth vector. As ESG reporting becomes commonplace in more markets, tools like Net Zero Cloud are well positioned to help businesses meet compliance requirements and improve data transparency.

Finally, the rapidly expanding ecosystem of certified professionals and ISV partners across Asia Pacific is enabling faster, more localised implementations. This grounds Salesforce’s capabilities in local context, accelerating time to value and delivering business outcomes that are tailored to the region’s diverse needs.

What does the Informatica acquisition mean for Salesforce’s AI strategy?

ACHIM GRANZEN

The planned acquisition of Informatica is a strategically important move that completes Salesforce’s Agentforce narrative. At the World Tour, Agentforce was positioned as the future of enterprise AI, allowing organisations to build and deploy autonomous agents across the Salesforce ecosystem. But some lingering concerns remained around how deeply Data Cloud could handle governance, especially as AI agents begin making decisions and executing tasks without human oversight.

Informatica answers that question. With proven tools for data quality, lineage, and policy enforcement, Informatica brings a level of governance maturity that complements Salesforce’s ambition. Its integration into Data Cloud strengthens the trust layer that underpins Agentforce and reinforces Salesforce’s positioning as an enterprise-grade AI platform.

Of course, there are broader implications too. Salesforce will gain access to Informatica’s installed base, potentially opening up cross-sell opportunities. And there are questions to resolve, such as how Informatica will operate as a product line within the larger Salesforce ecosystem.

But the core value of the deal is clear: by bringing Informatica’s governance expertise into the fold, Salesforce can significantly accelerate its ability to deliver trusted, production-ready AI at scale. From a risk and compliance standpoint, that governance capability may prove to be the most valuable part of the acquisition.

What will define Salesforce’s next chapter of growth in APAC?

SASH MUKHERJEE

Just as Salesforce is driving an integrated enterprise platform from the CRM and customer experience lens, competitors (and partners) are taking a similar platform-centric approach from other functional vantage points – whether it’s HR (like Workday), Finance (like Oracle), or IT (like ServiceNow). In fast-growing, cost-sensitive markets across APAC, competing on price alone won’t be sustainable, especially with strong regional players offering leaner, localised alternatives.

To win, Salesforce must adopt a nuanced strategy that goes beyond product breadth. This means addressing local economic realities – offering right-sized solutions for businesses at different stages of digital maturity – while consistently reinforcing the long-term value, resilience, and global standards that set Salesforce apart. Their differentiators in data security, compliance, and ecosystem depth must be positioned not as add-ons, but as essential foundations for future-ready growth.

More flexible entry points – whether modular offerings, usage-based pricing, or vertical-specific bundles – can reduce friction and make the platform more accessible. At the same time, strengthening local partnerships with ISVs, system integrators, and government bodies can help tailor offerings to market-specific needs, ensuring relevance and faster implementation.

Ultimately, Salesforce’s growth across APAC will depend on their ability to balance global strengths with local agility.

ULLRICH LOEFFLER

Salesforce is well positioned to lead in AI-driven transformation, but doing so will require evolving their sales approach to match the complexity and expectations of today’s enterprise buyers. With a strong foundation selling to marketing and customer leaders, the company now has an opportunity to deepen engagement with CIOs and CTOs, reframing themselves not just as a CRM provider, but as a full-spectrum enterprise platform.

Traditional sales reps who excel at pitching features to business users are no longer enough. Selling AI – particularly agentic, autonomous AI – demands sales professionals who can link technical capabilities to strategic outcomes and lead conversations around risk, compliance, and long-term value.

To sustain their leadership, Salesforce will need to invest in a new generation of sales talent: domain-fluent, consultative, and able to navigate complex, cross-functional buying journeys.

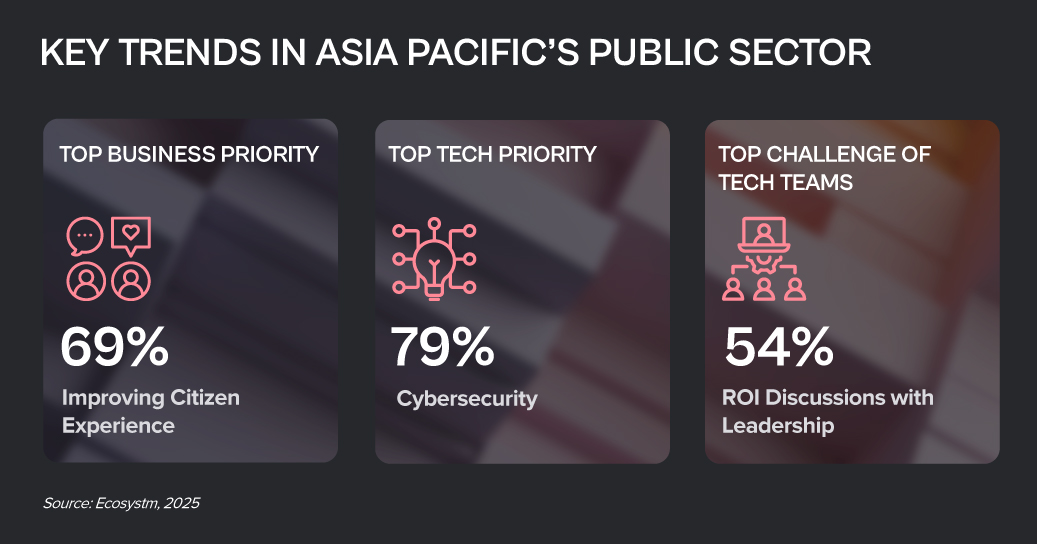

As rapid technological change, rising citizen expectations, and growing demands for efficiency and transparency converge, the public sector stands at a pivotal crossroads. Profound, system-wide transformation is no longer a future ambition – it is an urgent imperative. From streamlining services and optimising resources to strengthening engagement and building more resilient infrastructure, the challenges and opportunities facing governments are immense.

Now is the time to reimagine how innovation, technology, and a citizen-first mindset can come together to reshape the very fabric of the public sector.

Click here to download “Future Forward: Reimagining the Public Sector” as a PDF.

Smarter City Management with Digital Twin

GovTech Singapore faced challenges in managing data from smart infrastructure as part of its Smart Nation initiative. They needed a more efficient way to visualise and analyse data from sources like smart lamp posts to improve urban management and resource optimisation.

GovTech implemented a digital twin solution that integrates real-time data from environmental sensors and traffic cameras into a dynamic 3D visualisation platform, enhanced by AI-driven analytics for predictive maintenance and resource allocation.

This solution provided valuable operational insights, reduced maintenance costs, and improved responsiveness to urban challenges. It boosted scalability and performance, optimising city planning and advancing the Smart Nation initiative towards more sustainable and efficient urban development.

Digital Leap for Accessible Governance

Scattered across the Indian Ocean, the Maldives faced a major challenge: delivering government services to citizens spread over 1,000 islands without forcing them to travel. The Ministry of Environment, Climate Change and Technology aimed to build a digital economy that could bring essential services directly to every island, while cutting costs and supporting sustainability goals.

The Ministry unified government agencies on a single, secure digital platform, enabling cloud-based collaboration, virtual meetings, and streamlined access to services.

Now, 20,000 public servants collaborate online, reducing travel, paper use, and operational costs. Government services have become faster and more accessible, solar energy projects are managed more efficiently, and citizens can access services – from banking to legal hearings – without leaving their islands. With digitalisation now embedded, the Maldives is laying the groundwork for AI-driven innovation and further advances in sustainable governance.

Enhancing Urban Resilience

With rising flood risks and extreme weather, Melbourne Water needed a faster, smarter way to maintain its 4,000 stormwater grates. Manual inspections were slow, costly, and couldn’t keep up with intensifying storms. Crews struggled to inspect grates across 14,000 sq km, often arriving too late or checking clear grates. Frequent site visits drove up costs, safety risks, and stretched resources, while the city needed to scale inspections without overburdening crews.

Melbourne Water implemented a cloud-based image recognition system with real-time cameras, using AI to detect blockages and trigger work orders only when needed.

The system is expanding beyond trial sites to cover critical points in the drainage network, with early results showing tens of thousands in annual savings and further efficiency gains. By freeing up crews and reducing manual work, Melbourne Water is better prepared to manage flood risks and support the city’s sustainable growth.

Making the Cloud Shift to Address Bottlenecks

The Philippine national police force overhauled its outdated licensing system, where applicants endured weeks-long waits, repeated office visits, and costly delays. Staff were bogged down by manual checks, while on-prem systems struggled with capacity limits, poor scalability, and frequent outages.

By shifting to a cloud-native platform, processing times dropped from four weeks to 24 hours – a 96% improvement.

The system now handles 5x more applications daily, scaling automatically with demand. Secure cloud storage replaced legacy systems, freeing IT teams to focus on citizen services. A nationwide content network and built-in security keep access fast, reliable, and protected. The force is unifying IT on one cloud platform and rolling out disaster recovery to boost resilience and future-proof operations.

Streamlining Employee Services

The New Zealand Parliamentary Service needed a more efficient way to manage employee services. Previously reliant on 11 separate email inboxes and a third-party IT service desk, the system was slow, disjointed, and cumbersome. Onboarding and offboarding were a particularly time-sensitive challenge, often causing delays and frustrations.

To streamline operations, the service transitioned to a unified platform, consolidating services into a single portal.

This move cut response times from weeks to just two days and simplified access to essential services, improving employee satisfaction and operational efficiency. With real-time performance tracking and AI-driven case management, the Parliamentary Service is now equipped to scale and optimise service delivery as it continues its digital transformation.

Enhancing Weather Prediction

The Japan Meteorological Agency (JMA) faces the challenge of enhancing weather predictions, particularly for typhoons and torrential rains, as climate change increases their frequency and intensity.

JMA upgraded its supercomputing infrastructure to boost memory bandwidth and computational power, enabling higher-resolution forecasts and more accurate predictions for linear precipitation zones.

The result: JMA has improved the resolution of its local weather models, extending the forecast time for local predictions from 10 to 18 hours. The new system has also increased prediction accuracy for linear precipitation zones, raising the probability of forecasting these events 15 hours in advance from 33% to higher levels. Additionally, the new infrastructure has reduced the number of nodes needed for some weather prediction models by up to 80%, optimising computational resources for other forecasting needs.

As AI adoption continues to surge, the tech infrastructure market is undergoing a significant transformation. Traditional IT infrastructure providers are facing increasing pressure to innovate and adapt to the evolving demands of AI-powered applications. This shift is driving the development of new technologies and solutions that can support the intensive computational requirements and data-intensive nature of AI workloads.

At Lenovo’s recently held Asia Pacific summit in Shanghai they detailed their ‘AI for All’ strategy as they prepare for the next computing era. Building on their history as a major force in the hardware market, new AI-ready offerings will be prominent in their enhanced portfolio.

At the same time, Lenovo is adding software and services, both homegrown and with partners, to leverage their already well-established relationships with client IT teams. Sustainability is also a crucial message as it seeks to address the need for power efficiency and zero waste lifecycle management in their products.

Ecosystm Advisor Darian Bird comment on Lenovo’s recent announcements and messaging.

Click here to download Lenovo’s Innovation Roadmap: Takeaways from the APAC Analyst Summit as a PDF

1. Lenovo’s AI Strategy

Lenovo’s AI strategy focuses on launching AI PCs that leverage their computing legacy.

As the adoption of GenAI increases, there’s a growing need for edge processing to enhance privacy and performance. Lenovo, along with Microsoft, is introducing AI PCs with specialised components like CPUs, GPUs, and AI accelerators (NPUs) optimised for AI workloads.

Energy efficiency is vital for AI applications, opening doors for mobile-chip makers like Qualcomm. Lenovo’s latest ThinkPads, featuring Qualcomm’s Snapdragon X Elite processors, support Microsoft’s Copilot+ features while maximising battery life during AI tasks.

Lenovo is also investing in small language models (SLMs) that run directly on laptops, offering GenAI capabilities with lower resource demands. This allows users to interact with PCs using natural language for tasks like file searches, tech support, and personal management.

2. Lenovo’s Computer Vision Solutions

Lenovo stands out as one of the few computing hardware vendors that manufactures its own systems.

Leveraging precision engineering, Lenovo has developed solutions to automate production lines. By embedding computer vision in processes like quality inspection, equipment monitoring, and safety supervision, Lenovo customises ML algorithms using customer-specific data. Clients like McLaren Automotive use this technology to detect flaws beyond human capability, enhancing product quality and speeding up production.

Lenovo extends their computer vision expertise to retail, partnering with Sensormatic and Everseen to digitise branch operations. By analysing camera feeds, Lenovo’s solutions optimise merchandising, staffing, and design, while their checkout monitoring system detects theft and scanning errors in real-time. Australian customers have seen significant reductions in retail shrinkage after implementation.

3. AI in Action: Autonomous Robots

Like other hardware companies, Lenovo is experimenting with new devices to futureproof their portfolio.

Earlier this year, Lenovo unveiled the Daystar Bot GS, a six-legged robotic dog and an upgrade from their previous wheeled model. Resembling Boston Dynamics’ Spot but with added legs inspired by insects for enhanced stability, the bot is designed for challenging environments. Lenovo is positioning it as an automated monitoring assistant for equipment inspection and surveillance, reducing the need for additional staff. Power stations in China are already using the robot to read meters, detect temperature anomalies, and identify defective equipment.

Although it is likely to remain a niche product in the short term, the robot is an avenue for Lenovo to showcase their AI wares on a physical device, incorporating computer vision and self-guided movement.

Considerations for Lenovo’s Future Growth

Lenovo outlined an AI vision leveraging their expertise in end user computing, manufacturing, and retail. While the strategy aligns with Lenovo’s background, they should consider the following:

Hybrid AI. Initially, AI on PCs will address performance and privacy issues, but hybrid AI – integrating data across devices, clouds, and APIs – will eventually dominate.

Data Transparency & Control. The balance between convenience and privacy in AI is still unclear. Evolving transparency and control will be crucial as users adapt to new AI tools.

AI Ecosystem. AI’s value lies in data, applications, and integration, not just hardware. Hardware vendors must form deeper partnerships in these areas, as Lenovo’s focus on industry-specific solutions demonstrates.

Enhanced Experience. AI enhances operational efficiency and customer experience. Offloading level one support to AI not only cuts costs but also resolves issues faster than live agents.

Focused on Digital Transformation? It is now more about how fast you can react to market shifts by using specific infrastructural resources.

This period is about digital acceleration. Cloud automation, artificial intelligence (AI), robotic process automation (RPA) and machine learning are all means to accelerate using infrastructure scalability.

Digital acceleration addresses the pace of change

Enterprises are searching to find unique and innovative ways to leverage cloud infrastructures with automation and intelligence. This is both to modernise and to optimise business processes while decreasing expenses. The speed at which the economic landscape has changed during the pandemic has removed debates on cloud usage:

- Remote work from home (WFH) with the need for video conferencing and collaboration tools has been supported by cloud

- Record amounts of SPAM and hacking attempts during the pandemic have leveraged cloud implementations for key security controls

- Tracking apps and classification and encryption of personally identifiable information (PII) via mobile devices are using cloud technology for greater automation and use of AI

Bandwidth and capacity are needed now. The ability to pivot, turn and shoot forward is critical to surviving and thriving in today’s radically changed marketplace. Cloud enablement can deliver enhanced customer experiences, monetise data assets, and can create new revenue streams by enabling new business models.

Cloud enablement explained

Digital acceleration is driven by cloud enablement, amplifying the enterprise value in the infrastructural investment.

Cloud enablement is an ongoing operational model. It incorporates orchestration, correctly organising teams, and a shift away from thinking only about platforms. The cloud platform is now a launchpad, not the main choice that has to be made. Orchestration is around the business and the business model, not just the technology.

Creating a cloud enablement strategic vision can identify where you need to go. It can provide the necessary requirements for expertise along the journey and deliver rapid, meaningful automation services engagements to deliver unbreakable delivery pipelines and agile cloud operations.

But this also involves managing and adjusting on the fly. Initial platform decisions, rolling out countless configuration changes and adjusting to new cloud investments make cloud enablement a tricky road to manage. Enterprises need to be cloud-smart towards their own business model and their strategy. Whatever configuration (on-prem, hybrid, private, public) combination works is dependent on many factors, including industry, size of the enterprise, employee resources and location.

The goal is implementing secure, flexible, scalable, and cost-effective cloud solutions. To do this requires regular cloud enablement audits as to the state of play and measuring successes.

Building and maintaining modern IT

Modern IT is hybrid and all the pieces that collect and manage the data need to be properly and securely managed. Just as technological (and economic) disruption has generally led to automation and the elimination of outdated processes, it has also always created new ideas and innovations.

One way to make your organisation more data-centric and digital is to selectively invest in those technology choices that are most adaptable and flexible to business needs. Data is the most strategic of assets and can be empowered by increasingly sophisticated intelligent operations. Process automation and AI help put that data to work by adding valued intelligence and encapsulating information.

Hybrid cloud coordination automated

Hybrid cloud coordination is an increasing enterprise demand, particularly in the Asia Pacific region, leading to enhanced data centres with joint customer support like the new Tokyo interconnection with Oracle and Microsoft Azure. The key to successfully monitoring a distributed cloud ecosystem is not only in gathering data on usage; it’s about knowing which questions to ask to make it more efficient and effective. This includes tracking connectivity speeds, creating common technical support and using single sign-on for better security. Here both AI and automation can help.

In Asia Pacific, the multi-cloud theme is being promoted heavily among integration providers with solutions that can plug into multiple clouds with virtual machine usage. Enterprises value enabled automated orchestration between cloud platforms. There will be a continued need for integrated tools across public and private clouds. This includes advanced analytics and AI as important aspects of an IT infrastructural investment.

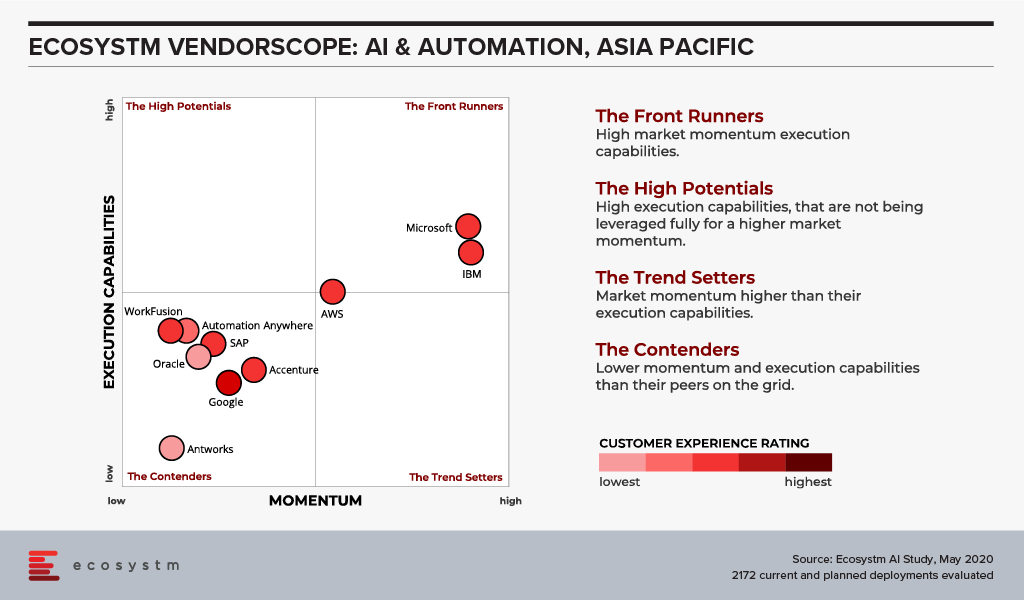

Your choice of vendor for AI & Automation

In my opinion, AWS has the broadest AI service capabilities in the Asia Pacific cloud/ AI space, when compared to Microsoft, Google, and IBM. AWS provides users with pre-trained AI services for computer vision, language, recommendations, and forecasting to build, train, and deploy machine learning models at scale.

The Ecosystm VendorScope (Figure 1) rates the leading AI & Automation vendors in Asia Pacific based solely on quantifiable feedback from those who actually procure technology. It becomes clear from the responses that many organisations still start their AI journey through Automation.

Most organisations understand the importance of leveraging AI to gain competitive advantage. But they do not necessarily know where to start. The secret is that AI is about intelligent process automation, and the firms who understand this are not the ones automating tasks. The use of RPA with vendors such as Antworks, WorkFusion, Arago and Automation Anywhere, leverages automated reasoning using knowledge-based problem-solving engines. These vendors add RPA to AI, not the other way around.

And domain-specific service providers have been creating the synergies for enterprises to link intelligent automation software and industry knowledge to create the necessary end-to-end workflows. An innate understanding of the specific business process is key to leveraging intelligent automation.

Focusing on developing a modern data supply chain process, with actionable analytics insights built into the infrastructure, can aid the development of self-service business intelligence capabilities along with visual data discovery solutions.

Cloud enablement solutions generate maximum business value by enabling IT with scalability and flexibility. This can reduce maintenance and security costs. A focus on cloud intelligence and scalability allows IT departments to concentrate more on innovative solutions, insights and systems that drive significant business growth. Now is the time, and speed is of the essence.

Ecosystm Vendorscope: AI & Automation

Sign up for Free to download the Ecosystm Vendorscope: AI & Automation report.

Roll Out of 5G will Contribute $900 Bn to APAC Economy over the next 15 years

According to a forecast by the GSMA Foundation, 5G will contribute almost $900 billion to APAC’s economy over the next 15 years. APAC’s edition of the GSMA’s Mobile Economy series published at MWC19 Shanghai revealed that Asia’s mobile operators will invest $370 billion – two-thirds of their overall investment in new networks – in building new 5G networks between 2018 and 2025. The report forecasts that the number of subscribers is expected to increase to 3.1 billion by 2025 with the main contributions coming from India, China, Pakistan, Indonesia, Bangladesh, and the Philippines.

The Roadmap for 5G

Every major Asia Pacific country has announced its intent or made the commitment to roll out 5G. The upside for an Asia Pacific digital economy is huge which will be driven by massive amounts of cross-cloud, inter-cloud, and smart infrastructure giving rise to the need for high-density connectivity between businesses and consumers.

“Take a step back and look at the key attributes of 5G – speed, latency, and density. Now take a step forward and look at global urban development. The explosion of bigger and more modern cities makes the telecom infrastructure a scaling issue for which 5G will be the right technology,” says Ecosystm Executive Analyst, Vernon Turner.

Working closely with the mobile operators pioneering 5G, governments are also engaging in the preparation and roll out of 5G Networks. Recently, the Singapore government announced to set aside SG$40 million to build up a 5G ecosystem. To promote digital transformation and economic growth, IMDA and the National Research Foundation (NRF) has allocated this funding for innovation, trials, R&D and enterprise use-cases in the 5G technology.

Similarly, the Vietnamese government awarded its first 5G trial licence to its largest telecommunications company, Viettel, to uplift the economy. Thailand is also seeking to deploy 5G and aims to start commercial 5G service next year.

“By 2022, 5G will be ‘the rising tide that lifts all boats’, making the Asia-Pacific region the biggest network offering network services that could give it an economic advantage,” says Turner. “But before that, some challenges for 5G belongs to regulatory approvals and the cost to build the next generation wireless network. For example, 5G networks operate on ‘millimetre waves’, a high radio frequency able to transmit large amounts of data but only over a short distance. To overcome this issue, governments have to approve large numbers of 5G small cells for operators to deploy.”

Is this an opportunity to skip out 4G altogether and leapfrog to 5G?

“The challenge for operators is to find workloads and applications that need 5G and at a price point that customers will pay. In my everyday travels, I have been underwhelmed by the number of customers ready to take advantage of 5G. Existing networks have the speed and capacity to run much of their businesses. I can see a scenario whereby operators will be forced to roll up 3G and LTE network functionality into 5G networks without being able to raise prices – despite being able to offer more benefits” says Turner.

How will 5G impact industries?

The future of interconnected ecosystems runs through IoT. The data that IoT sensors will create will be more valuable the faster it is analysed to produce business outcomes. Turner commented “Innovation accelerators such as VR (Virtual Reality) and AR (Augmented Reality) will generate new services for both consumers and industrial uses cases. The potential for asset management and services is ripe for disruption as 5G will bring more valuable information to workers through more efficient platforms. The knowledge-based worker and the future of work is here.”

Ultimately, APAC has the same possibilities and challenges as the rest of the world. Overall, the involvement of telecom companies, government organisations, infrastructure upgrades and the adoption of devices by consumers can affect the development and only after that can 5G become a reality.